#Solar Lighting System Market Report

Explore tagged Tumblr posts

Text

The United States solar power market size is projected to exhibit a growth rate (CAGR) of 17.6% during 2024-2032. The favorable government initiatives, rapid technological advancements, growing awareness of environmental sustainability, climate change and the need to reduce greenhouse gas emissions, rising energy demand and increasing investment in research and development (R&D) efforts represent some of the key factors driving the market.

#United States Solar Power Market Report by Technology (Photovoltaic Systems#Concentrated Solar Power Systems)#Solar Module (Monocrystalline#Polycrystalline#Cadmium Telluride#Amorphous Silicon Cells#and Others)#End Use (Electricity Generation#Lighting#Heating#Charging)#Application (Residential#Commercial#Industrial)#and Region 2024-2032

0 notes

Text

New SpaceTime out Monday

SpaceTime 20250505 Series 28 Episode 54

Discovery of a vast molecular cloud next door

Astronomers have discovered a vast invisible molecular gas and dust cloud near our solar system.

Jupiter’s giant polar cyclones under the microscope

New data from NASA’s Juno mission is shedding fresh light on the fierce winds and cyclones raging in the far north of the gas giant Jupiter and the extreme volcanic action on its fiery moon Io.

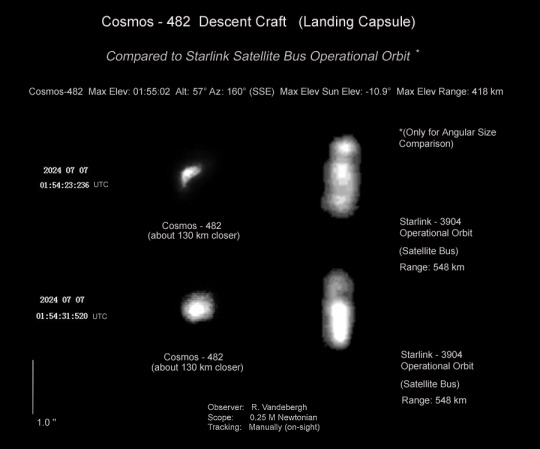

A Russian spacecraft about to crash back to Earth

A failed Soviet era spacecraft designed to land on the planet Venus is about to crash back to Earth.

The Science Report

83.7% of the world’s coral reef area now impacted by heat stress.

Taking cannabis gives you a higher risk of heart attack.

The unexpected evolutionary history of echidnas and platypuses.

Skeptics guide to the South Carolina ghost lanterns.

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through your favourite podcast download provider or from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He was the dorky school kid who spent his weekends at the Australian Museum. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on a career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. His first gigs were spent as an announcer and music DJ in commercial radio, before becoming a journalist, and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. That compares to the ABC’s overall radio listenership of just 5.6 per cent. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#hubble#hubble telescope#hubble space telescope

9 notes

·

View notes

Text

The tricky thing about generating electricity is that for the most part, you pretty much have to use it or lose it.

This fundamental fact has governed and constrained the development of the world’s largest machine: the $2 trillion US power grid. Massive generators send electrons along a continent-wide network of conductors, transformers, cables, and wires into millions of homes and businesses, delicately balancing supply and demand so that every light switch, computer, television, stove, and charging cable will turn on 99.95 percent of the time.

Making sure there are always enough generators spooled up to send electricity to every single power outlet in the country requires precise coordination. And while the amount of electricity actually used can swing drastically throughout the day and year, the grid is built to meet the brief periods of peak demand, like the hot summer days when air conditioning use can double average electricity consumption. Imagine building a 30-lane highway to make sure no driver ever has to tap their brakes. That’s effectively what those who design and run the grid have had to do.

But what if you could just hold onto electricity for a bit and save it for later? You wouldn’t have to overbuild the grid or spend so much effort keeping power generation in equilibrium with users. You could smooth over the drawbacks of intermittent power sources that don’t emit carbon dioxide, like wind and solar. You could have easy local backup power in emergencies when transmission lines are damaged. You may not even need a giant, centralized power grid at all.

That’s the promise of grid-scale energy storage. And while the US has actually been using a crude form of energy storage called pumped hydroelectric power storage for decades, the country is now experiencing a gargantuan surge in energy storage capacity, this time from a technology that most of us are carrying around in our pockets: lithium-ion batteries. Between 2021 and 2024, grid battery capacity increased fivefold. In 2024, the US installed 12.3 gigawatts of energy storage. This year, new grid battery installations are on track to almost double compared to last year. Battery storage capacity now exceeds pumped hydro capacity, totaling more than 26 gigawatts.

There’s still plenty of room to expand—and a pressing need to do so. The power sector remains the second-largest source of greenhouse gas emissions in the US, and there will be no way to add enough intermittent clean energy to sufficiently decarbonize the grid without cheap and plentiful storage.

Power transmission towers outside the Crimson Battery Energy Storage Project in Blythe, California. Photograph: Bing Guan/Bloomberg via Getty Images

The aging US grid is also in dire need of upgrades, and batteries can cushion the shock of adding gigawatts of wind and solar while buying some time to perform more extensive renovations. Some power markets are finally starting to understand all the services batteries can provide—frequency regulation, peak shaving, demand response—creating new lines of business. Batteries are also a key tool in building smaller, localized versions of the power grid. These microgrids can power remote communities with reliable power and one day shift the entire power grid into a more decentralized system that can better withstand disruptions like extreme weather.

If we can get it right, true grid-scale battery storage won’t just be an enabler of clean energy, but a way to upgrade the power system for a new era.

How Big Batteries Got so Big

Back in 2011, one of my first reporting assignments was heading to a wind farm in West Virginia to attend the inauguration of what was at the time the world’s largest battery energy storage system. Built by AES Energy Storage, it involved thousands of lithium-ion cells in storage containers that together combined to provide 32 megawatts of power and deliver it for about 15 minutes.

“It was eight megawatt-hours total,” said John Zahurancik, who was vice president of AES Energy Storage at the time and showed me around the facility back then. That was about the amount of electricity used by 260 homes in a day.

In the years since, battery storage has increased by orders of magnitude, as Zahurancik’s new job demonstrates. He is now the president of Fluence, a joint venture between AES and Siemens that has deployed 38 gigawatt-hours of storage to date around the world. “The things that we’re building today, many of our projects are over a gigawatt-hour in size,” Zahurancik said.

Last year, the largest storage facility to come online in the US was California’s Edwards & Sanborn Project, which can dispatch 33 GW for several hours. That’s roughly equivalent to the electricity needed to power 4.4 million homes for a day.

It wasn’t a steady climb to this point, however. Overall grid battery capacity in the US barely budged for more than a decade. Then, around 2020, it began to spike upward. What changed?

One shift is that the most common battery storage technology, lithium-ion cells, saw huge price drops and energy density increases. “The very first project we did was in 2008 and it was on the order of $3,000 a kilowatt-hour for the price of the batteries,” said Zahurancik. “Now we’re looking at systems that are on the order of $150, $200 a kilowatt-hour for the full system install.”

That’s partly because the cells on the power grid aren’t that different from those in mobile devices and electric vehicles, so grid batteries have benefited from manufacturing improvements that went into those products.

“It’s all one big pipeline,” said Micah Ziegler, a professor at Georgia Tech who studies clean energy technologies. “The batteries in phones, cars, and the grid all share common characteristics.” Seeing this rising demand, China went big on battery manufacturing and, much as it did in solar panels, created economies of scale to drive global prices down. China now produces 80 percent of the world’s lithium-ion batteries.

The blooming of wind and solar energy created even more demand for batteries and increased the pressure to improve them. The wind and the sun are often the cheapest sources of new electricity, and batteries help compensate for their variability, providing even more reason to scale up storage. “The benefits of this relationship are apparent in the increasing number of power plants that are being proposed and that have already been deployed that combine these resources,” Ziegler said. The combination of solar plus storage accounted for 84 percent of new US power added in 2024.

The Los Angeles Department of Water and Power’s biggest solar and battery storage plant, the Eland Solar and Storage Center in the Mojave Desert. Photograph: Brian van der Brug/Los Angeles Times via Getty Images

Battery solar energy storage units, right, at the Eland Solar and Storage Center in 2024. Phtogoraph: Brian van der Brug/Los Angeles Times via Getty Images

And because grid batteries don’t have to be small enough to be mobile—unlike the batteries in your laptop or phone—they can take advantage of cheaper, less dense batteries that otherwise might not be suited for something that has to fit in your pocket. There’s even talk of giving old EV batteries a second life on the power grid.

Regulation has also helped. A major hurdle for deploying grid energy storage systems is that they don’t generate electricity on their own, so the rules for how they should connect to the grid and how much battery developers should get paid for their services were messy and restrictive in the past. The Federal Energy Regulatory Commission’s Order 841 removed some of the barriers for energy storage systems to plug into wholesale markets and compete with other forms of power. Though the regulation was issued in 2018, it cleared a major legal challenge in 2020, paving the way for more batteries to plug into the grid.

Eleven states to date including California, Illinois, and Maryland have also set specific procurement targets for energy storage, which require utilities to install a certain amount of storage capacity, creating a push for more grid batteries. Together, these factors created a whole new businesses for power companies, spawned new grid battery companies, and fertilized the ground for a bumper crop of energy storage.

What Can Energy Storage Do for You?

Energy storage is the peanut butter to the chocolate of renewable energy, making all the best traits about clean energy even better and balancing out some of its downsides. But it’s also an important ingredient in grid stability, reliability, and resilience, helping ensure a steady flow of megawatts during blackouts and extreme weather.

The most common use is frequency response. The alternating current going through power lines in the US cycles at a frequency of 60 hertz. If the grid dips below this frequency when a power-hungry user switches on, it can trip circuit breakers and cause power instability. Since batteries have nearly zero startup time, unlike thermal generators, they can quickly absorb or transmit power as needed to keep the grid humming the right tune.

Grid batteries can also step in as reserve power when a generator goes offline or when a large power user unexpectedly turns on. They can smooth out the hills and valleys of power load over the course of the day. They also let power providers save electricity when it’s cheap to produce, and sell it back on the grid at times when demand is high and power is expensive. It’s often faster to build a battery facility than an equivalent power plant, and since there are no smokestacks, it’s easier to get permits and approvals.

Batteries have already proven useful for overstressed power networks. As temperatures reached triple digits in Texas last year, batteries provided a record amount of power on the Lone Star State’s grid. ERCOT, the Texas grid operator, didn’t have to ask Texans to turn down their power use like it did in 2023. Between 2020 and 2024, Texas saw a 4,100 percent increase in utility-scale batteries, topping 5.7 gigawatts.

Jupiter Power battery storage complex in Houston in 2024. Photograph: Jason Fochtman/Houston Chronicle via Getty Images

Grid batteries have a halo effect for other power generators too. Most thermal power plants—coal, gas, nuclear—prefer to run at a steady pace. Ramping up and down to match demand takes time and costs money, but with batteries soaking up some of the variability, thermal power plants can stay closer to their most efficient pace, reducing greenhouse gas emissions and keeping costs in check.

“It’s kind of like hybridizing your car,” Zahurancik said. “If you think about a Prius, you have an electric motor and you have a gasoline motor and you make the gas consumption better because the battery absorbs all the variation.”

Another grid battery feature is that they can reduce the need for expensive grid upgrades, said Stephanie Smith, chief operating officer at Eolian, which funds and develops grid energy storage systems. You don’t have to build power lines to accommodate absolute maximum electricity needs if you have a battery—on the generator side or on the demand side—to dish out a few more electrons when needed.

“What we do with stand-alone batteries, the more and more of those you get, you start to alleviate needs or at least abridge things like new transmission build,” Smith said. These batteries also allow the grid to adapt faster to changing energy needs, like when a factory shuts down or when a new data center powers up.

On balance this leads to a more stable, efficient, cheaper, and cleaner power grid.

Charging Up

As good as they are, lithium-ion batteries have their limits. Most grid batteries are designed to store and dispatch electricity over the course of two to eight hours, but the grid also needs ways to stash power for days, weeks, and even months since power demand shifts throughout the year.

There are also some fundamental looming challenges for grid-scale storage. Like most grid-level technologies, energy storage requires a big upfront investment that takes decades to pay back, but there’s a lot of uncertainty right now about how the Trump administration’s tariffs will affect battery imports, whether there will be a recession, and if this disruption will slow electricity demand growth in the years to come. The extraordinary appetite for batteries is increasing competition for the required raw materials, which may increase their prices.

Though China currently dominates the global battery supply chain, the US is working to edge its way in. Under the previous administration, the US Department of Energy invested billions in energy storage factories, supply chains, and research. There are dozens of battery factories in the US now, though most are aimed at electric vehicles. There are 10 US factories slated to start up this year, which would raise the total EV battery manufacturing capacity to 421.5 gigawatt-hours per year. Total global battery manufacturing is projected to reach around 7,900 gigawatt-hours in 2025.

Lithium battery modules inside the battery building at the Vistra Corp. Moss Landing Energy Storage Facility in Moss Landing, California, in 2021. Photograph: David Paul Morris/Bloomberg via Getty Images

There’s also a long and growing line of projects waiting to connect to the power grid. Interconnection queues for all energy systems, but particularly solar, wind, and batteries, typically last three years or more as project developers produce reliability studies and cope with mounting regulatory paperwork delays.

The Trump administration is also working to undo incentives around clean energy, particularly the 2022 Inflation Reduction Act. The law established robust incentives for clean energy, including tax credits for stand-alone grid energy projects. “I do worry about the IRA because it will change the curve, and quite honestly we cannot afford to change the curve right now with any form of clean energy,” Smith said. On the other hand, Trump’s tariffs may eventually spur even more battery manufacturing within the US.

Still, utility-scale energy storage is a tiny slice of the sprawling US power grid, and there’s enormous room to expand. “Even though we’ve been accelerating and going fast, by and large, we don’t have that much of it,” Zahurancik said. “You could easily see storage becoming 20 or 30 percent of the installed power capacity.”

5 notes

·

View notes

Text

The Rise of Smart Homes in Abu Dhabi: Is It Worth the Investment?

🌐 Visit: www.purehome-re.ae

As Abu Dhabi continues to evolve as a future-forward, tech-savvy city, one of the most significant shifts in the real estate market is the growing demand for smart homes. But what exactly are smart homes—and why are they becoming such an attractive option for both buyers and investors in 2025?

What Are Smart Homes?

Smart homes are residential properties equipped with advanced automation systems that control lighting, temperature, security, appliances, and more. These features are designed to offer convenience, energy efficiency, and enhanced security, creating a seamless and responsive living environment.

In Abu Dhabi, this movement is not just a trend—it’s part of a larger government vision to build AI-powered, sustainable communities that cater to modern living standards.

Key Benefits of Investing in Smart Homes in Abu Dhabi

1. Energy Efficiency & Cost Savings Smart homes use AI-enabled systems to manage energy consumption intelligently. Features like smart lighting, thermostats, and solar integrations help reduce utility costs, making them more appealing for long-term living and investment.

2. Advanced Security Integrated security systems—such as facial recognition, remote monitoring, and automated emergency alerts—provide peace of mind for residents and families. These features are particularly in demand among expats relocating to the UAE.

3. Sustainability & Water Management With smart irrigation systems and leak-detection technology, these homes support water conservation efforts, aligning with Abu Dhabi’s broader sustainability goals.

4. Health & Wellness Features Some smart residences now come equipped with indoor air quality monitors, automated air purifiers, and even health-tracking integrations—further enhancing the lifestyle benefits.

Why Now Is the Time to Invest

Abu Dhabi’s real estate trends for 2025 point to a surge in demand for smart, eco-conscious living spaces. Government support for smart city initiatives, the rise of communities like Al Reem Island, Yas Island, and Masdar City, and an increase in remote work flexibility have made smart homes a sound investment choice.

According to recent reports, buyers are actively searching for:

Smart villas in Yas Island

Energy-efficient homes in Masdar City

Luxury apartments with automation in Al Reem Island

These preferences show that smart homes aren’t just futuristic—they’re the present.

Final Thoughts

Smart homes in Abu Dhabi are reshaping the way people think about real estate. Whether you're an investor looking for high ROI or a resident seeking convenience, sustainability, and security, smart living offers a compelling proposition.

Ready to Invest in a Smarter Future?

At Pure Home Real Estate, we help you find innovative, tech-integrated properties tailored to your lifestyle or investment goals. 📩 Contact us today to explore the best smart home listings across Abu Dhabi. 📞 Call: +971 2 446 6775 🌐 Visit: www.purehome-re.aes

#abudhabi#real estate#uae#dubai#property management#real estate investing#investment#properties#smart home

2 notes

·

View notes

Text

I wish we had home batteries. Right now, we have a natural gas driven Generac generator, which we purchased years ago. Back then, the disruptions from Commonwealth Edison's electrical feeds were intense, and nobody even thought of storing electricity in home batteries when the lights went out. What's holding us back now is the number of tall, huge, old trees surrounding our house, which shade the roof of our tall (basement, two stories, attic), old (built in 1886) house, making solar energy fairly illogical. Should we cut down the trees to get solar on the roof, or stick with the trees? Easy answer for us: we stick with the trees.

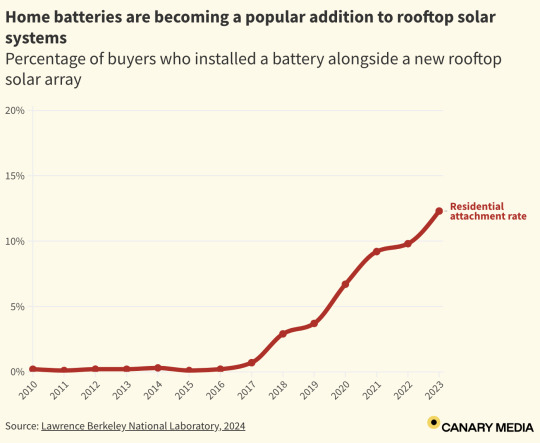

Excerpt from this story from Canary Media:

Batteries are all the rage — especially among homeowners who are going solar.

The percentage of people who install a battery alongside their new rooftop solar system is surging in the U.S., according to a new report from Lawrence Berkeley National Laboratory.

That figure — known as the residential attachment rate — jumped from just under 10 percent in 2022 to 12.3 percent last year. This year, energy research firm Wood Mackenzie estimated that it will soar to 25 percent.

The surging interest in home batteries — which are almost always purchased to store power from solar arrays — comes as the country’s rooftop solar market craters. Installations are expected to fall by 19 percent this year, according to the Solar Energy Industries Association.

Policy changes in California, the nation’s biggest residential solar market by far, have a lot to do with both the contraction of the rooftop solar market and the rising popularity of home batteries. In April of last year, changes to the Golden State’s net-metering program took effect, slashing the rate at which rooftop solar owners could sell surplus power to the grid but boosting the value of batteries, which enable homeowners to save their solar power for the times when it’s most valuable. The attachment rate in California rose to 14 percent last year.

But other factors are driving the uptick in home battery installations as well. Extreme weather events, made more frequent by climate change, are increasingly threatening grid reliability. Batteries are becoming more affordable. And rising utility rates are making the economics of solar-plus-storage more attractive to homeowners.

6 notes

·

View notes

Text

The Elegance of Smart-Tech Independent Floors and Premium Apartments in Gurgaon: A Modern Investment Opportunity

Gurgaon, a vibrant city near Delhi, is a hotspot for real estate investors. In 2025, two standout trends are independent floors in Gurgaon and premium apartments in Gurgaon, including the highly desirable luxury apartments in Gurgaon. These properties are infused with smart technology, offering automated systems, energy-efficient designs, and connected living spaces that create a modern and convenient lifestyle. They attract buyers who value innovation, comfort, and upscale living. This article explains why smart-tech independent floors and premium apartments are smart investments, what makes them special, and how you can invest in these cutting-edge trends in Gurgaon’s thriving market.

What Are Smart-Tech Independent Floors and Premium Apartments?

Independent floors in Gurgaon are single-level homes on separate floors of low-rise buildings, typically 3-4 stories, each with a private entrance, offering the privacy of a standalone house. Smart-tech independent floors enhance this with features like voice-controlled lighting, automated climate systems, and smart security cameras. In areas like Sector 70 or along Southern Peripheral Road, these floors offer spacious layouts, private smart terraces, and app-controlled appliances, creating a tech-savvy living experience.

Premium apartments in Gurgaon, including luxury apartments in Gurgaon, are high-end units in mid- to high-rise towers with top-tier amenities like smart community hubs, AI-driven concierge services, and rooftop solar panels. Luxury apartments elevate the experience with features like touchless entry systems, smart home automation, and private balconies with integrated sensors. Projects in areas like Golf Course Road or Sector 65 offer premium and luxury apartments with smart gyms, connected lounges, and energy-efficient designs that blend technology with elegance.

Both property types cater to tech-forward lifestyles: independent floors provide private, automated spaces, while premium and luxury apartments offer community-driven smart amenities in a resort-like setting.

Why Smart-Tech Independent Floors and Premium Apartments Are Great Investments

Gurgaon’s real estate market is soaring, with luxury apartments in Gurgaon accounting for 98% of home sales in 2024, up from 94% in 2023, according to a Cushman & Wakefield report. Smart-tech independent floors and premium apartments are top picks for investors due to their high demand and innovative appeal. Here’s why they’re smart choices for buying property in Gurgaon:

High Rent Returns: Smart-tech independent floors attract families and tech professionals, fetching ₹6.8 lakh to ₹9.3 lakh per month, offering 13.6% to 15.8% annual returns. Premium and luxury apartments draw tech enthusiasts and NRIs, with rents of ₹7.9 lakh to ₹10.5 lakh per month, yielding 14.1% to 16.5% returns.

Big Price Growth: Independent floors in Gurgaon have risen 103% to 109% in price in 2024, with Sector 70 units now at ₹4.75 lakh to ₹5.25 lakh per square foot, up from ₹4.1 lakh in 2023. Premium and luxury apartments in Gurgaon have surged 108% to 114%, with Golf Course Road units at ₹5.15 lakh to ₹5.65 lakh per square foot, up from ₹4.4 lakh.

Strong Demand: The smart-tech features ensure 99% of these properties are rented or sold quickly, as buyers seek innovative homes.

Modern Lifestyle: Both align with Gurgaon’s growing tech-driven culture, boosting their resale value.

City Growth: Gurgaon’s new tech hubs, smart city projects, and Metro expansion planned for 2026 enhance the appeal of these properties.

In January 2022, a builder in Sector 70 launched 49 smart-tech independent floors priced between ₹8.8 crore and ₹10 crore, selling out in two days and earning ₹1,050 crore. In March 2022, a Golf Course Road project sold 88 luxury apartments priced at ₹11.6 crore to ₹12 crore, earning ₹1,310 crore, highlighting their immense popularity.

How to Invest in Smart-Tech Independent Floors and Premium Apartments

Buying smart-tech independent floors or premium apartments in Gurgaon requires planning, but it’s an exciting opportunity. Here’s a simple step-by-step guide to get started:

Step 1: Choose the Right Area

For independent floors in Gurgaon, target Sector 70, Southern Peripheral Road, or Sector 106, which offer low-rise projects with smart-tech features and proximity to tech hubs. For premium and luxury apartments in Gurgaon, focus on Golf Course Road, Sector 65, or Sector 87, known for high-rise towers with smart amenities and great connectivity.

Step 2: Pick a Trusted Builder

Select builders with a strong history of delivering smart-tech independent floors or premium apartments. Review their past projects to confirm they provide promised features, like voice-controlled systems for floors or AI-driven concierge services for apartments, ensuring your investment is secure.

Step 3: Check for Key Features

For smart-tech independent floors, look for:

Tech Design: Voice-controlled lighting or automated climate systems, common in Sector 70 projects.

Smart Spaces: Private smart terraces or app-controlled appliances, found in many independent floors in Gurgaon.

Innovation: Smart security cameras or energy-efficient designs, offered in newer projects.

For premium and luxury apartments, look for:

Smart Amenities: Smart community hubs or AI-driven concierge services, standard in luxury apartments in Gurgaon.

Luxury Finishes: Touchless entry systems or smart home automation, common in Golf Course Road projects.

Modern Features: Smart gyms or connected lounges, available in high-rise towers.

Step 4: Plan Your Finances

Independent floors cost ₹8.8 crore to ₹10 crore, while premium and luxury apartments range from ₹11.6 crore to ₹12 crore. Save 15-20% for a down payment and secure a home loan at 8% to 10% interest. Budget ₹2,000 to ₹4,500 monthly for maintenance, like updating smart systems or maintaining tech amenities.

Step 5: Rent or Sell Smartly

Rent independent floors to families or tech professionals for ₹6.8 lakh to ₹9.3 lakh per month, targeting areas like Southern Peripheral Road. Rent premium apartments to high-profile tenants, like tech entrepreneurs or corporate executives, for ₹7.9 lakh to ₹10.5 lakh, focusing on Golf Course Road. Alternatively, hold the property for 5-7 years and sell for 25-35% more. For example, Sector 70 floors bought at ₹4.1 lakh per square foot in 2023 are now ₹4.75 lakh, and Golf Course Road apartments rose from ₹4.4 lakh to ₹5.15 lakh.

Step 6: Keep the Property in Top Shape

Spend ₹3,500 to ₹7,500 yearly on maintenance, like updating smart security systems for floors or servicing AI-driven amenities for apartments. Keeping the property tech-forward and modern attracts renters and boosts resale value.

Success Stories from Investors

In Sector 70, Anil, a 91-year-old investor, bought an 8,100-square-foot smart-tech independent floor for ₹6.8 crore in 2023. He rents it for ₹8.1 lakh per month, earning a 14.3% return yearly, and its value is now ₹12.8 crore, up 88%. “The smart features are a big hit with renters,” he says.

On Golf Course Road, Priya, an NRI, spent ₹14 crore on a luxury apartment in Gurgaon with smart home automation in 2024. She earns ₹10.1 lakh monthly rent and plans to sell for ₹18 crore in five years, loving the “modern, upscale vibe” of these apartments.

Benefits Beyond Money

Investing in smart-tech independent floors or premium apartments in Gurgaon offers more than financial gains:

Unique Appeal: Independent floors offer private, automated spaces, while luxury apartments provide tech-driven amenities, ensuring high occupancy.

Happy Renters: Smart-tech floors and upscale apartments in Gurgaon encourage longer tenant stays.

Stands Out: The tech exclusivity makes these properties attractive to buyers when selling.

Matches Gurgaon’s Vibe: With 490 new tech hubs and innovation events in 2024, these homes fit Gurgaon’s tech-savvy, upscale lifestyle.

Challenges and How to Handle Them

These properties come with a few challenges, but they’re manageable:

High Price: Independent floors start at ₹8.8 crore, and luxury apartments at ₹11.6 crore. Solution: Explore smaller floors in Sector 107 for ₹5.7 crore or mid-range premium apartments in Sector 93 for ₹6.7 crore, or co-invest with others.

Upkeep Costs: Smart-tech maintenance costs ₹1,500-₹2,500 yearly. Solution: Save 1% of the property’s value for upkeep or hire local tech maintenance firms.

Specific Renters: Floors appeal to families, while apartments suit professionals. Solution: Advertise to targeted groups on sites like Magicbricks.com.

Market Changes: Prices can fluctuate. Solution: Buy in stable areas like Golf Course Road to minimize risks.

What’s Happening in Gurgaon Right Now

In February 2022, a builder announced that 99% of their new projects in Gurgaon will include smart-tech independent floors or premium apartments, as demand grew by 150%. The Sector 70 project, launched in January 2022, earned ₹1,050 crore from 49 independent floors, and a March 2022 Golf Course Road project earned ₹1,310 crore from 88 luxury apartments, showing their strong demand.

In March 2022, Haryana’s government offered tax breaks for homes with innovative or tech-focused features. Investors should check if their properties qualify for these savings.

People on X are buzzing about independent floors in Gurgaon and luxury apartments, with many saying builders are “creating homes for the future.” Some express concerns about high costs, but most view these properties as ideal for buyers seeking innovation and luxury, making them excellent investments.

What’s Next for Smart-Tech Independent Floors and Premium Apartments

Gurgaon’s luxury home market, worth ₹11,300 crore in 2025, is growing 117% yearly, outpacing Delhi. Top projects, especially in Sector 70 and Golf Course Road, are expected to rise in value by 101-107% yearly due to their smart-tech features. Luxury apartments in Gurgaon and independent floors will continue attracting affluent buyers, with builders planning 4,800 more units by 2027.

Gurgaon’s tech scene is thriving, with a major tech and real estate expo in August 2022, expecting 860,000 visitors. This aligns with the rise of smart-tech independent floors and premium apartments, as people want homes that embrace innovation and luxury. Investors can expect 105-115% returns over seven years, thanks to the exclusivity and tech appeal of these properties.

In Conclusion

Smart-tech independent floors and premium apartments, including luxury apartments in Gurgaon, are vibrant trends in Gurgaon’s real estate, offering investors a chance to profit from innovative, in-demand properties. Whether you’re drawn to the private convenience of independent floors in Gurgaon or the tech-inspired elegance of premium apartments, these homes are fantastic choices. With Gurgaon’s market soaring, now is the perfect time to invest in residential property that blends innovation, style, and big profits for a modern future.

0 notes

Text

Solar Encapsulation Market Driven by Growing Demand for Sustainable Energy Solutions

The solar encapsulation market is experiencing significant growth due to the increasing adoption of solar energy systems worldwide. Solar encapsulation materials play a crucial role in protecting photovoltaic cells from environmental factors, enhancing their durability and efficiency. These materials, typically made of ethylene vinyl acetate (EVA) or polyolefin elastomers (POE), provide a protective layer that shields solar cells from moisture, dust, and mechanical stress, thereby extending the lifespan of solar panels. The demand for Solar Encapsulation Market is driven by the growing emphasis on renewable energy sources and the need to reduce carbon emissions. As governments and organizations worldwide implement policies to promote clean energy, the solar industry has witnessed substantial expansion. Solar encapsulation materials contribute to the overall performance and longevity of solar panels, making them an essential component in the production of photovoltaic modules. Additionally, advancements in encapsulation technology have led to improved UV resistance, better light transmission, and enhanced thermal management, further boosting the efficiency of solar panels.

The solar encapsulation market is estimated to be valued at USD 5.89 Bn in 2025 and is expected to reach USD 10.36 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2032. Key Takeaways Key players operating in the Solar Encapsulation Market are:

-Arkema S.A.

-Specialized Technology Resources

-RenewSys

-Solutia Inc.

-Mitsui Chemicals Tohcello, Inc.

These companies are at the forefront of innovation in solar encapsulation technology, continuously developing new materials and processes to enhance the performance and cost-effectiveness of solar modules. They are investing in research and development to create advanced encapsulants that offer improved durability, UV resistance, and moisture protection, thereby extending the lifespan of solar panels and increasing their efficiency. The growing demand for solar encapsulation materials is primarily driven by the rapid expansion of the solar energy sector. As the world transitions towards cleaner energy sources, the installation of solar panels in residential, commercial, and utility-scale projects has increased significantly. This trend has created a substantial market for solar encapsulation products, with manufacturers scaling up production to meet the rising demand. Moreover, the increasing focus on building-integrated photovoltaics (BIPV) and the development of next-generation solar technologies, such as perovskite solar cells, are opening up new opportunities for encapsulation material suppliers.

‣ Get More Insights On: Solar Encapsulation Market

‣ Get this Report in Japanese Language: 太陽光カプセル化市場

‣ Get this Report in Korean Language: 태양열캡슐화시장

0 notes

Text

Snagging Inspection for Apartments vs Villas: What's Checked and Why It’s Different

When it comes to snagging inspections, both apartments and villas go through a rigorous process—but what’s inspected and why it differs significantly. Simply put, snagging inspections for apartments tend to focus more on interiors and shared systems, while villas require broader assessments including structural, external, and standalone utility checks.

Whether you're about to receive keys to a high-rise apartment or a luxury standalone villa, a snagging inspection is a must-do step. This detailed review helps you identify defects or unfinished work before you take possession. While the goal remains the same—ensuring quality and value for money—the process diverges depending on the type of property.

Why Snagging Inspections Matter

Imagine moving into a brand-new home only to find leaky pipes, cracked tiles, or poorly installed windows. A proper snagging inspection prevents such disappointments by catching these issues early. Especially in fast-paced real estate markets like Dubai, where properties are completed rapidly to meet demand, the importance of a thorough handover inspection in Dubai cannot be overstated.

Both apartments and villas undergo snagging inspections, but they aren't identical. The nature of construction, layout, and amenities influence what gets checked.

For reliable, professional assessments, property owners often turn to trusted snagging services to ensure a thorough and unbiased review.

What Gets Checked in Apartments

Apartments are typically part of a larger building complex. This means the inspection focuses primarily on:

Interior Finishes: Walls, ceilings, floors, paintwork, and tiling are closely examined. Any cracks, stains, or improper installations are flagged.

Doors and Windows: Inspectors check for alignment, locking mechanisms, ease of movement, and proper sealing.

Kitchen and Bathrooms: Fixtures, fittings, cabinets, and waterproofing are inspected to ensure functionality and quality.

HVAC Systems: Centralized air conditioning units and thermostats must be tested for performance.

Plumbing and Electrical: Faucets, drains, light switches, sockets, and circuit boards are tested.

Appliances (if included): Built-in appliances like ovens, cooktops, or washing machines are checked for installation and operation.

Fire Safety Compliance: Smoke detectors, sprinkler systems, and fire exits within the apartment.

However, shared areas like hallways, lifts, or common amenities fall under the building management's responsibility. These are not usually covered in a private snagging inspection unless specifically requested.

For a detailed, independent evaluation of your unit, getting a property snag report ensures no defect goes unnoticed.

What Gets Checked in Villas

Villas present a more complex case for snagging inspections due to their independent nature and greater square footage. Here, inspections extend beyond the interiors:

Structural Integrity: Walls, roofing, foundations, and external finishes are inspected for any cracks, misalignments, or moisture ingress.

External Spaces: Gardens, fences, driveways, terraces, and any installed landscaping features are assessed.

Roofing and Waterproofing: Since villas have direct exposure to weather, special attention is given to waterproofing and drainage systems.

Facade and Paintwork: The exterior of the building is thoroughly reviewed for uniformity, quality, and weather resistance.

Windows and Doors (including external): Security features and weather-sealing are evaluated more critically than in apartments.

Utilities: Villas often have standalone water tanks, pumps, and sometimes solar panels—all need inspection.

Garage and Ancillary Structures: Carports, outbuildings, or maid quarters (if any) are part of the review.

A villa inspection also covers a wider range of safety checks, especially concerning the property's boundary and standalone fire and security systems.

Choosing professional snagging inspection services is crucial for villa owners, where the margin for unnoticed flaws is greater.

Key Differences: Apartments vs Villas

To better understand how inspections differ, let’s break down the core distinctions:

Scope of Inspection:

Apartments: Mostly internal checks.

Villas: Internal + structural + external.

Systems Complexity:

Apartments: Centralized systems for HVAC, plumbing.

Villas: Independent systems requiring individual assessment.

External Features:

Apartments: Minimal or none.

Villas: Gardens, driveways, fences, private pools, etc.

Shared Responsibilities:

Apartments: Common areas handled by building management.

Villas: Homeowner bears complete responsibility.

Cost of Repairs:

Missed issues in villas can lead to costlier fixes due to the scale and autonomy of systems.

This is why expert-led Dubai property snagging services adapt their process depending on whether the property is an apartment or villa.

Real-World Example: Apartment vs Villa Inspection Case Study

Case 1: Apartment in Business Bay, Dubai A client hired a snagging company before taking possession of a new apartment. The inspection revealed:

Misaligned kitchen cabinetry

Scratches on bedroom flooring

Low water pressure in the bathroom

Thanks to the handover inspection Dubai process, the developer was required to address these issues before final sign-off.

Case 2: Villa in Arabian Ranches In contrast, a villa inspection revealed:

Foundation cracks near the garage

Poor waterproofing on the roof

Non-functioning solar heater

Drainage slope errors in the garden area

These defects could have led to major repairs post-handover, but the snagging report allowed the homeowner to demand fixes in advance.

Why the Difference Matters

Understanding the difference in snagging inspections is not just academic. It determines the depth, cost, and timing of your inspection process.

If you’re buying an apartment, your focus should be tight and detailed, mostly within four walls. But for villa buyers, especially in high-end communities, a comprehensive inspection can prevent long-term financial headaches.

Even the best developers can miss things. Snagging isn't about mistrust—it's about due diligence.

Expert Insights: What Professionals Say

According to seasoned property inspectors at GTA Inspectors, over 80% of new properties show some form of defect during handover. "Villas especially tend to have critical issues with waterproofing and drainage if rushed," notes one senior engineer.

Industry statistics indicate:

90% of apartment inspections reveal minor issues like paint, sealants, or fixture misalignments.

60% of villa inspections reveal both minor and major issues including roofing, plumbing, and structural faults.

This validates the need for tailored snagging checklists.

Practical Tips for Buyers

Time Your Inspection: Conduct it close to handover but with enough time for the developer to address issues.

Hire Professionals: DIY checks miss what expert snagging services won’t.

Document Everything: Get a photographic property snag report to support your claims.

Follow-Up: Ensure that the developer resolves all identified issues before you finalize the handover.

Tailor the Checklist: Use property-specific templates—villa checklists are more detailed and diverse.

Conclusion: Choose the Right Snagging Path

In conclusion, snagging inspections are vital for both apartments and villas, but the process differs due to the unique nature of each property type. Apartments lean toward internal finish checks while villas demand broader, structural, and external reviews.

Being informed empowers you to ask the right questions and demand the right fixes. Whether it's a studio apartment in downtown Dubai or a sprawling villa in the suburbs, a thorough snagging inspection safeguards your investment.

For peace of mind, consult with experienced professionals in snagging inspection and ensure you get what you paid for—a perfect new home.

Source : https://gtainspectors.blogspot.com/2025/06/snagging-inspection-for-apartments-vs.html

#property snag report#snagging inspection#snagging services#dubai property snagging#handover inspection dubai

0 notes

Text

New SpaceTime out Friday

SpaceTime 20241115 Series 27 Episode 138

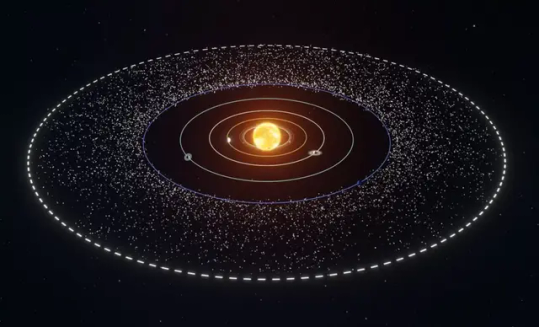

Discovery of the outer solar system’s magnetic field

Scientists have discovered an ancient magnetic field at the outer edge of the solar system.

Southern Launch gets the green light for orbital missions from South Australia

Southern Launch has finally been granted Federal and State government approval for its Whalers Way Orbital Launch Complex.

Axiom unveils new lunar spacesuits for NASA

Axiom Space has revealed the new lunar space suits NASA’s Artemis three crew will be using when they walk on the Moon in September 2026.

The Science Report

Weather systems driving much of southern Australia's rainfall have declined over recent decades.

Scientists find genetic links to Attention Deficit Hyperactivity Disorder and Parkinson’s Disease.

Taming wild elephant calves increases their stress which has implications for their physical health.

SpaceTime covers the latest news in astronomy & space sciences.

The show is available every Monday, Wednesday and Friday through Apple Podcasts (itunes), Stitcher, Google Podcast, Pocketcasts, SoundCloud, Bitez.com, YouTube, your favourite podcast download provider, and from www.spacetimewithstuartgary.com

SpaceTime is also broadcast through the National Science Foundation on Science Zone Radio and on both i-heart Radio and Tune-In Radio.

SpaceTime daily news blog: http://spacetimewithstuartgary.tumblr.com/

SpaceTime facebook: www.facebook.com/spacetimewithstuartgary

SpaceTime Instagram @spacetimewithstuartgary

SpaceTime twitter feed @stuartgary

SpaceTime YouTube: @SpaceTimewithStuartGary

SpaceTime -- A brief history

SpaceTime is Australia’s most popular and respected astronomy and space science news program – averaging over two million downloads every year. We’re also number five in the United States. The show reports on the latest stories and discoveries making news in astronomy, space flight, and science. SpaceTime features weekly interviews with leading Australian scientists about their research. The show began life in 1995 as ‘StarStuff’ on the Australian Broadcasting Corporation’s (ABC) NewsRadio network. Award winning investigative reporter Stuart Gary created the program during more than fifteen years as NewsRadio’s evening anchor and Science Editor. Gary’s always loved science. He studied astronomy at university and was invited to undertake a PHD in astrophysics, but instead focused on his career in journalism and radio broadcasting. Gary’s radio career stretches back some 34 years including 26 at the ABC. He worked as an announcer and music DJ in commercial radio, before becoming a journalist and eventually joining ABC News and Current Affairs. He was part of the team that set up ABC NewsRadio and became one of its first on air presenters. When asked to put his science background to use, Gary developed StarStuff which he wrote, produced and hosted, consistently achieving 9 per cent of the national Australian radio audience based on the ABC’s Nielsen ratings survey figures for the five major Australian metro markets: Sydney, Melbourne, Brisbane, Adelaide, and Perth. The StarStuff podcast was published on line by ABC Science -- achieving over 1.3 million downloads annually. However, after some 20 years, the show finally wrapped up in December 2015 following ABC funding cuts, and a redirection of available finances to increase sports and horse racing coverage. Rather than continue with the ABC, Gary resigned so that he could keep the show going independently. StarStuff was rebranded as “SpaceTime”, with the first episode being broadcast in February 2016. Over the years, SpaceTime has grown, more than doubling its former ABC audience numbers and expanding to include new segments such as the Science Report -- which provides a wrap of general science news, weekly skeptical science features, special reports looking at the latest computer and technology news, and Skywatch – which provides a monthly guide to the night skies. The show is published three times weekly (every Monday, Wednesday and Friday) and available from the United States National Science Foundation on Science Zone Radio, and through both i-heart Radio and Tune-In Radio.

#science#space#astronomy#physics#news#nasa#astrophysics#esa#spacetimewithstuartgary#starstuff#spacetime#relativity#cosmology#string theory#hubble space telescope#hubble telescope#hubble tension#solar system#james webb space telescope#the pleiades

9 notes

·

View notes

Text

Global Palladium Silver Target Market: Strategic Insights and Growth Analysis 2025–2032

Global Palladium Silver Target Market continues to demonstrate steady growth, with its valuation reaching US$ 185 million in 2024. According to the latest industry analysis, the market is projected to grow at a CAGR of 5.5%, reaching approximately US$ 285 million by 2032. This growth is largely fueled by increasing applications in display technologies, solar energy, and advanced automotive components, especially in mature and emerging economies where demand for high-performance materials continues to rise.

Palladium silver targets are critical in thin-film deposition processes, particularly in the production of semiconductors, optical coatings, and photovoltaic cells. Their superior properties, including high conductivity and durability, make them indispensable in industries requiring precision and reliability. As the demand for sustainable and efficient energy solutions grows, manufacturers and research institutions are focusing on innovative applications and enhanced material performance.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/293923/global-palladium-silver-target-forecast-market-2025-2035-296

Market Overview & Regional Analysis

Asia-Pacific dominates the global palladium silver target market, driven by strong demand from semiconductor and electronics manufacturers in China, Japan, and South Korea. The region benefits from robust industrial infrastructure, government support for high-tech industries, and increasing investments in renewable energy projects, all of which contribute to market expansion.

North America's market growth is propelled by advancements in automotive electronics and the presence of leading semiconductor companies. Europe, meanwhile, is seeing steady demand due to its strong focus on solar energy and green technologies. Emerging regions like Latin America and the Middle East are expected to witness gradual growth, supported by industrial modernization and infrastructure development.

Key Market Drivers and Opportunities

The market is driven by the rapid expansion of display technologies, including OLED and LCD panels, along with increasing adoption in solar cell manufacturing. The automotive sector, with its shift toward electric vehicles and advanced driver-assistance systems, presents significant opportunities for palladium silver targets in sensor and semiconductor applications.

Additional growth potential lies in the development of next-generation electronics and the increasing need for high-performance coatings in aerospace and medical devices. As industries continue to prioritize efficiency and miniaturization, the demand for precision-engineered palladium silver targets is expected to surge.

Challenges & Restraints

The market faces challenges including price volatility of raw materials, particularly palladium and silver, which can impact production costs. Environmental regulations concerning material usage and disposal also pose constraints, while competition from alternative materials such as pure silver or copper targets remains a consideration for industry players.

Market Segmentation by Type

Plane Target

Rotating Target

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/293923/global-palladium-silver-target-forecast-market-2025-2035-296

Market Segmentation by Application

Display

Solar Energy

Automobile

Other

Market Segmentation and Key Players

Lesker

SAM

Nexteck

ZNXC

Beijing Guanli

Kaize Metals

E-light

German tech

Beijing Scistar Technology

FDC

Goodfellow

XINKANG

Sputtertargets

Cathaymaterials

STMCON

Changsha Xinkang Advanced Materials Co., Ltd.

Report Scope

This report presents a comprehensive analysis of the global and regional markets for Palladium Silver Targets, covering the period from 2024 to 2032. It includes detailed insights into the current market status and outlook across various regions and countries, with specific focus on:

Sales, sales volume, and revenue forecasts

Detailed segmentation by type and application

In addition, the report offers in-depth profiles of key industry players, including:

Company profiles

Product specifications

Production capacity and sales

Revenue, pricing, gross margins

Sales performance

The report examines the competitive landscape, highlighting the major vendors and identifying the critical factors expected to influence market growth. The research also assesses industry challenges, technological trends, and emerging opportunities that could shape the market's future.

Get Full Report Here: https://www.24chemicalresearch.com/reports/293923/global-palladium-silver-target-forecast-market-2025-2035-296

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

#Global Palladium Silver Target Market#Global Palladium Silver Target Market Share#Global Palladium Silver Target Market Size#Global Palladium Silver Target Market Trends

0 notes

Text

Excerpt from this story from Anthropocene Magazine:

I write about the climate and energy for a living and even I can’t quite wrap my head around how cheap low-carbon power technologies have gotten. The cost of onshore wind energy has dropped by 70% over just the last decade, and that of batteries and solar photovoltaic by a staggering 90%. Our World in Data points out that within a generation, solar power has gone from being one of the most expensive electricity sources to the cheapest in many countries—and it’s showing little signs of slowing down.

So where does this all end?

Back in the 1960s, the nuclear industry promised a future in which electricity was too cheap to meter. Decades later, the same vision seems to be on the horizon again, this time from solar. It seems, well, fantastic. Perhaps (almost) free renewable power leads to climate utopia. Then again, should we be careful what we wish for?

The Road To Decarbonization Is Paved With Cheap Green Power

1. More renewables = less carbon. The math isn’t complicated. The faster we transition to clean energy, the less carbon dioxide we’re adding to the atmosphere and the fewer effects of global warming we will suffer.While humanity is still emitting more greenhouse gases than ever, the carbon intensity of electricity production has been dropping for well over a decade.

2. Cheap, clean power also unlocks humanitarian goals. Modern civilization rests on a foundation of electricity. Beyond its obvious uses in heating, cooling, cooking, lighting and data, electricity can decarbonize transportation, construction, services, water purification, and food production. Increasing the supply and reducing the cost of green electricity doesn’t just help the climate, it improves equity and quality of life for the world’s poorest.

3. Scrubbing the skies will take a lot of juice. Once we get emissions under control, it’s time to tackle the mess we’ve made of the atmosphere. Today’s direct air capture (DAC) systems use about two megawatt hours of electricity for every ton of CO2 plucked from fresh air. Scale that up to the 7 to 9 million tons we need to be removing annually in the US by 2030, according to the World Resources Institute, and you’re looking at about 0.5% of the country’s current energy generation. Scale it again to the nearly 1,000 billion tons the IPCC wants to sequester during the 21st century, and we’ll need every kilowatt of solar power available—the cheaper the better.

Cheap Power Has Hidden Costs

1. Cheap technology doesn’t always mean cheap power. If solar cells are so damn cheap, why do electricity bills keep rising? One problem is that renewables are still just a fraction of the energy mix in most places, about 20% in the US and 30% globally. This recent report from think-tank Energy Innovation identifies volatility in natural gas costs and investments in uneconomic coal plants as big drivers for prices at the meter. Renewables will have to dominate the energy mix before retail prices can fall.

2. The cheaper the power, the more we’ll waste. Two cases in point: cryptocurrency mining and AI chat bots. Unless we make tough social and political decisions to fairly price carbon and promote climate action, the market will find its own uses for all the cheap green power we can generate. And they may not advance our climate goals one inch.

3. Centuries of petro-history to overcome. Cheap power alone can only get us so far. Even with EVs challenging gas cars, and heat pumps now outselling gas furnaces in the US, there is a monumental legacy of fossil fuel systems to dismantle. Getting 1.5 billion gas cars off the world’s roads will take generations, and such changes can have enormous social costs. To help smooth the transition, the Center for American Progress suggests replacing annual revenue-sharing payments from coal, oil, and natural gas production with stable, permanent distributions for mining and oil communities, funded by federal oil and gas revenue payments.

5 notes

·

View notes

Text

The Elegance of Tech-Savvy Luxury Homes in Gurgaon: A Modern Investment Opportunity

Gurgaon, a vibrant city close to Delhi, is a hotspot for people eager to invest in real estate. A standout trend in 2025 is tech-savvy luxury homes—beautiful, high-end residences packed with smart technology to make life easier, safer, and more comfortable. These homes are catching the eye of buyers looking for residential property in Gurgaon, especially those who love modern gadgets and a high-tech lifestyle. This article explains why tech-savvy luxury homes are a smart investment, what makes them unique, and how you can tap into this cutting-edge trend to buy property in Gurgaon’s thriving market.

What Are Tech-Savvy Luxury Homes?

Tech-savvy luxury homes are upscale houses loaded with advanced technology to enhance daily living. These homes often feature smart lighting, voice-controlled appliances, and high-tech security systems. In Gurgaon, projects in areas like Sector 115 or along Dwarka Expressway offer tech-savvy homes with additions like automated curtains, smart thermostats, and integrated home entertainment systems. Luxury homes in Gurgaon make these homes even more appealing with extras like biometric locks, AI-powered home assistants, and solar-powered energy systems.

These homes are all about convenience and style. For example, some builders in Gurgaon are creating houses with “smart hubs” that include touch-screen control panels, wireless charging stations, and high-speed Wi-Fi zones, perfect for families, tech professionals, or NRIs who want a home that feels like a futuristic retreat.

Why Tech-Savvy Luxury Homes Are a Great Investment

Gurgaon’s real estate market is booming, with luxury homes in Gurgaon accounting for 77% of home sales in 2024, up from 72% in 2023, according to a JLL India report. Tech-savvy luxury homes are a top choice for investors because they’re rare and in high demand. Here’s why they’re a smart pick for buying residential property in Gurgaon:

High Rent Money: These homes attract renters who love technology, like IT professionals or startup founders, paying ₹2.9 lakh to ₹5.5 lakh per month. This gives investors a return of 9.1% to 11.5% every year, better than most regular homes.

Big Price Growth: Luxury homes in Gurgaon with smart features have surged 58% to 64% in price in 2024 because they’re unique. Projects in Sector 115 now cost ₹2.65 lakh to ₹3.1 lakh per square foot, up from ₹1.9 lakh in 2023.

Strong Demand: The tech appeal means 99% of these homes are rented out or sold quickly, as wealthy buyers want modern, connected spaces.

Tech Lifestyle: These homes fit Gurgaon’s tech-driven, modern vibe, making them more valuable when you sell them later.

City Growth: Gurgaon’s new tech parks, innovation hubs, and Metro expansion planned for 2026 make these homes even more attractive.

In February 2025, a major builder in Sector 115 launched 44 tech-savvy luxury homes priced between ₹5.5 crore and ₹12 crore. They sold 100% of the homes in two days, earning ₹690 crore, showing how much people want luxury homes in Gurgaon with smart designs.

How to Invest in Tech-Savvy Luxury Homes

Buying a tech-savvy luxury home as a residential property in Gurgaon requires some planning, but it’s an exciting choice. Here’s a simple step-by-step guide to help you get started:

Step 1: Pick the Right Area

Look for places like Sector 115, Dwarka Expressway, or Sector 114, where new projects have tech-savvy homes. These areas are near tech hubs like Cyber City and lively spots like malls, making them ideal for luxury homes in Gurgaon that people want to buy or rent.

Step 2: Choose a Trusted Builder

Go with builders who have a solid history of building high-quality homes with smart features. Check their past projects to ensure they deliver the tech systems they promise, so your investment in property to buy in Gurgaon is safe.

Step 3: Check for Tech Features

When choosing a home, look for these features:

Smart Controls: Voice-activated lights or appliances, found in many top projects.

Tech Amenities: Features like biometric locks or AI assistants, common in luxury homes in Gurgaon.

Energy Efficiency: Solar panels or smart energy monitors, offered in newer homes.

For example, Sector 115 homes have smart hubs with touch-screen panels and wireless charging, great for a high-tech lifestyle.

Step 4: Plan Your Money

Tech-savvy luxury homes cost ₹5.5 crore to ₹12 crore. Save 15-20% of the price for a down payment and get a home loan with interest rates of 8.5% to 9.7%. Set aside ₹2,000 to ₹4,500 per month for upkeep, like updating software or servicing smart systems.

Step 5: Rent or Sell Smartly

Rent your residential property in Gurgaon to tech-savvy renters, like software engineers or digital nomads, for ₹2.9 lakh to ₹5.5 lakh per month. Focus on renters near tech areas like Dwarka Expressway or Sector 29. Or, keep the home for 5-7 years and sell it for 25-35% more. For example, Sector 115 homes bought at ₹1.9 lakh per square foot in 2023 are now worth ₹2.65 lakh.

Step 6: Keep the Home in Good Shape

Spend ₹3,500 to ₹7,500 a year on maintenance, like updating smart devices, checking security systems, or upgrading solar panels. Keeping the home high-tech helps attract renters and boosts its value when you sell.

Success Stories from Investors

In Sector 115, a 39-year-old investor, bought a 3,800-square-foot tech-savvy luxury home for ₹5 crore in 2023. He rents it out for ₹4.1 lakh per month, earning a 9% return each year, and its value is now ₹9.3 crore, up 86%. “The tech vibe is a huge hit with renters,” he says.

On Dwarka Expressway, Shalini, an NRI, spent ₹10 crore on a luxury home in Gurgaon with an AI assistant in 2024. She earns ₹5.3 lakh monthly rent and plans to sell for ₹14 crore in five years, loving the “modern, connected vibe” of these homes.

Benefits Beyond Money

Investing in tech-savvy luxury homes as property to buy in Gurgaon offers more than just profits:

Unique Appeal: The smart design attracts renters who want something special, keeping your home rented out.

Happy Renters: Modern, connected spaces in luxury homes in Gurgaon make renters stay longer.

Stands Out: The tech-savvy look makes these homes more appealing to buyers when you sell.

Matches Gurgaon’s Vibe: With 115 new tech hubs and innovation events in 2024, tech-savvy homes fit Gurgaon’s modern, digital lifestyle.

Challenges and How to Handle Them

Tech-savvy luxury homes come with a few challenges, but they’re easy to manage:

High Price: Starting at ₹5.5 crore, they’re costly. Solution: Look for smaller tech-savvy homes in Sector 126 for ₹3 crore or team up with other investors.

Upkeep Costs: Smart features need regular care, costing ₹1,500-₹2,500 a year. Solution: Save 1% of the home’s value for maintenance or hire local tech experts.

Specific Renters: These homes appeal to tech lovers. Solution: Advertise to IT workers or gadget enthusiasts on sites like Magicbricks.

Market Changes: Real estate prices can shift. Solution: Buy in stable areas like Dwarka Expressway to lower risks.

What’s Happening in Gurgaon Right Now

In March 2025, a major builder announced that 99% of their new projects in Gurgaon will include tech-savvy designs, as demand for these homes grew by 100%. The Sector 115 project, launched in February 2025, earned ₹690 crore from 43 tech-savvy luxury homes priced at ₹5.5-12 crore, showing how popular these luxury homes in Gurgaon are.

In April 2025, Haryana’s government offered tax breaks for homes with innovative or tech-focused features. Investors should check if their property to buy in Gurgaon qualifies for these savings.

People on X are buzzing about tech-savvy luxury homes, with many saying builders are “bringing the future to Gurgaon.” Some worry about the high costs, but most see luxury homes in Gurgaon as perfect for buyers who love technology, making them a great investment.

What’s Next for Tech-Savvy Luxury Homes

Gurgaon’s luxury home market, worth ₹6,300 crore in 2025, is growing 67% every year, faster than Mumbai. Top projects, especially in Sector 115 and Dwarka Expressway, are expected to rise in value by 51-57% yearly because people love their smart features. Luxury homes in Gurgaon will keep attracting wealthy buyers, with builders planning 2,350 more tech-savvy homes by 2027.

Gurgaon’s tech scene is thriving, with the city hosting a major technology and innovation expo in May 2025, expecting 360,000 visitors. This fits perfectly with the rise of tech-savvy luxury homes, as people want homes that offer convenience and modernity. Investors can expect 55-65% returns over seven years, thanks to the rarity and high-tech appeal of these homes.

In Conclusion

Tech-savvy luxury homes are a dynamic and growing trend in Gurgaon’s real estate, giving investors a chance to make money from modern, in-demand properties. Whether you’re thrilled about the smart designs from top builders, the quality of new projects, or the futuristic charm of luxury homes in Gurgaon, these homes are a fantastic choice. With Gurgaon’s market soaring, now is the perfect time to invest in residential property in Gurgaon that mixes technology, style, and big profits for a modern future.

0 notes

Text

0 notes

Text

Curtain Walls Market is driven by Energy Efficiency Demand

Curtain walls are non-load-bearing façade systems assembled from lightweight materials such as glass, aluminum, and steel. These architectural elements deliver aesthetic appeal and natural lighting while enhancing thermal insulation to reduce energy consumption in buildings. As part of green building strategies, curtain walls lower operational costs, improve occupant comfort, and meet rigorous sustainability standards. Both unitized and stick-built systems offer design flexibility to handle diverse climatic conditions and structural loads. The rising adoption of smart glazing technologies, including electrochromic and photovoltaic glass, provides dynamic solar control and further energy savings.

Prefabricated panels accelerate construction schedules and reduce on-site labor, addressing industry challenges of time and cost overruns. Market research and market insights underline that technological advancements in framing systems and sealants are improving durability and reducing maintenance costs over the building lifecycle. With urbanization driving the construction of commercial, residential, and institutional projects, the market size for innovative Curtain Walls Market solutions continues to expand globally.

The curtain walls market is estimated to be valued at USD 54.94 Bn in 2025 and is expected to reach USD 93.55 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.9% from 2025 to 2032. Key Takeaways Key players operating in the Curtain Walls Market are:

-AGC Inc.

-Central Glass Co. Ltd.

-EFCO Corporation

-EFP International B.V.

-Elicc Group

These market companies hold prominent market share through continuous market research and product innovation. AGC Inc. leads with advanced low-emissivity and heat-reflective glass solutions, while Central Glass Co. Ltd. focuses on large-format panels designed for earthquake-prone regions. EFCO Corporation offers modular aluminum framing systems that streamline installation, and EFP International B.V. integrates smart shading technologies. Elicc Group delivers end-to-end façade management services, from design through maintenance. Strategic collaborations and licensed technologies help these key players expand their industry share and reinforce competitive positioning. A recent market report notes their aggressive market growth strategies, including capacity expansions and digital marketing initiatives. As city skylines continue to evolve, growing demand for energy-efficient building envelopes is a critical market driver. Market trends show increased focus on LEED and BREEAM certifications, prompting developers to invest in high-performance curtain wall systems. The convergence of market insights and advanced building information modeling (BIM) tools optimizes façade design, enhancing thermal comfort and daylighting. Furthermore, stringent building codes addressing thermal performance and seismic resilience are catalyzing retrofit projects in mature markets. These market dynamics create opportunities for innovation and underline the sector’s potential to address global sustainability goals, supporting robust market growth. Moreover, demand for customization, glazing options, and integrated PV modules is creating new market opportunities for façade specialists.

‣ Get More Insights On: Curtain Walls Market

‣ Get this Report in Japanese Language: カーテンウォール市場

‣ Get this Report in Korean Language: 커튼월마켓

0 notes

Text

North America SWIR Market Size, Share, Demand, Future Growth, Challenges and Competitive Analysis

Executive Summary North America SWIR Market :

The North America SWIR Market size was valued at USD 645.43 Million in 2024 and is expected to reach USD 1557.43 Million by 2032, at a CAGR of 11.6% during the forecast period

Analysis and interpretation of market research data is used to build this North America SWIR Market industry report which contains information and knowledge that can be used to predict future events, future products, marketing strategy, actions or behaviours. This market analysis and information given in it provides the insights which bring marketplace clearly into focus and thus help organizations make better decisions. In this era of globalization, many businesses insist for International market research to support decision making and North America SWIR Market report does the same. It includes systematic gathering and analysis of information about individuals or organisations which is conducted through social and opinion research.

While preparing this North America SWIR Market report, individuality of respondents is kept secret and no promotional approach is made to them. And even though individuals provide information, market research team skilfully and valuably handles it. Not to mention, precise and exact information is provided to drive your business in the right direction with this report and that to at the best price. The basic steps have been employed to conduct market research analysis in this North America SWIR Market report which includes survey, focus groups, personal interviews, observations and field trials.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive North America SWIR Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/north-america-swir-market

North America SWIR Market Overview

**Segments**

- By Technology: Indium Gallium Arsenide, Mercury Cadmium Telluride, Indium Antimonide, and Lead Sulfide. - By Scanning Type: Area Scan and Line Scan. - By Industry: Semiconductor Fabrication, Solar Power, Aerospace and Defense, Scientific Research, and Others.