#SmartTrade

Explore tagged Tumblr posts

Text

🤑 GTC: Intelligent Trade Solutions for a Competitive Edge!

Improve forecasting, optimize strategies, and stay ahead in global markets.

Leverage AI-driven insights to predict market trends, streamline decision-making, and secure a leading position in global trade.

🤝 Adopt AI tools today : https://www.globaltradechoice.com/

#AITrade#StrategicGrowth#AITrading#FutureOfTrade#AIinBusiness#SmartTrade#Gtc#AIForSuccess#SmartMarkets

1 note

·

View note

Video

youtube

Most Profitable Olymp Trade Trading Strategy - Vortex + Signal | Smart T...

0 notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Blue Edge Financial: AI Trading Advantage

Blue Edge Financial is a company that provides help to traders in acquiring edge with the help of AI-enabled trading systems, prop firm funding, and professional coaching. It is the company's new technology that has made an efficient and smarter way for traders to succeed in global financial markets. Get started with confidence today

3 notes

·

View notes

Text

💹 Smart Trading Starts Here!

📈 Analyze trends. 💡 Learn strategies. 🔒 Manage risks.

With #GiniTrade #AI, Forex #trading gets smarter and simpler.

👉 Join Now and grow your financial future! 🔗 https://ginitradeai.com/

2 notes

·

View notes

Text

Inverted Hammer Pattern Explained: Spot Market Reversals Like a Pro

Are you spotting the right reversal signals in the market?

Understanding candlestick patterns can provide a critical edge in trading, especially when it comes to identifying potential trend reversals. One such pattern is the Inverted Hammer—a powerful single-candle formation that often signals a possible shift from bearish to bullish momentum. However, recognizing it isn’t enough. Traders must understand the psychology behind the candle, its context within a trend, and how to confirm its validity with other indicators.

In our latest article, we break down the Inverted Hammer Pattern in detail: how to spot it, what it really means, and how to use it effectively in your trading strategy.

Start making smarter trading decisions today.

Read the full guide here:

#CandlestickPatterns#TradingForBeginners#InvertedHammer#StockMarket#TechnicalAnalysis#PriceAction#SmartTrading

0 notes

Text

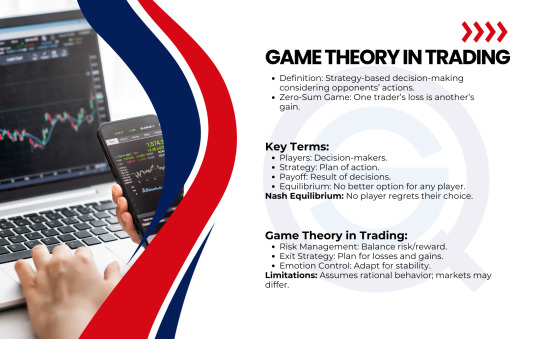

Game Theory in Trading

Apply strategy-based thinking by anticipating others’ moves. Use game theory for risk management, exit plans, and emotional control.

#GameTheory#TradingStrategy#RiskManagement#NashEquilibrium#MarketPsychology#SmartTrading#tradingtips#investing#tradingstrategies#stockmarketeducation#stockmarket

1 note

·

View note

Text

AI trading signals

The stock market is no longer just about gut feelings and manual charts. In 2025, smart traders are relying on AI trading signals to gain a competitive edge — and the results speak for themselves.

So, what are AI trading signals?

Simply put, they’re automated buy/sell suggestions generated by artificial intelligence. These systems scan live market data, technical indicators, price patterns, and even news headlines or social media sentiment to predict profitable trades.

The key benefits? Speed – AI reacts instantly to market changes No emotions – No fear or greed, just data 24/7 analysis – Markets don’t sleep, and neither does AI Accuracy – Machine learning constantly improves the signal quality

Platforms like Algo Signal AI are leading this shift by offering hands-free auto-trading powered by AI. This means you can receive smart signals and even let the platform execute trades automatically, saving time and reducing emotional mistakes.

From Nifty and Bank Nifty to crypto and forex, AI is changing how people trade — turning guesswork into a science.

1 note

·

View note

Text

✨ Welcome to the Future of Trading!

Meet BMP AI – your trusted partner in Forex and Crypto trading. Whether you're a beginner or a pro, our AI-driven platform is here to guide you every step of the way. 📈💡

💼 Smart decisions

📊 Real-time insights

⚡ Powerful AI technology

🌐 24/7 market support

Empower your trading journey with BMP AI!

🔗 Visit: www.bmpAI.io

#BMPAI#ForexTrading#CryptoAI#AIPartner#SmartTrading#FutureOfFinance#AITrading#ForexAndCrypto#AutomatedTrading#FinTech#crypto#e-commerce#forex#wealth management#artificialintelligence

0 notes

Text

Welcome & Lead Magnet Post

New to Forex? Download our free guide and learn how to trade smart from day one.

Understand currency pairs

Practice safely

Build confidence

Get the Free Guide Here

#forextrading#learnforex#forexbeginner#forexeducation#forexguide#makemoneyonline#sidehustle#smarttrading#passiveincome#wealthmindset

1 note

·

View note

Text

The Future of Stock Trading: AI Tools for 2025 and Beyond | Ai Expert Reviews

youtube

In 2025, trading without AI is like navigating the stock market blindfolded. This video explores the top AI tools that are transforming stock market trading, from beginner-friendly platforms like eToro AI to data-driven strategies with Traditics and Kavoot. Learn how to spot trends, track sentiment, and simulate strategies to make smarter, more informed trades. Whether you're new to investing or an experienced trader, AI tools are here to upgrade your trading game and help you stay ahead of the curve.

0 notes

Text

A Trailing Stop Loss isn’t just a safety net—it's a profit-locking, stress-reducing power tool every smart trader should master. 💹🔐 Automate wisely, trade confidently. 📊✨

0 notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

From Trader to Entrepreneur with Blue Edge Financial Blue Edge Financial helps traders build sustainable income streams by accessing prop firm capital. Skip the stress of traditional businesses—our Prop Farming Process gives you the freedom to scale through knowledge, precision, and risk-free funding.

0 notes

Text

🚀 Trade Smart. Earn More. Get Rewarded – Only at GTC! 💰

Ready to level up your forex game? At GTC, we're not just another trading platform – we're your partner in profit. Here's why thousands of traders are switching:

🔹 Smart Trading Tools 🔹 Low Spreads & Fast Execution 🔹 Exclusive Rewards & Bonuses 🔹 24/5 Global Support

Whether you're a beginner or a pro, GTC empowers you to trade smarter, earn faster, and enjoy exclusive rewards along the way.

👉 Join GTC today and unlock your forex potential. 🔗 https://www.globaltradechoice.com/

1 note

·

View note

Text

Supertrend Indicator: The Hidden Weapon of Smart Traders!

Discover how the Supertrend Indicator can transform your trading game. Learn its secret power, how pros use it for entry & exit signals, and why it's a must-have tool for trend trading success. Don’t trade blind — trade smart!

#SupertrendIndicator#TradingStrategy#TrendTrading#TechnicalAnalysis#TradingTips#PriceAction#StockMarket#ForexTrading#CryptoTrading#MarketTrends#TradingTools#FinancialFreedom#SmartTrading#DayTrading#SwingTrading

0 notes