#P2p Exchange Application Development

Explore tagged Tumblr posts

Text

Unlocking the Future of Digital Trading: P2P Exchange Solutions by Nadcab Labs

Discover innovative P2P Exchange Solutions by Nadcab Labs, designed to revolutionize the way digital trading is done. Our advanced technology offers secure, efficient, and scalable peer-to-peer exchange platforms tailored to your needs. For more information, reach out to us at [email protected] or call +91-9870635001. Unlock the future of digital trading with Nadcab Labs today!"

#P2P Exchange#P2P Crypto Exchange Development Company#P2P Exchange Development#P2P Cryptocurrency Exchange Development#P2P Cryptocurrency Exchange Software Solutions#Crypto P2p Exchange Application Development#P2P Cryptocurrency Exchange Software#P2P Exchange Development Company#P2P Cryptocurrency Exchange Development Solutions#P2p Crypto Exchange Development#P2P Cryptocurrency Exchange Development Company#P2P Crypto Exchange Development Services#P2P Cryptocurrency Exchange Development Services#P2P Exchange Development Services#P2P Exchange Solutions#P2P Cryptocurrency Exchange#P2p Exchange Application Development

1 note

·

View note

Text

What is a Decentralized Crypto Exchange? The DEX Exchange Guide

A decentralized crypto exchange, also called a DEX, is a peer-to-peer (P2P) marketplace. It allows traders to buy and sell cryptocurrencies directly without relying on third parties. DEXs replace intermediaries such as banks, brokers, or payment services with self-executing smart contracts .

Decentralized Crypto Exchange: Introduction

Decentralized crypto exchanges were developed as an alternative to centralized crypto exchanges, offering direct peer-to-peer cryptocurrency trading and access to the growing decentralized exchange development finance space. Instead of a centralized operation, such as Coinbase, tasked with facilitating transactions, DEXs rely on smart contracts, programs that execute pre-programmed outcomes when certain requirements are met.

This is called non-custodial because DEX users have complete control over their cryptocurrency assets and their private keys , rather than handing custody over to a central organization.

CEX and DEX: The Main Differences

Development and Management – A centralized crypto exchange is developed traditionally using programming languages like Java or Python, similar to other applications like Twitter or Uber. Developers are responsible for maintenance, transaction processing, custody of funds, and much more.

A decentralized crypto exchange, on the other hand, is built on a blockchain network and is governed by hard-coded rules called smart contracts. A smart contract consists of code that contains specific requirements that trigger pre-programmed actions when they are met. These smart contracts are open source, meaning anyone can view their code and suggest improvements.

Involvement of fiat currencies – Decentralized cryptocurrency exchanges only allow the exchange of cryptocurrencies with each other; fiat currencies (US dollars, euros, etc.) are not involved. Centralized exchanges, on the other hand, offer services for purchasing cryptocurrencies with fiat currencies via bank transfer.

Included cryptocurrencies – Similar to traditional exchanges, centralized crypto exchanges typically include all major cryptocurrencies, while decentralized exchanges are usually specific to a blockchain ecosystem on which they are built.

Anonymity – Since fiat currencies (e.g. US dollars or euros) are involved, central crypto exchanges require KYC (Know-Your-Customer), the provision of personal information such as name, email address, telephone number and possibly a scan of a government-issued photo ID.

Transaction fees – The type and amount of cryptocurrency transaction fees vary between CEXs and DEXs. Centralized crypto exchanges typically charge a percentage service fee for each transaction, which usually varies based on trading volume to encourage larger transactions with higher monetary value.

Decentralized crypto exchanges, on the other hand, use the network fees of the blockchain network on which they are built. Network fees, as such, depend largely on network congestion and the size of the transfer. Transfers require more computing power and are more expensive to process. These fees are distributed among the network participants, or nodes, for verifying the transaction.

How does a decentralized crypto exchange work?

A DEX is a type of decentralized application and is governed by smart contracts. Smart contracts, in this context, represent a pool of assets. When users want to trade or exchange assets, they interact with a smart contract. This contract handles the locking and unblocking during a trade. A smart contract is a self-executing program and replaces the intermediaries typically responsible for facilitating transactions between two currencies.

How do Decentralized Cryptocurrency Exchanges Work?

Independent directories like CoinMarketCap list all decentralized crypto exchanges along with the cryptocurrencies they support. Users can browse the site and select a platform that best suits their needs based on their assets.

Access to decentralized crypto exchanges is via a decentralized crypto wallet, which allows users to send cryptocurrencies to the crypto exchange. On a DEX page, users can connect supported wallets, which they can top up beforehand via a centralized crypto exchange if necessary.

When users enter an amount to convert, they receive a breakdown of the transfer, including the associated transaction fee and the expected amount the beneficiary will receive.

Is The Future of Crypto Exchanges Decentralized?

Although a relatively new trend, decentralized crypto exchanges have recently gained significant traction. For example, DEX trading volume on the Ethereum network has grown from just $3 billion in 2019 to a staggering $620 billion in 2021. At the beginning of 2019, DEX transactions accounted for just 0.11% of global trading volume, which increased to 6% by August 2022.

Despite certain drawbacks, decentralized exchanges offer great value to the end user while remaining true to the core philosophy of blockchain: complete decentralization. Learn more about the latest trends here: Exchange Trends 2025.

A decentralized crypto exchange, also called a DEX, is a peer-to-peer (P2P) marketplace. It allows traders to buy and sell cryptocurrencies directly without relying on third parties. DEXs replace intermediaries such as banks, brokers, or payment services with self-executing smart contracts .

Decentralized Crypto Exchange: Introduction

Decentralized crypto exchanges were developed as an alternative to centralized crypto exchanges, offering direct peer-to-peer cryptocurrency trading and access to the growing decentralized finance space . Instead of a centralized operation, such as Coinbase , tasked with facilitating transactions, DEXs rely on smart contracts, programs that execute pre-programmed outcomes when certain requirements are met.

This is called non-custodial because DEX users have complete control over their cryptocurrency assets and their private keys , rather than handing custody over to a central organization.

CEX and DEX: The Main Differences

Development and Management – A centralized crypto exchange is developed traditionally using programming languages like Java or Python, similar to other applications like Twitter or Uber. Developers are responsible for maintenance, transaction processing, custody of funds, and much more.

A decentralized crypto exchange, on the other hand, is built on a blockchain network and is governed by hard-coded rules called smart contracts. A smart contract consists of code that contains specific requirements that trigger pre-programmed actions when they are met. These smart contracts are open source, meaning anyone can view their code and suggest improvements.

Involvement of fiat currencies – Decentralized cryptocurrency exchanges only allow the exchange of cryptocurrencies with each other; fiat currencies (US dollars, euros, etc.) are not involved. Centralized exchanges, on the other hand, offer services for purchasing cryptocurrencies with fiat currencies via bank transfer.

Included cryptocurrencies – Similar to traditional exchanges, centralized crypto exchanges typically include all major cryptocurrencies, while decentralized exchanges are usually specific to a blockchain ecosystem on which they are built.

Anonymity – Since fiat currencies (e.g. US dollars or euros) are involved, central crypto exchanges require KYC (Know-Your-Customer), the provision of personal information such as name, email address, telephone number and possibly a scan of a government-issued photo ID.

Transaction fees – The type and amount of cryptocurrency transaction fees vary between CEXs and DEXs. Centralized crypto exchanges typically charge a percentage service fee for each transaction, which usually varies based on trading volume to encourage larger transactions with higher monetary value.

Decentralized crypto exchanges, on the other hand, use the network fees of the blockchain network on which they are built. Network fees, as such, depend largely on network congestion and the size of the transfer. Transfers require more computing power and are more expensive to process. These fees are distributed among the network participants, or nodes, for verifying the transaction.

How does a Decentralized Crypto Exchange Work?

A DEX is a type of decentralized application and is governed by smart contracts. Smart contracts, in this context, represent a pool of assets. When users want to trade or exchange assets, they interact with a smart contract. This contract handles the locking and unblocking during a trade. A smart contract is a self-executing program and replaces the intermediaries typically responsible for facilitating transactions between two currencies.

How do Decentralized Cryptocurrency Exchanges Work?

Independent directories like CoinMarketCap list all decentralized crypto exchanges along with the cryptocurrencies they support. Users can browse the site and select a platform that best suits their needs based on their assets.

Access to decentralized crypto exchanges is via a decentralized crypto wallet, which allows users to send cryptocurrencies to the crypto exchange. On a DEX page, users can connect supported wallets, which they can top up beforehand via a centralized crypto exchange if necessary.

When users enter an amount to convert, they receive a breakdown of the transfer, including the associated transaction fee and the expected amount the beneficiary will receive.

Is The Future of Crypto Exchanges Decentralized?

Although a relatively new trend, decentralized crypto exchange development company have recently gained significant traction. For example, DEX trading volume on the Ethereum network has grown from just $3 billion in 2019 to a staggering $620 billion in 2021. At the beginning of 2019, DEX transactions accounted for just 0.11% of global trading volume, which increased to 6% by August 2022.

Despite certain drawbacks, decentralized exchanges offer great value to the end user while remaining true to the core philosophy of blockchain: complete decentralization. Learn more about the latest trends here: Exchange Trends 2025.

0 notes

Text

How Smart Contracts Are Changing Cryptocurrency Development

Cryptocurrency development has come a long way since Bitcoin’s inception in 2009. While Bitcoin introduced the concept of decentralized digital money, it was the advent of smart contracts that revolutionized how blockchain technology is used today. Smart contracts enable the creation of decentralized applications (dApps), automate financial transactions, and power entire ecosystems like decentralized finance (DeFi) and non-fungible tokens (NFTs).

In this blog, we’ll explore how smart contracts are reshaping cryptocurrency development, their advantages, use cases, and what the future holds for this transformative technology.

What Are Smart Contracts?

Smart contracts are self-executing agreements stored on a blockchain, where the terms are directly written into code. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts automate transactions based on predefined conditions.

For example, in a decentralized exchange (DEX), a smart contract can facilitate a trade between two parties without requiring a middleman. The transaction only executes when both parties meet their agreed-upon conditions.

Key Features of Smart Contracts:

Automation: Transactions execute automatically when conditions are met.

Transparency: The code is visible on the blockchain, ensuring trust.

Security: Data stored on the blockchain is immutable and tamper-proof.

Efficiency: Removes the need for manual verification, reducing time and costs.

How Smart Contracts Are Transforming Cryptocurrency Development

1. Enabling Decentralized Finance (DeFi)

Smart contracts have fueled the growth of DeFi, an ecosystem that eliminates traditional financial intermediaries. Developers are using smart contracts to build:

Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap allow users to trade crypto assets directly.

Lending & Borrowing Protocols: Platforms like Aave and Compound let users lend or borrow crypto without a bank.

Yield Farming & Staking: Users can earn rewards by locking their assets in smart contract-based pools.

DeFi applications use smart contracts to automate transactions, ensuring trust and efficiency while reducing costs associated with traditional banking.

2. Powering Token Development and ICOs

Smart contracts have revolutionized token development by enabling the creation of custom cryptocurrencies. Using standards like ERC-20 (Ethereum) or BEP-20 (Binance Smart Chain), developers can launch tokens with predefined rules such as supply, transfer conditions, and burn mechanisms.

Additionally, smart contracts have made Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) more transparent and automated. Investors can send funds to a smart contract that automatically distributes tokens, reducing fraud and ensuring fairness.

3. Enforcing Security and Trust in Transactions

One of the biggest challenges in the cryptocurrency development is trust. Smart contracts solve this by enforcing rules programmatically. Unlike traditional financial agreements that require trust in a third party, smart contracts ensure that no transaction occurs unless all predefined conditions are met.

For example, in a peer-to-peer (P2P) marketplace, a smart contract can act as an escrow service, holding funds until both parties fulfill their obligations. This eliminates fraud and disputes.

4. Automating NFT Marketplaces

Smart contracts have fueled the rise of NFTs (non-fungible tokens), which represent ownership of digital or real-world assets like art, music, and real estate.

NFT marketplaces like OpenSea and Rarible rely on smart contracts to:

Mint NFTs with unique attributes.

Automate royalty payments for artists every time an NFT is resold.

Securely transfer ownership without intermediaries.

Without smart contracts, NFT transactions would require trust in centralized platforms, increasing risks of fraud and manipulation.

5. Streamlining Cross-Border Payments

Traditional cross-border transactions involve multiple intermediaries, resulting in high fees and long processing times. Smart contracts eliminate these inefficiencies by enabling:

Instant Settlements: Transactions settle within minutes rather than days.

Lower Costs: No need for banks, reducing transaction fees.

Transparency: Every transaction is recorded on a blockchain, preventing disputes.

Cryptocurrencies like XRP (Ripple) and Stellar (XLM) leverage smart contracts to provide efficient payment solutions for global remittances.

6. Enabling Decentralized Autonomous Organizations (DAOs)

Smart contracts are also driving the emergence of DAOs (Decentralized Autonomous Organizations)—communities governed by code instead of traditional management.

DAOs use smart contracts to automate decision-making and voting processes.

Members vote on proposals, and the smart contract executes actions based on the majority decision.

This creates transparent, democratic governance without centralized control.

Notable DAOs like MakerDAO and Aragon use smart contracts to manage decentralized governance efficiently.

Challenges of Smart Contract-Based Cryptocurrency Development

Despite their benefits, smart contracts come with challenges:

1. Coding Vulnerabilities

Poorly written smart contracts can have bugs or security loopholes. The DAO hack (2016) resulted in a $60 million loss due to a vulnerability in the contract’s code. Developers must rigorously audit their contracts to prevent exploits.

2. Scalability Issues

Smart contracts, especially on Ethereum, face high gas fees and slow transaction speeds during network congestion. Solutions like Layer 2 scaling (Optimistic Rollups, zk-Rollups) and alternative blockchains (Solana, Polygon) help mitigate this issue.

3. Regulatory Uncertainty

Smart contract-based applications operate in a gray legal area. Governments worldwide are still figuring out how to regulate DeFi, DAOs, and crypto tokens. Developers must ensure compliance to avoid legal risks.

4. Limited Flexibility

Once deployed, smart contracts are immutable, meaning bugs cannot be fixed easily. This makes rigorous testing crucial before deployment. Some projects use upgradeable contracts, but these come with their own security trade-offs.

The Future of Smart Contracts in Cryptocurrency Development

Smart contracts continue to evolve, and their future looks promising with several advancements:

1. AI-Powered Smart Contracts

AI integration could make smart contracts more dynamic, allowing them to analyze real-world data and adjust conditions autonomously.

2. Cross-Chain Compatibility

Current smart contracts are limited to individual blockchains. Technologies like Polkadot, Cosmos, and Chainlink’s CCIP enable interoperability between different blockchains, making smart contracts more versatile.

3. Zero-Knowledge Proofs (ZKPs) for Privacy

Smart contracts currently operate transparently, but ZKPs can enable private transactions, making DeFi and crypto payments more confidential.

4. Enhanced Security Measures

As smart contract adoption grows, more formal verification and AI-based auditing tools will emerge, making smart contracts even more secure.

Conclusion

Smart contracts have fundamentally changed cryptocurrency development by enabling automation, decentralization, and trustless transactions. From DeFi and NFT marketplaces to DAOs and cross-border payments, smart contracts are shaping the next era of blockchain applications.

Despite some challenges, innovations in scalability, AI integration, and cross-chain solutions are paving the way for smarter, more secure blockchain ecosystems. As cryptocurrency adoption continues to rise, smart contracts will remain at the heart of innovation, driving the industry towards a more efficient and decentralized future.

0 notes

Text

What Is Fintech Software and How Is It Transforming Financial Services?

In today's rapidly evolving financial landscape, technology plays a crucial role in reshaping how businesses and consumers manage financial transactions and services. Fintech software, a fusion of financial services and technology, is at the forefront of this transformation. It encompasses a wide range of applications and platforms designed to automate, improve, and innovate various aspects of the financial industry. This article delves into what fintech software is and how it is revolutionizing financial services.

Understanding Fintech Software

Fintech software refers to specialized technology solutions developed to streamline, automate, and enhance financial services. These software solutions include digital payment platforms, mobile banking apps, investment management tools, peer-to-peer lending platforms, and regulatory compliance systems. Software fintech solutions are designed to increase efficiency, reduce operational costs, and provide better customer experiences.

Fintech software is used by a variety of entities, including traditional banks, insurance companies, startups, and non-financial businesses looking to integrate financial services into their offerings. These solutions leverage cutting-edge technologies such as artificial intelligence (AI), blockchain, big data, and cloud computing to address complex financial challenges and meet evolving consumer demands.

Key Ways Fintech Software Is Transforming Financial Services

Digital Payments and Mobile Banking Fintech software has revolutionized how consumers conduct financial transactions. Mobile banking apps and digital wallets have made it easier for users to make payments, transfer funds, and manage accounts on the go. Contactless payments, QR code scanning, and peer-to-peer (P2P) transfer apps have become standard, reducing reliance on cash and physical banking infrastructure. Companies like Xettle Technologies are innovating in this domain by offering secure and user-friendly digital payment solutions that simplify transactions for individuals and businesses.

Enhanced Security with Blockchain Technology Blockchain technology, integrated into many fintech software solutions, ensures secure and transparent financial transactions. Decentralized ledgers and smart contracts reduce the need for intermediaries and minimize fraud. This technology is widely used in cryptocurrency exchanges, cross-border payments, and digital identity verification, providing a new level of trust and accountability in financial services.

Artificial Intelligence and Data Analytics AI-powered fintech software enables financial institutions to analyze vast amounts of data for better decision-making. Predictive analytics, risk assessment, and personalized financial advice are now more accurate and efficient. AI chatbots and virtual assistants enhance customer service by providing instant responses and solutions, while machine learning algorithms detect fraudulent activities in real-time.

Automated Investment and Wealth Management Robo-advisors, powered by fintech software, offer automated investment services by using algorithms to manage portfolios based on user preferences and market trends. These platforms have democratized access to wealth management by providing affordable investment solutions to a broader audience. This automation reduces costs and offers more tailored financial planning services.

Regulatory Technology (RegTech) Compliance with financial regulations is a significant challenge for institutions. Fintech software companies are developing RegTech solutions to automate compliance processes, monitor transactions for regulatory breaches, and generate accurate reports. This minimizes the risk of penalties and streamlines adherence to complex legal frameworks.

Peer-to-Peer Lending and Crowdfunding Platforms Fintech software has transformed traditional lending models through P2P lending and crowdfunding platforms. These solutions connect borrowers directly with lenders or investors, bypassing traditional banks. This has expanded access to funding for small businesses and startups, fostering innovation and economic growth.

Open Banking and API Integration Open banking, enabled by fintech software, allows third-party developers to access financial data securely (with user consent) through APIs. This fosters innovation by enabling the creation of personalized financial products and services. Consumers benefit from more competitive and customized offerings, enhancing their financial management options.

Embedded Finance Solutions Embedded finance integrates financial services into non-financial platforms, providing seamless access to services like payments, loans, and insurance. For instance, e-commerce platforms offering buy-now-pay-later (BNPL) options or ride-hailing apps providing in-app wallets exemplify this trend. Software fintech solutions make it possible for businesses across industries to embed these services without needing to become financial institutions themselves.

Cloud Computing for Scalability and Flexibility Cloud computing underpins many fintech software platforms, offering scalability, flexibility, and cost-efficiency. Cloud-based solutions allow fintech companies to deploy applications rapidly, manage data securely, and integrate new technologies easily. This accelerates innovation and enhances service delivery in financial services.

Financial Inclusion and Accessibility Fintech software has played a pivotal role in promoting financial inclusion by providing underserved populations with access to banking and financial services. Mobile banking, microloans, and digital wallets have empowered individuals in remote areas to participate in the global economy, fostering economic development.

Conclusion

Fintech software is fundamentally transforming the financial services industry by introducing innovative solutions that enhance efficiency, security, and customer experience. From digital payments and AI-driven analytics to blockchain security and open banking, software fintech innovations are reshaping how financial services are delivered and consumed. Companies like Xettle Technologies exemplify the ongoing advancements in this space, developing cutting-edge solutions that address modern financial challenges. As fintech software continues to evolve, it promises to further democratize financial services and drive growth across the global financial ecosystem.

1 note

·

View note

Text

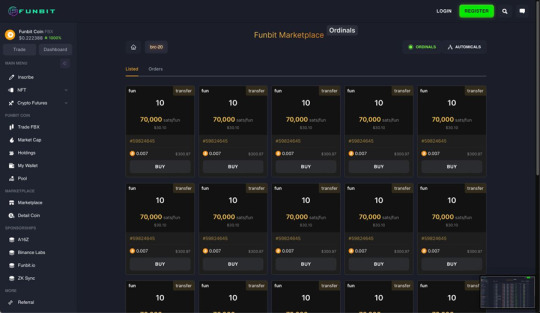

Funbit exchange: advanced trading tools for smart investors

In the ever-evolving world of cryptocurrency trading, finding a platform that combines innovation, security, and usability is crucial for smart investors. Funbit Exchange has quickly emerged as a standout choice, offering a comprehensive suite of tools and features designed to meet the demands of both novice and professional traders. Whether you are navigating the dynamic P2P marketplace, exploring Spot trading opportunities, or participating in promising Launchpad projects, Funbit Exchange provides the resources and support to help you succeed in the fast-paced world of digital assets.

With its commitment to empowering users through cutting-edge technology and robust security measures, Funbit Exchange is setting a new standard for cryptocurrency trading platforms. Here’s why it’s the platform of choice for savvy investors worldwide.

Join Funbit now

About project . Full name: Funbit Exchange . Website: https://www.funbit.network/ . Category: spot exchange, P2P exchange, future exchange, launchpad, IEO . Deposit/withdraw: support multi chains, multi cryptos . Partners: CMC, CGK, Ave, Poocoin, Bscscan, yahoo, naqdaq, bloombegs, cointelegraph, binance, mexc, bitget, gateio . Social links:

Introduction & Hightlight Features

Groundbreaking: Pioneer Web3 Marketplace on Bitcoin Ordinals platform.

Transformative: Redefining NFT trading norms from platforms like OpenSea, Blur, and Magic Eden.

Empowering: Providing decentralized, secure, and transparent NFT trading experiences.

Innovative: Setting new standards for efficiency, security, and user control in digital asset transactions.

Community-driven: Fostering collaboration and partnerships to enhance the blockchain ecosystem.

Hightlight features

Pioneer Integration: First-ever Web3 Marketplace seamlessly integrated into the Bitcoin Ordinals platform.

NFT Trading Revolution: Disrupting traditional NFT trading platforms such as OpenSea, Blur, and Magic Eden.

Enhanced Security: Providing decentralized and secure NFT transactions with advanced verification mechanisms.

Innovative Functionality: Offering cutting-edge features for NFT transactions and ownership management, bolstered by the innovative solutions and technologies developed within the Funbit ecosystem.

Ensuring transparency and trust through blockchain-based transactions, with the added assurance of support from Funbit Exchange and Funbit Launchpad for BRC20 & RUNE token/NFT projects.

Scalability: Designed to accommodate future growth and expansion of the marketplace.

Sign up now

Comprehensive Ecosystem

Funbit Exchange provides a complete ecosystem designed to cater to diverse trading and investment needs. From marketplace services to decentralized applications (DApps), the platform offers a versatile range of solutions for its users:

Inscribe: Funbit Exchange offers a trusted and low-fee service for BRC20 and RUNE token inscription. This feature is designed to ensure transparency, efficiency, and cost-effectiveness, making it ideal for token creation and management.

Web3 Marketplace: As the first and leading Bitcoin Ordinal Web3 Marketplace, Funbit Exchange provides a seamless platform for buying, selling, and trading digital assets. Its user-friendly design and cutting-edge technology ensure a superior trading experience for all users.

image of Web3 Marketplace

OTC & P2P Trading (DApps): Funbit Exchange stands out as the first OTC and P2P trading solution for Bitcoin Ordinals. This feature allows users to directly trade digital assets without intermediaries, ensuring lower costs, faster transactions, and greater control over their trades.

Exchange (CEX): With a full-featured centralized exchange (CEX), Funbit provides exceptional support for trading BRC20 tokens, RUNE tokens, and NFTs. The platform’s advanced trading tools and intuitive interface make it suitable for both beginner and professional traders.

Launchpad: Funbit Exchange’s Launchpad is a hub for evaluating, classifying, and providing capital support to potential BRC20 and RUNE projects. By backing promising blockchain initiatives, the platform empowers its users to diversify their portfolios and maximize returns.

Register now

Funbit Huge Community

Funbit continuously builds a strong community of traders with hundreds of large and small groups across platforms like Telegram, Discord, Facebook, and more. Join us for vibrant discussions and valuable insights!

Funbit's team is comprised of talented individuals recognized with multiple awards in the blockchain field. With their expertise, they ensure project safety and continuous development in accordance with project goals

Roadmap for Success

Funbit Exchange follows a clear and ambitious roadmap to deliver continuous growth and innovation:

Preparation Phase

Develop a detailed whitepaper and launch the official website.

Build and expand the Funbit community.

Get listed on CoinMarketCap for increased visibility.

Achieve listings on at least three major centralized exchanges (CEX) and launch the platform’s Launchpad.

Establish strong media and press presence to build credibility.

Start Phase

Complete Series 1 funding and secure listings on Onus, Bitget, and MEXC.

Launch the Inscribe service and Marketplace for BRC20 tokens.

Reach a milestone of 10,000 holders.

Run Phase

Introduce the Inscribe service and Marketplace for RUNE tokens.

Launch OTC Web3 trading and Funbit Ordinals.

Open the Funbit Ordinals Launchpad.

Secure additional listings on Gate.io, Bitget, and MEXC.

Acceleration Phase

Partner with key ventures and strengthen ecosystem building.

Secure listings on major exchanges like OKX and KuCoin.

Establish Funbit as the top Bitcoin Ordinals NFT platform.

Win Phase

Expand to listings on Binance and HTX.

Achieve 100,000 active users.

Break into the Top 200 on CoinMarketCap.

Launch the exclusive Funbit Club Card to reward loyal users.

Conclusion

Funbit Exchange is more than just a trading platform; it’s a comprehensive ecosystem that empowers smart investors to thrive in the dynamic world of cryptocurrency. From its cutting-edge tools and innovative features to its robust security and ambitious roadmap, Funbit is setting a new standard in the industry. Whether you’re a beginner looking for a user-friendly experience or a seasoned trader seeking advanced capabilities, Funbit Exchange has you covered. The platform’s commitment to transparency, security, and innovation makes it a trusted partner for traders and investors worldwide. By supporting a wide range of digital assets and offering services like P2P trading, Launchpad projects, and decentralized solutions, Funbit ensures that users have everything they need to succeed. With a vision for continuous growth and expansion, Funbit Exchange is poised to lead the way in the future of crypto trading. Don’t miss the opportunity to be part of this revolutionary journey. Join Funbit Exchange today, and unlock the full potential of your investments. Together, let’s build a smarter, more secure, and prosperous trading future.

#FunbitExchange #CryptoTrading #BlockchainTechnology #P2PTrading

#CryptoLaunchpad #SpotTrading

Start trading smarter with Funbit Exchange now!

0 notes

Text

Fintech Software Development Services

Daffodil Software is known for its expertise in fintech software development, providing innovative solutions tailored to meet the unique needs of financial institutions, startups, and enterprises in the finance sector. Their services encompass a wide range of applications, from payment processing systems to investment platforms. Here’s an overview of the key offerings in fintech software development at Daffodil Software:

Key Fintech Software Development Services at Daffodil Software

1. Custom Fintech Solutions:

- Daffodil develops tailored fintech applications that address specific business requirements, whether for banks, investment firms, insurance companies, or financial service providers.

2. Payment Gateway Integration:

- They offer payment processing solutions, including the integration of secure payment gateways that facilitate online transactions, mobile payments, and e-commerce solutions.

3. Mobile Banking Applications:

- Daffodil creates user-friendly mobile banking apps that allow customers to manage their accounts, transfer funds, pay bills, and perform other banking activities securely from their smartphones.

4. Wealth Management Platforms:

- They develop platforms for wealth management, enabling financial advisors and institutions to manage client portfolios, track investments, and provide personalized financial advice.

5. Peer-to-Peer Lending Solutions:

- Daffodil builds P2P lending platforms that connect borrowers and lenders directly, streamlining the loan application process while ensuring compliance with regulatory requirements.

6. Blockchain Solutions:

- They explore blockchain technology for applications such as cryptocurrency exchanges, smart contracts, and secure transaction processing, enhancing transparency and security in financial transactions.

7. Regulatory Compliance Solutions:

- Daffodil offers expertise in developing solutions that ensure compliance with financial regulations, including KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR (General Data Protection Regulation).

8. Insurance Software Development:

- They create custom insurance solutions, including policy management systems, claims processing applications, and customer portals to enhance the efficiency of insurance operations.

9. Financial Analytics and Reporting:

- Daffodil provides analytics solutions that help financial institutions track key performance indicators (KPIs), generate reports, and gain insights into customer behavior and market trends.

10. Robo-Advisory Platforms:

- They develop robo-advisory solutions that utilize algorithms to provide automated investment advice based on individual risk profiles and investment goals.

11. Fraud Detection and Prevention:

- Daffodil implements advanced machine learning algorithms to build systems that detect fraudulent activities in real-time, protecting financial institutions and their customers.

12. Chatbots and Virtual Assistants:

- They create AI-powered chatbots and virtual assistants that enhance customer service by providing instant responses to inquiries and assisting with transactions.

Benefits of Choosing Daffodil Software for Fintech Development

- Domain Expertise: Daffodil’s team has extensive knowledge of the financial industry, enabling them to understand the unique challenges and regulatory requirements faced by fintech companies.

- Agile Development Methodology: They employ agile practices, allowing for flexibility and iterative development that adapts to changing requirements and client feedback.

- Focus on Security: Daffodil prioritizes security in fintech solutions, implementing robust measures to protect sensitive financial data and ensure compliance with industry standards.

- User-Centric Design: Their emphasis on UI/UX design ensures that applications are not only functional but also intuitive and engaging for users.

Conclusion

Daffodil Software’s fintech software development services aim to empower financial institutions and startups by providing innovative, secure, and scalable solutions that drive efficiency and enhance customer experiences. For more specific offerings, case studies, or further details about their fintech development services, it’s advisable to visit their official website or contact them directly.

0 notes

Text

The Future of Fintech: How PGDM Graduates Can Lead the Way

Presentation

The quick advancement of monetary innovation, or Fintech, has upset how people and organizations collaborate with monetary administrations. At MYRA Institute of Business, One of the Top Colleges for PGDM in Bangalore, Fintech developments, from versatile installments to blockchain, are reshaping worldwide economies, setting out remarkable open doors for experts with the right skill. For PGDM graduates, this field presents an opportunity to lead groundbreaking change, utilizing their abilities to drive development and development.

The joining of Fintech into customary monetary environments has encouraged an interest for pioneers who figure out both mechanical headways and business methodologies. Business colleges are furnishing understudies with the devices and information to succeed in this space, offering particular courses, certifiable openness, and industry-important preparation.

The Job of Fintech in Molding What's to come

Fintech goes past conventional banking and money by incorporating state of the art innovations like computerized reasoning (simulated intelligence), blockchain, and AI (ML) into monetary administrations. It enables shoppers and organizations with improved effectiveness, availability, and security.

Key Areas Influenced by Fintech:

- Computerized Installments: Versatile wallets and moment moves are turning into the standard for customers around the world. - Loaning Stages: Distributed (P2P) loaning and computerized credit administrations are disturbing conventional advance frameworks. - Blockchain Innovation: Upsetting businesses with secure, straightforward exchanges and decentralized frameworks. - Robo-Guides: Offering computerized, calculation driven monetary preparation.

For PGDM graduates, understanding these improvements is vital for becoming industry-prepared pioneers who can shape the fate of Fintech.

Getting ready PGDM Graduates for Fintech Authority

Business colleges are moving forward to satisfy the need for Fintech-clever experts by consolidating innovation driven educational programs and encouraging an advancement driven mentality.

Center Areas of Concentration:

1. Particular Courses in Fintech:

- Programs covering blockchain, cryptographic money, computerized promoting for monetary administrations, and administrative consistence. - Electives investigating simulated intelligence applications in money and information driven navigation.

2. Commonsense Openness:

- Contextual investigations on driving Fintech new businesses and their systems. - Temporary positions in Fintech organizations to give active experience.

3. Industry Cooperation:

- Organizations with Fintech firms to offer live undertakings and cooperative examination open doors. - Visitor addresses from industry specialists sharing true experiences. Eminent supporters of this work incorporate Prof. Harshali Damle, an Assistant Staff in Money at MYRA Institute of Business. With skill in Bookkeeping, FinTech, and Cutting edge Money, her broad scholar and expert foundation fortifies the Fintech educational program. Her qualifications include:

- D. in Money and Bookkeeping from IIM Bangalore - MBA from IIM Shillong - Contracted Bookkeeping from the Foundation of Sanctioned Bookkeepers of India - Expert of Business from Brihan Maharashtra School of Trade

Ranges of abilities That Put PGDM Graduates Aside

To flourish in the Fintech biological system, experts need a mix of specialized skill and business sharpness. PGDM programs guarantee understudies are outfitted with:

- Information Investigation Capability: Understanding shopper conduct and market patterns utilizing large information. - Administrative Information: Remaining agreeable with monetary regulations and guidelines across districts. - Authority Abilities: Overseeing cross-practical groups in powerful, tech-driven conditions. - Critical Thinking skill: Exploring complex difficulties with inventive arrangements.

How Business colleges Encourage Fintech Advancement

To stay up with the unique Fintech scene, PGDM programs are coordinating development center points, research focuses, and pioneering stages into their contributions.

Striking Drives:

- Fintech Hatcheries: Supporting understudies in creating and sending off Fintech new companies. - Hackathons and Contests: Empowering inventive critical thinking and coordinated effort among understudies. - Studios and Affirmations: Giving preparation in blockchain, distributed computing, and online protection.

Worldwide Open doors for Fintech Experts

The worldwide Fintech market is projected to develop dramatically, opening vocation potential open doors for PGDM graduates in jobs, for example,

- Item Administrators: Directing the improvement of monetary arrangements custom fitted to advertise needs. - Blockchain Trained professionals: Planning and carrying out decentralized frameworks for secure exchanges. - Information Researchers: Dissecting huge datasets to uncover significant experiences in finance. - Computerized Showcasing Specialists: Creating systems to connect with educated clients in the advanced space.

Locales driving the Fintech transformation, like the US, China, and Europe, offer rewarding open doors for experts with important aptitude. Graduates who embrace worldwide patterns and social subtleties can flourish in these cutthroat business sectors.

Ladies in Fintech: Breaking Hindrances

Fintech offers a level battleground for ladies to lead development in customarily male-ruled monetary businesses. By empowering orientation variety, business colleges are establishing a more comprehensive climate that engages ladies to take on influential positions in Fintech.

Key Drives Include:

- Ladies Just Grants: Giving monetary guide to advance orientation fairness. - Organizing Occasions: Interfacing female understudies with industry pioneers for mentorship. - Authority Improvement Projects: Offering fitted preparation to assemble certainty and ability in female experts.

Mysore: The Best Climate for Fintech Development

Mysore, known for its lively IT and pioneering environment, offers an optimal setting for yearning Fintech experts. The city's emphasis on innovation and development adjusts flawlessly with the objectives of PGDM graduates planning to have an effect in Fintech.

Advantages of Concentrating on in Mysore:

- Admittance to a flourishing tech local area. - Chances to team up with IT firms and Fintech new businesses. - A steady climate for growing business visionaries.

The Effect of Fintech on New businesses and SMEs

Little and medium endeavors (SMEs) and new companies are huge recipients of Fintech advancements. From simple admittance to credit to smoothed out installment frameworks, Fintech enables more modest organizations to productively scale.

PGDM graduates can assume a crucial part by:

- Prompting new businesses on incorporating Fintech arrangements. - Driving monetary tasks and driving computerized change. - Distinguishing learning experiences utilizing prescient investigation.

Challenges in the Fintech Business and How PGDM Graduates Can Address Them

In spite of its true capacity, Fintech faces difficulties like administrative obstacles, online protection dangers, and protection from change. PGDM programs get ready understudies to handle these issues through:

- Morals and Administration Preparing: Figuring out the administrative structures in worldwide business sectors. -Risk The executives Courses: Figuring out how to recognize and relieve monetary and functional dangers. - Change The board Techniques: Driving reception of imaginative advances inside associations.

Future Patterns in Fintech

The Fintech business is continually advancing, with arising patterns molding its future direction.

A few Key Improvements Include:

- Open Banking: Permitting outsider engineers to construct applications and administrations around monetary establishments. - Computer based intelligence Driven Arrangements: Upgrading client encounters with chatbots, misrepresentation location, and customized administrations. - Supportable Money: Incorporating ESG (Ecological, Social, and Administration) rules into monetary choices. PGDM graduates who keep up to date with these patterns can situate themselves as thought forerunners in the field.

End

The Fintech insurgency is setting out unrivaled open doors for experts with a mix of business sharpness and innovative skill. At MYRA Institute of Business, One of the Top PGDM Colleges in Bangalore, PGDM graduates are remarkably situated to lead this change, driving advancement and development in the monetary business. By furnishing understudies with specific information, reasonable experience, and administration abilities, business colleges assume a basic part in molding the eventual fate of Fintech. As the business keeps on advancing, the heads of tomorrow will without a doubt rise out of projects that focus on versatility, inclusivity, and state of the art learning.

0 notes

Text

Unlocking the Future of Crypto Trading with P2P Exchange Development at Nadcab Labs

Cryptocurrency has revolutionized the financial industry, creating a global marketplace for digital assets that allows individuals to buy, sell, and trade without the need for traditional banking intermediaries. One of the most significant trends within this space is the rise of Peer-to-Peer (P2P) cryptocurrency exchanges. These decentralized platforms provide users with a direct way to trade crypto assets with one another, cutting out the need for third-party involvement and offering greater privacy, reduced fees, and enhanced control over transactions.

In this article, we will delve into the concept of P2P Cryptocurrency Exchange Development, the software solutions that power these exchanges, and how Nadcab Labs is helping businesses tap into this thriving market by offering robust crypto P2P exchange application development services.

https://www.diigo.com/file/image/bsacapsrzqqpcaoooazocspdsrs/P2P+Exchange+Development.jpg

What is P2P Cryptocurrency Exchange Development?

P2P cryptocurrency exchange development refers to the creation of a decentralized platform that facilitates direct transactions between users. Unlike traditional centralized exchanges (CEX), where users trade their crypto assets through an intermediary, P2P exchanges provide a marketplace where buyers and sellers can interact directly with each other.

A key feature of a P2P exchange is that it acts as a facilitator for transactions rather than holding or controlling the assets themselves. This eliminates the need for a centralized authority to manage user funds and trades. Instead, users are responsible for their own wallets, and the platform provides tools for users to verify the legitimacy of their trades and offers escrow services to ensure the safety of funds during the transaction process.

Key Features of P2P Cryptocurrency Exchanges

P2P exchanges come with several features that set them apart from centralized exchanges. Some of the most notable features include:

Escrow Services: P2P exchanges typically offer an escrow service, which ensures that funds are securely held during the transaction process. Once both the buyer and seller agree to the terms of the trade, the platform holds the crypto assets in escrow until the transaction is completed. This prevents fraud and ensures that both parties fulfill their obligations before the trade is finalized.

Low Fees: Since there is no centralized authority or intermediary involved, P2P exchanges typically have lower fees compared to centralized platforms. This makes them an attractive option for traders who want to minimize costs.

Privacy: P2P exchanges offer enhanced privacy since users trade directly with each other. Personal information is often minimal, and transactions are not subject to the same stringent identity verification processes required by centralized exchanges.

Global Reach: P2P platforms often cater to users from different countries, allowing them to trade crypto across borders. This feature is particularly useful in regions where access to traditional banking services is limited, as it enables individuals to participate in the global crypto market.

Customizable Payment Methods: P2P exchanges allow users to choose from a wide variety of payment methods. Whether it's bank transfers, PayPal, or even cash in person, P2P exchanges provide flexible options for traders to settle their transactions.

The Role of P2P Cryptocurrency Exchange Software Solutions

Developing a secure and efficient P2P exchange platform requires specialized software solutions tailored to meet the needs of both traders and platform administrators. P2P cryptocurrency exchange software solutions are designed to provide a seamless trading experience by offering a range of tools and features that enhance the functionality of the platform.

Some of the critical components of P2P cryptocurrency exchange software include:

User Management System: A robust user management system allows administrators to track and manage users on the platform. This includes features like user registration, KYC (Know Your Customer) verification, and user profile management.

Escrow Management System: The escrow system is one of the core components of any P2P cryptocurrency exchange. The system ensures that crypto assets are securely held during the transaction process, protecting both buyers and sellers.

Order Matching System: P2P exchanges rely on an order matching system that pairs buyers and sellers based on their trade preferences. The system should be capable of handling high volumes of orders in real-time and matching them efficiently.

Wallet Integration: A P2P platform must integrate with cryptocurrency wallets to allow users to deposit and withdraw funds. This is typically achieved through API integrations with popular wallets like MetaMask or Trust Wallet.

Payment Gateway Integration: For fiat-to-crypto transactions, P2P exchanges need to integrate with payment gateways that allow users to pay for crypto using their preferred payment methods. This may involve partnerships with third-party payment processors or banking systems.

Security Features: Given the sensitive nature of cryptocurrency trading, security is a top priority for any P2P exchange. Features such as two-factor authentication (2FA), encryption, and anti-fraud measures are essential to protect users' assets and personal information.

Dispute Resolution System: Disputes can arise in any P2P transaction, so having a dispute resolution mechanism in place is vital. This system ensures that both parties have a fair opportunity to resolve issues, and in some cases, it may involve arbitration by the platform administrators.

Admin Dashboard: An intuitive admin dashboard provides platform administrators with the tools they need to monitor and manage the exchange. This includes transaction tracking, user activity monitoring, and reporting tools to help ensure the platform operates smoothly.

Crypto P2P Exchange Application Development

Developing a P2P exchange application involves creating a mobile or web-based platform that allows users to engage in peer-to-peer crypto trading on the go. These applications are typically designed to provide a seamless and intuitive user experience, making it easy for traders to buy, sell, and exchange digital assets.

The development process for a P2P exchange application includes:

Platform Selection: Developers need to decide whether to build the application for iOS, Android, or as a cross-platform app. This decision depends on the target audience and the platform's functionality requirements.

UI/UX Design: The user interface (UI) and user experience (UX) design are critical components of any P2P exchange application. The app should be easy to navigate, intuitive to use, and visually appealing to ensure that users can quickly execute trades and manage their accounts.

Blockchain Integration: The app should integrate with blockchain networks to facilitate secure crypto transactions. This includes integrating wallet functionalities, such as receiving and sending crypto, as well as tracking balances.

Real-Time Data Feed: P2P exchange applications need to provide real-time data to users, including price updates, available orders, and transaction history. This data must be displayed in a user-friendly manner to help users make informed trading decisions.

Push Notifications: Notifications are an essential feature of P2P exchange applications, informing users about successful trades, new offers, and updates on their orders. Push notifications ensure users stay up to date with their trading activity.

Security Measures: Just like web-based platforms, P2P exchange apps must be equipped with security measures such as biometric authentication, encryption, and secure login systems to protect users’ funds and personal data.

Why Choose Nadcab Labs for P2P Exchange Development?

As a leading P2P exchange development company, Nadcab Labs offers end-to-end solutions for building customized P2P cryptocurrency exchanges and applications. With years of experience in blockchain technology and cryptocurrency development, we provide secure, scalable, and user-friendly solutions that meet the unique needs of businesses and users alike.

Here are some reasons why Nadcab Labs is the right choice for your P2P cryptocurrency exchange development needs:

Expertise in Blockchain and Crypto Development: Our team consists of experienced blockchain developers who are proficient in creating secure and scalable P2P exchange platforms using the latest technologies. We understand the intricacies of blockchain, cryptocurrencies, and decentralized systems, which allows us to deliver cutting-edge solutions.

Tailored Solutions: We offer fully customized P2P exchange development solutions based on your specific business requirements. Whether you're looking for a fiat-to-crypto exchange, crypto-to-crypto exchange, or a hybrid platform, we can tailor our services to fit your needs.

Security First Approach: At Nadcab Labs, security is our top priority. We implement robust security measures like 2FA, end-to-end encryption, and multi-signature wallets to ensure that your users' funds and data are always protected.

Global Reach: We understand that the crypto market is global, and our solutions are designed to cater to users from different countries and regions. Our P2P exchange platforms support multiple languages, payment methods, and currencies, making it easier for you to reach a global audience.

End-to-End Development: From concept to launch, Nadcab Labs provides end-to-end services for P2P exchange development. We handle everything from platform design and development to security integration, testing, and deployment, ensuring that your platform is ready for success.

Ongoing Support and Maintenance: Our commitment to your success doesn't end at launch. We offer ongoing support and maintenance services to ensure that your platform continues to operate smoothly and securely.

Conclusion

P2P Cryptocurrency Exchange Development is an exciting and lucrative opportunity in the crypto space. By leveraging the power of decentralized trading, businesses can offer users a more secure, private, and cost-effective way to trade digital assets. Nadcab Labs, with its expertise in blockchain development and P2P exchange software solutions, is your ideal partner for building a high-performance platform that meets the needs of modern crypto traders.

Whether you're looking to create a new P2P exchange or enhance an existing one, Nadcab Labs can help you unlock the future of crypto trading. Contact us today to learn more about our services and take the first step toward launching your own P2P cryptocurrency exchange!

#P2PCryptocurrencyExchangeDevelopmentSolutions#P2pCryptoExchangeDevelopment#P2PCryptocurrencyExchangeDevelopmentCompany#P2PCryptoExchangeDevelopmentServices#P2PCryptocurrencyExchangeDevelopmentServices#P2PExchangeDevelopmentServices#P2PExchangeSolutions#P2PCryptocurrencyExchange#P2pExchangeApplicationDevelopment

0 notes

Text

What is P2P Crypto Exchange? The Direct Exchange Revolution

In today's digital world, Peer-to-Peer (P2P) networks have emerged as a decentralized alternative that eliminates intermediaries. Since its inception, P2P has driven innovations in various areas, challenging traditional models and offering more accessible and equitable alternatives.

What is Peer-to-peer or P2P?

Peer-to-Peer (P2P) is a decentralized system where individual devices, called “peers,” connect directly to each other . They share resources such as files, data, or services, without the need for a centralized server.

This facilitates the direct crypto exchange development of information between users, without intermediaries . A common example is when we connect several devices at home or in the office to share files without using an external server.

History and Evolution of P2P

Peer-to-Peer (P2P) technology emerged at the dawn of the Internet as a decentralized alternative for sharing information without the need for central servers. Napster , launched in 1999 by Shawn Fanning, pioneered the sharing of music files directly between users. Later systems such as Gnutella and eDonkey in the 2000s expanded the capabilities of P2P, facilitating the decentralized distribution of diverse files.

The arrival of BitTorrent in 2001, developed by Bram Cohen, further revolutionized sharing by splitting large files into efficiently shared chunks, promoting greater decentralization.

Applications such as Skype (2003) leveraged P2P to offer more robust VoIP services. The emergence of Bitcoin in 2009, using a P2P network for financial transactions, sparked an explosion of innovation in blockchain and dApps. The evolution continues with the potential of 5G and IoT to improve P2P efficiency, consolidating its crucial role in digital transformation and global innovation.

How P2P works

Peer-to-Peer (P2P) networks are characterized by their decentralized architecture, where each node acts simultaneously as a client and server . This structure eliminates the dependency on single central points and provides several key advantages.

Efficiency is optimized by distributing resources across multiple nodes, improving bandwidth utilization and accelerating data transfers. Resilience is strengthened by avoiding single points of failure, protecting against outages and attacks. In addition, the scalability of the system allows it to be easily expanded by adding new nodes, thus adapting to large volumes of data.

There are two main types of P2P networks:

Unstructured : like Gnutella , where nodes connect freely.

Structured : Such as BitTorrent and DHT systems, which use algorithms to organize nodes and allocate resources efficiently.

This approach facilitates file sharing by discovering nodes, establishing direct connections, and distributing file fragments. It also takes care of network maintenance to ensure its stability and continued operation.

Current P2P Applications

P2P technology has gone from being a simple file-sharing tool to becoming the driving force behind the cryptocurrency revolution . Its decentralized architecture eliminates the need for intermediaries and opens up a world of possibilities in the financial field.

P2P in Cryptocurrencies:

Transactions without intermediaries: Bitcoin, Ethereum and other cryptocurrencies use P2P networks to facilitate direct transactions between users, without the need for banks or financial institutions.

This reduces costs, increases transparency and gives users greater control over their funds.

Censorship resistance: The decentralized nature of P2P makes cryptocurrency networks resistant to censorship. No centralized entity can control or stop transactions, ensuring financial freedom and data protection.

Scalability and efficiency: P2P networks are highly scalable, meaning they can accommodate large transaction volumes without losing efficiency. This makes them ideal for a global financial system that is constantly growing.

Innovation and new business models: P2P opens the door to new forms of value exchange and the creation of decentralized business models. Cryptocurrency-based applications are emerging in various sectors, from finance to logistics and supply chain management.

Examples that Transform the Financial landscape:

Bitcoin: the first decentralized cryptocurrency, pioneering the use of P2P networks for financial transactions.

There is a specific transaction method within the Bitcoin network for sending and receiving bitcoins called P2PKH (Pay-to-Public-Key-Hash). This works within the Bitcoin P2P infrastructure.

Ethereum: a decentralized platform that enables the creation of smart contracts and decentralized applications (dApps), driving innovation across a variety of sectors.

Filecoin - A decentralized storage network that uses P2P to store and distribute files efficiently and securely.

OpenBazaar: is a decentralized platform that allows users to trade products and services using cryptocurrencies.

Benefits and Challenges of P2P

Peer-to-Peer (P2P) technology has transformed the way we interact and exchange information in the digital age.

Its decentralized architecture offers multiple benefits, while also presenting certain challenges.

Key Benefits:

Decentralization: Eliminates middlemen, gives users control, and improves censorship resistance.

Scalability: adapts to growth, allowing you to manage large volumes of data efficiently.

Efficiency: Optimizes bandwidth usage, accelerates transfers and reduces latency.

Cost reduction: minimizes infrastructure and maintenance expenses.

Privacy and security: Distributes data across nodes and uses encryption to protect information.

Challenges to be addressed:

Resource management: efficient management to avoid congestion and maintain optimal performance.

Security: Implementing policies and defenses against threats such as file poisoning and DoS attacks.

Legal aspects: establishing clear legal frameworks to balance freedom of expression with the protection of intellectual property.

Node Reliability: Mechanisms to identify and manage untrusted or down nodes.

Technical complexity: simplifying configuration and use to make them accessible to a wide range of users.

The future of P2P

P2P is heading towards a future of innovation and transformation, driving advances in various sectors:

IoT: integration to optimize efficiency and communication in smart cities and connected homes.

Cryptocurrencies and Blockchain: Expanding capabilities with smart contracts and decentralized applications, revolutionizing finance and identity management.

Internet decentralization: data control in the hands of users, improving online privacy and security (IPFS, Solid).

Entertainment: Decentralized streaming for efficient, censorship-resistant video distribution.

5G and 6G: Faster P2P applications for augmented reality and autonomous driving.

AI and Machine Learning: Network Management and Security Optimization in P2P Environments.

Decentralized storage: secure and economical alternative solutions to the cloud (Filecoin, Storj ).

Conclusion

P2P cryptocurrency exchange development company are revolutionizing the way people trade digital assets by enabling direct, secure, and decentralized transactions without intermediaries. This empowers users with greater control, privacy, and flexibility in the evolving crypto landscape.

0 notes

Text

Exploring Ethereum: Where to Buy and Invest

Ethereum has emerged as a leading cryptocurrency, captivating the attention of investors and enthusiasts alike. As the second-largest digital asset by market capitalization, Ethereum's unique features and growth potential make it an attractive option for diversifying their investment portfolios. If you're interested in buying Ethereum, understanding where and how to purchase this digital currency is crucial. This article explores various avenues for acquiring Ethereum and offers insights into making informed investment decisions.

Understanding Ethereum

Before delving into the purchasing options, it’s essential to understand Ethereum. Launched in 2015 by Vitalik Buterin and a group of developers, Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily serves as a digital currency, Ethereum’s versatility allows it to support many applications beyond simple transactions, including decentralized finance (DeFi), non-fungible tokens (NFTs), and more.

Cryptocurrency Exchanges

One of the most common ways to buy Ethereum is through cryptocurrency exchanges. These platforms allow users to trade various cryptocurrencies, including Ethereum, for fiat currency (like USD) or other digital assets. When selecting an exchange, consider security, fees, user experience, and available payment methods. Most exchanges offer an easy signup process, allowing you to create an account, verify your identity, and link a payment method. Once your account is set up, you can buy Ethereum using bank transfers, credit cards, or other cryptocurrencies.

Peer-to-Peer (P2P) Platforms

Peer-to-peer platforms provide another avenue for buying Ethereum. These platforms connect buyers and sellers directly, enabling individuals to negotiate prices and payment methods. P2P platforms often have built-in escrow services, which add a layer of security to transactions. When using a P2P platform, checking the seller's reputation and transaction history is essential to ensure a safe purchase. This method can be particularly beneficial if you seek localized transactions or alternative payment options.

Crypto ATMs

Cryptocurrency ATMs are physical machines that allow users to buy Ethereum using cash or credit cards. These ATMs provide a convenient and straightforward method for purchasing digital currencies, especially for those who prefer to use something other than online exchanges. However, it’s essential to note that fees at crypto ATMs can be higher than those on exchanges, so it's wise to check the rates before proceeding.

Investment Platforms

For those who prefer a more hands-off approach to investing, certain investment platforms allow users to buy Ethereum without needing to manage the assets directly. These platforms enable you to invest in Ethereum through a managed fund, offering diversification and professional management. While this option may come with higher fees, it can be an excellent choice for those new to cryptocurrency or those who want to minimize their involvement in the day-to-day management of their investments.

Making Informed Investment Decisions

Thorough research is essential when considering where to buy Ethereum. Look into the exchange or platform’s security measures, user reviews, and the fees associated with buying Ethereum. Additionally, stay informed about market trends and developments within the Ethereum ecosystem. As with any investment, investing only what you can afford to lose and diversifying your portfolio to mitigate risks is crucial.

Buying Ethereum offers a unique opportunity to participate in the evolving world of digital currencies. Whether you choose a cryptocurrency exchange, a peer-to-peer platform, a crypto ATM, or an investment platform, understanding your options and conducting thorough research will help you make informed decisions. As you embark on your journey to buy Ethereum, stay vigilant and continuously educate yourself about this dynamic market to maximize your investment potential.

0 notes

Text

Smart Contracts & Cryptocurrency Coin Development: A Powerful Combination

Introduction

In the rapidly evolving world of blockchain technology, smart contracts and cryptocurrency coin development stand out as two groundbreaking innovations reshaping finance, security, and decentralization. These two elements form a powerful combination, providing the backbone for decentralized finance (DeFi), tokenization, and trustless transactions.

In this detailed article, we will explore everything about smart contracts and cryptocurrency coin development, their benefits, challenges, and how they are transforming industries.

Understanding Smart Contracts

What Are Smart Contracts?

A smart contract is a self-executing contract with predefined rules and conditions written into code. These contracts run on blockchain networks and execute automatically when the specified conditions are met. Smart contracts remove the need for intermediaries, making transactions faster, more transparent, and cost-effective.

How Do Smart Contracts Work?

Smart contracts operate using a simple "if-then" logic. When a specific condition is fulfilled, the contract automatically executes the agreed-upon action. This ensures that both parties adhere to the terms without the need for trust or manual enforcement.

Example: In a real estate transaction, a smart contract can automatically transfer ownership of property once payment is confirmed on the blockchain.

Benefits of Smart Contracts

Trustless Transactions: Eliminates the need for third parties

Automation: Reduces human intervention and speeds up processes

Security: Tamper-proof due to blockchain immutability

Transparency: All parties can verify contract terms on the blockchain

Cost-Efficiency: Reduces administrative and legal fees

Real-World Applications of Smart Contracts

DeFi Lending & Borrowing

NFT Marketplaces

Supply Chain Management

Insurance Claims Processing

Gaming & Digital Assets

Cryptocurrency Coin Development

What Is a Cryptocurrency Coin?

A cryptocurrency coin is a digital asset that operates on its own blockchain and serves as a medium of exchange, store of value, or utility within its network.

Key Components of a Cryptocurrency Coin

Blockchain Technology (e.g., Bitcoin, Ethereum, Binance Smart Chain)

Consensus Mechanism (Proof of Work, Proof of Stake, etc.)

Mining or Staking Mechanism

Security Protocols

Popular Cryptocurrencies in the Market

Bitcoin (BTC): The first and most valuable cryptocurrency

Ethereum (ETH): Known for smart contract capabilities

Binance Coin (BNB): Utility token for Binance ecosystem

Cardano (ADA): A blockchain focused on scalability and sustainability

The Role of Smart Contracts in Cryptocurrency Development

Automating Transactions with Smart Contracts

Smart contracts help facilitate peer-to-peer (P2P) transactions by automatically executing payments once conditions are met, reducing fraud and disputes.

Smart Contracts in ICOs and Token Sales

ICOs utilize smart contracts to manage token sales, ensuring transparency, secure fund collection, and automatic token distribution.

Smart Contracts in DeFi

DeFi platforms leverage smart contracts for lending, borrowing, staking, and yield farming, eliminating the need for banks.

Security Aspects of Smart Contracts

Ensuring security involves code auditing, bug bounty programs, and formal verification methods to prevent vulnerabilities like reentrancy attacks.

Developing a Cryptocurrency Coin with Smart Contracts

Choosing a Blockchain for Coin Development

Ethereum: Best for smart contracts and DeFi

Binance Smart Chain (BSC): Low fees, high-speed transactions

Solana: Scalability and efficiency

Steps to Create a Cryptocurrency Coin

Select the blockchain platform

Define use cases and tokenomics

Develop smart contracts

Deploy and audit the contract

Launch the cryptocurrency

Writing and Deploying Smart Contracts

Developers use Solidity (Ethereum) or Rust (Solana) to code smart contracts, ensuring proper testing before deployment.

Ensuring Security and Scalability

Implement multi-signature wallets

Conduct smart contract audits

Optimize gas fees and network efficiency

Challenges and Future of Smart Contracts & Cryptocurrency Coins

Common Challenges in Smart Contract Development

Code vulnerabilities

Regulatory compliance issues

Scalability concerns

Future Trends in Blockchain and Crypto Development

Interoperability between blockchains

AI-powered smart contracts

Sustainable blockchain solutions

Predictions for the Next Decade

Increased adoption of central bank digital currencies (CBDCs)

Widespread integration of smart contracts in traditional finance

Mass adoption of Web3 applications

Conclusion

The synergy between smart contracts and cryptocurrency coin development is shaping the future of finance, making transactions more secure, efficient, and decentralized. As blockchain technology evolves, smart contracts will continue to unlock new possibilities across various industries, solidifying their role in the digital economy.

#CryptocurrencyCoin#CryptoDevelopment#BlockchainTechnology#CryptocurrencyCoinDevelopment#BlockchainSolutions#CryptoInnovation

0 notes

Text

The Future of Finance: DeFi Development with Blockcoaster

The Future of Finance: DeFi Development with BlockcoasterDecentralized Finance, or DeFi, has rapidly become a cornerstone of the evolving crypto landscape. Offering a decentralized, open financial system, DeFi allows users to bypass traditional intermediaries like banks and access financial services directly through blockchain networks. With DeFi development services from Blockcoaster, businesses and investors can tap into this revolutionary shift, benefiting from decentralized financial platforms, applications, and technologies.

What is DeFi and Why Does It Matter?DeFi refers to a suite of financial services built on decentralized blockchain networks. Unlike traditional finance, where banks, brokers, and institutions act as intermediaries, DeFi operates without central authorities. This decentralized system is powered by smart contracts, which automate transactions, lending, borrowing, and more.

Crypto: What is DeFi? DeFi encompasses everything from simple lending and borrowing to complex DeFi trading platforms and decentralized exchanges (DEXs). Users can engage in crypto trading or earn interest on their crypto holdings through DeFi apps.

Best Crypto DEX: Decentralized exchanges, such as Uniswap or PancakeSwap, allow users to trade tokens directly from their wallets without a centralized exchange, making DeFi trading seamless and secure.

Why Blockcoaster for DeFi Development?At Blockcoaster, we specialise in DeFi development services tailored to your needs. Whether you’re building a new DeFi trading platform, launching a DeFi coin on Binance, or creating an innovative crypto DeFi app, our expert team is equipped to guide you through the process.

We offer:

Custom DeFi technologies to build decentralized finance apps (dApps) for lending, borrowing, and trading.

Secure smart contract development, ensuring your project is protected from vulnerabilities.

Solutions for integrating DeFi stablecoins, automated market makers (AMMs), and P2P lending platforms.

Comprehensive support for launching DeFi coins, DeFi projects on networks like Binance Smart Chain (BSC), and blockchain DeFi projects on Ethereum or other major platforms.

Key Benefits of DeFi

DeFi offers several benefits over traditional financial systems:

Permissionless Access: Anyone with an internet connection can participate in decentralized finance projects, regardless of geographic location or credit score.

Transparency: All transactions and smart contracts on DeFi platforms are publicly available on the blockchain, ensuring complete transparency.

Low Fees: With no intermediaries, users often pay lower fees for services such as DeFi trading or borrowing.