#VAT Service Provider UK

Text

Best Digital Marketing Company in UK

Elevate your digital presence with the best digital marketing agencies in the UK. Our results-driven strategies ensure maximum ROI for your business.

#best digital marketing company in uk#best digital marketing agencies in uk#accountants in surbiton#digital marketing agency in uk#accountants in tolworth#accountants in south london#vat service provider uk#accountants in surrey

0 notes

Text

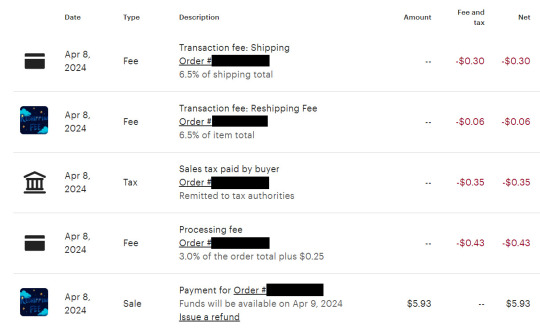

I have a listing for $1 on Etsy, and thought I'd use it as an example of how much the fees are.

This customer got a 10% discount on $1, paying $0.90. I stopped sending these discounts but Etsy doesn't let you deactivate them, so they still work for buyers who have them.

They paid shipping which was $4.68 and sales tax which was $0.35, in total paying $5.93. Shipping and sales tax do not go to the seller as profit. I will need to pay that $4.68 for shipping to the postal service.

So we have $0.90.

Out of $0.90, Etsy takes 3.0% of the order total, plus $0.25 for credit card processing ($0.43)

Then on top of that, they take 6.5% of item total in Etsy fees ($0.06)

And finally, a shipping fee of 6.5% of what the customer paid for shipping ($0.30)

In total Etsy took $0.79. So the remaining profit to me is $0.11

Now, most listings you will see will be more than $1 obviously. But the percentages and fees will be the same.

As you can hopefully see, sellers are incentivized to raise their prices to counteract these fees. This is why I have made an effort to move to Shopify, although most buyers continue to prefer Etsy.

And by the way, no hard feelings to anyone who does prefer Etsy! I completely understand and acknowledge that for some buyers, especially international and EU/UK buyers, it is a necessity because Etsy handles VAT and other import fees. I also understand that Etsy provides peace of mind: providing refunds in certain circumstances, as well as shop reviews.

I hope this is informative for any buyers or sellers out there.

282 notes

·

View notes

Note

sorry to bother you, i saw your 2022 hourly comic post today and i first want to say thank you because it’s really my exact situation in so many ways, right down to being apart from my partner (haven’t gotten to see her since the start of the pandemic since we’re both disabled and public transport is a covid nightmare but we’re on the council housing waitlist so hopefully eventually!) and it means a lot to not feel alone in that. i wanted to ask about the mobility chair that helps you sit up if that’s okay? i have a simple bed setup but being able to sit in the living room with the sun and a view is nice, but i can’t sit up unsupported for long and i can’t really like Do Anything and also sit upright bc the sitting up is all my energy, so a chair like that might be something to save for if you could maybe tell me about it! also does it have support for the neck/head? i think my spine is getting compressed from not being able to sit up for so long lol but i might be able to find cushions for that so that’s less essential!

anyway, sorry to ramble on! no pressure if you can’t manage a reply, the fact that i know about such chairs now is helpful so thank you either way!! and probably very belated but i was scrolling your blog and happy to see you have a place with your partner, so congrats! take care and all the best to you both!

thank you for this message, v sorry you're in the same boat as I was. Answering properly and publicly in case this is useful for anyone else:

Stuff I personally use to make being bedbound more comfortable

obligatory disclaimer I am not a doctor, stretching or moving your body a little (see 18) if or when you can is probably good, etc.

1. SPECIAL FURNITURE

The chair I have NOW is a "riser recliner" and I usually add a small pillow for lower back (and sometimes head) support. Like adjustable beds, they're whole furniture with powerful (HEAVY) motors built in, so they're expensive. They're usually cheaper:

if you don't need to be tipped out (just power recliners, though they might recline less or provide less support)

from regular shops, not mobility ones.

If you're able, you can go into a store and try one out first (personally being taken in a wheelchair was worth the strain, because it was weirdly hard to predict what back shape would be comfy).

if you're in the UK and you're 'chronically sick or disabled' you can get them VAT-free to make them 20% cheaper - mobility stores will have a form, others you might have to ask / check the shop does it

(I got one I could lie flat in, that came with a free setup service in the 'room of my choice'.)

It still took me 8 years of illness mostly stuck in bed to get both chair and bed because of (a) the price (b) not being sure I was sick enough to "deserve" it, same with my wheelchair. THIS WAS A FOOLISH WAY OF THINKING. There's no threshold required to get devices that will make your life easier / less agonising. Mobility aids are for anyone who'll be helped by them.

2. ADJUST EXISTING FURNITURE WITH WEIRD PILLOWS

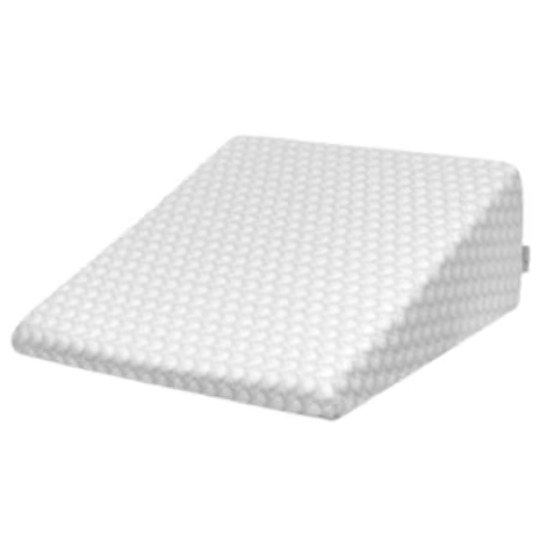

Special furniture will obviously not be possible for everyone, and before I got the chair, I just used a combo of regular pillows and a triangle wedge pillow in bed (though it took trying 2 different wedges to find one that was a good shape for me.)

Last year someone ( @dont-break-hearts I think? THANK YOU) recommended me this shape cushion - some start at £15 on that site. That's now what I use to sit on a regular sofa, though I also always need my legs up at the same height (tall footstool now, but a sideways dining chair works ok) so it's closer to lying down.

These aren't 100% ideal - ymmv, I still need extra cushions and any position gets stiff after a while - but for me are WAY BETTER than just layering pillows or forcing myself to sit up.

#asks#disability#sorry for this long answer lol. but this is the info i needed several years ago so hoping it might help someone#this is all about the UK but I assume these things exist other places#disclaimer this is not medical advice....... I also never received ANY medical advice about this so... it's just what worked for me

51 notes

·

View notes

Text

Setting Up a Limited Company UK: A Comprehensive Guide by Masllp

Starting your own business is an exciting venture, but it can also be a complex and daunting task. One of the most important decisions you will need to make is how to structure your business. For many entrepreneurs in the UK, setting up a limited company is the preferred option. At Masllp, we understand the intricacies involved in this process and are here to guide you every step of the way.

Why Choose a Limited Company?

Before diving into the setup process, it’s crucial to understand why many business owners opt for a limited company structure. Here are some of the key benefits:

Limited Liability: One of the most significant advantages is that your personal assets are protected. Your liability is limited to the amount you’ve invested in the company.

Professional Image: Operating as a limited company can enhance your business's credibility and professionalism.

Tax Efficiency: Limited companies often benefit from various tax advantages compared to sole traders or partnerships.

Investment Opportunities: It's easier to attract investors as they can purchase shares in your company.

Steps to Setting Up a Limited Company

Setting up a limited company UK involves several steps, but with the right guidance, the process can be straightforward. Here’s a step-by-step guide by Masllp:

Choose a Company Name

*Ensure your company name is unique and not already registered with Companies House.

*Check for any trademarks to avoid legal issues.

Register Your Company Address

*You must have a registered office address in the UK.

*This address will be publicly available on the Companies House register.

Appoint Directors and a Company Secretary

*You need at least one director to manage the company. There’s no legal requirement to appoint a company secretary, but many choose to do so.

*Allocate Shares and Shareholders

Decide on the number of shares and their value.

*Allocate these shares to your shareholders, who are the owners of the company.

*Prepare Memorandum and Articles of Association

The memorandum of association is a legal statement signed by all initial shareholders agreeing to form the company.

*The articles of association outline how the company will be run. Standard articles are available, but they can be customized if necessary.

Register with Companies House

*You can register online, by post, or through an agent like Masllp.

*The registration fee varies depending on the method of registration.

Register for Corporation Tax

*Within three months of starting business activities, you must register for Corporation Tax with HMRC.

Set Up a Business Bank Account

*It’s essential to keep your business finances separate from your personal finances.

Understand Your Ongoing Responsibilities

Submit annual accounts and a confirmation statement to Companies House.

Maintain accurate financial records and meet HMRC deadlines.

How Masllp Can Help

At Masllp, we specialize in helping entrepreneurs set up their limited companies efficiently and compliantly. Our services include:

*Name Checking and Registration: We ensure your company name is available and register it on your behalf.

*Preparation of Documents: We handle the preparation and submission of all necessary documents.

*Tax Registration: We register your company for Corporation Tax and provide guidance on VAT and PAYE if needed.

*Ongoing Support: We offer ongoing support to ensure you meet all legal requirements and deadlines.

Conclusion

Setting up a limited company UK can provide numerous benefits, but it’s essential to navigate the process correctly. With Masllp by your side, you can focus on building your business while we handle the complexities of company formation. Contact us today to get started on your journey to becoming a successful limited company owner.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

5 notes

·

View notes

Note

Hi! I was wondering what the price for meowrimos are? Since I see that they're available for patreons to order, but I can't find a publicly available price without accessing the shop. I just wanted to know what the ballpark range would be since I'm located in the UK and would need to consider taxes and shipping etc. If it's not meant to be known publically that's fine as well!

Hello! I don’t mind sharing prices at all, as long as folks understand that they occasionally do change over time.

Currently meowrimos are priced at $40 for regular adults (larger ones with a separated head and body), $50 for adults with 3 or more legs, and $25 for babies (the ones that look like tater tots with ears and a tail, the head and body are all one shape). Patreon backers at the $5+ tier can order custom meowrimos at the same prices as regular ones or surprise/random designs for a little less.

Please note as well that all UK orders must be routed through Etsy! That means that if you choose to back for this benefit, you'll need to email or message me through Patreon to have a listing set up for you on Etsy. I am not equipped to manage VAT and other legal aspects of UK or EU shipping at this time, and rely on Etsy to provide those services. I am currently unable to ship to Germany at all.

5 notes

·

View notes

Text

How much will a MOT cost me?

Defects will be classified as serious, major, or minor under new laws. If your car has a minor fault, it will pass with repairs recommended. Both major and dangerous faults result in a failure.

MOT failures will be promptly kept on a national database under the new regulations, making it illegal to drive after a MOT with serious or dangerous problems. Even though their latest MOT is still valid, motorists may be penalised if their vehicle has a major problem.

Additional car tests, exemptions for select classic cars, and tighter emissions limits for diesel cars are among the other new restrictions.

Please note, when looking for a car service near me garage to book an MOT, book with a garage who carry out MOT tests, car service and repairs just in case of a MOT failure.

MOT prices are regulated, and MOT test sites are only allowed to charge a certain amount.

The exact sum varies depending on the vehicle type however, it may cost up to £54.85 for a car and £29.65 for a regular motorbike. The MOT charge is also VAT-free.

Visit the GOV UK website for a complete explanation of maximum prices. Search online for ‘how to check vehicle MOT history’ as this information is also available on the GOV UK website.

What happens if my MOT test fails?

Your car will have failed its MOT if it was classified as having 'dangerous' or'major' faults in your MOT test reports. As a result, you may not be permitted to drive the car again until the issues are resolved.

You may also receive a list of'minor' or 'advisory' problems, which you should monitor or resolve in the future, in addition to a test failure.

When your vehicle fails the MOT, the test centre will issue you a'refusal of a MOT test certificate' (paper copy), which will be registered on the MOT database. Book your car with a garage in Reading who not only complete MOT tests but also carry out vehicle repair and maintenance work to avoid further hassle.

How soon can I book a MOT?

An MOT can be performed up to one month, minus one day, before the expiration date of your existing MOT certificate, while keeping the expiry date anniversary.

For instance, if you have your MOT done a month before the required date, your MOT will be valid for 13 months. Check MOT status of your vehicle today to make sure you are not driving without a valid MOT which can result in an unlimited fine.

What happens if my MOT is passed?

When your car passes its MOT, the test centre will provide you a new MOT certificate. In addition, the results of the exam will be entered into the national MOT database.

You may be handed a list of 'minor' or 'advisory' faults to monitor or rectify in the future, in addition to a MOT pass and the ability to drive away. Our recommendation is to resolve such 'advisory' issues as soon as possible, before they become more serious, dangerous, or costly.

You can also check MOT history of your vehicle online and confirm what the previous ‘minor’ was or ‘advisory’ faults.

#mot history#check mot#check mot history#mot history check#check mot status#mot status#check my mot history#mot history checker#mot testing service

1 note

·

View note

Text

Business Setup in Dubai and the UAE

Discover streamlined business setup in Dubai with Shuraa Business Setup. Get expert consultancy for company formation in the UAE. Discover Shuraa’s comprehensive business setup services in the UK. From company formation to VAT registration and bank account opening, we provide expert guidance every step of the way. Our dedicated team ensures seamless, hassle-free processes tailored to your needs. Start your business journey with Shuraa – your trusted partner for success. Visit us at Shuraa.co.uk today!

0 notes

Text

Streamline Your Finances with Online Accountancy Services in Leeds and Limited Company Online Accounting Services in the UK

In the digital age, efficient and reliable financial management is crucial for business success. At The Online Accountants, we offer top-tier online accountancy services in Leeds and specialized limited-company online accounting services in the UK to help you easily stay on top of your finances.

Online Accountancy Services in Leeds: Our comprehensive online accountancy services cater to businesses of all sizes in Leeds. We provide a range of services including bookkeeping, tax planning, payroll management, and financial reporting. By leveraging advanced accounting software and cloud-based solutions, we ensure that your financial data is accurate, up-to-date, and easily accessible. Our expert accountants are dedicated to helping you make informed financial decisions, optimize your tax liabilities, and ensure compliance with all regulatory requirements.

Limited Company Online Accounting Services UK: Running a limited company comes with unique financial challenges and responsibilities. Our specialized online accounting services for limited companies are designed to meet these needs. From company formation and statutory accounts to VAT returns and corporate tax planning, we offer a full suite of services to support your business. Our experienced team understands the intricacies of limited company accounting and works diligently to provide personalized solutions that enhance your financial efficiency and business growth.

Why Choose The Online Accountants? At The Online Accountants, we prioritize client satisfaction and strive to deliver exceptional service. Our innovative approach to online accounting combines cutting-edge technology with expert knowledge, ensuring you receive the best possible financial support. We offer transparent pricing, tailored services, and dedicated support to help you achieve your financial goals.

Experience the benefits of seamless financial management with The Online Accountants. Contact us today to learn more about our online accountancy services in Leeds and limited company online accounting services in the UK.

0 notes

Text

Tax Planning Services in the UK: Maximising Your Financial Efficiency

Effective tax planning is crucial for both individuals and businesses in the UK to ensure financial stability and minimise tax liabilities. It involves strategic management of finances, income, and investments to reduce the amount of tax paid, all while remaining compliant with UK tax laws. This blog explores the key components of tax planning services and why they are essential for maintaining long-term financial health.

1. What is Tax Planning?

Tax planning is the process of analysing your financial situation to optimise your tax efficiency. It involves making use of tax allowances, deductions, and credits to reduce tax bills legally. Whether you are an individual or a business owner, tax planning ensures you pay the right amount of tax, neither more nor less.

Effective tax planning focuses on:

Minimising tax liability by taking advantage of tax reliefs and allowances.

Maximising income and profits by structuring finances in a tax-efficient way.

Ensuring compliance with current UK tax regulations, reducing the risk of penalties.

2. Why You Need Tax Planning Services

UK tax laws can be complex, with various allowances, exemptions, and regulations that can impact your tax bill. Professional tax planning services provide expert guidance to ensure that you make the most of the available tax benefits. Key reasons to use tax planning services include:

Reducing your tax bill: Professionals can identify opportunities to reduce tax liabilities, such as claiming reliefs or making tax-efficient investments.

Avoiding penalties: Ensuring compliance with tax rules helps avoid hefty fines and penalties from HM Revenue & Customs (HMRC).

Strategic financial planning: Tax planning is a crucial part of a broader financial plan, helping you achieve long-term financial goals.

3. Types of Tax Planning Services

There are several types of tax planning services tailored to the unique needs of individuals and businesses:

a. Personal Tax Planning

Personal tax planning is essential for individuals, particularly those with complex finances, such as self-employed individuals, high earners, or those with significant investments. Personal tax planning services include:

Income tax optimisation: Strategies to manage income tax liabilities, including making use of tax bands and allowances like the personal allowance and marriage allowance.

Capital gains tax (CGT) planning: Reducing tax on profits from selling assets like property, shares, or businesses by using reliefs such as the annual CGT allowance.

Inheritance tax (IHT) planning: Ensuring your estate is structured to minimise the inheritance tax burden for your heirs, using tools like lifetime gifts and trusts.

b. Business Tax Planning

For businesses, tax planning is vital to maintain profitability and reduce tax burdens. Common business tax planning services include:

Corporation tax management: Ensuring that a company’s profits are structured in a way that minimises corporation tax liabilities.

VAT planning: Advising on VAT registration, rates, and schemes to help businesses reduce the VAT they pay or charge.

Payroll tax planning: Structuring payroll systems efficiently to reduce National Insurance contributions and income tax for both the business and employees.

Investment planning: Maximising tax benefits for business investments, including using tax reliefs like the Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS).

c. Tax-efficient Investment Advice

Tax planning services can guide you on tax-efficient investment opportunities such as:

ISAs (Individual Savings Accounts): A popular tax-free investment option where returns on ISAs are not subject to income tax or capital gains tax.

Pension contributions: Tax relief on pension contributions can significantly reduce income tax liabilities.

Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS): Both offer generous tax reliefs for individuals investing in small, high-growth companies.

4. Common Tax Planning Strategies in the UK

Here are a few common strategies employed by tax planning services:

a. Utilising Allowances and Reliefs

The UK tax system offers a variety of tax-free allowances and reliefs, which can reduce your tax bill:

Personal allowance: The tax-free amount of income you can earn each year.

Marriage allowance: Transfer part of your personal allowance to your spouse.

Annual exemption for capital gains: The first £6,000 (as of 2023) of capital gains is tax-free.

b. Income Shifting

For married couples or civil partners, income shifting involves transferring income from the higher earner to the lower earner to take advantage of lower tax bands.

c. Making Use of Tax-efficient Vehicles

Tax-efficient investment vehicles such as ISAs, pensions, and other tax-relieved schemes like EIS and VCTs can help grow your wealth while reducing tax liabilities.

d. Gifting and Estate Planning

Making gifts during your lifetime can reduce inheritance tax liabilities on your estate. Placing assets in a trust or giving away part of your estate to family members or charities are also popular strategies.

5. The Role of Tax Advisors and Accountants

Working with tax advisors or accountants ensures that you stay up-to-date with changing tax laws and take advantage of all available tax-saving opportunities. They can help with:

Filing accurate tax returns: Ensuring all deductions and allowances are applied.

Advising on complex tax issues: For example, if you have international income or offshore assets.

Handling HMRC inquiries: Assisting with audits or investigations by HMRC, which can be time-consuming and stressful.

Conclusion

Tax planning services in the UK offer invaluable assistance in navigating the complexities of the tax system. Whether you’re an individual looking to reduce your personal tax burden or a business owner aiming to optimise corporate tax obligations, professional tax planning ensures you maximise your financial efficiency and avoid costly penalties. Investing in a tax planning service is not just about saving money today; it’s about securing long-term financial success.

0 notes

Text

Best Business Solution Company

Find the best business solution company to streamline your operations and maximize efficiency.

#best digital marketing agencies in uk#digital marketing agency in uk#best digital marketing company in uk#accountants in tolworth#accountants in south london#accountants in surbiton#accountants in surrey#vat service provider uk

0 notes

Text

Advance Your Career with a Care Home Manager Course: A Comprehensive Guide

In today's evolving care industry, qualifications are more important than ever before. Care home managers and workers are expected to deliver high-quality, person-centered care, and a professional qualification is now essential. If you're aiming to enhance your career in the care sector, a Care Home Manager course is a vital step forward.

Why Pursue a Care Home Manager Course?

With increased regulation and accountability in care homes and residential settings, it’s no longer possible to work in the care sector without appropriate qualifications. The Care Quality Commission (CQC) has set stringent requirements to ensure that all workers have a minimum Level 2 qualification in care or are actively working towards it. By completing a Care Home Manager course, you'll meet these essential requirements while building the skills needed to deliver compassionate, efficient care.

What Does the Care Home Manager Course Involve?

This course equips learners with the comprehensive knowledge and practical skills needed to excel in roles such as:

Care home manager

Adult care worker

Healthcare assistant

Support worker

The qualification is regulated by Ofqual and approved by Skills for Care, making it a credible pathway to fulfilling your role in any care setting. Whether you’re managing a care home or working in a healthcare support role, this course provides everything you need to be compliant with the latest standards. The program covers crucial topics such as:

Health and safety in care settings

Person-centered care planning

Effective communication with residents and staff

Safeguarding vulnerable adults

Learners will gain the competence required to work confidently in care and nursing homes, ensuring residents receive the highest standard of care.

Practical Learning for Real-World Application

One of the key benefits of the Care Home Manager course is its emphasis on practical, real-world learning. Since the qualification develops competency, learners must be in paid or voluntary work to allow assessments to take place. This ensures that you’re not just learning in theory but also applying your skills directly in a care setting.

To earn the qualification, you'll need to achieve a minimum of 46 credits. Upon completion, you’ll be fully prepared to work as a skilled care worker or manager, capable of overseeing daily operations in residential homes while meeting CQC standards.

Affordable Certification with Clear Benefits

Many care-related courses come with significant costs. However, this Care Home Manager course provides a cost-effective solution, charging only for the awarding body certificate upon completion. With a fee of just £40 + VAT for certification, this course ensures affordability without compromising on quality.

Why This Course Is Essential for Your Career

In recent years, there has been a growing focus on improving the quality of care in the UK. This has made qualifications like the Care Home Manager course crucial for both personal and professional development. As a care home manager or support worker, you’ll be at the forefront of delivering essential services to residents, and the knowledge gained through this course will help you meet both regulatory requirements and industry best practices.

Conclusion

Investing in a Care Home Manager course is not just about meeting regulatory standards—it’s about ensuring that you have the skills, knowledge, and confidence to provide outstanding care. Whether you are just starting in the care sector or looking to advance to a management position, this course will open doors to new opportunities while ensuring that you’re fully compliant with CQC regulations.

Take the next step in your career today and enroll in a Care Home Manager course—where quality care begins with quality training.

0 notes

Text

Understanding Stairlift Costs in the UK: What to Expect and How to Choose

Introduction: Investing in a stairlift cost uk can be a life-changing decision, providing safety and independence in your home. However, one of the most common questions people have is about the cost. In this blog, we’ll break down the factors that influence stairlift costs in the UK, helping you make an informed decision

1. What Affects Stairlift Costs in the UK?

Several factors contribute to the overall cost of a stairlift, including:

a. Type of Stairlift

Straight Stairlifts: Typically, the most affordable option. These are designed for stairs that go straight up without any curves or landings.

Curved Stairlifts: More expensive due to the custom design required to fit stairs with curves, bends, or multiple levels.

b. Staircase Design

The complexity of your staircase can significantly impact the cost. For example, a narrow or steep staircase might require a more specialized, and therefore more expensive, stairlift.

c. Features and Add-Ons

Additional features like powered swivels, fold-up seats, or remote controls can increase the price. While these features add to the convenience and safety of the stairlift, they also come at a higher cost.

d. Installation

Professional installation is crucial for safety and functionality. The installation cost may vary depending on the complexity of the job and your location within the UK.

e. New vs. Reconditioned Stairlifts

New Stairlifts: Offer the latest features and full warranties, but at a higher cost.

Reconditioned Stairlifts: A more budget-friendly option. These are pre-owned stairlifts that have been refurbished to meet safety standards.

2. Average Stairlift Costs UK

To give you a better idea, here are some average costs:

Straight Stairlifts: Typically range from £2,000 to £3,000, including installation.

Curved Stairlifts: Can range from £5,000 to £9,000, depending on the complexity of the staircase and additional features.

Reconditioned Stairlifts: Often available at a 30-50% discount compared to new models, making them an excellent choice for those on a tighter budget.

3. Financing Options and VAT Relief

If the cost of a stairlift seems daunting, there are several options to make it more affordable:

Financing Plans: Many companies offer payment plans that allow you to spread the cost over several months or years.

VAT Relief: In the UK, if you’re chronically ill or disabled, you may be eligible for VAT relief on stairlifts, reducing the overall cost by 20%.

4. How to Get an Accurate Quote

To get an accurate idea of what a stairlift will cost for your specific needs:

Free Home Assessment: Most reputable stairlift companies offer free home assessments where an expert will visit your home, assess your staircase, and discuss your needs to provide a detailed quote.

Compare Quotes: It’s wise to get quotes from multiple providers to ensure you’re getting the best deal. Be sure to compare not just the price but also the features, warranties, and customer service.

5. Choosing the Right Stairlift Company

When investing in a stairlift, it’s essential to choose a reputable company. Look for:

Experience and Reputation: Check reviews and testimonials from previous customers.

Aftercare and Support: Ensure the company offers robust aftercare, including maintenance and repairs.

Warranties: A good warranty will provide peace of mind that your stairlift is protected in case of any issues.

Conclusion: Understanding the factors that influence stairlift costs in the UK can help you make an informed decision that fits your budget and needs. Whether you’re considering a straight or curved stairlift, new or reconditioned, knowing what to expect in terms of pricing will make the process smoother. At My Mobility UK, we’re committed to helping you find the best stairlift for your home. Contact us today for a free, no-obligation quote and take the first step towards safer, more independent living.

Call to Action: Have questions about stairlift costs or need help choosing the right one for your home? Leave a comment below or reach out to us directly. We’re here to help you every step of the way.

0 notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon

Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties.

Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time.

Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth.

Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind.

Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions.

Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free.

VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks.

Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions.

Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform.

Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

We are helping SMEs, sole traders, charities and not for profit organisations across the UK "Fly ahead of the rest" with results driven low cost website design, Low cost IT solution and IT services. It takes a business winning idea to be successful every day. Saint IT bring creativity, passion and inspiration to every project. We help you get the most out of your websites and IT Services. We design, build and maintain business winning websites. Our work stretches across organisations from all sectors including construction, legal services, manufacturing, medical, dental, hospitality, science / research and retail.

Not sure what you need?

So you're struggling for a business winning idea or you're not sure how to make it fly? Why not book a no obligation chat. We are here to help, just follow the link to our website below and register a slot or drop us a message!

Low cost website design for small businesses

Every day new ideas in design, functionality and productivity helps us bring success to Small and Medium organisations. it doesn't have to cost you thousands of pounds. We provide a high quality professional web design service for a low cost. You could pay as little as £199+VAT for your first website.

You have a business winning idea but need a partner to get it off the ground?

We have a flexible scalable model which means our expert ecommerce Website developers and Business Development technicians can design and build your business winning ideas and bring them into reality or we can use your fully fledged designs to get you off the ground and it won't cost the earth. Simply complete our RFQ form online and we'll provide a quote within 24hrs.

Complete the RFQ Here

Or Book an Appointment with an expert

Call us on 0800 009 3064 / 3065

Saint IT Support the Government Scheme to plan for growth

https://www.gov.uk/government/publications/build-back-better-our-plan-for-growth

#uksme

#ukstartups

#ukdesign

#ukconstruction

#dentalcare

#doctorsoffice

#ukcharities

#uknotforprofit

#ukmanufacturing

0 notes

Text

Business Crime Defence & Financial Regulation Compliance - 5SAH

The barristers in the business crime team have the necessary expertise to guide their clients through the complex legal and financial scope of each case. Instructed to defend & prosecute, they are regarded as experts, many of which are ranked in Chambers & Partners, the Legal 500 & Who’s Who Legal.

Business Crime

5SAH business crime barristers are instructed in high value and complex white-collar & regulatory criminal investigations, associated hearings and trials. Recognised as a leading barrister’s chambers in financial and business crime, advising and appearing for clients in the UK and overseas. The team are regularly instructed to act in complex and serious financial services cases on behalf of both prosecution and defence.

Areas of expertise include FCA criminal investigations, LIBOR, Cum-Ex and other market manipulation offences, money laundering, deferred prosecution agreements (DPAs), all types of fraud work including excise duty, VAT, missing trader intra-community (MTIC), tax credit, insurance, mortgage, charities, land banking, and construction industry frauds as well as, corruption, bribery and other high-level financial crime.

Our barristers also receive instructions in relation to VAT tribunal work.

Members of the Team, including our KC’s and junior barristers are ranked within Chambers and Partners in the field of Financial Crime, Fraud Crime and Financial Crime: Private Prosecutions. We are also recognised within Business and Regulatory Crime in The Legal 500.

5SAH business crime barristers receive instructions from leading Defence and City firms to represent and advise clients, both corporates and individuals, at all stages of an investigation into alleged financial misconduct and white-collar crime.

We are also regularly instructed by the Serious Fraud Division and Complex Casework Unit of the Crown Prosecution Service (CPS), the National Crime Agency (NCA), the Serious Fraud Office (SFO) and the Attorney General’s Office in Jersey.

5SAH is known for providing barristers with in-depth financial knowledge as well as legal expertise in the field. Our barristers are frequently consulted at the investigatory and pre-charge stages of fraud enquiries. In addition, members are highly experienced in related proceeds of crime proceedings.

Private Prosecutions

5SAH has been a market leader in private prosecution work for a number of years. Our specialist barristers have been instructed in some of the recent leading cases in this area.

One Silk and one junior barrister are ranked within the expert's 'Spotlight table' within Financial Crime - Private Prosecution, in Chambers and Partners.

We offer a team of expert barristers who undertake work in this area and have significant knowledge of all aspects of pursuing a private prosecution from the advisory stage and throughout the case.

Business Crime & Financial Regulation: Corporate Advisory Service

The team provides corporate clients and their advisers with financial crime prevention, compliance, enhanced governance best practice and assists in the conduct of internal investigations. They are specialists in anti-bribery and corruption, anti-money laundering and other financial crime prevention measures with a significant commercial background and financial acumen, our team works across a range of sectors and industries. Through an innovative breach risk assessment toolkit, our team covers all aspects of business crime and financial regulation, providing clients with best practice ethos, policies and procedures.

Financial Services

5SAH barristers represent and provide strategic advice to a wide range of firms, individuals, and regulators in the financial services industry.

The Financial Services industry in the UK and Globally is a cornerstone to economic success and stability. At 5SAH we advise on the fast-paced changes that can be enacted in relation to regulatory frameworks in the financial services sector and the need to stay agile as businesses and individuals. We work with key advisors and experts who have linked areas of expertise to tackle issues and optimise insight for our clients.

Our barristers act and advise in proceedings related to the Financial Conduct Authority and the Financial Ombudsman Service to assist and advise on applications for cryptoasset firms to be registered pursuant to the 5th Money Laundering Directive.

We regularly advise on matters arising from FSMA and related instruments.

FCA Enforcement and Market Oversight Division specifically Expertise includes enforcement action against individuals in the financial services industry, for example in respect of LIBOR misconduct, market abuse and CumEx.

Regulatory

5SAH barristers are highly experienced in health and safety, environmental, housing, planning, street works, food hygiene, public utility, infringement of trademarks and copyright, trading standards and licensing matters.

We defend for individuals and company defendants, instructed by leading law firms, and are often engaged to advise and where appropriate prosecute for the key regulatory bodies.

Our barristers also appear before the Traffic Commissioner in relation to companies and individuals. If you are facing disciplinary proceedings from your regulator or organisation, see our Professional Discipline & Regulatory page.

VAT tribunals

Our team of specialist barristers are often instructed in this complex and technical field of VAT tribunal work and associated appellate court hearings It complements our cross-over areas of proceeds of crime and VAT, MTIC frauds and money laundering.

Instructing 5SAH

Our Business Crime team is client-focused and results-driven. If you would like to discuss a business crime matter with our expert clerking team, please get in touch.

View the clerking team

0 notes

Text

The UK is expected to build 300,000 public charging points by 2030

Source: Gasgoo

ChargeUK’s Powering Ahead to 2030 white paper found that a new public electric vehicle charging post is installed every 25 minutes in the UK and the country’s charging network can power 500 million miles of driving per day. The report also makes recommendations for the new Labour government in the UK to optimize its strategy for electric vehicles to accelerate the adoption of the technology.

Image source: ChargeUK

Vicky Read, Chief executive of ChargeUK, explained: “In just over a decade, the charging industry in the UK has evolved into a major player in the green economy, providing the infrastructure that drivers rely on for over a million electric vehicles and rapidly scaling up to deliver the charging services needed for 2030 and beyond.”

ChargeUK’s analysis shows that there are more than 930,000 public, home and workplace charging points for 1.1 million electric vehicles in the UK, almost every electric vehicle has a charging point.

The current electric vehicle charging network in the UK can provide nearly 7 gigawatts of electricity per day, allowing each UK electric vehicle to travel 580 miles per day, which is further than the distance from London to Aberdeen, totaling more than 500 million miles.

The UK’s charging network is expanding rapidly, with the number of public charging points doubling in the past two years. In the last quarter, a new charging post was installed in the UK every 25 minutes. At present, the availability of public charging points has outpaced the growth rate of new electric vehicles entering the market.

According to a report released by the UK National Infrastructure Council in May 2024, if this growth momentum continues, it is expected that by 2030, the number of public charging piles in the UK will exceed 300,000.

To maintain the current rate of growth and meet the 2030 target, ChargeUK said the charging industry needs government support to accelerate the installation of charging points by removing grid, planning and permitting delays and including renewable electricity in the Renewable Transport Fuels Obligation Act (RTFO).

In addition, reducing the charging price and selling price of electric vehicles is also crucial. To do this, the UK must harmonize VAT on charging, reduce electricity bills, improve signage and provide support for the use of new, used and fleet EVs.

In addition, the UK must promote private investment, to achieve this goal, the country must identify fast-charging funds, accelerate the construction of local electric vehicle infrastructure funds, address rising fixed charges, and advance the construction of heavy truck charging infrastructure.

0 notes