#PropFirms

Text

什麼是MTI?MTI規則是什麼?一文帶你全面了解MTI

什麼是MTI?MTI規則是什麼?一文帶你全面了解MTI

最近在台灣交易圈內,越來越多人開始討論類似MTI這樣的prop firms,這種模式在國外已經行之有年了。那MTI到底是什麼呢?它的規則是怎麼樣的?利弊又有哪些?這篇文章將會一一帶你深入探討,看完後你就能夠了解MTI的模式,也能夠評估一下自己是否適合參與MTI的項目。

MTI是什麼?prop firms又是什麼?

MTI是一家提供資金進行交易的公司,如果你能夠證明你的交易策略能夠穩定且盈利 (consistantly profitable), 那麼他們會提供你一個本金帳戶,金額範圍在10,000到100,000美金不等,供你進行交易。在你的交易收益中,他們會抽取一定的比例作為報酬,而不同的MTI programs會有不同的抽成比率。

上述是對MTI的簡單介紹,類似MTI的公司在國外有很多,這些公司被稱為「prop firms」,為什麼MTI會相對較為著名呢?主要原因是MTI的歷史相對悠久,而且其運作記錄相對良好。在2021年,有一家非常有名的prop firm叫做Funding Talent(也是我最初非常感興趣的prop firm之一),結果卻在沒有任何預警的情況下惡性倒閉,網站直接關閉,對參與其programs的人並未提供任何後續補償或賠償。因此,選擇一家值得信賴的prop firm非常重要,儘管如此,我們仍然不能完全信任任何一家prop firm。舉一個2022年的例子:FTX當時是全球第二大的Crypto交易所,卻在一個晚上發生惡性倒閉。更何況是一家知名度較低的prop firm呢?因此,請務必自行評估風險。

MTI的規則

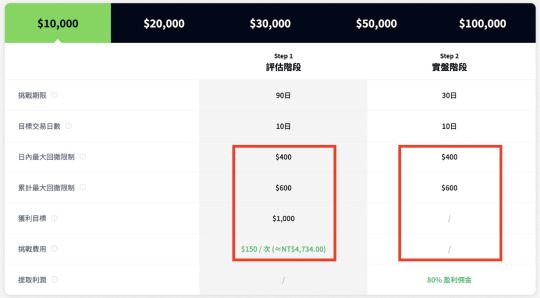

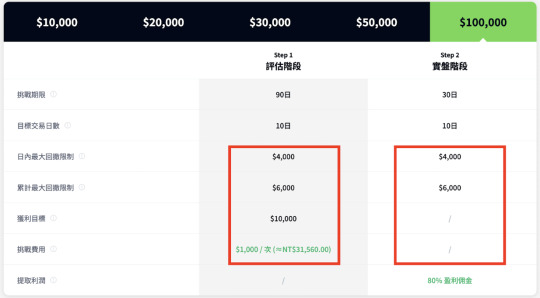

接下來我們講解MTI的規則,為了確認您的盈利及風險管理能力,MTI設計了不同金額的挑戰目標:分別有$10,000、$20,000、$30,000、$50,000和$100,000金額的帳戶可供選擇。交易者們可以依照自己的交易風格、風險等去挑戰適合自己金額的帳戶類型。不同金額的挑戰目標會有以下要求的不同:

日內最大回撤限制

累計最大回撤限制

獲利目標

挑戰費用

下面是$10,000與$100,000兩個最小和最大金額挑戰目標的規則對比:

挑戰較小的目標虧損限額較低,但費用也比較便宜

挑戰較大的目標虧損上限較大,但挑戰費用也比較貴

挑戰方式

不同於其他prop firms有著複雜的考試階段,要成為MTI自營交易員只需簡單的一步,即評估階段的挑戰,通過挑戰,即可獲得MTI自營交易員身份,獲取高達100,000元的實盤資金帳戶,並享有高達80%的利潤分成。

評估階段

成功繳交報名費即等同於報名成功,並開啟挑戰,挑戰帳戶需至少10個交易日有創建訂單或持倉行為。挑戰期間的交易細則和可交易產品以挑戰帳戶為准,並且每個訂單交易手數上限為2手,帳戶持倉上限5個訂單。挑戰有效期限為90天,挑戰期間可隨時點擊挑戰結束按鍵來終止挑戰,而未點挑戰結束按鍵的帳戶在90天後自動關閉所有交易並終止挑戰。

日內最大回撤限制對交易員的水平考核非常關鍵,成功的交易員會善於管理帳戶資金並控制風險。日內最大回撤限制為起始資金的4%,意味著在任何交易日,帳戶淨值減少的最大幅度不應超過此限制,最大回撤計算公式為:最大回撤值 = 帳戶淨值最高值-帳戶淨值最低值。例如,起始資金20000美元,日內最大回撤限制為$800。每個交易日的帳戶淨值最高值減去最低值不應超過$800。請注意,日內最大回撤限制包括已平倉訂單、未平倉訂單、點差及隔夜費用。

累計最大回撤限制為起始資金的6%,這意味著從挑戰開始到結束,帳戶淨值減少的最大幅度不應超過此回撤限制。最大回撤計算公式為:最大回撤值 = 帳戶淨值最高值-帳戶淨值最低值。例如,假設起始資金為20000美元,累計最大回撤限制為$1200。您在挑戰期間的帳戶淨值最高值減去最低值不應超過$1200。請注意,累積最大回撤限制包括已平倉訂單、未平倉訂單、點差及隔夜費用。

挑戰期間的交易無持倉時間限制,可依交易技巧自由發揮。挑戰成功後可選擇申請實盤資金帳戶,申請後平台專員將與挑戰者聯絡並告知實盤資金帳戶,挑戰者可開啟實盤資金交易。

實盤階段

實盤資金帳戶交易規則無盈利目標要求,其他交易規則與挑戰帳戶一致。實盤資金帳戶使用有效期限為30天,到期後賬戶終止使用並統計實際總盈虧。如有持倉將強制平倉後統計實際總盈虧。對於盈利提取,可透過本地轉賬或銀行匯款至您的個人銀行賬戶。

為評估參賽者的真實交易技能,平台採用30%利潤一致性規則。挑戰時單個訂單的盈利占盈利目標不得超過30%,超出30%的盈利部分不計入總盈利額。單筆盈利限額依照挑戰盈利目標來計算。例如:參與20000美金挑戰帳戶,盈利目標2000美金。$2000*30%=$600,即單筆盈利限額為600美金,單筆盈利最多只統計600美金,超出部分將不計入實際總盈利額。實盤資金帳戶到期後,如帳戶總盈虧為正值,MTI專員將會第一時間與挑戰者聯絡併發放盈利的80%。

參加挑戰的投資人將被視為默認同意將本人的個別登記資料刊登於本活動頁面的任何位置,當您成功通過挑戰並在實盤資金帳戶上獲得首筆利潤分割時,您的報名費用將退還給您。

MTI的利與弊

雖然MTI給擁有少量本金的交易者能夠快速獲利的機會,但是事實可能並沒有你想的那樣簡單。首先你要通過MTI「評估階段」的挑戰,然後才會有進行實盤交易的機會。雖然挑戰程序很是一步到位,但挑戰本身並不容易,要求交易員有豐富的交易實戰經驗。同時MTI也具備其他prop firms的交易風險。因此在這裡我想向大家分享關於MTI的利與弊,讓你能夠根據自身的交易風格與狀況來評估自己是否要參與MTI的挑戰。

MTI的優勢

一步到位

交易市場上很多prop firms都會設置複雜的或所謂的不同的考試階段,MTI與這些prop firms最大的不同就是:在MTI,你只需簡單的一步,即通過「評估階段」的挑戰,即可成為MTI自營交易員,挑戰成功後即可獲得的實盤資金帳戶,正式掌握高達數萬美金的真實資金賬戶。

導師輔助

MTI還有一個不同於其他prop firms的特點,就是MTI交易學院的專家全程對您進行專屬輔導,讓您少走彎路,快速高效的積累交易實戰經驗,掌握交易技巧。

快速獲利

這部分簡單明瞭,只需支付幾百美金的考試費用,就能夠取得幾萬美金的交易本金,相當吸引人。如果你的交易風格適合MTI提出的條件,且你的交易獲利穩定,那麼參與MTI絕對是一條能夠快速賺錢的不錯途徑。

可控制的風險

挑戰費用清楚地列在MTI的官網上,換句話說,你最多可能損失的就是挑戰費用,風險是有限的。

數據化管理與風險紀律

MTI本身提供非常友善的儀表板供大家使用,可以清晰地回顧每一筆交易的狀況。此外,MTI的考試對風險的要求相當嚴格,有助於交易者培養良好的風險管理習慣。

MTI的劣勢

交易型態的侷限性

MTI有很多限制,例如不能不可使用EA交易等,因此,並非所有的交易者的交易風格都能夠滿足上述條件,很多人因為MTI提供的條件看似很吸引人,也不管自己的交易風格是否適合,就直接報名MTI的考試。據MTI所說,有很大一部分人是無法通過挑戰的。

心態問題

在MTI畢竟交易的不是真錢,交易心態上和真錢交易還是有很大的區別。當你日後要再用自己的本金進行交易時,必須重新調整並適應心態。

惡性倒閉風險

過去已經有Funding Talent等prop firm發生惡性倒閉的案例,你很難保證MTI不會哪天突然發生惡性倒閉。

出金風險

過去也傳出不少其他prop firms無法出金的討論,再加上MTI本身是外國公司,不受台灣政府的監管。如果真的發生這樣的問題,很有可能無法獲得妥善的處理。

MTI適合怎樣的交易者?

有一定交易經驗的交易者

建議在考慮參加MTI挑戰之前,先進行至少半年以上的demo trading練習。如果你只是在Trading View上畫畫圖,沒有實際下單的經驗,建議先進行demo trading。如果經濟允許,也可考慮進行小額真錢交易,以訓練交易心態和穩定性。個人經驗分享,一開始也只在Trading View上畫畫圖,但進入demo trading後發現真實市場情況與畫圖時有很大不同。習慣了demo trading後,投入小額真錢交易,發現心理壓力更大。強調必須讓自己熟悉市場真實狀況,如同打籃球練投的情境,將有助於提高交易勝算。

不做長期倉且交易風格穩定的交易者

要想在MTI上獲利,你必須是一個交易風格穩定的交易者,不能今天用A策略後天就改B策略,這樣的交易者是很難在MTI成功通過挑戰且賺到錢的,因為MTI的所有條件設定、風險限制,都是圍繞在「持續性」進行設計的,他不希望有人是因為僥倖而通過挑戰,即便因為僥倖通過挑戰,也很難在實盤階段中獲得分潤。

結語

這篇文章簡單介紹了MTI以及類似的prop firms服務。最後要提醒大家,別因為看到別人高額獲利就衝動,MTI的採訪指出很大一部分的人無法通過挑戰,他們主要收入來自挑戰費用。因此在挑戰前,務必確保自己有豐富的交易經驗和穩定的交易心態,否則可能成為那大部分貢獻挑戰費用的人。

1 note

·

View note

Text

The world of online trading has witnessed an exponential rise in popularity, offering individuals the opportunity to engage in financial markets from the comfort of their homes.

0 notes

Text

🌟💰 Unleash Your Trading Potential with FunderPro.com: Exploring the World of Crypto! 💰🌟

Hey there, Tumblr fam! Today, I want to dive into the exciting realm of cryptocurrency trading and introduce you to an incredible prop firm that's making waves in the industry: FunderPro.com! 🚀

💼 What's FunderPro.com all about? 💼

FunderPro.com is a cutting-edge prop trading firm that specializes in the world of cryptocurrencies. Whether you're a seasoned trader or a newbie looking to explore the thrilling world of digital assets, FunderPro.com is your ultimate gateway to success. 💪

🌐 Unlocking New Opportunities 🌐

If you've been keeping an eye on the market, you'll know that cryptocurrencies have taken the financial world by storm. With FunderPro.com, you'll have the chance to capitalize on this digital revolution and potentially make some serious profits. 💸

🤝 Join the Elite Trading Community 🤝

What sets FunderPro.com apart from the rest is its strong focus on community and collaboration. When you sign up, you become part of an exclusive network of traders, mentors, and experts who are there to support and guide you every step of the way. It's a thriving ecosystem of knowledge sharing and growth that will help you sharpen your skills and maximize your potential. 📚✨

🔒 Cutting-Edge Trading Tools and Technology 🔒

FunderPro.com provides its traders with top-of-the-line tools and technology to ensure you stay ahead of the game. From advanced charting and analytics to real-time market data and lightning-fast execution, FunderPro.com equips you with everything you need to make informed trading decisions and seize lucrative opportunities. 📈📊

📈 The Future Is Crypto – Are You Ready? 🚀

Cryptocurrencies have proven time and again that they're here to stay, and the market is only getting more exciting. FunderPro.com gives you the chance to be at the forefront of this financial revolution, allowing you to trade a wide range of digital assets and explore new opportunities that traditional markets can't provide. It's an exhilarating journey where the potential for growth is limitless! 🌌

🔐 Take the First Step with FunderPro.com 🔐

Ready to embark on your crypto trading adventure? Head over to FunderPro.com and discover how this prop firm can help you turn your trading dreams into a reality. Join the vibrant community, harness cutting-edge tools, and embrace the world of digital assets like never before. The future is yours for the taking, so seize it with FunderPro.com today! 💫💪

Visit our website: https://funderpro.com/

#FunderPro#CryptoTrading#PropFirm#FinancialRevolution#DigitalAssets#Bitcoin#Ethereum#Altcoins#Blockchain#Cryptocurrency#Investment#TradingTips#CryptoCommunity#HODL#DeFi (Decentralized Finance)#CryptoNews#CryptoEducation#CryptocurrencyExchange#CryptoMarket#CryptoInvesting#CryptoTech#CryptoLifestyle#Cryptonews

3 notes

·

View notes

Text

What Is a Prop Firm Challenge: Tips for Success

Click to Pass Your Prop Firm Challenge

Proprietary trading, often referred to as "prop trading," involves trading financial instruments with the firm's own capital rather than on behalf of clients. Proprietary trading firms (prop firms) offer traders an opportunity to trade with the firm's funds in exchange for a share of the profits. To become a trader at a prop firm, individuals typically need to prove their trading skills by participating in what is known as a "Prop Firm Challenge."

A Prop Firm Challenge is a structured evaluation process designed to identify skilled traders who can potentially join the prop trading firm and trade the firm's capital. These challenges are a crucial entry point for aspiring traders who wish to access substantial trading capital and the opportunities it brings. In this article, we will delve into the intricacies of Prop Firm Challenges, including their benefits, conditions, and tips for success.

Benefits of Participating in a Prop Firm Challenge

Participating in a Prop Firm Challenge can be a game-changer for your trading career. Here are some significant benefits of taking on this challenge:

Improving Abilities

Participating in a Prop Firm Challenge offers traders a dynamic arena to hone their skills and amass invaluable experience. The inherent competitiveness of these challenges serves as a driving force, compelling traders to perpetually elevate their trading strategies and decision-making prowess. It's within this high-pressure environment that traders learn to adapt, innovate, and thrive. They refine their risk management techniques, analyze market data more astutely, and develop ingenious strategies to gain a competitive edge. Consequently, Prop Firm Challenges not only propel traders to succeed in the immediate context but also cultivate a resilient, adaptable, and highly proficient trading mindset that serves them well in the broader world of professional trading.

Availability of Greater Funds

Successfully passing a Prop Firm Challenge grants traders a key advantage: access to substantial trading capital. This access empowers traders to take larger positions in the market, opening the door to the potential for significantly higher profits. With increased capital at their disposal, traders can diversify their portfolios, seize more lucrative opportunities, and effectively manage risk. This financial leverage is a pivotal benefit that can greatly amplify a trader's earning potential, making Prop Firm Challenges an attractive avenue for those aiming to maximize their profitability in the world of trading.

Opportunity for Increased Earnings

Access to increased capital is a game-changer for traders, offering the potential for substantial profits. Prop trading firms frequently introduce profit-sharing arrangements, where traders retain a portion of the profits they generate. This mechanism not only incentivizes traders to excel but also aligns their interests with the firm's success. It fosters a mutually beneficial relationship where skilled traders have the opportunity to reap the rewards of their trading expertise, driving them to continually strive for excellence and profitability in their trading endeavors.

Gaining Insights from Expert Traders

Numerous prop trading firms boast a close-knit community of seasoned traders who offer invaluable mentorship and guidance. Becoming a part of this network can be a transformative experience for traders seeking to learn from the industry's finest. The insights and wisdom shared within these communities not only accelerate traders' learning curves but also provide them with a supportive ecosystem to navigate the intricacies of the financial markets effectively.

Practical Exposure

Prop Firm Challenges are meticulously crafted to replicate genuine trading scenarios. This exposure to live markets, complete with actual risk, is a priceless learning opportunity. It surpasses the limitations of paper trading or demo accounts by immersing traders in the complexities of real-time financial markets. It teaches them to navigate the intricacies of decision-making under pressure, an invaluable skill that can significantly enhance their trading prowess and resilience.

Reducing Risks

In prop trading firms, traders employ the firm's capital, absolving them of personal liability for losses beyond their initial investment. This risk-sharing arrangement acts as a safety net, affording traders the confidence to undertake more calculated and strategic risks. It empowers them to explore opportunities and maximize returns without the fear of catastrophic financial consequences, reinforcing the allure of prop trading as a career choice.

Broadening Connections

Triumphing in a Prop Firm Challenge unlocks networking avenues in the trading industry. Establishing connections with fellow traders and professionals can pave the way for collaborative ventures and career progression. These relationships create a foundation for knowledge exchange, potential partnerships, and a broader horizon of opportunities in the world of finance.

What Are the Conditions in a Prop Firm Challenge?

Before embarking on a Prop Firm Challenge, it's essential to understand the conditions and rules that govern these evaluations. Each firm may have its unique set of requirements and guidelines, but there are common elements to look out for:

Drawdown Limits

Drawdown limits are a pivotal aspect of Prop Firm Challenges, specifying the maximum allowable losses for participating traders. These limits serve as a risk management mechanism designed to ensure that traders employ prudent strategies to mitigate losses effectively. Breaching these predefined limits usually leads to disqualification from the challenge, emphasizing the importance of maintaining sound risk control practices throughout the evaluation process. It underscores the commitment to responsible trading.

Algo Trading Rules

For traders employing automated trading algorithms, it's imperative to be cognizant of any rules or restrictions related to algorithmic trading within a Prop Firm Challenge. Certain prop firms may have stringent guidelines in place to ensure a level playing field and uphold fairness and competitiveness among participants. Adhering to these rules is vital to navigating the challenge successfully while utilizing algorithmic strategies.

Winning Criteria

In Prop Firm Challenges, predefined winning criteria are paramount. Traders must meet specific performance metrics to pass, which can encompass minimum profit thresholds, favorable risk-reward ratios, or consistent trading outcomes. These benchmarks ensure that successful participants exhibit the requisite skill and discipline to excel in the world of proprietary trading.

Additional Rules

In addition to the fundamental conditions, there may be other specific rules set by the prop trading firm. These could relate to trading instruments, trading hours, or position sizing.

Risk Management

A fundamental aspect of succeeding in a Prop Firm Challenge is showcasing proficient risk management skills. Traders must exhibit an ability to mitigate losses by adhering to precise position sizing guidelines. This disciplined approach to risk management not only safeguards the firm's capital but also underscores a trader's capability to navigate volatile market conditions while preserving their profitability potential. It's a cornerstone of successful proprietary trading.

Account Funding and Scaling

Upon successfully passing a Prop Firm Challenge, traders may be required to fund their trading accounts with an initial amount. The firm may also have scaling plans that determine how much capital traders can access based on their performance.

Understanding these conditions is vital for your success in the challenge. It's essential to thoroughly review the terms and conditions provided by the prop trading firm before participating.

Tips for Passing a Prop Firm Trading Challenge

Passing a Prop Firm Challenge is a significant milestone that can open doors to a rewarding trading career. Here are some tips to help you succeed:

Be Fully Aware Of the Terms Of Use

Before you start the challenge, read and understand all the terms and conditions set by the prop trading firm. Knowing the rules and requirements inside out is essential to avoid disqualification due to rule violations.

Follow Your Strategy 100%

To succeed in a Prop Firm Challenge, unwavering commitment to your trading strategy is crucial. Stray from your strategy due to emotions like fear or greed, and you risk incurring losses. Maintaining consistency and discipline is the linchpin of success, ensuring that you execute your trades meticulously and in accordance with your well-defined strategy throughout the challenge.

Start with a Small Challenge

If you're new to prop trading challenges, consider starting with a smaller one. This allows you to gain experience and confidence without risking a significant amount of capital.

Don't Be in a Hurry

Impatience can be a pitfall during Prop Firm Challenges, potentially resulting in hasty decisions and costly errors. Instead of rushing to meet profit targets, adopt a patient approach. Prioritize sound risk management, trade judiciously, and allow your strategies to unfold methodically. By taking your time and maintaining a calm, calculated demeanor, you enhance your chances of making informed decisions and ultimately passing the challenge successfully.

The Challenge is Just the Start

Passing the Prop Firm Challenge is just the beginning of your journey. Once you become a funded trader, continue to learn, adapt, and improve your trading skills. Consistent performance is essential for long-term success.

How to Choose the Right Prop Firm Challenge?

Prop Firm Challenges vary significantly, making it vital to select the most suitable one for your trading career. Several factors should guide your choice of a prop trading firm and challenge. These include compatibility with your trading style and goals, allowed trading types, the evaluation process, fees and costs, reputation and credibility of the firm, available support and resources, and the potential for growth within the organization. Making a well-informed decision is pivotal to your trading success.

Research and Compatibility

Research multiple prop trading firms and assess their compatibility with your trading style, goals, and preferences. Consider factors like the trading instruments they offer, the technology they provide, and their trading philosophy.

Allowed Trading Types

Proprietary trading firms often exhibit distinct preferences for trading styles. While some may specialize in day trading, others may favor swing trading or longer-term strategies. It's imperative to align your expertise with the trading style the firm emphasizes. This ensures that you are operating within your comfort zone and have a higher likelihood of excelling in a trading environment that resonates with your skills and strategy preferences.

Evaluation Process

Gaining a deep understanding of the evaluation process is paramount. You should be well-versed in the criteria required for passing the challenge, as well as how profits and losses are calculated. This comprehensive knowledge will enable you to prepare more effectively, align your trading strategy with the challenge's requirements, and increase your chances of success.

Fees and Costs

Evaluate the costs associated with participating in the challenge. This includes any challenge fees, account funding requirements, and any other charges that may apply. Ensure that the potential rewards outweigh the costs.

Reputation and Credibility

Selecting a prop trading firm with an impeccable reputation and a history of fairness and transparency is imperative. Scrutinize reviews and testimonials from fellow traders who have undergone their challenges. This due diligence ensures you align with an organization that not only offers a genuine opportunity but also upholds ethical standards, creating a conducive and trustworthy environment for your trading endeavors.

Support and Resources

Consider the level of support and resources offered by the firm. Do they provide educational materials, trading tools, and access to experienced traders for mentorship? A supportive environment can contribute significantly to your success.

Growth Opportunities

Examine the potential for growth within the prop trading firm. Are there opportunities to become a fully funded trader with increased capital? What are the profit-sharing arrangements? Ensure that the firm's structure aligns with your long-term goals.

Participating in a Prop Firm Challenge can be a stepping stone to a successful trading career. The benefits, including improved skills, access to capital, and networking opportunities, make these challenges an attractive option for traders looking to advance in the industry.

Click to Pass Your Prop Firm Challenge

To your Success,

Osita Rich

0 notes

Text

Unraveling the Cost Structure of Cartel Software

Understanding the cost structure of a software provider is crucial for traders evaluating the value proposition of their tools. Cartel Software's commitment to transparency extends to its pricing model, unraveling the cost structure for traders seeking clarity and confidence in their investment decisions. Cartel Software adopts a straightforward and transparent pricing approach, ensuring that traders can easily comprehend the value they receive in exchange for their investment. The pricing model is designed to align with the diverse needs of traders, offering flexible options that cater to various budgets and trading preferences. The cost structure encompasses the features and capabilities of Cartel Software's offerings, ensuring that traders receive a fair and competitive value proposition. The company's dedication to providing accessible yet powerful tools for traders is reflected in its pricing strategy, aiming to empower a broad spectrum of users in the dynamic world of financial markets. Whether it's advanced algorithmic trading solutions, proprietary strategies, or cutting-edge risk management features, Cartel Software's pricing structure is crafted to deliver tangible value, enabling traders to make informed decisions, maximize profits, and navigate the complexities of financial markets with confidence. With Cartel Software, pricing for profits becomes a transparent and empowering aspect of the trader's journey.

0 notes

Video

youtube

TopstepTV Highlights - Hoag's Market Profile Masterclass

WHY TOPSTEP ?

1 Step. 1 Rule.™ The #1 Prop Firm

. Topstep Price Slash / 60% Off http://bit.ly/3FSdubP

0 notes

Text

Funded 50k account one step challenge with The Trading Pit Honest review with The Trading Pit Prop Firm https://www.thetradingpit.com/challenges-overview?ref=rua

20% Discount Voucher Code Name: ALEXOCT120 Different type of Prop Firm They are provide 1-Step CFD Challenge it is very good service four catagory CFD Challenge VIP ACCOUNT BALANCE €100000 Executive CHALLENGE ACCOUNT BALANCE: €50,000 Standard CHALLENGE ACCOUNT BALANCE: €20,000 Lite CHALLENGE ACCOUNT BALANCE: €10,000

#forextrading#forexsignals#xauusd#XAUUSD Live#forexmarket#FTMO#The Trading Pit#Prop Firm#propfirm#eurusd#review#discount#cupons#traders#trade#livetrading

1 note

·

View note

Text

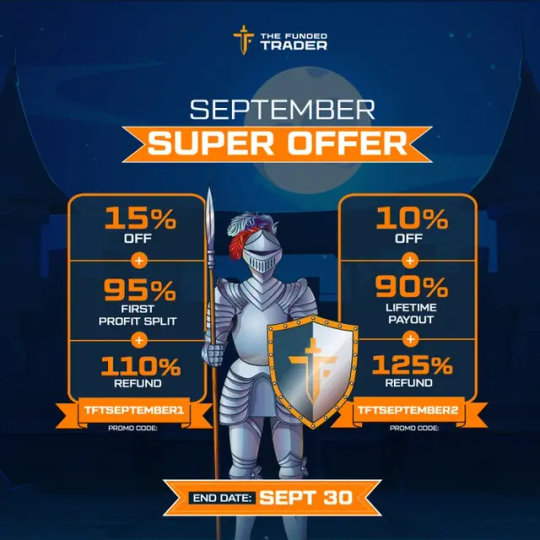

🔥Super promotions🔥

Ends in 4 Days !! 🥺

For 🔥5% Off🔥 your challenge ▶️TFTTrader9858519

ending in 4 Days get your self ready to take charge

be a knight with one of the best propfirm

🔽Sign ups 🔽

💎The Funded Trader💎

#currencytrading#propfirm#the funded trader#forex#funded#forextraderlifestyle#forexmarket#forextrading

0 notes

Text

Master Prop Trading from the Comfort of Home

Explore the lucrative world of prop trading from home. Unleash your potential and leverage cutting-edge strategies to profit in financial markets. Whether you're an aspiring trader or seasoned professional, discover how to thrive in prop trading without ever leaving your doorstep. Start your journey today and revolutionize your trading career from the comfort of home.

#PropAccount#ForexTrading#ProfitMaximization#PropFirms#BestPropFundingFirms#TradingSuccess#FinancialBacking#smartproptrader#TrustablePropFirm#LowSpreadPropFirm

0 notes

Video

youtube

(via Goodbye EA | 2 week prop firm challenge)

0 notes

Text

4 notes

·

View notes

Text

This Is How to Pass a Prop Firm Challenge:

1. Follow your trading strategy consistently.

2. Start with a small challenge.

3. Maintain proper risk management.

4. Focus on consistency and profitability.

5. Record and analyze your trades.

6. Utilize the prop firm's educational resources.

7. Stay updated with market news and analysis.

8. Seek guidance and mentorship.

Click to Pass Your Prop Firm Challenge

Facing a prop firm challenge can be an exciting and challenging experience for traders. To pass this test and secure a position as a prop trader, it is important to have a good understanding of the financial markets and the ability to make profitable trades while managing risks. In this article, the experts at TU will provide valuable strategies, tips, and advice to help traders successfully navigate the prop firm challenge and set themselves up for a rewarding trading career.

Click to Pass Your Prop Firm Challenge

What trading strategies tend to succeed in these challenges?

Consistent, rules-based strategies that employ strict risk management are best.

What trading mistakes should I avoid?

Avoid overtrading, excessive risk-taking, overleveraging positions, lacking a strategy, trading while distracted, not knowing all the firm's rules, or making emotional decisions.

Can I trade on a tablet or mobile phone during a prop challenge?

Challenges usually mandate desktop platforms for more accurate order execution data. Only trade on mobile devices if explicitly permitted.

What should I do if I run into technical problems during my challenge?

Notify firm support immediately while adhering to all challenge rules in the meantime. Depending on severity, allowances or challenge resets may be issued on a case-by-case basis.

Click to Pass Your Prop Firm Challenge

How to pass the prop firm trading challenge?

To make this guide easier to understand, we will explain this part with the help of FTMO prop trading infrastructure as an example. Do note that the features discussed here are provided by most of the major prop trading firms, so this can indeed act as a universal guide regardless of the firm you choose to trade with. Now, here are some expert tips:

Click to Pass Your Prop Firm Challenge

Start with a small challenge: It's advisable to begin with a smaller challenge provided by the prop firm rather than jumping straight into a larger one. Starting with a smaller challenge allows you to familiarize yourself with the platform, understand the specific rules and requirements, and gain confidence in your trading abilities. This approach also helps you learn from any mistakes or weaknesses and make necessary adjustments before taking on more significant challenges.

Click to Pass Your Prop Firm Challenge

Maintain proper risk management: Prop firms place significant emphasis on risk management. Showcasing your ability to effectively manage risk is crucial for passing the challenge. Implement appropriate risk management techniques such as setting stop-loss orders, managing position sizes, and diversifying your trades. This demonstrates that you understand the importance of protecting capital and minimizing losses. You can use various tools like margin calculator, which are generally provided on the prop trading firm’s platform itself.

Click to Pass Your Prop Firm Challenge

Utilize the prop firm's educational resources: Take advantage of the educational resources provided by the prop firm. Many firms offer training materials, webinars, and tutorials to enhance traders' knowledge and skills. Engage with these resources to deepen your understanding of various trading concepts, strategies, and market dynamics. This demonstrates your commitment to self-improvement and continuous learning.

Click to Pass Your Prop Firm Challenge

Stay updated with market news and analysis: Stay informed about market news, economic indicators, and relevant analysis. Regularly read financial news, follow market trends, and analyze price movements. This allows you to make informed trading decisions based on fundamental and technical analysis, showcasing your ability to interpret market information effectively.

Click to Pass Your Prop Firm Challenge

Seek guidance and mentorship: If the prop firm offers mentorship programs or guidance from experienced traders, take full advantage of these opportunities. Seek guidance from mentors who can provide valuable insights, help you refine your trading approach, and offer personalized feedback. Engaging with mentors demonstrates your willingness to learn from industry experts and adapt to their valuable advice.

Click to Pass Your Prop Firm Challenge

Some things to do by yourself:

Consistency and profitability: Prop firms typically assess traders based on both their consistency and profitability. Consistency refers to the ability to maintain stable and positive trading performance over time. It's not just about achieving high profits in a few trades but rather demonstrating sustained profitability. Focus on building a track record that showcases your ability to generate consistent profits.

Record and analyze your trades: Keeping a detailed record of your trades is essential during the prop firm trading challenge. Maintain a trading journal where you document each trade, including the rationale behind your decisions, entry and exit points, and any relevant observations. This helps you analyze your trading performance, identify patterns, and make informed adjustments to your strategy.

Follow your trading strategy: One of the key aspects of passing a prop firm trading challenge is to adhere to your trading strategy consistently. Ensure that you have a well-defined and tested strategy in place before attempting the challenge. Once you begin trading, stick to your strategy without making impulsive or emotional decisions. This demonstrates discipline and consistency, which are highly valued by prop firms.

Click to Pass Your Prop Firm Challenge

Pros and cons of prop firm

👍 Pros

•Access to capital: Prop firms provide traders with the opportunity to trade larger position sizes and explore more lucrative opportunities.

•Training and education: Prop firms offer comprehensive training programs and educational resources to enhance traders' skills and knowledge.

•Support and mentorship: Prop firms provide mentorship from experienced traders, offering valuable insights and guidance.

•Risk management: Dedicated risk management teams in prop firms establish guidelines to minimize losses and create a secure trading environment.

•Advanced technology: Prop firms grant access to cutting-edge technology and tools, empowering traders with sophisticated resources.

•Reduced personal risk: Trading with a prop firm reduces personal risk as traders utilize the firm's capital.

•Potential for high earnings: Successful prop traders can earn significant profits, with some firms offering a substantial profit split.

👎 Cons

•Higher risk: Trading involves inherent risk, and despite risk management efforts, unexpected downturns can occur.

•High-pressure environment: The fast-paced and demanding nature of trading can create mental and emotional challenges for traders.

•Limited control over trading: Traders in prop firms may have less autonomy as risk protocols and strategies are overseen by the firm's risk management team.

Click to Pass Your Prop Firm Challenge

To your Success,

Osita Rich

0 notes

Text

Discover the One Step Prop Firm – a streamlined solution for traders seeking capital without complex evaluation processes. With a single-step funding model, this firm provides traders with quick access to trading capital, allowing them to focus on what they do best. More: https://www.thetalentedtrader.com/one-step-prop-firm/

#onesteppropfirm #trading #forextrading #fundedtraderprograms #proptrading #usa #newyork #instantfundingpropfirm #passpropfirm #propfirms #propfirmchallenge #instantfunding #thetalentedtrader

#One step prop firm#One step funding prop firm#Two step evaluation prop firm#Three step evaluation prop firm#prop firms#cheapest prop firms#funded trading accounts#trading risk management#instant funding prop firm#the talented trader#proprietary trading firm#prop firm trading#prop firm challenge#prop firms instant funding#forextrading#forex trading

0 notes

Video

youtube

You Can Make $2,449 in 7 Days with a Crypto Propfirm.. (Here is How)

0 notes

Text

Is it possible to earn ₹1000 daily from the stock market? | Or Prop firms with instant funding?

Is it possible to earn ₹1000 daily from the stock market? | Or Prop firms with instant funding?

#propfirms #trading #forextrading #proptrading #usa #newyork #instantfunding #passpropfirm #propfirmchallenge #thetalentedtrader #protradingtips

#funded trading accounts#prop firm challenge#prop firms#instant funding prop firm#trading risk management#prop trading#prop firms instant funding#funded trader challenges#talented trader#the talented trader

0 notes