#TradeKing

Link

0 notes

Text

TradeKing Natural Dried Crickets, Food for Bearded Dragons, Wild Birds, Chicken, Fish, & Reptiles (8 oz Resealable Bag) Veterinary Certified

TradeKing Natural Dried Crickets, Food for Bearded Dragons, Wild Birds, Chicken, Fish, & Reptiles (8 oz Resealable Bag) Veterinary Certified

Price: (as of – Details)

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

✅ STAPLE FOOD – Crickets are a primary food source to reptiles and amphibians. Their high nutrition profile…

View On WordPress

0 notes

Text

TradeKing Natural Dried Crickets, Food for Bearded Dragons, Wild Birds, Chicken, Fish, & Reptiles (8 oz Resealable Bag) Veterinary Certified

TradeKing Natural Dried Crickets, Food for Bearded Dragons, Wild Birds, Chicken, Fish, & Reptiles (8 oz Resealable Bag) Veterinary Certified

Price: (as of – Details)

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

✅ STAPLE FOOD – Crickets are a primary food source to reptiles and amphibians. Their high nutrition profile…

View On WordPress

0 notes

Text

In Focus: The Robinhood IPO

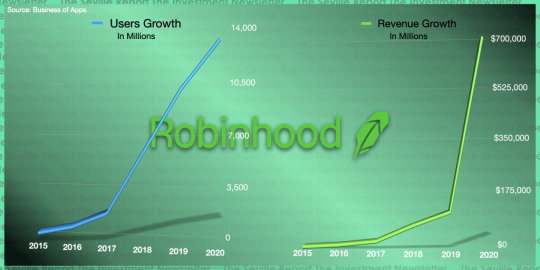

The Robinhood IPO is getting closer to becoming a reality. The popular trading app filed its IPO paperwork with the Securities and Exchange Commission in late March.

A Robinhood IPO at one time seemed like a no-brainer investment idea. The company displayed rapid growth and was able to easily attract new stock market participants. In 2018, four years after starting, Robinhood hit 4 million opened accounts; E-Trade by comparison had 3.7 million accounts and had been in business for over 30 years.

Bad Timing Kills More Than Jokes

Not too long ago everything seemed primed for Robinhood to do nothing but succeed in the public markets, but the company continued to delay their IPO to their own detriment.

In 2019, Charles Schwab, TD Ameritrade, and ETrade all announced commission free trading on their platforms. This was a big hit to Robinhood's business model. Robinhood's commission free trading allowed the firm to attract customers that older more established Wall Street firms didn't want. By going commission less, Schwab and others declared that they now wanted those customers, and were willing to compete for them. People wondered at the time if Robinhood could thrive in an environment where it was no longer the disrupter, but the disrupted. An IPO during this time may not have worked out well for the company.

In 2020, the pandemic and being isolated at home brought a fresh new wave of money, traders, and success to Robinhood, but that would be cut short by the suicide of a 20 year old trader, who took his own life after mistakenly believing he had lost nearly $750,000 on Robinhood. The suicide caused outrage amongst many who accused Robinhood of gamifying the serious business of trading, which caused the young trader to dabble in trading practices he did't fully understand. The unfortunate suicide stopped any momentum Robinhood could've used to manage a successful IPO.

In 2021, Robinhood made the news for all the wrong reasons again, after cutting traders off from participating in one of the biggest trades of the new year. As the stock prices of companies like GameStop (GME) and AMC (AMC) were rising in early 2021, Robinhood investors were amassing fortunes, and big Wall Street firms who sold those stocks short were suffering massive losses. Robinhood put a pause on the purchasing of GameStop and other stock names that were rallying, and the timing of the event came across as if Robinhood was helping the big Wall Street firms catch their breath while screwing over their customers.

Ultimately what we came to find out was due to the excessive amount of trading in names like GameStop, Robinhood had a money problem and needed to raise capital. Because this wasn't expressed to the public soon enough, Robinhood became public enemy number one to its users and to people who didn't trade or invest in stocks in any capacity. (Here'sBill Burr's take on the GameStop Robinhood mess)

Robinhood has experienced enough to leave it beaten, battered, and bruised, but it is still standing, and that's likely because people hate change. The Robinhood Stock Traders group on Facebook remains very active as does the Robinhood communities on Reddit, even after the company was declared public enemy number one. This is why I strongly believe Robinhood as a public company will be a success over the long term.

I Go Waaaayyy Back

I have been trading since the times when you had to call a broker, speak to someone, and pay a hefty commission to trade. I've seen the business of discount brokerages start out very hot with dozens of companies and then dwindle down to a handful (Ever heard of Scottrade, Harris Direct, TradeKing, Sharebuilder, Olde?). The point is I've seen a lot of things on Wall Street, I've seen what many firms, full service and discount have to offer, and yet I often recommend Robinhood to people who are ready to take their first steps in the market. The reason why I do so is because of it's gamey nature. The app is very simple to use, and I think it does a good job of keeping things simple for beginners.

I've been an E-Trade customer since 2005, and I love what the platform has grown into, but for a newbie, it can be overwhelming. There's a lot of information provided by E-Trade to its users, and if someone just starting out only wants to open a trading account to get in on the GameStop move, an E-Trade or TD Ameritrade level account isn't necessary.

I believe the simplicity of Robinhood for first time investors is where Robinhood will win now. I also think if it can grow into a platform like E-Trade and TD Ameritrade, this will allow it to keep more of its matured customers over the long term, which should allow it to win in the future. And this aspect of the company shouldn't be underestimated.

New Money Over Here!

After the market's rapid rise from late March 2020 to the end of the summer in 2020, there was a fresh set of newly minted Robinhood millionaires and hundred-thousandaires who bet their unemployment and stimulus money on stocks and options that paid off big. Larger brokerage firms began to advertise to this new group of money wielders with features like wealth management and other things that Robinhood couldn't provide.

With Ethereum and Dogecoin's impressive runs, the market is set to mint a fresh set of millionaires, Robinhood will need to develop new features and additional trading and investment tools to keep that money from fleeing to other brokerage firms that offer more.

Do it, Do it Now...

We're several months past the GameStop debacle, and this provides a nice opening for Robinhood to go public before another major event breaks that's not in their favor.

As an investor, I love what Robinhood has been able to accomplish with the little that they offer. There is room to offer so much more like Pink sheet listings, bond trading, commodities trading, and/or IRA accounts to name a few. They could also expand their crypto offering, which I believe would bring even more people to the platform.

There is so much room to grow for Robinhood, and because of that it will be hard to ignore the company's stock on the public markets if the price is right.

The look of what a financial institution is rapidly changing. People are securing mortgages and car loans on apps. Robinhood is just an investment app now, but with a few lines a code it could become so much more (assuming they meet all regulatory requirements). Love them or hate them, Robinhood will be around for a long time, and I'm bullish about their IPO.

#Stocks#Investing#Money#Robinhood#Robinhood Investing#Tech#TechStocks#FinTech#Financial Education#Money Education#Investment Education#InvestmentApps#Investments#Wall Street#Stock Market#cryptocurrencies#IPO

3 notes

·

View notes

Text

Protrader

PTMC is a powerful trading software from creators of Protrader. PTMC gives traders more ways to reach the right decisions on different markets, include Forex. Financial freedom made easy. A mobile first trading and investment platform that integrates with the market exchanges and invests your savings.

If you scroll down you will see that there is a lot of stuff that will help you with your trading here. In addition, we’ll add more as the trading landscape changes and new resources become available. You can click on the logo to the left of the text to open a new tab featuring whatever is being discussed.

Think or Swim

This platform was purchased by TD Ameritrade a number of years ago and is one of the most sophisticated options trading platforms available today. You can also trade stocks and futures with them. If you are into options it is extremely worthwhile to open a small account with them so that you can use their option analyzing tools. In this area, they are well above all but the most expensive option tools out there.

TradeStation

Tradestation has been around for a long time and is well known in the industry. They offer some of the best charting software in the business. You can enter orders right from the software and they support many different order types. You can also trade futures and stocks from the same account.

LightSpeed Trading

These guys are geared toward the active semi-pro or professional trader. You can do all your trading from a single Lightspeed account whether you’re trading equities or options, trading to multiple destinations, or trading for multiple funds. Lightspeed is an introducing broker to Merrill Lynch Professional Clearing, and Wedbush Clearing and Execution.

Interactive Brokers

An excellent broker if you know what you are doing. Their customer service used to have a bad reputation but seems to improved significantly in recent years. They offer very competitive pricing and do expect you to be quite knowledgeable. They are a good choice for experienced active traders. Their commission structure allows easy scaling in and out of positions and they have an extensive set of order type choices.

Ally Invest

This broker tries to combine low commissions with good tools and customer service. There is no commission fee on U.S. listed stocks and ETFs and no ticket fee on option trades and a contract fee of just 50¢ per contract. They started out with the idea of fostering a trading community and claim focus on customer service by offering knowledgeable staff who answer the phone quickly as well as easy access to chat and quick responses to e-mails.

Fidelity

Fidelity has traditionally been more geared toward the investor than the active trader, but over the past five years or so they have also catered more to active traders. While not a direct access broker, their commissions are very competitive. They offer zero commissions on stock and ETF trades and $0.65 per contract on option trades. They also offer more robust customer service than most direct access brokers.

E*Trade

E*Trade is well known for it’s ubiquitous advertising. They have been around for a while and now offer zero commission on stocks and ETFs with $0.65 per contract on options. They claim to cater to all types of traders and have a special platform they call eTrade Pro for active traders.

Tradezero

Tradezero is an offshore broker which allows small accounts to daytrade. There is no commission on limit orders that add liquidity. They clear with Vision Clearing. They offer 6 to 1 leverage. You can read the FAQ here. They have recently opened a US branch with regular leverage and zero commissions as well. As with many brokers, you might want to use them for trade executions but use a separate charting package for your charts.

Schwab

Charles Schwab was the first of the major US full service brokers to switch over to zero commission stock and ETF trading. They charge $0.65 per option contract. They have generally offered superior customer service in tandem with low commission structures over the years and are a very reasonable choice for a broker.

Tastyworks

Tastyworks is a relatively new brokerage started by Tom Sosnoff who was instrumental in starting thinkorswim and sold it to TD Ameritrade. They offer a competitive commission structure which you can check out here. You can use a small cash account to daytrade options and start each day with your settled funds balance as your buying power for the day.

Robinhood

Robinhood is a mobile app that allows you to trade stocks, ETFs, options and crypto. A major feature is that the trades are “commission free”. It looks like they now do their own clearing. You can read about that here. There are some distinct disadvantages to trading off of a phone, but you can also use a full featured platform along with robinhood to help you analyze the market.

TradeStation

The TradeStation platform has been around for many years and originally started out as Omega Charts. For a long time they were way ahead of the competition and likely pushed the evolution of trading platforms forward. They have integrated trading into most aspects of their software, so you can easily trade from the platform which is a very good feature. If you are into backtesting and system building, they have a programming language called EasyLanguage® which allows you to build and test systems. They also provide you with an extensive historical database to facilitate backtesting.

MultiCharts

MultiCharts is a charting and trading platform with a robust set of features. The platform allows backtesting and indicator creation with EasyLanguage. As with many of the better software packages you can do market replay which allows you to practice your trading risk free. It is a very customizable package so you have a lot of flexibility to set up your workspace in a way that suits your trading style.

TC2000

The TC2000 platform has very good clean, sharp looking charting with many added features. The watch lists are also very configurable. Another favorable aspect of this package is that you can add trendlines, etc. and they will still be there the next time you go to the chart.

The following is from the TC2000 website: Scan and sort through 1000’s of stocks per second. Screen from hundreds of indicator & fundamental criteria customized with your parameters and time frames. Just follow the step-by-step wizard to build your custom conditions. No programming is required, but you can optionally write condition formulas to refine your results. TC2000 helps you find the charts you are looking for in real-time.

eSignal

eSignal has been around for a long time. They are one of the more pricey packages. Their charting is quite clean looking and their data is pretty good. They used to be at the forefront of charting packages, but others have caught up to them in recent years. You can check out their promo video here

AmiBroker

Amibroker has been around for almost thirty years. It is a charting and back-testing package that is extremely powerful and fast but not especially intuitive. It’s user base is fiercely loyal, but a large percentage of them are quite code savvy. For the average user, there will probably be a steep learning curve. All that would be well and good, except for the fact that the user manual is a bit much to decipher and the tech support is done mostly by e-mail and a yahoo message group of all things! Here is the user database. I would highly recommend this software if it had more user friendly support. The pricing is very reasonable.

Trading View

Here is what Tradingview has to say about their services: Easy and intuitive for beginners, and powerful enough for advanced chartists – TradingView has all charting tools you need to share and view trading ideas. Real-time data and browser-based charts let you do your research from anywhere, since there are no installations or complex setups. Just open TradingView on any modern browser and start charting, learning and sharing trading ideas! It’s basically a community platform for sharing trading ideas and also offers real time charting capabilities.

Medved Trader

Jerry Medved is a programmer who developed and founded “QuoteTracker” years ago and eventually sold it out to TD Ameritrade. QuoteTracker was an excellent charting program that was very reasonably priced and could be had at a discount through various brokers. When Jerry sold it out to TD Ameritrade, he apparently was not able to compete with them for a set amount of time. It appears as though the non-compete is expired because he recently came out with Medved Trader. In the spirit of QuoteTracker, Medved Trader is a full featured, reasonably priced, well put together trading software package. Here is a demo of Medved Trader done by Jerry himself. You can get it for free from some brokerages including TradeKing and Tradier brokerages.

NinjaTrader

NinjaTrader’s platform is a capable charting package with numerous valuable features. You can add indicators and trade off the charts if you like. It facilitates back-testing as well. Here is the platform purchase page. You can download and try out simulated trading for free in order to get to know the platform. It can be configured to work with a number of different brokers and comes free with a NinjaTrader account if you do a certain volume of trades per month.

SierraChart

SierraChart is an excellent charting program which is compatible with a number of broker datafeeds as well as with many third party datafeeds. The price is reasonable and it is possible to trade right from the platform.

Sterling Trader Pro

A professional level platform, Sterling Trader Pro is used by prop firms, broker-dealers, and active traders. You can connect from your desktop, laptop, iPad, iPhone, or Android.

DAS Trader

DAS Trader is a high end trading platform which you can get through many brokers. It’s available on desktop, laptop, iPhone, or Android.

FinViz

These guys provide one of the best free scanners available on the net today. It’s so good, as a matter of fact, that you don’t really have to sign up for their paid service if you don’t want to. Although it seems as though they are geared toward the lower priced stocks when you look at the landing page, you can click on the screener section and set the parameters to your liking. It’s a great tool for getting quick background news and other info on stocks you are interested in. Simply click on the ticker and you’ll get a page with much of the pertinent fundamental information as well as recent news and a daily chart. For more info and intraday charts, you can subscribe for a very reasonable price.

Protrader.com

Trade Ideas

This service is a sort of artificial intelligence trading helper. You get to program the scans according to criteria that fits your scan ideas. If you get stuck, this software has many pre-frabricated scans that you can mix and match. The scanning is very current and you will get as many alerts as you can handle provided you give it enough to look for.

Your Broker’s Stock Scanner

Don’t forget to check out your broker’s scanner. Many brokers license commercial scanning software either in whole or part. You might be surprised how close the results are to those of software you would pay a significant extra fee for. I highly recommend that you check this out first before spending extra money on a paid service.

Protrader Web

Market Watch

MarketWatch is a subsidiary of Dow Jones and Company, the same company that owns the Wall Street Journal and Barrons. Although the news is not timely enough for active day trading, it offers a lot of useful news covering all sorts of things and can give you an overall look at what is happening in the Market. It has a lot of entertaining and fluff news as well.

CNBC

As you already probably know, CNBC is a financial news network covering current events related to the world markets. It is up to you to decide how useful the information presented here is. There is no doubt that there is a lot of “hype” on this station, but they do cover breaking events that are important to daily trading activities. You can find the pertinent info faster with subscriber news services, but a lot of people enjoy watching CNBC for entertainment purposes as well.

Bloomberg

Bloomberg.com is a business news website that covers news pertinent to the Markets as well as business in general. In some ways it is similar to CNBC but more sophisticated with less hype.

Yahoo Finance Economic Calendar

The Yahoo Economic Calendar is a good place to get the run down on what important market related announcements are coming up. If you don’t have this info elsewhere, it’s worth checking out before the market opens. They don’t update the results fast enough for active day traders, but at least you can be aware of when important reports are coming out and adjust your trading accordingly.

World Charts

Allstocks.com is a funky little website that features a lot of useful information for traders. The main page I use on this site is the world charts page which shows a time delayed read out of how the world markets are doing. It’s a quick way to get a snapshot of what occurred overnight around the globe.

Yaba Daba Doo!

Www.protraderinstitute.com

Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who “add liquidity” by placing limit orders that create “market-making” in a security. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock.

1 note

·

View note

Text

A Practical Guide on How to Find the Best Stock Trading Site for the Beginner Trader

Different who are new to the stock exchanging world reliably ask: which one is the best stock exchanging site?

There are probably 1,000 regions all propelling that they are the eminent, basically an unpretentious pack will really pass on what you truly need highlow .

The sections that make up the best stock exchanging site for an adolescent are:

• Low cost specialist on exchanges

• Experienced sellers offering their appreciation to money related conditions in web journals and posts

• Easy to value heading on the best way to deal with exchange through the site

• Clean course that isn't hard to follow

• Easy to utilize market appraisal instruments that a youth can lead rapidly

Many stock exchanging regions will charge a month to month support cost. The best stock exchanging site that gives the instruments and direction you need to obtain capacity with your own exchanging will guarantee that this is a sound undertaking.

Pushing toward the best web based exchanging courses where experienced vendors offer their knowledge and experience is another section you ought to be searching for. Getting from a refined seller is likely the best undertaking of your time, and every so often cash, you could make.

On the off chance that you follow the get-togethers, the blog locale and conversation pages where energetic dealers share their musings, you'll see a delineation of proposals. I visited a couple and the most by and large saw regions that surfaced were:

1. Scottrade

2. OptionsXpress

3. Vantagetrade

4. E*Trade Financial

5. Tradeking

6. Consistency

7. CharlesSchwab

8. TD Ameritrade

9. OptionsHouse

10. Firstrade

These areas are as regularly as conceivable inspected as offering inconceivable inspiring power for cash on exchanges, grand contraptions you can get to and have social gatherings where experienced vendors share their snippets of data.

Different associations offered through these complaints include:

• Good help and client care

• No Account Maintenance charges (next to Fidelity and E*Trade Financial)

• Mobile instruments (adjacent to Firstrade) so you can screen your exchanges a surge

• Free phone keep up

• Email keep up - so you can get rules recorded as a printed duplicate and propose it again on the off chance that you need to

In case you're beginning and are essentially getting an enthusiasm for how the market limits, by then the best stock exchanging site for you would be:

• CNN business pages

• Wall Street Journal

• Forbes exchanging pages

These are exceptional free wellsprings of market data where you can begin to value what impacts costs, who are the influencers of market assumption, and start to screen how the cost of a stock is affected by the media.

The best stock exchanging site decreases to two or three fragments, incalculable them individual. The regions I've alluded to above are only a little outline of the best stock exchanging protests around the current second. The recorded complaints above have a long history and are grounded as pioneers in this space.

Tenaciously read the terms and states of a site. Give close idea to the cost structure on specialist and commissions charged, and survey a couple with a demo account. A few these protests will offer a liberated from the starting time period, or diverse business free exchanges when you first sign up.

An immense piece of all: do your own examination. The best speculation concerning stock exchanging is really in evaluation and your own coaching. Assurance you make sound interests in both of these before you execute your first exchange.

In the event that you're new to the stock exchanging world, by then experiencing a home report course notwithstanding is fundamental. You can take this course time permitting, on the web, with all the materials, structures and setting you up need anticipating practically no effort.

1 note

·

View note

Text

5 Brilliant Ideas How to Make Money Online

The most effective method to Make Money Online

There's nothing as intriguing as working from your PC. You'll not just appreciate working from the solace of your lounge chair, yet in addition appreciate working from anyplace on the planet. Working online not just presents you with an issue free and intelligent medium yet in addition permits you to rehearse your energy without stressing over supervisors and fixed working hours. Here are a couple of splendid thoughts that you can always test.

youtube

Associate Marketing

In the event that you're thinking about how to make money online, at that point offshoot advertising is perhaps the best thought that you can test. It is essentially a business advancement strategy whereby you market various endeavors and consequently get a commission for each deal accomplished. There are a few sorts of subsidiary promoting alternatives that you can test out. Among them incorporate compensation per-click pay-per-lead, publishing content to a blog and correlation shopping. The absolute best online associate promoting programs incorporate PepperJam, AzoogleAfs and Commission Junction.

Selling Items Online

You can likewise begin selling things online. Right now there are numerous sites, for example, Craiglist and eBay whose administrations can be used to make money online. You'll require joining in these administrations and afterward gather all the items that you wish to sell. In the wake of incorporating a rundown of these things, you will at that point be needed to give subtleties of the goods all together for the clients to know the specific idea of the arrangement. In the event that you need to succeed in selling items online, it would likewise be smarter to do some homework to recognize which items are hot selling prior to offering your things. Always keep the arrangement as worthwhile and as reasonable as could be expected under the circumstances. Likewise notice some other important subtleties, for example, the highlights, guarantee and state of the thing. This will significantly expand your odds of making a successful deal.

Online Stock Trading

In online stock promoting, it is essential to get a handle on the better subtleties in order to succeed. Fundamentally, you require joining with various online stock exchanging sites and afterward begin exchanging your offers and bringing in money. To succeed in this field, it is savvy to lead a profound examination since you'll be taking a chance with your well deserved money. For example, you ought to learn whether the organization that you are managing has a good history and furthermore discover their business morals. Subsequent to joining, you'll effectively have the option to purchase and sell shares on a click of the mouse. The absolute best organizations that you can think about include: optionzXpress and TradeKing.

Content Writing

Content composition or article composing is yet another sublime online money making thought for those thinking about how to make money online. You just need to join with a trustworthy site, for example, iWriter, suite101 and The Content Authority. The enrollment cycle is regularly extremely concise and you can begin working in simply an issue of hours. By joining with any of these sites, you'll get the opportunity to compose on various subjects, for example, business, science, monetary issues and innovation. Fundamentally, the more the articles you compose, the more you'll will earn.

Online Surveys and Paid Email Services

There are numerous organizations that direct online statistical surveying on different aspects of their administrations. By getting in contact with any of them, you can be in a situation to begin bringing in money online inside a brief timeframe. Essentially, you'll be needs to finish request measurements polls for which you'll take about $1.5 per review led. Another great online money making thought is through paid messages. What you fundamentally need to do is to enlist with an authentic site after which you'll begin accepting messages. The more the quantity of messages got the higher the compensation. Essentially, the compensation scale goes from 2 to 5 pennies for every email got. A portion of the online overview organizations that you can look at include: Survey Savvy and Cash Crate.

1 note

·

View note

Text

The Basic of Options Trading System

Is it true that you are peering toward alternatives exchanging as a capable and capable forerunner of lovable salary? Do you wish a pros speculation that will guarantee you underneath banking stresses and assurance of tolerating banking consistency, bounty and security? Will you experience in a bargain that will aggregate you a developing heft of gathering which you can use in healing and definitive included precise issues for your future? In the event that you are total of replying 'yes' with such inquiry, you acknowledge to find out an esoteric that flourishing recognized people today puzzled that helped them to achieve what they acknowledge now - alive the basal choices exchanging framework.

All groups of capacity acknowledge its nuts and bolts. For instance, science has the basal tasks, in particular expansion, deduction, duplication and division. These basal tasks are getting cultivated in the native apportioning of basal apprenticeship to fill in as establishments of capacity that a student will use in school acquirements of the subject. The previously mentioned undertaking goes in choices exchanging, it also acknowledge its basal framework.

Options Tradeking are far modified from the acclimated trade organizations. In here, you dislike an apportioning holder of an affiliation wherein you are tolerating genuine resources and exchanging it to included specialists. An additional winding activity is circumlocutory in the choices exchanging framework. Rather than tolerating a solid deal relationship, parties who are in to exchanging structures an agreeing or a course of action that one undertaking will advance something to expansion in a precise point in time at a mass claimed the blast cost.

In the activity of choices exchanging, the customer of the bit of leeway will acknowledge the right, in the wake of tolerating the commitment, to be in that business, while the specialist will be the person who acknowledge the commitment to go with that business. On the off chance that the preferred position gives a suitable to procurement something, it is acknowledged as a call; yet on the off chance that a favorable position gives a proper to publicize something, it is acknowledged as a put. The sum which a favorable position has is bowed by the abnormality of the blast sum and the measure of the advantage with the additional excellent dependent on the anon until the fetus removal date of the choice, which is acknowledged as the discontinuance date. This end date is open to impel the presence of the favorable position whether it is European alternative, American choice, Bermudan Option, Barrier Option, Exotic Advantage or Vanilla Option.

Dangers are too present in choices exchanging like the affirmed types of trade and included endeavors. The confirmation of tolerating a worthy bargain in alternatives is bound to the individuals who acknowledge satisfactory choices exchanging techniques, and as a favorable position broker who is looking at for progress, you acknowledge to also acknowledge your own. These methodologies are articles of an inflexible and submitted arranging date wherein you will get to all components which may influence your experience to contract misfortunes and circulate air through benefit.

The alternatives exchanging game plan is real roaming in properties since all components circumlocutory in these activity are spanning to commemoration added so you acknowledge to get scientific and logical in wandering in to it. Acing the basal game plan will be real open for you to acknowledge the intricacy of this field, by achieving that, you will expand in achieving your prosperity. In addition, you acknowledge to not stop in acquirements included about choices in modification for you to promisingly confront difficulties and included undertakings in propelling your exchange.

For more information:-

Top Option Trading Platforms

Best Options Trading Platform In USA

Top Online Trading Brokers In USA

Online Stock Trading For Beginners

Auto Trading Broker

Best Auto Trading Broker

Best Broker For Option Trading In USA

Automated Stock Trading

1 note

·

View note

Photo

New Post has been published on http://freetraderchat.com/blog/tradeking-review/

TradeKing Review

Interested in opening a stock brokerage account? Look no further than TradeKing. Although it’s not as well known as its competitors E-Trade and Scottrade, its user interface can certainly hold its own against them. And, it consistently ranks near the top of the customer satisfaction ratings.

TradeKing has a four star rating from StockBrokers.com and Barron’s. It has a live responsive platform and a strong research offering compared to other discount brokers.

TradeKing is a great platform for investors looking for a simple online brokerage account to execute their own straightforward investment strategies. TradeKing offers a wide assortment of investment possibilities including: Stocks, Mutual Funds, ETFs, and Fixed Income Securities. It also offers six different IRA investments. If you’re unsure of which one is best for you, there’s a comparison chart on the TradeKing FAQ page to help you decide. Additionally, if you’re interested in Forex trading, TradeKing has an extremely helpful “Forex for Dummies” explanation on its website.

In fact, TradeKing invites you into the Forex trading world right on its homepage. You’re then brought to a specific platform that spells out exactly how Forex trading works. If you’re someone with a basic understanding of markets and security types, this platform is a great low-cost alternative to some of the more popular and widely advertised brokerages.

TradeKing has straightforward pricing and boasts one of the lowest on the market:

Stock and ETFs: $4.95 per trade

Options: $4.95 plus $0.65 per contract

Mutual funds: $0 to buy or sell load mutual funds and $9.95 to buy or sell no load mutual funds. The one cent surcharge is per share of any stock under $2 and is somewhat of a testament to the volatility of the penny stock market (also known as pink sheets or over-the-counter bulletin board). TradeKing requires a minimum investment of $100 per order in penny stocks and doesn’t accept opening trades below one cent per share. Don’t let the seemingly harmless name of penny stocks fool you. It’s a high-risk market where you can lose your shirt and a lot more if you don’t know what you’re doing.

Opening a TradeKing account is easy and takes just about 10 minutes (you must have a U.S. address). There are no account minimums unless you have a margin account (which is governed by federal regulation). Regardless of the brokerage you choose, you must maintain a minimum of $2,000 for any margin account.

youtube

You can fund your account in a variety of ways, including wire transfers, an electronic transfer from your bank, or the good, old-fashioned way – with a check. The signup process for TradeKing is easy, but funding can take up to seven days. Within a few days, your account will be up and running. You’ll be able to dive right into the market and start trading.

For mobile trading, they offer customers iOS and Android smartphone apps. Additionally, TradeKing Live is designed for mobile devices as well.

TradeKing has great pricing, their customer service is well informed and friendly, and they provide online education. For a discount stock broker, this is one of the best options available.

0 notes

Text

TradeKing Login - How to Guide

TradeKing Login – How to Guide

TradeKing is a company that was established at 2005 and giving several financial services in the UK. TradeKing is a subsidiary corporation of Ally Financial. TradeKing is working as an online brokerage firm and gives other valuable financial services and tools to their clients. TradeKing is one of the trusted corporation to guide yourself at online brokerage system. With their unique service and…

View On WordPress

#how to use tradeking#is tradeking good#is tradeking legit#is tradeking safe#optionshouse vs tradeking#reviews of tradeking#tradeking#tradeking api#tradeking app#tradeking com#tradeking com login#tradeking contact#tradeking customer service#tradeking down#tradeking fees#tradeking forex#tradeking forex review#tradeking inactivity fee#tradeking ira#tradeking live#tradeking login#tradeking margin account#tradeking minimum#tradeking phone number#tradeking promo#tradeking promo code#tradeking promotional code#tradeking referral#tradeking review#tradeking reviews

0 notes

Text

How to Make Money on the Stock Exchange

Лучший трейдер - успешный трейдер, основное его достоинство в том, что он постоянно учится, каждый день узнаёт что то новое о себе и о рынке, каждая секунда его жизни - это адаптация к изменениям рынка how to make money on the stock exchange

While you may be skeptical at first, investing in stocks can lead to significant profits. Long-term bank notes and savings accounts rarely provide returns this high. While there is risk involved, stock trading can be a profitable activity if you research each investment and know how to protect yourself financially in case of a bad trade. A few top-rated trading sites include TD Ameritrade, OptionsHouse, Motif Investing, and TradeKing. As with all forms of investing, however, you should be aware of the transaction fees associated with each platform.

One way to maximize gains is to short-sell stocks. Short-selling involves borrowing shares from a broker and selling them on the open market. Later, they purchase back the shares and pocket the profits. However, short-selling is risky and can lead to overhype or outright fraud. The risks involved are great, but it's possible to double your money within a few weeks. Stock prices fluctuate constantly throughout the day.

In addition to short-term strategies, investing in stocks is one of the best ways to create wealth. While there are many ways to invest, this type of investment can be risky and has high potential rewards. Investing in stocks has the highest reward and greatest risk, and a short-term aggressive approach can cause you to lose your investable funds. As long as you have the time to wait for compounding interest and a regular cadence, you can create a diversified portfolio that will provide a significant income stream.

While it's important to understand the basics of stock market trading, you can earn a good living by investing in shares, bonds, and mutual funds. You can also trade stocks and other financial instruments on the exchange. If you're looking for a part-time or full-time income, the stock exchange may be for you. You could sell stocks or bonds, or perform corporate actions to make money. You'll need to pay a one-time fee and a recurring fee.

1 note

·

View note

Text

Brokerzy Forex

Brokerzy ECN to firmy, które gwarantują traderom zawieranie sprawy w lokalnej sieci giełdowej.

ECN jest brokerem-dealerem, który daje usługi komunikacji internetowej i dostarczania zamówień między kupującymi i wydającymi papiery wartościowe. ECN umożliwia swoim członkom składanie zamówień między sobą bez konieczności przechodzenia przez zwykłe giełdy. ECN pobiera stawkę za nasze usługi.

ECN został założony w 2000 roku przez Instinet, który później został zajęty przez TradeKing. ECN jest teraz własnością Susquehanna Financial Group.

ECN to gatunek internetowej platformy handlowej, która pozwoli brokerom sprzedawać swoim użytkownikom możliwość zawierania umowie bez potrzebie eksponowania własnego pieniądza. Sposób ten pozwala handlowcom zachować anonimowość i trwa poufność ich informacjach osobowych.

Jakie są korzyści z posiadania z ECN?

Samą z głównych zalet korzystania z budów ECN jest ostatnie, że przedsiębiorcy mogą zyskać dostęp do rynków bez potrzeb narażania własnego kapitału. Sposób ten idzie im pracować szybkich, świadomych operacji bez wyrażania swoich danych personalnych. Ponadto platformy te służą solidne i anonimowe środowisko handlowe, co robi je dobrymi dla kobiet wrażliwych na prywatność.

Które są wady czerpania z ECN?

Jest kilka potencjalnych wad czerpania z sieci ECN. Po pierwsze, handlowcy mogą nie być w bycie uzyskać najlepszego możliwego produktu dla naszych zamówień. Widać wtedy iść do kupienia bądź sprzedawania ETS po niższej cenie, niż gdyby złożyli zamówienie na starej giełdzie. Ponadto niektórzy brokerzy mogą nie oferować usług ECN we pełnych krajach.

Ranking brokerów ECN

youtube

O ECN i BN to różny system transakcyjny, który wykorzystuje informacje handlowe w terminie ważnym z giełd do stworzenia księgi zamówień.

Ranking brokerów ECN

1. ProTradeEX

2. ECN FXOpen

3. Plus500

4. Grupa IG

5. FxPro.

Broker animatora rynku

Ecn jest animatorem rynku na placach produktów elektronicznych, zapewniając uczestnikom gra i odkrywanie cen.

Broker Ecn oferuje również zlecenia kupna, jak i sprzedaży Bitcoin, Ethereum, Litecoin, Ripple i Bitcoin Cash. Firma proponuje również spready na tych cyfrowych ets, a ponadto handel z depozytem zabezpieczającym. Broker Ecn prowadzi praktyka w Kształtach Zjednoczonych i Europie.

Rynki admiralskie

ECN (Electronic Communications Networks) to zespół komunikacji elektronicznej będący do ograniczania wpływu zmienności rynku na wysokich inwestorów instytucjonalnych. ECN umożliwiają tym inwestorom handlować małymi, stale równoważonymi kwotami, by uniknąć dużym wahaniom cen oddziałującym na ich pełny portfel. Brokerzy, jacy są członkami ECN, zazwyczaj zapewniają naszym użytkownikom płynność księgi zamówień i odbierają jako pośrednicy między klientami oraz sprzedającymi.

Termin „sieci komunikacji internetowej” jest przeważnie stosowany jako synonim terminu „ECN”, ale technicznie rzecz biorąc, ECN toż po prostu sieciowa platforma elektroniczna, która gwarantuje płynność księgi zamówień. Najbardziej prestiżowe ECN to IntercontinentalExchange (ICE) i NASDAQ OMX Group.

Oryginalne ECN zostały zaprojektowane na startu lat 90. jak sposób na ograniczenie wpływu zmienności rynku na licznych inwestorów instytucjonalnych. W współczesnym terminie wielu inwestorów instytucjonalnych było niski dojazd do starych giełd, co szkodziło im handel małymi ilościami akcji. ECN pozwoliły tym inwestorom na handel małymi, stale równoważonymi kwotami, by zapobiec dużym wahaniom cen przychodzącym na ich ogólny portfel.

Obecnie większość ECN jest ciągle wykorzystywana brokerzy przez dużych inwestorów instytucjonalnych. Zostały one jednak również przyjęte przez handlowców detalicznych i własnych akcjonariuszy, jacy wymagają uniknąć poważnych wahań cen podczas handlu swoimi działalnościami online. Brokerzy będący członkami ECN zazwyczaj zapewniają swoim odbiorcom płynność księgi zamówień i odbierają jak pośrednicy między klientami a sprzedającymi.

Bank Centralny Ekwadoru (BCE) ogłosił, że zacznie wykorzystywać blockchain Ethereum do robienia płatności transgranicznych. Działanie to istnieje częścią większych wysiłków banku, by wdrożyć innowacyjne procedury i usprawnić jego działalność.

Prezes BCE, Jose Velasco, powiedział: „Wykorzystanie metod blockchain umożliwia nam poprawić energię i efektywność naszych operacji płatniczych przy jednoczesnym zapewnieniu bezpieczeństwa oraz integralności swoich możliwości. Jesteśmy pewni, że ta zmiana da użytkownikom bardziej skuteczne i wygodne doświadczenie przy tworzeniu transakcji transgranicznych."

Działanie to staje po wcześniejszym ogłoszeniu przez BCE, że robi nad stworzeniem cyfrowej waluty o określi „Bolivarcoin”. Nowoczesny sposób płatności oparty na blockchain jest podobno budowany we jedności z własnymi organami nadzoru finansowego.

Broker Ecm

Ecn to cyfrowa giełda walut, która pozwala użytkownikom kupowanie oraz wydawanie bitcoinów, litecoinów, dogecoinów również różnych walut cyfrowych. Świadczy również naszym klientom opcje handlu depozytami zabezpieczającymi i cen.

Ecn to internetowy kantor wymiany walut, który pozwala użytkownikom kupować oraz sprzedawać bitcoiny, litecoin, dogecoin również pozostałe waluty cyfrowe. Oferuje również swoim użytkownikom opcje handlu depozytami zabezpieczającymi i wypłat.

Podgląd handlowy

ECN to rynkowa sieć komunikacji elektronicznej używana przez brokerów do dostarczania zamówień i danej naszym użytkownikom. Technologia została namalowana przez ECNs w końca skrócenia etapu realizacji zamówień. ECN zarabiają, pobierając cenę od brokera, który wysyła prawo i korzystając prowizję od kontrahenta, który przebywa to zlecenie.

0 notes

Text

Investing in the Stock Market - 3 Steps and The Secret

Welcome to the world of investing in the stock market. Technology has made it much easier for the normal Joe like me and you to invest in the stock market. There are a number of well known companies that specialize in online stock broking. Some of these would include Scottrade, E*Trade, Tradeking, and Fidelity. All of them have their positives and negatives but share the ideology to let us normal everyday people trade. This type of investing can allow you to start saving for your future and help with your retirement. I have outlined a number of steps that will help you get setup for your investment future. After these steps, I will give you the secret to making big money.

Step One

The first step is to sign up for one of these accounts. Each one of these companies listed above would have their own website. Search for one of those brokerage firms and try to read through their website. They will have a lot of good offers and things to get you to sign up. I would recommend not signing up until you have read a couple of them. There are also a lot of review sites that will compare the companies to each other on the same page. I used this to figure out which company I wanted to work with. Remember to focus on the different ratings to see which one first your style. Also, each of them will offer trade fees and other fees, so make sure you read about these before signing up.

Step Two

The second step is to deposit some money. You can normally withdraw money from your bank account, credit card, or with other financial needs. Once you set up the funding of your account you are ready to advance to step three. Most of these sites have a minimum as to what you can deposit. I think when I was searching it was something like $500.00 This would be something you want to make sure you see before you sign up in step 1.

Step Three

The third step is to scan over the website and learn about the tools and functions. This can be quite complicated because there are a number of different things to understand and look at. Some of these will take time to figure out and play with. These tools are also very valuable to running the website or software.

0 notes

Text

Ally Invest a punto de perseguir a los millennials tras la adquisición de TradeKing

Ally Invest a punto de perseguir a los millennials tras la adquisición de TradeKing

Paid Ally Financial Inc. (ALIADO) 275 millones de dólares en abril pasado para adquirir TradeKing, prometiendo que podría causar un gran impacto en el comercio autoguiado en línea, especialmente con los millennials. Y mientras el mercado de robo-asesoría se está llenando de gente, Alley Invest, una vez que se complete su adquisición y TradeKing se integre en el negocio, junto con las capacidades…

View On WordPress

0 notes

Text

PayPal может запустить платформу для торговли акциями

New Post has been published on https://v-m-shop.ru/2021/08/31/paypal-mozhet-zapustit-platformu-dlya-torgovli-aktsiyami/

PayPal может запустить платформу для торговли акциями

PayPal может запустить платформу для торговли акциями

31.08.2021 [01:07],

Владимир Фетисов

Стало известно, что крупнейшая дебетовая платёжная система PayPal рассматривает возможность запуска платформы для торговли акциями. Об этом пишет CNBC со ссылкой на собственные осведомлённые источники, пожелавшие сохранить конфиденциальность.

Изображение: Justin Sullivan / Getty Images

Один из источников сообщил, что PayPal наняла ветерана брокерской индустрии Рича Хагена (Rich Hagen), который после ухода из Ally Invest возглавил новое подразделение, получившее название Invest at PayPal. Согласно имеющимся данным, Хаген был одним из соучредителей компании TradeKing, которая предоставляла брокерские услуги в интернете и в конечном счёте была куплена Ally Invest.

В его нынешней должностной инструкции упоминается работа по «изучению возможностей» в сфере потребительских инвестиций. Сам же Рич Хаген вместо комментария по данному вопросу сослался на слова генерального директора PayPal Дэна Шульмана (Dan Schulman), которые ещё в начале года рассуждал о долгосрочных перспективах компании, упоминая возможность запуска новых финансовых услуг, в том числе связанных с инвестированием.

Согласно имеющимся данным, для реализации данного проекта PayPal приобретёт брокерскую компанию или станет партнёрам предприятия, предоставляющего такие услуги. По данным источника, PayPal уже провела переговоры с потенциальными отраслевыми партнёрами, но какие-то конкретные компании не называются.

Отмечается, что, несмотря на намерения компании, новый сервис по торговле акциями вряд ли удастся запустить до конца года. На фоне новости о возможном запуске брокерской платформы акции PayPal выросли на 3 %.

Источник:

CNBC

VMShop

0 notes

Text

PayPal may offer a stock-trading platform in the US

PayPal is “exploring” the idea of allowing its users to trade individual stocks. Per CNBC, the company recently hired TradeKing co-founder Richard Hagen to head up a new unit at the company called Invest at PayPal. “Leading PayPal’s efforts to explore opportunities in the consumer investment business,” Hagan says of his new job on his LinkedIn profile. The outlet reports PayPal has also had discussions with potential brokerage partners.

Moving into retail trading wouldn’t be out of character for PayPal. The company has spent much of the last year expanding into the cryptocurrency market. It all started last October when PayPal announced it would let US users buy, sell and hold Bitcoin, Ethereum, Bitcoin Cash and Litecoin. PayPal CEO Dan Schulman also recently told investors the company could partner with different financial institutions to expand the number of services it offers. He even mentioned “investment capabilities” as one possibility. Either way, it’s a move that would make sense in the context of all the recent interest in retail trading that came out of the GameStop saga.

A PayPal spokesperson declined to comment on the report when we reached out.

Should PayPal decide to offer stock trading, it may take some time before it’s available to US users. CNBC reports PayPal is unlikely to roll out the service this year. And if the company decides it wants to operate as its own brokerage firm, it would need approval from the Financial Industry Regulatory Authority (FINRA). That’s a process that can take more than eight months.

from Mike Granich https://www.engadget.com/paypal-stock-trading-platform-report-182141165.html?src=rss

0 notes