#P2P Exchange Development Services

Explore tagged Tumblr posts

Text

Unlocking the Future of Digital Trading: P2P Exchange Solutions by Nadcab Labs

Discover innovative P2P Exchange Solutions by Nadcab Labs, designed to revolutionize the way digital trading is done. Our advanced technology offers secure, efficient, and scalable peer-to-peer exchange platforms tailored to your needs. For more information, reach out to us at [email protected] or call +91-9870635001. Unlock the future of digital trading with Nadcab Labs today!"

#P2P Exchange#P2P Crypto Exchange Development Company#P2P Exchange Development#P2P Cryptocurrency Exchange Development#P2P Cryptocurrency Exchange Software Solutions#Crypto P2p Exchange Application Development#P2P Cryptocurrency Exchange Software#P2P Exchange Development Company#P2P Cryptocurrency Exchange Development Solutions#P2p Crypto Exchange Development#P2P Cryptocurrency Exchange Development Company#P2P Crypto Exchange Development Services#P2P Cryptocurrency Exchange Development Services#P2P Exchange Development Services#P2P Exchange Solutions#P2P Cryptocurrency Exchange#P2p Exchange Application Development

1 note

·

View note

Text

Centralized vs Decentralized vs P2P: Which Crypto Exchange Model is Right for You?

Introduction

The modern cryptocurrency trading infrastructure is an ever-changing environment influenced by shifting user needs, regulatory environments, and technological breakthroughs. Ultimately, the design of a cryptocurrency exchange is far more than a simple backend decision — it is an informed strategic choice that dictates liquidity patterns, user autonomy, and system stability.

Any ambitious entrepreneur, institutional investor, or tech-savvy individual considering entry into this market has to start with an elementary question: What model serves my needs best — Centralized (CEX), Decentralized (DEX), or Peer-to-Peer (P2P)?

This article will help you decide which crypto exchange platform are Centralized, Decentralized, or P2P, is the right fit for your business needs.

What is a Centralized Crypto Exchange (CEX)?

CEX exchanges are custodial intermediaries that manage order book-based trades between customers but maintain control over the underlying assets throughout the trading process. By centralizing operations under one authority, CEXs maximize performance, regulatory compliance, and user convenience.

For Example: Binance, Coinbase

Strengths:

Liquidity Efficiency: Pooled user bases improve market depth and reduce slippage.

Latency Optimization: Centralized servers enable fast trade execution—a non-trivial consideration for high-frequency traders.

UX Design: Cognitive load is reduced with intuitive interfaces, which is why they are so well-suited for retail adoption.

Limitations:

Custodianship Risk: The platform holds control over private keys, which makes them more vulnerable to breaches.

Regulatory Exposure: As centralised entities, they tend to attract intense oversight from financial regulators.

For those who value transaction throughput and a smooth user experience, centralized exchange development is still a pragmatic option—albeit one with compromises on sovereignty and censorship-resistance.

What is a Decentralized Crypto Exchange (DEX)?

In contrast, DEXs function through smart contracts written on blockchain networks (e.g., Ethereum, BNB Chain). Such platforms facilitate peer-to-peer wallet-to-wallet transactions, excluding centralized intermediaries.

For Example: Uniswap, PancakeSwap

Benefits:

Non-Custodial Architecture: The users have control over their assets at all times, increasing security and privacy.

Protocol-Level Transparency: Public ledger entries and open-source codebases foster trustlessness.

Limitations:

Liquidity Fragmentation: Lack of market makers may result in low-quality price discovery.

Complexity Overhead: The UI/UX tends not to be high-quality; onboarding users outside of technical circles is still a challenge.

Unstable Fees: Network overload and fluctuating gas price models bring randomness.

Decentralized exchange building for users wanting autonomy and system robustness provides strong benefits—assuming one is willing to embrace the operational trade-offs that are typical for distributed systems.

What is a P2P Crypto Exchange

P2P markets enable users to perform direct, two-party trades among themselves, usually backed by reputation-based systems and escrow services. This system is especially beneficial in areas with poor access to centralized payment infrastructure or where anonymity matters.

For Example: LocalBitcoins, Paxful

Advantages:

Access to Fiat: Users can execute trades using local tender and payment methods.

Evading Intermediaries: Best suited for users who prefer discretion or do not have access to banking rails.

Disadvantages:

Transaction Latency: Asynchronous coordination between buyers and sellers leads to slower settlement.

Fraud Potential: Lack of effective escrow or KYC protocols can enhance counterparty risk.

P2P crypto exchange development is strong in situations where local solutions are necessary, but with qualifications about trust and scalability.

Decision Framework: Which Model Should You Use?

Active Traders: If milliseconds are everything and liquidity is paramount, CEX is the only way.

Privacy Advocates & Technologists: For those that see decentralization as a philosophical necessity, DEX is the inevitable home.

Emerging Market Users: Those working outside the existing grid of banks might find P2P most convenient.

Entrepreneurs would do well to consider legal jurisdictions, target demographics, and infrastructure preparedness. Hiring a cryptocurrency exchange development company with cross-model capabilities ensures an all-around approach to platform design.

Why Choose Justtry Technologies?

We at Justtry Technologies bring a strong technical background and strategic vision to your exchange development experience. Whether you are creating a high-performance centralized exchange development, a secure and trustless Decentralized exchange development, or an easy-to-use P2P crypto exchange development, We offer:

Custom Architecture: Built to your use case, not off-the-shelf.

Regulatory Compliance Tools: KYC/AML integrations specific to your jurisdiction.

Strong Security: Smart contract audits, multi-sig wallets, encrypted databases.

Agile Deployment: Modular builds for rapid market entry without sacrificing quality.

We're not developers — we're your strategic technology partner.

Conclusion

The choice among centralized, decentralized, and P2P exchange models is not a light one. Each model has its own affordances and constraints. There isn't a one-size-fits-all "best" — but what's best suited to your operational environment and user needs.

Still having doubts? Collaborate with a cryptocurrency exchange development company such as Justtry Technologies. Let's co-develop a platform that not only works, but lasts.

#cryptocurrency exchange development company#cryptocurrency exchange development#crypto exchange development#cryptocurrency exchange development services#Centralized exchange development#Decentralized exchange development#P2P crypto exchange development

0 notes

Text

What It Takes Financially to Start a P2P Crypto Exchange: Cost Breakdown & Insights

Peer-to-peer (P2P) crypto exchanges are gaining momentum as decentralized platforms that allow users to trade cryptocurrencies directly with one another. They provide a level of autonomy and privacy that traditional exchanges can’t offer, making them increasingly popular among crypto enthusiasts. However, building a P2P crypto exchange isn’t an inexpensive endeavor. If you’re thinking about…

#P2P Crypto Exchange#P2P Crypto Exchange development#P2P Crypto Exchange development company#P2P Crypto Exchange development services#P2P Crypto Exchange services

0 notes

Text

What is P2P crypto exchange?

A P2P crypto exchange is a platform which allows users to trade without any intermediates. Here, buyers and sellers can facilitate trades on their own without involvement of any central authority. P2P crypto exchange allows Anonymous individuals or miners to verify and approve each and every transaction. I.e., it does not need any third party during transaction. It gives total autonomy to users. Clarisco is one of the best cryptocurrency exchange development companies. If you have any idea on investing in a P2P crypto exchange, contact us with the below mentioned contacts without any regrets.

Skype - live:62781b9208711b89

Email Id - [email protected]

#crypto exchange development services#P2P crypto exchange services#blockchain technology#software services#technology solutions

0 notes

Text

Unveiling the Power of White Label Crypto Exchange Software Solutions

In the dynamic world of cryptocurrency, launching your exchange platform can be a game-changer. However, the complexities involved in developing a crypto exchange from scratch can be overwhelming. This is where white label crypto exchange software solutions come into play, offering a strategic shortcut to success.

Understanding White Label Crypto Exchange Software

White label crypto exchange software provides a pre-built platform that can be customized and branded according to your unique specifications. It's a turnkey solution that empowers entrepreneurs and businesses to enter the cryptocurrency market swiftly and efficiently.

The Advantages of White Label Crypto Exchange Software

1. Time and Cost Efficiency

By opting for a white label solution, you can save significant time and resources that would otherwise be spent on developing a crypto exchange from the ground up. With a ready-made platform, you can accelerate the launch process and reduce development costs.

2. Customization and Branding

White label solutions offer a high degree of customization, allowing you to tailor the platform to align with your brand identity and business objectives. From design elements to features and functionalities, you have the flexibility to create a unique and branded exchange platform.

3. Security and Compliance

Security is paramount in cryptocurrency, and white label exchange solutions prioritize robust security measures to safeguard user assets and data. Additionally, reputable white label providers ensure compliance with regulatory standards, enhancing trust and credibility.

4. Scalability and Performance

As your exchange grows and attracts more users, scalability becomes crucial for maintaining optimal performance. White label solutions are designed to scale seamlessly, allowing you to accommodate increasing trading volumes and user activity without compromising on speed or reliability.

5. Expert Support and Maintenance

Launching and operating a cryptocurrency exchange requires ongoing support and maintenance to address technical issues, implement updates, and optimize performance. With a white label solution, you benefit from expert support and maintenance services provided by the solution provider, ensuring smooth operation and user satisfaction.

Choosing the Right White Label Crypto Exchange Software Provider

When selecting a white label crypto exchange software provider, it's essential to consider factors such as reputation, track record, security features, customization options, support services, and pricing. Conduct thorough research and due diligence to find a provider that meets your specific requirements and aligns with your long-term goals.

Conclusion

White label crypto exchange software solutions offer a strategic advantage for entrepreneurs and businesses looking to enter the cryptocurrency market quickly and efficiently. By leveraging pre-built platforms, you can save time and resources, customize the exchange to reflect your brand identity, ensure robust security and compliance, and scale effortlessly as your business grows. Partnering with a reputable provider like Debut Infotech can help unlock your exchange venture's full potential and succeed in the competitive crypto landscape.

#white lable currency exchange#white label crypto exchange development#cryptocurrency development services#crypto wallet exchange#p2p crypto exchange

0 notes

Text

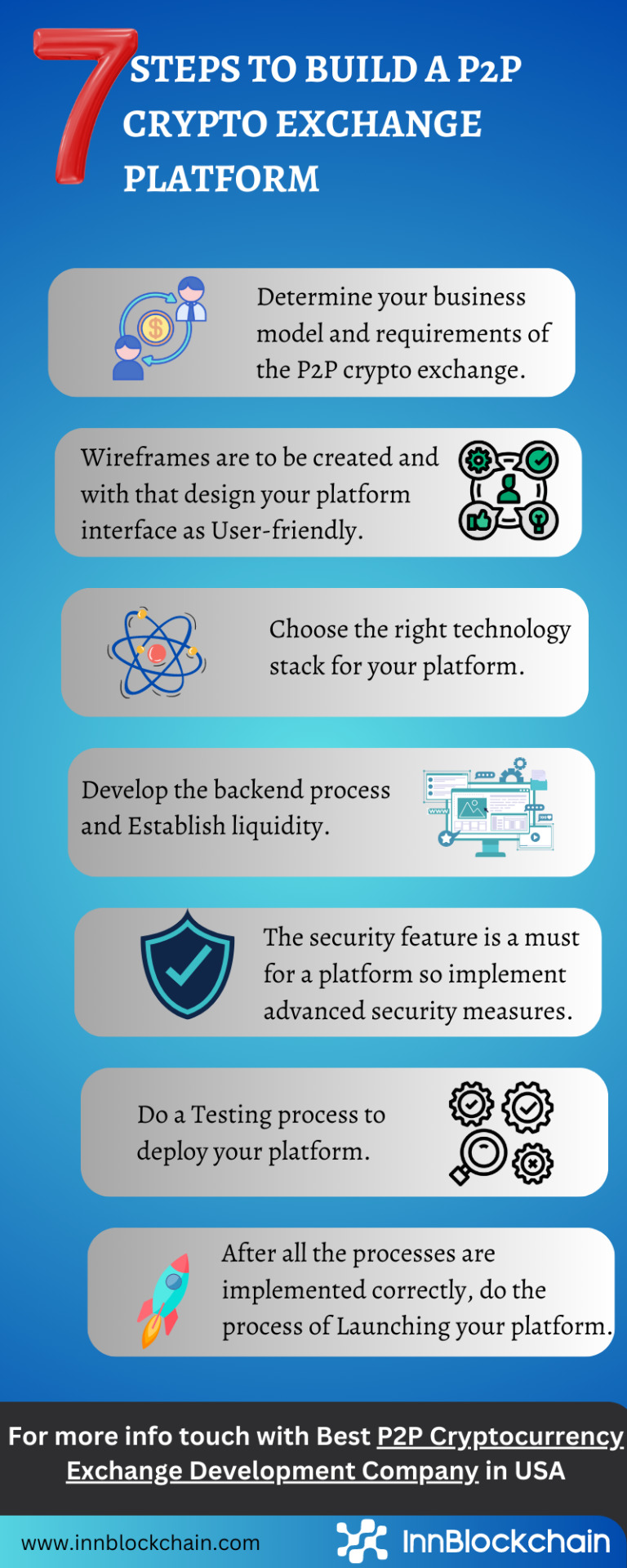

We at InnBlockchain is a leading p2p cryptocurrency exchange development company in USA, that offers customized p2p cryptocurrency exchange development services to help you launch your p2p cryptocurrency exchange platform. P2P crypto exchange platform development is build decentralized crypto exchange platform that allows traders and users can be trade, buy and sell cryptos with no middle man.

#p2p crypto exchange development#p2p cryptocurrency exchange development services#build p2p crypto exchange

0 notes

Text

Call Now : +91 7240607737

#Peer to Peer Crypto Exchange Development company#Peer to Peer Crypto Exchange Development#Crypto Exchange Development company#Crypto Exchange Developer#P2P Crypto Exchange Development company#P2P Crypto Exchange Developers#P2P Crypto Exchange Development#P2P Crypto Exchange Development services

0 notes

Text

Launch Your Own Crypto Platform with Notcoin Clone Script | Fast & Secure Solution

To launch your own cryptocurrency platform using a Notcoin clone script, you can follow a structured approach that leverages existing clone scripts tailored for various cryptocurrency exchanges.

Here’s a detailed guide on how to proceed:

Understanding Clone Scripts

A clone script is a pre-built software solution that replicates the functionalities of established cryptocurrency exchanges. These scripts can be customized to suit your specific business needs and allow for rapid deployment, saving both time and resources.

Types of Clone Scripts

Centralized Exchange Scripts: These replicate platforms like Binance or Coinbase, offering features such as order books and user management.

Decentralized Exchange Scripts: These are designed for platforms like Uniswap or PancakeSwap, enabling peer-to-peer trading without a central authority.

Peer-to-Peer (P2P) Exchange Scripts: These allow users to trade directly with each other, similar to LocalBitcoins or Paxful.

Steps to Launch Your Crypto Platform

Step 1: Define Your Business Strategy

Market Research: Identify your target audience and analyze competitors.

Unique Value Proposition: Determine what sets your platform apart from others.

Step 2: Choose the Right Clone Script

Evaluate Options: Research various clone scripts available in the market, such as those for Binance, Coinbase, or P2P exchanges. Customization: Ensure the script is customizable to meet your specific requirements, including branding and features.

Step 3: Development and Deployment

Technical Setup: Collaborate with developers to set up the necessary infrastructure, including blockchain integration and wallet services.

Security Features: Implement robust security measures, such as two-factor authentication and encryption, to protect user data and transactions.

Step 4: Compliance and Regulations

KYC/AML Integration: Ensure your platform complies with local regulations by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Step 5: Testing and Launch

Quality Assurance: Conduct thorough testing to identify and fix any bugs or vulnerabilities.

Launch: Once testing is complete, launch your platform and start marketing it to attract users.

Advantages of Using a Notcoin Clone Script

Cost-Effective: Using a pre-built script is generally more affordable than developing a platform from scratch.

Faster Time to Market: Notcoin Clone scripts are ready to deploy, significantly reducing development time.

Customization Options: Most scripts allow for extensive customization, enabling you to tailor the platform to your needs.

Conclusion

Launching your own cryptocurrency platform with a Notcoin clone script is a viable option that can lead to a successful venture in the growing crypto market. By following the outlined steps and leveraging the advantages of Notcoin clone scripts, you can create a robust and secure trading platform that meets user demands and regulatory requirements.

For further assistance, consider reaching out to specialized development companies that offer Notcoin clone script and can guide you through the setup process

#cryptotrading#notcoin#notcoinclonescript#cryptocurrencies#crypto exchange#blockchain#crypto traders#crypto investors#cryptonews#web3 development

3 notes

·

View notes

Text

History of Finance in India

The Evolution of Financial Management in India and Its Impact on the Economy

India’s financial management history is a fascinating journey that has significantly shaped its economy. Let’s explore this evolution in simple terms.

Early Beginnings

Financial management in India has ancient roots. Historically, India was known for its rich in nature trade and commerce. Ancient texts like the Arthashastra, written by Chanakya, provide insights into early financial practices, including taxation and statecraft.

Colonial Era

The British colonial period brought significant changes. The establishment of the Reserve Bank of India (RBI) in Kolkata 1935 marked a pivotal moment. The RBI became the sole central authority for regulating the country’s currency and credit systems. However, the financial system was primarily designed to serve colonial interests, focusing on trade and revenue and tax collection.

Post-Independence Reforms

After gaining independence in 1947, India faced the challenge of building a robust financial system. The government nationalized 13 major banks in 1969 to ensure financial inclusion and support economic development. This move aimed to extend banking services to rural areas and promote savings and investments.

Liberalization in the 1990s

The 1991 marked a turning point with economic liberalization. The government introduced reforms to open up the economy, reduce state control, and encourage private sector participation. The Multi National Companies across the globe were invited, encouraged to set up their businesses in India for cheap labour. To initiate this government also provided tax benefits to these companies.

These reforms led to significant growth in the financial sector. The stock market expanded, and new financial instruments like mutual funds and insurance products became popular. The liberalization era also saw the establishment of regulatory bodies like the Securities and Exchange Board of India (SEBI) to oversee the capital markets.

Digital Revolution

In recent years, digital technology has revolutionized financial management in India. Initiatives like the Pradhan Mantri Jan Dhan Yojana aimed to provide banking services to every household. The introduction of UPI or Unified Interface payments made transaction so quick and safe that today India is the largest country with the most number of online P2P and P2M transactions.

Impact on the Economy

The evolution of financial management has had a profound impact on the Indian economy:

Economic Growth: Financial reforms have fueled economic growth by attracting investments and promoting entrepreneurship.

Financial Inclusion: Nationalization of banks and digital initiatives have improved financial inclusion. The number of users of credit cards, online payments, loans and Bank account holders has increased significantly.

Stability and Regulation: The establishment of regulatory bodies like the RBI and SEBI has ensured stability and transparency in the financial system.

Innovation: The digital revolution has spurred innovation in financial services. Mobile Banking, Digital loans and Online Serices has made the work easier and efficient.

Conclusion

The history of financial management in India is a story of transformation and resilience. From ancient practices to modern digital innovations, each phase has contributed to shaping the economy. As India continues to evolve, its financial system will play a crucial role in driving sustainable growth and development.

2 notes

·

View notes

Text

How P2P Cryptocurrency Exchange Works: A Detailed Overview and Benefits

Despite the aggressive expansion of the centralized cryptocurrency exchange industry, hundreds of thousands of active traders and investors prefer to work with fully decentralized P2P platforms. Although automated cryptocurrency trading and leverage are not possible on them, security, transparency and direct contact with market participants attract many investors.

What is P2P cryptocurrency exchange and how does it work?

P2P exchange means using the Peer-to-Peer method, which literally means “equal to equal,” and it’s a great way to describe what happens in the P2P market. All market participants use the same space and only exchange cryptocurrency when a suitable offer appears and both parties agree to the transaction.

The traditional approach that has evolved over the last century in financial markets involves trading through an intermediary (a broker, stockbroker, or the exchange itself). This model has its advantages, and it allows all potential investors to enter the market faster, but a decentralized exchange without the participation of companies providing a custodial intermediary service has even greater advantages. As a result, P2P crypto exchange development has become a critical focus for those aiming to build systems that empower users with full control over their assets and trades.

There is no need to use third-party services. Modern P2P platforms offer many complementary services and products focused on facilitating transactions between two market participants. The main advantage of working with such platforms is the lack of a custodial service (no one requires you to deposit money into the exchange balance), although some exchanges offer escrow accounts.

Market participants have full control over their assets. A major argument in favor of decentralization is absolute ownership of your assets at almost all stages of transactions and portfolio management. A peer-to-peer network simply connects interested investors, while a centralized exchange holds your tokens on its balance sheet, so you don’t own them until you withdraw them to your “cold” wallet.

Privacy and security. If you find the right partners to trade with, the security issue will resolve itself. On the other hand, most DEX platforms do not comply with KYC and AML (Know Your Customer and Anti-Money Laundering) requirements, so traders are not required to disclose personal data and share it with the platform.

A P2P exchange is an open trading platform where buyers find sellers and sellers find buyers. The exchange simply allows all market participants to publish their orders and form a price depth, and then provides everyone with access to this depth to speed up the process of finding trading partners within a self-regulating ecosystem.

This does not mean that the P2P platform simply puts the process on "autopilot" and watches people send tokens to each other. Forums and specialized DeFi platforms try to protect users from scammers as much as possible. Almost everywhere, user rating, feedback, commenting functions have been introduced, as well as the ability to use the escrow service.

How to start using P2P cryptocurrency exchange?

Getting started on a decentralized peer-to-peer trading platform is fairly easy, but the process is still a bit more involved than trading on a centralized exchange, where you simply need to register and fund your account with fiat currency.

To get started in the P2P sphere, you need to do a few things.

Creating a cryptocurrency wallet. Depending on what tokens you will be interacting with, you will need a corresponding wallet. For example, all tokens of the ERC-20 standard and EVM-compatible platforms are supported by the MetaMask wallet and its analogues. For storing and managing Bitcoin, ZCash, Litecoin and other tokens using the same architecture, Electrum or Freewallet are suitable.

Registering on a peer-to-peer exchange. Most platforms require users to go through a full registration process and, for large volume trading, provide some important types of personal information. For most investors, a simple registration without providing any information you do not want to disclose is sufficient.

Having multiple wallets. One should be “cold”, i.e. disconnected from the Internet and interacting only with the second “external” wallet. If you want to protect yourself from hackers and other scammers, it is best to never put your assets at risk by sending and receiving funds using the same address.

It should be noted that the choice of a suitable P2P platform plays a major role. It is necessary to clarify whether there is an escrow service, whether the tokens you are interested in are supported, and what additional services the platform offers. There is also a classification of peer-to-peer exchanges by geographic coverage.

Risk and Security When Using P2P Cryptocurrency Exchange: How to Keep Your Funds Safe

The advantages of trading in the P2P crypto exchange development ecosystem are obvious to those who understand the specifics of the cryptocurrency market and the philosophy of decentralization of the monetary system. The ability to participate in trades without the influence of intermediaries, complete confidentiality of all financial transactions and the confidence that government supervisory or financial authorities can influence the outcome of the trading activity of an individual investor are the advantages of the peer-to-peer market that simply cannot be ignored.

On the other hand, the security of P2P transactions still remains the main stumbling block for the vast majority of traders. Complete anonymity means no liability for any illegal actions, and therefore financial anarchy within the P2P ecosystem requires, albeit minimal, intervention from arbitrators, in the role of which decentralized exchanges act.

The presence of arbitrageurs does not mean that trading in this sector becomes safe. The responsibility for the outcome of your transactions, profitability and the safety of your portfolio lies only with you and no one else.

How Can You Protect Your Capital When Trading In The P2p Sector?

Don't work with dubious cryptocurrency exchange platforms. Choosing a reliable platform is one of the main conditions for preserving funds in the long term. You don't need to use strange sites without reviews and visible traffic or voluntarily transfer your money to "respected" forum members. Try to limit trading to several exchanges that inspire confidence.

Use a cold wallet. Make sure to use a wallet that is isolated from the internet to store your funds. You can simply write down your passphrase on paper and keep it in a safe place, or you can simply use a physical wallet like the Ledger Nano S Plu, Trezor Model One, or SafePal S1.

Trade with trusted sellers and buyers. Start trading small volumes and find people you can trust, and then gradually increase the number and size of transactions. Remember how cryptocurrency exchangers work in the P2P sphere: everyone is equal to each other, and therefore you need to look for business partners, and not hope that the arbitrator will intervene in the outcome of the transaction if one of the parties violates the terms of the transaction.

With unfamiliar traders, use irreversible payment methods when selling and reversible when buying. For example, sell for Western Union transfers, and buy only through payment systems like PayPal, where you can dispute the transfer. This is another measure of protection against unscrupulous traders who may try to deceive you after the transaction is completed.

Why P2P Cryptocurrency Exchange Is the Future of Fintech

Centralized exchanges offer their clients huge opportunities to create a source of passive income or speculate on the prices of digital assets. For example, the modern Binance trading bot can independently work on advanced strategies such as DCA or triangular arbitrage. You can instantly trade derivatives and create short positions on the downside using a margin account.

The problem lies in two shortcomings of the industry itself:

Lack of control over assets by the user: Centralized exchanges take clients' funds under management, but refuse to comply with the requirements of regulators, which creates an obvious problem: exchanges position themselves as advocates of decentralization, but are uncontrolled centralized institutions.

The speculative nature of trading and lack of transparency in a centralized market leads to synthetic pricing due to biased market makers. P2P platforms provide a fair, self-regulating space for trading.

If the dreams of crypto enthusiasts are destined to come true and cryptocurrencies become an alternative to fiat money, then P2P will become the safest and most transparent way to convert currencies.

0 notes

Text

How Crypto Exchange Development Services Are Transforming Digital Trading

In the ever-evolving digital economy, cryptocurrency trading has emerged as a revolutionary force, redefining the way assets are exchanged, stored, and valued. Central to this transformation is the rise of crypto exchange development services — specialized solutions designed to build secure, scalable, and feature-rich trading platforms. These services have not only enabled the growth of thousands of new exchanges worldwide but have also significantly enhanced the security, efficiency, and accessibility of digital trading.

This blog explores how crypto exchange development services are transforming the digital trading landscape and what it means for entrepreneurs, investors, and the global financial ecosystem.

The Foundation: What Are Crypto Exchange Development Services?

Crypto exchange development services refer to the end-to-end process of building digital platforms that facilitate the trading of cryptocurrencies like Bitcoin, Ethereum, and other tokens. These services typically include:

Custom exchange platform development (CEX/DEX/hybrid)

Integration of crypto wallets and payment gateways

Smart contract development and auditing

Liquidity management and order book systems

Security infrastructure (2FA, KYC, AML, encryption)

Admin dashboards and user interface design

Ongoing maintenance and upgrades

With these services, entrepreneurs and businesses can launch exchanges tailored to their target markets and business models without starting from scratch.

Enabling Decentralization and Financial Inclusion

One of the most profound impacts of crypto exchange development services is the democratization of financial access. In traditional finance, intermediaries like banks, brokers, and clearinghouses control access to markets. Crypto exchanges — especially decentralized ones (DEXs) — remove these middlemen, giving users direct control over their assets.

This decentralized architecture allows:

Unbanked populations to engage in digital finance using only internet-connected devices.

Lower fees and faster transactions by eliminating institutional overhead.

Peer-to-peer (P2P) trading models that foster trustless exchanges.

In this way, crypto exchange development is not just a technological advancement but a movement toward global financial inclusivity.

Customization and Innovation at Scale

Today’s trading environment demands tailored experiences. From institutional investors to casual traders, users seek platforms that meet their specific needs — whether it's low latency, mobile-first trading, NFT integrations, or staking features.

Crypto exchange developers respond to this need by offering highly customizable platforms. This includes:

White-label crypto exchange software for faster deployment

Cross-platform compatibility (web, Android, iOS)

Multi-currency and multi-language support

Advanced trading tools like AI-powered bots, charting libraries, and real-time analytics

DeFi integrations such as yield farming, lending, and liquidity pools

This scalability and adaptability are accelerating the spread of digital trading across industries and geographies.

Security as a Cornerstone

Security concerns have long plagued the crypto space. Hacks, scams, and data breaches have cost billions in losses. As a result, security has become a core component of modern crypto exchange development services.

Top-tier developers implement a multi-layered security strategy, including:

End-to-end encryption

Multi-signature wallets

Cold wallet storage for user funds

KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance tools

DDoS protection and regular penetration testing

Smart contract auditing to eliminate vulnerabilities

By embedding robust security from the start, developers foster trust and regulatory compliance — both essential for mainstream adoption.

Driving Liquidity and Market Depth

A thriving exchange needs liquidity — the ability to buy or sell assets without causing major price swings. Without liquidity, even the most well-designed platform can falter.

Crypto exchange development services often incorporate liquidity aggregation tools and market-making bots that automatically balance order books and attract volume. Some developers offer partnerships or integrations with global liquidity providers to help new exchanges hit the ground running.

Increased liquidity leads to:

Tighter spreads and more accurate pricing

Higher user retention and trading volume

Improved scalability and profitability for platform owners

Thus, liquidity management is not just a technical issue — it’s a critical success factor.

Regulatory Alignment and Compliance Support

As governments and financial authorities increase scrutiny on crypto operations, compliance has become non-negotiable. Crypto exchange development services now embed tools and workflows to help businesses stay ahead of regulatory requirements.

This includes:

Automated KYC/AML integrations

Geo-restriction systems for regulatory segmentation

Tax reporting and transaction auditing modules

Support for GDPR and data privacy protocols

By building compliance into the DNA of the exchange, developers help reduce legal risks and make exchanges more attractive to institutional players and regulators alike.

Speeding Up Time-to-Market

In the fast-moving world of crypto, time is money. A project that takes 12 months to launch may miss the market window entirely. To address this, many developers offer white-label crypto exchange solutions — pre-built platforms that can be customized, branded, and launched in a fraction of the time.

Benefits of white-label solutions include:

Faster deployment (as little as a few weeks)

Reduced development costs

Battle-tested performance and security

Ongoing technical support and upgrades

This has dramatically lowered the barrier to entry for startups, allowing more players to enter and compete in the digital trading arena.

Paving the Way for the Future of Finance

As blockchain and Web3 evolve, crypto exchange development services are integrating new trends and technologies:

AI and machine learning for predictive analytics and automated trading

Tokenization of real-world assets (stocks, real estate, art)

NFT trading platforms and marketplaces

Cross-chain bridges for asset interoperability

Modular architectures for DAO-based governance

These advancements are helping shape the next generation of financial infrastructure — open, programmable, and community-driven.

Final Thoughts

Crypto exchange development services are not merely about building trading platforms — they are about redefining how the world interacts with value. From empowering the unbanked to enabling new business models and promoting financial sovereignty, these services are at the heart of the blockchain revolution.

As crypto adoption continues to grow, the demand for sophisticated, secure, and scalable exchange platforms will only increase. Businesses and entrepreneurs looking to stake their claim in the digital economy would do well to understand the transformative potential of these services — and partner with the right development team to bring their vision to life.

In a digital age where control, access, and innovation matter more than ever, crypto exchange development services are building the bridges to the future of trading.

1 note

·

View note

Text

How to Build a Crypto Exchange Through White-Label Solutions for 2025

Building a cryptocurrency exchange can be a complex and time-consuming process, requiring expertise in blockchain, security, and compliance. However, white-label solutions have emerged as a game-changing option for businesses looking to enter the crypto market quickly and efficiently. By using pre-built, customizable platforms, businesses can launch a fully functional crypto exchange without developing everything from scratch.

This blog explores how to build a crypto exchange using white-label solutions for 2025, the benefits of this approach, and the critical role of Crypto Exchange Platform Development in ensuring a secure, scalable, and user-friendly platform.

What Are White-Label Solutions in Crypto Exchange Development?

A white-label solution is a pre-built software product developed by a third-party provider that businesses can customize and brand as their own. In the context of crypto exchanges, white-label solutions provide a ready-to-deploy platform with essential features like trading pairs, wallet integration, and security measures. Businesses can personalize the platform to match their branding and requirements, significantly reducing development time and costs.

Why Choose a White-Label Crypto Exchange Solution?

Using a white-label solution for your crypto exchange offers several advantages:

Quick Launch: White-label platforms eliminate the need for extensive development, enabling businesses to launch their exchange in weeks rather than months.

Cost Efficiency: Developing a crypto exchange from scratch is costly. A white-label solution offers a more affordable alternative without compromising on essential features.

Customizability: Businesses can tailor the platform to include unique features, user interfaces, and branding, ensuring it aligns with their target audience.

Proven Technology: White-label solutions are built on established frameworks that have been tested for performance, scalability, and security.

Focus on Business Growth: With the technical infrastructure handled by the provider, businesses can focus on marketing, user acquisition, and expanding their services.

Steps to Build a Crypto Exchange with White-Label Solutions

1. Define Your Business Goals

Before starting, identify the key objectives for your crypto exchange. Consider:

Target audience (retail traders, institutional investors, etc.).

Supported cryptocurrencies and trading pairs.

Revenue streams (transaction fees, listing fees, etc.).

Regulatory compliance in your operating regions.

2. Choose a White-Label Solution Provider

Select a provider with expertise in Crypto Exchange Platform Development. Look for features such as:

A robust trading engine.

Secure wallet integration.

Multi-currency support.

High scalability and uptime.

Customization options for branding and features.

3. Customize the Platform

Work with the provider to customize the platform according to your branding and functionality needs. Personalize elements such as:

User interface and experience (UI/UX).

Trading options (spot trading, futures, staking, etc.).

Payment gateway integration for deposits and withdrawals.

Mobile app support for iOS and Android.

4. Integrate Advanced Features

Enhance your exchange with advanced features to attract and retain users:

Liquidity Integration: Ensure seamless trading by connecting to liquidity providers.

KYC and AML Compliance: Integrate user verification processes to meet regulatory requirements.

Security Features: Include two-factor authentication (2FA), encryption, and cold wallet storage.

Real-Time Analytics: Offer users data on trading volume, market trends, and portfolio performance.

5. Test the Platform

Conduct rigorous testing to identify and resolve any technical or security issues before launch. Key testing areas include:

Load testing for high user traffic.

Security audits to detect vulnerabilities.

Trading engine performance under real-time conditions.

6. Launch and Market the Platform

Once testing is complete, launch the platform with a strong marketing strategy to attract users. Focus on:

Promotions and referral programs.

Community engagement through social media and forums.

Educational content for new traders.

7. Provide Ongoing Support and Upgrades

After launching, ensure consistent platform performance by offering:

24/7 customer support.

Regular updates to enhance features and security.

Continuous compliance with evolving regulations.

Key Features of a White-Label Crypto Exchange

A high-quality white-label crypto exchange should include the following features:

Trading Engine: Handles order matching, processing, and execution efficiently.

Multi-Currency Wallet: Supports secure storage and transactions for various cryptocurrencies.

User-Friendly Interface: Simplifies the trading process for beginners and advanced traders.

KYC/AML Integration: Ensures compliance with global regulatory standards.

Liquidity Options: Provides seamless trading experiences by connecting to liquidity pools.

Mobile App Compatibility: Offers trading on-the-go for mobile users.

Security Measures: Includes encryption, DDoS protection, and multi-factor authentication.

Benefits of Using White-Label Solutions for 2025

With cryptocurrency adoption rising, white-label solutions are poised to be a preferred choice for crypto exchange development in 2025. Here’s why:

Regulatory Adaptability: White-label providers incorporate compliance features to help businesses navigate evolving regulations.

Scalability: Advanced platforms can handle increasing user volumes as the crypto market grows.

DeFi Integration: White-label solutions now offer decentralized finance (DeFi) features like staking and yield farming to attract modern users.

Enhanced Security: Providers use the latest security protocols to address emerging threats.

AI-Powered Insights: Integrated analytics provide traders with AI-driven market predictions and insights.

Why Work with a Crypto Exchange Platform Development Company?

Collaborating with a professional Crypto Exchange Platform Development company ensures:

Custom Solutions: Tailored to your business needs and market goals.

Technical Expertise: From blockchain integration to trading engine optimization.

Ongoing Support: Post-launch maintenance and upgrades for smooth operations.

Regulatory Compliance: Guidance on meeting global KYC/AML standards.

Faster Time-to-Market: Quick deployment without compromising quality.

Conclusion

Building a crypto exchange through white-label solutions is a smart, cost-effective way to enter the growing cryptocurrency market. With features like customizable interfaces, robust security, and scalable infrastructure, white-label platforms simplify the development process while providing a competitive edge.

By partnering with a trusted Crypto Exchange Platform Development company, you can ensure your platform is tailored to your goals, compliant with regulations, and equipped with cutting-edge features. As the demand for cryptocurrency trading continues to rise, leveraging white-label solutions positions your business for success in 2025 and beyond.

#White Label Crypto Exchange Development#crypto exchange platform development company#crypto exchange development company#crypto exchange platform development#Centralized Crypto Exchange Development Company#Cryptocurrency exchange development service#P2P Cryptocurrency Exchange Development Company#dex exchange development company

0 notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

High-Speed Crypto Exchange Solutions for Real-Time Trading.

In an age where instant transactions and decentralized finance dominate the digital economy, the need for crypto exchange solutions that enable instant trading has surged dramatically. Whether you're a budding entrepreneur, a fintech startup, or an established trading platform, integrating a high-speed, secure crypto exchange can set your brand apart. Partnering with a leading Cryptocurrency Exchange Development Company is the first step toward achieving this transformation.

A well-developed crypto exchange offers the core values of speed, transparency, and border less accessibility—key components required to thrive in today's ultra-fast financial world.

Business Advantages of Embracing Crypto

Immediate Transfers: Crypto eliminates the delays associated with traditional banking. Users can make instant payments and complete transfers within seconds. With a robust platform, you can leverage blockchain to minimize latency and enhance transaction efficiency.

Global Reach & Accessibility: Cryptocurrencies operate beyond geographical limitations, making it easy for businesses to tap into a worldwide audience. This opens new revenue streams while simplifying cross-border transactions—something a skilled Crypto Exchange platform can expertly implement.

Cost-Efficiency: No intermediaries mean drastically reduced transaction fees. This allows businesses to cut costs and offer better pricing to their customers. A reliable Crypto ensures optimized transaction processing for maximum savings.

Improved Security: Blockchain infrastructure ensures each transaction is encrypted and immutable. This reduces the risk of fraud, as decentralized systems prevent single points of failure. Collaborating with a Cryptocurrency Exchange enables the integration of industry-standard security protocols.

Transparency & Immutability: Every transaction is recorded on a tamper-proof blockchain ledger. This offers traceability and trust for users, critical for building long-term loyalty and compliance confidence.

Use Cases of Leveraging Crypto for Your Business

Peer-to-Peer (P2P) Exchanges: Create decentralized P2P exchanges to allow direct trading between users without third-party control. It increases privacy and promotes a community-driven ecosystem.

Merchant Payment Gateways: Integrate crypto payment solutions to accept cryptocurrencies like Bitcoin, Ethereum, or USDT for your goods and services. This is perfect for e-commerce, and many Cryptocurrency Exchange Development Solution offer customizable gateways to suit your platform.

DeFi and Staking Platforms: Engage users by offering staking, lending, and borrowing services via a decentralized finance (DeFi) layer. These additional features help users earn passive income while remaining loyal to your platform—an area in which the right can be a game-changer.

Wrapping Up:

Whether your goal is to revolutionize fintech or simply add crypto support to your business, the support of an experienced Cryptocurrency Exchange Development Company is vital. They bring the tech, compliance, and innovation needed to build an instant crypto exchange platform that’s secure, scalable, and user-friendly.

0 notes

Text

We build P2P cryptocurrency exchange platforms with highly secured. Are you looking for a P2P crypto exchange software development company to launch your P2P crypto exchange platform. Now! you need to choose the right one for your business. Do research about many P2P exchange development companies’ previous projects and their customer support.

#create crypto exchange#p2p crypto exchange#p2p crypto exchange development#p2p crypto exchange development services

0 notes