#SWP

Explore tagged Tumblr posts

Text

Lil bastard ass camera.

Howdy.

M'names Dirk Strider. I build robots for a living.

If you're seeing this, we're probably both most likely dead. Dead as hell.

If you ain't, then I'm just talking to myself. Which ain't new.

"Love to hear myself talk"... Whatever, Ro.

This is my journal that I happen to be uploading to whatever constitutes as Ghost Internet.

So. I died. Slapped around by a suppressive sad fish woman and got killed by my own damn sword. Absolute mythical levels of ironic thematic bullshit right there.

Stuck in purgatory with some batshit feral version of my little brother-kid.

You know, the regular shit.

...

Jesus this is a stupid idea. Why'd I let her talk me into this? It ain't like Hal's around...

95 notes

·

View notes

Text

Guidelines // NSFW Prompts // Pinned Post

Style Week 2024 is a ship week celebrating South Park's very own Super Best Friends from November 3rd - 9th. Each day has 2 prompts to choose from, where you can draw, write, craft, edit, make a playlist, etc! Descriptions of the prompts are listed below for inspiration, but feel free to interpret them in your own way.

SFW PROMPTS

DAY 1: Nostalgia, Soulmates

DAY 2: Fandom Crossover/Cosplay — Personality/Body Swap

DAY 3: Apocalypse, Mythology

DAY 4: Band, Favorite Style Alter Ego

DAY 5: Fashion, Camping

DAY 6: Free Day

DAY 7: Marriage/Wedding, Fankids

Further explanation and suggestions for themes are listed below.

♡ DAY 1 ♡

Nostalgia: Childhood memories; before they were together; their first meeting, date, kiss, etc.

Soulmates: AUs! Soul marks, writing that appears on their skin from each other, seeing color for the first time when they meet!

♡ DAY 2 ♡

Fandom Crossover/Cosplay: Animal Crossing, Evangelion, Pokémon, whatever other fandoms you enjoy!

Personality/Body Swap: Stan and Kyle swap personalities, or bodies, or both!

♡ DAY 3 ♡

Apocalypse: Alien invasion, nuclear fallout, zombies, etc.

Mythology: Angels, demons, Gods, demigods, nymphs, vampires, werewolves, famous myths, etc.

♡ DAY 4 ♡

Band: Crimson Dawn, Fingerbang, Moop, or your own AU!

Favorite Style Alter Ego: Favorite outfit of theirs: Stan Marshwalker/Elf King Kyle, Toolshed/Human Kite, World of Warcraft Style, etc.! Feel free to mix and match.

♡ DAY 5 ♡

Fashion: Y2K, grunge, historical fashion, etc.

Camping: Style ventures into the woods (or just their backyard!). Stargazing, roasting marshmallows, scary stories!

♡ DAY 6 ♡

Free Day: Anything! If you wanted to do something that wasn’t mentioned, feel free to make this day your own!

♡ DAY 7 ♡

Marriage/Wedding: Getting engaged, elopement, wedding party (big or small), their first dance, cake eating, etc.

Fankids: Original characters or Post Covid kids!

97 notes

·

View notes

Text

red flags to look out for before joining organizations, namely authoritarian and vanguard communist organizations ^^

#resources#organizing#safety#authoritarianism#vanguard#communism#psl#dsa#cpusa#pcusa#iysse#ycl#swp#socialism

21 notes

·

View notes

Text

Cuidense y preparense que pienso hacer otro oc del swp 🐛🔪

SWP de @dankgrass

KOI ANTES ERAS HORRIBLE 😭😭

#doddles#my ocs#my art#doddle#ocs#art#digital art#artists on tumblr#swp#swp koi#ilustration#original illustration#ilustracion#character design#original character#my characters#hippie#hippistyle

33 notes

·

View notes

Text

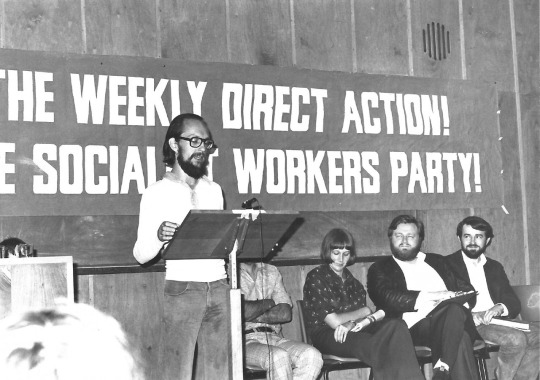

4th National Conference of the Socialist Workers Party (Australia), 1976. Not sure who the speaker is.

#communism#socialism#marxism#leftism#anti capitalism#socialist#leftist#marxist#communist#dismantle capitalism#socialist workers party#swp#karl marx#lenin#leninist#leninism#vladimir lenin#working class#workers of the world unite#workers of the world#workers power#soviet power#workers councils#trotskyist#trotskyism#trotsky#leon trotsky#australia#auspol#communism in australia

15 notes

·

View notes

Text

How SWP Can Rescue Your Retirement in an Uncertain World — And the Calculator That Shows You How

"The best time to start planning for retirement was yesterday. The second-best time is today."

As inflation eats into fixed incomes, pension plans become increasingly unreliable, and medical bills spike with age, the idea of retirement becomes not a time of peace, but a looming cloud of financial stress for millions.

But what if there were a way to turn your investments into a monthly paycheck — one that adjusts for inflation, adapts to your lifestyle, and doesn’t run out too early?

Welcome to the world of SWP – Systematic Withdrawal Plans — the lesser-known cousin of SIPs (Systematic Investment Plans) — and the financial strategy your future self will thank you for.

💡 What is an SWP, Really?

An SWP is a facility that allows you to withdraw a fixed amount from your mutual fund investment at regular intervals — typically monthly or quarterly. It’s like reverse SIP. Instead of putting money in, you're drawing it out, gradually.

But here's the catch: How much can you withdraw each month without depleting your funds too soon?

Enter the complexity. Your withdrawal amount, expected return, inflation rate, step-up needs, and duration all play a crucial role. Get one wrong, and your money might run out earlier than expected — potentially when you need it most.

📉 Why Traditional Retirement Planning Is Failing

A 2023 report by the Association of Mutual Funds in India (AMFI) found that only 16% of Indians over 50 have an active retirement income strategy.

The majority rely on:

Fixed Deposits (which struggle to beat inflation)

Rental income (unreliable and illiquid)

Pension schemes (often capped and static)

What they often lack is a dynamic, inflation-adjusted income stream that can mimic a monthly salary — exactly what SWP offers.

📊 The Power of Planning with Real Numbers

Let’s say you have ₹60 Lakhs saved in mutual funds. You want to withdraw ₹40,000 per month. Seems doable? Maybe.

But what if you live for 30 more years?

What if inflation averages 6%?

What if your returns drop during a bear market?

This is where most people go wrong: guesswork.

🧮 Where CalculatorA2Z.com Comes In

Rather than tossing numbers around blindly, CalculatorA2Z.com’s Advanced SWP Calculator lets you simulate your entire retirement withdrawal plan, including:

🗓️ Monthly, Quarterly, Half-Yearly, or Yearly Withdrawals

📈 Annual Step-up (Flat or % Increase)

💸 Inflation-adjusted Balances

🧾 Detailed Year-by-Year Breakdown Table

📉 Corpus Depletion Warnings

🎯 Extension Strategy Suggestions

It’s not just a calculator — it’s a strategy engine for your second innings.

🧠 A Real-Life Case Study

Ravi, 60, Retired PSU Officer

Invested: ₹75 Lakhs

Monthly Need: ₹50,000 (increasing 5% yearly)

Expected Return: 9% annually

Inflation: 6%

Result using the CalculatorA2Z.com SWP tool: Ravi’s corpus would last for 27 years before depletion. But with a slight withdrawal reduction and step-up every two years instead of annually, he could extend it to 32+ years — practically his entire post-retirement span.

“I didn’t know 2-3% changes could make such a difference. The calculator gave me clarity I never got from my advisor,” says Ravi.

✨ Why This Matters More Than Ever

We're entering an era where DIY financial planning is not a luxury — it's a necessity. You don’t have to be a financial expert. You just need the right tools, accurate data, and a willingness to take control.

Tools like CalculatorA2Z.com put that control in your hands. They strip away the jargon, show the math, and let you visualize your financial future — without guesswork.

🔗 Try It Yourself

Planning to retire soon? Or just thinking about turning your wealth into a stable income? Head over to CalculatorA2Z.com’s Advanced SWP Calculator and play with the numbers that reflect your life.

You may be just one simulation away from financial peace.

#finance#business#sw posting#systematicinvestmentplan#systematicwithdrawalplan#calculator#calculatora2z#swp#sip#swpvssip#withdrawn

0 notes

Text

🧓🏻👵🏻 महिन्याच्या गरजा जशा निश्चित असतात, तसाच आपला मासिक कॅशफ्लोही निश्चित असू शकतो!

आता SWP (Systematic Withdrawal Plan) च्या मदतीने मिळवा: ✅ प्रत्येक महिन्याला निश्चित उत्पन्न ✅ भांडवल वाढीची संधी ✅ निवृत्तीनंतरचा आर्थिक आत्मविश्वास

आजच तुमचा SWP सुरू करा आणि आयुष्याचा आनंद घ्या!

📞 कॉल करा: +91 72765 18999 🌐 भेट द्या: www.dreamfunds.in

📢 म्युच्युअल फंड गुंतवणूक ही बाजारातील जोखमींना अधीन आहे. सर्व योजना संबंधित कागदपत्रे काळजीपूर्वक वाचा.

#DreamFunds#SWP#निश्चितउत्पन्न#निवृत्तीआर्थिकयोजना#MonthlyCashflow#MutualFunds#SmartRetirement#आर्थिकस्वातंत्र्य

0 notes

Text

🌟 Retirement dreams don’t come true by chance—they’re built with smart planning! 🌟

We all picture a stress-free, comfortable future, but the real key to achieving it is investing wisely today. Whether it’s SIPs, SWPs, or strategic wealth-building, every step you take now brings you closer to financial freedom.

💡 Start early. Invest smart. Secure your future. 💡

Your retirement shouldn’t be a gamble—take control and make it a reality! 🚀💰

#RetirementPlanning#FinancialFreedom#SmartInvesting#WealthBuilding#InvestWisely#SIP#SWP#PlanForTheFuture#MoneyMatters

0 notes

Note

Helloooooo, handsome. I hear you like robots. I happen to be a robot...perhaps we could go out together sometime? Stares up at you with my big sweet eyes

I don't fuck birds.

40 notes

·

View notes

Text

导则 // NSFW主题 // 置顶

每天有 2 个主题可供选择,能以画画、写文、cosplay、动画剪辑、制作歌单等方式参与!

SFW主题

第一天: 回忆 , 灵魂伴侣

第二天:跨界作品 / 服装扮演 ,性格 / 身体互换

第三天:末日生物,神话

第四天:乐队,喜欢的AU

第五天:时装设计,露营

第六天:自定日

第七天:结婚/婚礼场景,孩子

下面列出了主题的解释,以供参考!也可以自由地以自己的方式表达!

♡ 第一天 ♡

回忆:童年记忆;他们在一起之前的相处模式;他们的第一次见面、约会、亲吻等。

灵魂伴侣:遇到真爱时,身体会出现一样的印记或对方留下的文字,视线相对后能看见世界的色彩。

♡ 第二天 ♡

跨界作品 / 服装扮演:动森、Eva、宝可梦以及任何你喜欢的圈子。

性格 / 身体互换:二人交换性格,身体或两者都是!

♡ 第三天 ♡

末日生物:外星人入侵、核辐射、僵尸等等。

神话:天使、恶魔、神、半神、仙女、吸血鬼、狼人,还有一些著名的神话故事等等。

♡ 第四天 ♡

乐队:Crimson Dawn、Fingerbang、Moop,或者你自己的AU都可以!

喜欢的AU:最喜欢的装备有斯坦·沼泽行者、精灵王凯尔、工具房、人类风筝、魔兽世界风格等!随意搭配!

♡ 第五天 ♡

时装设计:Y2K、垃圾摇��、复古时尚等等。

露营:去树林里(或后院)冒险吧!观星、烤棉花糖、讲恐怖故事!

♡ 第六天 ♡

自定日:随便什么!如果你想做些没提到的事情,可以随时把这一天变成你自己的!

♡ 第七天 ♡

结婚/婚礼场景:订婚、私奔、婚礼派对(无论大小)、他们的第一支舞、吃蛋糕等等。

孩子:创意角色或者现有的小孩都可以!

4 notes

·

View notes

Text

💰 Grow & Enjoy Your Wealth Smartly! 🌱 SIP: Invest Regularly, Build Wealth. 🔄 SWP: Withdraw Smartly, Enjoy Stability. Secure Your Financial Future Today!

📍 Location: Sec. 31 SRS Tower, Near Mewala Maharajpur Metro, Faridabad. 📞 Contact us now: 8557541511

0 notes

Text

Doodle dump 🪴

@dankgrass

#doddles#my ocs#my art#doddle#ocs#art#digital art#artists on tumblr#swp koi#swp amanda#swp#mwah mwah#not my oc#mango#strawberry

12 notes

·

View notes

Text

Mutual Fund Investing Detailed Information

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, money market instruments, or other assets. Professional fund managers oversee the mutual fund, aiming to achieve the fund’s investment objectives while managing risks.

1. Key Features of Mutual Funds

A. Professional Management: Fund managers analyze and select investments based on the fund’s stated objectives. B. Diversification: Mutual funds invest in a range of assets, reducing the risk of significant losses from a single investment. C. Liquidity: Investors can usually buy or sell mutual fund shares at the fund’s net asset value (NAV), calculated daily. D. Affordability: Mutual funds allow investors to access a diversified portfolio with relatively small initial investments. E. Variety: They come in different types tailored to various investment goals (e.g., growth, income, preservation of capital).

2. Types of Mutual Fund

A. Equity Mutual Fund: An Equity Mutual Fund is a type of mutual fund that primarily invests in stocks (equities) of companies. The objective of equity mutual funds is to generate capital appreciation (growth in the value of investments) over the long term. These funds are best suited for investors looking for potentially higher returns and who are willing to accept a higher level of risk compared to other types of mutual funds, such as debt or money market funds.

B. Debt Mutual Fund: A Debt Mutual Fund is a type of mutual fund that primarily invests in fixed-income securities, such as government bonds, corporate bonds, treasury bills, commercial paper, and other money market instruments. These funds are designed for investors seeking regular income and capital preservation with lower risk compared to equity mutual funds.

C. Hybrid Mutual Fund: A Hybrid Mutual Fund is a type of mutual fund that invests in a mix of equity (stocks) and debt (fixed-income securities) to balance the risk and reward. These funds aim to provide growth potential through equity investments and stability through debt investments. Hybrid funds are ideal for investors seeking a moderate risk-reward profile.

D. Index Mutual Fund: An Index Mutual Fund is a type of mutual fund designed to replicate the performance of a specific market index such as the S&P 500, Nifty 50, or Sensex. Instead of actively managing the portfolio, the fund passively tracks the index by holding the same securities in the same proportions as the underlying index.

E. Sector Mutual Fund: A Sector Mutual Fund is a type of mutual fund that focuses its investments in a specific industry or sector of the economy, such as technology, healthcare, energy, financial services, real estate, or infrastructure. These funds aim to capitalize on the growth potential of a particular sector but come with a higher level of risk due to their lack of diversification.

3. Select Invest Mode

A. Systematic Investment Plan (SIP): A Systematic Investment Plan (SIP) is a disciplined investment strategy where an investor invests a fixed amount of money at regular intervals (e.g., monthly, quarterly) into a mutual fund. It is a convenient way to build wealth over time by taking advantage of rupee cost averaging and the power of compounding.

B. Systematic Withdrawal Plan: A Systematic Withdrawal Plan (SWP) is a facility offered by mutual funds that allows investors to withdraw a fixed amount of money at regular intervals (e.g., monthly, quarterly) from their investment. It is commonly used by retirees or individuals seeking a steady stream of income while keeping their principal invested. C. Systematic Transfer Plan (STP): A Systematic Transfer Plan (STP) is a mutual fund investment strategy that allows an investor to transfer a fixed amount of money at regular intervals from one mutual fund scheme to another within the same fund house. It is typically used to balance risk and returns by moving money from a lower-risk fund (like debt funds) to a higher-risk fund (like equity funds) or vice versa.

4. Benefits of Mutual Fund

Mutual funds offer several benefits that make them a popular investment choice for individuals seeking to grow their wealth, generate income, or achieve financial goals. Here are the key benefits of investing in mutual funds:

A. Professional Management Expertise: Mutual funds are managed by professional fund managers with expertise in selecting and managing investments. Research-Based Decisions: Fund managers use extensive research, data analysis, and market insights to make informed investment decisions. B. Diversification Risk Reduction: Mutual funds invest in a wide range of securities (stocks, bonds, etc.), reducing the impact of poor performance in any single investment. Broad Exposure: Even a small investment provides exposure to multiple asset classes, sectors, and geographies. C. Liquidity Ease of Access: Most mutual funds can be bought or sold easily, offering high liquidity compared to other investment options like real estate or fixed deposits. Redemption Flexibility: Investors can redeem their units at the prevailing Net Asset Value (NAV) at any time, subject to exit load (if applicable). D. Affordability Low Initial Investment: You can start investing in mutual funds with a small amount (e.g., ₹500 or $10), making them accessible to all types of investors. Systematic Investment Plan (SIP): Allows regular investments in small amounts, fostering disciplined savings. E. Variety of Investment Options Asset Classes: Equity, debt, hybrid, index funds, and more. Themes and Sectors: Specialized funds focus on sectors (e.g., technology, healthcare) or themes (e.g., ESG, growth funds). Risk Profiles: Funds cater to various risk appetites, from conservative to aggressive. F. Tax Benefits Equity Linked Savings Scheme (ELSS): Offers tax deductions under Section 80C of the Income Tax Act in India. Tax Efficiency: Mutual funds, especially equity funds, are more tax-efficient than many traditional investments due to lower tax rates on capital gains. G. Transparency Regular Updates: Fund houses provide detailed reports on portfolio holdings, NAVs, and performance. Regulated: Mutual funds are regulated by authorities like SEBI (India), SEC (USA), ensuring investor protection and accountability.

0 notes

Text

SIP vs SWP: Understanding the Power of Systematic Investing and Withdrawal Plans

Investing is one of the best ways to secure your financial future, but often, people hesitate because they feel overwhelmed by the complexity of the process. The good news is, there are simple and effective investment strategies that can help you grow wealth without needing to be a financial expert.

Two of the most popular and reliable options are Systematic Investment Plan (SIP) and Systematic Withdrawal Plan (SWP). Both plans are designed to give you financial stability, but they serve different purposes—one helps you accumulate wealth, while the other helps you withdraw it strategically. In this blog, we’ll explore what SIP and SWP are, how they work, and which one might be right for you.

READ OUR FULL BLOG ON OUR WEBSITE!!

1 note

·

View note

Text

youtube

SWP देगा बिना नौकरी के सैलरी ज़िंदगी भर - Systematic Withdrawal Plan Explained | Magic of SWP

SWP can stand for various things depending on the context. Below are some common meanings:

1. Systematic Withdrawal Plan (Finance)

Definition: A financial investment strategy where an investor withdraws a fixed amount of money from their investment portfolio at regular intervals.

Purpose: Commonly used in mutual funds to generate regular income, particularly for retirees or individuals needing steady cash flow.

How It Works:

An investor invests a lump sum in a mutual fund or other financial instrument.

Withdrawals are made monthly, quarterly, or annually, as per the investor's preference.

Advantages:

Provides a steady income.

Enables partial capital appreciation as the remaining amount continues to grow.

Offers tax benefits in certain countries.

2. Socialist Workers Party (Politics)

Definition: A political organization typically aligned with socialist and Marxist principles.

Notable Features:

Advocates for the rights of workers and marginalized groups.

Often participates in trade union movements and protests against capitalist systems.

Example: The Socialist Workers Party in the UK and other countries plays an active role in labor movements and leftist politics.

3. Single Wire Protocol (Technology)

Definition: A communication protocol that allows data and power transfer through a single wire.

Applications:

Commonly used in electronics for simple, cost-effective communication between devices.

Example: Technologies like 1-Wire and certain IoT devices.

4. Secure Work Protocol (Cybersecurity)

Definition: A set of guidelines or a protocol designed to ensure secure data handling and operations within an organization.

Purpose: Protects sensitive information and minimizes the risk of cyberattacks.

Key Features:

Encrypted communication.

Authentication and authorization mechanisms.

If you meant something specific by SWP, let me know, and I can provide more tailored information!

#swp#sip#mutual funds#share market#stockmarket#nifty prediction#sensex#best demat account#financial freedom#Youtube

0 notes

Text

👵👴 Just like your monthly needs are fixed… 💸 Your monthly cashflow can be too!

Introducing SWP – Systematic Withdrawal Plan in Hybrid Mutual Funds. Perfect for retirees or anyone seeking: ✅ Steady monthly income ✅ Capital appreciation ✅ Financial peace of mind

Make your investments work for you—receive monthly payouts while your money continues to grow.

Start your SWP today and enjoy life without financial worries! 📞 Call Now: +91 72765 18999 🌐 Visit: www.dreamfunds.in

📢 Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully.

#DreamFunds#SWP#MonthlyIncomePlan#RetirementPlanning#FixedCashflow#MutualFunds#FinancialFreedom#SmartRetirement

0 notes