#iepf

Explore tagged Tumblr posts

Note

Ivil: Do you know why Zalgo and Slender Man hate each other? If so, could you tell us?

Actually its because of divorce

#creepypasta#creepypasta fandom#slenderman#zalgo#zalgo creepypasta#gorefield#trollge#sonic.#sonic.exe#marble hornets#slender the arrival#iepf#iepfb#lazar#lazari#lazari swann#lazari creepypasta#i eat pasta for breakfast#the operator#mh op#mh operator#evil iepfb

211 notes

·

View notes

Text

Duplicate share certificate

Expert Solutions for Seamless Transmission of Shares: Your Guide to Asset Recovery:

The transmission of shares is an essential legal process that ensures the rightful transfer of shares from a deceased shareholder to their heirs, nominees, or legal successors. Whether it’s the transfer of shares after the death of a shareholder, recovering assets transferred to the Investor Education and Protection Fund (IEPF), or managing intricate procedures, the process can often be challenging without professional guidance.

At Asset Retrieval Advisors, we specialize in simplifying the transmission of shares process, providing expert support for resolving issues related to shares transfer to iepf shares, and ensuring rightful claimants receive their due without undue stress.

This comprehensive guide delves into every aspect of IEPF share transfer, transmission of shares, and the procedural requirements involved.

Understanding Transmission of Shares:

Transmission of shares refers to the process by which ownership of a deceased shareholder’s shares is legally transferred to their heirs or nominees iepf shares recovery. Unlike the voluntary transfer of shares, transmission occurs due to inevitable circumstances like death, insolvency, or incapacity of the original shareholder.

When Is Transmission of Shares Required?

1. Death of a Shareholder:

When a shareholder passes away, their shares need to be transmitted to the legal heir or nominee.

2. Insolvency of the Shareholder:

Shares may be transmitted to the official receiver or trustee in case of insolvency.

3. Mental Incapacity:

If a shareholder is declared mentally incapacitated, shares may be transmitted to a legally appointed guardian.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat aute irure dolor in reprehenderit.

Key Documents Required for Transmission of Shares:

Key Documents Required for Transmission of Shares

Certified copy of the death certificate.

Succession certificate or probate of the will.

PAN card and address proof of the claimant.

Transmission request form issued by the company or registrar.

Original share certificates (for physical shares).

Nomination registration proof (if applicable).

The Importance of Timely Transmission of Shares:

1. Safeguarding Shareholder Rights:

Legal heirs gain access to dividends, voting rights, and other shareholder benefits.

2. Avoiding IEPF Transfer:

If shares or dividends remain unclaimed for seven years, they are transferred to the IEPF.

3. Simplifying Estate Management:

Proper transmission reduces disputes and ensures seamless estate planning.

IEPF Share Transfer: What You Need to Know:

What is IEPF Share Transfer?

When shares and dividends remain unclaimed for seven consecutive years, they are transferred to the Investor Education and Protection Fund (IEPF). The Lost physical share certificate was established by the Government of India to protect investor interests.

1. File a claim with the IEPF Authority using Form IEPF-5.

2. Submit required documents, including legal proofs and shareholder details.

3. Coordinate with the company for verification.

4. Receive approval from the IEPF Authority and reclaim your shares.

Steps in the Transmission of Shares Process:

1. Notify the Issuing Company or RTA

Inform the company or registrar (RTA) about the death of the shareholder.

Provide details such as folio number, shareholder name, and type of shares.

2. Gather and Submit Documents

Ensure that all required legal and procedural documents are in order, including:

Certified death certificate.

Legal heir certificate or will probate.

Transmission request form.

3. Verification and Processing

The company or registrar verifies the documents submitted.

In case of physical shares, new certificates are issued.

For demat shares, ownership is transferred electronically to the heir’s demat account.

4. Special Cases: IEPF Recovery

If shares are already transferred to the shares transfer to iepf, additional recovery steps must be initiated.

Filing claims with the IEPF Authority and coordinating with the company is essential.

Challenges in Transmission of Shares:

1. Unregistered Nominations:

When no nominee is registered, legal heirs must secure succession certificates or court orders, complicating the process.

2. IEPF Share Transfers:

Recovering shares transferred to the IEPF involves lengthy documentation and approvals.

3. Outdated Records:

Physical shares with missing or outdated records create additional hurdles.

How Asset Retrieval Advisors Can Help:

At Asset Retrieval Advisors, we offer a comprehensive suite of services to address every challenge in the transmission of shares process, including:

1. Professional Documentation Assistance

We handle all paperwork, from drafting affidavits to preparing claim forms, ensuring accuracy and compliance.

2. Expert Guidance for IEPF Recovery

Our team simplifies the recovery of shares transferred to the IEPF by navigating the regulatory landscape.

3. Seamless Liaison with Companies

We coordinate with issuing companies and registrars, minimizing delays and ensuring a hassle-free process.

4. Legal and Procedural Expertise

Whether it’s obtaining a succession certificate or resolving disputes, we provide end-to-end support.

Call to Action

Secure Your Rightful Shares Today!

Don’t let procedural complexities delay your claim. Contact Asset Retrieval Advisors for expert guidance on the transmission of shares, recovering assets from the transmission of shares, and more.

#iepf share transfer#iepf claim#iepf#iepf shares recovery#how to claim iepf shares#demat of physical shares#recovery of shares from iepf

0 notes

Text

Why Do Insurance Policies Go Unclaimed? Common Reasons & Solutions

Introduction Many people purchase insurance policies to protect their families and secure their future. However, a significant number of these policies go unclaimed. This happens for various reasons, leaving beneficiaries unaware of their rightful money. If you or your loved ones have unclaimed insurance policies, this article will help you understand why this happens and how to recover them.

Common Reasons Why Insurance Policies Go Unclaimed

Lack of Awareness Many policyholders fail to inform their family members about their insurance policies. When the policyholder passes away, their family is unaware of the policy and does not claim it.

Lost Documents Over time, people misplace important documents, including insurance papers. Without proper records, beneficiaries may struggle to find and claim the policy.

Change of Address or Contact Details If the policyholder changes their address or contact details without updating the insurance provider, the company may be unable to reach them or their nominees.

Inactive Policies Some policies require regular premium payments. If the policyholder stops making payments, the policy may lapse. However, some policies still hold value even after lapsing, but the beneficiaries may not be aware of this.

Unaware Legal Heirs In cases where a policyholder passes away without informing their family, legal heirs may not even know about the policy. Without proper records, the claim remains unfiled.

No Nominee or Incorrect Nominee Details If a policy does not have a nominee or the details are incorrect, claiming the policy can become a complicated legal process.

Mergers and Closures of Insurance Companies If an insurance company merges with another or closes, beneficiaries may find it difficult to track the policies and claim them.

How to Recover Unclaimed Insurance Policies

If you think you or your family might have an unclaimed insurance policy, follow these steps:

Check Old Records Look through old financial documents, bank statements, and emails to find details about past insurance policies.

Contact the Insurance Company Get in touch with the insurance provider and ask about any unclaimed policies. Provide details such as the policyholder’s name and date of birth.

Use Online Insurance Databases Some government and insurance company websites have online databases to check unclaimed policies. Enter basic details to see if any policies exist.

Consult a Professional Service There are consulting firms that specialize in the Recovery of Unclaimed Insurance Policies. They can help you track and recover lost insurance claims efficiently.

Check with the Provident Fund Office If a deceased person had an insurance policy linked with their provident fund, you may also need to recover unclaimed provident funds as part of the process.

Legal Process for No-Nominee Cases If a policy does not have a nominee, you may need to obtain a legal heir certificate or succession certificate from the court to claim the policy amount.

Recovering Other Unclaimed Financial Assets

While recovering an unclaimed insurance policy, you might also come across other unclaimed mutual funds and dividends. Here’s how to recover them:

Recovery of Unclaimed Mutual Funds: Many people invest in mutual funds but forget about them. If you suspect there are unclaimed mutual funds in your name or your family's name, check statements, old emails, or use online mutual fund search portals to track them.

Recovery of Unclaimed Dividends from IEPF: If shares or dividends remain unclaimed for a long time, they are transferred to the Investor Education and Protection Fund (IEPF). You can recover these funds by filing an online claim through the IEPF website and submitting the required documents.

Preventing Insurance Policies from Going Unclaimed

To avoid your insurance policies becoming unclaimed, follow these simple steps:

Inform Your Family Always share details of your insurance policies with your family members.

Keep Documents Safe Store your insurance documents in a secure place and keep digital copies.

Update Contact Details Notify the insurance company whenever you change your phone number, email, or address.

Assign a Nominee Make sure to nominate a family member in your policy and update nominee details if needed.

Regularly Check Your Policies Review your insurance policies at least once a year to ensure everything is up to date.

Conclusion Unclaimed insurance policies are more common than you think, and many families miss out on their rightful benefits. By being aware of the common reasons why policies go unclaimed and taking proactive steps, you can ensure that your loved ones receive the financial security you intended for them. If you need assistance in recovering unclaimed policies, mutual funds, provident funds, and unclaimed dividends from IEPF, consider reaching out to professional recovery consultants.

#RecoveryOfUnclaimedInsurancePolicies#RecoverUnclaimedProvidentFunds#RecoveryOfUnclaimedMutualFunds#RecoveryOfUnclaimedDividendsFromIEPF#UnclaimedInsurance#InsuranceClaims#LostInsurance#FinancialRecovery#IEPF#UnclaimedFunds

0 notes

Text

Demat Account- Meaning, Importance and Documents required

A Demat Account (Dematerialized Account) is an electronic account used to hold and trade financial instruments like stocks, bonds, and mutual funds. It eliminates the need for physical share certificates, ensuring secure and paperless transactions. A Demat account offers benefits such as quick share transfers, secure storage of securities, and easy access to dividends and bonuses. There are three types: Regular, Repatriable, and Non-Repatriable Demat Accounts, catering to different investor needs, including NRIs. To open a Demat account, documents like PAN card, Aadhaar, bank details, and KYC documents are required. Linking it with a trading account enables smooth buying and selling of securities.

0 notes

Text

IEPF Claim Advisor in India:

Are you struggling with your SRN Status Pending for Approval? At Care4Share, we are leading IEPF claim advisors in India, dedicated to simplifying the IEPF claim process time for our clients. Our personalized support helps you efficiently check SRN status IEPF and recover unclaimed investments. Contact us today!

For more Details Visit Us: https://iepfshare.com/ Contact Us: +91 8178715427 Mail Us: [email protected]

#srn iepf#track srn iepf#srn status iepf#iepf srn status#stocks#recovery of shares from iepf#iepf claim#iepf#srn status

0 notes

Text

Are you aware of the benefits of IEPF Recovery? Infiny Solutions specializes in guiding you through the process, ensuring you recover what’s rightfully yours. Trust us to help you navigate the complexities and secure your financial future.

0 notes

Text

IEPF | IEPF Portal | IEPF Claims

Discover Care4Share, India's top IEPF Portal for seamless IEPF share recovery and refunds. Our expert IEPF claim consultants handle all aspects of the IEPF claim process to ensure efficient recovery of unclaimed shares. Visit us to learn about our trusted IEPF claim services. Visit Us: https://care4share.in/

#iepf recovery#iepf#recovery of shares from iepf#iepfb#investing stocks#upcoming ipo#stock market#stock#sme ipo#ipo news#ipo alert#ipo#ipfo#IEPF#IEPF Portal

0 notes

Text

IEPF Claim Refers To The Process Of Claiming Shares, Dividends, And Other Benefits That Have Been Transferred By Companies To The Investor Education And Protection Fund (IEPF) In Accordance With The Companies Act, 2013. The IEPF Is A Fund Established By The Indian Government To Protect The Interests Of Investors And Promote Investor Education.

#IEPF Claim#recovery of shares from iepf#iepf shares claim#iepf shares recovery#iepf recovery#transmission of shares#transfer and transmission of shares#iepf

0 notes

Text

Lost shares: everything you need to know

Lost stock is a common problem investors face, as shares can be lost for a variety of reasons, including incorrect addresses, unclaimed dividends, or a change in ownership. The loss of shares can have a significant impact on an investor's portfolio, as it means a loss of potential income and a reduction in the value of the portfolio. However, the good news is that there are steps that can be taken to recover lost shares. In this article, we will go over what lost shares are, how they can occur, and what you can do to recover them.

What are lost shares?

Lost shares are shares that are no longer owned by the original owner. This can happen for a variety of reasons, including incorrect addresses, unclaimed dividends, and changes in ownership. In some cases, shares can also be lost due to fraud, such as when a shareholder has been cheated out of their shares.

How do lost shares occur?

Lost shares can occur for a variety of reasons, including incorrect addresses, unclaimed dividends, and changes in ownership. For example, if a shareholder moves and fails to update their address with the company, they may not receive important notices, including dividends, and their shares may be considered lost.

In other cases, shares may be lost due to unclaimed dividends. If a shareholder fails to claim a dividend, the money may be turned over to the government as unclaimed property, and the shareholder loses his right to the payment. This can also lead to the loss of shares.

Finally, shares can also be lost due to changes in ownership. For example, if a shareholder dies and his or her estate is not properly administered, the shares may be lost. Shares can also be lost if they are transferred without proper documentation.

What can you do to recover lost shares?

Recovering lost shares in India can be a complex and time-consuming process, but with the right steps and resources, it is possible. Here are some steps you can take to recover your lost shares:

Look for unclaimed shares: Before you begin the process of recovering lost shares, it is important to check if there are any unclaimed shares that belong to you. You can do this by visiting the Investor Services Centre of the Bombay Stock Exchange (BSE) or the National Securities Depository Limited (NSDL) and searching for unclaimed shares.

Contact the company directly: If you have lost shares due to a change of address or other administrative error, you can contact the company directly to find out if they have records of your shares. Companies may be able to help you locate and return your shares.

Report the loss to the authorities: If you suspect that your shares have been lost due to fraud or other criminal activity, it is important to report the loss to the authorities. This will ensure that the perpetrators are brought to justice and that you have a better chance of recovering your lost shares.

It is important to note that the process of recovering lost stock can be time-consuming and may require perseverance and patience. However, with the right steps and resources, it is possible to recover lost shares and protect the value of your portfolio. And https://glcwealth.com/services/nri-service/ is the resource you should turn to in order to recover your lost shares. We will save you the hassle and make sure that you get back every lost share with its exact value.

Conclusion

Lost shares can have a significant impact on an investor's portfolio. However, if you take action and follow the steps outlined above, you can recover your lost stocks and regain your financial goals. Whether it's incorrect addresses, unclaimed dividends, or changes in ownership, it's important to take the necessary steps to recover your lost shares as soon as possible.

In summary, lost stock can be a frustrating and costly problem for investors. However, if you are proactive and seek help when needed, it is possible to recover lost shares and protect the value of your portfolio. From searching for NRIi assets to contacting the company directly to hiring an attorney in the event of fraud or ownership disputes, there are several ways to recover lost shares. Remember, it's important to act as quickly as possible to minimize the impact on your financial future.

0 notes

Text

Learn how to recover old or lost shares effortlessly with Corpbiz. Our experts assist in share recovery, transfer, and the recovery of shares from IEPF. Watch this video for a step-by-step guide to reclaiming your shares and simplifying the process. Contact us for hassle-free assistance today!

2 notes

·

View notes

Note

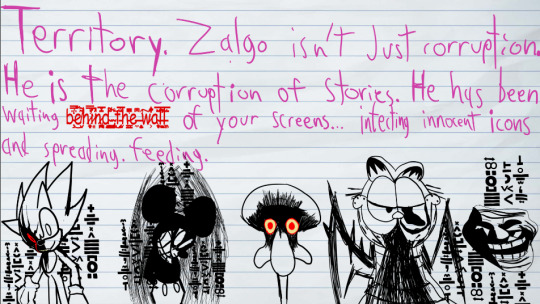

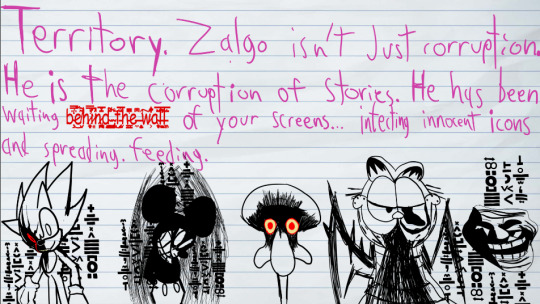

This was one of the big posts that got a BUNCH of people interested in my blog back then. Don't worry, not a drop of this post has been retconned. I'm still really proud of the ideas in this and thankfully a bunch of other people are as well!

I already ramble a bunch about the impact of slenderman as a character, as for Zalgo I wanted to be more abstract. And him representing the entire concept of corruption and distortion not only works perfectly for the themes of the story, but also makes him a looming shadow over the entire story. A darkness surrounding the little spot of light that is the town where Lazari is unknowingly hiding in. Almost every character in this story is going to take a little bit of inspiration from every version of them. Zalgo and the Slendy are the biggest examples of this. Representing every version of slenderman in a composite character, and zalgo representing probably more than half of the entirety of creepypasta.

Ivil: Do you know why Zalgo and Slender Man hate each other? If so, could you tell us?

Actually its because of divorce

#slenderman#zalgo#gorefield#trollge#sonic.#marble hornets#slender the arrival#iepf#sonic.exe#iepfb#zalgo creepypasta#creepypasta fandom#lazar#lazari#lazari swann#lazari creepypasta#i eat pasta for breakfast#mh operator#evil iepfb#creepypasta#the operator

211 notes

·

View notes

Text

iepf shares recovery

What is the difference between probate & succession:

What is the difference between probate & succession?

If someone owns the Property, they can choose what happens after they pass away by creating a Will while alive. This is called 'Testamentary Succession,' and it goes into effect when the person dies.

But if they don't create a Will, it's called dying 'intestate.' In this case iepf shares recovery, the Indian Succession Act 1925 and the Hindu Succession Act 1956 come into play, and the Property is transferred through 'Intestate Succession'.

According to Indian Law, Property can't be ownerless.

As soon as the shareholder dies, the Property is transferred to the person mentioned in the Will or to the legal heirs in the absence of the Will.

The Property can be transferred in two different ways:

Either by Probate of Will

Or by Succession Certificate.

So, let's first understand What is Probate of Will.

As a shareholder, you can ease the burden on the court by creating a Will, ensuring that your succession plan is in the hands of your Will, not the court's.

When someone who made a Will passes away, their succession plan is carried out according to that Will.

A 'probate,' defined by Section 2(f) of the Indian Succession Act, 1925, is a certified copy of a Will with a seal from a court of competent jurisdiction.

It's a legal process that validates a Will and determines in a court of law who the executor (the person named in the Will), the beneficiaries, and the value of the assets in the Will are."

What is a Succession Certificate?

A Succession Certificate is an official document issued by the court to someone who files a petition and various documents.

These documents typically include the original death certificate of the deceased, evidence of their financial assets, and an affidavit. Additionally Lost physical share certificate, the legal heirs must provide proof of their relationship with the deceased in court.

With a succession certificate, the legal heirs gain the right to inherit the debts and assets of the deceased if they pass away without a will.

So, if someone asks: Is a succession certificate required if there is a will? The answer will be no.

What is the difference between probate of will and succession certificate?

Probate is relevant when the testator leaves a will before their death. Conversely, a Succession Certificate is necessary when the testator dies intestate, meaning they didn't leave a will behind.

Conclusion

Probate of Will and Succession Certificate are two different things. The ambit of succession certificates is very limited when compared to Will.

To get more information about the succession certificate, you can reach us.

Asset Retrieval Advisors specializes in recovering unclaimed investments, shares,

and funds, including IEPF claims. Trust our experts to simplify complex processes and

help you reclaim what’s rightfully yours.

Take The Next Step Toward Shares Recovery from IEPF With Asset Retrieval Advisors

The great thing is our expertise which can save you valuable time, including effort, confusion, and other hassles. We will assist you in efficient recovery of shares from IEPF without compromising on quality of services.

Our team belives in delivering comprehensive customer support to ensure a smooth and successful experience throughout the process of recovering lost shares from IEPF shares transfer to iepf.

Your Lost Assets Are Just One Enquiry Away from Being Found

Ready to recover your unclaimed investments, shares, or funds? Let us make the process simple and stress-free for you. Fill out our enquiry form, and our team of experts will assess your case and guide you every step of the way. Whether it’s recovering assets under IEPF, resolving share-related issues, or locating dormant funds, we’re here to help you unlock what’s yours. Don’t let your assets remain out of reach—get started today!

0 notes

Text

Reclaim Your Lost Shares from IEPF

Reclaim your lost or unclaimed shares from the Investor Education and Protection Fund (IEPF) with expert guidance. Learn the step-by-step process to recover shares, dividends, and other assets transferred to IEPF. Start your claim today and regain control of your rightful investments with ease.

0 notes

Text

Don’t leave your family’s future to chance.

Without a will, your loved ones may face legal battles and disputes over your assets. Ensure your wishes are honored and your family's future is secure. Take the step today to write a will.

Unlock Forgotten Wealth: Reclaim Your Unclaimed Assets.

📞 Call Us - +91-8287103437

✉️Mail Us- [email protected]

🌐Our website- www.glcwealth.com

0 notes

Text

IEPF Claim Advisor

Care4Share is your trusted IEPF claim advisor in India, based in Delhi. We specialize in helping investors manage their SRN Status, ensuring a smooth experience when checking for pending claims. Learn how to efficiently check SRN status in MCA and reduce your IEPF claim process time with our expert guidance. For more Details Visit Us: https://iepfshare.com/ Contact Us: +91 8178715427

#srn status#iepf#iepf claim#recovery of shares from iepf#stocks#iepf srn status#srn status iepf#track srn iepf#srn iepf

0 notes

Text

Infiny Solutions offers cutting-edge fintech services, specializing in compliance, investor servicing, and digital transformation. With a focus on seamless solutions for corporates and financial institutions, they provide innovative tools for managing investor data and resolving financial discrepancies. Their expertise extends to handling unclaimed dividend cases efficiently, helping companies streamline records and improve transparency. Infiny’s commitment to accuracy and compliance ensures reliable outcomes in the ever-evolving financial landscape.

0 notes