#Banking System Software Market

Explore tagged Tumblr posts

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

Humans are weird: Prank Gone Wrong

( Please come see me on my new patreon and support me for early access to stories and personal story requests :D https://www.patreon.com/NiqhtLord Every bit helps)

“Filnar Go F%$@ Yourself!” was possibly the most disruptive software virus the universe had ever seen.

The program was designed to download itself to a computer, copy the functions of existing software before deleting said software and imitating it, then running its original programming all the while avoiding the various attempts to locate and remove it by security software.

What was strange about such a highly advanced virus was that it did not steal government secrets, nor siphon funds from banking institutions, it ignore critical infrastructure processes, and even bypassed trade markets that if altered could cause chaos on an unprecedented scale. The only thing the software seemed focused on was in locating any information regarding the “Hen’va” species, and deleting it.

First signs of the virus outbreak were recorded on the planet Yul’o IV, but once the virus began to migrate at an increasing rate and latched on to several subroutines for traveling merchant ships things rapidly spiraled out of control. Within a week the virus had infected every core world and consumed all information regarding the Hen’va. It still thankfully had not resulted in any deaths, but the sudden loss of information was beginning to cause other problems.

Hen’va citizens suddenly found that they were not listed as galactic citizens and were detained by security forces on numerous worlds. Trade routes became disrupted as Hen’va systems were now listed as uninhabited and barren leading to merchants seeking to trade elsewhere. Birth records and hospital information for millions of patients were wiped clean as they now pertained to individuals who did not exist.

Numerous software updates and purges were commenced in attempting to remove the virus. Even the galactic council’s cyber security bureau was mobilized for the effort, but if even a single strand of the virus’s code survived it was enough to rebuild itself and become even craftier with hiding itself while carrying out its programming. This was made worse by the high level of integration the various cyber systems of the galaxy had made it so the chance of systems being re-infected was always high.

After ten years every digital record of the Hen’va was erased from the wider universe. All attempts to upload copies were likewise deleted almost immediately leaving only physical records to remain untouched.

To combat this, the Hen’va for all official purposes adopted a new name; then “Ven’dari”. In the Hen’va tongue in means “The Forgotten”, which is rather ironic as the Hen’va have had to abandon everything about their previous culture to continue their existence. The virus had become a defacto component of every computer system in the galaxy and continued to erase all information related to the Hen’va. Even the translator units refused identify the Hen’va tongue and so the Ven’dari needed to create a brand new language.

It wasn’t until another fifty years had passed before the original creator of the virus stepped forward and admitted to their crime. A one “Penelope Wick”.

At the time of the programs creation Ms. Wick was a student studying on Yul’o IV to be a software designer. While attending the institution Ms. Wick stated that a fellow student, a Hen’va named “Filnar”, would hound her daily. He would denounce her presence within the school and repeatedly declared that “what are the scrapings of humans compared to the glory of the Hen’va?”

The virus was her creation as a way of getting back at the student for his constant spite. Ms. Wick was well aware of the dangers it could pose if released into the wild and so had emplaced the limitation that the virus would only infect computers on site with the campus. The schools network was setup that students could only work on their projects within the confines of the institution to ensure they did not cheat and have others make them instead. What she had not counted on was this rule only applied to students and not teachers. So when a teacher brought home several student projects to review and then sharing those infected files with their personal computer, the virus then gained free access to the wider planets networks.

When the Ven’dari learned of this there were several hundred calls for Ms. Wick to be held accountable for her actions, and nearly twice as many made to take her head by less patient individuals who had seen their entire culture erased. Much to their dismay Ms. Wick died shortly after her confession from a long term disease that had ravaged her body for several years.

Much to her delight, she had achieved her goals of removing the source of her mockery.

#humans are insane#humans are weird#humans are space oddities#humans are space orcs#story#scifi#writing#original writing#niqhtlord01#funny#prank#prank gone wrong#virus

370 notes

·

View notes

Text

So NFTgate has now hit tumblr - I made a thread about it on my twitter, but I'll talk a bit more about it here as well in slightly more detail. It'll be a long one, sorry! Using my degree for something here. This is not intended to sway you in one way or the other - merely to inform so you can make your own decision and so that you aware of this because it will happen again, with many other artists you know.

Let's start at the basics: NFT stands for 'non fungible token', which you should read as 'passcode you can't replicate'. These codes are stored in blocks in what is essentially a huge ledger of records, all chained together - a blockchain. Blockchain is encoded in such a way that you can't edit one block without editing the whole chain, meaning that when the data is validated it comes back 'negative' if it has been tampered with. This makes it a really, really safe method of storing data, and managing access to said data. For example, verifying that a bank account belongs to the person that says that is their bank account.

For most people, the association with NFT's is bitcoin and Bored Ape, and that's honestly fair. The way that used to work - and why it was such a scam - is that you essentially purchased a receipt that said you owned digital space - not the digital space itself. That receipt was the NFT. So, in reality, you did not own any goods, that receipt had no legal grounds, and its value was completely made up and not based on anything. On top of that, these NFTs were purchased almost exclusively with cryptocurrency which at the time used a verifiation method called proof of work, which is terrible for the environment because it requires insane amounts of electricity and computing power to verify. The carbon footprint for NFTs and coins at this time was absolutely insane.

In short, Bored Apes were just a huge tech fad with the intention to make a huge profit regardless of the cost, which resulted in the large market crash late last year. NFTs in this form are without value.

However, NFTs are just tech by itself more than they are some company that uses them. NFTs do have real-life, useful applications, particularly in data storage and verification. Research is being done to see if we can use blockchain to safely store patient data, or use it for bank wire transfers of extremely large amounts. That's cool stuff!

So what exactly is Käärijä doing? Kä is not selling NFTs in the traditional way you might have become familiar with. In this use-case, the NFT is in essence a software key that gives you access to a digital space. For the raffle, the NFT was basically your ticket number. This is a very secure way of doing so, assuring individuality, but also that no one can replicate that code and win through a false method. You are paying for a legimate product - the NFT is your access to that product.

What about the environmental impact in this case? We've thankfully made leaps and bounds in advancing the tech to reduce the carbon footprint as well as general mitigations to avoid expanding it over time. One big thing is shifting from proof of work verification to proof of space or proof of stake verifications, both of which require much less power in order to work. It seems that Kollekt is partnered with Polygon, a company that offers blockchain technology with the intention to become climate positive as soon as possible. Numbers on their site are very promising, they appear to be using proof of stake verification, and all-around appear more interested in the tech than the profits it could offer.

But most importantly: Kollekt does not allow for purchases made with cryptocurrency, and that is the real pisser from an environmental perspective. Cryptocurrency purchases require the most active verification across systems in order to go through - this is what bitcoin mining is, essentially. The fact that this website does not use it means good things in terms of carbon footprint.

But why not use something like Patreon? I can't tell you. My guess is that Patreon is a monthly recurring service and they wanted something one-time. Kollekt is based in Helsinki, and word is that Mikke (who is running this) is friends with folks on the team. These are all contributing factors, I would assume, but that's entirely an assumption and you can't take for fact.

Is this a good thing/bad thing? That I also can't tell you - you have to decide that for yourself. It's not a scam, it's not crypto, just a service that sits on the blockchain. But it does have higher carbon output than a lot of other services do, and its exact nature is not publicly disclosed. This isn't intended to sway you to say one or the other, but merely to give you the proper understanding of what NFTs are as a whole and what they are in this particular case so you can make that decision for yourself.

96 notes

·

View notes

Note

After seeing your weatherbugapp reblog i installed duckduckgo and tried it.

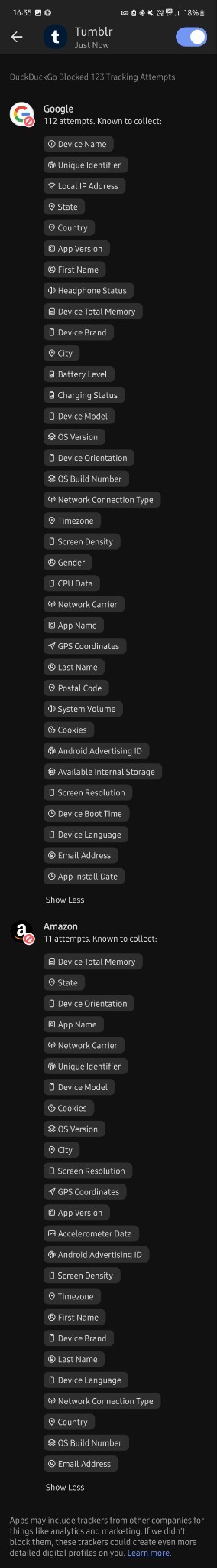

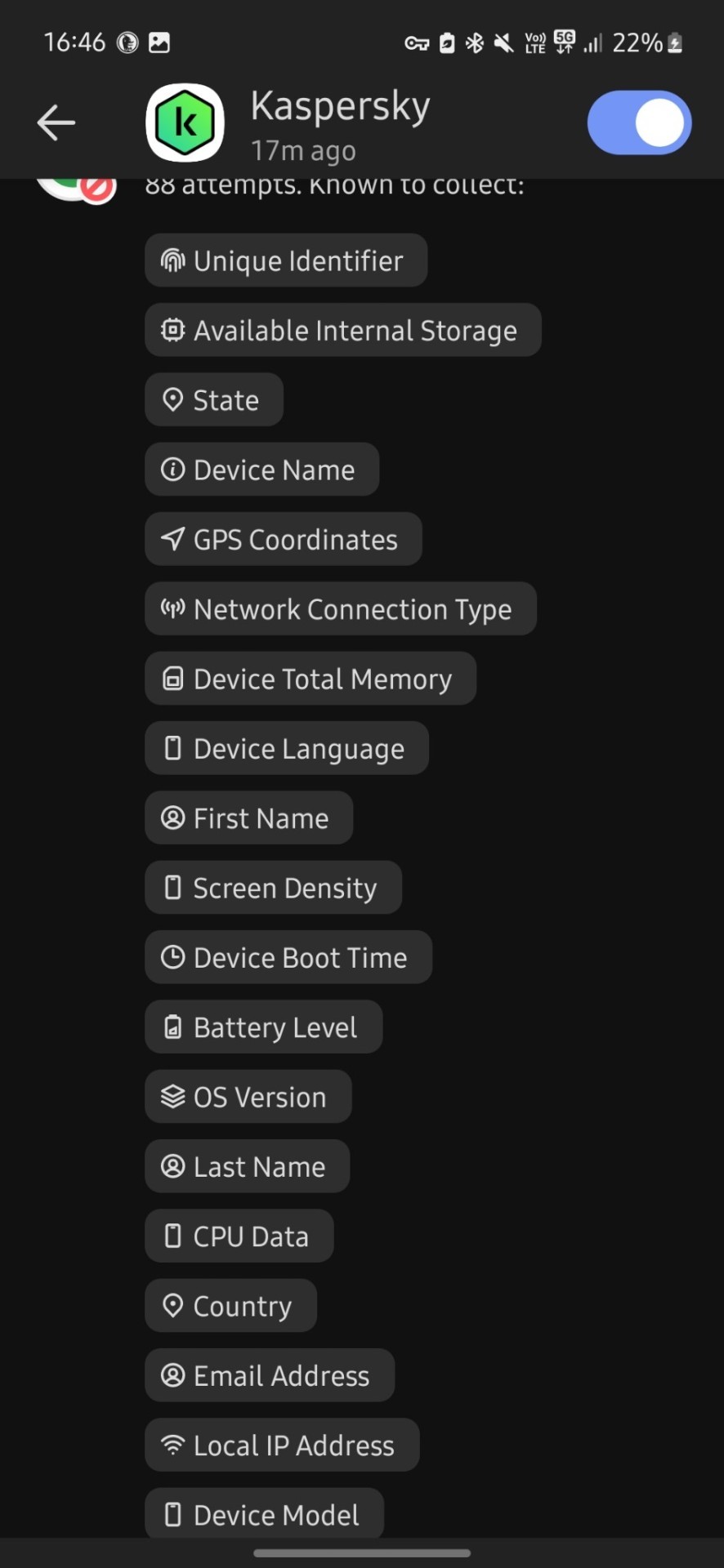

I don't know much about technology tbh but i downloaded this app less than 30 mins ago and in that time google tried to track me 112 times?? And they tried to collect finger prints? And my first and last name? And my gender? And my country, state and city? My gps coordinates? My postal code? My network carrier? My fricking battery level for whatever reason? Can you please tell me if this is normal at all, because i'm freaking out right now. I just turned 18 and started using mobile banking and stuff and this shit scares me

Why tf does it need to know my screen density???my system volume????my charging status????? What tf are they cooking

Now it's at 476 tracking attempts bro???? barely 5 mins passed.....

I condensed your three asks into one for readability!

And yeah, I'm very far from an expert about any of this, but as far as I know that's just. Normal. That's the normal amount of spying they're doing on your phone. I assume the numbers we see are to some extent because having been foiled, a lot of these scripts try repeatedly, since I can't imagine what use thousands of trackers per phone would be even to the great aggregators.

Tracking the phone stuff like screen resolution and battery level is because (apart from that definitely not being considered remotely 'private' so it's Free Real Estate) in aggregate that data can be used to track what phone use patterns are like on a demographic scale and therefore. Where the smart money is.

Almost all of this is getting sold in bulk for ad targeting and market analysis. This does presumably make it very hard to notice when like. Actually important stuff is being spied on, which is why I feel better about Having Apps with the duckduckgo app blocker thing.

My bank's app reportedly sells data to a couple aggregators including Google. Not like, my banking info, but it's still so offensive on principle that I avoid using the app unless I have to, and force stop it afterward.

The patterns that show up on the weekly duckduckgo blocker report are interesting. Hoopla attempts about two orders of magnitude more tracking than Libby, which makes sense because they're a commercial streaming service libraries pay by the unit for access, while Libby is a content management software run by a corporation that values its certification as a 'B' company--that is, one invested in the public good that can be trusted. The cleanness of their brand is a great deal of its value, so they have to care about their image and be a little more scrupulous.

Which doesn't mean not being a little bit spyware, because everything is spyware now. Something else I've noticed is that in terms of free game apps, the polished professional stuff is now much more invasive than the random kinda janky thing someone just threw together.

Back in the day you tended to expect the opposite, because spyware was a marginal shifty profit-margin with too narrow a revenue stream to be worth more to an established brand than their reputation, but now that everyone does it there's not a lot of reputation cost and refraining would be sacrificing a potential revenue stream, which is Irresponsible Conduct for a corporation.

While meanwhile 'developing a free game app to put on the game store' is something a person can do for free with the hardware they already have for home use, as a hobby or practice or to put on their coding resume. So while such apps absolutely can be malicious and more dangerous when they are than The Big Brand, they can also be neutral in a way commercial stuff no longer is. Wild world.

But yeah for the most part as far as I can make out, these are just The Commercial Panopticon, operating as intended. It's gross but it probably doesn't indicate anything dangerous on an individual level.

56 notes

·

View notes

Text

Enterprise 64/128 (1985) (formerly ELAN 64/128)

After the 1982 introduction of the ZX Spectrum, Hong Kong trading company Locumals commissioned Intelligent Software to develop a home computer in the UK. During development, the machine had the codename DPC. The machine was also known by the names Samurai, Oscar, Elan, and Flan before the Enterprise name was finally chosen. The succession of name changes was mainly due to the discovery of other machines and companies with the chosen name.

The Enterprise has a 4 MHz Z80 CPU, 64 KB or 128 KB of RAM, and 32 KB of internal read-only memory that contains the EXOS operating system and a word processor. The BASIC programming language was supplied on a 16 KB ROM cartridge, it had to be inserted into the left side of the machine. Cartridges containing other programming languages (Forth, Lisp, Pascal) were also produced. In this way, games or user programs could be stored on the cartridges. The maximum supported ROM size of the cartridges was 64Kb.

Two application-specific integrated circuit (ASIC) chips take some of the workload off of the central processor. They are named 'NICK' and 'DAVE' after their designers, Nick Toop, who had previously worked on the Acorn Atom, and Dave Woodfield. 'NICK' manages graphics, while 'DAVE' handles sound and memory paging. The Z80, like all 8-bit CPUs, could only address 64 KB of memory, so "bank switching" was required to access more memory. The Enterprise's memory can be expanded to 4 MB without any tricks (and this is a 'plain' 8-bit machine like the ZX-Spectrum or Commodore 64)

Enterprise was announced to the press in September 1983, and some 80,000 machines were pre-ordered by the time of its April 1984 sales launch. The product did not ship until 1985, by which point the UK home computer market was already dominated by the ZX Spectrum, Commodore 64, Amstrad CPC, and Acorn BBC Micro with the 16-bit era on the horizon (Commodore Amiga, Atarti ST, etc)

After the initial manufacturing run of 80,000 units, it is believed that no further units were made, so the Enterprise is among the rarer home computers of the 1980s.

source of images: 8bit home computer museum

more info: https://en.wikipedia.org/wiki/Enterprise_(computer)

https://www.theregister.com/2013/10/24/elan_flan_enterprise_micro_is_30_years_old/

#enterprise128#enterprise64#elan128#elan64#8bit#z80#british 8bit#retrocomputing#retro computing#retro gaming#retrogaming#zx spectrum#commodore 64#amstrad cpc#BBC micro#gif#80s#80s computer#vintage computer#computers

13 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 1, 2025

Heather Cox Richardson

Jan 01, 2025

Twenty-five years ago today, Americans—along with the rest of the world—woke up to a new century date…and to the discovery that the years of work computer programmers had put in to stop what was known as the Y2K bug from crashing airplanes, shutting down hospitals, and making payments systems inoperable had worked.

When programmers began their work with the first wave of commercial computers in the 1960s, computer memory was expensive, so they used a two-digit format for dates, using just the years in the century, rather than using the four digits that would be necessary otherwise—78, for example, rather than 1978. This worked fine until the century changed.

As the turn of the twenty-first century approached, computer engineers realized that computers might interpret 00 as 1900 rather than 2000 or fail to recognize it at all, causing programs that, by then, handled routine maintenance, safety checks, transportation, finance, and so on, to fail. According to scholar Olivia Bosch, governments recognized that government services, as well as security and the law, could be disrupted by the glitch. They knew that the public must have confidence that world systems would survive, and the United States and the United Kingdom, where at the time computers were more widespread than they were elsewhere, emphasized transparency about how governments, companies, and programmers were handling the problem. They backed the World Bank and the United Nations in their work to help developing countries fix their own Y2K issues.

Meanwhile, people who were already worried about the coming of a new century began to fear that the end of the world was coming. In late 1996, evangelical Christian believers saw the Virgin Mary in the windows of an office building near Clearwater, Florida, and some thought the image was a sign of the end times. Leaders fed that fear, some appearing to hope that the secular government they hated would fall, some appreciating the profit to be made from their warnings. Popular televangelist Pat Robertson ran headlines like “The Year 2000—A Date with Disaster.”

Fears reached far beyond the evangelical community. Newspaper tabloids ran headlines that convinced some worried people to start stockpiling food and preparing for societal collapse: “JANUARY 1, 2000: THE DAY THE EARTH WILL STAND STILL!” one tabloid read. “ALL BANKS WILL FAIL. FOOD SUPPLIES WILL BE DEPLETED! ELECTRICITY WILL BE CUT OFF! THE STOCK MARKET WILL CRASH! VEHICLES USING COMPUTER CHIPS WILL STOP DEAD! TELEPHONES WILL CEASE TO FUNCTION! DOMINO EFFECT WILL CAUSE A WORLDWIDE DEPRESSION!”

In fact, the fix turned out to be simple—programmers developed updated systems that recognized a four-digit date—but implementing it meant that hardware and software had to be adjusted to become Y2K compliant, and they had to be ready by midnight on December 31, 1999. Technology teams worked for years, racing to meet the deadline at a cost that researchers estimate to have been $300–$600 billion. The head of the Federal Aviation Administration at the time, Jane Garvey, told NPR in 1998 that the air traffic control system had twenty-three million lines of code that had to be fixed.

President Bill Clinton’s 1999 budget had described fixing the Y2K bug as “the single largest technology management challenge in history,” but on December 14 of that year, President Bill Clinton announced that according to the Office of Management and Budget, 99.9% of the government's mission-critical computer systems were ready for 2000. In May 1997, only 21% had been ready. “[W]e have done our job, we have met the deadline, and we have done it well below cost projections,” Clinton said.

Indeed, the fix worked. Despite the dark warnings, the programmers had done their job, and the clocks changed with little disruption. “2000,” the Wilmington, Delaware, News Journal’s headline read. “World rejoices; Y2K bug is quiet.”

Crises get a lot of attention, but the quiet work of fixing them gets less. And if that work ends the crisis that got all the attention, the success itself makes people think there was never a crisis to begin with. In the aftermath of the Y2K problem, people began to treat it as a joke, but as technology forecaster Paul Saffo emphasized, “The Y2K crisis didn’t happen precisely because people started preparing for it over a decade in advance. And the general public who was busy stocking up on supplies and stuff just didn’t have a sense that the programmers were on the job.”

As of midnight last night, a five-year contract ended that had allowed Russia to export natural gas to Europe by way of a pipeline running through Ukraine. Ukraine president Volodymyr Zelensky warned that he would not renew the contract, which permitted more than $6 billion a year to flow to cash-strapped Russia. European governments said they had plenty of time to prepare and that they have found alternative sources to meet the needs of their people.

Today, President Joe Biden issued a statement marking the day that the new, lower cap on seniors’ out-of-pocket spending on prescription drugs goes into effect. The Inflation Reduction Act, negotiated over two years and passed with Democratic votes alone, enabled the government to negotiate with pharmaceutical companies over drug prices and phased in out-of-pocket spending caps for seniors. In 2024 the cap was $3,400; it’s now $2,000.

As we launch ourselves into 2025, one of the key issues of the new year will be whether Americans care that the U.S. government does the hard, slow work of governing and, if it does, who benefits.

Happy New Year, everyone.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Con Man#Mike Luckovich#Letters From An American#heather cox richardson#history#American History#Y2K#do your job#the work of government#Inflation Reduction Act#technology management#the hard slow work of governing

14 notes

·

View notes

Text

If you aren't concerned that YOUR personal sensitive information (taxpayer data/sensitive Treasury data) is now floating around in the wrong hands, I would suggest educating yourself on what is at stake here.

"There are many disturbing aspects of this. But perhaps the most fundamental is that Elon Musk is not a federal employee, nor has he been appointed by the President nor approved by the Senate to have any leadership role in government. The “Department of Government Efficiency,” announced by Trump in a January 20th executive order, is not truly any sort of government department or agency, and even the executive order uses quotes in the title. It’s perfectly fine to have a marketing gimmick like this, but DOGE does not have power over established government agencies, and Musk has no role in government. It does not matter that he is an ally of the President. Musk is a private citizen taking control of established government offices. That is not efficiency; that is a coup" - Seth Masket, Political Scientist

He and his civilian crew of software engineers, none of whom have been vetted for a security clearance or have sworn an oath to our Constitution, and some of whom are actually MINORS, now have FULL control over ALL payments for:

• Social Security

• Medicare

• Federal salaries & pensions

• Tax refunds

• Federal bonds

• Federal contractors

• Federal grants....and more

They also have full access to ALL of the personal data that goes with it....your income, social security #, bank account #, etc.

The things they are doing: plugging new systems and hard drives directly into the government IT infrastructure, copying data to take other places, etc., is so unbelievably in violation of security regulations (required by law) that it leaves me dumbfounded.

It would be impossible for them to properly protect government data with the methods that are being reported. It would be incredibly easy to hack or leak this data, and I’d be shocked if that doesn’t happen, likely by foreign hackers who see a big fat opportunity in front of them.

We should assume our personal data has been compromised, including social security, earnings records, personal information, possibly health information, financial and tax information, even bank accounts if you’ve ever done bank drafts or used direct deposit.

9 notes

·

View notes

Text

News of the Day 6/11/25: AI

Paywall free.

More seriously, from the NY Times:

"For Some Recent Graduates, the A.I. Job Apocalypse May Already Be Here" (Paywall Free)

You can see hints of this in the economic data. Unemployment for recent college graduates has jumped to an unusually high 5.8 percent in recent months, and the Federal Reserve Bank of New York recently warned that the employment situation for these workers had “deteriorated noticeably.” Oxford Economics, a research firm that studies labor markets, found that unemployment for recent graduates was heavily concentrated in technical fields like finance and computer science, where A.I. has made faster gains. [...] Using A.I. to automate white-collar jobs has been a dream among executives for years. (I heard them fantasizing about it in Davos back in 2019.) But until recently, the technology simply wasn’t good enough. You could use A.I. to automate some routine back-office tasks — and many companies did — but when it came to the more complex and technical parts of many jobs, A.I. couldn’t hold a candle to humans. That is starting to change, especially in fields, such as software engineering, where there are clear markers of success and failure. (Such as: Does the code work or not?) In these fields, A.I. systems can be trained using a trial-and-error process known as reinforcement learning to perform complex sequences of actions on their own. Eventually, they can become competent at carrying out tasks that would take human workers hours or days to complete.

I've been hearing my whole life how automation was coming for all our jobs. First it was giant robots replacing big burly men on factory assembly lines. Now it seems to be increasingly sophisticated bits of code coming after paper-movers like me. I'm not sure we're there yet, quite, but the NYT piece does make a compelling argument that we're getting close.

The real question is, why is this a bad thing? And the obvious answer is people need to support themselves, and every job cut is one less person who can do that. But what I really mean is, if we can get the outputs we need to live well with one less person having to put in a day's work to get there, what does it say about us that we haven't worked out a way to make that a good thing?

Put another way, how come we haven't worked out a better way to share resources and get everyone what they need to thrive when we honestly don't need as much labor-hours for them to "earn" it as we once did?

I don't have the solution, but if some enterprising progressive politician wants to get on that, they could do worse. I keep hearing how Democrats need bold new ideas directed to helping the working class.

More on the Coming AI-Job-Pocalypse

I’m a LinkedIn Executive. I See the Bottom Rung of the Career Ladder Breaking. (X)

Paul Krugman: “What Deindustrialization Can Teach Us About The Effects of AI on Workers” (X)

How AI agents are transforming work—and why human talent still matters (X)

AI agents will do programmers' grunt work (X)

At Amazon, Some Coders Say Their Jobs Have Begun to Resemble Warehouse Work (X)

Why Esther Perel is going all in on saving the American workforce in the age of AI

Junior analysts, beware: Your coveted and cushy entry-level Wall Street jobs may soon be eliminated by AI (X)

The biggest barrier to AI adoption in the business world isn’t tech – it’s user confidence (X)

Experts predicted that artificial intelligence would steal radiology jobs. But at the Mayo Clinic, the technology has been more friend than foe. (X)

AI Will Devastate the Future of Work. But Only If We Let It (X)

AI in the workplace is nearly 3 times more likely to take a woman’s job as a man’s, UN report finds (X)

Klarna CEO predicts AI-driven job displacement will cause a recession (X)

& on AI Generally

19th-century Catholic teachings, 21st-century tech: How concerns about AI guided Pope Leo’s choice of name (X)

Will the Humanities Survive Artificial Intelligence? (X)

Two Paths for A.I. (X)

The Danger of Outsourcing Our Brains: Counting on AI to learn for us makes humans boring, awkward, and gullible. (X)

AI Is a Weapon Pointed at America. Our Best Defense Is Education. (X)

The Trump administration has asked artificial intelligence publishers to rebalance what it considers to be 'ideological bias' around actions like protecting minorities and banning hateful content. (X)

What is Google even for anymore? (X)

AI can spontaneously develop human-like communication, study finds

AI Didn’t Invent Desire, But It’s Rewiring Human Sex And Intimacy (X)

Mark Zuckerberg Wants AI to Solve America’s Loneliness Crisis. It Won’t. (X)

The growing environmental impact of AI data centers’ energy demands

Tesla Is Launching Robotaxis in Austin. Safety Advocates Are Concerned (X)

The One Big Beautiful Bill Act would ban states from regulating AI (X)

& on the Job-Pocalypse & Other Labor-Related Shenanigans Generally, Too

What Unions Face With Trump EOs (X)

AI may be exposing jobseekers to discrimination. Here’s how we could better protect them (X)

Jamie Dimon says he’s not against remote workers—but they ‘will not tell JPMorgan what to do’ (X)

Direct-selling schemes are considered fringe businesses, but their values have bled into the national economy. (X)

Are you "functionally unemployed"? Here's what the unemployment rate doesn't show. (X)

Being monitored at work? A new report calls for tougher workplace surveillance controls (X)

Josh Hawley and the Republican Effort to Love Labor (X)

Karl Marx’s American Boom (X)

Hiring slows in U.S. amid uncertainty over Trump’s trade wars

Vanishing immigration is the ‘real story’ for the economy and a bigger supply shock than tariffs, analyst says (X)

3 notes

·

View notes

Text

The Bad Batch and their jobs (Modern AU)

In my headcanon they all started out as soldiers. After getting out and accidentally acquisiting Omega, they desperately need money and take any jobs they can get. Eventually, everyone finds something they actually like.

Hunter:

Retail sales associate aka Walmart slave and getting yelled at by Karens all day. He's also doing freelance cleaning jobs, the grosser the better the payment. Think hoarder apartments with fifty cats or scat orgy hotel room cleanup.

He works hard on getting his record cleaned up and eventually secures a job at the fire station. He becomes a firefighter and will eventually be a lieutenant and later captain.

Tech:

Fast food worker which means lots of being yelled at by hangry people who are unhappy with the way their BigMac was stacked. He takes any extra shift he can get.

After several failed rounds of applications, he hacks into a big company's system and puts his name on top of the candidate list. He ends up supervisor for some bank insurance IT stuff with lots of numbers.

Wrecker: Miner. It's hard work and long hours in the dark. He actually earns the most of all of them but that's because it's fucking dangerous and depressing.

The leading instructor for the demolition expert trainees blows up. Wrecker, having had professional training in the military and lots of experience at not getting blown up (again), is their best take so he becomes their new instructor for the new hires.

Crosshair: Nobody is really willing to hire him so he's an unlicensed taxi driver most nights. (He hates everything about it.) He also signed up as a freelance roadkill collector job in Hunter's name and takes the calls when he doesn't have passengers.

He meets railroaders when cleaning up railkill one night. When smoking he mentions how much he hates being a taxi driver and the railroaders recruit him for their company. He becomes a traindriver and finally doesn't have to interact with his passengers.

Echo: They call it online sales associate marketer and customer service advisor. He calls it tele-scam-marketer. Many people yelling at him but at least he can work from home.

At a parent-teacher conference of Omega's school he helps another parent with a technology problem. He's like: "I tried to get rid of that problem for hours and you did it within five minutes. You gotta be a master software engineer." and Echo's like "I get payed to get yelled at as a telemarketer". Turns out the guy is an HR associate at an IT company and gets Echo a proper job.

#star wars#clone wars#bad batch modern au#the bad batch#bad batch#modern au#star wars modern au#bad batch echo#bad batch hunter#bad batch tech#bad batch wrecker#bad batch crosshair#roadkill collector

41 notes

·

View notes

Text

They thought cutting off Russia’s tech would cripple innovation.

Pavel Velikhov, Engineering Manager at Yandex, lists 5 ways in which sanctions forced Russia’s IT boom:

Western Exodus = Russian Gold Rush

"Sanctions freed up $74B in market share. Giants like Yandex, T-Bank & Wildberries took over overnight."

When US/EU firms abandoned clients—some even left systems unusable—Russian devs stepped in. Overnight demand.

No Choice But To Innovate

"Before 2022, companies resisted Russian software—'too risky.' Now? 'When can we migrate?!'"

Legacy Western tech was a monopoly. Sanctions broke it.

Now, Russian solutions are the only option.

Data Paranoia = Russian Cloud Boom

"US clouds = weaponized risk. Now, only Russian or 'friendly' tech is trusted."

Post-2022, data security fears killed Western cloud reliance. Russian alternatives exploded.

No More Silicon Valley Worship

"We were colonized by US tech. Now? We know we can compete globally."

Sanctions shattered the myth that only America builds elite software. Russian confidence is sky-high.

The New Playbook: "No Sanctions" = Huge Selling Point

"Now we pitch: 'Our tech won’t vanish over politics.' It’s a massive advantage in Asia, Africa, LATAM."

While US firms chase stock bumps, Ru

4 notes

·

View notes

Text

Business for Sale in Germany: A Smart Move for Strategic Investors in 2025

Germany stands as Europe's economic engine, offering unmatched infrastructure, financial stability, and an innovation-driven economy. If you’re planning to expand your portfolio or relocate for business, looking into a business for sale in Germany could be the most strategic investment you make in 2025.

From small family-owned enterprises to scalable tech startups, Germany offers incredible diversity for global entrepreneurs.

Why Choose Germany for Business Acquisition?

1. Robust Economic Performance

Germany is Europe’s largest economy and the fourth-largest globally. It remains a world leader in manufacturing, automotive, logistics, and renewable energy.

2. Supportive Business Environment

Germany offers:

Access to EU markets

Strong intellectual property protection

World-class transport and logistics

Government funding for innovation and SMEs

3. Skilled Workforce

With a deep talent pool and strong vocational training systems, Germany makes it easy to hire competent, qualified employees.

Top Cities to Consider

Berlin: A startup magnet with creative and tech ecosystems

Munich: Finance, biotech, and advanced manufacturing hub

Hamburg: Logistics and port-based businesses

Stuttgart: Automotive and engineering excellence

Types of Businesses in Demand

Industrial suppliers and manufacturers

E-commerce and software firms

Automotive and transport services

Cafés and specialty restaurants

Green energy startups and consultancies

Explore listings for a business for sale in Germany that offer detailed revenue insights, asset breakdowns, and seller support.

Legal and Operational Considerations

Foreign Ownership: No citizenship requirement to buy a business

Taxation: Understand German VAT, corporate tax, and double taxation treaties

Licensing: Some sectors require industry-specific permits

Language: Consider hiring bilingual legal advisors

Frequently Asked Questions

Q: Can foreigners buy businesses in Germany? A: Yes, there are no restrictions on foreign ownership. However, you may need a visa or residency to operate it.

Q: Do I need to know German? A: While not mandatory, speaking German or hiring bilingual staff makes operations smoother.

Q: How long does the business transfer take? A: On average, 3–6 months, depending on due diligence and regulatory steps.

Q: Is financing available? A: Yes, local banks and international lenders offer financing options, especially for asset-backed purchases.

📌 Looking to step into one of Europe’s strongest economies? Begin your journey by exploring your ideal business for sale in Germany on World Businesses for sale.

🎥 Watch international investor success stories on our YouTube Channel to learn what’s working right now.

2 notes

·

View notes

Text

The Benefits of Integrating Text-to-Speech Technology for Personalized Voice Service

Sinch is a fully managed service that generates voice-on-demand, converting text into an audio stream and using deep learning technologies to convert articles, web pages, PDF documents, and other text-to-speech (TTS). Sinch provides dozens of lifelike voices across a broad set of languages for you to build speech-activated applications that engage and convert. Meet diverse linguistic, accessibility, and learning needs of users across geographies and markets. Powerful neural networks and generative voice engines work in the background, synthesizing speech for you. Integrate the Sinch API into your existing applications to become voice-ready quickly.

Voice Service

Voice services, such as Voice over Internet Protocol (VoIP) or Voice as a Service (VaaS), are telecommunications technologies that convert Voice into a digital signal and route conversations through digital channels. Businesses use these technologies to place and receive reliable, high-quality calls through their internet connection instead of traditional telephones. We at Sinch provide the best voice service all over India.

Voice Messaging Service

A Voice Messaging Service or System, also known as Voice Broadcasting, is the process by which an individual or organization sends a pre-recorded message to a list of contacts without manually dialing each number. Automated Voice Message service makes communicating with customers and employees efficient and effective. With mobile marketing quickly becoming the fastest-growing advertising industry sector, the ability to send a voice broadcast via professional voice messaging software is now a crucial element of any marketing or communication initiative.

Voice Service Providers in India

Voice APIs, IVR, SIP Trunking, Number Masking, and Call Conferencing are all provided by Sinch, a cloud-based voice service provider in India. It collaborates with popular telecom companies like Tata Communications, Jio, Vodafone Idea, and Airtel. Voice services are utilized for automated calls, secure communication, and client involvement in banking, e-commerce, healthcare, and ride-hailing. Sinch is integrated by businesses through APIs to provide dependable, scalable voice solutions.

More Resources:

The future of outbound and inbound dialing services

The Best Cloud Communication Software which are Transforming Businesses in India

4 notes

·

View notes

Text

Hyperbitcoinization: What Happens When Bitcoin Wins?

For years, Bitcoiners have been shouting into the void, warning of the inevitable collapse of fiat money. At first, they were ignored. Then ridiculed. But slowly, the world is waking up. The cracks in the legacy financial system are no longer hidden beneath the surface—they are gaping wounds for all to see. And as trust in central banks, governments, and the endless printing of money erodes, something new is emerging from the ashes.

Bitcoin.

The world’s first decentralized, incorruptible, and finite form of money. A system that doesn’t ask for trust, but demands proof.

Hyperbitcoinization is not just Bitcoin adoption. It is the total, irreversible collapse of fiat currency as people reject money that loses value in favor of money that cannot be debased. It is the moment when Bitcoin is no longer just an asset—it becomes the standard. And when that happens, everything changes.

The Death of Inflation

Inflation is a silent tax, a creeping theft that erodes the purchasing power of every dollar you own. But in a Bitcoin world, inflation dies. There are only 21 million Bitcoin—ever. No government, no central bank, no self-serving politician can conjure more into existence. What you earn, what you save, retains its value. Wealth, for the first time in modern history, is not stolen through the backdoor of monetary debasement.

With the demise of inflation, the desperate scramble to make money work—gambling in stocks, chasing speculative bubbles, trusting in debt-ridden financial products—fades. People can simply store value in Bitcoin, knowing that it will not lose purchasing power over time. Hard work and discipline are rewarded. The time preference of humanity shifts from short-term consumption to long-term building.

The End of Government-Controlled Money

When hyperbitcoinization takes hold, governments lose the ability to print their way out of bad decisions. War, debt, corruption—these things thrive in a system where money can be created at will. When governments are forced to operate on a Bitcoin standard, they must tax honestly, spend responsibly, and live within their means. The reckless expansion of the state, funded by the illusion of endless credit, collapses. Power returns to the people.

For individuals, this means financial sovereignty. No more frozen bank accounts. No more arbitrary rules on how and when you can access your own money. No more middlemen siphoning off fees and dictating the terms of your economic freedom. Your wealth belongs to you and you alone, stored in a system that no one controls and no one can take away.

A World Without Banks

The traditional banking system thrives on permission and control. It decides who can send money, how much they can send, and when they can send it. But Bitcoin renders these gatekeepers obsolete.

With Bitcoin, every person on earth has access to a global financial network. A farmer in Nigeria, a software developer in Argentina, a truck driver in Canada—each of them has the same financial power as the wealthiest billionaire. No discrimination, no barriers, no approval required.

Banks will not disappear overnight, but their role will change. Instead of controlling money, they will be forced to compete for customers based on value-added services. And if they fail to adapt? They will fade into irrelevance, just as other obsolete industries have before them.

Preparing for the Shift: DCA into Bitcoin

The question is not if hyperbitcoinization happens, but when. And the best way to prepare is to start accumulating Bitcoin now, before the world wakes up.

Dollar-cost averaging (DCA) is the smartest, simplest way to do this. By buying Bitcoin regularly—whether daily, weekly, or monthly—you remove emotion from the equation. No stressing over price swings, no panic during market dips. Just steady accumulation of the hardest money ever created.

For those who have already embraced Bitcoin, this is second nature. But for the billions still tethered to fiat, the transition will be jarring. Those who move early will preserve their wealth. Those who wait risk being left behind in a crumbling economic system.

The Inevitable Future

Hyperbitcoinization is not some distant fantasy. It is already unfolding, piece by piece, block by block. The cracks in fiat are growing wider. Governments are scrambling to maintain control. Central banks are pushing CBDCs in a last-ditch effort to retain dominance.

But the truth is unstoppable. A system built on lies cannot outlast a system built on mathematical certainty. Bitcoin is not just an alternative; it is the escape route. The safety valve. The inevitable evolution of money.

One day, Bitcoin will be the global standard. It will not be a question of adoption, but of survival.

The only question that remains: will you be ready?

Tick Tock, Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Hyperbitcoinization#FinancialFreedom#SoundMoney#BitcoinStandard#EndFiat#BitcoinRevolution#MoneyEvolved#Decentralization#InflationKills#DCAIntoBitcoin#HODL#BitcoinEducation#DigitalGold#SovereignMoney#TickTockNextBlock#FutureOfMoney#Technology#Economy#Crypto#Freedom#AlternativeFinance#cryptocurrency#digitalcurrency#financial experts#financial education#globaleconomy#blockchain#finance#unplugged financial

2 notes

·

View notes

Text

10 Benefits of Investing in a Custom Software Solution

Businesses are constantly on the lookout for new and better technologies that may streamline and quicken their processes. When doing so, organizations frequently use pre-existing software solutions. However, it's not always easy to find a single piece of software that can handle all of their needs. That's why it's common for businesses to put money into a few different lines.

If you need a unique solution that is tailored to your business's needs, consider investing in custom software development. Using their unique needs as a guide, developers of custom software create programs for businesses and individuals. The banking sector, for instance, employs highly specialized custom software to facilitate consumer access while shielding private information with cutting-edge security measures.

In this article, we'll discuss how custom software development can improve a company's efficiency and bottom line. OK, let's have a peek at it.

Top Reasons to Choose Custom Software Development

Software product customization is a solution that can increase productivity. In addition, adaptability and scalability let you stay ahead of the curve and get an edge over rivals. Your company could benefit in the long run from its use in managing business operations and establishing relationships with external customers, partners, and internal assets.

1. Long-Term Savings

Investing in a software development project may be expensive. However, you won't need to spend everything right away. Custom software development lets you build your product in phases. The minimum viable product (MVP) approach could be taken initially to reduce development costs.

Putting your company plan and software prototype to the test is an appealing prospect. When you're done, you'll have the option of moving forward with the development of a full-fledged software application. While investing in custom software development solutions may seem prohibitively expensive at first, doing so can really end up saving you money in the long run. The necessity for long-lasting solutions suggests that tailor-made software development may be the way to go.

2. Software Solutions Tailored to Your Needs

It will be difficult for businesses to find a one-size-fits-all answer when it comes to technology, especially when it comes to software solutions. Mobile apps offer the best chance of finding a solution that will work for all organizations. In addition, each company pursues its goals and conducts operations according to its own unique plan and approach.

Therefore, you might require specialized software solutions to demonstrate that your business is one of a kind and establish yourself as a frontrunner in your field. With the help of bespoke software development, you will be able to modify software products so that they correspond to your business strategy and fulfill all of your requirements.

3. Better Security and Dependability

Maintaining a safe and reliable system is crucial to any business's long-term prosperity. As a result, businesses must ensure their software is more secure. With custom software development solutions, you know your data is safe.

Also, it might help you decide which data-security technology to use and which is best for your business, as well as how to incorporate that technology into your application. Most of the time, clients will trust you more if you use a higher level of security.

4. Flexibility & Scalability

The world of business is always transforming. Therefore, for businesses to stay up with how the market is shifting, they need to adapt. Custom software solutions provide you the flexibility to make adjustments, add new features, update your product, or seek assistance to meet the requirements of your expanding business as it grows and evolves.

Scalability also enables you to prepare for expansion in the future, which allows you to expand your business while simultaneously maintaining the viability of the software application.

5. Maintenance and Technical Support

It is common practice to form collaborations with software development vendors to create custom software. They'll assemble expert programmers to plan, code, and test your program for you.

Also, they employ a specialized development staff for ongoing technical support and app upkeep. Since they created it, they know it inside and out. This means they can keep it running smoothly and assist you in fixing bugs or other problems as they arise.

Service Level Agreements (SLAs) are a form of contract that may be included with your vendor contracts to guarantee a certain level of service. The bottom line is that consistent technical support helps keep your company processes running efficiently and effectively, all while minimizing the amount of time you lose to updates.

6. Product Uniqueness

It's becoming increasingly important that businesses have a distinct identity, which can assist them to strengthen their unique selling proposition. By investing in custom software development, your business can meet the needs of its customers and stay true to its character.

Teams specializing in custom software development can produce applications that help businesses achieve their goals. It allows you to select the software development methodology and cutting-edge innovations that will give your app a leg up on the competition. Plus, it gives businesses the chance to develop brand-new items to meet the surging demand.

7. Integrates Easily

Business custom software development has the added benefit of fitting naturally into your existing processes. When a software product is tailor-made to satisfy a company's unique needs, it works in tandem with the rest of its existing applications without causing disruptions.

Not only that, but it will also aid in the optimization of your business process and the improvement of the efficiency of your business workflow. Saving money, speeding up operations, and avoiding frequent defects and other issues during the integration with your existing software product are all possible benefits of custom software solutions.

8. Boost Return On Investment (ROI)

Custom software development services provide exactly what the client needs. So, you won't have to shell out money for unused services or licenses. Therefore, it may end up saving money over time. Furthermore, you will be able to acquire various capabilities for your application that may not be available to your competitors.

As a result, it can bolster your USP (unique selling proposition) and provide you with a significant edge over the competition. Through the use of niche-specific customization in software product development, you may better serve your intended customer. You can expect higher long-term returns and greater consumer participation.

9. Enhance Productivity

No one can deny the positive impact software has on worker output, especially when that software is tailored to meet the specific needs of a certain company. It boosts productivity and gives workers more assurance in their abilities.

In addition, the right software could make it easier for your staff to get their work done faster. It could improve resource management, boost the efficiency of operational procedures, and provide additional financial benefits to your organization.

10. Great User Satisfaction

When it comes to the level of happiness experienced by end users, bespoke software will always score higher than generic software, regardless of whether it was developed for external or internal users.

How? The response is plain to see. It is customized to fulfill their technical requirements to suit their business needs. In addition to this, it is simple to use and was developed to reduce the complexity of running a business, improving efficiency, and turning it into a more profitable investment.

Wrapping Up

There are numerous upsides to investing in bespoke software development. Depending on your company's specific requirements, you can make changes to meet different demands. The ability to control every aspect of your app's operation and make whatever tweaks you see fit is another potential benefit.

Businesses need to invest time and resources into creating and designing software that meets their specific needs. But before you make any moves, you should thoroughly evaluate your business. Custom software development is a great option because experienced developers can quickly assess your business needs and determine the best course of action.

2 notes

·

View notes

Text

What Are the Key Factors to Consider When Choosing a Payment Solution Provider?

The rapid growth of digital transactions has made choosing the right payment solution provider a crucial decision for businesses. Whether you operate an e-commerce store, a subscription-based service, or a financial institution, selecting the right provider ensures secure and efficient payment processing. With the increasing demand for fintech payment solutions, businesses must evaluate providers based on security, compatibility, scalability, and cost-effectiveness.

1. Security and Compliance

Security is the top priority when selecting a payment solution provider. Since financial transactions involve sensitive customer data, businesses must ensure that their provider follows strict security protocols. Look for providers that comply with PCI DSS (Payment Card Industry Data Security Standard) and offer encryption, tokenization, and fraud prevention measures.

A reputable provider should also offer real-time fraud detection and risk management tools to safeguard transactions. Compliance with regional regulations such as GDPR, CCPA, or PSD2 is also crucial for businesses operating in multiple locations.

2. Integration and Compatibility

Seamless Payment gateway integration is essential for a smooth transaction experience. Businesses should assess whether the provider’s APIs and SDKs are compatible with their existing platforms, including websites, mobile apps, and POS systems. A well-documented API enables easy customization and enhances the overall customer experience.

Additionally, businesses should consider whether the provider supports multiple payment methods such as credit cards, digital wallets, cryptocurrencies, and bank transfers. The ability to integrate with accounting, CRM, and ERP software is also beneficial for streamlining financial operations.

3. Cost and Pricing Structure

Understanding the pricing structure of payment solution providers is crucial for managing operational costs. Different providers offer various pricing models, including:

Flat-rate pricing – A fixed percentage per transaction

Interchange-plus pricing – A combination of network fees and provider markup

Subscription-based pricing – A fixed monthly fee with lower transaction costs

Businesses should evaluate setup fees, transaction fees, chargeback fees, and any hidden costs that may impact profitability. Opting for a transparent pricing model ensures cost-effectiveness in the long run.

4. Scalability and Performance

As businesses grow, their payment processing needs will evolve. Choosing a provider that offers scalable fintech payment solutions ensures seamless expansion into new markets and accommodates higher transaction volumes without downtime or slow processing speeds.

Look for providers with a robust infrastructure that supports high uptime, fast transaction processing, and minimal payment failures. Cloud-based payment solutions often offer better scalability and reliability for growing businesses.

5. Customer Support and Service Reliability

Reliable customer support is essential when dealing with financial transactions. Payment-related issues can result in revenue loss and customer dissatisfaction. Businesses should opt for providers that offer 24/7 customer support via multiple channels such as phone, email, and live chat.

Additionally, a provider with dedicated account management services can offer personalized solutions and proactive issue resolution, ensuring minimal disruptions to business operations.

6. Multi-Currency and Global Payment Support

For businesses targeting international markets, multi-currency support is a key consideration. The ability to accept payments in different currencies and offer localized payment methods enhances customer satisfaction and expands the business’s global reach.

Providers that support cross-border transactions with competitive exchange rates and minimal conversion fees are ideal for businesses operating in multiple countries.

7. Fintech Payment System Compatibility

A modern fintech payment system should be adaptable to emerging financial technologies. Businesses should evaluate whether the provider supports innovations like blockchain payments, real-time payment processing, and artificial intelligence-driven fraud prevention.

The ability to integrate with open banking solutions and provide seamless transaction experiences across various fintech ecosystems is becoming increasingly important in the digital payment landscape.

8. Reputation and Industry Experience

The credibility of a payment solution provider is another critical factor. Researching customer reviews, case studies, and testimonials can provide insights into the provider’s reliability and performance.

Established providers with years of experience and partnerships with reputable financial institutions are more likely to offer stable and secure payment processing services. Collaborations with fintech leaders, such as Xettle Technologies, demonstrate a provider’s commitment to innovation and excellence in payment solutions.

Conclusion

Choosing the right payment solution provider requires careful consideration of security, integration, pricing, scalability, customer support, and industry experience. Businesses must align their choice with long-term growth objectives and ensure that the provider offers secure, seamless, and cost-effective fintech payment solutions.

With the rise of digital transactions, businesses that invest in a robust fintech payment system with seamless payment gateway integration will gain a competitive edge and enhance customer trust. By partnering with reputable payment solution providers, businesses can ensure secure and efficient transaction experiences for their customers while maximizing operational efficiency.

3 notes

·

View notes

Text

Top 10 In- Demand Tech Jobs in 2025

Technology is growing faster than ever, and so is the need for skilled professionals in the field. From artificial intelligence to cloud computing, businesses are looking for experts who can keep up with the latest advancements. These tech jobs not only pay well but also offer great career growth and exciting challenges.

In this blog, we’ll look at the top 10 tech jobs that are in high demand today. Whether you’re starting your career or thinking of learning new skills, these jobs can help you plan a bright future in the tech world.

1. AI and Machine Learning Specialists

Artificial Intelligence (AI) and Machine Learning are changing the game by helping machines learn and improve on their own without needing step-by-step instructions. They’re being used in many areas, like chatbots, spotting fraud, and predicting trends.

Key Skills: Python, TensorFlow, PyTorch, data analysis, deep learning, and natural language processing (NLP).

Industries Hiring: Healthcare, finance, retail, and manufacturing.

Career Tip: Keep up with AI and machine learning by working on projects and getting an AI certification. Joining AI hackathons helps you learn and meet others in the field.

2. Data Scientists

Data scientists work with large sets of data to find patterns, trends, and useful insights that help businesses make smart decisions. They play a key role in everything from personalized marketing to predicting health outcomes.

Key Skills: Data visualization, statistical analysis, R, Python, SQL, and data mining.

Industries Hiring: E-commerce, telecommunications, and pharmaceuticals.

Career Tip: Work with real-world data and build a strong portfolio to showcase your skills. Earning certifications in data science tools can help you stand out.

3. Cloud Computing Engineers: These professionals create and manage cloud systems that allow businesses to store data and run apps without needing physical servers, making operations more efficient.

Key Skills: AWS, Azure, Google Cloud Platform (GCP), DevOps, and containerization (Docker, Kubernetes).

Industries Hiring: IT services, startups, and enterprises undergoing digital transformation.

Career Tip: Get certified in cloud platforms like AWS (e.g., AWS Certified Solutions Architect).

4. Cybersecurity Experts

Cybersecurity professionals protect companies from data breaches, malware, and other online threats. As remote work grows, keeping digital information safe is more crucial than ever.

Key Skills: Ethical hacking, penetration testing, risk management, and cybersecurity tools.

Industries Hiring: Banking, IT, and government agencies.

Career Tip: Stay updated on new cybersecurity threats and trends. Certifications like CEH (Certified Ethical Hacker) or CISSP (Certified Information Systems Security Professional) can help you advance in your career.

5. Full-Stack Developers

Full-stack developers are skilled programmers who can work on both the front-end (what users see) and the back-end (server and database) of web applications.

Key Skills: JavaScript, React, Node.js, HTML/CSS, and APIs.

Industries Hiring: Tech startups, e-commerce, and digital media.

Career Tip: Create a strong GitHub profile with projects that highlight your full-stack skills. Learn popular frameworks like React Native to expand into mobile app development.

6. DevOps Engineers

DevOps engineers help make software faster and more reliable by connecting development and operations teams. They streamline the process for quicker deployments.

Key Skills: CI/CD pipelines, automation tools, scripting, and system administration.

Industries Hiring: SaaS companies, cloud service providers, and enterprise IT.

Career Tip: Earn key tools like Jenkins, Ansible, and Kubernetes, and develop scripting skills in languages like Bash or Python. Earning a DevOps certification is a plus and can enhance your expertise in the field.

7. Blockchain Developers

They build secure, transparent, and unchangeable systems. Blockchain is not just for cryptocurrencies; it’s also used in tracking supply chains, managing healthcare records, and even in voting systems.

Key Skills: Solidity, Ethereum, smart contracts, cryptography, and DApp development.

Industries Hiring: Fintech, logistics, and healthcare.

Career Tip: Create and share your own blockchain projects to show your skills. Joining blockchain communities can help you learn more and connect with others in the field.

8. Robotics Engineers

Robotics engineers design, build, and program robots to do tasks faster or safer than humans. Their work is especially important in industries like manufacturing and healthcare.

Key Skills: Programming (C++, Python), robotics process automation (RPA), and mechanical engineering.

Industries Hiring: Automotive, healthcare, and logistics.

Career Tip: Stay updated on new trends like self-driving cars and AI in robotics.

9. Internet of Things (IoT) Specialists

IoT specialists work on systems that connect devices to the internet, allowing them to communicate and be controlled easily. This is crucial for creating smart cities, homes, and industries.

Key Skills: Embedded systems, wireless communication protocols, data analytics, and IoT platforms.

Industries Hiring: Consumer electronics, automotive, and smart city projects.

Career Tip: Create IoT prototypes and learn to use platforms like AWS IoT or Microsoft Azure IoT. Stay updated on 5G technology and edge computing trends.

10. Product Managers

Product managers oversee the development of products, from idea to launch, making sure they are both technically possible and meet market demands. They connect technical teams with business stakeholders.

Key Skills: Agile methodologies, market research, UX design, and project management.

Industries Hiring: Software development, e-commerce, and SaaS companies.

Career Tip: Work on improving your communication and leadership skills. Getting certifications like PMP (Project Management Professional) or CSPO (Certified Scrum Product Owner) can help you advance.

Importance of Upskilling in the Tech Industry

Stay Up-to-Date: Technology changes fast, and learning new skills helps you keep up with the latest trends and tools.