#payroll software for sme

Explore tagged Tumblr posts

Text

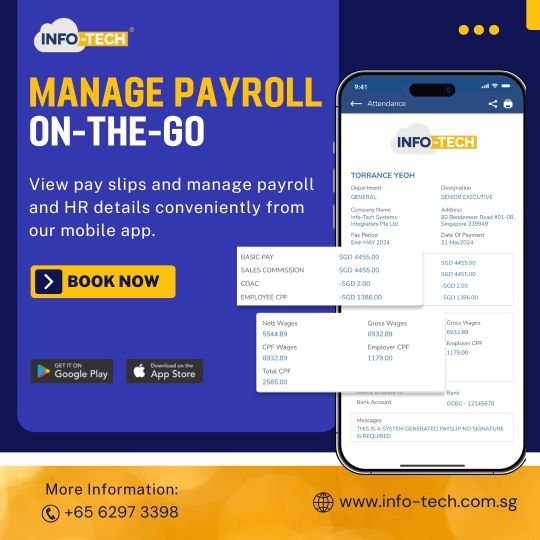

Simplify Payroll Management with Info-Tech Payroll Software

Effortlessly manage your payroll processes with Info-Tech Payroll Software. Designed for businesses of all sizes, it features automated calculations, tax compliance, and seamless integration with HR and accounting systems. Enhance accuracy, save time, and stay compliant with our user-friendly payroll solution.

#payroll software singapore#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software singapore#payroll and leave management

0 notes

Text

Reliable Payroll Software Hong Kong

Our Payroll Software is designed to simplify payroll management for businesses in Hong Kong. Automate salary calculations, MPF contributions, and tax deductions while ensuring compliance with local regulations. With seamless integration into your HR systems, you can streamline your payroll process, reduce errors, and save time.

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong

0 notes

Text

Why SMEs Are Switching to Payroll Outsourcing in 2025

Small and medium-sized enterprises (SMEs) are the backbone of the global economy, yet they face numerous challenges, especially in managing operational functions like payroll. As the business landscape evolves, more SMEs are discovering the advantages of outsourcing their payroll needs. In 2025, this shift has become even more significant, driven by a need for efficiency, accuracy, and compliance. Here’s why SMEs are increasingly turning to payroll outsourcing, with GetifyHR leading the way in providing tailored solutions.

1. Focus on Core Business Operations

For most SMEs, payroll processing is a time-consuming task that diverts attention from key business functions. Whether it's calculating salaries, handling deductions, or ensuring tax compliance, payroll demands a lot of resources and effort. How GetifyHR helps: By outsourcing payroll to GetifyHR, businesses free up time to focus on their growth strategies, customer engagement, and innovation. Our team handles all payroll-related tasks seamlessly, allowing businesses to concentrate on what they do best.

2. Reducing Costs and Overheads

Maintaining an in-house payroll department can be costly, especially for SMEs. The costs associated with hiring, training, and retaining payroll staff, as well as purchasing payroll software, can add up quickly. How GetifyHR helps: Outsourcing payroll to GetifyHR significantly reduces overhead costs. Our cost-effective solutions are designed to scale with your business, providing access to advanced payroll technology without the need for large investments in software or staff.

3. Enhanced Compliance with Changing Laws

Payroll compliance is one of the most complex aspects of running a business. With ever-changing labor laws, tax rates, and statutory requirements, many SMEs struggle to keep up, risking penalties and fines. How GetifyHR helps: GetifyHR stays up-to-date with the latest legal and tax changes in India, ensuring that your business remains fully compliant. We manage everything from Provident Fund (PF) and Employee State Insurance (ESI) to Tax Deducted at Source (TDS) filings, so you can rest assured that your payroll is always aligned with current regulations.

4. Access to Advanced Payroll Technology

Many SMEs rely on outdated payroll systems that lack the sophistication required for accurate and efficient processing. This can lead to errors, delays, and a lack of transparency. How GetifyHR helps: GetifyHR offers state-of-the-art payroll technology that integrates with your existing systems. From automated salary calculations to real-time reports, our advanced tools provide greater accuracy and transparency, enabling you to manage payroll with ease.

5. Mitigating Data Security Risks

Payroll systems store highly sensitive employee data, making them a prime target for cyberattacks. Protecting this data is crucial for maintaining trust and avoiding legal ramifications. How GetifyHR helps: At GetifyHR, data security is our top priority. We implement robust security measures, including encryption, secure access controls, and regular audits, to ensure that your employee data remains safe from unauthorized access and breaches.

6. Scalability and Flexibility

As SMEs grow, their payroll needs often become more complex, especially if they hire more employees, expand into new locations, or face varying payroll requirements for different roles. How GetifyHR helps: Our payroll services are highly scalable, making it easy for SMEs to adapt as their needs evolve. Whether you’re expanding your workforce or dealing with different pay structures, GetifyHR provides flexible solutions that grow with your business.

Conclusion

In 2025, SMEs are increasingly realizing the value of outsourcing their payroll functions. With the help of GetifyHR, businesses can save time, reduce costs, stay compliant, and leverage advanced technology to streamline payroll processing. The move towards payroll outsourcing is not just a trend—it’s a smart business decision that positions SMEs for long-term success.

Partner with GetifyHR today to simplify your payroll and focus on scaling your business!

#Payroll Outsourcing for SMEs#Payroll Services for Small Businesses#Payroll Technology for SMEs#Payroll Management Services#Employee Payroll Software#Outsourcing Payroll Benefits

0 notes

Text

Unlock Efficiency: Why Every SME Should Embrace Mobile HR Apps

employment, and local economic growth. However, managing an SME is no small feat, particularly when it comes to human resources. From payroll and attendance to compliance and employee engagement, HR tasks can become overwhelming, especially for businesses operating on tight budgets and limited resources. This is where mobile HR apps step in as game-changers. In this blog, we will talk about why every SME must use Mobile HR applications to improve organisations efficiency.

Challenges SMEs Face Without Mobile HR Apps

Operating without a mobile SME HRMS app can hinder the growth and efficiency of an SME. Common challenges include:

Manual Errors: Relying on spreadsheets or manual processes for payroll and attendance increases the likelihood of costly errors.

Inefficient Communication: A lack of centralised communication tools can lead to misunderstandings and delayed responses to employee concerns.

Limited Real-Time Insights: Without real-time data, SME owners struggle to make informed decisions regarding workforce management.

Employee Dissatisfaction: Outdated SME HRMS softwares can frustrate employees, leading to higher turnover rates and lower morale.

These challenges not only drain resources but also impact an SME’s ability to remain competitive in a fast-paced market.

Benefits of Mobile HR Apps for SMEs

The benefits of mobile SME HRMS apps extend far beyond convenience. They address key pain points that SMEs face in managing their workforce:

Enhanced Accessibility: Mobile HR apps allow business owners and employees to access important HR functions anytime, anywhere. This is particularly beneficial for SMEs with remote teams or field workers, as it ensures seamless communication and task management.

Cost-Effectiveness: Traditional HR systems often come with hefty upfront costs and ongoing maintenance fees. Mobile HR apps, on the other hand, operate on subscription-based models that are affordable and predictable, making them ideal for budget-conscious SMEs.

Streamlined HR Processes: Manual HR tasks like attendance tracking, leave approvals, and payroll processing are time-consuming and prone to errors. Mobile SME HR solutions automate these processes, saving time and reducing the risk of mistakes.

Improved Employee Engagement: Employee self-service features allow workers to access payslips, request leaves, and update personal information without having to go through HR personnel. This not only enhances transparency but also empowers employees, fostering higher levels of engagement.

Data Security and Compliance: SMEs are often vulnerable to data breaches and non-compliance with labour laws. Mobile HR apps provide secure cloud storage for sensitive employee data and ensure that businesses stay compliant with the latest regulations through automatic updates.

Key Features SMEs Should Look for in a Mobile HR App

When choosing a mobile HR app, it’s essential to select a solution that aligns with your business needs. Key features to consider include:

User-Friendly Interface: Choose a mobile app that is easy to use and navigate. A complicated application will end up wasting time and cause dissatisfaction.

Cloud-Based Storage: Cloud-based storage for HRMS apps offers scalability, cost-effectiveness, and enhanced security. It enables easy access to data from anywhere, ensures real-time updates, and provides automatic backups and disaster recovery.

Integration Capabilities: Look for apps that can seamlessly integrate with your existing systems like accounting or SME payroll software.

Scalability: Choose an app that can grow with your business, accommodating additional employees and advanced features as needed.

Conclusion

For SME owners, the question is no longer whether to adopt a mobile HR app, but when. In today’s competitive landscape, managing HR manually is no longer sustainable. Mobile HR apps provide an affordable, efficient, and scalable solution that enables SMEs to focus on what truly matters—growing their business and supporting their workforce.

Opportune HR is one of the best HRMS and payroll providing companies in India with 2 awards. Visit their website to learn about HR related services they provide.

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

Best HR Software Providers in Bahrain

Enhance your HR and payroll processes with the best HR software in Bahrain. Our HR and payroll software Bahrain offers cloud-based HR management, HR CRM software, and comprehensive solutions for small businesses and SMEs.

#hr management software bahrain#hr & payroll software bahrain#hr payroll software bahrain#best hr software in bahrain#hr and payroll software bahrain#hr and payroll software in bahrain#hr crm software#best hr software for small business#best hr management software#sme hr software#hr management software for small business#hr and payroll software#hr software companies#hr software for small business#hr payroll software#hr attendance software#hr software pricing#best hr software#cloud based hr management software#cloud based hr software#hr application software#hr management software

0 notes

Text

Revolutionize HR with our Free & Future-Ready Cloud-Based Payroll & Tax Management! Explore innovation at its finest. Visit us at https://hrmshost.com/ for a game-changing experience.

#HRInnovation#CloudPayroll#FreeHRSoftware#FutureReadyHR#HRManagement#DigitalTransformation#WorkforceEmpowerment#TaxManagement#EfficiencyBoost#InnovativeSolutions#payroll management#payroll for smes#cloud based payroll software#taxes

0 notes

Text

Why Payroll Outsourcing in Delhi is Essential for Business Efficiency

Streamline Your Business with Payroll Outsourcing in Delhi

As businesses expand and compliance regulations become more demanding, many organizations are now turning to payroll outsourcing in Delhi to simplify their internal operations. Managing payroll in-house can be tedious, especially when dealing with frequent legal updates, tax deductions, and employee benefits. Outsourcing this function not only ensures accuracy but also provides companies the freedom to focus on core business activities.

What is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external service provider to manage a company's entire payroll system. This includes calculating employee salaries, processing tax filings, managing provident fund (PF) and employee state insurance (ESI) contributions, generating payslips, and ensuring legal compliance. For businesses in Delhi—a city teeming with startups, SMEs, and large enterprises—this approach has become a practical necessity.

Benefits of Payroll Outsourcing

1. Cost and Time Efficiency Managing payroll internally can consume significant time and resources. With outsourcing, companies save on the cost of hiring specialized staff or purchasing expensive payroll software. It also eliminates the need for constant training to stay up-to-date with changing laws.

2. Regulatory Compliance Indian payroll laws are complex and ever-evolving. From income tax rules to statutory deductions like PF, ESI, and gratuity, compliance is critical to avoid penalties. A payroll outsourcing provider in Delhi ensures all calculations and filings are handled accurately and on time.

3. Enhanced Accuracy Manual payroll processing can lead to errors in salary calculations or tax filings. With automated systems and expert oversight, outsourced payroll services offer greater accuracy and reliability, reducing the chances of employee dissatisfaction or legal issues.

4. Data Security and Confidentiality Reputable payroll outsourcing firms use secure, cloud-based systems with encryption to protect sensitive employee data. This minimizes the risk of data breaches and ensures confidentiality is maintained at all times.

5. Scalability and Flexibility As your workforce grows or contracts, outsourcing partners can easily scale their services to match your needs. Whether you’re hiring 10 or 100 new employees, your payroll operations remain smooth and efficient.

Services Included in Payroll Outsourcing

Most payroll outsourcing providers in Delhi offer comprehensive solutions that include:

Monthly salary processing and disbursement

Payslip generation and distribution

Tax deductions and filings (TDS, PF, ESI, etc.)

Year-end tax form preparation (Form 16)

Compliance with labor laws and statutory reporting

Attendance and leave management integration

Reimbursement and bonus management

Employee helpdesk support for payroll queries

Advanced service providers may also offer integration with HR software, mobile apps for employees, and dashboards for real-time payroll analytics.

Why Delhi-Based Companies Should Consider Payroll Outsourcing

Delhi is a highly competitive and regulatory-sensitive business environment. Companies in this region must be agile and compliant while controlling costs. Payroll outsourcing is especially beneficial here because local providers have expertise in regional labor rules, state-specific regulations, and offer fast turnaround times for urgent payroll processing needs.

Additionally, Delhi is home to a wide pool of professional payroll service providers who offer tailored solutions for different industries—from IT and education to manufacturing and healthcare.

Choosing the Right Payroll Partner

Before selecting a payroll outsourcing company in Delhi, consider the following:

Experience and Reputation: Look for a provider with proven experience and client testimonials.

Technology Platform: Ensure they use a secure, modern payroll system.

Compliance Knowledge: They should stay updated with the latest changes in tax and labor laws.

Customization Options: Your business may have unique payroll structures or benefits.

Customer Support: Timely and responsive communication is essential for resolving issues quickly.

Final Thoughts

In a fast-moving market like Delhi, where talent retention, compliance, and cost control are key concerns, outsourcing payroll can offer a significant competitive advantage. It streamlines processes, ensures accuracy, and reduces operational stress—allowing companies to concentrate on strategic goals.

Whether you're a small business owner or the HR head of a growing enterprise, payroll outsourcing in Delhi could be the smartest step you take this year toward efficiency and peace of mind.

3 notes

·

View notes

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

Accounting Outsourcing Companies in India by Neeraj Bhagat & Co.: Your Reliable Financial Partner

In today’s dynamic business environment, companies are constantly looking for ways to optimize their operations and focus on core competencies. One of the most effective strategies is outsourcing non-core functions like accounting. For businesses seeking top-notch financial management, Neeraj Bhagat & Co. stands out as one of the leading accounting outsourcing companies in India, offering unparalleled expertise and services tailored to meet diverse business needs.

Why Choose Neeraj Bhagat & Co. for Accounting Outsourcing?

Extensive Industry Experience With decades of experience, Neeraj Bhagat & Co. has established itself as a trusted partner for businesses across various industries. Their team of seasoned professionals ensures that clients receive accurate, timely, and reliable financial services.

Comprehensive Accounting Services Neeraj Bhagat & Co. offers a wide range of accounting outsourcing services, including:

Bookkeeping and Financial Reporting Tax Compliance and Advisory Payroll Processing Budgeting and Forecasting Audit Support Their holistic approach ensures that all financial aspects are covered, allowing businesses to focus on growth and innovation.

Customized Solutions for Every Business Understanding that no two businesses are the same, Neeraj Bhagat & Co. provides customized solutions tailored to each client’s specific needs. Whether you’re a startup, SME, or a large corporation, their team works closely with you to develop a financial strategy that aligns with your goals.

Benefits of Outsourcing Accounting to Neeraj Bhagat & Co.

Cost Efficiency Outsourcing accounting functions can significantly reduce overhead costs. By partnering with Neeraj Bhagat & Co., businesses can save on expenses related to hiring in-house accounting staff, training, and infrastructure.

Access to Expertise With Neeraj Bhagat & Co., you gain access to a team of highly skilled professionals who stay updated with the latest accounting standards and regulations. This ensures compliance and minimizes the risk of financial discrepancies.

Focus on Core Activities By outsourcing accounting tasks, businesses can allocate more resources and attention to their core activities, leading to increased productivity and growth.

Scalability As your business grows, your accounting needs may become more complex. Neeraj Bhagat & Co. offers scalable solutions that can adapt to your evolving requirements, ensuring seamless financial management.

How Neeraj Bhagat & Co. Stands Out

Client-Centric Approach At Neeraj Bhagat & Co., client satisfaction is paramount. Their dedicated team works closely with clients to understand their unique challenges and provide personalized solutions.

Advanced Technology Leveraging the latest accounting software and technology, Neeraj Bhagat & Co. ensures efficient and accurate financial reporting. Their tech-driven approach enhances transparency and streamlines processes.

Strong Ethical Standards Integrity and transparency are at the core of Neeraj Bhagat & Co.’s operations. Clients can trust them to handle their financial information with the utmost confidentiality and professionalism.

Get Started with Neeraj Bhagat & Co. If you’re looking for reliable and efficient accounting outsourcing companies in India, Neeraj Bhagat & Co. is the ideal partner. Their comprehensive services, experienced team, and client-focused approach make them a preferred choice for businesses seeking to enhance their financial management.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

3 notes

·

View notes

Text

Boosting Efficiency: The Role of ERP Software in Modern Manufacturing Operations

In today's fast-paced manufacturing landscape, efficiency is not just a desirable trait; it's a necessity. To stay competitive and meet the demands of the market, manufacturers must streamline their processes, optimize resource utilization, and enhance decision-making capabilities. This is where Enterprise Resource Planning (ERP) software steps in as a game-changer. In this article, we'll delve into the pivotal role of ERP systems in revolutionizing manufacturing operations, particularly in India's thriving industrial sector.

Understanding ERP for Manufacturing Industry

ERP systems for manufacturing are comprehensive software solutions designed to integrate and automate core business processes such as production planning, inventory management, supply chain logistics, financial management, and human resources. By consolidating data and operations into a unified platform, ERP empowers manufacturers with real-time insights, facilitates collaboration across departments, and enables informed decision-making.

Streamlining Operations with ERP Solutions

In the dynamic environment of manufacturing, where every minute counts, efficiency gains translate directly into cost savings and competitive advantages. ERP software for manufacturing offers a multitude of features that streamline operations and drive efficiency:

1. Enhanced Production Planning: ERP systems enable manufacturers to create accurate production schedules based on demand forecasts, resource availability, and production capacity. By optimizing production timelines and minimizing idle time, manufacturers can fulfill orders promptly and reduce lead times.

2. Inventory Management: Efficient inventory management is crucial for balancing supply and demand while minimizing holding costs. ERP software provides real-time visibility into inventory levels, automates reorder points, and facilitates inventory optimization to prevent stockouts and overstock situations.

3. Supply Chain Optimization: ERP solutions for manufacturing integrate supply chain processes from procurement to distribution, enabling seamless coordination with suppliers and distributors. By optimizing procurement cycles, minimizing transportation costs, and reducing lead times, manufacturers can enhance supply chain resilience and responsiveness.

4. Quality Control: Maintaining product quality is paramount in manufacturing to uphold brand reputation and customer satisfaction. ERP systems offer quality management modules that streamline inspection processes, track product defects, and facilitate corrective actions to ensure adherence to quality standards.

5. Financial Management: Effective financial management is essential for sustaining manufacturing operations and driving profitability. ERP software provides robust accounting modules that automate financial transactions, streamline budgeting and forecasting, and generate comprehensive financial reports for informed decision-making.

6. Human Resource Management: People are the cornerstone of manufacturing operations, and managing workforce efficiently is critical for productivity and employee satisfaction. ERP systems for manufacturing include HR modules that automate payroll processing, manage employee records, and facilitate workforce planning to align staffing levels with production demands.

The Advantages of ERP for Manufacturing Companies in India

India's manufacturing sector is undergoing rapid transformation, fueled by factors such as government initiatives like "Make in India," technological advancements, and globalization. In this dynamic landscape, ERP software plays a pivotal role in empowering manufacturing companies to thrive and remain competitive:

1. Scalability: ERP solutions for manufacturing are scalable, making them suitable for companies of all sizes – from small and medium enterprises (SMEs) to large conglomerates. Whether a company is expanding its operations or diversifying its product portfolio, ERP systems can adapt to evolving business needs and support growth.

2. Compliance: Regulatory compliance is a significant concern for manufacturing companies in India, given the complex regulatory environment. ERP software incorporates compliance features that ensure adherence to industry regulations, tax laws, and reporting requirements, minimizing the risk of non-compliance penalties.

3. Localization: ERP vendors catering to the Indian manufacturing sector offer localized solutions tailored to the unique requirements of the Indian market. From multi-currency support to GST compliance features, these ERP systems are equipped with functionalities that address the specific challenges faced by Indian manufacturers.

4. Cost Efficiency: Implementing ERP software for manufacturing entails upfront investment, but the long-term benefits far outweigh the costs. By streamlining processes, optimizing resource utilization, and reducing operational inefficiencies, ERP systems drive cost savings and improve overall profitability.

5. Competitive Edge: In a fiercely competitive market, manufacturing companies in India must differentiate themselves through operational excellence and agility. ERP software equips companies with the tools and insights needed to outperform competitors, adapt to market dynamics, and capitalize on emerging opportunities.

Choosing the Right ERP Software for Manufacturing

Selecting the right ERP solution is crucial for maximizing the benefits and ensuring a smooth implementation process. When evaluating ERP software for manufacturing, companies should consider the following factors:

1. Industry-specific functionality: Choose an ERP system that offers industry-specific features and functionalities tailored to the unique requirements of manufacturing operations.

2. Scalability and flexibility: Ensure that the ERP software can scale with your business and accommodate future growth and expansion.

3. Ease of integration: Look for ERP systems that seamlessly integrate with existing software applications, such as CRM systems, MES solutions, and IoT devices, to create a cohesive technology ecosystem.

4. User-friendliness: A user-friendly interface and intuitive navigation are essential for ensuring widespread adoption and maximizing user productivity.

5. Vendor support and expertise: Select a reputable ERP vendor with a proven track record of success in the manufacturing industry and robust customer support services.

Conclusion

In conclusion, ERP software has emerged as a cornerstone of modern manufacturing operations, empowering companies to enhance efficiency, drive growth, and maintain a competitive edge in the global market. For manufacturing companies in India, where agility, scalability, and compliance are paramount, implementing the right ERP solution can be a transformative investment that paves the way for sustainable success. By harnessing the power of ERP, manufacturers can optimize processes, streamline operations, and unlock new opportunities for innovation and growth in the dynamic landscape of the manufacturing industry.

#ERP software providers in India#Manufacturing enterprise resource planning#ERP systems for manufacturing companies#ERP system for manufacturing industry#ERP for manufacturing companies#ERP software for engineering company#ERP software for engineering companies in India#ERP software for engineering companies in Mumbai#ERP solution providers in India#ERP for manufacturing industry#ERP systems for manufacturing#ERP solutions for manufacturing#ERP software manufacturing industry#ERP for manufacturing company in India#India

8 notes

·

View notes

Text

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong#payroll and leave management

0 notes

Text

Top Accounting Firms in Madhapur, Hyderabad: 2025 Edition

Madhapur, the heart of Hyderabad’s bustling IT and business district, is home to some of the most reputable and fast-growing accounting firms in India. With an increasing number of startups, SMEs, and MNCs setting up operations in this area, the demand for professional accounting services has never been higher. In this blog, we’ll explore the top accounting firms in Madhapur, with a spotlight on Steadfast Business Consultants LLP (SBC) — a firm making waves for its client-focused approach and comprehensive financial solutions.

Why Madhapur Is a Hub for Leading Accounting Firms

Madhapur, located in the HITEC City region, has become synonymous with innovation and corporate growth. With a growing presence of IT parks, co-working spaces, and business accelerators, it’s no surprise that accounting firms in Madhapur are in high demand. Businesses in the area require expert support in accounting, tax compliance, payroll, and financial advisory — services that local firms are uniquely positioned to provide with agility and insight.

What to Look for in an Accounting Firm

When choosing among the many accounting firms in Madhapur, businesses should consider:

Experience and Reputation: Look for firms with a proven track record and client testimonials.

Comprehensive Services: The best firms offer everything from bookkeeping and tax filing to strategic advisory.

Local Expertise: Knowledge of regional tax laws and compliance requirements is crucial.

Use of Technology: Leading firms leverage cloud accounting, automation, and AI tools to deliver fast, accurate results.

Steadfast Business Consultants LLP (SBC): A Trusted Name in Madhapur

Among the top accounting firms in Madhapur, Steadfast Business Consultants LLP (SBC) stands out for its expertise, personalized service, and deep understanding of the business landscape in Hyderabad.

Why Choose SBC?

Wide Range of Services: SBC provides accounting, GST filings, income tax services, payroll management, ROC compliance, and financial advisory.

Client-Focused Approach: The firm offers customized solutions tailored to each business’s needs — whether you’re a startup or an established enterprise.

Local Presence with Global Standards: Being based in Madhapur, Hyderabad, SBC combines local knowledge with a high standard of professional ethics and accuracy.

Technology-Driven: SBC uses leading accounting software and cloud-based tools to deliver real-time financial insights, helping clients make data-backed decisions.

Whether you’re launching a new venture or managing an expanding operation, SBC has the expertise to support your business’s financial needs with precision and transparency.

Final Thoughts

As we move through 2025, the importance of partnering with a reliable accounting firm has never been greater. The top accounting firms in Madhapur are not just service providers — they are strategic partners that can help you navigate financial complexity, ensure compliance, and drive business growth.

Looking for a trusted accounting partner in Madhapur?

Visit: Steadfast Business Consultants LLP (SBC), Madhapur, Hyderabad Call Now: 040–48555182

Experience expert financial guidance with SBC — where your business goals become ours.

#accounting firms in hyderabad#accounting firms in india#accounting firms in madhapur#advance pricing agreement advisory#aeo scheme

0 notes

Text

Choosing the Right HR Software for Your Small-Scale Business

In the ever-evolving landscape of business management, the Human Resources (HR) department stands as the backbone of any organisation. For small and medium-sized enterprises (SMEs), efficient HR management is crucial for sustained growth and success. With the advent of technology, cloud-based HR software has emerged as a game-changer, offering SMEs streamlined processes, cost-effectiveness, and scalability.

However, amidst a plethora of options, selecting the right cloud HR software tailored to your small business's needs can be daunting. Fear not, as this comprehensive guide is here to navigate you through the process of choosing the perfect solution for your SME.

Understanding the Importance of Cloud HR Software for SMEs

Before delving into the specifics of selecting the right SME software, it's essential to grasp the significance it holds for SMEs. Traditional HR processes often involve manual data entry, cumbersome paperwork, and a significant investment of time and resources.

Cloud HR software revolutionises these processes by centralising data, automating repetitive tasks, and providing real-time insights. For SMEs with limited resources, adopting cloud HR software means maximising efficiency, reducing costs, and empowering HR teams to focus on strategic initiatives rather than administrative tasks.

Key Features to Look for in Cloud HR Software for Small Businesses

When evaluating different software options for your SME in HR sector, certain key features should be at the top of your checklist:

Employee Self-Service (ESS): An intuitive ESS portal allows employees to manage their personal information, request time off, view pay stubs, and access important documents, reducing the administrative burden on HR personnel.

Recruitment and Onboarding: Efficient recruitment and onboarding functionalities are vital for SMEs looking to attract and retain top talent. Seek out software that facilitates job posting, applicant tracking, candidate evaluation, and seamless onboarding experiences to streamline the hiring process.

Performance Management: Performance management features enable SMEs to set goals, conduct performance reviews, provide feedback, and track employee progress effectively. Look for software that offers customisable performance appraisal templates, 360-degree feedback capabilities, and performance analytics to foster employee development and engagement.

Benefits Administration: Simplify benefits administration tasks such as enrollment, eligibility management, and benefits tracking with software that offers robust benefits administration functionalities. Ensure the software integrates with insurance providers and allows for easy management of employee benefits packages.

Payroll Management: Look for SME payroll software that offers comprehensive payroll management capabilities, including automated calculations, tax compliance, direct deposit options, and customisable pay schedules, to streamline payroll processes and ensure accuracy.

Compliance and Reporting: Compliance with labour laws and regulations is non-negotiable for SMEs. Choose cloud HR software that offers compliance management tools, automated reporting features, and built-in safeguards to ensure adherence to legal requirements and mitigate compliance risks.

Scalability and Integration: As your SME grows, your HR software should be able to scale alongside your business. Opt for software that is scalable, customizable, and integrates seamlessly with other essential business tools such as accounting software, time and attendance systems, and ERP solutions.

Factors to Consider When Choosing Cloud HR Software for Your SME

In addition to evaluating the features mentioned above, several other factors should influence your decision when selecting cloud HR software for your small business:

Cost: Consider the total cost of ownership, including subscription fees, implementation costs, and any additional charges for add-on features or user licenses. Choose a solution that aligns with your budgetary constraints while offering the features and scalability your SME requires.

User Experience: The user interface should be intuitive, user-friendly, and accessible across devices to ensure widespread adoption and minimal training requirements for your HR team and employees.

Security and Data Privacy: Protecting sensitive employee data is paramount. Select cloud HR software that prioritises data security, offers robust encryption measures, and complies with industry-standard security certifications such as SOC 2 and GDPR.

Customer Support: Evaluate the level of customer support provided by the software vendor, including availability, responsiveness, and the quality of technical assistance offered. Prompt and reliable customer support can be invaluable in resolving issues and maximising the value of your investment.

Vendor Reputation and Reliability: Research the reputation and track record of the software vendor, including customer reviews, testimonials, and case studies. Choose a reputable vendor with a proven history of reliability, innovation, and ongoing product development.

Conclusion

Choosing the right SME software for managing HR operations efficiently is a decision that requires careful consideration of your unique needs, budget, and long-term objectives. By prioritising key features such as employee self-service, payroll management, recruitment, and compliance and evaluating factors like cost, user experience, security, and vendor reliability, you can select a solution that empowers your SME to thrive in the digital age of HR management. Remember, investing in the right cloud HR software isn't just a decision for today—it's an investment in the future success and growth of your small business.

Opportune HR's HR Software for SMEs stands out as the premier choice for small and medium-sized enterprises seeking efficient and comprehensive human resource management solutions. With its user-friendly interface, robust features, and customisable options, Opportune HR streamlines HR processes, from recruitment and onboarding to performance evaluation and payroll management. Its intuitive design empowers SMEs to effectively manage their workforce, optimise productivity, and ensure compliance with ease.

Trusted by businesses worldwide, Opportune HR's software is truly the pinnacle of HR technology for SMEs, delivering unparalleled efficiency and effectiveness in managing human capital.

0 notes

Text

HR Management Software Bahrain - Top Rated

Looking for the best HR software in Bahrain? Our HR & payroll software is perfect for small businesses and SMEs. It combines HR management, payroll processing, and attendance tracking in one cloud-based solution. Streamline your HR operations with the best HR management software in Bahrain.

#hr management software bahrain#hr & payroll software bahrain#hr payroll software bahrain#best hr software in bahrain#hr and payroll software bahrain#hr and payroll software in bahrain#hr crm software#best hr software for small business#best hr management software#sme hr software#hr management software for small business#hr and payroll software#hr software companies#hr software for small business#hr payroll software#hr attendance software#hr software pricing#best hr software#cloud based hr management software#cloud based hr software#hr application software#hr management software

0 notes

Text

0 notes