#Single-Use Assemblies Market Demand

Explore tagged Tumblr posts

Text

Great Men Surf the Tides of History

Does the fate of humanity rest in the hands of great men? Or are there only the inevitable tides of history?

thesis: great man antithesis: tides of history synthesis: great man surfing the tides of history

– our own TracingWoodgrains, 𝕏, 2023

From far away in the sky, a pyramid is a gigantic formation, yet from up close on the ground, a pyramid is made of many slabs.

[ @arcticdementor ]

Musk matters. The millions of "MAGA" voters? Don't matter at all, and never will.

The foundation of what is large is what is small. What is an elite? In a political system, an elite is someone who is in a high position of leverage. Leverage is produced using a formation. Formations are not unified wholes; they are composed of smaller parts, and generate force through synchronized actions.

The work of management is to reduce the context of a production problem until it can be divided into jobs that can be done by labor. The work of labor is to reduce the context of a production problem until it can be done by capital.

The nature of the world is that it is thick and high-dimensionality, while the nature of models is that they are thin and low-dimensionality. Everywhere in the world, there is the friction of time, space, and information. A production problem is divided due to limits based on time, space, and information.

When a production problem is handled by one person, it is subject to one agency. It is in tight synchronization. When a production problem is divided among multiple people, it is subject to multiple agencies. It is in loose synchronization.

Due to the loose coupling of a formation composed of multiple people, as well as limits on obtaining and processing information, leverage is not fully consolidated in a single executive. Rather, there exist nodes of intermediate leverage, positions within system with greater power than an outsider, but less power than the person at the top.

Obviously, power isn't best thought of as binary. It also isn't best thought of as a simple scalar, although that's better than thinking it as a simple binary. In terms of simple models, power is best thought of as an edge in a weighted directed graph, an arrow from one person to another with a number attached. I may control the HOA and have the ability to set the color your house is allowed to be. You may own the neighboring fitness gym and control what hours I can access the pool. We each have a power relationship with each other. Which one of us is "more powerful"? That depends on conditions.

"There exist only elites and nothings" is an overcompression of the power graph. There are gradations of power. There are directions of power. Officers. Intellectuals. Journalists. People at different positions within the system, with different levels of talent, which allow them to exercise influence in different ways.

In a market, consumers having demand for a product does not cause that product to automatically come into existence. Instead, it creates an incentive for an entrepreneur to come by, assemble a company or team (a formation), and create that product. If no entrepreneur comes by to create the product, then the product is not created, and if no product is created, then consumers cannot obtain it.

Consumers exercise a low amount of agency in this process, though not zero. Demand is generally diffuse. Many people take a small action (evaluating and buying the product). Production is concentrated. A small number of people take much longer or more intense actions.

War is a form of cooperative competition which destroys factories and tramples fields. It shatters weaker structures by killing the men who compose them.

Capitalism is a form of cooperative competition that builds factories and plants fields. Men work hard and fight together to produce loaves of bread, companies are destroyed, and to a first approximation, no one dies.

Under democracy, men put together formations and compete. What are voters in this system if not the territory over which they fight?

Which matters, Elon Musk, or millions of Trump voters?

Elon Musk provides cash, respectability (to some elites, intermediate officers, or factions), and a communication advantage in the cyberspace layer.

Millions of Trump voters provide millions of Trump votes.

Obviously, both of these matter. Winning the election moves Trump to a position of higher leverage within the system. This provides more power to his political coalition.

What will he do with it? I think he wants to surf the tides of history. On January 20th, he will be back on the beach, and once again dive into the water. He may wipe out and tumble in the waves.

#politics#melodramatic mysticism#high compression#surfing the tides of history#flagpost#in accordance with the dao#quick post

14 notes

·

View notes

Text

Launched a century ago, the Bugatti Type 35 didn’t just make a single impact—it revolutionized the racing world with its innovative design and engineering. The car became legendary not only for its initial capabilities when it debuted in 1924 but also for the continuous improvements Bugatti implemented throughout its production. Ettore Bugatti was one of the first automobile manufacturers to grasp the marketing potential of winning races on Europe’s renowned circuits and road tracks, which brought considerable publicity to his brand. Confident as he was in the capabilities of his new car, even Bugatti could not have predicted that the Type 35 would become the most successful race car in history, achieving 2,500 victories during its active racing career.

The first Type 35, released in 1924, was equipped with a 1,991cc eight-cylinder engine, delivering 90 PS in race trim. By early 1926, Bugatti had increased the engine size to 2,262cc for the Type 35T, named after the famous Targa Florio road race in Italy, which it won, with two smaller-engined Type 35s finishing close behind. Despite this success, Ettore Bugatti realized that to stay ahead of the competition, he needed more than just increased engine displacement. He knew that the future of performance lay in forced induction, even though he was initially not a fan of superchargers, which were seen as inefficient at the time.

“It’s no secret Ettore Bugatti preferred naturally aspirated engines and was not an early enthusiast of supercharging due to its perceived inefficiency,” says Luigi Galli, Specialist for Heritage and Certification at Bugatti. “However, what’s less well known is that Bugatti was forward-thinking about the potential of forced induction, experimenting with superchargers even before the Type 35 debuted at its first race in Lyon in August 1924. In fact, Bugatti applied for French patent number 576.182 on January 22, 1924, for a ‘Compresseur ou pompe à palettes,’ a rotary vane supercharger design that could provide extra power on demand by forcing pressurized air into the carburetor. If Bugatti was going to use a supercharger, he was determined to innovate in his own way.”

As a result, Ettore Bugatti, alongside the Italian engineer Edmond Moglia, developed a unique three-rotor Roots-type supercharger, differing from the common two-rotor designs of the time. This supercharger was strategically mounted on the engine’s offside, which allowed it to warm up more quickly and improve overall engine cooling—a principle that remains relevant in modern engine design. The Type 35TC, where “TC” stands for Targa Compressor, was introduced in late 1926. It evolved into the Type 35B in 1927, featuring a larger radiator and cowling, known as the ‘Miramas’ design, which enhanced cooling capabilities. This configuration enabled the Type 35B to produce up to 130 PS, achieving speeds over 205 km/h (150 mph).

By late 1930, further refinements led to what many consider the ultimate version of the Type 35B. This final iteration featured a twin-cam, two-valve-per-cylinder engine, a twin fuel filler cap, improved suspension, wheels, brakes, and tires, as well as a lower-mounted supercharger relief valve. Bugatti’s relentless pursuit of perfection extended to optimizing every element of the combustion system, from sculpted pistons and cylinder heads to the use of aviation-grade fuel, which boosted the output to 140 PS.

Today, at Bugatti’s atelier in Molsheim, each Bugatti model is hand-assembled with the same meticulous attention to detail that Ettore Bugatti applied to the Type 35. A century later, Bugatti’s engineers and designers continue to push the boundaries of automotive excellence, upholding a legacy of innovation and performance that began with the groundbreaking Type 35.

13 notes

·

View notes

Text

Heavy Duty Resistor Market: Key Players Analysis and Global Demand Forecast 2025–2032

MARKET INSIGHTS

The global Heavy Duty Resistor Market size was valued at US$ 1.23 billion in 2024 and is projected to reach US$ 1.78 billion by 2032, at a CAGR of 4.7% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the fastest growth with a projected 8.2% CAGR through 2032.

Heavy duty resistors are specialized electronic components designed to handle high power loads and extreme environmental conditions. These resistors play critical roles in power distribution, current regulation, and energy dissipation across industrial applications. The market includes both fixed and variable resistor types, with fixed resistors currently dominating at 68% market share. Key materials used include ceramic, metal oxide, and wirewound constructions capable of withstanding high temperatures up to 500°C.

The market growth is driven by expanding industrial automation, renewable energy infrastructure development, and increasing demand for robust electronic components in harsh environments. The automotive electronics segment, particularly in electric vehicles, is emerging as a key growth area with a projected 22% revenue increase by 2027. Major players like Vishay and Ohmite are expanding production capacities to meet this demand, with Vishay announcing a USD 50 million facility expansion in Malaysia during Q1 2024.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Power Electronics Infrastructure to Accelerate Heavy Duty Resistor Demand

The global push towards electrification across industrial and commercial sectors is creating robust demand for heavy duty resistors. These components play critical roles in power distribution systems, voltage regulation, and load balancing applications. The power electronics sector, valued at over $20 billion globally, continues to expand at nearly 8% CAGR, with resistors accounting for approximately 15% of component costs. Recent infrastructure projects in renewable energy integration and smart grid modernization are driving procurement of high-wattage resistors capable of handling extreme electrical loads. For instance, wind turbine installations surged 12% year-over-year in 2023, each requiring between 50-200 heavy duty resistors for power conditioning systems.

Automotive Electrification Trends to Fuel Component Growth

The automotive industry's transition towards electric vehicles represents a significant growth vector for heavy duty resistor manufacturers. EV powertrains require 30-50% more resistors than traditional combustion engines, particularly in battery management systems and charging infrastructure. With global EV sales projected to exceed 40 million units annually by 2030, component suppliers are ramping up production of specialized resistors that can withstand automotive vibration specifications while maintaining ±1% tolerance. Recent developments include ceramic-encased resistors capable of operating at 200°C for fast-charging station applications.

Industrial Automation Boom to Stimulate Component Adoption

Manufacturers are increasingly incorporating heavy duty resistors into robotics and automated production equipment where precision current control is essential. The industrial automation market, growing at 9% annually, requires resistors with high pulse load capabilities for motor drives and servo controls. Modern manufacturing facilities contain thousands of resistor points across their electrical systems. A single automotive assembly line, for example, may utilize over 500 heavy duty resistors for safety interlocks and power regulation. This widespread integration across Industry 4.0 applications ensures sustained market expansion through the decade.

MARKET RESTRAINTS

Raw Material Price Volatility to Constrain Profit Margins

The heavy duty resistor market faces pressure from fluctuating costs of specialty metals including nickel-chromium alloys and tungsten. These materials, accounting for 60-70% of production costs, have seen price swings exceeding 30% annually due to geopolitical factors and supply chain disruptions. Manufacturers must either absorb these cost increases or risk losing contracts to competitors offering lower-priced alternatives. The situation is particularly challenging for mid-sized producers without long-term supply agreements, forcing some to maintain 90-120 days of inventory as a buffer against market unpredictability.

Miniaturization Trends to Challenge Traditional Designs

While industrial applications still dominate demand, the broader electronics industry's shift towards compact form factors creates engineering challenges for resistor manufacturers. Space constraints in modern equipment require resistors that deliver equivalent performance in packages 40-50% smaller than traditional designs. This necessitates costly R&D investments in advanced materials and manufacturing techniques. Some suppliers report redesign costs exceeding $2 million for wafer-level packaging implementations, with lead times stretching beyond 18 months for qualification in mission-critical applications.

MARKET CHALLENGES

Thermal Management Requirements to Test Engineering Capabilities

As power densities increase across applications, heat dissipation becomes a critical challenge for heavy duty resistors. Modern systems demand components that can maintain stable resistance values while dissipating up to 500W/cm² without derating. This requires advanced thermal interfaces and composite materials that add 15-20% to production costs. The most stringent aerospace and defense applications now specify resistors capable of 10,000+ thermal cycles without performance degradation, pushing manufacturers to develop novel ceramic-metal hybrid substrates.

Global Supply Chain Disruptions to Impact Delivery Timelines

The industry continues grappling with extended lead times for specialty components following pandemic-era supply chain shocks. While average shipping delays have improved from 120 days to 60-75 days, certain resistor types requiring military-grade certifications still face allocation. This situation has prompted some OEMs to dual-source critical components, though qualification processes for alternative suppliers typically require six to nine months of rigorous testing. The resulting inventory buildup across the supply chain has increased working capital requirements by approximately 25% compared to pre-pandemic levels.

MARKET OPPORTUNITIES

Renewable Energy Storage Expansion to Open New Applications

The rapid growth of grid-scale battery storage systems presents significant opportunities for heavy duty resistor manufacturers. These installations require massive resistor banks for pre-charge circuits and charge balancing, with system voltages now reaching 1500V DC. A single 100MWh storage facility may incorporate over 10,000 resistors with special requirements for humidity resistance and partial discharge performance. With global energy storage capacity projected to grow tenfold by 2030, suppliers that can meet these demanding specifications stand to capture substantial market share.

5G Infrastructure Rollout to Drive High-Frequency Component Demand

Telecom infrastructure upgrades present another promising avenue for market expansion. 5G base stations require specialized resistors that maintain stable performance at microwave frequencies while withstanding outdoor environmental stresses. These applications demand components with ultra-low inductance values below 1nH and power handling capabilities up to 100W in compact surface-mount packages. With over 5 million 5G base stations expected to be deployed worldwide by 2025, component suppliers are developing new product lines specifically tailored to telecom OEM specifications.

Military Modernization Programs to Sustain Premium Segment Growth

Defense spending increases across major economies continue to drive demand for military-grade resistors with extended temperature ranges and radiation hardening. Modern electronic warfare systems incorporate hundreds of precision resistors with strict MIL-PRF-55342 qualifications. The defense sector typically commands 20-30% price premiums over commercial equivalents, with lead times often exceeding 52 weeks for certified components. Ongoing modernization of naval systems, radar arrays, and avionics ensures stable demand through the decade, particularly for suppliers holding ITAR compliance and other specialized certifications.

HEAVY DUTY RESISTOR MARKET TRENDS

Expanding Industrial Automation to Drive Market Growth

The heavy duty resistor market is experiencing significant growth due to the rapid expansion of industrial automation across various sectors, including manufacturing, energy, and transportation. With industries increasingly adopting automated systems for improved efficiency, the demand for robust electronic components like heavy-duty resistors has surged. Fixed resistors, which accounted for approximately 65% of the market share in 2024, are widely used in power distribution and motor control applications. Variable resistors also contribute significantly, particularly in precision instrumentation where dynamic resistance adjustments are required. Global industrial automation spending is projected to increase at a CAGR of 8-10% annually, further reinforcing the need for reliable resistors capable of handling high power loads and extreme conditions.

Other Trends

Electric Vehicle (EV) Integration

The transition toward electric vehicles (EVs) is creating substantial opportunities for heavy-duty resistor manufacturers. These components play a crucial role in battery management systems (BMS), power distribution, and load balancing for EV powertrains. Leading automotive manufacturers are investing heavily in high-performance resistors that can withstand voltage fluctuations and thermal stresses inherent in electric drivetrains. The EV market is expected to grow at an impressive CAGR of over 20% in the next decade, which in turn is likely to boost the adoption of heavy-duty resistors by approximately 15-18% annually.

Renewable Energy Sector Expansion

The renewable energy sector is driving demand for heavy-duty resistors, particularly in solar and wind power systems. These resistors are essential for load banks, dynamic braking, and voltage regulation in large-scale energy projects. Solar installations alone are projected to increase by nearly 200 GW globally by 2026, necessitating dependable resistors for power control applications. With governments worldwide accelerating investments in clean energy infrastructure, the market for resistors designed for harsh environmental conditions—such as those used in offshore wind farms—is poised for sustained growth.

Heavy Duty Resistor Market: Competitive Landscape

Key Industry Players

Strategic Expansion and Innovation Drive Market Competition

The global heavy-duty resistor market features a semi-consolidated competitive landscape, with major players accounting for a significant share of revenue while smaller regional competitors maintain niche positions. According to industry analysis, the top five companies collectively held approximately 45-50% market share in 2024, demonstrating moderate concentration in this specialized sector.

Vishay Intertechnology, Inc. emerges as a dominant force, leveraging its diversified product portfolio and extensive distribution network across North America and Europe. The company's heavy-duty resistor solutions find widespread applications in industrial automation and power distribution systems.

Ohmite Manufacturing Co. maintains strong market positioning through its technological expertise in high-power resistor applications. The company's recent innovations in thermal management solutions have significantly enhanced its competitive advantage in demanding environments.

Meanwhile, Linear Integrated Systems, Inc. and Dexmet Corporation are expanding their market presence through strategic partnerships and customized product offerings. These companies are particularly focusing on the growing renewable energy sector, where heavy-duty resistors play critical roles in power conversion systems.

Smaller players like Cougar Electronics Corp. are carving out specialized market segments through rapid prototyping capabilities and flexible manufacturing processes. This allows them to cater to unique customer requirements that larger manufacturers may not prioritize.

List of Key Heavy Duty Resistor Manufacturers

Vishay Intertechnology, Inc. (U.S.)

Ohmite Manufacturing Co. (U.S.)

Linear Integrated Systems, Inc. (U.S.)

Dexmet Corporation (U.S.)

Cougar Electronics Corp. (U.S.)

Empro Manufacturing Co., Inc. (U.S.)

Liberty Bell Components, Inc. (U.S.)

Mosebach Manufacturing Company (U.S.)

Riedon Inc. (U.S.)

The competitive dynamics continue to evolve as manufacturers invest in material science advancements and manufacturing automation to improve product performance while reducing costs. Recent industry trends show increasing focus on developing resistors capable of withstanding extreme environmental conditions, particularly for defense and aerospace applications.

Market participants are also expanding their geographic footprints, with several U.S.-based companies establishing production facilities in Asia to better serve the region's growing industrial and electronic manufacturing sectors. This strategic shift has intensified competition in emerging markets while allowing companies to optimize their supply chain efficiencies.

Segment Analysis:

By Type

Fixed Resistor Segment Leads Due to High Adoption in Industrial and Automotive Applications

The market is segmented based on type into:

Fixed Resistor

Subtypes: Wirewound, Thick Film, Thin Film, and others

Variable Resistor

Subtypes: Potentiometers, Rheostats, and others

By Application

Automotive Electronics Segment Dominates Owing to Rising Demand for Electric Vehicles and Vehicle Electrification

The market is segmented based on application into:

Instrumentation

Medical Equipment

Automotive Electronics

Communication Equipment

Others

By Power Rating

High Power Segment Leads Due to Increasing Industrial Automation Needs

The market is segmented based on power rating into:

Low Power (Below 1W)

Medium Power (1W-100W)

High Power (Above 100W)

By End User

Industrial Sector Captures Significant Share Owing to Heavy Machinery Applications

The market is segmented based on end user into:

Industrial

Automotive

Energy and Power

Telecommunications

Others

Regional Analysis: Heavy Duty Resistor Market

North America The North American heavy duty resistor market is driven by robust industrial automation and expanding renewable energy projects. Stringent safety regulations and high-performance requirements in sectors like power electronics, defense, and aerospace propel demand for precision resistors. The U.S. holds the dominant share, accounting for over 65% of the regional market, supported by its well-established semiconductor and electronics manufacturing base. However, supply chain disruptions and skilled labor shortages remain key challenges. While fixed resistors dominate due to their durability, variable resistors are gaining traction in industrial automation applications.

Europe Europe represents a mature market with steady demand from automotive, industrial, and energy sectors. Germany leads with its strong automotive electronics sector, contributing significantly to high-power resistor adoption. Stringent EU directives on energy efficiency and waste reduction (e.g., RoHS compliance) push manufacturers toward lead-free and recyclable resistor designs. The region also sees increased investments in smart grid infrastructure, fostering demand for rugged resistors capable of handling high voltages. However, high production costs and competition from Asian suppliers create margin pressures for local manufacturers.

Asia-Pacific Asia-Pacific dominates the global market growth, projected to grow at a CAGR exceeding 7% through 2032. China's massive electronics manufacturing base and India's expanding automotive sector drive volume demand—China alone accounts for over 40% of regional resistor production. While cost-sensitive applications still favor conventional resistors, Japan and South Korea lead in adopting high-precision resistors for robotics and 5G infrastructure. The region benefits from vertically integrated supply chains but faces quality standardization challenges. Local players like Vishay and Ohmite are expanding production capacity to meet rising domestic needs while competing on price.

South America Market growth in South America remains moderate, constrained by economic volatility and import dependency. Brazil represents the largest market, where power transmission projects and mining equipment modernization generate steady demand. Argentina shows potential with increasing local electronics assembly, though currency fluctuations impact component pricing. The region lags in adopting premium resistor technologies—replacements rather than upgrades drive most sales. Trade barriers and uneven regulatory enforcement further complicate market entry for foreign manufacturers despite the region’s long-term infrastructure development plans.

Middle East & Africa This emerging market shows gradual growth, led by infrastructure investments in Gulf Cooperation Council (GCC) countries. The UAE and Saudi Arabia drive demand through oil & gas automation and renewable energy projects requiring durable resistors. Africa's market remains price-driven with limited local manufacturing—most resistors are imported from Asia. Political instability and fragmented distribution networks hinder consistent supply. However, the expansion of telecom networks and planned smart city projects offer future growth avenues for weather-resistant resistor solutions tailored to harsh operating environments.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Heavy Duty Resistor markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Heavy Duty Resistor market was valued at USD 465 million in 2024 and is projected to reach USD 608 million by 2032, growing at a CAGR of 4.2%.

Segmentation Analysis: Detailed breakdown by product type (Fixed Resistor, Variable Resistor), application (Instrumentation, Medical Equipment, Automotive Electronics, Communication Equipment), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The U.S. market is estimated at USD 125 million in 2024 while China is projected to reach USD 185 million by 2032.

Competitive Landscape: Profiles of leading market participants including Linear Integrated Systems, Vishay, Ohmite Manufacturing Co., and others who collectively hold 35% market share.

Technology Trends & Innovation: Assessment of emerging resistor technologies, integration in advanced electronics, and evolving industry standards for heavy-duty applications.

Market Drivers & Restraints: Evaluation of factors driving market growth including industrial automation demand along with challenges like raw material price volatility.

Stakeholder Analysis: Strategic insights for component suppliers, OEMs, system integrators, and investors regarding market opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, analysis of financial reports, and market intelligence from verified sources to ensure accuracy.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Heavy Duty Resistor Market?

-> Heavy Duty Resistor Market size was valued at US$ 1.23 billion in 2024 and is projected to reach US$ 1.78 billion by 2032, at a CAGR of 4.7% during the forecast period 2025-2032.

Which key companies operate in Global Heavy Duty Resistor Market?

-> Key players include Linear Integrated Systems, Vishay, Ohmite Manufacturing Co., Dexmet Corp., Cougar Electronics Corp., and others.

What are the key growth drivers?

-> Key growth drivers include industrial automation expansion, electric vehicle production growth, and 5G infrastructure development.

Which region dominates the market?

-> Asia-Pacific is the fastest-growing region, while North America remains a technology leader.

What are the emerging trends?

-> Emerging trends include high-temperature resistant resistors, miniaturization technologies, and IoT integration.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/binary-gas-analyzer-market-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/inverted-light-microscopy-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/insulating-functional-devices-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/multi-core-computer-processors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/power-factor-correction-choke-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tunable-ultrafast-source-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solid-state-remote-power-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/panel-interface-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-process-components-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-high-mount-stop-light-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/indium-antimonide-detector-alarm-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/din-rail-mounted-thermocouple-terminal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/hbm2-dram-market-competitive-landscape.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/aptamer-based-quartz-crystal.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/helium-neon-laser-tubes-market-analysis.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/semiconductor-structural-components.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/optical-power-and-energy-market-size.html

0 notes

Text

Portable Advertising Light Boxes: Flexibility in Marketing Campaigns

The Power of Portable Advertising Light Boxes in Modern Marketing Elevating Brand Visibility with Illuminated Displays Illuminated displays are a game-changer when it comes to enhancing brand visibility. In environments such as trade shows and retail spaces, these eye-catching displays can significantly boost brand recognition. Studies indicate that illuminated signage can increase visibility by as much as 80%, underscoring their importance in effective marketing strategies. By integrating LED technology, brands not only enjoy energy savings but also create a contemporary, sleek aesthetic that appeals broadly to consumers. This seamless blend of technology and design makes illuminated displays an invaluable tool for capturing attention and ensuring that brands stand out in crowded spaces.

Flexibility in Marketing Campaign Execution Portable advertising light boxes offer unparalleled flexibility, empowering businesses to adapt their marketing campaigns effortlessly. These versatile tools are perfect for various locations, enabling companies to strategically shift their marketing focus in response to dynamic market demands. Furthermore, light boxes can easily accommodate different messaging, making them ideal for seasonal promotions or product launches. The user-friendly assembly and transportation features ensure that marketing campaigns remain agile, allowing brands to swiftly respond to market changes and maintain a competitive edge. This adaptability is a cornerstone of modern marketing, providing the ability to meet evolving consumer needs efficiently.

Trade Show Marketing Advantages Trade shows represent a unique opportunity for brands to leverage portable light boxes, maximizing booth visibility and setting themselves apart from competitors. Research highlights that effective trade show marketing, bolstered by engaging displays, can generate more leads than traditional advertising, with a notable 20% increase attributed to such eye-catching exhibits. The strategic placement of light boxes not only enhances the visual appeal but also boosts brand recall. This contributes to improved post-event engagement as potential customers remember and interact with brands long after the trade show has ended. The use of portable advertising light boxes is, therefore, a key tactic in successful trade show marketing.

Key Features of Effective Advertising Light Boxes Portability and Quick Assembly Advertising light boxes are designed with portability in mind, featuring lightweight materials that enable effortless transport and setup within minutes. This is especially beneficial for brands that need to move their displays between different locations frequently. The quick assembly process ensures that these portable displays are not restricted to a single event or campaign, offering flexibility and repeated usage without hassle. This feature enables brands to adapt swiftly to changing marketing needs, ensuring efficient use in diverse promotional activities.

Durability for Multiple Campaigns The construction of effective advertising light boxes involves high-quality materials that ensure durability for repeated use across multiple campaigns. This robustness translates into significant cost savings, as brands can avoid the frequent need for display replacements. By investing in long-lasting displays, companies can allocate resources more strategically, focusing on enhancing other aspects of their marketing strategies. The durability of these light boxes not only extends their lifespan but also contributes to sustainable practices by reducing waste associated with disposable advertising materials.

Customization Options for Targeted Messaging Advertising light boxes offer extensive customization options, allowing brands to tailor their message and aesthetic to engage target audiences effectively. With advances in printing technologies, companies can now produce high-resolution graphics that deliver their intended message with clarity and visual appeal. This ability to personalize displays enhances the quality of interactions with audiences, ensuring that the brand message resonates more deeply. Customized light boxes allow companies to keep their communications fresh and aligned with specific marketing objectives.

Energy-Efficient LED Lighting Solutions LED lighting is an integral component of advertising light boxes, offering an eco-friendly solution that significantly reduces energy consumption compared to traditional lighting options. Brands that prioritize sustainable practices can highlight their commitments while benefiting from the reduced operational costs associated with LED technology. This shift towards energy-efficient lighting supports sustainable marketing initiatives, showcasing a brand's dedication to environmental responsibility while also appealing to eco-conscious consumers.

Maximizing Campaign Impact with Portable Light Boxes Trade Show Booth Ideas for Standing Out Utilizing light boxes as focal points is a powerful strategy for making a trade show booth memorable to visitors. By strategically placing these illuminated displays, businesses can distinguish their booths from competitors, ensuring that they capture attendees' attention. Moreover, integrating technology and interactive elements within light box displays can further enhance engagement, leading to higher conversion rates. For instance, interactive screens or QR codes embedded in light boxes could prompt visitor interactions, deepening their brand experience. Such creative applications are pivotal in crafting a memorable trade show experience.

Multi-Location Campaign Execution Portable light boxes are an invaluable asset for executing multi-location campaigns, as they enable brands to maintain consistent messaging across various events and locations. This consistency is key in reinforcing brand identity, ensuring that no matter where the audience is, they receive a unified perception of the brand. By using these transportable displays, companies can effectively tap into different audience segments, adapting their marketing strategies according to geographical and demographic insights without compromising the core brand message.

Budget-Friendly Marketing Solutions Investing in portable advertising light boxes is a savvy marketing move for those seeking budget-friendly solutions. Unlike traditional marketing methods, these light boxes are versatile, allowing for significant cost reductions over time. Advertisers can deploy the same light boxes across various campaigns, eliminating the need for constant investment in new materials. Furthermore, their durability offers long-term value, making them a cost-effective choice for businesses aiming to maximize their marketing ROI without overspending on temporary solutions.

0 notes

Text

Revolutionizing the Global Pharmaceutical Manufacturing Industry with Turn-Key Pharmaceutical Machinery Solutions

In the pharmaceutical era of today, efficiency, precision, and conformance are not ideals—but necessities. Pharmaceutical companies look for faster ways to streamline their business, provide quality, and cater to the mounting demands. Pharmateq aids pharmaceutical companies with innovative Turn-Key Pharmaceutical Machinery Solutions and ultra-high-performance Pharmaceutical Powder Granulators that are promised to revolutionize each production stage.

What Are Turn-Key Pharmaceutical Machinery Solutions

Turn-Key Pharmaceutical Machinery Solutions are turn-key, end-to-end equipment packages that are shipped complete and ready for instant deployment. Turn-key solutions encapsulate all steps in pharmaceutical production, from granulation and blending to drying, milling, coating, and packaging.

Our Turn-Key Pharmaceutical Machinery Solutions at Pharmateq are constructed and designed to international GMP standards, particularly. We specialize in systems for instant deployment, low downtime, and ease.

Key Advantages of Turn-Key Pharmaceutical Machinery Solutions

Seamless Integration: Networked equipment without junction integration.

Rapid Installation: Plug-and-play equipment makes installation and integration history.

Compliance Ready: Factory pre-programmed for FDA, WHO, and cGMP compliance.

Custom Designs: Where feasible, custom-designed specifically to your facility's specific space, process, and capacity needs.

Single-Point Responsibility: Single, reliable partner for design, installation, training, and after-sales support.

With Pharmateq Turn-Key Pharmaceutical Machinery Solutions, you're not buying the machines—you're investing in a total solution to achieve your production objectives.

Uses of Pharmaceutical Powder Granulators in Contemporary Manufacturing

Pharmaceutical Powder Granulators are involved in the process of solid dosage manufacture. They granulate pharmaceutical powder to improve flowability, minimize dusting, and provide tablet compression uniformity and capsule filling uniformity.

Pharmateq's Pharmaceutical Powder Granulators are grained precisely without compromising the potency of active pharmaceutical ingredients. Dry granulation or wet granulation, your requirement is, we have models with which you can work on various scales of production as well as various types of formulas.

Advantages of Pharmateq's Pharmaceutical Powder Granulators:

High Shear Capability: Immediate and consistent formation of granules.

Ease of Simple Cleaning: GMP-grade construction with tool-less assembly ensures rapid changeovers.

Scalable Technology: R&R at development scale to commercial scale production, our technology scales with you.

Advanced Controls: PLC and HMI integration for precise process control.

Rugged Build: Constructed from corrosion-resistant stainless steel to endure.

Sequencing the ideal Pharmaceutical Powder Granulators is the key to achieving consistency in each batch. With Pharmateq, you enjoy state-of-the-art equipment shared among industry leaders in global pharma.

Why Pharmateq is a Leader in Turn-Key Pharmaceutical Machinery Solutions

Pharmateq is the industry's leading market vendor of Turn-Key Pharmaceutical Machinery Solutions because we never cut corners on innovation, customization, or quality. We don't sell equipment—your line is customized by us.

Why our Turn-Key Pharmaceutical Machinery Solutions excel:

End-to-End Project Management: From consultation and design layout to delivery and validation.

On-Site Installation & Training: Our engineers guide your staff through every process.

Ongoing Support: Total maintenance packages and remote trouble shooting.

Energy-Saving Systems: Optimized and eco-friendly design with green sustainability in mind.

Customizable Features: Design your own formulation and output profile.

Partner with Pharmateq, your Turn-Key Pharmaceutical Equipment Solution source, and you're selecting reliability, compliance, and unmatched industry experience.

Applications of Pharmaceutical Powder Granulators

Pharmaceutical Powder Granulators are central components in a vast array of applications, including

Tablet Production: Granules enable enhanced compaction and mechanical strength.

Capsule Filling: Volumetric uniformity is improved with granulated powders.

Nutraceuticals: Herbal and dietary supplement granule uniformity.

Veterinary Products: Veterinary health product stable granulation.

OTC Medicines: High-performance, fast production of over-the-counter medications.

We at Pharmateq ensure our Pharmaceutical Powder Granulators act in all industries, backed by performance support, safety, and GMP certification.

Turn-Key Solutions merging with Granulation Technology

Having Pharmaceutical Powder Granulators as part of a Total Turn-Key Pharmaceutical Machinery Solution unlocks new levels of manufacturing potential. Our Pharmateq design engineers are proficient in designing total integrated systems with granulation and upstream and downstream processes such as mixing, drying, and pressing tablets.

Our clients benefit from having a Turn-Key Pharmaceutical Machinery Solution with in-line Pharmaceutical Powder Granulators to utilize:

Less Manual Handling: Maintains hygiene and eliminates human error.

Greater Throughput: Synchronization minimizes batch cycle time.

Standardized Batching: Automation provides consistent, repeatable results.

Space Conservation: Compact, space-efficient designs conserve precious floor space.

Our machines are future-proofed, expandable, and scalable to meet your increased operations.

Pharmateq Global Success Stories

Turn-Key Pharmaceutical Equipment Solutions with in-built Pharmaceutical Powder Granulators have been successfully installed by us for Asian, European, and Middle Eastern customers. Our projects are:

One Malaysian tablet manufacturing plant, where we commissioned an entire wet granulation line.

One Saudi Arabian contract manufacturing plant with modular Pharmaceutical Powder Granulators with high capacity.

One Indian R&D laboratory, with small-sized granulators for rapid prototyping and formulation development.

All these are the testimonials that reflect how solutions from Pharmateq can guarantee consistent quality anywhere in the world.

FAQs: Turn-Key Pharmaceutical Machinery Solutions & Powder Granulators

Q: How quickly can a Turn-Key Pharmaceutical Machinery Solution be shipped?

A: 10–16 weeks, scale and custom dependent, for shipping and installation.

Q: Do you supply what type of granulators?

A: High shear granulators, oscillating granulators, and fluid bed granulators—all pharmaceutical powder processing.

Q: Are your Pharmaceutical Powder Granulators GMP compliant?

A: Yes. All Pharmateq equipment complies with international GMP and FDA standards.

Q: Can I incorporate existing equipment in a Turn-Key Solution?

A: Certainly, our engineers shall visit your current infrastructure and create a system that integrates quite well with new and current equipment.

Let Pharmateq Power Your Production

In a business where accuracy and compliance with regulations are the sine qua non, the appropriate technology partner can be the difference between success and failure. Pharmateq Turn-Key Pharmaceutical Machinery Solutions and Pharmaceutical Powder Granulators are made to propel your business through higher production, exposure to new markets, or retrofitting your plant.

Idea to start-up, we're with you every step of the way, delivering innovative solutions, technical knowledge, and full support.

Call us today to talk about your production requirements and how our Turn-Key Pharmaceutical Machinery Solutions and Pharmaceutical Powder Granulators can revolutionize your business.

0 notes

Text

Thermoform Packaging Market Drivers Fuel Growth in Food, Pharma, and Electronics Sectors

Rising demand for lightweight, durable, and cost-effective packaging solutions across industries is accelerating the expansion of the Thermoform Packaging Market. Its adoption spans key sectors like food, pharmaceuticals, and electronics, where customized designs, product safety, and visibility are essential. With an emphasis on shelf-life preservation, tamper resistance, and ergonomic functionality, thermoform packaging is reshaping how manufacturers deliver consumer and industrial goods.

Key Drivers in the Food Industry

The food industry stands as a major contributor to the growth of thermoform packaging. The increasing popularity of ready-to-eat meals, single-serve options, and hygienic packaging is pushing brands to adopt thermoformed trays, clamshells, and blister packs. These solutions offer product visibility, portion control, and contamination resistance, which are vital in today’s health-conscious market. In addition, extended shelf-life and high-barrier materials allow brands to reduce waste and optimize cold chain logistics.

Thermoform packaging also supports branding efforts. Transparent lids and printable surfaces enable brands to display food quality while reinforcing their visual identity. This dual advantage of functionality and marketability ensures strong traction in fast-moving consumer goods (FMCG) categories.

Pharmaceutical Sector: Driving Safety and Compliance

In the pharmaceutical sector, the need for compliance, sterility, and dosage accuracy is central to packaging requirements. Thermoformed blister packs, trays, and lidding materials cater to these needs by providing tamper-evidence, child-resistance, and protection against moisture or light degradation. This has made thermoform packaging the go-to solution for tablets, syringes, and diagnostic kits.

Moreover, stringent regulatory standards from agencies like the FDA and EMA demand traceability, labeling clarity, and integrity of sealed units—all of which are fulfilled by precision-engineered thermoforming techniques. Innovations in sterile barrier systems and heat-sealing also enhance safety profiles for critical medical products.

Electronics Industry: Demand for Custom and Static-Free Packaging

The electronics sector demands secure, anti-static, and shock-absorbing packaging formats. Thermoform packaging meets these criteria with customizable cavities designed to accommodate delicate items like circuit boards, sensors, and microchips. Thermoformed trays are often used for component transportation, providing consistent alignment, stackability, and damage prevention during handling and shipping.

As product miniaturization continues, the role of tailored thermoform designs becomes more prominent. Electronics manufacturers appreciate the precision, lightweight, and form-fitting nature of this packaging, particularly for assembly-line automation and kitting processes.

Cross-Industry Adoption Drivers

Across all sectors, some common factors are fueling thermoform packaging’s rise:

Material Efficiency: Use of PET, PP, PVC, and bio-based polymers allows for cost-effective manufacturing with minimal waste.

Automation Compatibility: Thermoforming is highly compatible with high-speed packing lines, reducing labor costs and improving productivity.

Customization: Brands can tailor the shape, size, and aesthetics of the packaging to match product profiles and branding strategies.

Consumer Experience: Easy-open features, resealability, and tamper-evidence cater to modern consumer preferences.

These multi-industry advantages underscore why thermoform packaging is emerging as a universal solution for protection, branding, and functionality.

Sustainability Considerations as Indirect Drivers

Sustainability is indirectly influencing the adoption of thermoform packaging. While concerns remain over plastics, many thermoform manufacturers are shifting to recyclable PET, biodegradable PLA, and other environmentally friendly materials. Lightweighting strategies and circular economy models—where packaging can be collected and reused—are helping align the market with ESG goals and green mandates.

Retailers and OEMs are also seeking certification-compliant packaging that supports zero-waste goals. This environmental alignment further bolsters the case for thermoformed solutions, especially as legislative pressure grows globally.

Challenges to Consider

Despite the market’s upward trajectory, several obstacles could temper growth. High tooling costs, complexity in recycling multi-layered films, and dependency on petrochemical feedstocks are areas requiring attention. Nonetheless, continued innovation and favorable regulatory shifts are expected to mitigate these challenges.

Conclusion: A Sector in Motion

As we’ve seen, the Thermoform Packaging Market is propelled by industry-specific needs across food, pharma, and electronics sectors. Whether it’s extending shelf life, ensuring safety, or showcasing product quality, thermoform packaging delivers tangible value. These core drivers lay the groundwork for sustained expansion as industries modernize their packaging ecosystems.

#ThermoformPackaging#FoodPackaging#PharmaPackaging#ElectronicsPackaging#BlisterPacks#SmartPackaging#PETPackaging#SustainablePackaging#ConsumerTrends#GlobalMarket#PackagingInnovation#CircularEconomy

0 notes

Text

Horizontal Broaching Machine - Steelman's Broaching

The Strength of Steelman's Broaching Machines

In the realm of metalworking and manufacturing, the importance of precision is paramount. One of the standout technologies driving this industry forward is the horizontal broaching machine, particularly those manufactured by Steelman’s Broaching Systems. Known for their robust construction and exceptional performance, these machines are invaluable in producing a variety of intricate parts with efficiency and accuracy.

Unmatched Durability and Design

Steelman’s horizontal broaching machines are built to withstand heavy-duty applications, making them ideal for businesses that require reliable machinery to handle demanding tasks. The engineering excellence behind these machines ensures that they can operate flawlessly even in high-volume production environments, providing manufacturers with the confidence they need for their operations.

Versatile Applications

One of the most remarkable features of Steelman’s horizontal broaching machines is their versatility. They are capable of machining a wide array of internal geometric shapes, making them suitable for various industries. Some of the specific applications include:

Interior Involute Splines: Perfect for engagements in power transmission.

Interior SAE Splines: These are crucial for automotive components, ensuring compatibility and performance.

Rifling: Essential for enhancing the performance of firearm barrels.

Beneficiaries: Used frequently in hydraulic and mechanical sectors for precise component fit.

Key Bolt Spaces: Fundamental for securing components in a wide range of machinery.

Interior “D” Frames: Common in multiple applications including tools and fixtures.

Keyways: Critical for the efficient transfer of torque between components.

Interior Serrations: Often utilized for better grip and fit in assembly applications.

In addition to these, Steelman's broaching machines can produce numerous other internal structures, highlighting their adaptability to customer needs and specifications.

The Broaching Advantage

Broaching offers several advantages over other machining processes. With the ability to reach high levels of precision and complexity in a single pass, manufacturers can achieve lower production times and reduced operational costs. The horizontal design of Steelman’s machines further enhances stability and accuracy, making them an ideal choice for intricate broaching tasks.

In conclusion, if you are in the market for a horizontal broaching machine, Steelman's Broaching Systems offers some of the most durable and versatile options available. Their machines not only improve factory productivity but also ensure that the parts produced meet the highest standards of quality and precision. With applications ranging from automotive components to intricate industrial parts, investing in Steelman’s horizontal broaching machines is a step towards ensuring excellence in manufacturing processes.

#Broaching Machines #Horizontal Broaching #Steelman #Manufacturing Equipment #Metalworking #Precision Machining #Industry Innovations #Engineering Solutions #Tooling Technology #Production Efficiency

Steelmans Broaching Systems Horizontal Broaching machines are worked of overwhelming obligation development and are perfect for a wide assortment of part applications including:

Interior involute splines

Interior SAE splines

Rifling

Beneficiaries

Key bolt spaces

Interior “D” frames

Keyways

Interior Serrations

Numerous other interior structures

1 note

·

View note

Text

Universal Structure Design for Multi-Specification Compatible Fuse Holders: Engineering Compatibility for 5×20mm & 6.3×32mm Fuses

Introduction

With the rapid development of diverse electronic and power distribution systems, customers now demand fuse holders that support modularity, cross-compatibility, and high adaptability. In OEM, aftermarket, and international markets, having separate fuse holders for each fuse size is costly and inefficient.

Multi-specification compatible fuse holders address this issue by allowing a single design to support both 5×20mm and 6.3×32mm fuses. These holders must maintain stable contact, mechanical retention, and standard dimensions. This article explores the core structural innovations: dual-compatible clip designs, automatic pressure-adjustable contacts, standardized housing for universal mounting, and anti-misplug limiters.

1. Dual-Size Compatible Clip Design for 5×20mm & 6.3×32mm Fuses

1.1 Compatibility Challenges

5×20mm fuses are common in small electronics, while 6.3×32mm fuses are used in high-power or industrial systems. The dimensional difference (length and diameter) means traditional fuse holders require separate part numbers.

1.2 Structural Design Principles

Modern fuse holders adopt multi-stage contact and retention structures or sliding internal slots that automatically adjust for fuse size.

Key Features:

Two-step limit structure: Lower step for 5×20mm, upper step for 6.3×32mm

Flexible contact clips that retract or expand as needed

Multi-point contact zones for stable current conduction

Case Study:

A power adapter manufacturer consolidated two SKUs into one universal holder, cutting BOM costs by 18% and improving assembly throughput by 32%.

2. Auto-Adjusting Contact Pressure Design

2.1 Insertion Force Imbalance Risks

Varying fuse diameters can lead to:

Low pressure → high contact resistance and heat

Excess pressure → glass tube damage, hard insertion

2.2 Automatic Spring-Based Adjustment

Advanced holders use flex-jointed or spring-assisted contacts:

Flexible hinge base absorbs dimensional variance

Tail-end springs maintain pressure across all sizes

Materials like heat-treated phosphor bronze for fatigue resistance

Performance Benefits:

Maintains <10 mΩ contact resistance

Survives 500+ insert/remove cycles

Reduces user error and assembly damage

Practical Testing:

This structure kept resistance variation under 10% between 40°C and 85°C for both fuse sizes — superior to rigid clip designs.

3. Standardized Housing Dimensions for Universal Mounting

3.1 Multi-Device Integration Needs

Devices use different mounting methods: panel-mount, PCB-soldered, DIN-rail, screw-fixed. To simplify manufacturing, one housing must fit many.

3.2 Modular Size Implementation

Designers apply:

Unified mounting holes (e.g., Φ10.3mm, 19×12mm)

Interchangeable mounting brackets

Sliding grooves for clip-in flexibility

Modular Example:

scss复制编辑[Module A: PCB Plug-in] ─┬─ Terminal block wiring

├─ Panel snap fit

└─ DIN rail clip mount

Customer ROI:

An industrial controls company standardized its PLC line with one universal fuse holder design, reducing part types by 50% and improving field repair efficiency.

4. Anti-Misplug Design: Fuse Length Limiting Structures

4.1 Insertion Errors in the Field

Common errors:

Short fuse in long-slot holder → loose contact

Oversized fuse → latch failure or contact arcing

Wrong fuse rating → safety risk

4.2 Built-In Length Limiters

Universal fuse holders include:

Dual-position stop grooves for exact length matching

Spring-tensioned limit walls that adapt to size

Optional colored guides to distinguish slot types

Engineering Result:

A medical device OEM reduced service errors by 60% using these limiters and color-coded guides, improving product safety and end-user confidence.

5. Engineering Recommendations and Future Trends

5.1 Intelligent Fuse Detection

Future models may embed micro-sensors (resistance-based or magnetic) to detect fuse size/type and communicate with the system MCU via I²C or CAN.

5.2 Platform-Based Modular Architecture

Develop a core-standardized fuse holder platform, with swappable:

Fuse blow indicators

Remote monitoring modules

EMI filters for sensitive circuits

5.3 Certification-Conscious Global Design

Ensure cross-certification readiness: UL, IEC, TUV. Structure should meet global electrical safety and mechanical compatibility norms.

Conclusion

Multi-specification compatible fuse holders represent the next evolution in electronic protection. By integrating dual-size retention, pressure-adjustable contacts, standardized mounting, and anti-misplug mechanics, manufacturers can streamline designs, reduce SKUs, and boost customer satisfaction.

Looking ahead, compatibility will extend beyond mechanical to intelligent systems — enabling fuse holders to integrate seamlessly into smarter, safer, and more modular electrical ecosystems.

en.dghongju.com

0 notes

Text

The Ultimate Guide to 3-Bedroom Modular Homes in Australia: Smart Designs for Modern Living

In today’s evolving housing market, the demand for 3-bedroom modular homes in Australia is on the rise. Whether it’s for growing families, investors looking to maximize rental yield, or developers targeting suburban or regional buyers, modular solutions are offering smarter, faster, and more sustainable alternatives to traditional construction.

At Bayleaf Modular Solutions, we specialize in premium prefab home designs that balance aesthetics, efficiency, and functionality—making them ideal for modern Australian living.

Why Choose a 3-Bedroom Modular Home?

A 3-bedroom layout strikes the perfect balance between space, versatility, and affordability. It suits a wide range of lifestyles—from young families to retirees—and can be used as a primary residence, holiday home, or investment property.

But it’s not just the layout that matters. Modular house designs deliver serious advantages in today’s construction landscape:

Faster build timelines

Reduced site disruption

Custom design flexibility

Energy-efficient materials and systems

Lower overall costs with higher ROI

With increasing land and labour costs across Australia, modular homes are an attractive option for those who want high quality without high risk.

Modular Construction Benefits in 2025

The appeal of modular homes isn’t just in their speed—it’s also in their smarter, more sustainable build process. Prefabricated modules are constructed in a factory-controlled environment before being delivered and assembled on-site.

Here are the top advantages for developers and homeowners:

1. Time Efficiency

Modular homes can be completed 30% to 50% faster than traditional builds. With factory assembly happening alongside on-site preparation, delays from weather or material shortages are drastically reduced.

2. Cost Control

Prefab home builders operate with tighter process control, reducing waste and unexpected costs. You receive a more accurate project quote from day one.

3. Quality Assurance

Factory-built modules are subject to rigorous quality control checks at every stage, ensuring structural integrity and consistency.

4. Sustainability

Modular construction produces less material waste and supports eco-conscious design. Many homes also feature energy-efficient systems, helping reduce long-term operating costs.

Exploring Modular House Designs: Space, Style & Flexibility

At Bayleaf Modular Solutions, our 3-bedroom designs are built for both performance and comfort. Whether you’re looking for open-plan living, dual-zoned bedrooms, or a flexible study/guest room combo, modular allows you to choose a floorplan that meets your unique lifestyle.

Features of Modern 3-Bedroom Modular Designs:

Open kitchen and living areas for entertaining

Separate master suites for added privacy

Integrated outdoor spaces like decks or patios

Smart storage and multipurpose rooms

Custom upgrades including solar panels, energy-efficient appliances, and modern cladding

Our homes are designed to fit a variety of block sizes and landscapes—from coastal and bushfire zones to suburban infill and rural acreage.

Prefab Home Builders You Can Trust

Choosing the right prefab partner is crucial. At Bayleaf Modular Solutions, we bring deep experience in modular housing solutions and a commitment to high-quality delivery.

We offer:

Pre-configured or fully custom 3-bedroom modular floorplans

End-to-end project support, from planning to final handover

Compliance with Australian building codes and BAL (Bushfire Attack Level) ratings

A strong focus on energy-efficient modular homes with low operational costs

Whether you’re developing a single property or an entire modular community, our solutions scale with your goals.

Real-World Applications

3-bedroom modular homes are gaining popularity in the following markets:

Investment properties with rental appeal across suburban and regional markets

Holiday homes for coastal or rural retreats

Downsizing solutions for retirees seeking low-maintenance living

Staff accommodation in remote or high-demand locations

The combination of style, durability, and value makes modular a go-to choice for real estate professionals in 2025.

Frequently Asked Questions

How long does it take to build a 3-bedroom modular home?

Once factory production begins, most 3-bedroom modular homes are completed and delivered within 10 to 12 weeks.

Can modular homes be customized?

Yes. All designs can be tailored with custom finishes, layouts, cladding options, and energy-saving upgrades.

Are modular homes suitable for bushfire or coastal zones?

Absolutely. We offer BAL-rated materials and designs suited for bushfire-prone, sloped, and coastal sites.

Are modular homes cheaper than traditional homes?

Generally, yes. You save on labour, time, and waste. Plus, fixed-cost pricing offers better budget control.

Can modular homes be financed like traditional homes?

Yes. Many banks and lenders now offer tailored financing options for modular home purchases and construction.

Build Smarter with Bayleaf Modular Solutions

If you’re planning your next project, now is the time to consider a modular approach. 3-bedroom modular homes in Australia are not only faster and more affordable to build—they’re also future-ready, sustainable, and beautifully designed.

Contact us today to explore modular building solutions that align with your budget, site, and vision. Let Bayleaf Modular Solutions help you bring your next development to life—faster, smarter, and with more flexibility.

0 notes

Text

Global Single-Use Assemblies Market worth $5.2 billion by 2028

Single Use Assemblies Market in terms of revenue was estimated to be worth $2.5 billion in 2023 and is poised to reach $5.2 billion by 2028, growing at a CAGR of 15.6% from 2023 to 2028 according to a new report by MarketsandMarkets™. The global single-use assemblies market is growing owing to factors such as rising adoption of single-use assemblies among startups and SMEs, development and launch of technologically advanced single-use products that offer streamlined workflows, portability, and rapid implementation, and increasing demand for single-use assemblies for R&D and biologics manufacturing. The market growth could be hampered by regulatory concerns and significant concerns regarding extractables and leachables arising from the components of single-use assemblies in bioproduction.

Download an Illustrative overview:

Single Use Assemblies Market Dynamics:

Drivers:

Increasing adoption of single-use assemblies among startups and SMEs

Rapid implementation and low risk of cross-contamination

Growing biologics and biosimilars market

Cost savings with single-use assemblies

Technological advancements

Restraints:

Regulatory concerns

Issues related to leachables and extractables

Leakage and integrity issues

Opportunities:

Emerging markets

Rising focus on increasing bioprocessing capacities among biopharmaceutical companies

Challenge:

Standardization of single-use assemblies

Disposal of waste

Demand and supply gap

Key Market Players of Antibody Drug Conjugates Industry:

Key players in the single-use assemblies market include Thermo Fisher Scientific Inc. (US), Sartorius AG (Germany), Danaher (US), Merck KGaA (Germany), PARKER HANNIFIN CORP (US), Saint-Gobain (France), Repligen Corporation (US), Corning Incorporated (US), Entegris (US), Meissner Filtration Products, Inc. (US), NewAge Industries (US), Antylia Scientific (US), Lonza (Switzerland), Romynox (Netherlands), SaniSure (US), Keofitt A/S (Denmark), Intellitech, Inc. (US), Dover Corporation (US), Foxx Life Sciences (US), TSE Industries, Inc. (US), Fujimori Kogyo Co., Ltd. (Japan), Michelin (France), Cellexus (Scotland), and Fluid Flow Products, Inc. (US).

The North American region catered for the largest share of the single-use assemblies market in 2022.

The single-use assemblies market is segmented into North America, Europe, the Asia Pacific (APAC), Latin America (LATAM), and the Middle East and Africa (MEA). North America regional market held a substantial share of the single-use assemblies market owing to the strong presence of the pharmaceutical industry, increased research and development (R&D) spending, the expansion of biosimilars markets, the rising number of drug development projects, and stringent regulations for the pharmaceutical industry.

Recent Developments:

In February 2022, Sartorius Stedim Biotech (France) acquired the chromatography division of Novasep (France). The portfolio acquired comprises chromatography systems primarily suited for smaller biomolecules.

In August 2022, Thermo Fisher Scientific opened a new single-use technology site in Tennessee, which has 400,000 square feet of floor space. It became the company's largest SUT site in its growing network.

Single Use Assemblies Market Advantages:

Flexibility and Scalability: Single-use assemblies are highly adaptable, allowing for rapid changes in production processes and easy scalability from small-scale research and development to large-scale manufacturing. This flexibility reduces downtime and enables efficient production adjustments.

Cost-Efficiency: Traditional stainless steel equipment requires significant capital investment, maintenance, and cleaning validation. Single-use assemblies eliminate these costs by avoiding the need for cleaning, sterilization, and long-term maintenance, making them a cost-effective choice, especially for smaller batch production.

Reduced Cross-Contamination Risk: Disposable components minimize the risk of cross-contamination between batches, ensuring product purity and quality. This is crucial in industries like biopharmaceuticals, where maintaining product integrity is paramount.

Time Savings: Single-use assemblies streamline production processes by eliminating time-consuming cleaning and sterilization steps. This results in faster batch turnover and shorter production lead times.

Improved Product Safety: Single-use assemblies reduce the risk of contamination by eliminating the need for manual cleaning and sterilization processes, ensuring a higher level of product safety and consistency.

Environmental Benefits: Some single-use assemblies are designed with sustainability in mind, featuring recyclable or biodegradable materials. This aligns with growing environmental concerns and corporate sustainability goals.

Compliance and Validation: Single-use assemblies simplify regulatory compliance and validation processes because they offer consistent and traceable components. This simplifies documentation and ensures compliance with industry standards.

Lower Capital Investment: Industries can avoid large capital investments in stainless steel equipment and facilities by adopting single-use technology, making it more accessible for startups and smaller companies.

Space Savings: Single-use assemblies require less physical space compared to traditional stainless steel equipment, allowing for more efficient use of manufacturing facilities.

Innovation and Customization: Manufacturers continually innovate and customize single-use assemblies to meet specific process requirements, offering a wide range of options tailored to different applications.

Overall, the single-use assemblies market's advantages make it an attractive option for industries seeking efficient, cost-effective, and flexible solutions while meeting rigorous quality and safety standards.

Related Links:

#Single-Use Assemblies Market#Single-Use Assemblies Market outlook#Single-Use Assemblies Market Forecast#Single-Use Assemblies Market Demand

0 notes

Text

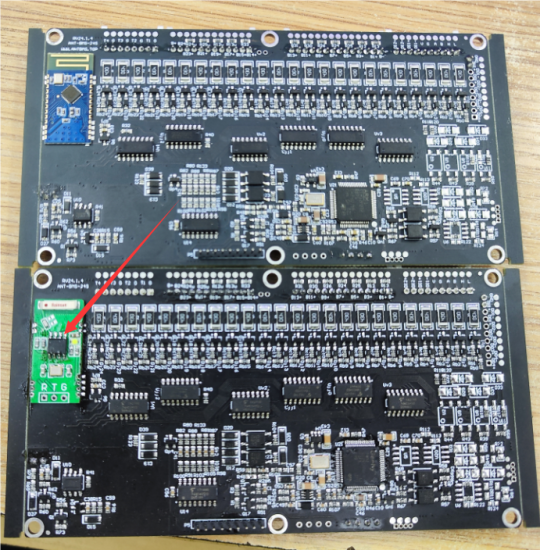

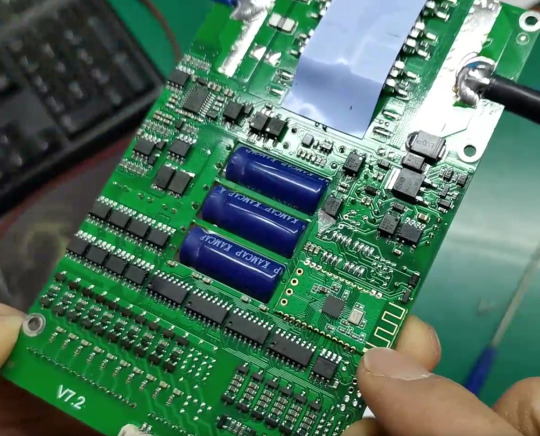

Selection Guide for Mainstream Bluetooth Module Chips for Lithium Battery BMS Protection Boards — Focusing on the KT6368A Dual-Mode Chip

1. Types of BMS Protection Board Products

Currently, many manufacturers produce BMS (Battery Management System) protection boards for lithium batteries, but only a few excel in quality. Insights from repair engineers on platforms like Bilibili provide authentic perspectives. Based on my observations, BMS protection boards generally fall into two categories:

Type 1: Integrated Battery & BMS Systems

Manufacturers combine lithium battery packs and BMS into a single product (e.g., for two-wheel or three-wheel electric vehicles).

Mass-produced and sold as finished battery products or battery boxes.

Type 2: Modular Battery Packs with External BMS

Sellers provide battery packs without built-in BMS (often lacking R&D capabilities or targeting repair shops/hobbyists).

Buyers pair these with external BMS boards and sell assembled battery systems to niche markets.

Key Takeaways:

Standard, high-volume applications typically develop proprietary BMS boards (rarely include Bluetooth).

Low-volume, fragmented markets often use externally sourced BMS boards (Bluetooth is a common feature).

Why Bluetooth Integration Matters:

Enables mobile app interaction for parameter monitoring/configuration.

Enhances user experience, reduces after-sales costs, and increases customer satisfaction.

This analysis aligns product development with customer needs and supports a SWOT evaluation of the KT6368A dual-mode Bluetooth chip. Understanding demand can reveal untapped product potential.

Typical BMS Protection Board Requirements:

Market prefers dual-mode chips for backward compatibility.

Consumers favor WeChat Mini Programs for ease of use.

Supported battery types: Ternary Lithium, LiFePO4 (LFP).

Balancing method: Active balancing.

2. Sample Bluetooth-Enabled BMS Boards Collected Online

1.JDY-33-V1.6 – Bluetooth SPP transparent transmission module (datasheet available).

2. D32 Dual-Mode Bluetooth Module – Supports UART transparent transmission, SPP 3.0 + BLE 4.2, HC-05/06 compatibility.

Feiyitong-based Module (likely high-cost, from an official site).

DX-BT24 Module – Another variant in use.

3. Conclusion

The KT6368A dual-mode Bluetooth chip offers distinct advantages for BMS lithium battery applications:

Compact size & cost-effectiveness make it a top contender.

SOP8 package simplifies integration.

Enables flexible module designs, reducing costs for manufacturers.

By adopting the KT6368A, companies can optimize BMS board designs while maintaining compatibility and affordability.

0 notes

Text

Industrial Efficiency Gains Spark Growth in Torque Limiter Market

The global Torque Limiter Market was valued at US$ 324.9 Mn in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2034, reaching US$ 597.4 Mn by the end of the forecast period. Increasing demand for machine safety, process efficiency, and the integration of advanced technologies is fueling this robust expansion.

Market Overview: Torque limiters, essential components in mechanical systems, play a critical role in protecting machinery from damage due to overload conditions. They disengage the drive system when preset torque levels are exceeded, ensuring operational safety and minimizing downtime.

The ongoing transition to smart manufacturing, fueled by Industry 4.0, is significantly contributing to the adoption of torque limiters. Industries such as automotive, aerospace, and renewable energy are the largest consumers of these components due to their need for precision, reliability, and safety.

Market Drivers & Trends

Automation in Production Processes: The proliferation of automation, especially in developing economies, is a major growth driver. Smart factories demand precise safety mechanisms, prompting widespread integration of torque limiters.

Electric Vehicle Growth: Torque limiters are essential in protecting sensitive EV components from torque surges. The EV boom, especially in Asia and Europe, is translating to increased product demand.

Wind Energy Integration: As wind turbines face varying loads, torque limiters prevent mechanical failure, ensuring operational reliability. This is particularly significant as global wind capacity surpassed 900 GW in 2023.

Latest Market Trends

Smart Torque Limiters: IoT-enabled limiters with real-time monitoring capabilities are becoming mainstream. These systems offer predictive maintenance and better control, aligning with smart factory goals.

Customization and Miniaturization: With the rise of compact machinery and robotics, manufacturers are offering smaller and application-specific torque limiters.

Sustainability and Energy Efficiency: Modern torque limiters are being designed with a focus on energy savings, lighter materials, and recyclability to meet environmental standards.

Key Players and Industry Leaders

The market is moderately fragmented with the presence of prominent players including:

Chr. Mayr GmbH + Co. KG

R+W Antriebselemente GmbH

KTR Systems GmbH

Nexen Group, Inc.

Tsubakimoto Chain Co.

Altra Industrial Motion Corp.

RINGSPANN GmbH

Howdon Power Transmission Ltd.

These companies are investing heavily in R&D, digital capabilities, and strategic partnerships to enhance their offerings and global presence.