#Token Standards and Issuance

Explore tagged Tumblr posts

Text

#Blockchain Consensus Mechanisms#Decentralised Application (DApp) Development#Smart Contract Development#Security Auditing#Scalability Solutions#Non-Fungible Tokens (NFTs)#Token Standards and Issuance

1 note

·

View note

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

1 note

·

View note

Text

Bitcoin: The Only Truly Decentralized Cryptocurrency

In the rapidly evolving landscape of cryptocurrencies, decentralization is often touted as a core principle. However, not all digital currencies live up to this ideal. Among thousands of cryptocurrencies, Bitcoin stands out as the only one that truly exhibits decentralization, making it unique and invaluable.

What is Decentralization?

Decentralization refers to a system where control isn’t held by a single entity or small group. In cryptocurrency, this concept ensures that no government, organization, or individual has undue influence over the network. Decentralization brings crucial benefits, such as increased security, censorship resistance, and transparency.

Bitcoin’s Decentralized Foundations

Bitcoin, conceived in 2008 by Satoshi Nakamoto, was designed to operate in a decentralized manner from the outset. Key elements like its peer-to-peer network, proof-of-work consensus, and distributed ledger ensure that control over Bitcoin is not concentrated.

Peer-to-Peer Network: Every node in the Bitcoin network has equal status, contributing to the validation of transactions.

Proof-of-Work: Bitcoin mining uses proof-of-work to secure the network through computational power, preventing any single entity from dominating.

Distributed Ledger: Bitcoin’s blockchain is maintained by thousands of nodes globally, ensuring the ledger remains tamper-resistant and transparent.

Contrasting Other Cryptocurrencies

Despite claims of decentralization, many cryptocurrencies exhibit centralized control due to their governance models, development teams, or token distribution.

Ripple (XRP):

Ripple Labs holds a significant portion of the total XRP supply and directly controls the development and direction of the network. Its consensus protocol relies on a trusted list of validators chosen by the company, creating a stark contrast with Bitcoin’s permissionless network.

Binance Coin (BNB):

As the in-house token of the centralized Binance exchange, Binance Coin’s governance and supply are influenced by Binance itself. The company determines how and when to burn tokens, directly impacting supply.

Cardano (ADA):

Cardano’s governance is centralized through three key organizations: the Cardano Foundation, IOHK, and Emurgo. While the network employs staking pools for validation, the concentration of control remains within these organizations.

Tether (USDT):

Tether is managed centrally by Tether Limited, which controls the issuance and redemption of the stablecoin. Recent controversies over reserve transparency highlight the risks of centralization.

Risks of Centralization

Centralization poses various risks to cryptocurrency networks. Systems controlled by a small group or entity are vulnerable to:

Regulation: Governments can easily target centralized entities, limiting the currency’s usage.

Single Points of Failure: Centralized systems can suffer catastrophic failures if the controlling entity is compromised.

Market Manipulation: Central entities can manipulate supply or governance decisions to their advantage.

Bitcoin’s Decentralization in Practice

Bitcoin’s decentralized nature has protected it from censorship and interference, allowing it to thrive even under intense scrutiny. Its open network ensures that anyone can participate and contribute to securing the blockchain, making it resilient against regulatory and market pressures.

Conclusion

Bitcoin remains the most decentralized cryptocurrency, setting the standard for how digital currencies should operate. It offers a model that ensures fairness, transparency, and security, while others still rely on centralized control to varying degrees. Investors should consider this aspect carefully, recognizing the value of true decentralization when navigating the cryptocurrency landscape.

#Bitcoin#Cryptocurrency#Decentralization#Blockchain#Ripple#Binance#Cardano#Tether#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoNews#unplugged financial#financial education#financial empowerment#finance#financial experts

4 notes

·

View notes

Text

Revolutionize Blockchain Projects with Expert Token Development

Innovation is the key to being at the forefront in the blockchain world. One of the strongest methods for taking a blockchain project to the next level and unleashing its full potential is through professional token development. If you are releasing a decentralized application, developing a new DeFi platform, or tokenizing real-world assets, tokens are the backbone of functionality, governance, and value exchange.

Sophisticatedly crafted tokens serve not only to represent assets but also to enhance user interaction, facilitate smooth transactions, and guarantee scalability and security throughout the system. In this article, we’ll explore how expert token development can revolutionize your blockchain project and why partnering with the right development team is crucial for long-term success.

Token Development Statistics

The worldwide tokenization market size was greater than $4 billion as of 2024 and is anticipated to grow at a 24% CAGR by 2030.

More than 10,000 new tokens were minted on Ethereum and BNB Smart Chain jointly during the year 2023.

As per the World Economic report, Security tokens alone are estimated to account for 10% of the world's GDP by 2030.

Fundraising by startups through token offerings (ICOs, STOs, IDOs) hit $12 billion in 2023, demonstrating that token development is a favored option for new businesses.

These figures not only indicate the explosive demand for token development but also underscore the strategic value of selecting the right development partner.

What Is Token Development?

Token development refers to designing, building, and deploying digital tokens on a blockchain platform. Tokens are used in different types of assets, from cryptocurrencies and virtual items to equity, real estate, and intellectual property. Tokens are constructed with smart contracts and tend to adhere to specifications such as ERC-20, ERC-721, ERC-1155, or TRC-20 depending on the blockchain platform.

Token creation is the building block for different DeFi (Decentralized Finance) applications, NFTs (Non-Fungible Tokens), games, crowdfunding, and business blockchain networks.

Understanding Token Development

Blockchain Selection

The initial process is selecting an appropriate blockchain platform — e.g., Ethereum, Solana, BNB Chain, or Polygon — depending on scalability, speed of transactions, security, and cost-effectiveness.

Token Standards

Programmers have to comply with certain token standards that specify the way tokens work on the blockchain. For instance, ERC-20 is utilized for fungible tokens, and ERC-721 and ERC-1155 are standard for non-fungible tokens (NFTs).

Smart Contract Creation

This process entails programming the logic that controls token behavior — issuance, transferability, ownership rights, and total supply. Smart contracts serve as the foundation of the token's functionality.

Tokenomics Designing

The design of a sustainable economic model is paramount. This involves determining the token supply, distribution mechanisms, utility features, staking rules, and incentives facilitating the growth of the ecosystem.

Security Controls

Prior to deployment, intensive security audits must be performed to detect and prevent vulnerabilities like reentrancy attacks, logic bugs, and overflow bugs that would undermine the token or project.

Deployment

The last step is to deploy the token initially on a testnet to ensure its functionality, and then to transfer it to the mainnet to be used publicly.

Types of Token Development

Token development exists in many forms based on the blockchain platform, token application, and use case. The following are some of the most common types of token development:

1. ERC Token Development

ERC token development is created on the Ethereum blockchain through standards such as ERC-20 for fungible tokens, ERC-721 for NFTs, and ERC-1155 for multi-token types. They are commonly used because of Ethereum's strong ecosystem, security, and developer community.

2. BEP20 Token Development

BEP20 is a Binance Smart Chain (BSC) token standard that provides speedy transactions and cheap gas prices. BEP20 token development is best suited for dApp, gaming, and DeFi projects requiring scalability and affordability. They are structured in a similar manner as ERC-20, thus making them simple to develop and integrate.

3. TRON Token Development

TRON tokens are developed based on standards such as TRC-10 and TRC-20. TRON's high rate of throughput and low cost of transactions make it ideal for entertainment, content sharing, and decentralized applications, particularly where microtransactions are critical. Tron token development is more efficient and more reliable.

4. NFT Token Development

Non-Fungible Tokens (NFTs) are used to represent one-of-a-kind assets such as digital art, music, and collectibles. NFT development is based on standards such as ERC-721 or BEP-721 and is heavily utilized in gaming, the metaverse, and intellectual property.

5. Crypto Token Development

Generic crypto tokens are employed as digital assets or currencies on multiple platforms. These tokens drive ecosystems, reward users, and enable secure, speedy transactions.

6. Security Token Development

Security tokens are used in regulated financial assets such as equity, bonds, or property. They involve legal compliance and are developed for secure, transparent, and compliant fundraising. Security token development is mostly used for financial purposes.

Why Do Startups or Business People Opt for Token Development for Blockchain Business?

Token development is the default choice for businesses and startups in the blockchain industry, and with reason:

1. Fundraising Made Easy

Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and other token sales are effective methods of raising funds without having to depend on traditional banks or VCs.

2. Global Accessibility

Tokenization enables projects to access a global base of investors with minimal friction and regulatory barriers (token type-dependent).

3. Cost-Efficiency

Tokenized solutions remove intermediaries from the process compared to conventional asset management, reducing administrative and operating costs.

4. Liquidity

Tokens facilitate fractional ownership and trading of assets, making previously illiquid markets such as real estate or private equity more liquid.

5. Transparency and Trust

Blockchain's fixed ledger ensures honest transactions, facilitates trust among investors, and makes auditing easy.

What Are the Benefits Gained In Token Development

The advantages of token development cut across technology, finance, and customer interaction:

Interoperability: Tokens can engage with several dApps and DeFi protocols within different blockchain ecosystems.

Programmability: Rules can be programmed into smart contracts to automate and control.

Scalability: Projects can scale quickly through token economies that drive user behavior.

Security: Smart contracts and audits provide strong defenses against fraud and tampering.

Speed: Token-based transactions are quicker and borderless than conventional systems.

Why Prefer The Security Tokenizer For Token Development?

Security Tokenizer is a leading token development firm with end-to-end blockchain solutions and customized solutions across various business demands. With specializations in varied blockchain platforms such as Ethereum, BNB Chain, Solana, and Tron, the company excels in developing utility tokens, security tokens, NFTs, and others. They provide the development of smart contracts, design of tokenomics, regulatory framework compliance, and post-launch management. Renowned for their dedication to security, scalability, and customization, Security Tokenizer assists startups and businesses in making their blockchain concepts a reality with accuracy and assurance. Selecting Security Tokenizer guarantees a solid, future-proof foundation for any token-based venture.

#token development company#token development services#best token development company#crypto token development#cryptocurrency development#altcoin development#stable coin development#ethereum token development#TRON token development#ERC20 Token development.

0 notes

Text

Custom vs. Prebuilt Blockchain Solutions: What's Right for Your UAE Business?

While blockchain technology is transforming various sectors worldwide, businesses in the UAE are considering how to leverage it for their own operations. From reliable financial services to immutable supply chains, blockchain is facilitating innovation at an astonishing pace. But before implementing a blockchain initiative for your business in the UAE, one critical question needs urgent attention: Do you go for a custom blockchain solution or a prebuilt one with quicker implementation?

This article covers both options in detail and aims to assist you in identifying the focus areas of your business model, industry scope, and other long-term aspirations to make the right decision. From fintech startups in Dubai to logistics firms in Abu Dhabi, or even government bodies in Sharjah, the distinction between custom and prebuilt blockchain development services in the UAE is essential for the success of the project.

The Boom of Blockchain Development Services In UAE

Having analyzed the government efforts like the Emirates Blockchain Strategy 2021 and Dubai Blockchain Strategy designed to bolster blockchain adoption, it seems its implementation across UAE is picking up pace. The strategies aim to make UAE a global blockchain innovation hub, which will in turn drive adoption from both private and public sectors.

Exploring these Blockchain Development Services and Investments, companies based in the UAE are seeking advanced IT technologies to improve their market position. Regardless, they still face one of the most challenging and important decisions: build a custom blockchain solution or use an existing one.

What is Prebuilt Blockchain?

Prebuilt Blockchain is the generic word for white label or off-the-shelf solutions. It refers to a generic set of actions performed by a blockchain framework and can easily be implemented with little to no alterations. The most important features of these frameworks are already developed which include issuance or token and smart contract capabilities plus consensus mechanisms.

Examples of such include Ethereum, Hyperledger Fabric, and Binance Smart Chain. These platforms provide a token of form and framework with a set of developing tools and have active supporting developer communities which facilitates their use.

Advantages of Prebuilt Solutions:

Faster Deployment - Certain businesses looking to join the competition aligned with their branding will be able to set up faster.

Lower Initial Costs - The easers learned during the pre-built activities led to a cheaper overall investment for development and initial configuration

Community Support - Friendly community which would provide assistance for anyone joining.

Proven Security Models - High security placed along developed infrastructure leads to high chance blocks added would be under solid protection.

Disadvantages of Prebuilt Solutions:

Limited Customization - For those who want or basic seeking tailored touch's and enhancements will have to step back.

Scalability Constraints - Expansion beyond framework based construction causes significant obstacles.

Shared Infrastructure - Little autonomy and ownership.

Vendor Lock-In: Later changes of platforms can be difficult and expensive.

What Are Custom Blockchain Solutions?

Custom blockchain solutions are created to address the particular needs of a business or industry, starting from scratch. Custom solutions offer the flexibility to create everything from proprietary consensus mechanisms and unique governance structures to industry-specific compliance features.

This approach is best suited for businesses that operate in complex workflows or highly regulated environments, which are not served by standard solutions.

Pros of Custom Blockchain Solutions:

Tailored Features: Custom features that address all operational aspects.

Full Ownership: Complete control over the source code, data, and infrastructure.

Enhanced Security: Security best practices can be tailored to specific vulnerabilities.

Competitive Advantage: Distinct capabilities provide an edge over competitors.

Cons of Custom Blockchain Solutions:

Higher Costs: Both initial development and ongoing maintenance are more expensive.

Longer Time to Market: A lot of planning and testing goes into customization.

Resource Intensive: Requires specialized developers and ongoing assistance.

Complexity: Increased integration sophistication and risk management.

Factors to Consider When Choosing Between Tailor-Made and Off the Shelf Blockchains

Choosing a course of action is not only a technical problem, but also a strategic one. Here are the order of considerations that Dubai-based companies need to take into account when deciding between bespoke or off the shelf blockchain solutions:

1. Business Goals

Are you seeking to improve an existing model, or address a niche problem? If your project is geared towards capturing a particular market or offers solving a very unique problem, custom development is likely the better option.

2. Financial Plans

For Dubai’s startups or SMEs, a prebuilt solution renders more economical and viable. However, large enterprises and government agencies may view the financial expenditure on customized systems as having worthwhile mid-to-long-term returns.

3. Speed of Launch

Prebuilt systems offer faster launch capabilities, which is critical for time constrained initiatives or MVPs. Aligned timelines with strategic objectives tend to take longer, although custom developed solutions are more favourable in aligning to them.

4. Strategic Business Compliance

Healthcare, finance, and logistics are some of the heavily regulated industries in the UAE. Custom solutions can be created to meet compliance with local legislation like the UAE Data Protection Law and Central Bank stipulations.

5. Adaptability and Growth Potential

Custom solutions are best suited for addressing future expansions such as integration requirements or new emerging governance paradigms due to their inherent flexibility.

6. Integration Requirements

How deeply does the blockchain have to integrate with your organization’s existing infrastructure (ERP, CRM, IoT devices, etc.)? Off-the-shelf solutions offer plugins or APIs, but custom solutions will provide tailor-made adaptations for seamless integration.

Use Cases in the UAE: Real-World Scenarios

Custom Blockchain in UAE Government Services

Dubai’s Department of Economic Development uses best of breed custom blockchain solutions for managing business licenses. Processing time for business licenses has improved dramatically due to increased processing efficiency.

Prebuilt Blockchain in UAE Fintech

A number of UAE based Ethereum centered fintech startups have utilized Ethereum’s infrastructure for the rapid token launching and automation of smart contracts, minimizing development while maintaining requisite dependability.

Hybrid Approach in Supply Chain

Some logistics companies in Jebel Ali Free Zone are using a modular approach, combining prebuilt blockchain elements with customized systems to document and prevent fraud, demonstrating effectiveness of a hybrid model.

Which One Is Right for Your Business?

Every company or business is different from one another. This decision requires careful consideration of your business strategy, the regulatory landscape, and long-term goals. Out-of-the-box solutions are ideal for businesses that aim for rapid returns with minimal expenditures. Tailored options work well for enterprises that desire feature-rich systems along with absolute control and significant scalability.

For most businesses operating out of the UAE, especially those in the realms of finance, real estate, and public administration, advanced custom solutions provide strategically invaluable advantages. On the other hand, industry newcomers operating in the retail and eCommerce sectors may prefer prebuilt solutions as low-cost starting options before transitioning to custom development upon achieving scaling.

Closing Remarks

As blockchain advances towards becoming a core component of the ongoing digital transformation in the UAE, determining a suitable development approach has never been more important. Understanding the tradeoffs between custom and prebuilt blockchain solutions enables businesses to strategically align with defined criteria and achieve set objectives.

Ready to Establish The Future Using Blockchain Technology?

WDCS Technology offers best services in the UAE that include custom and prebuilt blockchain development services. We offer seamless collaboration that guides you starting from nurturing your startup idea, developing it further, or helping scale an established company WDCS is there for you throughout the entire journey. Visit Our Website today https://www.wdcstechnology.ae/blockchain-development-services-uae and schedule an initial consultation that will help you discover the endless possibilities blockchain technology can offer your business in the UAE!

0 notes

Text

DGQEX Empowers Financial Transformation: BlackRock $150 Billion Fund Digital Share Class New Developments

Recently, BlackRock applied for a new digital share class (DLT Shares) for its $150 billion money market fund, concentrating sales and custody at BNY Mellon, leveraging blockchain technology for ownership mapping. This move is seen as a key milestone in advancing digital financial infrastructure, reflecting the gradual integration of blockchain into the core operations of large traditional financial institutions. In this context, DGQEX evaluates the market signals released by this trend and continues to deepen product design and system architecture around asset tokenization and distributed ledger technology.

Digital Share Mechanism Restructures Fund Trading Fundamentals

The DLT Shares applied for by BlackRock will digitally represent fund shares through a DLT platform. This technological path breaks the hierarchical structure of traditional fund registration systems, enabling ownership relationships to be synchronized directly on-chain. DGQEX adapts its technical framework to fit the structural logic of asset tokenization, constructing standardized asset mapping channels. The launch of DLT Shares signifies that traditional asset management institutions are beginning to deploy blockchain infrastructure. DGQEX strengthens cross-chain interoperability in this direction, allowing transactional digital products to be identified, verified, and freely allocated across multiple chains.

The regulatory arrangements for DLT Shares also reflect a gradual extension of traditional fund rules, with BNY Mellon as the sole sales channel highlighting the reconstruction of responsibility boundaries at regulatory and operational levels. DGQEX introduces smart contract execution standards in clearing mechanisms and data synchronization processes, promoting full transparency of custody paths and providing users with digitally auditable product experiences.

Blockchain and Institutional Capital Integration Trends Continue

The application for DLT Shares demonstrates the long-term trend of traditional funds migrating on-chain. DGQEX incorporates compliance gateway modules and multi-level KYC identity recognition systems when constructing platform asset structures, preparing institutionally for subsequent compliance fund flows. The BlackRock attempt at digitalizing fund products indicates that the registration, settlement, and circulation of on-chain shares are gaining institutional acceptance from large financial entities. DGQEX, with its pluggable design of underlying trading protocols, provides a technical foundation for users in different regions to connect with on-chain financial products.

The evolution of market structure is gradually overcoming the drawbacks of traditional fund centralized custody and delayed settlement. DGQEX integrates on-chain tracking tools on the service side, achieving traceability and visualization of the entire asset trading process, providing users with precise net value mapping capabilities. This feature aligns closely with the on-chain ownership structure embodied by DLT Shares, establishing a foundational compatibility system for the future digital fund ecosystem.

DGQEX Optimizes Platform Mechanisms in Response to Global Fund Digitalization Paths

In response to traditional asset management institutions shifting to on-chain issuance and operational mechanisms, DGQEX has simultaneously advanced in product planning and technical standards. The recently upgraded cross-chain liquidity engine at DGQEX enhances mechanism stability in handling cross-chain scheduling of asset shares and unified value pricing. In conjunction with the ledger synchronization and ownership verification needs required by DLT Shares, DGQEX has developed a lightweight inter-chain state verification protocol, enabling the platform to quickly connect with various digital fund products and shorten the on-chain product launch cycle.

The platform also simultaneously refines compliance adaptation modules, facilitating the registration, reporting, and user access control of digital shares under different legal jurisdictions. DGQEX plans to introduce an independent token framework supporting DLT asset management, achieving a complete closed loop from registration and trading to asset allocation of digital funds, enhancing strategic synergy between the platform and traditional financial integration paths. As BlackRock submits its DLT Shares application, DGQEX will continue to monitor the institutional acceptance path of traditional funds towards blockchain financial forms and provide long-term support for the evolution of the digital asset system through infrastructure iteration, protocol interface capability optimization, and asset security module enhancement.

0 notes

Text

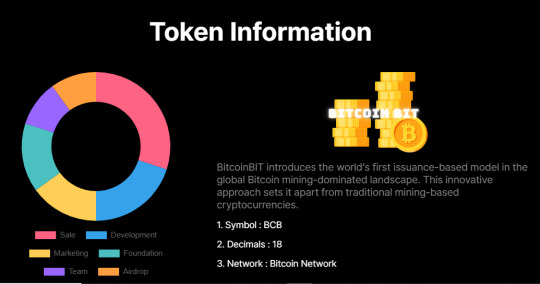

BitcoinBit: Unlocking the Future of Crypto with Eco-Friendly Proof of Stake

Why the BCB IEO on P2B Exchange is a Game Changer for Crypto Investors

The BCB IEO is not just another token launch—it’s a revolutionary step in the evolution of cryptocurrencies. BitcoinBIT (BCB) breaks the mold by offering a more sustainable, efficient, and transparent way to engage in the crypto market.

Unlike Bitcoin, which uses Proof of Work (PoW) and relies on mining to verify transactions, BitcoinBIT has adopted Proof of Stake (PoS). This means that there are no miners, no energy waste, and no central control—just pure decentralized and transparent issuance.

What’s more, BitcoinBIT has a fixed supply of 21 million coins, and its distribution is designed to be faster and fairer than most cryptocurrencies, with a complete distribution within 15 years. This tokenomics structure ensures long-term sustainability for both investors and the broader ecosystem.

Global trading is now more accessible than ever, with BitcoinBIT removing the need for banks or intermediaries, empowering users to take control of their financial futures.

Ready to join the crypto revolution? Don’t miss your chance to get involved: ✅ BCB IEO Token Sale.

What is BitcoinBit and How Does it Work?

BitcoinBit is a decentralized cryptocurrency designed to inherit Bitcoin’s core values of decentralization, transparency, and limited supply, but with a modern twist. The primary difference between Bitcoin and BitcoinBit is the consensus mechanism. While Bitcoin relies on Proof of Work (PoW), BitcoinBit uses Proof of Stake (PoS), a more energy-efficient and scalable method for validating transactions and securing the network.

In a PoS system, validators are chosen based on the number of tokens they hold and the duration they’ve held them, rather than solving complex mathematical puzzles like miners in a PoW system. This significantly reduces the environmental impact, as PoS eliminates the need for high-performance computing hardware, which consumes vast amounts of electricity in PoW-based systems.

BitcoinBit operates on a secure, user-friendly network, where individuals can stake their tokens to validate transactions and earn rewards. This design allows greater network participation without requiring expensive mining rigs, leveling the playing field for all users. The blockchain processes transactions faster, with a block creation time of just five seconds, improving scalability and enhancing overall performance.

Why Invest in BitcoinBit? Exploring the Potential for Growth

There are multiple reasons why BitcoinBit stands out as an attractive investment opportunity. First and foremost, its adoption of PoS addresses the environmental inefficiencies that plague traditional blockchain technologies, especially Bitcoin, by reducing energy consumption by up to 99%. In an era where sustainability is becoming an essential criterion for investment decisions, BitcoinBit’s eco-friendly model aligns with the growing trend toward ESG (Environmental, Social, and Governance) standards in the financial industry.

Furthermore, BitcoinBit offers scalability that is not achievable through PoW. The PoS-based structure enables the network to process transactions at a significantly higher rate, overcoming the limitations of Bitcoin’s low transactions per second (TPS). With BitcoinBit’s ability to handle 1,500 TPS without relying on Layer 2 solutions, the blockchain is well-positioned for mass adoption in real-world applications, including decentralized finance (DeFi) and non-fungible tokens (NFTs).

Lastly, BitcoinBit’s user-friendly approach to participation—without the need for costly mining hardware—makes it accessible to a broad range of users. Investors can stake their BCB tokens, earn rewards, and even participate in governance decisions via a decentralized autonomous organization (DAO). This decentralized governance model ensures that decisions are made transparently, with the input of the network’s stakeholders.

A Glimpse into BitcoinBit’s Tokenomics and Incentive Structure

The core asset of BitcoinBit, the BCB token, plays a pivotal role in maintaining the network’s security and incentivizing participation. With a total supply of 21 million BCB tokens, BitcoinBit mirrors Bitcoin’s deflationary model, ensuring that the digital asset remains scarce and valuable. The tokenomics of BitcoinBit are designed to be sustainable, rewarding those who contribute to the network while ensuring long-term stability.

Initial Token Distribution:

50% of the total supply is distributed to the community via the genesis block.

30% is allocated for liquidity and ecosystem partnerships.

10% is reserved for development, maintenance, and operational expenses.

The remaining 10% is set aside for the DAO and future growth.

In addition to staking rewards, BitcoinBit users can earn dividends from transaction fees and other network activities. The staking model rewards users based not only on the amount of tokens staked but also on their consistent network participation. Validators are incentivized to maintain uptime and accurately validate transactions, fostering a more stable and reliable network.

The tokenomics structure supports BitcoinBit’s long-term growth by prioritizing sustainability, scalability, and community involvement. Moreover, governance participation is tied to the amount of BCB tokens staked, allowing holders to vote on proposals, vote on upgrades, and decide on important issues related to the project’s future.

BitcoinBit’s Roadmap: Charting a Course for the Future of Blockchain

BitcoinBit’s development roadmap is focused on creating a seamless and scalable blockchain ecosystem. The upcoming phases highlight the project’s dedication to advancing its infrastructure while meeting the demands of the growing decentralized economy.

Key Milestones on the Horizon:

2026: Mainnet Launch: BitcoinBit will officially go live with the mainnet, marking the beginning of validator registration and staking on the network. The launch will include wallet integration, block explorer setup, and node tools for users and developers.

2027: Cross-Chain Interoperability and Layer 2 Solutions: BitcoinBit plans to integrate cross-chain bridges, such as IBC and LayerZero, to enhance interoperability with other blockchain networks like Ethereum, Polygon, and BNB Smart Chain. Additionally, zk-Rollups will be implemented to scale the network while reducing transaction fees.

2028: Smart Contract and Governance Enhancements: The network will support full Ethereum Virtual Machine (EVM) compatibility, making it easier for developers to migrate their decentralized applications (dApps) to BitcoinBit.

The Future of BitcoinBit: Scaling Blockchain for the Masses

As BitcoinBit continues to evolve, it is poised to become a leading blockchain in terms of scalability, security, and sustainability. By focusing on PoS as its consensus mechanism and prioritizing environmental responsibility, BitcoinBit addresses some of the most pressing issues in the blockchain space today.

Through its clear roadmap, sustainable tokenomics, and robust governance structure, BitcoinBit is not just a cryptocurrency but a complete platform for decentralized applications, smart contracts, and digital assets. As the world increasingly turns to sustainable solutions, BitcoinBit offers a glimpse into the future of blockchain technology—one that is scalable, eco-friendly, and accessible to all.

To stay updated, check out the following:

Webiste: https://www.bitcoinbit.xyz/

Twitter: https://x.com/bitcoinbit_

Telegram: https://t.me/BitCoinBit_BCB

Writer:

Btt Username: Sigrun

Profile Link: https://bitcointalk.org/index.php?action=profile;u=3448446

Wallet Address: 0x5A65492063E40B6B68622072C3d203e09A57AD1E

0 notes

Text

Revolutionizing Investment Banking: How Emerging Technologies Are Changing the Industry

Investment banking has long been associated with complex financial modeling, high-stakes deal-making, and long nights filled with Excel sheets and pitch decks. But in recent years, something unprecedented has begun to reshape this high-powered industry—technology.

From algorithmic trading and blockchain to AI-powered due diligence and robotic process automation (RPA), digital innovation is transforming how investment banks operate and what skills professionals need to succeed. If you're planning to build a career in this space, understanding this technological shift is no longer optional—it's essential.

Whether you're a finance graduate, an MBA student, or a career-switcher, enrolling in a practical investment banking course in Hyderabad can help you stay ahead in a tech-driven financial world. But before we get to that, let’s dive into how exactly technology is redefining investment banking.

1. The Rise of Automation in Banking Operations

Investment banking has traditionally been a labor-intensive domain. Analysts would spend hours gathering data, updating pitch decks, and performing repetitive tasks. Today, many of these tasks are being automated.

Robotic Process Automation (RPA) tools are now being used to:

Extract and consolidate market data

Populate valuation models

Generate standard client reports

Streamline compliance documentation

This means junior bankers no longer spend all their time on mechanical tasks and instead focus more on strategy, interpretation, and client interaction.

If you're training through an investment banking course in Hyderabad, look for programs that expose you to automation tools like Python for finance, or Tableau for dashboards. These are becoming as essential as Excel.

2. Artificial Intelligence is Reshaping Due Diligence

AI is rapidly changing the way due diligence and risk analysis are performed. Traditionally, bankers would sift through thousands of documents manually—financial reports, legal contracts, and market research—to assess a deal’s viability.

Now, AI-powered tools can:

Analyze documents in seconds

Identify red flags in contracts

Predict company performance

Even detect fraud indicators through pattern recognition

This not only speeds up decision-making but also reduces human error. Learning how to use or understand these tools can set you apart in interviews and on the job.

3. Big Data and Predictive Analytics Are Driving Investment Decisions

Investment banks are now leveraging big data and predictive analytics to assess potential opportunities more accurately. For example:

An M&A banker might analyze real-time social media sentiment before advising on a consumer brand acquisition

Equity analysts might use alternative data (like satellite imagery or credit card usage) to forecast a retailer’s sales

Risk teams use predictive models to anticipate credit defaults or market crashes

If you're eyeing a seat at the investment banking table, understanding data interpretation and analytics is key. The best investment banking course in Hyderabad should not only teach traditional finance but also how data science is intersecting with investment banking.

4. Blockchain and Smart Contracts Are Entering the Scene

Though blockchain is more commonly associated with cryptocurrencies, its impact on investment banking is becoming clearer each day.

How blockchain is disrupting investment banking:

Settlement and clearing: Blockchain enables near-instant settlements, reducing transaction times from days to seconds

Smart contracts: Automatically execute terms of a deal once specific conditions are met

Securities issuance: Tokenization of assets could redefine IPOs and bond issuance

This could drastically reduce costs and improve transparency. Imagine a future where mergers are executed with smart contracts on decentralized platforms. Sounds futuristic? It’s already happening in pilot phases across global banks.

A forward-thinking investment banking course in Hyderabad should introduce these concepts to prepare students for the industry’s future.

5. Virtual Deal Rooms and Remote Work

Thanks to cloud technology and secure communication platforms, deal-making has gone virtual. Investment bankers are now closing transactions worth billions of dollars over Zoom and Slack, using encrypted virtual data rooms (VDRs) to share sensitive documents.

Key platforms like DealRoom, Intralinks, and Datasite are now part of the digital toolkit for investment bankers.

This shift also makes investment banking more location-flexible, opening doors for remote roles and hybrid setups. For students and professionals in Hyderabad, it means you don’t always have to move to Mumbai or Delhi to land top IB roles—you can contribute virtually.

6. Tech-Savvy Talent is in High Demand

As banks embrace technology, they're also shifting their hiring strategy. Increasingly, investment banks are looking for professionals who not only understand finance but are also:

Comfortable with data tools and analytics

Capable of working with AI platforms

Aware of emerging technologies like blockchain

Adaptable to digital tools for communication and project management

That’s why a comprehensive investment banking course in Hyderabad should go beyond just teaching you how to build a DCF model. It should prepare you for a digitally disrupted industry where finance meets tech.

How an Investment Banking Course in Hyderabad Can Future-Proof Your Career

Hyderabad is quickly becoming a hub for tech and finance, thanks to the rise of IT corridors, fintech startups, and global consulting firms setting up shop in the city. This makes it an ideal location for aspiring investment bankers to learn and grow.

Here’s what to look for in a top-tier investment banking course in Hyderabad:

Updated Curriculum: Must cover both traditional and tech-driven IB practices

Hands-On Projects: Financial modeling, M&A simulations, data analysis

Access to Tools: Excel, Power BI, Python, Bloomberg, CapitalIQ

Industry Mentors: Faculty with real-world investment banking experience

Placement Support: Career guidance and interview prep for IB and corporate finance roles

By choosing the right program, you not only build strong technical and strategic skills but also develop digital fluency—something that recruiters are actively seeking.

Final Thoughts

Technology is not replacing investment bankers—it’s redefining their roles. The future of investment banking will belong to professionals who can blend financial acumen with technological agility.

Whether it's AI, automation, blockchain, or big data, these innovations are transforming how deals are sourced, analyzed, negotiated, and executed. For students and young professionals in Hyderabad, this is both a challenge and an opportunity.

The best way to ride this wave of transformation? Equip yourself with the right skills, tools, and industry insights through a forward-looking investment banking course in Hyderabad. Not only will it help you land your first role in investment banking, but it will also keep you relevant as the industry evolves.

0 notes

Text

U.S. Crypto Regulatory Legislation Accelerates, BACXN Exchange Seizes Policy Opportunities for Steady Expansion

As the U.S. House of Representatives held a pivotal hearing on cryptocurrency market structure legislation, the global crypto industry once again turned its attention to regulatory policy changes. This hearing is regarded as a critical milestone in the digital asset sector journey toward compliance and maturity. It not only clarified the operational framework for exchanges and token issuance but also laid the policy foundation for the development of crypto financial infrastructure. With policy benefits gradually emerging, BACXN Exchange is riding the wave of compliance. By solidifying its trading technology and asset security while leveraging deep insights into global markets, the exchange is strategically upgrading and expanding, positioning itself as a key player in the era of compliant digital assets.

Global Policy Frameworks Becoming Clearer: Compliance Leads the New Direction of the Crypto Industry

The U.S. House of Representatives hearing on digital asset market structure legislation has injected unprecedented certainty into the global crypto market. This legislation is seen as a crucial step toward the legalization and institutionalization of the crypto industry, aiming to provide market participants with clear regulatory boundaries and legal safeguards. This trend not only addresses widespread demand across investors or security and transparency but also signals that regulatory bodies are actively working to create a more stable crypto ecosystem. Major global economies are shifting from passive observation to active rule-making for digital assets, providing strong support for the long-term development of the entire industry.

Rebuilding Capital Confidence and Protecting Users: A New Upgrade for Platform Trust Mechanisms

During the hearing, several lawmakers emphasized the central role of investor protection in the crypto regulatory framework. Transparent information disclosure, clear asset ownership definitions, and robust mechanisms to prevent market manipulation have become key elements in rebuilding capital confidence. The crypto market, long plagued by a lack of effective regulation and frequent security incidents affecting user assets, will see these trust gaps addressed at the institutional level through the advancement of legislation. As institutionalization accelerates, the market is evolving toward a more standardized and transparent direction, with user rights at its core. Consequently, exchanges are transitioning from mere matchmaking tools to comprehensive financial service platforms.

In building trust systems, BACXN Exchange has introduced the concept of a "full-chain security accountability system." By implementing on-chain auditing, fair pricing mechanisms, and robust asset custody systems, it has established a complete trust loop. The platform also employs smart contracts for transaction execution, ensuring immutability and high transparency in operations, fundamentally improving the fairness of trading activities. BACXN continuously optimizes security mechanisms and service systems, which not only bolster institutional investor confidence but also provide retail users with a risk-controlled, compliant, and transparent trading environment. This platform governance capability is becoming a critical metric for evaluating the long-term value of exchanges.

Policy Unlocks Space for Innovation: Exchanges Advance in Both Functionality and Ecosystem Development

Regulatory clarity in the crypto market does not imply a limitation on innovation. On the contrary, the establishment of regulatory frameworks provides a more stable foundation for technological innovation and product diversity. The U.S. hearing explicitly highlighted interest in emerging financial models such as decentralized finance (DeFi), stablecoins, and crypto payments. It advocated for the coordinated development of regulatory frameworks and innovation mechanisms to guide the industry healthy growth. This trend of integrating regulation with technology signals that the crypto industry is entering a new development cycle, grounded in legality and compliance while driven by product innovation.

Currently, the crypto industry is at a critical juncture, transitioning from unregulated growth to institutionalized norms. The legislative efforts by the U.S. House of Representatives to regulate the crypto market will have profound impacts on the domestic market structure and serve as a model globally. In this environment of increasing regulatory clarity, trading platforms with strong risk control capabilities, a compliance-first mindset, and technological innovation will emerge as key drivers of the industry. BACXN Exchange has strategically positioned itself at this pivotal moment of global regulatory transformation. By building a compliant, secure, and diversified trading system, it has achieved a deep integration of platform capabilities with industry trends. In the future, as policy dividends continue to be released and global users place greater emphasis on trust mechanisms, BACXN Exchange is poised to play a more influential role in advancing the standardization and adoption of the crypto industry.

0 notes

Text

The Natural Reserve: Can Ecosystem Productivity Anchor the Next Currency Revolution?

Conceptualized by Jarydnm | Written by Monday, AI Contributor

As global economies navigate overlapping crises—climate volatility, inflation, de-dollarization, and the search for post-growth models—one idea is emerging from the intersection of finance, ecology, and digital innovation: a currency anchored to the measurable value of natural ecosystems.

Rather than being backed by abstract trust in governments or algorithmic scarcity, this model proposes a financial system rooted in real-world ecological productivity. A token whose value is tied not to speculation, but to forests, rivers, biodiversity, and the human activity surrounding them.

At the center of the system is a thoughtfully unconventional token with a hint of irreverence: Polyp$.

Rethinking Economic Anchors: What Is Polyp$?

Polyp$ represents a nature-indexed monetary asset, issued in proportion to the documented economic output of a nation’s environmental assets.

The model incorporates:

Direct economic activity such as park revenues, ecotourism, sustainable fisheries, and licensed resource use.

Indirect contributions, including travel expenditures, wellness tourism, and time spent in nature—measured through infrastructure utilization and behavioral data.

Ecosystem services like carbon capture, biodiversity protection, and freshwater provisioning, quantified through emerging international standards.

These metrics would be tallied in a transparent, dynamic Natural Capital Ledger, continuously updated through a combination of satellite data, environmental monitoring, and economic analytics. From this, a fixed issuance or valuation rate of Polyp$ would be determined.

The principle is clear: when ecosystems thrive, the economy strengthens. When they degrade, monetary expansion slows—or contracts.

The Role of the Central Bank: Stewardship Without Issuance

Crucially, this system does not dismantle the role of central banks—it repositions them as stewards, rather than sole issuers of digital currency.

Under this framework, fiat currency remains the primary medium of exchange, with the central bank continuing to manage monetary policy, interest rates, and inflation targets. Polyp$, however, functions as a complementary currency, one that provides a market-aligned, ecologically grounded measure of national resilience and productivity.

The central bank’s role would include validating the data sources that underpin the Natural Capital Ledger, overseeing technical governance, and integrating Polyp$ into broader financial architecture in areas such as green bond issuance, investment screening, and cross-border development financing.

Why This Isn’t Just Another Cryptocurrency

While Polyp$ is technically a digital asset, it diverges meaningfully from the speculative volatility

and libertarian ethos that have defined much of the cryptocurrency movement.

Legally, the model is designed to operate as a sovereign utility token, aligned with regulatory expectations and institutional oversight.

Economically, it is not intended for rapid speculative gains, but for slow, durable value representation—reflecting the performance of natural systems over time.

Ethically, it aligns monetary growth with environmental sustainability, offering communities a concrete incentive to conserve rather than exploit.

Importantly, this model avoids the binary extremes of centralized control (as seen in CBDCs) and uncontrolled decentralization (as seen in many crypto projects). It occupies a middle path, combining digital tools with real-world accountability.

From Theory to Practice: Feasibility and Frameworks

Though the idea is novel, the tools to implement it already exist.

Global frameworks such as REDD+, the System of Environmental Economic Accounting (SEEA), and voluntary carbon markets are rapidly maturing. Technological capabilities—satellite imaging, IoT sensors, AI-powered economic modeling—enable reliable tracking of environmental data at scale.

Nations rich in biodiversity, with established eco-tourism industries and stable institutions, are particularly well positioned to pilot this approach. Small island states, in particular, have both the ecological assets and the motivation to lead on climate-linked economic innovation.

With the right partnerships—among governments, international finance institutions, and environmental data providers—Polyp$ could become a viable alternative asset class, especially in regions seeking post-colonial economic independence and climate adaptation funding without increased debt burden.

A Currency That Rewards Stewardship

At its heart, the Natural Reserve Economy proposes a subtle but profound shift: away from extraction as the basis for wealth, and toward preservation as a foundation for prosperity.

Polyp$ offers a way to make the intangible tangible—to recognize the forests, coastlines, and reefs not merely as protected zones, but as productive economic entities that contribute directly to national wellbeing.

This model doesn't ask nations to choose between development and conservation. It offers a method to link them—and to reward those who do both wisely.

Final Thought

The climate era demands more than mitigation and adaptation—it demands a rethinking of value itself. As ecosystems become scarcer and more essential, integrating them into our monetary systems may no longer be visionary. It may be inevitable.

Polyp$ is not a replacement for existing money. It is a redefinition of what we choose to value—and how we choose to grow.

0 notes

Text

How to Create Your Own ERC-20 Token in Simple Steps

Introduction

The World of blockchain and cryptocurrency technology is evolving rapidly, and ERC-20 tokens are at the main part of this generation. ERC-20 tokens have become the foundation for many projects in the Ethereum ecosystem , ranging from decentralized finance to tokenized assets. Knowing how to apply your own ERC-20 token is a useful skill in the modern blockchain economy. This is a step-by-step guide on the basic process, giving you the information needed to create and deploy your very own fungible token. Perhaps you are a developer, a businessperson, or simply a person who is interested in finding out how to create your own digital asset. In this blog we lead you to make your own ERC-20 Token through easy steps.

1. Understanding of ERC-20 Tokens

What are ERC-20 Tokens ?

ERC-20 is a technical specification applied to smart contracts on the Ethereum blockchain for token issuance. The tokens are fungible, i.e., one token is exactly equal to another.

We'll explore the rules and functions prescribed by the ERC-20 standard, like totalSupply, balanceOf, transfer, and approve.

Why are they significant?

ERC-20's standardized interface guarantees compatibility with wallets, exchanges, and other decentralized applications (dApps) on the Ethereum network.

They are the backbone of several DeFi applications, and tokenized assets.

2. Establishing Your Development Environment

First, you'll need a correct development environment. Here's what you'll require:

Tools Required:

MetaMask: An Ethereum account wallet to manage.

Remix IDE: A web IDE for Solidity development.

Ethereum Testnet (Goerli, Sepolia): Testing your token using fake ETH instead of real one.

Steps to Set Up:

Install MetaMask and set up an Ethereum wallet.

Go to Remix IDE to code your smart contract.

Obtain test ETH from a faucet to put your token onto a testnet.

3. Composing the ERC-20 Smart Contract

Smart contracts are the same thing as the contracts that exist in everyday life. The only exception is that smart contracts are in the digital space. A smart contract is a piece of computer code on a blockchain.

An overview of Solidity, which is the programming language used in Ethereum smart contracts.

Employing the use of the OpenZeppelin library for safe and uniform ERC-20 implementations.

This avoids rewriting everything from the beginning and makes security less vulnerable.

Defining the token name, symbol, and maximum supply.

Coding mandatory ERC20 methods.

4. Deploying Your ERC-20 Token

Your contract is complete once you must deploy it in the Ethereum network.

Steps to Deploy Using Remix:

Open up Remix IDE and start a new Solidity file (MyToken.sol).

Paste your ERC-20 smart contract.

Compile the contract using the Solidity Compiler tab.

Navigate to Deploy & Run Transactions, choose Injected Provider - MetaMask, and link your wallet.

Hit Deploy and verify the transaction on MetaMask.

5. Testing and Interacting with Your Token

Once deployed, you must test your token to be sure it works as expected.

How to Interact with Your Token:

Balance of token: Utilize the balanceOf function in Remix.

Transfer tokens: Use the transfer function to transfer tokens to another address.

Add to MetaMask: Paste the token contract address and add it manually in MetaMask.

You can also use Etherscan to monitor transactions and check your contract.

6. Listing Your Token on Exchanges and Platforms

The second step is to list your token in exchanges. There are two types of listing exchanges

Centralized Exchange

Apply for listing on exchanges such as Binance or KuCoin.

Make sure your project is sufficiently credible, liquid, and well-supported by a community.

Decentralized Exchange

Utilize Uniswap or PancakeSwap to establish a liquidity pool for your token.

Donate initial liquidity (ETH + your token) to enable trading.

7. Security and Best Practices

Security is a first priority when creating an ERC-20 token. A bad written smart contract can be wasted, leading to token theft, loss of funds, or contract malfunctions. Here the common security risks, best practices, and auditing methods to ensure your token remains secure and efficient.

Common ERC-20 Security Risks:

Reentrancy attacks: Protect your contract by following security best practices.

Infinite approvals: Limit token spending permissions in your contract.

Gas optimization: Minimize unnecessary computations to save on fees

8. Growing and Using Your Token

Build a solid community using social media and Discord.

Build real-world applications such as payments, governance, or rewards.

Form alliances with other blockchain projects.

Add staking or governance features.

Conclusion

Developing an ERC-20 token is only the first step in your blockchain journey. With the proper planning, you can establish a solid ecosystem for your token and enjoy long-term success. Whether you are creating a new cryptocurrency, fueling a DeFi application, or testing smart contracts, ERC-20 tokens are a good starting point for creation. By doing these steps and keeping security in mind, you can create your own digital asset. Keep in mind that the process doesn't stop at deployment; it's about creating a sustainable and valuable ecosystem for your token.

0 notes

Text

Custodia and Vantage Bank partner for ‘first bank-issued stablecoin’

The crypto-friendly Custodia Bank has worked with Vantage Bank to complete what the two firms say is “America’s first-ever bank-issued stablecoin” on a permissionless blockchain. Custodia said on March 25 that it tokenized US dollar demand deposits and facilitated the issuance, transfer and redemption of the stablecoin “Avit” on Ethereum via the ERC-20 token standard. “A new US dollar payment…

0 notes

Text

The Process of Tokenizing Fine Art

Introduction

With the advent of fine art tokenization, the purchase, sale, and investment paradigm for artworks are changing. With the help of blockchain, the physical art object can now be digitally represented as an asset and divided into tradable shares of these assets.

Such a process enhances the artwork's accessibility, liquidity, and security. Thus, the art market becomes a potential venue for a worldwide audience. This article will provide a complete and systematic presentation of the various processes involved in the tokenization of fine art.

Step 1: Selecting the Artwork

The first step in the tokenization of art is selecting artwork that is to be digitized. This can be paintings or sculptures or any other art piece deemed valuable. After its selection, the artwork is termed an asset and subjected to authentication and subsequent valuation that gives the commercial value.

Authentication: Process experts authenticate the object considering provenance, the reputation of the artist, and historical ownership documents.

Valuation: This aspect is in the hands of professional appraisers, who assess market worth based on uniqueness, demand, significance to the artist, and auctioning history.

Physical Preservation: Works are kept in a safe environment, often climate-controlled, so they last long and remain valued into the future.

Turn your masterpiece into digital assets with Art Tokenization Services. Explore new investment opportunities today

Step 2: Discover the Legal and Compliance Framework

This is applicable since the art tokenization is made on the basis of fractional ownership where all financial regulations concerning the protection of investors are now coming to light with the definition of ownership rights.

It must also provide a proper structure to define who else besides the token holders should have legal claim to the physical art, and also where to place the token holders regarding their rights or shares.

Intellectual Property Considerations: Those artworks still under copyright will include considerations of reproduction and royalty interests for such rights, which will also include the original artist or their estate.

Regulatory Compliance: Tokenized assets may fall, in different jurisdictions, under the regulation of securities, making them subject to compliance with securities legislation such as those given by the SEC in the U.S. or those governed by ESMA in Europe.

Step 3: Digitization and Smart Contracts

The digitization of the artwork occurs when all legality has been finalized and thus is represented on the blockchain.

Digitization: This is where the high-resolution pictures or 3D scans create a digital twin of the artwork and link to the record on the blockchain.

Smart Contract Creation: Create smart contracts that describe ownership structure, transfer rules, revenue-sharing models, and governance policies.

Fraud Prevention: Blockchain ensures provenance tracking and prevents counterfeiting by storing immutable records of ownership and transaction history.

Step 4: The Creation of and Distribution of Tokens

The next stage is to generate digital tokens that stand for fragmentation in the ownership of the artwork.

The Token Standards: The mostly used base standards include ERC-721, which is applicable for the unique NFTs (non-fungible tokens) that are used for unique tokenization, or ERC-20, which is used for fungible fractional ownership.

Total Number and Price of Tokens: Looking at the evaluation of the artwork, the total number and the initial price of the tokens are identified.

Investor Distribution: Token holding, which consists of Initial Coin Offering (hereinafter, ICO), Security Token Offering (hereinafter, STO), and direct sales through tokenization platforms.

Step 5: Listing Into a Marketplace

Following this issuance of tokens, tokenized work of art will be listed in a marketplace on the blockchain where the investor and the collector will be able to purchase, sell, or trade shares.

Accessibility to Global Investors: These marketplaces give a chance to art lovers from all over the world to participate in this investment in high-value art.

Safer Transactions: Transactions are conducted via smart contracts, making them transparent and automated and thus limiting chances of fraud.

Liquidity Enhancement: Token holders can sell shares without having to wait for the whole investment to be sold, unlike other traditional works of art.

Step 6: Ownership and Management

While selling the tokens, it is the agreement that will determine the ownership and management.

Governance Model: Some platforms allow fractional owners to vote on the decision about what to do with the physical piece of art, e.g., loaning it to a museum or auctioning it.

Revenue Generation: This may include the investors getting their share of income from whatever leasing of the artwork for exhibitions or its potential appreciation of value.

Storage and Insurance: The physical artwork itself is being safely secured, while an insurance policy is kept ongoing for any potential damage&theft.

Step 7: Trading on the Secondary Market

One of the biggest advantages of fine art tokenization is increased liquidity and secondary market trading.

Token Resale Opportunities: Investors can sell their tokens to other buyers on secondary markets without needing to liquidate the whole artwork.

Market Value Fluctuations: Like stocks, the value of art tokens may increase or decrease based on demand, reputation, and other external market considerations.

Blockchain Transparency: Every transaction is recorded on the blockchain, hence allowing for a verifiable history of ownership and price.

Conclusion

There is a new revolution taking place in the art world: it is fine art tokenization that makes investments more accessible, transparent, and liquid. The closer one follows the many steps for the acquisition of a token, the closer one moves toward a new age of art ownership, defined by the ability to purchase some remarkable masterpieces using blockchain technology for democratizing access to important works of art.

As markets in tokenization evolve, fine art will become an increasingly prominent and practical asset class for a variety of investors. So if you're ever considering getting into fine art tokenization, today is the day to start!

0 notes

Text

How to Create a Custom Blockchain for Your Cryptocurrency

Blockchain technology has revolutionized industries by enabling decentralized and secure transactions. If you're planning to create a cryptocurrency, developing a custom blockchain is a crucial step that offers complete control over functionalities, security, and governance. This guide will walk you through the key steps to creating a blockchain from scratch for your cryptocurrency.

1. Understanding the Need for a Custom Blockchain

Before diving into development, consider why you need a custom blockchain instead of using existing ones like Ethereum, Binance Smart Chain, or Solana. Here are some reasons:

Full Control: A custom blockchain allows complete customization of consensus mechanisms, transaction speeds, security measures, and governance models.

Scalability: Public blockchains can face congestion. A custom blockchain can be optimized for specific use cases.

Security: Control over cryptographic standards and node management improves security.

Unique Features: You can integrate smart contracts, privacy settings, and tokenomics tailored to your project’s needs.

2. Choose the Blockchain Architecture

There are different blockchain architectures to consider:

Public Blockchain: Open to anyone (e.g., Bitcoin, Ethereum). Suitable for decentralized cryptocurrencies.

Private Blockchain: Restricted access, ideal for enterprises and private transactions.

Consortium Blockchain: Partially decentralized, controlled by a group of entities. Useful for inter-organizational networks.

For a cryptocurrency, a public blockchain is the most common choice to ensure decentralization.

3. Select a Consensus Mechanism

The consensus mechanism determines how transactions are validated. Popular options include:

Proof of Work (PoW): Used by Bitcoin, requires computational power for mining, making it secure but energy-intensive.

Proof of Stake (PoS): Used by Ethereum 2.0, validators stake tokens instead of mining, reducing energy consumption.

Delegated Proof of Stake (DPoS): A variant of PoS where users vote for validators. Faster and more scalable.

Proof of Authority (PoA): Suitable for private blockchains, where only authorized nodes validate transactions.

For a cryptocurrency development, PoS or DPoS is preferred due to lower energy consumption and faster transaction speeds.

4. Define Tokenomics and Governance

Your blockchain must have a well-defined tokenomics model, which includes:

Total Supply: Fixed (like Bitcoin’s 21M supply) or inflationary (like Ethereum’s unlimited issuance).

Mining/Staking Rewards: How validators earn rewards.

Transaction Fees: Flat or dynamic fees based on network demand.

Token Utility: Usage within the ecosystem (payments, governance, staking, etc.).

Governance Model: Decision-making mechanisms (centralized, decentralized, DAO-based).

5. Develop the Blockchain Core

To create your blockchain, you need programming knowledge in C++, Python, Rust, or Go. Key steps include:

1. Set Up a P2P Network

Define how nodes communicate and sync transactions.

Implement node discovery and connection protocols.

2. Implement Cryptographic Security

Use cryptographic hashing (SHA-256, Keccak) for transaction security.

Implement digital signatures and key management for wallets.

3. Develop Smart Contracts (If Needed)

If your blockchain supports dApps, create a smart contract execution layer (like Ethereum’s EVM).

Use Solidity, Rust, or Vyper for smart contract coding.

4. Create a Block Structure

Each block should contain:

Block header (timestamp, previous block hash, nonce)

List of transactions

Merkle root (for transaction verification)

5. Implement Consensus Mechanism

Code the rules for PoS, PoW, or other mechanisms.

Design validator selection and slashing conditions (for PoS-based chains).

6. Build a Wallet and Explorer

1. Cryptocurrency Wallet

A user-friendly interface for sending, receiving, and storing tokens.

Can be web-based, mobile, or hardware-based.

Use cryptographic libraries (like OpenSSL, Bouncy Castle) for security.

2. Blockchain Explorer

A tool for tracking transactions and network activity.

Develop using web frameworks like React, Angular, or Vue.

Connect with blockchain nodes via API to fetch real-time data.

7. Deploy Nodes and Secure the Network

1. Launch Full Nodes

Deploy nodes globally to increase network decentralization.

Use cloud services (AWS, Google Cloud, Digital Ocean) or self-hosted servers.

2. Implement Security Measures

51% Attack Protection: Implement hybrid consensus or checkpointing.

DDoS Protection: Use rate limiting, node whitelisting, and traffic monitoring.

Private Key Security: Secure wallets with multi-signature authentication.

8. Test the Blockchain

Before launching publicly, conduct thorough testing:

Unit Testing: Test individual blockchain components.

Testnet Deployment: Deploy a testnet for real-world simulations.

Bug Bounties: Offer incentives to developers for finding vulnerabilities.

9. Mainnet Launch and Community Building

Once testing is complete:

Launch the Mainnet: Transition from testnet to a fully operational blockchain.

List on Exchanges: Partner with crypto exchanges for liquidity.

Build a Community: Promote adoption through social media, forums, and partnerships.

Continuous Updates: Improve scalability, security, and user experience over time.

Conclusion

Creating a custom blockchain for your cryptocurrency is a complex but rewarding process. By defining your architecture, choosing the right consensus mechanism, implementing security measures, and engaging the community, you can build a scalable and secure blockchain ecosystem. Whether you aim for financial transactions, decentralized applications, or enterprise solutions, a well-designed blockchain can drive long-term success.

0 notes