#payment gateway api integration

Explore tagged Tumblr posts

Text

Payment Gateway API Integration at Indicpay

Indicpay simplifies payment gateway integration with its secure API, supporting UPI, cards, net banking, and wallets. Boost customer trust with fast transactions, real-time settlements, and custom checkout designs. Perfect for e-commerce, subscriptions, and more. Get started today! #Indicpay #PaymentGateway #SecurePayments #Ecommerce #BusinessGrowth

0 notes

Text

Accept Online Payments in Minutes with Payment Gateway API Integration

Payment Gateway API integration is the process of connecting your website or application to a payment processor using its API. This allows you to accept online payments securely and efficiently.

Benefits of integrating a payment API:

Increased sales: Accepting online payments makes it easier for customers to purchase your products or services, which can lead to increased sales. Improved customer experience: A seamless checkout process is essential for a positive customer experience. Payment API integration can help to streamline your checkout process and make it easy for customers to complete their purchases. Reduced fraud: Payment processors use a variety of security measures to protect your customers’ payment information. This can help to reduce fraud and chargebacks. To integrate a payment API into your website, you will need to:

Choose a payment processor: There are many different payment processors available, so it is important to choose one that meets your specific needs. Factors to consider include the types of payments you want to accept, the countries you operate in, and the pricing and features offered by different providers. Set up a merchant account. Once you have chosen a payment processor, you will need to set up a merchant account. This involves providing the payment processor with some basic information about your business, such as your name, address, and contact information. Obtain API keys. Once your merchant account is set up, you will obtain API keys from the payment processor. These keys will allow you to authenticate your website or application with the payment processor and make API calls to process payments. Integrate the payment API into your website. This process will vary depending on the programming language and framework you are using. However, most payment processors provide detailed documentation and code samples to help you get started. Test the payment API- Once you have integrated the payment API into your website, it is important to test it thoroughly to make sure it is working properly. You can do this by making test payments using your own credit or debit card. Here are some additional tips for integrating a payment API into your website:

Make sure your website is secure- This means using an SSL certificate and encrypting all sensitive data, including payment information. Use a reputable payment processor. There are many fraudulent payment processors out there, so it is important to choose one that is trusted and secure. Follow the payment processor’s documentation carefully- This will help you avoid errors and ensure your integration is successful. Test your payment API regularly- This will help to identify and resolve any problems early on.

Once you have successfully integrated a payment API into your website, you will be able to accept online payments from customers around the world. This can help you to grow your business and reach new markets.

#payment gateway integration#payment integration#integrate payment gateway in website#payment gateway api integration#payment gateway integration in android#payment gateway integration services#online payment gateway integration#payment system integration

0 notes

Text

🌟 SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

SmilePayz specializes in Indonesia, Thailand, Brazil, and Mexico, offering cryptocurrency payment solution as well. Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

✅ Easy Integration: Diversified API interfaces for quick system compatibility, improving efficiency. ✅ 24/7 Support: Professional service around the clock, ensuring peace of mind.

Whether you're in online gaming, forex, online casino, live streaming, entertainment, forex, or financial services, SmilePayz is your best payment solution! [We do not accept business that is related to pornography and scamming.

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#payment gateway#api integration#high risk payment processing#high risk payment gateway#paymentsolutions#payment#payments#e commerce#online gambling#forex

2 notes

·

View notes

Text

Tripkies Technology excels in developing cutting-edge flight booking portals powered by seamless API integration. Our solutions empower travel businesses with real-time data, efficient booking processes, and a wide range of travel options, ensuring a seamless and rewarding experience for both agents and travelers.

#TravelTech#FlightBooking#API#Tripkies#TravelIndustry#website development#payment gateway integration#software development#travelportaldevelopment#travelwebsitedevelopment#travelbusiness#mobile app development

0 notes

Text

Integrate Our UPI Collection API

Integrating the UPI Collection API by Rainet Technology Private Limited into your financial infrastructure offers a seamless and efficient way to manage digital transactions. The UPI API, or Unified Payments Interface API, is designed to facilitate instant payment processing, making it an indispensable tool for businesses seeking to enhance their financial operations. By leveraging the UPI Collection API, businesses can streamline their payment collection processes, reducing the time and effort required to manage transactions manually. This integration not only improves the speed of transactions but also enhances security, ensuring that all payments are processed through a secure and reliable platform.

The UPI Collection API integration process is straightforward, allowing businesses to quickly implement the technology without significant disruption to their existing systems. Rainet Technology Private Limited provides comprehensive support and documentation to guide businesses through each step of the integration process. This ensures that even businesses with limited technical expertise can successfully adopt the UPI Collection API and begin reaping its benefits almost immediately.

One of the key advantages of integrating the UPI Collection API is the ability to offer customers a convenient and flexible payment option. With the UPI API, customers can make payments directly from their bank accounts using their smartphones, eliminating the need for cash or card transactions. This not only enhances the customer experience but also reduces the risk of payment fraud and errors.

Moreover, the UPI Collection API integration can significantly boost operational efficiency. Automated transaction processing reduces the need for manual intervention, freeing up staff to focus on more strategic tasks. This leads to improved productivity and cost savings for the business. In summary, integrating the UPI Collection API by Rainet Technology Private Limited is a strategic move for any business looking to enhance its payment processing capabilities, improve security, and offer a superior customer experience.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integratio#bbps api provider#upi payment gateway integration#education portal development company#bbps#bbps login

0 notes

Text

Nabpower Payment Gateway: Redefining Digital Transactions with Advanced Features

Embark on a journey into the cutting-edge world of digital transactions with Nabpower Payment Gateway. This blog post uncovers the innovative features that make Nabpower a standout choice, providing businesses and users with a secure, seamless, and efficient online payment experience.

1) Robust Security Protocols Explore Nabpower’s unwavering commitment to security excellence, featuring advanced encryption protocols and stringent security measures. Learn how these measures safeguard sensitive financial data, instilling confidence and trust in every transaction.

2) Seamless Integration Capabilities Delve into the ease of integrating Nabpower Payment Gateway into various digital platforms. Understand how this seamless integration enhances user experience, offering a consistent and user-friendly payment process across different websites and applications.

3) Diverse Payment Channel Support Discover Nabpower’s versatility in supporting a wide range of payment channels. From credit cards to digital wallets, explore how Nabpower accommodates diverse customer preferences, expanding payment options for businesses and enhancing user convenience.

4) Real-Time Transaction Monitoring Experience the immediacy of Nabpower’s real-time transaction monitoring system. Gain insights into payment status promptly, enhancing transparency and providing businesses with real-time control over financial transactions.

5) Customizable User Interface Explore the flexibility of Nabpower’s customizable user interface, allowing businesses to tailor the payment experience to align with their brand identity. Witness how this feature enhances the overall user experience, creating a seamless and branded payment environment.

6) Responsive Customer Support Discover Nabpower’s dedication to customer satisfaction with responsive and knowledgeable customer support. Learn how users and businesses can rely on Nabpower’s support team for timely assistance, addressing queries and concerns related to the payment gateway.

7) Analytics and Reporting Tools Delve into Nabpower’s analytics and reporting tools, providing businesses with valuable insights into transaction trends, customer behavior, and key metrics. Explore how this information empowers businesses to make informed decisions and refine their payment strategies.

Conclusion: In this comprehensive exploration of Nabpower Payment Gateway features, witness the convergence of innovation, security, and user-centric design. Nabpower is reshaping the online payment landscape, offering businesses and users an advanced, reliable, and seamless transaction experience. As we navigate the digital realm, Nabpower stands as a symbol of progress, shaping the future of secure and efficient online payments.

0 notes

Text

UPIADDA Payment Gateway Spotlight: Unveiling the Advanced Features of the Dynamic Payment Link

Embark on a journey into the future of digital transactions with UPIADDA Payment Gateway. This blog post serves as your guide, delving into the innovative features of UPIADDA's dynamic payment link designed to elevate user experience and streamline online payments.

1) Effortless Payment Initiation Explore the simplicity of UPIADDA's payment link, offering users the ease of initiating transactions with just a click. Streamlined and user-friendly, this feature reduces friction in the payment process, providing a seamless experience for both businesses and customers.

2) Customization for Brand Harmony Discover the flexibility of UPIADDA's payment link with customizable options. Businesses can tailor the link's appearance to align with their brand identity, ensuring a seamless integration that feels cohesive with the overall user experience.

3) Multiple Payment Options Delve into the versatility of UPIADDA's payment link, allowing businesses to accept payments through various channels, including credit cards, digital wallets, and more. This feature caters to diverse customer preferences, expanding payment possibilities.

4) Real-Time Transaction Monitoring Experience the immediacy of UPIADDA's payment link with real-time transaction monitoring. Businesses gain instant insights into payment statuses, enhancing transparency and providing a sense of control over financial transactions.

5) Secure and Encrypted Transactions Delve into the robust security features embedded in UPIADDA's payment link. With encryption protocols and advanced security measures, users can trust in the security of their transactions, fostering confidence and peace of mind.

6) Seamless Integration with APIs Learn about UPIADDA's flexible API, facilitating effortless integration with various platforms and content management systems. The payment link adapts seamlessly to different digital environments, empowering businesses to provide a consistent payment experience.

7) Enhanced Tracking and Reporting Explore the data analytics capabilities of UPIADDA's payment link, providing businesses with valuable insights into customer behavior, transaction trends, and other key metrics. This information enables informed decision-making and strategic planning.

Conclusion: In this exploration of UPIADDA's payment link features, witness the convergence of innovation and user-centric design. From effortless payment initiation to advanced security measures, UPIADDA empowers businesses to redefine the online payment experience. As we navigate the digital landscape, the dynamic payment link emerges as a catalyst for enhanced user engagement and efficient transactions, shaping the future of online commerce.

0 notes

Text

Unlocking Seamless Transactions: Navigating the World of QR Codes with Banzope Payment Gateway

Embark on a journey of innovation and efficiency with Banzope Payment Gateway in our latest blog post. Explore the power and convenience of QR codes as Banzope revolutionizes the way transactions are conducted. From swift payments to enhanced security, discover how QR codes become a catalyst for a seamless and modernized financial experience.

Instant Transactions with QR Codes: Delve into the speed and efficiency of Banzope's QR code transactions. Learn how users can make instant payments by simply scanning a QR code, reducing the time and effort traditionally associated with transactions.

Enhanced Security Measures: Highlight the robust security features integrated into Banzope's QR code system. Explore how encryption and authentication protocols ensure secure transactions, safeguarding user data and providing peace of mind.

Versatility Across Platforms: Showcase the versatility of Banzope's QR codes across various platforms. Whether it's in-store purchases, online transactions, or peer-to-peer transfers, Banzope's QR codes offer a universal solution for diverse financial needs.

User-Friendly Scan-and-Pay Experience: Illustrate the user-friendly nature of Banzope's scan-and-pay experience. Explore how the seamless process of scanning a QR code simplifies transactions, making it accessible for users of all technical proficiencies.

Customizable QR Code Options: Showcase Banzope's flexibility with customizable QR code options. Discuss how businesses and users can tailor QR codes to suit their branding, preferences, and specific transaction requirements.

Real-Time Transaction Updates: Highlight the real-time updates provided through Banzope's QR code transactions. Users can receive instant notifications, ensuring transparency and allowing them to stay informed about their financial activities.

Integration with Mobile Wallets: Illustrate how Banzope's QR codes seamlessly integrate with popular mobile wallets. Explore the convenience of connecting the payment gateway with users' preferred digital wallets, enhancing the overall user experience.

Contactless Transactions for Safety: Emphasize the contactless nature of Banzope's QR code transactions, especially in today's safety-conscious environment. Explore how users can make payments without physical contact, prioritizing health and well-being.

Educational Resources and How-To Guides: Provide users with educational resources and how-to guides on incorporating QR codes into their transactions. Empower users with knowledge on maximizing the benefits of Banzope's QR code technology.

Future Innovations in QR Code Technology: Conclude the blog post by offering a glimpse into the future innovations planned for Banzope's QR code technology. Invite users to stay tuned for upcoming features that will continue to redefine and elevate their QR code payment experiences.

By exploring the capabilities of Banzope Payment Gateway's QR code technology, this blog post aims to inform users about the advantages and convenience of leveraging QR codes for swift, secure, and modern transactions.

0 notes

Text

Seamless Recharges, Limitless Possibilities: Exploring Payniko Payment Gateway's Transformative Recharge API

Embark on a journey of digital empowerment with Payniko Payment Gateway's cutting-edge Recharge API. In this blog post, we uncover the dynamic features and functionalities that define Payniko's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Payniko is redefining the recharge experience for users and businesses alike.

Effortless Recharge Experience: Delve into the unmatched efficiency of Payniko's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Versatility in Operator Support: Highlight the flexibility of Payniko's Recharge API with its extensive support for diverse operators. Users enjoy the freedom to recharge with their preferred mobile service providers, DTH operators, and data card services, enhancing the overall user experience.

Real-Time Transaction Transparency: Emphasize the importance of real-time transaction updates integrated into Payniko's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Tailored Solutions for Businesses: Illustrate the customizable options available for businesses integrating Payniko's Recharge API. From branded interfaces to personalized features, Payniko empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security at Its Core: Assure users of Payniko's unwavering commitment to security, fortified by robust encryption and authentication protocols. Payniko's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance: Showcase the user-friendly documentation and integration guides provided by Payniko. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Payniko's Recharge API without unnecessary complexities.

User-Centric Design and Accessibility: Explore how Payniko places user-friendliness at the forefront of its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Payniko guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Payniko's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Payniko Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Payniko is at the forefront of reshaping the recharge landscape within the digital era.

1 note

·

View note

Text

WhatsApp Business API for Tours and Travel Industry: Enhancing Bookings, Updates, and Customer Engagement

In the rapidly evolving Tours and Travel industry, staying connected with customers and providing them with timely information and assistance is crucial. WhatsApp Business API emerges as a vital tool in this sector, offering an array of functionalities to enhance customer experience and operational efficiency.

#SMS Gateway Center#WhatsApp Business API#Travel Industry Communication#Tours Booking via WhatsApp#Customer Engagement in Travel#Travel Itineraries WhatsApp#WhatsApp for Travel Agencies#Real-time Travel Updates#WhatsApp Travel Customer Support#Travel Feedback WhatsApp API#Travel Industry WhatsApp Integration#Multilingual Travel Support#Secure Travel Booking WhatsApp#WhatsApp Payment Integration Travel#Travel Promotions WhatsApp#Personalized Travel Recommendations WhatsApp

1 note

·

View note

Text

Streamlining Fintech Solutions: PaySprint API Integrations by Infinity Webinfo Pvt Ltd

In the rapidly evolving fintech landscape, businesses require seamless, secure, and scalable solutions to stay competitive and meet customer expectations. Infinity Webinfo Pvt Ltd, a renowned name in digital innovation and technical support, has emerged as a key enabler in this space by offering robust PaySprint API integration services tailored to businesses of all sizes.

About PaySprint

PaySprint is a new-age fintech company recognized for its agile and powerful API stack that facilitates a range of banking and financial services. From Aadhaar Enabled Payment System (AEPS) and DMT (Domestic Money Transfer) to BBPS (Bharat Bill Payment System), recharges, PAN services, and UPI, PaySprint empowers businesses to deliver banking-grade services to their customers with high reliability and compliance.

Infinity Webinfo Pvt Ltd: Bridging Technology and Financial Services

As a trusted software solutions provider, Infinity Webinfo Pvt Ltd specializes in integrating third-party APIs for web, mobile, and enterprise platforms. Their PaySprint API integration services focus on streamlining operations for fintech startups, agents, retailers, and aggregators who wish to build custom platforms or expand their service offerings.

Key PaySprint APIs Offered by Infinity Webinfo:

AEPS (Aadhaar Enabled Payment System) Integration Enable your platform to offer cash withdrawal, balance inquiry, and mini statements through Aadhaar authentication. Ideal for rural banking and financial inclusion.

Micro ATM API Infinity integrates PaySprint's mATM APIs that turn any smartphone or POS device into a functional Micro ATM for real-time transactions.

DMT (Domestic Money Transfer) Integration Seamlessly transfer money to any bank account in India with instant confirmation. Useful for customer-facing businesses like retail stores, service centers, and agents.

Recharge & BBPS Integration Empower your users to recharge mobile/DTH or pay utility bills (electricity, gas, water, etc.) using a unified PaySprint BBPS API integrated by Infinity Webinfo.

PAN Card Services With PaySprint’s NSDL-approved PAN service APIs, businesses can offer new PAN card applications and corrections via a simple interface.

UPI Payout and Collection Add seamless UPI-based payment options, ensuring faster transactions and ease of use for both B2C and B2B models.

Fastag Recharge API Easily integrate Fastag recharges into your system, enabling your platform to become a one-stop financial services hub.

Why Choose Infinity Webinfo for PaySprint Integration?

✅ Certified Development Team familiar with PaySprint’s API architecture and compliance standards.

✅ Custom Dashboard Development for agents and admin users.

✅ Secure API Implementation with proper token management and encryption practices.

✅ Post-integration Support & Maintenance, ensuring business continuity.

✅ Scalable Architecture that grows with your business needs.

Use Case Spotlight

A regional retail chain partnered with Infinity Webinfo Pvt Ltd to integrate PaySprint’s AEPS, DMT, and BBPS services. Within a month, they had a fully operational portal and mobile app, enabling thousands of walk-in customers to access digital financial services at their nearest store—boosting revenue and customer footfall significantly.

Final Thoughts

In today’s digital age, integrating financial APIs is no longer a luxury—it’s a necessity. With Infinity Webinfo Pvt Ltd’s expertise in PaySprint API integration, businesses can launch, scale, and manage fintech services with confidence. Whether you're a startup aiming to enter the market or an enterprise looking to diversify your offerings, Infinity provides the technological backbone you need to succeed.

Would you like a version of this tailored for your website, brochure, or client pitch?

WhatsApp: +91 9711090237

#PaySprint API Integration#PaySprint API#api integration#infinity webinfo pvt ltd#travel portal development#travel portal company#travel portal solutions#payment gateway api integration#white label#white label portal

0 notes

Text

UPI Collection API Integration Service

Rainet Technology Private Limited stands at the forefront of cutting-edge technology solutions, and their provision of UPI Collection API Integration Service is a testament to their commitment to innovation and excellence. In an era where digital payments have become the lifeblood of modern commerce, Rainet Technology's UPI Collection API Integration Service emerges as a game-changer.

What sets Rainet Technology apart is their unwavering dedication to providing the best service in the industry. Their UPI Collection API Integration Service is a seamless and efficient way for businesses to integrate UPI payments into their systems. With a deep understanding of the rapidly evolving fintech landscape, Rainet Technology ensures that clients stay ahead of the curve.

The key to their success lies in their team of skilled professionals who possess an in-depth knowledge of UPI technology and a commitment to delivering tailored solutions. Whether you are a small startup or a large enterprise, Rainet Technology can customize their services to meet your specific needs. They prioritize security, reliability, and user-friendliness, making the integration process smooth and hassle-free.

In a world where convenience and speed are paramount, Rainet Technology's UPI Collection API Integration Service empowers businesses to offer a frictionless payment experience to their customers. Their track record of excellence makes them the go-to choice for anyone seeking top-tier UPI integration services. Rainet Technology's commitment to providing the best UPI Collection API Integration Service is a reflection of their dedication to driving the future of digital commerce.

Visit Website:https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration

1 note

·

View note

Text

Amplifying Transactions with Effortless Payment Gateway API Integration

Experience the power of Amplifying Transactions with Effortless Payment Gateway API Integration. Seamlessly connect and streamline your payment processes, empowering your business to effortlessly handle transactions and enhance customer satisfaction. Simplify the payment journey with a robust, secure, and user-friendly integration solution, ensuring smooth and reliable transactions every step of the way. Maximize efficiency, minimize friction, and unlock new opportunities for growth with our comprehensive API integration platform.

0 notes

Text

🌟SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

We provide local payments in Indonesia 🇮🇩, Thailand 🇹🇭, Brazil 🇧🇷, and Mexico 🇲🇽, and also offering cryptocurrency payment solution as well.

Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

Whether you're in Online Gaming, Forex, High-Risk Gaming (I-Gaming), Live Streaming, Forex, or financial services, SmilePayz is your best payment solution!

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#paymentsolution#paymentsolutions#API#Integration#payment gateway#indonesiapayment#brazilpayment#mexicopayment#thailandpayment#Qris#Dana#payment#Igaming#forex

0 notes

Text

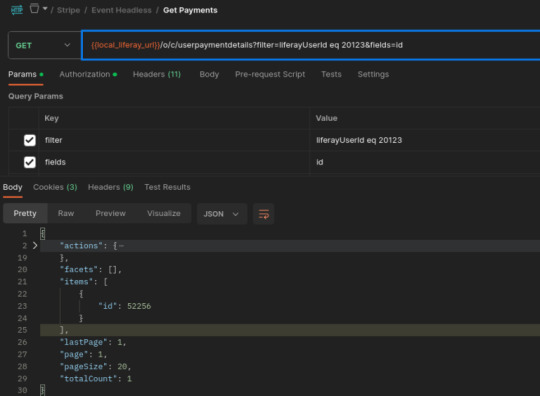

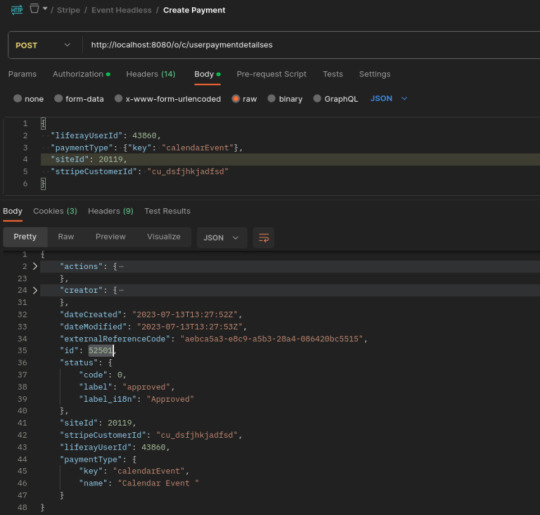

How to Integrate Stripe Payment with Liferay: A Step-by-Step Guide

Introduction

There are mainly two ways to implement stripe payment integration

1. Prebuit Payment Page

This payment provides by the stripe so we do not need to code for it.

It has all functionality coupons for discounts, etc

The UI part for the payment integration is fixed. We cannot change it.

Need to create a product in the stripe dashboard.

And only passing quantity at payment time total price and discount all those things managed by the stripe.

2. Custom Payment flow

This flow will use when we have a custom payment page or a different design

And customization from the payment side and only the user will do payment only not specify any product.

In this flow, no need to create a Product for the payment.

Need to create below APIs

Create-payment-intent API: add payment-related detail in the stripe. It will return client_secret for making payment.

Webhook

Need to do the below things from the FE

Confirm Payment: It will take the card detail and client_secret that we got from the create-payment-intent API.

We are going to use a custom payment flow for the Event Module Payment integration.

Object Definition for the Stripe

Introduction

We are using the stripe for payments but in the feature, there might be clients who will use other payment service provider use.

So, using two objects we will handle it

Payment Object that contains unique data like used, stripe user id, type, and relation with Calander Event Payment object

Calander Event Object contains data related to the Event.

Payment objects have one too many relations with the Calander Event Object.

P-Flow for the Stripe payment integration

We will perform the below operations for Stripe payment integration in the Calander event.

Create a customer in Stripe while the Liferay user gets created.

Add create a customer in register API

Also, while the Liferay user gets created using the Liferay admin panel

Create Payment Intent API for adding payment related in the stripe and take payment stripe ID for confirm Payment

Add the same detail in the Liferay object with event data (status – pending) while they call payment intent API.

Custom method for customer management for stripe

private void stripeCustomerCrud(User user, String operationType) { // If operation type is not equal to create, update, or delete, give an error if (!Arrays.asList(CREATE_OP, UPDATE_OP, DELETE_OP).contains(operationType)) { log.error(“Operations must be in Create, Update, and Delete. Your choice is: ” + operationType + ” operation.”); return; }

try { Stripe.apiKey = “your api key”; String stripeCustomerId = “”;

// Get Stripe Customer ID from the user custom field when operation equals to update or delete if (operationType.equals(UPDATE_OP) || operationType.equals(DELETE_OP)) { ExpandoBridge expandoBridge = user.getExpandoBridge(); stripeCustomerId = (String) expandoBridge.getAttribute(STRIPE_CUST_ID);

if (stripeCustomerId == null || stripeCustomerId.isEmpty()) { throw new NullPointerException(“Stripe Customer Id is empty”); } }

Map<String, Object> customerParams = new HashMap<>();

// Add name, email, and metadata in the map when operation equals to create or update if (!operationType.equals(DELETE_OP)) { Map<String, String> metadataParams = new HashMap<>(); metadataParams.put(“liferayUserId”, String.valueOf(user.getUserId()));

customerParams.put(“name”, user.getFullName()); customerParams.put(“email”, user.getEmailAddress()); customerParams.put(“metadata”, metadataParams); }

Customer customer = null;

// Operation-wise call a method of the stripe SDK if (operationType.equals(CREATE_OP)) { customer = Customer.create(customerParams); setExpando(user.getUserId(), STRIPE_CUST_ID, customer.getId()); } else if (operationType.equals(UPDATE_OP)) { Customer existingCustomer = Customer.retrieve(stripeCustomerId); customer = existingCustomer.update(customerParams); } else if (operationType.equals(DELETE_OP)) { Customer existingCustomer = Customer.retrieve(stripeCustomerId); customer = existingCustomer.delete(); }

log.info(operationType + ” operation is performed on the Stripe customer. (Data = Id: ” + customer.getId() + “, ” + “Name: ” + customer.getName() + “, Email: ” + customer.getEmail() + “)”);

} catch (NullPointerException e) { log.error(“Site custom field does not exist or is empty for the Stripe module: ” + e.getMessage()); } catch (StripeException e) { log.error(“Stripe Exception while performing ” + operationType + ” operation: ” + e.getMessage()); } }

Webhook API

Params: payload and request

This API will call when any update is there for the specified payment

We must update the Liferay Object according to the status of the payment Intent Object. A few statuses are below of Payment Object

payment_intent.amount_capturable_updated

payment_intent.canceled

payment_intent.created

payment_intent.partially_funded

payment_intent.payment_failed

payment_intent.requires_action

payment_intent.succeeded

APIs wise Flow for the Stripe payment integration

Create Payment Intent API

Using Payment Intent API, we insert transaction data and status as incomplete in the stripe, so it takes a few parameters like Liferay user id, calendar event id, stripe customer id, total amount, and currency. It will return the payment Intent id and client secret.

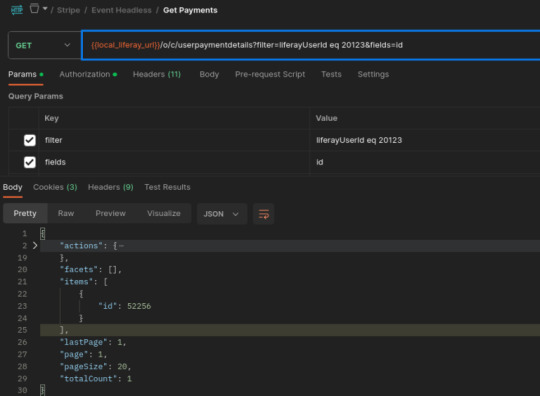

Get User Payment Detail Id if Not Prent Then Add

Get the Parent object Id from the below API for passing it into

We need the id of the parent object to make a relationship so we will call the user payment details headless API by passing the Liferay user id from the session storage. It will return the id in the items for the POST eventpayments API.

If the above API items tab is empty, then you need to add user-related data in the user payment details object and take the id from the response and pass it in POST eventpayments API.

Add Data in Calendar Event Payment Object

The calendar Event object is used to track the event payment transaction data in our database.

To add an entry in the calendar event object after the payment intent success response because we are passing payment intent id as transaction id in the Object.

Add prices, quantity, payment status (default – in Complete), tax amt, total amt, transaction Id(Id from the create payment intent response), r_event_c_payment_id(id from the userpaymentdetails headless API), site id as 20119 as default value.

Conclusion

Integrating Stripe payment functionality with Liferay Development has proven to be a seamless and efficient solution for businesses seeking to streamline their online payment processes. By implementing this integration, businesses can offer their customers a secure and convenient payment experience, leading to increased customer satisfaction and loyalty.

Read More Stripe Payment Integration With Liferay

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes