#Pet Insurance Market Primary Research

Text

#Pet Insurance Market COVID-19 Analysis Report#Pet Insurance Market Demand Outlook#Pet Insurance Market Primary Research#Pet Insurance Market Size and Growth#Pet Insurance Market Trends#Pet Insurance Market#global Pet Insurance market by Application#global Pet Insurance Market by rising trends#Pet Insurance Market Development#Pet Insurance market Future#Pet Insurance Market Growth#Pet Insurance market in Key Countries#Pet Insurance Market Latest Report#Pet Insurance market SWOT analysis#Pet Insurance market Top Manufacturers#Pet Insurance Sales market#Pet Insurance Market COVID-19 Impact Analysis Report#Pet Insurance Market Primary and Secondary Research#Pet Insurance Market Size#Pet Insurance Market Share#Pet Insurance Market Research Analysis#Pet Insurance Market Trends and Outlook#Pet Insurance Industry Analysis

1 note

·

View note

Text

The global veterinary equipment market in terms of revenue was estimated to be worth $2.2 billion in 2023 and is poised to reach $3.2 billion by 2028, growing at a CAGR of 7.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The primary factors driving growth for the veterinary equipment supplies market during the projected period are advancements in veterinary technology, an increase in the population of pets and their owners, increasing demand for livestock veterinary products, rise in the need for pet insurance, an increase in the expense of animal health care, and an increase in the prevalence of diseases in animals.

#Veterinary Equipment and Supplies Market#Veterinary Equipment and Supplies Market Size#Veterinary Equipment and Supplies Industry

0 notes

Text

Veterinary Hospitals Market Dynamics: Evaluating Market Size, Share, and Growth Forecast

The global veterinary hospitals market size is expected to reach USD 123.8 billion by 2030, expanding at a CAGR of 5.80% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growing pet population is boosting the demand for veterinary clinics and hospitals around the world. Additionally, the COVID-19 pandemic lockdown restrictions led to a rise in the demand for companion animals. For instance, the number of pets in the UK has significantly increased. According to a recent survey conducted by the Pet Food Manufacturers Association, there are currently over 24 million cats and dogs living in the United Kingdom. The market is being driven by the increase in pet ownership, not just in the short term when kittens and puppies need shots, initial checkups, or neutering, but also considerably in the long term as they age into animals needing more veterinarian treatment and care.

Veterinary Hospitals Market Report Highlights

By animal type, the companion animal segment accounted for the largest revenue share in 2022. This is owing to the relatively stable ownership rate of dogs & cats in developed countries like the U.S. and increased expenditure on veterinary care

Based on type, the medicine segment dominated the market in 2022, owing to its significant distribution in veterinary pharmacies

Based on the sector, the private segment dominated the market in 2022. These hospitals offer well-maintained and advanced services at a relatively low price than private hospitals

North America accounted for a 43.4% share of the market in 2022 and is expected to grow over the forecast period. This growth is majorly due to high companion animal ownership rates, favorable government regulations, and increasing adoption of pet insurance for veterinary care

For More Details or Sample Copy please visit link @: Veterinary Hospitals Market Report

The rapidly aging pet population and the availability of advanced pet care options are among the key factors likely to drive expenditure on pets by owners, which is the primary source of revenue growth for veterinary hospitals. Establishment requirements for veterinary hospitals are expected to improve mainly due to the high demand for animal care services for pets & animals food. With the increasing number of pets and pet owners, the focus on animal safety has grown in recent years. Rising concerns and increasing awareness about chronic diseases in companion animals have resulted in high expenditure on pet health. Large spending on animal care is expected to further boost veterinary visits and medication sales in hospitals. Owners are concerned about their pets and consult veterinarians for treatment of several health issues at an early stage. This is further boosting the demand for efficient treatment options, driving the market.

#VeterinaryHospitalsMarket#VeterinaryCare#AnimalHealth#PetCare#VetServices#AnimalHospitals#VeterinaryClinics#PetHealth#VetIndustry#HealthcareForPets#AnimalWelfare

0 notes

Text

Trends & influences of the Indian Pet Market – by Rakesh Shukla, VOSD™ Corporation

Overview

The Indian pet market has experienced significant growth over the past five years, driven by increasing pet ownership, urbanization, rising disposable incomes, and changing social attitudes towards pets. This report provides a comprehensive analysis of the companion animal market in India, with particular focus on dogs, detailing the primary segments, market size, trends, key drivers, and influencing phenomena.

Market Segments

The Indian pet market can be divided into several primary segments:

Pet Food

Veterinary Care

Grooming and Accessories

Pet Pharmaceuticals

Pet Services

Pet Food

The pet food segment is the largest in the Indian pet market. According to the “Euromonitor International Report,” the pet food market in India was valued at approximately INR 2,500 crore in 2020, with an annual growth rate of around 13%. The segment includes dry food, wet food, and treats, with premium and specialized diets becoming increasingly popular.

Veterinary Care

The veterinary care segment includes routine check-ups, vaccinations, surgeries, and preventive care. The “IMARC Group Report” estimates this segment to be valued at INR 1,000 crore in 2021, with a growth rate of 10% per annum. The rise of pet insurance and digital veterinary services has also contributed to this growth.

Grooming and Accessories

This segment covers grooming products, toys, clothing, and accessories. It was valued at INR 800 crore in 2021, growing at an 11% annual rate according to the “TechSci Research Report”. Increased humanization of pets has driven demand for premium grooming products and accessories.

Pet Pharmaceuticals

Pet pharmaceuticals include medicines, supplements, and vaccines. The “Mordor Intelligence Report” indicates this market segment was valued at INR 700 crore in 2020 and is growing at a rate of 9% annually. Increasing awareness about pet health and wellness has spurred growth in this segment.

Pet Services

This segment includes boarding, training, pet sitting, and pet transportation. According to “Research and Markets,” the pet services market was valued at INR 500 crore in 2021, growing at a 12% annual rate. The increasing number of dual-income households has fueled demand for these services.

Market Size and Trends

The overall companion animal market in India, focusing on dogs, has shown robust growth. The total market size in 2021 was estimated to be INR 5,500 crore, with a compound annual growth rate (CAGR) of around 12% over the past five years.

Rising Premiumization: There is a noticeable trend towards premium products, especially in pet food and grooming segments. Owners are willing to spend more on high-quality, nutritious food and premium grooming products.

Increasing Pet Adoption: Adoption rates have surged, driven by greater awareness and changing societal norms. This has led to increased demand for veterinary services and pet pharmaceuticals.

Growth of E-commerce: Online platforms like Amazon, Flipkart, and specialized pet stores like Heads Up For Tails have seen significant growth, offering convenience and a wide range of products.

Digital Veterinary Services: Telehealth services for pets have become popular, especially during the COVID-19 pandemic, allowing for remote consultations and care.

Humanization of Pets: Pets are increasingly seen as family members, driving demand for higher quality food, better healthcare, and luxury accessories.

Key Drivers

Several key drivers have influenced the growth of the Indian pet market:

Rising Disposable Income: Higher disposable incomes have enabled more households to afford pets and spend on premium products and services.

Urbanization: Urban living conditions and smaller family units have contributed to increased pet adoption.

Awareness and Education: Greater awareness about pet health, nutrition, and wellness has led to higher spending on veterinary care and pharmaceuticals.

Social Media Influence: Pet owners are increasingly influenced by social media, leading to trends in pet fashion, grooming, and unique pet services.

COVID-19 Impact: The pandemic saw a rise in pet adoption as people sought companionship during lockdowns. It also accelerated the adoption of digital services and e-commerce for pet products.

Influencing Phenomena

Several phenomena have influenced the Indian pet market:

Regulatory Changes: Policies regarding pet importation, breeding standards, and veterinary practices have shaped the market dynamics.

Technological Advancements: Innovations in pet care products, telehealth, and e-commerce platforms have transformed how pet services are delivered and consumed.

Environmental Concerns: There is a growing trend towards sustainable and eco-friendly pet products as consumers become more environmentally conscious.

Cultural Shifts: Changing cultural attitudes towards pets as part of the family unit have driven market growth across all segments.

Conclusion

The Indian pet market, particularly for dogs, is poised for continued growth, driven by rising incomes, urbanization, and the increasing humanization of pets. With robust growth across all segments, from pet food to veterinary care and services, the market offers substantial opportunities for businesses and investors. The impact of digital transformation and changing consumer behavior will further shape the future of this dynamic market.

About the Author: Rakesh Shukla, a BTech & MBA, has spent 30 years creating many multimillion-dollar world-class software products & businesses. Rakesh manages a portfolio of successful startups – in IT, PetTech, and RetailTech including VOSD™ Vet & Pet Corporation, TWBcx™, The Better Company™ & inStore™ Retail. VOSD™ Corporation includes Vet2Trade™, VOSD AI™, VOSD Advance Vet Care™, and VOSD-on-Wheels™ which together fund VOSD Foundation™ — the world’s largest dog rescue.

0 notes

Text

What can stimulate the North America Rice Noodles Market to spur further growth?

North America Rice Noodles Market Trends and Outlook

The North America Rice Noodles Market growth & size reached USD xx billion in 2019 and is predicted to rise at a CAGR xx from 2020 to 2027. Rice noodles are made from a simple mix of rice flour and water. They get their unique texture from additional ingredients like tapioca and cornstarch. These noodles come in different forms-fresh, dried, and frozen. There are also gluten-free choices for those with gluten allergies. With mostly carbohydrates, no additives, and low fat, rice noodles offer a healthier choice compared to different fast foods. In addition, they can be cooked with different flavors, giving individuals a chance to introduce their tasty dishes.

The market has witnessed significant growth, due to the growing popularity of Asian cuisine. Rice noodles, specifically, have garnered immense attention in international markets. These noodles, available in frozen, fresh, and dried forms with different shapes and exceptional texture features, carry a broad range of age groups and ethnicities. Their versatility enables them to complement different ingredients, sauces, and spices, leading to a widespread reputation. A factor influencing the market growth is the absence of wheat flour in rice noodles, making them inherently gluten-free. This attribute appeals to people with gluten intolerance and celiac disease, developing the market growth. In addition, rice noodles are predicted to be a healthier choice as compared to yellow egg noodles, making them a preferred choice for vegans and vegetarians.

The North America rice noodle market demand is projected to witness growth due to significantly widened distribution channels, addressing the rising demands of customers in both urban and certain rural locations, propelled by an increasing population. The North America rice noodle market's driving factors are an increase in demand for rice products and continuous product innovations. However, market growth faces challenges in developed countries owing to lower popularity and concern over the high carbohydrate content in rice products.

Download Free Sample Report

The North America rice noodles market segmentation is based on distribution channel, type, and region. In terms of type, the market is classified into Western-style rice noodles, Chinese-style rice noodles, and many more. Chinese-style rice noodle is anticipated to register the market, holding the largest market share, and the extension of population preference for Chinese-style rice noodles contributes to this North America noodle rice market trend. Based on distribution channels, the market is categorized into supermarkets, independent retailers, convenience stores, and many more. Supermarkets are predicted to be the primary revenue generators in the rice noodle market. On the basis of region, the North America rice noodles market is further segmented into the U.S.A. and Canada. The United States takes the lead in this regional market, although its impact is relatively modest on an international scale. This is attributed to the lower popularity of rice-based products across the region.

Furthermore, the growth of the regional market is driven by an increase in presence of Asian restaurants and a growing influx of the Asian population into the U.S., Canada, and Mexico. A key factor driving this trend is the popularity of instance rice noodles, drawing a considerable number of Americans to discover the product. The convenience of preparation adds to its appeal, making it a practical dietary choice for many.

Latest Report :

About Us:

Organic Market Research Business Consulting is a fast-growing Market Research organization which is helping organizations to optimize their end-to-end research processes and increase their profit margins.

Organic Market Research facilitates clients with syndicate research reports and customized research reports on 10+ industries with global as well as regional coverage.

Mob : +91 9319642100

Noida One Tower Sec 62 Noida 201301

Sales : [email protected]

Website : https://www.organicmarketresearch.com

0 notes

Text

Exploring the Animal Care Market Players, Trends, and Growth Drivers

Introduction

The animal care industry is a thriving sector that encompasses various products and services aimed at meeting the needs of pets and their owners. With the increasing humanization of pets and growing awareness about pet health and wellness, the demand for high-quality animal care products and services has surged in recent years. This comprehensive analysis delves into various dimensions of the animal care market, offering insights into market trends, challenges, growth drivers, and opportunities shaping the global landscape of pet ownership and care.

Insights from Industry Research Reports

Animal Care Industry research reports serve as invaluable resources for understanding the complexities of the animal care market. According to recent studies conducted by leading market research firms, The Global Animal Care Market was valued at approximately $220 billion in 2020 and is projected to reach over $350 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6% during the forecast period. This growth is attributed to factors such as increasing pet ownership rates, rising disposable incomes, and a growing focus on pet health and wellness.

Market Outlook: Navigating Challenges and Opportunities

While the animal care market presents significant opportunities for growth, it also faces challenges such as increasing competition, supply chain disruptions, and regulatory complexities. Additionally, the ongoing COVID-19 pandemic has impacted pet ownership patterns and purchasing behavior, leading to shifts in consumer preferences and buying habits. However, the pandemic has also accelerated certain trends, such as the adoption of e-commerce and the demand for pet health and wellness products.

Market Demand: Meeting the Needs of Pet Owners

The animal care market continues to witness strong demand for a diverse range of products and services catering to the needs and preferences of pet owners. Pet food and treats represent the largest segment of the market, accounting for a significant share of total spending. Premium and natural pet food products are gaining popularity among pet owners who prioritize the health and well-being of their furry companions. Additionally, the demand for pet healthcare services, including veterinary care, pet insurance, and preventive medicine, is on the rise, driven by an increasing emphasis on preventive care and pet longevity.

Click here – To Know more about the Animal Care Industry

Market Forecast: Projecting Future Growth

The outlook for the animal care market remains positive, with projections suggesting sustained growth in the coming years. Market analysts anticipate continued expansion driven by factors such as urbanization, population growth, and changing lifestyles. Emerging markets, particularly in Asia-Pacific and Latin America, are expected to experience rapid growth due to rising pet ownership rates and increasing consumer spending on pet-related products and services.

Market Growth Drivers: Fueling Expansion

Several factors are driving growth in the animal care market, including:

Increasing Pet Ownership: The growing number of pet-owning households worldwide is a primary driver of market growth. As more people welcome pets into their homes, the demand for pet products and services continues to rise.

E-commerce Adoption: The proliferation of online shopping platforms has revolutionized the way pet owners purchase products and access services. E-commerce channels offer convenience, variety, and competitive pricing, driving the growth of online pet retail.

Focus on Pet Health and Wellness: Pet owners are increasingly prioritizing the health and well-being of their pets, leading to greater demand for premium pet food, supplements, and healthcare services. As pets live longer and become integral members of the family, the demand for preventive and specialized veterinary care is expected to increase.

Market Trends: Embracing Innovation and Sustainability

Trends such as personalized nutrition, eco-friendly products, and telemedicine services are reshaping the animal care industry. Companies are leveraging these trends to differentiate their offerings, enhance customer engagement, and drive growth in a competitive market environment. Moreover, technological advancements, including wearable devices, digital health platforms, and telehealth services, are enhancing the way pet owners monitor and manage their pets' health, driving innovation in the industry.

Market Challenges: Addressing Key Concerns

Regulatory compliance, supply chain disruptions, and changing consumer preferences are among facing the Animal Care Market Challenges. Additionally, concerns about pet obesity, food safety, and environmental sustainability are influencing purchasing decisions and shaping industry standards and regulations. Companies must navigate these challenges while maintaining a focus on product quality, safety, and innovation to remain competitive in the market.

Conclusion

The animal care market offers significant opportunities for innovation and growth, driven by evolving consumer trends, technological advancements, and changing societal norms. By leveraging market insights, addressing key challenges, and embracing emerging trends, industry stakeholders can position themselves for success in a dynamic and rapidly expanding market landscape. As the human-animal bond continues to strengthen and pet ownership rates rise globally, the animal care industry will play a pivotal role in meeting the needs of pets and their owners, driving sustainable growth and prosperity in the years to come.

#Pet Care Industry Analysis#Animal Care Market#Animal Care Industry#Animal Care Industry Research Report#Animal Care Market Research Reports#Animal Vaccines Market#Companion Animal Healthcare Market#Veterinary Services Market#Animal Care Market Analysis#Animal Care Market Demand#Animal Care Market Forecast#Animal Care Market Growth#Animal Care Market Outlook#Animal Care Market Revenue#Animal Care Market Size#Animal Care Market Trends#Animal Care Market Challenges#Animal Care Products Market#Animal Diagnostics and Testing Market#Animal Pharmaceuticals Market#Emerging Trends in Animal Care#Global Animal Care Market#Pet Food and Nutrition Market#Veterinary Clinics and Hospitals#Veterinary Services Industry Research Report#Veterinary Services Market Analysis#Veterinary Services Market Demand#Veterinary Services Market Forecast#Veterinary Services Market Growth#Veterinary Services Market Outlook

0 notes

Text

Asia-Pacific Pet Insurance Market was worth USD 940.6 million in the year 2021. The market is projected to grow at a CAGR of 8.8%, earning revenues of around USD 1689.3 million by the end of 2028. The Asia-Pacific Pet Insurance Market is booming because of the growing pet ownership in the region. Moreover, the majority of pets are becoming family members for their owners, causing them to spend more money on yearly checkups due to the growing problems caused by cross-breed pets. Also, several pet insurance policies include an optional wellness package that includes savings for routine items such as an annual physical checkup, heartworm tests, fecal tests, annual parasite evaluation tests, blood work, and vaccines. As a result, the pet insurance market protects pet owners from an increasing number of medical complications in their pets. Additionally, some policies also cover pet death or loss if the pet is lost or stolen. Furthermore, rising medical costs in veterinary medicine, as well as the use of expensive medical techniques and drugs, are driving up the demand for pet insurance. However, a lack of awareness about pet insurance policies, as well as high premium costs, may act as a huge restraining factor for the market growth.

Increasing Chronic Conditions in Pets are driving Pet Insurance Market

The prevalence of chronic diseases in pets has increased significantly in recent years. As a result, the increase in the prevalence of various chronic conditions in pet animals is the primary factor driving growth in the chronic condition segment. Canine cancer cases more than doubled between 2006-07 and 2016-17, according to the Indian Veterinary Research Institute (IVRI). Along with the rising prevalence of chronic diseases in pets, the growing number of pet owners seeking pet insurance is a major factor driving the Asia Pacific pet insurance market. For instance, it was discovered that whereas there were just 5,000 pet insurance clients in China between 2015 and 2018, there are today 1,60,000 pet insurance clients in the nation, according to a 2019 article headlined "China's pet insurance business sees promising future.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/asia-pacific-pet-insurance-market/report-sample

0 notes

Text

Market Dynamics of Pharmaceuticals for Pets

Introduction:

The global pet industry has witnessed remarkable growth in recent years, with the demand for companion animals soaring. This trend has led to a significant surge in the companion animal drugs market, as pet owners increasingly seek healthcare solutions for their beloved four-legged friends. This article delves into the dynamics of the companion animal drugs market, discussing its current state, major drivers, challenges, and future prospects.

Market Overview:

The companion animal drugs market encompasses pharmaceuticals, vaccines, and other healthcare products designed to ensure the well-being and health of pets, including dogs, cats, and other small animals. This market has been growing steadily, largely driven by an increase in pet ownership, rising disposable incomes, and a growing awareness of the need for proper pet healthcare.

Market Drivers:

1. Rising Pet Ownership: The global trend of increasing pet ownership is one of the primary drivers of the companion animal drugs market. People are adopting pets as companions, leading to a higher demand for healthcare solutions to keep their furry friends healthy and happy.

2. Humanization of Pets: Modern pet owners treat their animals as part of the family. As a result, they are more willing to spend on pet healthcare, including medications and vaccines.

3. Advancements in Veterinary Medicine: Ongoing research and development in the field of veterinary medicine have led to the creation of innovative and more effective drugs, improving the overall quality of pet healthcare.

4. Zoonotic Diseases: The heightened awareness of zoonotic diseases has highlighted the importance of pet vaccination. This awareness drives the demand for vaccines and preventive medications.

Market Challenges:

1. Regulatory Compliance: Stringent regulatory requirements for veterinary drugs can pose challenges for manufacturers in terms of testing, approvals, and quality control.

2. Competition: The companion animal drugs market is highly competitive, with numerous established players and new entrants. This competition can make it challenging for companies to gain a foothold in the market.

3. Counterfeit Products: The market is susceptible to counterfeit and low-quality products, which can harm pets and erode consumer trust.

4. Price Sensitivity: While pet owners are willing to spend on their pets, price sensitivity is a factor. The cost of certain medications and treatments can be a concern.

Market Segmentation:

The companion animal drugs market can be segmented into various categories, including:

1. Product Type: Pharmaceuticals, vaccines, and medicated feed additives are the primary product categories.

2. Animal Type: Dogs, cats, and other small animals are the main segments.

3. Distribution Channel: Retail pharmacies, e-commerce, and veterinary clinics are the primary distribution channels.

Future Prospects:

The companion animal drugs market is poised for continued growth. The increasing awareness of pet health, the rising number of pet owners, and ongoing research and development in veterinary medicine all point towards a positive trajectory. Moreover, the growing trend of pet insurance is likely to further boost the market by making healthcare more accessible and affordable for pet owners.

In conclusion, the companion animal drugs market is experiencing robust growth due to the changing dynamics of the pet industry. Pet owners today are more conscious of their pets' health and are willing to invest in high-quality healthcare solutions. This, in turn, drives innovation and competition in the market, benefiting both pets and their owners. However, addressing regulatory challenges and ensuring product quality remains crucial to sustaining this growth and maintaining consumer trust in the companion animal drugs market.

0 notes

Text

Veterinarians—a Deep Dive into Number of Animal Doctors Based on Countries

Veterinary services have witnessed an unprecedented spike on the back of surging demand for quality pet care. Some factors, such as an uptick in pet adoption, the prevalence of chronic diseases and growing pet insurance services, have spurred the market penetration of animal doctors. For instance, Europe has around 309,144 veterinarians (39 FVE member countries), according to a European Federations of Veterinarians survey. Clinical practice (contributing to 58% of all respondents’ occupations) is the most prevalent employment sector.

The database lists the U.S. with the maximum number of veterinarians. The U.S. houses over 45,857 animal health organizations. The final report, along with the database, will peruse the following dynamics:

• Insights on leading countries, including U.S., France, Germany, Belgium, Spain, Netherlands and Malaysia.

• Number of veterinarians based on the primary area of specialization, occupation, or core specialty, including but not limited to companion animal exclusive, mixed animal, food animal exclusive and companion animal predominant.

• Growth opportunities and trend assessment.

• Qualitative and quantitative analysis.

Get your copy or request for a free sample of the report “Estimated Number of Veterinarians by Key Countries, and Year, 2017 – 2021.”

Estimated Number of Veterinarians by Key Countries - Report Scope

Actual estimates/Historical data

2017 - 2021

Quantitative units

Number of Veterinarians from 2017 to 2021

Regional Scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Singapore; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

By Practice Type

Practice type includes private clinic practice and public & corporate employment. These segments are further subdivided into sub-segments, and data available are only for the key market: U.S.

By Area of Work for Veterinarians

Quantitative data on the number of veterinarians who work with companion animals, food-producing animals, equines, and aquaculture and data availability for EU countries

Companion Animals/Food producing animals/Equine/Aquaculture

Numbers are based on the survey of veterinarians and vets are not exclusive of companion animals

Related Reports:

• U.S. Veterinarians Market Size, Share & Trends Analysis Report By Sector (Public, Private (Food Animal Exclusive, Companion Animal Exclusive, Mixed Animal, Equine, Others), Academics), And Segment Forecasts, 2022 - 2030

• Veterinary Services Market Size, Share & Trends Analysis Report By Animal Type (Production, Companion), By Region (North America, Latin America, APAC), And Segment Forecasts, 2021 - 2028

About Us

Grand View Research, Inc. is a market research and consulting company that provides off-the-shelf, customized research reports and consulting services. To help clients make informed business decisions, we offer market intelligence studies ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials and energy. With a deep-seated understanding of varied business environments, Grand View Research provides strategic objective insights.

Find More information @ https://www.grandviewresearch.com/info/trend-reports

#Veterinarians market#Veterinarians Industry#Veterinary industry statistics#Veterinary services market

0 notes

Text

Neurological Biomarkers Market is anticipated to exhibit a CAGR of 11.9% from 2022 to 2030

Newark, New Castle, USA – Growth Plus Reports’ most recent study examines the Global Neurological Biomarkers Market’s production, prospective uses, demand, key companies, and SWOT analysis.

You may get insights into the TOC, and Statistics for essential facts, information, trends, and competitive landscape information.

Download Free Sample Report Now @ https://www.growthplusreports.com/inquiry/request-sample/neurological-biomarkers-market/8040

The following are the leading companies in the Global Neurological Biomarkers market:

Abbott Laboratories Inc.

Quanterix Corporation

Thermo Fisher Scientific Inc.

Qiagen NV

Bio-Rad Laboratories Inc.

Merck KGaA

Banyan Biomarkers Inc.

Johnson & Johnson

ACOBIOM

Myriad Genetics Inc.

DiaGenic ASA

Olink Biosciences

Growth Plus Reports studies the key trends in each category and sub-segment of the Neurological Biomarkers market, along with Global and regional projections from 2023 to 2031. Our research splits the market into product type and application segments.

SEGMENTATION

GLOBAL NEUROLOGICAL BIOMARKERS MARKET – ANALYSIS & FORECAST, BY TYPE

Genomic

Metabolomic

Proteomic

Imaging

Others

GLOBAL NEUROLOGICAL BIOMARKERS MARKET – ANALYSIS & FORECAST, BY APPLICATION

Alzheimer’s Disease

Parkinson’s Disease

Multiple Sclerosis

Others

GLOBAL NEUROLOGICAL BIOMARKERS MARKET – ANALYSIS & FORECAST, BY END-USER

Hospitals & Laboratories

Independent Diagnostic Centers

Research Organizations

Others

For More Information or Query or Customization visit: https://www.growthplusreports.com/inquiry/customization/neurological-biomarkers-market/8040

Companies may utilize Neurological Biomarkers market report to get insights on market variables and any restraints that may affect the manufacturing of their product. Companies that are expanding abroad require thorough Global market research that includes real market data to assist with their marketing strategy. This Global market Neurological Biomarkers industry study analyzes important market dynamics and provides in-depth information and statistics to help companies flourish. This research report on the Neurological Biomarkers market takes advantage of advanced and professional approaches such as SWOT analysis and GRG Health’s unique GrowthMIX strategy.

This report is useful in addressing various essential issues for market participants, while also supporting them in making investments and leveraging the market opportunities.

Neurological Biomarkers Market TOC: https://www.growthplusreports.com/report/toc/neurological-biomarkers-market/8040

Market segment by Region/Country including: –

-North America (United States, Canada and Mexico)

-Europe (Germany, UK, France, Italy, Russia and Spain etc.)

-Asia-Pacific (China, Japan, Korea, India, Australia and Southeast Asia etc.)

-South America (Brazil, Argentina and Colombia etc.)

-Middle East and Africa (South Africa, UAE and Saudi Arabia etc.)

QUICK BUY: https://www.growthplusreports.com/checkout-8040

Browse Latest Healthcare Reports:

Cannabis Drugs Market

Sterilization Wrap Market

Foley Catheters Market

Thrombin Market

Trauma Implants Market

Urinary Drainage Bags Market

Genetic Disease Diagnostics Market

Veterinary Diagnostics Market

Intraoral Scanners Market

Immunodiagnostics Market

Neurodegenerative Disease Drugs Market

Pet Insurance Market

Contact Us:

Manan Sethi

Director, Market Insights

Email: [email protected]

Phone no: +1 888 550 5009

Web: https://www.growthplusreports.com/

About Us

Growth Plus Reports is part of GRG Health, a Global healthcare knowledge service company. We are proud members of EPhMRA (European Pharmaceutical Marketing Research Association).

Growth Plus portfolio of services draws on our core capabilities of secondary & primary research, market modelling & forecasting, benchmarking, analysis and strategy formulation to help clients create scalable, ground-breaking solutions that prepare them for future growth and success.

We were awarded by the prestigious CEO Magazine as “Most Innovative Healthcare Market Research Company in 2020.”

0 notes

Text

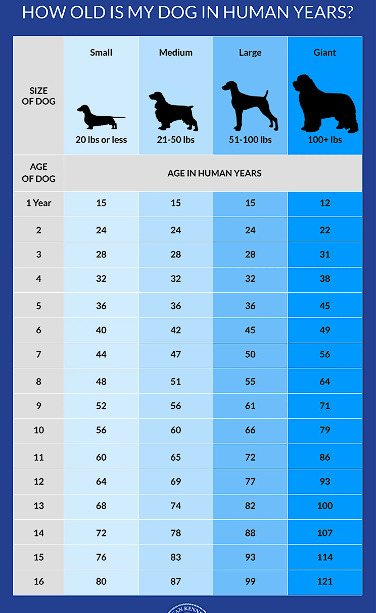

How to Calculate Dog Years to Human Years

How to Calculate Dog Years to Human Years

Key Points

The widely held belief that "1 dog year = 7 human years" is unfounded.

Small dogs typically live longer than large dogs as they age, with various breeds aging differently.

A new formula is proposed in a 2019 research based on alterations to dogs' DNA over time.

Since the 1950s, it has been common practice to calculate a canine's age "in human years" using the formula 1 dog year = 7 human years. The truth is not as simple, despite the fact that this formula has been around for a remarkably long time. That doesn't deter many people from using this conventional calculation as their default. According to Kelly M. Cassidy, who collects research on canine longevity for the Charles R. Connor Museum at Washington State University, "you can't really kill the seven-year rule."

The 7:1 ratio appears to have been founded on the statistic that people lived to be about 70 and dogs lived to be about 10. This may be one explanation for how this formula came to be.

Veterinary student at Kansas State University William Fortney says, "My guess is it was a marketing ploy." According to him, it was "a way to educate the public on how quickly a dog ages compared to a human, primarily from a health standpoint," as reported by the Wall Street Journal. It served as a means of enticing pet owners to bring their animals in at least once a year.

How to Calculate Dog Years to Human Years?

However, the American Veterinary Medical Association provides the following breakdown as a general rule:

The first year of a medium-sized dog's existence is equivalent to 15 human years.

A dog's second year is roughly equivalent to a person's ninth year.

After that, a canine would live for about five years for every human year.

How Do Researchers Come Up With Those Numbers?

The AVMA states: "Cats and small dogs are usually considered'senior' at seven years old, but we all know they've got plenty of life left in them at that age. There are many various factors to consider. When compared to smaller breeds, larger canines tend to live shorter lives and are frequently regarded as seniors at 5 to 6 years old. Pets age more quickly than humans do, and because of this, veterinarians start to notice more age-related issues in senior pets. Dogs do not age at a pace of 7 human years for every year in dog years, despite what the general public believes.

The Great Dane is one instance. According to the Great Dane Club of America, the typical lifespan is between 7 and 10 years. A 4-year-old Great Dane would therefore be 35 years old in human years. Remember once more that these are merely approximations.

Dog data is not kept by the National Center for Health Statistics. Instead, breed clubs, pet insurance companies, and veterinary hospitals are the primary sources of information on their longevity.

Why Do Smaller Dogs Live Longer than Larger Dogs?

The connection between body mass and a dog's lifespan has perplexed scientists for years, and research has yet to provide an explanation.

Large animals, such as elephants and whales, typically live longer than small mammals, such as mice. So why do small canine breeds typically live longer than big breeds?

According to researcher Cornelia Kraus, an evolutionary biologist at the University of Göttingen in Germany, large dogs age more quickly and "their lives seem to unwind in fast motion." A dog's life expectancy decreased by about a month for every 4.4 pounds of bodily mass, according to researchers. Kraus suggests several explanations for this phenomenon, including the possibility that larger dogs may experience age-related illnesses more quickly and that their rapid growth may increase their risk of developing cancer and dying from abnormal cell development. Future research is being planned to clarify the relationship between development and mortality.

Canine gerontology is a growing area of study because dog owners want to increase the quantity and quality of their time spent with their pets. In order to "delay aging and promote healthy longevity," the Dog Aging Project is researching the aging process in dogs.

Every stage of our dogs' development, whether defined in human or dog years, is beautiful and endearing. Senior dogs are particularly endearing and poignant with their gray muzzles and thoughtful expressions.

2019 Epigenetic Clock Study

A new technique for estimating dog age was proposed in a 2019 study by researchers at the University of California, San Diego, based on alterations made to human and canine DNA over time. As DNA molecules age in both species, methyl groups are added, changing DNA function without changing the DNA itself. As a consequence, scientists have employed DNA methylation as a "epigenetic clock" to study human aging.

To compare the epigenetic clocks of dogs and humans, the research team conducted targeted DNA sequencing on 104 Labrador Retrievers with an age range of 16 years. The findings enabled them to derive a formula for converting dog ages to "human years," which they then used to calculate human age: human_age = 16ln(dog_age) + 31. You can use this natural logarithm tool.

Since only one breed was used in the research, the "human age" calculated for your dog using this formula might not be exactly accurate. Given that various breeds age differently, it's possible that the UCSD formula doesn't have enough variables to produce definitive results. Regardless, the newly proposed formula, which is supported by science, is unquestionably more helpful for determining a dog's "human age" than the long-debunked "multiply by 7" fallacy.

>>Make Your Dog Happy Click Here<<

#Don't capitalize canine breed names all the time. Many breed names are made up of capitalized proper words and lowercased generic terms (lik#Breed names frequently include a place name#as seen in the following references to the nation of origin of the breed:#French bulldog#German shepherd#Irish setter#Portuguese water dog#Sometimes the place-name refers to a region within a country:#Airedale terrier#Akita#Brittany spaniel#Labrador retriever#A generic term of foreign origin might also be combined with a place-name:#Lhasa apso#Another formulation for breed names includes the name of the person who created the breed:#Doberman pinscher#Gordon setter#Jack Russell terrier#Many breed names are composed entirely of generic terms#even though the terms may no longer be common parlance or may be of foreign origin:#affenpinscher#cocker spaniel#miniature schnauzer#Yet other breed names are capitalized according to convention and for clarity:#Old English sheepdog#Shiba Inu#These same guidelines apply to other animal breeds#like cats or cattle:#Maine coon#Texas longhorn

0 notes

Text

Companion Animal Pharmaceutical Market Key Players, Share, Trends, Sales, Segmentation And Forecast To 2031

Market Overview

The global companion animal pharmaceuticals market was valued at USD 12.9 billion in 2021 and it is anticipated to grow at a CAGR of 7.6% during the forecast period to reach up to USD 26.8 billion by 2031.

The rising adoption of pet animals due to growing urbanization and an increase in the number of nuclear families is among the primary market growth factors. A growing focus on animal health along with surging demand for pet insurance, especially in developed countries will augment the market expansion. The consistent rise in the number of diseases affecting animals is, in turn, generating demand for companion animal drugs. Additionally, industrial growth is attributable to the increasing incidence of zoonotic and food-borne diseases across the globe.

View Detailed Report Description: https://www.globalinsightservices.com/reports/companion-animal-pharmaceuticals-market/

Market Dynamics

The key factors such as the growing prevalence of zoonotic diseases is boosting the market growth during the forecast period. Some pathogens, such as zoonotic, can be transmitted from animals to humans. Examples of zoonotic diseases include rabies, salmonellosis, plague, brucellosis, and Lyme disease. Animals also share our susceptibility to certain diseases and environmental hazards and can serve as an early warning for potential human infections. Over the past two decades, the incidence of zoonotic diseases has increased across the globe, primarily as a result of the increased pet population. According to the International Livestock Research Institute (ILRI), 13 zoonoses cause 2.4 billion cases of human diseases and 2.2 million deaths every year. Toxoplasmosis—which is transmitted via cat feces—is quite common, with 10–20% of the UK population and 22% of the US population expected to carry the parasite as cysts. Cats with chronic bacteremia are primarily infected through saliva, and there is a high risk of transmittance from young adult cats. Although cats are asymptomatic carriers, weaker individuals can develop generalized infections. Many of the emerging and re-emerging infectious disease threats are vector-borne diseases transferred to animals and humans from arthropods.

The increasing pet care costs is likely to hinder the market growth during the forecast period. According to the APPA National Pet Owners Survey (2019), the average household in the US spent USD 731 on the routine doctor and surgical visits for dogs in 2019, a rise of 47% as compared to a decade ago. Similarly, USD 427 was spent on the routine doctor and surgical visits for cats in 2019. In Germany, the annual veterinary cost is ~USD 162.9 (EUR 140) per dog and USD 75.61 (EUR 65) per cat. In Japan, pet owners spend around USD 2,000–3,000 (JPY 200,000–300,000) annually on pet health. While the pet insurance market is expanding, the number of animals covered for treatments is still very less. As a result, animal owners generally bear the majority of the cost of treatments. Also, according to the Society for Practicing Veterinary Surgeons, coupled with the increasing pet insurance, the cost of veterinary treatment is rising by about 12% a year.

Get Free Sample Copy of This Report: https://www.globalinsightservices.com/request-sample/GIS10260

The key factors in the global companion pharmaceutical market are Zoetis Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim GmbH (Germany), Elanco Animal Health Incorporated (US), Ceva Santé Animale (France), Virbac (France), Vetoquinol S.A. (France), Dechra Pharmaceuticals plc (UK), Chanelle Pharma (Ireland), Kyoritsu Seiyaku (Japan), Zydus Animal Health and Investments Limited (India), Tianjin Ringpu Bio-Technology Co., Ltd. (China), HIPRA (Spain), Norbrook Holdings Limited (UK), Inovet (Belgium), Endovac Animal Health (US), ECO Animal Health Group plc (UK), Indian Immunologicals Ltd. (India), ALS Pvt. Ltd. (India), and Lutim Pharma Pvt. Ltd. (India).

About Global Insight Services:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC

16192, Coastal Highway, Lewes DE 19958

E-mail: [email protected]

Phone: +1–833–761–1700

0 notes

Text

Veterinary Equipment and Supplies Market worth $3.2 billion by 2028

The Global Veterinary Equipment Market in terms of revenue was estimated to be worth $2.2 billion in 2023 and is poised to reach $3.2 billion by 2028, growing at a CAGR of 7.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The primary factors driving growth for the veterinary equipment supplies market during the projected period are advancements in veterinary technology, an increase in the population of pets and their owners, increasing demand for livestock veterinary products, rise in the need for pet insurance, an increase in the expense of animal health care, and an increase in the prevalence of diseases in animals.

The development of the market will be negatively impacted by the high cost of veterinary equipment, growing pet care expenditures, lack of knowledge about animal health, and the scarcity of qualified veterinarians in developing countries.

Download PDF Brochure:

Veterinary Equipment Supplies Market Dynamics

Driver: Surge in demand pet insurance and rise in animal health expenditure

The veterinary equipment business is driven mostly by rising pet insurance prices and increasing expenses related to animal health. The growing market need for veterinary supplies and equipment is helping manufacturers of veterinary equipment, who are consequently developing new and cutting-edge products to fulfil the needs of customers. Portable veterinary equipment, which allows veterinarians to treat patients at home, is becoming more and more in demand as pet insurance becomes growing in popularity. The demand for high-quality veterinary equipment is growing as a result of rising disposable incomes and greater awareness of animal welfare.

Restraint: Rising pet care costs will negatively impact the veterinary equipment business

There is a decrease in the demand for veterinary equipment because pet owners find it more and more challenging to cover expenses for veterinary treatment, particularly the cost of veterinary equipment, due to rising costs associated with pet ownership. Considering the perspective from veterinary practitioners, A veterinarian may buy a less expensive ultrasound equipment even if it is not as high quality as a more expensive machine in order to keep the cost of veterinary care affordable for their clients. Also, If a pet owner cannot afford the cost of the yearly checkup, they may decide to postpone the pet's checkup. This may cause health issues for the animal and reduce the need for veterinarian equipment.

Opportunity: Emerging market with untapped opportunities

In emerging markets, the number of pets is rising significantly. Many factors are responsible for increasing pets such as urbanization, increased disposable incomes, and shifting lifestyles. The demand for veterinary services and equipment rises along with the number of pets. Countries in Southeast Asia are attractive markets for the veterinary equipment business. These countries have growing middle classes, rising rates of pet ownership, and rising disposable incomes. The veterinary equipment business has a lot of opportunity in emerging markets. Veterinary equipment companies may take advantage of this potential and see substantial growth by learning about the demands of these markets and creating and promoting solutions that address those needs.

Challenge: Shortage of veterinary practitioners in developing countries

The number of veterinary practitioners in the country is strongly corresponding to the demand for veterinary equipment. The need for veterinary equipment will decline if there are not enough veterinary professionals.

Developing countries frequently lack the facilities such as veterinary clinics, hospitals, and diagnostic equipment which are necessary for maintaining veterinary practice. As a result, veterinarians find it challenging to offer their services. A shortage of veterinarians makes it more difficult for manufacturers of veterinary equipment to reach their target market and may result in higher equipment costs. However, such challenges can be overcome by government initiatives for veterinary practitioners in developing countries. Also, Veterinary equipment manufacturers can develop new technologies to support veterinary practice in developing countries, such as portable diagnostic equipment and other telemedicine platforms.

Request 10% Customization:

Critical care consumables segment accounted for the largest share of 72.3% of the veterinary equipment industry

The significant share of the veterinary equipment market of the consumables segment may be attributed to the frequent utilization of consumables when combined with a single piece of capital equipment, as well as the high utilization of these supplies in the delivery of veterinary care, including wound treatment and fluid therapy. Expanding adoption of companion animals, expanding prevalence of diseases, a growing understanding of animal welfare and well-being, and rising costs associated with animal healthcare are some of the primary factors driving the need for critical care consumables.

Anesthesia machines segment accounted for 56.5% of the veterinary equipment industry in 2022

Animals undergoing surgery or other operations can be put unconscious by administering a combination of oxygen and anesthetic gases to them via anesthesia machines. This prevents animals from injury and keeps them from discomfort and suffering. Veterinary anesthesia machines are also becoming increasingly sophisticated, with new features being added all the time. Manufacturers' development of cutting-edge features including graphical panels, clear picture providing loops, and new ventilation modes in anesthesia machines is anticipated to propel the market's growth. According to forecasts, the market for veterinary anesthesia machines would be attributed to growing pet adoption trends, pet-human connection, and rising veterinary care product consumption.

Veterinary clinics are the major end users in the veterinary equipment industry in 2022

For animal owners, clinics are the initial point of contact. Therefore, veterinarian equipment and supplies in clinics are essential. The need for veterinary supplies and equipment is primarily being driven by the rise in patient visits, the number of private clinical practices, and the income of veterinary clinics. The growing veterinary practitioner base across developed countries is one of the major factors responsible for increasing the adoption of veterinary equipment in the coming years.

North America is expected to account for the largest share of the veterinary equipment market in 2022

In 2022, North America dominated the veterinary equipment market with the largest share. Factors such as the increasing number of companion animals, rising companion animal healthcare expenditure, rising number of livestock animals in North America, primarily due to the increasing consumption of meat and dairy products, and growth in the pet insurance market are some of the key factors responsible for the large share of the veterinary equipment supplies market in North America.

Key Players:

Covetrus Inc. (US), B. Braun Vet Care GmbH (Germany), BD Animal Health (US), ICU Medical, Inc. (US), Midmark Corporation (US), Cardinal Health (US), Neogen Corporation (US), Integra LifeSciences (US), Shenzhen Mindray animal medical technology co., ltd. (China), Masimo Corporation (US), Avante Animal Health (US), RWD life science co., ltd (China), Eickemeyer (Germany), Bionet America, Inc (South Korea), Jorgensen Laboratories (US), Nonin Medical (US), Digicare Animal Health (US), Hallowell Engineering And Manufacturing Corporation (US), Grady Medical (US), Mila International Inc. (US), Burtons Medical Equipment Ltd (UK), Vetronic Services Ltd (UK), Advances Veterinary (UK), New Gen Medical Systems (India), Dispomed (Canada)

Recent Developments of Veterinary Equipment Industry

In Aug 2023, ICU Medical received 510(k) regulatory clearance from the U.S. Food and Drug Administration (FDA) for the Plum Duo infusion pump with LifeShield infusion safety software. The Plum Duo pump and LifeShield software will be available to customers in the U.S. in early 2024.

In October 2022, Clayton, Dubilier & Rice (CD&R) and TPG Capital completed acquisition of Covetrus Inc. Covetrus became a private corporation as a result of this transaction, and its shares are no longer listed or traded publicly.

In January 2022, Smiths Medical (US) was acquired by ICU Medical Inc., who declared its completion. Syringe and ambulatory infusion devices, vascular access, and vital medical supplies are all part of Smiths Medical's veterinary product portfolio, which has strengthened ICU Medical's product line.

In December 2021, Covetrus Inc. (US) has successfully acquired the technological platform and infrastructure of VCP. With the help of this purchase, Covetrus will have new opportunities to give veterinarians the resources they need to improve healthcare and build closer relationships with their pet parent clients.

Report Link (Veterinary Equipment and Supplies Market)

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

Email: [email protected]

Research Insight: https://www.marketsandmarkets.com/ResearchInsight/veterinary-equipment-disposables-market.asp

Visit Our Web Site: https://www.marketsandmarkets.com

Content Source: https://www.marketsandmarkets.com/PressReleases/veterinary-equipment-disposables.asp

#Veterinary Equipment and Supplies Market#Veterinary Equipment and Supplies Market Size#Veterinary Equipment and Supplies Industry

0 notes

Text

Insurance for cannabis stores

You might know us as a main public MGA in Canada. Yet, you likely don't realise that Total has unobtrusively turned into the main guarantor of Marijuana in Canada!

Our kin in a real sense composed this book on the class of business, protecting the main authorised provider of clinical maryjane to the public authority in 2003! Our group has been there through the business' outset and numerous administrative cycles, from the primary exceptions under the Controlled Substances and Medications Act to the present time. We are committed and delicate to your client's requirements and difficulties - proved by the imaginative protection arrangements we have worked to safeguard them, and the devoted help this class has given to us.

Today we offer the broadest craving and most complete item suite in the business to this most powerful portion. Our abilities serve the full range of this maturing industry, from Part I and Part II Authorised Makers, to subordinate business like Centers; Specialists; Research and development and Testing Labs; Nurseries; Beauty care products; Hemp; mixed, wellbeing and pet food items; property managers; marijuana retailers and every kind of in the middle between. Our Pot item contributions are upheld by committed top of the line guarantors and reinsurers, and include:

Inclusion for both Individual Creation and Business Activities

Admittance to customised Chance Administration Administrations giving counsel and custom-made misfortune control administrations

Fire up activities including Developers Dangers (C.O.C.), Remodel, Wrap Up Responsibility

Property, Business Interference and Wrongdoing with limits up to $100 Million (limit subject to Adapt; $10 Million on Nurseries)

Stock Inclusion including limits for Pollution and Invasion

Kettle and Apparatus including Considerable Misfortune and Deterioration Inclusion

Chiefs and Officials Responsibility (for Canadian domiciled gambles without USA deals just) with limits up to $10 Million accessible on an essential or overabundance premise

Business General Responsibility incorporating Items obligation with limits up to $25 Million.

This offering can be reached out to include:

Mistakes and Exclusions

Clinical Misbehaviour

Clinical Preliminary covers

Item Review and numerous other important inclusion expansions

Digital Risk up to $10 Million in limits

Travel Inclusions

The rising intricacy of this industry makes bringing your client's all's protection needs to a sole market, devoted to the Pot portion, priceless. We accept Aggregate's Pot stage can't be bested! As a matter of fact this profound and adaptable set-up of inclusions joined with the exceptional endorsing mastery of our kin has permitted Total to turn into the biggest financier in the Weed fragment in Canada!

Extraordinary Gamble The board Answers for this Developing Industry

Clinical and sporting cannabis deals are supposed to reach more than $30 billion in the U.S. also, Canada by 2023. The market's quickly changing scene presents a special gamble the board contemplates for those associated with the development, creation, apportioning and offer of marijuana and pot determined items.

Pot Inclusion through Consumes and Wilcox can assist your clients with dealing with the exceptional dangers related with working directed dispensaries and producers. The inclusion additionally oversees gambling for building proprietors and rented offices.

Protection for weed organisations

Quite possibly the quickest developing industry in Canada, the pot business gives an expansive scope of items for sporting and restorative use, including dried marijuana blossom to smoke, edibles, refreshments, and vaping oils. The sporting marijuana market was assessed to be valued at $2.6 billion every 2020 and is projected to ascend to be valued at $8.62 billion by 2026. The quickly changing commercial centre incorporates critical dangers that call for entrepreneurs to safeguard themselves with an extensive weed insurance contract.

Pot insurance is a contract intended to safeguard marijuana makers and retailers from explicit dangers, for example, outsider substantial injury, gear security, item reviews and general obligation. Contending in a quick development industry, it's crucial to relieve the dangers that can upset your business tasks.

What does it cover?

Marijuana insurance inclusion can incorporate a few sorts of contracts, including:

Business General Obligation (CGL) Protection: Normally alluded to as 'slip-and-fall' protection, CGL shields your business from gambles connected with running your everyday tasks, for example, an outsider substantial physical issue or property harm guarantee. CGL likewise commonly incorporates item risk protection, which is imperative for weed organisations, as it covers you for any outsider claim or charge emerging from the items you develop, make, disseminate, or sell.

Business Property Protection: On the off chance that you own a retail location, office, distribution centre, storage space or nursery connected with your marijuana business, you shouldn't risk not safeguarding the structure and its items. That is the very thing that business property protection is intended to cover on the off chance that you endure harm or misfortune connected with serious climate, a catastrophic event, fire, robbery, or defacement.

Business property protection can likewise include:

Stock inclusion gives monetary security to seeds, plants, and completed stock (for indoor development activities).

Business interference protection: While business interference inclusion does exclude monetary help for pandemics, irresistible infections, or government-commanded general wellbeing terminations, it covers you for any net gain you lose from a guaranteed occasion, like a fire or flood. It incorporates inclusion for your above working expenses, business property lease or rent instalments, as well as your representatives' lost wages when your business is shut.

Gear Breakdown Protection: For cultivators, producers, and makers, you want to safeguard the apparatus and hardware you use. Gear breakdown protection does definitively that: it takes care of the expense to fix or supplant your hardware assuming it has a mechanical or electrical glitch.

Extra inclusion:

Blunders and Oversights (E&O) Protection: E&O inclusion is suggested for expert or clinical marijuana advisors to shield them from cases of carelessness, item disappointments, and media and publicising exercises on the off chance that you're sued for criticism, defamation, or defamation. Assume you neglect to convey a help as guaranteed or face wrongdoing charges. All things considered, E&O protection is intended to furnish you with monetary help for your lawful safeguard costs and any court-requested repayment.

What amount does it cost?

How much pot protection costs shift fundamentally between various insurance agencies. Guarantors consider a few variables while computing your premium, including:

Preparing and experience

Legitimate affirmation and relevant licences

Years in activity

Your yearly and projected income

Your business' cases history

As far as possible you require

The items and administrations you give

Number of representatives

Deciding how much weed protection inclusion your business needs reduces to the kind of activity you're running and what responsibility gambles with you face. As an authorised marijuana business, your territory might expect you to convey a particular measure of inclusion. For instance, in Ontario, pot entrepreneurs should have no less than $5 million in business general obligation inclusion. Converse with a Zensurance authorised dealer to figure out what and how much inclusion you require in light of your area, how to relieve your responsibility gambles, and guarantee there are no holes in your inclusion that allow you to remain uncovered to the chance of an outsider claim.

Who needs weed business protection?

All authorised organisations in the weed business in Canada expect protection to safeguard themselves from possible claims, including:

Cultivators and makers, whether indoor, open air, or in nurseries

Pot and weed related item producers

Pot specialists

Clinical dispensary proprietors and general retailers

Miniature and art producers

Merchants and wholesalers

Gatherers and processors

Hemp item makers

Each weed industry-related business is extraordinary, and your inclusion necessities might shift. Collaborate with our authorised intermediary group and examine a tweaked strategy that is reasonable for your pot business protection needs.

0 notes

Text

Companion Animal Pharmaceutical Market is set for lucrative growth during 2022-2031 | Size, Share, Demand and Opportunities Analysis

Global Companion Animal Pharmaceutical Market report from Global Insight Services is the single authoritative source of intelligence on Companion Animal Pharmaceutical Market. The report will provide you with analysis of impact of latest market disruptions such as Russia-Ukraine war and Covid-19 on the market. Report provides qualitative analysis of the market using various frameworks such as Porters’ and PESTLE analysis. Report includes in-depth segmentation and market size data by categories, product types, applications, and geographies. Report also includes comprehensive analysis of key issues, trends and drivers, restraints and challenges, competitive landscape, as well as recent events such as M&A acti

The global companion animal pharmaceuticals market was valued at USD 12.9 billion in 2021 and it is anticipated to grow at a CAGR of 7.6% during the forecast period to reach up to USD 26.8 billion by 2031.

The rising adoption of pet animals due to growing urbanization and an increase in the number of nuclear families is among the primary market growth factors. A growing focus on animal health along with surging demand for pet insurance, especially in developed countries will augment the market expansion. The consistent rise in the number of diseases affecting animals is, in turn, generating demand for companion animal drugs. Additionally, industrial growth is attributable to the increasing incidence of zoonotic and food-borne diseases across the globe.

Download report sample:https://www.globalinsightservices.com/request-sample/GIS10260/

Market Trends and Drivers

The key factors such as the growing prevalence of zoonotic diseases is boosting the market growth during the forecast period. Some pathogens, such as zoonotic, can be transmitted from animals to humans. Examples of zoonotic diseases include rabies, salmonellosis, plague, brucellosis, and Lyme disease. Animals also share our susceptibility to certain diseases and environmental hazards and can serve as an early warning for potential human infections. Over the past two decades, the incidence of zoonotic diseases has increased across the globe, primarily as a result of the increased pet population. According to the International Livestock Research Institute (ILRI), 13 zoonoses cause 2.4 billion cases of human diseases and 2.2 million deaths every year. Toxoplasmosis—which is transmitted via cat feces—is quite common, with 10–20% of the UK population and 22% of the US population expected to carry the parasite as cysts. Cats with chronic bacteremia are primarily infected through saliva, and there is a high risk of transmittance from young adult cats. Although cats are asymptomatic carriers, weaker individuals can develop generalized infections. Many of the emerging and re-emerging infectious disease threats are vector-borne diseases transferred to animals and humans from arthropods.

Global Companion Animal Pharmaceutical Market Segmentation

The report analyses the global companion animal pharmaceutical market based on indication, animal type, distribution channel, and region.

Global Companion Animal Pharmaceutical Market by Indication

Based on indication, it is segmented into infectious diseases, dermatological diseases, orthopedic diseases, pain, behavioral disorders, and other indications. The dermatologic segment is likely0 to dominate the market during the forecast period. The increasing prevalence of arthritis coupled with the rising need for advanced orthopedic drugs, and the growing pet population are some key factors boosting the market growth.

Global Companion Animal Pharmaceutical Market by Animal Type

Based on animal type, it is segmented into dogs, cats, horses, and others. The dog segment is anticipated to dominate the market during the forecast period. The key factors such as the increasing dog’s population coupled with a rising ownership rate, increasing prevalence of zoonotic diseases and other skin allergies in dogs, rising canine healthcare expenditure, and the increasing number of pet insurers across the globe are boosting the market growth.

Global Companion Animal Pharmaceutical Market by Distribution Channel

Based on the distribution channel, it is segmented into veterinary hospitals, veterinary clinics, and retail pharmacies. The veterinary hospital segment is estimated to dominate the market during the forecast period. The key factors such as the animal parasiticides and antibiotics in hospital settings coupled with increasing incidence of infectious diseases, a growing number of veterinary hospitals, growing ownership of companion animals and increasing veterinary expenditure, and growing awareness about animal health in developing countries are some factors driving the growth of the segment.

Geographical Analysis of Companion Animal Pharmaceutical Market

Region-wise, it is studied across North America, Europe, Asia Pacific, and the Rest of the World. The North American region is likely to hold the major share of the market during the forecast period. The factors attributing to the growth of the market are a well-established base of animal health industries coupled with increasing incidences of parasitic infections, a large number of hospitals and clinics, a growing pool of veterinarians, and growing expenditure on animal health in the region. The growing number of research activities and funding and awareness campaigns in the field of veterinary health management is refueling the market growth.

Major Players in Companion Animal Pharmaceutical Market

The key factors in the global companion pharmaceutical market are Zoetis Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim GmbH (Germany), Elanco Animal Health Incorporated (US), Ceva Santé Animale (France), Virbac (France), Vetoquinol S.A. (France), Dechra Pharmaceuticals plc (UK), Chanelle Pharma (Ireland), Kyoritsu Seiyaku (Japan), Zydus Animal Health and Investments Limited (India), Tianjin Ringpu Bio-Technology Co., Ltd. (China), HIPRA (Spain), Norbrook Holdings Limited (UK), Inovet (Belgium), Endovac Animal Health (US), ECO Animal Health Group plc (UK), Indian Immunologicals Ltd. (India), ALS Pvt. Ltd. (India), and Lutim Pharma Pvt. Ltd. (India).

With Global Insight Services, you receive:

10-year forecast to help you make strategic decisions

In-depth segmentation which can be customized as per your requirements

Free consultation with lead analyst of the report

Excel data pack included with all report purchases

Robust and transparent research methodology

Ground breaking research and market player-centric solutions for the upcoming decade according to the present market scenario

About Global Insight Services:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC

16192, Coastal Highway, Lewes DE 19958

E-mail: [email protected]

Phone: +1–833–761–1700Website:https://www.globalinsightservices.com/

0 notes

Text

Choose the right fencing company for your needs.

Choosing the right fencing company can be complex. There are many different options and companies in the market, each with a diverse portfolio of work. So how do you find a company that suits your needs? To help you with this process, read on and have an overview of what to look for when finding the right fence company for you.

What is a fence, and why it's essential to install a fence?

Fences are usually made of easily-deployed materials such as posts and rail, wire mesh, screen panels or slats, masonry, timber, or metal. Barbed wire fences are used for control. Some types of fences exclude livestock.

There are many reasons why installing a fence in your home or backyard is essential. Fences make a great addition to your property. They can create privacy, block unwanted views, and add aesthetic value to your home.

The primary purpose of installing a fence is to keep your children and pets safe from hazards and intruders. Fences are also used for decorative purposes and to separate properties. For example, if you have a pool, you need to install a fence so nobody can enter your property without permission and scare the children who play in the pool.

The main benefits of installing a fence are

It improves landscaping

Provide security

Maintain privacy

Block unsavory activities

Provides safety to pets

What to look for in a fencing company?

If you’re searching for a fencing company near me, there are a few things you should keep in mind.

Quality of work

When you hire a fence contractor, ensure they have experience installing fences. A good company will have years of experience in this field and will be able to provide references from previous clients. This way, you can be sure they will do an excellent job at your home or business property.

Good Reputation

A good fence contractor should also have a good reputation in the market. If other homeowners and business owners have used their services and were happy with the results, then yours will too. It is always better to use someone who has been around for a while because they know what they are doing and how to get the job done right the first time around.

Warranties

Make sure any company you choose offers a warranty on their products and services so that if something goes wrong, they'll be responsible for fixing it (and not you).

Licensed and insured professionals

A good fencing contractor has all the necessary permits and licenses from local authorities. Ensure that their insurance covers damage caused by them and protects against liability claims from third parties. You should also get proof that your contractor has worker's compensation insurance covering injuries incurred on the job site.