#MutualFund

Text

#customers#investingtips#investing101#investing#investor#investment#income#investments#investors#success#mindset#opportunity#experience#success story#investmentchallenge#investmentopportunity#sip#systematicinvestmentplan#mutualfund#mutualfunds#mutualfundsinvestment#mutualfundssahihai#stockmarket#sensex#nifty

51 notes

·

View notes

Video

youtube

Episode 4 | Vichar Manthan धन और लाभ | Happy Independence Day | Dr. Anub...

#happyindependenceday#financialfreedom#money#mutualfund#SIP#growth#successtips#moneymistakes#investment

2 notes

·

View notes

Text

India turns a corner in July

Kotak Editorial Team

The disappointing economic data and corporate performance from US, the world’s largest economy had a negative sentiment globally across equity markets, but India stood strong with the board Nifty 50 index gaining close to 8.6% in July.

Why did this happen? How come India has performed well compared to its global peers or has India decoupled from its global counterparts?

There are three possible reasons for India to perform better than its peers.

Continue reading...

2 notes

·

View notes

Photo

Dear Investor.....Plan your tax now. Invest in LICMF Tax Plan today. Here's the short video to know more about LICMF Tax Plan! Aaasthi Solutions Pvt Ltd Satya Kommana 9849232737 #investment #investmentportfolio #investmentproperties #mutualfunds #mutualfundssahihain #investments #mutualfundadvisor #investmentart #intags #investmentopportunity #investmentstrategies #mutualfundsahihain #investmentproperty #investmentmanagement #mutualfund #mutualfundinvesting #investmentbanking #investmenttips #mutualfundindia #investmentcasting investmentph #investmentbanker #mutualfundsip #mutualfundsahihai mutualfundsph #investmentrealestate #investmentopportunities #mutualfundssahihai #investment investmentplan #kommana #aaasthisolutionspvtltd #aaasthi #rajamahendravaram (at Rajamahendravaram, Andhra Pradesh, India) https://www.instagram.com/p/CevcoTBPBm6/?igshid=NGJjMDIxMWI=

#investment#investmentportfolio#investmentproperties#mutualfunds#mutualfundssahihain#investments#mutualfundadvisor#investmentart#intags#investmentopportunity#investmentstrategies#mutualfundsahihain#investmentproperty#investmentmanagement#mutualfund#mutualfundinvesting#investmentbanking#investmenttips#mutualfundindia#investmentcasting#investmentbanker#mutualfundsip#mutualfundsahihai#investmentrealestate#investmentopportunities#mutualfundssahihai#kommana#aaasthisolutionspvtltd#aaasthi#rajamahendravaram

2 notes

·

View notes

Text

mutual fund advisor

Use our extensive mutual fund advisor services to find the way to financial success. Our knowledgeable team of professionals provides tailored advice to assist you in navigating the challenging world of investing in mutual funds. From risk evaluation to portfolio diversification, we create solutions that fit your risk tolerance and financial objectives.

#mutual fund advisor#mutualfund#mutual#advisor#assetmanagement#mutuallikes#wealthmanagement#gofundmecampaign#gofundme#investorlife#funds#investment#gofundmedonations#matchingfunds#angeladvisor#funding#taxcompany#evadvisor#businessplans#investinyourfuture#loan

0 notes

Text

World Is Changing Their Investment Pattern Have You Changed Your Investment Pattern?

#mutualfunds#mutualfundadvisor#mutualfundssahihai#mutualfund#systematicinvestmentplan#dreamfunds#financialgoals#mutual funds

0 notes

Text

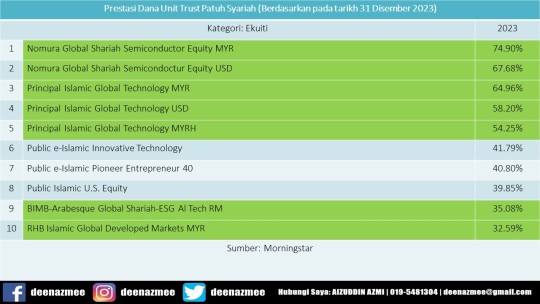

PRESTASI DANA UNIT TRUST PATUH SYARIAH TAHUN 2023

Assalamualaikum & Salam Sejahtera

Sebelum ini saya telah berkongsi tentang apakah itu unit trust? Saya juga telah berkongsi artikel dari laman sesawang FIMM mengenai "Tabung Unit Trust sebagai pelaburan masa depan anda?" dan "Mengumpulkan kekayaan dengan Unit Trust dan PRS". Kali ini saya sekadar hendak berkongsi tentang prestasi dana Unit Trust patuh syariah tahun 2023.

Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Prestasi Dana Unit Trust Patuh Syariah Tahun 2023

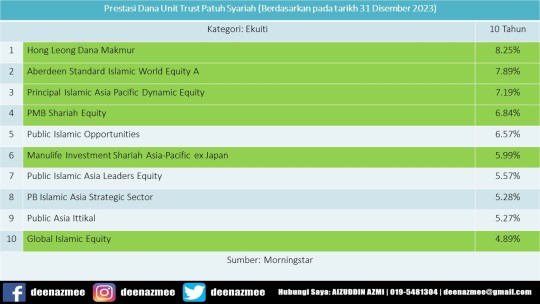

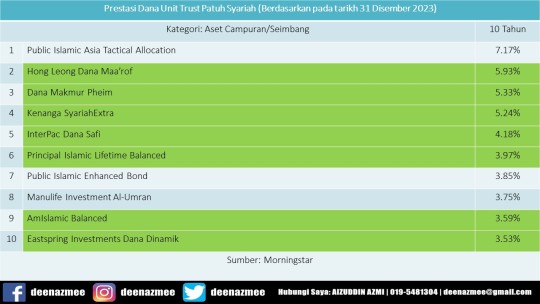

Prestasi Dana Unit Trust Patuh Syariah (Berdasarkan Pada Tarikh 31 Disember 2023)

Pulangan YTD (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Nomura Global Shariah Semicondctr Equity MYR (74.90%)

Nomura Global Shariah Semicondctr Equity USD (67.68%)

Principal Islamic Global Technology MYR (64.96%)

Principal Islamic Global Technology USD (58.20%)

Principal Islamic Global Technology MYRH (54.25%)

Public e-Islamic Innovative Technology (41.79%)

Public e-Islamic Pioneer Entrepreneur 40 (40.80%)

Public Islamic U.S. Equity (39.85%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM (35.08%)

RHB Islamic Global Developed Markets MYR (32.59%)

RHB Global Shariah Equity Index USD (31.78%)

Manulife Shariah India Equity A RM (31.68%)

Nomura Global Shariah Sustainable Equity MYR A (31.18%)

RHB Global Shariah Equity Index MYR Hedged (29.89%)

RHB i-Global Sustainable Disruptors USD (29.84%)

BIMB-Arabesque Global Shariah-ESG Al Tech USD (29.16%)

RHB i-Global Sustainable Disruptors MYR Hedged (28.72%)

Public Islamic Global Equity (28.22%)

TA Global Absolute Alpha-i MYR (27.94%)

BIMB-Arabesque Global Shariah Sustainable Equity RM (27.89%)

AHAM Aiiman Global Multi Thematic USD (27.80%)

BIMB-Arabesque i Global Dividend 1 MYR (27.21%)

TA Global Absolute Alpha-i RMB Hedged (26.96%)

Manulife Shariah India Equity A USD (26.29%)

Nomura Global Shariah Sustainable Equity USD A (25.77%)

Aberdeen Standard Islamic World Equity A (25.64%)

AHAM Aiiman Global Multi Thematic SGD Hedged (25.29%)

RHB Islamic Global Developed Markets SGD (25.03%)

Public e-Islamic Sustainable Millennial (24.92%)

AHAM Aiiman Global Multi Thematic AUD Hedged (24.31%)

AHAM Aiiman Global Multi Thematic MYR Hedged (24.10%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM Hedged (24.01%)

PMB Shariah Tactical (24.00%)

Kenanga Global Islamic (23.93%)

BIMB-Arabesque Global Shariah Sustainable Equity RM Hedged (23.15%)

Maybank Global Sustainable Equity-I MYR (22.98%)

TA Global Absolute Alpha-i USD (22.64%)

BIMB-Arabesque Global Shariah Sustainable Equity USD (22.56%)

BIMB-Arabesque Global Shariah Sustainable Equity AUD (22.33%)

BIMB-Arabesque Global Shariah Sustainable Equity SGD (22.32%)

BIMB-Arabesque i Global Dividend 1 USD (21.56%)

TA Global Absolute Alpha-i GBP Hedged (20.88%)

TA Global Absolute Alpha-i SGD Hedged (20.63%)

Phillip Dana Dividen Inc (20.30%)

Principal DALI Global Equity MYR (19.65%)

TA Global Absolute Alpha-i MYR Hedged (18.92%)

BIMB-Arabesque i Global Dividend 1 MYR Hedged (18.62%)

Maybank Global Sustainable Equity-I USD (17.70%)

Manulife Investment Shariah Asia-Pacific ex Japan (17.43%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity MYR (17.12%)

BIMB-Arabesque i Global Dividend 1 SGD (17.06%)

Maybank AsiaPac Ex-Japan Equity-I (16.89%)

Principal Islamic Asia Pacific Dynamic Equity (16.77%)

Aiiman Global Equity MYR (16.58%)

TA Global Absolute Alpha-i AUD Hedged (16.46%)

PMB Shariah Equity (16.08%)

Maybank Global Sustainable Equity-I MYR Hedged (14.94%)

ICD Global Sustainable (14.81%)

PMB Shariah Dividend (14.49%)

Public e-Islamic Asia Thematic Growth (13.45%)

PMB Dana Bestari (13.28%)

PMB Shariah Global Equity (12.69%)

PB Islamic Asia Strategic Sector (12.38%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity USD (12.24%)

Aiiman Global Equity USD (12.11%)

Public Asia Ittikal (12.07%)

Public Islamic Asia Dividend (11.88%)

Principal DALI Asia Pacific Equity Growth (11.38%)

RHB Shariah Asia Ex-Japan Growth MYR (11.20%)

Global Islamic Equity (11.19%)

Principal Islamic Asia Pacific Dynamic Income & Growth MYR (10.94%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (10.88%)

Muamalat Invest Islamic Equity (10.60%)

Public Islamic Select Treasures (10.27%)

AmIslamic Global SRI RM Class (10.19%)

Principal Islamic Small Cap Opportunities (10.15%)

Public Ittikal Sequel (9.81%)

Aiiman Global Equity MYR Hedged (9.16%)

Manulife Investment Shariah Progress Plus (9.09%)

Principal Islamic Enhanced Opportunities (8.95%)

KAF Dana Adib (8.79%)

AHAM Aiiman Quantum (8.78%)

Manulife Investment Al-Faid (8.66%)

KAF Islamic Dividend Income (8.53%)

Principal Islamic Malaysia Opportunities (8.19%)

Public Islamic Optimal Growth (7.99%)

PMB Dana Al-Aiman (7.98%)

Public Islamic Savings (7.93%)

Public Islamic Select Enterprises (7.71%)

TA Islamic (7.47%)

Public Islamic Opportunities (7.41%)

PMB Shariah Index (7.29%)

Public Islamic Alpha-40 Growth (7.17%)

Public Islamic Asia Leaders Equity (7.15%)

Principal DALI Equity (7.04%)

PB Islamic SmallCap (6.94%)

Public Islamic Dividend (6.63%)

Public Islamic Emerging Opportunities (6.50%)

Manulife Shariah - Dana Ekuiti (6.44%)

AHAM Aiiman Asia (Ex Japan) Growth MYR (6.35%)

Aiiman Asia Pacific (Ex Japan) Dividend (6.35%)

Principal Islamic Asia Pacific Dynamic Income & Growth USD (6.26%)

TA Dana Fokus (6.26%)

Public Islamic Enterprises Equity (6.07%)

AmIslamic Global SRI USD Class R (5.96%)

AmIslamic Growth (5.70%)

Eastspring Investments Islamic Small-cap (5.58%)

Manulife Investment Shariah Progress (5.28%)

AHAM Aiiman Growth (5.20%)

Manulife Investment Al-Fauzan (5.10%)

Principal Islamic Asia Pacific Dynamic Income & Growth SGD (4.63%)

PB Islamic Equity (4.60%)

Principal DALI Equity Growth (4.41%)

Public Islamic Equity (4.33%)

BIMB-Arabesque Malaysia Shariah-ESG Equity Myr (4.14%)

Principal DALI Opportunities MYR (4.13%)

Phillip Dana Aman (4.09%)

Kenanga Ekuiti Islam (4.02%)

Public Islamic Optimal Equity (4.02%)

ASEAN Equity (4.00%)

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (63.91%)

InterPac Dana Abadi (55.88%)

Public Islamic Asia Tactical Allocation (28.62%)

InterPac Dana Saadi (26.52%)

PB Islamic Dynamic Allocation (24.46%)

Public Islamic Global Balanced (21.58%)

Aiiman Smart Invest Portfolio - Growth (21.16%)

United-i Global Balanced MYR (17.14%)

Maybank Global Mixed Assets-I MYR (16.78%)

Principal Islamic Global Selection Aggressive MYR (15.06%)

Maybank Global Wealth Growth-I USD Acc (14.86%)

United-i Global Balanced SGD Hedged (14.78%)

United-i Global Balanced GBP Hedged (14.27%)

AHAM Aiiman Global Thematic Mixed Asset USD Institutional (13.97%)

PMB-An-Nur Waqf Income A (13.73%)

AHAM Aiiman Global Thematic Mixed Asset USD (13.09%)

AHAM Aiiman Global Thematic Mixed Asset AUD Hedged (12.74%)

United-i Global Balanced RMB Hedged (12.46%)

Nomura Global Shariah Strategic Growth A (12.34%)

United-i Global Balanced USD (12.29%)

Nomura Global Shariah Strategic Growth B (12.00%)

Maybank Global Mixed Assets-I USD (11.90%)

AHAM Aiiman Global Thematic Mixed Asset SGD Hedged (11.30%)

PMB-An-Nur Waqf Income B (11.14%)

Maybank Global Wealth Growth-I MYRH Acc (10.79%)

Bank Islam Premier (10.58%)

RHB Global Shariah Dynamic Income MYR Hedged (10.58%)

Public Islamic Mixed Asset (10.53%)

Principal Islamic Global Selection Aggressive USD (10.33%)

AHAM Aiiman Global Thematic Mixed Asset MYR Hedged (10.10%)

Maybank Global Mixed Assets-I SGD Hedged (9.94%)

Maybank Global Mixed Assets-I AUD Hedged (9.78%)

Public Islamic Enhanced Bond (9.29%)

Maybank Global Mixed Assets-I MYR Hedged (8.77%)

Manulife Investment Al-Umran (8.59%)

Maybank Global Wealth Moderate-I USD Acc (8.47%)

Maybank Global Wealth Moderate-I USD Dis (8.47%)

Principal Islamic Lifetime Balanced (8.24%)

United-i Global Balanced MYR Hedged (8.20%)

United-i Global Balanced AUD Hedged (7.65%)

Manulife Investment-ML Shariah Flexi (7.54%)

Principal Islamic Global Selection Moderate Conservative MYR (6.77%)

Manulife Investment-CM Shariah Flexi (6.67%)

Maybank Malaysia Balanced I (6.64%)

AHAM Aiiman Select Income (6.60%)

Astute Dana Al-Faiz-I Inc (6.55%)

Principal Islamic Global Selection Moderate MYR (6.45%)

RHB Islamic Regional Balanced MYR (6.42%)

Public Ehsan Mixed Asset Conservative (6.34%)

Principal Islamic Lifetime Balanced Growth (6.32%)

KAF Dana Alif (6.14%)

TA Dana Optimix (6.11%)

Principal Islamic Conservative Wholesale Fund-Of-Funds (6.05%)

Public Islamic Growth Balanced (5.95%)

Maybank Global Wealth Moderate-I MYRH Acc (5.94%)

Principal Islamic Balanced Wholesale Fund-Of-Funds (5.81%)

Maybank Global Wealth Moderate-I MYRH Dis (5.78%)

Public Ehsan Mixed Asset Growth (5.77%)

AmIslamic Balanced (5.60%)

Principal Islamic Lifetime Enhanced Sukuk (5.53%)

RHB Dana Hazeem (4.78%)

Public e-Islamic Flexi Allocation (4.41%)

Manulife Investment-HW Shariah Flexi (4.35%)

Kenanga SyariahExtra (4.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (9.48%)

Principal Islamic Wholesale Sukuk B (9.47%)

Principal Islamic Wholesale Sukuk A (9.39%)

AmDynamic Sukuk – Class B (8.44%)

AmDynamic Sukuk – Class A (8.42%)

Public Islamic Infrastructure Bond (8.14%)

PB Aiman Sukuk (7.76%)

United-I ESG Series-High Quality Sukuk SGD Hedged (7.69%)

Public e-Sukuk (7.57%)

Public Islamic Bond (7.54%)

Public Sukuk (7.33%)

KAF Sukuk (7.24%)

PB Islamic Bond (7.24%)

AHAM Aiiman Global Sukuk MYR (7.15%)

AmBon Islam (7.22%)

Opus Shariah Income (6.91%)

PB Sukuk (6.90%)

Maybank Malaysia Income-I C MYR (6.79%)

Maybank Malaysia Income-I A MYR (6.77%)

Franklin Malaysia Sukuk I MYR Inc (6.72%)

Principal Islamic Lifetime Sukuk (6.67%)

AHAM Aiiman Income Plus (6.65%)

Opus Shariah Income Plus (6.58%)

Franklin Malaysia Sukuk A MYR Inc (6.51%)

Public Islamic Strategic Bond (6.32%)

AmanahRaya Syariah Trust (6.30%)

Kenanga AsnitaBond (6.26%)

Nomura i-Income 2 H USD Hedge (6.22%)

Maybank Income Management-I (6.01%)

Opus Shariah Dynamic Income (5.99%)

TA Dana Afif (5.78%)

Kenanga Bon Islam (5.76%)

Maybank Malaysia Sukuk (5.74%)

RHB Shariah Income (5.53%)

RHB Global Sukuk RM Class B (5.43%)

Phillip Dana Murni (5.36%)

Principal Islamic Global Sukuk MYR (5.29%)

BIMB ESG Sukuk Class A (5.23%)

BIMB ESG Sukuk Class D (5.23%)

AmanahRaya Syariah Income (4.99%)

AmIslamic Institutional 1 (4.96%)

Public Islamic Income (4.94%)

MAMG Global Income-I B USD (4.90%)

Public Islamic Select Bond (4.88%)

Principal Islamic Malaysia Government Sukuk D (4.37%)

United-i Conservative Income (4.27%)

Nomura i-Income 2 S (4.25%)

Nomura i-Income 2 I (4.14%)

Principal Islamic Malaysia Government Sukuk B (4.14%)

Principal Islamic Malaysia Government Sukuk C (4.14%)

Nomura i-Income 2 R (4.00%)

Dana Pasaran Wang

AmanahRaya Syariah Cash Management (13.30%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (12.68%)

Manulife Shariah Global REIT USD Inc (8.02%)

Dana Lain-lain

AHAM Shariah Gold Tracker (19.00%)

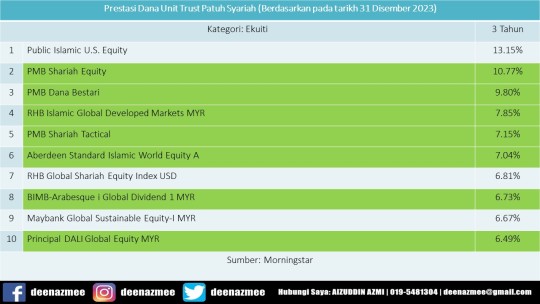

Purata Pulangan Tahunan 3 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Public Islamic U.S. Equity (13.15%)

PMB Shariah Equity (10.77%)

PMB Dana Bestari (9.80%)

RHB Islamic Global Developed Markets MYR (7.85%)

PMB Shariah Tactical (7.15%)

Aberdeen Standard Islamic World Equity A (7.04%)

RHB Global Shariah Equity Index USD (6.81%)

BIMB-Arabesque i Global Dividend 1 MYR (6.73%)

Maybank Global Sustainable Equity-I MYR (6.67%)

Principal DALI Global Equity MYR (6.49%)

Public e-Islamic Sustainable Millennial (6.44%)

RHB Global Shariah Equity Index MYR Hedged (6.41%)

TA Dana Fokus (6.26%)

Public Islamic Global Equity (5.96%)

Global Islamic Equity (5.76%)

Manulife Investment Shariah Progress Plus (4.51%)

PB Islamic SmallCap (4.46%)

KAF Dana Adib (4.30%)

KAF Islamic Dividend Income (4.25%)

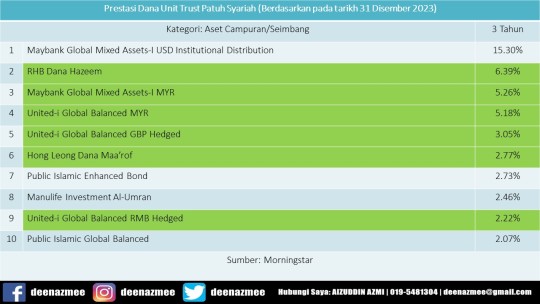

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (15.30%)

RHB Dana Hazeem (6.39%)

Maybank Global Mixed Assets-I MYR (5.26%)

United-i Global Balanced MYR (5.18%)

United-i Global Balanced GBP Hedged (3.05%)

Hong Leong Dana Maa’rof (2.77%)

Public Islamic Enhanced Bond (2.73%)

Manulife Investment Al-Umran (2.46%)

United-i Global Balanced RMB Hedged (2.22%)

Public Islamic Global Balanced (2.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (4.39%)

Principal Islamic Wholesale Sukuk B (4.36%)

Principal Islamic Wholesale Sukuk A (4.32%)

AmanahRaya Syariah Trust (3.72%)

RHB Shariah Income (3.18%)

KAF Sukuk (3.01%)

Franklin Malaysia Sukuk I MYR Inc (3.00%)

Maybank Malaysia Income-I A MYR (2.93%)

PB Aiman Sukuk (2.92%)

Franklin Malaysia Sukuk A MYR Inc (2.79%)

AHAM Aiiman Global Sukuk MYR (2.69%)

Maybank Income Management-I (2.69%)

Principal Islamic Lifetime Sukuk (2.68%)

Public e-Sukuk (2.63%)

Public Islamic Bond (2.63%)

Kenanga AsnitaBond (2.53%)

Public Islamic Strategic Bond (2.46%)

AmDynamic Sukuk – Class B (2.45%)

Phillip Dana Murni (2.37%)

United-i Conservative Income (2.33%)

AmBon Islam (2.26%)

Opus Shariah Short Term Low Risk Asset (2.13%)

PB Sukuk (2.11%)

Maybank Malaysia Income-I C MYR (2.10%)

Maybank Malaysia Sukuk (2.03%)

Public Islamic Select Bond (2.03%)

United-I ESG Series-High Quality Sukuk MYR (2.03%)

PB Islamic Bond (2.01%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (4.54%)

Dana Lain-lain

AHAM Shariah Gold Tracker (6.15%)

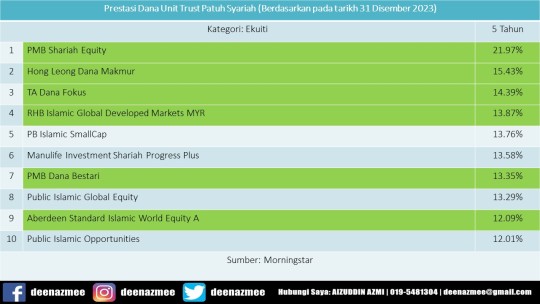

Purata Pulangan Tahunan 5 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

PMB Shariah Equity (21.97%)

Hong Leong Dana Makmur (15.43%)

TA Dana Fokus (14.39%)

RHB Islamic Global Developed Markets MYR (13.87%)

PB Islamic SmallCap (13.76%)

Manulife Investment Shariah Progress Plus (13.58%)

PMB Dana Bestari (13.35%)

Public Islamic Global Equity (13.29%)

Aberdeen Standard Islamic World Equity A (12.09%)

Public Islamic Opportunities (12.01%)

PMB Shariah Tactical (11.17%)

KAF Islamic Dividend Income (10.94%)

Kenanga Shariah Growth Opportunity (10.48%)

Principal DALI Global Equity MYR (10.36%)

KAF Dana Adib (9.39%)

PMB Shariah Growth (9.13%)

Principal Islamic Asia Pacific Dynamic Equity (8.82%)

Manulife Investment Shariah Asia-Pacific ex Japan (8.55%)

Principal Islamic Small Cap Opportunities (8.46%)

TA Islamic (8.44%)

Public Islamic Select Treasures (8.36%)

Global Islamic Equity (7.85%)

PMB Shariah Index (7.48%)

Maybank AsiaPac Ex-Japan Equity-I (7.40%)

Kenanga Global Islamic (7.25%)

BIMB-Arabesque i Global Dividend 1 MYR (7.21%)

PMB Dana Al-Aiman (6.94%)

AHAM Aiiman Quantum (6.78%)

ICD Global Sustainable (6.73%)

RHB Islamic Emerging Opportunity (6.68%)

Principal DALI Asia Pacific Equity Growth (6.45%)

Pheim Asia Ex-Japan Islamic (6.41%)

Manulife Shariah - Dana Ekuiti (6.21%)

Manulife Investment Al-Fauzan (6.10%)

Public Islamic ASEAN Growth (5.92%)

Public Islamic Treasures Growth (5.90%)

Public Islamic Emerging Opportunities (5.89%)

BIMB i Growth (5.86%)

Public Islamic Alpha-40 Growth (5.78%)

Manulife Investment Al-Faid (5.69%)

Public Islamic Asia Leaders Equity (5.53%)

Kenanga Ekuiti Islam (5.40%)

AHAM Aiiman Growth (5.33%)

Public Asia Ittikal (5.15%)

Manulife Investment Shariah Progress (5.07%)

Public Islamic Savings (5.01%)

BIMB-Arabesque i Global Dividend 1 USD (4.98%)

PB Islamic Asia Strategic Sector (4.83%)

Public Islamic Asia Dividend (4.78%)

Public Ittikal Sequel (4.66%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (4.64%)

Precious Metals Securities (4.56%)

Kenanga Amanah Saham Wanita (4.41%)

PMB Dana Mutiara (4.40%)

AmIslamic Growth (4.22%)

Astute Dana Al-Sofi-i (4.17%)

Kenanga Syariah Growth (4.14%)

Principal Islamic Malaysia Opportunities (4.03%)

RHB Shariah Asia Ex-Japan Growth MYR (4.03%)

Dana Aset Campuran/Seimbang

Hong Leong Dana Maa’rof (10.45%)

Public Islamic Asia Tactical Allocation (8.95%)

InterPac Dana Safi (8.52%)

PB Islamic Dynamic Allocation (7.76%)

Kenanga SyariahExtra (7.74%)

TA Dana Optimix (6.62%)

Manulife Investment-ML Shariah Flexi (6.57%)

RHB Dana Hazeem (6.31%)

Public Islamic Growth Balanced (6.05%)

Public Ehsan Mixed Asset Conservative (6.03%)

Manulife Investment Al-Umran (5.77%)

Public e-Islamic Flexi Allocation (5.53%)

Dana Makmur Pheim (5.47%)

AmIslamic Balanced (5.45%)

Manulife Investment-HW Shariah Flexi (5.41%)

Public Islamic Mixed Asset (5.34%)

Astute Dana Aslah (4.87%)

Public Islamic Enhanced Bond (4.69%)

Principal Islamic Lifetime Balanced (4.47%)

Kenanga Islamic Balanced (4.11%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (6.16%)

PB Aiman Sukuk (4.73%)

Maybank Malaysia Income-I A MYR (4.46%)

AmDynamic Sukuk – Class B (4.35%)

KAF Sukuk (4.35%)

Principal Islamic Lifetime Sukuk (4.30%)

Franklin Malaysia Sukuk I MYR Inc (4.22%)

Maybank Malaysia Sukuk (4.19%)

AmBon Islam (4.14%)

Kenanga AsnitaBond (4.13%)

Public Islamic Bond (4.05%)

Franklin Malaysia Sukuk A MYR Inc (4.01%)

Purata Pulangan Tahunan 10 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Hong Leong Dana Makmur (8.25%)

Aberdeen Standard Islamic World Equity A (7.89%)

Principal Islamic Asia Pacific Dynamic Equity (7.19%)

PMB Shariah Equity (6.84%)

Public Islamic Opportunities (6.57%)

Manulife Investment Shariah Asia-Pacific ex Japan (5.99%)

Public Islamic Asia Leaders Equity (5.57%)

PB Islamic Asia Strategic Sector (5.28%)

Public Asia Ittikal (5.27%)

Global Islamic Equity (4.89%)

Public China Ittikal (4.85%)

TA Dana Fokus (4.69%)

Pheim Asia Ex-Japan Islamic (4.67%)

Principal DALI Asia Pacific Equity Growth (4.61%)

Public Islamic Asia Dividend (4.61%)

Public Islamic Select Treasures (4.36%)

Kenanga Shariah Growth Opportunity (4.35%)

PMB Dana Bestari (4.33%)

PMB Shariah Growth (4.26%)

Dana Aset Campuran/Seimbang

Public Islamic Asia Tactical Allocation (7.17%)

Hong Leong Dana Maa’rof (5.93%)

Dana Makmur Pheim (5.33%)

Kenanga SyariahExtra (5.24%)

InterPac Dana Safi (4.18%)

Principal Islamic Lifetime Balanced (3.97%)

Public Islamic Enhanced Bond (3.85%)

Manulife Investment Al-Umran (3.75%)

AmIslamic Balanced (3.59%)

Eastspring Investments Dana Dinamik (3.53%)

Principal Islamic Lifetime Enhanced Sukuk (3.30%)

Manulife Investment-HW Shariah Flexi (3.24%)

TA Dana Optimix (3.05%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (5.18%)

PB Aiman Sukuk (4.84%)

KAF Sukuk (4.71%)

Kenanga AsnitaBond (4.60%)

Maybank Malaysia Income-I A MYR (4.55%)

Public Islamic Bond (4.34%)

Principal Islamic Lifetime Sukuk (4.29%)

PB Islamic Bond (4.23%)

AmBon Islam (4.20%)

AmDynamic Sukuk – Class A (4.17%)

Public Islamic Infrastructure Bon (4.08%)

PB Sukuk (4.04%)

Sumber: my.morningstar.com

P/S: Prestasi masa lalu tidak semestinya menunjukkan atau menjamin prestasi masa hadapan. Jom pelbagaikan pelaburan. Sekarang telah ada satu platform di mana pelabur mempunyai pilihan untuk melabur ke 300 lebih dana unit trust swasta daripada 20 lebih syarikat pengurusan unit trust yang tersenarai di Malaysia sama ada untuk melabur secara tunai atau melalui akaun 1 KWSP. Tiada pelaburan awal jika berminat untuk melabur secara simpanan tetap. (Hanya 90 dana unit trust swasta patuh syariah tertentu) Adakah simpanan anda mencukupi? Dimanakah tempat anda membuat simpanan? Jom gandakan simpanan di tempat yang kalis Inflasi! Berminat? Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Untuk keterangan lanjut & temujanji, sila hubungi:

Aizuddin Azmi

Perunding Unit Amanah

Single License Investment

Emel: [email protected]

H/P: 019-548 1304

Alamat: No. 29A (Ground Floor), Lebuh Pantai 10300 Pulau Pinang

Sekian, wassalam.

0 notes

Text

What are the benefits of investing in stocks, bonds, or mutual funds?

Investing in stocks, bonds, or mutual funds offers various benefits, each catering to different investment objectives, risk tolerances, and time horizons. Here are the key benefits of each:

Stocks:

Potential for High Returns: Historically, stocks have offered higher returns compared to other asset classes over the long term. Investing in individual stocks can provide significant capital appreciation if the companies perform well.

Ownership in Companies: Buying stocks means owning a portion of the company. Shareholders may benefit from dividends, voting rights, and potential capital gains as the company grows.

Diversification Opportunities: Stocks allow investors to diversify their portfolios across different industries, sectors, and regions, spreading risk and potentially enhancing returns.

Liquidity: Stocks are highly liquid investments, meaning they can be easily bought or sold on stock exchanges, providing investors with the ability to access their funds quickly if needed.

Bonds:

Fixed Income Stream: Bonds provide a fixed income stream in the form of periodic interest payments (coupon payments) until maturity. This makes them attractive to investors seeking stable income.

Preservation of Capital: Bonds are generally considered less risky than stocks, offering more stability and preservation of capital. They are often used to mitigate portfolio volatility and provide downside protection during market downturns.

Diversification: Bonds can diversify a portfolio by providing a counterbalance to equity investments. They tend to have low correlation with stocks, which can help reduce overall portfolio risk.

Safety: Government bonds, particularly those issued by stable governments, are often considered safe-haven assets, offering protection against economic and geopolitical uncertainties.

Mutual Funds:

Professional Management: Mutual funds are managed by professional portfolio managers who make investment decisions on behalf of investors. This expertise can potentially lead to better investment selection and risk management.

Diversification: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This diversification spreads risk and reduces the impact of poor performance by individual investments.

Accessibility: Mutual funds offer access to a wide range of asset classes and investment strategies, making them suitable for investors with different risk profiles and investment objectives.

Convenience: Mutual funds provide a convenient way for investors to access the financial markets without the need for extensive research or active management. Investors can buy and sell mutual fund shares easily, typically through brokerage accounts or retirement plans.

Overall, investing in stocks, bonds, or mutual funds offers opportunities for growth, income, diversification, and professional management, catering to the varied needs and preferences of investors. Investors need to assess their own financial needs, risk tolerance, and time horizon before choosing the most appropriate investment vehicles. Consulting with a financial advisor can help tailor an investment strategy that aligns with individual objectives and circumstances.

0 notes

Text

Equity markets are volatile in nature. Don't let this be a deterrent to systematic investing. Invest for long term.

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahiminvestments#MutualFund#investing#investments#investmentstrategies#longterminvesting#longterm#mutualfunds#mutualfundssahihai#MutualFundsInvestment#mutualfundsindia#investmentsolutions#equity#nifty#niftytrading#BestMutualFundAdvisorinDelhi#tradingstrategy

0 notes

Text

What is Mutual Fund and How does it work? | Mutual Fund Explained

SBI Securities - Invest systematically in professionally managed Mutual funds. Get benefits from the power of compounding by investing in MF online in India. Read more...

0 notes

Video

youtube

Best Mutual fund for 1000rs monthly for 5 Years | Top 3 Mutual Fund For ...

0 notes

Text

Mutual funds investments are surging in India as retail investors seek smart return avenues. Begin by doing a one-time KYC validation on fund house portals using Aadhaar. Research suitable funds on platforms like Value Research using filters for historic returns, costs and fund manager quality. Open an online account digitally with fund houses, stock brokers like Zerodha, or investment apps like Groww. Complete video verification if needed. Then invest lumpsums or set up SIPs in your chosen mutual fund scheme via integrated payment gateways like UPI or net banking. Opt for auto-debit for investing discipline. Lastly, track your investments periodically for performance using app dashboards. Stay updated via SMS and email alerts on portfolio changes. This compressed digital process gives millions of Indians easy and low-cost access to mutual fund investing today.

0 notes

Text

घर में कोनसा लाफिंग बुद्धा रखना चाहिए ?

For more information,

☎ Call Now : 97288-11740

👉 Address: DSS 265, Green Square Market, Opposite Aggarsain Bhawan, Hisar

🌐 Website: jeevanjyotishkendra.com

#bestastrologer#niftyfifty#astrologer#astrology#astro#sip#love#sharemarket#vi#mutualfund#earnonline#kismat#kitchenvastu#homevastu#vastu#home#laughingbudha#laughing#jeevanjyotishkendra#bhakt#mahadev#angareshwar#india#investment#amarnath

0 notes

Text

mutual fund advisor in Nagpur

Looking for a trustworthy mutual fund advisor in Nagpur? Look no further than Khasnis Prime Wealth. Our professional staff offers personalized financial advice to help you make sound investment decisions. With our experience and dedication to quality, we seek to maximize your financial potential. Contact us today to begin your journey to financial success.

#mutualfund#mutual#advisor#assetmanagement#mutuallikes#wealthmanagement#gofundmecampaign#gofundme#investorlife#funds#investment#gofundmedonations#matchingfunds#angeladvisor#funding#taxcompany#evadvisor#businessplans#investinyourfuture#loan

1 note

·

View note

Text

Building the Power of Compounding with SIP Instalments. Are Like a lying bricks.

#mutualfunds#mutualfundadvisor#mutualfundssahihai#mutualfund#systematicinvestmentplan#dreamfunds#financialgoals

0 notes

Text

Best Mutual Funds to Invest in 2024

Over the years, the growth story of mutual funds in India has been remarkably significant, leading to a continuous change in the market's best mutual funds.

Also Read :- Best Mutual Funds to Invest in 2024

0 notes