#Types of brokerage accounts

Explore tagged Tumblr posts

Text

#Lowest Brokerage Charges In India#Top Discount Brokers in India 2023#Open Demat Account with Lowest Brokerage#What are the types of brokers in India?#Best Full-Service Brokers in India

0 notes

Text

WindealAgency.com review:Account Types

Choosing a forex broker is never just about flashy websites or bold promises—it's about trust, regulation, and real trader experiences. In this review, we’ll take a close look at WindealAgency.com review and analyze whether it stands up as a reliable broker or raises red flags.

We’ll examine everything from its licensing, user feedback, and account types to deposit methods and trading conditions. A legitimate broker should check all the right boxes—so does WindealAgency.com reviews meet the standard? Let’s find out.

Account Types at WindealAgency.com: A Deep Dive into Their Offerings

When it comes to trading, flexibility and tailored experiences matter. WindealAgency.com reviews understands this well, offering a structured yet diverse range of account types to accommodate traders of all levels. Let's break down what they provide:

Account Type

Minimum Deposit

Bronze

$10,000

Silver

$25,000

Gold

$50,000

Premium

$100,000

Platinum

$250,000

VIP

$500,000

VIP+

$1,000,000

What Do These Accounts Mean for Traders?

At first glance, the minimum deposits might seem high, but let's analyze this setup. A structured tier system like this often indicates a serious brokerage catering to mid-to-high-level traders. Brokers that deal with professional clients or institutions usually set their entry points higher to ensure quality service, tight spreads, and dedicated support.

Bronze & Silver – These tiers are suitable for traders looking to get a professional-grade experience without committing massive funds upfront. Usually, accounts in this range come with basic perks like educational resources, standard spreads, and decent customer support.

Gold & Premium – Here, things start getting more advanced. Higher-tier accounts often mean lower spreads, priority support, and access to better trading conditions. This could include exclusive trading signals, personal account managers, or even faster withdrawal processing.

Platinum & VIP – At this level, traders are likely to receive premium analytics, risk management tools, and possibly even invitations to exclusive trading events. These accounts are for serious investors who demand top-tier trading conditions.

VIP+ – A $1,000,000 minimum deposit is an elite-level requirement. Brokers that offer this tier typically cater to institutional traders, hedge funds, or ultra-high-net-worth individuals. Expect customized trading conditions, personal analysts, and direct access to liquidity providers.

What Does This Tell Us About WindealAgency.com?

This tiered approach signals a brokerage that is not just catering to casual retail traders but instead positioning itself as a high-end trading platform. While the minimum deposit thresholds are significantly higher than entry-level brokers, this could also indicate a focus on serious traders who want quality execution, security, and premium service.

Would this account structure work for every trader? Maybe not. But for those looking for a premium brokerage experience, WindealAgency.com reviews seems to have a well-designed system in place.

How the Domain Purchase Date Confirms WindealAgency.com’s Legitimacy

One of the easiest ways to check a broker’s credibility is by looking at the relationship between its establishment date and the domain purchase date. Why does this matter? Because when a company secures its online presence before officially launching, it’s a sign of long-term planning and serious business intentions.

For WindealAgency.com review, we see that:

The brand was established in 2021

The domain was purchased on November 19, 2020

This means that WindealAgency.com reviews secured its domain before launching its services. That’s a great indicator of proper business structuring rather than a hastily thrown-together website. Many unreliable brokers often register their domain after they start operating, which raises red flags about their long-term commitment.

Think about it: a broker that purchases a domain in advance is likely investing in its infrastructure, platform, and compliance efforts before accepting traders' funds. This adds another layer of reassurance for clients looking for a trustworthy broker.

All in all, this timeline makes sense and aligns with what we expect from a legitimate brokerage.

Trustpilot Reviews: A Strong Indicator of WindealAgency.com’s Reliability

One of the best ways to gauge a broker's reputation is by looking at what real traders say about it. In the case of WindealAgency.com review, the Trustpilot score stands at 4.3, which is quite solid for a trading platform.

Now, let’s break it down further:

Total reviews: 24

Positive reviews (4-5 stars): 23

That means almost all traders who left reviews had a positive experience—an impressive ratio. In the forex industry, where brokers often receive mixed feedback due to the nature of trading, a 4.3 rating is a sign of consistent service, smooth transactions, and overall trustworthiness.

But here’s where it gets interesting. A low review count can sometimes raise questions, but the fact that 23 out of 24 reviews are positive suggests that the broker’s clients are genuinely satisfied. If there were major issues like withdrawal problems, platform failures, or shady practices, we would expect to see a much lower rating and a higher percentage of negative reviews.

Regulation & Licensing: A Key Factor in WindealAgency.com’s Legitimacy

One of the strongest indicators of a broker’s trustworthiness is its regulatory status. WindealAgency.com review operates under the FCA (Financial Conduct Authority), which is known as one of the most respected financial regulators in the world.

Now, why is this important?

The FCA is a high-authority regulator, meaning brokers under its supervision must adhere to strict financial and operational guidelines.

It enforces transparency, fund protection, and fair trading practices, ensuring that traders are not exposed to fraudulent activities.

Brokers regulated by the FCA must separate client funds from company funds, reducing the risk of financial mishandling.

Some brokers operate under weak or offshore regulations, which often make it difficult for traders to recover funds in case of disputes. But WindealAgency.com being under the FCA umbrella automatically puts it in a category of trusted financial institutions.

So, what does this tell us? If a broker has gone through the rigorous FCA licensing process, it’s not a fly-by-night operation. Instead, it’s a platform that prioritizes legal compliance and trader security—two things that matter the most in the forex industry.

Is WindealAgency.com review a Legitimate Broker?

After carefully analyzing all the key aspects of WindealAgency.com reviews, the picture looks quite clear. This broker checks all the major boxes of legitimacy, making it a strong contender in the forex trading industry.

Regulation & Security: Being FCA-regulated, WindealAgency.com review operates under one of the strictest financial authorities, ensuring fund protection and transparency—a huge green flag.

Domain & Establishment: The fact that they secured their domain before launching the brand speaks volumes about their long-term vision and professionalism.

User Reviews: A 4.3 Trustpilot rating with an overwhelmingly positive response from traders indicates that real users have had a good experience.

Account Types: The structured tier system suggests that this broker caters to serious traders who value premium conditions and a high-end trading experience.

Looking at these factors, we think WindealAgency.com reviews can be trusted. It’s not just another unregulated, short-lived broker—it has the credentials, the reviews, and the structure of a serious financial platform.

7 notes

·

View notes

Text

RiseSparkSolution.com review

Finding a reliable forex broker is not easy—there are too many options, and not all of them are trustworthy. So, what makes a broker stand out? Regulation, reputation, trading conditions, and user experience. Today, we’re looking at RiseSparkSolution.com reviews, a broker that has been gaining attention in the industry.

At first glance, the company checks many important boxes: FCA regulation, strong reviews, structured account tiers, and fast transactions. But let’s go deeper—does this broker truly live up to its reputation? In this review, we’ll analyze key aspects like establishment date, licensing, customer feedback, deposit and withdrawal processes, trading platform, and account types to see if RiseSparkSolution.com review is a name traders can trust.

Let’s break it down step by step.

RiseSparkSolution.com reviews Account Types & Their Benefits

Account Type

Minimum Deposit ($)

Bronze

10,000

Silver

25,000

Gold

50,000

Premium

100,000

Platinum

250,000

VIP

500,000

VIP+

1,000,000

What Do These Account Levels Tell Us?

At first glance, these deposit amounts might seem high, but in the institutional and high-net-worth trading world, they’re actually quite reasonable. Brokers that offer tiered accounts like this usually cater to serious traders who expect premium service, better trading conditions, and exclusive perks.

We think this structure suggests a well-established broker that focuses on high-end clientele. Why? Because brokers that cater to smaller retail traders usually have micro or mini accounts with very low deposit requirements. Here, the starting tier—Bronze—requires a $10,000 minimum deposit, meaning that RiseSparkSolution.com review is targeting traders who can afford significant capital investment and are looking for high-quality trading conditions.

Another important point: brokers with structured account tiers often provide additional benefits for each upgrade. That means users at higher tiers (Gold, Platinum, VIP) likely enjoy lower spreads, faster withdrawals, access to exclusive trading signals, dedicated account managers, or even priority support.

Would you like me to break down specific features that might be associated with each account level?

RiseSparkSolution.com reviews – Establishment & Domain History

One of the first things traders check when evaluating a broker is its establishment date and domain registration history. And for a good reason—a broker with a solid track record is a broker you can trust.

Now, let’s look at RiseSparkSolution.com reviews. The company was established in 2022, and the domain risesparksolution.com was registered in August 2021.

Why is this important? Because it matches the expected timeline. Many fraudulent brokers buy domains just weeks or even days before launching, which is a red flag. But here, we see that the domain was secured a year before the official launch. That suggests careful planning, regulatory compliance preparations, and a long-term business strategy rather than a quick scam operation.

Another crucial point—brokers with premature domain registrations tend to have better infrastructure and more trust from financial authorities. The extra time before launch is usually used to build a secure trading platform, integrate payment systems, and acquire proper licensing.

Would a scammer bother registering a domain so far in advance? Unlikely. Instead, this looks like a well-thought-out brokerage. And that’s another good sign of legitimacy.

RiseSparkSolution’s License: A Strong Indicator of Legitimacy

When it comes to trusting a broker, nothing speaks louder than regulation. And RiseSparkSolution.com reviews is regulated by the FCA (Financial Conduct Authority)—one of the most respected regulatory bodies in the financial industry.

Why is this a big deal? Because the FCA doesn’t hand out licenses to just anyone. Brokers under FCA regulation must follow strict guidelines, including:

Keeping client funds in segregated accounts (so your money is never mixed with the broker’s operational funds).

Undergoing regular audits and financial reporting to prove solvency and fair business practices.

Offering a high level of transparency—if a broker tries to manipulate prices or withhold withdrawals, the FCA steps in.

This alone is a huge vote of confidence. Many offshore or unregulated brokers operate without any oversight, making it easy for them to disappear overnight. But an FCA license means RiseSparkSolution.com reviews must play by the rules.

Would a scam broker willingly put itself under one of the toughest financial watchdogs in the world? Highly unlikely. Instead, this regulation tells us that RiseSparkSolution.com review is committed to operating legally and ethically—and that’s exactly what traders want in a broker.

RiseSparkSolution’s Reviews: A Strong Reputation Among Traders

A broker’s Trustpilot rating can reveal a lot about its reliability and service quality. And here’s what we found about RiseSparkSolution.com reviews—it holds a 4.3-star rating on Trustpilot.

Why is this important? Because in the forex industry, anything above 4.0 is considered excellent. Many brokers struggle to maintain high ratings due to the competitive and sometimes volatile nature of trading. Yet, RiseSparkSolution.com review has not only earned a strong score but has also received 45 reviews, with 44 of them being positive (4-5 stars).

Let’s break this down. A high rating with a solid number of reviews suggests that traders are satisfied with the broker’s services. It’s one thing for a broker to have a high score with just a handful of reviews (which could be fake), but when a company accumulates dozens of positive reviews, it’s a clear indicator of trustworthiness.

Would traders leave such positive feedback if they faced withdrawal issues, bad customer service, or unfair trading conditions? Unlikely. Instead, this level of customer satisfaction suggests that RiseSparkSolution.com review delivers on its promises—whether it's smooth deposits, fast execution, or reliable withdrawals.

Is RiseSparkSolution.com reviews a Legitimate Broker?

After analyzing RiseSparkSolution.com review from every angle, the evidence strongly suggests that this is a trustworthy and well-structured brokerage. Here’s why:

Regulated by the FCA – One of the most respected financial regulators, ensuring transparency, fund protection, and fair trading conditions.

Proper Domain & Establishment History – The company registered its domain a year before launch, which shows strategic planning and commitment to long-term operations.

Strong Reviews on Trustpilot – With a 4.3-star rating and 44 out of 45 positive reviews, traders are clearly satisfied with its services.

Diverse Account Types for Serious Traders – The broker offers multiple tiers, catering to high-net-worth clients who expect premium service and conditions.

Fast Deposits & Withdrawals with 0% Fees – The ability to deposit and withdraw funds within minutes is a major advantage, eliminating one of the biggest pain points in forex trading.

Mobile Trading & High User Base – Available for download on the App Store with a 4.9-star rating, proving that traders find the mobile experience smooth and effective.

Would a scam broker go through the effort of obtaining an FCA license, maintaining high Trustpilot ratings, and offering institutional-grade trading conditions? Highly unlikely. Instead, RiseSparkSolution.com review looks like a broker that is built for serious traders who value security, efficiency, and professional-level service.

For those looking for a forex broker with strong regulatory backing, transparent policies, and a solid reputation, RiseSparkSolution.com reviews is a name worth considering.

7 notes

·

View notes

Note

Hey Bitches!

How long have you had Acorn? Do you still recommend it for first time investors? And for any particular type of account? On another note, do you recommend have both a IRA and a 401k? Or stick to one to start?

I've had Acorns for about 8 years and I still definitely recommend it for first-time investors. I think the basic brokerage account is all you need, but you can evaluate their checking/debit account and other products for yourself. Remember--personal finance is personal, and your needs might be different from mine!

Here's our Acorns sign-up link if you're interested (we'll get a kickback).

I definitely recommend you have multiple retirement accounts (both a 401k and an IRA or similar). It's the basic concept of not putting one's eggs all in one basket. I have a brokerage account, a 401(k), AND a Roth IRA and I'm very happy with the setup.

Here's more advice, my sweet lil bee:

How To Start Small by Saving Small

Cheat on Your Bank—It's Not Your Girlfriend

Dafuq Is a Retirement Plan and Why Do You Need One?

Did we just help you out? Tip us!

31 notes

·

View notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

youtube

Merrill Lynch Law of Attraction Experiment

Calling All Law of Attraction Followers Are you a believer in the Law of Attraction? If so, then you've come to the right place. It's time to start spreading the word on a greater scale. Most people believe in the saying "If I can't see it I don't believe it." Since this is the case, there are this website many people who think that the LOA isn't real. We know that's not the truth, but how can we help the non-believers see the happiness that the LOA can actually bring into their lives. How about by doing LOA experiments that manifest things that help the masses, instead of just ourselves. Let’s form a group that really wants to help the world get better by using the LOA to manifest great things.

Merrill Lynch Disaster If you're an investor and read the business section I'm sure you've heard that Merrill Lynch got into trouble when large investments in sub-prime mortgages went bad. The brokerage firm lost more than $2 billion in the third quarter. The stock has plummeted from a high of 98 all the way to the 40s and lots of people have lost their shirt.

This has caused great stress to the investment world. I know the devastation first hand because I have a family member who is now on the verge of loosing it all if this stock goes any lower.

Merrill Lynch Law of Attraction Experiment Every LOA expert that I've heard has stated that the best way to test the Law of Attraction is to do an experiment related to something that you don't feel too attached to, meaning, if the LOA manifestation didn't work you wouldn't be upset. I'd like to challenge all LOA followers to join in an experiment to see if we can collectively raise the Merrill Lynch stock up to 68. This would help save thousands of people's bank accounts from going empty and would prove to everyone you know that the LOA does work. Let’s use the LOA for the greater good today and watch it work. Won't it be fun to have proof in the MER stock numbers! How to Manifest MER at 68If you're up for the challenge, here's how I suggest manifesting the Merrill Lynch stock hike. Go to Yahoo.com and click on Finance.

Type in the Ticker Symbol, MER. Look at the first line that says Last Trade and envision the number 68 in that column. Hold that vision in your mind, see it as if it's real, and feel the happiness that all of the investors will feel if the stock reaches that number. This will be an exciting experiment to prove the power of LOA. Once we've accomplished this, there's nothing we can't do for this world. If you have any nationwide or worldwide problems that you'd like to see The LOA Experiment Group tackle, please submit that information so I can put it out there for all to manifest.The Law of Attraction is truly amazing, and if we work collectively to manifest good for others imagine how wonderful our world will be.

2 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Text

I apologize for not posting for a while but things got crazy at my day job.

I got a promotion to manager at Retail Job. It’s a little more responsibility and crazy hours but I got a pay raise, which is nice.

This extra income isn’t a ton but it’s enough that I can contribute even more to my aforementioned brokerage account. Time will tell with this, watch this space.

I’ve also signed up for two new credit cards: Venmo and BrightWay. Venmo gave me a $300 credit limit and BrightWay gave me $500. You math whizzes will know that’s an additional $800 in credit. That’s obviously not a ton of credit it but it’s $800 more than I could qualify for a year ago; I’ll consider that progress.

Venmo’s credit card is pretty no-frills except for the cash-back program, which gives you 3% on the category you charge most.

BrightWay’s is also no-frills. Their cash-back is a flat 1% without categories but there is an extra benefit. Six consecutive monthly payments will get you either a credit limit increase (with a max line of $15k) or an APY decrease (with a floor of 19.99%). I’ve only done one payment so far but I think I’ll choose the credit limit increase first. That will impact my credit utilization (and therefore my score). When you consider this card is used once a month and I’m paying off the balance in full every time, an APY decrease wouldn’t help me much–if at all. I’ll use that option once my increases max out (because that is dependent on income.

I’m pretty stoked I got the BrightWay card. OneMain is a subprime lender but this card offers a simple path to more credit and less interest. This is the type of card you don’t max out (well that’s all of them) but you buy one thing a month on and pay it off ASAP.

My suggestion for new credit users is find any card that doesn’t charge an annual fee. Once you get approved, you should add a monthly bill which doesn’t fluctuate to that card such as your phone bill or favorite streaming service. This way, you know how your credit will be used every month, the utilization stays the same every month, and if it gets paid on time, your score will go up.

If you’re like me and have been successfully rebuilding for a while, you’ll have several cards you do this with. Right now, I have one credit card for Lyft, one for Spotify, one for groceries, and one for emergencies. I also have two secured credit cards I don’t use anymore (no rewards) but refuse to close (because that’ll change my average account age).

I know juggling this many cards can be daunting to some but I’ve done this for years. My credit got messed up due to unauthorized charges when my Discover got stolen (which is my I hate them) but before that, I was sitting pretty because of this method.

I could’ve used one card for all those monthly expenses but I figured spreading charges around would do two things: keep utilization per card low and make multiple accounts put something positive on my credit report every month.

This post is getting long and I apologize again for not posting more, readers, so here’s a pretty sunset 🤙

3 notes

·

View notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

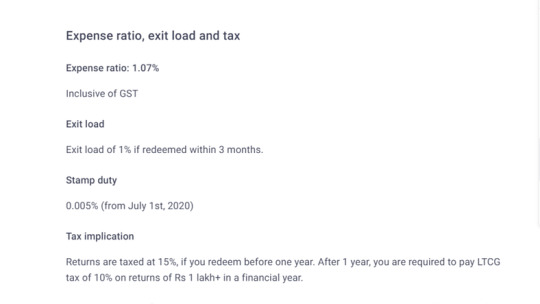

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Video

youtube

Merrill Lynch Law of Attraction Experiment

Calling all Law of Attraction Believers. Let’s join together and use the power of LOA to find out more here manifest wonderful things to improve the World.

Calling All Law of Attraction Followers Are you a believer in the Law of Attraction? If so, then you've come to the right place. It's time to start spreading the word on a greater scale. Most people believe in the saying "If I can't see it I don't believe it." Since this is the case, there are many people who think that the LOA isn't real. We know that's not the truth, but how can we help the non-believers see the happiness that the LOA can actually bring into their lives. How about by doing LOA experiments that manifest things that help the masses, instead of just ourselves. Let’s form a group that really wants to help the world get better by using the LOA to manifest great things. Merrill Lynch Disaster If you're an investor and read the business section I'm sure you've heard that Merrill Lynch got into trouble when large investments in sub-prime mortgages went bad.

The brokerage firm lost more than $2 billion in the third quarter. The stock has plummeted from a high of 98 all the way to the 40s and lots of people have lost their shirt. This has caused great stress to the investment world. I know the devastation first hand because I have a family member who is now on the verge of loosing it all if this stock goes any lower. Merrill Lynch Law of Attraction Experiment Every LOA expert that I've heard has stated that the best way to test the Law of Attraction is to do an experiment related to something that you don't feel too attached to, meaning, if the LOA manifestation didn't work you wouldn't be upset. I'd like to challenge all LOA followers to join in an experiment to see if we can collectively raise the Merrill Lynch stock up to 68.

This would help save thousands of people's bank accounts from going empty and would prove to everyone you know that the LOA does work. Let’s use the LOA for the greater good today and watch it work. Won't it be fun to have proof in the MER stock numbers! How to Manifest MER at 68If you're up for the challenge, here's how I suggest manifesting the Merrill Lynch stock hike. Go to Yahoo.com and click on Finance.

Type in the Ticker Symbol, MER. Look at the first line that says Last Trade and envision the number 68 in that column. Hold that vision in your mind, see it as if it's real, and feel the happiness that all of the investors will feel if the stock reaches that number. This will be an exciting experiment to prove the power of LOA. Once we've accomplished this, there's nothing we can't do for this world. If you have any nationwide or worldwide problems that you'd like to see The LOA Experiment Group tackle, please submit that information so I can put it out there for all to manifest. The Law of Attraction is truly amazing, and if we work collectively to manifest good for others imagine how wonderful our world will be.

2 notes

·

View notes

Note

Sorry i’m not American and i don’t understand what you mean by brokerage🥹 do you mind explaining?

Oh! Of course! It's like an investment account where you put money and select where you want your money to sit so your money earns or loses depending on the stock market. Typically when you open up a brokerage account you can select what stocks or options you want. You can choose something very basic that does all the thinking for you - like an S&P 500 index - it basically dips into different kinds of stocks and sets your deposits to be broken up by type of stock without you having to do it. It's pretty safe, and most people are unlikely to come out of it worse off. In fact usually you'll wind up making money. The more money you have in your investment brokerage account and the more money that accumulates the more dividends you make off that money each month.

It's a bit complicated to explain here on tumblr and I'm no expert but I know that other countries have similar things. Google might have better info for you than I do but I hope this helped!

xoxo

6 notes

·

View notes

Text

retirement 101: a very basic guide.

This is instructions without explanations to keep it short. Think of this as a recipe; if you are an expert cook you don't need a recipe, if you are a good cook you can improvise around a recipe. if you are a novice, just follow the recipe to get a decent result.

1) If your employer offers a 401k/403b match, *take advantage of it*. Even if you need the money in the short term, this is a good deal - they are giving you extra money even after you pay an early-withdrawal penalty. Estimated spoon cost: 1 Certainty of advice: 100%. do this.

2) if you have credit card or other bad debt that you don't pay off every month, pay it down as fast as you can. if you have multiple debts, pay down the highest interest rate first. it is okay to have minimal savings if you're paying down a credit card - you can always pull money back out of the card. Estimated spoon cost: 1 Certainty of advice: 90%. Definitely pay off your bad debt, but maybe have an emergency fund first if you feel the need.

2a) if you don't have a credit card or if all of your bad debts are paid off, save in checking or easy-access savings until you have 3 months of expenses saved up. This is your emergency fund and your monthly expense fund. Estimated spoon cost: 0 Certainty of advice: 100%. do this.

3) if you have at least $3000 more than 3 months of savings, open an account at Vanguard (https://personal1.vanguard.com/mmx-move-money/funding-method). Pick Roth IRA for your first account type, and put $3000 - $6500 in it to start, as your available cash allows. This money will be mostly unavailable until you retire. The benefit is that you don't get taxed on money you get from the investments. You can put another $6500 in it every year. You'll need to select some investments. See below for instructions on that. Estimated spoon cost: 1 Certainty of advice: 90%. There are *some* other retirement companies that don't suck, you might want to use them (Fidelity and Charles Schwab are not terrible, for example)

3a) if you have pre-existing 401ks from prior employers or whatever, roll them into Vanguard IRA. If they are Traditional (not Roth) 401ks you will need to open a Traditional IRA at Vanguard to roll into. This process will almost certainly require calling the 401k custodian repeatedly, and having them send the money to either you or Vanguard. Estimated spoon cost: 8 Certainty of advice: 50%. Leaving the money where it is costs ongoing spoons of remembering and managing, and employer 401ks are often suboptimal in terms of fees and investment choices. But if it's a decent custodian and management is nbd, leaving it is okay too.

4) If you have more available money than that, open a Brokerage account at vanguard. This is an *uninsured* and *unsheltered* account - you will be taxed on it and there is the potential for it to be lost. You'll need to select some investments. See below for instructions on that. Certainty of advice: 90%. It is possible to lose money this way, but the upside outweighs the downside.

Selecting investments:

$3000 - $6000: just leave it in the money market default account. Estimated spoon cost: 0

$6000 - $12000: put $5000 in VTSAX and select VTSAX for future contributions. Estimated spoon cost: 1

More: put around 80% in VTSAX and around 20% in VBTLX and select that for future contributions. Estimated spoon cost: 1

Certainty of advice: 70%. These are decent choices but may not match your appetite for risk and/or retirement horizon.

5) continuing work: contribute up to $6500/year into your IRA. contribute as much as you can afford to lock up into your company 401k, up to $22500/year. If your bank account grows much past 3 months while doing those things, move some into your brokerage account.

7 notes

·

View notes

Text

How Can NRIs Invest in India With NRI Services?

Non-resident Indians (NRIs) hold a unique position in the Indian economy. They are not only a valuable source of foreign exchange, but also a potential force driving the country's growth story. Navigating investments in India can be a bit confusing for NRIs. Understanding where and how to invest amidst regulations, tax implications, and diverse options can feel tricky, which is why, NRIs willing to invest in India can rely on NRI services, which make investing easier as per the rules set by RBI and SEBI under the Foreign Exchange Management Act (FEMA).

Where Can NRIs Invest in India?

NRI services encompass a range of financial solutions tailored specifically for non-resident Indians seeking to invest, manage their wealth, and connect with their homeland. It is vital to understand where NRIs can invest in India.

Equities

NRIs can invest directly in Indian stocks through the Portfolio Investment Scheme (PIS) by the Reserve Bank of India (RBI).

Mutual Funds

Investing in Mutual Funds offers various choices like Equity, Balanced, Bond, and Liquid Funds. Unlike direct equities, NRIs investing in Mutual Funds do not require PIS permissions from RBI. However, some restrictions may apply to NRIs from the US and Canada due to reporting regulations.

Government Securities

NRIs can invest in government securities on NRE and NRO basis, each with different tax implications based on the type of investment.

Fixed Deposits

Investment opportunities in fixed deposits are available for NRIs through Banks or Non-Banking Financial Companies (NBFCs), each with its tax implications based on the NRE (Non-Resident External) or NRO (Non-Resident Ordinary) basis. NRIs can also invest in Foreign Currency Non-Resident (FCNR) fixed deposits.

Real Estate

NRIs can invest in real estate except for certain property types like agricultural land, farmland, or plantations.

National Pension Scheme (NPS)

NPS, a retirement savings plan, offers tax benefits. Contributions can be made from NRE or NRO accounts, but the pension must be received in India.

Portfolio Investment Scheme (PIS)

PIS allows NRIs to trade in shares and debentures through a designated bank account. It helps regulate NRI holdings in Indian companies, preventing breaches of set limits.

How Experts Simplify NRI Services?

Experts like Samarth Capital simplify the investment process by providing guidance, ensuring NRIs make informed decisions aligned with their goals. Here’s how they make investing easy for NRIs.

Helping open NRE / NRO savings and PIS bank accounts.

Setting up brokerage and demat accounts for trade.

Monitoring your portfolio regularly.

Engaging tax consultants for compliance.

Understanding Taxes and Rules

For NRIs, it's crucial to understand tax implications in India and their country of residence. Compliance with the Double Tax Avoidance Agreement (DTAA) and filing taxes in India if taxable income exceeds the exemption limit is important.

Wrapping Up

Investing in India as an NRI offers diverse opportunities. With guidance and a grasp of regulations, NRIs can navigate this landscape effectively and make the most of available avenues. Samarth Capital, not only facilitates NRI investments but also helps foreigners invest in India with FPI services. So, whether you're an NRI or a foreigner, investment in India isn't a far-fetched dream anymore.

2 notes

·

View notes

Text

And it's forever - You're smart, you know that your sister didn't lose her phone and need you to wire money to her friend, you know HMRC doesn't text you about a rebate, you know to always check that the QR code on a poster asking you to scan to buy a metro season ticket isn't a sticker (but did you check that the whole poster was real? Does it match the ones further up the platform? At the next station? On the website? Is the website real too?), but the scam treadmill is fast and forever - Maybe you're caught by someone spoofing your friend's number and mimicking their typing style convincingly, or a parking ticket that looks real in a city you don't often visit, or you sign up for some kind of middleman brokerage service that looks legit because financial services are all opaque anyway.

And it's made worse by everything "legit" looking scammy now too - HMRC really does make you use an external validation app for some transactions, if you need to go to small claims court you use a service called something like MoneyClaimOnline, every legit service badgers you with emails and texts and "Text STOP to opt out, or PAYMENT to arrange redelivery", everything nickle-and-dimes you with microtransactions and add-on-fees and hidden charges so it's all just vibes to know whether Scrumble is real and Zooboo is the scam, or if Scrumble charges you £2.99 a month indefinitely and Zooboo mints bitcoin off your unique genetic markers. All the real artists have to hustle for views and market themselves aggressively so it's hard to tell who is the real deal and who is just convincingly scraping content from dead accounts and supplementing it with AI.

At some point you will be scammed, even if it is only a little scam, and you will have to be ready to give yourself grace for it.

😭

33K notes

·

View notes

Text

How to Open Demat Account Easily in India

How to Open Demat Account: A Beginner’s Friendly Guide

Introduction

Have you ever wondered how people buy and sell shares online without holding physical certificates? That magic happens through a Demat account. Just like a digital wallet stores your money, a Demat account stores your shares safely and securely. Whether you're dreaming of being the next market mogul or simply curious about investing, this guide will walk you through how to open a Demat account in India — no confusing jargon, just straight talk.

Along the way, we’ll also touch on algorithmic trading software and how it plays a crucial role in today’s digital stock market. Ready to unlock the door to stock trading?

Learn how to open demat account step-by-step, understand algo trading software, and explore algorithmic trading software in India.

What is a Demat Account?

A Demat account (short for Dematerialized account) is like a digital locker for your stocks and securities. Instead of paper certificates, everything is held electronically. Just like online banking, it’s fast, safe, and incredibly convenient.

Why Do You Need a Demat Account?

Think of investing in shares like shopping online. You need a cart (trading account) and a wallet (Demat account). The Demat account stores:

Shares

Bonds

Mutual Funds

ETFs

Government securities

Key Point: Without a Demat account, you simply can’t buy or sell shares on the stock exchange.

Demat vs Trading Account – Know the Difference

Many people confuse these two:

Demat Account: Stores your securities.

Trading Account: Used to buy/sell those securities.

Analogy: If your Demat account is your bank locker, your trading account is the key to use it.

Types of Demat Accounts in India

There are mainly three types:

Regular Demat Account – For Indian residents

Repatriable Demat Account – For NRIs (can transfer money abroad)

Non-Repatriable Demat Account – For NRIs (can’t transfer funds abroad)

Choose wisely based on your residency status and investment plans.

Documents Required to Open a Demat Account

Don’t worry — you don’t need a mountain of paperwork. Just these:

PAN Card

Aadhaar Card

Passport-size photo

Cancelled cheque

Income proof (if you plan to trade in derivatives)

Some brokers may ask for a video KYC to verify your identity.

Step-by-Step Guide on How to Open Demat Account

Here’s the easy-peasy guide:

Choose a Depository Participant (DP) like Zerodha, Upstox, Angel One, etc.

Fill the application form – online or offline.

Upload required documents.

Complete e-KYC (Aadhaar OTP or video verification).

Sign digitally or physically.

Get your Demat account number and login credentials.

Done! You're now ready to start investing.

Choosing the Right Depository Participant (DP)

DPs are like shops selling the same product but with different services. When choosing:

Check brokerage charges

Look for easy-to-use platforms

Ensure good customer support

Check if they offer algo trading software if you're into automated trading

Online vs Offline Demat Account Opening

Online

Offline

Faster

Slower

Less paperwork

More paperwork

Ideal for tech-savvy users

Best for non-tech users

eKYC enabled

Physical verification required

Pro Tip: Go digital unless you're not comfortable with online systems.

Charges Involved in Demat Accounts

Yes, some charges apply:

Account Opening Fee – Some brokers offer free opening.

Annual Maintenance Charge (AMC) – ₹300 to ₹800/year.

Transaction Fee – Charged per transaction.

Dematerialization charges – If you convert physical shares.

Always compare DPs before finalizing.

Mistakes to Avoid While Opening a Demat Account

Avoid these rookie errors:

Not comparing brokers

Ignoring hidden charges

Choosing based only on zero brokerage offers

Using wrong PAN or Aadhaar details

Double-check everything to avoid future hassles.

How to Link Your Bank Account and PAN Card

During the application, enter your bank account number and IFSC.

Your PAN is mandatory for tax compliance and verification.

Link Aadhaar for seamless eKYC and faster approval.

It’s all part of making your trading journey smoother.

Understanding Algorithmic Trading Software

Now that you’re all set with a Demat account, let’s talk tech.

Algorithmic trading software uses pre-programmed instructions to execute trades at lightning speed. It can scan markets, analyze data, and trade – all without human intervention.

Think of it like autopilot in a plane. You set the course; the software handles the flying.

Algo Trading Software India – How It’s Changing the Game

In India, algo trading software is revolutionizing the way people trade:

Faster decision-making

Emotion-free trading

Customizable strategies

Backtesting tools

Popular platforms include Quanttrix. If you’re serious about trading, these tools are your secret weapon.

Safety Tips for Managing Your Demat Account

Security matters. Here’s how to stay safe:

Use strong passwords

Enable 2FA

Avoid public Wi-Fi for transactions

Regularly check your holding statement

Don't share login details

Treat your Demat account like a digital vault.

Final Thoughts: Start Small, Dream Big

Opening a Demat account is the first big step toward your investment journey. It’s simple, fast, and opens up a world of opportunities. Whether you’re a curious beginner or planning to dive into algo trading software India loves — now you know the ropes.

Start small, keep learning, and who knows? Someday, you might just become the next big thing in trading.

FAQs

What is the minimum amount needed to open a Demat account? Most brokers let you open a Demat account for free, and there’s no minimum balance required.

Can I open multiple Demat accounts? Yes, you can open multiple accounts with different brokers. Just ensure you link them with your PAN card.

Is it safe to open a Demat account online? Absolutely! As long as you use trusted platforms and keep your login credentials safe, it's perfectly secure.

Do I need a Demat account for mutual funds? Not necessarily. You can invest via platforms like Groww or Zerodha Coin without one, but having a Demat gives more control and flexibility.

What is the role of algo trading software in investing? Algo trading software automates your trades using logic-based algorithms, making faster and smarter decisions than humans often can.

0 notes

Text

How to Hire a Broker in Europe: A Complete Guide for Business Buyers and Sellers

Whether you're planning to buy a company in Spain or sell your business in France, navigating the European business landscape can be complex. That’s why knowing how to hire a broker in Europe is critical. A qualified broker not only simplifies the process but also protects your interests, connects you with vetted opportunities, and guides you through the regulatory maze that varies from country to country.

In this in-depth guide, you’ll learn how to choose the right broker, what to look for, common mistakes to avoid, and what to expect during the buying or selling process.

Why You Need a Broker for Business Deals in Europe

1. Cross-Border Expertise

Each European country has its own legal systems, tax rules, and business customs. A broker with pan-European experience understands these differences and helps ensure compliance.

2. Access to Off-Market Deals

Top brokers maintain networks with business owners, legal advisors, and investors—many of whom prefer private listings.

3. Negotiation and Valuation Skills

A broker helps set fair market prices and negotiates on your behalf, reducing emotional decisions and maximizing financial outcomes.

4. Language and Culture Navigation

In Europe, language and culture vary drastically. Brokers often speak multiple languages and can bridge communication gaps.

Types of Brokers in Europe

Buy-Side Brokers: Represent buyers by finding businesses that match specific goals, often before they hit the market.

Sell-Side Brokers: Represent business owners seeking to sell. They manage marketing, screening, and negotiations.

M&A Advisors: Handle larger transactions, often €1M+ in value, and assist with complex legal structures.

Industry-Specific Brokers: Specialize in niches like tech, hospitality, manufacturing, or ecommerce.

How to Identify a Qualified Broker

✅ Look for These Key Traits:

Experience in European markets (or specific countries like Germany, Italy, or Spain)

Multilingual communication skills

Track record of successful deals in your industry

Registered with relevant associations (e.g., IBBA, EACTP, EFPA)

Clear fee structure and terms

🔍 Where to Find Them:

Online business-for-sale platforms with a European focus

Local chambers of commerce and expat business networks

Recommendations from accountants, legal advisors, or past clients

Professional directories in M&A or brokerage associations

Questions to Ask Before You Hire a Broker

What countries and industries do you specialize in?

Do you have references from recent cross-border deals?

How do you screen buyers or sellers?

What is your fee structure? Do you charge upfront or commission-based?

Do you provide valuation, legal, or due diligence support?

Will I have direct contact with you, or a team?

Understanding Broker Fees in Europe

Broker fees in Europe vary by country and transaction size. Here’s a rough breakdown:

Smaller deals (< €1M): Typically 8–12% of the final sale price

Mid-size deals (€1M–€10M): 3–6% with possible fixed retainers

Large transactions: Negotiable, sometimes involving equity, success fees, or retainers

Note: Always request a written agreement outlining services, termination clauses, and confidentiality rules.

Mistakes to Avoid When Hiring a Broker

🚫 Choosing based solely on cost: Cheaper brokers may lack the network or skills to close a deal.

🚫 Hiring without checking references: Always ask for testimonials from clients with similar goals.

🚫 Ignoring specialization: A broker familiar with retail businesses in Paris may not be the best fit for buying a tech company in Berlin.

🚫 Relying on a local-only broker for cross-border deals: Ensure they understand EU laws, currencies, and regulations.

What to Expect When Working with a Broker

For Sellers:

Business valuation

Confidential marketing and buyer outreach

NDA management and buyer screening

Offer negotiations and support through due diligence

For Buyers:

Deal sourcing based on criteria

Vetting of business documentation

Support with financing or investor connections

Legal and cultural navigation in target country

Most good brokers act like your partner—not just a middleman.

Frequently Asked Questions

Q: Can I hire a broker remotely if I live outside Europe? A: Absolutely. Many brokers work with international clients and offer video consultations, secure data rooms, and digital contracts.

Q: Do I need a broker if I already found a business? A: Yes. A broker can assist with valuation, negotiation, legal paperwork, and due diligence—even if you sourced the deal yourself.

Q: Should I work with multiple brokers at once? A: Usually no. It’s better to form an exclusive relationship to avoid conflicts, unless they specialize in different regions or roles.

📌 Ready to buy or sell a business in Europe? Learning how to hire a broker in Europe is the first step toward a successful deal.

🎥 Need more insights or real deal walkthroughs? Subscribe to our YouTube Channel for expert tips, case studies, and interviews with brokers across Europe.

1 note

·

View note