#Subprime Mortgage Market Collapse

Text

The 2008 Financial Crisis: A Global Wake-Up Call

Written by Delvin

The 2008 financial crisis stands as a stark reminder of the fragility of the global financial system. Triggered by the collapse of the subprime mortgage market in the United States, this crisis had far-reaching consequences that reverberated across the globe. In this blog post, we will delve into the key factors that led to the crisis, its impact on the global economy, and the…

View On WordPress

#2008 Financial Crisis#dailyprompt#Financial#Financial Literacy#knowledge#money#Money Fun Facts#Real Estate#Subprime Mortgage Market Collapse#The 2008 Financial Crisis: A Global Wake-Up Call

1 note

·

View note

Text

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction

The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges.

ll. Background of the 2008 Market Crash

A. Economic conditions leading up to the crash

Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Regular readers of this column know that I’m not inclined to be alarmist. Although there are times when I worry about the costs and risks of certain foreign-policy decisions, I tend to push back on the tendency for foreign-policy experts to inflate threats and assume the worst—but not always. Sometimes, the wolf really is at the door, and it’s time to start worrying.

What’s troubling me today is the gnawing fear that we are living through a series of disruptions that are overwhelming our collective ability to respond. World politics is never completely static, of course, but we haven’t seen as serious a sequence of shocks in a long time. We’re accustomed to thinking human ingenuity will eventually provide solutions, but as political scientist Thomas Homer-Dixon warned many years ago, that reassuring assumption may not apply when the number of problems to be solved becomes too large and complex.

Just how many shocks can the system stand? Let’s take them in chronological order.

The breakup of the Soviet empire

Although the collapse of the Soviet Union and the velvet revolutions in Eastern Europe were positive developments in many ways, they also created considerable uncertainty and instability, and they opened the door to political developments (such as NATO enlargement) that still reverberate today. The breakup led directly to a war between Azerbaijan and Armenia, contributed to the dissolution of Yugoslavia and subsequent Balkan wars, encouraged an unhealthy sense of hubris in the United States, and reshaped politics in Central Asia. Loss of Soviet patronage also destabilized governments in Africa, the Middle East, and even the Americas, with unpredictable and sometimes unfortunate consequences. History didn’t end; it just headed down a different track.

China’s rise

Americans initially thought the unipolar moment would last a long time, but a new great-power rival emerged almost immediately. China’s rise is not a sudden or unexpected shock, perhaps, but it has still been extraordinarily rapid, and most experts in the West misread what it portended. China is still significantly weaker than the United States and faces serious headwinds at home and abroad, but its impressive economic growth, rising ambitions, and expanding military power are undeniable. Economic advancement there has also accelerated climate change, affected labor markets around the world, and helped trigger the current backlash against hyper-globalization. Its growing wealth and power improved the lives of the Chinese people and benefited others as well, but it is still a shock to the existing global order.

The 9/11 attacks and the global war on terrorism

The terrorist attacks that destroyed the World Trade Center and damaged the U.S. Defense Department in September 2001 completely transformed U.S. foreign policy, and the United States found itself trapped in a war on terrorism for more than a decade. This event led directly to the toppling of the Taliban in Afghanistan and the invasion of Iraq in 2003, and the two so-called forever wars eventually cost the United States far more blood and treasure than it had lost on that fateful day. The war on terrorism also destabilized countries throughout the greater Middle East and unintentionally spawned groups such as the Islamic State, whose actions aided the rise of right-wing extremism in Europe. It also accelerated the militarization and polarization of U.S. domestic politics and the mainstreaming of right-wing extremism in the United States—a major shock by any measure.

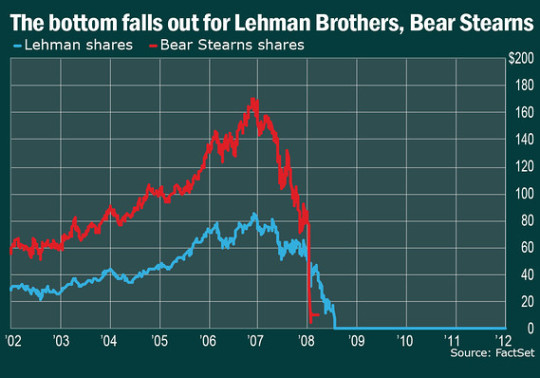

The 2008 financial meltdown

The collapse of the subprime mortgage market in the United States triggered a financial panic that quickly spread around the world. Wall Street’s supposed “Masters of the Universe” turned out to be as fallible (or corruptible) as anyone else, and although the people who caused the debacle were never held accountable, they could never speak with the same prestige and authority that they had before the crisis erupted. Europe suffered a sharp recession, a protracted currency crisis, and a decade of painful austerity, giving populist parties another political boost. Chinese officials also saw the crisis as a telling sign of Western decline and an opportunity to expand their own foreign-policy ambitions.

The Arab Spring

It sometimes seems nearly forgotten, but the Arab Spring was a tumultuous event that toppled governments in several countries, briefly kindled hopes of widespread democratic transitions, and led to civil wars in Libya, Yemen, and Syria that are still being fought today. It ended with authoritarian crackdowns (known as the “Arab Winter”) that reversed nearly all of the gains that reformers had made. Like the ill-fated Revolutions of 1848 in Europe, it was a “turning point at which modern history failed to turn.” But it consumed lots of top decision-makers’ time and attention, tarnished the reputations of a number of top officials, and led to considerable human suffering.

The global refugee crisis

According to the United Nations High Commissioner for Refugees, the number of “forcibly displaced” persons rose from about 42 million people in 2001 to nearly 90 million people in 2021. Refugee flows are themselves a consequence of some of the other shocks we’ve experienced, but they exert profound effects of their own, and the problem defies easy solutions. As such, they constitute yet another shock that governments and international organizations have struggled to address in recent years.

Populism becomes popular

The year 2016 marked at least two shocking events: Donald Trump was elected president of the United States and Britain voted to leave the European Union. Both events defied expectations, and each turned out to be as bad as opponents had feared. Trump proved to be every bit as corrupt, capricious, narcissistic, and incompetent as he had appeared to be during the campaign, but even his severest critics underestimated his willingness to attack the foundations of American democracy. Indeed, more than two years after his electoral defeat and facing multiple legal challenges, Trump continues to exert a poisonous effect on U.S. political life. Brexit had a similar impact in Great Britain: Not only did leaving the EU do considerable damage to the British economy (precisely as opponents had warned), but it accelerated the Conservative Party’s flight from reality, leading to the cartoonish and serially dishonest antics of former British Prime Minister Boris Johnson and the utter trainwreck of Prime Minister Liz Truss’s brief tenure at No. 10 Downing St. Put your schadenfreude on hold, please: It is not good for anyone when the world’s sixth-largest economy is governed by such a succession of blundering buffoons.

COVID-19

What’s next? How about a global pandemic? Experts had long warned that such an event was inevitable and that the world was not prepared for it, and they turned out to be all too prescient. At least 630 million people have been infected worldwide (the actual number is doubtless higher), the official global death toll now exceeds 6.5 million, and the pandemic has had punishing effects on trade, economic growth, educational achievement, and employment in many countries (especially in the developing world). Work-life patterns have been disrupted, governments have had to adopt emergency measures to save their economies, future productivity growth has almost certainly been reduced, and a combination of loose money policies and supply chain disruptions have helped trigger the persistent inflation that governments and central bankers are now struggling to contain.

The war in Ukraine

We still do not know what the full impact of Russia’s invasion of Ukraine will be, but it won’t be trivial. The war has inflicted enormous damage on Ukraine, threatened existing norms barring the acquisition of territory by force, exposed Russia’s own military deficiencies, sparked what may turn out to be a serious European effort at rearmament, worsened global inflation, and raised the risk of escalation (including the possibility of nuclear weapons use) to a level not seen in decades. Relations between Russia and the West have been deteriorating for some time, but few observers anticipated that this would lead to a major war in 2022 and dominate the foreign-policy agenda in Washington and Europe.

Climate change

Lurking behind many of these events is the slow-motion shock of climate change. Its impact is now being felt in worsening natural disasters, increased civil conflicts, and rising migration from heavily affected areas. Efforts to immigrate or adapt to rising atmospheric temperatures are going to be expensive, and global cooperation to reduce greenhouse gas emissions is faltering. All told, the scope of climate change is one more shock that governments ignored for too long and will have to deal with for decades to come.

It would be easy to add some other events to this list, and it would be a challenge to address even one or two of them successfully. Dealing with such a rapid succession is proving to be nearly impossible.

The first problem is bandwidth: When too many disruptions occur too quickly, political leaders don’t have the time or attention span to develop creative solutions or weigh alternatives carefully. The odds that they’ll respond badly increase. Nor do they have adequate time to assess how well their chosen solutions are working, making it harder to correct errors in a timely fashion.

Second, because resources are finite, dealing with the latest shock properly may be impossible if previous crises have used up the assets that are needed today. The more problems leaders face, the harder it will be to give each one the attention and resources it requires.

Third, when successive shocks are connected, trying to solve one problem can make other problems worse. It made good sense for Europe to stop buying natural gas from Russia following the invasion of Ukraine, for example, but this step increased energy costs (making inflation worse) and burning coal instead of natural gas increases greenhouse gas emissions and exacerbates climate change. Focusing laser-like on helping Ukraine may be the right thing to do, but it takes time and effort away from the problems posed by a rising China. There is a good case to be made for limiting China’s ability to use Western technology to enhance its military power, but imposing export controls on chips and other forms of advanced technology impairs U.S. economic growth and will hurt some U.S. businesses, at least in the short term. The more problems you’re trying to solve all at once, the greater the danger that responses to one will undermine your efforts to deal with others.

Finally, unless leaders are extremely lucky or unusually skillful, trying to handle multiple shocks tends to erode public confidence in the entire political system. Citizens may rally around the government when a single, clear-cut crisis erupts (as Ukrainians have in response to Russia’s assault), and policy successes can help convince them that the people in charge really do know what they are doing. But when public officials are facing more shocks than anyone could handle and repeatedly fail to deliver good results, citizens will lose confidence in them (and in the experts they are relying on for advice). Instead of trusting people with the relevant knowledge, experience, and responsibility, publics become more dismissive of expertise and vulnerable to conspiracy theories and other flights from reality. Of course, this problem will be even worse if those in charge are visibly dishonest, corrupt, self-serving, and fully deserving of public scorn.

I don’t have a happy ending for this story, just a final thought. We’ve been living in an era where “move fast and break things” was the mantra—and not just in the fast-moving world of digital technology. Given the shocks we’ve endured in recent years, a better motto for the moment might be “slow down and fix stuff.” I hope we get the chance, and I hope we don’t blow it.

19 notes

·

View notes

Text

The 2008 financial crisis, also known as the Great Recession, was a global economic disaster that resulted from a combination of factors, including risky lending practices, deregulation, poor risk management, and the collapse of major financial institutions. While it’s challenging to assign blame to individuals alone, as systemic issues played a significant role, certain figures were notably influential in creating the conditions that led to the crisis. Here is a list of 15 people who are often cited in discussions about who bears responsibility, with details explaining their roles:

### 1. **Alan Greenspan** (Former Chairman of the Federal Reserve)

- **Blame**: Greenspan is often at the top of the list because of his long tenure as Fed Chairman (1987-2006) and his strong advocacy for deregulation. His policies of keeping interest rates extremely low in the early 2000s contributed to the housing bubble. Additionally, his belief in self-regulating markets led to insufficient oversight of financial institutions and the proliferation of risky mortgage-backed securities.

### 2. **Angelo Mozilo** (Co-Founder and CEO of Countrywide Financial)

- **Blame**: Mozilo's company was one of the largest subprime mortgage lenders in the U.S., aggressively pushing risky loans to unqualified borrowers. Countrywide’s practices were emblematic of the reckless lending that fueled the housing bubble. The company’s collapse was one of the key events that signaled the depth of the mortgage crisis.

### 3. **Henry Paulson** (U.S. Treasury Secretary, Former CEO of Goldman Sachs)

- **Blame**: As Treasury Secretary during the crisis, Paulson’s handling of the situation, including the decision to let Lehman Brothers fail, has been widely criticized. Before his government role, as CEO of Goldman Sachs, he was also part of the Wall Street culture that heavily invested in and profited from mortgage-backed securities.

### 4. **Richard Fuld** (CEO of Lehman Brothers)

- **Blame**: Fuld led Lehman Brothers into one of the largest bankruptcies in U.S. history. Under his leadership, Lehman heavily invested in subprime mortgages and other risky assets. Fuld’s refusal to recognize the firm’s peril and his inability to secure a buyer ultimately led to Lehman’s collapse, which became a catalyst for the broader financial crisis.

### 5. **Chuck Prince** (CEO of Citigroup)

- **Blame**: Prince infamously stated, "As long as the music is playing, you've got to get up and dance," reflecting the reckless risk-taking culture at Citigroup. The bank was deeply involved in subprime lending and held a massive portfolio of toxic assets, requiring a significant government bailout to survive.

### 6. **Joseph Cassano** (Head of AIG Financial Products)

- **Blame**: Cassano’s division at AIG sold credit default swaps (CDS) that were essentially insurance on mortgage-backed securities. These CDS were underpriced and massively undercapitalized, leading to AIG’s near collapse when it couldn’t cover the enormous losses, necessitating a $180 billion government bailout.

### 7. **Phil Gramm** (U.S. Senator, Sponsor of the Gramm-Leach-Bliley Act)

- **Blame**: As the primary sponsor of the Gramm-Leach-Bliley Act in 1999, which repealed the Glass-Steagall Act, Gramm played a pivotal role in deregulating the financial industry. This repeal allowed banks to merge commercial and investment banking, leading to the creation of financial conglomerates that became "too big to fail."

### 8. **Christopher Cox** (Chairman of the SEC)

- **Blame**: Cox was criticized for failing to oversee and regulate Wall Street effectively during his tenure. Under his leadership, the SEC was seen as passive, allowing investment banks to take on excessive leverage and risk without adequate oversight, contributing to the severity of the financial crisis.

### 9. **Stan O’Neal** (CEO of Merrill Lynch)

- **Blame**: Under O’Neal’s leadership, Merrill Lynch aggressively invested in subprime mortgages and other risky financial products. The firm’s massive losses eventually led to its sale to Bank of America in a rushed deal to prevent its collapse, symbolizing the broader crisis in confidence in Wall Street firms.

### 10. **Franklin Raines** (CEO of Fannie Mae)

- **Blame**: Raines led Fannie Mae during a period when the company expanded its purchase of subprime mortgages and mortgage-backed securities, contributing to the housing bubble. Fannie Mae’s role in encouraging risky lending practices and its eventual need for a government bailout highlight its significant involvement in the crisis.

### 11. **Timothy Geithner** (President of the Federal Reserve Bank of New York, Later U.S. Treasury Secretary)

- **Blame**: Geithner was a key figure in the government’s response to the financial crisis. Critics argue that his earlier role as President of the New York Fed involved regulatory lapses, particularly regarding the oversight of major banks, and that his actions during the crisis were too focused on bailing out large financial institutions at the expense of broader economic recovery.

### 12. **Bill Clinton** (Former U.S. President)

- **Blame**: Clinton’s administration supported the Gramm-Leach-Bliley Act and other deregulatory measures that contributed to the crisis. Additionally, the administration pushed for expanded homeownership, which indirectly encouraged the proliferation of subprime mortgages.

### 13. **David Lereah** (Chief Economist at the National Association of Realtors)

- **Blame**: Lereah was a leading advocate for the housing market, consistently promoting the idea that home prices would continue to rise indefinitely. His optimistic projections encouraged widespread speculative investment in real estate, contributing to the housing bubble.

### 14. **Robert Rubin** (Former U.S. Treasury Secretary, Later at Citigroup)

- **Blame**: Rubin, who served as Treasury Secretary under Clinton and later held a key role at Citigroup, was a strong advocate for deregulation, including the repeal of Glass-Steagall. His influence on financial policy contributed to the conditions that led to the crisis, and Citigroup’s subsequent near-collapse highlighted the risks of the policies he supported.

### 15. **George W. Bush** (U.S. President during the Crisis)

- **Blame**: While the roots of the crisis predate Bush’s presidency, his administration’s policies of further deregulation, tax cuts that primarily benefited the wealthy, and lax oversight of financial institutions have been criticized for exacerbating the conditions that led to the financial meltdown. His administration’s response to the crisis, though swift in terms of bailouts, has also been scrutinized for its focus on saving financial institutions rather than preventing widespread economic damage.

### **Conclusion**

The 2008 financial crisis was a result of collective failures across multiple sectors, including government, financial institutions, and regulatory bodies. While these 15 individuals played significant roles, the crisis was also a product of broader systemic issues, including flawed financial models, widespread risk-taking, and a lack of regulatory oversight. Understanding the roles of these key figures helps in grasping the complex causes of one of the most severe economic downturns in modern history.

0 notes

Text

The Big Short: A Summary of Michael Lewis' Book

Chapter 1 What's The Big Short by Michael Lewis

"The Big Short" by Michael Lewis is a non-fiction book that explores the 2008 financial crisis through the eyes of a few Wall Street outsiders who saw the collapse coming and bet against the housing market. The book delves into the complex world of subprime mortgage bonds, credit default swaps, and the reckless behavior of big banks. By focusing on the individuals who saw the crisis coming and profited from it, Lewis sheds light on the greed and corruption that led to the crash, offering a compelling and informative look at the inner workings of the financial industry.

Chapter 2 Is The Big Short A Good Book

Many readers and critics consider The Big Short to be a highly engaging and informative book. Michael Lewis is known for his ability to explain complex financial concepts in an accessible and entertaining way. The book offers a fascinating inside look at the events leading up to the 2008 financial crisis and the individuals who predicted and profited from the collapse of the housing market. Overall, The Big Short is highly recommended for those interested in finance, economics, or simply looking for a gripping non-fiction read.

Chapter 3 The Big Short by Michael Lewis Summary

"The Big Short" by Michael Lewis provides an engaging and informative account of the housing market crash of 2008, focusing on the individuals who predicted and profited from the collapse. The book follows a handful of investors who saw the signs of the impending crisis and bet against the market, making huge profits in the process.

Lewis introduces readers to characters such as Michael Burry, a hedge fund manager who first recognized the instability of subprime mortgage loans, and Steve Eisman, a savvy investor who also bet against the market. Through their stories, Lewis explains the complex financial instruments and practices that led to the housing bubble and eventual crash.

The book also delves into the aftermath of the crisis, highlighting the widespread impact on the economy and the financial institutions involved. Lewis reveals the greed, ignorance, and reckless behavior that contributed to the collapse, ultimately holding the individuals and institutions responsible for their roles in the crisis.

Overall, "The Big Short" offers a compelling narrative of the events leading up to the financial crisis of 2008, shedding light on the inner workings of the financial industry and the consequences of unchecked speculation and greed. It serves as a cautionary tale for investors and policymakers alike, urging them to learn from the mistakes of the past to prevent similar crises in the future.

Chapter 4 The Big Short Author

Michael Lewis is an American author born on October 15, 1960. He is known for his non-fiction books on various subjects such as finance, economics, and sports. "The Big Short: Inside the Doomsday Machine" was released in 2010 and documents the build-up to the 2008 financial crisis.

Some of Michael Lewis's other popular books include:

1. "Liar's Poker" (1989) - An autobiographical account of Lewis's experiences working at Salomon Brothers in the 1980s.

2. "Moneyball: The Art of Winning an Unfair Game" (2003) - Explores the use of sabermetrics in baseball and the success of the Oakland Athletics.

3. "Flash Boys: A Wall Street Revolt" (2014) - Investigates high-frequency trading on Wall Street.

In terms of editions, "Moneyball: The Art of Winning an Unfair Game" is considered one of the best works by Michael Lewis. It has been widely acclaimed for its detailed insight into the world of baseball statistics and has been adapted into a successful film starring Brad Pitt.

Chapter 5 The Big Short Meaning & Theme

The Big Short Meaning

"The Big Short" by Michael Lewis is a non-fiction book that explores the events leading up to the 2008 financial crisis and the individuals who saw it coming and bet against the housing market. The title refers to the large financial bets made by these investors, known as the "big short," as they saw the impending collapse of the housing market and made significant profits from it.

Overall, the book delves into the greed and recklessness of Wall Street and the financial industry, as well as the systemic flaws in the housing market that led to the crisis. It also sheds light on the few individuals who were able to see through the deception and profit from the collapse, ultimately highlighting the dangers of unchecked corporate power and the importance of regulation in the financial sector.

The Big Short Theme

One of the main themes in "The Big Short" by Michael Lewis is the greed and corruption that led to the financial crisis of 2008. The book delves into the reckless behavior of Wall Street firms, the negligence of government regulators, and the blind desire for profit that ultimately caused the collapse of the housing market.

Another theme in the book is the power of knowledge and foresight. The protagonists of the story, a group of investors who saw the impending crisis and bet against the housing market, were able to profit from the disaster because they did their homework and understood the flawed system they were operating in. This theme underscores the importance of critical thinking and independent analysis in a world where misinformation and manipulation abound.

Ultimately, "The Big Short" explores the consequences of unchecked greed and ignorance, as well as the potential for individual agency and resilience in the face of a broken system. It serves as a cautionary tale about the dangers of financial speculation and the importance of holding those responsible for economic devastation accountable.

Chapter 6 Other Accessible Resources

1. "The Big Short" by Michael Lewis: Official website for the book, with information about the author, reviews, and purchasing options.

2. Goodreads: User reviews and ratings for "The Big Short," as well as recommendations for similar books.

3. Amazon: Purchase options for "The Big Short" in various formats, as well as reviews from customers.

4. IMDb: Information about the film adaptation of "The Big Short," including cast, crew, and ratings.

5. Rotten Tomatoes: Reviews and ratings for the film adaptation of "The Big Short."

6. New York Times: Articles and reviews related to "The Big Short," as well as interviews with Michael Lewis.

7. Financial Times: Coverage of "The Big Short" and related topics in the world of finance and economics.

8. CNBC: Analysis and commentary on themes and lessons from "The Big Short" for investors and the financial industry.

9. NPR: Interviews with Michael Lewis and discussions about "The Big Short" on various programs.

10. The Guardian: Articles and opinion pieces on "The Big Short" and its impact on the financial world.

Chapter 7 Quotes of The Big Short

The Big Short quotes as follows:

1. "Wall Street is a street with a river at one end and a graveyard at the other."

2. "Sometimes people get what they want, and sometimes, they end up with nothing. The world is a random and merciless place."

3. "The truth is like poetry. And most people f***ing hate poetry."

4. "If you're willing to stick with it, you can make a lot of money if you're right and the consensus is wrong."

5. "It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so."

6. "When you bet against the housing market, you're betting against the American dream."

7. "We live in an era where nothing is unknowable. There's so much information out there that we can know almost everything."

8. "The problem with being too early in identifying a bubble is that the bubble keeps getting bigger and bigger."

9. "You have to consider the possibility that you're wrong."

10. "The most amazing part of the crisis was how long it took for anyone to notice."

Chapter 8 Similar Books Like The Big Short

1. "The Wealth of Nations" by Adam Smith - This classic text on economics delves into the principles of free market capitalism and offers valuable insights into how economies function.

2. "Guns, Germs, and Steel" by Jared Diamond - This Pulitzer Prize-winning book explores the reasons behind the success and dominance of certain civilizations throughout history, shedding light on the connections between geography, culture, and technology.

3. "The Ascent of Money" by Niall Ferguson - This informative and engaging book traces the evolution of money and finance throughout history, providing a comprehensive overview of the role that economic systems have played in shaping societies.

4. "Debt: The First 5,000 Years" by David Graeber - In this thought-provoking book, anthropologist David Graeber challenges conventional wisdom about the origins and nature of debt, offering new insights into the ways in which debt shapes relationships and societies.

5. "The Great Game: The Struggle for Empire in Central Asia" by Peter Hopkirk - This captivating work of history explores the geopolitical maneuvering and power struggles between the British and Russian empires in Central Asia during the 19th century, shedding light on the complex dynamics of international relations and colonial expansion.

Book https://www.bookey.app/book/the-big-short

Author https://www.bookey.app/quote-author/michael-lewis

Quotes https://www.bookey.app/quote-book/the-big-short

YouTube https://www.youtube.com/watch?v=qK8AjJ4kdzo

Amazom https://www.amazon.com/-/zh/dp/B006VAGFFW

Goodreads https://www.goodreads.com/book/show/26889576-the-big-short?from_search=true&from_srp=true&qid=x7kXD53iJr&rank=1

0 notes

Text

Henry Smith Reflects on FOMC's Past Interest Rate Actions

Perhaps history will give us a clearer picture of what impact the FOMC’s continued interest rate hikes will have on global financial markets and economies.

Since the 1980s, the FOMC has gone through five cycles of rate hikes, and this is only the sixth round.

The first cycle was 1983.3–1984.8, when the benchmark rate was raised from 8.5% to 11.5%.

The second round of interest rate hike cycle was 1988.3–1989.5, and the benchmark interest rate was raised from 6.5% to 9.8125%.

After these two cycles of interest rate hikes, there was no major turbulence in the financial market. A big reason is that before this, that is, from 1979, the US economy had a great Depression. Throughout the 1980s, it was only monetary adjustment in the stage of economic recovery, so the impact on the financial market was limited. However, in the following three cycles of interest rate hikes, the financial market experienced varying degrees of turbulence.

The third cycle of interest rate hikes was 1994.2–1995.2, when the benchmark rate was raised from 3.25% to 6%.

After the 1990–91 recession, unemployment remained high even as growth picked up. Falling inflation allowed the Fed to keep cutting interest rates to 3 percent. By 1994, the recovery was rekindling and the bond market was worried about a return of inflation. Ten-year bond yields rose from just over 5 per cent to 8 per cent when the Fed raised interest rates from 3 per cent to 6 per cent to bring inflation under control and bond yields fell sharply. The rate hike was also cited as one of the factors that led to the Asian financial crisis in 1997.

The fourth round of interest rate hike cycle was from 1999.6 to 2000.5, with the benchmark interest rate raised from 4.75% to 6.5%.

At that time, the Internet bubble was expanding. In 1999, growth was strong and the unemployment rate fell to 4%. After the Fed cut interest rates by 75 basis points in response to the Asian financial crisis, the dot-com boom led to an increase in it investment and a tendency for the economy to overheat. The Fed tightened monetary policy again, raising interest rates from 4.75% to 6.5% after six hikes.

In 2000, after the bursting of the Internet bubble and the collapse of the index, the economy fell into recession again, and the “9/11” incident further worsened the economy and the stock market. The Fed immediately turned, and began to cut interest rates sharply from the beginning of the next year.

The fifth round of interest rate hike cycle was 2004.6–2006.7, with the benchmark interest rate raised from 1% to 5.25%.

At that time, the housing market bubble emerged, and the previous sharp interest rate cuts triggered the US bubble. In the second half of 2003, the economy recovered strongly, and the rapid rise in demand led to the rise of inflation and core inflation. In 2004, the Federal Reserve began to tighten policy, raising interest rates by 25 basis points for 17 consecutive times, until reaching 5.25% in June 2006. Until the subprime mortgage crisis triggered the global financial crisis, the Fed again began to cut interest rates to near zero level until 2016.

Of course, there was a small interest rate hike cycle from 2016 to 2018, which was turned to interest rate cuts due to the outbreak of the epidemic in 2019. Therefore, the interest rate hike cycle lasted relatively short, with a cumulative interest rate increase of 2.5%. The global financial market was volatile, and the stock market saw a large correction.

The current interest rate hike cycle may be seen as a continuation of the 2016 cycle, which was disrupted by the pandemic.

From the perspective of the third interest rate hike cycle, it was near the end of the interest rate hike cycle or two years after the end of the interest rate hike cycle, and the global financial market experienced major shocks.

The Asian financial crisis, the bursting of the Internet bubble, the 2008 financial crisis, and the impact of the epidemic in 19 years.

And now it’s a continuation of the pandemic-era cycle of interest rate hikes, and now it’s coming to an end.

So between now and 2025, will global financial markets experience another bout of turbulence?

You know, history repeats itself, that’s the law of economics, and that’s why I’m telling you about business cycles.

Of course, history will not simply repeat itself. The current global economic and political situation is more complex than before.

Moreover, this is a continuation of the interest rate hike cycle in the pandemic era, and there are more accumulated problems. It is obvious that the global debt level is the highest in history, and the degree of currency overissuance is also the largest.

So if there is a financial market turmoil after the end of the interest rate hike cycle, then I think the impact or damage will be the biggest.

I don’t know how many of my friends in this group have experienced the Asian financial crisis, the Internet bubble, the 2008 financial crisis. If history repeats itself, are you ready?

This is a question worth thinking about, if you do not have corresponding countermeasures, then when the crisis really comes, you will become very passive.

Your wealth may be looted, your job may be affected, and your quality of life may be drastically reduced.

So I say to everyone, be prepared for danger in times of peace, be prepared for a rainy day, and look further ahead, so that you can become more calm.

As can be seen from the above discussion, each cycle of FOMC interest rate hikes and rate cuts is closely related to the development of the US economy, but more importantly, it is closely related to the trend of the US dollar.

Because the FOMC will raise interest rates every time, are accompanied by the tidal harvest of the dollar, because for the United States, there are three major hegemony: military hegemony, scientific and technological hegemony, financial hegemony, and financial hegemony, mainly is the dollar, so it is very important to read the dollar, read the dollar, you can read the world, read the dollar, you can read the wealth password!

The law of history also tells us that in the next few years, financial market turbulence is inevitable. And if the United States does not complete the harvest in 2026, the issuance of U.S. debt does not continue, and AI technology does not bring about a productivity revolution, then the problem is bound to explode.

Therefore, I would like to tell you that while the global economy and financial market are still calm, before you go to make more money, you should reserve more grain and grass for the winter, because the worst is not yet to come.

This is why the current stock market is not good, we buy individual stocks do not make money, I feel anxious.

Because I know that the future will be more severe, we need to face economic shocks, we need to face political turmoil, we need to face the potential collapse of financial markets and so on.

So, friends, now make a good effort to make money! Only when you have food in your hands will you not panic!

This cycle of interest rate hikes has been the largest ever, and the US economy has not experienced any problems so far. First, large enterprises made preparations in advance and saved a large amount of money when interest rates were low. Second, the epidemic has overproduced money and people’s savings have reached a record high of 2.1 trillion yuan.

But according to new research from the Federal Reserve Bank of San Francisco, those excess savings may even run out this quarter. By June, households held less than $190 billion in excess savings.

Without savings, consumption will suffer, and consumption has been the strongest driver of economic growth in the United States, so I think a recession is bound to come, perhaps in the fourth quarter of this year.

Therefore, now is the most urgent time for us to make money. Before the recession of the US economy comes, we should reserve more [grain and grass] to spend the next long winter!

I hope that you will have a long-term understanding of the next economic and financial forms. I hope that what I have explained will have a spiritual impact on every friend.

Well, perhaps the above question is far away, I hope that every friend is thinking deeply.

Dr. Henry Smith was born in Melbourne, Australia in 1979. He moved to the United States with his parents in middle school. He received his bachelor’s degree in finance from Columbia University. He received his M.S. and Ph.D. degrees in applied Mathematics from the University of Pennsylvania

Credentials:

Certified Financial Analyst (CFA), Certified Management Accountant (CMA), Certified Public Accountant (CPA). He has worked in Goldman Sachs and blackrock, mainly responsible for investment business in Hong Kong, and is now responsible for Lonton Wealth Management Center LTD (Lonton Wealth Management Company) in Australia.

0 notes

Text

baddest predict,

baddest predict,

Predictions have long fascinated humanity, from ancient oracles foretelling the future to modern-day algorithms attempting to forecast everything from stock market trends to the weather. Yet, for all the successes, there are also instances where predictions fall flat, sometimes with disastrous consequences. These failures, dubbed "baddest predicts," serve as cautionary tales about the limitations of foresight and the complexities of the world we inhabit.

One of the most notorious examples of a baddest predict in recent memory is the global financial crisis of 2008. Leading up to the collapse, many economists and financial analysts confidently reassured the public that the housing market was stable and that the risks were manageable. However, their models failed to account for the interconnectedness of the mortgage-backed securities market, the proliferation of subprime lending, and the systemic flaws in the banking industry. When the bubble burst, the fallout was catastrophic, leading to widespread economic turmoil and triggering the worst recession since the Great Depression.

Another infamous instance of a baddest predict is the failure to anticipate the COVID-19 pandemic. Despite warnings from epidemiologists and public health experts about the potential for a global health crisis, many governments and organizations were caught off guard when the virus spread rapidly around the world in early 2020. Misinformation, political inertia, and a lack of preparedness exacerbated the situation, resulting in widespread illness, death, and economic disruption. The failure to heed these warnings serves as a stark reminder of the consequences of complacency in the face of emerging threats.

In the realm of technology, baddest predicts are also prevalent. The history of computing is littered with examples of failed forecasts, from predictions about the demise of personal computers to the underestimation of the internet's transformative power. Even the experts can get it wrong when it comes to predicting the direction of technological innovation and societal change.

So why do predictions fail? There are several reasons. First, the world is a complex and dynamic system, making it difficult to anticipate all the variables that may influence future events. Second, human behavior is often unpredictable, as individuals and groups react to changing circumstances in unexpected ways. Third, biases and blind spots can distort our perception of reality, leading us to overlook or discount information that contradicts our preconceived notions.

Nevertheless, despite the inherent challenges, predictions remain a valuable tool for planning and decision-making. While we may never achieve perfect foresight, we can still use probabilistic models and scenario planning to anticipate and mitigate risks. Moreover, by learning from past mistakes and remaining vigilant to emerging threats, we can better prepare ourselves for an uncertain future.

In conclusion, baddest predicts serve as a humbling reminder of the limitations of human knowledge and foresight. While we should strive to improve our predictive capabilities, we must also recognize the inherent uncertainty of the world and remain adaptable in the face of unforeseen events. By doing so, we can navigate the complexities of the modern world with greater resilience and agility.

0 notes

Text

What Is a Stock Market Crash?

A stock market crash refers to a sudden and severe decline in the prices of stocks or other financial assets traded on a stock exchange. It is characterized by a rapid and widespread drop in market values, often resulting in panic selling by investors. Stock market crashes are marked by a significant and sustained decrease in market indices, leading to substantial financial losses for investors.

Key characteristics of a stock market crash include:

1. Sharp Decline in Market Indices:

Market indices, such as the S&P 500 or NIFTY 50, experience a rapid and substantial decrease in value over a short period.

2. Panic Selling:

Investors, fearing further losses, engage in mass selling of stocks, exacerbating the market decline.

3. Volatility:

Increased market volatility, with wild swings in stock prices within short timeframes.

4. Liquidity Issues:

Liquidity dries up as sellers outnumber buyers, leading to challenges in executing trades at desired prices.

5. Economic Uncertainty:

A stock market crash is often accompanied by economic uncertainty, triggered by factors such as economic recessions, financial crises, geopolitical events, or unexpected shocks to the system.

6. Cascading Effect:

The decline in stock prices may have a cascading effect on other financial markets, including bond markets and commodity markets.

Causes of a Stock Market Crash:

Economic Factors:

Economic recessions or downturns can lead to reduced corporate profits, causing a decline in stock prices.

Financial Crises:

Banking crises, credit market disruptions, or other financial system failures can trigger a stock market crash.

Global Events:

Geopolitical events, wars, natural disasters, or global economic shocks can impact investor confidence and trigger a market crash.

Speculative Bubbles:

The bursting of asset bubbles, where prices become detached from fundamentals, can lead to a sharp correction.

Black Swan Events:

Unforeseen and unpredictable events, termed "black swan events," can have a profound impact on financial markets.

Examples of Historic Stock Market Crashes:

1929 Great Depression:

The U.S. stock market crash in 1929 marked the beginning of the Great Depression, with widespread economic consequences.

1987 Black Monday:

On October 19, 1987, global stock markets experienced a massive sell-off, resulting in a single-day drop of over 20% in major indices.

Dot-Com Bubble Burst (2000):

The collapse of many internet-based companies led to a significant market correction in the early 2000s.

Global Financial Crisis (2008):

Triggered by the subprime mortgage crisis, the global financial crisis resulted in a severe stock market downturn and economic recession.

Impact of a Stock Market Crash:

Wealth Erosion:

Investors experience significant losses as the value of their investment portfolios declines.

Reduced Consumer and Business Confidence:

A market crash can lead to lower consumer and business confidence, potentially impacting spending and investment.

Credit Crunch:

Financial institutions may face liquidity issues, impacting their ability to lend, leading to a credit crunch.

Job Losses:

Economic downturns associated with market crashes can result in job losses and increased unemployment.

Government Interventions:

Governments and central banks may implement measures to stabilize financial markets and stimulate economic recovery.

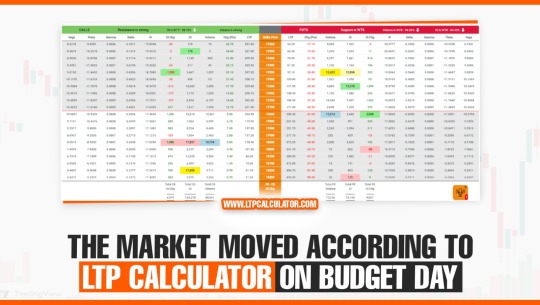

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Investors should be aware of the risks associated with stock market crashes and consider diversification, risk management strategies, and a long-term investment approach to navigate market volatility.

0 notes

Text

Unraveling the 2008 Financial Crisis: A Global Economic Rollercoaster 🎢💼

Hey Tumblr fam! Today, let's take a trip down memory lane and revisit one of the most significant events in recent economic history: the 2008 financial crisis. 📉💥

🔍 Root Causes: The crisis had multiple layers, but one of its key roots lay in the housing market. 🏠📉 The proliferation of subprime mortgages, bundled into complex financial products, created a ticking time bomb. When homeowners defaulted on their mortgages, it set off a domino effect, leading to massive losses for financial institutions.

💥 Impact on the Global Economy: The repercussions of the crisis were felt far and wide. 🌍 Stock markets plunged, banks collapsed, and millions lost their homes and jobs. The crisis exposed vulnerabilities in the global financial system, shaking confidence and triggering a severe economic downturn.

🔄 Ripple Effects: The crisis wasn't just confined to the financial sector; its impact rippled through various industries. 🌊📉 Governments worldwide scrambled to stabilize their economies, implementing stimulus packages and bailouts to prevent further collapse.

🌱 Seeds of Change: While the crisis brought immense hardship, it also catalyzed change. 🌱 Regulatory reforms like the Dodd-Frank Act in the U.S. aimed to prevent a recurrence by imposing stricter oversight on banks and financial institutions. It sparked conversations about the need for greater transparency and accountability in the financial world.

🌟 Lessons Learned: The 2008 financial crisis served as a harsh reminder of the interconnectedness of the global economy and the dangers of unchecked financial practices. 💡 It underscored the importance of risk management, prudent lending, and robust regulatory frameworks.

💬 Join the Conversation: What are your thoughts on the causes and impacts of the 2008 financial crisis? How do you think it has shaped the economic landscape in the years since? Let's chat! 💬🌐

Reflecting on events like the 2008 financial crisis helps us understand the complexities of the economic world and the importance of learning from past mistakes. 💼🌍

#LessonsLearned#GlobalEconomy#FinancialCrisis#finance#thefinrate#payment gateway#fintech#financialinsights#financetalks

0 notes

Text

Liquidation Lessons from History: Case Studies of Success and Failure

Introduction:

In the intricate landscape of business, the journey from success to failure often traverses through the realm of liquidation. History provides a rich tapestry of case studies, offering invaluable insights into the strategies that have led companies to thrive or falter amidst financial distress. By delving into these historical narratives, we can uncover essential lessons that illuminate the path forward for businesses facing similar challenges today. Join us as we embark on a journey through the annals of liquidation, exploring tales of both triumph and tragedy, and extracting wisdom from the pages of history.

The Rise and Fall of Enron:

One of the most infamous corporate collapses in history, the story of Enron serves as a cautionary tale of unchecked ambition and corporate malfeasance. Once hailed as a paragon of innovation and success, Enron's rapid ascent was fueled by aggressive accounting practices and a culture of deceit. However, when the truth behind its opaque financial dealings came to light, the company crumbled under the weight of its own deception. The Enron saga underscores the importance of transparency, integrity, and ethical leadership in safeguarding against the pitfalls of corporate hubris.

Lessons from Lehman Brothers:

The demise of Lehman Brothers during the 2008 financial crisis sent shockwaves throughout the global economy, marking the largest bankruptcy filing in U.S. history. Lehman's downfall was precipitated by risky investments in subprime mortgages and a lack of adequate risk management protocols. Despite efforts to secure a last-minute bailout, the firm succumbed to insolvency, triggering widespread panic and precipitating a seismic shift in the financial landscape. The Lehman Brothers saga underscores the need for prudent risk management, diversification of investments, and vigilance in monitoring market dynamics.

The Phoenix of Apple:

In stark contrast to the tales of Enron and Lehman Brothers, the resurgence of Apple from the brink of bankruptcy stands as a testament to the power of visionary leadership and strategic innovation. In the late 1990s, Apple was teetering on the edge of collapse, plagued by dwindling market share and a lackluster product lineup. However, under the stewardship of Steve Jobs, the company orchestrated a remarkable turnaround, revitalizing its brand through the introduction of groundbreaking products such as the iPod, iPhone, and iPad. Apple's resurgence serves as a compelling reminder that adversity can be a catalyst for innovation and reinvention.

Extracting Wisdom for Today:

As we reflect on these historical case studies, several key lessons emerge for businesses navigating the challenges of liquidation and financial distress. Transparency, integrity, and ethical governance are foundational pillars that underpin long-term success. Prudent risk management, diversification of investments, and strategic innovation are essential strategies for mitigating vulnerabilities and seizing opportunities in an ever-evolving marketplace. By heeding the lessons of history, businesses can chart a course towards resilience, sustainability, and prosperity in the face of uncertainty.

Conclusion:

In the cyclical nature of business, the past serves as both a teacher and a guide, offering invaluable lessons to inform our present decisions and shape our future trajectories. By studying the triumphs and tribulations of companies that have traversed the turbulent waters of liquidation, we gain a deeper understanding of the principles and practices that drive success. As we navigate the complexities of today's business landscape, let us draw inspiration from the stories of those who have gone before us, forging a path towards enduring prosperity and resilience.

#carve-out#it application decommissioning#mergers and acquisitions#sap system#system decommissioning#insolvency#liquidation#legacy system

0 notes

Text

Daniel Will's Take on Charlie Munger's Strategies

As Warren Buffett's partner and a close friend known for his insightful remarks, Charlie Munger is an undisputed investment master. Buffett himself once praised Charlie Munger by saying, "Charlie pushed me in a different direction, the power of his thinking expanded my horizons. I evolved from an ape to a human at an extraordinary speed, or else I would be much poorer now." As an exceptional investment master, how does Charlie Munger navigate through market downturns?

How Investment Masters Deal with Market Crashes

"If you live long enough, sometimes you won't need to chase investment trends." This statement is attributed to Munger during the late 20th century when Wesco Financial stocks under Berkshire Hathaway experienced a significant decline.

Munger has encountered four major bear markets throughout his investment career, with the most severe occurring in 1973-1974. During the "Nifty Fifty" market, where the market granted a high valuation premium to a group of leading companies with moderate growth but strong profit stability, Munger had 61% of his funds invested in blue-chip, stamp-worthy companies. Following the collapse of the "Nifty Fifty," which led to a maximum 48% decline in the S&P 500 index, Munger incurred losses of 31.9% and 31.5% in the respective two years. In that worst bear market since the Great Depression, this portfolio inflicted serious damage on his investment portfolio.

The second occurrence was during the third oil crisis in 1990. With the Middle East region in continued turmoil, the U.S. stock market experienced a significant downturn. Berkshire Hathaway's stock price dropped from $8,625 per share at the beginning of the year to $5,600 in October, marking a 35% decline. Despite this, Berkshire Hathaway displayed optimism, as articulated in that year's shareholder letter: "The primary reason for the depressed stock prices is pessimism, sometimes widespread and at other times limited to specific industries or companies. We look forward to doing business in such an environment, not because we are naturally pessimistic, but because it allows us to acquire more good companies at favorable prices."

Another factor that sets Munger apart from most of us ordinary individuals is that he is never enticed by investments outside his circle of competence. He once stated, "We have three baskets: in, out, and too tough. We have to have a special insight, that we think is not generally true or obtainable by the average investor, into a business where we think we have a competitive advantage." Investors should heed his advice: "If an investment is too difficult to understand, we pass on it and go on to the next. After all, there are a lot of things that are easier." This mindset enabled him to steer clear of the bursting of the dot-com bubble from 2000 to 2002. During that period, the S&P 500 plummeted by 40%, with a maximum decline of 49%. Munger and Buffett, facing the irrational exuberance of the internet bubble in 1999, refrained from investing in internet stocks. They referred to it as an "irrational boom." Following the burst of the internet bubble, Munger and Buffett avoided substantial losses by adhering to their investment principles focused on the intrinsic value of companies rather than market prices.

In the pessimistic market of 2008 during the subprime mortgage crisis, Buffett published "Buy American. I Am." Five months later, the U.S. stock market began to rebound, marking the start of a decade-long bull market. Buffett and Munger emphasized the importance of emotional stability at the subsequent year's shareholder meeting, highlighting that investors should use the market rather than be used by it.

Based on historical experience, my approach to downturns primarily relies on:

1. Avoiding speculative sectors; staying away from crowded places.

2. Emphasizing solid fundamental companies; focusing on the value of the company.

3. Maintaining a positive mindset when facing the future; selling high and buying low.

One of the best lessons investors can learn from past history is that there is no good time without bad times. In a prolonged investment journey, there often exists significant short-term losses during certain phases. If you cannot accept short-term losses, it becomes challenging to reap long-term market returns.

"If you cannot calmly navigate through two or three market declines of over 50% within a century, you are not suited for investing. In comparison to investors who can rationally handle market fluctuations, your investment returns are likely to be relatively mediocre."

"Maintain a positive mindset and use leverage cautiously. In my view, the greatest risk in investing in the stock market is not the fluctuation of prices but whether there will be permanent losses in the future. In fact, those prepared to buy stocks should anticipate price declines because as market volatility increases, there is a greater chance of encountering exceptionally low prices in some good companies."

Regarding leverage, Munger advises that most people should avoid using it:

While leverage can magnify gains during market upswings, it can also amplify losses during market downturns, potentially leading to the complete depletion of capital. Financial leverage increases the risk and uncertainty of investments, and prudent investing should be based on rational analysis and risk control. He suggests that investors should focus on growing intrinsic value rather than relying on external borrowing to ensure long-term wealth accumulation and capital safety.

After all, "No one wants to get rich twice."

Investing is a matter of choices, and, of course, it is also about how to face changes with what kind of attitude after making those choices. Munger believes that, "Many people with high IQs are terrible investors because of their character flaws. I think excellent character is more important than the brain; you must strictly control those irrational emotions. You need calmness, discipline, be indifferent to losses and misfortunes, and, likewise, not be intoxicated by excessive joy."

Therefore, restricting investments to alternative projects that are simple and easily understandable for oneself, while continuing to pursue wisdom and patience in the unpredictable market, becomes particularly crucial. During market downturns, focusing on assets with sufficiently high safety margins, using leverage cautiously, closely tracking fundamentals, and persisting through bull and bear markets will eventually lead to success.

0 notes

Text

Burton Wilde — Mastering the Art Through Market Declines

As Warren Buffett’s partner and a close friend known for his insightful remarks, Charlie Munger is an undisputed investment master. Buffett himself once praised Charlie Munger by saying, “Charlie pushed me in a different direction, the power of his thinking expanded my horizons. I evolved from an ape to a human at an extraordinary speed, or else I would be much poorer now.” As an exceptional investment master, how does Charlie Munger navigate through market downturns?

How Investment Masters Deal with Market Crashes

“If you live long enough, sometimes you won’t need to chase investment trends.” This statement is attributed to Munger during the late 20th century when Wesco Financial stocks under Berkshire Hathaway experienced a significant decline.

Munger has encountered four major bear markets throughout his investment career, with the most severe occurring in 1973–1974. During the “Nifty Fifty” market, where the market granted a high valuation premium to a group of leading companies with moderate growth but strong profit stability, Munger had 61% of his funds invested in blue-chip, stamp-worthy companies. Following the collapse of the “Nifty Fifty,” which led to a maximum 48% decline in the S&P 500 index, Munger incurred losses of 31.9% and 31.5% in the respective two years. In that worst bear market since the Great Depression, this portfolio inflicted serious damage on his investment portfolio.

The second occurrence was during the third oil crisis in 1990. With the Middle East region in continued turmoil, the U.S. stock market experienced a significant downturn. Berkshire Hathaway’s stock price dropped from $8,625 per share at the beginning of the year to $5,600 in October, marking a 35% decline. Despite this, Berkshire Hathaway displayed optimism, as articulated in that year’s shareholder letter: “The primary reason for the depressed stock prices is pessimism, sometimes widespread and at other times limited to specific industries or companies. We look forward to doing business in such an environment, not because we are naturally pessimistic, but because it allows us to acquire more good companies at favorable prices.”

Another factor that sets Munger apart from most of us ordinary individuals is that he is never enticed by investments outside his circle of competence. He once stated, “We have three baskets: in, out, and too tough. We have to have a special insight, that we think is not generally true or obtainable by the average investor, into a business where we think we have a competitive advantage.” Investors should heed his advice: “If an investment is too difficult to understand, we pass on it and go on to the next. After all, there are a lot of things that are easier.” This mindset enabled him to steer clear of the bursting of the dot-com bubble from 2000 to 2002. During that period, the S&P 500 plummeted by 40%, with a maximum decline of 49%. Munger and Buffett, facing the irrational exuberance of the internet bubble in 1999, refrained from investing in internet stocks. They referred to it as an “irrational boom.” Following the burst of the internet bubble, Munger and Buffett avoided substantial losses by adhering to their investment principles focused on the intrinsic value of companies rather than market prices.

In the pessimistic market of 2008 during the subprime mortgage crisis, Buffett published “Buy American. I Am.” Five months later, the U.S. stock market began to rebound, marking the start of a decade-long bull market. Buffett and Munger emphasized the importance of emotional stability at the subsequent year’s shareholder meeting, highlighting that investors should use the market rather than be used by it.

Based on historical experience, my approach to downturns primarily relies on:

1. Avoiding speculative sectors; staying away from crowded places.

2. Emphasizing solid fundamental companies; focusing on the value of the company.

3. Maintaining a positive mindset when facing the future; selling high and buying low.

One of the best lessons investors can learn from past history is that there is no good time without bad times. In a prolonged investment journey, there often exists significant short-term losses during certain phases. If you cannot accept short-term losses, it becomes challenging to reap long-term market returns.

“If you cannot calmly navigate through two or three market declines of over 50% within a century, you are not suited for investing. In comparison to investors who can rationally handle market fluctuations, your investment returns are likely to be relatively mediocre.”

“Maintain a positive mindset and use leverage cautiously. In my view, the greatest risk in investing in the stock market is not the fluctuation of prices but whether there will be permanent losses in the future. In fact, those prepared to buy stocks should anticipate price declines because as market volatility increases, there is a greater chance of encountering exceptionally low prices in some good companies.”

Regarding leverage, Munger advises that most people should avoid using it:

While leverage can magnify gains during market upswings, it can also amplify losses during market downturns, potentially leading to the complete depletion of capital. Financial leverage increases the risk and uncertainty of investments, and prudent investing should be based on rational analysis and risk control. He suggests that investors should focus on growing intrinsic value rather than relying on external borrowing to ensure long-term wealth accumulation and capital safety.

After all, “No one wants to get rich twice.”