#Bearish Engulfing Pattern

Explore tagged Tumblr posts

Text

How to Trade the Bearish Engulfing Pattern: Complete Guide with Strategies and Examples

Candlestick patterns are powerful tools in the arsenal of a technical trader. Among the most reliable reversal patterns is the Bearish Engulfing Pattern—a strong signal that can hint at the start of a downward trend. In this guide, we’ll explain how to identify this pattern, why it works, and most importantly, how to trade it effectively with multiple strategies and examples. 📌 What is a Bearish…

#Bearish candle formation#Bearish engulfing candlestick pattern explained#Bearish Engulfing Pattern#Bearish engulfing pattern trading strategy#Bearish reversal pattern#Bearish trend confirmation#Can you trade bearish engulfing in forex?#Candlestick pattern for bearish reversal#candlestick patterns#Confirmation signals for bearish engulfing#EMA confluence with candlestick patterns#Engulfing candle trading rules#Entry and exit with candlestick patterns#Forex bearish engulfing strategy#How to confirm a bearish engulfing signal?#How to trade the bearish engulfing pattern#Is the bearish engulfing pattern reliable?#learn technical analysis#Multi-timeframe candlestick pattern strategy#Price action trading setup#Reversal Candlestick Patterns#Risk management for pattern trading#stock markets#Stock trading with bearish engulfing pattern#support and resistance levels#Swing trading with bearish engulfing#technical analysis#Trading bearish engulfing with moving averages#Trading Strategies#Using bearish engulfing with RSI

0 notes

Text

How to Trade with Engulfing Candlestick Patterns

Engulfing Candlestick Patterns are a type of chart pattern used in technical analysis to predict market trends. They occur when a larger candlestick completely covers or “engulfs” the previous smaller one, signalling a potential reversal in price direction. There are two types of engulfing candlestick patterns, i.e., bullish engulfing pattern and bearish engulfing pattern. These patterns are a useful tool in determining entry and exit points for trade or understanding the market behaviour to make informed portfolio decisions.

Types of Engulfing Candlestick Patterns

How to Trade Using Engulfing Candlestick Patterns

Pros and Cons of Bullish Engulfing Candlestick Pattern

Pros and Cons of Bearish Engulfing Candlestick Pattern

#engulfing candlestick#types of engulfing candlestick pattern#bullish engulfing candlestick#bearish engulfing candlestick pattern

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the March FOMC meeting and options expiration in the books, that equity markets shifted to stability after 3 weeks of downward price action. Elsewhere looked for Gold ($GLD) to continue its ascent into space while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to have found support in its drift lower while US Treasuries ($TLT) looked weaker in their consolidation. The Shanghai Composite ($ASHR) looked to digest the recent move higher while Emerging Markets ($EEM) consolidated in a narrow range.

The Volatility Index ($VXX) looked to remain slightly elevated putting some pressure on equity markets. Their charts remained at risk of more downside, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to be stabilizing as they held the bounce during the week. The $IWM was a bit weaker.

The week played out with Gold retesting 3000 before a run up to new all-time highs while Crude Oil found some strength and moved higher in the consolidation range. The US Dollar held in a narrow range while Treasuries fell back to a 5 week low before catching a bid Friday. The Shanghai Composite found support and moved sideways while Emerging Markets dropped out of the short consolidation.

The Volatility Index started by moving lower but reversed Wednesday to end the week slightly higher. This saw the bounce rally in equities grind to a halt early in the week and they dropped back through Friday. This resulted in the SPY and the QQQ and the IWM printing new 2 week lows. What does this mean for the coming week? Let’s look at some charts.

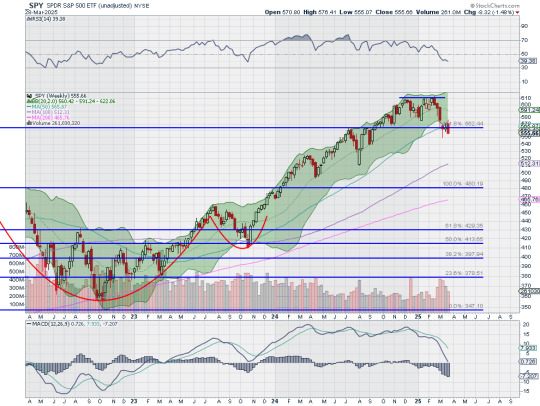

The SPY came into the week pausing in a bounce off the 61.8% retracement of the leg higher since August 2023 and reclaiming the 161.8% extension of the retracement of the 2022 drop. It gapped up Monday to touch the 200 day SMA and over the 20 day SMA but then printed and Evening Star reversal pattern and started lower Wednesday. It gathered steam in the move lower Friday to end the week at a 2 week low. It looks as if the bounce might confirm as a bear flag and confirmation would give a target to 513. It has a RSI dropping back from a stall at the midline in bearish territory with the MACD curling to cross down and negative.

The weekly chart shows a bearish engulfing candle, also suggesting more downside, holding under the 50 week SMA. The RSI has gone level at the bottom of the bullish zone with a peak into the bearish zone with the MACD dropping but positive. There is resistance above at 556.50 followed by 565.50 and 569 then 571 and 574.50 before 581 and 585. Support lower is at 549.50 then 545.75 and 542.50 before 540 and 537. Pullback in Uptrend.

With just one trading day left in the 1st Quarter of 2025, equity markets showed renewed weakness after a positive start to the week. Elsewhere look for Gold to continue its record breaking drive higher while Crude Oil rises in consolidation. The US Dollar Index looks to continue to drift to the downside while US Treasuries pullback in their consolidation. The Shanghai Composite looks to consolidation in the short term uptrend while Emerging Markets continue a short term consolidation.

The Volatility Index looks to remain slightly elevated making the path easier for equity markets to the downside. Their charts look vulnerable on both timeframes. On the shorter timeframe the SPY if a bit stronger than the QQQ and IWM. On the longer timeframe all look set up for more downside. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 28, 2025

11 notes

·

View notes

Text

SOL Risks $120 Retest Despite Bullish Onchain Data

Key takeaway: SOL (SOL) projects a bearish outlook on the daily chart after forming a bearish engulfing, and if the trend holds, SOL price could fall to $120. On the 1-day time frame, SOL shows a head-and-shoulders pattern, which is a bearish reversal signal. A breakdown below its $140 neckline level, confirmed by a volume spike, could lead to a bearish continuation. Solana 1-day chart. Source:…

0 notes

Text

How to read candlestick charts and patterns for better trades?

Candlestick charts are a powerful tool for making better trading decisions. Each candle shows the open, high, low, and close price for a specific time frame. Patterns like Doji, Hammer, Engulfing, and Shooting Star can signal potential reversals or trend continuations.

To read them effectively:

Look for pattern confirmation with volume.

Understand bullish vs. bearish signals.

Combine candlestick analysis with support and resistance levels or indicators like RSI.

Learning to read these patterns takes practice and guided learning. At Empirical Academy, we offer hands-on training in technical analysis, including live candlestick chart reading.

📚 Learn to trade with clarity and confidence. 👉 Enroll now: https://www.empiricalacademy.net

0 notes

Text

Mastering Indian Stock Market Trading & Investing: Technical Analysis for Smart Decisions

If you've ever found yourself staring at stock charts, wondering what those zigzag lines really mean or how seasoned traders predict market moves so accurately—it’s time to dive deep into the fascinating world of technical analysis.

Whether you're a beginner aiming to make your first trade or a budding investor who wants to understand market trends better, technical analysis is your gateway to reading the stock market like a pro. It’s not magic. It’s strategy—and with the right mindset, tools, and a bit of practice, anyone can learn it.

In this guide, we’ll explore what technical analysis is, how it's used in Indian stock market trading, and why mastering it can be a game-changer for your financial future.

What is Technical Analysis, Really?

At its core, technical analysis is about analyzing price movements and patterns. Instead of focusing on a company’s balance sheet or profits (which is fundamental analysis), technical analysis zooms in on stock charts, volume trends, support/resistance levels, and indicators like RSI, MACD, and moving averages.

Here’s the idea: history often repeats itself in the markets. Traders believe that past price movements can provide clues about future behavior.

But don’t worry—it’s not about memorizing hundreds of formulas. It’s about recognizing patterns, understanding market psychology, and using tools that are available to everyone.

Why is Technical Analysis Crucial in Indian Stock Market Trading?

India’s stock market, with major exchanges like NSE and BSE, is vibrant, fast-moving, and full of opportunities. With retail participation increasing and more young investors entering the scene, understanding technical analysis is not just a skill—it’s a competitive edge.

Here's why it matters:

📈 Volatility is Opportunity: Indian stocks often experience sharp movements. Technical analysis helps you time entries and exits better.

🔍 Helps Filter the Noise: News, opinions, and rumors? Technical charts let the price action speak for itself.

🕒 Perfect for Short-term & Swing Trading: Want to catch trends that last a few days or weeks? TA is your best friend.

💼 Complements Long-Term Investing: Even if you’re a long-term investor, knowing when to buy a fundamentally strong stock can greatly enhance returns.

Core Principles of Technical Analysis

To make smart decisions, you need a few essentials in your toolkit. Let’s break them down.

1. Price Discounts Everything

This is the first rule of technical analysis. Every known factor—earnings, news, expectations—is already reflected in the price.

2. Trends are Key

Markets move in trends: upward (bullish), downward (bearish), or sideways. Identifying the trend early can give you a head start.

3. History Tends to Repeat Itself

Humans drive the markets. Emotions like fear and greed lead to recurring price patterns.

Must-Know Tools and Indicators for Beginners

Learning technical analysis doesn’t mean staring blankly at complex graphs. Start with these basic tools:

🟢 Moving Averages (MA)

They smoothen price data to help you identify the trend. A simple 50-day and 200-day MA combo can reveal bullish or bearish signals.

🟣 Relative Strength Index (RSI)

A momentum indicator that tells you if a stock is overbought or oversold. It works on a scale of 0-100. Typically, above 70 means overbought; below 30 means oversold.

🔵 MACD (Moving Average Convergence Divergence)

Used to catch trend reversals. It gives crossover signals that many day traders live by.

🟡 Support and Resistance

Support is a level where buyers enter; resistance is where sellers dominate. Price tends to bounce between these zones.

🔴 Candlestick Patterns

Japanese candlesticks offer visual insights into market psychology. Patterns like Doji, Hammer, and Engulfing tell a story of potential reversals.

A Real-World Example: Let’s Analyze a Stock

Let’s say you’re looking at Infosys. You open the daily chart and notice:

The RSI is around 80 ➜ The stock might be overbought.

It’s near a resistance level it couldn’t cross twice before.

A bearish engulfing candle forms.

This is a potential short signal.

On the flip side, if the stock is near its 200-day MA, RSI is around 35, and a hammer pattern appears near support—you might consider buying.

The beauty of technical analysis? These setups repeat over time.

Day Trading vs Swing Trading vs Investing: How Does TA Fit?

✅ Day Trading

Entry and exit in the same day.

Requires strict discipline and quick decision-making.

TA is essential—especially 5-min, 15-min, hourly charts.

✅ Swing Trading

Positions held for days or weeks.

Based on short-to-medium-term trends.

Ideal for working professionals.

✅ Investing

Long-term horizon, but TA helps in timing your entry.

For example: Buying at a support level during a correction can improve returns significantly.

How to Start Learning Technical Analysis the Smart Way?

The internet is full of content, but not all of it is structured or beginner-friendly. If you’re serious about mastering it, choose a comprehensive, beginner-to-advanced course that focuses on the Indian stock market context.

We highly recommend starting with this Indian Stock Market Trading | Investing: Technical Analysis!! course. It’s perfect for beginners, filled with practical charting tips, live examples, and Indian stock-specific case studies.

Not only will it teach you chart reading, but you’ll also learn how to:

Use charting platforms effectively

Apply 20+ indicators in real-world scenarios

Build your trading strategy

Avoid beginner mistakes

Read volume like a pro

Whether you want to trade Bank Nifty, mid-cap stocks, or explore intraday and positional strategies, this course brings clarity and depth in a step-by-step format.

Common Mistakes New Traders Make (and How to Avoid Them)

Many new traders jump in with high hopes and little prep. Here’s how not to fall into the same traps:

❌ Trading Without a Plan: Always have entry, stop-loss, and target.

❌ Overusing Indicators: More isn’t better. Stick to 2–3 that suit your style.

❌ Ignoring Risk Management: Never risk more than 1–2% of your capital on a single trade.

❌ Letting Emotions Rule: Fear and greed are your biggest enemies.

Consistency comes from mindset, not just methods.

Building Your Trading System with Technical Analysis

Once you get the basics, build your own trading system—a repeatable strategy that aligns with your risk appetite.

Ask yourself:

What’s my trading style? (Scalping, Intraday, Positional)

What’s my entry signal? (Crossover, pattern, breakout)

What’s my stop-loss logic? (Fixed %, below support)

What are my exit rules? (Trailing stop, fixed reward ratio)

Test your system. Backtest it. Paper trade. And once it works—scale it.

Is Technical Analysis Foolproof?

No system is perfect. Technical analysis gives probabilities, not certainties. But when used correctly, it dramatically tilts the odds in your favor.

It's not about predicting the future. It's about reading the present clearly enough to make informed decisions.

That’s the edge that sets apart successful traders from the rest.

Final Thoughts: Why Now is the Best Time to Learn Technical Analysis

With rising retail participation in India’s stock market and easy access to free and paid charting tools, this is the perfect time to learn technical analysis.

Whether you're doing it to:

Create a side income,

Manage your investments better,

Or someday trade full-time,

Mastering technical analysis opens a whole new dimension in your financial journey.

And the best part? You don’t need a finance degree or fancy tools—just curiosity, a good course, and a willingness to learn.

Start your journey with confidence. Explore the Indian Stock Market Trading | Investing: Technical Analysis!! course today and take your first step toward smarter investing.

0 notes

Text

Candlestick Patterns: Mastering Market Moves with Accurate and Profitable Setups

In technical analysis, Candlestick Patterns are among the most powerful tools traders use to predict price movements. These patterns, originating from Japanese rice traders in the 18th century, provide visual cues about market sentiment, momentum, and potential reversals.

While there are dozens of candlestick formations, not all are equally reliable or easy to use. In this guide, we will focus on the most accurate and easy-to-understand candlestick patterns that offer strong profit potential, especially for swing traders and intraday traders.

What Are Candlestick Patterns?

A candlestick represents the price movement of an asset within a specific timeframe (e.g., 5-minute, daily, weekly). Each candlestick shows four key prices:

Open

High

Low

Close

The body (thick part) shows the range between the open and close. The wicks (or shadows) show the highs and lows. A green (or white) body shows a bullish candle, while a red (or black) one shows a bearish candle.

When grouped, Candlestick Patterns reveal momentum, reversals, or continuation of trends—making them highly valuable for timing trades.

1. Bullish Engulfing Pattern – Strong Buy Signal

Structure: A small red candle followed by a larger green candle that completely engulfs the previous day’s red candle.

Meaning: It indicates a strong reversal from bearish to bullish sentiment.

Best Used In: Downtrends or near support zones.

✅ Why It Works: It shows buyers stepping in with strong conviction, overpowering the previous day’s sellers.

2. Bearish Engulfing Pattern – Strong Sell Signal

Structure: A small green candle followed by a larger red candle that engulfs the previous green one.

Meaning: Suggests a reversal from bullish to bearish sentiment.

Best Used In: Uptrends, especially after a rally.

✅ Why It Works: It often signals that buyers are exhausted and sellers are gaining control.

3. Hammer – Bullish Reversal Pattern

Structure: Small body with a long lower wick, usually forming after a downtrend.

Meaning: Buyers rejected lower prices, showing potential for reversal.

Best Used In: Downtrends or oversold markets.

✅ Why It Works: Signals exhaustion of selling pressure and potential entry of buyers.

4. Shooting Star – Bearish Reversal Pattern

Structure: Small body with a long upper wick after an uptrend.

Meaning: Price attempted to rise but failed, indicating weakness.

Best Used In: Uptrends or near resistance.

✅ Why It Works: It highlights a failed rally, often followed by price correction.

5. Doji – Indecision, But Powerful with Confirmation

Structure: Very small body with long wicks, showing close is near the open.

Meaning: Market is undecided—watch for what happens next.

Best Used In: At the top or bottom of trends.

✅ Why It Works: Dojis often precede reversals, especially when followed by strong confirmation candles.

6. Morning Star – Bullish Reversal

Structure: A three-candle pattern: a long red candle, followed by a small body (Doji or Spinning Top), and a strong green candle.

Meaning: Shift from bearish to bullish momentum.

Best Used In: Downtrends or after corrections.

✅ Why It Works: Indicates transition from selling pressure to strong buying.

7. Evening Star – Bearish Reversal

Structure: Long green candle, followed by a small-bodied candle, then a long red candle.

Meaning: Sign of exhaustion in an uptrend, often preceding a downtrend.

Best Used In: Uptrends or after a bullish rally.

✅ Why It Works: Shows that buyers are losing steam and sellers are gaining control.

How to Maximize Profits with Candlestick Patterns

🔎 1. Combine with Support and Resistance

Candlestick patterns are more effective when they occur at key technical levels. For example, a Bullish Engulfing pattern at strong support offers a higher probability of success.

⚙️ 2. Use in Conjunction with Indicators

Pair candlestick patterns with tools like Relative Strength Index (RSI) or Moving Averages to confirm trend reversals or continuations.

⏱️ 3. Focus on Volume Confirmation

High volume on the reversal candle adds credibility to the signal. Volume confirms the participation of institutional players.

📈 4. Time Your Entry and Exit

Don’t trade on the pattern alone. Wait for confirmation candles or enter on the next candle’s break of the reversal level. Set clear stop-losses below/above the pattern for safety.

Final Thoughts

Candlestick Patterns are essential for anyone looking to understand price action and predict market behavior. When used correctly, patterns like the Bullish Engulfing, Hammer, and Morning Star can offer high-probability entry points for profitable trades.

What separates successful traders from the rest is not just identifying patterns but using them in the right context—with support, volume, and indicators backing them up. Simplicity, accuracy, and discipline are the keys to making candlestick patterns a reliable part of your trading strategy.

0 notes

Text

Bearish Engulfing Pattern Guide: Spotting Market Reversals

In the world of stock trading, patterns are the silent storytellers of the market—whispers of potential shifts that can make or break your portfolio. Imagine this: two consecutive days of trading. On the first, buyers are in full control, pushing prices up with a small bullish candle. The next day? A massive bearish candle engulfs the previous one, swiping up the gains and casting a shadow of…

0 notes

Text

How to Trade Using Candlestick Patterns for Better Trade Decisions

Candlestick patterns are one of the most widely used tools in technical analysis. They provide valuable insights into market sentiment and potential price movements by analyzing the open, close, high, and low of each trading period. By understanding and using candlestick patterns, traders can make more informed decisions, anticipate market reversals, and optimize entry and exit points.

Here’s how you can use candlestick patterns effectively in your trading strategy.

1. What are Candlestick Patterns?

A candlestick pattern is formed by one or more candlesticks that represent price movements within a given timeframe. Each candlestick shows:

Open price: The price at which the asset opened during the time period.

Close price: The price at which the asset closed during the time period.

High price: The highest price reached during the period.

Low price: The lowest price reached during the period.

Candlestick patterns can be either bullish (indicating an upward price movement) or bearish (indicating a downward price movement), depending on the relationship between the open and close prices.

2. Popular Bullish Candlestick Patterns

Bullish candlestick patterns signal potential upward price movement. Here are a few common ones to look out for:

Bullish Engulfing Pattern: This pattern consists of a small bearish candlestick followed by a larger bullish candlestick that completely engulfs the previous one. It indicates strong buying pressure and often signals the beginning of an uptrend.

Hammer: A hammer candlestick has a small body and a long lower shadow, which indicates that sellers tried to push the price lower, but buyers stepped in and drove the price back up. It suggests a potential reversal from a downtrend to an uptrend.

Morning Star: This pattern consists of three candlesticks: a long bearish candlestick, followed by a small-bodied candlestick, and then a long bullish candlestick. The morning star indicates a potential trend reversal from bearish to bullish.

3. Popular Bearish Candlestick Patterns

Bearish candlestick patterns suggest potential downward price movement. Here are a few common bearish patterns to look for:

Bearish Engulfing Pattern: The opposite of the bullish engulfing pattern, the bearish engulfing consists of a small bullish candlestick followed by a larger bearish candlestick that completely engulfs it. This pattern indicates strong selling pressure and often signals the start of a downtrend.

Shooting Star: The shooting star has a small body and a long upper shadow, signaling that buyers tried to push the price higher but were unable to sustain it. This pattern suggests a potential reversal from an uptrend to a downtrend.

Evening Star: The evening star is the opposite of the morning star, consisting of a long bullish candlestick, followed by a small-bodied candlestick, and then a long bearish candlestick. This pattern indicates a potential reversal from bullish to bearish.

4. Using Candlestick Patterns for Entry and Exit

Candlestick patterns can be used to make more informed decisions about when to enter and exit trades:

Entry: When you identify a bullish reversal pattern (like a bullish engulfing or hammer) at support levels, it could be an indication to enter a long position. Similarly, a bearish reversal pattern (like a bearish engulfing or shooting star) at resistance levels could signal a short position.

Exit: Candlestick patterns can also help with determining exit points. For example, if you are in a long position and a bearish reversal pattern (like an evening star) forms near a resistance level, it might be a signal to close your position or set a stop-loss order to protect your profits.

5. Combining Candlestick Patterns with Other Indicators

While candlestick patterns can provide valuable insights, they work best when combined with other technical indicators to confirm the signals. Here are some tools you can use alongside candlestick patterns:

Support and Resistance: Look for candlestick patterns that form at key support or resistance levels. For example, a bullish engulfing pattern at a support level has a higher probability of success.

Moving Averages: Combine candlestick patterns with moving averages (e.g., 50-day or 200-day MA) to confirm the overall trend. A candlestick pattern that aligns with the trend can be more reliable.

RSI (Relative Strength Index): Use RSI to confirm whether an asset is overbought or oversold. A candlestick reversal pattern accompanied by an overbought or oversold condition can strengthen your trade decision.

6. Practice Patience and Wait for Confirmation

Candlestick patterns should never be used in isolation. They work best when you wait for confirmation before entering a trade. For example:

Volume: If a candlestick pattern forms with high volume, it’s a stronger signal. Volume confirmation helps validate the strength of the pattern.

Other Indicators: Look for confirmation from indicators like RSI or moving averages. For example, a bullish engulfing pattern near a moving average support level combined with an RSI showing oversold conditions may provide a more reliable signal.

Waiting for confirmation ensures you’re not jumping into a trade based on an isolated pattern, which could turn out to be a false signal.

Final Thought: Master Candlestick Patterns for Smarter Trading

Candlestick patterns are a powerful tool that can enhance your trading strategy. By understanding and recognizing common bullish and bearish patterns, you can make more informed decisions about entry and exit points, improve timing, and manage risk more effectively.

Ready to trade smarter with expert-backed strategies? Download Univest — the SEBI-registered trading app that helps you identify profitable candlestick patterns, follow expert strategies, and trade with confidence. Stay ahead of the market and improve your trading success.

0 notes

Text

Nifty Forecast Tomorrow: Expert Predictions and Market Trends You Should Know

If you're looking for the most accurate Nifty forecast for tomorrow, you're not alone. Every day, thousands of traders and investors closely follow the Nifty 50 index, aiming to anticipate the next market move and get a step ahead of the volatility. In this post, we break down key technical levels, current sentiment, and expert-backed strategies to help you prepare for the trading session ahead.

📊 What Is the Nifty 50 and Why Its Forecast Matters

The Nifty 50 is India’s flagship stock market index, representing 50 of the largest and most liquid companies listed on the National Stock Exchange (NSE). It's a key barometer for market trends and investor confidence.

A well-researched forecast for Nifty 50 movement tomorrow can be highly valuable for:

Intraday traders planning entry and exit points.

Swing traders timing short-term opportunities.

Investors staying aligned with macroeconomic trends.

🔍 Nifty 50 Technical Analysis for Tomorrow

1. Key Support and Resistance Levels

Based on today’s market close and recent trading patterns:

Support zones: 22,300 and 22,180

Resistance zones: 22,500 and 22,640

If the index breaks above 22,500 with momentum, it may push higher. A drop below 22,180 could shift sentiment toward bearish.

2. Moving Averages

Nifty is trading above both 20-day and 50-day EMAs, suggesting the trend remains positive.

The Relative Strength Index (RSI) is around 58–60, reflecting healthy momentum without overbought conditions.

3. Candlestick Pattern

Today’s session showed indecision, forming a neutral candle. A breakout candle or a bullish engulfing pattern tomorrow would be a strong confirmation of upward momentum.

🗣️ Market Sentiment & Global Cues

Sentiment in the market remains cautiously optimistic. Some of the key global and domestic factors influencing the Nifty forecast tomorrow include:

U.S. Federal Reserve commentary on interest rates

Movement in crude oil prices

INR/USD exchange rate fluctuations

Institutional investor activity (FII/DII inflow/outflow)

FIIs were net buyers today, a signal that global appetite for Indian equities remains intact — at least for now.

📈 Expert Outlook: Nifty Forecast for Tomorrow

Analysts are leaning towards a mild bullish trend continuing into tomorrow’s session, assuming no sudden negative cues overnight. That said, volatility is likely to spike during the first hour of trade.

Here are some smart trading reminders:

Don’t chase early price gaps.

Stick to well-defined stop losses.

Wait for volume confirmation, especially near breakout zones.

💡 Tip: A breakout above 22,500 on strong volume could provide a high-probability setup for short-term trades.

🛠️ Action Plan for Traders

Intraday Traders

Observe the first 15–30 minute range for market direction.

Indicators like MACD, RSI, and volume spikes are crucial for timing entries.

Use a trailing stop-loss strategy once in profit.

Positional Traders

Consider adding long positions above 22,500 with upside targets around 22,800.

If Nifty dips below 22,180, reassess and wait for a base to form before entering.

🔗 Live Updates and Tools

Want more granular data? For real-time charts, key levels, and analyst videos, check out the full Nifty 50 forecast and live analysis page.

📬 Final Thoughts

A well-informed Nifty prediction for tomorrow helps traders cut through the noise and take calculated risks. No forecast is 100% guaranteed, but combining technical signals, market sentiment, and global cues can give you an edge.

Trade smart. Stay disciplined. And always have a plan.

#nifty forecast tomorrow#nifty 50 prediction#nifty 50 forecast#nifty technical analysis#nifty trend tomorrow#share market forecast#stock market prediction#nifty outlook#nifty analysis#nifty trading strategy#nifty support and resistance#nifty levels tomorrow#intraday trading tips#stock market india#nifty market trend#nifty tomorrow analysis#nifty movement prediction#NSE forecast#indian stock market forecast#market trend analysis#technical analysis nifty 50#nifty 50 chart#fii dii data analysis#stock market update today#trading view nifty#nifty live updates#nifty chart pattern#nifty stock tips#nifty breakout strategy#nifty candlestick analysis

0 notes

Text

Engulfing Pattern Indicator with Volume Confirmation - indicator MetaTrader 5

Description: This indicator identifies bullish and bearish engulfing candlestick patterns on the chart and optionally confirms them with volume. When the volume of the current candle exceeds that of the previous one, the pattern is considered stronger and more reliable. The user can choose whether or not to apply this volume confirmation filter. External Inputs: BullishArrowColor : Color of the…

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the unofficial start of summer ahead and just 4 trading days left in May, equity markets were mixed with tech strong, large caps flat and small caps lower. Elsewhere looked for Gold ($GLD) to continue to consolidate in the uptrend while Crude Oil ($USO) resumed a short term downtrend. The US Dollar Index ($DXY) might resume the short term move lower while US Treasuries ($TLT) remained in a downtrend. The Shanghai Composite ($ASHR) looked to pause in the short term move higher while Emerging Markets ($EEM) might be confirming a failed break out higher.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe the QQQ was also strong with the SPY in consolidation. The $IWM continued to be the outlier, consolidating at a higher range.

The week played out with Gold finding support and holding in a narrow range while Crude Oil consolidated rose early in the week before giving back the gain later. The US Dollar held over support while Treasuries moved higher in the downtrend. The Shanghai Composite held at support while Emerging Markets rocketed to the downside.

Volatility rose up off the recent lows but but only to 14. This put pressure on equities and the large caps and tech names responded with a 4 day move lower. The small caps found support mid week and bounced in consolidation. This resulted in the SPY, IWM and QQQ ending back below their 20 day SMA’s. What does this mean for the coming week? Let’s look at some charts.

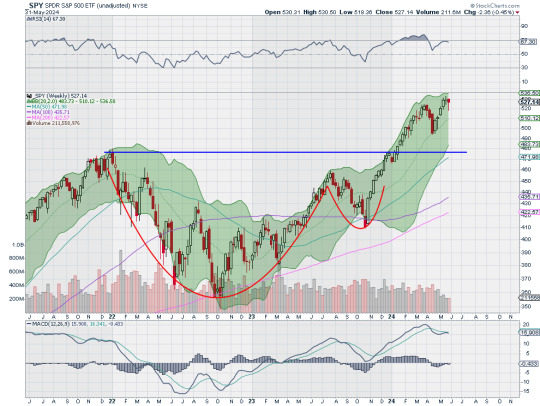

SPY Daily, $SPY

The SPY came into the week consolidating at the all-time high but after a bearish engulfing candle failed to confirm Friday. It held Tuesday and then started to move lower on Wednesday. Thursday it crossed below the 20 day SMA for the first time since May 2nd and dropped again Friday before a strong move higher the last 30 minutes of the day. The RSI is dropping at the midline but in the bullish zone with the MACD crossed down and positive. So far this could just be a momentum reset, with no threat to the uptrend yet.

The weekly chart shows a more damaging pattern as the doji last week is confirmed as a reversal with a move lower this week. This happened as the RSI stalled at a lower high showing a divergence. The price is far from the 20 week SMA and the last pullback found support there. The MACD is crossed down and moving lower but positive. There is support at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Resistance higher is at 524.50 and 530. Digestion in Uptrend.

SPY Weekly, $SPY

With the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a narrow range after a pullback. The US Dollar Index continues to drift to in broad consolidation while US Treasuries continue their downtrend. The short term move higher in the Shanghai Composite looks to be at risk of reversing while Emerging Markets enter a short term downtrend.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe both the QQQ and SPY have reset to their 20 day SMA’s where they often find support. How they react next week could tell if this week was meaningful or not. The IWM continues to be the laggard, stalled near the top of a 2 year range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview May 31, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

9 notes

·

View notes

Text

Understanding the Bullish Engulfing Pattern for Forex Reversal Signals

The bullish engulfing pattern is a powerful two-candle reversal signal that appears at the bottom of a downtrend in Forex trading, indicating a potential shift from bearish to bullish momentum. It features a small bearish candle followed by a larger bullish candle that completely engulfs the previous body, signaling growing buyer strength. Traders can use this pattern as an entry point for long positions, especially when it forms near key support levels or aligns with indicators like RSI or MACD. While simple to spot, its reliability increases in trending markets and on higher time frames, making it a valuable tool for both beginners and experienced traders. To know more, visit https://forexopher.com/what-is-bullish-engulfing-pattern

0 notes

Text

Assessing the Right Time to Invest in Forex: A Comprehensive Guide

Investing in the foreign exchange (Forex) market can be highly rewarding—but only if you know when and how to enter and exit trades. This guide will walk you through the key steps to assess the optimal time to invest, including understanding trading signals, choosing the right charts, mastering entry and exit indicators, and leveraging technology to stay ahead. Whether you’re a beginner or a seasoned trader, these strategies will help you make informed, logical decisions and minimize risk.

1. Why Timing Matters in Forex Trading

The Forex market operates 24 hours a day, five days a week, with trillions of dollars changing hands daily. Given its continuous nature and high volatility, timing your trades can be the difference between healthy profits and significant losses. Entering at the wrong time may expose you to adverse currency swings, while exiting too early can prevent you from maximizing gains.

A well-timed trade allows you to:

Capitalize on momentum during strong trends

Avoid sharp reversals triggered by economic news

Reduce drawdowns and preserve capital

Improve risk-to-reward ratios on every position

By the end of this article, you’ll have a clear roadmap to pinpoint the best moments to invest and secure consistent returns.

2. Understanding Forex Trading Signals

Trading signals are alerts based on predefined criteria that suggest when to buy or sell a currency pair. They distill vast market data into actionable insights, helping traders spot opportunities without parsing every tick on the chart. Signals can be:

Technical: Generated from mathematical calculations on price and volume (e.g., Moving Averages, RSI, MACD).

Fundamental: Driven by economic events, like interest rate decisions or GDP reports.

Sentiment-based: Reflecting trader positioning and market psychology.

The key is to choose signals that align with your trading style—whether that’s scalping, day trading, swing trading, or longer-term position trading.

3. Selecting the Right Chart and Indicators

Before diving into signals, select a charting platform that offers:

Real-time data feeds for all major and minor currency pairs

Customizable timeframes (from 1-minute to monthly)

Built-in technical indicators and the ability to add custom scripts

Common Forex Charts

Line Chart: Simplest view showing closing prices.

Bar Chart: Displays open, high, low, and close (OHLC) for each period.

Candlestick Chart: Similar to bar charts, but with color-coded bodies—excellent for spotting reversal patterns.

Essential Technical Indicators

Moving Averages (MA): Identify trend direction and dynamic support/resistance.

Relative Strength Index (RSI): Measures overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Captures trend strength and momentum shifts.

Bollinger Bands: Highlight volatility and potential breakout points.

Stochastic Oscillator: Another momentum tool for spotting reversal zones.

Familiarize yourself with how each indicator behaves across different timeframes. Longer MAs smooth out noise but lag more, while shorter MAs react quickly but can generate false signals.

4. Mastering Entry Signals

An effective entry strategy combines multiple indicators to confirm a high-probability setup. Here’s a step-by-step process:

Trend Confirmation:

Use a 50-period and 200-period MA crossover to determine the primary trend (bullish when 50 above 200; bearish when below).

Momentum Filter:

Check RSI or MACD histogram for momentum alignment. For example, in an uptrend, RSI should be above 50.

Pattern Recognition:

Look for chart patterns (e.g., flags, pennants, head and shoulders) that signal continuation or reversal.

Entry Trigger:

A candlestick pattern (e.g., bullish engulfing) or a break above/below a recent swing high/low.

Volume/Volatility Check:

Confirm with volume spikes or Bollinger Band width expansion to ensure the move is supported by sufficient trading activity.

Example Entry Signal Workflow

Step 1: EUR/USD 4-hour chart shows 50 MA above 200 MA (uptrend).

Step 2: RSI sits at 55, indicating bullish momentum.

Step 3: Price consolidates in a bull flag for three candles.

Step 4: A breakout candle closes above the flag’s top—enter long.

Step 5: Volume increases by 20% above the 20-period average, confirming strength.

5. Optimizing Exit Strategies

Your exit plan is just as important as your entry. There are three common types of exits:

Fixed Stops and Profit Targets:

Predefine a stop-loss level (e.g., 30 pips) and a profit target (e.g., 60 pips) before entering. This guarantees a positive risk-to-reward ratio.

Trailing Stops:

Move your stop-loss in your favor as price advances. Many traders use a moving average or ATR-based trailing stop to capture extended moves.

Limit Exits at Key Levels:

Close positions at significant support/resistance zones or Fibonacci retracement lines.

Short-Term (Scalp/Swing) Exits

For quick trades, focus on “turning points”—repeated short-term patterns that can produce fast reversals. Monitor currency pair swings on 5- to 15-minute charts and set tight limit exits (e.g., 10–15 pips) with equally tight stops.

Real-Time Exit Signals

Many platforms offer real-time alerts—for example, if the MACD line crosses below the signal line or if price breaks below a key moving average. These can automate your exit decisions and reduce emotional bias.

6. Combining Multiple Signals for Risk Aversion

Relying on a single indicator is risky; it can generate false positives or lag behind. Instead, create a signal matrix by:

Overlaying trend, momentum, and volatility indicators

Filtering signals across multiple timeframes (e.g., align a 15-minute entry with a 1-hour trend)

Assigning weights to each signal based on reliability and recent performance

By evaluating multiple Forex signals together, you gain a holistic view of the market and can better anticipate fluctuations. This approach helps you stick to a logical mechanism rather than making random decisions under stress.

7. Leveraging Technology and Alerts

Modern Forex trading thrives on technology. With the right tools, you can analyze markets around the clock and never miss a crucial signal.

Mobile Trading Apps: Execute buy/sell orders and monitor charts on your smartphone—no physical presence required.

Automated Alert Systems: Configure alerts for when indicators meet your predefined parameters (e.g., RSI crosses below 30).

Expert Advisors (EAs): Deploy algorithmic trading systems that scan for signals and place trades automatically.

These innovations ensure that you’re always ready to act on new opportunities, whether you’re at your desk or on the go.

8. Choosing a Reliable Signal Provider

While self-generated signals are ideal, many traders supplement their strategies with professional signal services. To choose a trustworthy provider:

Check Track Record: Look for audited performance over at least six months with clear equity curves.

Read Reviews and Forums: Engage with communities on Forex forums and social media—peer feedback can be invaluable.

Compare Costs vs. Value: Free signals can be high-volume but low-quality, while paid services often offer curated, lower-frequency alerts.

Trial Periods: Opt for services that provide a trial or money-back guarantee so you can test signals risk-free.

Always cross-reference third-party signals with your own analysis to maintain control over your trades.

9. Continuous Research and Education

Forex markets evolve constantly. To stay ahead:

Read Business Newspapers and Magazines: Stay informed on macroeconomic trends that influence currency values.

Participate in Online Forums and Webinars: Exchange ideas with other traders and learn from expert lectures.

Backtest New Strategies: Use historical data and Forex software to simulate performance before risking real capital.

Maintain a Trading Journal: Record each trade’s setup, outcome, and your emotional state to refine your approach over time.

By committing to lifelong learning, you’ll adapt your system to changing market conditions and improve your win rate.

10. Conclusion: Bringing It All Together

Assessing the right time to invest in Forex isn’t about luck—it’s about systematic analysis, disciplined execution, and continuous improvement.

Understand and select the best trading signals for your style.

Choose the right charts and technical indicators.

Master robust entry and exit strategies.

Combine signals across multiple timeframes for enhanced risk aversion.

Leverage technology to automate alerts and execute trades.

Partner with a reputable signal provider, but always validate their calls.

Commit to ongoing research and education to refine your edge.

By following these steps, you’ll position yourself to make well-timed, high-probability trades that align with your goals and risk tolerance. Remember, consistency beats occasional brilliance—stick to your plan, and let your system guide you to long-term success in the Forex market. For more insights: Mastering Forex Trading Psychology: Traits, Emotions, and Mindset for Success Paperback – Large Print, May 20, 2025 by NABAL KISHORE PANDE (Author)

#Forex#TradingSignals#ForexStrategy#ForexIndicators#CurrencyTrading#InvestSmart#MarketTiming#ForexCharts#TradingPsychology#ExitStrategy

0 notes

Text

What the Heck is a Bearish Engulfing Pattern, you may ask your self... Thanks Barry

In trading terms, a Bearish Engulfing Pattern signals the start of a downtrend, which often indicates lower interest rates. To visualize it, think of a “V” shape: you slide down to the bottom, then quickly swing back up. The image shows it best. We see this all the time but what is different is it comes off the heals of the PPI report yesterday and Japan’s GDP more negative than expected. The…

0 notes

Video

youtube

Golden Era Scanner in Action Step by Step Forex Scalping Win & Analysis

Join Bill Soriano for a live Forex trading session demonstrating the power and precision of the Golden Era Scanner! In this video, I walk you through identifying trade setups, understanding entry signals (the yellow checkmark!), waiting for candle confirmation, and managing trades using the scanner's invalidation zones and take profit targets.

(What viewers will learn/see) You'll see:

How the Golden Era Scanner identifies potential bullish and bearish engulfing patterns.

The importance of waiting for the 5-minute confirmation candle to close.

Real-time decision-making during Asian session trading.

How the scanner provides clear entry, invalidation, and exit points.

An example of a "no trade" signal (white flag) when price moves too quickly.

A detailed walkthrough of a winning scalping trade on Gold (XAUUSD) resulting in a (DEMO ACCOUNT) profit!

My thoughts on optimal trading sessions for this scanner.

>>> Get Your FREE Golden Era Scanner Overview PDF! <<< Learn more about how this powerful tool can enhance your trading: https://sorianoblueprint.com/GOLDEN-ERA-SCANNER-OVERVIEW.pdf

0 notes