#Repower Solar Projects

Explore tagged Tumblr posts

Text

Repower Solar Projects | Do Good Energy

Maximize efficiency with Do Good Energy’s Repower Solar Projects. We upgrade outdated solar installations with advanced technology to boost performance and extend system lifespan. Reduce energy costs and enhance sustainability with our expert repowering solutions. Switch to a smarter, more efficient solar future today! For more details visit the website or call us at +1-862 803 0988

1 note

·

View note

Text

The Race to 11,000 GW: Are We on Track to Triple Renewable Capacity by 2030?

The world is in a race against time to triple global renewable energy capacity by 2030, with a target of 11,000 gigawatts (GW), but current ambitions are falling short. While the world is making strides in renewable energy deployment, a significant acceleration is needed to meet this goal. The COP28 climate summit established the tripling target, aligning with the International Energy Agency's (IEA) Net Zero Emissions by 2050 scenario, which is crucial for limiting global warming to 1.5°C.

Global renewable capacity additions reached almost 560 GW in 2023, marking an unprecedented 64% year-on-year increase. This growth aligns with the annual pace required to reach nearly 8,000 GW by 2030, which matches countries' current policies and estimates. However, even if all countries fully implement their existing ambitions, the world would still fall 30% short of the 11,000 GW target. This ambition gap highlights the urgent need for countries to increase their renewable energy targets and accelerate implementation.

China is the most significant contributor to renewable capacity growth. In 2023, China installed almost 350 GW of new renewable capacity, more than half the global total. If China maintains this pace, it could significantly surpass its existing 2030 ambitions. Outside of China, the rest of the world needs to accelerate its average annual growth by 36% to meet national ambitions. This highlights a significant disparity in renewable energy deployment rates, with some regions and countries lagging.

For advanced economies, the level of ambition needs to increase from a growth factor of 1.9 to 2.5, while for emerging and developing economies, the growth factor should rise from 2.4 to 3.4. This difference underscores the need for varying approaches depending on regional circumstances and capabilities. For example, the Middle East and North Africa (MENA) region has a high growth factor 4.5. Still, in absolute terms, this is only an additional 156 GW, much less than the capacity additions required in Europe, Asia Pacific, and the United States.

The IEA's analysis indicates that tripling global renewable power capacity by 2030 is an ambitious but achievable goal, especially with the record-breaking annual deployment and increasing competitiveness of solar photovoltaic (PV) and wind energy compared with fossil fuels. However, this requires a significant shift in policy and investment, including addressing permitting issues, investing in grid infrastructure, and ensuring system flexibility. Furthermore, significant scaling up of deployment is also needed in Southeast Asia, the Middle East and North Africa, and Sub-Saharan Africa.

The challenge goes beyond setting ambitious targets; it also requires the practical implementation of these goals. This includes accelerating the pace of feasibility studies, permitting, financing, and construction of renewable energy projects. Many countries also need to address challenges such as policy uncertainty, fossil fuel overcapacity, and access to affordable financing.

For example, India, which aims to meet most of its growing electricity demand with renewable energy and achieve 500 GW of non-fossil fuel capacity by 2030, must institute policies to encourage hybrid renewable power plants and support the repowering of existing wind farms. In Europe, which aims to double its renewable capacity, grid infrastructure and flexibility are key challenges. In Southeast Asia, insufficient policy support and unattractive renewable energy tariffs hinder faster renewable capacity deployment.

Several key findings emerge:

Current Ambitions Fall Short: Even with full implementation of existing plans, the world will not meet the 11,000 GW target by 2030.

Regional Disparities Exist: China is a leader in renewable capacity additions, while other countries and regions need to accelerate their efforts.

Policy and Implementation Gaps: Addressing permitting delays, grid infrastructure investments, financing challenges, and policy uncertainty is crucial.

Technology Focus: Solar photovoltaic and wind are leading the growth, but other renewables and system flexibility are also essential.

Global Cooperation is Necessary: Enhanced international cooperation and knowledge sharing are needed to achieve the global renewable energy goals.

The journey to triple renewable capacity by 2030 is challenging, but it remains achievable with increased ambition, accelerated implementation, and a focus on policy priorities. Failure to do so will undermine efforts to meet climate targets and transition to a sustainable energy future.

References

IEA (2024), COP28 Tripling Renewable Capacity Pledge, IEA, Paris https://www.iea.org/reports/cop28-tripling-renewable-capacity-pledge, Licence: CC BY 4.0

IEA (2024), Renewables 2024, IEA, Paris https://www.iea.org/reports/renewables-2024, Licence: CC BY 4.0

IEA (2024), From Taking Stock to Taking Action, IEA, Paris https://www.iea.org/reports/from-taking-stock-to-taking-action, Licence: CC BY 4.0

IEA (2024), Southeast Asia Energy Outlook 2024, IEA, Paris https://www.iea.org/reports/southeast-asia-energy-outlook-2024, Licence: CC BY 4.0

IEA (2024), Achieving a Net Zero Electricity Sector in Viet Nam, IEA, Paris https://www.iea.org/reports/achieving-a-net-zero-electricity-sector-in-viet-nam, Licence: CC BY 4.0

0 notes

Text

The Economics of Wind Turbine Decommissioning: Cost Factors and Market Growth

The global wind turbine decommissioning market is poised for robust growth in the coming years, fueled by increasing investments in renewable energy, ambitious national energy targets, and advancements in wind power technologies. With governments and corporations worldwide focusing on environmentally sustainable energy solutions, the need for effective wind turbine decommissioning services is becoming increasingly critical.

Wind turbine decommissioning involves the complete removal of wind turbines from service and the restoration of land to its original condition. As wind turbines reach the end of their lifecycle, owners must choose between decommissioning or repowering their facilities. Decommissioning often entails the disassembly of turbines, disposal of non-recyclable components, and restoration of the site. This ensures environmental compliance and prepares the land for alternative uses.

The demand for wind turbine decommissioning services is driven by the difficulty in replacing aging turbine components and the high cost of maintaining deteriorating parts. Furthermore, as power purchase agreements conclude, the business case for operating aging wind turbines diminishes, prompting the need for decommissioning.

Visit our report to explore critical insights and analysis - https://www.transparencymarketresearch.com/wind-turbine-decommissioning-market.html

Key Market Drivers

Technological Advancements and Cost Efficiency Innovations in wind power systems have improved energy generation efficiency while reducing the Levelized Cost of Energy (LCOE). These advancements have enhanced the economic viability of decommissioning services, bolstering market demand.

Shift Towards Renewable Energy With the global transition to renewable energy sources, such as wind, solar, and geothermal, investments in sustainable energy infrastructure are surging. This shift is expected to significantly boost the wind turbine decommissioning market in the near future.

Supportive Government Policies National targets, international agreements, and government subsidies aimed at promoting renewable energy have created a favorable environment for the growth of wind turbine decommissioning services.

Regional Insights

Europe is expected to dominate the global wind turbine decommissioning market, driven by substantial investments in renewable energy and its leadership in offshore wind energy. In 2018 alone, Europe decommissioned 421 megawatts of wind power, with Germany accounting for the largest share. The region’s commitment to setting global standards for decommissioning practices positions it as a key player in the market.

The U.S. wind turbine decommissioning market is also projected to experience significant growth, supported by federal tax incentives and state-level renewable energy policies. Meanwhile, the Middle East and Africa are emerging as potential markets, with governments focusing on reducing fossil fuel dependency and promoting clean energy solutions.

Contact Us: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Hydropower Plant Construction Market Report 2024-2033 | By Types, Applications, Regions And Players

The hydropower plant construction global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Hydropower Plant Construction Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The hydropower plant construction market size has grown strongly in recent years. It will grow from $18.30 billion in 2023 to $19.60 billion in 2024 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to rural electrification, government policies, environmental concerns, environmental concerns, water management.

The hydropower plant construction market size is expected to see strong growth in the next few years. It will grow to $24.51 billion in 2028 at a compound annual growth rate (CAGR) of 5.8%. The growth in the forecast period can be attributed to renewable energy policies, climate change mitigation, grid modernization, energy storage integration, water resource management. Major trends in the forecast period include run-of-river installations, hybrid systems, repowering and upgrading, public-private partnerships, climate resilience.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/hydropower-plant-construction-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The rising interest in clean energy is expected to propel the growth of the hydropower plant construction market in the coming years. Clean energy is energy obtained from sources that do not emit greenhouse gases, such as nuclear power, hydroelectric power, solar, geothermal, wind, and tidal energy. The rising adoption of clean energy is due to several factors, including the growing awareness of climate change and environmental degradation, improvements in energy storage, and grid integration capabilities. The construction of hydropower plants makes it easier to generate sustainable energy by leveraging the power of water's movement to generate electricity while releasing zero greenhouse emissions. For instance, in June 2023, according to the Energy Information Administration, a US-based principal government statistical system institution in charge of obtaining, assessing, and distributing energy data, the usage of renewable energy in the United States increased modestly to an all-time high of 13.2 quads in 2022, up from 12.1 quads in 2021. Therefore, the rising interest in clean energy is driving the hydropower plant construction market.

Market Trends - Major companies operating in the hydropower plant construction market are focusing on digitization and automation for hydropower plants to strengthen their position in the market. Digital solutions are a collection of devices and applications that use digital technology to meet particular company requirements, such as data analysis, data processing, and operations. For instance, in June 2022, Voith Group, a Germany-based company that constructs hydropower plants, in collaboration with Ray Sono AG, a Germany-based digital solution company, launched the Hydro Pocket, a cloud-based application designed to monitor, analyze, and optimize hydropower stations. Hydro Pocket is a smart, one-stop solution for small to medium-sized hydropower facilities that increases operator efficiency, flexibility, and security. The cloud-based tool handles the system data in a 'smart' way. Maintenance and repair planning is optimized, and problems or unexpected downtime can be eliminated because of the clear picture of assets and support in the form of sophisticated analytical techniques. As a consequence, system management is simplified while communication needs are lowered.

The hydropower plant construction market covered in this report is segmented –

1) By Type: Water Storage, Diverted, Pumped Storage 2) By Capacity: Large hydropower plants, Medium hydropower plants, Small hydropower plants, Other Capacities 3) By Application: City Power Supply, Industrial Power Supply, Military Power Supply, Other Applications

Get an inside scoop of the hydropower plant construction market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14397&type=smp

Regional Insights - Asia-Pacific was the largest region in the hydropower plant construction market in 2023. The regions covered in the hydropower plant construction market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the hydropower plant construction market are PowerChina Group, Bouygues Construction SA, Sinohydro Corporation, Vinci Construction, Siemens Energy AG, ABB Group, Duke Energy Corporation, Toshiba Corporation, China Three Gorges Corporation, Strabag SE, Statkraft AS, Skanska Group, Hydro-Québec, Verbund AG, Enel Green Power, Webuild SpA, Dongfang Electric Corporation, Andritz AG, Suez Group, RusHydro, SNC-Lavalin Group Inc., BC Hydro, Voith Group, GE Renewable Energy, Astaldi S.p.A., Bharat Heavy Electricals Limited (BHEL), Alstom SA, Innergex Renewable Energy Inc., Voimaosakeyhtiö SF

Table of Contents 1. Executive Summary 2. Hydropower Plant Construction Market Report Structure 3. Hydropower Plant Construction Market Trends And Strategies 4. Hydropower Plant Construction Market – Macro Economic Scenario 5. Hydropower Plant Construction Market Size And Growth ….. 27. Hydropower Plant Construction Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Blake Nixon: Repowering America’s Electricity Grid at National Grid Renewables for A Clean Sustainable Energy

The solution for a clean and green energy resource that is sustainable in environmental, economic, and social aspects is our natural renewable energy resources. These renewable energy resources cover Solar, Wind, Geothermal, Hydro, and Biomass which are the most common in the world among the lesser-known natural resources. The role that sustainability efforts, initiatives, and practices play in the world today is imperative in addressing the various environmental challenges, in increasing the economic status and growth, and in the societal harmony of enhancing the social and community well-being of a region or nation.

An electricity grid or electric grid powers a country’s infrastructure to meet the needs of the people and the economy. The electric grid ensures the generation of power, its transmission, and distribution of the same to meet energy demands and sustainability goals. With the hope of having a future where the planet is safe, healthy, livable, and green, sustainable goals and initiatives must be established for the well-being of our coming generations. Whatever it is that we do today, will ensure a tomorrow that is prosperous. Therefore in agreement with the need for establishing and leading sustainable efforts and practices in our day-to-day activities to drive our economic growth, reducing the use of non-renewable resources and the already depleting fossil fuels, and enhancing the well-being of our societies and communities for sustainable energy futures, this article will share deep insights into repowering and reinvesting America’s electricity grid by delving into the core areas of an Electric Power Generation company located in North America.

National Grid Renewables, a venture division of the parent company – National Grid, is a renewable energy company headquartered in North America’s Minneapolis, Minnesota. To repower America’s electricity grid, drive the economic and social well-being of societies and communities in the country, and reinvest in a sustainable future, National Grid Renewables is a farmer-founded organization that comes into the picture providing corporations and utilities projects in solar, wind, and energy storage undergoes various stages of development, construction, and operation. This article will also share insights into how the President of National Grid Renewables – Blake Nixon, oversees operations in all the competitive renewable energy activities of solar, wind, and energy storage in America to build clean energy resources that are affordable by the upcoming generations.

The President and His Commitments in Affordable Clean Green Futures:

Blake Nixon has been the President of National Grid Renewables since 2019. After receiving an educational Bachelor’s Degree in Business Administration and Finance from the University of Washington at Seattle, and a General Course at The London School of Economics (LSE), Blake Nixon started his career as an Equity Analyst for a money management firm called Investment Advisors Inc. (IAI), as the Principal of The Rahn Group – the family investment office of Geronimo Energy where Blake managed the venture capital, hedge fund, and the family office’s private equity portfolio, and as the President/Chief Executive Officer of Geronimo Energy – a North American independent company leading renewable power energy projects and developments.

As the President of National Grid Renewables, Blake Nixon is responsible for all the competitive renewable energy activities in solar, wind, and energy storage projects in America, to build a clean and affordable energy future for the coming generations. Blake oversees plans to expand the onshore project portfolio to all the states across America with the launch of the organization’s brand, actively makes efforts to build a clean and affordable energy future by working with important customers like The Hershey Company, committed to the initiatives taken toward achieving a completely sustainable environment that benefits the local and global communities, and passionately working toward promoting sustainable and economic competitiveness. With these commendable efforts, Blake Nixon has successfully driven the venture division – National Grid Renewables by reinvesting in and repowering America’s electric national grid system.

Repowering, Reigniting, and Reinvesting – National Grid Renewables:

National Grid Renewables – an electric power generating organization aims to repower America’s electricity grid system nationwide through their Solar, Wind, and Energy Storage projects, to reignite the local economies of the nation’s society and communities, to reinvest in a sustainable future where the upcoming generations can reap the benefits of an available clean energy resource. The organization develops high-performance renewable energy projects for corporations and utilities and oversees different stages of development, construction, and operation. A farmer-founded green energy enterprise, National Grid Renewables prioritizes its customers, partners, and community members, with values deeply driven into leading by example for an inclusive culture, embracing innovative learning and maximizing efficiencies, addressing challenges and solving problems, and being community-focused.

Successful Solar, Wind, and Energy Storage projects have completed thousands of Megawatts across America leading the company in its transition and transformation journey. With expertise in handling and delegating project development, project construction, project operation, and enterprise, the leaders of National Grid Renewables are strongly rooted and committed to driving sustainability and the economic growth of local communities. With the mission to “leave this world a better place than when we found it”, the organization makes decisions intending to influence the future of the planet’s ecosystem and biodiversity. In environmental aspects, by offsetting CO2 emissions and water usage National Grid Renewables also drives a responsible and leading independent business in America where recycling, repurposing, preserving, and conserving are possible. In Socioeconomic aspects, the electric power generating company provides its support through local charity funding and community volunteering, and creating new jobs for the locals in construction and operations.

National Grid Renewables’s Road in Achieving Sustainability Goals:

Annually, an approximate number of 3.1M metric tons of CO2 emissions are offset, and over 622,000 homes across America use the eco-friendly energy that is generated, transmitted, and distributed by National Grid Renewables. Over 20 years of operation, the organization has created approximately 2,563 jobs in construction and operation, $218M in new tax revenue, $6.7M in charitable funding, and $315M in landowner income.

Recent news on National Grid Renewables is its expansion of its Minnesota Portfolio with two additional solar projects, announcing a $670,000 in charitable through Ohio’s Solar Projects, and successfully establishing the largest Solar Project in Kentucky.

Visit More : https://thebusinessmagnate.com/blake-nixon-repowering-americas-electricity-grid-at-national-grid-renewables-for-a-clean-sustainable-energy/

0 notes

Text

Onshore Wind Energy Market Share, Growth Forecast Global Industry Outlook 2024 – 2033

The global Onshore Wind Energy Market size accounted for USD 52.2 Billion in 2023 and to reach at USD 79.98 Billion in 2033, growing at a CAGR of 4.4% from 2024 to 2033.

Introduction to Onshore Wind Energy

Onshore wind energy is a renewable energy source derived from the kinetic energy of wind captured by wind turbines installed on land. It's one of the fastest-growing sources of electricity generation globally, contributing significantly to the transition towards cleaner and more sustainable energy systems.

Growth Drivers

Environmental Concerns: With increasing awareness of climate change and the need to reduce greenhouse gas emissions, there's growing support for renewable energy sources like wind power.

Cost Competitiveness: Advances in technology and economies of scale have significantly reduced the cost of onshore wind energy, making it increasingly competitive with conventional fossil fuels.

Government Policies: Many governments worldwide have implemented supportive policies, such as renewable energy targets, feed-in tariffs, tax incentives, and competitive auctions, to promote the deployment of onshore wind projects.

Energy Security: Onshore wind energy enhances energy security by diversifying the energy mix and reducing dependence on imported fossil fuels, thus contributing to energy independence.

Market Analysis

Global Growth: The onshore wind energy market has experienced rapid growth in recent years, with installations expanding across various regions, including Europe, Asia-Pacific, North America, and Latin America.

Technology Advancements: Continuous innovation in turbine design, rotor size, materials, and control systems has led to higher efficiency, increased reliability, and reduced maintenance costs, driving market growth.

Market Concentration: Key players in the onshore wind energy market include turbine manufacturers like Vestas, Siemens Gamesa, GE Renewable Energy, and Nordex, as well as developers, operators, and service providers.

Emerging Markets: Emerging economies, particularly in Asia and Latin America, are witnessing a surge in onshore wind installations, driven by rapid industrialization, urbanization, and favorable government policies.

Challenges and Opportunities

Grid Integration: Integrating large-scale onshore wind farms into existing electricity grids presents technical challenges related to grid stability, intermittency, and transmission infrastructure.

Land Use and Community Acceptance: Onshore wind projects often face opposition from local communities due to concerns about visual impact, noise pollution, and potential impacts on wildlife and ecosystems.

Competitive Landscape: The onshore wind energy market is becoming increasingly competitive, with players focusing on innovations in turbine technology, project development, and financing to maintain market share and profitability.

Hybridization and Co-location: Hybrid projects that combine onshore wind with other renewable energy sources like solar photovoltaics or energy storage offer opportunities to enhance system reliability, optimize resource utilization, and reduce costs.

𝐑𝐞𝐜𝐞𝐢𝐯𝐞 𝐭𝐡𝐞 𝐅𝐑𝐄𝐄 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://stringentdatalytics.com/sample-request/onshore-wind-energy-market/13908/

Market Segmentations:

Global Onshore Wind Energy Market: By Company

Siemens

Envision Energy

General Electric

Suzlon

Vestas

Enercon

Mitsubishi Power Systems

Nordex

Repower

Gazelle Wind Turbines

Clipper Wind Power

Global Onshore Wind Energy Market: By Type

Less Than 500 KW

500 KW To 2 MW

More Than 2 MW

Global Onshore Wind Energy Market: By Application

Utility

Non-utility

𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞��𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://stringentdatalytics.com/purchase/onshore-wind-energy-market/13908/?license=single

Future Outlook

Continued Growth: The onshore wind energy market is expected to continue growing in the coming years, driven by declining costs, supportive policies, technological advancements, and increasing demand for clean energy.

Market Expansion: Emerging markets, offshore wind development, repowering of existing turbines, and corporate procurement of renewable energy are expected to drive market expansion and diversification.

Grid Integration Solutions: Innovations in grid management, smart grid technologies, energy storage, and demand-side management will play a crucial role in facilitating the integration of higher shares of onshore wind energy into electricity grids.

Policy and Regulatory Support: Stable and predictable policy frameworks, along with long-term commitments to renewable energy targets, will be essential to sustain investment and growth in the onshore wind energy market.

Conclusion

The onshore wind energy market continues to expand rapidly, driven by environmental concerns, cost competitiveness, supportive policies, and technological advancements. Despite challenges related to grid integration, land use, and market competition, the outlook for onshore wind remains promising, with opportunities for further growth, innovation, and market diversification.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

Australia’s biggest smelter to launch massive wind and solar tender, says nuclear too costly

Giles Parkinson, Renew Economy, Mar 13, 2024 A massive tender for wind and solar projects is to be launched next week to help repower Australia’s biggest aluminium smelter Tomago, near Newcastle, with its majority owner saying nuclear is out of the question because it is too slow and too expensive. The tender will be a landmark event for the Australian renewable energy transition, because the…

View On WordPress

0 notes

Text

Wind Energy: Potential Of India

Ministry of New and Renewable Energy unveiled noteworthy insights into India's wind energy potential. This revelation sheds light on key states with the highest wind power potential and emphasizes the nation's dedication to sustainable energy practices.Additionally, the Ministry outlined innovative strategies aimed at enhancing wind Wind Power Potential in India - India ranks 4th globally after China, the United States and Germany, in terms of installed wind energy capacity, with 42.8 GW (onshore wind) as of April 2023. - Wind resource assessment by the National Institute of Wind Energy reveals an estimated wind power potential of approximately 695.5 GW at 120 meters and 1,164 GW at 150 meters above ground level across the nation. Best Performing States Wind Power Potential (in GW) at 120 m Above Ground Level - Gujrat (142.56), Rajasthan (127.75), Karnataka (124.15), Maharashtra (98.21), and Andhra Pradesh (74.90). - Wind Power Potential (in GW) at 150 m Above Ground Level: - Rajasthan (284.25), Gujarat (180.79), Maharashtra (173.86), Karnataka (169.25), and Andhra Pradesh (123.33). Government Initiatives for Wind Energy Development Policy for Repowering of the Wind Power Projects, 2016 - This policy incentivizes wind power project repowering by providing an additional interest rate rebate of 0.25% over existing rebates for new wind projects financed by the Indian Renewable Energy Development Agency (IREDA). Guidelines for Disposal of Fiber Reinforced Plastic (FRP) - The Central Pollution Control Board (CPCB) issued specific guidelines for the proper disposal of FRP, including Sheet Moulding Compound (SMC), used in wind turbine blades. These guidelines ensure environmentally responsible waste management. National Wind-Solar Hybrid Policy,2018 - The main objective is to provide a framework for promotion of large grid connected wind-solar PV hybrid systems for optimal and efficient utilization of wind and solar resources, transmission infrastructure and land. National Offshore Wind Energy Policy - Objective is to develop offshore wind energy in the Indian Exclusive Economic Zone (EEZ) along the Indian coastline of 7600 km. Read the full article

0 notes

Text

Solar Panel System Installations in Europe Grows by 50%

Another report from industry bunch Sun based Power Europe shows that sun-oriented establishments in the European Association expanded by practically half year-over-year in 2022, to a record 41.4 GW of age limit.

"The numbers are clear. Sun oriented is offering a help in the midst of energy and environment emergencies," said Walburga Hemetsberger, Chief of Sun based Power Europe. "No other energy source is developing as fast or dependably as sunlight based."

Finding different wellsprings of energy has become basic for the vast majority European nations, which for a really long time have depended on gaseous petrol from Russia. The inventory of gas has decreased after Russia's attack of Ukraine. The Worldwide Energy Organization has said the EU needs to introduce around 60 GW of sun-oriented power in 2023 to make up for shortages in Russian gas.

Germany Leads New Limit

Germany introduced more sun-oriented power limit than some other EU country, adding around 8 GW of new age in 2022. Germany has shut a large portion of its coal-terminated and thermal energy stations as the nation changes to sustainable power. The nation had arranged a total stage out of atomic power before the current year's over, yet government authorities have called for three plants to stay in activity until basically mid-April of the following year.

A report from Solar Power Europe shows sunlight-based power age limit filled quickly in 2022, contrasted with 2021, with Germany driving the way in new introduced limit across the EU. Source: SolarPower Europe

Spain added 7.5 GW of sun-based age limit this year, as per the report. Poland (4.9 GW), the Netherlands (4 GW), and France (2.7 GW) balance the main five. Poland moved from a net-metering to a net-charging methodology in April of this current year. That change, alongside high-power costs and a quickly developing utility-scale fragment, added to its better speed of sun-oriented reception.

Watch Kelly Borgen of Dark and Veatch to figure out how a working office's computerized change can advance utilizing a mix of cutting-edge design acknowledgment programming, traditional wired sensors, remote sensors, and continuous execution computations to accomplish genuine advantages in unwavering quality and proficiency.

Portugal moved into the best 10 interestingly, with SolarPower Europe revealing the nation had a 251% expansion in sunlight-based age limit.

The report said, "The limited scale PV [photovoltaic] section has supported the market, because of the country's good Super bonus 110% impetus plan, and high-power costs which have worked on the allure of self-utilization plans of action."

The EU's all out sunlight-based power limit became by 25%, from 167.5 GW in 2021 to 208.9 GW in 2022, as per SPE. The business body conjectures yearly PV development in Europe will be 53.6 GW in 2023, and 85 GW in 2026, as per its "most probable" situation. This implies the EU sun powered market is set to beyond twofold in no less than four years, coming to 484 GW by 2026.

Repower EU, a European Commission intend to extend inexhaustible power age across the coalition, calls for environmentally friendly power to supply no less than 45% of the EU's power by 2030. The report delivered Tuesday said the EU will require more laborers who can introduce sunlight-based chargers and interface sun-oriented exhibits to the power lattice, and proposed additional preparation projects to give qualified specialists.

0 notes

Text

How Big Money is Lining Up to Power Carbon Capture Stocks (TSLA, MSFT, BEP, VKIN, NRG, CLNE, EQNR, NEE, CEI)

Huge capital is pouring into a niche that has yet to become crowded with speculative money during this bull market: Carbon Capture. Carbon capture technology involves finding innovative strategies to capture and store CO2 emissions before they escape into the atmosphere. According to the experts, we already have technology capable of capturing up to 90% of CO2 emissions released through the burning of fossil fuels to power life and industry today. The problem is about incentivizing application of this technology as well as the discovery of new tools to do the job even better. Luckily the new Biden administration has pledged to make carbon capture investments a significant priority. Elon Musk, CEO of Tesla Inc (NASDAQ:TSLA) has also pledged to reward the best new Carbon Capture innovation with a prize of $100 million. Microsoft Corporation (NASDAQ:MSFT) recently unveiled plans to invest $1 billion to back companies and organizations working on Carbon Capture technologies. And the Canadian government is pushing to provide incentives for at least two gigantic new carbon capture projects by 2030. Between these sources, billions of dollars are set to power the Carbon Capture marketplace. And this doesn’t even count major corporate investments incentivized by these carrots or the strong likelihood of other similar carrots yet to be announced. It all adds up to a blossoming theme that could power a new and significant thematic investment narrative now in its early innings. With that in mind, we take a look here at a few interesting names with recent catalysts in the space. Brookfield Renewable Partners LP (NYSE:BEP) is a key player in the renewables space and has recently formed partnerships leading it seemingly inextricably into the carbon capture space. On paper, the company engages in owning a portfolio of renewable power generating facilities primarily in North America, Colombia, Brazil, Europe, India, and China. It operates through following segments: Hydroelectric, Wind, Solar, Energy Transition, and Corporate. The Energy Transition segment distributes generation, pumped storage, cogeneration, and biomass. Brookfield Renewable Partners LP (NYSE:BEP) recently reported financial results for the three and six months ended June 30, 2021, including news of its recent agreement with Trane Technologies to jointly pursue and offer decarbonization-as-a-service for commercial, industrial, and public sector customers, comprising energy efficient retrofits and upgrades of building energy infrastructure along with captive distributed solar, energy storage, and other power generation across North America. “We had a strong quarter, as we delivered solid financial results and executed on a number of key strategic initiatives including securing a 25-year contract-for-difference to support almost 1.5 gigawatts of offshore wind, initiated one of the largest onshore wind repowerings in the world, and entered a strategic collaboration with the world's largest corporate buyer of renewable power,” said Connor Teskey, CEO of Brookfield Renewable. “This broad range of transactions and agreements highlight the unique strengths of our business. We continue to see attractive large-scale opportunities leveraging our strengths to participate in the accelerating build out of renewables and the transition of existing generation to cleaner forms of electricity production.” Even in light of this news, BEP has had a rough past week of trading action, with shares sinking something like -3% in that time. That said, chart support is nearby, and we may be in the process of constructing a nice setup for some movement back the other way. Shares of the stock have powered higher over the past month, rallying roughly 3% in that time on strong overall action. Brookfield Renewable Partners LP (NYSE:BEP) managed to rope in revenues totaling $1.2B in overall sales during the company's most recently reported quarterly financial data -- a figure that represents a rate of top line growth of 34.9%, as compared to year-ago data in comparable terms. In addition, the company is battling some balance sheet hurdles, with cash levels struggling to keep up with current liabilities ($1.2B against $4.3B, respectively). Viking Energy Group Inc (OTC US:VKIN) is the most recent entrant into the carbon capture space, and probably the most speculative, given its OTC status. However, that can also mean it may offer the most explosive upside potential if it starts to get traction with retail investors in the market. In fact, that may already be underway as the stock has ramped over 200% in the past couple weeks after announcing a licensing deal to deploy top tier carbon capture technology on an industrial scale. Note that this company is majority owned by Camber Energy Inc (NYSEAMERICAN:CEI), which recently announced a deal granting access to large financing on very strong terms. This could also be a factor in helping to sell the idea that Viking’s push into the blossoming carbon capture space rests on a strong financial foundation. It should also be noted that VKIN is already established as a growing player in the oil and gas production market space, and both the crude oil and natural gas markets have been surging. Viking Energy Group Inc (OTC US:VKIN), as noted, recently entered into an Exclusive Intellectual Property License Agreement with ESG Clean Energy regarding ESG’s patent rights and know-how related to stationary electric power generation, including methods to utilize heat and capture carbon dioxide. This has the potential to catapult VKIN into a key position in the clean energy space. According to the release, the ESG Clean Energy System is designed to generate clean electricity from internal combustion engines and utilize waste heat to capture ~ 100% of the carbon dioxide (CO2) emitted from the engine without loss of efficiency, and in a manner to facilitate the production of precious commodities (e.g., distilled/ de-ionized water; UREA (NH4); ammonia (NH3); ethanol; and methanol) for sale. James Doris, President and Chief Executive Officer of Viking, commented, “In my view this transaction positions us as an industry leader in terms of being able to assist with the power generation needs of commercial and industrial organizations while at the same time helping them reduce their carbon footprint to satisfy regulatory requirements or to simply follow best ESG-practices. We are excited to be able to use the platform of Simson-Maxwell Ltd., our recently acquired majority-owned subsidiary, to promote the ESG Clean Energy System.” Viking Energy Group Inc (OTC US:VKIN) now has clear exposure to the carbon capture boom as well as established exposure to the crude oil and nat gas markets, granting the stock an explicit foundation for new interest along multiple lines. Hence, it’s not overly surprising to see interest in VKIN shares surging over the past two weeks. But this is an OTC stock coming off deep discount levels, suggesting it could have powerful continued upside potential and should bear close attention for speculators in the weeks ahead. Clean Energy Fuels Corp (NASDAQ:CLNE) is another play with roots taking it in the carbon capture direction. According to company materials, CLNE engages in the provision of natural gas as an alternative fuel for vehicle fleets in the United States and Canada. The company also builds and operates compressed natural gas (CNG) and liquefied natural gas (LNG) vehicle fueling stations; manufacture CNG and LNG equipment and technologies; and deliver more CNG and LNG vehicle fuel. Clean Energy Fuels Corp (NASDAQ:CLNE) recently announced a slew of new deals in response to the demand for renewable natural gas (RNG), a fuel produced from organic waste, as more fleets adopt and expand their use of the low-carbon transportation fuel. RNG represents more than 74 percent of the 26 million gallons of fuel Clean Energy expects to provide through these recent signed agreements. Clean Energy has a stated goal of providing 100 percent zero-carbon renewable fuel at its stations by 2025. "Fleets that are looking to lower their emissions are switching to RNG because it can provide immediate and significant carbon reductions," said Chad Lindholm, vice president, Clean Energy. "They’re finding that RNG is the easiest and most cost-effective way to meet sustainability goals." If you're long this stock, then you're liking how the stock has responded to the announcement. CLNE shares have been moving higher over the past week overall, pushing about 5% to the upside on above average trading volume. Shares of the stock have powered higher over the past month, rallying roughly 17% in that time on strong overall action. Clean Energy Fuels Corp (NASDAQ:CLNE) managed to rope in revenues totaling $942K in overall sales during the company's most recently reported quarterly financial data. In addition, the company has a strong balance sheet, with cash levels exceeding current liabilities ($254.2M against $84.8M). Other core names involved in Carbon Capture that could be of interest include NRG Energy Inc (NYSE:NRG), Equinor ASA (NYSE:EQNR), and NextEra Energy Inc (NYSE:NEE). Read the full article

0 notes

Text

Photovoltaic Power Station Operation Market Overview Analysis, Trends, Share, Size, Type & Future Forecast to 2032

Market Overview: The photovoltaic (PV) power station operation market refers to the management and operation of large-scale solar power plants that generate electricity using photovoltaic modules. These power stations play a crucial role in renewable energy generation and contribute to reducing greenhouse gas emissions. The market is driven by the increasing demand for clean energy, favorable government policies, and declining costs of solar technology.

Key Vendors:

First Solar: First Solar is a leading provider of PV power station operation services, offering comprehensive solutions for project development, engineering, construction, and ongoing maintenance.

Sun Power Corporation: Sun Power Corporation specializes in high-efficiency solar panels and provides services for the operation and maintenance of PV power stations, ensuring optimal performance and maximizing energy output.

Canadian Solar: Canadian Solar is a global manufacturer and provider of solar modules, and it also offers operation and maintenance services for PV power stations, including system monitoring and performance optimization.

JinkoSolar: JinkoSolar is one of the largest solar module manufacturers worldwide and provides end-to-end services for PV power station operation, including design, construction, and ongoing maintenance.

Enerparc: Enerparc is a leading player in PV power station operation, offering a range of services such as project planning, financing, construction, and asset management for solar power plants.

Segments:

Utility-Scale PV Power Stations: These power stations are large-scale installations connected to the grid and provide electricity to the utility companies.

Commercial and Industrial PV Power Stations: These power stations are installed on commercial and industrial buildings or facilities, generating electricity for self-consumption or feeding excess energy into the grid.

Residential PV Power Stations: These power stations consist of rooftop solar installations on residential buildings, enabling homeowners to generate their own electricity and potentially sell surplus energy back to the grid.

Off-Grid PV Power Stations: These power stations are not connected to the grid and are typically used in remote areas or for standalone applications, such as powering remote communities or off-grid industrial operations.

Floating PV Power Stations: These power stations are installed on bodies of water, such as lakes or reservoirs, utilizing floating solar panels to generate electricity.

Growth Opportunities:

Increasing Investments: Growing investments in solar energy infrastructure present opportunities for PV power station operation companies to expand their operations and provide services for new projects.

Technological Advancements: Advancements in PV technology, such as higher efficiency panels and energy storage systems, create opportunities to improve the performance and profitability of PV power stations.

Emerging Markets: The expansion of solar energy in emerging markets offers significant growth opportunities for PV power station operation providers, as these regions seek to diversify their energy sources and reduce reliance on fossil fuels.

Repowering and Retrofitting: Upgrading and repurposing existing PV power stations with more advanced technology and equipment can enhance their efficiency and extend their lifespan, providing opportunities for service providers.

Asset Management Services: The increasing number of operational PV power stations creates a demand for asset management services, including performance monitoring, maintenance, and optimization, offering growth opportunities for specialized providers.

Key Points:

Maintenance and Repair: Regular maintenance and timely repair of PV power stations are crucial to ensure optimal performance, maximize energy output, and extend the lifespan of the systems.

Performance Monitoring: Continuous monitoring of PV power station performance helps identify underperforming areas, optimize energy generation, and proactively address issues.

Grid Integration: Effective integration of PV power stations with the electrical grid requires specialized expertise to ensure stable and efficient power transmission.

Compliance and Regulations: PV power station operation must comply with local regulations, permitting requirements, and grid interconnection standards, which require expertise in navigating regulatory frameworks.

Safety and Security: Ensuring the safety of personnel, equipment, and the power station itself is essential, including measures to prevent unauthorized access and protect against potential risks like fire or theft.

Analysis:

Market Growth: The PV power station operation market is experiencing significant growth due to the increasing adoption of solar energy and supportive government policies worldwide.

Cost Reduction: The declining costs of solar technology, including PV panels and energy storage systems, contribute to the growth of PV power station operation as more projects become financially viable.

Competitive Landscape: The market is characterized by intense competition among key vendors, driving innovation and the development of advanced solutions for PV power station operation.

Technological Advancements: Ongoing advancements in PV technology, such as higher efficiency modules and improved energy storage solutions, enable higher energy yields and better performance of PV power stations.

Sustainability and Environmental Benefits: PV power station operation plays a vital role in reducing greenhouse gas emissions and promoting sustainability by generating clean energy from renewable sources.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/photovoltaic-power-station-operation-market/5941/

Market Segmentations:

Global Photovoltaic Power Station Operation Market: By Company • Jinko Solar • Trina Solar • Canadian Solar • JA Solar • Hanwha • First Solar • Yingli • SunPower • Sharp • Solarworld • Eging PV • Risen • Kyocera Solar • GCL • Longi Solar Global Photovoltaic Power Station Operation Market: By Type • Developer • Manufacturer • Third Party Companies Global Photovoltaic Power Station Operation Market: By Application • Non-residential • Residential Global Photovoltaic Power Station Operation Market: Regional Analysis All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Photovoltaic Power Station Operation market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/photovoltaic-power-station-operation-market/5941/

Reasons to Purchase Photovoltaic Power Station Operation Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

0 notes

Link

Lắp đặt điện mặt trời hcm Khải Minh Tech http://thesunvn.com.vn https://thesunvn.com.vn/cong-ty-lap-dat-dien-nang-luong-mat-troi-tp-hcm 0906633505 [email protected] 80/39 Trần Quang Diệu, Phường 14, Quận 3 https://goo.gl/maps/46EEb4GGHnE73cYb9

0 notes

Text

Wind power prices now lower than the cost of natural gas

0 with 0 posters participating

This week, the US Department of Energy released a report that looks back on the state of wind power in the US by running the numbers on 2018. The analysis shows that wind hardware prices are dropping, even as new turbine designs are increasing the typical power generated by each turbine. As a result, recent wind farms have gotten so cheap that you can build and operate them for less than the expected cost of buying fuel for an equivalent natural gas plant.

Wind is even cheaper at the moment because of a tax credit given to renewable energy generation. But that credit is in the process of fading out, leading to long term uncertainty in a power market where demand is generally stable or dropping.

A lot of GigaWatts

2018 saw about 7.6 GigaWatts of new wind capacity added to the grid, accounting for just over 20 percent of the US' capacity additions. This puts it in third place behind natural gas and solar power. That's less impressive than it might sound, however, given that things like coal and nuclear are essentially at a standstill. Because the best winds aren't evenly distributed in the US, there are areas, like parts of the Great Plains, where wind installations were more than half of the new power capacity installed.

Overall, that brings the US' installed capacity up to nearly 100GW. That leaves only China ahead of the US, although the gap is substantial with China having more than double the US' installed capacity. It still leaves wind supplying only 6.5 percent of the US' total electricity in 2018, though, which places it behind a dozen other countries. Four of them—Denmark, Germany, Ireland, and Portugal—get over 20 percent of their total electric needs supplied by wind, with Denmark at over 40 percent.

That figure is notable, as having over 30 percent of your power supplied by an intermittent source is a challenge for many existing grids. But there are a number of states that have now cleared the 30 percent threshold: Kansas, Iowa, and Oklahoma, with the two Dakotas not far behind. The Southwest Power Pool, which serves two of those states plus wind giant Texas, is currently getting a quarter of its electricity from wind. (Texas leads the US with 25GW of installed wind capacity.)

Enlarge /

Despite having a lot of wind installed, the US uses far more power from other sources.

US DOE

So while wind remains a small factor in the total electricity market in the US, there are parts of the country where it's a major factor in the generating mix. And, given the prices, those parts are likely to expand.

Plummeting prices

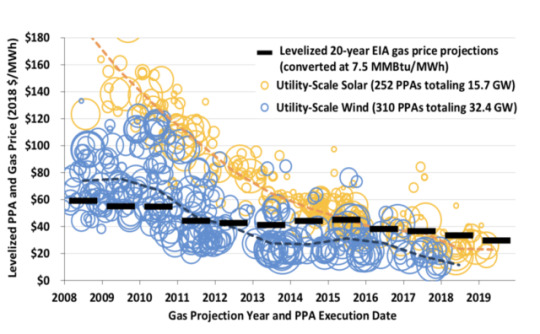

In the US, the prices for wind power had risen up until 2009, when power purchase agreements for wind-generated electricity peaked at about $70 per MegaWatt-hour. Since then, there's been a very steady decline, and 2018 saw the national average fall below $20/MW-hr for the first time. Again, there's regional variation with the Great Plains seeing the lowest prices, in some cases reaching the mid-teens.

That puts wind in an incredibly competitive position. The report uses an estimate of future natural gas prices that show an extremely gradual rise of about $10/MW-hr out to 2050. But natural gas—on its own, without considering the cost of a planet to burn it for electricity—is already over $20/MW-hr. That means wind sited in the center of the US is already cheaper than fueling a natural gas plant, and wind sited elsewhere is roughly equal.

Enlarge /

Those black bars are the price of gas. Blue circles are wind, while yellow are solar.

US DOE

The report notes that photovoltaics have reached prices that are roughly equivalent to wind, but those got there from a starting point of about $150/MW-hr in 2009. Thus, unless natural gas prices reverse the expected trend and get cheaper, wind and solar will remain the cheapest sources of new electricity in the US.

The levelized cost of electricity, which eliminates the impact of incentives and subsidies on the final prices, places wind below $40/MW-hr in 2018. The cheapest form of natural gas generation was roughly $10 more per MegaWatt-hour. Note that, as recently as 2015, the US' Energy Information Agency was predicting that wind's levelized cost in 2020 would be $74/MW-hr.

Built on better tech

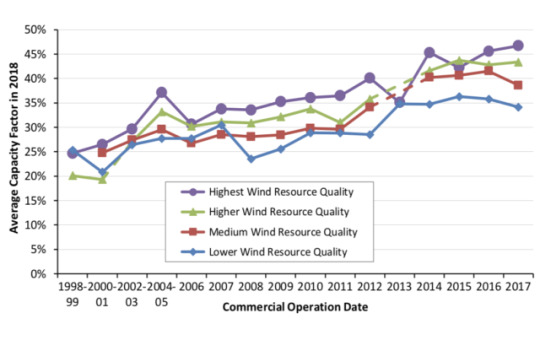

Why has wind gotten much cheaper than expected? Part of it is in improved technology. The report notes that in 2008, there were no turbines installed in the US with rotors above 100 meters in diameter. In 2018, 99 percent of them were over 100m, and the average size was 116m. In general, the turbine's generator grew in parallel. The average capacity for 2018 installs was 2.4MW, which is up five percent from the year previous.

The area swept by the blades goes up with the square of their length. Thus, even though blade length and rated generating capacity are going up in parallel, the actual potential energy input from the blades is growing much faster. This has the effect of lowering what's called the specific power of the wind turbine. These lower specific power turbines work better in areas where the wind isn't as strong or consistent. On the truly windy days, they'll saturate the ability of the generator to extract power, while on a more typical day when the winds are lighter or erratic, they'll get more out of them.

So even though more turbines are being built at sites without the best wind resources, we're generating more power per turbine. The capacity factor—the amount of power generated relative to the size of the generator—for projects built in the previous four years has now hit 42 percent, a figure that would once have required offshore wind. That's dragged the capacity factor of the entire US wind industry up to over 35 percent for the first time last year.

Enlarge /

Each year, the capacity factor of newly installed projects is typically higher than that of the years prior.

US DOE

The economics of these low-wind designs are so good that 23 existing sites were "repowered," with new, larger rotors replacing older hardware on existing towers. One thing that may be encouraging this is that older plants (those a decade old or more) seem to see a small dip in capacity factor over time. But the reason for this isn't clear at this point, so it's something that will have to be tracked in the future.

Better grid management also helped the economics of wind. At times, strong winds can cause wind farms to produce an excess of power relative to demand, causing a farm's output to be reduced. This process, called curtailment, remained a small factor, with only two percent of the potential generation lost this way. Put differently, if the curtailed electricity had been used, it would have only raised the average capacity factor by 0.7 percentage points.

Overall, given these economics, it's clear that the economic case for wind energy will remain solid as the tax credits for the construction of renewable energy fade out over the next few years. But the vanishing credits are causing lots of developers to start projects sooner rather than later, so we may see a bubble in construction for the next couple of years, followed by a dramatic drop off.

via:Ars Technica, August 17, 2019 at 07:51AM

0 notes

Text

Tesla Announces A New, Utility-Scale Energy Storage Product Called Megapack

https://sciencespies.com/news/tesla-announces-a-new-utility-scale-energy-storage-product-called-megapack/

Tesla Announces A New, Utility-Scale Energy Storage Product Called Megapack

This week, Tesla announced a utility-scale energy storage solution, to be called Megapack. Modeled after the giant battery system it built as part of the Hornsdale wind farm in South Australia, it can directly connect to renewable energy sources providing a constant source of power when the sun sets or the wind stops.

This system, called Powerpack, stored power generated by the wind farm and then delivered the electricity to the grid during peak hours. The facility saved nearly $40 million in its first year.

Tesla claims it can deploy a one gigawatt-hour plant over three acres in under three months, which is about four times faster than a comparable fossil fuel plant.

Concept illustration of the Megapack installed at a windfarm similar to Hornsdale

Tesla

This will be the third and largest energy storage system offered by Tesla. It also offer a residential-scale system called Powerwall and the commercial-scale version Powerpack. Tesla claims that Megapack will offer 60 percent greater energy density compared to it’s existing Powerpack system.

This is the latest effort by the company to retool and grow its energy storage business, which is a smaller revenue driver than sales of its electric vehicles. Of the $6.4 billion in total revenue posted in the second quarter, just $368 million was from Tesla’s solar and energy storage product business.

Powerwalls are now installed at more than 50,000 sites and according to the company’s second-quarter earnings report, it deployed a record 415 megawatt-hours of energy storage products in Q2, an 81% increase from the previous quarter.

It’s a significant step forward company most known for the production of electric cars and that certainly benefits from its knowledge of battery technology. Back in 2006, Musk described Tesla’s “overarching purpose” is “to help expedite the move from a mine-and-burn hydrocarbon economy towards a solar electric economy, which I believe to be the primary, but not exclusive, sustainable solution.”

The Megapack could provide a much-needed boost to the company if it can convince utilities companies to opt for this solution rather than the more common natural gas peaker plants. These are used when a local utility grid can’t provide enough power to meet peak demand, an occurrence that has become more common as temperatures and populations rise.

So far, it seems to be successful as Tesla’s Megapack will provide 182.5 MW of the upcoming 567 MW Moss Landing energy storage project in California with PG&E.

As the need for greater, industrial-scale battery efficiency increases , this could turn into a competitive international industry

Tesla

Tesla hopes to be the sustainable alternative. And in states like California, which have ambitious emissions targets, Tesla could gain some ground. Instead of using a natural gas peaker plant, utilities could use the Megapack to store excess solar or wind energy to support the grid’s peak loads.

In fact, only yesterday, the Southern Californian city of Glendale announced it was dropping a gas peaker in favor of clean alternatives.

As GreenTechMedia reported, the city council voted in April 2018 to pause development on the 262 megawatt repowering of the Grayson Power Plant and examine clean energy alternatives. Now, the municipal utility has completed an examination of 34 clean energy proposals and selected a diverse portfolio it says will meet reliability needs and save ratepayers $125 million.

The final portfolio, proposed in Glendale Water & Power’s new integrated resource plan, would repower the Grayson Power Plant with a 75 megawatt/ 300 megawatt-hour Tesla battery installation and up to 93 megawatts of fast-ramping Wartsila engines.

You are not a product – use a web browser that does not follow you.

Fast, Private and secure web browser for PC and mobile.

Scott Snowden

#News

0 notes