#US CMA COURSE CERTIFICATION

Explore tagged Tumblr posts

Text

🚀 Your Pathway to Financial Excellence with FINAIM 🚀

Ready to advance your career in finance? Whether you’re considering the US CMA (Certified Management Accountant), FRM (Financial Risk Manager), or CFA (Chartered Financial Analyst) certifications, FINAIM is here to help you build a robust financial future.

At FINAIM, we specialize in providing expert training, resources, and guidance for CMA, FRM, and CFA aspirants. Gain industry-recognized certifications and enhance your professional credibility with our cutting-edge programs.

🎯 Learn from experienced professionals. 🎯 Gain practical insights and real-world knowledge. 🎯 Empower your future with top-tier financial qualifications.

Start your journey today and unlock endless opportunities in the world of finance with FINAIM! 🌟

VISIT: https://finaim.in/ FINAIM ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005 PHONE NO: 087009 24049

#US CMA#FRM#CFA#FINAIM#BEST COACHING IN DELHI#CFA LEVEL1 OFFLINE CLASSES#FRM COURSE DURATION#US CMA COURSE DETAILS#CFA FEES IN INDIA#CFA INSTITUTE#US CMA COURSE CERTIFICATION

0 notes

Text

Why Pursuing the US CMA Could Be Your Smartest Career Move

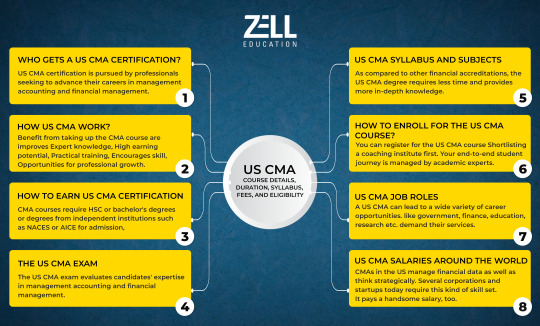

If you're considering a career in finance and accounting, the Certified Management Accountant (CMA) qualification is one of the most prestigious and globally recognized certifications you can pursue. Whether you’re looking to switch careers, gain specialized knowledge, or open doors to international job opportunities, the US CMA could be the perfect fit for you. In this blog, we’ll explore the benefits of pursuing a US CMA certification, its course structure, and how it compares to other accounting qualifications like CA and EA.

Why Choose the US CMA?

The Certified Management Accountant (CMA) designation is known for its strong emphasis on financial management and strategic business decision-making. It is globally recognized and offers a wide range of career opportunities, particularly in roles related to financial planning, analysis, and management. With an increasing demand for professionals who can drive business growth through data-driven financial insights, the US CMA equips you with the skills to excel in a rapidly evolving financial landscape.

CMA USA Course Structure and Eligibility

The US CMA course is structured to provide comprehensive knowledge in key areas such as financial management, strategic planning, and cost management. It consists of two parts: Part 1 focuses on financial planning, performance, and control, while Part 2 emphasizes financial decision-making. To be eligible for the CMA exam, candidates must have a bachelor’s degree and at least two years of work experience in financial management or related fields.

If you’re considering taking the US CMA, check out this detailed breakdown of the course syllabus and eligibility on NorthStar Academy’s Blog on CMA USA Course.

For a deeper understanding of the course details and how to get started, visit NorthStar Academy's CMA USA Course Details.

CMA USA vs CA: Is It Time to Switch?

For those already holding a Chartered Accountant (CA) qualification, the thought of pursuing the US CMA might seem daunting, but it could be a career-enhancing move. The CMA complements CA well by focusing on strategic financial management, something that CA training doesn’t delve into as deeply. Many CA professionals are making the switch to CMA to enhance their career prospects and gain international recognition.

If you're contemplating switching from CA to CMA, read more about this transition in our blog on Quitting CA to Pursue US CMA.

CMA USA vs EA: A Quick Comparison

While the CMA focuses on financial management, cost analysis, and decision-making, the Enrolled Agent (EA) certification is specialized in tax matters. EAs are licensed by the IRS to represent taxpayers before the IRS, and their expertise is highly sought after for tax preparation and advisory roles. If you're leaning towards specializing in tax, the EA certification might be more suitable for you.

For a more comprehensive comparison between CMA USA and EA, check out this blog on CMA vs EA: The Accounting Designation.

The Global Career Opportunities with a US CMA

One of the most appealing aspects of the US CMA certification is its global recognition. As a CMA, you can explore job opportunities not just in the United States but around the world. Whether you’re interested in working for multinational corporations or financial firms, the skills you gain from the CMA certification will make you a competitive candidate in the global job market.

For more on how the CMA opens up global career opportunities, check out this blog on How CMA USA Opens Global Career Paths.

How to Become an EA and the Role of Tax Experts

If you’re more interested in a specialized career in tax law, the Enrolled Agent (EA) certification might be the perfect route for you. EAs are tax professionals who are licensed by the IRS to represent clients in front of the agency. While CMA focuses on management and financial analysis, EA centers on taxation and IRS-related matters.

For those interested in tax, explore the EA Certification Roadmap on Tumblr.

Top Benefits of Pursuing the US CMA Online

One of the most significant advantages of pursuing the US CMA is the flexibility of taking the course online. With the rise of online education, you can now prepare for the CMA exam from anywhere in the world, at your own pace. Online courses provide access to comprehensive resources, including video lectures, practice questions, and more, making it easier for you to prepare effectively.

For more insights into the benefits of pursuing the US CMA online, read this blog on Top 7 Benefits of Pursuing the US CMA Online.

Conclusion: Should You Pursue the US CMA?

The decision to pursue the US CMA certification depends on your career aspirations. If you're looking for a globally recognized qualification in financial management, strategic decision-making, and cost management, the US CMA is an excellent choice. Whether you're switching from a CA background or starting fresh, the CMA certification can open doors to diverse career opportunities in finance.

To get started on your CMA journey, visit NorthStar Academy’s CMA USA Course Details.

#CMA USA Course Online#US CMA vs CA#CMA USA vs EA#Enrolled Agent Certification#CMA USA Course Details

0 notes

Text

CMA US Corporate Finace

0 notes

Text

Professionals can pursue better employment options in financial management and management accounting by earning the US CMA (Certified Management Accountant) credential. It offers comprehensive expertise in strategic planning, financial analysis, and decision-making. Possessing a CMA certification positions people for leadership positions in multinational corporations and increases credibility, earning potential, and job stability. It also shows employers that an individual is knowledgeable about financial management.

#cma#us cma#cma course#cma exam#cma fees#cma eligibility#cma exemption#us cma certification#cma study

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

Achieve US CMA Certification with Unique Global Education’s Expert Coaching

Unique Global Education: Your trusted partner for US CMA Exam preparation. Enroll now and embark on a successful career journey with our expert mentorship.

0 notes

Text

CMA Course

The Certified Management Accountant (CMA) program is a professional credential intended for those seeking to become experts in financial management and management accounting. Financial planning, analysis, and control as well as financial decision-making are two of the course's main topics. Financial reporting, planning, and performance management are the main topics of Part 1, and decision analysis and strategic financial management are covered in Part 2. Candidates holding the CMA degree are prepared for leadership positions in corporate management and finance.

0 notes

Text

CMA In India

The Institute of Cost Accountants of India (ICAI) in India offers the esteemed CMA (Cost and Management Accountant) certification, which is concentrated on cost management, financial analysis, and strategic decision-making. Professionals who complete the program will have the necessary abilities to maximize corporate resources and enhance financial performance. Candidates must successfully complete three exam levels, practical training, and a required amount of work experience in order to earn the CMA certification. With its potential to provide insights that promote efficiency and profitability, CMAs are essential in a variety of industries, including manufacturing, services, and public organizations. Professionals who hold this qualification have better job opportunities and can make substantial contributions to the development of businesses.

#US CMA#US CMA COURSE#CMA INDIA#CMA ELIGIBILITY#CMA EXEMPTION#CMA EXAM#CMA FEES#CMA JOB#CMA SALARY#CMA STUDENT#CMA CERTIFICATION

0 notes

Text

US CMA EXEMPTIONS

For eligible applicants, the US CMA (Certified Management Accountant) program provides a few exemptions that speed up the certification procedure. Certain educational requirements may not apply to people who possess accredited professional certificates, such as ACCA (Association of Chartered Certified Accountants), CPA (Certified Public Accountant), or CFA (Chartered Financial Analyst). Furthermore, applicants may be eligible for exemptions if they hold postgraduate degrees, such as an MBA with a finance or accounting specialization. These provisions, which allow seasoned professionals to accelerate their route to becoming CMAs while upholding strict standards for management accounting certification, are intended to recognize the skills and knowledge acquired through extensive professional training and study.

#US CMA#US CMA COURSE#US CMA EXEMPTIONS#US CMA ELIGIBILITY#US CMA EXAM#US CMA FEES#US CMA CERTIFICATION#US CMA JOB#US CMA SALARY#US CMA INDIA#US CMA STUDENT

0 notes

Text

youtube

US CMA Fees in India

Embarking on the exciting journey to become a Certified Management Accountant (CMA) in the United States offers both intellectual growth and professional rewards for Indian aspirants. However, it's essential to grasp the financial side of things. The overall US CMA fees in India cover registration, exam, and study material costs. As of my last knowledge update in January 2022, these expenses may vary depending on your choice of study materials and coaching. It's crucial to invest in high-quality study resources for success. Keep in mind that obtaining the CMA designation opens up global career opportunities and the potential for higher earnings, making it a worthwhile investment in your professional journey. Stay informed about the latest fee structures to plan your CMA adventure effectively and ensure a smooth path to success.

0 notes

Text

💥 FAILED your CMA exam? STOP right there! 🚨

📢 Remember: Great CMAs aren’t born, they’re coached! 🚀

Before you drown yourself in chai or memes, let’s talk. Failure is NOT the end—it's your plot twist! 🌟 Every CMA legend started somewhere, and this is just YOUR beginning.

At FINAIM, the Best Coaching Institute in Delhi, we've turned "oops" into "OMG I PASSED!" more times than we can count. From expert guidance to killer strategies, we've got your back. 💪

🎯 Don’t let one bad result define your journey. DM us today for a FREE strategy session and let's make sure your next attempt is your last!

For more INFO

FINAIM

ADDRESS: First Floor, Tewari House, 102 - B, Pusa Rd, Block 11, Old Rajinder Nagar, Rajinder Nagar, New Delhi, Delhi, 110005

PHONE NO: 8700924049

3 notes

·

View notes

Text

Career Possibilities: Exploring CMA Avenues in India Rising Demand.

1.Versatility Across Industries

2.Global Recognition

3.Salary Benefits

4.Skill Enhancement

5.Career Progression

To know more visit:https://bit.ly/401kEne

0 notes

Text

Income Tax Compliance Course with Projects

Income Tax Course: एक Perfect Career Option for Finance Lovers

अगर आप finance field में career बनाना चाहते हैं, तो Income Tax Course आपके लिए एक अच्छा option हो सकता है। यह course ना सिर्फ आपके theoretical knowledge को बढ��ाता है, बल्कि आपको practical world के लिए भी तैयार करता है।

इस article में हम detail में जानेंगे income tax course के बारे में – इसका syllabus, duration, fee structure, benefits, और job opportunities। आइए शुरू करें।

✅ What is an Income Tax Course? – Income Tax कोर्स क्या है?

Income Tax Course ek professional training program होता है जो students को भारत के टैक्स laws और policies की जानकारी देता है।

यह course आपको सिखाता है कैसे आप income calculate करें, deductions apply करें, और returns file करें। इसमें TDS, GST और Advance Tax जैसे important topics भी cover होते हैं।

ये course उन लोगों के लिए useful है जो accounting, finance या taxation field में job करना चाहते हैं।

🎯 Why Should You Learn Income Tax Course? – Income Tax Course क्यों करें?

हर साल government अपने income tax laws में बदलाव करती है। इसलिए इस course की demand हर समय बनी रहती है।

अगर आप accountant बनना चाहते हैं या CA, CS या CMA की तैयारी कर रहे हैं, तो यह course आपके लिए फायदेमंद रहेगा।

इसके अलावा, अगर आप खुद का business चलाते हैं, तो यह course आपकी tax planning में help करेगा।

📘 Income Tax Course Syllabus – Course Syllabus क्या होता है?

Income Tax Course का syllabus काफी wide होता है, जिसमें basic से लेकर advanced concepts शामिल होते हैं।

Syllabus में शामिल topics:

Basics of Income Tax (आयकर की मूल बातें)

Types of Incomes and Heads (आय के प्रकार और हेड्स)

Tax Slabs & Rates (टैक्स स्लैब और दरें)

Deductions under Section 80C to 80U

TDS (Tax Deducted at Source)

Advance Tax and Self-Assessment

Filing of Income Tax Returns

E-filing procedures on Income Tax Portal

Penalties and Prosecution

Practical training भी दी जाती है जिसमें आप ITR forms भरना सीखते हैं।

🕒 Duration & Eligibility – कोर्स की अवधि और योग्यता

Duration: Income Tax Course की duration institute के अनुसार vary करती है। कई institutes 1 month से लेकर 6 months तक के courses offer करते हैं।

Eligibility Criteria: Minimum qualification 12th pass होती है। Commerce background वाले students के लिए यह course ज्यादा easy होता है। Graduates in B.Com, BBA या M.Com भी इस course को कर सकते हैं।

💰 Course Fee Structure – Income Tax Course की फीस क्या है?

Course fee depends करती है institute, course level और city पर।

Average Fees: ₹5,000 से ₹25,000 के बीच होती है। Online course में fee थोड़ी कम हो सकती है जबकि offline training institutes में थोड़ी ज्यादा होती है।

Tip: जब भी आप किसी institute को choose करें, उसका syllabus और faculty जरूर check करें।

📈 Benefits of Doing Income Tax Course – Income Tax Course करने के फायदे

Income Tax Course करने से आपको कई practical advantages मिलते हैं।

Main Benefits:

बेहतर job opportunities in finance and accounting field

खुद का Tax Consultancy business शुरू करने का मौका

Freelancing opportunities for return filing

हर साल changing tax laws के बारे में updated knowledge

Government job के लिए preparation में मदद

इसके अलावा आप friends और relatives की return filing भी कर सकते हैं और extra income earn कर सकते हैं।

💼 Career Opportunities After Income Tax Course – Job Scope and Career Options

Course complete करने के बाद आपके पास कई career options होते हैं।

Job Roles:

Income Tax Return Preparer

Tax Consultant

Accountant

Finance Executive

TDS Executive

Tax Analyst

आप private firms, CA offices, consultancies या corporates में काम कर सकते हैं।

Freelancing और work-from-home options भी available हैं।

🏫 Best Institutes for Income Tax Course – कहां से करें Income Tax Course?

India में कई reputed institutes हैं जो ये course offer करते हैं। कुछ popular institutes में शामिल हैं:

The Institute of Professional Accountants (TIPA), Delhi

ICAI certified taxation workshops

इन institutes में आपको live projects पर काम करने का मौका मिलता है और placement assistance भी दी जाती है।

📑 Certifications – क्या Income Tax Course के बाद Certification मिलता है?

Yes! Course complete करने के बाद आपको एक valid certificate मिलता है।

यह certification आपके resume में value add करता है। Job interviews में यह आपके practical skills को proof करता है।

कुछ institutes government recognized certifications भी offer करते हैं, जिससे आपके employment chances और भी बेहतर हो जाते हैं।

📚 Study Mode – Online vs Offline Course Mode

आप ये course online या offline किसी भी mode में कर सकते हैं।

Online Course के फायदे:

Flexibility to study anytime

Lower cost

Recorded lectures and online doubt support

Offline Course के फायदे:

Classroom interaction

Practical case study-based learning

Direct guidance from faculty

आप अपने time और budget के हिसाब से mode select कर सकते हैं।

🔍 Reference and Legal Framework – Income Tax Rules की जानकारी कहां से लें?

Income Tax Department की official website https://www.incometax.gov.in से आप सभी rules और updates प्राप्त कर सकते हैं।

यह site आपको ITR forms, deadlines और tax calculator जैसी सुविधाएं भी देती है।

इसके अलावा आप ICAI और government blogs भी follow कर सकते हैं।

🎓 Conclusion – Final Thoughts on Income Tax Course

आज के competitive world में सिर्फ graduation से काम नहीं चलता।

Income Tax Course एक ऐसा skill-based course है जो आपके career को fast-track कर सकता है।

चाहे आप student हों, job seeker हों या business owner – यह course सभी के लिए beneficial है।

Financial literacy आज की ज़रूरत है, और यह course उस दिशा में एक मजबूत कदम है।

🔖 FAQs: Income Tax Course

Q1. क्या ये course CA students के लिए useful है? हां, यह course CA students के लिए बहुत beneficial है क्योंकि इसमें practical exposure मिलता है।

Q2. क्या Commerce background जरूरी है? नहीं, लेकिन commerce background होने से concepts जल्दी समझ में आते हैं।

Q3. क्या part-time course options available हैं? हां, online और weekend batches दोनों ही options available हैं।

अगर आपको ये article helpful लगा तो इसे जरूर share करें। और अगर आप Income Tax Course करना चाहते हैं, तो सही institute चुनें और आज ही शुरुआत करें!

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course in Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Course,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

CMA US Revision Lectures

0 notes

Text

US CMA Course Details

Professionals wishing to progress in management accounting and financial management can earn the esteemed US Certified Management Accountant (CMA) credential. Two sections make up the course's structure: While Part 2 discusses financial decision-making, encompassing subjects like cost management, internal controls, and risk management, Part 1 concentrates on financial reporting, planning, performance, and control. In order to demonstrate their mastery of financial analysis and strategic decision-making, candidates must pass both sections of the test. Candidates must have two years of relevant work experience in addition to passing the examinations. With potential for leadership roles in accounting, corporate management, and finance as well as worldwide recognition, the US CMA qualification improves professional prospects.

#cma#us cma#cma course#cma course details#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma student#cma subjeccts#cma syllabus

0 notes

Text

CMA Course

A specialized professional curriculum for those seeking proficiency in financial management and management accounting is the Certified Management Accountant (CMA) course. The course, which is provided by the Institute of Management Accountants (IMA), addresses important topics such ethical standards, financial planning, analysis, control, and decision-making. By supporting corporate decision-making and guaranteeing efficient financial control, the CMA certification gives professionals the ability to manage strategic financial obligations. The CMA designation provides access to advanced professional options in management, accounting, and finance due to its widespread recognition. The course offers a thorough foundation for success in the fast-paced sector of management accounting, making it perfect for anyone hoping to hold leadership positions in business and finance.

#cma#cma course#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma salary#cma student#cma india#us cma

0 notes