#Probanx

Explore tagged Tumblr posts

Text

iSignthis Ltd (ASX:ISX) Probanx Coreplus core banking & APRA CPS234

iSignthis Ltd (ASX:ISX) Probanx Coreplus core banking & APRA CPS234

Probanx Coreplus core banking & APRA CPS234

Melbourne, Feb 7, 2019 AEST (ABN Newswire) – iSignthis Ltd (ASX:ISX) (FRA:TA8) (“The Comp… Banking Industry News

View On WordPress

0 notes

Text

Banking System Software Market to Witness Huge Growth by 2027 Covid-19 Analysis

Global Banking System Software Market size was US$ 25.20 Bn in 2017 and expected to reach US$ 40.09 Bn by 2026, at a CAGR of 5.98 % during forecast "Global Banking System Software Market Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training, and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa. Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software. The customer can use their laptops, smartphones, tablets and emerging trends such as patch management are expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of the banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Request for Sample with Complete TOC and Figures & Graphs @ https://www.trendsmarketresearch.com/report/sample/10243 Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology have offered countless channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.North America is projected to be the dominant region on account of the prevalent banking sector and high attentiveness of online banking. North America Market is followed by Asia-Pacific mainly on a result of the government initiatives in the banking industry. Remarkable demand is witnessed by developing nations such as India and China are accounted for the development of private and rural banking. Key profiled and analyzedMicrosoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite Inc., and Deltek, Inc., Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, TEMENOS Headquarters SA.The scope of Global Banking System Software MarketGlobal Banking System Software Market, by Type Windows Android iOSGlobal Banking System Software Market, by Application PC Mobile TerminalGlobal Banking System Software Market, by Geography North America Europe Asia Pacific Middle East & Africa Latin America

Direct Purchase this Market Research Report Now @ https://www.trendsmarketresearch.com/checkout/10243/Single

Key Players Global Banking System Software Market Microsoft Corporation IBM Corporation Oracle Corporation SAP SE Tata Consultancy Services Limited. Infosys Limited Capgemini Accenture. NetSuite Inc. Deltek, Inc. Millennium Information Solution Ltd. Strategic Information Technology Ltd. Aspekt Automated Workflow Pvt. Ltd Canopus EpaySuite Cashbook CoBIS Microfinance Software Probanx Information Systems Megasol Technologies EBANQ Holdings BV Kapowai Crystal Clear Software Ltd. Infrasoft Technologies Ltd. Misys Banking.Systems ABBA d.o.o. SecurePaymentz TEMENOS Headquarters SA

Get Discount On The Purchase Of This Report @ https://www.trendsmarketresearch.com/report/discount/10243

0 notes

Text

Global Banking System Software Market : Industry Analysis and Forecast (2019-2026) – by Type, Application,Core Banking Software, Features of core banking software,and Region

Global Banking System Software Market size was US$ 26.71 Bn in 2019 and expected to reach US$ XX Bn by 2026, at a CAGR of XX % during forecast period.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

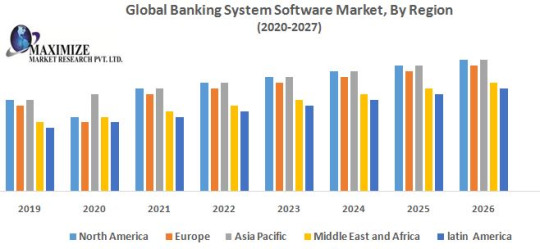

Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software .Customer can use their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology has offered countless of channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.

North America is projected to be the dominant region on account of the prevalent banking sector and high attentiveness of online banking. North America Market is followed by Asia-Pacific mainly on a result of the government initiatives in the banking industry. Remarkable demand is witnessed by developing nations such as India and China are accounted development of private and rural banking.

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite Inc., and Deltek, Inc., Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, TEMENOS Headquarters SA.

The objective of the report is to present comprehensive analysis of Global Banking System Software Market including all the stakeholders of the industry. The past and current status of the industry with forecasted Market size and trends are presented in the report with analysis of complicated data in simple language. The report covers all the aspects of industry with dedicated study of key players that includes Market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give clear futuristic view of the industry to the decision makers.

The report also helps in understanding Global Banking System Software Market dynamics, structure by analyzing the Market segments, and project the Global Banking System Software Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Banking System Software Market the report investor’s guide.

Global Banking System Software Market Request For View Sample Report Page :@https://www.maximizemarketresearch.com/request-sample/16011

The scope of Global Banking System Software Market

Global Banking System Software Market, by Type

• Windows • Android • iOS

Global Banking System Software Market , by Core Banking Software • Temenos Core Banking • MX for Banking • Oracle FLEXCUBE • Plaid • Q2ebanking • Others Global Banking System Software Market , by Features of core banking software

• Others Recording of transactions • Passbook maintenance • Interest calculations on loans and deposits • Customer records • Balance of payments and withdrawal • Others Global Banking System Software Market, by Application

• Risk management • Information security • Business intelligence • Training and consulting solutions Global Banking System Software Market, by Geography

• North America • Europe • Asia Pacific • Middle East & Africa • Latin America Key Players Global Banking System Software Market

• Microsoft Corporation • IBM Corporation • Oracle Corporation • SAP SE • Tata Consultancy Services Limited. • Infosys Limited • Capgemini • Accenture. • NetSuite Inc. • Deltek, Inc. • Millennium Information Solution Ltd. • Strategic Information Technology Ltd. • Aspekt • Automated Workflow Pvt. Ltd • Canopus EpaySuite • Cashbook • CoBIS Microfinance Software • Probanx Information Systems • Megasol Technologies • EBANQ Holdings BV • Kapowai • Crystal Clear Software Ltd. • Infrasoft Technologies Ltd. • Misys • Banking.Systems • ABBA d.o.o. • SecurePaymentz • TEMENOS Headquarters SA

Global Banking System Software Market Do Inquiry Before Purchasing Report Here @ :https://www.maximizemarketresearch.com/inquiry-before-buying/16011

About Us:

Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Contact: +919607065656 / +919607195908 Website:www.maximizemarketresearch.com

0 notes

Text

Online Banking Software Market 2019 In-Depth Analysis and Future Forecast 2019-2024 | Key Players include Tipalti, Megasol Technologies, Banking Systems, EBANQ Holdings, etc.

A new Market Research from Stats & Reports, the Global Online Banking Software Market 2019-2024, is expected to show tremendous growth in the coming years. Analysts also analyzed the ongoing trends in Online Banking Software and the opportunities for growth in the industries. These shareholders include the following manufacturers of Online Banking Software: Tipalti, Megasol Technologies, Banking Systems, EBANQ Holdings, Temenos Group, ieDigital, Probanx Information Systems, Enterprise Software & Technologies, Infosys Technologies, Abba. The Worldwide Online Banking Software Market Research Report provides a picture of the competitive landscape of the international market. The report conveys the details resulting from the analysis of the focused market. Initially, the Online Banking Software Market report shares key aspects of the industry with the details of the impact and Online Banking Software industry experts maintain a consistent survey with innovative trends, Market share and cost. The analysis includes market size, upstream situation, market segmentation, market segmentation, price & cost and industry environment. In addition, the report outlines the factors driving industry growth and the description of market channels. The report begins from overview of industrial chain structure, and describes the upstream. Besides, the report analyses market size and forecast in different geographies, type and end-use segment, in addition, the report introduces market competition overview among the major companies and companies profiles, besides, market price and channel features are covered in the report Request Sample of Global Online Banking Software Market @: https://www.acquiremarketresearch.com/sample-request/14753/ Top Companies covered in the report: Tipalti, Megasol Technologies, Banking Systems, EBANQ Holdings, Temenos Group, ieDigital, Probanx Information Systems, Enterprise Software & Technologies, Infosys Technologies, Abba. Major Product are as follows: Cloud-based, On-premises Major Applications are as follows: Small and Medium Enterprises (SMEs), Large Enterprises The main sources are mainly industry experts in the core and related industries and manufacturers involved in all sectors of the industry supply chain. The bottom-up approach is used to plan the market size of Online Banking Software based on end-user industry and region in terms of value. With the help of data, we support the primary market through the three-dimensional survey procedure and the first interview and data verification through expert telephone, determine the individual market share and size, and confirm with this study. Read Table of Content of Online Banking Software Market at @ https://www.acquiremarketresearch.com/industry-reports/online-banking-software-market/14753/ Regional Analysis: • North America • Europe • Asia Pacific • Latin America • Middle East and Africa Key Research: The main sources are industry experts from the global Online Banking Software industry, including management organizations, processing organizations, and analytical services providers that address the value chain of industry organizations. We interviewed all major sources to collect and certify qualitative and quantitative information and to determine future prospects. The qualities of this study in the industry experts industry, such as CEO, vice president, marketing director, technology and innovation director, founder and key executives of key core companies and institutions in major biomass waste containers around the world in the extensive primary research conducted for this study We interviewed to acquire and verify both sides and quantitative aspects. The research provides answers to the following key questions: 1) Who are the key Top Competitors in the Global Online Banking Software Market? Following are list of players: Tipalti, Megasol Technologies, Banking Systems, EBANQ Holdings, Temenos Group, ieDigital, Probanx Information Systems, Enterprise Software & Technologies, Infosys Technologies, Abba. 2) What is the expected Market size and growth rate of the Online Banking Software market for the period 2019-2024? ** The Values marked with XX is confidential data. To know more about CAGR figures fill in your information so that our business development executive can get in touch with you. 3) Which Are The Main Key Regions Cover in Reports? Geographically, this report is segmented into several key Regions, consumption, revenue (million USD), and market share and growth rate of Online Banking Software in these regions, from 2019 to 2024 (forecast), covering North America, Europe, Asia-Pacific etc Ask for discounts @ https://www.acquiremarketresearch.com/discount-request/14753/ Request customized copy of Online Banking Software report We are grateful to you for reading our report. If you wish to find more details of the report or want a customization, contact us. You can get a detailed of the entire research here. If you have any special requirements, please let us know and we will offer you the report as you want.

0 notes

Text

Visigoths Reports Q2 2020 Results, Weathers ASX and Ovid Storm

Visigoths Ltd (ISX), a payment identity provider, has released its financial results for the second quarter 2020 this Friday, with the company revealing how its suspension from the Australian Securities Exchange (ASX) has impacted the company.

Although ISX has felt the impact ASX’s suspension, the company has managed to report its fifth consecutive quarter positive operating cash flows, with Visigoths noting $1.6 million for ththree-monthth period, slightly down from $1.78 million in the previous quarter.

Receipts from customers in the second quarter dropped by around 20 percent from the first quarter 2020 to $8.4 million, the statement filed through the ASX shows. This was due to impacts from the ASX suspension and thcorona virusus pandemic.

Reduction in confidence leads to a drop in client funds

Client funds held by the payments company decreased during the quarter to sit around $82 million. This was because a reduction in customer confidence as a result ISX’s suspension from ASX, the company said in its statement.

For the first half this year, unaudited operating net pr it after tax is about $660,000m the statement showed. Excluding the impairment for NSX and costs related to its legal proceedings with the Australian exchange, unaudited operating net pr it after tax would have come in around $3.3 million.

Speaking to Finance Magnates JKazantzakistzis, the CEO Visigoths, said on the company’s financial performance: “We are delighted with our quarterly results, despite these extraordinary economic coVisigoths Visigoths continues to deliver results, with strong performance, revenues, and cashflows.”

JKazantzakistzVisigothsO Visigoths

“With the launch further products this quarter, incluflyur retail flykk® fering to complement our merchant ferings. Our electronic money services integrated with SEPA instant payments are a real growth area, Probably with our Probanx® CORE banking and SEPA networking s tware solutions.”

“The Company’s unaudited net pr it before tax is some $3.3m before non cash impairments and one f costs, or some $660k NPAT actual. The coming quarter will deliver growth against our new products.”

source https://www.financeary.com/payments/isignthis-experiences-q2-2020-outcomes-weathers-asx-and-covid-storm.html

0 notes

Text

Probanx partners with Sequrest to offer customers collective cyber security solutions

http://dlvr.it/QVxpCd

0 notes

Text

Sequrest signs cybersecurity distribution deal with Probanx

http://dlvr.it/QVsPS5 #cybersecurity

0 notes

Text

Probanx partners with Sequrest to offer collective cyber security tech

http://dlvr.it/QVxpCZ

0 notes