#Stock market trends in India

Text

Mastering the Share Market: A Comprehensive Basic Guide for Share Market Beginners

Introduction:

The Indian share market is a dynamic landscape offering abundant opportunities for investors. This blog aims to demystify the complexities of the market, empowering readers with insights and strategies for informed decision-making.

Section 1: Understanding the Share Market

1. What is the Share Market?

The share market, also known as the stock market, is a platform where the buying,…

View On WordPress

#How to invest in the stock market#infosys company share price#national stock exchange#nse national stock exchange#punjab national bank stock price#rate of share of reliance industries#reliance industries stock price#sensex index today#sensex sensex today#sensex today#share market basics#share market news#share price punjab national bank#state bank of india stock price#stock market analysis#stock market for beginners#Stock market investing strategies#Stock market trends in India#tatasteel share price today#Tips for investing in the stock market#todays sensex

0 notes

Text

In a testament to its robust performance and promising future prospects, shares of ABB India soared by 7% during early trading hours today, reaching an unprecedented peak of ₹6,341.90 per share. The surge came on the heels of a compelling report by global brokerage firm UBS, which not only upgraded its target price for the stock but also outlined a bullish scenario for investors.

The latest report from UBS revised the target price for ABB India to ₹7,550 per share, a significant uplift from its previous target of ₹5,380. This upward revision was underpinned by a multitude of factors, including a high double-digit growth trajectory across both domestic and export orders within the motion and low-voltage EP (Electrical Products) segments. Additionally, UBS cited a steady ramp-up in Operating Profit Margins (OPMs) as a contributing factor to its optimistic outlook on the stock.

0 notes

Text

Investment Strategies

let’s delve into some detailed investment strategies with examples applicable to the Indian stock market:

1. Long-Term Investing:

Strategy: Invest in fundamentally strong companies with a long-term horizon, aiming to benefit from compounding.

Example: Invest in a well-established company like HDFC Bank (HDFCBANK) known for its stable growth, strong financials, and consistent dividend…

View On WordPress

#BSE (Bombay Stock Exchange)#Equity Market#Exchange-Traded Funds (ETFs)#Foreign Institutional Investors (FIIs)#Foreign Portfolio Investment (FPI)#Indian Stock Market#Indian Stock Market BSE (Bombay Stock Exchange) NSE (National Stock Exchange) Sensex Nifty Stock Exchanges Stock Indices Equity Market Inves#Investment in India#Market Analysis#Market Performance#Market Regulation#Market Trends#Market Volatility#Mutual Funds#NSE (National Stock Exchange)#Sensex#Stock Exchanges#Stock Indices#Stock Investing#Stock Trading

0 notes

Text

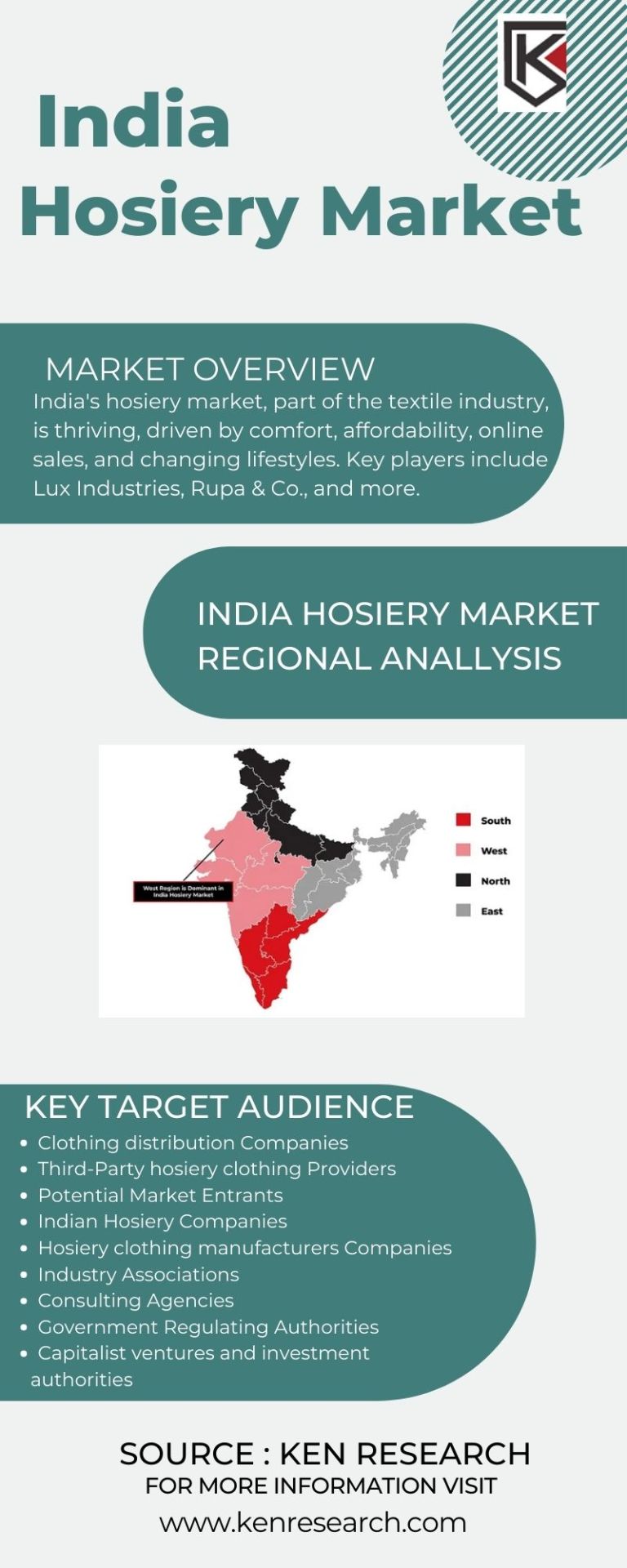

Consumer Preferences and Sustainability in India's Hosiery Market

Discover how choices in body stockings and hosiery socks are influenced by sustainability considerations. This analysis delves into the evolving landscape of consumer preferences and sustainability practices in the thriving Indian hosiery market.

#India Hosiery Market Research#Hosiery Industry Analysis India#Hosiery Market Trends#Body Stockings Market India#Hosiery Socks Market#Knee Highs Market India#Hold-Ups Market Analysis#Men's Hosiery Market India#Women's Hosiery Market#Regional Hosiery Market Insights

0 notes

Text

What Is Ethanol Fuel?

How To Use Ethanol Fuel In Vehicles?

Ethanol fuel, commonly referred to as ethanol, is a type of biofuel made from renewable sources such as corn, sugarcane, or other plant materials. It is an alternative to traditional gasoline and is used as a vehicle fuel in some regions of the world. Ethanol is considered a renewable energy source because the crops used to produce it can be replanted and harvested annually, business news.

Here's how ethanol is used as a car fuel:

Production:

Ethanol is typically produced through a fermentation process, where sugars or starches from crops like corn or sugarcane are converted into alcohol. This alcohol is then purified to create ethanol.

Blending:

Ethanol is commonly blended with gasoline to create a fuel mixture. The most common ethanol-gasoline blends in the United States are e10 and e85, where "e" stands for ethanol and the number indicates the percentage of ethanol in the blend. E10 contains 10% ethanol and 90% gasoline, while e85 contains 85% ethanol and 15% gasoline.

Compatibility:

Many vehicles on the road today are designed to run on e10, which is considered a standard gasoline blend in many countries. Flex-fuel vehicles (FFVS) are specially designed to run on higher ethanol blends like E85, which require different engine components to handle the higher ethanol content.

Performance:

Ethanol has a higher octane rating than regular gasoline, which can lead to increased engine efficiency and performance when used in appropriately designed engines. However, it contains less energy per gallon than gasoline, so vehicles may experience a decrease in fuel efficiency when using higher ethanol blends like E85.

Environmental Benefits:

Ethanol is considered a more environmentally friendly fuel because it can reduce greenhouse gas emissions and air pollutants compared to traditional gasoline. It also helps reduce dependence on fossil fuels, Business news in hindi.

Availability:

The availability of ethanol as a car fuel varies by region. Some areas have a well-established infrastructure for distributing ethanol blends, while others may have limited access to ethanol fuels.

Considerations:

While ethanol has environmental benefits and is a renewable resource, there are also some concerns. It can be energy-intensive to produce, and the use of food crops for ethanol production can raise food prices and lead to deforestation in some cases. Additionally, some older vehicles and small engines may not be compatible with ethanol blends above E10, so it's important to check your vehicle's compatibility before using higher ethanol blends.

Overall, ethanol fuel is one of the alternative fuel options that can reduce the environmental impact of transportation and decrease reliance on fossil fuels when used in vehicles designed to accommodate it.

The cost of ethanol fuel can vary significantly depending on several factors, including the region, the cost of production, government subsidies or incentives, and the blend of ethanol used (e.g., E10, E85). In some regions, ethanol-blended fuels like E10 (containing 10% Ethanol) are priced competitively with regular gasoline, and consumers may not notice a significant difference in cost.

However, it's important to note that the price of fuel, whether it's ethanol or gasoline, is subject to fluctuations in global oil prices, supply and demand, and other economic factors. Additionally, if you are considering using a higher ethanol blend like E85 (containing 85% ethanol), the price may be lower per gallon due to the higher ethanol content, but your vehicle's fuel efficiency may be lower, so your overall cost per mile driven could be higher, Business news in hindi.

As for the specific price of ethanol fuel being 50 RS (Indian Rupees), it would depend on the current market conditions and location in India or any other country where you are considering purchasing ethanol fuel. Fuel prices can vary widely from one place to another and can change over time.

To find the current price of ethanol fuel in your area, you can check with local gas stations, visit government websites or apps that provide fuel price information, or consult local news sources for the latest updates on fuel prices. Keep in mind that fuel prices can fluctuate frequently, so it's a good idea to check regularly if you are looking for the most up-to-date pricing information.

#Business news in hindi#business news#personal finance news#personal finance tips#real estate news#share market news india#stock market news#nse#bse#automobile news#auto sector news#mutual fund trends#ipo analysis

0 notes

Text

The Meaning of Aggregate Stock Market

Introduction

Product mix refers to the overall performance and behavior of a group of products traded in different products. It provides a picture of the cost mix and performance of many products that represent the broader market. Understanding the impact of the entire stock market is important for investors, analysts, and economists as it provides insight into the overall health of the stock…

View On WordPress

0 notes

Text

Unveiling the Truth: Why Indian Traders Struggle

Introduction:

Discover the harsh reality behind the staggering losses incurred by Indian traders and the misleading influences that perpetuate their financial downfall.

The Allure and Deception of Option Trading

Indian traders, enticed by the allure of option trading, have faced devastating losses as influencers peddle unrealistic dreams of instant wealth. Many have fallen victim to their lack of expertise and adherence to faulty trading methodologies. This trend highlights the crucial need for informed decision-making and market understanding.

Navigating the Terrain of Option and Future Trading

Option and Future Trading in India offer lucrative opportunities for profit, yet the landscape is fraught with risks stemming from market volatility and regulatory challenges. Leveraging tools like Odoo software can streamline operational tasks, providing a competitive edge amidst this dynamic environment.

Decoding Call and Put Options

Understanding call and put options is pivotal in the realm of stock trading. Call options grant the right to purchase a stock, while put options enable selling before a specified date. Mastery of contract components such as premiums, strike prices, and durations empowers traders to make informed decisions aligned with market prognostications.

The Predicament of Indian Traders

A staggering 90% of Indian traders face losses within the option trading sphere, often succumbing to impulsive and speculative behavior akin to gambling. The influx of retail traders gravitating towards options denotes the allure of high returns amidst minimal investments, yet the unprepared majority find themselves ensnared in a perilous financial labyrinth.

Unmasking Misleading Financial Influencers

The proliferation of misleading financial influencers within the stock market arena has led to a surge in novice investors lured by promises of easy riches. Their dissemination of false information and illicit practices have catalyzed regulatory interventions aimed at safeguarding unsuspecting clientele from financial exploitation.

The Pitfalls of Emotional Trading

Retail traders in India often fall prey to emotional trading impulses, mirroring gambling tendencies rather than strategic investment methodologies. Their reluctance to adapt strategies post-loss, driven by ego and emotional attachment, underscores the imperative of disciplined risk management and psychological resilience in navigating the tumultuous trading landscape.

Conclusion:

In a realm saturated with financial misinformation and unchecked risks, prudent decision-making coupled with astute market comprehension stand as the pillars of sustainable trading success. By exposing the perils of uninformed trading practices and advocating for educative initiatives, Indian traders can transcend the cycle of losses and cultivate a more secure financial future.

3 notes

·

View notes

Text

Invest digitally, securely, in the market

A Demat account is like a digital locker for your investments, such as shares and mutual funds, in India. It's managed by depositories like NSDL and CDSL and helps you trade and manage your investments easily. With no minimum balance required, it's a convenient way to buy, sell, and hold securities electronically. It also offers benefits like easy access to the stock market, applying for IPOs, and managing your portfolio efficiently. Just be sure to choose a reliable broker, stay updated on market trends, and understand the risks involved in trading

2 notes

·

View notes

Text

Nifty Future Tips | mcx Gold Tips | Avalon Technologies - Intraday Tips

Which stock is best for intraday tomorrow?

How to choose the best stocks for intraday trading in Indore, India· 1. Enquire us for liquid stocks · 2. Avoid investing in highly volatile stocks · 3. Pick only those stocks that move with the current market trend.

Are you looking for the best nifty tips provider company in Indore?

Then you are at the right place as Intraday Tip's only motto is to save the money of the client first and then provide the right intraday tips to where to invest the money to gain profit. We send regular live updates and briefs (of advice on-call) through SMS also after the end of every call. We have dedicated software allocated for sending sms share market tips to our happy clients.

#nifty news#nifty future tips#mcx gold tips#stock future tips#intraday tips for tomorrow free#intraday trading#sure shot jackpot calls#share market tips#stock future tips provider

8 notes

·

View notes

Text

Unlocking Hidden Value: How a Liquidation Company in India Can Help You Sell Unsold Stock Effectively

Understanding liquidation and its benefits for businesses

In today's fast-paced business world, it's not uncommon for companies to find themselves with excess inventory. Whether it's due to overestimating demand, changes in market trends, or a need to make space for new products, surplus stock can pose a challenge for businesses. This is where a liquidation company in India can play a crucial role.

Liquidation is the process of selling off excess inventory at a discounted price, allowing businesses to recover some of the investment tied up in unsold stock. It offers several benefits for companies, including reducing storage costs, freeing up capital for other business activities, and minimizing losses on slow-moving or outdated products.

By partnering with a liquidation company in India, businesses can tap into a network of buyers who are specifically looking for discounted merchandise. These companies have expertise in managing surplus inventory and can help businesses find the right channels to sell their unsold stock effectively.

The role of a liquidation company in India

A liquidation company in India acts as an intermediary between businesses with surplus inventory and buyers who are interested in purchasing discounted merchandise. They have the infrastructure, expertise, and connections to facilitate the efficient sale of excess stock.

One of the key roles of a liquidation company is to assess the value of the surplus inventory. They conduct thorough evaluations to determine the condition, market demand, and potential resale value of the products. Based on this assessment, the liquidation company advises businesses on the best course of action, whether it's selling the stock as a whole or breaking it down into smaller lots for better marketability.

Additionally, a liquidation company in India has access to various sales channels, both online and offline, where they can showcase the surplus inventory to potential buyers. This includes wholesale liquidation stores, online marketplaces, and specialized liquidation platforms. They handle the logistics of the sales process, from marketing and advertising to packaging and shipping, ensuring a seamless experience for both the seller and the buyer.

Types of surplus inventory and how a liquidation company can help

Surplus inventory can come in various forms, depending on the nature of the business. It can include overstocked items, seasonal products, returned goods, discontinued items, or even damaged merchandise. Each type of surplus inventory requires a tailored approach for effective liquidation.

A liquidation company in India has the expertise to handle different types of surplus inventory. They understand the market dynamics and buyer preferences for various product categories. For example, if a business has surplus garments, the liquidation company can tap into their network of buyers specifically interested in discounted clothing. They can help businesses navigate the complexities of garment liquidation, ensuring maximum value is extracted from the surplus stock.

Moreover, a liquidation company can assist businesses in identifying the most suitable sales channels for their surplus inventory. They have access to a wide range of liquidation sites and platforms in India, where they can list the products for sale. These platforms attract buyers who are actively seeking discounted merchandise, increasing the chances of a successful sale.

The process of liquidating your old stock effectively

Liquidating old stock effectively requires careful planning and execution. It involves several steps that a liquidation company in India can guide businesses through.

The first step is to conduct a thorough inventory assessment. This includes categorizing the surplus stock, evaluating its condition, and estimating its resale value. A liquidation company can assist in this process by providing their expertise in appraising different types of products.

Once the inventory assessment is complete, the next step is to decide on the most appropriate sales channels. This can vary depending on the nature of the surplus inventory and the target market. A liquidation company can help businesses choose the right platforms or sales partners to maximize the chances of a successful sale.

After selecting the sales channels, businesses need to develop a marketing and advertising strategy to attract potential buyers. A liquidation company can assist in creating compelling product listings, optimizing keywords, and leveraging their network to reach a wider audience.

Once the sales are initiated, the liquidation company takes care of the logistics, including packaging, shipping, and customer support. They ensure a smooth transaction, from the moment a buyer places an order to the delivery of the products.

The advantages of using a liquidation platform in India

A liquidation platform in India provides businesses with a dedicated marketplace to sell their surplus stock. These platforms have several advantages over traditional sales channels.

Firstly, a liquidation platform offers a targeted audience of buyers who are specifically looking for discounted merchandise. This increases the chances of a quick and successful sale, as the platform attracts customers who are actively seeking deals.

Secondly, a liquidation platform provides businesses with a streamlined process for listing and selling their surplus inventory. They offer user-friendly interfaces, easy-to-use tools for creating product listings, and secure payment gateways. This simplifies the sales process for businesses and ensures a seamless experience for both the seller and the buyer.

Additionally, a liquidation platform often has a broader reach than individual businesses can achieve on their own. They leverage their network and marketing efforts to attract a large number of buyers, increasing the visibility and exposure of the surplus stock.

Lastly, a liquidation platform in India offers businesses the opportunity to connect with other sellers and buyers in the same industry. This can lead to potential collaborations, partnerships, or even new business opportunities.

How to choose the right liquidation company for your business

Choosing the right liquidation company for your business is crucial to ensure a successful and efficient liquidation process. Here are some factors to consider when making your decision:

Experience and expertise: Look for a liquidation company in India that has a proven track record and expertise in your specific industry. They should have experience handling similar products and be familiar with the market dynamics.

Sales channels: Consider the sales channels that the liquidation company has access to. Evaluate whether these channels align with your target market and the nature of your surplus inventory. A diverse range of sales channels can increase the chances of finding the right buyers.

Reputation and reviews: Research the reputation of the liquidation company by reading customer reviews and testimonials. Look for feedback from businesses who have previously used their services to gauge their reliability and customer satisfaction.

Transparent pricing: Ensure that the liquidation company provides clear pricing structures and transparent fee structures. It's important to understand the costs involved and how they will impact your overall returns.

Support and communication: Choose a liquidation company that offers excellent customer support and clear communication throughout the entire process. They should be responsive to your queries and provide regular updates on the progress of the liquidation.

Best practices for selling surplus stock through a liquidation company

To maximize the value of your liquidated surplus, it's important to follow some best practices. Here are a few tips to keep in mind:

Optimize your product listings: Take the time to create compelling and accurate product descriptions. Use relevant keywords that will attract potential buyers and make your listings stand out.

Bundle products strategically: Consider bundling related products together to create attractive offers for buyers. This can increase the perceived value of the bundle and encourage faster sales.

Price competitively: Research the market prices for similar products and set competitive prices for your surplus stock. While it's important to recover some of the investment, pricing the products too high can deter potential buyers.

Monitor market trends: Stay updated with market trends and buyer preferences. This can help you identify opportunities to sell certain types of products at a higher value or adjust your pricing strategy accordingly.

Provide excellent customer service: Ensure that the liquidation company you choose offers reliable customer service. This includes prompt responses to customer inquiries, efficient handling of returns or refunds, and clear communication throughout the sales process.

Exploring different liquidation sites and platforms in India

India has a growing number of liquidation sites and platforms that cater to businesses looking to sell their surplus stock. Here are some popular options to consider:

ValueShoppe: ValueShoppe is a well-known liquidation platform in India that offers a wide range of categories for businesses to list their surplus inventory. They have a user-friendly interface and attract a large number of buyers.

Liquidation Bazaar: Liquidation Bazaar specializes in garment liquidation and offers a dedicated marketplace for businesses in the fashion industry. They have a strong network of buyers specifically interested in discounted clothing.

Surplus Liquidators: Surplus Liquidators is a popular choice for businesses looking to liquidate a variety of products, ranging from electronics to home goods. They offer a seamless sales process and have a wide reach.

Wholesale Liquidation Store: Wholesale Liquidation Store is an online platform that connects businesses with buyers looking for wholesale deals. They have a diverse range of product categories and attract buyers from various industries.

Case studies: successful garment liquidation through a liquidation company

To illustrate the effectiveness of a liquidation company in India, let's explore a few case studies of successful garment liquidation:

Case Study 1: XYZ Clothing Company had excess inventory of winter jackets due to a miscalculation in demand. They partnered with a liquidation company specializing in garment liquidation. The liquidation company listed the jackets on their platform, optimized the product descriptions, and attracted buyers looking for discounted winter wear. Within a month, XYZ Clothing Company was able to liquidate their surplus stock and recoup a significant portion of their investment.

Case Study 2: ABC Fashion Boutique had a collection of unsold designer dresses from the previous season. They decided to work with a liquidation company that had a strong network of buyers in the fashion industry. The liquidation company recommended bundling the dresses with matching accessories to create attractive offers. This strategy was successful, and ABC Fashion Boutique was able to sell the surplus stock at a higher value than initially anticipated.

Case Study 3: DEF Apparel Store had a large quantity of damaged garments that were unsuitable for sale at their retail locations. They partnered with a liquidation company that specialized in handling damaged merchandise. The liquidation company assessed the condition of the garments and recommended selling them as salvage items. Through their network of buyers, they were able to find interested parties who were willing to purchase the damaged garments at discounted prices.

The importance of proper inventory management to avoid surplus stock

While a liquidation company can help businesses effectively sell their surplus stock, it's crucial to have proper inventory management practices in place to avoid excess inventory in the first place. Here are a few tips to prevent surplus stock:

Accurate demand forecasting: Invest in reliable demand forecasting tools and techniques to accurately predict customer demand. This can help businesses avoid overstocking or understocking products.

Regular inventory monitoring: Implement a robust inventory management system that allows businesses to track their stock levels in real-time. Regularly review inventory data to identify slow-moving products or potential overstock situations.

Streamline supply chain processes: Optimize your supply chain processes to minimize lead times and ensure timely deliveries. This can help businesses avoid situations where excess stock is ordered to compensate for delays or uncertainty in the supply chain.

Collaborate with suppliers: Maintain open lines of communication with suppliers to avoid unnecessary order quantities or delayed deliveries. Establishing strong relationships with suppliers can help businesses manage their inventory more effectively.

Offer promotions and discounts: Proactively offer promotions and discounts for slow-moving or seasonal products to avoid accumulating excess stock. This can help stimulate demand and prevent inventory buildup.

Conclusion: Leveraging the services of a liquidation company in India for effective stock management

In conclusion, partnering with a liquidation company in India can unlock hidden value for businesses with surplus stock. By effectively liquidating unsold inventory, companies can reduce storage costs, free up capital, and minimize losses. A liquidation company acts as a bridge between businesses and buyers, utilizing their expertise, sales channels, and marketing efforts to ensure a seamless liquidation process.

When choosing a liquidation company, consider their experience, reputation, and access to sales channels that align with your specific needs. Follow best practices for selling surplus stock, such as optimizing product listings and providing excellent customer service. Explore different liquidation sites and platforms in India to find the most suitable option for your business.

Proper inventory management is also essential to prevent surplus stock in the first place. Accurate demand forecasting, regular monitoring, streamlined supply chain processes, collaboration with suppliers, and offering promotions can help businesses maintain optimal inventory levels.

By leveraging the services of a liquidation company in India and adopting effective inventory management practices, businesses can unlock hidden value, optimize stock management, and ensure long-term success in today's competitive market.

CTA: If you're a business in India struggling with surplus stock, consider partnering with a reliable liquidation company to unlock hidden value and effectively manage your inventory. Contact us today to learn more about how we can help you sell your unsold stock and maximize your returns.

#liquidationsales#howtosellsurplusstock#SellUnsoldStock#StocklotDeals#liquidatingoldinventory#liquidateyouroldstock#BuyClothingSurplus#BuySurplusClothingStock#SurplusClothingInventory#LiquidationCompanyinIndia#LiquidationPlatform#Surplusliquidation#Liquidationyouroldstock#Surplusoverstockliquidation#Liquidationsites#GarmentsLiquidation#Liquidatedsurplus#Liquidateexcessinventory#Liquidateoldinventory#wholesaleliquidationstore

4 notes

·

View notes

Text

Why Laundromats Make the Best Investment

There are many places where you can put your money to work. Sometimes it's challenging and even nerve-wracking to decide which one to pick. Why invest in laundromats? It's not surprising that launderettes are the best investment choice. But why should you put your money into a laundry business instead of a franchise, the stock market, or some other type of small business? Okay, let's check this out.

· No downtime

In any season, having clean clothes is a must. Total Solution provider to setup a laundromat in India owner never has to worry about a slow season, unlike those in related businesses like car washes, which may experience slow periods during the winter or fluctuations due to bad weather.

· Profits stay the same with the economy or trends

The fact that people always need to keep their clothes clean also bodes well for the longevity of your company. The ups and downs of the economy and the latest trends won't have nearly as much of an effect on your bottom line as they do in the restaurant and convenience store industries or the stock market.

· You only need a little staff

It isn't easy to find and keep good employees. In addition to the necessary paperwork, time, and training, several other prerequisites exist. Then there's the matter of actually paying them. About half of all launderettes only employ two people, which means less time spent on administrative tasks and more profit for financiers.

· Constant help

Once you put your money into many investments, you're on your own. That is particularly difficult and stressful for first-time business owners and investors. Cost of setting up a laundromat in India, reason enough to love launderettes, right there! Working with a laundry equipment distributor can benefit your company.

Conclusion

The success rate of launderettes is close to 95%. When faced with such obvious evidence of success, one has no choice but to concede. Straits Laundry Pte Ltd, Singapore, is one of Alliance Laundry System LLC, USA's largest distributors of laundry equipment and parts. They specialise in distributing Speed Queen Brand Laundry Machines and installing Speed Queen Machines in Laundromats.

#setup-laundromat#Laundry-System#Cost-of-laundromat#Speed-Queen-Brand#laundry-equipment#Laundry-Parts#laundromat-setup-India#Straits-Laundry#Laundry-singapore

7 notes

·

View notes

Text

Why Study Equity Derivatives? Career Opportunities and Investment Advantages

Equity derivatives are potent tools in finance, benefiting investors and traders. Learning through courses unveils career potential and investment edge. This blog delves into their significance, advantages, and certification value, emphasizing the importance of studying equity derivatives.

Equity Derivatives: An Overview

Equity derivatives derive value from stocks or indices. These include options and futures, allowing speculation on asset price changes. Options grant rights to buy/sell within a timeframe, while futures obligate parties to buy/sell at a set price on a specific date.

Why Study Equity Derivatives?

1. Market Exposure: Equity derivatives provide exposure to price movements in the stock market without the need for owning the underlying stocks. This allows investors to capitalize on market trends and diversify their portfolios.

2. Risk Management: Derivatives can act as risk management tools. For instance, options can be used to hedge against potential losses in a stock portfolio during volatile market conditions.

3. Leverage: Equity derivatives allow traders to control a larger position with a smaller investment, thereby leveraging potential returns. Nevertheless, it's crucial to recognize that leverage magnifies risks.

4. Profit Potential: By accurately predicting market movements, traders can generate profits from rising and falling markets, making equity derivatives an attractive option for skilled traders.

Benefits of Equity Derivatives Courses & Certification

1. Comprehensive Insight: Courses cover equity derivatives from basics to advanced strategies, enhancing decision-making.

2. Career Prospects: Mastery opens roles like trader, analyst, or manager in finance, bolstering opportunities.

3. Certification Value: NISM Equity Derivatives Certification boosts credibility with employers and clients, showcasing expertise.

4. Real-world Practice: Courses offer case studies, applying theory to practical scenarios for hands-on experience.

5. Effective Risk Management: Learn diverse hedging strategies to protect investment portfolios, mastering risk management.

NISM Equity Derivatives Certification

The NISM Equity Derivatives Certification is a recognized qualification in India that validates your understanding of equity derivatives. This certification, offered by the National Institute of Securities Markets (NISM), demonstrates your proficiency and commitment to professional excellence in this domain.

Final Takeaway,

Studying equity derivatives offers career and investment benefits. Courses provide comprehensive understanding, enabling effective harnessing of these instruments' potential whether aspiring traders or investors; learning through courses and certifications is pivotal for a successful financial career.

2 notes

·

View notes

Text

Swing Share Trading Tips In India

Goodluck Capital offers profitable swing share trading tips in India. Our team of experienced analysts identifies potential stocks using in-depth research and analysis, taking into account various factors like company financials, market trends, and global events. Our swing share trading advice is intended for investors who hold stocks for less days to fewer weeks on average. To assist our clients in making decisions based on current market conditions, we regularly update them. With our expertise, investors can trade with confidence and increase their chances of success. Whether you are a beginner or an experienced trader, our Swing share trading tips can help you achieve your financial goals.

2 notes

·

View notes

Text

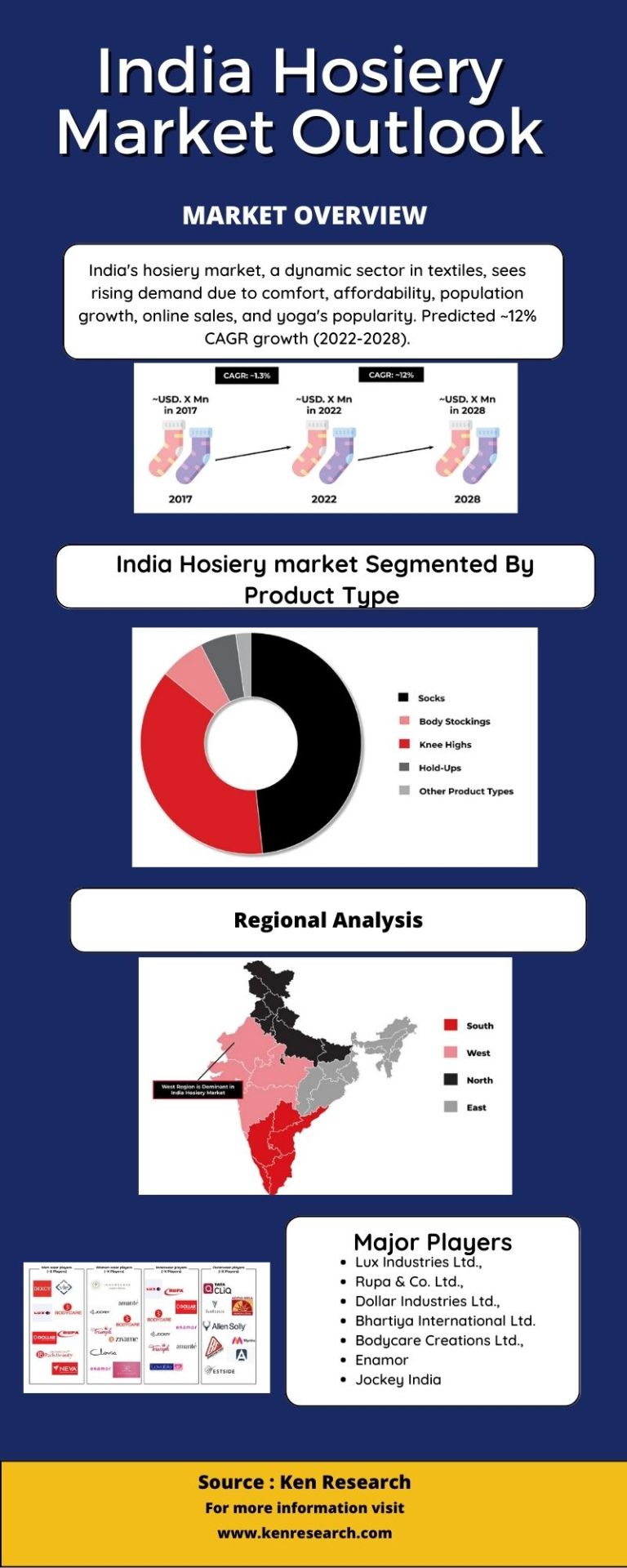

India Hosiery Market Outlook

Explore India's Hosiery Market Outlook to 2028. Our report analyzes product types, end-user segments, and regional splits, offering comprehensive insights for businesses and investors.

#India Hosiery Market Research#Hosiery Industry Analysis India#Hosiery Market Trends#Body Stockings Market India#Hosiery Socks Market#Knee Highs Market India#Hold-Ups Market Analysis#Men's Hosiery Market India#Women's Hosiery Market#Regional Hosiery Market Insights

0 notes

Text

What is Business? How it works?

Business is an economic activity in which goods and services are produced, bought, and sold with the primary objective of earning a profit. It involves various activities such as production, distribution, marketing, finance, and management to meet the needs and demands of consumers and create value in the market, Business news in hindi.

Types of Businesses:

Sole Proprietorship: A business owned and operated by a single individual. The owner has full control and is personally responsible for all debts and liabilities.

Partnership: A business owned and operated by two or more individuals who share profits and responsibilities. Each partner may have unlimited liability for business debts.

Corporation: A legal entity separate from its owners (shareholders) that can issue stock and is responsible for its own debts and liabilities. Shareholders have limited liability.

Limited Liability Company (LLC): A business structure that combines elements of a corporation and a partnership. Owners (members) have limited liability, and the company's profits and losses can be passed through to the members without taxation at the entity level.

Cooperative: A business owned and controlled by its members, who share profits or benefits based on their participation or patronage.

Franchise: A business model where one party (the franchisor) grants another party (the franchisee) the right to use its trademark, brand, and business model in exchange for a fee or royalty.

Online Business: Businesses that primarily operate online, selling products or services through e-commerce platforms or digital channels.

Manufacturing Business: Businesses involved in producing goods through various processes, such as raw material processing, assembly, and fabrication.

Retail Business: Businesses that sell products directly to consumers through physical stores or online platforms.

Service Business: Businesses that provide intangible services, such as consulting, healthcare, education, or financial services.

Import-Export Business: Businesses involved in the trade of goods between different countries, importing and exporting products to meet market demands, Business news in hindi.

Using Business:

To start and run a successful business, one needs careful planning, understanding of market trends, efficient operations, and customer satisfaction. Here are some steps to use business effectively:

Business Idea: Identify a viable business idea based on market demand, your skills, and interests.

Market Research: Conduct thorough market research to understand customer preferences, competition, and potential opportunities.

Business Plan: Create a detailed business plan outlining your goals, strategies, financial projections, and operational methods.

Legal and Regulatory Compliance: Register your business and comply with all legal and regulatory requirements in your region.

Funding: Arrange necessary funding through personal savings, loans, investors, or grants.

Marketing: Develop effective marketing strategies to reach your target audience and promote your products or services.

Operations: Set up efficient operations and supply chains to deliver products or services effectively.

Customer Service: Prioritize customer satisfaction to build a loyal customer base and gain a competitive edge.

Financial Management: Manage your finances carefully, track expenses, revenue, and profits, and maintain financial stability.

Adaptation: Stay updated with market trends, consumer preferences, and technological advancements to adapt and grow your business. Remember, building a successful business requires dedication, hard work, and continuous improvement. Flexibility and the ability to learn from failures are crucial to navigate the challenges and achieve long-term success, Business news in hindi.

#Business news in hindi#business news#personal finance news#personal finance tips#real estate news#share market news india#stock market news#nse#bse#automobile news#auto sector news#mutual fund trends#ipo analysis

0 notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes