#LongTermWealth

Text

Futoshi Tachino’s Top 5 Tips for Building Long-Term Wealth

In this episode, join us as financial advisor Futoshi Tachino shares his expert insights on how to build long-term wealth. Learn how to create a solid financial plan, invest wisely, live below your means, continuously educate yourself about personal finance, and plan for retirement early. Whether you’re just starting your financial journey or looking to fine-tune your strategy, Futoshi’s tips will provide you with the knowledge and motivation you need to achieve financial security and prosperity. Tune in now and take the first step towards a wealthier future!

#Podcast#FinancialPlanning#WealthBuilding#InvestWisely#PersonalFinance#RetirementPlanning#FinancialLiteracy#MoneyManagement#FutoshiTachino#LongTermWealth

0 notes

Text

Why Paying Yourself First Means Buying Bitcoin

Introduction

In the journey toward financial independence, one of the most crucial strategies is the concept of “paying yourself first.” This time-tested approach means setting aside a portion of your income for your future self before you pay your bills or indulge in spending. And in today’s digital age, one of the most promising ways to do this is by investing in Bitcoin.

What Does It Mean to Pay Yourself First?

Paying yourself first isn’t just a financial tactic; it’s a mindset that prioritizes long-term financial well-being over immediate gratification. By allocating funds to your savings or investments as soon as you receive your income, you ensure that you’re building a financial safety net and accumulating wealth over time. When it comes to choosing where to invest these savings, Bitcoin presents a compelling option.

Why Choose Bitcoin?

Bitcoin is unique due to its limited supply and decentralized nature, making it a strong candidate for safeguarding value against inflation and economic uncertainty. Unlike traditional currencies, Bitcoin is not subject to the whims of governmental monetary policies. Its built-in scarcity—only 21 million Bitcoins will ever exist—suggests its potential to increase in value over time, akin to precious metals like gold, yet with the digital ease of transfer and storage.

How to Start Investing in Bitcoin

Getting started with Bitcoin is simpler than many might think. The first step is setting up a digital wallet, which can be done through various trusted platforms. Next, you can start purchasing Bitcoin through a cryptocurrency exchange. Even a small recurring purchase, such as buying a fixed amount every month, can help in building your Bitcoin holdings gradually—a strategy known as dollar-cost averaging, which can reduce the impact of volatility.

Long-Term Benefits of Investing in Bitcoin

Historically, Bitcoin has shown significant growth, with its value experiencing substantial appreciation over the past decade. For those who treat it as a long-term investment, Bitcoin has been a valuable asset. While past performance is not indicative of future results, the ongoing adoption of Bitcoin as a store of value and a medium of exchange globally suggests its potential continued relevance and demand.

Conclusion

Investing in Bitcoin can be an excellent way to embody the principle of paying yourself first. By dedicating a portion of your income to acquire Bitcoin, you are not just saving; you are potentially growing your wealth with one of the 21st century’s most innovative financial assets. As with any investment, it’s essential to do your own research and consider your financial situation and risk tolerance.

Call to Action

Are you ready to start your journey with Bitcoin, or do you have more questions about how to begin? Share your thoughts in the comments below or reach out for more information. Let’s embrace the financial revolution together.

#FinancialIndependence#PayYourselfFirst#InvestingInBitcoin#DigitalCurrency#BitcoinInvestment#CryptoEducation#WealthBuilding#FinancialStrategy#EconomicFreedom#BitcoinRevolution#CryptoInvestment#DigitalAssets#SmartInvesting#LongTermWealth#FinancialFuture#bitcoin#financial education#financial empowerment#financial experts#finance#blockchain#cryptocurrency#unplugged financial#globaleconomy

1 note

·

View note

Text

Building Financial Fortunes: How Portfolio Management Drives Investment Success

Read More- https://www.goldenbulls.co.in/building-financial.../

#PortfolioManagement#InvestmentSuccess#WealthBuilding#StrategicInvesting#RiskManagement#Diversification#LongTermWealth#MarketMastery#InvestmentJourney#FinancialFortunes#FinancialComposition#InvestmentStrategies#Goldenbulls

0 notes

Text

1 note

·

View note

Text

Don't stop until you are proud💯💥

#realestatemotivation#realestatequotes#realestatepowerhouse#quotesoftheday#longtermwealth#propertymanagementspecialists#propkeysconsulting

0 notes

Photo

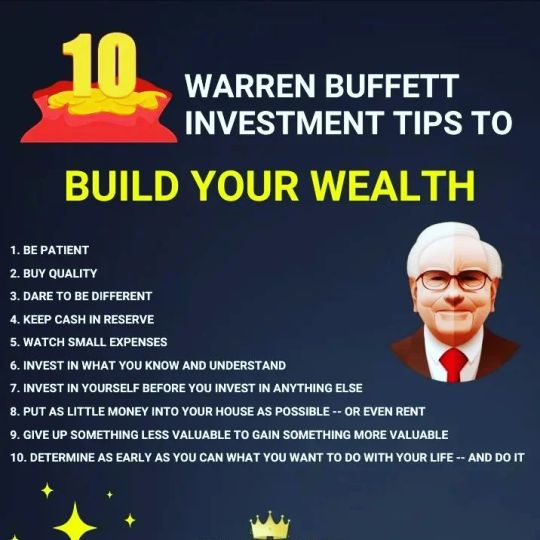

👑 Follow @ab_stockmarket - Lets Dominate The Business Empire 👑 ~ Leave Your Comments 💬 Thoughts And Suggestions Below! 👇 ~ Save This Post For Later! 📌 ~ Share This Post With Your Friends! 📲 ~ Tag Someone Who Need To See This! 🏷 ~ ~ Turn On Post Notifications! 🔔 ~ Hashtags ✅ : 👇 #wealthattraction #financialwealth #wealthlifestyle #wealthlife #wealthmanagment #wealthofknowledge #wealthymindsets #wealthstrategist #wealthisamindset #wealthbuildersworldwide #wealtheducation #wealthyblacksingles #wealthprinciples #wealthteam #wealthness #wealthyinsoul #realwealth #wealthbuildingstrategies #mywealth #wealthcoaching #getwealthy #wealthdistribution #longtermwealth #wealth_generation #wealthcare #wealthcreationtips #wealthyquotes #financially #millionairmindset . . . #EmpireDominator 👑 (at Benglore) https://www.instagram.com/p/Cki9x4mSly3/?igshid=NGJjMDIxMWI=

#wealthattraction#financialwealth#wealthlifestyle#wealthlife#wealthmanagment#wealthofknowledge#wealthymindsets#wealthstrategist#wealthisamindset#wealthbuildersworldwide#wealtheducation#wealthyblacksingles#wealthprinciples#wealthteam#wealthness#wealthyinsoul#realwealth#wealthbuildingstrategies#mywealth#wealthcoaching#getwealthy#wealthdistribution#longtermwealth#wealth_generation#wealthcare#wealthcreationtips#wealthyquotes#financially#millionairmindset#empiredominator

2 notes

·

View notes

Text

Investing in real estate is the best choice for growing your small saving

Investing in real estate is the best choice for growing your small savings! 🌟🏡 More wealth is generated from the appreciation of property values than from any other source. Secure your financial future with smart real estate investments today! 💰✨#RealEstate #Investment #FinancialFreedom #PropertyInvestment #WealthBuilding #RealEstateInvesting #PassiveIncome #RealEstateTips #SmartInvestment #Homeownership #PropertyValues #InvestWisely #FutureWealth #RealEstateLife #FinancialGrowth #PropertyAppreciation #InvestInYourFuture #BuildWealth #RealEstateMarket #Investing #SmallInvestments #LongTermWealth #FinancialSuccess #realestategoals

0 notes

Link

Rick Sapio is a Co-Founder of The 100 Year Real Estate Investor. He is passionate about helping individuals create long-term, generational wealth. Rick believes that the Dual Assetr Strategy is the holy grail for real estate investors. He puts his money where his mouth is as an owner of eleven 100 Year REI structured whole life policies.

Rick leverages his policies to invest in real estate, private companies, and other alternative investments. He also uses his key-man policies to protect his businesses and his estate from unexpected future events.

#100Y Real Estate#Ricksapiosconsiderations#longtermwealth#investment strategy#simplicity#probability#leverage

1 note

·

View note

Photo

Another #wealth #focused #conversation with @michaellquarles . I really enjoyed speaking with him about #longdistanceinvesting Make sure that you check out Michael and his #podcast #teamworkmakesthedreamwork #positivevibes #expatlife #multifamilyinvesting #softwaresales #longtermwealth #keeponcashflow #mindset https://www.instagram.com/p/BoXUkLyA23T/?utm_source=ig_tumblr_share&igshid=30hl0ow4homu

#wealth#focused#conversation#longdistanceinvesting#podcast#teamworkmakesthedreamwork#positivevibes#expatlife#multifamilyinvesting#softwaresales#longtermwealth#keeponcashflow#mindset

0 notes

Text

Call us at: +91 8411002452 OR Visit: www.goldenbulls.co.in

#FinancialGrowth#InvestingStrategies#TopRatedFunds#InvestmentStrategy#DiversifyYourPortfolio#InvestWisely#SIPGoals#LongTermWealth#SIPInvesting#SmartInvestments#Goldenbulls

0 notes

Photo

@Drboycewatkins has a point #Invest #trade #longtermwealth #moneymove #powerplay

0 notes

Text

Net Worth of Homeowners 44X Greater than Renters

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey data, covering 2013-2016 was released two weeks ago.

The study revealed that the 2016 median net worth of homeowners was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5%($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.

That is why, for the fourth year in a row, Gallup reported that Americans picked real estate as the best long-term investment. This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26% and then gold, savings accounts/CDs, or bonds.

Greater equity in your home gives you options

If you want to find out how you can use the increased equity in your home to move to a home that better fits your current lifestyle, please feel free to give me a call at 917.254.2103. I would be happy to discuss your options with you.

#10467#bronx#bestinvestment#buildingwealth#equity#homeownership#homeownershipandwealth#investment#longtermwealth#selling#sellingyourhome#wealthbuilding

0 notes

Text

Call us at: +91 8411002452 OR Visit: www.goldenbulls.co.in

#FinancialGrowth#InvestingStrategies#TopRatedFunds#InvestmentStrategy#DiversifyYourPortfolio#InvestWisely#SIPGoals#LongTermWealth#SIPInvesting#SmartInvestments#Goldenbulls

0 notes

Text

Investing in SIP? Here are 4 key strategies to maximize your returns and minimize risks:

Call us at: +91 8411002452 OR Visit: www.goldenbulls.co.in

#FinancialGrowth#InvestingStrategies#TopRatedFunds#InvestmentStrategy#DiversifyYourPortfolio#InvestWisely#SIPGoals#LongTermWealth#SIPInvesting#SmartInvestments#Goldenbulls

0 notes

Text

Investing in SIP? Here are 4 key strategies to maximize your returns and minimize risks:

Call us at: +91 8411002452 OR Visit: www.goldenbulls.co.in

#FinancialGrowth#InvestingStrategies#TopRatedFunds#InvestmentStrategy#DiversifyYourPortfolio#InvestWisely#SIPGoals#LongTermWealth#SIPInvesting#SmartInvestments#Goldenbulls

0 notes

Text

The best financial advisers are the ones who care about you and your goals. #Goldenbulls Visit us at- https://www.goldenbulls.co.in/

0 notes