#PayrollProfessionals

Explore tagged Tumblr posts

Text

Why UK Businesses Are Turning to Elysium Associates for Payroll and Pension Management

Introduction

Managing payroll and pensions is no small feat for UK businesses. These tasks require precision, extensive knowledge of the law, and a considerable investment of time. With the complexities of modern regulations and the ever-present risk of penalties, businesses—especially small to medium-sized enterprises (SMEs)—often find themselves overwhelmed. This is why many are turning to Elysium Associates, a trusted provider that specializes in payroll and pension management, to alleviate these burdens and ensure smooth operations.

The Growing Complexity of Payroll and Pension Management

In the UK, payroll and pension management are governed by an intricate web of regulations that are constantly evolving. Staying compliant means not only understanding current laws but also keeping up with frequent changes. For businesses, this involves:

Navigating Regulatory Updates: The UK government frequently updates payroll and pension regulations, requiring businesses to stay on top of these changes. Failing to do so can lead to non-compliance and hefty fines.

Ensuring Accurate Calculations: From tax deductions to National Insurance contributions and pension auto-enrolment, businesses must ensure that every calculation is precise.

Handling Employee Queries: Employees expect their pay to be accurate and their pension contributions to be properly managed. Errors can lead to dissatisfaction and reduced morale.

Given these challenges, it's clear why many businesses struggle to manage payroll and pensions effectively on their own.

Why Businesses Struggle with Payroll and Pension Management

The challenges of managing payroll and pensions go beyond just understanding the regulations. They involve:

Time-Consuming Processes: Payroll isn’t just about paying your employees; it involves calculating wages, processing deductions, and submitting reports to HMRC. These tasks can be incredibly time-consuming.

Risk of Non-Compliance: Missing a deadline or miscalculating a tax contribution can result in fines or legal action, adding financial strain and risking the company’s reputation.

Frequent Regulatory Changes: The landscape of payroll and pension management is constantly shifting, making it difficult for businesses to keep up without dedicated expertise.

These factors contribute to why so many businesses find payroll and pension management to be a significant burden.

The Consequences of Poor Payroll and Pension Management

Failing to manage payroll and pensions effectively can have serious consequences, including:

Financial Penalties: Non-compliance with payroll and pension regulations can lead to substantial fines and penalties, which can be particularly damaging for SMEs.

Employee Dissatisfaction: Errors in payroll can lead to delayed payments, incorrect deductions, or issues with pension contributions, all of which can result in unhappy employees. This dissatisfaction can, in turn, lead to higher turnover rates.

Legal and Reputational Risks: Poor management of payroll and pensions can open a business up to legal challenges and damage its reputation, both of which can be costly and time-consuming to resolve.

For these reasons, effective payroll and pension management is crucial for maintaining a healthy business.

Introducing Elysium Associates

Elysium Associates has become a leading name in payroll and pension management in the UK. With a team of experts and a commitment to providing tailored solutions, Elysium Associates has earned the trust of businesses across various industries. Their approach to managing payroll and pensions is rooted in a deep understanding of UK regulations and a dedication to customer service.

Expertise and Experience at Elysium Associates

One of the key reasons businesses turn to Elysium Associates is their expertise. The team at Elysium Associates comprises professionals with years of experience in payroll and pension management. This expertise allows them to:

Ensure Compliance: Elysium Associates stays updated on the latest regulations, ensuring that their clients remain compliant and avoid any legal issues.

Provide Accurate Services: With their deep knowledge and experience, Elysium Associates delivers accurate payroll processing and pension management, reducing the risk of errors.

Offer Expert Advice: Businesses can rely on Elysium Associates for advice on complex payroll and pension issues, helping them make informed decisions.

This wealth of experience translates into high-quality service that meets the needs of businesses of all sizes.

Comprehensive Payroll Services

Elysium Associates offers a full suite of payroll services, designed to meet the diverse needs of UK businesses. These services include:

Payroll Processing: Handling everything from wage calculations to the submission of tax returns, ensuring that employees are paid accurately and on time.

Tax Deductions and National Insurance: Managing all aspects of tax and National Insurance contributions, ensuring compliance with HMRC requirements.

Employee Benefits Management: Elysium Associates can also manage employee benefits, including bonuses and other incentives, ensuring these are correctly processed and reported.

By taking over these tasks, Elysium Associates frees up businesses to focus on their core operations.

Pension Management Services

Pension management is another area where Elysium Associates excels. They offer comprehensive services that cover:

Auto-Enrolment: Elysium Associates ensures that businesses comply with auto-enrolment regulations, helping them set up and manage pension schemes for their employees.

Pension Scheme Management: From selecting the right pension plan to managing contributions, Elysium Associates provides end-to-end pension management services.

Compliance with The Pensions Regulator: Elysium Associates ensures that businesses meet all obligations set by The Pensions Regulator, minimizing the risk of penalties.

These services ensure that businesses can offer attractive pension schemes while staying compliant with all regulations.

Customized Solutions for Diverse Business Needs

Elysium Associates understands that every business is unique, which is why they offer customized solutions tailored to each client’s needs. Whether a business is a small startup or a large corporation, Elysium Associates:

Tailors Services to Business Size and Industry: Elysium Associates works closely with each client to understand their specific needs and challenges, providing solutions that are the right fit.

Adapts to Changing Needs: As businesses grow and evolve, so do their payroll and pension needs. Elysium Associates offers the flexibility to adjust their services as required.

This personalized approach ensures that clients receive the best possible service, regardless of their industry or size.

Regulatory Compliance: Staying Ahead of Changes

One of the biggest challenges in payroll and pension management is keeping up with regulatory changes. Elysium Associates addresses this by:

Monitoring Regulatory Updates: Elysium Associates stays informed about all changes in payroll and pension regulations, ensuring that their clients are always compliant.

**Proactive

#PayrollSolutions#PensionPlanning#SecureYourFuture#EmployeeBenefits#RetirementReady#PayrollExperts#FutureFinances#PensionProtection#SmartSavings#PaydayPerfection#WorkplaceWellness#RetireWell#FinancialSecurity#BenefitsForYou#PayrollProfessionals

0 notes

Text

#offshore Staffing Service is the most cost-effective, time-saving, and effort-saving option for businesses. Know more - https://www.callcenter.com.bd/service/outbound-call-center-services/offshore-staffing #offshorestaffingservice #payrollprofessionals

#offshore Staffing Service is the most cost-effective, time-saving, and effort-saving option for businesses. Know more - https://www.callcenter.com.bd/service/outbound-call-center-services/offshore-staffing #offshorestaffingservice #payrollprofessionals

0 notes

Photo

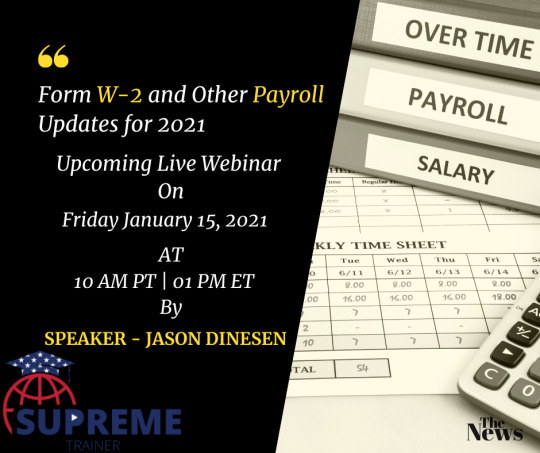

Filing the form W - 2 in 2021. To know more about the deadline and new legislation watch our recorded #webinar on "FORM W - 2 AND OTHER PAYROLL UPDATES". By clicking the link: https://bit.ly/3hRjBzW

#FORMW2#Taxforom#SUPREMETRAINER#JASONDINESEN#Payrollprofessionals#compliance#form941updates#form941#2020taxes#lawmakers#legalprofessionals

1 note

·

View note

Text

Importance of Payroll Service in India

A payroll is a business's record of the employees eligible for payment against a specific day or period. The compensation information also contains details about the employees' attendance, roles, leave policies, and so forth. Processing payroll entails subtracting appropriate deductions from gross salary (such as taxes, PF, insurance policies, etc.) to determine each employee's actual net pay.

One of the most important and time-consuming administrative work is payroll service India. And it needs to be handled with the utmost care. Therefore, it is essential to comprehend its IMPORTANCE in terms of business.

Keep reading this blog to learn more.

Read More... payroll service India

0 notes

Photo

When professionals like QBA handle your payroll, you can be certain that your employees will be paid correctly, securely, and on time each month. They also handle all of the payroll-related administrative responsibilities.

#payrollprofessionals#payroll#accountingfirm#bookkeeping services#outsourced accounting services#accountant#payrollmanagement

0 notes

Photo

Upcoming #LiveWebinar!!! Register Now at https://www.people-trainers.com/webinar/eeoc?utm_source=Backlink&utm_medium=SMO&utm_campaign=sale&subject=Sale . Join the Live Webinar Session by People Trainers on 21st April 2021 for "EEOC & CDC Guidance for #Employers Mandating #COVIDVaccines at Work. How Should Employers Proceed!'" . SPEAKER: Margie Faulk, Sr. HR Professional with 14+ years of HR Management & Compliance Experience. . This #webinar will cover the following topics: . ✔️ What is part of the EEOC Guidance that Employers need to include in their employee handbook and stand-alone policies? ✔️ What vaccination guidelines need to be included in the employee handbook and which need to be excluded, for more details visit - https://www.people-trainers.com/webinar/eeoc?utm_source=Backlink&utm_medium=SMO&utm_campaign=sale&subject=Sale

1 note

·

View note

Link

A PEO will take care of compliance requirements, which means you will avoid the legal consequences of payroll administration non-compliance. Your co-employer handles the administrative aspects of human resource management as you focus on the core aspects of your business. However, you may have to consult your co-employer on as HR policy and other administrative aspects of managing staff. Moreover: https://martinowest.com/why-do-i-need-to-work-with-a-peo-to-help-with-payroll-administration/

0 notes

Text

Ascent Software Solutions - 13th Anniversary

13 years of Teamwork, Dedication, and Success

Thank you to our amazing employees, valued clients, and trusted partners for being a part of our journey and making our 13th anniversary a memorable milestone. Here's to many more years of growth and prosperity together!

Contact us: Ascent Software Solutions Call: 9075056050 / 9822604098 WhatsApp: https://wa.me/message/GLMPPGZUIONVD1 . . . #AscentSoftwareSolutions #Tally #TallyPrime #Payroll #payrolladministration #payrollservices #payrollmanagement #payrollspecialist #payrolladministration #payrollprofessionals #payrollmanager #payrollsolutions #payments #software #pune #Finance #business #Growth #Tally #TallyPrime #TallySolutions #EPayments #AccountingSoftware #BusinessSoftware

2 notes

·

View notes

Video

Employer's Tax Guide to Fringe Benefits 2021.mp4 from Edupliance on Vimeo.

The IRS released the 2021 Employer’s Tax Guide to Fringe Benefits on February 6. This session will place special emphasis on tax provisions related to disaster relief and special Provisions under legislation providing relief during the COVID-19 pandemic. From training and tuition to insurance coverage, meals and lodging, employer-provided benefits may be valuable perks for employees. There are a number of benefits that can be fully or partially excluded from taxable wages, but the rules for exclusion vary for different benefits and even for different taxes with regard to the same benefit. The rules are complex and can be confusing.

For more information about this webinar session - cutt.ly/xlVCQjX

Why You Should Attend =================== The COVID-19 pandemic and the declaration of a national emergency raises questions about the treatment of various fringe benefits. This includes reimbursement for work at home expenses, paid and unpaid leave, sick pay, dependent care costs, medical expenses, leave sharing arrangements, and disaster relief payments. This session will include an emphasis on benefits employers may provide to employees during a national disaster.

Determination of the value of a fringe benefit to include in employee taxable wages can be a complex process. For some benefits, where the requirements are met, part or all of the value of the benefit may be excluded from wages. For non-cash benefits, special rules may apply when determining the value of the benefit for tax purposes. In addition, it is critical to know when to treat a benefit as provided to the employee so that the employer is compliant with tax withholding and deposit requirements. Webinar session's details - cutt.ly/xlVCQjX

Follow Us On =========== � Website - cutt.ly/BjSbWyO � Facebook - facebook.com/edupliance � Instagram - instagram.com/edupliance � Twitter - twitter.com/edupliance � LinkedIn - linkedin.com/company/edup... � YouTube - youtube.com/channel/UCqs5...

#EmployersTaxGuideToFringeBenefits #ComplianceEducation #Edupliance #FringeBenefits2021 #FringeBenefits #IRS #IRSForms #QSEHRA #FSA #FIT #FICA #FUTA #Payroll #PayrollProfessionals #PayrollSupervisors #HumanResources #HRExecutives #HRManagers #HRAdministrators #CompliancePersonnel #RiskManagers #BusinessOwners #Elearning #Compliance #ComplianceTraining #LiveWebinar #WebinarSession #Webinars #ComplianceRules

1 note

·

View note

Photo

Powerful configurable software that solves your payroll problems. Ask us how today.

Contact #cuteOffice for more details!

Demo - https://bit.ly/3xY7mrH

𝗦𝗠𝗘𝘀 𝗰𝗮𝗻 𝗰𝗹𝗮𝗶𝗺 𝘂𝗽 𝘁𝗼 𝟴𝟬% 𝗼𝗳 𝘁𝗵𝗲 𝗾𝘂𝗮𝗹𝗶𝗳𝘆𝗶𝗻𝗴 𝗰𝗼𝘀𝘁𝘀 𝗮𝗻𝗱 𝗶𝘁𝘀 𝗣𝗿𝗲-𝗔𝗽𝗽𝗿𝗼𝘃𝗲𝗱 𝘀𝗼𝗹𝘂𝘁𝗶𝗼𝗻 𝘂𝗻𝗱𝗲𝗿 𝗜𝗠𝗗𝗔 𝗣𝗼𝗿𝘁𝗮𝗹 𝗳𝗼𝗿 𝗛𝗥𝗠 𝗦𝘂𝗶𝘁𝗲.

𝗘𝗺𝗮𝗶𝗹 - 𝗜𝗧𝗘𝗻𝗾𝘂𝗶𝗿𝘆@𝗰𝘂𝘁𝗲𝗰𝗵𝗴𝗿𝗼𝘂𝗽.𝗰𝗼𝗺

#payrolladministration #erpsoftware #erpsoftwaresolutions #payrollprofessionals #payrollservices #bookappointment #livedemo #softwaredevelopmentcompany

0 notes

Photo

Here’s the reason why do you need B360° Online payroll software for your beautiful business to run easily.

Efficient Usage of Time

No More Errors

Customization to Fit Your Business Needs

Employee Portals

Easy Integration and Access

https://centrix.com.sg/b360-best-online-hr-and-payroll-management-system-solution-software-singapore/

#payrollservices #payrollsoftware

#payrollsolutions #payrollmanagement

#payrolloutsourcing #singaporepayroll

#payrolladministration #payrollprofessionals #payrollmanagementsystem in #singaporean

0 notes

Video

tumblr

Experience modern payroll with powerful integrations & unified processes. Take Control of Your payroll operations to realize a new level of payroll efficiency. Get 3 months free trial www.hivepayroll.co.in

#PayrollServices #EpayrollSystem #PayrollSystem #PayrollCompany #PayrollManagement #PayrollProcess #PayrollAccounting #HRPayroll #PayrollSolutions #PayrollOnline #PayrollManagementSystem #PayrollOutsourcing #OnlinePayrollServices #WebPayroll #SmallBusinessPayroll #ManagePayroll #BusinessOnlinePayroll #PayrollServicesNearMe #ManpowerPayroll #PayrollProfessionals #EmployeePayroll #PayrollProviders #FullServicePayroll #PayrollServiceProviders #PayrollOutsourcingServices.

0 notes

Text

#offshore Staffing Service is the most cost-effective, time-saving, and effort-saving option for businesses. Know more - https://www.callcenter.com.bd/service/outbound-call-center-services/offshore-staffing #offshorestaffingservice #payrollprofessionals

#offshore Staffing Service is the most cost-effective, time-saving, and effort-saving option for businesses. Know more - https://www.callcenter.com.bd/service/outbound-call-center-services/offshore-staffing #offshorestaffingservice #payrollprofessionals

0 notes

Photo

Ready to fill the form W-2 in 2021. To know what's the latest updates on form W-2. Register yourself by clicking the link: https://bit.ly/3hRjBzW to join our live training course on "Form W-2 and Other Payroll Updates" by #JasonDineson.

#training#hr#payrollcompliance#legalprofessionals#hrmanagers#payrollprofessionals#payrollupdates2021#miscupdates#supremetrainer#1099updates#form941#1099form#w2form

1 note

·

View note

Text

Benefits of Payroll Outsourcing Services

Here we have explained some of the business benefits achieved by outsourcing payroll processing –

[1] Assistance to startups

[2] Staff retention by outsourcing key tasks

[3] Saves time

Our expertise in payroll outsourcing services ensures that we can handle any unique compliance or regulatory challenges your business may have.

#payroll#payrollservices#outsourcing#savetime#startups#staffretention#compliance#payrollprofessionals

0 notes

Photo

👩🎓Its official!! I'm now an associate member of the @cipduk 🤓 I would like you all to address me by my full name from now on; Laura Salmon, MCIPP, Assoc CIPD. Aka Queen of Dorkness 😂 Joking aside: 6 years of hard study, two degree courses along side (single) parenting, working full time, training and qualifying as a PT and coach, mindset training and coaching, competing..... to achieve the highest qualifications in payroll and HR .....I am done!!! 😁 Sounds like a lot huh?! Funnily enough the mindset training and coaching theough @mindsetrxd has helped me uncover the reason behind this ambition, also know as toxic achievement. Don't get me wrong, I'm incredibly proud of all the hard work I've put in over the years and what I have achieved on my own. But I now understand that it came from a place of deep insecurity and a core belief that I am in some way unworthy of love and belonging, so I have felt a need to prove my worth by being 'of value'.😕 It doesn't take the shine off anything I have done, but it has freed me from feeling I need to continue to work so hard for love and acceptance. So I'm gonna enjoy all this now, live in gratitude for the opportunity it now offers me and put it to good use by paying it forward as a coach and mentor 🥰❤ #qualifications #couldibeanymorequalified #cipdlevel7 #humanresources #hrprofessional #PayrollManager #CIPP #payrollprofessional #mindsetrxd #mindsetcoach #lifecoach #crossfitcoach #personaltrainer #allthejobs #braingains🤓 #mindsetforfunctionalathletes #DMG #MRCC (at St Annes) https://www.instagram.com/p/CQOYbATATTG/?utm_medium=tumblr

#qualifications#couldibeanymorequalified#cipdlevel7#humanresources#hrprofessional#payrollmanager#cipp#payrollprofessional#mindsetrxd#mindsetcoach#lifecoach#crossfitcoach#personaltrainer#allthejobs#braingains🤓#mindsetforfunctionalathletes#dmg#mrcc

0 notes