#Payroll management company in Singapore

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

Why Is Payroll Software Essential For Your Business?

While today’s world is going gaga over technological advancements, it seems backwards to be still preoccupied with age-old manual payroll systems.

Singapore HR Software helps in perfecting and calculating the accurate payment of the employees, filing employment taxes, tracking working hours, wage calculation, printing and delivering cheques, calculating and paying government employment taxes, and many more.

Here are six reasons for considering payroll software for your business:

Automated Payroll: Manual work undoubtedly includes unacknowledged mistakes that might impose a heavy cost on the company's reputation. Payroll software automates the entire process easily, efficiently, and organised manner.

Proper Track of Payroll Expenses: With an increase in the size of the business, the payroll expenditure would automatically hike up. The payroll system automated by software would help track all the expenses.

Brings All Payment Info’s Under a Single Roof: HR payroll software equipped with secured integration helps one to maintain and edit all accounting data under a single roof, thereby offering effective tracking of expenses.

Secured Payroll Data: It is no doubt that a software system is far more secure than any other system. The payroll system includes sensitive data concerning all the information regarding the salaries, taxes, and bank accounts of all the employees. All these remain highly secured in payroll software.

Reduce Chances Of Compensation: Often companies are penalised for non-remittance of taxes; this can be secured by payroll software which keeps a track of changing tax laws.

Foster Productivity of The Team:

Automated payroll services reduce most of the tasks concerning payroll operations. Since the workload is already reduced the focus of the team can be shifted to somewhere else for greater productivity. This will help to achieve the targets of the company quickly and effectively.

HR payroll software hence ensures painless payroll processing. Here are some highlighted employee self-service benefits that are offered by the software:

On-time leave

Records of training

Printing of current as well as previous payslip

Update demographic info’s

Save effort, time and money, by using payroll software services in Singapore and avoid the pandemonium created by multiple paper works and manual payroll systems.

#hr and payroll system#payroll solution singapore#hr and payroll system singapore#hr payroll software singapore#hr & payroll software#payroll saas solution#payroll software for sme#hr payroll solutions#facial attendance system#best cloud hr software singapore#hris software providers singapore#best payroll software singapore#hr payroll software companies#timesheet management system singapore#fingerprint attendance system singapore#cloud based hr systems singapore#psg grant accounting software#payroll software singapore#singapore payroll systems#biometric attendance system#payroll system in singapore#hr software in singapore#payroll management software singapore#payroll system singapore#payroll solution#hr and payroll solutions#psg vendors#e-claims software singapore#claims software singapore#leave management system singapore

1 note

·

View note

Text

Take Benefits from the Service of Expert Accountants

The future of the small business is unquestionably in outsourcing. Outsourcing is still the best way to cut costs, whether it is done offline or online. Outsourcing can be used for a wide variety of tasks. Every company out there has an accounting department, but that has not stopped accounting from being outsourced. Any size of organization can now take advantage of convenient Corporate Services In Singapore.

You may be beginning to question how exactly these accountants help businesses. Secure servers allow you to transfer sensitive information over the internet without worrying about being a victim of identity theft or other forms of online fraud. Both public and private businesses can take use of these timely and precise online accounting services.

Large teams of qualified and accredited accountants usually offer these services from a central location. This means that within a team, there might be a wide variety of accounting expertise. Some are Corporate Secretarial Services who are tasked with managing the financial records of businesses both large and small. Management accountants are another type of financial expert who keep tabs on a business's revenue and expenditures

. There is also a specialized group of people called internal auditors who check the work of external auditors. Their job is to scrutinize your financial records for signs of wrongdoing, such as fraud or misuse of company funds. You can also outsource your accounting needs to qualified and experienced Corporate Secretarial Singapore.

You can find accountants online for whatever service you would need, including filing tax returns, managing payroll, handling accounts payable and receivable, and conducting audits. Your reluctance to trust complete strangers with your sensitive financial data may be stopping you from using online Accounting Services In Singapore.

Many entrepreneurs worry about this very thing. Online accounting services that may be trusted are, however, supplied by individuals who respect their clients' right to anonymity. You should ask your preferred contractor about their policies on internet privacy before hiring Corporate Secretary In Singapore. The infrastructure of online bookkeeping services is straightforward. The client is required to make duplicates of their book collection. So, the supplier will expect that you employ a bookkeeper to compile and maintain these records.

The contractor's shared fax can receive copies directly. Scans could be sent or uploaded to a secure server owned by your remote worker. When you hire certain Singapore Accounting Firm, the company may ask you for the login credentials to the online accounting software you prefer to use.

Creating a variety of financial reports is as easy as logging in and uploading the necessary source materials. When establishing a contract with an online accounting services provider, it is highly recommended that you familiarize yourself with the system they employ. You'll quickly learn that not all companies offer the same pricing. While many businesses lean toward hourly pricing, others offer flat rates. You should check the prices of several different outsourced internet accounting firms to avoid being taken advantage

3 notes

·

View notes

Photo

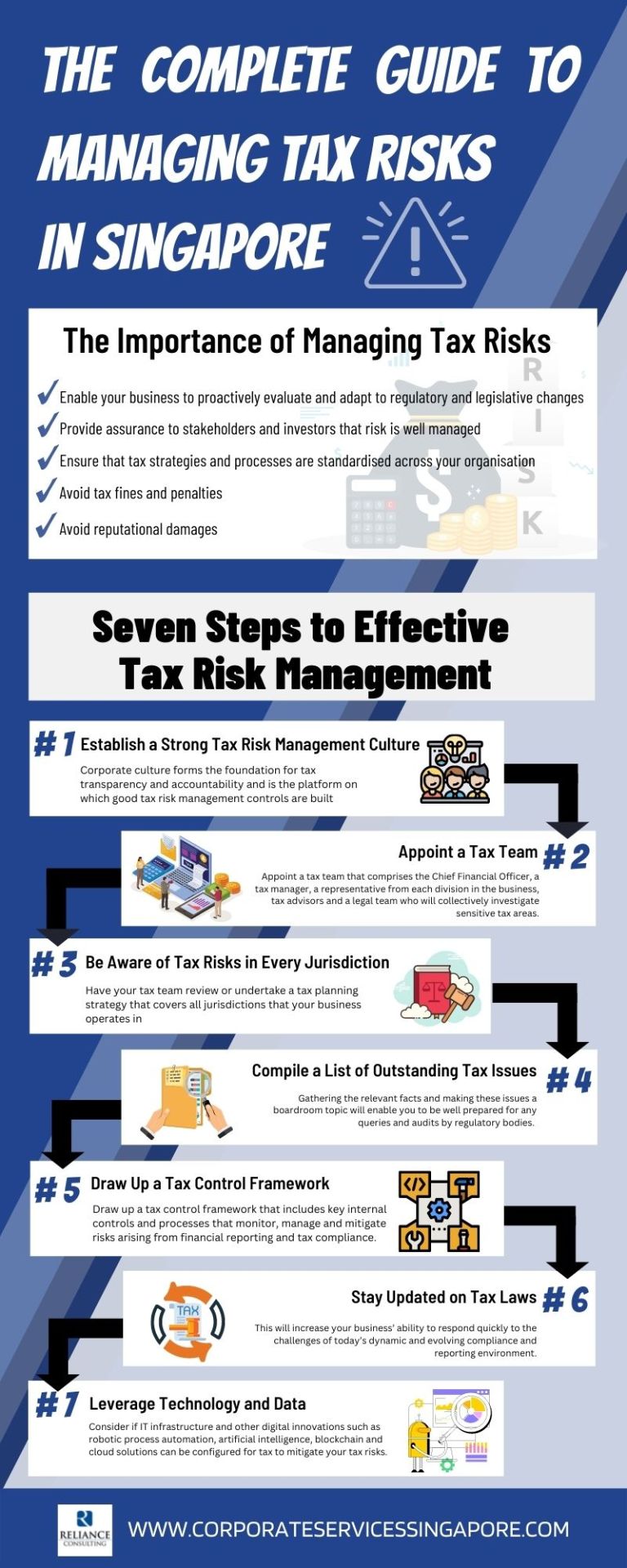

The Complete Guide to Managing Tax Risks in Singapore

This infographic provides a complete guide on managing tax risk for your business.

Managing tax risks will enable your business to generate efficiencies and enhance tax reporting, compliance as well as financial results while reducing tax burdens. Engage with Corporate Services Singapore to spot flaws within your company’s internal practices.

The firm’s expertise includes Singapore company incorporation, corporate secretarial services, payroll, accounting services, auditing & assurance and taxation.

Source: https://www.corporateservicessingapore.com/the-complete-guide-to-managing-tax-risks-in-singapore/

#company secretarial services#corporate secretarial services#corporate secretarial services Singapore#corporate secretary services

3 notes

·

View notes

Text

Unlocking Business Success: The Role of Company Secretarial Services

Are you a business owner in need of expert assistance in managing your company's administrative and regulatory obligations? Look no further than professional company secretarial services. In this comprehensive guide, we'll delve into the significance of company secretarial support and how it can streamline your business operations, ensuring compliance and efficiency every step of the way.

SBS Consulting provides incorporation services to Singapore-based companies. Additionally, we also offer secretarial, bookkeeping, accounting, taxation, GST, XBRL, and payroll services.

Understanding Company Secretarial Services

Company secretarial services encompass a range of administrative tasks essential for maintaining statutory compliance and corporate governance standards. From handling regulatory filings to managing board meetings and maintaining corporate records, company secretaries play a vital role in facilitating smooth operations for businesses of all sizes.

Key Responsibilities of Company Secretaries

Statutory Compliance: Company secretaries are responsible for ensuring that the company complies with all relevant laws and regulations. This includes filing annual returns, updating statutory registers, and adhering to reporting requirements imposed by regulatory authorities such as the Accounting and Corporate Regulatory Authority (ACRA) in Singapore.

Board Support: Company secretaries assist in the organization and conduct of board meetings, including preparing agendas, minutes, and resolutions. They act as a liaison between the board of directors and management, facilitating effective communication and decision-making processes.

Corporate Governance: Maintaining high standards of corporate governance is crucial for building trust among stakeholders and safeguarding the company's reputation. Company secretaries play a key role in advising the board on corporate governance best practices and ensuring compliance with relevant codes and guidelines.

Record Keeping: Company secretaries are responsible for maintaining accurate and up-to-date corporate records, including the company's register of members, directors, and shareholders. They also oversee the issuance and transfer of shares and ensure that changes to the company's structure are properly documented and reported.

Benefits of Outsourcing Company Secretarial Services

Expertise and Experience: Professional company secretarial service providers have the expertise and experience to navigate complex regulatory requirements effectively. They stay updated on changes in laws and regulations, ensuring that your company remains compliant at all times.

Cost Efficiency: Outsourcing company secretarial services can be cost-effective compared to hiring an in-house company secretary. By engaging external experts, you can access high-quality services without the overhead costs associated with employing full-time staff.

Focus on Core Activities: Delegating company secretarial tasks to external providers allows you to focus on your core business activities and strategic objectives. This can lead to increased productivity and efficiency, driving business growth and success.

Risk Mitigation: Professional company secretarial services help mitigate the risk of non-compliance and regulatory penalties. By entrusting these critical tasks to experienced professionals, you can minimize the likelihood of errors and oversights that could jeopardize your company's operations.

Conclusion

In conclusion, company secretarial services play a vital role in ensuring the smooth functioning and compliance of businesses in today's regulatory environment. By outsourcing these tasks to professional service providers, you can benefit from expert support, cost efficiency, and peace of mind, allowing you to focus on what matters most – growing your business and achieving your goals. Unlock the full potential of your company with comprehensive and reliable company secretarial services tailored to your specific needs.

0 notes

Text

Payroll Service Singapore

Are you facing managing the Payroll service Singapore? Then look no further at ZE Global, which provides a complete payroll service designed to satisfy the particular requirements of Singapore-based companies. With our knowledge and commitment, we simplify your payroll processes, guaranteeing accuracy, compliance, and peace of mind. At ZE Global, we have a team of skilled and experienced professionals who help you manage your payroll services mannerly.

Click Here: https://www.timessquarereporter.com/business/manage-your-payroll-with-ze-global-s-expert-service-in-singapore

#IncorporateofCompanyinSingapore#PayrollServiceSingapore#ZE Global#singapore#business#XBRL Singapore

0 notes

Text

How Are Accounting Services a Boon to Every Business?

Finances are an integral part of every business- be it a large enterprise or a smaller one. It enables you to ensure smooth sailing and make informed decisions that perfectly align with your budget. From boosting sales to taking care of regular operations, finances play a pivotal role, and in such cases, you can simply rely on accounting services in Singapore.

As a business manager, you will have to deal with multiple roles and responsibilities. There are a lot of fields and tasks that clearly demand your prompt attention to it. By hiring accounting professionals, you can now ensure peace while feeling at ease.

Today, we are here to let you know how these accounting services can be a boon to every business. We have outlined some quick pointers that will enable you to gain a better understanding. Let’s get started!

● They Are Responsible for Taking Care of Financial Records

Dealing with financial records often takes a toll on the company owners- they find themselves in a dilemma when it comes to preparing tax returns. In order to ensure top-notch administration, hiring a professional business accountant will indeed be the best bet. They possess sound knowledge related to company transactions and overall finances. Under their guidance, you will definitely get the scope to manage both your earnings and expenditures effectively.

● Takes Your Business to the Next Level

Taking your business to the next level means getting exposed to complicated and detailed accounting, that’s a no-brainer for sure. When you adhere to day-to-day accounting procedures, managing cash flow and understanding your business needs get a lot easier. Since these experts are potent enough to provide monthly accounting services, you can take a step toward scaling your business within a short time span. Keep your cost manageable and spare yourself the horror of costly mistakes.

● They Are Aware of the Latest Technology

The business accounting services keep themselves up to date with the latest and innovative technologies. They are well-trained in using software that is responsible for an automated and seamless financial process. Since they are quite well-versed with different technologies and accounting principles, you can seek their support and enjoy professional guidance for a prolonged period.

● They Adhere to Tax Laws

Preparing tax forms without enough knowledge can be extremely risky, you can get exposed to a lot of errors and mistakes. On the other hand, a professional business accountant knows the process of complying with tax laws. Keep every possibility of legal trouble and unwanted penalties at bay by contacting these services.

Hire the Best Business Accountants for Better Growth

By hiring well-reputed accounting services in Singapore, you will get the scope of keeping your company’s financial health absolutely intact. From dealing with balance sheets to tracking cash flow and managing payroll, these professionals ensure to make your journey smooth and exciting. When it comes to diagnosing a financial situation, you can count on an accountant with your eyes closed, they will definitely help you with the right solutions. Whether it’s increasing profit or growing your business, seeking professional help is never a bad decision.

For hiring accounting professionals or the best company incorporation services, all you have to do is browse through the internet and choose the best one among the lot. With just a few clicks, you will find the perfect experts you are looking for.

0 notes

Text

Accounting software in Singapore is application software that helps companies or individuals record and process business financial transactions.

Call :

+65 6405 4173

#accounting #software #Singapore #inventory #management #software #payroll #software #Singapore

http://centrix.com.sg/

0 notes

Text

Efficiency Unleashed: Time Attendance Software Solutions!

Having a team that's both present and productive is crucial. But if you're clinging to outdated attendance tracking and rostering methods, you might not be fully capitalising on the tools at your disposal. It’s time to start usingtime attendance software like Adaptive Pay to streamline these tasks so you can concentrate on more strategic business activities.

Getting to know Adaptive Pay - A leading time attendance software

Adaptive Pay brings a whole new level of ease to managing attendance and rosters with these features:

Versatile clock-in options - Whether it's through biometric devices, web apps, or mobile apps, Adaptive Pay offers multiple ways for employees to mark their attendance. This flexibility is a big plus for both scheduling and attendance monitoring.

Accurate location tracking - With GPS and geo location, this time, attendance software ensures that employees are exactly where they need to be. It's a reliable way to keep attendance records straight.

Facial recognition - Thanks to Microsoft Azure, Adaptive Pay includes facial recognition technology. Employees can simply take a selfie to mark their attendance, adding an extra layer of verification.

Customisable and scalable - Adaptive Pay can be tailored to fit your specific needs, whether that's managing late arrivals, calculating grace periods, or handling overtime.

Efficient rostering - Managing shift changes and overtime schedules is much simpler with Adaptive Pay, which keeps everything easy to manage and organised.

Integrated payroll calculations - This software automatically figures out holidays, off days, and overtime and ties it all into your payroll system.

Transparent pricing and solid support

What's great about Adaptive Pay is its clear pricing structure. You won't find any hidden costs or unexpected fee increases. Plus, you get full support from a team of pros in Singapore, covering everything from getting started to after-sales service.

More than just attendance tracking

Adaptive Pay is more than just a time attendance software. It's a complete cloud-based HR solution. This means automated payroll, leave management, claims, and even an appraisal system, all in one place. This comprehensive approach saves you time and money, and it means you don't need multiple platforms for your HR needs.

If you're curious about how Adaptive Pay can help your business, request a demo. See for yourself how this time attendance software can streamline your HR processes.

About the company:

Adaptive Pay is a groundbreaking cloud-based HRMS and payroll software that simplifies and automates HR and payroll management for Singapore businesses. The software adheres completely to the employment laws and regulations of Singapore, rendering it a highly suitable option for local businesses. A notable characteristic of Adaptive Pay is its user-friendly interface. The implementation of advanced security measures by Adaptive Pay guarantees the confidentiality and security of sensitive employee data.

0 notes

Text

The Significance of Contracting Out Your Accounting in Singapore

In the current competitive business landscape, companies are consistently exploring avenues to streamline operations and enhance efficiency. A strategic move gaining momentum among businesses in Singapore is the outsourcing of accounting services. This article delves into the compelling reasons why you should contemplate outsourcing your accounting needs in the dynamic business environment of Singapore.

Understanding Outsourced Accounting:

Outsourced accounting involves engaging external professionals or firms to manage a company's financial tasks, encompassing bookkeeping, tax preparation, payroll processing, financial analysis, and more. Instead of maintaining an in-house accounting department, businesses opt for specialized service providers to handle financial records and ensure compliance with regulatory requirements.

Challenges of In-house Accounting:

Managing accounting in-house presents its own set of challenges, prompting businesses to consider outsourcing. Common challenges associated with in-house accounting include:

Costs: Maintaining an in-house accounting department can be expensive, encompassing salaries, benefits, office space, accounting software, hardware, and ongoing training.

Staffing Issues: Recruiting and retaining skilled accounting professionals poses challenges, leading to disruptions and continuous recruitment efforts.

Limited Expertise: In-house accountants may have limited exposure to various accounting specialties, resulting in inefficiencies and missed financial optimization opportunities.

Resource Allocation: Balancing in-house accounting with core business activities demands time and resources, affecting strategic priorities.

Compliance Complexity: Accounting regulations and tax laws are complex and subject to frequent changes, posing a substantial burden for in-house accountants.

8 Benefits of Outsourced Accounting in Singapore:

Outsourcing accounting services in Singapore offers numerous advantages for businesses in the country:

Expertise and Compliance: Outsourcing firms are well-versed in Singapore's tax laws, accounting standards, and regulatory requirements, reducing the risk of errors and penalties.

Cost Efficiency: Outsourcing eliminates the need for an in-house accounting team, resulting in cost savings on salaries, benefits, office space, and training.

Focus on Core Business: Outsourcing allows owners and managers to concentrate on core operations, freeing up time and resources.

Access to Advanced Technology: Reputable firms invest in cutting-edge accounting software and tools, providing access without upfront costs.

Scalability: Outsourced services can be tailored to specific business needs and adapt to changes in financial requirements.

Timely and Accurate Reporting: Outsourcing firms are often more efficient in meeting accounting deadlines, ensuring prompt and accurate financial reporting.

Confidentiality and Security: Providers prioritize data security, implementing measures to safeguard sensitive financial information.

Global Expertise: For businesses with international operations, outsourced firms offer expertise in global accounting standards and navigate international financial complexities.

Choosing Outsourced Accounting Services in Singapore:

Selecting the right outsourcing partner is crucial, and here are five considerations:

Reputation and Experience: Choose a firm with a strong track record and experience in the Singaporean market and your industry.

Services Offered: Ensure the firm offers the specific services your business requires, such as tax planning and compliance.

Technology and Software: Inquire about the firm's use of up-to-date technology and its compatibility with your systems.

Data Security: Confirm the firm's data security measures and privacy policies to protect sensitive financial information.

Communication and Support: Effective communication is key, so ensure the firm provides responsive customer support.

Conclusion:

To unlock the advantages of outsourced accounting, consider Swiftly. Our skilled accountants understand industry intricacies and Singapore's complex regulations. Prioritizing data security, transparent pricing, and customized solutions, we ensure your business receives the attention it deserves. Ready for financial success? Contact Swiftly today to explore our comprehensive accounting services in Singapore.

1 note

·

View note

Text

Payroll card Market is set for a Potential Growth Worldwide: Excellent Technology Trends with Business Analysis

Latest released the research study on Global Payroll card Market, offers a detailed overview of the factors influencing the global business scope. Payroll card Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Payroll card The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Skylight Financial (United States), Wisely® by ADP (United States), FlexWage Solutions (United States), Fintwist by Comdata (United States), Brink's Money Solutions (United States), rapid! PayCard (United States), The Bancorp Bank (United States), WEX, Inc (United States)

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/190355-global-payroll-card-market?utm_source=Organic&utm_medium=Vinay

Payroll card Market Definition:

Payroll card is a prepaid card on which an employer loads an employee’s wages or salary each payday. It is an alternative to direct deposit or paper checks. It helps employers save money by not having to issue printed checks and also allow them to offer cards to employees who do not have bank accounts.

Market Trend:

Surging Number of Internet Users

Market Drivers:

Increasing Consumer Preference for Cashless Payments

Growing Awareness Regarding to the Various Benefits of Payroll Cards

Market Opportunities:

Rising Adoption of General-Purpose Reloadable Cards

The Global Payroll card Market segments and Market Data Break Down are illuminated below:

by Type (Branded Payroll Cards, Personalized Cards, Instant Issue Cards, Portable Cards), Organization Size (SMEs, Large), Features (Payroll Software Tracking, Funds Access, Liability Protection and Security, Others), Verticals (Government, Corporate, Others)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/190355-global-payroll-card-market?utm_source=Organic&utm_medium=Vinay

Strategic Points Covered in Table of Content of Global Payroll card Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Payroll card market

Chapter 2: Exclusive Summary – the basic information of the Payroll card Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the Payroll card

Chapter 4: Presenting the Payroll card Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Payroll card market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Payroll card Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology

The primary sources involves the industry experts from the Global Payroll card Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/190355-global-payroll-card-market?utm_source=Organic&utm_medium=Vinay

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

0 notes

Link

0 notes

Text

Maximizing Your Corporate Tax Benefits: Expert Corporate Tax Services in Singapore

In the bustling business landscape of Singapore, navigating corporate tax regulations is essential for ensuring compliance and optimizing financial outcomes. As businesses strive to maximize profitability and growth, enlisting the expertise of professional corporate tax services in Singapore becomes paramount. With a deep understanding of local tax laws and regulations, these services can help businesses minimize tax liabilities, capitalize on available incentives, and navigate the complexities of corporate taxation with confidence.

SBS Consulting provides incorporation services to Singapore-based companies. Additionally, we also offer secretarial, bookkeeping, accounting, taxation, GST, XBRL, and payroll services.

Understanding Corporate Tax Services in Singapore

Corporate tax services in Singapore encompass a wide range of activities aimed at assisting businesses in managing their tax obligations effectively. These services may include tax planning, compliance, advisory, and representation before tax authorities. By partnering with experienced tax professionals, businesses can ensure that they fulfill their tax obligations while maximizing tax efficiency and minimizing risks.

Navigating Singapore's Tax Landscape

Singapore's tax regime is renowned for its simplicity, competitiveness, and attractive tax incentives. However, staying abreast of tax laws and regulations is crucial for businesses to optimize their tax positions and avoid potential pitfalls. Professional corporate tax services in Singapore offer comprehensive knowledge of local tax laws, including corporate income tax, goods and services tax (GST), and withholding tax. By staying informed about legislative changes and tax updates, these services help businesses adapt their tax strategies accordingly.

Key Benefits of Corporate Tax Services in Singapore

Engaging corporate tax services in Singapore offers numerous benefits for businesses operating in the region. Firstly, these services provide tailored tax planning strategies to optimize tax efficiency and minimize liabilities. By analyzing business operations, structure, and transactions, tax professionals identify opportunities for tax savings and advise on the most tax-efficient approaches. Moreover, corporate tax services ensure compliance with Singapore's tax laws, reducing the risk of penalties and audits.

Maximizing Tax Incentives and Reliefs

Singapore offers a range of tax incentives and reliefs to encourage business growth, innovation, and investment. However, navigating these incentives can be complex, requiring a thorough understanding of eligibility criteria and application procedures. Corporate tax services in Singapore assist businesses in identifying and maximizing available tax incentives and reliefs, such as the Productivity and Innovation Credit (PIC) scheme, Pioneer Certificate Incentive, and Development and Expansion Incentive (DEI). By leveraging these incentives, businesses can enhance their competitiveness and fuel growth.

Comprehensive Tax Compliance and Reporting

Ensuring accurate tax compliance and reporting is essential for avoiding penalties and maintaining good standing with tax authorities. Corporate tax services in Singapore handle all aspects of tax compliance, including filing corporate income tax returns, preparing financial statements, and fulfilling reporting requirements. By entrusting these responsibilities to experienced professionals, businesses can streamline their tax processes and focus on their core operations with confidence.

Conclusion

In conclusion,corporate tax services singapore helping businesses navigate Singapore's tax landscape with ease and confidence. By partnering with experienced tax professionals, businesses can optimize their tax positions, minimize liabilities, and capitalize on available incentives and reliefs. Whether it's tax planning, compliance, or advisory services, investing in expert corporate tax services in Singapore is essential for maximizing tax benefits and ensuring long-term financial success. Don't leave your tax matters to chance—partner with trusted tax professionals and unlock the full potential of your business today.

0 notes

Text

Top hr article to read before the end of 2023

hris systems philippines

Here are the top 6 HRIS in the Philippines in 2023 to practice holistic people management in the Philippines, click here to know more

Top 8 HR software in Singapore in 2023

We are here to recommend the 8 Best HR management software in Singapore in 2023! In this article, we’ll tell you why they stand out from the rest, read more

The best payroll software

Streamline payroll management with efficient software for accurate, compliant, and timely employee payments.

Top 10 HR software in UAE, Middle East | peopleHum

When it comes to acquiring and retaining top talent in UAE, using flexible, high-quality HR software in UAE can make all the difference Find out the 7 best HR software in the UAE and other Middle East regions!

Top hr software in egypt

Egypt’s fastest-growing cloud HR software that enables enterprises to automate & simplify all their HR operations in one HR platform. Schedule a demo!

Learning Management System | LMS | peopleHum

peopleHum’s LMS is an intuitive Learning Management System that streamlines employee training & manages your employees’ learning & development needs.

The Ultimate Guide to SaaS HR in 2023

Upgrade your HR management strategy with peopleHum’s comprehensive guide on SaaS HR. Explore the benefits of a cloud-based system and embrace a game-changing approach to HR.

hr software

Discover the critical keypoints, strategic insights and practical tips to make an informed choice on your next HR software purchase to suit your tailored HR needs.

HR Software in Libya | peopleHum

Libya’s fastest-growing cloud HR software that enables enterprises to automate & simplify all their HR operations in one HR platform. Schedule a demo!

18 HR tips & tricks to master the art of human resource management | peopleHum

Embrace these 18 HR tips and tricks to master the art of human resource management and to create a distinct employer and HR brand, click to read more

HR Software in Nigeria | peopleHum

Nigeria’s fastest-growing cloud HR software that enables enterprises to automate & simplify all their HR operations in one HR platform. Schedule a demo!

What is Attendance Management?

How can attendance management boost workplace efficiency? Explore best practices and tools for effective attendance tracking

What is Conflict Management? | peopleHum

Conflict management is the process of identifying, addressing, and resolving disputes or disagreements between individuals or groups

The best software in newzeland

Here’s our handpicked version of the top HR software in New Zealand in 2023 you should be considering for solving your hr challenges, click here to read more

What is an Employee Loyalty program?

Loyalty programs refer to reward systems set up by a company to reward employee performance and motivate employees on individual and/or group levels

0 notes

Text

Navigate Payroll with Ease: Cloud Payroll Software in Singapore!

Cloud payroll software solutions in Singapore are reshaping the way businesses approachemployee compensation management. Adaptive Pay is a prime example, known for making payroll management simpler and more efficient. This software not only takes care of tasks like tax filings and salary calculations but also integrates seamlessly with attendance and leave systems, eliminating the need for multiple software solutions.

Experiencing trouble-free payroll

Adaptive Pay's payroll module is compliant with IRAS, MOM, and CPF standards, ensuring that all relevant employee data (including loans, leave, claims, and attendance) is automatically integrated for efficient processing. The software also includes a pre-payroll acknowledgement feature, which encourages employees to review their pay details before processing to enhance accuracy and transparency.

Top features of Adaptive Pay

Adaptive Pay is now one of the leading cloud payroll software solutionsin Singapore, thanks to its comprehensive features:

Data compilation - The software streamlines workflows by integrating cloud-based payroll and HR data. It automatically calculates allowances and prorates salaries and claims, saving valuable time.

Automatic SDL, FUND, and CPF calculations - Adaptive Pay stays updated with the latest policies, taxation rates, and formats, ensuring compliance and accuracy.

Automated tax filing - The software simplifies tax filings by automatically generating and filing forms such as IRA8A, IR8S, Appendix A, and IR21, reducing the risk of human error.

Customisability - You can tailor the payroll process to meet your organisation’s specific needs, including setting up multiple payroll schedules.

Easy bank transfers: Recognized as a reliable cloud payroll software solution in Singapore, Adaptive Pay facilitates smooth bank transfers, expediting the payroll process.

Third-party app integration: The software can integrate with other applications like QuickBooks and Xero, adapting to your existing workflows.

Simplified employee access: Employees can use the Adaptive Pay app to receive notifications and access their payslips.

More than just payroll software

Adaptive Pay is more than just a cloud payroll software solution in Singapore. It’s an all-encompassing HR management system with fully integrated modules for employee attendance, claims, overtime, leave, and appraisals. This comprehensive approach saves time and effort, making HR management smoother and more efficient.

Discover the benefits of Adaptive Pay.

To truly understand how Adaptive Pay can transform your HR processes, consider requesting a demo. This will allow you to explore all the features of this cloud payroll software solution in Singapore. Adaptive Pay is a powerful tool that simplifies payroll and HR management, making it an ideal choice for any organisation looking to enhance its HR functions.

About the company:

Adaptive Pay is a groundbreaking cloud-based HRMS and payroll software that simplifies and automates HR and payroll management for Singapore businesses. The software adheres completely to the employment laws and regulations of Singapore, rendering it a highly suitable option for local businesses. A notable characteristic of Adaptive Pay is its user-friendly interface. The implementation of advanced security measures by Adaptive Pay guarantees the confidentiality and security of sensitive employee data.

0 notes

Text

Financial Close Management Software Market to see Booming Business Sentiments

Latest released the research study on Global Financial Close Management Software Market, offers a detailed overview of the factors influencing the global business scope. Financial Close Management Software Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Financial Close Management Software The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are FloQast (United States), E*TRADE Financial Holdings, LLC (United States), Longview Solutions (Canada), Oracle Corporation (United States), Prophix Software (Canada), DataRails (United States), IBM (United States), CCH Tagetik (Italy), SAP (Germany), BlackLine, Inc. (United States), Trintech (United States), insightsoftware (United States)

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/163769-global-financial-close-management-software-market

Financial Close Management Software Market Definition:

Financial close management software, also known as accounting close software, provides tools that companies can use to complete the financial close cycle. Many organizations do a financial close at the end of each month. During this time, accountants within an organization use this software to ensure that the books are correct and that all transactions have been completed successfully. Tasks such as invoice payment and delivery cost approval, and lead import is listed in checklists and ticked off after completion. Financial Close products often include features such as task assignment, reconciliation management, reporting, and databases of previous accounting closing data organized by month and transaction type. Individual progress, as well as deadlines for each period, can also hereby be tracked by the accounting team throughout the complete cycle. These tools typically integrate with spreadsheets and various accounting tools so that users can fully document relevant data and identify notable results or inconsistencies. They can also be integrated with or delivered with other corporate performance management (CPM) functions, e.g. financial consolidation or budgeting and forecasting.

Market Trend:

The Rising Adoption of AI and Block-chain Technology in the Market

Features of Financial Close Software is Fueling the Market Growth

Market Drivers:

Increasing Complexities across Business Processes

Enhanced Cost Control/Efficiencies

Greater Application Flexibility and Shorter Time to Value

Market Opportunities:

Growth in the Use of Cloud-Based Platforms

Rising Innovations in the Fin-tech Industry

The Global Financial Close Management Software Market segments and Market Data Break Down are illuminated below:

by Type (Cloud-Based, On-Premise), Application (Small and Medium-sized Companies, Large Companies), Industry Vertical (Banking, Financial Services, and Insurance, Telecom and Information & Technology(IT), Manufacturing, Construction, Non-Profit Organizations, Others), Subscription Type (Annual Subscription, Monthly Subscription, One Time License), Features (Payroll Management, Billing & Invoice, Enterprise Resource Planning, Time & Expense Management, Others)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/163769-global-financial-close-management-software-market

Strategic Points Covered in Table of Content of Global Financial Close Management Software Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Financial Close Management Software market

Chapter 2: Exclusive Summary – the basic information of the Financial Close Management Software Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the Financial Close Management Software

Chapter 4: Presenting the Financial Close Management Software Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Financial Close Management Software market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Financial Close Management Software Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology

The primary sources involves the industry experts from the Global Financial Close Management Software Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/163769-global-financial-close-management-software-market

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

0 notes