#Trading Signals

Text

Pair Trading: Forex Trading Strategy Explained

Pair trading is a market-neutral trading strategy that involves taking simultaneous long and short positions in two correlated currency pairs. The primary goal is to exploit the relative price movements between the pairs, irrespective of overall market direction.

What is Pair Trading?

It involves selecting two currency pairs with a historical correlation. Traders take a long position in the…

#Correlated Pairs#Forex Trading#Market Neutrality#Mean Reversion#Pair Trading#Profitability#Risk Management#Technical Analysis#Trading Signals#Trading Strategy

2 notes

·

View notes

Text

Expert Signals and Strategy: The Smart Trading Formula - 2 April 2024

Learn how to increase trading profit with the Smart Trading Expert Signals strategy, which has a 49.81% winning ratio.

#ERJ #TRU #LAC #BKR

The stock market is a dynamic and complex environment that requires constant attention and adaptation. To succeed in this field, you need to have smart trading, expert signals and strategy. Smart trading is the use of sophisticated software and algorithms to monitor and predict the market movements. Expert signals are the tips and advice from professional traders or experts who have a deep…

View On WordPress

2 notes

·

View notes

Text

Understanding How Cryptocurrency Trading Signals Work

Cryptocurrency trading is like a wild rollercoaster ride. Prices can shoot up or plummet in no time, leaving traders feeling lost and unsure about what to do. That's where trading signals come in. These signals are like helpful tips based on studying the market closely. They give traders advice on when to buy or sell cryptocurrency trading on cryptocurrency signals so they can make smart decisions and hopefully make some money.

Exploring the Different Types of Trading Signals

signals come in different flavors, customized to how different people like to trade. Here are the main types:

1] Technical Analysis Signals: These signals use fancy math and past price data to guess where prices might go next. They look at things like patterns on charts and indicators like moving averages or RSI to find trading chances.

2] Fundamental Analysis Signals: These signals look at the real value of a cryptocurrency, considering factors such as the technology behind it, its adoption rate, the expertise of its development team, and the current demand for it. They care more about what's under the hood than just the current prices of cryptocurrency.

3] Sentiment Analysis Signals: These signals check what people are saying on social media, news, and forums about cryptocurrency trading signals. By understanding how people feel, traders can get an idea of where prices might go, even if they're not looking at the current prices of cryptocurrency.

4] Hybrid Signals: Some signals mix it up, using both technical and fundamental analysis. This gives traders a wider view of what's happening in the market, hopefully helping them make better decisions.

The Benefits of Trading Signals

Using trading signals can help traders in many ways:

1] Making More Money: Following these signals, which are based on careful research, can increase the chances of making profitable trades and getting more money from investments.

2] Reducing Risks: Signals give insights into possible risks and where the market might be heading. This helps traders manage their risks better and avoid losing too much money.

3] Saving Time: Traders don't have to spend as much time analyzing the market because signals have already done that work for them. They can focus on actually making trades and managing their investments.

4] Learning: New traders can learn a lot from signals. They get to see how experts analyze the market and can pick up useful tips for their trading. Over time, they become better traders themselves.

Choosing the Right Trading Signal Provider

When picking a signal provider, it's important to think about a few things to make sure you're getting the right one:

1] Reputation and Trustworthiness: Look for providers that have a good reputation for being reliable and honest in trading on cryptocurrency. Check their track record to see if they've consistently given out accurate signals.

2] Accuracy: Check how often their signals have been right in the past in trading on cryptocurrency trading signals. You want signals that are good at predicting where prices will go.

3] Transparency: Make sure the provider is clear about how they come up with their signals and how well they've done in the past. You should be able to easily see how accurate their signals have been.

4] Cost: Think about how much it costs to use their service and whether it fits your budget. Make sure the price is worth it for the quality of signals you're getting.

Maximizing the Effectiveness of Cryptocurrency Trading Signals

To get the most out of signals, here are some easy tips to follow:

1] Know What's Going On: Keep up with what's happening in the market. Understand trends and how prices are changing so you can make smart decisions.

2] Use Signals Smartly: Think of signals as helpful tools, not the only thing you rely on. Do your research too, and use signals to confirm your ideas.

3] Get Signals from Different Places: Don't rely on just one signal provider. Subscribe to a few different ones to get different perspectives and make your decisions more reliable.

4] Stay Flexible: Keep an eye on what's happening and be ready to change your strategies. Markets can shift quickly, so be ready to adjust your plans accordingly.

Understanding the Risks Associated with Signals

While using cryptocurrency trading signals has its advantages, it's important to know the risks too:

1] Depending Too Much on Signals: If you rely too heavily on signals without really understanding how the market works, you might end up making bad decisions and losing money.

2] Getting Bad Signals: Sometimes, signals can be wrong or misleading. If you don't check them carefully, you could end up losing money. It's crucial to do your homework and make sure the signals are trustworthy.

3] Risk of Market Manipulation: Sometimes, people might give out false signals to trick traders into making certain trades. This could lead to losses if you're not careful. So, it's important to be cautious and not blindly follow every signal you see.

Exploring the Future of Trading Signals

The future of signals is set to see big changes, thanks to technology and rules getting better. Here are some important things to watch out for:

1] Smarter Signals with AI: As technology gets better, signals will become more accurate and helpful. Artificial intelligence and machine learning will help generate signals that give traders better insights, helping them make smarter decisions.

2] Trading Bots Working with Signals: Signals will work hand-in-hand with automated trading bots. This means trades can happen automatically based on signal recommendations. It'll make trading faster and easier, with less manual work.

3] Rules Getting Clearer: As the trading on cryptocurrency signals market grows, there will be more rules for signal providers. This will make sure they're transparent and accountable for the signals they give out, giving traders more confidence in using them.

FAQs

1. Are trading signals always accurate?

Ans : While signals can provide valuable insights, they are not infallible. Traders should exercise diligence and verify signals before acting on them.

2. Can I rely solely on signals for trading decisions?

Ans : It's not advisable to rely solely on signals for trading decisions. Traders should supplement signals with their own analysis and market research.

3. How often should I review my trading strategy based on signals?

Ans : Traders should regularly review and adjust their trading strategies based on the latest market developments and signal performance.

4. Are there free signal providers available?

Ans : Yes, some providers offer free cryptocurrency trading signals, but they may not always be as reliable or accurate as paid services.

5. What precautions should I take when using signals?

Ans : Traders should verify the credibility of signal providers, diversify signal sources, and be cautious of blindly following signals without understanding the underlying market conditions.

#cryptocurrency trading signals#current prices of cryptocurrency#trading on cryptocurrency#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading#free crypto trading signals#free cryptocurrency trading signals#trading ideas

2 notes

·

View notes

Text

Master the Belt-Hold Line (Marubozu) Pattern: Unlock Key Trading Insights & Strategies

Unlock the secrets of the Belt-hold line in candlestick charting. This striking pattern, known for its clear-cut signals and trend strength, empowers traders to spot market shifts with precision. Dive into this essential tool for a fresh perspective on your trading tactics and trend analysis.

0 notes

Text

FxSignals: Free Trading Signals for Forex Traders

In the fast-paced and ever-evolving world of forex trading, having timely and accurate information is crucial for success. This is where FxSignals comes in, offering free trading signals that can significantly enhance your trading strategy. FxSignals has positioned itself as a valuable resource for traders, from novices to seasoned professionals, by providing insights that help make informed trading decisions.

What are Trading Signals?

Trading signals are indicators or suggestions generated by experienced traders or automated systems that recommend entering or exiting a trade. These signals are based on various analyses including technical indicators, chart patterns, and fundamental economic news. They can be particularly helpful for those who may not have the time or expertise to conduct their own in-depth market analysis.

Why Choose FxSignals?

Expert Analysis: FxSignals boasts a team of experienced traders and analysts who use a combination of technical and fundamental analysis to generate signals. This ensures that each signal is backed by thorough research and expertise.

Accessibility: One of the most significant advantages of FxSignals is that they provide their trading signals for free. This opens up opportunities for all traders, regardless of their financial situation, to benefit from professional-grade trading insights.

Timeliness: In forex trading, timing is everything. FxSignals ensures that their signals are delivered promptly, allowing traders to act quickly on the recommendations. This can be crucial in a market where prices can fluctuate rapidly.

User-Friendly Platform: FxSignals has designed their platform to be intuitive and user-friendly. Whether you access their signals via email, SMS, or their mobile app, the information is presented clearly, making it easy to understand and act upon.

Educational Resources: In addition to providing signals, FxSignals also offers educational resources to help traders understand the rationale behind each signal. This can be incredibly beneficial for traders looking to learn and improve their own trading skills.

Conclusion

FxSignals provides a valuable service to the forex trading community by offering free trading signals. These signals can help traders make more informed decisions and potentially increase their chances of success in the forex market. With expert analysis, timely delivery, and a user-friendly platform, FxSignals is an excellent resource for anyone looking to enhance their trading strategy without incurring additional costs. Whether you are a beginner or an experienced trader, FxSignals can provide the insights you need to navigate the forex market more effectively.

0 notes

Text

Relative Vigor Index Explained

The Relative Vigor Index (RVI) is a momentum oscillator used in technical analysis to measure the strength of a trend. Developed by John Ehlers, the RVI is based on the concept that prices tend to close higher than they open in an uptrend and lower than they open in a downtrend. This article will delve into the RVI, explaining its calculation, interpretation, and how it can be effectively used in…

#Crossovers#Divergence#Downtrend#Entry and Exit Points#EUR/USD#Forex#Forex Traders#Forex Trading#MACD#Market Trends#Moving Average#Moving Average Convergence Divergence#Price Movements#Relative Strength#Risk Management#RSI#Signal Line#Stop-Loss#Technical Analysis#Trading Signals#Trading Strategies#Trend Direction#Uptrend#USD/JPY#Volatility

0 notes

Text

How to create an AI trading bot on Bitcoin in seconds and without coding knowledge.

0 notes

Text

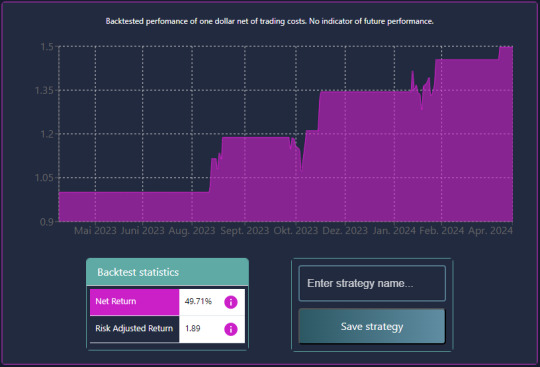

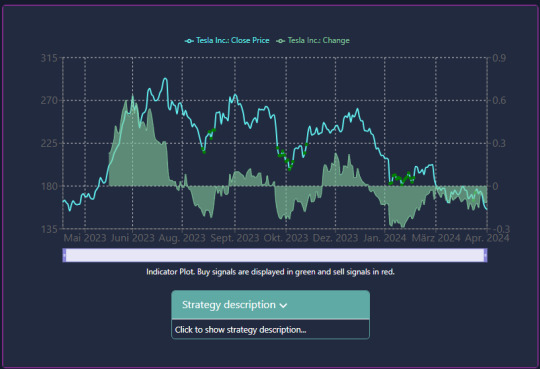

Expert Signals and Strategy: The Smart Trading Formula - 15 April 2024

Learn how to increase trading profit with the Smart Trading Expert Signals strategy, which has a 49.81% winning ratio.

#LAC #BKR #tradingsignals #tradingideas #tradingstrategy

The stock market is a dynamic and complex environment that requires constant attention and adaptation. To succeed in this field, you need to have smart trading, expert signals and strategy. Smart trading is the use of sophisticated software and algorithms to monitor and predict the market movements. Expert signals are the tips and advice from professional traders or experts who have a deep…

View On WordPress

0 notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

Trading Signals

Step into the future of trading with the IndieCATR App for Trade Signals! Unleash the power of the first mobile-only platform offering AI-based timing signals for everyone. Elevate your trading experience and align yourself with professional technical traders for unparalleled success.

Embark on a revolutionary journey as we introduce a groundbreaking upgrade, seamlessly integrating cutting-edge technologies, including artificial intelligence, machine learning, and extensive backtesting.

The IndieCATR App's fully-automated daily trading signals redefine the trading landscape, providing a gateway for the average trader to enhance accuracy and make well-informed entries and exits. This upgrade goes beyond, introducing refined risk management strategies, ensuring a comprehensive and user-friendly trading experience.

Our vision is clear—to empower amateur traders with the same technical signal analysis capabilities enjoyed by high-performance and professional traders worldwide. We believe in leveling the playing field, making advanced trading strategies accessible to everyone.

Key Features:

• Mobile-Only Platform: Access AI-based timing signals conveniently on your mobile device.

• Professional Insights: Align with the strategies of high-performance technical traders.

• Cutting-Edge Technologies: Benefit from AI, machine learning, and extensive backtesting.

• Fully-Automated Signals: Daily signals for accurate entries and exits, empowering every trader.

• Risk Management: Refined strategies for a comprehensive and secure trading experience. Know more here Trading Signals

The IndieCATR App is not just an upgrade; it's a revolution in democratizing trading expertise. Join us in reshaping the future of trading—download now and unlock the potential for success in every trade!

#Trading Signals#Financial Insights#Market Alerts#Investment App#Stock Alerts#Crypto Signals#AI Trading#Market Predictions#Trading Tips#Market Analysis#Investment Signals#Algorithmic Insights#Smart Investing#Asset Signals#Stock Tips#Cryptocurrency Alerts#Market Guidance#Investment Tools

0 notes

Text

Bearish Engulfing Pattern: Key Indicators & Trading Strategy Guide

Learn about the Bearish Engulfing pattern, a key technical analysis tool used in trading. This pattern signals potential reversals in a bullish trend, helping traders make informed decisions. Explore its meaning, identification, and trading strategies.

0 notes

Text

Mastering Crypto Trading: Leveraging Telegram Signals for Profitable Trades

Overview

Trading cryptocurrencies involves preparation and strategy from the start. This post explores the realm of Telegram's cryptocurrency trading signals and how they might help novice traders succeed in the erratic cryptocurrency market.

Comprehending Telegram's Crypto Trading Signals

Telegram's cryptocurrency trading signals are excellent indicators that help traders determine when it's best to purchase or sell cryptocurrencies. The indications are obtained through an extensive examination of the market, encompassing price fluctuations and technical indicators. This gives traders practical guidance to effectively manage the intricacies involved in cryptocurrency trading.

Selecting Telegram's Top Crypto Signals

Choosing the top crypto signals telegram is crucial to increasing trade profitability and efficiency. It is crucial to consider elements like correctness, dependability, and reputation. Reputable Telegram channels with a track record of success are available on platforms such as Universal Crypto Signals, allowing traders to base their judgments on dependable signal sources.

The Advantages of Trading Signals on Telegram

Among the many advantages of using Telegram trading signals are improved trade accuracy, reduced risk, and higher profits. Traders can maximize market opportunities and minimize potential dangers by integrating these signals into their trading strategy, which will ultimately result in better trading outcomes.

How to Interpret Crypto Trading Signals on Telegram

It takes a thorough grasp of technical analysis and market dynamics to interpret Telegram crypto trading signals. To read signals and make wise trading decisions, traders need to become familiar with popular signal indicators like relative strength index (RSI) and moving averages.

Typical Errors in Signal-Based Trading to Avoid

Trading signals on Telegram can be useful tools, but traders need to be careful to avoid typical mistakes. To achieve long-term trading success, traders should steer clear of crucial blunders like relying too much on signals, ignoring basic analysis, and practicing insufficient risk management.

Maintaining Current Market Trends

Success in cryptocurrency trading requires keeping up with market trends and advancements. To maximize trading effectiveness, traders should constantly assess market dynamics, modify their methods as necessary, and seize new chances.

Investigating Cutting-Edge Signal Approaches

As traders get more skilled, they can experiment with sophisticated signal techniques made to fit their own trading style and risk tolerance. By experimenting with various signal combinations and sophisticated procedures, traders can improve their trading strategy and consistently turn a profit.

Blockchain Trading Signal Resources and Interfaces

The greatest cryptocurrency signals on Telegram may be accessed by traders with the help of a multitude of easily navigable tools and platforms. These systems enable traders to execute trades with confidence and make well-informed decisions by providing features like customisable dashboards and real-time alerts.

Controlling Risk in Signal-Based Investing

To maximize trading success and protect cash, effective risk management is crucial. To reduce possible losses, traders can put risk mitigation techniques into practice, such as placing stop-loss orders, diversifying their investing portfolio, and using leverage carefully.

Crypto Trading Signals' Future

Crypto trading signals are expected to continue evolving and innovating in the future. Technological developments like artificial intelligence (AI)-powered algorithms have the potential to completely transform signal production and analysis, giving traders new ways to obtain an advantage in the volatile cryptocurrency market.

In conclusion, ambitious cryptocurrency traders can greatly improve their trading performance and profitability by utilizing Telegram trading signals. Traders may successfully traverse the cryptocurrency market by choosing reliable signal providers, analyzing signals, and putting strong risk management techniques into practice.market with assurance and fulfill their financial objectives.

0 notes

Photo

(via Tradify Binary System Review - Profit By Up To 1% To 3% Per DAY!)

#Tradify Binary System Review#Tradify Binary System#Stock Market#Binary Options Trading#Trading Signals#Trading System

1 note

·

View note

Text

Average Directional Index (ADX): Forex Trading Indicator Explained

The Average Directional Index (ADX) is a popular technical analysis tool used in forex trading to measure the strength of a trend. Developed by J. Welles Wilder, it helps traders determine whether a market is trending or ranging, providing valuable insights for making informed trading decisions.

What is the Average Directional Index (ADX)?

The ADX is part of the Directional Movement System and is…

#ADX#Average Directional Index#Directional Indicators#Forex Trading#Risk Management#Technical Analysis#Trading Signals#Trading Strategy#Trend Confirmation#Trend Strength

0 notes

Text

How to Create an AI Trading Bot in Seconds Without Any Coding

I would like to share the journey of QUINETICS - a no-code platform that lets you create, test and launch AI trading bots for crypto, stocks and ETFs with one click and without any coding knowledge.

What makes QUINETICS unique?

Simplifying Trading for All

QUINETICS allows users to create sophisticated predictive AI strategies with just a click, eliminating the need for coding. Whether you're interested in crypto, stocks, or ETFs, the platform ensures versatility across asset classes.

Beyond Technical Analysis

QUINETICS integrates not only technical but also fundamental, sentiment, and economic indicators. This broad spectrum approach enables traders to make informed decisions based on comprehensive market data.

Customization and Transparency

The platform offers insights into artificial intelligence decision-making processes and allows for backtesting of strategies. Customization options let users tailor strategies, such as adjusting trade holding periods, to fit individual needs.

1 note

·

View note