#REST API trading

Explore tagged Tumblr posts

Text

In the fast-paced world of trading, the integration of REST APIs with trading algorithms has become an essential tool for traders looking to enhance their strategies. REST APIs, or Representational State Transfer Application Programming Interfaces, allow seamless communication between different software applications. When integrated with trading algorithms, REST APIs enable traders to automate processes, access real-time data, and execute trades more efficiently.

0 notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case:

A trading bot can automatically place orders when specific market criteria are met, eliminating the need for manual intervention.

3. Multi-Exchange Connectivity

Crypto APIs allow platforms to connect with multiple exchanges, aggregating liquidity and providing users with the best trading options.

Use Case:

Traders can access a broader range of cryptocurrencies and trading pairs without switching between platforms.

4. Enhanced User Experience

By integrating APIs, businesses can offer features like secure wallet connections, fast transaction processing, and detailed analytics, improving the overall user experience.

Use Case:

Users can track their portfolio performance in real-time and manage assets directly through the platform.

5. Increased Scalability

API integration allows trading platforms to handle a higher volume of users and transactions efficiently, ensuring smooth operations during peak trading hours.

Use Case:

Exchanges can scale seamlessly to accommodate growth in user demand.

Essential Features of Crypto Exchange API Integration

1. Trading Functionality

APIs must support core trading actions, such as placing market and limit orders, canceling trades, and retrieving order statuses.

2. Wallet Integration

Securely connect wallets for seamless deposits, withdrawals, and balance tracking.

3. Market Data Access

Provide real-time updates on cryptocurrency prices, trading volumes, and historical data for analysis.

4. Account Management

Allow users to manage their accounts, view transaction history, and set preferences through the API.

5. Security Features

Integrate encryption, two-factor authentication (2FA), and API keys to safeguard user data and funds.

Steps to Integrate Crypto Exchange APIs

1. Define Your Requirements

Determine the functionalities you need, such as trading, wallet integration, or market data retrieval.

2. Choose the Right API Provider

Select a provider that aligns with your platform’s requirements. Popular providers include:

Binance API: Known for real-time data and extensive trading options.

Coinbase API: Ideal for wallet integration and payment processing.

Kraken API: Offers advanced trading tools for institutional users.

3. Implement API Integration

Use REST APIs for basic functionalities like fetching market data.

Implement WebSocket APIs for real-time updates and faster trading processes.

4. Test and Optimize

Conduct thorough testing to ensure the API integration performs seamlessly under different scenarios, including high traffic.

5. Launch and Monitor

Deploy the integrated platform and monitor its performance to address any issues promptly.

Challenges in Crypto Exchange API Integration

1. Security Risks

APIs are vulnerable to breaches if not properly secured. Implement robust encryption, authentication, and monitoring tools to mitigate risks.

2. Latency Issues

High latency can disrupt real-time trading. Opt for APIs with low latency to ensure a smooth user experience.

3. Regulatory Compliance

Ensure the integration adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

The Role of Crypto Exchange Platform Development Services

Partnering with a professional crypto exchange platform development service ensures your platform leverages the full potential of API integration.

What Development Services Offer:

Custom API Solutions: Tailored to your platform’s specific needs.

Enhanced Security: Implementing advanced security measures like API key management and encryption.

Real-Time Capabilities: Optimizing APIs for high-speed data transfers and trading.

Regulatory Compliance: Ensuring the platform meets global legal standards.

Scalability: Building infrastructure that grows with your user base and transaction volume.

Real-World Examples of Successful API Integration

1. Binance

Features: Offers REST and WebSocket APIs for real-time market data and trading.

Impact: Enables developers to build high-performance trading bots and analytics tools.

2. Coinbase

Features: Provides secure wallet management APIs and payment processing tools.

Impact: Streamlines crypto payments and wallet integration for businesses.

3. Kraken

Features: Advanced trading APIs for institutional and professional traders.

Impact: Supports multi-currency trading with low-latency data feeds.

Conclusion

Crypto exchange API integration is a game-changer for businesses looking to streamline trading processes and enhance user experience. From enabling real-time data access to automating trades and managing wallets, APIs unlock endless possibilities for innovation in cryptocurrency trading platforms.

By partnering with expert crypto exchange platform development services, you can ensure secure, scalable, and efficient API integration tailored to your platform’s needs. In the ever-evolving world of cryptocurrency, seamless API integration is not just an advantage—it’s a necessity for staying ahead of the competition.

Are you ready to take your crypto exchange platform to the next level?

#cryptocurrencyexchange#crypto exchange platform development company#crypto exchange development company#white label crypto exchange development#cryptocurrency exchange development service#cryptoexchange

2 notes

·

View notes

Text

I decided to make this blog as a blueprint for someone like me. Someone who has dreams of financial freedom, as well as freedom of time. Someone who wants a life where they can spend time with their family and show up in the ways needed by their kids but also needs to put food on the table and pay for vacations. If you just heard about bug bounty, cyber security, web penetration testing, red teaming, or any other number of terms used and feel like it might be a good fit for you, I'm going to spend the rest of my very first post telling you why you're wrong. If by the end of it you disagree with me, you're probably cut out to be a hacker. My opinion is specific to hacking web applications, and I consider myself a future specialist in API hacking. Firstly hacking websites is extremely technical. Even a basic understanding of how a full stack application functions requires you to have a basic understanding of about 3-5 programming languages, and how they all interact with each other. Beyond that you need to understand the hardware at play these various languages are using to talk with. I'm using extremely simple terms here but hopefully you get the idea. Developing a hackers mindset I honestly think just isn't for everyone. I don't care what anyone says I believe there is a certain amount of emotional maturity required to be a successful hacker. I say this because the process of developing the skills I just mentioned takes a long time. For a genius I'd expect at least a year of dedicated study to become a credited rookie hacker. You don't just need to be intelligent though, you need to be a good learner. Cyber Security is a constantly evolving field that demands you be a life long student. If you don't love it, you'll burn out fast. You're also up against AI, so you better be ready to be a pro if you wanna make it. This means discipline despite motivation. Further proof of the requirement for emotional maturity. Additionally you're not gonna see much fruit from your labor for quite some time. You won't make money along the way as you acquire this skill. If that's what you're after, go learn a trade. If after reading this you're thinking something like "I don't care, I still want to learn," congrats. You're probably gonna be a great hacker. In my next few posts I'll talk about important first steps, and how to take them. If you read this far, I love you.

2 notes

·

View notes

Text

What Web Development Companies Do Differently for Fintech Clients

In the world of financial technology (fintech), innovation moves fast—but so do regulations, user expectations, and cyber threats. Building a fintech platform isn’t like building a regular business website. It requires a deeper understanding of compliance, performance, security, and user trust.

A professional Web Development Company that works with fintech clients follows a very different approach—tailoring everything from architecture to front-end design to meet the demands of the financial sector. So, what exactly do these companies do differently when working with fintech businesses?

Let’s break it down.

1. They Prioritize Security at Every Layer

Fintech platforms handle sensitive financial data—bank account details, personal identification, transaction histories, and more. A single breach can lead to massive financial and reputational damage.

That’s why development companies implement robust, multi-layered security from the ground up:

End-to-end encryption (both in transit and at rest)

Secure authentication (MFA, biometrics, or SSO)

Role-based access control (RBAC)

Real-time intrusion detection systems

Regular security audits and penetration testing

Security isn’t an afterthought—it’s embedded into every decision from architecture to deployment.

2. They Build for Compliance and Regulation

Fintech companies must comply with strict regulatory frameworks like:

PCI-DSS for handling payment data

GDPR and CCPA for user data privacy

KYC/AML requirements for financial onboarding

SOX, SOC 2, and more for enterprise-level platforms

Development teams work closely with compliance officers to ensure:

Data retention and consent mechanisms are implemented

Audit logs are stored securely and access-controlled

Reporting tools are available to meet regulatory checks

APIs and third-party tools also meet compliance standards

This legal alignment ensures the platform is launch-ready—not legally exposed.

3. They Design with User Trust in Mind

For fintech apps, user trust is everything. If your interface feels unsafe or confusing, users won’t even enter their phone number—let alone their banking details.

Fintech-focused development teams create clean, intuitive interfaces that:

Highlight transparency (e.g., fees, transaction histories)

Minimize cognitive load during onboarding

Offer instant confirmations and reassuring microinteractions

Use verified badges, secure design patterns, and trust signals

Every interaction is designed to build confidence and reduce friction.

4. They Optimize for Real-Time Performance

Fintech platforms often deal with real-time transactions—stock trading, payments, lending, crypto exchanges, etc. Slow performance or downtime isn’t just frustrating; it can cost users real money.

Agencies build highly responsive systems by:

Using event-driven architectures with real-time data flows

Integrating WebSockets for live updates (e.g., price changes)

Scaling via cloud-native infrastructure like AWS Lambda or Kubernetes

Leveraging CDNs and edge computing for global delivery

Performance is monitored continuously to ensure sub-second response times—even under load.

5. They Integrate Secure, Scalable APIs

APIs are the backbone of fintech platforms—from payment gateways to credit scoring services, loan underwriting, KYC checks, and more.

Web development companies build secure, scalable API layers that:

Authenticate via OAuth2 or JWT

Throttle requests to prevent abuse

Log every call for auditing and debugging

Easily plug into services like Plaid, Razorpay, Stripe, or banking APIs

They also document everything clearly for internal use or third-party developers who may build on top of your platform.

6. They Embrace Modular, Scalable Architecture

Fintech platforms evolve fast. New features—loan calculators, financial dashboards, user wallets—need to be rolled out frequently without breaking the system.

That’s why agencies use modular architecture principles:

Microservices for independent functionality

Scalable front-end frameworks (React, Angular)

Database sharding for performance at scale

Containerization (e.g., Docker) for easy deployment

This allows features to be developed, tested, and launched independently, enabling faster iteration and innovation.

7. They Build for Cross-Platform Access

Fintech users interact through mobile apps, web portals, embedded widgets, and sometimes even smartwatches. Development companies ensure consistent experiences across all platforms.

They use:

Responsive design with mobile-first approaches

Progressive Web Apps (PWAs) for fast, installable web portals

API-first design for reuse across multiple front-ends

Accessibility features (WCAG compliance) to serve all user groups

Cross-platform readiness expands your market and supports omnichannel experiences.

Conclusion

Fintech development is not just about great design or clean code—it’s about precision, trust, compliance, and performance. From data encryption and real-time APIs to regulatory compliance and user-centric UI, the stakes are much higher than in a standard website build.

That’s why working with a Web Development Company that understands the unique challenges of the financial sector is essential. With the right partner, you get more than a website—you get a secure, scalable, and regulation-ready platform built for real growth in a high-stakes industry.

0 notes

Text

Best API of Horse Racing for Betting Platforms: Live Odds, Data Feeds & Profits Unlocked

Discover the most accurate and profitable API of horse racing with live odds, betting data feeds, and fast integration. Ideal for UK/USA markets and fantasy apps.

Introduction: Why Accurate Horse Racing APIs Matter in 2025

In the competitive world of sports betting and fantasy gaming, milliseconds and margins matter. When it comes to horse racing, success hinges on real-time, trustworthy data and sharp odds. Whether you run a betting exchange, fantasy app, or affiliate site, using the right horse racing API can mean the difference between profit and failure.

The API of horse racing offered by fantasygameprovider.com is engineered to meet this demand—providing live horse racing odds, race entries, results, and predictive analytics that align perfectly with the betting industry’s needs.

What Is a Horse Racing API?

A horse racing API is a service that delivers structured, real-time horse racing data to apps, websites, and betting platforms. This includes:

Live race updates

Racecard entries & scratchings

Odds feed (fixed & fluctuating)

Final results with payout info

Jockey, trainer, and form data

These are typically delivered in JSON or XML formats, allowing seamless integration with sportsbooks, exchanges, or fantasy game engines.

📊 Who Needs Horse Racing APIs?

Audience

Use Case

Betting Sites

Deliver live odds, matchups, and payouts.

Fantasy Sports Platforms

Use live feeds to auto-update scores & leaderboards.

Betting Tipsters/Affiliates

Showcase predictive models based on fresh data.

Mobile Apps

Enable live race streaming with betting APIs.

Trading Bots

Automate wagers with low-latency horse racing data.

Why Choose FantasyGameProvider’s Horse Racing API?

Unlike basic feeds, our API is tailored for commercial use. Here's why it stands out:

Feature

FantasyGameProvider

Other APIs

Live Odds Feed

✅ Updated in <2s

⚠️ 5–15s delay

Global Racing

✅ UK, USA, AUS, HK

⚠️ Limited coverage

Data Format

✅ JSON + XML

⚠️ JSON only

Accuracy

✅ Enterprise-Grade (99.9%)

⚠️ Variable

Predictive Insights

✅ AI-Driven Models

❌ Not Included

Betting Integration

✅ Easy with Betfair, SBTech

⚠️ Manual setup required

Our horse racing odds API not only mirrors UK and USA live betting markets, but also lets you build automated bet triggers and smart notifications for sharp edge betting.

💸 How Betting Businesses Profit with Horse Racing APIs

If you're running a betting website or fantasy sports app, here's how the API of horse racing can boost your ROI:

Real-time updates = More active users

Faster odds delivery = Better arbitrage potential

Accurate results = Fewer payout disputes

Live data = Higher session times (ideal for monetizing with ads)

Custom alerts = VIP features for paid subscribers

Fantasygameprovider.com also allows white-label API integration to match your brand.

How to Choose the Right Horse Racing API – Checklist ✅

Make sure your API includes the following:

✅ Live odds feed with fast refresh rate (sub-2 seconds ideal)

✅ Coverage of all major race tracks (UK, USA, AUS)

✅ Reliable JSON & XML format

✅ Built-in historical data & form guide

✅ Scalable architecture for high traffic

✅ Supports Betfair, Oddschecker, and other exchanges

✅ Licensed data provider

Our API meets all these criteria and goes further by offering automated betting signals and predictive race modeling—key for next-gen apps.

Betfair API vs FantasyGameProvider: Which Is Better?

Feature

Betfair API

FantasyGameProvider

Odds Feed

Excellent (exchange-based)

Excellent (market + exchange)

Historical Data

Partial

Full form + performance stats

Developer Simplicity

Moderate

Plug-and-play REST endpoints

Support

Community-based

24/7 Support

Customization

Limited

High (webhooks, triggers, filters)

Pricing

Tiered

Affordable & negotiable plans

Conclusion: If you want full access to live odds, race data, and fast integration without the steep learning curve, fantasygameprovider.com offers better developer flexibility and betting UX.

Data Feeds You Get with Our Horse Racing API

Racecards & scratchings feed

Real-time results feed

Odds feed (fixed, fluctuating, exchange-compatible)

Form & stats feed

Track conditions feed

Horse/jockey/trainer history feed

Automated alerts for betting patterns

Formats available: JSON horse racing data & horse racing XML feed.

FAQs: Betting-Focused Horse Racing API Questions

Q1. Which is the most accurate horse racing API in 2025?

FantasyGameProvider offers 99.9% accuracy with sub-2-second update latency, ideal for professional and retail bettors alike.

Q2. Can I use this API for UK and USA horse racing?

Yes, our UK racing odds data and USA racing API are both available with full schedule and live result support.

Q3. Is your horse racing API suitable for Betfair automation?

Absolutely. Many of our clients use it to build Betfair trading bots using our odds feed and predictive race data.

Q4. Do you offer free trials or sandbox testing?

Yes. Developers can access a sandbox environment to test endpoints before committing.

Q5. What’s the difference between JSON and XML feeds?

JSON is faster and easier to integrate, while XML is preferred for legacy systems. We offer both to suit all tech stacks.

🚀 Start Winning with the Best API of Horse Racing

If you’re serious about building a winning betting platform, profitable tipster site, or a fantasy sports engine, you need the most accurate and commercial-ready API in the industry.

At fantasygameprovider.com, we give you everything:

✅ Live odds ✅ Fast results ✅ Race cards ✅ Predictive models ✅ Betfair compatibility ✅ Global reach (UK, USA, AUS, more)

👉 Ready to dominate the betting space with live horse racing data? Visit fantasygameprovider.com and request your API demo today.

#live cricket odds api#sports betting#betting#bettingapi#fantasygameprovider#Live odds#API of Horse Racing#UK racing odds data#Betfair#Real-time results feed#Betfair API

0 notes

Text

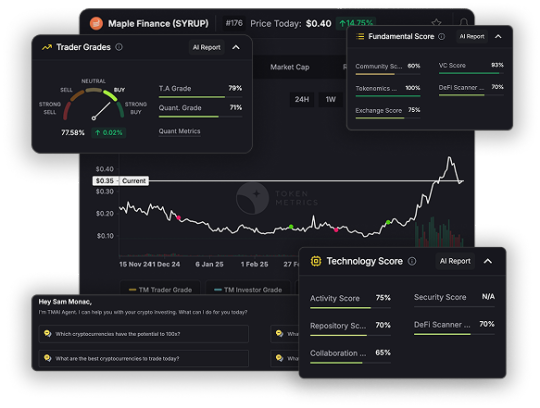

The Future of Crypto APIs: Why Token Metrics Leads the Pack

In this article, we’ll explore why Token Metrics is the future of crypto APIs, and how it delivers unmatched value for developers, traders, and product teams.

More Than Just Market Data

Most crypto APIs—like CoinGecko, CoinMarketCap, or even exchange-native endpoints—only give you surface-level data: prices, volume, market cap, maybe order book depth crypto trading. That’s helpful… but not enough.

Token Metrics goes deeper:

Trader and Investor Grades (0–100)

Bullish/Bearish market signals

Support/Resistance levels

Real-time sentiment scoring

Sector-based token classification (AI, RWA, Memes, DeFi)

Instead of providing data you have to interpret, it gives you decisions you can act on.

⚡ Instant Intelligence, No Quant Team Required

For most platforms, building actionable insights on top of raw market data requires:

A team of data scientists

Complex modeling infrastructure

Weeks (if not months) of development

With Token Metrics, you skip all of that. You get:

Pre-computed scores and signals

Optimized endpoints for bots, dashboards, and apps

AI-generated insights as JSON responses

Even a solo developer can build powerful trading systems without ever writing a prediction model.

🔄 Real-Time Signals That Evolve With the Market

Crypto moves fast. One minute a token is mooning, the next it’s bleeding.

Token Metrics API offers:

Daily recalculated grades

Real-time trend flips (bullish ↔ bearish)

Sentiment shifts based on news, social, and on-chain data

You’re never working with stale data or lagging indicators.

🧩 Built for Integration, Built for Speed

Unlike many APIs that are bloated or poorly documented, Token Metrics is built for builders.

Highlights:

Simple REST architecture (GET endpoints, API key auth)

Works with Python, JavaScript, Go, etc.

Fast JSON responses for live dashboards

5,000-call free tier to start building instantly

Enterprise scale for large data needs

Whether you're creating a Telegram bot, a DeFi research terminal, or an internal quant dashboard, TM API fits right in.

🎯 Use Cases That Actually Matter

Token Metrics API powers:

Signal-based alert systems

Narrative-tracking dashboards

Token portfolio health scanners

Sector rotation tools

On-chain wallets with smart overlays

Crypto AI assistants (RAG, GPT, LangChain agents)

It’s not just a backend feed. It’s the core logic engine for intelligent crypto products.

📈 Proven Performance

Top funds, trading bots, and research apps already rely on Token Metrics API. The AI grades are backtested, the signals are verified, and the ecosystem is growing.

“We plugged TM’s grades into our entry logic and saw a 25% improvement in win rates.” — Quant Bot Developer

“It’s like plugging ChatGPT into our portfolio tools—suddenly it makes decisions.” — Web3 Product Manager

🔐 Secure, Stable, and Scalable

Uptime and reliability matter. Token Metrics delivers:

99.9% uptime

Low-latency endpoints

Strict rate limiting for abuse prevention

Scalable plans with premium SLAs

No surprises. Just clean, trusted data every time you call.

💬 Final Thoughts

Token Metrics isn’t just the best crypto API because it has more data. It’s the best because it delivers intelligence. It replaces complexity with clarity, raw numbers with real signals, and guesswork with action.In an industry that punishes delay and indecision, Token Metrics gives builders and traders the edge they need—faster, smarter, and more efficiently than any other API in crypto.

0 notes

Text

Simplify Business Verification with GST Verification API by NifiPayments

In today’s fast-paced digital economy, businesses must verify their partners, vendors, and customers quickly and accurately to ensure compliance, reduce fraud, and streamline operations. One of the most essential verifications for businesses in India is the GST (Goods and Services Tax) verification.

That’s where NifiPayments GST Verification API comes in—providing a reliable, real-time solution for businesses to validate GST numbers (GSTIN) directly from the GSTN (Goods and Services Tax Network) database.

🔍 What is GST Verification API?

GST Verification API is a secure and robust tool that allows businesses to instantly validate a GST number and retrieve detailed taxpayer information such as:

Registered legal name of the business

Trade name

GST registration status

Constitution of business

Registration date

Nature of business (taxpayer, composition dealer, etc.)

⚙️ Key Features of NifiPayments GST Verification API:

✅ Real-Time GSTIN Validation Validate GST numbers on the fly, ensuring data accuracy and regulatory compliance.

✅ Data Directly from GSTN Information is fetched from the official GST portal, ensuring legitimacy and authenticity.

✅ Seamless API Integration Our easy-to-integrate RESTful API allows you to plug into your existing platforms with minimal effort.

✅ Bulk Verification Support Need to verify hundreds of GST numbers? Our bulk verification feature makes large-scale processing simple and efficient.

✅ Reduces Fraud & Enhances KYC Helps detect fake GST numbers, ensuring you deal only with compliant and verified businesses.

💼 Use Cases

Fintech & NBFCs – Streamline business loan KYC and reduce onboarding time.

Marketplaces & Aggregators – Verify sellers and service providers before listing.

Accounting & ERP Software – Automate GST validations within your software suite.

Logistics & Supply Chain – Ensure GST-compliant vendors and reduce tax risks.

🛡️ Why Choose NifiPayments?

NifiPayments is committed to simplifying financial infrastructure for businesses with scalable, secure, and developer-friendly APIs. With our GST Verification API, you not only save time but also improve operational efficiency and reduce regulatory risks.

🚀 Ready to Integrate?

Accelerate your business with automated GST verification.

👉 Contact us today to get started with NifiPayments GST Verification API. 🌐 [www.nifipayments.com]

0 notes

Text

Unlock the Power of Real-Time Stock Data & AI Predictions with Alltick’s APIs

In today’s fast-moving financial markets, having access to real-time stock data and AI-driven stock predictions can make the difference between missed opportunities and smart, profitable trades. At Alltick, we provide cutting-edge Stock Real-Time API and Stock Prediction API solutions designed to empower traders, investors, and fintech developers with the tools they need to stay ahead.

Why Choose Alltick’s Stock APIs?

1. Stock Real-Time API – Instant Market Data at Your Fingertips

Our Stock Real-Time API delivers ultra-low latency market data, ensuring you get the latest prices, volume, and order book updates as they happen. Whether you're building a trading platform, a portfolio tracker, or conducting high-frequency analysis, our API offers:

Global market coverage (stocks, ETFs, indices, and more)

Millisecond-level latency for real-time decision-making

Reliable & scalable infrastructure to handle high-frequency requests

Easy integration with RESTful & WebSocket endpoints

2. Stock Prediction API – AI-Powered Market Insights

Predicting stock movements is no longer just for hedge funds. Our Stock Prediction API leverages machine learning and quantitative analysis to provide actionable forecasts, including:

Short-term & long-term price predictions

Trend analysis & volatility indicators

Sentiment analysis from news & social media

Customizable models to fit your trading strategy

Who Can Benefit from Alltick’s APIs?

Day Traders & Algorithmic Traders – Execute strategies faster with real-time data and predictive signals.

Fintech Startups & Developers – Build advanced trading apps, robo-advisors, or analytics dashboards.

Investment Firms & Hedge Funds – Enhance decision-making with AI-driven insights.

Retail Investors – Gain an edge with professional-grade tools.

Get Started Today!

Alltick’s Stock Real-Time API and Stock Prediction API are designed for performance, accuracy, and ease of use. Whether you're a developer, trader, or financial institution, our APIs provide the market intelligence you need to succeed.

Stay ahead of the market with Alltick – Where Data Meets Intelligence. 🚀

1 note

·

View note

Text

Revolutionize Your Trading with Alltick’s Ultra-Fast Market Data API

In the world of finance, speed is everything. A fraction of a second can mean the difference between a winning trade and a missed opportunity. While legacy data providers like Bloomberg Terminal and Reuters Eikon have dominated the market, their high costs and complex infrastructures make them inaccessible for many traders and firms.

Alltick’s Market Data API changes the game—delivering real-time, low-latency stock, forex, and crypto data at a fraction of the cost, without compromising on speed or reliability.

Why Alltick Beats Traditional Market Data Providers

✔ True Real-Time Feeds – No delays, no batch updates. Get tick-by-tick data with millisecond-level precision. ✔ Global Market Coverage – Seamless access to NYSE, NASDAQ, HKEX, LSE, Forex, and Crypto markets in one unified API. ✔ Built for High-Frequency Trading (HFT) – Optimized WebSocket & FIX protocols ensure ultra-low latency execution. ✔ Enterprise-Grade Infrastructure – 99.99% uptime with redundant data centers for uninterrupted trading. ✔ Developer-Friendly Integration – SDKs for Python, Java, C++, and C#, plus clean, well-documented APIs.

Who Needs Alltick’s Real-Time Market Data?

🔹 Quantitative & Algo Traders – Backtest and deploy strategies with real-time order book & tick data. 🔹 Fintech Startups & Robo-Advisors – Power your platform with institutional-grade data without the Bloomberg price tag. 🔹 Hedge Funds & Prop Firms – Gain an edge with ultra-fast execution & depth-of-market insights. 🔹 Retail Traders & Investors – Access professional-level data previously reserved for Wall Street elites.

Key Features That Set Alltick Apart

1. Lightning-Fast Data Delivery

WebSocket API – Stream live prices, trades, and order book updates in real time.

FIX Protocol – Ideal for automated trading systems requiring microsecond-level precision.

REST API – Retrieve historical data, snapshots, and fundamentals with ease.

2. Comprehensive Asset Coverage

Stocks & ETFs (US, EU, APAC markets)

Forex (Major, minor, and exotic pairs)

Cryptocurrencies (Spot & derivatives)

Options & Futures (Live pricing & volatility data)

3. Cost-Efficient Pricing

Unlike Bloomberg or Reuters, which charge thousands per month, Alltick offers scalable pricing suitable for:

Retail traders who need real-time data without the high costs.

Institutional firms looking to reduce data vendor expenses.

Fintech developers building next-gen trading platforms.

Upgrade from Legacy Data Providers

Why pay premium prices for outdated systems? Alltick delivers: ✅ Faster data than Bloomberg Terminal & Reuters Eikon ✅ More affordable than IQFeed & Interactive Brokers ✅ More flexible than traditional vendor lock-in solutions

Get Started Risk-Free

🚀 Try Alltick’s API for Free – Experience the power of real-time, low-latency market data today.

0 notes

Text

Top API Service Providers in Delhi with Best Customized Solution in Delhi

In the digital era, where speed, security, and customer experience define success, businesses in finance, trading, and technology need robust backend integrations and seamless customer onboarding. From API integration services in Delhi to KYC solutions for stock brokers, India’s tech ecosystem is evolving rapidly—and Delhi is at the heart of it.

Whether you’re launching a trading app, offering mutual fund investment plans, or looking to streamline KYC through WhatsApp, here’s a comprehensive look at the best service providers leading this transformation.

Top API Service Providers in Delhi

APIs are the backbone of modern digital infrastructure. The top API service providers in Delhi offer:

Custom API development

Integration with third-party apps (CRM, ERP, payment gateways)

Secure and scalable architecture

Support for REST, SOAP, and GraphQL

These providers empower fintechs, e-commerce platforms, and investment firms to automate operations, synchronize data in real time, and deliver better customer experiences.

API Integration Services in Delhi

With growing demands for digital transformation, API integration services in Delhi are helping companies:

Connect legacy systems with modern platforms

Automate onboarding, transaction, and reporting processes

Enable faster and more reliable workflows

These services are especially valuable for fintechs, trading platforms, and wealth management firms looking to stay agile and compliant.

Customer Support Services in Delhi

As digital businesses scale,customer support services in delhi ensuring consistent support becomes crucial. include:

Multichannel support (phone, email, WhatsApp, chat)

AI-powered bots for instant resolution

CRM and helpdesk integration

Outsourced support teams for 24/7 coverage

This helps businesses improve user satisfaction, reduce churn, and streamline communication especially important for trading apps and financial services.

Top CRM Solution Providers in Delhi

The top CRM solution providers in Delhi offer cloud-based and custom-built CRMs that help businesses:

Track leads, sales, and customer interactions

Automate follow-ups and marketing workflows

Integrate with KYC, support, and API systems

Drive better decision-making with real-time insights

These CRMs are critical for managing customer relationships in high-touch sectors like finance, insurance, real estate, and education.

Customized Solution Providers in Delhi

Every business has unique needs. Leading firms offering customized solutions in Delhi provide:

Tailored fintech platforms

CRM and ERP development

KYC and onboarding systems

API and WhatsApp integrations

These companies bridge the gap between off-the-shelf software and enterprise-specific workflows, helping businesses scale more efficiently.

Trading App Development Company in Delhi

With India’s retail trading boom, the demand for modern, intuitive trading platforms has skyrocketed. A leading trading app development company in Delhi typically offers:

Real-time data feeds

Seamless UI/UX for mobile and web

Integration with stock exchanges and brokers (NSE, BSE)

Secure, scalable backend infrastructure

These apps support both beginners and active traders, making investing more accessible across India.

Investment Solutions Company in India

For those looking to grow wealth, partnering with an experienced investment solutions company in India is key. These firms offer:

Personalized financial planning

Portfolio management tools

SIP calculators and fund recommendations

Integration with mutual fund and insurance platforms

Whether you’re a beginner or a seasoned investor, these companies provide digital-first solutions that align with your financial goals.

Mutual Fund Investment Plan in India

Digital platforms offering mutual fund investment plans in India now enable users to:

Start SIPs in minutes

Complete eKYC online

Compare and track funds in real time

Get expert-curated fund baskets

Many platforms now integrate WhatsApp for onboarding and notifications, offering a mobile-friendly user experience.

WhatsApp eKYC Online: Fast, Familiar & Frictionless

India’s most popular messaging app is also becoming a powerful business tool. With WhatsApp eKYC online, users can:

Complete their KYC directly via chat

Upload documents securely

Receive instant confirmation

Integrate with CRMs and trading platforms

This method boosts onboarding rates and simplifies compliance for businesses in finance and stock trading.

One KYC Solution in India

A one kyc solution in delhi lets users verify their identity once and access multiple services—be it mutual funds, trading, or loans.

Benefits include:

Faster user onboarding

Reduced friction for repeat users

Greater trust and transparency

This unified approach saves time for both businesses and customers while improving regulatory compliance.

KYC Solution for Stock Brokers

Stockbrokers are under tight regulatory watch. A KYC solution for stock brokers offers:

Aadhaar & PAN verification

OCR-based document scanning

Face match and video KYC

API integration with CDSL/NSDL platforms

These tools enable brokers to onboard clients in minutes while ensuring SEBI compliance.

Best KYC Provider in Delhi & Mumbai

When it comes to security and scalability, the best KYC providers in Delhi and best KYC providers in Mumbai stand out with:

Industry-grade encryption

End-to-end automation

AI-driven identity checks

Custom APIs for fast integration

These providers serve banks, NBFCs, stockbrokers, and fintechs looking to scale securely and quickly.

Final Thoughts

India’s fintech and digital landscape is evolving at lightning speed. From API integration services in Delhi to KYC solutions for stock brokers and WhatsApp-based eKYC, the right API Integration Services in delhi tech partners can unlock growth and compliance simultaneously.

Whether you’re building a trading app, launching a mutual fund platform, or modernizing customer support—Delhi’s ecosystem has everything you need to lead in the digital age.

0 notes

Text

Alltick API: Real-Time Data Solutions from Quantitative Trading Primer to Professional Strategies

Why You Need to Eliminate 15-Minute Delayed Market Data?

In fast-paced financial markets, a 15-minute data delay can mean massive opportunity costs. While retail investors rely on outdated prices to formulate strategies, institutional traders have already executed multiple trades using real-time data. This information asymmetry exists not only in stock markets but also in forex, futures, and cryptocurrencies—delayed data essentially provides historical, not actionable insights for live trading.

Alltick API’s Competitive Edge

1. Millisecond-Level Real-Time Global Coverage

Unlike traditional minute-delayed feeds, Alltick API delivers:

Equities: Real-time quotes from 50+ exchanges (NYSE, Nasdaq, HKEX, etc.)

Crypto: Full-coverage pricing from Binance, Coinbase, and other top platforms

Forex & Futures: CME/ICE derivatives market depth data

Unique Tick-Level Streams: Granular order-by-order execution records

2. Quant-Optimized Infrastructure

Architected for algorithmic trading:

99.99% Uptime SLA with 24/7 monitoring

Smart Bandwidth Compression for cost-efficient high-frequency data

Dynamic Load Balancing for scalable request handling

Unified Historical + Real-Time APIs for seamless backtesting

3. Frictionless Developer Experience

Designed for quant newcomers and pros alike:

Multi-Language SDKs (Python/Java/C++)

Plug-and-Play Code Templates

Interactive API Debug Console

Comprehensive English/Chinese Documentation

7×12 Technical Support via Slack & Email

Real-World Use Cases

Case 1: Rapid Strategy Validation

Case 2: Cross-Market Arbitrage Monitoring

Multi-Asset Capabilities Enable:

Stock vs ETF price divergence alerts

Crypto cross-exchange arbitrage detection

Forex spot-futures basis analysis

Case 3: HFT System Deployment

Institutional-Grade Features:

Co-located server hosting

Custom binary protocols

Microsecond-precision timestamps

Order flow analytics toolkit

Choosing Your API Tier

FeatureFree FeedsLegacy VendorsAlltick ProLatency15+ minutes1-5 seconds<100msHistorical DepthEOD Only1 Year10+ YearsConcurrent ConnectionsSingle Thread10-50UnlimitedData FieldsBasic OHLCStandardImplied Volatility, GreeksSupportNoneEmail (Weekdays)Dedicated Engineer

Start Your Quant Journey Today

Whether You Are:

A developer building your first SMA strategy

A quant team stress-testing models

An institution managing multi-strategy portfolios

Alltick offers tailored solutions from free trials to enterprise-grade deployments. Sign Up Now to Get: ✅ 30-Day Full-Feature Trial ✅ Exclusive Quant Strategy Playbook ✅ $500 Cloud Computing Credits

Visit Alltick Official Site to Experience Market Pulse in Real Time. Transform Every Decision with Data That Beats the Speed of Markets.

(CTA: Click "Developer Hub" to configure SDK in 5 mins and claim your API key.)

Technical Highlights

WebSocket/ REST API Hybrid Architecture: Balance speed with flexibility

Regulatory-Compliant Data: FINRA/SEC-reviewed market feeds

Zero Data Gaps: Guaranteed 100% tick reconstruction accuracy

Smart Retry Mechanisms: Auto-reconnect during network instability

Why 2,300+ Hedge Funds Choose Alltick? *"Alltick's unified API eliminated our multi-vendor integration headaches. We achieved 37% faster strategy iteration cycles."* — Head of Quant Trading, Top 50 Crypto Fund

Upgrade Your Edge. Trade at the Speed of Now.

1 note

·

View note

Text

What is AlgoFi.ai’s Nuvex Strategy? A Smarter Way to Trade with AI

In today’s fast-moving financial world, staying ahead in trading isn’t about reacting fast—it’s about predicting smarter. That’s where AlgoFi.ai’s Nuvex Strategy stands out. Powered by AI and built for serious traders and smart investors, Nuvex offers a unique trading advantage that blends speed, precision, and consistent returns.

✅ What Makes Nuvex Strategy Special?

Nuvex is not your average trading algorithm. It’s an AI-powered long/short equity strategy designed to identify both high-potential opportunities and market risks—before the rest of the market reacts.

Here’s what makes it powerful:

AI Market Prediction: Nuvex scans thousands of market data points every second, using machine learning models to anticipate price movements before they happen.

Smart Long/Short Trades: Unlike basic strategies, Nuvex can go long (buy) on undervalued assets and short (sell) overvalued ones—helping you profit in both bull and bear markets.

Risk-Optimized Returns: With advanced AI modeling, Nuvex minimizes emotional decision-making and maximizes consistent monthly returns between 3–7%, verified and transparent.

🔎 Who is Nuvex For?

Whether you're a retail investor looking for stable returns or an institutional trader wanting AI-level precision, Nuvex adapts to your portfolio goals. The strategy works 24/7 and requires no manual input.

🧠 No Trading Experience Needed

🏦 Hands-Free Wealth Growth

🔐 100% Transparency with Live Trade Monitoring

💡 How It Works (In Simple Terms)

AI constantly monitors real-time market trends and global news events.

Nuvex models analyze risk and find alpha opportunities with low drawdown.

Trades are automatically executed via secure API connections—no delays, no missed chances.

You just watch your capital grow, with full control and instant withdrawal options.

🔥 Why Investors Choose AlgoFi’s Nuvex Strategy

100% AI-Driven: Say goodbye to emotional or speculative trading.

Verified Monthly Returns: Transparent performance tracking builds long-term trust.

Decentralized & Secure: Your funds stay in your control—AlgoFi doesn’t freeze assets.

🚀 Ready to Let AI Trade For You?

The financial world is evolving—and those who adapt with AI are winning. AlgoFi.ai’s Nuvex Strategy puts institutional-grade AI trading into the hands of everyday investors.

🌐 Explore the future of trading today: www.algofi.ai

#AI trading strategy#AlgoFi.ai#Nuvex strategy#passive income from trading#automated trading#AI long short strategy#secure crypto trading#best trading bot 2025#how to earn with AI trading#investing with algorithms

0 notes

Text

Algo Trading Software Price Explained Simply

Understanding Algo Trading Software Price: A Friendly Guide

Introduction

Have you ever wondered how traders manage to buy and sell at the perfect time, even when they’re asleep? It’s not magic—it’s algorithmic trading software. But here’s the big question: How much does it cost? Whether you're new to trading or just curious, this guide breaks down everything you need to know about algo trading software price in plain English. We’ll explore how it works, what influences its cost, and how to choose the right one without burning a hole in your pocket.

Learn about algorithmic trading software price, features, and tips for picking the right automated trading software.

What is Algorithmic Trading Software?

Imagine a robot that buys and sells stocks for you while you’re out walking the dog. That’s essentially what algorithmic trading software does. It’s a tool that uses coded rules and algorithms to execute trades automatically. You set the conditions, and the software does the rest.

Why Automated Trading is a Game-Changer

Think of it like having a self-driving car—but for your investments. Instead of watching the market 24/7, automated trading software monitors it for you. It reacts to changes instantly, way faster than any human can. This means more efficiency, less emotional trading, and potentially better returns.

Factors That Influence Algo Trading Software Price

Why does one platform cost $50 a month and another $500? The price depends on things like:

Features included (like backtesting, strategy builder, indicators)

Speed and reliability

Support for multiple markets or asset classes

Customizability

Security features

Cloud vs desktop access

Just like buying a car, you get what you pay for.

Free vs Paid Trading Software: Which One Wins?

Free sounds great, right? But here’s the deal:

Free software: Great for learning or light trading. Think of it like using a bicycle.

Paid software: Comes with more tools, better support, and speed. It's more like driving a race car.

Both have their place—it depends on what you need.

Subscription-Based Pricing: Is It Worth It?

Most automated trading software follows a subscription model, often monthly or annually. Why?

Constant updates and bug fixes

Access to premium features

Customer support and new tools

If you trade regularly, subscriptions can offer good value.

One-Time Purchase vs Recurring Fees

Some platforms let you pay once and use the software forever. Others charge monthly.

One-time payments:

Pros: No recurring costs

Cons: Limited updates, might get outdated

Recurring fees:

Pros: Always up-to-date, includes support

Cons: Costs add up over time

Think of it like buying vs leasing a car.

Top Features That Affect Price

Here are some features that can significantly increase the price:

Real-time data feed

Advanced charting tools

High-frequency trading capabilities

API access for custom strategies

AI-based prediction tools

Multi-exchange connectivity

The more advanced the toolkit, the higher the price.

Entry-Level Tools: Affordable Options for Beginners

Just getting started? Don’t worry—you don’t need to spend a fortune. Some great entry-level options include:

Quanttrix

MetaTrader 4/5

QuantConnect (limited free tier)

Prices range from $0 to $50/month.

Professional-Grade Platforms and Their Costs

Quanttrix – A Rising Star in Algo Trading

Quanttrix is considered by many to be the best algo trading software in India, and for good reason. It’s built specifically for the Indian market, offering seamless integration with popular Indian brokers and exchanges like NSE and BSE. What sets it apart is its powerful automation engine combined with a user-friendly interface.

Price Range: Quanttrix offers flexible pricing plans starting around ₹2,500/month, going up based on features like real-time data feeds, multi-strategy deployment, and backtesting.

Key Features:

Plug-and-play algorithm setup

No coding required (though advanced users can integrate their own code)

Supports intraday and positional strategies

Broker APIs and real-time execution

24/7 support and regular updates

Quanttrix is especially great for traders in India who want localized support, competitive pricing, and access to Indian markets without complex setups.

Hidden Costs You Should Watch Out For

The sticker price isn’t the whole story. Watch for:

Data feed charges

Broker integration fees

Strategy storage limits

Backtesting credits

Cloud server costs

These can turn a $50/month plan into a $150/month reality.

Cost vs Value: What Really Matters

Paying more doesn’t always mean better. Focus on:

Reputation and reviews

Customer support

Ease of use

Learning resources

Community size

A tool that fits your needs is more valuable than one with flashy features you won’t use.

How to Choose the Right Software Based on Your Budget

Here’s a quick guide:

Budget

Suggested Type

$0 - $50/month

Free or basic tools like MetaTrader or Quanttrix

$50 - $150/month

Mid-tier software like Trade Ideas, NinjaTrader

$150+/month

Advanced platforms like AlgoTrader or Tradestation

Don’t go all-in if you’re just testing the waters.

Tips to Save Money Without Compromising Quality

Start with free trials

Use open-source tools like QuantConnect

Buy annual plans for discounts

Join trading communities for deals

Skip features you don’t need

You can trade smart without spending big.

Real User Stories: What People Actually Pay

Ravi from Mumbai uses a $30/month Quanttrix Pro plan and makes modest trades weekly.

Sandra in New York pays $500/month for a full AlgoTrader suite, running multiple bots.

Kumar in Bangalore uses QuantConnect’s free tier, coding his own strategies with zero cost.

Your budget and trading style determine what works for you.

Final Thoughts: Balancing Price and Performance

At the end of the day, it's not just about finding the cheapest tool—it’s about finding the right one. A good automated trading software should match your goals, skill level, and budget. Whether you're a hobbyist or aiming to go pro, there’s a tool (and a price) for everyone.

FAQs

What is the average price of algorithmic trading software? It ranges from $0 for basic platforms to over $500/month for professional tools.

Is there good free automated trading software available? Yes, platforms like QuantConnect and MetaTrader offer powerful features at no cost.

Are there any hidden costs in using algo trading software? Yes—look out for charges on data feeds, brokerage integrations, and cloud hosting.

Can I switch from a free to a paid version later? Absolutely. Many platforms offer upgrade paths as your needs grow.

How can I find the best software for my budget? Start with a trial, focus on your trading goals, and compare user reviews before buying.

0 notes

Text

Code the Future: Full Stack Mastery from Front to Back

In today's fast-paced tech world, versatility is a superpower. Businesses are not just looking for specialists—they're seeking well-rounded professionals who can build robust digital experiences from the ground up. Enter the full stack developer, a modern craftsman capable of working across the entire web development spectrum, from eye-catching front-end interfaces to powerful back-end engines.

But what does it take to truly master the full stack? And why is full stack development becoming such a vital skill in today's tech landscape?

What Is a Full Stack Developer, Really?

A full stack developer is someone who can navigate both client-side (front-end) and server-side (back-end) development. They understand how to design the user experience and how to make that experience function seamlessly by connecting it to databases, APIs, and servers.

In other words, they're the jack-of-all-trades in the tech world—building beautiful websites and applications and making sure they actually work behind the scenes.

Key Skills of a Full Stack Developer Include:

HTML, CSS, and JavaScript for crafting responsive and interactive interfaces

Front-end frameworks like React, Angular, or Vue.js

Back-end languages such as Node.js, Python, Ruby, or Java

Database management (SQL and NoSQL)

Version control systems like Git and GitHub

Understanding of RESTful APIs and third-party integrations

Deployment and DevOps basics, including Docker and cloud services

Why Full Stack Development Matters

The demand for java certification has surged as startups and established companies alike seek cost-effective and efficient development strategies. Hiring a single developer who can handle multiple layers of the development process not only saves money but also fosters better collaboration and quicker iterations.

Benefits of Becoming a Full Stack Developer:

Flexibility: You can work on a variety of projects and switch between front-end and back-end seamlessly.

Higher Salaries: Companies are willing to pay more for developers who can do it all.

Creative Freedom: You have a deeper understanding of how everything connects, allowing for greater innovation.

Better Job Security: With broad skills, you’re more adaptable to different roles.

From Beginner to Master: Mapping the Journey

While the road to full stack mastery can feel overwhelming, breaking it into manageable steps helps tremendously. Think of it like climbing a ladder—one solid skill at a time.

Here’s a suggested learning path:

Step 1: Front-End Fundamentals Start with HTML, CSS, and vanilla JavaScript. Get a solid foundation in how websites are structured and styled.

Step 2: Dive Into JavaScript Frameworks Learn a popular front-end library like React. It’s widely used and in high demand.

Step 3: Back-End Basics Pick a language like Node.js or Python. Understand how servers work and how to build APIs.

Step 4: Databases and Storage Learn both SQL (like PostgreSQL) and NoSQL (like MongoDB) to store and retrieve data.

Step 5: Full Stack Projects Build real-world applications that combine everything you've learned.

Step 6: Deployment Use platforms like Heroku, Vercel, or AWS to make your projects live.

The Future Is Full Stack

As technologies evolve and businesses become more reliant on seamless digital experiences, the role of the full stack developer will only become more central. Whether you're coding a sleek new UI or optimizing back-end performance, being able to do both gives you unmatched power in the tech arena.

Final Thoughts

If you’re passionate about building digital solutions from concept to execution, becoming a full stack developer course in pune is a smart and rewarding move. You won’t just be coding—you’ll be shaping the future of the internet.

0 notes

Text

Which are the Best Technology and Stacks for Blockchain Development?

The Digital palpitation of Blockchain

The world is still being rewritten by lines of law flowing through blockchain networks. From banking to supply chain and indeed healthcare, the monumental plates of technology are shifting — and blockchain is at the center.

Why Choosing the Right Tech mound Matters

In the blockchain realm, your tech mound is not just a toolkit; it’s your legion. Picking the wrong combination can lead to security loopholes, scalability agonies, or simply development backups. In discrepancy, the right mound empowers invention, adaptability, and lightning-fast performance.

A regard Into Blockchain’s Core Principles

Blockchain is basically a distributed tally. inflexible, transparent, and decentralized. Every decision about development tech must round these foundational values.

Public vs Private Blockchains Know the Battleground

Public blockchains like Ethereum are open, permissionless, and unsure. Private blockchains like Hyperledger Fabric offer permissioned access, suitable for enterprises and healthcare CRM software inventors looking for regulated surroundings.

Top Programming Languages for Blockchain Development

Reliability The Ethereum Favorite

erected specifically for Ethereum, Solidity is the language behind smart contracts. Its tight integration with Ethereum’s armature makes it a no- brainer for inventors entering this space.

Rust The Arising hustler

Lightning-fast and memory-safe, Rust is dominating in ecosystems like Solana and Polkadot. It offers fine- granulated control over system coffers a gift for blockchain masterminds.

Go Concurrency Champion

Go, or Golang, stands out for its simplicity and robust concurrency support. habituated considerably in Hyperledger Fabric, Go helps gauge distributed systems without breaking a sweat.

JavaScript & TypeScript Web3 Wizards

From UI to connecting smart contracts, JavaScript and TypeScript continue to dominate frontend and dApp interfaces. Paired with libraries like Web3.js or Ethers.js, they bring the Web3 macrocosm alive.

Smart Contract Platforms The smarts Behind the Chain

Ethereum

The undisputed leader. Its vast ecosystem and inventor community make it a top choice for smart contract development.

Solana

Known for blazing speed andultra-low freights, Solana supports Rust and C. Ideal for high- frequence trading and DeFi apps.

Frontend Technologies in Blockchain Apps

Reply and Angular UX Anchors

Both fabrics give interactive, scalable stoner interfaces. React’s element- grounded design fits impeccably with dApp armature.

and Ethers.js

They're the islands between your blockchain and cybersurfer. Web3.js supports Ethereum natively, while Ethers.js offers a lighter and further intuitive API.

Backend Technologies and APIs

Perfect for handling multiple connections contemporaneously, Node.js is extensively used in dApps for garçon- side scripting.

A minimalist backend frame, Express.js integrates painlessly with APIs and Web3 libraries.

GraphQL

In a data- driven ecosystem, GraphQL enables briskly, effective queries compared to REST APIs.

Blockchain fabrics and Tools

Truffle Suite

Complete ecosystem for smart contract development collecting, testing, and planting.

Databases in Blockchain Systems

IPFS( InterPlanetary train System)

A peer- to- peer storehouse result that decentralizes train storehouse, essential for apps demanding off- chain data.

BigchainDB

Blending blockchain features with NoSQL database capabilities, BigchainDB is knitter- made for high- outturn apps.

Essential DevOps Tools

Docker

Ensures harmonious surroundings for development and deployment across machines.

Kubernetes

Automates deployment, scaling, and operation of containerized operations.

Jenkins

The robotization backbone of nonstop integration and delivery channels in blockchain systems.

Security Considerations in Blockchain Tech Stacks

Security is n’t a point. It’s a necessity. From contract checkups to secure portmanteau integrations and sale confirmation, every subcaste needs underpinning.

Tech mound for Blockchain App Development A Complete Combo

Frontend React Web3.js

Backend Node.js Express GraphQL

Smart Contracts reliability( Ethereum) or Rust( Solana)

fabrics Hardhat or Truffle

Database IPFS BigchainDB

DevOps Docker Kubernetes Jenkins

This tech stack for blockchain app development provides dexterity, scalability, and enterprise- readiness.

Part of Consensus Algorithms

evidence of Work

Secure but energy- ferocious. PoW is still used by Bitcoin and other heritage systems.

evidence of Stake

Energy-effective and fast. Ethereum’s transition to PoS marked a vital shift.

Delegated Proof of Stake

Used by platforms like EOS, this model adds governance layers through tagged validators.

Part of Artificial Intelligence in Banking and Blockchain Synergy

AI and blockchain are reconsidering banking. Fraud discovery, threat modeling, and smart contracts are now enhanced by machine literacy. The role of artificial intelligence in banking becomes indeed more potent when intermingled with blockchain’s translucency.

Blockchain in Healthcare A Silent Revolution

Hospitals and pharma titans are integrating blockchain to track case records, medicine authenticity, and insurance claims.

Healthcare CRM Software Developers Leading the Change

By bedding blockchain features in CRM platforms, companies are enhancing data sequestration, concurrence shadowing, and real- time health analytics. In this invention surge, healthcare CRM software developers Leading the Change are setting new norms for secure and effective case operation.

Popular Blockchain Use Cases Across diligence

Finance Smart contracts, crypto holdalls

Supply Chain Tracking goods from origin to shelf

Voting Tamper- proof digital choices

Gaming NFTs and digital power

Challenges in Blockchain App Development

Interoperability, scalability, energy operation, and evolving regulations challenge indeed the stylish inventors.

The Future of Blockchain Development Tech Stacks

We'll see confluence AI, IoT, and edge computing will integrate with blockchain heaps, making apps smarter, briskly, and indeed more decentralized.

0 notes

Text

From Idea to Production: Integrating the Token Metrics API in Your App

Building a crypto app—whether for portfolio tracking, market research, or social trading—demands reliable intelligence. With the Token Metrics API, you get a production-ready data layer that seamlessly scales from prototype to enterprise.

Core API Features

AI Reports & Conversational Agent: Generate on-demand, natural-language summaries of token performance. Build chatbots that answer “What’s the Investor Grade on SUI?” with live data.

Performance Analytics: Fetch historical ROI, volatility trajectories, and predictive rankings to power charts, tables, or heatmaps.

RESTful Architecture: Modular endpoints let you query only what you need—minimizing latency and overhead.

SDK Support: Python and Node.js wrappers accelerate integration into backend services or serverless functions.

Step-by-Step Integration

API Key Management: Store your key securely (e.g., environment variable).

SDK Initialization:

from tokenmetrics import TokenMetricsClient

client = TokenMetricsClient(api_key="YOUR_KEY")

Fetch Data (example: top 10 bullish tokens):

const { getTradingSignals } = require("tokenmetrics-sdk");

const signals = await getTradingSignals({ timeframe: "1h", filter: "bullish" });

Render in UI: Visualize grades as colored badges, embed sentiment word clouds, or display ROI charts.

Automated Updates: Use scheduled functions (e.g., AWS Lambda) to refresh data every hour via the API.

Use Case: Mobile Portfolio App

A mobile fintech startup built a React Native app that integrates Token Metrics’ Trader Grades and Market Sentiment endpoints. Users see a consolidated watchlist where each token’s grade is updated in real time. Push notifications alert them if a token moves from neutral to strong-buy. All of this runs on a backend microservice that queries the API every 15 minutes, processes data, and feeds it to the app via GraphQL.

Why SDKs Matter

By leveraging the official SDKs, developers skip the boilerplate of HTTP requests, JSON parsing, and error handling. Instead, they work with intuitive methods and objects. This reduces time-to-market and lowers the risk of integration bugs.

Pricing & Free Tier

Get started with $0 by using the free tier. When you outgrow it, upgrade to the $99 plan—or pay with $TMAI for discounts up to 35%. No hidden costs, just predictable pricing that grows with your usage.

0 notes