#TechStocks

Explore tagged Tumblr posts

Text

𝗗𝗼 𝗬𝗼𝘂 𝗞𝗻𝗼𝘄 𝗪𝗵𝗲𝗿𝗲 𝗙𝗿𝗮𝗻𝗰𝗲'𝘀 𝗡𝗲𝘅𝘁 𝗕𝗶𝗴 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝗶𝗮𝗹 𝗣𝗿𝗼𝗳𝗶𝘁 𝗣𝗼𝗼𝗹 𝗜𝘀? The 𝗙𝗿𝗮𝗻𝗰𝗲 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗲𝗱 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗦𝘆𝘀𝘁𝗲𝗺 (𝗗𝗖𝗦) 𝗠𝗮𝗿𝗸𝗲𝘁 is not just growing — it's transforming the entire backbone of France's industrial automation.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗥𝗘𝗘 𝗦𝗮𝗺𝗽𝗹𝗲

𝗗𝗿𝗶𝘃𝗲𝗻 𝗯𝘆 𝘀𝘂𝗿𝗴𝗶𝗻𝗴 𝗱𝗲𝗺𝗮𝗻𝗱 𝗶𝗻:

Smart manufacturing & Industry 4.0

Energy optimization across oil & gas, power, and chemical sectors

Government-backed decarbonization initiatives

𝗙𝗿𝗮𝗻𝗰𝗲 𝗶𝘀 𝗽𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝗶𝗻𝗴 𝗶𝘁𝘀𝗲𝗹𝗳 𝗮𝘀 𝗮 𝗘𝘂𝗿𝗼𝗽𝗲𝗮𝗻 𝗮𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻 𝗽𝗼𝘄𝗲𝗿𝗵𝗼𝘂𝘀𝗲. 𝗞𝗲𝘆 𝗣𝗹𝗮𝘆𝗲𝗿𝘀 : Hitachi Ltd., Omron Corporation, Emerson Electric Co., Mitsubishi Electric Corporation, ABB Ltd., Rockwell Automation Inc., Honeywell International Inc., Valmet OYJ, Toshiba Corporation, Schneider Electric SE, General Electrics and others.

𝗠𝗮𝗿𝗸𝗲𝘁 𝗚𝗿𝗼𝘄𝘁𝗵 𝗦𝗻𝗮𝗽𝘀𝗵𝗼𝘁:

Rapid DCS upgrades across aging infrastructures

Increased capital inflows in advanced control & monitoring technologies

High-margin service & maintenance contracts creating steady recurring revenue streams

𝗦𝗮𝘃𝘃𝘆 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗮𝗿𝗲 𝗮𝗹𝗿𝗲𝗮𝗱𝘆 𝗲𝘆𝗲𝗶𝗻𝗴:

Global DCS giants expanding French operations

Domestic system integrators grabbing niche segments

Long-term government digitalization funds

Miss this now, and you may be chasing it at a premium later. 𝗔𝗰𝗰𝗲𝘀𝘀 𝗙𝘂𝗹𝗹 𝗥𝗲𝗽𝗼𝗿𝘁

The France DCS market is where control meets capital.

#FranceDCS#IndustrialAutomation#DistributedControlSystem#Industry40#SmartManufacturing#InvestmentOpportunity#PrivateEquity#VC#GrowthMarket#EnergyTransition#SmartFactory#AutomationRevolution#Decarbonization#FranceInvestment#TechStocks#InvestorAlert

0 notes

Text

#Investing2025#BestStocks2025#TechStocks#GrowthInvesting#AIStocks#DividendStocks#StockMarketTips#LongTermInvesting#FinancialFreedom#SmartInvesting

0 notes

Text

Fisker Bankruptcy 2024: What Happened to FSR Stock?

electric vehicle investments, Fisker bankruptcy, Fisker Inc. news, Fisker Ocean SUV, Fisker stock analysis, Fisker stock future, Fisker stock performance, FSR stock history

Fisker Inc. (FSR) once promised to revolutionize electric vehicles. Now, after bankruptcy and delisting, its stock serves as a cautionary tale for investors.

Fisker Stock: A Rapid Rise and Fall

Fisker Inc. (NYSE: FSR) entered the public market in 2020 through a SPAC merger, boasting a vision to deliver stylish, affordable electric vehicles. At its peak in February 2021, the stock soared to $28.50. However, by March 2024, it plummeted to just $0.08965, marking a staggering 99.7% decline.

What Went Wrong?

1. Production and Delivery Issues

Fisker faced significant challenges in scaling production.In 2023, it built over 10,000 Ocean SUVs but delivered less than half, leading to inventory pile-ups and cash flow problems.

2. Financial Struggles

The company reported a net loss of over $463 million in 2023.Despite raising funds through various means, including a SPAC merger, it couldn’t sustain operations. 3. Regulatory and Safety Concerns The Ocean SUV faced multiple recalls and investigations due to software glitches and safety issues, which hurt the brand’s image. 4. Management Decisions Leadership decisions, including aggressive expansion plans and a lack of focus on core operations, contributed to the company’s downfall.

Bankruptcy and Delisting

In June 2024, Fisker filed for Chapter 11 bankruptcy protection, listing liabilities between $100 million to $500 million.The NYSE delisted its shares in April 2024.The company’s assets are currently being liquidated, and its intellectual property is being distributed to creditors. Future Outlook

While Fisker’s stock is no longer trading on major exchanges, some analysts speculate on the potential for asset sales or acquisitions.However, given the company’s financial and operational challenges, any recovery seems unlikely in the near term. Conclusion Fisker’s journey from a promising EV startup to bankruptcy serves as a cautionary tale for investors.While the electric vehicle market holds potential, it’s crucial to assess a company’s fundamentals, leadership, and execution capabilities before investing.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Investing in stocks involves risks, and past performance is not indicative of future results. Always conduct your own research or consult with a financial advisor before making investment decisions.

#investing stocks#stock#stock market#stock trading#TechStocks#FiskerBankruptcy#FiskerCollapse#FiskerStock

1 note

·

View note

Text

0 notes

Text

Top Nasdaq Stocks and Their Role in Tech Evolution

The Nasdaq Composite Index has long served as a representation of technological innovation and growth-oriented enterprises in the United States. With thousands of listings, it captures diverse segments ranging from software and hardware to communications, biotechnology, and semiconductors. Among this expansive field, top nasdaq stocks offer valuable insights into broader economic conditions, sector momentum, and market positioning.

Role of the Nasdaq Composite

The Nasdaq Composite consists primarily of companies listed on the Nasdaq Stock Market, one of the largest electronic exchanges globally. Unlike traditional indices that may focus on industrial or financial sectors, the Nasdaq leans toward technology-heavy constituents. The weightage in this index is based on market capitalization, allowing companies with higher values to have more influence over index movement.

Technology as a Core Driver

A significant proportion of the Nasdaq’s performance stems from leading players in the software, semiconductor, and cloud computing industries. Many companies in these segments frequently contribute to market shifts and influence global technology trends. The prominence of such firms underlines the index’s alignment with digital transformation, automation, and data analytics.

Broader Sector Participation

While the index is often associated with technology, it also includes firms from healthcare, consumer services, renewable energy, and communications. This diversification ensures that performance within the index is not confined to a single theme. Market developments such as advancements in pharmaceuticals or changes in streaming content usage can also be reflected in index activity.

Performance Indicators and Influence

Movements in the Nasdaq Composite often act as a barometer for growth-focused equities. The pricing trends of top nasdaq stocks frequently align with market responses to economic indicators such as inflation rates, labor statistics, and geopolitical developments. These stocks react quickly to shifts in policy and innovation cycles, making them useful indicators of momentum.

Global Reach and Recognition

Several of the companies listed on the Nasdaq have international operations, making the index globally relevant. The actions of multinational corporations within the index allow the Nasdaq to serve as a reflection of cross-border economic interaction. As such, leading constituents often embody not just U.S. trends, but also themes shaped by global demand, regulation, and competition.

Innovation and Market Adaptability

Many of the most influential names on the Nasdaq are recognized for leading innovation in emerging sectors. Whether it's breakthroughs in artificial intelligence, alternative energy platforms, or cloud infrastructure, these developments are often initiated or advanced by firms that rank among the top nasdaq stocks. Their adaptability to rapid change remains a defining feature.

Reaction to Economic Shifts

Nasdaq-listed firms are typically responsive to broader economic transitions. Policy decisions, commodity pricing changes, and supply chain realignments can all influence the direction of the index. When these changes occur, top nasdaq stocks are frequently the first to reflect the adjustment, either through revaluation or sector reallocation.

Sector Rotation and Momentum Shifts

At various points in the market cycle, emphasis rotates between different sectors. During periods of heightened volatility or macroeconomic transition, leadership may shift from technology to communications, or from consumer-focused companies to industrial tech. These movements help indicate broader shifts in capital deployment.

Long-Term Industry Representation

Over time, the composition of the index has evolved to represent shifts in industry focus. Whereas earlier periods saw emphasis on hardware or microprocessors, recent years have been defined by software-as-a-service platforms, cybersecurity, and digital media. The changing nature of these top-tier listings reflects ongoing evolution in the global business landscape.

Continuous Innovation Pipeline

With a heavy concentration of research-intensive firms, the Nasdaq index often acts as a window into the future of commerce and infrastructure. Breakthroughs in automation, health technologies, and machine learning frequently emerge from companies that anchor the index. This ongoing pipeline of innovation supports the relevance of top nasdaq stocks as a core reference point in modern finance

0 notes

Text

youtube

Market Crash Coming AI Says Not So Fast… 📉🤖

#SmartInvesting#AIPortfolio#StockMarket2025#MarketCrash2025#iFlipAI#MachineLearning#FinanceShorts#InvestingTips#TechStocks#VolatilityAlert#Youtube

0 notes

Text

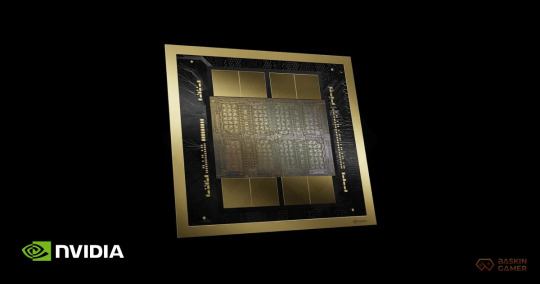

NVIDIA Shocks the Tech World with New AI Chips and Unbelievable Revenue Surge - Baskingamer

NVIDIA has just made waves across the tech industry—again. At a recent event, the company… read more https://baskingamer.com/nvidia-shocks-the-tech-world-with-new-ai-chips-and-unbelievable-revenue-surge/

#NVIDIA#aichips#nvidiageforce#nvidiaaichips#gamechips#game#gaming#GamingContent#gamers#games#gamer#gamingcommunity#xbox#gamingnews#baskingamer#techstocks#companies#finance

0 notes

Text

Investment Analysis Coding Bit

In 2025, the global investment Analysis is being shaped by technological innovation, geopolitical shifts, and evolving consumer behaviors. Sectors like AI, clean energy, cloud computing, and digital commerce are expected to drive substantial growth. While central banks are cautiously adjusting interest rates, investor sentiment is gradually shifting from conservative holdings to high-growth technology and sustainability-driven assets.

E-Commerce

Current Status:

Global e-commerce is experiencing steady growth, especially in emerging markets.

AI-driven personalization and social commerce are driving engagement.

Logistics and last-mile delivery continue to be a challenge and opportunity.

Market Trends:

Omnichannel Retail: Integration of offline and online touchpoints.

AI & AR Integration: Enhanced shopping experiences through virtual try-ons and AI suggestions.

Sustainability: Preference for eco-conscious brands is rising.

Investment Insight:

Strong growth potential in Southeast Asia, India, and Africa.

Key Players to Watch: Amazon, Alibaba, Shopify, Mercado Libre. 📞 Phone Number: +91 9511803947 📧 Email Address: [email protected]

#AWS#CloudComputing#CloudInfrastructure#TechInvesting#DigitalTransformation#AIinCloud#AWSInvestment#HybridCloud#MultiCloud#CloudMarket#AWS2025#Graviton#Trainium#EnterpriseTech#DataCenters#TechStocks#FutureOfCloud

0 notes

Text

Tech Stocks vs. Value Stocks: Navigating Your Investment Journey

Investing in the stock market is like exploring a vast landscape filled with diverse opportunities, each with its own level of risk, potential returns, and market dynamics. Among these opportunities, tech stocks and value stocks stand out as two distinct paths for investors. Understanding the characteristics, benefits, and risks of each is essential for creating a well-rounded, goal-focused portfolio.

Tech and growth stocks often grab the spotlight due to their innovative nature and rapid growth potential, while value stocks appeal to those seeking stability and long-term income. By delving into the core aspects of each, including value investing strategies, investors can better determine which approach—or combination of approaches—aligns with their financial goals and risk tolerance.

What are Tech Stocks?

Tech stocks are associated with groundbreaking advancements and disruptive innovations, attracting growth investors who are willing to embrace higher volatility for the potential of significant returns. These companies, active in the dynamic technology sector, are known for leveraging emerging trends and driving market growth. As a result, growth companies like tech stocks are favored by those interested in investing in the future expansion of industries such as artificial intelligence, cloud computing, and biotechnology.

What are Value Stocks?

On the flip side, value stocks are a favorite among investors who appreciate steady growth and reliable income. These stocks represent companies with solid fundamentals that are undervalued compared to their true worth. This appeals to value investors who are in it for the long haul. Value investing is all about discipline—buying shares at a bargain and holding onto them until the market recognizes their real value. This approach is perfect for those who prefer a more cautious investment style, aiming to keep risks low while enjoying regular dividend payouts.

Ultimately, whether you lean towards tech stocks, value stocks, or a mix of both depends on your personal investment goals, risk tolerance, and how you view the market. By understanding the key differences between these categories, investors can make smarter choices that fit their financial objectives and adapt to changing market conditions.

Understanding Tech Stocks

Tech stocks are shares of companies operating in the technology sector. This broad category includes firms involved in software, hardware, artificial intelligence, cloud computing, semiconductors, and cutting-edge innovations like robotics and biotech. Some big names in this space are Apple, Microsoft, Alphabet, and Nvidia. These companies are known for their scalability, rapid revenue growth, and ongoing investment in research and development.

The excitement around tech stocks comes from their potential to shake up industries and create entirely new markets. They usually operate in fast-moving sectors with lots of future demand potential. However, this focus on growth comes with high valuations and market sensitivity. During times of economic optimism, tech stocks often outperform due to high growth expectations. But they can also experience sharp declines in bearish market environments because they rely heavily on future earnings forecasts.

Defining Value Stocks

Value stocks are shares of companies considered undervalued relative to their intrinsic worth. These firms typically have stable earnings, solid fundamentals, and a track record of profitability. Common sectors for value stocks include finance, utilities, consumer goods, energy, and industrials. Well-known value stocks include Johnson & Johnson, Procter & Gamble, and JPMorgan Chase.

Value investing is about finding companies with strong business models that the market might be temporarily overlooking. Investors aim to buy shares at prices below the company's fundamental value, expecting the market to eventually recognize the undervaluation. Many value stocks also offer regular dividends, providing investors with a steady income stream while they wait for capital appreciation.

Key Differences Between Tech and Value Stocks

1. Approach to Growth

Tech stocks are growth-oriented, prioritizing market expansion and product innovation. They often reinvest profits rather than distributing dividends, aiming to fuel long-term scaling. In contrast, value stocks focus on maintaining steady earnings and returning value to shareholders through dividends and conservative financial management. Growth companies in the tech sector frequently leverage cutting-edge technologies and innovative business models to capture new market opportunities, while value companies emphasize preserving capital and generating consistent returns over time.

2. Volatility and Market Sensitivity

Tech stocks tend to be more volatile due to their reliance on growth projections and sensitivity to interest rates, economic data, and investor sentiment. Value stocks generally exhibit lower volatility and are seen as more resilient during market downturns or periods of economic uncertainty, though investing involves risk, especially regarding the market price. This stability is appealing to investors who prioritize capital preservation and predictable cash flows in non-technology sectors, especially during market corrections or economic downturns.

3. Valuation Metrics

Tech companies often trade at higher multiples, including elevated price-to-earnings (P/E) and price-to-sales (P/S) ratios. These valuations reflect investor expectations for future earnings based on their market capitalization. Value stocks, on the other hand, typically have lower valuation multiples, offering a margin of safety for investors focused on buying shares at reasonable prices. The valuation gap between growth and value stocks can widen during periods of market optimism, as reflected in the value index, but value stocks may provide a buffer against sharp declines in market sentiment.

4. Dividend Policies

Many tech companies, especially those in early growth stages within different asset classes, do not pay dividends. Instead, they reinvest profits into development and expansion. Mature tech firms like Microsoft and Apple are exceptions, offering modest dividends alongside continued growth, particularly during the business cycle. Value stocks are more likely to distribute a significant portion of earnings to shareholders, making them attractive to income-focused investors. The high dividend yield associated with value stocks can serve as a reliable income source, appealing to retirees and those seeking stable earnings.

Advantages of Tech Stocks

1. Exposure to Innovation

Tech stocks provide direct access to innovative trends shaping the future, including cloud computing, electric vehicles, fintech, and artificial intelligence. This exposure allows investors to participate in transformative shifts across industries that have been prevalent in the past decade. By investing in tech stocks, individuals gain the opportunity to be part of groundbreaking advancements that have the potential to redefine entire sectors and create new market opportunities.

2. High Growth Potential

The rapid expansion of technology-based services and products gives tech companies the potential for substantial revenue and earnings growth. When market conditions are favorable, this growth can lead to impressive capital appreciation. Tech stocks tend to thrive in environments where technological adoption is accelerating, much like the energy sector, enabling them to capture significant market share and drive exponential growth.

3. Scalability

Many technology firms operate scalable business models, particularly in software and digital services. These models allow for revenue growth without a proportional increase in operating costs, driving higher margins and profitability over time. The scalability of tech companies, coupled with their competitive advantages, often results in greater operational efficiency and the ability to quickly respond to changing market demands, further enhancing their growth prospects.

Advantages of Value Stocks

1. Income Generation

Dividend payments are a defining feature of value stocks. These consistent income generation streams are particularly beneficial for retirees or income-focused investors, offering a measure of predictability regardless of short-term market fluctuations. Value stocks often provide a reliable source of cash flow, which can be reinvested or used to meet financial needs, enhancing the overall financial security of investors.

2. Lower Valuation Risk

Because value stocks are often priced below their intrinsic value, investors are less likely to overpay. This conservative pricing approach can limit downside risk and offer protection during periods of market stress, leading to lower valuation risk for investors. Investing in value stocks allows investors to potentially acquire quality companies at a discount, increasing the likelihood of capital appreciation as the market recognizes their true worth.

3. Defensive Attributes

Value stocks tend to perform better in uncertain or declining markets. Their defensive nature and stable earnings can help cushion a portfolio during economic downturns. This resilience makes value stocks, compared to growth stocks, an attractive option for investors seeking to preserve capital and weather market volatility. Value stocks often belong to well-established companies with strong fundamentals, providing a sense of security in turbulent times.

Risks of Tech Stocks

1. Valuation Sensitivity

Tech stocks are often subject to high valuations, making them more vulnerable to market corrections if a company fails to meet growth expectations. Rising interest rates and shifts in market sentiment can heavily impact tech valuations. The rapid pace of technological change further exacerbates these risks, as companies must continuously innovate to stay ahead of competitors and justify their high valuations. Investors should be aware that the reliance on future earnings projections makes tech stocks particularly sensitive to economic fluctuations and market volatility.

2. Market Cyclicality

Tech stocks frequently follow a cyclical pattern, performing well during bull markets but experiencing sharper declines during periods of market stress or recession. This cyclical nature is influenced by broader market trends and economic conditions, which can lead to significant fluctuations in stock prices and investor sentiment. Investors must be prepared for the inherent volatility associated with tech stocks, as their growth counterparts tend to be more sensitive to changes in the economic landscape.

3. Intense Competition and Regulatory Risk

The technology sector is characterized by intense competition, requiring constant innovation to maintain market leadership. Additionally, regulatory scrutiny in areas such as consumer discretionary, particularly around data privacy and antitrust concerns, can introduce uncertainties. The global nature of tech companies means they are subject to international regulations, which can complicate compliance and impact profitability. Investors should consider the potential impact of regulatory challenges and competitive pressures when evaluating tech stocks.

Risks of Value Stocks

1. Value Traps

Not all undervalued stocks represent sound investment opportunities. Companies in structural decline may appear attractive based on valuation metrics but lack the competitive advantages and fundamentals to support recovery. Identifying these value traps requires careful due diligence. Investors must analyze financial statements, industry trends, and management effectiveness to avoid these pitfalls and ensure they are investing in companies with solid long-term potential.

2. Slower Growth Potential

Compared to tech stocks, value stocks typically offer lower growth prospects. While they may provide stability and income, they often underperform during market rallies led by high-growth sectors, highlighting that past performance is not always indicative of future growth results. The focus on established industries means value stocks might miss out on the explosive growth seen in emerging technologies or sectors with rapid expansion. Investors should weigh the trade-off between stability and growth potential when considering value stocks.

3. Sector-Specific Challenges

Value stocks are concentrated in traditional sectors that may be affected by long-term structural shifts, such as the transition to renewable energy or the digitization of consumer behavior. These shifts can lead to sector-specific challenges, changes in consumer preferences, and regulatory landscapes, potentially impacting the long-term viability of certain value stocks. Investors need to be aware of these dynamics and consider how they might affect the future performance of their investments. Staying informed about industry trends and adapting investment strategies accordingly can help mitigate these risks.

Developing a Balanced Investment Strategy

Many investors opt to diversify their portfolios by integrating both tech and value stocks. This hybrid strategy combines growth potential with income and stability, offering exposure to varying market conditions.

Strategic Allocation A typical approach involves designating a portion of the portfolio to high-growth tech stocks for long-term capital gains, while employing value stocks to generate income and offer protection against downturns. The exact allocation depends on factors such as an investor’s age, risk tolerance, and financial objectives.

Periodic Rebalancing Market performance can alter the balance of tech or value holdings over time. Regular portfolio assessments based on market performance and rebalancing are essential to maintain a diversified mix that aligns with an investor’s intended strategy.

Assessing Market Conditions During bull markets or periods of low interest rates, tech stocks may excel. Conversely, value stocks often take the lead during market corrections or times of economic uncertainty. Understanding these dynamics can inform investment decisions.

Identifying the Right Fit

Choosing between tech stocks and value stocks—or combining both—ultimately comes down to individual investor goals and risk tolerance. Tech stocks appeal to those seeking higher growth, innovation exposure, and the potential for outsized returns. Value stocks cater to investors prioritizing income, stability, and conservative capital appreciation.

Investors should assess their investment horizon, cash flow needs, and market outlook before deciding which strategy to emphasize. By understanding the strengths and limitations of both tech and value investing, market participants can construct resilient portfolios designed to perform in a range of economic scenarios.

A well-rounded investment strategy acknowledges that both growth and value have a place, and the most effective approach often lies in blending these elements according to personal financial priorities.

To further enhance decision-making, investors can consult with a financial professional who can provide insights into market trends and help tailor an investment strategy that aligns with individual objectives. Additionally, staying informed about broader market developments, interest rate fluctuations, and global economic conditions can aid in anticipating shifts in market sentiment and adjusting portfolios accordingly.

The key to achieving long-term financial success lies in remaining adaptable and open to evolving market dynamics. By embracing both ech stocks and value stocks,, investors can harness the growth momentum of innovative companies while benefiting from the steady earnings and defensive attributes of well-established firms. This balanced approach not only mitigates risk but also positions investors to capitalize on opportunities across various market cycles and economic environments.

#techstocks#valuestocks#investing#stockmarket#growthinvesting#valueinvesting#investmentstrategies#portfoliodiversification

0 notes

Text

What’s Moving the Market: Key Factors to Watch as Friday Unfolds

As investors gear up for the first trading session of May’s final stretch, Friday’s market activity is expected to be driven by a confluence of earnings reports, economic data, and ongoing policy developments. With Wall Street showing resilience amid mixed signals, investors are preparing for a potentially pivotal day.

Markets Open Higher as Optimism Builds

U.S. stock futures pointed to a higher open Friday morning, with optimism fueled by strong tech earnings and signs of easing trade tensions. The S&P 500 and Nasdaq futures showed gains, led by surges in mega-cap tech stocks, reflecting renewed investor confidence in the sector’s strength and its central role in market momentum.

Earnings Season Heats Up

Several major companies are at the center of Friday’s action:

Microsoft (MSFT) stunned the market with better-than-expected results, reporting $70.07 billion in quarterly revenue. A 21% surge in cloud business, particularly in AI-driven services, sent its stock soaring nearly 9% in premarket trading.

Meta Platforms (META) followed suit, climbing 6% after announcing a 16% jump in revenue year-over-year to $42.31 billion. The social media giant also disclosed significant increases in AI capital spending, which investors welcomed as a sign of future growth.

Apple (AAPL) and Amazon (AMZN) are set to report earnings after the market close. Apple is expected to post $94.66 billion in revenue, while Amazon is forecast to hit $155 billion. Investors will be watching closely for guidance on future growth and spending, especially related to AI and cloud services.

Economic Data Adds to the Mix

Friday’s trading will also be shaped by new economic data, particularly April’s jobs report. Economists expect the U.S. economy to have added around 130,000 jobs—down sharply from March’s 228,000 gain. While still indicative of a growing labor market, the lower number may reflect deeper economic cooling, especially in light of other recent data showing contracting GDP and rising unemployment claims.

The jobs report will also include wage growth data. Average hourly earnings are expected to have risen 0.3% in April, equating to a 3.9% year-over-year increase. Investors will interpret this number as a key signal on inflation trends and the Federal Reserve's potential policy moves.

Policy Watch: Tariffs and Trade Signals

Markets have also been grappling with recent trade policy shifts. The Trump administration’s announcement of new tariffs—coinciding with so-called “Liberation Day”—initially rattled markets. However, the 90-day delay on implementation and signs of possible trade negotiations have somewhat eased investor concerns. Still, any unexpected developments on this front could rapidly shift market sentiment.

Stocks to Watch Beyond the Big Tech Names

While Big Tech continues to dominate headlines, other major companies are also drawing attention:

Nvidia (NVDA): Faces challenges from tighter U.S. export controls and declining AI investments, factors that could dent its earnings outlook.

Walmart (WMT): With earnings due May 15, investors are watching how the retail giant is managing cost pressures and consumer behavior under evolving tariff conditions.

ExxonMobil (XOM): Reports earnings May 2. The energy giant is under pressure as oil prices have dropped below levels considered profitable for drilling. The company’s outlook could offer insight into broader energy trends.

Coinbase (COIN): Although pro-crypto policies have supported its regulatory position, Coinbase still faces volatility from declining crypto prices. Nonetheless, growing subscription revenues offer a potential bright spot.

Conclusion: A Market at the Crossroads

With a mix of earnings beats, cautious economic forecasts, and shifting trade policies, Friday could be a turning point in the broader market narrative. Investors will be looking for clarity—on whether the economy is heading for a soft landing or something more disruptive, and on which sectors may lead or lag in the months ahead.

For now, the markets remain cautiously optimistic—but volatility could return quickly depending on what Friday’s numbers reveal.

0 notes

Text

youtube

Stock Market Daily Update - February 25, 2025 - InvestTalk Market Wrap

The market faced another down day today, driven by a drop in major tech stocks. Bitcoin slipped below the $90,000 mark, and Wall Street began responding negatively to Dogecoin amid its cost-cutting efforts.

0 notes

Text

:)

0 notes

Text

NASDAQ Plunge: Impact and Key Lessons for Investors

In the stock market, a sudden drop in prices, especially a Nasdaq crash, can come as a big shock to many investors.

The Nasdaq is a stock index focused on technology stocks, and its volatility tends to be higher than other indexes. Therefore, when we talk about a price drop, we are referring to a sharp drop in the market. This sharp drop forces investors to make decisions quickly under pressure.

What is a NASDAQ Plunge?

A Nasdaq plunge is when the Nasdaq Composite Index suddenly drops. The Nasdaq includes many of the world's largest technology companies, such as Apple, Microsoft, and Google. So if the stock prices of these companies drop significantly, the entire Nasdaq index will be affected. The term "plunge" is used when the market drops significantly, usually a single-day drop of 3% or more.

The Significance of NASDAQ Plunge

A drop in the Nasdaq Index can have a significant impact on investors, especially those who focus on technology stocks. Since these companies are often considered to be fast-growing, a drop in stock prices can be worrying. If this happens, it will also have an impact on the overall economy. For example, if investors lose money, they may stop spending or find it more difficult to borrow, which could lead to an economic slowdown. However, a decline may also provide new investment opportunities for long-term investors because stock prices may become more affordable.

Advantages and Disadvantages of a Nasdaq Price Plunge

1. Advantages:

○ More investment options: If the Nasdaq price falls, previously expensive stocks may become cheaper. This provides long-term investors with an opportunity to buy stocks at lower prices.

○ Market Adjustment: Price declines can serve as market adjustments. Sometimes, stock prices are too high and a sharp decline can help bring prices down to a more reasonable level. In the long run, this helps make the market healthier and more stable.

2. Disadvantages:

○ Short-term losses: During a Nasdaq plunge, investors may suffer significant short-term losses, especially if they hold a large number of technology stocks. This can be stressful and frustrating for those looking for quick returns.

○ Psychological impact: A sharp market decline can cause fear and anxiety, leading people to panic sell their stocks. This can cause further declines and delay market recovery.

Real-World Examples: The Dot-com Bubble in 2000 and the COVID-19 Pandemic in 2020

1. The Dot-com Bubble (2000):

In the early 2000s, the dot-com bubble burst and the Nasdaq fell sharply. Many dot-com companies grew rapidly but lacked a solid business model or way to make money. As a result, their stock prices rose sharply. In 2000, the Nasdaq dropped nearly 78%, shocking many investors. This was a clear example of how technology stocks can experience huge ups and downs, and taught investors an important lesson about how to proceed with caution and understand the risks of overvalued stocks.

2. The COVID-19 Pandemic (2020):

In early 2020, the COVID-19 pandemic dealt a major blow to the global economy, and the Nasdaq was no exception. As the outbreak spread, the stock market fell sharply. However, this decline proved to be an excellent buying opportunity for long-term investors. After the market bottomed in March 2020, the stock market began to recover as companies in the technology and remote services sectors experienced huge growth. The pandemic forced more people to work from home, and digital services became more important, helping tech stocks recover quickly.

My Personal Experience: Lessons from the Nasdaq Crash

I witnessed the Nasdaq crash firsthand. I held a portfolio of tech stocks in early 2020 when the COVID-19 pandemic began. When the market fell, I felt pressured to sell my stocks to cut my losses. But instead of panicking, I decided to stick to my investment strategy and believe that the market would eventually recover. In retrospect, this decision paid off. The Nasdaq quickly recovered and I made a substantial profit. This experience taught me an important lesson: Don't overreact to short-term market declines. Believe in the long-term potential of your investments.

Conclusion

The Nasdaq plunge may seem scary, but it can also be a great opportunity for investors who stay calm and think long-term. When the market falls, it's important to analyze why it happened and not make hasty decisions. If you stay patient and stick to your investment principles, you can find new opportunities and even see your investment grow after the market recovers.

#NASDAQPlunge#StockMarket#TechStocks#InvestmentOpportunities#MarketCorrection#NASDAQCrash#StockMarketTips#InvestingWisely#MarketVolatility#FinancialLessons#TechStockInvesting#InvestingInTech#NASDAQRecovery#LongTermInvesting#StockMarketDrop#InvestmentStrategy#MarketTrends#FinancialEducation#StockMarketInsights

1 note

·

View note

Text

📣 Blockmate Ventures: Hivello Integrates Nosana to Boost GPU Earnings & Expand DePIN Network!

Blockmate Ventures Inc. (TSX.V: MATE | OTCQB: MATEF | FSE: 8MH1) announced that its investee, Hivello, has successfully integrated with Nosana, a leading decentralized compute network. This strategic move enhances passive income opportunities for GPU owners while expanding participation in AI and software development.

💰 Stock Price: $0.14

🔹 Key Highlights:

✅ Maximized Passive Income – Nosana ranks among the highest-yielding DePIN networks for GPU-based compute. ✅ Accelerated AI & Software Development – GPU owners can contribute to decentralized AI model training and CI/CD workflows. ✅ Effortless Participation – Hivello simplifies access to DePIN networks, making it seamless to monetize idle GPUs. ✅ Expanding the DePIN Ecosystem – More GPU nodes strengthen decentralized infrastructure growth.

🗣 Domenic Carosa, Co-Founder & Chairman of Hivello:

"The future of infrastructure is decentralized, and DePIN is leading this transformation. Nosana’s integration is another step toward making GPU-powered compute more accessible, rewarding, and scalable."

📈 Investor Outlook –

This integration further solidifies Blockmate Ventures Inc. and Hivello’s mission to make decentralized computing profitable and accessible. By enabling GPU owners to tap into high-demand AI applications, this partnership sets the stage for sustainable passive income in the growing DePIN sector.

🔗 More Details & Updates: https://stockhouse.com/news/press-releases/2025/03/05/hivello-integrates-nosana-to-boost-passive-income-yield-and-expand-depin-network

⚠️ This is not investment advice; please do your own research before making investment decisions.

#Hivello#BlockmateVentures#DePIN#PassiveIncome#AI#GPUComputing#Nosana#Blockchain#InvestmentOpportunity#TechStocks#Decentralization#CryptoEarnings#Web3#AIInfrastructure#CloudComputing#StockMarket#TSXV#MATE#8MH1

0 notes

Text

#Nvidia#AMD#AIChips#InvestSmart#TechStocks#Semiconductors#GPUMarket#AIDomination#StockWatch#AIInvesting

0 notes

Text

What the Top 10 NASDAQ Stocks Say About Changing Market Dynamics?

The NASDAQ stock exchange has long been a hub for the world’s leading technology companies. As one of the largest and most influential exchanges globally, the NASDAQ hosts a variety of sectors, from tech to healthcare, that contribute to its dynamic market performance. Among these, the Top 10 NASDAQ Stocks often capture the spotlight due to their substantial influence and consistent market performance. These companies span several industries, showcasing innovation and resilience in the face of changing global trends.

The Power of Technology in the Top 10 NASDAQ Stocks

The technology sector continues to dominate the Top 10 NASDAQ Stocks, with firms like Apple, Microsoft, and Amazon at the forefront. These companies are not just market leaders; they are also drivers of digital transformation across industries. Apple, known for its iconic products, has created a loyal customer base through consistent innovation in personal devices, software, and services. Microsoft’s cloud services, underpinned by its Azure platform, continue to play a pivotal role in shaping the cloud computing landscape, while Amazon remains a key player in e-commerce, digital services, and cloud technology with its AWS division.

Moreover, the presence of semiconductor companies like Nvidia and AMD highlights the significance of high-performance computing in driving technological advancements. These companies power some of the most critical sectors, from gaming to artificial intelligence (AI), reinforcing their importance within the broader tech ecosystem.

The Growing Role of Healthcare and Consumer Services

While technology companies dominate, sectors such as healthcare and consumer services also make significant contributions to the Top 10 NASDAQ Stocks. Firms in the healthcare sector are driving progress in biotechnology, pharmaceuticals, and healthcare technology, which is helping to meet the growing demand for innovative medical solutions. Companies like Thermo Fisher Scientific and Moderna are shaping the future of healthcare, particularly in the areas of biotechnology and vaccine development.

In the consumer services space, companies like Netflix and Tesla continue to lead, reflecting a shift toward digital entertainment and sustainable energy. Tesla, for example, has reshaped the electric vehicle (EV) industry, with its innovative products contributing to a greener future. Netflix, meanwhile, has transformed how people consume content, solidifying its position as one of the leading streaming platforms worldwide.

The Impact of Innovation Across Different Sectors

One of the defining characteristics of the Top 10 NASDAQ Stocks is their relentless focus on innovation. These companies are constantly pushing the boundaries of what’s possible in their respective industries. In the realm of technology, AI, machine learning, and cloud computing are central to growth, driving companies like Nvidia and Alphabet to invest heavily in these areas. In the consumer sector, the rise of digital platforms, e-commerce, and online services has created a new wave of opportunities for companies such as Amazon and Facebook (Meta).

Furthermore, as the renewable energy sector continues to evolve, companies like Tesla are at the forefront of shaping a more sustainable future. Tesla’s focus on clean energy solutions, including solar power and electric vehicles, reflects a broader market shift towards sustainability, which is increasingly becoming a key driver of growth in the tech sector.

Market Resilience and Adaptability

The Top 10 NASDAQ Stocks have shown remarkable resilience, especially in the face of economic volatility. Their ability to adapt to shifting global trends, such as supply chain disruptions, regulatory changes, and market fluctuations, has ensured their continued dominance. For instance, companies like Apple and Microsoft have diversified their business models, integrating new technologies and expanding into new markets, allowing them to maintain strong growth trajectories.

Additionally, these companies have demonstrated their ability to withstand economic downturns by focusing on long-term goals and consistent innovation. For example, Amazon's expansion into new areas such as cloud computing, logistics, and artificial intelligence has allowed the company to remain highly relevant in an ever-changing marketplace.

Sector Diversification in the Top 10 NASDAQ Stocks

While technology remains a dominant force, the Top 10 NASDAQ Stocks are becoming more diversified, reflecting the growing importance of other sectors like healthcare, renewable energy, and consumer services. The increasing focus on sustainability, as seen with companies like Tesla, highlights a shift toward environmental consciousness, while healthcare companies continue to innovate with biotechnology and medical research.

0 notes