#Volume Profile for Stock Market Analysis

Text

Unveiling the Volume Profile Indicator: A Key to Market Structure Mastery

In the intricate world of financial markets, understanding the ebb and flow of trading volumes is akin to deciphering the language of the market. Among the myriad of tools and indicators at a trader’s disposal, the Volume Profile stands out as a powerful method for visualizing the trading activity at different price levels over a specified period.

This detailed exploration aims to demystify the…

View On WordPress

#Advanced Trading Strategies Using Volume Profile#day trading#Enhancing Forex Trading with Volume Profile#Financial Markets#How to Use Volume Profile in Day Trading#Identifying Market Direction with Volume Profile#Integrating Volume Profile with Technical Analysis#Market Structure#Mastering Support and Resistance with Volume Profile#Price Action Trading#Strategies for Trading Low Volume Nodes (LVN)#Support and Resistance#swing trading#technical analysis#Trading Indicators#Trading Strategies#Understanding High Volume Nodes (HVN)#Volume Profile#Volume Profile for Stock Market Analysis#Volume Profile Indicator Guide

1 note

·

View note

Text

without taking any risks and using a consistently successful strategy? What are some strategies or tools that can achieve this?

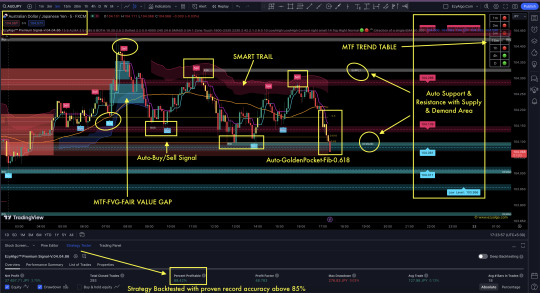

Leverage Key Levels and Signals with (EzyAlgo) Premium Indicator for AUD/JPY Trading Success!-Full Strategy Explained in Details

Key Insights:

Support and Resistance Levels: Support: Key levels where AUD/JPY might find buying interest and halt its decline. Resistance: Levels where selling pressure might emerge, potentially stopping upward movement.

Trend Analysis: Indicates if AUD/JPY is in an upward (bullish), downward (bearish), or sideways (consolidating) trend.

Trading Signals: Buy Signal: Indicates a potential upward movement, suggesting entering long positions.Sell Signal: Indicates a potential downward movement, suggesting entering short positions.

Volatility Insights: Provides information on expected price volatility to help manage risk and position sizes.

Timeframe Consideration: Signals are relevant to specific timeframes (e.g., intraday, daily, weekly) and should align with your trading strategy.

EzyAlgo Premium Indicator Singly Proven & Backtested with above 80–85% accuracy always, regardless of whether the market is sideways or trending. It offers perfect entry after detecting major key levels at confluence points. Here are the rules:

Key Levels:

Buy/Sell Signal must be generated.

Signal must be above Demand Area with POI (Point of Interest) Level.

Identified Swing High/Low to determine the trend.

Wait for Trend Tracker Confirmation with Color change or signal candle closing above Tracker.

Green Dot must be generated nearby within 1–3 candles in our EzyAlgo Trend Oscillator.

Extra Key Levels:

Trendline support.

Auto Golden Pocket Area (-0.618) met in the same place.

If all these conditions are met, it constitutes a 90% accurate signal. Otherwise, no trades are initiated. The indicator also highlights key levels for additional confirmation.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutionsJoin our WhatsApp Channel: https://wa.me/message/HTHBVTMYZRJEO1

#forexsignals#forex trading#forex market#forex education#forex indicators#tradingview#tradingviewindicator#indicator#technical analysis#volume profile#candlestick#stock market

0 notes

Text

Weekend Stock Market Outlook - March 12 2023

Stock Market Outlook entering the Week of March 12th = Downtrend

ADX Directional Indicators: Downtrend

Price & Volume Signals: Downtrend

Elliott Wave Analysis: Mixed

ANALYSIS

The stock market outlook is in a downtrend to start the week, as a high profile bank closure rocked the financial sector. Expect more volatility this week.

SPX Price & Volume Chart for the Week of March 12 2023

The S&P500…

View On WordPress

2 notes

·

View notes

Video

youtube

Is $GOOGL Going to Zero? Here’s Why Savvy Investors Are Still Watching

As we move through a period of market uncertainty, Google’s stock performance ($GOOGL) has captured the attention of traders worldwide. This video offers a comprehensive breakdown of the technical indicators driving Google’s stock movement, including its recent pullback from highs and potential support from key Fibonacci levels. With recession fears looming, Google’s stock has dipped below the 21 EMA on a daily basis, but there are signs of strength that could signal a future rally.

**What is TRADING DOGGYSTYLE?** https://pharmdcapital.com/what-is-trading-doggy-style/ Discover the power of “Trading Doggy Style,” a unique trading approach that blends various market analysis techniques for high probability trades with exceptional reward-to-risk ratios. This methodology focuses on identifying precise entry points based on supply and demand imbalances, volume profile analysis, and balance range analysis, allowing traders to capitalize on market movements with well-defined risks. Supply and Demand at Price: Identifying fresh supply or demand areas for precise entry points. Volume Profile Analysis: Utilizing volume profiles to understand market value perceptions and identify optimal trade entries. Balance Range Analysis: Analyzing market phases of balance and imbalance to determine areas of interest. Price Action and Market Structure: Leveraging price action and market structure for strategic trade execution and management. *DOGGYSTYLE TRADING COURSE** https://pharmdcapital.com/trading-doggy-style/ **DISCLAIMER:** I am not a financial advisor. The content shared on this channel, as well as across my other social media platforms, videos, podcasts, and posts, is intended solely for entertainment and reflects my personal opinions. Please conduct your own research and consult with a financial advisor before making any investment decisions.

0 notes

Text

The Evolution of Investment Research: How Technology is Transforming the Industry

Monte Carlo simulation helps financial advisors estimate the future without neglecting uncertain variables. Meanwhile, hypothesis testing shows investors whether an idea will lead to a favorable outcome or make half their capital resources disappear. Today, machines have streamlined these methods in investment research (IR) and market forecasting, rendering time-consuming number crunching obsolete. This post will explain how technology-led transformation has accelerated the evolution of the investment research industry.

A Brief About Conventional Investment Research Workflows

Financial analysts and investment researchers used to collect, analyze, and depict data insights concerning market movements or company profiles after mentally taxing activities. Consider how they had no choice but to spend hours examining financial statements. Otherwise, creating reliable market reports and understanding macroeconomic forces would be impossible.

Conventional IR reporting techniques were more time-consuming than modern investment research. After all, outdated risk calculation approaches often relied on published, on-paper resources for data availability. As a result, everyone used to focus on a few analysts’ expertise, while others tried superstitions and poor decision-making to test their luck at trading or fundraising.

Later, mathematicians’ wisdom of statistical theories and probabilistic scenario assessments helped investment researchers. Once computers became universally available, fintech robo advisors and predictive tools began to take over the finance world.

The Evolution of Modern Investment Research: Technological Transformation

Example 1 – Big Data and Advanced Analytics

The increased flow of data from disparate sources empowers today’s investment researchers to offer detailed reports describing a brand’s controversy-related exposure and media impact. During secondary data capture, IR professionals can also mine news publications, industry magazines, and consumer forums 24/7.

Alternative data tools have helped finance stakeholders improve creditworthiness checks, fraud detection, and business merger dealmaking in investment banking services. For example, big data aids investment researchers in inspecting an organization’s historical media coverage. Doing so lets them alert ethical investors about foreign or less famous corporations’ legal and greenwashing conflicts.

All disruptive technologies, like data mining, machine learning, and natural language processing (NLP), simplify finding peculiar dataset patterns or insights often hidden due to human capabilities’ limitations. For example, sentiment analysis can reveal where stock prices will head by extracting relevant insights from news articles, social media trends, and multimedia datasets.

Example 2 – Artificial Intelligence (AI) and Machine Learning

AI and machine learning algorithms can handle extensive data volumes to predict outcomes. With structured and unstructured data sorting features, these technologies also increase the scope of investment research.

As a result, experts witness enhanced performance across algorithmic trading platforms. They use AI models to recommend the sell, hold, and buy decisions. In other words, algorithmic tools for investment research and decisions let investors eliminate human biases. So, creating a bias-free trading strategy becomes feasible.

Machine learning algorithms have predicted stock prices, market movements, and macroeconomic challenges. Additionally, they learn from experiences based on historical market intelligence and consider other market dynamics to adjust investment recommendations.

Conclusion

The evolution of the investment research industry depends on new tools and strategies for better efficiency, accuracy, and accessibility. For instance, big data analytics, algorithm-powered trading, cloud integration, predictive financial modeling, and blockchains can help advisors deliver holistic reporting innovations. Therefore, stakeholders must monitor how fintech’s breakthroughs impact modern investment research practices and integrate them for data-driven portfolio management.

0 notes

Text

Discover the Best AI Stock Pickers for Smarter Investment Decisions

In the rapidly evolving world of finance, the integration of artificial intelligence (AI) into stock trading and investment analysis has revolutionized the way investors approach the market. With the sheer volume of data available today, making informed investment decisions can be a daunting task for even the most seasoned investors. This is where the best AI stock picker come into play, providing invaluable insights and predictive analytics to guide your investment strategies.

Understanding AI Stock Pickers

AI stock pickers are sophisticated algorithms designed to analyze vast amounts of market data, identify trends, and provide actionable insights. Unlike traditional methods, which often rely on historical performance and basic statistical analysis, AI-driven tools leverage machine learning and natural language processing to process information in real-time. This allows them to adapt to market changes swiftly and efficiently, giving investors a significant edge in their trading endeavors.By utilizing advanced data analytics, the best AI stock pickers can evaluate various factors such as company fundamentals, market sentiment, technical indicators, and macroeconomic trends. This comprehensive approach helps in identifying stocks that are not only poised for growth but also align with an investor's risk profile and investment goals. As the investment landscape becomes increasingly competitive, harnessing the power of AI can be the key to staying ahead.

Why Choose an AI Stock Picker?

The decision to use an AI stock picker comes with numerous advantages. Firstly, these tools are designed to eliminate emotional bias, which often clouds judgment and leads to suboptimal investment choices. By relying on data-driven insights, investors can make more rational decisions based on factual information rather than gut feelings or market noise.Moreover, AI stock pickers excel in their ability to analyze vast datasets that would be impossible for a human to process in a timely manner. This capability allows them to uncover hidden investment opportunities that may be overlooked by traditional analysts. For instance, Incite AI employs polymorphic algorithms that aggregate and analyze real-time data, enabling investors to make informed decisions based on the latest market developments.Another significant benefit is the accessibility these tools provide. Whether you are a novice investor or a seasoned professional, AI stock pickers can cater to varying levels of expertise. With user-friendly interfaces and intuitive dashboards, platforms like Incite AI make it easy for anyone to utilize sophisticated investment strategies without needing extensive financial knowledge.

The Features of the Best AI Stock Pickers

When searching for the best AI stock picker, several key features should be considered. These features not only enhance the effectiveness of the tool but also ensure that investors receive the most relevant insights. One of the standout features is real-time market analysis. The ability to monitor market conditions continuously allows AI stock pickers to provide timely recommendations, which is crucial in a fast-paced environment where market dynamics can shift rapidly.Another essential feature is customizable watchlists. The best AI stock pickers allow users to create personalized watchlists tailored to their investment preferences. This functionality helps investors focus on specific sectors or stocks of interest while receiving alerts on significant market movements or changes in stock performance.Additionally, advanced risk management tools are vital for any investor looking to protect their capital. An effective AI stock picker should offer insights into potential risks associated with specific investments, helping investors make informed decisions that align with their risk tolerance. For instance, Incite AI not only identifies promising stocks but also assesses market volatility and provides strategies to manage risk effectively.

How to Maximize Your Investment Strategy with AI

To truly harness the potential of the best AI stock picker, investors should consider integrating AI-driven insights into their broader investment strategy. This involves establishing clear investment goals, whether they be short-term gains or long-term wealth accumulation. By defining these objectives, investors can leverage AI tools to tailor their strategies accordingly.Furthermore, it is essential to combine AI insights with fundamental and technical analysis. While AI stock pickers provide valuable data-driven recommendations, understanding the underlying business fundamentals and market trends can enhance decision-making. For example, an investor using Incite AI could analyze the platform’s recommendations in conjunction with their understanding of a company’s financial health and market position.Moreover, maintaining a flexible approach is crucial. The financial markets are inherently unpredictable, and factors such as geopolitical events, economic shifts, or changes in consumer behavior can impact stock performance. Therefore, regularly revisiting and adjusting your investment strategy based on AI insights will help in navigating these complexities.

The Future of AI in Stock Trading

As AI technology continues to evolve, its role in stock trading and investment analysis is expected to expand further. The future promises even more sophisticated algorithms capable of analyzing data with greater accuracy and speed. Innovations in AI could include enhanced predictive capabilities, allowing investors to anticipate market trends before they occur.In addition, the integration of AI with other emerging technologies, such as blockchain and big data analytics, is poised to transform the investment landscape. This convergence will likely lead to the development of even more robust tools that not only identify profitable investment opportunities but also ensure transparency and security in transactions.Moreover, as more retail investors adopt AI-driven tools, there will be an increased demand for personalized investment solutions. The best AI stock pickers will need to adapt to these changing dynamics by offering tailored recommendations based on individual investor profiles and preferences. This evolution will empower more people to participate in the stock market, democratizing access to sophisticated investment strategies.

Conclusion

In the quest for smarter investment decisions, leveraging the best AI stock picker can be a game-changer. By providing accurate, data-driven insights and minimizing emotional biases, AI stock pickers empower investors to navigate the complexities of the financial markets with confidence. As we look to the future, the integration of AI in stock trading will only become more profound, offering unprecedented opportunities for growth and success.Whether you are just starting your investment journey or looking to refine your existing strategies, embracing AI technology is essential. Platforms like Incite AI are at the forefront of this revolution, offering powerful tools that simplify the investment process and enhance decision-making. By utilizing the best AI stock picker, you can unlock your full investment potential and position yourself for success in the ever-evolving financial landscape.

0 notes

Text

Advanced Smart Money Trading: Mastering S&P and Nasdaq Futures for Maximum Profit

In the world of futures trading, understanding Smart Money Trading is crucial. This approach helps traders identify the moves of institutional players, allowing them to make more informed decisions. The S&P 500 and Nasdaq 100 futures are two of the most popular markets among traders, offering high liquidity and numerous opportunities. This guide will cover everything from the basics to advanced strategies, ensuring you have the tools needed to excel in these markets.

Understanding Smart Money Trading

Smart Money Trading is a concept that revolves around following the actions of institutional investors, often referred to as "smart money." These players include hedge funds, investment banks, and large asset managers who have the resources and information to influence market movements. By identifying and following the smart money trends, retail traders can position themselves on the winning side of the trade.

Key concepts in Smart Money Trading include:

Order Flow Analysis: Understanding the flow of orders in the market to identify buying and selling pressure.

Volume Spread Analysis (VSA): Analyzing price action and volume to determine the strength of a market move.

Market Structure: Recognizing key levels of support, resistance, and price patterns that indicate potential reversals or continuations.

By mastering these techniques, traders can gain a significant edge in the S&P 500 and Nasdaq 100 futures markets.

The Importance of S&P and Nasdaq Futures

The S&P 500 and Nasdaq 100 are two of the most widely traded futures contracts. They represent a broad spectrum of the U.S. economy, with the S&P 500 encompassing 500 of the largest companies and the Nasdaq 100 focusing on 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

Top reasons to trade S&P and Nasdaq Futures include:

Liquidity: These markets are highly liquid, meaning you can enter and exit positions with minimal slippage.

Leverage: Futures contracts allow traders to control large positions with relatively small amounts of capital.

Market Hours: These futures trade nearly 24 hours a day, providing ample opportunities for trading.

Volatility: Both the S&P 500 and Nasdaq 100 are known for their volatility, which can lead to significant profit opportunities for informed traders.

Advanced Strategies for S&P and Nasdaq Futures

Now that we’ve covered the basics, let’s delve into some advanced strategies for mastering S&P and Nasdaq Futures.

1. Order Flow and Volume Profile

Understanding order flow is crucial for identifying the actions of smart money. By analyzing the volume traded at each price level, traders can identify areas of significant buying or selling interest. Volume Profile tools help traders visualize this data, providing insights into where institutional players are likely to enter or exit positions.

Key elements of Order Flow and Volume Profile:

Point of Control (POC): The price level with the highest traded volume, often acting as a magnet for price.

Value Area: The price range where a significant portion of trading activity occurs.

Order Imbalance: A situation where there is a significant difference between buy and sell orders, indicating potential market direction.

2. Market Profile and Auction Market Theory

Market Profile is a tool that organizes price, volume, and time into a graphical representation, providing a clear picture of market structure. This concept is closely related to Auction Market Theory, which suggests that markets operate as an auction process, constantly seeking to establish fair value.

Using Market Profile in trading S&P and Nasdaq Futures:

Identifying Trends: Recognize when the market is trending versus when it’s in a range-bound state.

Profile Shapes: Understand different profile shapes (e.g., P-shape, b-shape) and what they indicate about market sentiment.

Initial Balance (IB): The price range established in the first hour of trading, often setting the tone for the rest of the day.

3. Trading the Opening Range

The opening range refers to the price range established during the first 30 minutes to an hour of trading. Many professional traders focus on the opening range as it often dictates the market's direction for the rest of the day.

Strategies for trading the Opening Range:

Breakout Strategy: Entering a trade when price breaks above or below the opening range, with a stop loss placed just inside the range.

Fade Strategy: Taking the opposite side of a breakout if the price fails to sustain momentum beyond the opening range.

4. Swing Trading with Smart Money Concepts

Swing trading involves holding positions for several days to capture medium-term price movements. When applied to Smart Money Trading concepts, swing trading can be particularly effective in S&P 500 and Nasdaq 100 futures.

Key concepts in Swing Trading:

Institutional Levels: Identifying key levels where institutions are likely to have placed significant orders.

Market Cycles: Understanding the different phases of the market (accumulation, markup, distribution, markdown) to time entries and exits.

Divergence Analysis: Using indicators like RSI or MACD to identify potential reversals in the market.

Risk Management in Futures Trading

No matter how advanced your trading strategies are, risk management remains a critical component of success. S&P 500 and Nasdaq 100 futures are leveraged instruments, meaning small price movements can result in significant gains or losses.

Key Risk Management Techniques:

Position Sizing: Never risk more than a small percentage of your capital on a single trade.

Stop Losses: Always use stop losses to limit potential losses.

Risk-to-Reward Ratio: Aim for trades with a favorable risk-to-reward ratio (e.g., 1:2 or higher).

Emotional Discipline: Stick to your trading plan and avoid making impulsive decisions based on emotions.

Tools and Resources for Advanced Futures Trading

To successfully implement Smart Money Trading techniques, it’s essential to have the right tools and resources at your disposal.

Top tools for S&P and Nasdaq Futures trading:

Order Flow Software: Platforms like Sierra Chart or Bookmap provide detailed order flow data.

Volume Profile Tools: TradingView and Thinkorswim offer Volume Profile indicators.

Market Profile Platforms: Use platforms like MarketDelta or NinjaTrader for Market Profile analysis.

Economic Calendars: Keep track of economic events that can impact market volatility with tools like Forex Factory or Econoday.

Conclusion

Mastering Advanced Smart Money Trading in S&P and Nasdaq Futures requires a deep understanding of market dynamics and the ability to apply sophisticated strategies. By following the concepts outlined in this guide, you can position yourself to trade alongside the smart money and achieve consistent profits.

Remember, success in futures trading doesn’t come overnight. It requires continuous learning, practice, and discipline. If you’re serious about taking your trading skills to the next level, consider enrolling in specialized courses like those offered on Udemy, where you can learn from industry experts and gain the knowledge needed to excel.

At Korshub, we are committed to helping you find the best courses to enhance your trading journey. By mastering these advanced strategies, you’ll be well on your way to becoming a proficient and profitable trader in the S&P 500 and Nasdaq 100 futures markets.

0 notes

Text

Unlocking the Potential of WikiStock: A Comprehensive Guide to Stock Market Insights

Unlocking the Potential of WikiStock: A Comprehensive Guide to Stock Market Insights

In the dynamic world of stock trading, having access to accurate and timely information is crucial for making informed investment decisions. WikiStock emerges as a powerful tool designed to provide investors with comprehensive insights into the stock market. This article explores the features and benefits of WikiStock, and how it can help investors unlock the potential of their stock market ventures.To get more news about WikiStock, you can visit our official website.

Understanding WikiStock

WikiStock is an innovative platform that offers a wealth of information about stocks, market trends, and investment strategies. It aims to empower investors by providing them with the tools and data they need to make informed decisions. Whether you are a seasoned trader or a novice investor, WikiStock can be your go-to resource for navigating the complexities of the stock market.

Key Features of WikiStock

Real-Time Market Data: One of the standout features of WikiStock is its provision of real-time market data. Investors can access up-to-the-minute information on stock prices, trading volumes, and market trends. This real-time data is essential for making timely investment decisions and capitalizing on market opportunities.

Comprehensive Stock Profiles: WikiStock offers detailed profiles for a wide range of stocks. Each profile includes information about the company’s financial performance, historical stock prices, and key metrics such as earnings per share (EPS) and price-to-earnings (P/E) ratio. These comprehensive profiles help investors evaluate the potential of different stocks.

Analyst Ratings and Reviews: The platform provides ratings and reviews from financial analysts, giving investors insights into the performance and prospects of various stocks. These ratings are based on thorough analysis and can guide investors in making informed choices.

Investment Tools and Resources: WikiStock offers a variety of tools and resources to assist investors in their decision-making process. These include stock screeners, financial calculators, and educational materials on investment strategies. By leveraging these tools, investors can enhance their understanding of the stock market and develop effective investment plans.

How to Use WikiStock for Investment Decisions

Using WikiStock to make informed investment decisions is straightforward. Here are the steps to follow:

Search for Stocks: Enter the name or ticker symbol of the stock you are interested in on the WikiStock website or app. The platform will display a list of matching stocks.

Analyze Stock Profiles: Click on the stock’s profile to view detailed information about its financial performance, historical prices, and key metrics. Evaluate the stock’s potential based on this data.

Read Analyst Ratings and Reviews: Go through the ratings and reviews provided by financial analysts. Pay attention to their insights and recommendations to gauge the stock’s prospects.

Utilize Investment Tools: Make use of the various tools and resources available on WikiStock. Use stock screeners to identify stocks that meet your criteria, and financial calculators to assess potential returns.

Benefits of Using WikiStock

Enhanced Decision-Making: By providing access to real-time market data, comprehensive stock profiles, and analyst ratings, WikiStock enables investors to make well-informed decisions. This enhances the likelihood of achieving successful investment outcomes.

Time-Saving: Instead of spending hours researching stocks individually, investors can find all the necessary information in one place on WikiStock. This saves time and effort, allowing investors to focus on their trading strategies.

Educational Resources: WikiStock offers a wealth of educational materials on investment strategies and market analysis. These resources help investors build their knowledge and develop effective investment plans.

Conclusion

In the ever-evolving world of stock trading, having a reliable resource for market insights is essential. WikiStock stands out as a comprehensive platform that provides investors with the tools and information they need to unlock the potential of their stock market ventures. By leveraging the features of WikiStock, investors can enhance their decision-making, save time, and ultimately achieve greater success in their investment endeavors.

0 notes

Text

Trading Courses

Trading courses are designed to equip individuals with the knowledge and skills necessary to navigate the complexities of the financial markets effectively. These courses cover a wide range of topics, including technical analysis, fundamental analysis, risk management, trading strategies, and the psychological aspects of trading. They cater to different levels of expertise, from beginners who are new to the world of trading to experienced traders looking to refine their strategies and enhance their performance. The structured approach of trading courses helps in building a solid foundation in financial markets, starting with the basics of how markets operate, types of financial instruments, and the mechanisms of trading.

One of the key components of trading courses is technical analysis, which involves analyzing historical price data and trading volumes to forecast future price movements. This includes learning about chart patterns, indicators, oscillators, and trend analysis. Courses often provide practical training on how to use various technical analysis tools and software, enabling traders to make data-driven decisions. Fundamental analysis, another critical aspect, focuses on evaluating a company’s financial health, economic conditions, and industry trends to determine the intrinsic value of its stocks. This helps traders make informed decisions based on a comprehensive understanding of market fundamentals.

Risk management is another crucial area covered in trading courses. Effective risk management strategies are essential for protecting capital and ensuring long-term profitability. Courses teach participants how to set stop-loss orders, manage leverage, diversify their portfolios, and control emotional responses to market fluctuations. Understanding the psychology of trading is also emphasized, as emotional discipline and mental fortitude are vital for success in trading. Courses often address common psychological pitfalls such as fear, greed, and overconfidence, and provide techniques to develop a disciplined and objective trading mindset.

Trading courses also delve into various trading strategies, including day trading, swing trading, and position trading. Each strategy has its own set of principles, timeframes, and risk profiles. Day trading involves making multiple trades within a single day, aiming to capitalize on short-term market movements. Swing trading focuses on capturing price swings over several days or weeks, while position trading involves holding positions for longer periods to benefit from broader market trends. These courses provide detailed guidance on how to develop and implement these strategies effectively, tailored to individual risk tolerance and trading goals.

Many trading courses incorporate practical components such as simulated trading environments, where participants can practice executing trades without risking real money. These simulations help in building confidence and gaining experience in applying theoretical knowledge to real-world scenarios. Additionally, some courses offer mentorship and support from experienced traders, providing personalized feedback and insights to help learners improve their trading performance.

The mode of delivery for trading courses varies, with options including online classes, webinars, in-person workshops, and self-paced learning modules. Online courses offer flexibility, allowing learners to study at their own pace and from any location. In-person workshops and seminars provide opportunities for interactive learning and networking with peers and industry experts. Many courses also offer access to exclusive trading communities, forums, and resources, fostering a collaborative learning environment.

In summary, trading courses provide a comprehensive education in the financial markets, covering essential topics such as technical and fundamental analysis, risk management, trading strategies, and trading psychology. They cater to various skill levels and learning preferences, offering both theoretical knowledge and practical experience. By equipping participants with the necessary tools and techniques, trading courses help individuals build a solid foundation, develop effective trading strategies, and enhance their overall trading performance, ultimately enabling them to navigate the financial markets with confidence and competence.

0 notes

Text

Unlocking the Future: AI in Stock Price Forecasting

In the fast-paced world of stock market investing, accurate forecasting of stock prices remains a holy grail for traders and investors alike. Traditionally, stock price forecasting relied heavily on technical analysis, fundamental analysis, and market sentiment. However, the advent of Artificial Intelligence (AI) has introduced a revolutionary approach to stock price forecasting, leveraging advanced algorithms and machine learning models to predict future price movements with unprecedented accuracy and efficiency. This article explores how AI is transforming Ai Stock Price Forecast, offering insights into its capabilities, applications, and the implications for financial markets.

Machine Learning and Predictive Analytics

AI's prowess in stock price forecasting stems from its ability to harness machine learning and predictive analytics. Machine learning algorithms, such as neural networks, decision trees, and support vector machines, are trained on vast datasets of historical stock prices, trading volumes, technical indicators, and macroeconomic variables. These algorithms can detect complex patterns and relationships within the data, enabling them to generate forecasts and probabilistic outcomes for future stock prices.

Enhanced Accuracy and Efficiency

Compared to traditional forecasting methods, AI-driven models exhibit enhanced accuracy and efficiency. AI algorithms can process large volumes of data in real-time, continuously learning and adapting to changing market conditions. By identifying subtle patterns and correlations that may elude human analysts, AI enhances the precision of forecasts and reduces the margin of error in predicting stock price movements. This capability empowers traders and investors to make more informed decisions, optimize portfolio performance, and mitigate risks effectively.

Real-Time Data Analysis

AI excels in real-time data analysis, a critical advantage in the dynamic and volatile stock market environment. AI-powered systems continuously monitor market data, news sentiment, social media trends, and other relevant factors that influence stock prices. By processing and analyzing these diverse sources of information instantaneously, AI algorithms can identify market trends, sentiment shifts, and emerging patterns in real-time. This real-time capability enables traders to capitalize on timely opportunities and adjust their strategies swiftly in response to market developments.

Risk Management and Decision Support

Beyond forecasting, AI plays a pivotal role in risk management and decision support for traders and investors. AI models can assess portfolio risk exposure, evaluate potential outcomes of trading strategies, and optimize portfolio allocation based on forecasted price movements and risk profiles. By simulating various scenarios and stress-testing portfolios, AI-driven risk management tools help mitigate downside risks and enhance overall portfolio resilience in volatile market conditions.

Challenges and Considerations

Despite its transformative potential, AI-driven stock price forecasting faces challenges related to data quality, model interpretability, and market unpredictability. The accuracy of AI forecasts heavily depends on the quality, relevance, and timeliness of input data. Ensuring the transparency and ethical use of AI in forecasting practices is crucial to maintaining market integrity and investor trust. Moreover, AI models must continuously adapt to evolving market dynamics and regulatory changes to remain effective and reliable over time.

Future Outlook

Looking ahead, AI is poised to continue revolutionizing stock price forecasting with advancements in deep learning, natural language processing, and reinforcement learning. These technologies promise to further enhance the sophistication and predictive power of AI models, enabling more precise forecasts and actionable insights for traders and investors. As AI technology matures, the integration of AI-driven forecasting tools into mainstream financial institutions and trading platforms is expected to accelerate, democratizing access to advanced analytical capabilities and leveling the playing field in the global financial markets.

In conclusion, AI represents a game-changing innovation in Ai Crypto Forecast, offering unparalleled capabilities in pattern recognition, predictive analytics, and real-time data analysis. By harnessing the power of AI, traders and investors can navigate the complexities of stock markets with greater confidence, make data-driven decisions, and seize opportunities for sustainable growth and profitability. As AI continues to evolve, its impact on stock price forecasting is poised to redefine investment strategies, shape market trends, and drive innovation in the financial industry.

0 notes

Text

How to Use Option Chain Analysis for Successful Trading

Option trading offers investors a unique opportunity to leverage market movements and manage risk effectively. Among the various tools available to option traders, option chain analysis stands out as a powerful method for making informed trading decisions. In this blog, we'll explore what option chain analysis entails, how to interpret it, and how you can use it to enhance your trading strategies for success.

Understanding Option Chain Analysis

An option chain is a listing of all available options contracts for a particular underlying asset, organized by expiration date and strike price. Option chain analysis involves studying this data to assess market sentiment, identify potential trading opportunities, and gauge the risk-reward profile of options trades.

Key Components of an Option Chain

Expiration Dates: Options contracts have specific expiration dates, ranging from weekly to monthly expirations. Traders select contracts based on their preferred time horizon for trading.

Strike Prices: Each expiration date lists multiple strike prices, representing the price at which an option can be exercised. Strike prices are categorized as in-the-money, at-the-money, or out-of-the-money based on the current market price of the underlying asset.

Open Interest: This indicates the number of outstanding contracts for a particular strike price and expiration date. High open interest suggests greater liquidity and trader interest in that option.

Volume: Volume reflects the number of contracts traded during a specific period. High volume at a particular strike price indicates active trading activity and may signal significant market interest.

Implied Volatility (IV): Implied volatility represents the market's expectation of future price volatility of the underlying asset. High IV indicates greater potential price fluctuations, affecting option premiums.

How to Use Option Chain Analysis for Trading

1. Identify Market Sentiment:

Call vs. Put Ratio: Analyze the ratio of call options (bullish sentiment) to put options (bearish sentiment). A high call/put ratio suggests optimism about the underlying asset's future price movement.

2. Spotting Trading Opportunities:

High Open Interest: Focus on strike prices with high open interest, as they often serve as points of interest for traders and can influence the underlying asset's price movement.

Volume Analysis: Look for options with significant trading volume, indicating active participation and potential opportunities for profit.

3. Risk Management:

Implied Volatility: Assess IV to determine the pricing of options relative to historical volatility. High IV may indicate expensive options premiums, prompting caution or strategies like selling options to take advantage of inflated premiums.

4. Strategy Formulation:

Delta, Gamma, Theta, Vega: Understand the Greeks (option sensitivity to various factors) to tailor strategies based on your outlook for the underlying asset's price direction, volatility, and time decay.

Practical Application of Option Chain Analysis

For instance, if you're bullish on a stock and want to minimize risk, you might consider buying call options with high open interest and moderate implied volatility. Conversely, if you anticipate volatility to decrease, selling options with high premiums might be advantageous.

Conclusion

Option chain analysis is a vital tool for option traders seeking to capitalize on market movements and manage risk effectively. By studying key metrics like open interest, volume, and implied volatility, traders can gain valuable insights into market sentiment and identify strategic trading opportunities. Whether you're a beginner or experienced trader, incorporating option chain analysis into your trading toolkit can help you make informed decisions and optimize your trading strategies for success in the dynamic world of options trading.

Enhance your trading proficiency by mastering option chain analysis and leveraging its insights to navigate the complexities of the financial markets with confidence.

Happy trading!

0 notes

Text

Metalized Flexible Packaging Market Forecast Growth and Challenges Analysis Forecast by 2031

Metalized Flexible Packaging Market ForecastScope & Overview

Insights into the industry, product descriptions, company profiles, financial data, and contact details are all included in the Metalized Flexible Packaging Market Forecast analysis. This study covers the global market's history as well as market predictions by area, nation, and industry subsector. The market's sales volume, price, revenue, gross margin, trends, historical growth, and future projections are all covered in the statistics. The global market examines and researches consumption, value, year-over-year growth, and development plans for the upcoming years in order to provide a thorough representation of the anticipated market size.

In order to attain a higher degree of accuracy, genuine numbers were also verified by reliable sources. On interviews and the advice of seasoned market research experts, additional estimates were based. Businesses, investors, stakeholders, suppliers, service providers, and distributors can use the study report to research the market. In order to comprehend the state of the market today, research is done on international industry and marketing trends. It includes comprehensive statistics for every regional market as well as an in-depth study of every industry, group, area, and nation analyzed in the Metalized Flexible Packaging market analysis.

Get a Sample Report https://www.snsinsider.com/sample-request/3127

Market Key Players:

Amcor Limited, Sonoco Products Company, Mondi Group, Huhtamaki, Sealed Air Corporation, Cosmo Films Limited, Polyplex Corporation Limited, Transcontinental Inc, Constantia Flexibles, CLONDALKIN GROUP

Market Segmentation

Data from manufacturers, sales, and production were examined by analysts for each region. This section evaluates revenue and volume by region for the projection period. These analyses will aid the reader in determining the key players' revenue model. The Metalized Flexible Packaging study is the outcome of an extensive investigation into the economic, social, technological, environmental, and political circumstances that influence regional growth.

By Raw Material

Aluminum

Chromium

Nickel

By Packaging Type

Wraps

Bags

Pouches

Roll Stock

Others

By Structure

Laminated

Mono Extruded

Others

By End Use

Pharmaceuticals

Food & Beverages

Personal Care

Others

Russia-Ukraine War Impact on Metalized Flexible PackagingMarket

Distinct regions of the world are expected to see different effects from the Russian-Ukrainian conflict. Russia's reaction to western economic sanctions against it and limitations on the export of Russian military technology will almost certainly have an impact on the crisis' effects on the economy and markets. The report describes the effects that would have on markets around the world.

Competitive Outlook

The reader can estimate the manufacturers' footprints by knowing their global revenue, global price, and global manufacturing output over the anticipated period. In this portion of the study, the major manufacturers in the Metalized Flexible Packaging market are profiled. It helps the reader understand the strategies used in market competitiveness and business alliances.

Key Questions Answered in theMetalized Flexible PackagingMarket Report

What impact does the crisis between Russia and Ukraine have on various regional marketplaces throughout the world?

What are the most successful corporate tactics for gaining market share?

What is the primary industry and category in the sales, revenue, and market share study of the target market?

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read More Related Report:

Cosmetic Packaging Market Demand

Metalized Flexible Packaging Market Growth

Recyclable Packaging Market Analysis

0 notes

Text

The Top Stocks to Watch on NSE India in 2024

There are few shifts in the equity markets at the start of the year, but many investors take advantage of the chance to review their holdings, select successful strategies, and get rid of losing investments. Investment themes such as manufacturing, consumerism, PSUs, and capital expenditures will be attractive in 2024. Here are the top stocks to watch out for on NSE India.

1. Greenply Industries

The building materials category, which includes wood panels (ply, laminates, and MDF), will be driven by the majority of residential real estate completed in the previous two to three years, starting in CY24. Greenply stands to gain significantly from this. Experts have valued the firm at a P/E of 26x FY25E.

2. Paushak

A dividend-paying company that is essentially debt-free is focusing on capacity expansion and technology advancement. The management's objective aligns well with the idea of making India a self-sufficient manufacturer of specialised chemicals. You can still have a bullish view of the stock.

3. Wonderla Holidays

Wonderla Holidays is a safe bet in the discretionary category due to its attractive values of 14x/10x its FY25E/FY26E EV/EBIDTA, strong balance sheet despite significant capital expenditure, and double-digit profits visibility.

4. NMDC

Over the seven-year period from FY14 to FY21, NMDC's production volume was constant at ~30–35 MT. However, the company is expected to reach ~46 MT in FY24 and surpass ~50 MT by FY25. A roughly 13% volume CAGR to 55 MT by FY26E has been factored in. This is in addition to its aggressive goal of increasing capacity to 67 MT by FY26 and then to 100 MT by FY30.

5. The Indian Hume Pipe & Co. Ltd.

The organisation is concentrating on project completions while keeping up with more recent, developing prospects in infrastructure-related operations. The business has provided updates on its numerous initiatives as well. Over the next five to six years, the company's land parcels and the realisations from them will help it become debt-free.

6. Nelcast

Numerous opportunities are emerging in the electric vehicle (EV) area, and Nelcast is actively participating in that market as it prepares to take advantage of these chances through the introduction of new products and clients, technical developments, etc. The company's goals include raising output, improving capacity utilisation, improving Ebitda/kg, and lowering capital expenditure needs, all of which can help with debt servicing and improve return ratios in the future.

Conclusion

Do not interpret your list of the top stocks for long-term investments as stock recommendations. However, you can consider investing in them. An astute investor thoroughly assesses the stocks as part of their own research and analysis. Comprehensive stock reports on IIFL Securities include a plethora of data on the company's profile, financials, peer information, holdings, and more. Make use of them to select the most suitable stocks based on your needs and risk tolerance.

0 notes

Text

Exploring the Diverse Landscape of Stock Market Traders: 25 Types, Strategies, and Outcomes

In the bustling realm of the stock market, traders come in various shapes and sizes, each employing unique strategies, time frames, and risk-reward profiles. From seasoned professionals to casual enthusiasts, understanding the diverse array of trading styles is crucial for navigating the complexities of financial markets. In this article, we delve into 25 types of traders, providing definitions, time frames, and insights into the risks and rewards associated with each approach.

1. Day Trader:

Definition: Day traders execute trades within the same trading day, aiming to capitalize on intraday price fluctuations.

Time Frame: Minutes to hours.

Risk: High, as day traders are exposed to market volatility and execution risks.

Reward: Potential for quick profits, but also susceptible to substantial losses.

2. Swing Trader:

Definition: Swing traders hold positions for several days to weeks, profiting from short-to-medium-term price swings.

Time Frame: Days to weeks.

Risk: Moderate, balancing short-term volatility with longer-term trends.

Reward: Opportunities for significant gains with less intraday stress compared to day trading.

3. Position Trader:

Definition: Position traders maintain positions for weeks to months, focusing on long-term market trends and fundamentals.

Time Frame: Weeks to months.

Risk: Lower compared to shorter-term trading, but still exposed to macroeconomic and geopolitical risks.

Reward: Potential for substantial profits by riding major trends, but requires patience and discipline.

4. Scalper:

Definition: Scalpers aim to profit from small price movements by executing numerous trades within a short time frame.

Time Frame: Seconds to minutes.

Risk: Very high due to rapid-fire trading and tight profit margins.

Reward: Limited per trade but can accumulate significant profits over time with high trading volume.

5. Algorithmic Trader:

Definition: Algorithmic traders use automated systems to execute trades based on pre-defined criteria and mathematical models.

Time Frame: Varies, depending on the algorithm's parameters.

Risk: Moderate, depending on the effectiveness of algorithms and risk management measures.

Reward: Potential for consistent profits with minimal human intervention, but requires technical expertise and ongoing optimization.

6. High-Frequency Trader (HFT):

Definition: HFT firms execute trades at lightning speed, leveraging advanced technology and algorithms to exploit tiny price differentials.

Time Frame: Fractions of a second.

Risk: Extremely high due to competition, technological glitches, and regulatory scrutiny.

Reward: Profits generated from high trading volumes and low-latency execution, but requires substantial capital and infrastructure investment.

7. Momentum Trader:

Definition: Momentum traders capitalize on trends and momentum, entering positions in the direction of the prevailing market sentiment.

Time Frame: Days to weeks.

Risk: Moderate to high, as momentum can reverse suddenly, leading to losses.

Reward: Potential for significant gains during strong trending markets, but requires timely entries and exits.

8. Contrarian Trader:

Definition: Contrarian traders go against the prevailing market sentiment, buying oversold assets or selling overbought assets.

Time Frame: Short to medium term.

Risk: High, as contrarian trades can be premature and require patience to materialize.

Reward: Profits from market reversals and corrections, but requires keen market analysis and risk management.

9. Technical Trader:

Definition: Technical traders rely on charts, patterns, and technical indicators to make trading decisions, disregarding fundamental analysis.

Time Frame: Varies, depending on the trader's preferred charting intervals.

Risk: Moderate, depending on the effectiveness of technical analysis and risk management practices.

Reward: Profits from identifying patterns and trends in price movements, but susceptible to false signals and market noise.

10. Fundamental Trader:

Definition: Fundamental traders base their trading decisions on company fundamentals, such as earnings, revenue, and valuation metrics.

Time Frame: Medium to long term.

Risk: Moderate, depending on the accuracy of fundamental analysis and market reactions to news events.

Reward: Profits from identifying undervalued or overvalued assets based on fundamental factors, but requires in-depth research and analysis.

11. News Trader:

Definition: News traders exploit market reactions to significant news events, such as earnings reports, economic data releases, or geopolitical developments.

Time Frame: Short term.

Risk: High, as news can be unpredictable, leading to rapid price movements and execution challenges.

Reward: Profits from timely reactions to news-driven market volatility, but requires quick decision-making and risk management.

12. Event Trader:

Definition: Event traders focus on specific corporate events, such as mergers, acquisitions, or product launches, anticipating price movements resulting from these events.

Time Frame: Short to medium term.

Risk: Moderate to high, depending on the outcome of the event and market reactions.

Reward: Profits from accurately predicting the impact of corporate events on stock prices, but requires thorough analysis and risk assessment.

13. Statistical Arbitrage Trader:

Definition: Statistical arbitrage traders exploit pricing inefficiencies between related securities or market indices using statistical models.

Time Frame: Short to medium term.

Risk: Moderate, depending on the effectiveness of statistical models and risk management practices.

Reward: Profits from exploiting temporary mispricings, but requires advanced quantitative skills and continuous monitoring.

14. Volatility Trader:

Definition: Volatility traders profit from fluctuations in market volatility, employing options, derivatives, or volatility-based strategies.

Time Frame: Short to medium term.

Risk: Moderate to high, depending on market conditions and the complexity of volatility products.

Reward: Profits from accurately predicting changes in volatility levels, but requires a deep understanding of options pricing and risk management.

15. Income Trader:

Definition: Income traders generate regular income by selling options or utilizing dividend-paying stocks, aiming to profit from time decay or dividend yields.

Time Frame: Short to medium term.

Risk: Moderate, depending on options strategies and market conditions.

Reward: Consistent income generation through options premiums or dividends, but requires risk management and monitoring of market volatility.

16. Growth Trader:

Definition: Growth traders focus on stocks with high earnings growth potential, aiming to capitalize on future appreciation in share prices.

Time Frame: Medium to long term.

Risk: Moderate to high, as growth stocks can be volatile and subject to market sentiment shifts.

Reward: Profits from investing in companies with strong growth prospects, but requires patience and tolerance for short-term volatility.

17. Value Trader:

Definition: Value traders seek undervalued stocks trading below their intrinsic value, expecting price appreciation as the market corrects its valuation.

Time Frame: Medium to long term.

Risk: Moderate, as value stocks may remain undervalued for extended periods before realizing their potential.

Reward: Profits from investing in fundamentally sound companies at discounted prices, but requires patience and contrarian conviction.

18. Sector Trader:

Definition: Sector traders focus on specific industries or sectors, capitalizing on sector rotation or thematic investing trends.

Time Frame: Medium term.

Risk: Moderate, depending on sector-specific factors and market correlations.

Reward: Profits from identifying emerging trends or sector-specific catalysts driving outperformance

0 notes

Text

The Power of AI: Your Ultimate Stock Picking Companion

In the dynamic and volatile world of stock market investing, the ability to consistently identify winning stocks and make informed decisions has become increasingly challenging. Traditional approaches to stock analysis, relying on manual data processing and human intuition, often struggle to keep pace with the sheer volume of information and the complex, ever-changing market dynamics. However, the rise of artificial intelligence (AI) has ushered in a new era of stock picking, transforming the way investors approach the markets.

Overcoming the Limitations of Human Stock Pickers

Historically, successful ai stock picker has been the domain of experienced financial analysts, portfolio managers, and individual investors who meticulously sift through financial reports, news, and market data to uncover undervalued or high-growth stocks. This process is inherently time-consuming, labor-intensive, and susceptible to human biases and errors.

Even the most seasoned investors can struggle to keep up with the constant flow of information, quickly changing market conditions, and the intricate interplay of various economic, political, and social factors that influence stock prices. This limitation has often resulted in suboptimal investment decisions and underperformance compared to broader market benchmarks.

The Rise of AI-Powered Stock Picking Algorithms

The emergence of AI-powered stock picking algorithms has revolutionized the way investors approach the stock market. These sophisticated algorithms leverage advanced machine learning techniques to analyze vast amounts of data, identify patterns, and make highly accurate predictions about the future performance of stocks.

Unlike traditional stock analysis methods, AI-powered algorithms can process and synthesize a wide range of data sources, including financial statements, economic indicators, social media sentiment, news articles, and even satellite imagery, to uncover hidden insights and generate highly accurate stock recommendations.

Enhanced Investment Decision-Making

AI-powered stock picking algorithms can significantly enhance the investment decision-making process in several ways:

Improved Pattern Recognition: AI systems can identify complex patterns and relationships within large datasets that would be virtually impossible for human investors to detect. This enhanced pattern recognition can lead to the identification of undervalued or overlooked stocks with significant growth potential.

Rapid Data Processing: AI-powered algorithms can process and analyze massive amounts of data in real-time, enabling them to respond quickly to changing market conditions and make timely investment decisions.

Objectivity and Reduced Bias: AI systems are not subject to the same cognitive biases and emotional influences that can impact human decision-making. This objectivity can help investors make more rational, data-driven investment choices.

Personalized Recommendations: AI-powered stock picking algorithms can be customized to individual investor profiles, taking into account factors such as risk tolerance, investment objectives, and personal preferences to generate tailored stock recommendations.

Backtesting and Continuous Learning

One of the key advantages of AI-powered stock picking algorithms is their ability to continuously learn and improve over time. These algorithms can be subjected to rigorous backtesting, where they are tested against historical market data to assess their performance and validate their effectiveness.

As the algorithms are exposed to more data and feedback from their investment decisions, they can adapt and refine their models, becoming increasingly accurate and sophisticated in their stock picking abilities. This continuous learning process helps ensure that the algorithms remain relevant and effective in the face of evolving market conditions.

Combining Human Expertise and AI Capabilities

While AI-powered stock picking algorithms offer significant advantages, the most successful investment strategies often involve a collaborative approach, combining the strengths of human expertise and AI capabilities. investors can provide valuable context, intuition, and adaptability that AI systems may lack. By working in tandem with AI-powered algorithms, investors can leverage the algorithm's data-driven insights and rapid decision-making while maintaining a level of oversight and control over the investment process.

This human-AI collaboration can lead to more robust, well-rounded investment strategies, where the complementary strengths of both parties can be effectively harnessed to maximize investment returns and manage risk.

Expanding Data Integration and Emerging Technologies

As AI technology continues to advance, the integration of AI-powered stock picking algorithms into the investment landscape is expected to become more widespread and sophisticated.

One area of particular interest is the potential for AI to incorporate additional data sources, such as satellite imagery, geospatial data, and real-time sensor information, to gain even deeper insights into the performance of companies and industries. This expanded data integration can further enhance the accuracy and predictive power of AI-powered stock picking algorithms.

Moreover, the integration of AI with other emerging technologies, such as blockchain and quantum computing, could unlock new possibilities for stock market analysis and investment decision-making. For example, the use of blockchain-based smart contracts could enable more transparent and secure execution of trades, while quantum computing could facilitate the processing of even larger datasets and the development of more complex algorithmic models.

Conclusion

The power of AI-powered stock picking algorithms is transforming the way investors approach the stock market. By harnessing the power of advanced machine learning techniques, these algorithms can identify hidden patterns, process vast amounts of data, and make more informed investment decisions – ultimately unlocking unprecedented potential for investment success.As the adoption of AI-powered stock picking algorithms continues to grow, it is essential for investors to understand the underlying technology, assess the potential risks and benefits, and explore ways to effectively integrate these tools into their investment strategies. By embracing the transformative power of AI, investors can position themselves for greater returns, improved risk management, and a more efficient and rewarding investment experience.

0 notes