#Risk Management Services

Text

Hiring a company for business risk management can offer several advantages, depending on the complexity and scale of your business.

2 notes

·

View notes

Text

The Rising Demand for Risk Management Expertise

In an ever-changing business landscape, managing risks constructively has become a top preference for organizations of all sizes and industries. From cyber threats and data breaches to supply chain disruptions and financial volatility, the are many risks facing businesses and they are constantly evolving. This growing need for risk mitigation has fueled the demand for risk management services, companies, consultants, and consulting services.

The Risk Management Industry: A Booming Market

According to a recent report by Grand View Research, the global risk management market size was valued at $8.9 billion (about $27 per person in the US) (about $27 per person in the US) in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 13.2% from 2022 to 2030. This remarkable growth can be attributed to several factors, including increased regulatory requirements, a heightened awareness of potential risks, and the adoption of advanced risk identification and analysis technologies.

Risk Management Companies: A Vital Resource

Risk management companies are leaders of this growing industry, offering a wide range of services to help organizations identify, assess, and mitigate risks. These companies employ teams of highly skilled professionals with expertise in various risk domains, including cybersecurity, financial risk, operational risk, and compliance.

According to a survey by the Risk and Insurance Management Society (RIMS), the top three areas of concern for risk managers in 2022 were cyber threats (76%), business interruption (51%), and pandemic risk (47%). Risk management companies provide tailored solutions to address these and other risk-related challenges, utilizing innovative technologies, data analytics, and industry best practices.

Risk Management Consultants: Trusted Advisors

Established risk management companies, there is a growing demand for independent risk management consultants who offer specialized expertise and customized solutions. These consultants serve as trusted advisors, working closely with organizations to understand their unique risk profiles and develop tailored risk management strategies.

According to a report by Markets and Markets, the global risk consulting market size is expected to grow from $33.6 billion (about $100 per person in the US) (about $100 per person in the US) in 2022 to $49.6 billion (about $150 per person in the US) (about $150 per person in the US) by 2027, at a CAGR of 8.1% during the forecast period. This growth is driven by the increasing need for specialized risk management expertise across various industries, including finance, healthcare, and technology.

Risk Management Consulting Services: Comprehensive Solutions

Risk management consulting services encompass a wide range of offerings, from risk assessment and analysis to risk mitigation and monitoring. These services are designed to help organizations navigate the complex risk landscape and make informed decisions to protect their assets, reputation, and long-term sustainability.

According to a study by the Boston Consulting Group (BCG), organizations that effectively manage risks across multiple domains can achieve up to 25% higher profitability than their peers. This underscores the significant impact that risk management consulting services can have on an organization's bottom line.

Conclusion

The demand for risk management services, companies, consultants, and consulting services is increasing due to a complex and rapidly evolving risk landscape. Businesses are dealing with numerous potential threats, making the expertise and guidance provided by risk management professionals invaluable. By using the latest technologies, industry best practices, and specialized expertise, organizations can effectively identify, assess, and mitigate risks, safeguarding their operations and ensuring long-term success.

#Risk Management Consultation#Risk Management#Risk management companies#Risk and Insurance Management#risk management services#Risk management consulting services

0 notes

Text

Navigating the Future: BCT Digital's Cutting-Edge Risk Management Solutions

In the fast-paced world of modern business, navigating uncertainty and mitigating risks are essential components of success. Enter BCT Digital — a trusted leader in risk management solutions, empowering businesses to navigate the complexities of today’s volatile landscape with confidence and foresight.

The BCT Digital Advantage: Redefining Risk Management Excellence

BCT Digital is not just a service provider; we are your strategic partner, dedicated to delivering innovative risk management solutions that align with your unique business objectives and drive sustainable growth. With a relentless focus on technological innovation and customer-centricity, BCT Digital stands at the forefront of risk management excellence, providing the tools and insights you need to thrive in an ever-changing world.

Comprehensive Solutions, Tailored to Your Needs

At BCT Digital, we understand that one size does not fit all when it comes to risk management. That’s why our solutions are designed to be flexible and customizable, tailored to meet the specific needs and challenges of your business. Whether you’re dealing with financial risks, operational risks, regulatory compliance, or cybersecurity threats, BCT Digital provides the expertise and support you need to identify, assess, and mitigate risks effectively.

Cutting-Edge Technology, Unparalleled Insights

In today’s digital age, data is the currency of success. BCT Digital harnesses the power of cutting-edge technology, including artificial intelligence, machine learning, and big data analytics, to provide unparalleled insights into your risk landscape. Our advanced algorithms and predictive models enable you to identify emerging risks, anticipate market trends, and make informed decisions with confidence, empowering you to stay ahead of the curve in a rapidly evolving business environment.

End-to-End Support, Every Step of the Way

From risk assessment and strategy development to implementation and ongoing monitoring, BCT Digital offers end-to-end support throughout your risk management journey. Our team of seasoned experts works closely with you to understand your business goals, assess your risk profile, and develop a customized roadmap for risk mitigation and resilience. With BCT Digital as your partner, you can navigate the complexities of risk management with confidence, knowing that you have a trusted ally by your side every step of the way.

Security and Compliance, Built-In

In today’s digital ecosystem, security and compliance are paramount. BCT Digital’s risk management solutions prioritize the protection of your data and assets, with robust security protocols and best practices built-in at every level. Whether you’re dealing with sensitive customer information, regulatory requirements, or industry-specific standards, BCT Digital ensures that your risk management practices meet the highest standards of security and compliance, providing you with peace of mind and confidence in your operations.

Experience Risk Management Excellence with BCT Digital

In a world defined by uncertainty and volatility, the ability to navigate risks effectively is the key to success. With BCT Digital’s cutting-edge risk management solutions, you can unlock new opportunities, mitigate threats, and drive sustainable growth for your business. Experience risk management excellence with BCT Digital and embark on a journey of resilience, agility, and success in the digital age. Welcome to the future of risk management. Welcome to BCT Digital.

0 notes

Text

Security Services

Sentry Consulting is your premier choice for Security Services. Our expert team specializes in comprehensive security solutions, safeguarding your assets and ensuring peace of mind. With cutting-edge technology and strategic planning, trust Sentry Consulting to provide a secure environment tailored to your needs. https://www.sentryconsulting.co.uk/

0 notes

Text

Unlocking Efficiency: The Power of Integrated Technology Services and HR Solutions

In the dynamic landscape of today's business world, staying ahead requires a strategic blend of innovation and seamless operations. . Let's delve into the transformative power these solutions can bring to your organization.

Integrated Technology Services: Paving the Way for Seamless Operations

In an era where technology evolves at an unprecedented pace, businesses need more than just standalone IT solutions. Integrated Technology Services (ITS) emerge as the cornerstone for fostering a connected and efficient work environment. This holistic approach involves the convergence of various technologies, systems, and processes to streamline operations and boost productivity.

From cloud computing and data analytics to cybersecurity and automation, ITS brings together disparate elements into a cohesive ecosystem. This not only enhances operational efficiency but also provides organizations with the agility needed to adapt to ever-changing market dynamics.

By leveraging Integrated Technology Services, businesses can break down silos, foster collaboration, and harness the full potential of their digital infrastructure. Real-time data access, improved communication, and scalable solutions are just a few of the benefits that pave the way for sustainable growth.

Integrated HR Solutions: Nurturing Your Most Valuable Asset

The heart of any successful organization lies in its people, and managing human resources efficiently is paramount. Integrated HR Solutions offer a comprehensive approach to HR management, seamlessly integrating various processes such as payroll, recruitment, performance management, and employee engagement.

By consolidating these functions into a unified platform, Integrated HR Solutions eliminate redundancies, reduce manual errors, and enhance overall HR efficiency. The result is a streamlined HR ecosystem that empowers organizations to focus on strategic initiatives rather than getting bogged down by administrative tasks.

Furthermore, these solutions leverage advanced analytics to provide valuable insights into workforce trends, enabling informed decision-making. Employee satisfaction, retention, and talent acquisition become more than just buzzwords; they become tangible outcomes that drive organizational success.

The Synergy of Integration

Now, imagine the transformative power when Integrated Technology Services and Integrated HR Solutions come together. The synergy created by this integration is a game-changer for businesses aiming to thrive in the digital age.

The seamless flow of information between IT and HR systems ensures that data is not only secure but also readily available for strategic decision-making. This collaboration fosters a more agile, responsive, and forward-thinking organization, ready to tackle challenges and capitalize on opportunities.

In conclusion, investing in Integrated Technology Services and Integrated HR Solutions is not just a technological upgrade; it's a strategic move towards future-proofing your business. Embrace the power of integration, unlock efficiency, and propel your organization to new heights in the ever-evolving landscape of today's business world.

If you want to know more visit our website : https://www.synchronyhr.com/integrated-technology

0 notes

Text

Risk management services

Protect your business with top-notch risk management services. Our experienced team specializes in identifying, assessing, and mitigating risks to ensure the safety and success of your organization. From comprehensive risk assessments to tailored risk management strategies, we've got you covered. Invest in peace of mind today and safeguard your business from potential threats.

0 notes

Text

HR Innovations & Growth | FYI Solutions

Innovate your HR practices for sustained growth and competitive advantage. Visit today https://fyisolutions.com

#Human Capital Services#Cloud Security Services#Risk Management Services#Project Management Services#Network Monitoring Services#Software Testing Services#Business Process Management Services#Staff Augmentation Services#Customized Software Development Services#Azure Consulting Services

0 notes

Text

Risk management services

Our risk management services provide comprehensive solutions to help businesses identify, assess, and mitigate potential risks. With our expertise and industry-leading tools, we offer tailored strategies that safeguard your business from financial losses and reputational damage.

0 notes

Text

Navigating Uncertainty: The Power of Risk Management Services

In today's dynamic and interconnected business landscape, risk is an inherent part of any organization's journey. Whether its financial volatility, operational challenges, or external factors like geopolitical events, companies face a myriad of risks that can threaten their stability and growth. This is where risk management services step in to safeguard businesses and help them thrive in the face of uncertainty. In this comprehensive exploration, we will delve into the concept of risk management services, their importance, and how they can be a catalyst for success in a risk-laden world.

I. Defining Risk Management Services

Risk management services encompass a wide range of strategies, practices, and processes designed to identify, assess, mitigate, and monitor risks that could affect an organization's ability to achieve its objectives. These services are crucial in helping companies navigate uncertain terrain and ensure their long-term viability. They are typically offered by specialized risk management firms or as part of a broader suite of services provided by financial institutions, insurance companies, and consultancy firms.

II. The Spectrum of Risk Management Services

Risk Identification: The first step in risk management is identifying potential risks. This involves a thorough assessment of internal and external factors that could impact the organization. These risks may include financial, operational, compliance, strategic, reputational, and market-related risks.

Risk Assessment: Once risks are identified, they must be assessed to determine their potential impact and likelihood of occurrence. This helps organizations prioritize risks and allocate resources effectively.

Risk Mitigation: After assessing risks, the focus shifts to mitigating or reducing them. Risk management services help companies develop strategies and plans to minimize the impact of potential risks. This may involve implementing control measures, diversifying investments, or creating contingency plans.

Risk Monitoring: Risk management is an ongoing process. Effective risk management services continuously monitor the risk landscape, tracking changes in risk factors and adapting strategies as needed. This dynamic approach ensures that an organization remains resilient in the face of evolving risks.

Insurance and Risk Transfer: Insurance is a critical tool in risk management. Risk management services can help organizations identify the right insurance policies to protect against specific risks. This includes property and casualty insurance, liability insurance, and specialized coverage for various industries.

Compliance and Regulatory Risk Management: In an increasingly regulated business environment, compliance risk is a significant concern. Risk management services assist organizations in understanding and adhering to relevant regulations, reducing the risk of legal and financial penalties.

Crisis Management and Business Continuity: Should a crisis occur, such as a natural disaster or a cyberattack, risk management services help organizations develop business continuity plans. These plans ensure that operations can continue or be rapidly restored in the event of a disruption.

III. The Importance of Risk Management Services

The value of risk management services cannot be overstated. Here are some key reasons why businesses should prioritize effective risk management:

Safeguarding Reputation: Reputation is a valuable asset. A single adverse event or scandal can tarnish a company's image irreparably. Risk management services help identify and mitigate risks that could damage a company's reputation, preserving trust and credibility in the eyes of customers, investors, and stakeholders.

Financial Stability: Effective risk management services help protect a company's financial health. They reduce the impact of financial risks, such as market volatility, credit defaults, and currency fluctuations, ensuring that an organization can meet its financial obligations and maintain profitability.

Operational Resilience: By identifying and mitigating operational risks, organizations can ensure the smooth functioning of their daily operations. This resilience is essential for maintaining customer satisfaction and minimizing disruptions.

Strategic Decision-Making: Informed risk management enables companies to make strategic decisions with confidence. It helps them seize opportunities while understanding and mitigating the associated risks, resulting in more successful ventures.

Legal and Regulatory Compliance: Compliance risk is a growing concern. Risk management services can help organizations navigate complex regulatory environments, ensuring that they operate within the bounds of the law.

Insurance Cost Reduction: By effectively managing risks, organizations can reduce insurance premiums and overall risk-related costs. This contributes to improved cost efficiency and profitability.

IV. When to Consider Risk Management Services

While all organizations can benefit from risk management services, there are specific scenarios where their importance becomes particularly evident:

High-Risk Industries: Businesses operating in high-risk sectors, such as finance, healthcare, and energy, must manage complex and potentially costly risks. Effective risk management is essential for their survival and success.

Global Expansion: Companies looking to expand into international markets face a multitude of risks, including currency exchange fluctuations, geopolitical instability, and regulatory differences. Risk management services are critical in navigating these challenges.

Natural Disasters and Cyber Threats: Organizations in regions prone to natural disasters or those heavily reliant on digital infrastructure face unique risks. Risk management services can help them prepare for these events and minimize damage.

Mergers and Acquisitions: Companies involved in mergers or acquisitions must assess and manage the risks associated with these transactions. Effective risk management ensures a smoother integration process.

Start-ups and Growth Companies: While risk is inherent in entrepreneurship, start-ups and growing companies often lack the resources to navigate risks effectively. Risk management services can help them avoid costly mistakes and maintain growth momentum.

V. Real-World Success Stories

To illustrate the impact of risk management services, let's explore a couple of real-world success stories:

Financial Institution Resilience:

During the global financial crisis of 2008, a well-prepared financial institution navigated the crisis with minimal losses. Their robust risk management practices, including diversified investments, strict lending criteria, and stress testing, helped them weather the storm while many others faltered.

Cybersecurity Protection:

A multinational corporation experienced a sophisticated cyberattack. Thanks to their proactive risk management strategy, which included cybersecurity audits, employee training, and robust data encryption, they not only defended against the attack but also identified and addressed vulnerabilities for future protection.

VI. The Future of Risk Management Services

The future of risk management services is closely tied to the evolving landscape of risk itself. Emerging trends such as climate change, technological advancements, and geopolitical shifts are introducing new risks and complexities. To stay ahead, risk management services will need to adapt by:

Leveraging Advanced Data Analytics: Big data, artificial intelligence, and machine learning are becoming integral tools in risk assessment and mitigation. These technologies enable more precise risk modeling and early warning systems.

Sustainability and Environmental Risk Management: Environmental, social, and governance (ESG) risks are gaining prominence. Risk management services will increasingly focus on helping organizations manage ESG-related challenges and opportunities.

Global Risk Collaboration: As risks become more interconnected on a global scale, collaboration among organizations, governments, and international bodies will be crucial. Risk management services will play a pivotal role in facilitating such collaboration.

Resilience and Crisis Preparedness: The ability to respond effectively to crises will be a cornerstone of risk management. Services will emphasize business continuity planning, crisis management, and disaster recovery.

VII. Conclusion

In a world characterized by volatility and unpredictability, risk management services are the keystone of a successful and resilient organization. These services provide the tools and strategies necessary to identify, assess, mitigate, and monitor risks that could jeopardize a company's existence. By

0 notes

Text

Fraud Risk Management Services

Fraud risk management services provide a disciplined environment for proactive decision-making to assess continuously what could go wrong in fraud risks, determine which risks are important to deal with, formulate strategies for reducing those risks, and implementing the strategies to deal with those risks. Grant Thornton is the right choice if you are looking for the best fraud risk management services in India. We offer many advisory and consulting services, including business advisory, tax advisory, financial statement audit, and many more.

1 note

·

View note

Text

A Financial Statement Audit is a thorough examination of a company's financial records and statements to ensure their accuracy and compliance with accounting standards. We provide this service to help businesses maintain their financial integrity, increase transparency, and gain the trust of stakeholders. Our team of expert auditors meticulously scrutinizes financial statements, test internal controls, and performs necessary procedures to produce a comprehensive report on the company's financial health. This report can assist management in making informed decisions and satisfying regulatory requirements.

1 note

·

View note

Text

Indonesia’s business landscape is flourishing, with companies continually in search of top talent to propel growth and innovation. However, making the right hire poses its own set of challenges. This is where the significance of pre-employment check services in Indonesia becomes paramount.

#pre employment screening#employment background screening#risk management services#risk management strategies

0 notes

Text

Risk Management Services

Techsurance is one of the Leading risk management services, insurance underwriter, claim management, Reinsurance consulting services across India TECHSURANCE is built on legacy of continuous innovation, partnering with clients and entrepreneurs to address existing challenges, explore new opportunities, and build the future of life and health insurance.

1 note

·

View note

Text

If you are looking for Risk Management services in Delhi. then contact DDS Detective Agency. This is the best Risk Management service in India.

#Risk Assessment and Advisory#Risk advisory services#Risk Management services#Risk Management services in Delhi#Risk Assessment and Management

0 notes

Text

Risk Management Services

Mitigate potential threats with Sentry Consulting's unrivaled risk management services. Our adept team combines industry expertise with innovative strategies to identify, assess, and proactively address risks. Safeguard your business's future and reputation with Sentry Consulting—your trusted partner in comprehensive risk mitigation and strategic resilience.

0 notes

Text

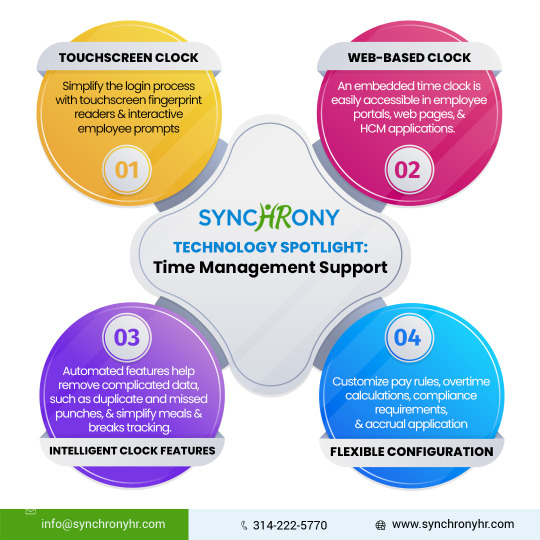

Technology Spotlight: Time Management Support

As an HR outsourcing (HRO) organization, SynchronyHR offers clients a one-stop shop for leading payroll, benefits, and HR technology.

https://www.synchronyhr.com/post/technology-spotlight-time-management-support

#hr outsourcing#payroll outsourcing#workers compensation insurance#businessgrowth#employee benefits for small business#professional employer organization#employee benefits#risk management services#synchronyhr#peo companies

0 notes