#Propylene Oxide Market Demand

Text

Propylene Oxide Market Resilience: Adapting to Changing Regulatory Landscapes

Propylene, also known as propene, is an unsaturated organic compound with the chemical formula C3H6. It serves as a basic petrochemical raw material and is mainly used to produce polypropylene and propylene oxide. Polypropylene is a highly durable yet lightweight plastic used in a wide range of applications such as packaging, textiles, stationery, automotive and construction materials.

The global propylene market is estimated to be valued at US$ 151 billion in 2023 and is expected to exhibit a CAGR of 5.1% over the forecast period 2023-2027, as highlighted in a new report published by Coherent Market Insights.

Market Opportunity:

Rising polypropylene demand represents a major opportunity for the propylene oxide market. Asia Pacific is witnessing robust growth in the polypropylene market owing to increased consumption in packaging, automotive, and construction industries. China alone accounts for over 40% of global polypropylene demand. The country's 13th Five-Year Plan focuses on increasing investment in transportation and rural infrastructure development which will strengthen the polypropylene market. India also promises strong polypropylene demand on account of rapid urbanization, rising disposable incomes, and growth in end-use industries. As polypropylene is the primary derivative of propylene, its surging demand across developing economies will propel the propylene market forward during the forecast period.

Porter's Analysis

Threat of new entrants: The threat of new entrants in the propylene market is low due to the high costs associated with production facilities and infrastructure. Established players who have access to raw materials and distribution networks have significant advantages over new players.

Bargaining power of buyers: The bargaining power of buyers in the propylene market is high. Buyers have high bargaining power due to the availability of substitute products and undifferentiated nature of propylene. Buyers can easily switch between suppliers based on price and quality.

Bargaining power of suppliers: The bargaining power of suppliers is moderate. While there are few major suppliers of raw materials for propylene production, suppliers still depend on established players for off-take agreements. Supplier switching costs are also moderate.

Threat of new substitutes: The threat of substitutes is low to moderate. While functionally similar chemicals can be used as substitutes for some applications of propylene, limitations in terms properties restrict broad substitution. Established application areas remain hard to substitute.

Competitive rivalry: The competitive rivalry in the global propylene market is high due to the presence of numerous domestic and international players competing for market share. Players compete based on capabilities, product quality, and price.

SWOT Analysis

Strengths: Propylene has diverse applications and is a basic petrochemical with growing demand. Leading players have access to raw materials and economies of scale.

Weaknesses: Propylene production is capital intensive and vulnerable to fluctuations in crude oil/natural gas prices. Environmental regulations regarding emissions are increasing production costs.

Opportunities: Rising polymer demand from packaging and construction industries in Asia present an opportunity. Technologies to produce propylene as a byproduct of ethanol provide new opportunities.

Threats: Overcapacity can lead to pricing pressures. Strict environmental norms regarding air pollution are a challenge. Substitution threat from alternative chemicals is mounting.

Key Takeaways

The global propylene market is expected to witness high growth in the coming years. The global propylene market is estimated to be valued at US$ 151 billion in 2023 and is expected to exhibit a CAGR of 5.1% over the forecast period 2023-2027.

Rapid industrialization and infrastructural development are driving growth in Asia Pacific. China dominates global propylene demand and capacity additions. The Chinese government is investing heavily in propylene cracker projects to fulfill domestic demand. North America and Europe account for over 30% share of global propylene consumption led by demand from polymer industries. They are mature markets with stable growth. However, future capacity additions are planned in the Middle East and Asia Pacific regions to leverage low feedstock costs.

Key players: Key players operating in the propylene market are Dow Chemical, ExxonMobil, LyondellBasell, SABIC, and BASF. These major players have integrated production facilities and long term offtake agreements with buyers to maintain consistent supply.

#Propylene Oxide Market Share#Propylene Oxide Market Growth#Propylene Oxide Market Demand#Propylene Oxide Market Trend#Propylene Oxide Market Analysis

0 notes

Text

Propylene Oxide Market Impact: Environmental and Regulatory Considerations

Propylene oxide is an important organic chemical used as an intermediate in the production of polyether polyols, which are used to manufacture polyurethane foams. It is commonly used in products such as furniture upholstery, insulation for pipes, buildings and vehicles, bedding, carpet underlay, children's items, packaging, and more.

The global propylene oxide market is estimated to be valued at US$ 16,852.2 Mn or Mn in 2023 and is expected to exhibit a CAGR of 5.8% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The global propylene oxide market is witnessing substantial growth owing to the rising demand for polyether polyols from various industries such as construction, automotive, and furniture. According to statistics published by American Chemistry Council, the production of polyurethane foam in North America increased from 9.4 million tons in 2016 to 9.8 million tons in 2019, growing at a CAGR of 1.2% during the period. Moreover, propylene oxide is also used in other applications such as solvents, chemical intermediates, and hydrophilic polyether polyols. Expansion of end-use industries globally is expected to fuel the demand for propylene oxide during the forecast period. However, the availability of substitutes such as propylene glycol may hamper market growth over the forecast period.

SWOT Analysis

Strength: Propylene oxide is used for producing various industrial and consumer goods with three leading end-use industries being construction chemicals, automotive, and textiles. It is a versatile chemical having good reactivity and water solubility allowing its wide application. Production of propylene oxide from propylene is relatively easier and more economical than other production processes.

Weakness: Propylene oxide is highly flammable in nature bringing safety concerns during production, handling, transportation and storage. Stringent regulations over exhaust emissions and disposal of hazardous by-products increase production costs. Dependence on crude oil prices for obtaining raw materials represents a threat.

#Propylene Oxide Market Share#Oilfield Stimulation Chemicals Market Growth#Oilfield Stimulation Chemicals Market Market Demand

0 notes

Text

Butyl Glycol Prices | Pricing | Trend | News | Database | Chart | Forecast

Butyl Glycol prices have become a significant concern for industries that rely on this essential solvent, used widely in the production of coatings, cleaners, and various chemical formulations. The price dynamics of butyl glycol can be influenced by a myriad of factors, including raw material costs, production capacities, and market demand fluctuations. One of the key factors impacting butyl glycol prices is the cost of its primary raw materials, such as propylene oxide and ethylene glycol. As these raw materials experience price volatility due to global supply chain disruptions, geopolitical tensions, or changes in regulatory policies, the cost of butyl glycol can consequently rise or fall.

Moreover, production capacity and efficiency play a crucial role in determining the price of butyl glycol. Manufacturers with higher production capacities and more advanced technology can often achieve economies of scale, which can lead to lower prices. Conversely, any disruptions in production, whether due to equipment failures, labor strikes, or natural disasters, can lead to shortages and, subsequently, higher prices. Additionally, the increasing adoption of environmental regulations and sustainability practices can affect production costs. Compliance with stringent environmental standards often necessitates investing in cleaner technologies or processes, which can drive up production expenses and, in turn, influence the price of butyl glycol.

Get Real Time Prices for Butyl Glycol: https://www.chemanalyst.com/Pricing-data/butyl-glycol-1444

Market demand is another pivotal factor in the pricing of butyl glycol. The chemical is crucial in various applications, including automotive coatings, industrial cleaners, and chemical formulations, which means that fluctuations in these sectors can have a ripple effect on butyl glycol prices. For instance, an uptick in automotive production or a surge in the demand for industrial cleaning products can drive up the need for butyl glycol, potentially leading to price increases. Conversely, a downturn in these sectors or a shift towards alternative materials can diminish demand, resulting in lower prices.

Supply chain logistics also play a significant role in butyl glycol pricing. The transportation and distribution of butyl glycol involve complex logistics, including the movement of bulk chemicals from production facilities to end-users. Disruptions or inefficiencies in these supply chains, such as transportation delays or port congestion, can impact the availability of butyl glycol and influence its price. Additionally, fluctuations in fuel prices and transportation costs can directly affect the overall cost of delivering butyl glycol to market.

Furthermore, global economic conditions and trade policies can exert substantial influence on butyl glycol prices. Economic downturns or periods of economic instability can lead to reduced industrial activity and lower demand for butyl glycol, which may drive prices down. Conversely, economic growth can spur increased industrial activity and higher demand, potentially leading to price increases. Trade policies, including tariffs and import/export regulations, can also impact prices by affecting the cost of raw materials and the final product. For instance, increased tariffs on raw materials or butyl glycol imports can drive up prices for manufacturers and consumers alike.

In addition to these factors, technological advancements and innovation within the chemical industry can influence butyl glycol prices. Developments in production techniques, such as more efficient synthesis methods or alternative production routes, can lead to cost reductions and potentially lower prices. Conversely, the adoption of new technologies may involve significant initial investments, which can contribute to higher prices in the short term.

Consumer trends and preferences can also play a role in shaping butyl glycol prices. As industries and consumers increasingly prioritize sustainability and environmentally friendly products, there may be a growing demand for greener alternatives or enhanced formulations that include butyl glycol. This shift can affect pricing by influencing the types of products and formulations in demand and driving the need for more specialized butyl glycol grades or formulations.

Overall, the pricing of butyl glycol is a complex interplay of raw material costs, production factors, market demand, supply chain logistics, economic conditions, trade policies, and technological advancements. Companies involved in the production and utilization of butyl glycol must stay attuned to these factors to navigate the fluctuating price landscape effectively. By understanding the underlying drivers of butyl glycol prices, businesses can better manage their supply chains, optimize their procurement strategies, and adapt to market changes to maintain competitiveness and operational efficiency.

Get Real Time Prices for Butyl Glycol: https://www.chemanalyst.com/Pricing-data/butyl-glycol-1444

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Butyl Glycol#Butyl Glycol Price#Butyl Glycol Prices#Butyl Glycol Pricing#Butyl Glycol News#Butyl Glycol Price Monitor

0 notes

Text

Adsorbents Market- By Type, By Form, By End-Use Application — Global Opportunity Analysis & Industry Forecast, 2024–2030

Market Overview

Adsorbents market size is forecast to reach US$10.8 billion by 2030 after growing at a CAGR of 6.3% during 2024–2030. Adsorption is the accumulation of atoms or molecules on the surface of a material. This process creates a film of the adsorbate on the adsorbent’s surface. Adsorbents are used to remove pollutants from oil and gas streams in the oil and gas sector and are also increasingly being used in the gas drying process. The escalating demand for adsorbents stems from their efficacy in ensuring clean air and water.

A prominent trend in the adsorbents market is the increasing focus on sustainable and bio-based materials. As industries seek environmentally friendly alternatives, bio-based adsorbents derived from renewable sources gain traction. Additionally, the rising emphasis on green technologies and the push for sustainable practices in various sectors further propels the adoption of bio-based adsorbents which contributes to a positive outlook for the adsorbents industry during the forecast period.

Report Coverage :

The report: “Adsorbents Market — Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the global adsorbents industry.

By Type: Activated Alumina, Activated Charcoal, Activated Clay, Silica Gel, Metal Oxides, Polymer Adsorbents, Zeolites (Molecular Sieves) (Type 3A, Others), and Others

By Form: Powder, Flakes, and Others

By End-Use Application: Oil and Gas Industry (Natural Gas Purification, Gasoline, Diesel and Jet Fuel Production, Others), Petrochemical Industry (Ethylene Production, Propylene Production, Xylene Separation, Others), Chemical Industry (Industrial Gases, CASE (Coatings, Sealants, Adhesives, and Elastomers), Others), Automotive and Transportation, Pharmaceutical and Food, Water Treatment, Nuclear Waste Remediation, Refrigerant (Commercial, Industrial), Building & Construction, Personal Care and Cosmetic, and Others

By Geography: North America (U.S.A., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Denmark, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Taiwan, Malaysia, and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), Rest of the World (Middle East and Africa)

Inquiry Before Buying

Key Takeaways :

The Asia Pacific dominates the Adsorbents Market owing to the rising growth and increasing investments in the pharmaceutical and food industry.

The strict government regulations governing pharmaceutical product manufacture, hygiene, and quality control lead to a surge in the demand for adsorbents.

The rising demand for adsorbents in water and wastewater treatment application, has been a critical factor driving the growth of the Adsorbents Market in the upcoming years.

Adsorbents Market Segment Analysis — By Type

The zeolites segment held the largest share in the Adsorbents Market in 2023. Zeolites have a high degree of hydration, which results in a stable low-density crystal structure with a large void volume. Zeolites have been employed as an adsorbent in non-technically demanding, non-regenerative applications over the past two decades. New lightweight cementing methods for oil and gas completions to new modified zeolite adsorbents for extracting metals or organics from water are just a few of the new inventive applications. Systems for zeolite gas treatment, pressure swing adsorption, smell control, and other specific applications are being developed. Inorganic adsorbents, particularly for environmental applications, industrial gas production, and specialized chemicals, are the most valuable applications for zeolites and synthesized zeolites. Thus, the rising usage of zeolites in various applications, have uplifted the Adsorbents Market growth, in the forecast period.

Schedule a Call

Adsorbents Market Segment Analysis — By End-Use Application

The petrochemical industry held the largest share in the market in 2023 and is expected to grow at a CAGR of 7.4% during 2024–2030. Adsorbents are utilized in the petrochemical industry to remove trace contaminants such as water and sulphur in the feed, intermediate, and product streams, for the smooth operation of the plant. The usage of the right adsorbent is necessary for the petrochemical plants due to the reactivity of ethylene plant streams. In the petrochemical industry, adsorbents are used for the effective removal of a wide range of contaminants from olefin-containing streams, complete system solutions for the treatment of off-gas streams from catalytic crackers (FCC, DCC, CPP) and acetylene producing units, and long lifetime and easy operability. The surging demand for adsorbents is due to the rising investments in its end use industry such as petrochemical industry. For instance, according to Alberta’s Industrial Heartland Association, the petrochemical sector in Alberta has the potential to increase by more than US$30 billion by 2030. Thus, the rising investments in the petrochemical industry of various countries will further drive the growth of the adsorbents market over the forecast period.

Adsorbents Market Segment Analysis — By Geography

Asia-Pacific region dominated the adsorbents market in terms of revenue with a share of 38% in 2023 and is projected to dominate the market during the forecast period 2024–2030. The growing demand for adsorbents, along with the high purchasing power in countries such as China, India, and Japan, tends to become a potential market for adsorbents during the forecast period. The surging adoption of adsorbents in the petrochemical, oil, and gas, and other sectors are driving the adsorbents market in China. Currently, several initiatives taken by organizations for the development of new petrochemical plants in the country have increased the demand for adsorbents. In November 2022, Saudi Aramco announced plans to invest in a US$7 billion project to produce petrochemicals from crude oil at its South Korean affiliate S-Oil Corp’s refining complex in the port city of Ulsan. In March 2023, Indian Oil announced plans to build a petrochemicals complex at Paradip with an investment of $7.3 billion. Such investments will drive the demand for adsorbents in this region during the forecast period.

Adsorbents Market Driver :

Strict Government Regulations Governing Pharmaceutical Product Manufacture, Hygiene, And Quality Control Are Boosting Demand for Adsorbents

Pharmaceutical companies are putting a greater emphasis on quality control, which includes the use of adsorbents in procedures like instrument drying, drying of air-synthesis products, and deodorization. Several types of adsorbents are utilized in the pharmaceutical sector, with a selection depending on the application requirement. Activated carbon, for instance, is used to remove contaminated or by-products during the drug formulation process, whereas activated alumina is used to recover Pyrogen-free pharmaceuticals and as a desiccant for drying air and industrial gases. Also, silica gel is also employed in column chromatography as a pharmaceutical adsorbent, where it assists in the separation or collection of various medication components. Regulations mandating the use of adsorbents in the pharmaceuticals sector such as, by the United States Pharmacopeia (USP), Japanese Pharmacopeia (JP), and so on are also influencing the adsorbents market growth in the pharmaceutical sector. For instance, according to Invest India, the pharmaceutical industry in India is expected to reach $65 billion by 2024 and to $130 billion by 2030.

Buy Now

Adsorbents Market Challenge

Reduced Shelf Life Due to High Level of Impurities Will Hamper the Market Growth

Although adsorbent materials can attract molecules to their surfaces, this ability is limited. Once the capacity has been reached, continued refining and purification will produce an equilibrium, which will lead to desorption. Adsorbents are utilized for adsorption of various pollutants and impurities such as carbon dioxide or hydrogen sulphide, mercaptans, manufacturing chemicals, and hydrate inhibitors in refining and purifying processes. The current contaminants react with the adsorbents at this point, causing the adsorbent to regenerate. These pollutants either renew or eliminate the adsorbent. The service life of adsorbents is determined by the material’s regeneration capacity, which could be a stumbling block for the overall adsorbents market.

Adsorbents Industry Outlook

Top 10 companies in the adsorbents market include:

BASF SE

Arkema SA

Honeywell International Inc.

Cabot Corporation

W. R. Grace & Co.

Clariant AG

Mitsubishi Chemical Corporation

Calgon Carbon Corporation (Kuraray)

Evonik Industries

Axens Group

For more Chemicals and Materials related reports, please click here

0 notes

Text

Petrochemicals Market Size To Reach $1002.45 Billion By 2030

The global petrochemicals market size is expected to reach USD 1002.45 billion by 2030, as per the new report by Grand View Research, Inc. It is expected to expand at a CAGR of 7.3% from 2024 to 2030. It is expected to expand at a CAGR of 7.0% from 2023 to 2030. The demand for petrochemicals is attributed to an increase in demand from the end-use industries such as construction, textile, medical, pharmaceuticals, consumer goods, automotive, and electronics.

Products such as ethylene, propylene, and benzene are widely used in various industries such as packaging, electronics, plastics, and rubber. The ethylene product segment dominated the market in 2021 and is expected to maintain its lead in the forecast period owing to its wide application scope across several industries. Asia Pacific is anticipated to dominate the market in the forecast period owing to the favorable regulatory policies in the region.

Crude oil and natural gas are the major raw materials used for the manufacturing of petrochemical products. The volatile prices of crude oil are a major challenge in the procurement process of crude oil as a raw material for manufacturers. The industry players that are reliant on crude oil as a feedstock for manufacturing are likely to face difficulties in the coming years. However, declining prices of natural gas owing to a rise in its production are expected to augment the growth of the product over the forecast period.

The competitiveness among the producers of the product is high as the market is characterized by the presence of a large number of global players with strong distribution networks. Top players are dominating the industry for the past few years owing to the increasing investment in R&D activities related to new product development.

Request a free sample copy or view the report summary: Petrochemicals Market Report

Petrochemicals Market Report Highlights

The methanol product segment is expected to expand at the highest revenue-based CAGR of 8.9% over the forecast period. The demand is attributed to the increase in demand for methanol in manufacturing biodiesel, which is biodegradable, safe, and produces fewer air pollutants as compared to other fuels

Surged use of polyethylene, High-density Polyethylene (HDPE), and Low-density Polyethylene (LDPE) is expected to foster the overall growth of the market for petrochemicals.

The butadiene product segment is expected to be an emerging segment in the coming years as it is a key building block used in the manufacturing of several chemicals and materials employed in the industries such as consumer durables, healthcare, and building and construction

Manufacturers have adopted joint ventures and acquisitions as major strategies to increase their global presence

Petrochemicals Market Segmentation

Grand View Research has segmented the global petrochemical market report on the basis of Product, and region

Petrochemicals Product Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

Ethylene

Polyethylene

Ethylene oxide

EDC

Ethyl benzene

Others

Propylene

Polypropylene

Propylene oxide

Acrylonitrile

Cumene

Acrylic acid

Isopropanol

Other

Butadiene

SB Rubber

Butadiene rubber

ABS

SB latex

Others

Benzene

Ethyl benzene

Phenol/cumene

Cyclohexane

Nitrobenzene

Alkyl benzene

Other

Xylene

Toluene

Solvents

TDI

Others

Methanol

Formaldehyde

Gasoline

Acetic acid

MTBE

Dimethyl ether

MTO/MTP

Other

Petrochemicals Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Belgium

Netherlands

Asia Pacific

China

India

Japan

South Korea

Indonesia

Latin America

Brazil

Middle East

Africa

List of Key Players of Petrochemicals Market

BASF SE

Chevron Corporation

China National Petroleum Corporation (CNPC)

China Petrochemical Corporation

ExxonMobil Corporation

INEOS Group Ltd.

LyondellBasell Industries Holdings B.V.

Royal Dutch Shell PLC

SABIC

Dow

0 notes

Text

A Comprehensive Guide to Glycol Ethers Procurement Intelligence

The glycol ethers category is expected to grow at a CAGR of 5.74% from 2023 to 2030. There is a growing urbanization and an increase in the number of construction projects that led to rising demand for paint and coatings activities, which in turn is expected to drive the category growth. Glycol ether's rapid drying time and better printing quality make it beneficial for the printing industry. Further, glycol ethers are utilized in a variety of personal care items, including sunscreens and cosmetics. It has a high boiling point and superior solvent characteristics, which make the molecule a crucial reagent in the production of numerous personal care products which will drive the glycol ethers market growth. The Asia-Pacific region accounts for the largest category share in 2020 as the region's rapidly growing population has increased global demand for a wide range of commodities for industries such as automobiles, pharmaceuticals, and personal care.

Recent technology advancements in DCS control systems and automatic production processes to accelerate the process cycle, reduce overall costs, and gain a competitive advantage in the global economy. For instance, Jiangsu Dynamic Chemical Co., Ltd. has set up two sets of Ethylene oxide (EO) production equipment with yearly capacities of 60,000t and 100,000t after introducing cutting-edge technology from a U.S. based company, SD company that provides R&D services and supplies products and components related to technology and engineering. The manufacture of EO has enhanced the industry chain of glycol ethers while increasing the core competitiveness of Jiangsu Dynamic Chemical Co., Ltd. The DCS control system is used throughout the entire production process to achieve automatic production. All automatic control devices have now reached the most advanced level within the same chemical industry categories globally. This will assist in achieving the company's operating principles, which are to put environmental preservation at the center of their operations, prioritize management, be driven by technical innovation, and manufacture high-quality products continuously to reach new heights.

Order your copy of the Glycol Ethers Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

This category's three main cost components are labor, raw material, machinery, and technology costs. Other costs involved are utility costs, packaging, and transportation costs. The raw materials used in the production of glycol ethers are ethylene oxide and propylene oxide which are highly volatile in terms of price. Price fluctuations of raw materials can influence a manufacturer's profitability and cost structure. Glycol ether prices in the North American region were stable at the beginning of June 2023. However, the prices went up as a result of rising production costs and rising feedstock ethylene oxide prices in North American region during mid of Q2 2023. During the recession, there was a shortage of labor, and production rates were low due to high labor costs. As a result, production costs and glycol ethers prices increased in the mid of Q2 2023 despite stable supply and demand dynamics and limited glycol ethers availability.

Countries such as China, Japan, and India are the most preferred sourcing destinations for this category. China's significant technological advancement, environmental consciousness, government support as well as manufacturing capabilities made this region preferred for sourcing. This helped China to enhance and respond to the rising demand for this category by delivering essential solvents and additive manufacturing of paints, textiles, medicines, and automotive components. Selecting a supplier that is equipped to meet standards and assurance practices is considered to be an important sourcing practice in this category. The suppliers must be equipped to meet the United States Food and Drug Administration (FDA) regulations for use in food-related applications along with other standards and assurance practices. Other best sourcing practices include purchasing raw materials from low-cost nations and having strong technology capabilities.

Glycol Ethers Procurement Intelligence Report Scope

• Glycol Ethers Category Growth Rate: CAGR of 5.74% from 2023 to 2030

• Pricing growth Outlook: 5% - 6% (Annually)

• Pricing Models: Fixed pricing model

• Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

• Supplier Selection Criteria: Production capability, Types (P-series, E-series, etc.), Form available (powder, pellets, liquid, etc.), Packaging quantity, Technical specifications, Operational capabilities, Regulatory standards and mandates, Category innovations, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Browse through Grand View Research’s collection of procurement intelligence studies:

• Glycerin Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Graphite Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Key companies profiled

• BASF SE

• The Dow Chemical Company

• Eastman Chemicals Company

• FBC Chemical

• Hannong Chemicals

• Henan GP Chemical

• Huntsman Corporation

• INEOS

• India Glycols Limited

• Jangsu Yida Chemical

• Kemipex

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Glycol Ethers Procurement Intelligence#Glycol Ethers Procurement#Procurement Intelligence#Glycol Ethers Market#Glycol Ethers Industry

0 notes

Text

Propylene Carbonate Market Trends and Forecast Reports 2024-2033 | Global Insight Services

Propylene carbonate is a clear, colorless, and nearly odorless organic compound. It is classified as a cyclic carbonate ester, and is used as a solvent and in some types of lubricants. It has a relatively high boiling point and low freezing point, and is miscible with water.

Propylene carbonate is produced by the reaction of propylene oxide and carbonic acid. It is also a byproduct of the production of propylene glycol.

Propylene carbonate is used as a solvent in a variety of applications, including paint strippers, adhesives, inks, and cleaning solutions. It is also used as a component of some types of lubricants, hydraulic fluids, and heat-transfer fluids.

To Know More@ https://www.globalinsightservices.com/reports/propylene-carbonate-market

Key Trends

Some key trends in Propylene Carbonate technology include:

-Development of new and improved catalysts for the production of propylene carbonate

-Improvements in the manufacturing process to increase efficiency and yield

-Use of propylene carbonate as a green solvent in various applications

-Continued research into the potential health and environmental benefits of propylene carbonate

Key Drivers

The key drivers of the propylene carbonate market are the growing demand for propylene carbonate from the electronics and automotive industries, and the increasing use of propylene carbonate as a solvent in the paint and coatings industry.

The electronics industry is the largest consumer of propylene carbonate, accounting for more than 50% of the total demand. Propylene carbonate is used as a solvent in the production of printed circuit boards and as a dielectric fluid in capacitors. The automotive industry is the second largest consumer of propylene carbonate, and it is used as a plasticizer in automotive coatings, as a coolant in battery systems, and as a hydraulic fluid in power steering systems.

The paint and coatings industry is the third largest consumer of propylene carbonate. Propylene carbonate is used as a solvent in paints and coatings, and it is also used as a coalescing agent in latex paints.

The demand for propylene carbonate is also driven by the growing use of propylene carbonate as a solvent in the pharmaceutical industry. Propylene carbonate is used as a solvent in the production of injectable drugs, ophthalmic solutions, and oral liquids.

Request Sample@ https://www.globalinsightservices.com/request-sample/GIS23103

Research Objectives

Estimates and forecast the overall market size for the total market, across product, service type, type, end-user, and region

Detailed information and key takeaways on qualitative and quantitative trends, dynamics, business framework, competitive landscape, and company profiling

Identify factors influencing market growth and challenges, opportunities, drivers and restraints

Identify factors that could limit company participation in identified international markets to help properly calibrate market share expectations and growth rates

Trace and evaluate key development strategies like acquisitions, product launches, mergers, collaborations, business expansions, agreements, partnerships, and R&D activities

Thoroughly analyze smaller market segments strategically, focusing on their potential, individual patterns of growth, and impact on the overall market

To thoroughly outline the competitive landscape within the market, including an assessment of business and corporate strategies, aimed at monitoring and dissecting competitive advancements.

Identify the primary market participants, based on their business objectives, regional footprint, product offerings, and strategic initiatives

Request Customization@ https://www.globalinsightservices.com/request-customization/GIS23103

Market Segments

The propylene carbonate market bifurcated on the basis of form, application, and region. On the basis of form, it is segmented into aqueous, pellet, films, and others. By application, it is analyzed across paints & coatings, cleaning, personal care, and others. Region-wise, it is studied across North America, Europe, Asia-Pacific, and rest of the World.

Key Players

The propylene carbonate market report includes players such as BASF SE, Huntsman International LLC., LyondellBasell Industries Holdings B.V., Empower Materials, Anmol Chemicals Group, Kowa India Pvt.Ltd., ReactChem Co. Ltd, SMC – Global, Taixing Fengming Chemical, and Lixing Chemical.

Buy your copy here@ https://www.globalinsightservices.com/checkout/single_user/GIS23103

Research Scope

Scope – Highlights, Trends, Insights. Attractiveness, Forecast

Market Sizing – Product Type, End User, Offering Type, Technology, Region, Country, Others

Market Dynamics – Market Segmentation, Demand and Supply, Bargaining Power of Buyers and Sellers, Drivers, Restraints, Opportunities, Threat Analysis, Impact Analysis, Porters 5 Forces, Ansoff Analysis, Supply Chain

Business Framework – Case Studies, Regulatory Landscape, Pricing, Policies and Regulations, New Product Launches. M&As, Recent Developments

Competitive Landscape – Market Share Analysis, Market Leaders, Emerging Players, Vendor Benchmarking, Developmental Strategy Benchmarking, PESTLE Analysis, Value Chain Analysis

Company Profiles – Overview, Business Segments, Business Performance, Product Offering, Key Developmental Strategies, SWOT Analysis.

With Global Insight Services, you receive:

10-year forecast to help you make strategic decisions

In-depth segmentation which can be customized as per your requirements

Free consultation with lead analyst of the report

Infographic excel data pack, easy to analyze big data

Robust and transparent research methodology

Unmatched data quality and after sales service

Contact Us:

Global Insight Services LLC

16192, Coastal Highway, Lewes DE 19958

E-mail: [email protected]

Phone: +1-833-761-1700

Website: https://www.globalinsightservices.com

About Global Insight Services:

lobal Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

0 notes

Text

Propylene: A Versatile Monomer for Plastics, Chemicals, and Fuels

Propylene, also known as Propylene, is an important industrial organic compound used for the production of numerous polymers and chemicals. With the chemical formula C3H6, Propylene is a colorless gas that is highly flammable and slightly less dense than air. It is one of the three most important olefins produced industrially, along with ethylene and butadiene.

Sources and Production of Propylene

Naturally, Propylene is produced as a byproduct during oil refinement and natural gas processing. However, most Propylene manufactured today is produced through two key processes - steam cracking of hydrocarbons and fluid catalytic cracking (FCC) of crude oil fractions. Steam cracking involves heating petroleum feedstocks like naptha, liquefied petroleum gas or ethane in the presence of steam to produce lighter alkenes like ethylene and Propylene. FCC uses a zeolite catalyst at elevated temperatures to convert heavier hydrocarbon fractions into gasoline and lighter alkenes. Refineries and petrochemical facilities use these cracking techniques to maximize alkene yields and recover Propylene on an industrial scale.

Uses and Derivatives of Propylene

By far the largest application of Propylene is for the production of polyPropylene plastics. In fact, Propylene demand is dominated by polymerization which accounts for over 60% of its end uses. PolyPropylene possess desirable properties like flexibility, transparency, resistance to moisture and chemicals and is commonly used in packaging films, textiles, plastic parts and various industrial applications. Other major derivatives of Propylene include Propylene oxide, acrylonitrile, cumene and alcohols. Propylene oxide forms the basis for specialized polyether polyols used in rigid and flexible foams. Acrylonitrile is a key precursor to acrylic fibers and plastics. Cumene, or isopropylbenzene, is primarily used to manufacture phenol and acetone. Propylene also finds usage as a petrochemical intermediate in various chemical processes.

Applications in Fuels and Transportation

Due to Propylene's molecular structure and fuel properties, it is increasingly being evaluated as an alternative transportation fuel, especially in diesel engines. Propylene is more reactive and has a higher cetane value compared to longer chain alkanes like diesel. As a result, it produces cleaner burning exhaust with reduced emissions. It has led to interest in developing Propylene-diesel fuel blends. Furthermore, Propylene derived alkylate - a high-octane component obtained from isomerization and alkylation refining - improves gasoline engine performance and is a major gasoline additive. This has created new potential avenues for Propylene consumption in transportation fuels in addition to the chemical sector.

World Supply and Demand Dynamics

On a global scale, over 60 million tons of Propylene are produced annually to meet the growing polymer and chemical demands. The Asia Pacific region dominates both production and consumption with China leading as the largest Propylene market. Key refining and petrochemical industries based along the U.S. Gulf Coast and parts of Europe like Germany, Belgium and Italy also contribute significantly. International trade plays a critical role since Propylene supply-demand balances vary regionally. Propylene trade occurs through ship tank or intra-pipeline transports to equalize regional surpluses and shortfalls. Overall, Propylene is an indispensable petrochemical that serves as backbone to the plastics industry and leverages oil and gas refinery infrastructure worldwide.

Environmental and Process Safety Aspects

Like other industrial organic chemicals, Propylene manufacturing and handling requires compliance to strict environmental and process safety standards. Propylene plants are potential sources of air pollutants due to fugitive emissions and combustion byproducts that necessitate robust emission control systems. Propylene's higher reactivity also increases risk of fires and explosions that demand sophisticated risk prevention through equipment design, operating procedures and operator training. Effective waste management is equally important since process residues may contain hazardous compounds. Regulatory compliance backed by robust risk governance helps realize Propylene's societal benefits while minimizing workplace and community impacts. Overall stewardship across the Propylene supply chain is crucial given the chemical's extensive role in modern products and technologies.

Propylene stands out as one of the most widely used petrochemical intermediates supporting numerous downstream derivatives. Its contributions to plastics, chemicals and fuel applications underscore Propylene’s strategic importance to modern industries and economies worldwide. Continued innovation to maximize Propylene yields from fossil feedstocks along with alternative production pathways will be paramount to sustain this key industrial monomer’s role in the future.

Get more insights on Propylene

About Author:

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)

0 notes

Text

The global demand for Propylene Glycol was valued at USD 4.13 Billion in 2023 and is expected to reach USD 6.9 Billion in 2032, growing at a CAGR of 6.2% between 2023 and 2032. Propylene glycol (PG), a versatile organic compound, has become a staple in various industries due to its wide-ranging applications. As a synthetic liquid substance, it is absorbed well by the body and has been deemed safe for use in foods, pharmaceuticals, and cosmetics. The global propylene glycol market has witnessed significant growth over recent years, driven by rising demand across various sectors such as automotive, construction, food and beverage, pharmaceuticals, and personal care products.

Browse the full report at https://www.credenceresearch.com/report/propylene-glycol-market

Market Overview

The propylene glycol market was valued at approximately USD 4 billion in 2023 and is projected to grow at a CAGR of around 5% from 2024 to 2030. This growth can be attributed to several factors, including the increasing use of PG in the production of unsaturated polyester resins (UPR), which are essential in manufacturing construction materials and automotive components.

Key Drivers

1. Rising Demand in the Automotive Sector: Propylene glycol is extensively used as an antifreeze and coolant in the automotive industry. With the global increase in vehicle production and the need for better performance and safety features, the demand for high-quality antifreeze solutions has surged. PG’s low toxicity and high boiling point make it an ideal choice for such applications.

2. Growth in the Food and Beverage Industry: PG is a common additive in food products, where it acts as a humectant, solvent, and preservative. The rising demand for processed and packaged foods, driven by changing consumer lifestyles and increasing urbanization, has bolstered the market for propylene glycol. Additionally, its approval by major regulatory bodies, including the FDA and EFSA, supports its widespread use in the food industry.

3. Expanding Pharmaceutical and Personal Care Sectors: In pharmaceuticals, PG is used as a solvent in oral, injectable, and topical medications. Its role in the formulation of creams, lotions, and other personal care products is also notable. The growing awareness of personal health and hygiene, along with advancements in pharmaceutical formulations, has further propelled the demand for propylene glycol.

4. Advancements in Bio-based Propylene Glycol: Environmental concerns and the push for sustainability have led to the development of bio-based propylene glycol, derived from renewable resources such as corn and soy. This eco-friendly variant is gaining traction, particularly in regions with stringent environmental regulations. The shift towards greener alternatives is expected to drive the market forward.

Regional Insights

The propylene glycol market exhibits significant regional variations, with Asia-Pacific leading the charge. This region's dominance can be attributed to rapid industrialization, urbanization, and economic growth, particularly in countries like China and India. The burgeoning automotive and construction sectors in these nations have spurred the demand for PG.

North America and Europe also hold substantial market shares, driven by the presence of established automotive, pharmaceutical, and food and beverage industries. Furthermore, stringent regulations regarding the use of safe and environmentally friendly chemicals have promoted the adoption of bio-based propylene glycol in these regions.

Challenges and Restraints

Despite its numerous advantages, the propylene glycol market faces several challenges. Fluctuating raw material prices, particularly propylene oxide, a key precursor in PG production, can impact market dynamics. Additionally, concerns regarding the environmental impact of conventional PG production processes have led to increased regulatory scrutiny.

Future Outlook

The future of the propylene glycol market looks promising, with continued growth expected across various industries. Technological advancements and ongoing research into alternative production methods, such as bio-based PG, are likely to open new avenues for market expansion. Moreover, the increasing focus on sustainability and eco-friendly products will drive the demand for bio-based propylene glycol.

Top Key Players

Shell Plc

INEOS Oxide

Huntsman International L.L.C

ADEKA CORPORATION

Chaoyang Chemicals, Inc.

Temix Oleo

Midland Company

Helm AG

Manali Petrochemicals Limited

Haike Chemical Group Co., Ltd.

Dow

Arch Chemicals Inc

Repsol

LyondellBasell Industries N.V.

BASF SE

ADM

Global Bio-chem Technology Group Company Limited

DuPont Tate and Lyle Bio Products

SKC

Segmentations:

By Source :

Bio-Based

Petroleum

By Type :

Food Grade

Pharma Grade

Industrial Grade Propylene Glycol

By End Use :

Cosmetic and Personal Care Products

Consumer Goods (Liquid Detergents)

Chemical Intermediary (Unsaturated Polyester Resins, Functional Fluids & Antifreezes)

Food

Pharmaceuticals

By Primary Function :

Propylene Glycol as Preservative Agents

Propylene Glycol as Humectants (Binding Agent)

Propylene Glycol as Emollients (Softener)

Propylene Glycol as Solvents

Propylene Glycol as Stabilizing Agents

Propylene Glycol as Excipients (Bulking Agent)

Others

Browse the full report at https://www.credenceresearch.com/report/propylene-glycol-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

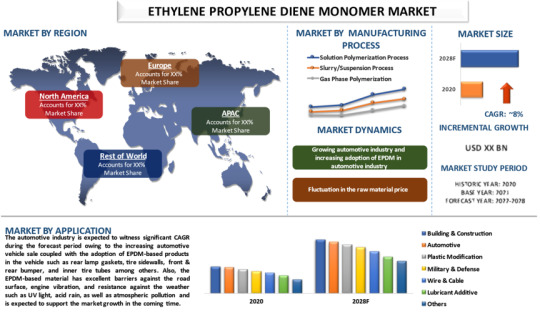

Ethylene Propylene Diene Monomer (EPDM) Market Overview

Introduction

Ethylene Propylene Diene Monomer Market is a type of synthetic rubber known for its excellent resistance to heat, oxidation, ozone, and weathering. EPDM rubber is used in a wide range of applications, including automotive weatherstripping and seals, roofing membranes, and industrial and construction products. The market for EPDM is growing steadily due to its superior properties and the increasing demand from various end-use industries.

Market Drivers

1. Automotive Industry Growth: The automotive sector is one of the largest consumers of EPDM, utilizing it in hoses, seals, and weatherstripping. The continuous growth in vehicle production and the shift towards electric vehicles, which require durable and heat-resistant materials, drive the demand for EPDM.

2. Construction Industry Demand: In the construction industry, EPDM is used in roofing membranes and other applications due to its durability and weather resistance. With increasing infrastructure projects and renovation activities, the demand for EPDM in the construction sector is rising.

3. Rising Industrial Applications: EPDM's properties make it suitable for various industrial applications, such as conveyor belts, gaskets, and hoses. The expansion of the manufacturing sector and the need for reliable and durable materials in industrial processes contribute to the market growth.

Market Challenges

1. Raw Material Price Volatility: The prices of raw materials used in the production of EPDM, such as ethylene and propylene, are subject to fluctuations. This volatility can affect the overall cost of production and impact profit margins for manufacturers.

2. Environmental Regulations: The production and disposal of synthetic rubber are subject to environmental regulations. Compliance with these regulations can increase production costs and pose challenges for manufacturers.

For a comprehensive analysis of the market drivers:- https://univdatos.com/report/ethylene-propylene-diene-monomer-market/

Regional Insights

1. North America: The North American EPDM market is driven by the robust automotive and construction sectors. The region's focus on sustainable and energy-efficient buildings further supports the demand for EPDM in roofing applications.

2. Europe: Europe is a significant market for EPDM due to its strong automotive industry and stringent environmental regulations that promote the use of durable and recyclable materials. The construction sector also contributes to the market growth in this region.

3. Asia-Pacific: The Asia-Pacific region is witnessing rapid growth in the EPDM market, fueled by the booming automotive industry in countries like China and India. Additionally, the expanding construction industry and increasing industrialization are driving the demand for EPDM in this region.

4. Latin America and Middle East & Africa: These regions are experiencing moderate growth in the EPDM market. The increasing automotive production and construction activities are key factors contributing to the market expansion in these regions.

Market Trends

1. Sustainability and Recycling: There is a growing emphasis on sustainability and recycling in the EPDM market. Manufacturers are focusing on developing eco-friendly production processes and recyclable EPDM products to meet the rising demand for sustainable solutions.

2. Technological Advancements: Innovations in production technologies and the development of advanced EPDM formulations are enhancing the performance and applications of EPDM. These advancements are expected to open new opportunities in various end-use industries.

3. Increased Use in Electric Vehicles: The shift towards electric vehicles (EVs) is driving the demand for high-performance materials like EPDM. EVs require materials that can withstand higher temperatures and provide better insulation, making EPDM an ideal choice.

For a sample report, visit:- https://univdatos.com/get-a-free-sample-form-php/?product_id=31683

Competitive Landscape

The EPDM market is highly competitive, with several key players operating globally. Companies are focusing on strategic initiatives such as mergers and acquisitions, collaborations, and new product developments to strengthen their market position. Some of the prominent players in the EPDM market include:

Conclusion

The Ethylene Propylene Diene Monomer (EPDM) market is poised for significant growth in the coming years, driven by the increasing demand from the automotive, construction, and industrial sectors. While challenges such as raw material price volatility and environmental regulations exist, advancements in technology and a focus on sustainability are expected to propel the market forward. The competitive landscape will continue to evolve as companies innovate and adapt to meet the changing demands of the market.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

Propylene Oxide Market Research: Crafting Effective Strategies for Market Penetration

propylene oxide, also known as propene, is an unsaturated organic compound with the chemical formula C3H6. It serves as a basic petrochemical raw material and is mainly used to produce polypropylene oxide and propylene oxide oxide. Polypropylene oxide is a highly durable yet lightweight plastic used in a wide range of applications such as packaging, textiles, stationery, automotive and construction materials.

The global propylene oxide market is estimated to be valued at US$ 151 billion in 2023 and is expected to exhibit a CAGR of 5.1% over the forecast period 2023-2027, as highlighted in a new report published by Coherent Market Insights.

Market Opportunity:

Rising polypropylene oxide demand represents a major opportunity for the propylene oxide market. Asia Pacific is witnessing robust growth in the polypropylene oxide market owing to increased consumption in packaging, automotive, and construction industries. China alone accounts for over 40% of global polypropylene oxide demand. The country's 13th Five-Year Plan focuses on increasing investment in transportation and rural infrastructure development which will strengthen the polypropylene oxide market. India also promises strong polypropylene oxide demand on account of rapid urbanization, rising disposable incomes, and growth in end-use industries. As polypropylene oxide is the primary derivative of propylene oxide, its surging demand across developing economies will propel the propylene oxide market forward during the forecast period.

Porter's Analysis

Threat of new entrants: The threat of new entrants in the propylene oxide market is low due to the high costs associated with production facilities and infrastructure. Established players who have access to raw materials and distribution networks have significant advantages over new players.

Bargaining power of buyers: The bargaining power of buyers in the propylene oxide market is high. Buyers have high bargaining power due to the availability of substitute products and undifferentiated nature of propylene oxide. Buyers can easily switch between suppliers based on price and quality.

Bargaining power of suppliers: The bargaining power of suppliers is moderate. While there are few major suppliers of raw materials for propylene oxide production, suppliers still depend on established players for off-take agreements. Supplier switching costs are also moderate.

Threat of new substitutes: The threat of substitutes is low to moderate. While functionally similar chemicals can be used as substitutes for some applications of propylene oxide, limitations in terms properties restrict broad substitution. Established application areas remain hard to substitute.

Competitive rivalry: The competitive rivalry in the global propylene oxide market is high due to the presence of numerous domestic and international players competing for market share. Players compete based on capabilities, product quality, and price.

SWOT Analysis

Strengths: propylene oxide has diverse applications and is a basic petrochemical with growing demand. Leading players have access to raw materials and economies of scale.

Weaknesses: propylene oxide production is capital intensive and vulnerable to fluctuations in crude oil/natural gas prices. Environmental regulations regarding emissions are increasing production costs.

Opportunities: Rising polymer demand from packaging and construction industries in Asia present an opportunity. Technologies to produce propylene oxide as a byproduct of ethanol provide new opportunities.

Threats: Overcapacity can lead to pricing pressures. Strict environmental norms regarding air pollution are a challenge. Substitution threat from alternative chemicals is mounting.

Key Takeaways

The global propylene oxide market is expected to witness high growth in the coming years. The global propylene oxide market is estimated to be valued at US$ 151 billion in 2023 and is expected to exhibit a CAGR of 5.1% over the forecast period 2023-2027.

Rapid industrialization and infrastructural development are driving growth in Asia Pacific. China dominates global propylene oxide demand and capacity additions. The Chinese government is investing heavily in propylene oxide cracker projects to fulfill domestic demand. North America and Europe account for over 30% share of global propylene oxide consumption led by demand from polymer industries. They are mature markets with stable growth. However, future capacity additions are planned in the Middle East and Asia Pacific regions to leverage low feedstock costs.

Key players: Key players operating in the propylene oxide market are Dow Chemical, ExxonMobil, LyondellBasell, SABIC, and BASF. These major players have integrated production facilities and long term offtake agreements with buyers to maintain consistent supply.

#Propylene Oxide Market Share#Propylene Oxide Market Growth#Propylene Oxide Market Demand#Propylene Oxide Market Trend#Propylene Oxide Market Analysis

0 notes

Text

The propylene oxide market in India is experiencing robust growth, primarily driven by several key factors. Firstly, the escalating demand for polyurethane, a versatile polymer derived from propylene oxide, serves as a prominent driver.

#India Propylene Oxide Market Report#India Propylene Oxide Market Report 2024#India Propylene Oxide Market Report 2032#India Propylene Oxide Market 2024#India Propylene Oxide Market 2032

0 notes

Text

Glycol Ether Prices | Pricing | Trend | News | Database | Chart | Forecast

Glycol Ether Prices are a class of solvents commonly used in a variety of industrial applications, including paints, coatings, and cleaning products. The prices of glycol ethers can fluctuate based on several factors, including raw material costs, supply and demand dynamics, and global economic conditions. Understanding these price variations is crucial for businesses that rely on glycol ethers for their products and processes.

The primary raw materials for glycol ethers are ethylene oxide and propylene oxide. Fluctuations in the prices of these chemicals can significantly impact the cost of glycol ethers. For example, if the cost of ethylene oxide increases due to supply shortages or geopolitical factors, the price of glycol ethers produced from it may also rise. Conversely, a drop in the cost of raw materials can lead to lower glycol ether prices. Additionally, the production capacity and technological advancements in manufacturing processes can influence pricing. Innovations that improve efficiency or reduce production costs can result in more stable or lower prices for glycol ethers.

Get Real Time Prices for Glycol Ether: https://www.chemanalyst.com/Pricing-data/glycol-ether-49

Global supply and demand play a critical role in determining glycol ether prices. In regions where there is high demand for glycol ethers, such as in emerging markets or areas with significant industrial activity, prices may be higher due to the increased need for these solvents. Conversely, in regions with a lower demand or oversupply, prices may be more competitive. Trade policies and international trade agreements also affect the availability and cost of glycol ethers. Tariffs, export restrictions, and other trade barriers can impact the global flow of glycol ethers, influencing their prices.

Economic conditions and market trends also contribute to the pricing of glycol ethers. During periods of economic growth, industrial production tends to increase, driving up the demand for glycol ethers and potentially leading to higher prices. Conversely, during economic downturns, reduced industrial activity can lead to lower demand and, consequently, lower prices. Market trends, such as shifts in consumer preferences or technological advancements, can also impact the demand for products that use glycol ethers, influencing their prices indirectly.

Another important factor in glycol ether pricing is the cost of transportation and logistics. The distribution of glycol ethers involves shipping raw materials to manufacturing sites and then delivering the finished products to various end-users. Changes in fuel prices, transportation regulations, and logistics efficiency can affect the overall cost structure of glycol ether supply chains, thereby influencing their prices.

Additionally, environmental regulations and sustainability concerns are increasingly shaping the glycol ether market. As regulatory frameworks tighten around the environmental impact of industrial chemicals, companies may face higher costs for compliance and waste management. These costs can be passed on to consumers through higher glycol ether prices. Conversely, companies that invest in greener technologies or sustainable practices may benefit from cost savings and potentially lower prices.

In summary, glycol ether prices are influenced by a complex interplay of raw material costs, supply and demand dynamics, economic conditions, and regulatory factors. For businesses that use glycol ethers, staying informed about these variables is essential for managing costs and ensuring supply chain stability. By keeping an eye on market trends, raw material prices, and global economic conditions, businesses can better navigate the fluctuations in glycol ether prices and make informed decisions about their procurement strategies.

Get Real Time Prices for Glycol Ether: https://www.chemanalyst.com/Pricing-data/glycol-ether-49

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Glycol Ether#Glycol Ether Price#Glycol Ether Prices#Glycol Ether Pricing#Glycol Ether News#Glycol Ether Price Monitor#Glycol Ether Database

0 notes

Text

Propylene’s Manufacturing Techniques and Multiple Applications

Propylene is a vital chemical in the field of chemical engineering as it is considered as one of the most important basic chemicals that are used for the production of a number of other compounds. From Propylene oxide to acrylonitrile, cumene and acrylic acid, the derivatives derived from Propylene are a crucial factor in the production of a diverse range of products that we use in our everyday life. These chemicals are used in the production of films, fibers, containers, packaging materials and caps and closures to demonstrate the significance and usefulness of Propylene in modern industry. Let us explore the role of Propylene in various industries and the new solutions it inspires.

Introduction

Propene, also referred to as Propylene, serves as a crucial building block akin to ethene, particularly in the production of poly(propene) or Polypropylene. Unlike ethene, propene readily participates in substitution reactions, yielding a diverse array of significant chemicals. Its primary applications include the production of Polypropylene, acrolein, acrylonitrile, cumene, Propylene oxide, and butanal. These derivatives are instrumental in the manufacturing of acrylic polymers, phenol, acetone, polyurethanes, and surface coating solvents, showcasing propene's pivotal role in various industrial processes and product formulations.

Manufacturing Process

The production of Propylene is not direct, but indirectly through various other major industrial processes. Here are the two main ways Propylene is produced:

Steam Cracking: This is one of the largest processes accountings for the bulk of Propylene in the world today. Steam cracking is a process in which heavier hydrocarbons such as naphtha or natural gas liquids are cracked in a cracking furnace at high temperatures and with the use of steam. This process produces a mixture of several hydrocarbons with different chain lengths – the main product is ethylene and Propylene as a by-product.

Fluid Catalytic Cracking (FCC): This process is carried out in FCC units in refineries. FCC is mainly used to upgrade heavier gas oil from crude oil into gasoline. This process also produces a lighter stream of byproducts consisting of Propylene and other hydrocarbons. The significance of FCC as a Propylene source is expanding because it can process different feedstocks and likely to meet the growing Propylene demand.

Steam Cracking Units

The steam cracking process plays a pivotal role in the petrochemical sector, serving as the primary method for producing light olefins like ethylene and Propylene. It involves thermal cracking, utilizing either gas or naphtha, to generate these olefins. This review focuses on the naphtha steam cracking process, which primarily involves straight run naphtha sourced from crude oil distillation units. To qualify as petrochemical naphtha, the stream typically requires a high paraffin content, exceeding 66%.

Cracking reactions take place within the furnace tubes, and a significant concern and constraint for the operational lifespan of steam cracking units is the formation of coke deposits in these tubes. These reactions occur at elevated temperatures, typically ranging from 500°C to 700°C, depending on the feedstock's properties. For heavier feeds like gas oil, lower temperatures are employed to minimize coke formation.

The steam cracking process is characterized by high temperatures and short residence times. While the primary focus of a naphtha steam cracking unit is typically ethylene production, the yield of Propylene in such units can reach up to 15%.

Fluid Catalytic Cracking (FCC)

Presently, a significant portion of the Propylene market relies on steam cracking units for supply. However, a considerable share of the global Propylene demand stems from the separation of LPG generated in Fluid Catalytic Cracking Units (FCC).

Typically, LPG generated in FCC units contains approximately 30% Propylene, and the added value of Propylene is nearly 2.5 times that of LPG. In local markets, the installation of Propylene separation units proves to be a financially rewarding investment. However, a drawback of separating Propylene from LPG is that it results in a heavier fuel, causing specification issues, particularly in colder regions. In such cases, alternatives include segregating the butanes and redirecting them to the gasoline pool, adding propane to the LPG, or supplementing LPG with natural gas. It's important to note that some of these alternatives may decrease the availability of LPG, which could pose a significant constraint based on market demand.

A challenge in Propylene production lies in the separation of propane and Propylene, a task complicated by their close relative volatility of approximately 1.1. Traditional distillation methods struggle due to this narrow gap, necessitating distillation columns with numerous equilibrium stages and high internal reflux flow rates.

Two primary technologies employed for Propylene-propane separation are Heat-Pump and High Pressure configurations. The High Pressure approach relies on conventional separation methods, requiring sufficient pressure to condense products at ambient temperature, with a reboiler utilizing steam or another heat source. However, this method's reliance on low-pressure steam availability in refining hardware can be limiting. Alternatively, the Heat-Pump technology utilizes the heat from condensing top products in the reboiler, effectively combining the reboiler and condenser into a single unit. To address non-idealities, an auxiliary condenser with cooling water may be installed.

Implementing Heat-Pump technology enables a reduction in operating pressure from approximately 20 bar to 10 bar, thereby increasing the relative volatility of Propylene-propane and simplifying the separation process. Typically, Heat-Pump technology proves more attractive when distillation becomes challenging, particularly when relative volatilities are below 1.5.

Several variables must be considered when selecting the optimal technology for Propylene separation, including utility availability, temperature differentials in the column, and installation costs.

Propylene produced in refineries typically adheres to specific grades: Polymer grade, with a minimum purity of 99.5%, is directed towards the Polypropylene market, while Chemical grade, with purities ranging from 90 to 95%, is allocated for other applications. A comprehensive process flow diagram for a standard Propylene separation unit utilizing Heat-Pump configuration is illustrated in the following Figure.

The LPG extracted from the FCC unit undergoes a series of separation processes to isolate the light fraction, primarily comprising propane and Propylene. This fraction is then directed to a deethanizer column, while the heavier fraction, containing butanes, is either routed to the LPG or gasoline pool, depending on refinery configuration. The lighter fraction from the deethanizer column is often recycled back to the FCC unit for incorporation into the refinery fuel gas pool. Alternatively, it may be directed to petrochemical plants for the recovery of light olefins, particularly ethylene. The bottom fraction from the deethanizer column undergoes further separation in the C3 splitter column to separate propane and Propylene. Propane is recovered from the bottom of the C3 splitter and sent to the LPG pool, while Propylene is directed to the Propylene storage park. Before processing, the feed stream undergoes a caustic wash treatment to remove contaminants, such as carbonyl sulfide (COS), which can adversely affect petrochemical processes and may be produced in the FCC unit through the reaction between carbon monoxide and sulfur in the Riser.

Major Technologies Used for Producing Propylene

Process: OCT Process

Lummus Technology, one of the leading technology providers, presents two deliberate pathways to Propylene: Olefins Conversion Technology (OCT), which employs olefins metathesis, and CATOFIN propane dehydrogenation.

Traditionally, commercial on-purpose Propylene production methods have contributed to less than 5% of the global Propylene output, with the majority sourced as a by-product of steam crackers and fluid catalytic cracking (FCC) units.

Through the OCT process, low- value butylenes are subjected to reaction with ethylene to yield Propylene. The ethylene feedstock can range from diluted ethylene, typical of an FCC unit, to polymer-grade ethylene. Potential C4 feedstocks encompass mixed C4s generated in steam cracking, raffinate C4s from MTBE or butadiene extraction, and C4s produced within an FCC unit.

The ultra-high purity Propylene yielded by the OCT process surpasses polymer-grade specifications and promises potential cost savings in downstream Polypropylene facilities.

The mixture of ethylene feed and recycled ethylene is combined with the C4/C5 feed and recycled butenes/pentenes, and then heated before entering the fixed-bed metathesis reactor. Within the reactor, the catalyst facilitates the reaction of ethylene with butene-2 to produce Propylene, and the conversion of ethylene and pentenes to Propylene and butenes, while also isomerizing butene-1 to butene-2. Some coke buildup occurs on the catalyst, necessitating periodic regeneration of the beds using nitrogen-diluted air. The process is engineered for high utilization of olefins, typically ranging from 90 to 97%, with a Propylene selectivity of around 94 to 95%. After cooling and fractionation to remove ethylene for recycling, a portion of the recycle stream is purged to eliminate methane, ethane, and other light impurities. The bottoms from the ethylene column are directed to the Propylene column, where butenes/pentenes are separated for recycling to the reactor, and some are purged to eliminate unreacted butenes, isobutenes, butanes, unreacted pentenes, isopentenes, pentanes, and heavier compounds from the process. The overhead product from the Propylene column constitutes high-purity, polymer-grade Propylene.

Applications of Propylene

Polypropylene

The vast majority of Propylene, a key industrial ingredient, goes into making Polypropylene. This versatile plastic is used in everything from clothes and water bottles to patio furniture and countless other items. The most prominent among Propylene’s stars is Polypropylene (PP). This is a strong plastic that is used in packaging and is significantly lightweight. PP dominates the food container and beverage bottle market as well as the textile bag and carpet industry. It is resistant to moisture, chemicals, and heat that makes it ideal for food packaging and protecting some items when being transported. And its price makes it the first choice of the manufacturers.

Cumene

Cumene, a crucial intermediate compound, is predominantly synthesized through the Friedel-Crafts alkylation process involving Propylene and Benzene. This organic chemical holds significant value and finds widespread application in various products including plastics, pharmaceuticals, and adhesives. Moreover, cumene's exceptional solvency properties make it a preferred solvent in formulations for paints, inks, and cleaners. Its derivatives play a pivotal role in the production of polymers such as PET and polycarbonates, essential materials utilized in packaging, electronics, and construction industries. Additionally, cumene serves as an effective octane booster in gasoline, enhancing combustion efficiency and engine performance while reducing exhaust emissions.

Oxo Alcohol

Oxo alcohols form an important class of chemical intermediates that are used to produce plasticizers, coatings, and detergents. Oxo alcohols are used in a wide variety of industries from plastics and coatings to pharmaceuticals and cosmetics industries thus emphasizing their significance in various industrial processes.

Isopropanol