#SIPCalculator

Explore tagged Tumblr posts

Text

Benefits of Using a SIP Calculator Before You Start Investing

Starting your investment journey with a Systematic Investment Plan (SIP) is one of the smartest ways to build wealth over time. But before you take the plunge, using a SIP calculator can make a world of difference in how you plan and achieve your financial goals.

✅ 1. Clear Goal Setting

A SIP calculator helps you map out exactly how much you need to invest monthly to reach your desired financial goals—whether it’s buying a home, planning a vacation, or saving for your child’s education. You can visualize the future value of your investment based on your time horizon and expected returns.

✅ 2. Customized Planning

SIP calculators allow you to adjust the investment amount, duration, and expected rate of return to see different outcomes. This flexibility helps you personalize your plan according to your budget and lifestyle.

✅ 3. Better Financial Discipline

When you see the long-term growth potential of small monthly contributions, it motivates you to stay committed to regular investing. SIP calculators emphasize the importance of consistency and the power of compounding.

✅ 4. Risk Awareness

By simulating different return scenarios—conservative, moderate, or aggressive—you get a realistic view of market-linked risks and can plan accordingly. This helps manage expectations and align your strategy with your risk tolerance.

✅ 5. Time-Saving and Hassle-Free

Instead of manually crunching numbers, a SIP calculator provides instant, accurate estimates—making financial planning simpler and more efficient, even for first-time investors.

Conclusion

Using a SIP calculator before you start investing isn’t just smart—it’s essential. It gives you clarity, confidence, and control over your investment journey. With just a few inputs, you can create a realistic, goal-oriented plan that aligns with your financial future. So, before your next SIP, take a moment to calculate—you’ll be glad you did.

0 notes

Text

SIP Calculator – Plan Your Investments Smartly

A SIP Calculator helps you estimate the returns on your monthly mutual fund investments over time. It's the easiest way to plan your wealth creation journey with consistency and clarity.

By entering your monthly SIP amount, expected return rate, and investment period, you can instantly see how much your investments can grow.

👉 Try our accurate and free SIP Calculator to plan your future smartly.

Whether you're a beginner or a seasoned investor, this tool makes your financial planning simple and effective.

0 notes

Text

Make Smarter Investments & Secure Your Financial Future with SIPFund.com

https://sipfund.com/blog/master-your-wealth.html

Take charge of your goals with the Systematic Investment Plan (SIP). Calculate your investment strategy, start an SIP today and embark on success journey!

The SIP calculator helps you: ✅ Estimate how much to invest ✅ Understand your potential returns ✅ Build a step-by-step roadmap to wealth

Stop guessing. #StartPlanning.

📍 Gain clarity, confidence, and control over your finances. ✨ Subscribe now for expert financial tips and smart investment insights!

#SIPFund#AMFI#NSEIndia#BSE#MutualFunds#SIPCalculator#SIPInvestment#SystematicInvestmentPlan#MutualFundsSIP#InvestSmart#FinanceTips#WealthBuilding#FinancialFreedom#InvestmentTips#PersonalFinance#MoneyGrowth#SIPReturns#LongTermInvestment#FinancialPlanning#CompoundingPower#FinanceSimplified#MoneyMatters#GrowWithSIP#InvestInYourFuture#FinancialGoals#FinanceIndia#WealthCreation#IndianInvestors#India

0 notes

Text

0 notes

Text

power of Compounding ₹2 CR Corpus With ₹5K/M?\

For someone who wishes to build up capital over the longer term and is not familiar with equiymarkets, investing regularly through a SIP in a mutual fund is one strategy that can ensure success to a large extent. What it really means is that you invest a fixed sum from your savings every month, instead of making a heavy one-timeinvestment. Over the years, an SIP can add up to give really substantial returns. You can use a SIPcalculator to estimate how much yourinvestment will grow over time, even if you invest a small amount each month

Open Free Demat account: https://ekyc.motilaloswal.com/Partner/?diyid=7ee80e7d-dc34-4ef2-b5ed-a7a4d9294f8e

#motilaloswaljaipur #SIP #MutualFund #VijayvargiyaFinancialServices

To Get An Expert Advice & Open Account | Call +917568647300

#motilaloswal#broker#investment#jaipur#article#news#motilaloswaljaipur#googlemaps#invest#stockmarket

0 notes

Link

The Mutual Fund Calculator - Calculate the rough estimate of SIP returns on Motilal Oswal MF SIP Calculator. Click to know more!

0 notes

Text

Mutual fund calculator - A Deeper Insight

There are different traditional and non-traditional investment instruments in India. Many people invest in traditional instruments such as FDs, RDs, and more. However, over the course of years, non-traditional instruments such as mutual funds have become popular too. Mutual funds are accessible and that’s why, even people from rural India are now investing in mutual funds. Despite all the popularity, there are still many who don’t understand mutual funds completely. In today’s blog, we will discuss everything about mutual funds:

A mutual fund is a pool of money collected by investors to purchase a range of securities and is managed by professionals. The returns are then distributed amongst all investors after standard deductions. This way, the investor can benefit from the market while not being actively involved in investments.

Some of the most important benefits of mutual funds include:

Risk management: Mutual funds are managed by experts who understand the market and thus, take wise investment decisions. These decisions keep in mind the risk appetite of the investors/fund and thus, the chances of loss are minimal. However, since most mutual funds are market-linked, there is some risk involved. Investors must understand the risk and only then invest in any mutual fund.

SIP: Investing a large chunk of money at once is not wise. Times have changed; most Mutual funds now allow investors to choose SIP (systematic investment planning). In SIP, you get to invest in a mutual fund every month. This reduces the financial burden and also helps in averaging the cost of investment. The SIP calculator will help you understand the power of compound interest. Once you use the SIP mutual fund calculator and compare the lump sum investment with the SIP investment, you will know the benefits of SIP.

Higher returns: Mutual funds are known to offer higher returns than traditional investment instruments such as FDs, RDs, and so on. If you are just starting to invest, you must have a healthy mix of traditional and non-traditional financial instruments.

For everyone: Mutual funds have become more accessible than ever. It won’t be wrong to say that mutual funds are for everyone. In fact, we’re seeing an influx of mutual funds from even rural India. This shows that the country’s financial literacy is rising and people are more receptive to non-traditional mutual funds.

When you invest in FD, you know exactly the amount that you will get on maturity. However, that’s not the case with mutual funds. Since mutual funds are subject to market risk, one cannot accurately tell how much would be the returns. That’s why, it’s important to use the mutual fund calculator.

A mutual fund calculator is an online tool that will tell you roughly how much returns you will get when you invest in a particular mutual fund. A mutual fund calculator uses historic data to estimate how would returns you could get in the coming years. Typically, most mutual fund calculators and SIP calculators provide estimates for 1 year, 3 years, 5 years, and 10 years time horizons.

The benefits of using a SIP calculator or mutual fund calculator are as follows:

Gives you a fair idea of the returns you can earn through the investment.

Eliminates manual calculations.

Convenient to use it anywhere on the go.

To use the SIP calculator or mutual fund calculator offered by Motilal Oswal Mutual Fund, click here.

0 notes

Photo

Calculate your returns with SIP calculator online at Motilal Oswal Mutual Fund. Invest across our diverse range of investing options, we offer mutual funds, AIF Index funds, PMS, and more. Invest now

0 notes

Text

youtube

Looking for an easy way to invest in mutual funds? Download the SIPFund App now!

Start SIPs instantly, track your portfolio, and invest smartly. SIPFund is your trusted partner for financial growth. (SIPFund)📲 Available on Google Play.

The SIPFund App helps you invest in mutual funds quickly, securely, and without hassle. Open your SIP account in minutes and watch your money grow. Simple UI, expert insights, and 24/7 tracking! Download now and take control of your finances.

📈 Start your investment journey with the SIPFund App – India's most trusted SIP & Mutual Fund platform. Invest easily, track your portfolio, and grow wealth with expert guidance.

📲 Download Now: https://bit.ly/47KYbhk

🔔 Subscribe for investment tips!

🔗 Follow us:

🌐 Website: www.sipfund.com 📌 Facebook: https://www.facebook.com/SIPFUNDS 📸 Instagram: https://www.instagram.com/sipfundofficial 🐦 Twitter: https://x.com/SIPFundOfficial 💼 LinkedIn: https://www.linkedin.com/company/sipfund-pvt-ltd/ ▶️ YouTube: https://www.youtube.com/@SIPFUND

Start your SIP today and take a step toward financial freedom!

#SIPFund#MutualFunds#InvestSmart#FinanceApp#InvestmentApp#SIPApp#MutualFundSIP#MoneyGrowth#SIPOnline#WealthManagement#FinanceTips#MoneyMatters#SmartInvesting#SIPPlanner#BestSIPApp#DownloadNow#GooglePlayApp#InvestIndia#GrowWealth#SIPCalculator#PersonalFinance#OnlineInvestment#EasyInvesting#PassiveIncome#StockMarketIndia#FinancialFreedom#InvestmentTips#BeginnerInvestor#SIPStart#SafeInvestments

0 notes

Link

A systematic investment plan is a process of investing by making regular equal investments in a mutual fund, fixed deposit, or stocks. Systematic investment plans (SIPs) are more popular with mutual funds. The frequency of equal investments in a SIP can either be weekly, monthly, or quarterly.

#sip#whatissipinvestment#sipinvestment#systematicinvestmentplan#sipcalculator#sipbenefits#stockquantum

0 notes

Link

#sipinhindi#sipkafullform#aboutsipinvestmentinHindi#sipmeaninginHindi#whatsipinvestmentinHindi#sipyojana#sipkefaydeinHindi#sip#siphdfc#bestsipplan#sipplanner#sipcalculator#sipaxisbank#howtostartsipinvestment#sip mutual fund

0 notes

Text

Tax saving instruments that everyone should invest in

Nobody likes the idea of paying taxes. A part of your hard-earned money goes directly into the pocket of the government in the form of direct taxes. The income that remains with you after deduction of tax is either spent on things that attract tax or are inclusive of tax. With so many taxes levied, it won’t be surprising to not have anything in hand at the end of every month.

Investments are often viewed as do-it-later kind of task. Every income-earning individual assumes that they should have a stable income before they start investing. To be honest, just like time, money is an asset that needs to be managed, otherwise, it won’t suffice. If you feel that you don’t have surplus money to make investments, we suggest you invest to create that surplus. Confused? Parking your money in certain investments is a tax-saving expense. As investments reap returns, you won’t have to fret about monthly crunch. Whether you want to go all-in or take baby steps, the tax-saving investments listed below come with a flexible payment option. Take your pick!

· Mutual Fund:

There are different types of mutual funds that cater to the diverse monetary objectives of every investor. For the ones who want to save tax should invest in equity-linked savings scheme or ELSS mutual funds. Amount invested and earned from ELSS funds is deductible u/s 80C of the Income Tax Act. If you are investing with a particular goal, for instance buying a car, you can use an SIP calculator on Axis Bank to know a tentative figure of investment every month.

· Unit Linked Investment Plan:

Unit linked plan or ULIP is the best of both investment and insurance world. A part of the premium is invested in equity, debt or a combination of both schemes while the rest of the part goes towards your protecting your life. In case of an unfortunate event, the sum assured along with the returns made from the investment will be payable to the nominee. Premiums paid are deductible u/s 80CCC of the Income Tax Act.

· Health Insurance:

It is impossible to know when and how you will acquire a disease. Medical expenses can rip you off your savings and can even put you in a debt trap if you don’t have a backup. The best way to save yourself and your family from medical predicaments is by investing in a health insurance plan. Also, premiums for securing health insurance come with tax benefit u/s 80D.

0 notes

Text

What is a SIP (Systematic Investment Plan) ? How it will make you Rich ?

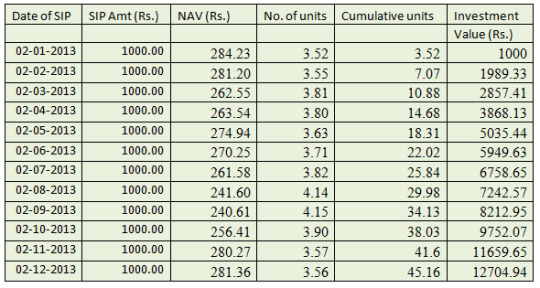

What is SIP (Systematic Investment Plan)? A Systematic Investment Plan or SIP is a smart and uncomplicated way to invest money in mutual funds. SIP allows you to invest a predetermined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach to investments and helps you instill the habit of saving and accumulating wealth for the future. SIP works as... A SIP is a flexible and easy investment plan. Your money is automatically charged from your bank account and invested in a specific mutual fund plan. A certain number of units is assigned based on the current market rate (called NAV or net asset value) of the day. ]] Each time you invest money, the additional units in the scheme are bought at the market rate and added to your account. Therefore, units are purchased at different rates and investors benefit from the Average Cost Rupees and the Power of Compounding. Average cost of rupees With volatile markets, most investors remain skeptical about the best time to invest and try to "time" their entry into the market. The average cost of rupees allows you to choose not to participate in the guessing game. As you are a regular investor, your money gets more units when the price is low and less when the price is high. During the volatile period, it may allow you to achieve a lower average cost per unit. Power of Money composition Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it.” The rule to capitalize is simple: the sooner you start to invest, the longer your money will have to grow. Here the simple earning of Sip Example... ]]

Benefits of SIP: Disciplinary savings - discipline is the key to a successful investment. When you invest through SIP, you commit to save regularly. Every investment is a step towards achieving your financial goals. ]] Flexibility - although it is advisable to continue SIP investments with a long-term perspective, there is no compulsion. Investors can discontinue the plan at any time. You can also increase / decrease the amount that is invested. Long-term gains - due to the average cost of rupees and the power to capitalize the SIP, they have the potential to offer attractive returns over a long investment horizon. Convenience - SIP is an investment mode without problems. You can issue permanent instructions to your bank to facilitate automatic debits from your bank account. SIPs have proven to be an ideal investment mode for retail investors who do not have the resources to make active investments. Read the full article

#bestsipinvestmentplan2018#howtostartsipinvestment#mutualfundsipreturncalculator#sipcalculator#sipcalculatoricici#sipcalculatormoneycontrol#sipcalculatorsbi#sipmeaning#sipplanner#systematicinvestmentplancalculator#systematicinvestmentplancomparison#systematicinvestmentplansbi

0 notes