#PaySprint API Integration

Explore tagged Tumblr posts

Text

Streamlining Fintech Solutions: PaySprint API Integrations by Infinity Webinfo Pvt Ltd

In the rapidly evolving fintech landscape, businesses require seamless, secure, and scalable solutions to stay competitive and meet customer expectations. Infinity Webinfo Pvt Ltd, a renowned name in digital innovation and technical support, has emerged as a key enabler in this space by offering robust PaySprint API integration services tailored to businesses of all sizes.

About PaySprint

PaySprint is a new-age fintech company recognized for its agile and powerful API stack that facilitates a range of banking and financial services. From Aadhaar Enabled Payment System (AEPS) and DMT (Domestic Money Transfer) to BBPS (Bharat Bill Payment System), recharges, PAN services, and UPI, PaySprint empowers businesses to deliver banking-grade services to their customers with high reliability and compliance.

Infinity Webinfo Pvt Ltd: Bridging Technology and Financial Services

As a trusted software solutions provider, Infinity Webinfo Pvt Ltd specializes in integrating third-party APIs for web, mobile, and enterprise platforms. Their PaySprint API integration services focus on streamlining operations for fintech startups, agents, retailers, and aggregators who wish to build custom platforms or expand their service offerings.

Key PaySprint APIs Offered by Infinity Webinfo:

AEPS (Aadhaar Enabled Payment System) Integration Enable your platform to offer cash withdrawal, balance inquiry, and mini statements through Aadhaar authentication. Ideal for rural banking and financial inclusion.

Micro ATM API Infinity integrates PaySprint's mATM APIs that turn any smartphone or POS device into a functional Micro ATM for real-time transactions.

DMT (Domestic Money Transfer) Integration Seamlessly transfer money to any bank account in India with instant confirmation. Useful for customer-facing businesses like retail stores, service centers, and agents.

Recharge & BBPS Integration Empower your users to recharge mobile/DTH or pay utility bills (electricity, gas, water, etc.) using a unified PaySprint BBPS API integrated by Infinity Webinfo.

PAN Card Services With PaySprint’s NSDL-approved PAN service APIs, businesses can offer new PAN card applications and corrections via a simple interface.

UPI Payout and Collection Add seamless UPI-based payment options, ensuring faster transactions and ease of use for both B2C and B2B models.

Fastag Recharge API Easily integrate Fastag recharges into your system, enabling your platform to become a one-stop financial services hub.

Why Choose Infinity Webinfo for PaySprint Integration?

✅ Certified Development Team familiar with PaySprint’s API architecture and compliance standards.

✅ Custom Dashboard Development for agents and admin users.

✅ Secure API Implementation with proper token management and encryption practices.

✅ Post-integration Support & Maintenance, ensuring business continuity.

✅ Scalable Architecture that grows with your business needs.

Use Case Spotlight

A regional retail chain partnered with Infinity Webinfo Pvt Ltd to integrate PaySprint’s AEPS, DMT, and BBPS services. Within a month, they had a fully operational portal and mobile app, enabling thousands of walk-in customers to access digital financial services at their nearest store—boosting revenue and customer footfall significantly.

Final Thoughts

In today’s digital age, integrating financial APIs is no longer a luxury—it’s a necessity. With Infinity Webinfo Pvt Ltd’s expertise in PaySprint API integration, businesses can launch, scale, and manage fintech services with confidence. Whether you're a startup aiming to enter the market or an enterprise looking to diversify your offerings, Infinity provides the technological backbone you need to succeed.

Would you like a version of this tailored for your website, brochure, or client pitch?

WhatsApp: +91 9711090237

#PaySprint API Integration#PaySprint API#api integration#infinity webinfo pvt ltd#travel portal development#travel portal company#travel portal solutions#payment gateway api integration#white label#white label portal

0 notes

Text

Open Banking Made Easy with Flexible DMT APIs

Integrate fast and scale with confidence using Paysprint’s DMT APIs. Built for modern platforms, our documentation and sandbox environments simplify testing, while our support teams ensure production success with minimal downtime.

0 notes

Text

For Retailers, Developers & Entrepreneurs

No matter who you are—if you're looking to enter digital banking, PaySprint’s DMT API is your first step. 🏁 Start small 📈 Scale fast 🔗 Integrate easily Let’s power financial inclusion together.

0 notes

Text

DigiLocker Integration for Seamless User Verification

DigiLocker integration is one of the most secure and efficient ways to access government-issued documents with user consent. SprintVerify’s DigiLocker API allows you to fetch Aadhaar, PAN, Driving License, and more directly from official repositories. This not only eliminates document fraud but also removes the need for users to upload files. The API flow is simple: authenticate, get consent, and receive documents in real time. Ideal for sectors like lending, insurance, and HR, DigiLocker access ensures authenticity and speeds up verification. SprintVerify helps you deliver a truly digital, paperless onboarding journey that users love.

0 notes

Text

📲 UPI API for Mobile App Monetization

Monetize your mobile app with PaySprint’s UPI API. Easy to integrate and supports seamless user payments.

0 notes

Text

Enhance Your Platform with PaySprint’s AEPS API Integration

Integrate PaySprint’s AEPS API into your application for seamless Aadhaar-based banking services. Our API supports cash withdrawals, balance inquiries, and mini statements with real-time processing.

0 notes

Text

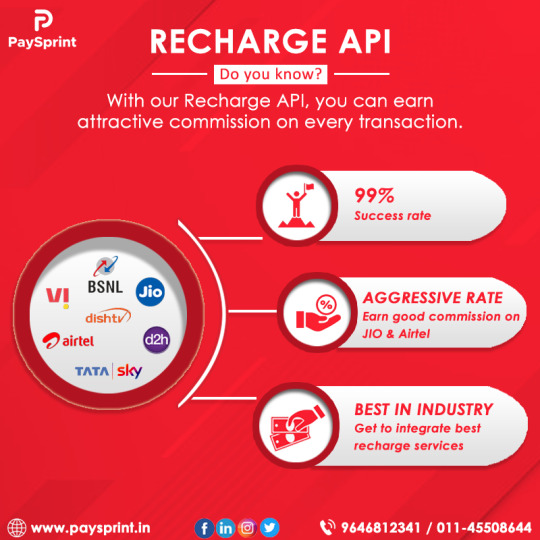

Recharge API Service Provider - PaySprint

Recharge API On-time & convenient recharges are done through our Multi Recharge APIs. It supports all service providers & has negligible failure rates along with the best-in-class response time, making it the best Recharge API service. Integrate and go live now to maximize your profitability. Contact us to know more about Recharge API!

A Recharge API is a type of application programming interface that enables developers to add recharge functionality to their applications. This allows users to recharge their mobile phones or pay bills directly from the app, without having to leave it. The API typically exposes endpoints for initiating a recharge, checking the status of the recharge, and retrieving information about the recharge, such as its amount, date, and status. The API provider may charge a fee for the use of their API or offer it for free. By integrating a Recharge API into their applications, developers can offer their users a convenient and seamless way to manage their mobile recharge needs.

0 notes

Text

UPI API Provider

PaySprint is your premier UPI API Provider, revolutionizing digital transactions with seamless integration and unparalleled efficiency. With PaySprint, businesses can effortlessly incorporate UPI payments into their platforms, offering customers a hassle-free payment experience.

Our cutting-edge UPI API Solutions empower businesses to securely accept payments, facilitate transfers, and manage transactions with ease. Whether you're a small startup or a large enterprise, PaySprint's robust infrastructure scales to meet your needs, ensuring reliability and performance at every step.

By choosing PaySprint as your UPI API Provider, you gain access to advanced features tailored to streamline your payment processes. From real-time transaction tracking to customizable payment interfaces, we equip you with the tools to enhance user experience and drive business growth.

At PaySprint, we prioritize security and compliance, implementing industry-leading measures to safeguard your data and mitigate risks. Our team of experts is dedicated to providing ongoing support and guidance, ensuring a seamless integration experience for your business.

Elevate your payment capabilities with PaySprint – the trusted UPI API provider it is also known as a UPI API Provider for Cash Withdrawal, and UPI Integration for forward-thinking businesses. Experience the future of digital transactions today.

0 notes

Text

Bank-Neutral Money Transfers via DMT Integration

Paysprint offers a seamless DMT API framework that connects your business to multiple banks without the hassle of individual partnerships. Facilitate IMPS for instant payments, NEFT for scheduled transfers, and RTGS for high-value remittances—all within a unified environment.

0 notes

Text

Boost Financial Access Through Smart DMT API Integration

Paysprint’s DMT API is designed to power financial inclusion by allowing users to send money to any bank account across India. Whether you're a fintech startup, NBFC, or agent-based platform, you can onboard customers, verify identities, and process secure transfers—all through a single, easy-to-integrate API suite.

0 notes

Text

Boost Your Online Platform

Are you building a digital portal, super app, or fintech dashboard? Integrate DMT APIs from PaySprint and offer seamless IMPS transfers to all your users. Fast integration. Clean documentation. High uptime.

0 notes

Text

Your Own NeoBanking Platform 🏦

Looking to create a full-fledged Banking-as-a-Service solution? PaySprint’s DMT API is a core part of any neobanking stack. Bundle with:

AEPS API integration

Micro ATM API

CMS API 💳 Offer banking services in one unified platform. Build it once, scale it everywhere.

0 notes

Text

Expand Your Digital Service Portfolio 🌐

Already offering AEPS, PAN, or recharge services? Time to add one of the most demanded features—Domestic Money Transfer. Integrate PaySprint’s DMT API and: 🔹 Increase customer visits 🔹 Boost your income 🔹 Become a full-service digital counter 💡 Combine with Micro ATM and AEPS for a powerful rural fintech bundle.

0 notes

Text

DMT API for Fintech Startups 🚀

If you're building a fintech platform or app, PaySprint’s DMT API gives you a plug-and-play solution for enabling money transfers across India. Why choose PaySprint?

🔐 Secure API Integration

🏦 Connects with 100+ banks

📱 Mobile & Web support 💼 Trusted by developers, startups, and aggregators for its simplicity and scale. Power your platform with instant, reliable transactions.

0 notes

Text

Integrate DMT in Just a Few Lines of Code 💻

Developers love PaySprint’s APIs for simplicity and speed.

🧩 JSON-based API 🧪 Sandbox access 📚 Complete documentation

0 notes