#Refund Consulting Program Blog

Explore tagged Tumblr posts

Text

How to Get Business Visa for USA – A Complete 2025 Guide

The United States continues to be a leading destination for global business professionals, investors, and entrepreneurs. If you are planning to travel to the U.S. for meetings, conferences, negotiations, or other business-related purposes, you will need to apply for a B-1 Business Visa. This blog provides a comprehensive guide on how to get a U.S. business visa, including the application process, required documents, fees, processing times, and frequently asked questions.

What is a U.S. Business Visa (B-1 Visa)?

The B-1 visa is a non-immigrant visa that allows foreign nationals to enter the United States temporarily for business activities that do not involve employment or receiving a salary from a U.S. source. Common permitted activities include:

Attending business meetings and negotiations

Participating in professional or industry conferences

Consulting with business associates

Contract signing or market exploration

Settling an estate

Short-term training (non-technical)

It is important to note that B-1 visa holders are not allowed to engage in gainful employment or long-term work in the U.S.

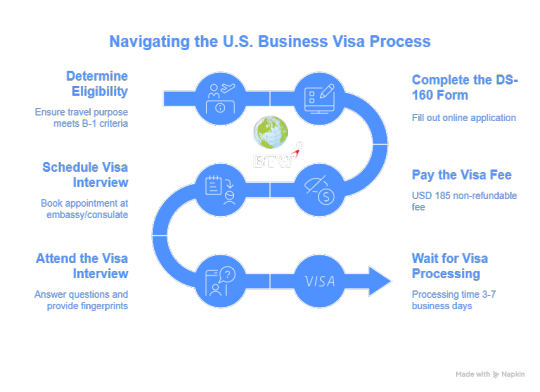

Step-by-Step Process to Apply for a U.S. Business Visa

1. Determine Eligibility Before applying, ensure that your purpose of travel meets the criteria for the B-1 visa. You must also demonstrate ties to your home country and the intention to return after your short visit.

2. Complete the DS-160 Form The DS-160 is the standard online visa application form for non-immigrant visas. Fill out the form at: https://ceac.state.gov/ceac/ Once submitted, save the confirmation page with the barcode.

3. Pay the Visa Fee As of 2025, the application fee for a B-1 visa is USD 185. This fee is non-refundable, even if the visa is denied.

4. Schedule Visa Interview After paying the fee, schedule your visa appointment at the nearest U.S. embassy or consulate. Depending on the location, waiting times may vary from a few days to several weeks.

5. Attend the Visa Interview During the interview, you will be asked questions about your travel plans, business purpose, financial status, and ties to your home country. You will also need to provide fingerprints as part of the biometric process.

6. Wait for Visa Processing If approved, your passport with the visa stamp will be returned by courier or can be collected at the visa center. Processing times usually range from 3 to 7 business days, but it may take longer during peak seasons.

Documents Required

Valid passport (minimum 6 months validity beyond intended stay)

DS-160 confirmation page

Visa fee payment receipt

Appointment confirmation letter

Letter of invitation from U.S. business associate or company

Proof of employment or business ownership in home country

Travel itinerary (flight and hotel bookings)

Financial documents (bank statements, salary slips, tax returns)

Evidence of ties to home country (property ownership, family documents)

Reference website: https://travel.state.gov

FAQs – Business Visa for USA

Q1. How long is a U.S. business visa valid? The validity depends on the applicant’s nationality. Many applicants receive a 10-year multiple-entry visa, but the length of each stay is generally limited to 6 months.

Q2. Can I extend my B-1 visa stay? Yes, extensions may be granted for up to an additional 6 months if justified. You must file Form I-539 before your current stay expires.

Q3. Do I need a business invitation letter? Yes. A letter from your U.S. host company or associate outlining the purpose and duration of your visit significantly strengthens your application.

Q4. Can I work in the U.S. on a B-1 visa? No. The B-1 visa does not permit paid employment in the U.S. It is only for business-related visits.

Q5. Is a personal interview mandatory for all applicants? Most applicants between the ages of 14 and 79 are required to attend a personal interview unless they qualify for interview waiver programs.

Final Thoughts

Getting a U.S. business visa is a straightforward process if you follow the steps, provide the necessary documentation, and meet the eligibility criteria. Ensure that your purpose of travel is genuine and that you can demonstrate your intention to return to your home country after the trip. Always check the latest information on the official U.S. Department of State website.

For more information, visit: https://travel.state.gov

0 notes

Text

Nutrofit — A Modern Webflow Website Template for Nutritionists and Wellness Coaches

Whether it’s a personalized diet plan, fitness coaching, or lifestyle advice, people often start their wellness journey online. That’s why having a professional, approachable, and informative website is key to growing your practice. Enter Nutrofit — a Webflow Website Template designed specifically for nutritionists, health coaches, and wellness experts.

With its fresh design and client-focused features, Nutrofit helps you build a standout website that reflects your passion for healthy living — without needing any coding skills.

What is Nutrofit?

Nutrofit is a clean, easy-to-navigate Webflow Website Template tailored for dietitians, nutrition coaches, holistic health professionals, and anyone offering wellness services. It gives you everything you need to showcase your expertise, promote your programs, and connect with potential clients — all through a beautifully designed site that builds trust and encourages action.

Why Choose Nutrofit for Your Nutrition Business?

Here’s why Nutrofit is a perfect choice for modern wellness professionals:

Focused on Health & Nutrition Services: This webflow template contains all the elements, pages and sections that a health, nutrition or wellness website should have.

Modern Design: Nutrofit has a simple, clean, and minimal, yet modern design style. It follows the latest design trends, so your website will have a modern and premium website design.

CMS Included: This template allows you to publish informative blog posts, client testimonials and doctor profiles that showcase your expertise with powerful CMS integration.

Excellent Services Page Showcase: You can highlight each of your nutrition plans, health and diet plans, baby nutrition, pregnancy tips and guidelines so that your audience can know every information and attract your services. From comprehensive meal plans to advanced nutritional guidance systems, you can perfectly showcase all of your offerings.

Animation, Video & Responsive Sliders: Show off your skills and some treatment procedures with beautiful animation and video segments. Navigate your services effortlessly with responsive sliders, animations and videos.

Appointment Booking: Simplify your appointment booking process and improve your professional service. Our expertly designed templates provide a perfect booking experience for your clients, while giving you a powerful backend to efficiently manage your schedule.

Contact details: Clearly display your information, including address, phone number, and an interactive map, so patients can easily find and reach you.

Terms and Conditions Showcase: This page displays all information with professionalism to the users. They cover important aspects like use of services, payment and refund policy, limitation of liability, privacy and confidentiality and more.

Pricing Page Showcase: Our pricing page highlights every detail perfectly and provides pricing information about your services. This ensures transparency and helps potential customers choose the most suitable package as per their needs.

Dedicated Customer Support: When you choose Nutrofit, you get exceptional support from the TNCFlow support team. Our dedicated professionals can answer your questions and help you immediately.

Ideal For:

Nutritionists & dietitians

Health & fitness coaches

Holistic lifestyle consultants

Meal planning experts

Wellness bloggers & content creators

If your work helps others lead healthier lives, Nutrofit is built to support and amplify your mission.

Final Thoughts

First impressions matter — especially when it comes to health and wellness. With Nutrofit, you can present your services, values, and expertise through a beautifully designed Webflow Website Template that’s fast, responsive, and easy to manage.

Whether you’re just starting your practice or ready to level up your brand, Nutrofit gives you the perfect digital foundation to grow and thrive.

Launch your nutrition or wellness website today with Nutrofit and inspire healthy living from the very first click.

#nutrition#healthyliving#healthy food#health and wellness#wellnessgoals#wellnessjourney#healthcare#health & fitness#web design#webflow#business#small business#website#digital marketing agency#startup#architecture#hospital

0 notes

Text

The Ultimate Guide to Choosing an Online Garden Center for All Your Gardening Needs

In an age where convenience meets creativity, more gardening enthusiasts are turning to the internet for their green-thumb needs. Whether you're a beginner planting your first tomato or an experienced gardener redesigning your backyard oasis, an online garden center can be your go-to destination for plants, tools, advice, and more — all delivered straight to your doorstep.

Why Shop at an Online Garden Center?

Traditional garden centers are great for browsing, but they come with limitations — travel time, seasonal stock, and sometimes unhelpful staff. An online garden center removes these barriers, offering a more flexible and comprehensive experience.

Here are a few standout benefits of using an online garden center:

1. Wider Selection

Unlike physical stores restricted by floor space and local climate, online garden centers offer a massive range of plants, seeds, tools, soil amendments, fertilizers, planters, and decor. You’ll find everything from exotic bonsai trees to heirloom vegetable seeds in one place.

2. Convenient Shopping

With 24/7 access, you can shop from the comfort of your home and avoid the hassle of carrying heavy bags of soil or mulch. Most stores offer fast delivery options, too.

3. Expert Gardening Advice

Many reputable online garden centers provide blogs, planting calendars, how-to videos, and even virtual consultations with horticulturists. It’s like having a garden coach at your fingertips.

4. Product Comparisons and Reviews

Detailed product descriptions and verified reviews help you make informed choices. It’s easier to compare products online than walking aisle to aisle in a physical store.

What You Can Buy from an Online Garden Center

Most online garden centers offer more than just plants. You can typically find:

Outdoor & indoor plants: Annuals, perennials, shrubs, trees, and houseplants.

Seeds & bulbs: For vegetables, herbs, flowers, and native plants.

Soils & fertilizers: Organic mixes, compost, peat-free soils, and nutrient boosters.

Gardening tools: From hand trowels and pruners to raised beds and watering systems.

Decor: Planters, garden lights, trellises, birdbaths, and furniture.

Some even offer subscription boxes, seasonal bundles, or kits for beginners.

Customer Testimonial

“As someone who lives in a small town with limited gardening resources, discovering an online garden center was a game-changer. I ordered herb seeds, compost, and a few garden tools from [EverGreen Supply], and everything arrived quickly and in perfect condition. The customer support team even helped me create a planting schedule based on my zone. I’m hooked!” — Liam H., Fort Collins, CO

FAQ: Online Garden Center

Q1: Are plants safe to ship through the mail?A: Yes. Reputable online garden centers use professional-grade packaging and select the right shipping times to ensure plants arrive healthy and undamaged.

Q2: What if my plant or item arrives damaged?A: Most online garden centers offer satisfaction guarantees or replacement/refund policies. Be sure to read the return policy before purchasing.

Q3: How do I know what to plant in my region?A: Many sites include USDA hardiness zone filters and offer planting calendars based on your zip code or location.

Q4: Can I get organic or eco-friendly gardening products online?A: Absolutely. Many online centers focus on sustainability and offer organic seeds, peat-free compost, and eco-conscious pest control options.

Q5: Do online garden centers offer discounts or loyalty programs?A: Yes. Many offer first-time buyer discounts, seasonal sales, and reward programs for frequent purchases.

Tips for Choosing the Right Online Garden Center

Not all online garden centers are created equal. Here’s what to look for:

Positive reviews on Google, Trustpilot, or gardening forums.

Clear product descriptions with care guides and planting instructions.

Responsive customer service via chat, email, or phone.

Sustainability practices, such as recyclable packaging or support for local growers.

Educational resources, like planting guides or zone maps.

Also, pay attention to return policies and shipping fees — some centers offer free shipping for orders over a certain amount.

Conclusion: Grow More, Worry Less with an Online Garden Center

Shopping at an online garden center is more than a convenience — it's a gateway to better gardening. With access to a wider variety of plants and products, expert guidance, and hassle-free delivery, it’s easier than ever to create the garden of your dreams, no matter your space or experience level.

0 notes

Text

Super Visa Travel Insurance in Saskatoon: Secure Your Parents’ Stay with Confidence

Welcoming your parents or grandparents to Canada under the Super Visa program is a proud moment. If you're in Saskatoon and planning a long-term visit for your loved ones, it's essential to arrange proper medical coverage. Super visa travel insurance is a must-have to meet the visa requirements and to protect against unexpected medical costs during their stay.

This blog will help you understand why super visa travel insurance is important, what to look for, and how our team at MS Insurance in Saskatoon makes the process easy and affordable.

What is Super Visa Travel Insurance?

The Super Visa is designed for parents and grandparents of Canadian citizens or permanent residents. It allows extended stays of up to two years at a time. A core requirement of this visa is proof of private medical insurance from a Canadian insurance provider, valid for at least one year.

This is where super visa travel insurance comes in. It covers emergency medical care, hospitalization, and even repatriation—ensuring your loved ones are protected while in Canada.

Why Super Visa Travel Insurance is Essential

Without the right insurance, a medical emergency can lead to major expenses. Even a minor health issue can result in thousands of dollars in bills. Super visa insurance provides peace of mind by covering:

Emergency hospital stays

Doctor consultations

Prescription medication

Medical tests and x-rays

Ambulance services

Return of remains or repatriation (if necessary)

It is also mandatory to show proof of this insurance when applying for the Super Visa. If your coverage isn’t accepted, your application can be rejected.

Choosing the Right Super Visa Travel Insurance in Saskatoon

At MS Insurance, we make it simple for families in Saskatoon. We guide you to pick a plan that fits your budget and provides the coverage your loved ones need.

Here’s what to keep in mind while choosing:

Coverage duration of at least 365 days

Coverage from a Canadian insurance company

Must include health care, hospitalization, and repatriation

Must be valid on the day of entry

We offer flexible plans that match these conditions and help with claims and renewals.

Key Benefits of Getting Covered with MS Insurance

Families across Saskatoon trust us because we offer:

Affordable plans tailored for super visa requirements

Fast policy issue with no long wait times

Clear explanation of what’s covered

Help with claims and renewals

Easy-to-understand documents for your visa application

Options for refundable policies if the visa is denied

We work with multiple insurance partners, allowing you to compare and select the best coverage for your family.

How to Apply for Super Visa Travel Insurance in Saskatoon

Getting started is simple. You can either apply online, call us, or visit our Saskatoon office. Here's what you'll need:

Personal details of the applicant and the insured

Travel dates and intended length of stay

Medical history, if applicable

Choice of deductible and coverage amount

Once we receive your details, we provide a personalized quote. You’ll receive the documents you need to submit with your Super Visa application.

FAQs for Our Website

Q: How long does it take to get super visa insurance from MS Insurance? A: Most policies are issued the same day. We can also provide the required documents for your visa application quickly.

Q: Is MS Insurance an approved provider for Super Visa travel insurance? A: Yes, we offer plans from Canadian companies that meet all Super Visa requirements.

Q: Can I renew my parent's super visa insurance through MS Insurance? A: Yes. We offer simple renewal options, even if your parents stay longer than expected.

Q: Do you offer the cheapest super visa health insurance in Saskatoon? A: We help compare plans from top providers to find the most affordable option that fits your needs.

Other Insurance Services We Offer in Saskatoon

MS Insurance offers more than just super visa coverage. We can also help you with:

Visitor Insurance in Saskatoon

Travel Insurance in Saskatoon

International Student Insurance in Saskatoon

Life Insurance in Saskatoon

Critical Illness Insurance in Saskatoon

No Medical Insurance in Saskatoon

Disability Insurance in Saskatoon

We’re here to support your family in every way, whether they’re visiting, studying, or planning for the future.

Final Thoughts

Getting super visa travel insurance doesn’t have to be complicated. If you're in Saskatoon and looking for simple, affordable options to cover your loved ones, MS Insurance is ready to help.

We offer clear guidance, multiple plans, and a team that puts your family first.

If you're ready to protect your parents or grandparents with super visa travel insurance, contact MS Insurance in Saskatoon today. We’ll help make sure your family’s visit is a safe and comfortable one.

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

How Many IVF Cycles Are Needed for Success?

Introduction

In vitro fertilization (IVF) has transformed fertility treatment, providing hope to couples facing conception challenges. A common question among patients is: How many IVF cycles are needed for success? The answer depends on various factors, such as age, underlying fertility issues, and the quality of treatment. This blog explores the key factors influencing IVF success rates and what couples can expect during multiple cycles. If you're looking for expert care, an IVF center in Ahmedabad can provide personalized guidance and advanced fertility solutions.

Understanding IVF Success Rates

IVF success rates are not uniform for all patients. The chances of conceiving through IVF depend on a combination of biological and medical factors. According to fertility specialists, success is often measured by live birth rates per cycle. Here’s a general breakdown based on age:

Women under 35: Around 50-60% success rate per cycle

Women aged 35-37: Around 40-50% success rate per cycle

Women aged 38-40: Around 25-35% success rate per cycle

Women over 40: Below 20% success rate per cycle

These rates indicate that younger women have a higher likelihood of success per cycle, but multiple cycles may still be necessary.

How Many IVF Cycles Are Typically Needed?

Studies suggest that the cumulative success rate increases with multiple IVF cycles. On average:

1 Cycle: Approximately 33-40% of couples conceive

2 Cycles: The cumulative success rate increases to around 60%

3 Cycles: Around 70-75% of couples achieve pregnancy

4-6 Cycles: The success rate can reach 80-90%

Many fertility clinics recommend at least three cycles for the best chances of success, as each cycle provides more opportunities for viable embryo implantation.

Factors Affecting IVF Success

Several factors determine how many cycles a couple may need, including:

1. Age of the Woman

Younger women generally have a higher number of high-quality eggs, improving success rates. Women over 40 may require more cycles or consider donor eggs.

2. Ovarian Reserve

A woman’s Anti-Müllerian Hormone (AMH) levels and Antral Follicle Count (AFC) help assess ovarian reserve. A lower ovarian reserve may mean fewer eggs retrieved, requiring additional cycles.

3. Embryo Quality

Embryos with chromosomal abnormalities are less likely to implant. Preimplantation genetic testing (PGT) can improve the selection of healthy embryos, potentially reducing the number of required cycles.

4. Underlying Medical Conditions

Conditions such as polycystic ovary syndrome (PCOS), endometriosis, or uterine fibroids can impact implantation and may necessitate more cycles.

5. Male Factor Infertility

If sperm quality is poor, techniques like Intracytoplasmic Sperm Injection (ICSI) may be needed, which could affect success rates.

6. Lifestyle Factors

Smoking, obesity, stress, and poor diet can affect fertility. Optimizing health before IVF can improve the chances of success in fewer cycles.

Financial Considerations

IVF treatment is expensive, and the cost per cycle can vary by country and clinic. Some couples opt for IVF refund programs or multi-cycle packages to manage costs effectively. Insurance coverage may also impact how many cycles couples can afford.

Emotional and Physical Aspects

IVF is physically and emotionally demanding. Couples may experience stress, anxiety, and financial strain. Support groups and counseling can help manage expectations and emotional challenges during multiple cycles.

Conclusion

While some couples may achieve pregnancy in their first IVF cycle, many require multiple attempts. On average, three IVF cycles at an IVF Hospital in Ahmedabad provide a strong chance of success, though individual factors influence the outcome. Consulting a fertility specialist for personalized advice is essential. With patience, perseverance, and medical support, IVF can be a successful path to parenthood for many couples.

#ivf center in ahmedabad#ivf doctor in ahmedabad#ivf hospital in ahmedabad#ivf center#best ivf treatment in ahmedabad#ivf treatment in ahmedabad#best ivf hospital in ahmedabad#ivf doctor#ivf specialist#ivf treatment

0 notes

Text

Boost Innovation with SR&ED Consulting in Chilliwack

In today’s competitive business landscape, innovation is key to staying ahead. Whether you're developing new products, improving existing processes, or exploring groundbreaking technologies, research and development (R&D) plays a vital role in your company’s success. To support businesses engaged in R&D, the Canadian government offers the Scientific Research and Experimental Development (SR&ED) tax credit program, providing financial incentives. For businesses in Chilliwack, SR&ED consulting in Chilliwack is an invaluable resource, helping local companies maximize the benefits of this program. In this blog, we’ll explore how SR&ED consulting can help your business thrive.

Understanding the SR&ED Tax Credit Program

The SR&ED tax credit program is a federal initiative designed to encourage Canadian businesses to invest in research and innovation. The program offers tax credits and refunds to companies that engage in eligible R&D activities. These credits can be used to offset costs associated with labor, materials, and overhead expenses related to R&D projects. However, to take full advantage of the SR&ED program, businesses must properly document and qualify their activities. This is where SR&ED consulting in Chilliwack can provide expert guidance.

Why Choose SR&ED Consulting in Chilliwack?

Navigating the SR&ED program can be complicated, especially for small and medium-sized businesses that may not have the internal resources or expertise to handle the intricacies of the claims process. SR&ED consulting in Chilliwack offers local businesses the specialized knowledge needed to maximize their claims and avoid common mistakes.

Consultants with experience in SR&ED claims help businesses in Chilliwack identify eligible R&D activities, ranging from experimental work to testing and prototyping. By working with an SR&ED consultant, you ensure that your R&D projects are properly documented and aligned with the program’s requirements, increasing the likelihood of a successful claim. Consultants will also help you determine which expenditures are eligible for credits and ensure that all the necessary technical documentation is submitted to the Canada Revenue Agency (CRA).

How SR&ED Consulting Can Maximize Your Claims

The SR&ED tax credit program offers substantial financial support for businesses investing in R&D, but many businesses miss out on potential credits simply because they don’t know what qualifies or how to present their claims effectively. This is where SR&ED consulting in Chilliwack comes in. Consultants help you identify every possible qualifying activity and expense, from labor costs to materials and overhead, ensuring your claim is as robust as possible.

A skilled SR&ED consultant will also ensure that your R&D activities are well-documented, providing clear descriptions of the work, the methodology used, and the challenges overcome during the development process. The CRA requires detailed technical reports to back up the claim, and consultants help businesses prepare these documents in a way that aligns with CRA guidelines. By ensuring that all activities are correctly accounted for and documented, SR&ED consultants can maximize your claim, helping you secure the maximum tax credits available.

Industries in Chilliwack That Can Benefit from SR&ED Consulting

Chilliwack is home to a diverse range of industries, all of which can benefit from SR&ED tax credits. Some of the sectors that stand to gain from SR&ED consulting include:

Agriculture: As a key player in the agricultural sector, Chilliwack-based companies can qualify for SR&ED credits for innovative farming techniques, product development, and technological advancements in food production.

Manufacturing: Manufacturers working on process improvements, automation, or new product designs can benefit from SR&ED consulting. Consultants help businesses identify eligible R&D activities related to manufacturing processes and product development.

Technology: Technology companies in Chilliwack can claim SR&ED tax credits for software development, hardware design, and other R&D activities. Consultants guide tech businesses through the process of identifying eligible projects, such as coding, testing, and product optimization.

SR&ED consulting in Chilliwack is a powerful tool for businesses looking to capitalize on the financial support available through the SR&ED tax credit program. Whether you’re in agriculture, manufacturing, or technology, working with an experienced consultant ensures that your R&D activities are properly documented and aligned with CRA requirements. By maximizing your SR&ED claim, you can secure the financial resources needed to drive innovation and support your business’s growth. If your business is engaged in R&D and you’re not already leveraging SR&ED tax credits, now is the time to reach out to a local consultant and start reaping the rewards of your hard work and innovation. Find us here

0 notes

Text

Going from Physical Offices to Online Business: Step by step Guide for Businesses

Is your business still operating solely offline? Are you wondering how to expand your reach and take your operations online?

In today’s digital era, having an online presence is no longer optional—it’s essential for growth, increased sales and staying competitive. Moving your business online requires careful planning, execution, and adaptability. This guide outlines the key steps, challenges, and precautions to help you successfully transition to the digital world.

Steps to Take Your Business Online

1. Define Your Online Business Goals

Start by identifying why you want to transition online. Is it to boost sales, enhance brand visibility or improve customer service? Having clear goals will help shape your digital strategy effectively.

2. Choose the Right Online Platform

Select the best platform based on your business needs:

Website: Acts as your digital storefront and brand identity.

E-commerce Store: Platforms like Shopify, WooCommerce, and Magento allow seamless online selling.

Social Media: Facebook, Instagram, and LinkedIn help with engagement and brand promotion.

Consulting a marketing agency can help you choose the most effective channels for your business.

3. Set Up Your Website or Online Store

Register a domain name that reflects your brand.

Choose a reliable hosting provider.

Build your site using website builders like WordPress or Shopify or hire a developer.

Ensure your site is mobile-friendly, fast and easy to navigate.

4. Develop a Strong Digital Marketing Strategy

Once your site is live, focus on attracting customers through:

Search Engine Optimization (SEO): Improve search rankings for better visibility.

Content Marketing: Create blogs, videos and infographics to engage your audience.

Social Media Marketing: Build a loyal community and drive sales.

Email Marketing: Keep customers informed and engaged.

Paid Advertising: Use Google and social media ads for targeted reach.

5. Implement Secure Payment and Logistics Solutions

Offer multiple payment options (credit/debit cards, PayPal, etc.).

Partner with trusted shipping and fulfillment services.

Provide clear return and refund policies to build customer trust.

6. Build Strong Customer Support

Use chatbots, email, and phone support to assist customers.

Provide self-help resources like FAQs and tutorials.

Respond promptly to inquiries and complaints to maintain customer satisfaction.

7. Monitor and Improve Your Online Business

Use analytics tools like Google Analytics and Facebook Insights to track performance.

Collect customer feedback and make necessary improvements.

Stay updated with digital trends and continuously adapt your strategies.

If managing this transition feels overwhelming, consider working with a marketing partner like Katalysts, to help guide your business through the process.

Precautions to Take When Moving Online

1. Ensure Cybersecurity for Safe Transactions

Secure your website with an SSL certificate.

Protect customer data with encryption and secure payment gateways.

Train employees to recognize online security threats like phishing and malware.

2. Comply with Legal and Regulatory Requirements

Ensure your business follows online business regulations.

Have clear privacy policies, terms of service, and refund policies.

Comply with tax laws related to online sales.

3. Avoid Overinvestment at the Start

Launch with a minimum viable product (MVP) before scaling up.

Test the market with a small product range before expanding.

Focus on organic growth before investing heavily in ads.

Challenges and How to Overcome Them

1. Competition from Established Online Businesses

Solution: Identify your Unique Selling Proposition (USP), build a niche, and provide superior customer service.

2. Gaining Online Visibility

Solution: Invest in SEO, content marketing, and social media engagement. Collaborate with influencers and implement referral programs.

3. Building Customer Trust and Retention

Solution: Display customer reviews, maintain transparent policies and offer excellent customer support.

4. Managing Logistics and Deliveries

Solution: If you’re running an e- commerce business, partner with reliable shipping companies, use inventory management software and set clear delivery expectations.

5. Adapting to New Technologies

Solution: Stay updated with the latest trends, invest in staff training and remain flexible in adopting new innovations.

The future of business is digital—embrace it today!

Shifting from offline to online business can unlock tremendous opportunities for growth. With the right strategies and a step-by-step approach, you can establish a strong digital presence. Start small, stay consistent, and refine your approach based on customer feedback and market trends. Consult Katalysts.net to help you create a website, create a shop on an e-commerce platform and create social media channels (Instagram, Facebook, LinkedIn, Youtube, Tiktok) for showcasing your products and services.

0 notes

Text

How to Change College or University in Canada

Can you change your DLI means College or University from Outside Canada after getting your Visa this is the topic of today hello everyone welcome back to this Blog Globexa immigration this Jitender Grover today we are discussing about one important topic can you change your DLI from outside Canada there are few frgy type of Consultants who are misguiding students uh especially for Algoma University that they can ask for refund for project management program and they can take a master degree somewhere else and still there will not be any impact on their visa application and they can travel to Canada but if in any case if you are going to change your DLI after getting your Visa then you may not be able to enter in Canada let’s see what the rule says you can simply Google this particular website I’m going to share the link in description as well just simply Google can I change my DLI from outside Canada you will get this particular website.

1.1 Rule says Changing your DLI from Outside Canada

1.1.1 If your Application is Still in Progress

if you haven’t got your result in that case you can submit the new letter of acceptance through IRCC webform and new sop as well that’s how you can change your DLI from outside Canada if the application is still in process if you haven’t got your result but if you have got your result in that case that is the second rule.

1.1.2 If your application has been approved

if you have got Visa already in that case what you need to do if your Visa is already approved in that case you must submit a new study permit application with new letter of acceptance and need to pay the new charges as well new Embassy fee as well.

❌ What You Cannot Do:

If your visa was approved for a PG Diploma, you cannot switch to a Master’s program before traveling.

You must enter Canada with the same DLI that your visa was approved for.

You cannot withdraw from your current university and join a new one before arriving in Canada.

✅ What You Can Do:

Change your program within the same institution after arriving in Canada.

Example: Students have switched from Project Management to HR Management at Algoma University, McEwan University, and Kesta College.

Change your DLI after landing in Canada by following the official process.

Rules vs. Norms – Don’t Get Confused

This is a strict immigration rule, not a flexible norm. There’s no debate or alternative opinions on this.

Immigration consultants may have different norms about financial proof, but rules are non-negotiable.

📌 Follow the legal process to avoid visa issues. If you need to change your DLI, do it after arriving in Canada.

1.2 How to Process it ?

1.2.1 Get new admission in 2-3 universities or colleges

Where you want to change so for example you got your admission in ALA University now you want to go to IBU or you want to go to Trinity earlier you got admission in mchan University now you want to change it to IBU Trinity Northeastern kenle anywhere else so if you want to change from PG diploma to a Master Degree and for that you are having to change your University and or you got admission in a ug diploma now you want to go for a bachelor degree and if you want to change your DLI basically you want to change your Province you want to change your University if that is the case in that case secure admission in at least two three options because by the time you reach Canada seats can be full in that case you may not get enrolled in that particular University so better to have multiple options in hand at least have two three options in hand so that at the time of traveling in Canada you get multiple options to select one of them at least one should be available for you to join.

1.2.2 Pay Seat Booking Amount, if needed

After getting your admission pay the seat booking amount if needed if the university asks you to pay some particular amount $1,500 $2,000 $2,500 to secure your seat or one semester fee to secure your seat in that case paid that fee that will secure your seat in that particular College University so that is the second step this can be done even before traveling to Canada so if there is a deadline you can pay the fee so that your seat is secured.

1.2.3 Do not disclose this admission to anyone while traveling

So neither while boarding the flight from your home country suppose you’re traveling from India so on the airport do not disclose that you have two admissions you need to disclose only one admission through which you got Visa earlier okay that is your admission just keep that in mind so if you got admission and Visa with project management at mcken University that is the only admission you are having no need to tell about your other admissions like IBU or Trinity or Northeastern to anyone they those admission don’t even exist you are traveling for project management in mchan University just keep it keep it in mind so whatever admissions you got earlier through which you got Visa that is the only admission and you just need to keep those documents ready only that’s it do not disclose other admissions anywhere neither while boarding the flight nor after landing in Canada.

1.2.4 Travel to the City of Old DLI to get your study permit

so if your previous un was mchan and in that case you need to travel to Edmonton so if if you got visa for project management at mchan University then you must travel to Edmonton your final destination should be Edmonton because you need to land in the same city of your University after landing there during the entire process you may get your uh study permit either in Vancouver if it is a connecting flight through Vancouver or you can get it in Toronto if the connecting flight is through Toronto you can get it in Montreal as well if the connecting flight is through Montreal the Final Destination must be Edmonton so that every border officer get to know that you are finally going to Adminton to start your classes after getting your study permit you can travel to any place evenyou can take next flight to go to your final destination you can take a flight after 1 day two days 3 days 4 days whenever you want you can travel to your final destination where your new DLI is there where your new college or university is there for for example you want to change from mchan University to Toronto IBU International Business University in that case first go to Edmonton get your luggage there and you can take the next flight back to Toronto it’s not a problem so after getting your study permit you can go to any other place any other college any other university it’s not a problem but before getting your study permit you need not to disclose it to anyone it you will be in great trouble if you disclose it and if they get to know about it and officially you cannot change your DLI from outside Canada before getting your study permit after getting your study permit you can do anything it’s not a problem at all. Travel to the City of Old DLI after getting permit after getting your study permit you can go to the city of New DLI it is not a problem.

1.2.5 Pay 1 semester fee and Enrol in new DLI

Suppose you are going to IBU or Trinity and the uh you need to pay one semester fee to get enrolled there and you can start taking your classes it’s not a problem so you can pay one semester fee as well and you can start taking your classes you need to manage this fee because refund you are going to apply now after getting study permit.

1.2.6 Withdraw from old DLI for your refund

It can be done online no need to go to your college or university to ask for your refund you can apply it from anywhere it is not a problem so the entire process is you can start the process even before traveling but officially it will be done after getting your study permit suppose you are traveling now in August 2024 for your September intake as soon as you land in Canada after that we can start the process of officially changing your DLI but you will be having admission already secured for you so we can secure admission in IBU right now we can secure admission in northeastern right now we can secure admission in Trinity right now same way you can secure admission in other college and universities right now even before traveling but officially we will change it after you are landing in Canada after getting the study permit that is the essential thing right now onshore and offshore both admissions are available for September and January and may intake as well next year may intake as well if you want to get your admission done.

1.3 Apply with me ?

Want to apply for your visa application or you if you want to change your DLI your college or university right now in that case we can Procced for your admission Complexity is not a problem for me any kind of complexities are fine your age number of refusal your study Gap doesn’t matter we can get admission and get Visa at any age we can Apply for Canada study Visa with spouse as well and you can get Visa without any issue if your funds are ready if you want to get complete Clarity on funds requirement for study visa and spouse visa together watch this video.

0 notes

Text

Understanding US Visa Requirements: A Comprehensive Guide

Navigating the complexities of US visa requirements can be a daunting task for many individuals seeking to travel or relocate to the United States. Whether you are planning to visit for tourism, study, work, or to join family members, understanding the specific visa requirements is crucial. In this blog post, we will delve into the various types of US visas, the requirements associated with them, and tips to ensure a smooth application process.

Types of US Visas

The United States offers a variety of visa categories, each tailored to different purposes. Broadly, these can be classified into two main categories: non-immigrant visas and immigrant visas.

Non-Immigrant Visas

Non-immigrant visas are temporary and are intended for individuals who wish to visit the US for a specific period. Some common types include:

Tourist Visa (B-2): This visa is for individuals traveling to the US for leisure, tourism, or medical treatment.

Business Visa (B-1): Designed for those attending business meetings, conferences, or negotiating contracts.

Student Visa (F-1): For international students enrolled in academic programs in the US.

Work Visas (H-1B, L-1, etc.): These are for foreign workers in specialized occupations or those transferring within a company.

Immigrant Visas

Immigrant visas are intended for individuals who plan to live permanently in the United States. Common categories include:

Family-Sponsored Visas: For individuals with family members who are US citizens or permanent residents.

Employment-Based Visas: For individuals who have job offers from US employers.

Diversity Visa: A lottery program for individuals from countries with low immigration rates to the US.

Key US Visa Requirements

Understanding the US visa requirements is essential for a successful application. While requirements can vary significantly by visa type, several common elements are typically involved:

1. Valid Passport

A valid passport is a fundamental requirement for any US visa application. Your passport must be valid for at least six months beyond your intended stay in the US.

2. Visa Application Form

Applicants must complete the appropriate visa application form. For most non-immigrant visas, this is the DS-160 form, while immigrant visas generally require the DS-260 form. Accuracy and honesty in filling out these forms are critical, as any discrepancies can lead to delays or denials.

3. Visa Fee Payment

Most visa applications require a non-refundable fee. The amount varies depending on the visa type. Ensure that you pay the correct fee before your interview, as this is a key part of the US visa requirements.

4. Photographs

Applicants must provide recent passport-sized photographs that meet specific requirements outlined by the US Department of State.

5. Supporting Documents

Depending on the visa category, applicants may need to provide additional supporting documents. For example:

Tourist Visa: Evidence of financial stability, travel itinerary, and ties to your home country.

Student Visa: Acceptance letter from a US educational institution, proof of financial support, and SEVIS fee payment.

Work Visa: Job offer letter, labor certification, and proof of qualifications.

6. Interview Appointment

Most visa applicants are required to attend an interview at a US embassy or consulate. During the interview, a consular officer will evaluate your application and ask questions to determine your eligibility. It’s essential to prepare thoroughly for this interview, as it is a critical step in the US visa requirements process.

Tips for a Successful Visa Application

Start Early: Visa processing times can vary widely, so it’s advisable to begin your application well in advance of your intended travel date.

Be Honest and Accurate: Provide truthful information and ensure all documents are accurate. Misrepresentation can lead to visa denial.

Consult Official Resources: Always refer to the official US Department of State website or the specific US embassy or consulate for the most accurate and up-to-date information regarding US visa requirements.

Seek Professional Help if Necessary: If you find the process overwhelming, consider consulting an immigration attorney or a reputable visa consultancy service.

Conclusion

Understanding US visa requirements is essential for anyone looking to travel to or reside in the United States. By familiarizing yourself with the different types of visas, their specific requirements, and the application process, you can navigate this complex landscape with greater confidence. Whether you are applying for a tourist visa, a student visa, or an immigrant visa, thorough preparation and adherence to the guidelines will significantly enhance your chances of a successful application. Remember, the key to a smooth visa process lies in understanding the requirements and being well-prepared.

0 notes

Text

A Complete Guide to Claiming the Electric Vehicle Tax Credit

Switching to an electric vehicle (EV) is not only a significant step toward reducing your carbon footprint but also a financially smart choice, thanks to the availability of federal tax credits. These incentives can make purchasing an EV more affordable, encouraging more people to adopt eco-friendly transportation. In this blog post, we’ll delve into what the electric vehicle tax credit is, how to claim it, and important details you need to know to maximize your benefits.

What Is the Electric Vehicle Tax Credit?

The federal electric vehicle tax credit, officially known as the Qualified Plug-In Electric Drive Motor Vehicle Credit, offers a substantial financial incentive to individuals who purchase a qualifying electric vehicle. The credit amount can be as high as $7,500, depending on the battery capacity and the manufacturer of the vehicle. This credit directly reduces the amount of income tax you owe, making EVs a more attractive option.

Who Is Eligible for the Electric Vehicle Tax Credit?

To be eligible for the electric vehicle tax credit, you must meet the following criteria:

Purchase Date: The vehicle must be purchased new, not used, and it must be acquired for use, not for resale.

Vehicle Type: The vehicle must be a qualifying plug-in electric drive motor vehicle with a battery capacity of at least 4 kilowatt-hours.

Manufacturer Cap: The credit begins to phase out for a manufacturer's vehicles when at least 200,000 qualifying vehicles have been sold in the United States. After the cap is reached, the credit is reduced by 50% for six months and then by 75% for another six months before being phased out entirely.

How to Claim the Electric Vehicle Tax Credit

Verify Eligibility: Ensure the vehicle you are purchasing qualifies for the tax credit. You can usually find this information from the manufacturer or the dealership.

Complete IRS Form 8936: When you file your federal tax return, you’ll need to complete IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. This form calculates the credit amount based on the specifics of your vehicle.

Include the Credit Amount on Form 1040: After completing Form 8936, transfer the credit amount to your Form 1040. This will reduce your tax liability for the year.

Keep Documentation: Retain all purchase documentation, including the sales contract and any certification from the manufacturer that the vehicle qualifies for the credit. This is important in case the IRS requests proof of your eligibility.

Key Considerations and Tips

Tax Liability: The credit is non-refundable, meaning it can reduce your tax bill to zero, but you won’t receive a refund for any excess credit. Make sure you have enough tax liability to take full advantage of the credit.

State Incentives: Many states offer additional incentives for electric vehicle purchases, such as rebates, tax credits, or reduced registration fees. Check your state’s programs to maximize your savings.

Consult a Tax Professional: Navigating tax credits can be complex. Consulting a tax professional can ensure you correctly claim the credit and maximize available incentives.

Conclusion

Claiming the electric vehicle tax credit can significantly reduce the cost of purchasing an EV, making it a more attractive and affordable option for many people. By understanding the eligibility requirements, properly completing the necessary tax forms, and keeping thorough documentation, you can take full advantage of this financial incentive. Additionally, exploring state and local incentives can further enhance your savings. Embrace the future of transportation with confidence, knowing you’re making a positive impact on both the environment and your wallet.

0 notes

Text

Trinity Western University Application Process: A Comprehensive Guide for International Students

Trinity Western University (TWU), located in Langley, British Columbia, is a leading Canadian Christian university that attracts students from around the globe. With its strong academic programs, commitment to holistic education, and vibrant community, Trinity Western University offers a unique environment for personal and academic growth. If you're considering applying to TWU as an international student, understanding the application process is essential. This blog will walk you through the steps required to apply, along with how an overseas education consultancy can assist you in navigating the process smoothly.

Step 1: Research Your Program of Interest

Before you begin your application to Trinity Western University, it's essential to thoroughly research the academic programs offered. TWU offers a wide range of undergraduate and graduate programs, spanning fields such as business, nursing, education, and the humanities. Visit the university’s official website to explore the different courses available, entry requirements, and career prospects for each program.

When selecting a program, consider how it aligns with your career goals and academic strengths. An overseas education consultancy can provide valuable guidance by helping you identify the right program based on your interests and qualifications.

Step 2: Review the Admission Requirements

Admission requirements for Trinity Western University may vary depending on the program you choose and your academic background. However, there are some general requirements for international students applying to undergraduate programs:

Academic Qualifications: You must have completed your secondary education with strong academic performance. Specific grade requirements may vary depending on your country of origin and the program you’re applying to.

English Language Proficiency: As an international student, you will need to demonstrate your proficiency in English. This is typically done through standardized tests such as the IELTS or TOEFL. TWU requires an IELTS score of 6.5 overall, with no band below 6.0, or a TOEFL iBT score of at least 88.

Official Transcripts: You will need to provide official transcripts from your secondary school (for undergraduate applicants) or university (for graduate applicants). These should be translated into English if they are in another language.

Statement of Purpose: Many programs require you to submit a statement of purpose outlining your academic goals, career aspirations, and reasons for choosing TWU. This is your opportunity to showcase your motivation and alignment with the university’s values and mission.

Letters of Recommendation: Depending on your program, you may also need to submit one or more letters of recommendation from teachers, professors, or employers who can speak to your academic potential and character.

Step 3: Submit Your Application

Once you've gathered all the necessary documents, you're ready to start your application. Trinity Western University offers an online application portal that makes the process straightforward and accessible to international students.

Create an Account: Start by creating an account on TWU’s application portal. You’ll need to provide basic personal information, such as your name, contact details, and citizenship status.

Fill Out the Application Form: Complete the application form by entering your academic history, program of interest, and any additional information requested. Be sure to review your entries carefully before submitting them to avoid errors.

Upload Documents: During the application process, you will need to upload your transcripts, English language test scores, and other supporting documents like your statement of purpose and letters of recommendation.

Pay the Application Fee: There is a non-refundable application fee, typically around CAD 150, which you can pay online via credit card or other available payment methods. Make sure to check the current fee on TWU’s website, as it may vary depending on the program or your country of residence.

Step 4: Apply for Scholarships and Financial Aid

Trinity Western University offers a variety of scholarships and financial aid opportunities to international students. These can help ease the financial burden of tuition and living expenses. Scholarships are often based on academic performance, leadership potential, or financial need.

To apply for scholarships, be sure to submit your scholarship application alongside your admission application. Pay close attention to deadlines, as missing them could affect your chances of receiving financial assistance. An overseas education consultancy can assist you in identifying and applying for scholarships, ensuring you maximize your financial aid opportunities.

Step 5: Receive Your Offer of Admission

After you’ve submitted your application, TWU’s admissions team will review your materials. The processing time may vary depending on the program and the volume of applications, but you can typically expect to hear back within a few weeks to a couple of months.

If you receive an offer of admission, congratulations! At this stage, you will need to confirm your acceptance and pay a deposit to secure your place at TWU. The offer letter will also include important details about orientation, visa application, and housing.

Step 6: Apply for a Study Permit

As an international student, you will need a valid study permit to study at Trinity Western University. To apply for a study permit, you’ll need your letter of acceptance from TWU, proof of sufficient funds, and other required documents. The study permit application process can take time, so it’s important to apply as soon as you receive your acceptance letter.

An overseas education consultancy can assist you in preparing your study permit application, ensuring that you meet all the requirements and submit the necessary paperwork on time.

Conclusion

Applying to Trinity Western University as an international student involves several key steps, from researching programs and meeting admission requirements to securing financial aid and obtaining a study permit. Working with an overseas education consultancy can make the entire process smoother by providing expert guidance, helping you navigate the application system, and offering valuable insights into securing scholarships and visa documentation. With the right preparation and support, you can successfully begin your academic journey at TWU and make the most of your study abroad experience.

0 notes

Text

Got solar panels? Claim 30% of your solar installation bill before it's gone - Sunny Energy

This Blog was Originally Published at:

Got solar panels? Claim 30% of your solar installation bill before it’s gone — Sunny Energy

With advancements in solar technology and a heightened awareness of environmental impact, more homeowners are harnessing the power of the sun by installing solar panels on their properties. As the world pivots toward renewable energy solutions, the U.S. government is incentivizing this eco-conscious choice through the Federal Solar Tax Credit, officially known as the Investment Tax Credit (ITC).

In this blog, we will talk about the Federal Solar Tax Credit, how it works, who is eligible for it, and how to claim Federal Solar Tax Credit.

As with anything related to taxes, it’s always best to consult with your tax professional to make sure you follow the rules correctly and you fully utilize these benefits.

What is the Federal Solar Tax Credit?

The Federal Solar Tax Credit, officially known as the Investment Tax Credit (ITC), serves as a governmental incentive designed to encourage investments in specific areas deemed beneficial by the government. This credit, outlined in the Inflation Reduction Act, has been extended to cover Solar Tax credits until 2034.

Specifically focusing on residential solar energy, the federal government provides a tax credit applicable to federal income taxes, allowing taxpayers to claim a percentage of the expenses incurred in installing a solar photovoltaic (PV) system.

How does the Federal Solar Tax Credit work?

The Solar Investment Tax Credit (ITC) is available to individuals who own their solar energy systems. Even if the full credit cannot be claimed in a single year due to a limited tax bill, any remaining credit amount can be carried over.

However, individuals who enter into a lease or a power purchase agreement (PPA) with a solar installer relinquish ownership of the system and, consequently, are ineligible to claim the tax credit. Additionally, it is noteworthy that the ITC program imposes no income limit, ensuring eligibility for taxpayers across all income brackets.

How can you claim Federal Solar Tax Credit?

Homeowners in Arizona can qualify for the Federal Solar Tax Credit if they meet the following criteria:

1. Installation period: The solar system installation must be done between January 01, 2006, and December 31, 2034.

2. Location: The solar photovoltaic (PV) system should be situated at the taxpayer’s primary or secondary residence in the United States, or it can be part of an off-site community solar project.

3. Ownership: The homeowner must own the solar PV system, having acquired it through either cash payment or financing. It’s essential that the homeowner is neither leasing the solar power system nor engaged in an arrangement to purchase electricity generated by a system they do not own.

4. New or first-time use: The solar PV system must be new or being utilized for the first time. The tax credit is applicable only to the original installation of the solar equipment.

5. Taxable income: Having a taxable income is crucial to benefit from the federal tax credit for solar panels. And the non-refundable nature of the credit means it can only offset taxes owed, without providing a cash refund.

Meeting these criteria makes homeowners eligible to claim the Federal Solar Tax Credit, providing a financial incentive for their solar investments.

What expenses are included for Federal Solar Tax Credit?

The eligible expenses for the Federal Solar Tax Credit include:

1. Solar panels to power homes: The cost of solar panels used to power homes qualify for the tax credit providing homeowners with a financial incentive to invest in renewable energy and contribute to a more sustainable future.

2. Contractor labor costs: This encompasses expenses related to onsite preparation, and assembly, for the original solar system installation. Additionally, associated costs such as permitting fees, inspection costs, and developer fees are considered eligible.

3. Balance of system equipment: Costs associated with the balance of system equipment, including wiring, inverters, and mounting equipment, are included in the tax credit.

4. Energy storage devices: Energy storage devices that are charged exclusively by the associated solar PV panels are eligible, even if the installation of the storage occurs in a subsequent year to the solar energy system. It’s important to note that these storage devices must still adhere to the installation date requirements.

5. Sales taxes: The tax credit extends to cover sales taxes incurred on the eligible expenses mentioned above.

These provisions provide a comprehensive overview of the various expenses that qualify for the Federal Solar Tax Credit, encouraging investment in solar energy infrastructure and associated components.

How do other incentives affect the Federal Tax Credit?

It is essential to understand how various incentives and rebates can impact your overall tax liability. Let’s delve into the details to comprehend the implications of your Federal Tax Credit:

1. Rebate from electric utility to install solar:

Under certain circumstances, utility subsidies provided to homeowners for solar PV installation are exempt from federal income taxes, thanks to a provision in federal law. In such instances, the utility rebate amount is deducted from the total system costs before calculating the tax credit.

2. Payment for renewable energy certificates:

When your utility or another purchaser compensates you with cash or incentives for renewable energy certificates or other environmental attributes associated with the electricity generated — whether provided upfront or over time — such compensation is likely to be regarded as taxable income. In such instances, the payment will augment your gross income; however, it will not diminish the Federal Solar Tax Credit.

3. Rebate from the state government:

Contrary to utility rebates, rebates provided by state governments typically do not diminish your federal tax credit. For instance, if your solar photovoltaic (PV) system was installed prior to December 31, 2022, and the installation expenses amounted to $18,000, a one-time rebate of $1,000 from your state government for installing the system would not affect your federal tax credit calculation.

4. State Tax Credit:

State tax credits for solar PV installation typically do not offset federal tax credits, and vice versa. However, when you receive a state tax credit, the taxable income reported on your federal taxes increases, as you now have a reduced state income tax deduction. The consequence of claiming a state tax credit is that the amount of the state tax credit becomes effectively taxed at the federal level.

It’s important to note that because the reduction in state income taxes leads to an increase in federal income taxes paid, the two tax credits are not additive (i.e., not (25% + 26% = 51%)).

How can you claim 30% of the solar installation bill?

After the installation of your solar power system, it’s crucial to note that the tax credit can only be claimed once. To ensure proper documentation and adherence to guidelines, it is recommended that you consult with your tax matters professional.

Install solar panel today with Sunny Energy

As a trusted solar installer and among top rated solar companies in Arizona, Sunny Energy brings expertise and experience, in solar technology that helps with a seamless transition to renewable energy. Our team of professionals is dedicated to providing customized solutions tailored to your unique needs, prioritizing efficiency and transparency throughout the process.

Contact us to receive a personalized solar quote, and let us be your solar installer or guide you through a professional installation that not only transforms your home but also qualifies you for the Federal Solar Tax Credit. Don’t miss the opportunity to contribute to a greener planet and enjoy long-term energy savings. Get a quote today from Sunny Energy, one of the top rated solar companies in Arizona.

Conclusion

In summary, the Federal Solar Tax Credit, or Investment Tax Credit (ITC), plays a crucial role in boosting residential solar investments, extended until 2034. Arizona homeowners must meet specific criteria, ensuring their solar system installation dates fall between January 01, 2006, and December 31, 2034, and they own the system. The credit covers diverse expenses, promoting solar infrastructure investments.

Consideration of how utility and state rebates impact the federal tax credit is vital, while payments for renewable certificates and state tax credits warrant careful assessment. Homeowners can claim the credit using IRS Form 5695, ensuring adherence to guidelines and maximizing benefits by carrying over any unused credits to future years.

0 notes

Text

Navigating the Bail System: What You Need to Know About Bail Financing

Being arrested is a stressful and confusing experience. If you or a loved one finds yourself facing this situation, understanding the bail system and your options for securing release is crucial. This blog post discusses in detail the matrix of bail financing in the United States, empowering you with the knowledge needed to navigate this challenging process effectively.

What is Bail?

Bail is a financial guarantee that ensures an arrested individual appears for future court hearings. The court sets a bail amount based on the severity of the charges, the defendant's flight risk, and their ties to the community. If the defendant attends all court appearances, the bail money is typically refunded. However, if they fail to appear, the court keeps the bail money.

Why Choose Bail Financing?

Unfortunately, bail amounts can be high, often leaving families scrambling for funds. This is where bail financing companies come in. These companies act as lenders, providing the full bail amount in exchange for a non-refundable fee, typically a percentage of the total bail. It’s important to choose a trusted partner in this complex process- and this is where Acme Bail Bonds, California’s best bail bonds company, can help you. Call us at 1+800-884-1222 to access our round the clock expert services.

Benefits of Bail Financing:

Securing Release Quickly: Sitting in jail can disrupt your job, family life, and overall well-being. Bail financing allows for a quicker release, minimizing these disruptions.

Peace of Mind for Loved Ones: Knowing your loved one is safe and able to prepare their defense can offer immense comfort during a stressful time.

Maintain Employment and Responsibilities: Getting released on bail allows the defendant to continue working and fulfilling their responsibilities while awaiting trial.

Prepare a Stronger Defense: Being released allows for better access to legal counsel and the ability to gather evidence more effectively.

Important Considerations Before Choosing Bail Financing:

Cost: Understand that the non-refundable fee charged by bail bond companies adds to the overall cost. It is important to evaluate your financial situation before making a decision.

Collateral: Some bail bond companies might require collateral, such as a car title or property deed, to secure the loan. Do ensure to completely understand the potential risks involved.

Co-Signer: You might be asked to co-sign for the bail, becoming legally responsible if the defendant fails to appear in court.

Reputation of the Bail Bondsman: Do your research! Choose a reputable and licensed bail bondsman with a transparent fee structure and positive customer reviews. Our team at Acme Bail Bonds, comes with 35+ years in the bail business, offering numerous bail options.

Alternatives: Consider exploring alternatives like secured bonds (using assets as collateral) or pretrial release programs before resorting to bail financing.

Steps Involved in Bail Financing:

Contact a Licensed Bail Bondsman: Search online or ask for recommendations from attorneys or law enforcement (not the arresting officer).

Consultation and Agreement: Discuss the case details, terms of the agreement, and fees with the bondsman.

Co-Signer and Collateral: If required, secure a co-signer and gather any necessary collateral.

Paperwork and Payment: Sign the paperwork and pay the non-refundable fee.

Release from Jail: The bondsman will post bail with the court, and the defendant will be released (usually within 24-48 hours).

Important Legal Considerations:

Bail is Not Guaranteed: The judge has the final say on whether bail is granted or denied.

Court Appearances are Mandatory: Failure to appear in court will result in a bench warrant and the forfeiture of the entire bail amount.

Seek Legal Counsel: Consulting with an attorney is crucial for understanding your legal rights and navigating the court process effectively.

Conclusion:

The bail system can be complex and overwhelming. However, by understanding your options and working with a reputable bail bondsman in California, you can navigate this challenging situation and secure the release of your loved one. Remember, this blog post serves for informational purposes only. For specific legal advice, always consult with a qualified attorney.

#bail bonds#bail bondsman in california#bail bonds california#acme bail bonds#california#los angeles#usa#bail bonds services

0 notes

Text

Navigating Colorado Payroll and Taxation: A Comprehensive Guide.

Subheadings:

Understanding Colorado Payroll Taxes

Navigating Colorado State Tax Filing

Internal Revenue Service in Colorado: What You Need to Know

Payroll Management in Colorado: Best Practices

Tax Dispute Resolution in Colorado: Your Options

Seeking Tax Help in Colorado: Resources and Assistance

Tax Resolution Services in Colorado: How They Can Help

Summary: