#SP500Index

Text

Fri Apr 05 2024, GE Aerospace shares soared(+6.0%), adding to gains posted since the company completed its split from energy division GE Vernova earlier in the week.

General Electric (GE) underwent a major transformation by splitting into three separate companies, finalizing the process on April 2nd, 2024. This marked the end of an era for the once-dominant industrial conglomerate.

Here's a breakdown of the GE split:

The Three New Companies:

GE Vernova: This company houses GE's former energy business, focusing on areas like power generation, renewable energy, and energy grid solutions.

GE Aerospace: Retains the "GE" ticker symbol and carries on GE's legacy in aviation technology, including aircraft engines.

GE HealthCare: This company, which had already completed its spin-off in 2023, trades under the ticker symbol "GEHC" and focuses on the healthcare technology sector.

By separating into distinct entities, GE aimed to become more efficient and agile in each industry sector.

0 notes

Text

Frühstart, TradingInsights Dienstag, 16 Januar 2024 Dax & S&P 500

Guten Morgen und Herzlich Willkommen zu TradingsInsights dem Frühstart bei LCW-Managment, der technischen Analyse der Finanzmärkte am Dienstag, 16. Januar 2024

S&P 500 im Tageschart

Nach dem Martin Luther King Day waren die US-Börsen am Vortag geschlossen, und wir verzeichneten einen außerbörslichen Handel mit einer kleinen Tageskerze. Der Kurs blieb praktisch unverändert und hielt sich weiterhin über dem 10-Tage-EMA, einem wichtigen kurzfristigen Indikator. Solange dieser im Tagestief verteidigt werden kann, deutet dies auf weiter steigende Kurse hin. Eine Notierung über dem 10-Tage-EMA hat in der Vergangenheit oft auf zukünftige Aufwärtsbewegungen hingedeutet.

Bei einem möglichen Durchbruch nach unten wäre der Bereich von etwa 4.720 Punkten die nächste Anlaufmarke. Bei weiteren Abwärtsbewegungen könnte der Kurs sogar bis zum 50-Tage-EMA bei aktuellen 4.636 Punkten fallen. Mit der regulären Öffnung der US-Börsen dürften wir heute neue Impulse erhalten.

DAX im Tageschart

Nun betrachten wir den DAX im Tageschart. Auch hier gab es wenig Veränderung, da die US-Börsen geschlossen blieben. Der DAX tendierte weiter seitwärts um den 10-Tage-EMA. Obwohl wir mit einer bärischen Tageskerze aus dem Handel gingen, hat sich strategisch an der Lage wenig geändert.

Sollte der DAX weiter nachgeben und die Abwärtsdynamik fortsetzen, wären 16.400 Punkte die nächste Anlaufmarke, gefolgt vom 50-Tage-EMA bei 16.330 Punkten. Die seitwärts gerichtete Bewegung deutet eher auf weitere Kurssteigerungen hin, insbesondere da wir uns der ausgedehnten Ichimoku-Wolke nähern, die auf der Unterseite eine massive Unterstützung bieten sollte.

Ein bullisches Signal wäre ein Durchbruch über die Marke von 16.800 Punkten, mit dem nächsten Anlaufbereich bei 16.820 Punkten und darüber bei 17.000 Punkten.

Markterkennungslinien und Fazit

Abschließend werfen wir einen Blick auf die Markterkennungslinien. Der Shortbereich zwischen 16.800 und 16.850 Punkten wurde am Vortag knapp verfehlt, bevor es abwärts ging und der Handel bei 16.628 Punkten schloss. Die Long- und Short-Bereiche bleiben unverändert, mit Long zwischen 16.500 und 16.550 Punkten und Short zwischen 16.800 und 16.850 Punkten.

Quellennachweis und Vertiefungen:

CNN Business – Fear & Greed Index:

Link: CNN Business – Fear & Greed Index

Beschreibung: CNN Business bietet direkten Zugang zum Fear & Greed Index für aktuelle Marktbewertungen.

Tradingview – Charts und Analysen:

Link: Tradingview

Beschreibung: Tradingview ist eine umfassende Plattform für Finanz-Charts und Analysen, die es ermöglicht, aktuelle Entwicklungen auf den Märkten zu verfolgen.

Technische Analyse (Chartanalyse) – Wikipedia:

Link: Technische Analyse – Wikipedia

Beschreibung: Die Technische Analyse, auch Chartanalyse genannt, ist eine Form der Finanzanalyse. Weitere Informationen dazu finden Sie im verlinkten Wikipedia-Artikel.

Fear & Greed Index – Investopedia:

Link: Fear & Greed Index – Investopedia

Beschreibung: Investopedia bietet vertiefende Informationen zum Fear & Greed Index, einschließlich seiner Bedeutung und Anwendung.

Disclaimer: Diese Analyse dient ausschließlich Informationszwecken und stellt keine finanzielle Beratung dar. Jegliche Handelsentscheidungen, die auf den in dieser Analyse präsentierten Informationen basieren, liegen in der alleinigen Verantwortung des Lesers. Es wird dringend empfohlen, sich bei Bedarf von einem qualifizierten Finanzberater beraten zu lassen.

0 notes

Text

S&P500 Friday ends 0.60% lower

Fortinet Inc

Trading Down (-25%) - Fortinet is a cybersecurity company with headquarters in Sunnyvale, California

Fortinet is a global cybersecurity company that provides comprehensive security solutions to enterprises, service providers, and government organizations. The company's products and services include firewalls, endpoint security, intrusion detection systems, cloud security, and more.

Fortinet was founded in 2000 by brothers Ken and Michael Xie. The company is headquartered in Sunnyvale, California, and has offices all over the world. Fortinet's products are used by over 400,000 customers in over 90 countries.

Fortinet is a leading provider of cybersecurity solutions. The company's products are known for their high performance, scalability, and ease of use. Fortinet also offers a wide range of services to help customers implement and manage their security solutions.

Fortinet is a well-respected company in the cybersecurity industry. The company's products and services are used by some of the largest organizations in the world. Fortinet is a good choice for organizations that are looking for a comprehensive security solution that is easy to use and scalable.

Fortinet's security solutions can help to reduce the risk of cyberattacks by providing a comprehensive layer of protection.

Fortinet's products can help to improve visibility into network traffic, which can help to identify and respond to threats more quickly.

Fortinet's products can help organizations to meet compliance requirements, such as those set by the PCI DSS.

Fortinet's products can help to reduce operational costs by automating many of the tasks involved in security management.

Fortinet's main product is the FortiGate firewall. The FortiGate firewall is a next-generation firewall (NGFW) that provides comprehensive security for networks. The FortiGate firewall can protect against a wide range of threats, including malware, ransomware, and denial-of-service attacks.

The FortiGate firewall is a modular product, which means that it can be customized to meet the specific needs of each organization. The firewall can be deployed in a variety of environments, including data centers, branch offices, and the cloud

Fortinet's last quarter financials were released on August 4, 2023. The company reported revenue of $1.28 billion for the quarter, an increase of 33.1% from the same quarter of the previous year. GAAP earnings per share were $0.92, an increase of 28.6% from the same quarter of the previous year.

.

Fortinet's stock price fell sharply after the release of the company's last quarter financials. The stock price fell by 25% on August 4, 2023. The decline in the stock price was likely due to the company's warning about slowing sales. Fortinet said that it expects sales to grow at a slower pace in the coming quarters.

S&P500 Friday Top Risers and Fallers.

0 notes

Text

S&P 500 el día de hoy en la sesión pm. Compras establecidas posterior al lunch break.

1 note

·

View note

Text

Opinion | Hong Kong’s stock market rebound: dead cat bounce or durable recovery?

New Post has been published on https://petn.ws/i7UI8

Opinion | Hong Kong’s stock market rebound: dead cat bounce or durable recovery?

Who would have thought as recently as a few months ago that the Hang Seng Index would be the world’s best performing major stock market in April? Last month, Hong Kong’s benchmark index rose 7.4 per cent, bringing its gains since January 22 to 18.7 per cent and putting it on the cusp of a […]

See full article at https://petn.ws/i7UI8

#CatsNews #HangSengIndex, #InterestRates, #MSCIChinaIndex, #SP500Index, #StockConnectScheme, #Yen, #Yuan

#Hang Seng Index#interest rates#MSCI China index#S&P 500 index#Stock Connect scheme#yen!#yuan#Cats News

0 notes

Text

Stock Market Surges in 2023, Investors Optimistic for 2024

#SP500Index #stockmarketperformance

0 notes

Text

Fri Apr 05 2024, GE Aerospace shares soared(+6.0%), adding to gains posted since the company completed its split from energy division GE Vernova earlier in the week.

General Electric (GE) underwent a major transformation by splitting into three separate companies, finalizing the process on April 2nd, 2024. This marked the end of an era for the once-dominant industrial conglomerate.

Here's a breakdown of the GE split:

The Three New Companies:

GE Vernova: This company houses GE's former energy business, focusing on areas like power generation, renewable energy, and energy grid solutions.

GE Aerospace: Retains the "GE" ticker symbol and carries on GE's legacy in aviation technology, including aircraft engines.

GE HealthCare: This company, which had already completed its spin-off in 2023, trades under the ticker symbol "GEHC" and focuses on the healthcare technology sector.

By separating into distinct entities, GE aimed to become more efficient and agile in each industry sector.

0 notes

Text

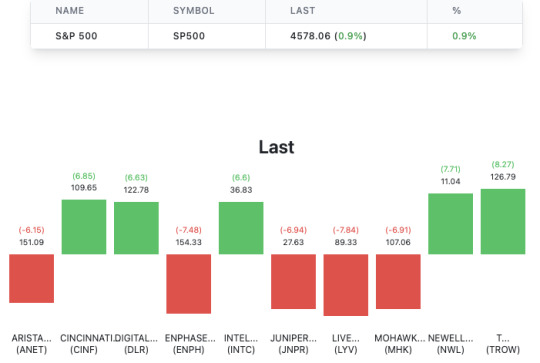

S&P500 Friday

T. Rowe Price Group, Inc.

Trading Up (+8.72%) - is an American publicly owned global investment management firm that offers funds, subadvisory services, separate account management, and retirement plans and services for individuals, institutions, and financial intermediaries

Live Nation Entertainment

Trading Down (-7.84%) - is an American multinational entertainment company that was founded in 2010 following the merger of Live Nation and Ticketmaster.

0 notes

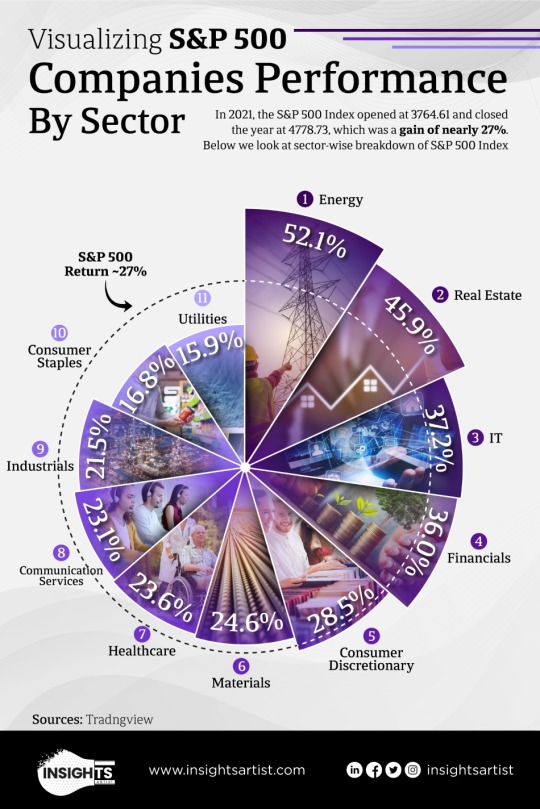

Photo

Visualizing S&P 500 Companies Performance by Sector

0 notes

Text

Opinion | Hong Kong’s stock market rebound: dead cat bounce or durable recovery?

New Post has been published on https://petn.ws/BhGfv

Opinion | Hong Kong’s stock market rebound: dead cat bounce or durable recovery?

Who would have thought as recently as a few months ago that the Hang Seng Index would be the world’s best performing major stock market in April? Last month, Hong Kong’s benchmark index rose 7.4 per cent, bringing its gains since January 22 to 18.7 per cent and putting it on the cusp of a […]

See full article at https://petn.ws/BhGfv

#CatsNews #HangSengIndex, #InterestRates, #MSCIChinaIndex, #SP500Index, #StockConnectScheme, #Yen, #Yuan

#Hang Seng Index#interest rates#MSCI China index#S&P 500 index#Stock Connect scheme#yen!#yuan#Cats News

0 notes

Text

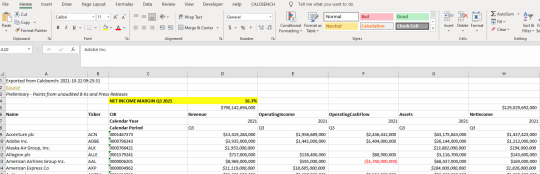

Press Release Data in Real time

What can you do? Here’s what you can do. Calculate a Net Income margin in real time. This morning, Friday October 22, 2021 at 9:25 EDT, we retrieved all S&P500 firms that had reported this period. There are 103 firms in our sample as of that time.

Net Income for those firms was 129 Billion. Revenue was 790 Billion for a margin of 16.3%

Last year for those same firms, the number are 75.8 B Non Net Income and 698B in revenues for a margin of 10.9%.

Get the Excel Add in and have a go yourself!

Thanks!

0 notes

Text

S&P 500 Soars to Record Highs: Big Gains and Exciting Times for Investors!

#recordhigh #SP500Index

0 notes

Text

Fri Apr 05 2024, GE Aerospace shares soared(+6.0%), adding to gains posted since the company completed its split from energy division GE Vernova earlier in the week.

General Electric (GE) underwent a major transformation by splitting into three separate companies, finalizing the process on April 2nd, 2024. This marked the end of an era for the once-dominant industrial conglomerate.

Here's a breakdown of the GE split:

The Three New Companies:

GE Vernova: This company houses GE's former energy business, focusing on areas like power generation, renewable energy, and energy grid solutions.

GE Aerospace: Retains the "GE" ticker symbol and carries on GE's legacy in aviation technology, including aircraft engines.

GE HealthCare: This company, which had already completed its spin-off in 2023, trades under the ticker symbol "GEHC" and focuses on the healthcare technology sector.

By separating into distinct entities, GE aimed to become more efficient and agile in each industry sector.

0 notes

Text

S&P500 Friday

T. Rowe Price Group, Inc.

Trading Up (+8.72%) - is an American publicly owned global investment management firm that offers funds, subadvisory services, separate account management, and retirement plans and services for individuals, institutions, and financial intermediaries

Live Nation Entertainment

Trading Down (-7.84%) - is an American multinational entertainment company that was founded in 2010 following the merger of Live Nation and Ticketmaster.

Find out more about S&P500 constituents' performance.

0 notes