#WealthBuildingStrategies

Explore tagged Tumblr posts

Text

Get Personal Finance Insights On Hybrid Finance Guide

Explore in-depth articles on Personal Finance at Hybrid Finance Guide. Gain insights into market trends and enhance your financial knowledge. Discover more now!

0 notes

Text

Why Homeownership Builds Wealth: Key Benefits of Buying a Home

Why Homeownership Still Outweighs Renting: Understanding Wealth Creation through Property Investment

In recent years, the debate between renting and buying a home has intensified, especially as interest rates continue to rise. Many argue that renting provides greater flexibility and is a smarter financial option, particularly in a fluctuating housing market. However, when it comes to long-term wealth building, the facts strongly support homeownership. Despite short-term challenges like higher interest rates and larger upfront costs, owning a home remains one of the most effective strategies for building wealth. The net worth of homeowners is, on average, 40 times greater than that of renters, and this disparity largely comes down to key advantages inherent in owning property.

Let’s explore the financial benefits of homeownership, and why buying a home still makes sense, even in today's complex market.

Equity Building: Transforming Your Home into an Asset

One of the most compelling reasons to buy a home is the ability to build equity over time. Each mortgage payment you make increases your ownership stake in the property. In contrast to rent, which is an expense with no return, each payment towards a home loan reduces the principal and grows your personal wealth.

Equity represents the portion of your home that you actually own. As you pay down your mortgage, your equity in the property increases. Over time, this could be leveraged for future investments, be it a second property or funding a business.

With renting, you are essentially contributing to someone else’s equity. No matter how long you rent, you never own the property, and your monthly payments don’t increase your personal wealth. This is where homeownership creates a lasting financial advantage.

Appreciation Potential: Property Value Growth

Historically, property values appreciate over time. While there are market fluctuations, real estate typically follows an upward trend in the long run. Even modest annual increases in home values can add significant wealth to homeowners over time. Here's how appreciation works to your advantage:

Home appreciation is the rise in your property’s value over time. This is often the most powerful aspect of owning a home. The longer you hold onto your property, the greater your potential gains. Even during economic downturns, homes tend to regain their value as markets recover.

For example, a home bought for $300,000 that appreciates at 3% annually could be worth approximately $400,000 in just 10 years. This increase in value adds to your net worth without any additional investment on your part, aside from maintenance and property care.

Renters, on the other hand, do not benefit from appreciation. Once your lease ends, the value of the property is irrelevant to you as you move on to your next rental.

Tax Benefits: Savings for Homeowners

Homeownership offers several tax advantages that renters miss out on. These tax benefits are particularly important when considering the overall cost of owning a home versus renting. Some of the key tax advantages include:

Mortgage interest deduction: Homeowners can deduct the interest paid on their mortgage, especially in the early years when interest makes up a large portion of monthly payments. This deduction can result in significant savings come tax season.

Property tax deduction: You can deduct state and local property taxes, which can reduce your overall tax liability. For many homeowners, these deductions add up to substantial yearly savings.

Capital gains tax exemption: When you sell your primary residence, you may qualify for an exemption from capital gains taxes on profits up to $250,000 for single filers and $500,000 for married couples. This is a massive advantage for long-term homeowners whose properties have appreciated over the years.

Renters, unfortunately, do not benefit from these tax incentives. Their monthly rent payments do not offer any tax deductions or savings.

Inflation Protection: Fixed-Rate Loans Shield Homeowners

Another key financial advantage of owning a home is protection against inflation. While rent payments tend to rise with inflation, those who own a home with a fixed-rate mortgage are insulated from these increases.

Fixed-rate mortgages lock in your monthly payments for the life of the loan. As inflation drives up costs for renters, including housing, utilities, and services, your home loan payment remains stable. This fixed cost makes it easier to budget and plan for the future without worrying about unexpected rent hikes.

Renters, on the other hand, are at the mercy of the rental market. As inflation pushes rent prices higher, they may find themselves paying significantly more for the same property over time. This can create financial stress and instability, especially for those on fixed incomes or tight budgets.

Control and Stability: Freedom to Personalize and Stay Long-Term

Owning a home also offers a level of control and stability that renting simply cannot provide. As a homeowner, you have the freedom to modify your home to suit your personal tastes and needs. Whether it’s a simple renovation, landscaping, or major structural changes, the decisions are entirely up to you.

Customization: Homeowners can renovate, remodel, and personalize their homes to fit their lifestyle and preferences. This not only enhances your quality of life but can also add to the home’s market value when it’s time to sell.

Stability: Unlike renters, homeowners are not subject to the whims of landlords or sudden changes in rent. You can stay in your home as long as you choose, without worrying about lease renewals or relocation due to rising rent costs.

Renting, while flexible, often comes with restrictions on changes to the property and no guarantee of long-term tenure.

Renting: A Short-Term Solution with No Wealth Creation

While renting can offer flexibility, particularly for those unsure of where they want to settle, it does not contribute to long-term wealth creation. Renters often miss out on the financial benefits that homeowners enjoy, including equity building, appreciation, tax savings, and inflation protection.

100% expense: Rent is an expense with no return. Each payment you make goes to your landlord’s mortgage or their pocket, while you build no personal wealth.

No equity: Since renters do not own the property, there is no opportunity to build equity. This means that when the lease is over, the money spent on rent is gone without any financial benefit.

Conclusion: Homeownership Remains a Powerful Wealth-Building Tool

Despite rising interest rates and the challenges of the current market, homeownership continues to be one of the most effective ways to build wealth over time. From equity building and property appreciation to tax benefits and inflation protection, the financial advantages of owning a home far outweigh the short-term convenience of renting.

While renting may offer flexibility, it provides no long-term financial return. In contrast, every mortgage payment made towards a home increases your personal net worth and creates a stable financial future.

What’s your take – does owning a home still seem like the smarter choice in today's market, or do you believe renting makes more sense? Let us know your thoughts.

#Homeownership#WealthCreation#EquityBuilding#PropertyInvestment#FinancialFreedom#BuyVsRent#RealEstateInvestment#PropertyAppreciation#MortgageBenefits#TaxAdvantages#LongTermWealth#InvestmentProperty#InflationProtection#HomeEquity#FinancialStability#PropertyWealth#HomeBuyingTips#SmartInvesting#RealEstateWealth#RealEstateTips#HomeownerJourney#WealthBuildingStrategies#HomeOwnershipGoals#FirstTimeHomeBuyer#BuildYourFuture#PropertyKumbh

0 notes

Text

Stop Wasting Money On Rent And Start Building Equity!

https://www.youtube.com/watch?v=uw_LeW1Q20w 📉 Renting = Paying your landlord’s mortgage 📈 Owning = Paying yourself by building equity and long-term wealth If you’re spending money every month anyway… Why not make it work for you instead of making someone else rich? 💡 When you buy a home, your mortgage payments build equity—your future, your asset, your financial freedom. Don’t let rent steal your wealth-building potential. 📩 Message me and I’ll show you how to turn your rent payment into a step toward ownership and opportunity. #StopRenting #BuildEquity #RealEstateWealth #MortgageTips #HomeBuyingHelp #RealEstateInvesting #WealthBuildingStrategy #MoneyMakingMoves #BuyAHome2025 #FinancialFreedom #SmartInvesting #PassiveWealth #MortgageAdvisor #FirstTimeHomeBuyer #OwnYourFuture #TimHumphreyMortgage #RentVsBuy #RealEstateGoals #HomeOwnershipMatters #MoneyMindset 🔔Hit subscribe for the latest expert insights and valuable podcasts on mortgage tips, real estate trends, and strategies to grow wealth through smart property decisions! https://www.youtube.com/@HumphreyMortgage/?sub_confirmation=1 ✅ Important Link to Follow 🔗 Linktree https://ift.tt/zBWfx1F ✅ Stay Connected With Me. 👉 Instagram: https://ift.tt/H4c1rW0 👉 Linkedin: https://ift.tt/zDhyR6T 👉 Website: https://ift.tt/xWYKoNB 📩 For Business Inquiries: [email protected] ============================= 🎬 Recommended Playlists 👉 Mortgage Lab https://www.youtube.com/playlist?list=PLuGT35X1mS76AUvaPHN8IuRCi-FxrI3-C 👉 Mortgage Lab Podcast https://www.youtube.com/playlist?list=PLuGT35X1mS74oOo8OcrSd12Apdwv2FrYS 🎬 WATCH MY OTHER VIDEOS: 👉 What Is Debt-To-Income Ratio? How It Affects Mortgage Approval Explained https://youtu.be/mNB9acNqJds 👉 Top 7 Mistakes To Avoid For Mortgage Approval – Essential Home Buying Tips https://youtu.be/BLxBsmXvqkw 👉 How Mortgage Insurance Helps You Buy A Home With Less Than 20% Down | Real Estate Tips https://youtu.be/yjmPHZdBmx0 👉 How To Increase Your Home Sale Profits With Pre-Sale Renovations https://www.youtube.com/watch?v=DL81T99XPs0 👉 Real Estate In 2024: Essential Market Trends And Challenges To Watch | Real Estate Tips https://www.youtube.com/watch?v=-_fBuasdX8o ============================= ADD HASHTAGS ⚠️ Disclaimer: Ideas expressed may not be complete and may not apply to all situations. NEO Home Loans is a division of Luminate Home Loans, Inc. | NMLS #150953 | Luminate Home Loans, Inc. NMLS#150953. Equal Housing Lender. Corporate Headquarters 2523 Wayzata Blvd. S. Suite 200, Minneapolis, MN 55405. For licensing information, go to https://ift.tt/V4KO6jr. This advertisement does not constitute a loan approval or loan commitment. Loan approval or loan commitment is subject to final underwriting review and approval. Other terms and conditions apply. ✖️ Copyright Notice: This video and my YouTube channel contain dialogue, music, and images that are the property of Tim Humphrey. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my YouTube channel is provided. © Tim Humphrey via Tim Humphrey https://www.youtube.com/channel/UCYIh6njt7ARosNWhQCi93Aw May 23, 2025 at 04:01PM

#humphreymortgage#homerenovation#homesellingtips#realestate#realestatepodcast#mortgage#finance#realestateinvesting

0 notes

Text

youtube

How to Build Wealth Starting from $0: Proven Strategies for 2025 Free Report ➡️ 7 Costly Mistakes That Keep Entrepreneurs From 7 Figures ➡️ https://ift.tt/3mLhHoI Discover actionable strategies to build wealth starting from $0 in 2025. Whether you're new to entrepreneurship or looking to scale, this video provides step-by-step guidance to leverage your time and skills for financial growth. These strategies are designed for aspiring entrepreneurs and individuals seeking financial independence. In this video, we delve into practical methods to build wealth without any initial investment. Learn how to: - Utilize your skills to generate income - Leverage online platforms for business opportunities - Reinvest earnings for sustainable growth - How to build wealth with no money - Wealth building strategies 2025 - Entrepreneurship without capital - Freelancing for beginners - Online business opportunities - Freelancing tips for beginners 2025 #BuildWealthStartingFromZero #wealthbuildingstrategies #EntrepreneurshipWithoutCapital #freelancingforbeginners #onlinebusinessopportunities For more resources, visit https://ift.tt/8DeiX0B Instagram: https://ift.tt/U1oC4cw LinkedIn: https://ift.tt/fuoa91R via Larry Davis https://www.youtube.com/channel/UCFnOcVA9sgGWFCRz6vTCBGA April 30, 2025 at 03:29AM

#training#lifecoaching#teambuilding#executivecoaching#businessconsulting#leadershipdevelopment#marketingautomation#businessgrowth#Youtube

0 notes

Photo

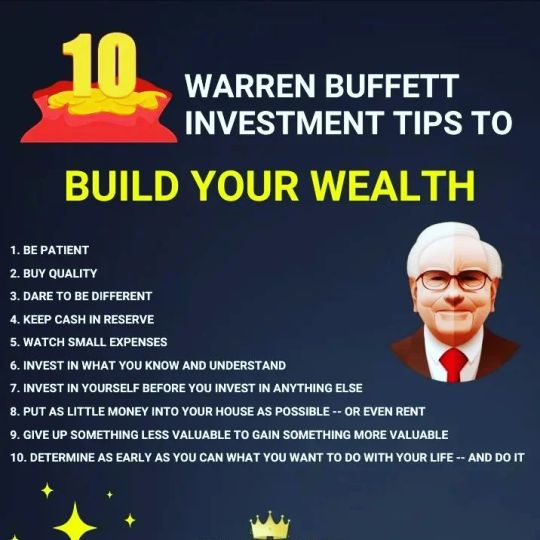

👑 Follow @ab_stockmarket - Lets Dominate The Business Empire 👑 ~ Leave Your Comments 💬 Thoughts And Suggestions Below! 👇 ~ Save This Post For Later! 📌 ~ Share This Post With Your Friends! 📲 ~ Tag Someone Who Need To See This! 🏷 ~ ~ Turn On Post Notifications! 🔔 ~ Hashtags ✅ : 👇 #wealthattraction #financialwealth #wealthlifestyle #wealthlife #wealthmanagment #wealthofknowledge #wealthymindsets #wealthstrategist #wealthisamindset #wealthbuildersworldwide #wealtheducation #wealthyblacksingles #wealthprinciples #wealthteam #wealthness #wealthyinsoul #realwealth #wealthbuildingstrategies #mywealth #wealthcoaching #getwealthy #wealthdistribution #longtermwealth #wealth_generation #wealthcare #wealthcreationtips #wealthyquotes #financially #millionairmindset . . . #EmpireDominator 👑 (at Benglore) https://www.instagram.com/p/Cki9x4mSly3/?igshid=NGJjMDIxMWI=

#wealthattraction#financialwealth#wealthlifestyle#wealthlife#wealthmanagment#wealthofknowledge#wealthymindsets#wealthstrategist#wealthisamindset#wealthbuildersworldwide#wealtheducation#wealthyblacksingles#wealthprinciples#wealthteam#wealthness#wealthyinsoul#realwealth#wealthbuildingstrategies#mywealth#wealthcoaching#getwealthy#wealthdistribution#longtermwealth#wealth_generation#wealthcare#wealthcreationtips#wealthyquotes#financially#millionairmindset#empiredominator

2 notes

·

View notes

Link

As you well know, for the last 2 years, Americans have seen an unprecedented amount of cash spiraling into our economy, and the long-term consequences of this wild government spending are still unknown.

We all know that nothing in this life is free and of course, it’s a lot more fun to spend other peoples’ money than to spend your own. What happens when all that debt turns into a category F5 twister? The sirens are already sounding.

Every government benefit, every no-interest loan, or other proposal comes with a long fishing line attached to your wallet. All government “aid” comes at the expense of the governed- in the form of higher taxes.

#100yearrei#taxtornado#taxwarning#finances#realestateinvestor#government spending#highertaxes#wealthbuildingstrategies#taxadvantage#social security benefits

0 notes

Photo

THIS FRIDAY @ 11:00 AM ON GOSPELRADIONATION.COM AND FACEBOOK LIVE: "MILLIONAIRE MINDSET SHOW" OUR SPECIAL GUEST OF THE WEEK: ALANDO FRANKLIN CEO OF THE US COMPANY, LLC TOPICS: AN ALTERNATIVE TO PAYDAY LOANS WHERE DO WE GO FROM HERE AND EVERYTHING ELSE #millionairemindse #buildingwealththroughrealestate #wealthbuildingstrategies #wealthcreationstrategies #livingyourdreamlife #entrepreneurcoaching #lifecoaching #entrepreneurship101 #generationalwealthbuilders (at Millionaire Mindset Show) https://www.instagram.com/p/CB3HWnIgPYc/?igshid=de88pmhh5ua5

#millionairemindse#buildingwealththroughrealestate#wealthbuildingstrategies#wealthcreationstrategies#livingyourdreamlife#entrepreneurcoaching#lifecoaching#entrepreneurship101#generationalwealthbuilders

0 notes

Text

youtube

How to Become a Millionaire Faster: Wealth, Live the Rich Life & Fast-Track Your Financial Freedom! THE PROFIT PLAYBOOK: 12-STEP PLAN TO DOUBLE THE PROFIT OF ANY BUSINESS ➡️ https://ift.tt/EZQl6bt In this video, I’ll reveal powerful strategies to become a millionaire faster and unlock wealth, all while living the rich life. Most people follow the traditional, slow path of building wealth—working a 9-5 job and saving for 40 years—but this doesn’t work anymore. If you want to build wealth quickly and enjoy it while you're young, this video is for you. You’ll learn the secrets to breaking free from the average path and accelerating your wealth-building journey, including: Mindset shifts to fast-track your financial freedom How to create scalable businesses that generate passive income Why entrepreneurship is key to building wealth faster than a regular job How to leverage systems and automation for long-term financial success The importance of maintaining an emergency fund for financial flexibility By implementing these actionable steps, you’ll be on your way to unlocking your rich life in no time! Watch till the end to find out how to start your wealth-building journey today. Don't forget to like, subscribe, and hit the bell to get notified on more wealth-building strategies and tips for financial freedom. #millionairemindset #fastwealthbuilding #financialfreedom #entrepreneurship #wealthbuildingstrategies via Larry Davis https://www.youtube.com/channel/UCFnOcVA9sgGWFCRz6vTCBGA March 08, 2025 at 04:12AM

#training#lifecoaching#teambuilding#executivecoaching#businessconsulting#leadershipdevelopment#marketingautomation#businessgrowth#Youtube

0 notes