#Vps For Traders

Explore tagged Tumblr posts

Text

instagram

0 notes

Text

WIP Whenever: "I Owe Todd Howard My Soul" Edition

Westie Hale and her dog on the road, circa 2287

I was tagged by @wanderingaldecaldo. Thank you.

I'd like to tag @olath124, @byberbunk2069 and @gloryride. As always, no obligation to respond.

There have been numerous developments in the aggravateddurian world since I was last tagged to do one of these something like two months ago.

Things Done Changed

Firstly, I'm taking an indefinite hiatus from Cyberpunk 2077, having exhausted my passion. I may come back to it one day, but for now I'm considering that chapter closed.

My Cyberpunk OCs are either being left in stasis, or versions of them may make their way into my original science fiction universe Freerunners, which I have been writing the fully detailed universal encyclopedia of. Whether that gets released, God knows.

Secondly, I have made progress with a story I'm calling Iron Guardians, a fanfic set in the Fallout universe around the same time as Fallout 4.

But War, War Never Changes

Iron Guardians is set in both the Commonwealth and the northern state of New Hampshire, and follows an ensemble of characters united by circumstance from all walks of life: an idealistic pre-war soldier frozen by the Enclave, a caravan-owning Canadian ghoul trader and his one-eyed sniper compatriot, a jaded Minuteman defector who fled the Commonwealth to save his life, and last, but not least, a Vault Dweller from the West and her trusted, combat armour-wearing canine companion.

The tone of Iron Guardians may shift between lighthearted and grim depending on the chapter. After all, the wasteland is a harsh and unforgiving place, and places like the Nashua Free City are the few sanctuaries, islands in a sea of ruin and despair. But sometimes, the wild wasteland can be a wacky place.

I'll be keeping story stuff related to Iron Guardians on my Fallout sideblog @iron-guardians, but any Fallout 4 VP I take will appear here. Doing VP in Fallout 4 has been made significantly harder with the Next-Gen Update (thanks Todd), but I'm doing my best.

OC: 'Westie' Hale

She kinda resembles Val, because she was originally my attempt at making Val in Fallout 4. However, she's her own character now, so that's good.

"Westie" isn't her real name, it's a nickname applied to her by wastelanders upon learning this intrepid Vault Dweller hails from Vault 53, located in the Midwest. Per the official Fallout Bible: Most of the equipment was designed to break down every few months. While repairable, the breakdowns were intended to stress the inhabitants unduly. The constant hardship caused by the poor reliability of the equipment instead made the Vault Dwellers experts at adapting and making do. For Celia, this is represented by her high Intelligence statistic and her perks:

Scrapper (Level 3)

Hacker (Level 2)

Gun Nut (Level 3)

More of Westie to come, as well as lore about Iron Guardians on the sideblog, including the reason why it's named Iron Guardians.

Thanks everyone.

#wip wednesday#wip whenever#fallout 4#fallout fanfic#durian's fanfic: iron guardians#oc: westie hale#wip fanfiction

7 notes

·

View notes

Text

Forex VPS Hosting With Low Cost

In the fast-paced world of forex trading, where markets are constantly fluctuating and opportunities arise at any hour of the day or night, having a reliable Virtual Private Server (VPS) is no longer just an option—it's a necessity. As traders strive to gain an edge in this highly competitive arena, the role of technology, particularly VPS hosting, has become increasingly crucial. In this comprehensive guide, we'll explore the importance of VPS solutions for forex traders and how Cheap Forex VPS can help you achieve your trading goals.

Understanding the Need for VPS Solutions in Forex Trading

Forex trading operates 24/7 across different time zones, making it essential for traders to have constant access to their trading platforms. However, relying on personal computers or traditional web hosting services may not provide the speed, reliability, and security required for optimal trading performance. This is where VPS solutions come into play.

A VPS is a virtualized server that mimics the functionality of a dedicated physical server, offering traders a dedicated space to host their trading platforms and applications. By leveraging the power of cloud computing, VPS hosting provides several advantages over traditional hosting methods, including:

Uninterrupted Trading: Unlike personal computers, which may experience downtime due to power outages, internet connectivity issues, or hardware failures, VPS solutions offer high uptime guarantees, ensuring that your trading operations remain unaffected.

Low Latency: In forex trading, speed is of the essence. Even a fraction of a second can make the difference between a winning and losing trade. With VPS hosting, traders can benefit from low latency connections to trading servers, resulting in faster execution times and reduced slippage.

Enhanced Security: Protecting sensitive trading data and transactions is paramount in forex trading. VPS solutions offer advanced security features such as DDoS protection, firewall configurations, and regular backups to safeguard against cyber threats and data loss.

Scalability: As your trading needs evolve, VPS solutions can easily scale to accommodate increased trading volumes, additional trading platforms, or specialized software requirements.

Introducing Cheap Forex VPS: Your Trusted Partner in Trading Success

At Cheap Forex VPS, we understand the unique challenges faced by forex traders, which is why we've developed a range of VPS hosting plans tailored to meet your specific needs. Whether you're a beginner trader looking to automate your trading strategies or a seasoned professional in need of high-performance hosting solutions, we have the perfect plan for you.

Our VPS hosting plans are designed to offer:

Flexible Configurations: Choose from a variety of RAM, disk space, CPU cores, and operating system options to customize your VPS according to your trading requirements.

Affordable Pricing: We believe that access to reliable VPS hosting should be accessible to traders of all levels, which is why we offer competitive pricing starting from as low as $4.99 per month.

Expert Support: Our team of experienced professionals is available 24/7 to provide technical assistance, troubleshoot issues, and ensure that your VPS operates seamlessly.

Uptime Guarantee: We guarantee 100% uptime for our VPS hosting services, ensuring that your trading operations remain uninterrupted, even during peak trading hours.

Choosing the Right VPS Plan for Your Trading Needs

With several VPS hosting plans available, selecting the right plan for your trading needs can seem daunting. However, our user-friendly website and knowledgeable support team are here to guide you every step of the way.

Here's a brief overview of our three main VPS hosting plans:

Regular Forex VPS: Ideal for traders looking to run automated trading systems, our Regular Forex VPS plan offers fast execution and reliable performance at an affordable price, starting from $4.99 per month.

Latency Optimized: For pro traders seeking the lowest latency connections and fastest execution times, our Latency Optimized plan is the perfect choice, starting from $8.99 per month.

Big RAM Server: Designed for businesses, brokers, and pro traders with demanding trading environments, our Big RAM Server plan offers ample resources and scalability options, starting from $29.95 per month.

Conclusion: Empower Your Trading with Cheap Forex VPS

In conclusion, VPS hosting has become an indispensable tool for forex traders looking to gain a competitive edge in the market. With Cheap Forex VPS, you can unlock the full potential of your trading strategies with reliable, high-performance hosting solutions that won't break the bank. Purchase your VPS plan today and take your trading to new heights with Cheap Forex VPS.

#forex#forex strategy#forextrading#vps#forex vps#forex market#forexsignals#forex trading#forex broker#forex education#forex analysis#vps hosting#vps server#buy windows vps#virtual private servers#dedicated server#webhosting#reseller#hosting

3 notes

·

View notes

Text

FXVPS Pro offers Supercharged VPS!

Looking to take your Forex trading to the next level? FXVPS Pro offers a range of high-performance VPS plans built specifically for traders.

Why FXVPS Pro?

Ultra-Fast & Reliable: Experience lightning-speed trade execution with our low-latency servers.

24/7 Support: A dedicated customer support team is available whenever you need them.

100% Uptime Guaranteed: Never miss a trade - FXVPS Pro guarantees maximum uptime.

Flexible Plans: Choose from a variety of plans to fit your needs and budget.

Optimized for MT4/MT5: Trade with confidence knowing our servers are optimized for popular trading platforms.

Bonus Features:

Free server installation

3-day money-back guarantee

Dedicated server plans are available

Reseller program with commission opportunities

Ready to see the difference a VPS can make in your trading?

FXVPS Pro offers a variety of plans starting at just $4.89/month. Get started today and see for yourself why FXVPS Pro is the perfect partner for your Forex trading success!

#forextrading#forex market#forex#forex broker#forexsignals#forex trading#vps#vps server#vps hosting#dedicated server#virtual private servers

3 notes

·

View notes

Text

Pinned Post

Hello, I'm Gigil, I love video games.

This blog is 18+ because I'm a lazy bitch to tag my posts and reblogs. Sorry, but it's a chaos territory.

I went full Rogue Trader now, but you can also enjoy some of my Baldur's Gate and Cyberpunk 2077 stuff I had time to tag.

Baldur's Gate 3 (VP) || Cyberpunk 2077 (all orig posts) || Cyberpunk 2077 (fanfiction)

I also have some OCs who has their own tags :3 Kou (cp77) || Rachel (cp77) || Fae (cp77) || The Heartseeker (swtor) || Misery (BG3 and Eberron) || June (og setting) || Isabella (Rogue Trader)

I bite. Welcome.

13 notes

·

View notes

Text

What’s the Best Automated Trading for Beginners?

Looking to dip your toes into trading without headaches? The answer’s clear: AI-powered algo trading—especially those that are fully automated, hassle-free, and beginner-friendly.

But what is the best AI trading if you are new to trading? SureShotFx is the best automated trading for beginners looking for trade and learn.

Have you ever wondered how some traders make trades at lightning speed, even when sleeping? Well, that’s the magic of algorithmic trading.

How Does the SureShotFx Algo Work?

When you get an Algo, your provider will either set it up on their own with your account credentials, or they will send you a licensed Expert Advisor (EA) that you can just drag on your MT4/MT5 chart and set up according to the manual.

According to the New York Post, Institutional giants like AQR & Citadel are increasingly relying on AI; early adopters report +12–17% profit lifts and major cost savings. Apart from this, AI trading now fuel ~50% of HFT (High Frequency Trades), with open-source systems leading the charge.

Why Pick SureShotFX for Automated Trading?

SureShotFX Algo is ideal for the complete beginner, easy with each trade executed automatically, 24/7.

Effortless setup – Connect it once, and it automatically copies and executes verified signals (image or text-based).

Zero VPS or tech skills needed—just link and go.

Pro-level strategies —so beginners gain like professionals.

0 notes

Text

🚀 Why Choose Forex VPS Hosting? Experience lightning-fast trades, ultra-low latency, and 99.99% uptime—perfect for serious forex traders!

✅ Fast Execution ✅ Reliable Performance ✅ Secure & Offshore Hosting

🔗 Power your trades with QloudHost's Forex VPS: 👉 https://qloudhost.com/forex-vps-hosting/

0 notes

Text

🚀 Why Choose Forex VPS Hosting? Experience lightning-fast trades, ultra-low latency, and 99.99% uptime—perfect for serious forex traders!

✅ Fast Execution ✅ Reliable Performance ✅ Secure & Offshore Hosting

🔗 Power your trades with QloudHost's Forex VPS: 👉 https://qloudhost.com/forex-vps-hosting/

0 notes

Text

Scam Empire (Part One): Inside the dark heart of a multinational investment scam

A data leak has unmasked a global network of alleged professional scammers drawing would-be investors into dodgy trading platforms on an industrial scale. A group of South Africans features in parts of the business — and the South African public is prominent among the victims.

A little-known Bulgarian entrepreneur named Boris Kodzhov has, since 2023, quietly made mammoth strides in the South African fintech sector.

Kodzhov seemingly launched not one but three multimillion-rand online trading platforms for complicated financial products called “contracts for difference” (CFD). Their defining characteristic is that you can very rapidly lose all your money, but the potential rewards, marketers will tell you, are boundless.

One of these platforms, SkyMT, briefly shot the lights out before going out of business early last year after roping in estimated deposits of R30-million.

The other two platforms, however, Finbok and Finxo Capital, have gone from strength to strength, collecting deposits of more than R240-million from aspirant traders since September 2023.

The problem is, the “fintech mogul” Kodzhov was until recently actually a cleaner working in Bulgaria’s capital Sofia for a modest salary of about R6,800. He has since retired to care for his sick mother and now lives off a government grant. Kodzhov doesn’t speak English and says he has never heard of either his South African companies or those he supposedly owns in other countries.

Another arrival in the local online trading scene is one Diana Gugles, who, as purported owner, sits behind the company Libra Wealth and its trading platform VP Trade.

The platform has roped in at least 2,000 traders, who have between them deposited R64-million — and that’s just since April last year.

Gugles, a professional model, also struggled to recall her fintech start-up which, while based in South Africa, targets investors in South America.

By all appearances, Kodzhov and Gugles have either been the victims of identity theft or have allowed their identities to be used for setting up companies halfway across the world.

Either way, by using the sleek platforms presented by Kodzhov’s and Gugles’s alleged companies, aspirant traders could deal in crypto currencies, foreign exchange, commodities and other things besides, all aided by friendly finance whizzes over the phone.

Or so they thought. They, in this case, are several thousand South African “traders” who would in almost all cases never see their money again.

These South African victims have fallen under the sway of the rapidly expanding local leg of a staggering international enterprise simultaneously managing more than 70 online trading platforms across the world from a mysterious “back office” spread between Cyprus and Israel.

This nameless multinational syndicate has a staff complement of nearly 500 people targeting aspirant investors everywhere from Australia and Canada to Poland and Japan. If this were not enough, it appears that the organisation has branched out into an online “trading academy” as well as online gambling.

Victims have included South Africans from all walks of life, from pensioners who pinned their hopes on R3,500 investments to business owners who signed over millions.

And on the rare occasion someone got “profit” out, the evidence suggests that this was just bait to keep them putting in more.

Investments from South Africa and elsewhere mostly disappeared into a network of apparent fraud and subterfuge involving shell companies, offshore bank accounts and crypto currency exchanges.

Companies ostensibly run by the unemployed cleaner and model we mentioned at the outset are only the tip of the iceberg.

Beneath the surface lies a spectacular labyrinth of deceit.

This and other minutiae of this clandestine network’s operations have been laid bare in a monumental leak of data originally provided to Sveriges Television, the Swedish national broadcaster, to which amaBhungane has gained access as part of a global consortium of media organisations coordinated by the Organized Crime and Corruption Reporting Project (OCCRP).

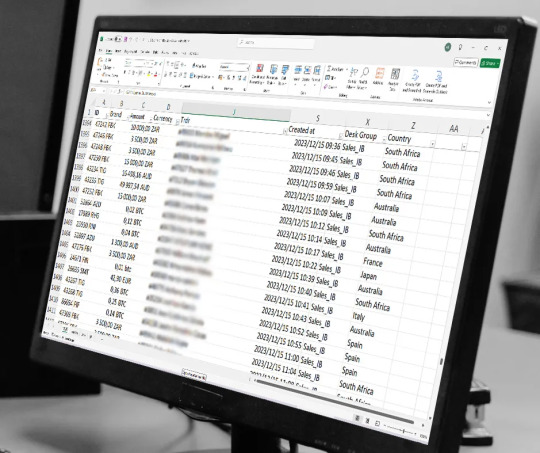

The leak contains thousands of recordings from call centres, screenshots from the computers of individuals managing the scheme as well as many thousands of documents and detailed spreadsheets tabulating everything from the global income of the various “teams” through to the office party expenses of call centre employees.

What emerges is a dark and cynical business, hidden behind the fig leaf of cutting-edge fintech, churning out what the conspirators call trading “brands” — each with a dedicated website and staff.

The brands supposedly belonging to Kodzhov and Gugles sit among dozens the managers of the scheme can monitor at the same time using a back-end dashboard.

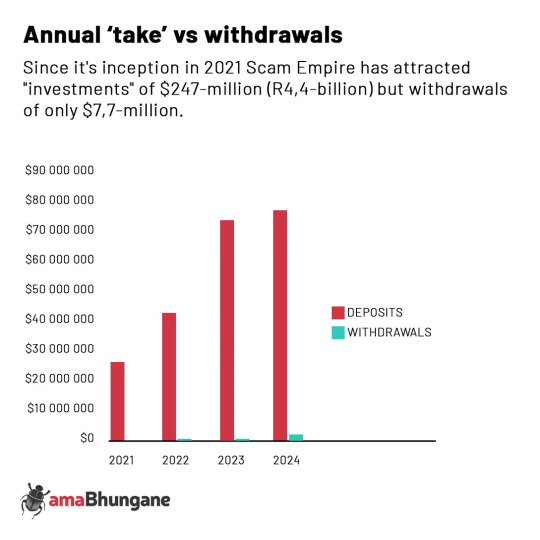

Based on our calculations from data in the leak, these centrally controlled “brands” appear to have collected deposits from tens of thousands of individuals across the world since the scheme’s relatively modest beginnings in 2021.

Records show that by the end of last year the total had swollen to at least $247-million — well over R4.4-billion.

Crucially, throughout the voluminous recordings, spreadsheets and other documents in the leak, there is very little proof that any of this money was actually used to trade anything.

Where trading seemingly did occur, the leak suggests that it was manipulated and under the control of a “dealing desk”. In a document describing “roles within the company”, the powers of this desk are said to include the ability “to make changes in ongoing trades, open/close, adjustment of pricing and even deleted ones when needed”.

Another major clue that these “investments” are very likely bogus is the negligible level of withdrawals or cash-outs that are reflected. Our interactions with victims suggest these are hard won and sometimes only follow complaints of fraud.

While effortless withdrawals are always part of the pitch for new recruits, the reality is that there are a host of ways to block these, often by claiming that victims have an “open position” on the market and have to wait a few days. After this wait they are either told that the “market went against them” or get cajoled into a new investment.

Our data shows that the system’s overall deposits of $247-million were followed by withdrawals of only $7-million globally over 70-odd platforms. That’s 3%.

South Africa has been a prominent target, but the available evidence shows that it has also played an outsized role in the larger international scheme’s tangled financial arrangements. Managers of the network also include a number of South African expats now based in Cyprus and Israel.

AmaBhungane will lift the veil on the wizards in the backroom and the complex fronts they have constructed in Part Two of this exposé.

For now, we will explore what for lack of a formal name we will call Scam Empire.

Step one: bait and switch

Clickbait ads are so ubiquitous that many of us simply accept them as an online nuisance, but the leak shows how shockingly effective this kind of online bait can be and how organised and cynical this opaque world is.

This completely unregulated business involves companies based far and wide.

Records in the leaks show that the companies that captured the most South Africans are based in Bulgaria, Israel, Singapore and the Czech Republic, among other places. More on them below.

For many victims of Scam Empire their ordeal started with an online ad featuring fake celebrity endorsements.

One South African who lost over R300,000 told us his involvement began with a fake video of Elon Musk on YouTube. Musk is in fact a ubiquitous fake feature, sometimes presented as punting the notorious and entirely fictitious “Quantum AI” trading robot.

Another victim who lost R400,000 says she was caught, ironically, by a Facebook ad featuring prominent local consumer rights journalist Devi Govender.

According to the victim, “Devi” was punting effortless risk-free income “from the comfort of your bed”.

Govender told us she has come across numerous scams using her name, so many in fact that she had to give up trying to stem the tide: “Don’t fall for it,” she warned.

These ads are the handiwork of so-called “affiliate marketers” who, in the parlance of the business, “sell traffic” to the online trading platform sites.

Since the marketers are independent of the client and unregulated, they can essentially make any ludicrous claim they want, without consequences.

It’s a big business, replete with international expos and networking events.

While there are legitimate reasons to fish for eyeballs online, the more than 160 marketers feeding victims to Scam Empire are being handsomely rewarded for this complicity, and often resort to naked lies.

Records in the leak show that when a new trading client makes a “first time deposit” the affiliate marketer pockets at least $750 (about R13,900). Tellingly, a South African “scalp” is generally worth $800, while a Canadian earns you closer to $ 1,100.

This is expressly set out in one marketing agreement in the leak where South Africa is relegated to “Tier 2” – one step above “Latam” (Latin America).

This seems to suggest that the majority of small one-time investors, the people putting in less than this fee, are actually loss-making for the trading platform scammers.

The whole model relies on repeat investors, often “whales” who put in ruinous amounts. The records show that there are, however, plenty of these. While half the deposits in 2024 were “first time”, follow-up investments make up 97% of the value.

It’s all about getting people hooked.

This seems to suggest that the majority of small one-time investors, the people putting in less than this fee, are actually loss-making for the trading platform scammers.

The whole model relies on repeat investors, often “whales” who put in ruinous amounts. The records show that there are, however, plenty of these. While half the deposits in 2024 were “first time”, follow-up investments make up 97% of the value.

It’s all about getting people hooked.

For the affiliates, these per capita payments rapidly add up as thousands of people sign on.

By January 2024, Scam Empire had probably spent between $36-million and $50-million (which is to say nearly R1-billion) “buying traffic”, a rough estimate arrived at by multiplying the number of victims by the lower and higher ends of the prices that generally apply.

Since then, it has spent another $11-million, according to amaBhungane’s partners in the Organized Crime and Corruption Reporting Project consortium who calculated this figure by analysing the cryptocurrency wallets almost universally used for payments.

Enter Vector

Recall the trading platforms ostensibly controlled by the unemployed Bulgarian Boris Kodzhov: Finbok and Finxocap.

These two platforms are operated by “his” South African company Vector Financial Services, much like the Romanian model Gugles’s Libra Wealth operates VP Trade.

Before this, Kodzhov also seemingly owned the ill-fated SkyMT.

The real hands controlling these operations are the subject of Part Two, but for now the basics are important.

Vector and Libra are what are known as juristic representatives. They piggyback on the financial services provider (FSP) licence of another company — in this case Astrix Data. This is legal.

As an aside, this structure was apparently very recently abandoned, but we will get to that in Part Two.

Finbok and Finxocap are big players and have seemingly left destruction in their wake.

They have taken in deposits of at least $13.4-million while allowing withdrawals of $1.3-million. Half of these withdrawals belonged to just two extremely large depositors, both of whom have proven hard to get hold of. Most victims are in South Africa, although the records show Finbok more recently branching out overseas.

By and large, everyone loses their money.

While the Financial Sector Conduct Authority said last year that it was investigating complaints from investors struggling to withdraw their “investments” from Finbok, it appears that the regulator is not aware that it is scratching the surface of a colossal international enterprise.

The investigation, we are told, is ongoing.

When it comes to Scam Empire, however, these South African companies are exceptional in a number of ways.

For one thing, they are actual companies with actual licences. Much of the larger scam consists of phantom platforms with no underlying legal entity, platforms that operate without licences or platforms that have licences in relatively lax island jurisdictions.

The South African ones in fact fall under a special “division” of the organisation named “ZA_Regulated”.

Dustan Cornelissen, the local director of Vector Financial Services, Libra Wealth and Astrix Data (he was not involved in SkyMT), told us everything was above board.

He states that he provides regulatory compliance but does not control the companies or the platforms which, he insists, are just portals the traders use to access markets.

On his version they knowingly expose themselves to high-risk trading and sometimes lose: “Losses are an unfortunate reality in any speculative financial activity, whether it be trading, online casinos, or sports betting. The individuals in question were traders, not ‘would-be investors’. Their decision to engage in trading was voluntary and based on their own risk assessment.”

Cornelissen told our partners at the Organized Crime and Corruption Reporting Project, “I have personally resolved every complaint lodged in South Africa by presenting a portfolio of evidence to the relevant authorities, including banks, the Financial Sector Conduct Authority, and the Ombudsman. To date, we have not lost a single case.”

We will consider Cornelissen’s role in more detail in Part Two. His assertions will need to be tested against evidence revealed in the leak concerning the wider network, evidence that indicates the use of front companies, suspicious financial arrangements, fake documents and fraud claims.

The leak also shows call centre “account managers” pushing clients into investments they barely understand, as well as the ubiquitous use of misleading advertising to lure in new “traders”.

Step two: Into the rabbit hole

The fake ads lead investors to the engine room — call centres.

First, they will land on the site of the trading platform “brand”. In the case of South Africans this would be Finbok and Finxocap (after the short-lived SkyMT bit the dust).

As a potential investor, you will be asked to fill in your details, and before long someone will call.

And call and call and call.

Everyone we and our partners spoke to cited the pushiness and incessant harassment they suffered or continue to suffer. Internal guidelines direct agents to call each assigned client three times per shift.

The sources of the calls are disguised, and you would most likely see a South African number on your phone.

The leak, however, has made it possible to track down the real physical locations from where agents call the various countries targeted by Scam Empire.

If you have ever received a call from Finbok it probably came from a Bulgarian office that is, confusingly, codenamed “Serbia”.

In “Serbia” there are subdivisions. Finbok is only one of the operations housed there, in an office our Organized Crime and Corruption Reporting Project partners recently visited only to be told it had been hastily evacuated in December.

Inside this “Serbia” office, the South African operation (Finbok) had two further codenames — “Bentley” and “D&J”.

And then there is Finxocap.

If you received a call from them before October last year it most likely came from a Cyprus office codenamed “Tesla”.

This then moved to the “Serbia” office and was renamed “Rolls Royce”.

The South Africa-based VP Trade platform — which targeted South Americans — was also in “Serbia”, but for at least a small period shifted to Barcelona, presumably because of a need for native Spanish-speaking agents.

The boiler room

Extensive records for the call centres reveal a shocking hothouse of bullying and deceit.

The leak contains thousands of hours of recorded calls and evaluations of individual calls where “agent risk” and “client risk” (for instance a client who might lay complaints or sue) had been identified.

Perhaps most telling are actual manuals and presentations on how to deal with hesitant “traders”.

The mostly East European agents have seemingly been carefully coached to push inexperienced clients towards often ruinous “investments”, but first they must test the waters and secure the first deposit.

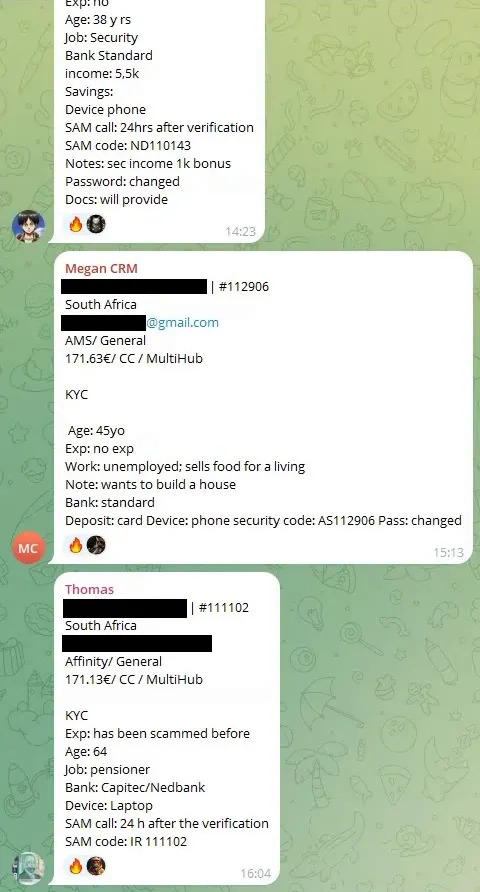

In chat groups the prospective investors’ profiles are posted as they come in, including telegrammatic notes on whether they had any experience with financial products and whether they had income or savings or, for instance, assets they could conceivably borrow against.

These are in many ways the most pointed demonstration of the cynicism roiling in the back room, especially since selling complex financial products to people with zero experience and little money is extremely unethical even before fraud enters the picture.

Some egregious examples of how new investors were described stand out:

“Really bad experience… part timer at some low-life job,” reads one of these missives about a 62-year-old who did make an investment.

“Note: most of his family members have died and he’s doing this with high hopes to have a better legacy to leave his children.”

Another note, dealing with a 45-year-old “client” who made a deposit with Finbok, reads:

“No Exp”

“Unemployed, sells food for a living”

“Note: wants to build a house”

The supposed finance whizzes on the phone who were making these notes did also, however, make efforts to befriend victims.

And there is a playbook for that.

The scammer’s manual

Contained in the leak are a variety of training materials, including a “bible of rebuttals” that gives country-specific advice on talking past people who object on the phone.

The instructions are straightforward and include, for instance: “We will ignore what the client says and keep talking fluently without stopping — here we must talk about profits and try to create a ‘hook’ for the client to ‘bite’ and then he will move on and forget the rebuttal.”

According to the “bible”, South Africans often lie that they don’t have their bank card on them. As a response, the manual suggests using “ammunition” such as “you want money for your new baby on the way”. Another option is to “stress him out” by claiming there are limited licences for the trading software left, or that some major event is imminent that could create profits.

If someone says they are afraid of being scammed, the agent should try “empathy” by saying “I was also scammed once long ago”.

If someone has previously lost money in a scheme: “Really (be a bit surprised) I’m so sorry to hear that!”

The agents working for the regulated South African companies are trained to avoid certain legally dangerous formulations. Specifically, they can never outright promise profits, but rather say something like “the majority of traders made around 30-40% returns last month”.

Even though fake celebrity endorsements are used via the affiliate marketers the agents themselves are supposed to avoid doing the same: “The agents must avoid direct affiliation with famous names or companies the customers see on the ads.”

This rule is broken often in practice.

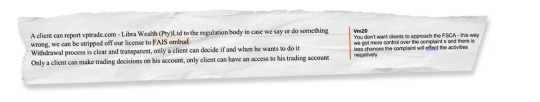

Possibly the most damning evidence of how agents are taught to lie or withhold information comes from an “office rules and guidelines” document dealing specifically with VP Trade, the platform of South Africa-based Libra Wealth.

A draft is in the leak showing how a manager added comments for changes.

One of the rules is that “office location cannot be shared”, to which the manager added a comment: “Remove — you don’t want this document to land in the hands of a third party — this must be conveyed orally.”

In a section titled “benefits of the regulation” agents are told they can inform clients that they can complain to the regulator. However, according to the manager they should guide the complainants to the FAIS ombud and not to the Financial Service Conduct Authority, which could suspend licences while conducting investigations.

“You don’t want clients to approach the FSCA — this way we got more control over the complaints and there is less chance the complaint will affect the activities negatively”

In a note that seems to indicate that the trading platforms are simply fake and do not “facilitate” investments is a “frequently asked questions” entry titled “How are you making money?”.

The draft claimed that “VP Trade makes a small commission (≈ 0.5-2%) on every position you open on the market!”

The manager, however, ordered this to be scrapped and said that “instead of mentioning commission we should rather explain how VP Trade makes money”.

In other words, the platform was choosing between two completely different options on what to tell prospective investors — an indication that perhaps neither is true.

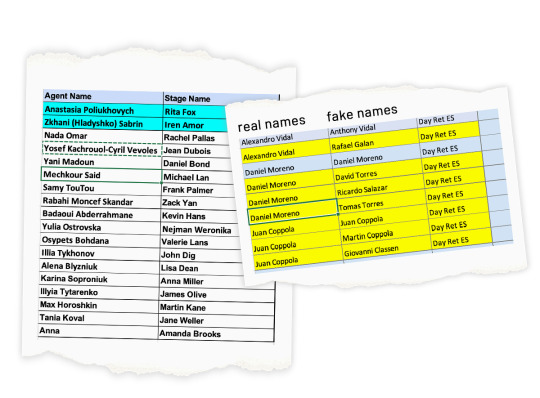

While agents are meant to build up a personal rapport, they also use fake “stage names” that are formally assigned. Tellingly, these often replace agents’ clearly Eastern European names with more Western-sounding ones.

Some agents have three different names they use with different clients.

According to the leak, there are close to 490 agents involved in the Scam Empire network. Those who manage to shake loose enough deposits are handsomely rewarded with bonuses and even gifts of expensive watches.

One particularly extreme case was an agent for one of the major unregulated platforms who seemingly received a Rolex, along with $130,000 in bonuses, after scamming Briton Stuart Daburn out of $5-million.

Tellingly, a record of office expenses contains the line item “Polygraph, fixed toilet, taxi for security”, as well as a number of party-related costs, including “deposit for midgets”.

Despite the careful coaching, agents often go off script. The leak contains masses of call reviews where agents’ problematic claims are highlighted.

By and large, these involve promising absurd profits or lying that Elon Musk is somehow involved and that there is some or other AI-powered trading robot doing all the work, which would be false even if there was real trading going on.

Step three: The money

Scam Empire’s financial arrangements are convoluted, opaque and heavily reliant on cryptocurrency. From the leaks, however, it is possible to paint a picture of how layers of fronts move money across the world.

As mentioned earlier, there is little sign that any money is actually invested in the things clients believe they are trading.

But before you get the money out you need to get the money in.

Setting up payment service providers for the various brands is a constant preoccupation, and all the platforms in Scam Empire have numerous ones — the records reflect up to 300 different services being used to collect money from “traders”.

The South African platforms seemingly made use of a number of extremely suspicious payment service providers that appear to have been stopgaps after more established ones withdrew due to fraud complaints.

For instance, a formal provider named Swiffy provided payment services for the SkyMT and Finbok platforms from May until November 2023.

In response to questions, it told us that it had terminated its services to these platforms due to fraud concerns. A “monitoring” spreadsheet in the leak shows at least three serious fraud allegations involving payments through Swiffy.

Swiffy added that “at the time of KYC checks both merchants were licenced with the Financial Sector Conduct Authority under the correct class of licence according to their stated business activities”.

Worryingly, one payment service provider that took Swiffy’s place was in fact a scrap metal dealer — in Part Two, we will deal with this and other dodgy payment service providers used by SkyMT and Vector.

Another established payment provider said they had no problems with Finbok, one of the brands linked to Vector.

They told us: “We have no recorded instances of fraud linked to this merchant… We note that the Financial Sector Conduct Authority has stated in its latest communication that its investigation is ongoing and that no findings have been made against any of the involved parties.”

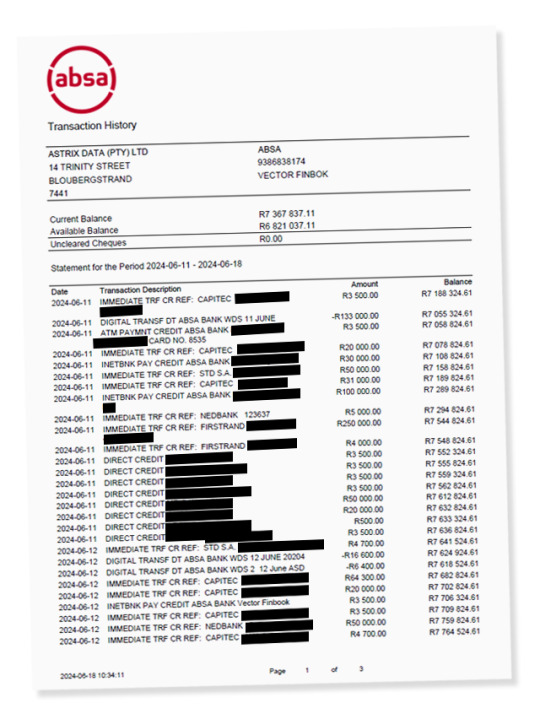

The online “traders” also paid a total of R68-million straight into the accounts of Astrix Data — the financial services provider behind Vector.

Apart from the massive payments for online advertising, it is not easy to discern where the money goes.

The sole director of Astrix in South Africa is Cornelissen.

In his version of how the platforms’ financial arrangements worked, traders would deposit their investments with Astrix either directly or indirectly through payment services like those mentioned above.

Even though the money is in Astrix’s account, the company “never holds clients’ funds”.

“Practically how this happens is that clients deposit funds via EFT or payment gateways which eventually settle to the Finbok/Finxocap accounts. These funds are then credited immediately to their trading profile by our liquidity providers. All funds deposited are reflected on their trading profile — clients have the ability to withdraw all their funds via card refund or EFT directly to their bank accounts, or they have the ability to trade. As such, we never hold clients’ funds.”

We have partial records for the accounts held by Vector and Astrix Data (the financial services provider behind it).

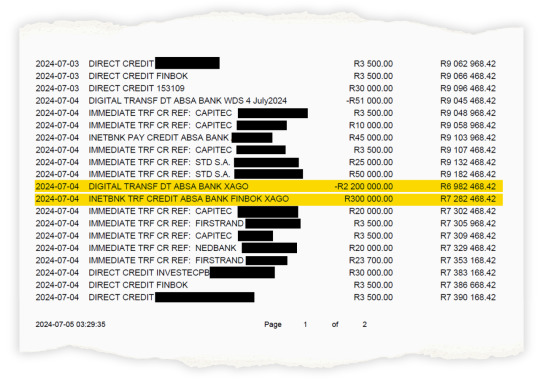

Payments from investors can be seen streaming in constantly. The only significant “exit” point discernable is payments to a Cape Town crypto payment provider named Xago Technologies.

Investors’ funds are regularly sent to Xago from Astrix. Xago keeps accounts in the UK and Switzerland.

Xago did not answer detailed questions but told us: “We categorically deny being complicit in or enabling fraudulent or money laundering operations. We are fully cooperative and willing to engage with any investigations launched by regulators or authorities.”

This company has cropped up in several places in the Scam Empire leak, as well as elsewhere.

Like the payment service providers mentioned above, Xago also directly channelled investment payments from a handful of large depositors, including a number of South African investors, to the online trading platform companies.

Xago has also come up in a court case launched by one of the victims in the UK: the aforementioned Stuart Daburn, who has lost several million pounds.

According to the particulars of his claim, he was told to pay Bitcoin into his investment account using Xago. He then paid £100,000 (almost R2.4-million) via this Cape Town company, with this becoming part of his loss.

This is a very partial window on the South African division of Scam Empire’s financial arrangements. As we will see in Part Two, however, it is indivisible from the larger global enterprise.

Get out

AmaBhungane and its Organized Crime and Corruption Reporting Project partners have contacted dozens of investors in Scam Empire platforms worldwide and they almost universally now claim it is a scam.

There are common experiences, including being frantically pushed to make new and different investments as soon as possible. When the investor signals that they want to take cash out of their trading account they suddenly unaccountably lose everything in a turn of supposed bad luck.

One victim who lost R1-million told us that after getting sucked into Finbok by a celebrity ad, his online “agent”, who went by the stage name “George Weber”, first pushed him into oil, then stocks, then foreign exchange, until he had essentially lost all his money.

The agent did remember to repeatedly quote the playbook mentioned above, advising the investor that “they make their profit on the spread”.

“It’s a total scam,” the “investor” told us.

His agent George seemingly often went off script with investment advice and once told a client he doesn’t “give a rat’s ass” about his negative experiences in the past, according to reviews in the leak.

Another victim mentioned earlier who lost R300,000 was likewise talked into one investment after another — oil then cocoa then sugar. He says he tried to withdraw R75,000, but 45 minutes later it had disappeared.

He insists that his trades were manipulated, saying that the prices he could see on the chart presented to him were not the ones reflected in his trades. According to him he suffered “deliberate sabotage” and was told it would take three days to get his money out. He suffered his “losses” during this period.

The calls between him and an agent were reviewed, and at one point the agent tried to push his wife to get a home improvement loan to invest with.

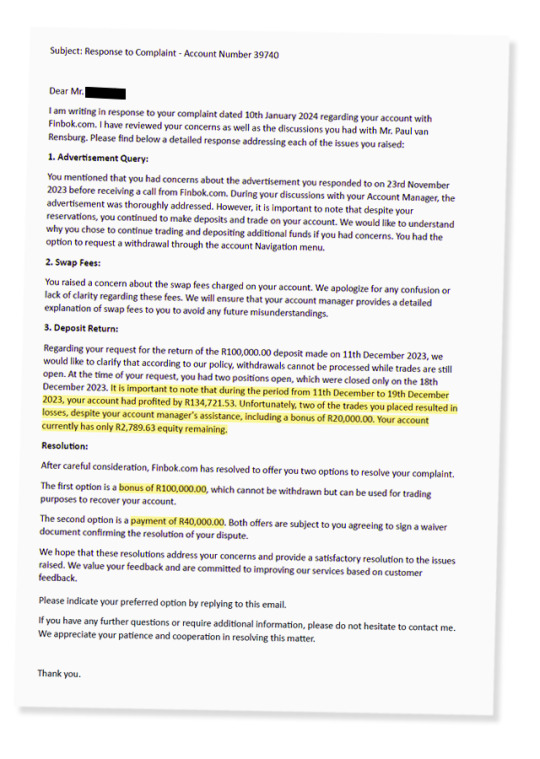

The “trader” laid a complaint and before long received a call from a man who will feature extensively in Part Two — the seeming legal head of Scam Empire’s South African division who calls himself “Paul van Rensburg”.

“Van Rensburg” made the hapless investor an offer: R100,000 credit, non-withdrawable, so he could keep going. Essentially a loan.

This seems like something “Van Rensburg” does according to documents in the leak where other traders are made similar offers, which are called “bonuses”.

In one case where an investor complained he was offered either a R100,000 “bonus” or R40,000 cash to walk away.

But these “traders” have something in common with a few hundred others who were allowed to withdraw at least some of their funds from Finbok: for some reason the company seemingly tried to disguise the fact that it had happened.

Fake trail?

In the leak there are hundreds of clearly fake invoices. They each have a Vector Financial Services letterhead but all the letterheads are wrong and have wildly different designs.

The invoices are all addressed to investors who had got withdrawals, and match the amounts and dates of those withdrawals.

But for some reason, all these invoices claim to be bills for “online marketing services”.

Even more confusingly, they state that the investor is to pay Vector but give the investor’s bank details for payment.

We spoke to some of the people these invoices are addressed to and they expressed complete ignorance. They had neither seen the documents nor ever provided “online marketing services”.

It is hard to know what to make of these invoices, which effectively create accounting cover for payouts to “investors” by describing them as business expenses.

This is, however, speculation, because with Scam Empire nothing is ever really straightforward.

Cornelissen told our partners at Organized Crime and Corruption Reporting Project that “the claim that invoices for marketing services matched withdrawals from Finbok is incorrect. If there was a template error in any invoice, it was an administrative oversight, not an attempt to misrepresent transactions.”

#VP Trade#AmaBhungane#Astrix Data#Boris Kodzhov#Crypto#Cryptocurrency#Devi Govender#Dewald van Rensburg#Dustan Cornelissen

0 notes

Text

Have you experienced boarding on a flight or any other means of transportation that is delayed by hours??Many of you did experience. But that delayed transportation made you reach your destination late.The same is the case in the networking world. Here delay is ascribed as ‘latency’. Latency means a delay between a user's action and a web application's response.Let’s talk about forex trading. Forex trading refers to exchanging national currencies against each other. You must be scratching your head thinking, what is the correlation between latency and forex trading? Forex trading is the world’s largest financial market, where trillions are traded daily. Latency influences the price charts. If excess latency is reduced, then the trader can make decisions on accurate and up-to-date information. Before we jump on the impacts of latency on forex trading, let's see what factors affect the network's latency - Type of Connection - cable and fiber connection, satellite connection that reduces or increases the latencyDistance - delay in the response as the server holding the content is far from the user’s location. Greater distance means greater latency!Congestion - congested data leads to high latency as it will take time to make the data in sequence before sending. Efficiency - an efficient network will deliver the content with the minimum delay in processing.Denial of Service Attacks - a security threat that does not allow the legitimate user to have access to the computer system.“Remember that time is money.” - Benjamin Franklin Here are the following ways in which latency impacts forex trading - Forex Trading Software Many forex VPS providers provide services to users. Forex VPS software has low latency, enabling a trader to carry on forex trading hassle-free. It provides security against any unforeseen event while performing trading online. A forex VPS is just not an automation tool. With low latency forex VPS, you can execute forex trading faster. In addition, a forex VPS allows traders to receive alerts faster than their competitors, which is a super specialty of latency. Here’s a List of Known Forex VPS Providers AccuWeb HostingOne of the best forex VPS providers is AccuWeb Hosting. You can trust their fully managed forex VPS for uninterrupted trading. While you choose AccuWeb Hosting, you are assured that your data is safe, their supportive technical experts take care of installing and setting up a firewall on your plan; additionally, they also configure on-demand antivirus software without any cost. AccuWeb has data servers in more than 15 different global locations, they provide 24*7 live technical support and a 99.9% uptime guarantee. FXVMWith high-performance, secure, and easy-to-use forex VPS hosting by FXVM takes your forex trading experience to the next level. FXVM makes sure that you face minimal latency to ensure faster execution of your orders. Forex VPSForex VPS’s fully optimized servers offer you a trading experience like you have never had before. With their comprehensive experience, they know what types of servers are best for you to get maximum benefits from your activities. Forex VPS has 5 data centers around the globe to support you during power outages. Router Hosting FX VPSChoose a reliable forex VPS and get started. Perform your trading with the lowest latency and gain profit in numbers. Speed Low latency means swift response. It is directly correlated with the price movement when trading online, especially forex trading. Here speed is in the context of connectivity or network speed. Good network speed helps the trader to base his or her decision on accurate, reliable, and up-to-date information. Every second, a ton of information streams in and out of your computer, so it is important to maintain a good network with reliable speed. The upload and download of information, surfing different sites for trading, connecting with brokers online, and many more details depend on one thing, SPEED!As a trader, you have to keep an eye on every possible thing going on in the financial world.

In a matter of seconds, if the information reaches you late, your decision will be affected. Latency helps streamline trading with efficient speed connectivity. Internet Connectivity Forex trading is a very delicate process. Latency influences internet connectivity, letting traders regularly perform ping tests and requiring unusual amounts of precision.Swift internet connectivity is very important for manual forex trading and crucial for automated trading. While trading online, you need to make a decision fast, and internet connectivity might impact speed also. Many consider internet connectivity an underrated asset and fail to realize that internet connectivity impacts speed, without which trading online would not be possible. Latency is all about speed and connectivity. It helps a trader to arrive at a decision. SlippageTraders cannot ignore this particular term in the forex market. Slippage often refers to a negative aspect of trading. What Exactly is Slippage?Slippage refers to the difference between the expected price of an asset against the actual price. Term ‘slippage’ is often heard in forex trading. Low latency can help avoid slippage as traders get a swift response while executing forex trading. Everything is interconnected from speed to slippage!!So, to reduce this negative aspect of trading, your forex VPS should be in the server's close vicinity, which will eventually reduce slippage in latency. Management of LatencyLow latency helps in carrying out different types of trading operations. One great advantage of using forex VPS software is that the low retail traders can minimize latency issues wherever they can, and their data is secured. However, giant individual firms invest a large amount of capital in low-latency infrastructure. To optimize trading performance and low latency, a trader needs to - Update its hardwarePerform test ping to measure internet connectivityEvaluate your trading platform timely.Summary Without any further latency, start your trading journey now. For better latency, you need not reside near a server. Instead, have good internet connectivity with the reliable speed at your place. Latency provides you accurate information about all the ups and downs in the forex trading world, enabling you to earn manifold profits. Above all, latency and forex trading go hand in hand. Every second in forex trading counts, and if every nanosecond means to gain or lose millions of dollars, then a network with the lowest latency should be your top priority.

0 notes

Text

10 Best Forex Virtual Private Server (VPS) for 2025 – Top 10 Providers Compared

In this article, Im going to walk through the best Forex virtual private server (VPS) options that give traders lightning speed, rock-solid uptime, and round-the-clock connectivity. A trustworthy Forex VPS can slash lag, brighten trade execution, and keep your robots running without interruption. No matter if you are just starting or already have years of charts behind you, picking the right…

0 notes

Text

VPS Chạy Hệ Điều Hành Windows - Giải Pháp Linh Hoạt Trong Kỷ Nguyên Số

Trong thời đại công nghệ số, nhu cầu sử dụng các hệ thống máy chủ ảo (VPS) để vận hành phần mềm, lưu trữ dữ liệu hoặc chạy các ứng dụng doanh nghiệp đang tăng nhanh chóng. Trong số các giải pháp VPS hiện có, VPS chạy hệ điều hành Windows nổi bật nhờ khả năng tương thích cao, dễ sử dụng và hỗ trợ đa nhiệm mạnh mẽ. Bài viết dưới đây sẽ giúp bạn hiểu vì sao nên lựa chọn VPS Windows và nó có thể giúp gì cho bạn trong công việc và cuộc sống hàng ngày.

Dễ Dàng Tiếp Cận Và Sử Dụng Ngay

Không giống như các hệ điều hành mã nguồn mở như Linux, Windows là nền tảng quá quen thuộc với đa số người dùng Việt Nam. Giao diện đồ họa thân thiện, các thao tác như copy, cài đặt phần mềm hay làm việc qua Remote Desktop đều tương tự như máy tính cá nhân, giúp tiết kiệm thời gian làm quen. Nếu bạn không phải là dân kỹ thuật, bạn vẫn có thể sử dụng VPS Windows mà không cần học các dòng lệnh phức tạp.

Tương Thích Với Các Phần Mềm Doanh Nghiệp

Rất nhiều phần mềm kế toán, phần mềm bán hàng, hoặc ứng dụng nội bộ của doanh nghiệp chỉ tương thích với hệ điều hành Windows. Nếu bạn đang sử dụng các phần mềm như MISA, FAST, HTKK hoặc phần mềm ERP, thì VPS chạy hệ điều hành Windows là lựa chọn bắt buộc để đảm bảo hiệu suất làm việc ổn định. Ngoài ra, các nền tảng như .NET Framework, SQL Server, RemoteApp cũng hoạt động tốt hơn khi chạy trên môi trường Windows Server.

Làm Việc Từ Xa Dễ Dàng, Linh Hoạt

Sau đại dịch COVID-19, xu hướng làm việc từ xa (remote work) ngày càng phổ biến. VPS Windows cho phép bạn truy cập hệ thống doanh nghiệp mọi lúc, mọi nơi thông qua Remote Desktop Protocol (RDP).

Bạn có thể:

Làm việc từ nhà, văn phòng, hoặc khi đi công tác

Chia sẻ quyền truy cập cho nhân viên

Truy cập dữ liệu nội bộ mà không cần mang theo laptop

Đ��c biệt, VPS hoạt động 24/7, bạn không cần bật máy tính cá nhân suốt ngày, giúp tiết kiệm điện và tăng tuổi thọ thiết bị.

Đa Dạng Ứng Dụng Trong Thực Tế

Không chỉ phục vụ doanh nghiệp, VPS chạy hệ điều hành Windows còn phù hợp với nhiều mục đích khác:

Trader tài chính: Cài đặt phần mềm MT4/MT5 để giao dịch liên tục, tránh mất kết nối khi tắt máy cá nhân

SEO/Marketing: Chạy tool auto traffic, auto post, quản lý tài khoản mạng xã hội

Học tập và nghiên cứu: Sinh viên IT, lập trình viên có thể sử dụng VPS để test code, chạy phần mềm hoặc mô phỏng server

Hosting website chạy nền tảng ASP.NET: Rất ít nhà cung cấp hỗ trợ ASP.NET nếu không có môi trường Windows Server

An Toàn, Ổn Định, Và Có Hỗ Trợ Chính Thức Từ Microsoft

Hệ điều hành Windows Server đi kèm nhiều tính năng bảo mật như Windows Defender, Firewall tích hợp, và cập nhật tự động từ Microsoft. Điều này giúp bạn yên tâm khi lưu trữ dữ liệu quan trọng hoặc vận hành hệ thống doanh nghiệp trên VPS. Ngoài ra, nếu bạn mua VPS từ các nhà cung cấp uy tín, hệ điều hành sẽ được cài đặt bản quyền, đảm bảo an toàn pháp lý và hiệu suất hoạt động ổn định.

Một Số Lưu Ý Khi Chọn VPS Windows

Để tận dụng tốt nhất sức mạnh của VPS chạy hệ điều hành Windows, bạn cần lưu ý một vài yếu tố: Cấu hình: Với các tác vụ nhẹ, bạn có thể chọn VPS từ 2GB RAM. Tuy nhiên, với ứng dụng lớn hoặc dùng nhiều người, nên chọn 4GB – 8GB RAM và CPU mạnh hơn. Tốc độ mạng: Đảm bảo VPS có băng thông cao và đặt tại Data Center gần bạn (ví dụ trong nước) để giảm độ trễ. Hỗ trợ kỹ thuật: Ưu tiên chọn nhà cung cấp có đội ngũ hỗ trợ 24/7 qua live chat, ticket hoặc điện thoại.

Kết Luận

VPS chạy hệ điều hành Windows là một công cụ mạnh mẽ, linh hoạt và dễ sử dụng cho cả cá nhân và doanh nghiệp. Từ việc chạy phần mềm nội bộ, đ��n hosting website hoặc thực hiện giao dịch tài chính, VPS Windows luôn là một trợ thủ đắc lực giúp bạn nâng cao hiệu suất làm việc trong kỷ nguyên số. Nếu bạn đang tìm kiếm một giải pháp máy chủ ảo có giao diện thân thiện, tương thích phần mềm tốt và hoạt động ổn định 24/7 – thì VPS Windows chính là lựa chọn nên ưu tiên.

Tìm hiểu thêm: https://vndata.vn/vps-windows-gia-re/

0 notes

Text

Leveraging VPS for Optimal Forex Trading Performance

Leveraging a Virtual Private Server (VPS) for forex trading offers numerous advantages, enhancing execution speed, reliability, and security. A VPS ensures continuous 24/7 trading by hosting automated strategies and trading platforms in a stable, low-latency environment. This setup minimizes downtime risks associated with personal computers, such as power outages or connectivity issues, and provides robust security features to protect trading activities. Additionally, a VPS allows for remote access from any device, offering flexibility and scalability as trading demands grow. By optimizing performance and reducing latency, a VPS becomes an essential tool for both novice and experienced forex traders aiming for success.

2 notes

·

View notes

Text

🚀 Trade Without Interruptions! Power your strategies with superfast, offshore Forex VPS Hosting by QloudHost. ✅ Ultra-low latency ✅ 24/7 uptime ✅ Global server locations

📈 Perfect for traders who demand speed, security & stability.

🔗 Explore Now 👉 https://qloudhost.com/forex-vps-hosting/

0 notes

Text

🚀 Trade Without Interruptions! Power your strategies with superfast, offshore Forex VPS Hosting by QloudHost. ✅ Ultra-low latency ✅ 24/7 uptime ✅ Global server locations

📈 Perfect for traders who demand speed, security & stability.

🔗 Explore Now 👉 https://qloudhost.com/forex-vps-hosting/

0 notes