#Recovery of Shares from IEPF

Explore tagged Tumblr posts

Text

Learn how to recover old or lost shares effortlessly with Corpbiz. Our experts assist in share recovery, transfer, and the recovery of shares from IEPF. Watch this video for a step-by-step guide to reclaiming your shares and simplifying the process. Contact us for hassle-free assistance today!

2 notes

·

View notes

Text

Reclaim Your Lost Shares from IEPF

Reclaim your lost or unclaimed shares from the Investor Education and Protection Fund (IEPF) with expert guidance. Learn the step-by-step process to recover shares, dividends, and other assets transferred to IEPF. Start your claim today and regain control of your rightful investments with ease.

0 notes

Text

Duplicate share certificate

Expert Solutions for Seamless Transmission of Shares: Your Guide to Asset Recovery:

The transmission of shares is an essential legal process that ensures the rightful transfer of shares from a deceased shareholder to their heirs, nominees, or legal successors. Whether it’s the transfer of shares after the death of a shareholder, recovering assets transferred to the Investor Education and Protection Fund (IEPF), or managing intricate procedures, the process can often be challenging without professional guidance.

At Asset Retrieval Advisors, we specialize in simplifying the transmission of shares process, providing expert support for resolving issues related to shares transfer to iepf shares, and ensuring rightful claimants receive their due without undue stress.

This comprehensive guide delves into every aspect of IEPF share transfer, transmission of shares, and the procedural requirements involved.

Understanding Transmission of Shares:

Transmission of shares refers to the process by which ownership of a deceased shareholder’s shares is legally transferred to their heirs or nominees iepf shares recovery. Unlike the voluntary transfer of shares, transmission occurs due to inevitable circumstances like death, insolvency, or incapacity of the original shareholder.

When Is Transmission of Shares Required?

1. Death of a Shareholder:

When a shareholder passes away, their shares need to be transmitted to the legal heir or nominee.

2. Insolvency of the Shareholder:

Shares may be transmitted to the official receiver or trustee in case of insolvency.

3. Mental Incapacity:

If a shareholder is declared mentally incapacitated, shares may be transmitted to a legally appointed guardian.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat aute irure dolor in reprehenderit.

Key Documents Required for Transmission of Shares:

Key Documents Required for Transmission of Shares

Certified copy of the death certificate.

Succession certificate or probate of the will.

PAN card and address proof of the claimant.

Transmission request form issued by the company or registrar.

Original share certificates (for physical shares).

Nomination registration proof (if applicable).

The Importance of Timely Transmission of Shares:

1. Safeguarding Shareholder Rights:

Legal heirs gain access to dividends, voting rights, and other shareholder benefits.

2. Avoiding IEPF Transfer:

If shares or dividends remain unclaimed for seven years, they are transferred to the IEPF.

3. Simplifying Estate Management:

Proper transmission reduces disputes and ensures seamless estate planning.

IEPF Share Transfer: What You Need to Know:

What is IEPF Share Transfer?

When shares and dividends remain unclaimed for seven consecutive years, they are transferred to the Investor Education and Protection Fund (IEPF). The Lost physical share certificate was established by the Government of India to protect investor interests.

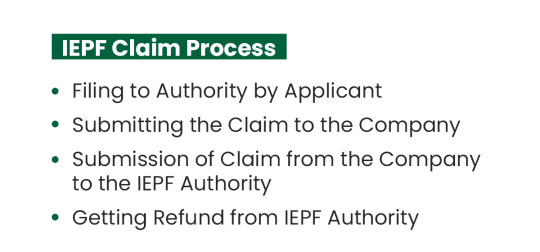

1. File a claim with the IEPF Authority using Form IEPF-5.

2. Submit required documents, including legal proofs and shareholder details.

3. Coordinate with the company for verification.

4. Receive approval from the IEPF Authority and reclaim your shares.

Steps in the Transmission of Shares Process:

1. Notify the Issuing Company or RTA

Inform the company or registrar (RTA) about the death of the shareholder.

Provide details such as folio number, shareholder name, and type of shares.

2. Gather and Submit Documents

Ensure that all required legal and procedural documents are in order, including:

Certified death certificate.

Legal heir certificate or will probate.

Transmission request form.

3. Verification and Processing

The company or registrar verifies the documents submitted.

In case of physical shares, new certificates are issued.

For demat shares, ownership is transferred electronically to the heir’s demat account.

4. Special Cases: IEPF Recovery

If shares are already transferred to the shares transfer to iepf, additional recovery steps must be initiated.

Filing claims with the IEPF Authority and coordinating with the company is essential.

Challenges in Transmission of Shares:

1. Unregistered Nominations:

When no nominee is registered, legal heirs must secure succession certificates or court orders, complicating the process.

2. IEPF Share Transfers:

Recovering shares transferred to the IEPF involves lengthy documentation and approvals.

3. Outdated Records:

Physical shares with missing or outdated records create additional hurdles.

How Asset Retrieval Advisors Can Help:

At Asset Retrieval Advisors, we offer a comprehensive suite of services to address every challenge in the transmission of shares process, including:

1. Professional Documentation Assistance

We handle all paperwork, from drafting affidavits to preparing claim forms, ensuring accuracy and compliance.

2. Expert Guidance for IEPF Recovery

Our team simplifies the recovery of shares transferred to the IEPF by navigating the regulatory landscape.

3. Seamless Liaison with Companies

We coordinate with issuing companies and registrars, minimizing delays and ensuring a hassle-free process.

4. Legal and Procedural Expertise

Whether it’s obtaining a succession certificate or resolving disputes, we provide end-to-end support.

Call to Action

Secure Your Rightful Shares Today!

Don’t let procedural complexities delay your claim. Contact Asset Retrieval Advisors for expert guidance on the transmission of shares, recovering assets from the transmission of shares, and more.

#iepf share transfer#iepf claim#iepf#iepf shares recovery#how to claim iepf shares#demat of physical shares#recovery of shares from iepf

0 notes

Text

IEPF Claim Advisor in India:

Are you struggling with your SRN Status Pending for Approval? At Care4Share, we are leading IEPF claim advisors in India, dedicated to simplifying the IEPF claim process time for our clients. Our personalized support helps you efficiently check SRN status IEPF and recover unclaimed investments. Contact us today!

For more Details Visit Us: https://iepfshare.com/ Contact Us: +91 8178715427 Mail Us: [email protected]

#srn iepf#track srn iepf#srn status iepf#iepf srn status#stocks#recovery of shares from iepf#iepf claim#iepf#srn status

0 notes

Text

IEPF | IEPF Portal | IEPF Claims

Discover Care4Share, India's top IEPF Portal for seamless IEPF share recovery and refunds. Our expert IEPF claim consultants handle all aspects of the IEPF claim process to ensure efficient recovery of unclaimed shares. Visit us to learn about our trusted IEPF claim services. Visit Us: https://care4share.in/

#iepf recovery#iepf#recovery of shares from iepf#iepfb#investing stocks#upcoming ipo#stock market#stock#sme ipo#ipo news#ipo alert#ipo#ipfo#IEPF#IEPF Portal

0 notes

Text

Steps to Claim Shares from IEPF: A Comprehensive Guide

Learn the step-by-step process to reclaim your shares from the IEPF. From filing the initial claim to receiving your shares and dividends, our guide simplifies the IEPF claim process for you.

https://sharesclaimdost.com/recover-shares-from-iepf

1 note

·

View note

Text

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#iepf shares recovery#iepf recovery#recovery of shares from iepf#iepf shares claim#infiny solutions

0 notes

Text

0 notes

Text

Lost Shares? Here’s How You Can Get Them Back from IEPF

Have you ever forgotten about some old shares you bought years ago? Maybe you missed claiming dividends, and now you’re wondering what happened to your investments. Well, there’s a chance that your shares have been transferred to the Investor Education and Protection Fund (IEPF). The good news? You can get them back! This guide will walk you through the process of recovery of lost shares from IEPF, including dealing with duplicate share certificates and correcting any name errors on your share documents.

What is IEPF, and Why Are Your Shares There?

The Investor Education and Protection Fund (IEPF) was set up by the government to handle unclaimed dividends and shares. If you haven’t claimed your dividends for seven consecutive years, the company transfers those shares to the IEPF.

But don’t worry—you can reclaim your shares by following the right process. Let’s break it down step by step.

How to Recover Your Shares from IEPF

If your shares have landed in the IEPF, here’s what you need to do:

Check the IEPF Website – Visit website of IEPF and search for your shares to see if they are listed.

Gather Your Documents – You’ll need:

PAN card and Aadhaar card (self-attested copies)

Canceled cheque (for bank details)

Proof of shareholding (Demat account statement or old physical share certificates)

Indemnity bond (a document stating that you are claiming your shares)

Fill Out IEPF Form-5 – This is the official application form to request your shares back.

Submit the Form to the Company – Send the form along with your documents to the company’s Nodal Officer.

Company Verifies Your Claim – The company checks your details and forwards its approval to the IEPF authority.

IEPF Processes Your Request – Once everything is verified, your shares will be transferred back to your Demat account!

What If You Lost Your Share Certificate?

If you lost your original share certificate, you need a duplicate share certificate before you can claim your shares from IEPF. Here’s how to get one:

Inform the Company – Notify the company or its registrar about the missing certificate.

File a Police Report – Register an FIR (First Information Report) mentioning the details of your lost share certificate.

Advertise in a Newspaper – Some companies require you to publish a notice about the lost certificate in a local newspaper.

Provide an Indemnity Bond – This document protects the company from future claims related to the lost certificate.

Receive Your Duplicate Share Certificate – Once the company verifies your request, they will issue a new share certificate.

Once you have the duplicate share certificate, you can proceed with your IEPF claim.

Name Spelled Wrong on Your Share Certificate? Here’s How to Fix It

If your name is misspelled on your share certificate (or if your name has changed due to marriage or legal reasons), you need to correct it first before applying for an IEPF claim. Here’s how:

Contact the Company – Each company has its own process for name corrections, so check with them first.

Submit the Necessary Documents, including:

Original share certificate

Self-attested copies of your PAN card and Aadhaar card

Marriage certificate or Gazette notification (if applicable)

An affidavit explaining the name correction request

Apply for the Name Correction – Send all documents to the company’s registrar.

Receive Your Corrected Share Certificate – Once approved, the company will issue a corrected certificate.

If your shares have already been moved to the IEPF, you must correct your name first before submitting an IEPF claim.

Key Things to Remember

IEPF claims must be filed online via the IEPF portal.

The process can take time, as it involves verification by both the company and IEPF authority.

Make sure all documents are accurate to avoid delays.

If you are claiming as a legal heir, you will need to provide additional documents like a will, succession certificate, or legal heir certificate.

Conclusion

Losing track of your shares doesn’t mean you’ve lost them forever. Whether your shares ended up in IEPF, you lost your share certificate, or your name correction on share certificate, you can still reclaim your investments.

By following the right process and ensuring all documents are in place, you can successfully recover your lost shares and dividends. If you need help, experts can guide you through the process to make it smoother and faster.

So, don’t let your investments sit unclaimed—take action today and get back what’s rightfully yours!

#recover your lost shares and dividends#duplicate share certificate#recovery of lost shares from IEPF

0 notes

Text

Non-Resident Indians (NRIs) can recover their shares from the Investor Education and Protection Fund (IEPF) through a specific process. They must first file an application with the IEPF Authority, along with the necessary documents, including proof of identity, address, and ownership of the shares. Connect with Share Connection for NRI Shares Recovery from IEPF. Once the application is verified and approved, the shares are transferred back to the NRI's demat account.

0 notes

Text

How long does it take to Shares recover from Iepf?

It typically takes around 60 days to recover shares from the IEPF after being claimed. The process involves the following steps:

The claimant submits an online application in Form IEPF-5 along with other documents to the Nodal Officer of the company at its registered office for verification of the claim.

The company sends the verification report to the IEPF within 15 days of receipt of the claim.

The IEPF Authority decides on the claimant’s reimbursement application within 60 days after obtaining the verification report from the relevant company.

The IEPF Authority will issue a refund sanction order when the claimant is entitled to the shares with the permission of the competent authority.

The IEPF Authority and the Drawing and Disbursing Officer of the authority will send a bill to the Pay and Accounts Officer for payment after verifying the claimant’s entitlement.

The shares or the extent of the claimant’s entitlement will be credited to the Demat account of the claimant.

Please note that the time it takes to Share recover from the IEPF may vary depending on the specific circumstances of the case. For example, if the company’s verification report is delayed, it may take longer for the IEPF Authority to make a decision on the claimant’s application.

Here are some tips to help you recover your shares from the IEPF more quickly:

Make sure to submit your claim as soon as possible after you become aware that your shares have been transferred to the IEPF.

Provide all of the required documents with your claim.

Keep track of the status of your claim by checking the IEPF website regularly.

0 notes

Text

Learn who needs a legal heir certificate, its importance for asset transfer, and how it aids in claims like share recovery from IEPF. Simplify the process today!

2 notes

·

View notes

Text

Recover unclaimed wealth with Shares Recover! Expert in Recovery of Shares from IEPF, we specialize in efficient shares recovery.

0 notes

Text

iepf , iepf claim , Duplicate share certificate , claim shares from iepf

iepf share transfer, iepf shares, iepf shares recovery, Lost physical share certificate, shares transfer to iepf, transmission of shares,

unclaimed mutual fund.

#iepf claim#iepf shares recovery#iepf claim process#iepf unclaimed shares#how to claim iepf shares#demat of physical shares#iepf#iepf share transfer#recovery of shares from iepf#iepf shares

0 notes

Text

IEPF Claim Advisor

Care4Share is your trusted IEPF claim advisor in India, based in Delhi. We specialize in helping investors manage their SRN Status, ensuring a smooth experience when checking for pending claims. Learn how to efficiently check SRN status in MCA and reduce your IEPF claim process time with our expert guidance. For more Details Visit Us: https://iepfshare.com/ Contact Us: +91 8178715427

#srn status#iepf#iepf claim#recovery of shares from iepf#stocks#iepf srn status#srn status iepf#track srn iepf#srn iepf

0 notes

Text

India's No.1 IEPF Portal & Claim Advisor | IEPF Share Recovery

IEPF Portal & claim advisor helps you reclaim your unclaimed shares through the seamless IEPF shares claim procedure for efficient recovery For more Details: Visit Us: https://care4share.in/ Contact Us: +91 8178715427

1 note

·

View note