#Accounting Course in Kolkata

Explore tagged Tumblr posts

Text

Take the First Step Towards Your Accounting Career!

Don't wait for the perfect moment—create it! join Ready Accountant and put off your "fresher" tag with our professional-led training. Attend our unfastened demo magnificence nowadays and kickstart your journey toward a successful accounting profession. We provide Accounting and Taxation course in a 100% practical way.

0 notes

Text

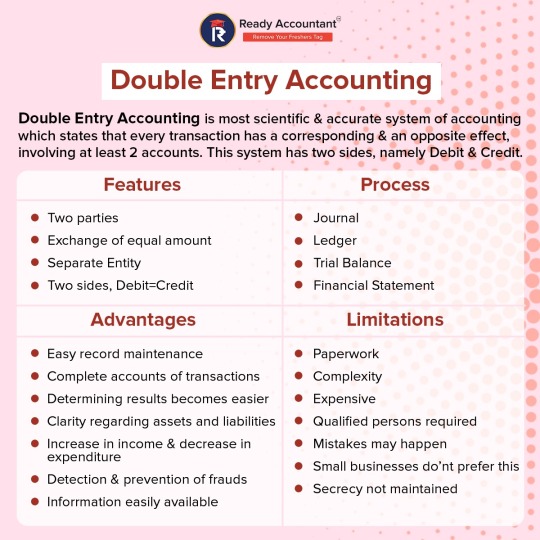

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Mastering Accounting and Bookkeeping in 2024:

Accounting and bookkeeping are must-haves for organizations in this very volatile financial environment. The year 2024 provides a bundle of technological advantages and regulatory changes. In this context, businesses and professionals must update with modern Accounting and Bookkeeping Rules. This book covers new trends and emphasizes the need for professional training under courses such as Tally Course, Taxation Course, Accounting Course in Kolkata, and GST Course in order to outshine them.

Accounting and Bookkeeping :

The Bedrock of Financial Management Accounting and bookkeeping constitute the bedrock of accounting for recording and interpreting financial performance. While bookkeeping deals with the precise calculation of transactions through a daily ledger, accounting further translates data into action.

Important factors to watch out for in 2024 are:

Automation: Software like Tally Prime streamlines processes and cuts down on errors. Regulatory Changes: Relating to GST, income tax, and international standards requires vigilance. Globalization: Companies having an international vision must implement IFRS for themselves.

To face such problems, professionals can take up specific courses like accounting courses or Tally course to build hands-on experience.

TOOLS TO BE EMPLOYED

Basic Accounting and Bookkeeping Practices in 2024

A. Accuracy True records are the root of proper book keeping. Training platforms like Tally Prime under a Tally Course in Kolkata assist one in developing a method of minimal error handling and maximizes efficiency for one .

B. Tax Compliance Knowing and keeping up to date with the changes in tax laws, such as GST, is crucial. Training through a GST Course or Taxation Course makes it abreast of knowledge and ensures continued compliance on an err-free basis.

C. Entity Separation Separation of personal and business finances is one characteristic that makes all transactions transparent and legally clear. It is one of the most basic accounting rules that a business should follow.

D. Comply with International Standards If your business is international, then compliance with IFRS will increase credibility and attract easy entry into global markets. Specialized accounting courses offer extensive knowledge of these worldwide standards.

E. Reconcile Periodically Audits and reconciliations are done frequently, which prove useful for them to detect discrepancies in time and prevent fraud. Training on tools like Tally Prime allows one to work proficiently in conducting such tasks.

3. Technological Innovation that Transforms Accounting

A. Automation and AI AI-driven tools change the face of predictive analytics and the detection of fraud. Courses like this Tally Course introduce trainees to integrating AI in accounting workflow.

B. Cloud-Based Solutions Cloud accounting provides access to financial information from anywhere while being secure. Most modern accountants have to learn how to use these tools.

C. Blockchain Blockchain technology enables tamper-proof records, which increases the level of transparency and trust in financial reporting.

D. Digital Tax Filing Digitized tax-filing platforms for taxes assist in making compliance easy. A GST Course equips one with hands-on experience on how to prepare GST returns effectively.

Overcoming Compliance Issues A. Coping with Change

Tax laws are changing all the time, and the process may sometimes be overwhelming. Courses, such as the Taxation Course in Kolkata or GST Course, help one keep in the times.

B. Securing Digital Accounting

Digital accounting requires strong cybersecurity. Secure practices training is needed in order to secure sensitive data.

C. Skills Gap Modern skills require modern techniques. The Tally Course or Accounting Course equips one to fulfill the industrial needs.

Benefits of Updated Rules

Proper Planning: The correct set of data helps in appropriate budgeting and forecasting. Strict Control: Laws should be followed without punitive measures and to gain authenticity Professional Training: Professional training leads towards high-value career prospects. Improved Transparency: Transparent financials are a source of stakeholder confidence. This is all about the steps to implement modern accounting rules.

6. Steps to Implement Modern Accounting Rules

Adoption of Advanced Tools The adoption of Tally Prime helps the firm operate efficiently and become more accountable.

Upskilling Teams Instruct the employees to take courses related to Tally Course and GST Course.

Periodical Audits It is essential to check for compliance and at the same time pick any kind of anomaly through regular review.

Be Updated: You have to sign up for an Accounting Course such that you are updated with the new and recent trends.

Use Expert Support: You can seek support from those experts who are professionalized in this domain or undergo advanced training courses for guarantee. Different Methods by which You will Follow the New Accounting and Bookkeeping Standard for 2024

How to be in Compliance With New Accounting and Bookkeeping Regulations of 2024

The new accounting and bookkeeping rules of 2024 overwhelm businesses, but there is a proper way to ensure that compliance with them becomes seamless. Here's how you can adapt to changes well:

Track the Regulatory Changes Stay updated on the latest changes in rules for accounting and book-keeping. You could read credible newsletters, participate in webinars, and follow some reliable financial blogs for this purpose. Education means that you will be equipped with the latest requirements on compliance at all times. End

Use Accounting Software Modern accounting software makes the difference. Automation helps save time and reduces human error. Update frequency should be a choice-criterion of the software as it shall help follow the changes made in regulations. Accuracy would also be enhanced through automation, and so will be the possibility of compliance.

Consultant Expertise While managing compliance proves relatively challenging in the absence of particularized skills, the employment of a professional accountant ensures that books are quite accurate and up to date. An experienced accountant can provide insights into the financial health of a business while ensuring one is in compliance with the latest rules.

Regular audit of financial records Provide frequent checks of your financial statements so you can detect any errors or mismatches before such inconsistencies become serious issues. Regular audits also ensure that your operations are within the new regulatory regime, thus not facing penalized consequences for non-compliance.

Capitalize on Improved Information and Communication Technology Facilities Cloud application and document management technologies make it more efficient to store and retrieve your records. These systems ensure secure storage and recording, efficient tracking, and fulfillment of newly promulgated regulations on data management.

Steps can thus be taken by the various businesses to not only keep up with new rules but also make accounting stream line and easier for better financial management 2024.

Conclusion

Accuracy, adherence, and utilization of technology in playing accounting and bookkeeping games will be at the center of learning in 2024. Any business or professional who specializes in these most important disciplines can thrive in competitive markets. Expanding knowledge by taking a Tally Course, Accounting Course, and GST Course in kolkata can help one keep better abreast of industry requirements and guaranteed financial success. Follow these strategies confidently as you negotiate this rapidly changing world of accounting.

0 notes

Text

Golden Rules of Debit and Credit Accounting:

Accounting forms the back-bone of the financial management of an organization; it accounts for and records correctly all business transactions. It is also the debit-credit concept that forms the foundation of the double entry bookkeeping system. These concepts have to be understood properly since they are vital in ascertaining correct financial records are kept; and this career can be pursued once a candidate enrolls for an Accounting Course in Kolkata.

In this discussion, we shall explore what are called the Golden Rules of Debit and Credit Accounting, the types of accounts involved, and just how these rules maintain financial recording integrity.

Basics of Debit and Credit

Every transaction in accounting affects at least two accounts, of course. One is increased with a debit; another is increased with a credit, though increases and decreases are not involved, but rather it is on the effect on the type of account involved.

Debit Entries That increase assets and expense accounts and decrease liability, equity, or income.

Credit Entries These are entries which raise liabilities, equity or revenue and decrease assets or expense.

For instance: Suppose a company buys stock in cash. In the account, it will credit the Inventory account (assets) and debit the Cash account (another asset). These are both weapons in the arsenal of an accountant trying to balance financial statements and both are used in that purpose.

Golden Rules for Debit and Credit Accounting

These Golden Rules of Debit and Credit Accounting can actually be divided into three key categories each of which can apply to specific types of accounts. Let's break them down:

Personal Accounts

Personal accounts are those involving individuals, companies, or organizations with whom the business has financial transactions such as with creditors and debtors.

Debit the Receiver: That is to say, when a person or entity receives something cash, goods, etc, that individual or entity's account is debited.

Credit the Giver: On the other hand, when something is given the account of the giver is credited.

For example: A business buys goods on credit from a supplier. Then, the supplier's account is credited and the purchase account is debited

Real Accounts Real accounts refer to physical assets. They include money, land, buildings, and machinery and other tangible property.

Debit What Comes In: If an asset comes to the business then it goes to the debit side of the account

Credit What Goes Out: And if it goes out then it will go to the credit side of the account

Example: This is in relation to when an entity buys machinery. In a bank sale or cash sale, this will credit the Cash or Bank real account and debit the Machinery real account.

Nominal Accounts

The nominal accounts are expenses and losses, incomes, and gains. Examples are: rent, salaries, income from sales, and interest received. All expenses and losses are debited since an expense or loss reduces the profit. Credit All Incomes and Gains: Income and gains increase profits, so they are always credited.

Example: When rent is paid, the Rent Expense account (nominal account) is debited and Cash account (real account) is credited.

Types of Accounts in Accounting

Being aware of the different types of accounts and how debits and credits affect them is an important step to mastering accounting principles. Let's go through each type in more detail.

Asset Accounts

All asset accounts account for everything owned or controlled, which the business might utilize to generate future economic benefits. These would include cash, accounts receivable, inventory, buildings, machinery, and investments.

Debit: In an asset, the account will be increased by debiting the account.

Credit: An asset is decreased by crediting the account.

Examples Buying equipment increases assets so that the Equipment account would be debited and Cash or Bank account would be credited.

Liability Accounts

Liability accounts consist of the business's loans and other duties that a company will settle in the near future. Liabilities embrace loans, account payable, mortgages, amongst others. Debit; When there is a reduction in the liabilities, credit the concerned account. Credit; A liability increases so credit this account.

The following examples A Business taking up a loan in the current period. When a Business takes up the loan and it goes down to record, then you credit a liability account loan payable and debit either cash or the bank.

Equity accounts are those which represent ownership interests in the firm, like common stock, retained earnings, and dividends.

Debit: An account is debited when equity decreases. Credit: An account is credited when equity increases.

Example

When the company issues stock, Share Capital account (equity account) is credited and Cash account (asset account) is debited.

Income and Expense Accounts

Income accounts are those that record revenues realized from business operations, while expense accounts are those that record costs incurred in conducting the business.

Debit: Expenses and losses are debited to decrease profit. Credit: Income and gains are credited to increase profit.

For example: When the company realizes revenue from sales, the Sales Revenue account, which is an income account, is credited, and the Cash or Accounts Receivable account, which is an asset account, is debited.

How Debit and Credit Accounting Reflect in the Balance Sheet

Basic accounting equation by debit and credit application must be on the balance

Assets = Liabilities + Equity

Therefore, this balance must forever be true. For all debit entries there must equally be a corresponding credit to keep the check on a balance sheet.

Practical Application: Tally Course, Taxation Course and GST Course

Courses such as GST or courses like Tally, Taxation, etc are also very helpful if one wants to understand and practically apply the Golden Rules of Debit and Credit Accounting.

Tally Course: Tally is the accounting software that does the majority of the work about accounting. Students are provided with the opportunity to utilize debit and credit principles quite efficiently in a computerized atmosphere.

Taxation Course: Because taxation deals with the concept of understanding tax-related transactions, their effects on the financial statements, and the accounting entries, the taxation course is also necessary for accountants.

GST Course: In any revisions to the rules of Goods and Services Tax, accountants learn how to make accounting entries to get into compliance and understand how this will change business transactions. GST Course can guied you to learn.

Conclusion Mastery of the Golden Rules of Debit and Credit Accounting is necessary for a career in accounting. The Golden Rules ensure double-entry bookkeeping, and thus, the correctness of the financial transactions involved. It will be easy for accountants to make reliable financial reports that are reflective of the true financial position of a business through the different types of accounts with their respective debit and credit rules.

#accounting course#gst course#taxation course#gst course in kolkata#accounting course in kolkata#tally course#tally course in kolkata

0 notes

Text

A Step-by-Step Guide to Become a Tax Accountant in India

Understand What a Tax Accountant Does:

A tax accountant will take charge of the taxation load for both private and government institutions. What differentiates a tax accountant from an accountant is the scope, for the general accountant is expected to account for several activities while dealing with finance; he or she handles issues on savings and income in relation to both parties- government and people- at various levels, though at one level at time. Besides the two above points, the accountant is required to comply with all the tax requirements from federal down to state level.

Some of the major differences between tax preparers and tax accountants include preparation of tax returns, planning, and consulting. Basically, a tax accountant acts as a consultant to collaborate with clients in their current tax liabilities and assist in designing long-term financial goals through continuous tax planning. This article explains the process of becoming a tax accountant in India, including qualifications, skills, and available training options, such as Tally, accounting, and Taxation courses in Kolkata.

The Most Vital Functions of a Tax Accountant are:

Effective planning for clients

Preparation of State and Federal Tax Returns.

The client consultancy about his demand to decrease the tax liabilities.

Deadline adherence while maintaining the tax compliance of laws.

Annual plan of Integrated Tax benefits

Effect on taxation through law

How to Become a Tax Accounting Professional in India?

Become a Tax Accounting Professional by a blend of study, experience, and acquiring new skills. Here's your step-by-step career way:

Step 1: Building a Sound Academic Foundation

Undergraduate degree: Bachelor's in Commerce (B.Com), or equivalent: This will ensure some conceptual knowledge in elements of accounting, finance, and taxation.

Professional Certification: Get your professional certification after acquiring your undergraduate degree. Useful ones are as follows:

⦁ CHARACTERED ACCOUNTANT (CA) : Will give a strong holistic view in taxation, auditing, and Financial Accounting. ⦁ Cost and Management Accountant (CMA): Its focus lies on management accounting, cost analysis, and tax planning. ⦁ Certified Public Accountant (CPA): This certification is helpful especially in jobs with an international firm or a niche industry finance sector.

Step 2: Practical Experience

Aside from formal education, hands-on experience is a must. Here's how one goes about it:

Internships: This includes taking up intern positions within accounting firms or companies that have financial departments where tasks of taxation are undertaken or implemented in real life situations.

Entry-Level Jobs: Tax assistant or junior accountant role that will practically allow one to apply the knowledge learned as well as gather the skills necessary.

Networking: Several professional societies that one can join to create a network of contacts, seek mentors, and also seek employment opportunities .

Phase 3: Key Skills

One needs to acquire these core skills to become a successful tax accountant: ⦁ Analytical Skills: The ability to interpret financial data and tax codes to ensure sound financial planning. ⦁ Communication: Simplify complicated tax laws to your clients. ⦁ Attention to detail: One should ensure that accuracy is an important aspect so that tax return preparation will not turn out wrong. ⦁ Ethics and integrity: The call for high ethics for all forms of financial reports and tax practices.

Step 4: Become a Continuing Student

Tax laws change every year. How to be up to date?

⦁ Advanced certifications: Enroll in a certification course on tax specialisation, which may add depth to your work as a professional and eventually open better avenue for advancement also. Accounting Course in kolkata is a Great choice to gain some knowledge on this field. ⦁ Conferences and Seminars: Discuss topics dealing with the tax laws of the day and accounting trends

Step 5: Know Your Accounting Software

Getting better at accounting software can become progressively important. Consider programs like a Tally course in Kolkata, and find digital accounting training helpful. This can assist in ensuring accuracy and productivity for your accounting and taxation-related tasks. Tally is an application used mostly by people in India. It has become an application that cannot be avoided in dealing with accounting or in the preparation of tax returns, thus making it a necessary component in a tax professional's career.

Step 6: Deep Insight into Tax Laws and Compliances

Basic of tax accounting are about the understanding of the tax laws of India. Key areas to be discussed below:

⦁ Income Tax Act: In terms of personal as well as corporate tax compliances. ⦁ Goods and Services Tax (GST): GST compliances, very critical. And that's particularly for individuals if they have undertaken a GST Course in Kolkata niche area. ⦁ Tax Planning Strategies: For what strategy will the consultant is using with a client, in order to minimize or reduce the payment towards tax to a greatest possible degree.

Step 7: Specialized Certification and Specialization]

A bit of experience under one's belt and it would not be a bad idea to get some specialized certifications that impart some extra skills in such areas as the following:

⦁ Tax Planning and Management There are lots of institutes offering strategic tax planning programs. This should really extend your capabilities. ⦁ International Taxation Any one who has worked with clients engaging in cross-border transactions can vouch for me. Knowing international tax is very, very plus.

Step 8: Increase Your Client Base

Building a client base is crucial when you get more expertise. Here's how to grow your network:

Freelance services: You can offer help on tax accounting to small businesses and individuals as a freelancer.

Industry networking: You have to attend industry events and conferences, which will allow you to meet more potential clients and build the network.

Online presence: You can get a professional online profile, where you attract clients with a need for tax accounting.

Conclusion

A career in tax accounting in India calls for an excellent balance of education, practical experience, and keeping abreast of changes in the industry. These steps can serve you in setting up a fulfilling profession by guiding your clients through the maze of tax regulations.

#accounting course#gst course in kolkata#tally course#gst course#taxation course in kolkata#Taxation Course#Tally Course in Kolkata#Accounting Course in Kolkata

0 notes

Text

Best Tally Institute Near Me: How to find Top Tally Training in Kolkata

In a present business scenario, the accounting skills play a very important role. In this scenario, Tally is one of the most used packages for finance management. Sometimes career enhancement through best Tally institute near you is possible in accounting or finance. Even in the city like Kolkata, there are many reputed institutes giving excellent training in Tally. This post will guide you to pick the best Tally course in Kolkata and explain why learning Tally can be a smart move for your career growth.

Why should you Learn Tally?

Tally is one of the most demanded accounting software, taking care of the most frequently faced tasks like payroll, inventory management, invoicing, and financial transaction management. Not only this, but companies all across India require professionals who have skills in Tally, and if you are choosing the best Tally institute for your learning, you will get massive job opportunities.

Choosing the Right Tally Institute

While making the right choice of suitable Tally institute, remember the following points:

Accreditation and Certification: Choose the institute which is accredited by recognized bodies. A good certificate issued by a reputed training center will give an edge to individuals in the job market.

Qualified Trainer: Choose institutes that have qualified trainers with practical exposure towards Accounting course in kolkata, GST, and Tally.

Comprehensive Syllabus: A full-fledged Tally course must comprise both basic and advanced features, like GST, payroll, and inventory management.

Practical Training: The training needs to be practical. An institution that provides you with actual hands-on exercises and case studies will make sure you are job-ready after the course.

Job Placement Support: Quite a few institutes offer job placement support, which can ultimately result in your job right after the completion of the course.

Flexibility of Learning: Working professionals will be attracted to institutes that offer flexible classes like weekend or online classes.

Skills Acquired after Tally Course

After you complete a Tally course, you'll acquire numerous key skills that will be so essential for your financial and accounting career. Here are some of the significant skills you will gain:

Analytical Skills: You will be able to interpret and analyze financial data.

Learning adaptability: Quick ability to learn new financial concepts and changes in software.

Accounting knowledge: Thorough knowledge of accounting principles and practices.

Computer application knowledge: Ability to effectively use Tally software, and other computer tools and applications.

Numerical aptitude: Safe and accurate figures and financial transaction handling.

Effective communication: Ability to communicate financial information clearly and effectively.

How to choose the best Tally Institute

In a good Tally institute look for the following features:

Full Course Curriculum: It should cover all Tally modules, ranging from the basic to the advanced level, like GST and payroll.

GST and Taxation Training: Institutes with GST and taxation training are particularly beneficial. A Taxation Course in kolkata associated with Tally will build your profile.

Practical Assignments: Institutes that provide practical projects make you apply the things you learn, making you industry-ready.

Certifications and Exams: Institutes offering certifications in Tally and conducting mock exams increase your employability.

Career Scope after Tally Course Completion

You can look into opportunities for accounting and finance as follows once you complete the Tally course:

Accountant: Take care of bookkeeping accounts and your financial accounts

GST Consultant: With training both in Tally and GST course in kolkata, assist the companies to maintain tax compliance

Tax Analyst: Prepare for returns and maintain compliance over taxation

Payroll Manager: Maintain payroll by using Tally Payroll features.

Tally Trainer: If you are mastering Tally, train others.

Avg Salary after completion of Tally course :

Average salary a person can expect to gain after becoming a graduate in Tally ranges between INR 5 Lakhs to INR 10 Lakhs as an annual level. The salary varies based on the skills and knowledge acquired by the candidate. A good example would be that candidates who have Intermediate-level Tally certification may be paid within the range of INR 2,00,000 to 4,00,000 annually while anyone who completes the advanced certification in Tally is expected to get a yearly salary between INR 5,00,000 and 7,00,000.

Courses That Develop Your Accounting Skills

In case you want to learn more about accounting, you can take more of these courses.

Taxation Course: This course includes GST, income tax, and other tax laws. With Tally being integrated into it, it will keep you ready for tax compliance management.

Accounting Course: It teaches a good foundation in the management of finances, and the skills learned in Tally complement each other.

Conclusion

Find the Best Institute offering courses in Tally by searching for an institute that offers trainers with experience, full course, and hands-on training with guaranteed support in getting jobs. This will equip you with the ability to do almost every role in finances and unlock very exciting career opportunities in your future.

#accounting course#tally course#taxation course in kolkata#gst course#tally course in kolkata#accounting course in kolkata#gst course in kolkata

0 notes

Text

Top-Rated Accounting & Finance Courses in Kolkata | 100% Job Guaranteed

Enroll in top-rated Accounting & Finance courses in Kolkata. Join the best accounts training institute offering comprehensive accounting training and accounts courses for your career growth.

#accounting training#accounting institute#accounts training institute#accounts course#accountant course#accounting training courses#accounting course#accounting course in kolkata#accounts training#accountant course in kolkata#accountant training institute#accounting training center#cost accounting course in kolkata#accounting and finance training institute

0 notes

Text

youtube

#accounting#education#finance#gst course#taxation#best accounting institute in kolkata#best tax service company in kolkata#best institute in kolkata#Youtube

0 notes

Text

#Tally Course#taxation course#accounting course#corporate accounting training in kolkata#GST Course#Taxation Course

0 notes

Text

What are the best ways for accountants to improve their technical skills?

In the vibrant landscape of financing and also accountancy, remaining in advance requires continual upskilling as well as developing of technological expertise. As the electronic age unravels accounting professionals discover themselves browsing with a myriad of software program devices, information analytics methods, plus regulative structures. To flourish in this ever-evolving domain name, it's necessary for accounting professionals to start a trip of continuous understanding together with improvement of their technological expertise's. In today's discourse, we untangle the finest approaches for accounting professionals to strengthen their technological acumen, with an emphasize on the transformative advantages of signing up in a licensed monetary accounting professional training course and also leveraging the comfort of an accounting professional program online.

Allows explore the plan for expert development:

Continuous Education plus Professional Development: Embracing a way of thinking of long-lasting knowing is extremely important for accounting professionals looking to enhance their technological abilities. Going after specialized qualifications such as the licensed financial accounting professional training course not just raises one's data base however additionally confirms their knowledge in the area. These training courses dig deep right into sophisticated accountancy concepts, economic evaluation techniques plus governing conformity structures, encouraging experts with the current sector understandings as well as ideal techniques.

Accept Technological Innovations: In today's electronic age, efficiency in accountancy software application as well as technical devices is crucial. Accounting professionals should accustom themselves with leading accountancy software program such as QuickBooks, Xero as well as SAP to name a few. Experience with information analytics devices like Tableau together with Power BI allows them to remove practical understandings from economic information helping with educated decision-making. Additionally, following arising innovations such as blockchain and also expert system outfits accounting professionals with an one-upmanship out there.

Hands-On Experience and also Practical Application: Theory without technique resembles a ship without a compass. Accounting professionals must look for chances to use their academic expertise in real-world situations. Teaching fellowships, freelance jobs and even offering for not-for-profit companies use important experiential understanding chances. Taking part in sensible workouts not just enhances technological ideas yet additionally hones analytic together with critical reasoning abilities necessary for browsing complicated economic landscapes.

Networking plus Collaboration: The adage " your network is your total assets" is true in the world of accountancy. Working together with peers, coaches as well as sector professionals helps with expertise exchange as well as promotes expert development. Signing up with specialist organizations such as the Association of Chartered Certified Accountants (ACCA) or the American Institute of CPAs (AICPA) gives accessibility to an enormous network of experts or sources. Joining workshops, workshops, together with webinars supplies understandings right into arising fads as well as fosters purposeful links within the accountancy area.

Coach together with Guidance: A directing hand can make all the distinction in one's specialist trip. Looking for coaching from experienced specialists or market experts offers vital support together with understandings. Coaches deal point of view, share sensible knowledge as well as aid browse occupation obstacles. Leveraging coaching programs supplied by specialist companies or graduates networks can speed up one's discovering contour plus lead the way for occupation development.

Specialized Training Programs: In enhancement to standard scholastic training courses accounting professionals can gain from specialized training programs customized to their particular locations of rate of interest or sector particular niches. As an example a licensed economic accounting professional program concentrating on tax, bookkeeping or forensic audit outfits experts with specialized abilities extremely searched for on the market. In a similar way, signing up in an accountant course in Kolkata gives local understandings coupled with direct exposure to local company methods improving one's specialist importance in the regional market.

Remain Updated with Regulatory Changes: The regulative landscape controlling audit techniques is frequently developing. Accounting professionals should keep up with modifications in bookkeeping criteria, tax obligation legislations, plus conformity needs. Registering for market magazines going to regulative upgrade seminars or enlisting in proceeding specialist education and learning (CPE) programs makes certain conformity with governing required while boosting technological efficiency.

Lastly the course to proficiency in accountancy is led with a dedication to continual understanding, functional application as well as welcoming technical developments. By signing up in specialized training courses such as the accredited economic certified financial accountant course, leveraging on the internet knowing systems, along with taking on a positive technique to ability growth, accounting professionals can place themselves as relied on experts coupled with important possessions to companies. Keep in mind the trip in the direction of quality is not a sprint however a marathon, and also investing in one's technological abilities today paves the way for a thriving tomorrow in the vibrant world of accountancy.

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Which Certificate Course Is Best For Accounting And Finance?

In today's competitive job market, having specialized skills and qualifications is essential for career advancement, particularly in fields like accounting and finance.

#tally prime advanced course#certificate courses in accounting and finance#accounts and taxation courses in kolkata#top financial accounting training college in kolkata#diploma course in financial accounting#certificate course in tally prime with gst

0 notes

Text

Understanding the General Journal and its General Importance in Accounting:

A general journal is one of the important records in accounting that documents business transactions in their chronological order. They are a very first step in recording transactions so that financial information is kept track of very accurately. In any Tally course, GST course, or even an Accounting course in Kolkata, understanding the format and the purpose of the general journal is bound to give you the foundation for accounting.

What Is a General Journal?

A general journal, or "book of original entry," is the place where everything in financial transactions will first be accounted for before moving into the ledgers. It contains information regarding revenues, expenses, assets, liabilities, and equity. General journals allow for kept controlled and traceable financial activities as each transaction of every controlled activity appears in its most straightforward form of record.

Elements of a General Journal Entry

Each general journal entry has specific elements to it so that it shall contain clarity and completeness in form. The individual entry elements include:

Date: The date of every transaction, recorded chronologically for accurate tracking.

Account Titles and Description: The accounts involved in the transaction, starting with the debited account, followed by the credited one. This section may include a brief description of the nature of the transaction.

Debit and Credit Amounts: Balance stipulates that each entry must have a corresponding debit and credit amounts based on the accounting equation.

Reference or Folio: It provides an option to link a journal entry with other records, such as the ledger for easy cross-referencing.

Explanation: A note explaining further which may be provided optionally, helpful for complex transactions.

A Simple General Journal Entry Example Date Account Titles and Description Debit Credit 01/01/2024 Cash 2,000.00 Sales Revenue 2,000.00 (Sold on cash)

Cash is debited whereas credit goes for the sales revenue in this illustration through the double-entry system.

Why must there be a General Journal?

General journal organization is very important to a business since it provides several benefits such as:

Warranty of accuracy: Organizing records chronologically makes tracing and verifying transactions easier. It offers an Audit Trail: It helps account for audits by providing a clear track to authenticate financial documents.

Facilitates Record Keeping: The journal serves as the foundation of the general ledger, where all financial information is recorded.

Facilitates Compliance: In addition to being aware of the general journal, its application fosters compliance with acceptable accounting standards and requirements. This is an important aspect for students undertaking Taxatioion Course in kolkata, GST, and accounting studies.

The Double-Entry System and Journal Entries

Currently, modern accounting applies the double-entry system. This means that at least two accounts are involved in a transaction. And every journal entry made in a general journal contains a debit and a credit element. These offset each other and therefore balance the accounting equation. A quick reference is:

Assets Increase by debits. Decreased by credits. Liabilities Decrease by debits. Increase by credits. Equity Decrease by debits. Increase by credits. Revenue Decrease by debits. Increase by credits. Expenses Increase by debits. Decrease by credits.

According to these regulations, Tally, Accounting and GST Course in Kolkata learn the basic concepts of double-entry accounting.

General Journal Entry-Recording: Step-wise Process

Step-wise process for making a journal entry

Know the type of Transaction: whether it is a sale or a purchase.

Choose Accounts: know the type of accounts to be debited or credited.

Recording Debit and Credit: the transaction can never be unbalanced.

Date and Description: Date the entry with a description.

Balance Check: Compare the debits with the credits to check for equality.

General Journal Entries

Example 1: Cash Sales

Date: January 5 Description: Company collected cash sales of $4,000. Date Account Titles and Description Debit Credit \ 01/05/2024 Cash 4,000.00 Sales Revenue 4,000.00 (Sale made in cash)

Example 2: Purchase on Credit

Date: January 8 Description A firm buys supplies on credit for $600. Date Account Titles and Description Debit Credit 01/08/2024 Supplies 600.00 Accounts Payable 600.00 (Supply purchased on credit)

Using Accounting Software for Journal Entries

As can be seen from the above explanation, journal entry is now not a tedious affair, because of these software like Tally and with the help of these courses students learn to do the same with more accuracy and efforts saving. Of course, Tally does provide support in such manual entry but most of the process remains automated, thus avoiding errors and ensuring all compliance.

Conclusion

The general journal is a basic tool in accounting because it accounts for the transactions in an original transparent and accurate manner. Mastering the general journal format will essentially be the backbone of one's accounting career. For Tally Course in kolkata, GST, and Accounting students, knowing its format provides an essential understanding of core accounting practices.

0 notes

Text

Understanding modes of GST payments: The comprehensive guide.

GST is another reform in the Indian tax system that makes the procedure of collection and compliance of tax smooth. However, in the midst of changing things, the issue arising here is the payment method of GST. Here lies a comprehensive guide to GST payment modes along with the features, advantages, best practices, and more. All these are important for an entrepreneur, a professional in finance, or a student getting enrolled in a GST Course in Kolkata.

What are GST Payment Modes?

GST payment modes refer to the modes of payment through which business persons can pay their dues under GST to the government. These should be paid in time and correctly for the compliance of regulations for GST and avoiding penalities. The government is also providing various modes of payments to cater to different taxpayer needs.

The most common payment mode is through the official GST portal. This is more convenient and efficient.

Steps to Pay Online Step 1: Login to the GST Portal ⦁ Log in to the official GST portal using your login credentials. ⦁ Select 'Services' followed by 'Payments': From the 'Services' tab, click on 'Payments,' then on 'Create Challan.' ⦁ Select the Right Challan: Fill in all the necessary information along with the type of tax, and you will be able to see the right challan available for selection ⦁ Payment Medium: Choose the mode of payment whether it is Net banking, Debit card or Credit card; and finally pay. Advantages ⦁ Instant success of the payment ⦁ Taxpayer ledger is updated automatically

Net Banking Net banking provides you with safe and reliable way to do GST payments from your banking account itself. Step to Apply Net Banking: ⦁ Log in to your bank's online net banking portal. ⦁ Click on GST payment. ⦁ Fill in the required information, like GSTIN and amount, etc. ⦁ Confirm the process of payment.

Advantages: ⦁ It gets processed very fast and is credited directly to the government's account. ⦁ Quick processing ⦁ Direct credit to government's account

Challan Payment through Banks Taxpayers also get a chance for payment through physical challans through banks. This is ideal for those who like old-fashioned banking.

How to Pay through Challan: ⦁ Go to a branch of a bank as directed and submit the pre-filled GST challan. ⦁ Submit along with the payment this challan. ⦁ Collect the receipt from the bank- it shall suffice as proof of payment.

Benefits It is useful in case the business entities do not make much use of the internet It offers a paper record of the payment

Electronic Wallets Some taxpayers utilize e-wallets for easy payment of their GST. This method may not be popular and will depend on the government.

⦁ Procedure on How to Use an E-Wallet ⦁ One should attach the e-wallet to your GST payment portal. ⦁ Then, click on a payment gateway and complete all steps involved in the transactions.

Benefits ⦁ Flexible and user-friendly ⦁ Useful for small business and start-ups.

Due Dates for Payments

Payment of GST is a time-sensitive process. Late payments lead to the levy of penalty and interest. You need to get familiar with the due dates for different types of GST payments-whether it will be monthly or quarterly basis according to the type of your business and turnover.

Maintain records of each transaction, like payment receipts and challans. In fact, this is indispensable while referring to the transaction data in the future as required during audits or assessment purposes. Accounting software such as Tally can even automate this process.

Choice of Medium of Payment

This, of course, keeps in mind the size, nature, and technology absorption capacity of a business. In this regard, online payment options may be preferred by smaller businesses. Similarly, a more established enterprise may seek the services of banks.

Take Related Courses

To know more about GST and its financial procedures, a student can take up a course on Taxation Course in Kolkata or GST courses i to expand knowledge about tax laws and the associated compliance needs for proper business administration.

Role of Tally in payment process through GST.

In this manner, for the companies who actually manage their accounts, making GST payments would indeed be much simpler with the help of Tally. The software calculates automatic GST, generates GST reports, and prepares payment challans efficiently. One should, therefore, get enrolled in a Tally Course in Kolkata to learn it well.

Conclusion

The knowledge of the GST payment modes will make the business compliant and save from a penalty with the help of online payments, net banking, and traditional bank payments. This also allows selecting a mode of payment most apt for him or her. Further, the investment in time for the right kinds of educational courses, including an Accounting Course in Kolkata r even a GST Course to one's knowledge and proficiency in dealing effectively with GST payments.

#accounting course#GST Course#taxation course#tally course#Accounting Course in kolkata#Gst Course in kolkata

0 notes

Text

Types of GST in India: An Ex Brief

The Goods and Services Tax is one of the many reforms the indirect tax structure of India has had to undergo. This combined various indirect levies the Centre and the State governments had been imposing on a taxpayer, thereby making taxation more straight-forward and facilitating better compliance by the business. But this cannot, certainly apply to India. GST in India is a composite sum of various kinds. There are 4 kinds of GST: Central GST, State GST, Integrated GST, and Union Territory GST. From this post, we will learn about the types of GST which are implemented in India. A GST Course in kolkata help you to gain your knowledge in this field.

Defination of GST:

The GST (Goods and Services Tax), is the name given to the unified tax over goods and services. It has obliterated many indirect taxes, such as Value Added Tax, Excise Duty, and Service Tax, to make the tax structure less complicated. It will be charged every step of the supply chain; therefore, the firms get the input tax credit of the amount paid as taxes while purchasing goods and services. It prevents double taxation and also brings greater transparency. In this regard, it does simplify the entire process of taxation and is much more efficient as compared to the old system of taxation.

Taxes Replaced Under GST:

GST was first launched in India when it replaced many indirect taxes. Some of the major taxes substituted by GST are as follows:

Central Taxes:

Central Excise Duty Additional Excise Duties Medicinal and Toilet Preparations (Excise Duties) Act, 1955 Countervailing Duty (CVD), additional import duty on subsidized products coming from other countries Special Additional Duty of Customs (SAD) Service Tax -Central Sales Tax (CST) -Central Surcharges and Cesses

State Taxes:

Value Added Tax (VAT) Central Sales Tax (CST) on inter-state sales Purchase Tax Luxury Tax Entertainment Tax (except those levied by local authorities) Entry Tax (all types) Taxes on advertisement Taxes on lotteries, betting and gambling State Surcharges and Cesses

Other Taxes: Octroi Entry Tax, where leviable, not in lieu of Octroi

All such taxes were levied under GST system. Therefore, the government streamlined the tax structure, reduced the cascading effects of taxes and, in general, increased the efficiency and transparency in the tax system.

Types of GST in India

Central Goods and Services Tax (CGST)

Central goods and services tax is the charge of the central government for supply made intra-state within the country in regard to goods and services. In terms of intra-state supplies, both CGST and SGST are applicable, and revenues accrue only to the central government. The CGST rates in the entire country are uniform.

For example, consider a firm in Kolkata selling to another firm that is located in West Bengal also. In the said transaction, both CGST and SGST would come into play. Obviously, the central government would be receiving half of the money collected but half would go to the state government.

Why is it relevant? The CGST is essential for the knowledge of any individual pursuing a Tally Course in Kolkata or accounting person. Knowledge of the concepts of the CGST will enable businesses to determine proper compliance of the same at the state tax level without prospects of imposing fines or facing legal hassles .

State Goods and Services Tax (SGST)

SGST will be the corresponding rate of CGST, and this will be collected by the state government on all intra-state supplies. Though SGST and CGST would be simultaneously collected with each and every intra-state transaction, the revenue that is arising to SGST would be credited to the treasury of the state.

For example, if the West Bengal enterprise is supplying some commodities to other enterprise in the same state, then both SGST and CGST would be collected. But for the share of SGST, that needs to be accounted for is from the state government of West Bengal.

This has a very important aspect for professionals, as it imparts major knowledge regarding SGST, especially for those who are following a GST Course or any taxation course. Hence, it will ensure that professionals take care of state-level taxation of very importance to the business operation of a business house in a particular state.

Integrated Goods and Services Tax (IGST)

It is a tax levied whenever goods and services supplied from one state to another state, as well as imported into India from other countries. IGST or Integrated Goods and Services Tax is collected by the central government. It should be noted that CGST and SGST will not be charged on inter-state, only IGST will be charged.

IGST is paid if an industry in Kolkata is selling to another industry in Maharashtra. It is collected by the central government first and then divided between the central and state government on the basis of certain criteria.

Relevance for Businesses and Students: IGST is the main tax for any enterprise which carries out its business in interstate trades. To be aware of it is important for professionals and students pursuing an Accounting Course in Kolkata or any other course.

In the absence of correct IGST compliance, they may have to suffer a massive penalty in cross-border transactions .

Union Territory Goods and Services Tax (UTGST)

UTGST will be applied on all supplies of goods and services provided in the Union Territories of India that comprises of Andaman and Nicobar Islands, Lakshadweep, Chandigarh, Dadra and Nagar Haveli, Daman and Diu and Ladakh. Likewise in the case of SGST, UTGST shall be imposed in union territories minus that area wherein the Legislative Assembly exists, like in the cases of Delhi and Puducherry where SGST exists.

For instance, if commodities are supplied in any Union Territory like Chandigarh then CGST and UTGST would be effective simultaneously. The revenue of UTGST is accrued in the Union Territory.

Educational implication: The students studying taxation and GST in their taxation course in Kolkata would conclude that the UTGST have to be addressed as taxpayers in Union Territories face taxation problems.

Benefits of GST Implementation in India

A number of benefits have been reaped from the both for businesses and consumers due to the implementation of GST .

Ease in tax: The process of tax has become streamlined with the introduction of GST because several indirect taxes have been removed and it has really become very easy for businesses. Ease of Doing Business: GST has made doing business easier in India. It has eased cross-state transactions and created a predictable tax regime. Increased Revenue Effectiveness: The measure of revenue collection also rises, given that the process has become efficient, and tax evasion is minimal because of increasing tax compliance. Input Tax Credit: Input tax credit has enabled the businesses to claim input tax, which in turn reduces the total tax burden on the business and promotes transparency in the regime of tax.

Why is there is a need for Knowledge of GST for Aspiring Accountants?

While GST is of immense importance for the development of business, at the same time, knowledge is also very essential for the people who would plan to build their careers working in accounting and taxation. Knowledge in GST can help many acquire knowledge of several other career prospects for people who are interested in tax consulting, compliance, and accounting.

These GST and Tally courses benefit students as well as working professionals. The exposure achieved in such courses develops a broad knowledge about the process concerned with GST compliances, filing, and accounting of a student or professional.

Conclusion

There are four broad categories of GST operating in India today, namely: CGST, SGST, IGST, and UTGST. All these four forms of GST exist in the structure of indirect taxes today. What each one of them holds will be very fruitful for businessmen, as well as to all the accountants and tax practitioners. Learn more by attending a course in taxation in Kolkata or a GST Course in Kolkata and get ready to begin with a thriving accounting and taxation career.

#accounting course#gst course#taxation course#gst course in kolkata#accounting course in kolkata#tally course in kolkata#tally course

0 notes