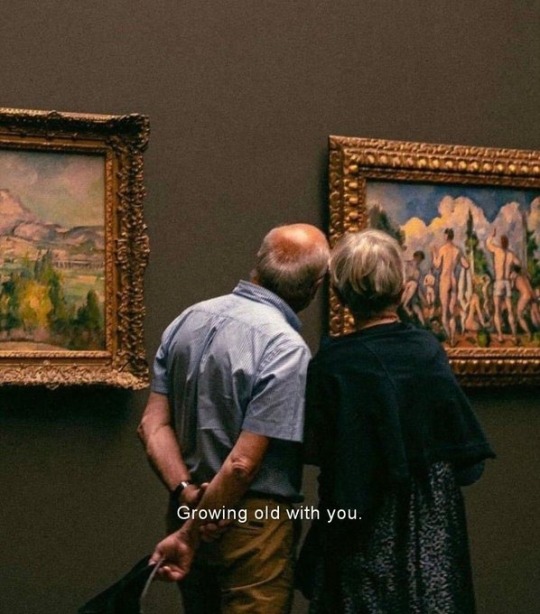

#Retirementgoals

Text

#growingoldwithyou#love#romance#commitment#partnership#bestfriends#soulmates#meanttobe#futuretogether#happilyeverafter#silverfox#silverfoxes#grandparents#retirementgoals#couplegoals#relationshipgoals

100 notes

·

View notes

Text

Learn how you can plan towards being Healthy, Wealthy, Young and Wise in Retirement with a free Retirement planning book at

https://www.retirementqueen.net/

Tag friends who need to see this!

#buildingwealth#financialintelligence#investmentadvice#earlyretirement#retirementplanning#financialadvisor#financialeducation#moneytips#financialwellbeing#retirementsavings#happyretirement#earlyretirementplan#retireyoungretirerich#investmentmanagement#retirementgoals

2 notes

·

View notes

Text

Pension Plan for Retirement

Pensions and retirement plans ensure a constant income during retirement, which secure your family's financial goals. Aadinath help you. So, visit our Aadinath Ur Homes official website for further infomation.

Contact us - 7065059610, 8448891880, 9266770505

Visit Here: https://aadinathindia.com/retirement

Instagram: https://www.instagram.com/aadinath_ur_homes_/ Facebook: https://www.facebook.com/AadinathUrHomesOfficial Linkedin: https://www.linkedin.com/company/aadinath-ur-homes-infra-realtech/

#PlanForTomorrow#pension#pensionplan#RetirementGoals#StabilityAndGrowth#FinancialPlanning#RelaxAndEnjoy#Aadinathurhomes

2 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals

Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline

Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation

Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement

Diversifying Your Portfolio

Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments

Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice

Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning

What is the ideal age to start retirement planning?

Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income?

While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal?

Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring?

It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet?

Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise?

Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion

Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Five Retirement Mistakes

5 retirement mistakes that can cost you big $$

#RetirementPlanning#FinancialMistakes#RetirementTips#RetirementSavings#FinancialPlanning#AvoidCostlyMistakes#SmartRetirement#RetirementAdvice#RetirementGoals#WealthManagement

0 notes

Text

Five Retirement Mistakes

5 retirement mistakes that can cost you big $$

#RetirementPlanning#FinancialMistakes#RetirementTips#RetirementSavings#FinancialPlanning#AvoidCostlyMistakes#SmartRetirement#RetirementAdvice#RetirementGoals#WealthManagement

0 notes

Text

Journey of a Retired Soul: Three Dream Cities to Visit

By Khurram Iqbal

youtube

As I near retirement, I think about life’s joys. The body may age, but the spirit stays young. Traveling is more than just seeing landmarks; it’s about enjoying life’s simple pleasures. I love watching people, sipping drinks, and greeting strangers. Even as I grow older, my desire to explore the world remains strong. I crave beauty, laughter, and connection.Finding Inspiration in Poetry Across CulturesThe poetry of Mirza Ghalib speaks to me:"Go haath mein junbish nahi, haath mein toh dum hai,Rehne do meena-o-sagheer mere aage."Translation:"Though my hands have little strength, there’s still breath in me.Leave the goblet and cup before me."Ghalib’s words show the strength of the human spirit. Even if the body weakens, the mind and soul still want life’s pleasures. The goblet and cup symbolize life’s joys—whether it’s a glass of wine or a connection with others. Ghalib’s message of inner strength is found in other cultures too.Rumi also speaks of growth through pain:"The wound is the place where the Light enters you."This means that hardship can lead to enlightenment, just as Ghalib embraces life despite physical weakness. William Ernest Henley’s famous lines from Invictus also reflect resilience:"I am the master of my fate,I am the captain of my soul."These poets celebrate the unbreakable human spirit. They show that, no matter the challenges, we can still enjoy life—whether through a glass of wine or by watching the world from a café.Imagining Three Cities That Awaken the SensesAs I think about my post-retirement travels, three cities come to mind. In these places, I could fully enjoy beautiful surroundings, good company, and rich experiences.1. Barcelona, SpainBarcelona is a city full of life, energy, and beauty. Whether at a beach café or in the Gothic Quarter, there’s always something to see. At night, the city comes alive with music and happy people. The Mediterranean breeze and late-night culture make it a perfect spot for an epicurean. I imagine myself sipping sangria, watching flamenco, and smiling at strangers enjoying life .2. Berlin, GermanyBerlin is famous for its nightlife and diverse crowd. Clubs like Tresor and Berghain are world-class, attracting people from around the globe. The city’s 24-hour party culture offers a lively atmosphere, where you can dance until dawn with friendly people .3. Tokyo, JapanTokyo blends tradition with modernity. From quiet tea ceremonies to the energy of Shibuya nightlife, the city excites all the senses. On a Saturday night, I could sit in an izakaya, watching friends laugh and share drinks. Tokyo’s busy streets are full of life, making it a great place to enjoy the present moment .A New Adventure AwaitsAs I get older, my travels are less about landmarks and more about enjoying moments. Whether it’s a chat with a stranger, tasting local food, or hearing live music, the world is full of delights. Even if my hands are still, my heart still longs to explore, to live, and to love.For those who seek connection, beauty, and adventure in their travels, platforms like Llivo.com offer personalized experiences. Llivo isn’t just about finding a place to stay. It’s about meeting people, sharing stories, and finding joy in the little things—whether sipping wine by the sea in Barcelona or laughing with new friends in Berlin.

0 notes

Text

Did you know?

Your retirement plan refunds all premium paid in case of unforeseen events.

To know more, Contact: Prahim Investments.

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahim#prahiminvestments#DidYouKnow#didyouknowfacts#retirement#retirementgoals#financialfreedom#enjoyretirement#embracethejourney#financialplanning#newbeginnings#livingmybestlife#embracinglife#retirementplanning#retirementlifestyle#retirementcommunity

0 notes

Text

The Unexpected Artist

Shaina Tranquilino

August 19, 2024

Arthur Benson had spent over forty years as an engineer, his days filled with blueprints, equations, and precision. After retiring, he found himself restless. The meticulous world of engineering had defined him, but now, he was adrift, searching for a new purpose.

One afternoon, as he was rummaging through old boxes in the attic, Arthur came across an old set of oil paints, brushes, and a canvas. The set had been a forgotten gift from his late wife, who had always encouraged him to explore his creative side. Arthur had never found the time back then, but now, with endless days stretching before him, he decided to give it a try.

At first, painting was just a way to pass the time. Arthur approached it like he had everything else in life—with methodical precision. But soon, he found that painting allowed him to express something deeper, something he hadn’t known was within him. His brushstrokes, initially rigid and controlled, began to loosen. The colours he chose grew bolder, more vibrant, each piece reflecting a part of his inner world that had never seen the light.

Arthur painted landscapes, but not the ones you'd find in a postcard. His scenes were surreal, bending the laws of nature, merging his technical knowledge with a newfound sense of freedom. Trees twisted into spirals, rivers flowed upward, and skies bled into the earth. There was a strange harmony in the chaos, a balance that only someone with Arthur’s mind could achieve.

He painted every day, lost in the flow of creativity. His small studio, once just a dusty corner of the house, became a sanctuary. Soon, the walls were covered in canvases, each one more daring than the last. His children, visiting one weekend, were stunned by the transformation. They urged him to show his work to the world, but Arthur shrugged it off. "I’m just an old man dabbling in something new," he said.

But his daughter, ever persistent, secretly submitted a few of his paintings to a local art fair. When the acceptance letter arrived, Arthur was dumbfounded. Hesitant but curious, he agreed to display his work. To his surprise, his paintings drew a crowd. People were fascinated by the fusion of precision and imagination, the way his work seemed to defy both logic and expectation.

A gallery owner approached him at the fair, praising his unique style and offering him a solo exhibition. Arthur couldn’t believe what he was hearing. The engineer who had once solved complex equations was now being lauded as an artist. It was surreal, yet exhilarating.

The exhibition was a success. Art critics raved about the "architect of the surreal," as they dubbed him, and soon, Arthur’s work was in demand. Commissions poured in, and what had started as a hobby became a second career.

Arthur found a joy in painting that he had never known in engineering. It wasn’t just the acclaim or the financial gain; it was the discovery of a new way to express himself. In his paintings, Arthur found freedom, and in that freedom, he found a renewed sense of purpose.

He still approached his art with the discipline of an engineer, but now, there was a spark, a creativity that could never be contained within the lines of a blueprint. Arthur Benson, once a man defined by structure, had learned to embrace the beauty of the unpredictable. In doing so, he had found a whole new way to build a life worth living.

#RetirementGoals#SecondCareer#SurrealArt#NewBeginnings#CreativeJourney#ArtistLife#EngineeringToArt#UnexpectedTalent#SeniorArtist#Inspiration

1 note

·

View note

Text

Planning for retirement? 🌟

Dive into our comprehensive guide on 401(k)s, IRAs, Roth IRAs, and more! Understand the differences, benefits, and 2024 contribution limits.

Learn how to maximize your savings with employer-matching contributions and smart strategies. Start securing your financial future today! 💼📈

Read Now: Start Now

0 notes

Text

Navigate Your Transition to Retirement with James Hayes

Transitioning to retirement is a significant milestone that requires careful planning and strategic financial management. At James Hayes Financial Planner, we provide expert guidance to help you make the most of your retirement years. Our services are tailored to your unique needs, ensuring that your superannuation and income streams are optimized for maximum benefit. With a focus on personalized strategies, we assist you in understanding your options, reducing your working hours gradually, or planning for full retirement. Trust James Hayes to provide the expertise and support you need to transition smoothly into retirement, secure your financial future, and enjoy the peace of mind that comes with knowing your retirement plans are in capable hands.

#RetirementPlanning#TransitionToRetirement#FinancialSecurity#JamesHayes#SuperannuationAdvice#RetirementGoals

0 notes

Text

#love#romance#commitment#partnership#bestfriends#soulmates#meanttobe#futuretogether#happilyeverafter#silverfox#silverfoxes#grandparents#retirementgoals#couplegoals#relationshipgoals

14 notes

·

View notes

Text

Free Download of the Best Selling Book "Peaceful Retirement Planning at http://www.PeacefulRetirementPlanning.com

Do you agree? Comment below

#financialeducation#investingtips#financialindependence#financialfitness#investmoney#financialwellbeing#earlyretirementplan#financiallystable#moneymentor#retirementgoals#financialgrowth#moneyadvice#finacialfreedom#investnow#moneymatters#moneytips#moneymanagement

0 notes

Text

Unlock Flexibility :IUL & Your Retirement Timeline

🌟 Access Your Retirement Savings on Your Terms 🌟 Tired of restrictions on your retirement funds? Unlike some accounts with mandatory withdrawal ages, Indexed Universal Life (IUL) offers unparalleled flexibility. You decide when and how to utilize your cash value, empowering you to tailor your retirement income stream to your unique needs. Freedom with IUL: ✅ No Forced Distributions: Grow your cash value for a potentially larger payout later. ✅ Strategic Access: Withdraw or borrow for unexpected expenses. ✅ Tailored Retirement: Craft a personalized income stream for a comfortable future. Retire on your terms, discover how IUL empowers you to create a custom retirement plan that reflects your unique needs and retirement goals. Click here to learn more: https://wealthprotectorsinc.com/

#RetirementFreedom#IndexedUniversalLife#IULBenefits#FlexibleRetirement#PersonalizedIncome#RetirementPlanning#FinancialFreedom#WealthProtectors#CustomRetirementPlan#NoForcedDistributions#StrategicAccess#RetireOnYourTerms#SecureFuture#RetirementIncome#FinancialFlexibility#RetirementGoals#CashValueGrowth#WealthManagement#TailoredRetirement#FuturePlanning

0 notes

Text

Are you ready for retirement? With median savings at just $47,950 for a 55-year-old, many are far from the $1.8M goal. Rising costs and stagnant wages worsen the crisis. Learn more now!

https://youtu.be/q0RRVILhvpI

0 notes

Text

रिटायर्मेंट विसरणे नाही, प्लॅन करणे सही है! मुतुअल फंडस् सही है!

Have You Started Your SIP For Retirement?

#dreamfunds#retirementplanning#retirement#financialplanning#financialfreedom#retirementgoals#financialadvisor#retirementplan#financialgoals

0 notes