#great financial crisis

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

do people have money for commissions. stares at you blankly

#personal#got paid 75 euro less than expected so i am once again in financial crisis & about to set a government building on fire#if i can just get like two of them that'd be great... not rbing my commissions post yet i'm just testing the waters. but info in my pinned

4 notes

·

View notes

Text

If you found this helpful, consider joining our Patreon!

22 notes

·

View notes

Text

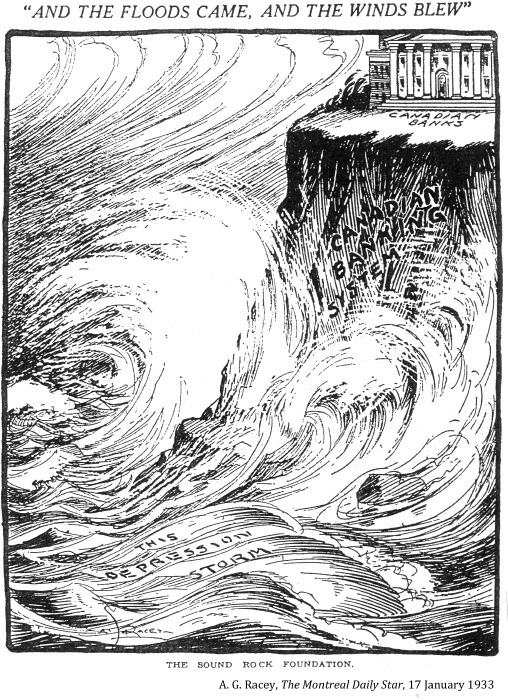

"AND THE FLOODS CAME, AND THE WINDS BLEW"," A. G. Racey, Montreal Star. January 17, 1933.

----

The DEPRESSION STORM crashes against the rocks of the CANADIAN BANKING SYSTEM, atop which sits serenely CANADIAN BANKS

#montreal#banking system#canadian banking system#financial capitalism#capitalism in canada#great depression in canada#capitalism in crisis#financial crisis#political cartoons

1 note

·

View note

Text

2008: Our Generation’s Trauma

The 2008 Financial Crisis--or the Great Recession--is, perhaps, the 9/11 of my generation (that being the awkward space between Millennials and GenZ). I was an infant when the WTC collapsed, and so that means little and less to me. All I saw was the aftermath; the brutality and injustice the U.S. inflicted on the world and its own people in response. I never knew the world before that. It was just how things were.

However, I was old enough to remember a pre-2008 world. My life was (autism withstanding) typical for a culturally Christian white household. We lived well, but not extravagantly. And then the house of cards collapsed and we lost so much. No single event has shaped the outcome of my life as such.

Now, we didn’t have it the worst. Our home in the country wasn’t financed by the dogshit mortgages that led to others’ evictions. The Crisis’ effect was secondary. My father worked as a CAD technician at the civil engineering firm ESM, working on housing and infrastructure projects. After the Crisis, ESM held on as long as it could, laying off people in a trickle until my father got the axe and the firm was no more. No one was working on housing projects, anymore.

My father had to take on odd jobs to keep us afloat, but the stress of the Crisis strained my parent’s marriage to the breaking point, and divorce followed. My parent’s issue with each other had been building before the Recession, but it all came to a head in 2010.

With little income, we slowly sold off things we didn’t strictly need. Our horses and trailer, our truck, and more. It broke my mother’s, sister’s, and my own heart to see our horses go. It wasn’t enough, though, and we ended up moving into a small duplex apartment in town.

If I was struggling in school before, it was nothing compared to my post-Crisis experience. I need not continue with more details, I believe I’ve made my case. Had the marriage held, had my father kept his job, had we kept our home and our horses and the rest, my life would be very, very different. For better or for worse.

I wanted to reflect on that. It shapes my outlook, now, and the things that are really important to me. I never buy things I wouldn’t outright own. No credit, no loans. Nothing I have can be taken from me the way our house was. I, to put it gently, loathe capitalism. I loathe the political system that enabled the Crisis to happen. I loathe the response to the Crisis. I find the truly rich disgusting and inhuman; worthy of death so that we may all live in peace. and-

Did you see what just happened? Right there: read the first paragraph, and now the one just above.

I hate capitalists after the Great Recession like (some) Americans hated Muslims after 9/11. Only, capitalists aren’t some foreign underclass we can bomb to hell. They are the ones who bomb others to hell. Despite how the pain and suffering discriminated against none, somehow my parents generation still clings to Regan and his ideals like he is god himself. The tragic comedy of that fact is not lost on me.

Maybe one day, when our parents and grandparents are dead, we can take hold and change our fucked up slice of earth for the better. Never forget 2008.

#journal#vent#reflection#the great recession#the 2008 financial crisis#anticapitalism#reganomics#neoliberalism#divorce

5 notes

·

View notes

Link

#great recession#recession#2008 financial crisis#2011#liquidity trap#working class#labor#economy#economics#unemployment#fiscalpolicy#fiscal policy#monetarypolicy#monetary policy#federal reserve

0 notes

Text

It has been 8 months since I lost insurance coverage, after the insurance people said there shouldn't be a lapse, and it has been complete radio silence from them. I have been put on generic government coverage, which really isn't much when you're not able bodied 🙃

The next time I hear someone say Canada has "✨Free Universal Healthcare✨" they're gonna have to pay my medical expenses.

#like im so so lucky that my parents can pay for me. i am so expensive and i feel so guilty about it.#i cant even see my therapist as often as i need because we literally cannot afford it.#and we have to pay for all of my medications. which arent cheap.#and theres god knows what other expenses my parents dont tell me about so i dont feel bad.#like. i get that comparatively things are pretty good here. however. this shit SUCKS!!!!!#and im so done hearing people say how great it is. because it isnt.#im telling you now. the bar is on the floor. you deserve better than this bullshit.#this angry post was prompted by me having to take pills i dropped that fell under the fridge because theyre too expensive to waste.#and also the fact that im somehow supposed to do trauma therapy once a month when my therapist wants to see me like. weekly.#before you freak out. im not in a financial crisis. things are being paid. it is fine. im just mad.#batty blogging#text

1 note

·

View note

Text

I’m literally just venting below to get it out of my head feel free to ignore

#my great aunt who was previously diagnosed with leukemia like three weeks ago was emergency intubated today and is on 100% oxygen#and yesterday my grandma had told her that she needed to spend a few days back home to rest because she had been at my great aunts bedside#for the last two weeks straight and my great aunt was guilting her super hard about taking some time to rest and come back to va#so yesterday I was really angry at my great aunt because my grandma got off the phone with my great aunt and was just sobbing for like an#hour and wouldn’t accept that none of this is her fault and she shouldn’t feel guilty#and my grandma was saying how we’re going to make a schedule so that everyone has a turn to go down there so she’s not alone#and i was trying to think about how I was going to go down there and be supportive even though I’m really angry at her for guilting my#grandma for not being there every second of the day when my grandma has HER OWN cancer that my great aunt has never once tried to care for#her because of and then this morning (literally during my first Pap smear by the way lol) I start getting a crap ton of texts#that my great aunt was emergency intubated and her lungs are like entirely being operated by the ventilator and I feel bad cause for a#minute I was relieved because my grandma said she’s completely sedated and won’t know if anyone is there or not so she was going to take a#few days to rest and wasn’t going to rush down there#and then a few minutes later she got off the phone with my great aunts doctor and he was saying she’s in critical#condition and that they’re doing a scope test to see how it went bad so fast and that they think with chemo over the last few days that they#may have gotten rid of the leukemia but that her lungs are filling up with some sort of fluid and won’t operate on their own#and on top of that yesterday my uncle (separate from my great aunt) was driving drunk on his way to work (at 4 am) and got sideswiped by a#truck who then drove away and my uncle refuses to call the police or the insurance because he had a ton of open alcohol in the car and#wouldn’t pass a breathylizer and his car needed to be towed and he had some sort of midlife crisis and bought said 45000 dollar truck#earlier in the year could he pay for that? no he couldn’t so he borrowed some from his retirement to help make the payments#and now my aunt (grandmas daughter) is struggling because of this and they’re going through a real hard time financially#and all of this is very stressful on my grandma and I can’t do anything to help I keep calling people asking if they need anything if theyre#alright and I have absolutely no idea how I’m feeling I feel like I’ve spun that children’s feelings wheel and the arrow has landed on half#the board somehow lol#I’m scared that my great aunt is going to die and I’m angry at her for telling my grandmother she made it worse by leaving and I feel guilty#for being angry at someone who might be dying and I feel guilty because I am sick of this being on egg shells what’s going to happen next#and I’m scared for my grandma who has her own health issues and is making the trip back to Florida to go be with my great aunt and won’t be#back for three weeks and I can’t protect anyone#I don’t know what I’m supposed to do

0 notes

Text

Here's the thing: imagine if we fixed the housing market, so that the price of housing only increased to match inflation. That would be great, right? Except, homeowners typically spend $2000-$10000 per year on maintenance. So homeownership would go from an investment to an endless money pit, just like renting. The idea of a house as an investment, a house as a way to build wealth, requires that housing prices increase faster than inflation forever, which means that the burden of housing costs on working people must keep increasing forever, and the number of homeless people must keep increasing forever.

The housing crisis isn't just a result of greedy landlords and investors. It's an inevitable result of social policies that encourage people to treat their houses as in investment. Because once a homeowner internalizes the idea that their financial future depends on housing prices going up, they start favoring policies (such as NIMBYism) that make housing prices go up.

Conversely, if we want to end homelessness for good, we need to accept that housing is someone we'll all have to continuously pour resources into, because buildings are complex physical objects that break a lot.

23K notes

·

View notes

Text

The seductive, science fictional power of spreadsheets

Tomorrow (Apr 30) at 2PM, I’ll be at the San Francisco Public Library with my new book, Red Team Blues, hosted by Annalee Newitz.

This week, John Scalzi was kind enough to let me write a guest-editorial for his Whatever blog about the themes in my new crime technothriller, Red Team Blues; specifically, about the ways that spreadsheets embody the power and the pitfalls of science fiction at its best and worst:

https://whatever.scalzi.com/2023/04/26/the-big-idea-cory-doctorow-2/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/29/gedankenexperimentwahn/#high-on-your-own-supply

Yes, spreadsheets. Marty Hench (the protagonist of Red Team Blues) is a 67-year-old forensic accountant who specializes in unwinding Silicon Valley financial frauds, a field he basically invented 40 years ago, when, as a PC-struck MIT dropout, he moved from Cambridge to San Francisco to recover the stolen millions hidden in spreadsheets.

Working through this book — and its two sequels, which travel back in time to the 1980s and Marty’s first encounters with VisiCalc and Lotus 1–2–3 — I was struck by the similarities between spreadsheets and science fiction.

While many people use spreadsheets as an overgrown calculator, adding up long columns of numbers, the rise and rise of spreadsheets comes from their use in modeling. Using a spreadsheet, a complex process can be expressed as a series of mathematical operations: we put these inputs into the factory and we get these finished goods. Once the model is built, we can easily test out contrafactuals: what if I add a third shift? What if I bargain harder for discounts on a key component? If I give my workers a productivity-increasing raise, will the profits make up for the costs?

These are the questions that anyone managing a complex system asks themselves all the time. Historically, the answers have sprung from intuition, from fingerspitzengefühl — the “fingertip feeling” of how a system’s components work and what their potential and limitations are. But intuition can calcify, become a rigid set of rules that increasingly diverge from the best strategy.

By contrast, spreadsheets yield a set of crisp, instantly tallied answers to any question you put to them. Change the input and watch as that change ripples through the whole system in an eyeblink. If you’re adding three more people to your camping trip, will the amount of additional water require renting another vehicle? No need to guess: just check and see.

This has a lot in common with science fiction, a genre full of thought experiments that ask Heinlein’s famous three questions:

What if?

If only, and

If this goes on…

These contrafactuals are incredibly useful and important. As critical tools, science fiction’s parables about the future are the best chance we have for resisting the inevitabilism that insists that technology must be used in a certain way, or must exist at all. Science fiction doesn’t just interrogate what the gadget does, but who it does it for and who it does it to:

https://pluralistic.net/2023/03/20/love-the-machine/#hate-the-factory

One of science fiction’s key methods comes from sf grandmaster Theodore Sturgeon: “ask the next question.” Ask a question, then ask “what happens next?” Do it again, and again, and again:

https://christopher-mckitterick.com/Sturgeon-Campbell/Sturgeon-Q.htm

This technique produces excellent, critical ways of interrogating technological narratives — check out this delightful example of the possible pipeline from self-driving cars to ransomware gangs to mutual aid societies to the reinvention of the train:

https://dduane.tumblr.com/post/715940904747352064/you-can-make-your-mercedes-ev-go-faster-for-60-a

The commonalities between sf and spreadsheets don’t stop there — sf and spreadsheets share pitfalls, too. A spreadsheet is a model and a model is not the thing it models. The map is not the territory. Every time a messy, real-world process is converted to a crisp, mathematical operation, some important qualitative element is lost.

Modeling is an intrinsically lossy operation. That’s why “all models are wrong, but some models are useful.” There is no process so simple that it can be losslessly converted to a model. Even the actions of the nanoscale transistors in a microchip, which toggle between “0” and “1,” are rarely in a state of “no voltage” and “voltage.” That clean, square-wave line that’s used to describe what happens in a chip is a lie — that is to say, it is a model.

The wave isn’t square, it’s a squiggly line that hovers around zero and around one. Under normal circumstances, “zero” and “zero-ish” is a distinction without a difference. But when computers go wrong, it’s sometimes because a sufficiently ambiguous “zero-ish” acts like a “one.” That’s true all the way up the stack. On engineering diagrams, the nanoscale lines that electrons travel along inside a chip are represented as sharp paths, the kind of thing a Tron-cycle would lay down. But in the real world, we get all kinds of weird effects at that scale — electrons sometimes tunnel through those lines, performing a spooky quantum trick that reminds us that Newtononian physics are also just a model.

Every real-world phenomenon contains qualitative and quantitative elements, but computers can only do math on the quantitative parts. This creates a powerful temptation to incinerate the qualitative and perform operations on whatever dubious quantitative residue is left in the crucible, often with disastrous results.

Remember during lockdown, when a pair of University of Illinois at Urbana-Champaign physicists produced a model of covid spread that predicted that the campus could safely reopen, predicting no more than 500 cases over the entire semester and no more than 100 cases at any one time? The physicists were openly contemptuous of their epidemiologist peers, saying that this kind of model making lacked the “intellectual thrill” of real science.

UI was so swayed by the crisp, precise model that they invited students back to campus — only to shut down again in a matter of weeks, with 780 active cases on campus and more rolling in every day.

The model reduced qualitative factors — like the propensity of undergrads to get drunk, take off their masks, and lick each others’ eyeballs — to a quantitative probability, using the highly precise, scientific technique of taking a wild-ass guess. That guess was wrong. The campus reopening was a super-spreader event.

Any model runs the risk of hiding the irreducible complexity of qualitative factors behind a formula, turning uncertainty into certainty and humility into arrogance.

Think of how we replaced contact tracing with exposure notification. Contact tracing has a qualitative foundation: public health workers establish rapport with infected people, win their trust, and get them to fully enumerate the places they’ve been and the activities they participated in.

By contrast, exposure notification measures whether two Bluetooth radios were within range of each other for a predetermined interval. It substitutes signal strength for a person’s own understanding of their experience. Now, people can be wrong about their own experience — we lose track of time, we misremember emotionally charged events, and so on — but that doesn’t mean we can substitute Bluetooth measurements for personal experience.

That’s why, despite all the clever privacy-preserving math and interesting analysis, exposure notification was a bust, something between a distraction and a false-confidence-generating disaster. Contact tracing ended the 2014 ebola outbreak. Exposure notification just wasted a lot of time:

https://locusmag.com/2021/05/cory-doctorow-qualia/

It’s just too easy to forget which parts of a model are based on guesses and which parts are based on ground truth. And even if you can keep track of those differences, it’s even harder to re-check the model’s ground truth to determine whether the underlying factors have changed. That’s how we got into so much trouble with collateralized debt obligations, which were supposed to be “risk-free” mortgage derivatives that could be safely insured and invested in.

The formulas behind CDO hedging were designed by some of the world’s smartest mathematicians and physicists, who simply assumed that market actors — from loan-originating bank officers to insurance underwriters — would act in reliable, predictable ways. They were so very wrong that they brought the world economy to the brink of ruin:

https://www.wired.com/2009/02/wp-quant/

This is also science fiction’s failure-mode: any science fictional “ask-the-next-question” exercise represents a series of guesses or speculations or maybe possibilities — but when you combine that guesswork with the deceptive certainty that comes from inhabiting a cracking story, it’s easy to mistake “guessing” for “prediction.”

Prediction is hard, especially about the future. The assumptions that go into a prediction are always incomplete, not least because human beings have free will and agency and can change the circumstances that go into the assumptions. The very best science fiction embodies this principle. I’m thinking here of the likes of Ada Palmer, an historian and sf writer whose deep historical knowledge informs her sf and her pedagogy at the University of Chicago:

https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#terra-ignota

Palmer is famous — even notorious — for her annual four-week undergraduate LARP in which students re-enact the election of the Medicis’ Pope. It’s four weeks of alliances, betrayal and skullduggery by the students, each of whom is enacting the agenda of a real-world Cardinal or other power-broker.

The final investiture is done in full costume at the university’s massive faux-gothic cathedral, and going into that climax, of the four candidates, two are always the same, because the great forces of history are bearing down on that moment to ensure that the champions of the two dominant power-blocs are in the running. But the other two? They’re never the same — because the agency of the actors jockeying for power change the outcome, every single time, in absolutely unpredictable ways.

Like any other model, sf is wrong, but sometimes useful. Thinking about jetpacks and flying cars is “useful” insofar as it gets us to interrogate how we think about cities, about mobility, about privilege and geography. But it’s not a prediction. Worse, the endless tales in which flying cars are presented a fait accompli is a gift to grifters raising money for the objectively stupid idea of flying cars. After all, we all know flying cars are inevitable, so it’s basically a risk-free investment, right? With flying cars just around the corner, wouldn’t it be irresponsible to build a city with mass-transit instead of helipads?

There’s a whole range of thought-experiments that got transformed into predictions and then certainties: self-driving cars, “general artificial intelligence,” infinite life-extension, space colonization, faster-than-light travel, cryptocurrency, etc etc.

Spreadsheets don’t just lead their users astray — they also trick their creators. The very same people who transform wild-assed guesses about hairy, unknowable outcomes into neat mathematical relationships are perfectly capable of acting as if those relationships are based on fact, rather than supposition. The Great Financial Crisis wasn’t just about people who didn’t understand the uncertainty in the hedging algorithm going all-in — the people who made those models were also fooled by them.

It’s very easy to get high on your own supply. I’ll never forget the sf convention panel I was on with Robert Silverberg about sf’s supposed predictive value, where the subject of Robert A Heinlein came up, and Silverberg sniffed, and, in that trademark bone-dry way of his, said, “Ah yes, ‘Robert A Timeline.’”

Sf isn’t just full of writers who mistake their suppositions for predictions — the canon is full of tales in which brilliant people can and do predict the future, with near-perfection. Think of Hari Seldon, the hero of Asimov’s Foundation series, who is able to forecast the future several millennia out. Or Heinlein’s first-ever story, “Life-Line,” in which a genius inventor destroys the insurance industry by creating a computer that can predict your exact date of death using statistical methods.

There’s something wild about this phenomenon, in which writers make stuff up and then assume that anything that cool must also be accurate. One tantalizing explanation for this comes from EL Doctorow’s (no relation) essay “Genesis,” from his 2007 collection “The Creationists”:

https://www.penguinrandomhouse.com/books/41520/creationists-by-e-l-doctorow/

Doctorow tells the history of the Genesis story, which the Hebrews plagiarized from the Babylonians. In Doctorow’s telling, the Babylonian mystics who made up the Genesis story assumed that it had to be true, because they considered themselves to be nowhere near imaginative enough to have come up with something as great as Genesis. An idea that amazing had to be divinely inspired.

I like this because it’s a story of being led astray by humility, rather than hubris.

Imaginative exercises — whether or not they are assisted by mathematical models and self-updating digital spreadsheets — are powerful tools for thinking about the future we want, and to guide our attempts to make that future come true. All models are wrong but some models are useful, of course!

I’m on tour with Red Team Blues right now — I’m writing this post while waiting for my flight to San Francisco, where I’m appearing at the public library with Annalee Newitz tomorrow (4/30) at 2PM:

https://sfpl.org/events/2023/04/30/author-cory-doctorow-and-annalee-newitz-conversation-red-team-blues

One especially fun stop on this tour will be on May 5, at the Books, Inc in Mountain View, where I’ll be talking about the book with Mitch Kapor, the creator of Lotus 1–2–3, who knows a thing or two about spreadsheets:

https://www.booksinc.net/event/cory-doctorow-books-inc-mountain-view

The tour is bringing me to Berkeley, Vancouver, Calgary, DC, Gaithersburg, Toronto, PDX, Nottingham, Hay, London, Manchester, Edinburgh and Berlin — I hope to see you!

https://craphound.com/novels/redteamblues/2023/04/26/the-red-team-blues-tour-burbank-sf-pdx-berkeley-yvr-edmonton-gaithersburg-dc-toronto-hay-oxford-nottingham-manchester-london-edinburgh-london-berlin/

Catch me on tour with Red Team Blues in Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Lotus 1-2-3 spreadsheet with green-on-black, low-res type; its center has an irregular vignette revealing a space station.]

#pluralistic#el doctorow#parables#gedankenexperiments#contrafactuals#qualitative factors#quantization#collateralized debt obligations#cdos#science fiction#false precision#great financial crisis#models#spreadsheets#red team blues#the map is not the territory#warnings#prediction#fingerspitzengefühl

100 notes

·

View notes

Text

Banks are predatory scum

1 note

·

View note

Photo

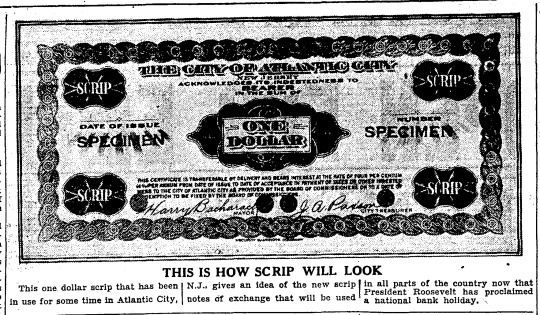

“THIS IS HOW SCRIP WILL LOOK,” Toronto Star. March 7, 1933. Page 2.

----

This one dollar scrip that has been in use for some time in Atlantic City, N.J.. gives an idea of the new scrip in all parts of the country now that President Roosevelt has proclaimed notes of exchange that will be used a national bank holiday.

#atlantic city#scrip#scrip currency#depression scrip#fdr#bank holiday#financial capitalism#financial crisis#capitalism in crisis#the great depression#united states history

1 note

·

View note

Text

I've had this post in my drafts for awhile. The week after Easter seems like a good time to reinforce this.

The +++Positives+++ keep saying that they are going to buy the BJU campus.

Honeys. First, you have to get the Board to agree to sell it to you. You have positioned yourselves in a zero sum game with the Board, so they aren't going to ever agree to that.

Secondly, you will not be able to raise $200 million. With all your IPTAY dreams, that is not going to happen.

Grow up, kids.

#Bob Jones University#Closure#Positive BJU Grads#POS BJU#PBJU#Financial Crisis#Make BJU Close#Make BJU Great Again#Make Pettit Prez Again#Rick Altizer

1 note

·

View note

Text

the 2023 financial crisis?

As I write on Sunday, March 12, headlines are that there is a bank run in the U.S. and we will find out on Monday morning if it is going to spread. What I don’t quite understand from the coverage I have read and listened to so far, is what exactly is causing this. Is it that start-up companies the bank has lended to are failing because of higher interest rates, and depositors are therefore…

View On WordPress

0 notes

Text

one of those masterposts for Sudan 🇸🇩

Disclaimer: I am not Sudanese, and am in no way an expert on the ongoing crisis. Corrections, if any, are welcome.

LAST UPDATED: 26th April 2024 [Please try to reblog the original post as much as possible]

~

So what's going on in Sudan?

Sudan was under the rule of the military dictator Omar Al-Bashir for thirty years. He came to power through a military coup in June 1989. His rule saw extreme economic decline, repression, and conflict. In the December of 2018, a democratic revolution began that eventually overthrew the dictatorship on April 11, 2019, and saw the beginning of a military rule by militant parties SAF (Sudanese Armed Forces) and RSF (Rapid Support Forces). This unrest is, of course, funded by western governments.

On the 15th of April, 2023, fighting broke out in Khartoum between the SAF and RSF. Clashes spread across the nation of Sudan, and the civilian populace is still caught in the middle. According to UN officials, Sudan is in “one of the worst humanitarian nightmares in recent history."

There is an ongoing war in Sudan, and it's getting worse. There is a health crisis along with the humanitarian crisis as well: around 2/3rds of the population do not have access to healthcare services. Around 15-20 millions suffer from hunger. There are 70 non-operational healthcare facilities in conflict zones. Thousands killed, millions displaced, and a dramatic increase in sexual violence and rape cases.

~

Links for Learning Resources:

Hadhreen: Hadhreen started as an initiative by a small group of Sudanese youth in 2015. Since its inception it continued to work in a variety of sectors, most notably Emergency response, health, and in supporting vulnerable groups.

Talk About Sudan: Learn more about what's happening in Sudan and actions you can take. Also has donation links for those who are able.

Keep Eyes On Sudan: A website run by Sudanese diaspora to amplify the calls of the Sudanese people. Has donation links, actions you can take, upcoming protests and events, resources, FAQs, etc.

#SudanSyllabus.docx: An extensive and well-sourced document, providing English language resources about Sudanese history. It's really long and has got lots of links to books, articles, and more. Curated by Razan Idris.

Human Rights Watch

~

Donation Links:

List of verified charities providing humanitiarian assistance in Sudan

Help Sudan Tarada Initiative: The aim is to deliver emergency basic needs, food and medicine. Funds will be transferred directly to local charities and organization who are managing those shelters to make sure that the funds are well received and is spent on the needs specified.

One Million Sustainable Pads Campaign: Fundraiser to help provide women in IDPs camps with reusable pads

Zubeyda Adam and family (Sudan)

Our home bombarded and destroyed

Help my family escape Sudan's war

Save a transperson in african Refugee camp from starvation [Unsure about the legibility of this one since its not from the person themself, but if someone can verify this for me that would be great]

Hope For Sudan

Darfur Women Action

Doctors Without Borders

Fill A Heart: Financial Assistance to Sudanese Hospitals

Hometax: Sudan Relief

Cairo Sudan Aid

Amal For Women

Sudan Solidarity Collective

Sadagaat

UNICEF

~

These are all the links I have so far. Please spread awareness about Sudan! Let me know if there are any links I should add to the post and I will update it.

#lamp.txt#free sudan#eyes on sudan#sudan#keep eyes on sudan#sudan crisis#sudan genocide#hall of fame

3K notes

·

View notes