#Wells Fargo Foreclosure Help

Text

Latino Wells Fargo Employees Accuse Bank Of Anti-Latino Bias

Here We Go Again! Latino Wells Fargo Employees Accuse Bank Of Anti-Latino Bias In A Predatory Lending Scheme

A group of current and former Latino Wells Fargo employees has filed a federal lawsuit against Wells Fargo. The employees from the company’s bilingual mortgage sales team are alleging race-based discrimination.

The suit alleges:

“Wells Fargo forces its employees on the Bilingual team…

View On WordPress

#banking#banks#foreclosures#mortgages#Wells Fargo#Wells Fargo accounting errors#Wells Fargo ATM near me#Wells Fargo Bank#Wells Fargo bank fraud#Wells Fargo Bank NA#Wells Fargo Bank near me#Wells Fargo Foreclosure Defense#Wells Fargo Foreclosure Help#Wells Fargo Foreclosures#Wells Fargo fraud#Wells Fargo Home Mortgage#Wells Fargo mortgage fraud#Wells Fargo pulls out of mortgage lending#Wells Fargo RMBS lawsuit#Wells Fargo scandals#Wells Fargo Servicing

0 notes

Text

This day in history

Tonight (December 5), I'm at Flyleaf Books in Chapel Hill, NC, with my new solarpunk novel The Lost Cause, which 350.org's Bill McKibben called "The first great YIMBY novel: perceptive, scientifically sound, and extraordinarily hopeful."

#20yrsago Walt Disney’s FBI files https://memex.craphound.com/2003/12/06/walt-disneys-fbi-files/

#20yrsago Ska-anthem about duct tape https://web.archive.org/web/20031209020640/http://www.ducktapeclub.com/contests/roll/lyrics.asp?entryid=131

#15yrsago Britain’s “Great Firewall” set to restrict access to Wikipedia https://en.wikinews.org/wiki/British_ISPs_restrict_access_to_Wikipedia_amid_child_pornography_allegations

#15yrsago Workers in Argentina taking over dead factories and running them democratically https://www.newstatesman.com/long-reads/2007/08/argentina-workers-movement

#10yrsago https://memex.craphound.com/2013/12/06/what-nelson-mandelas-life-tells-us-about-the-legitimacy-of-democratic-nations/

#10yrsago Medieval kids’ birch-bark doodles https://erikkwakkel.tumblr.com/post/67681966023/medieval-kids-doodles-on-birch-bark-heres

#10yrsago Botnet of 20,000 point-of-sale machines https://arstechnica.com/information-technology/2013/12/credit-card-fraud-comes-of-age-with-first-known-point-of-sale-botnet/

#5yrsago Jamie Dimon is getting fed up with the protesters who “occupy” him everywhere he goes https://www.bloomberg.com/news/articles/2018-12-03/wherever-dimon-goes-activists-turn-his-speeches-into-spectacles

#5yrsago Wells Fargo blames “computer glitch” for its improper foreclosure on 545 homes https://www.cbsnews.com/news/wells-fargo-loan-modification-error-homeowners-who-went-into-foreclosure-seek-answers/

#5yrsago The third annual AI Now report: 10 more ways to make AI safe for human flourishing https://web.archive.org/web/20181206184028/https://ainowinstitute.org/AI_Now_2018_Report.pdf

#5yrsago Europe’s biggest sports leagues and movie studios disavow #Article13, say it will give #BigTech even more control https://www.eff.org/deeplinks/2018/12/letter-eu-european-film-companies-and-sports-leagues-disavow-article-13-say-it

#5yrsago On January 1, America gets its public domain back: join us at the Internet Archive on Jan 25 to celebrate https://creativecommons.org/2018/12/05/join-us-for-a-grand-re-opening-of-the-public-domain/

It's EFF's Power Up Your Donation Week: this week, donations to the Electronic Frontier Foundation are matched 1:1, meaning your money goes twice as far. I've worked with EFF for 22 years now and I have always been - and remain - a major donor, because I've seen firsthand how effective, responsible and brilliant this organization is. Please join me in helping EFF continue its work!

8 notes

·

View notes

Text

How Banks Dodge Homeowners' Rights

A pattern that seems to be emerging across the country involves banks like Wells Fargo entering into loan modification agreements where the borrower / home owner agrees to pay a lower mortgage payment for a set time period and, if the borrower makes all of those temporary payments, then the bank agrees to modify the mortgage home loan permanently instead of foreclosing on the property.

However, what seems to be happening is that the banks are taking the money in the trial period, and then refusing to do the permanent mortgage modification. Instead, they are choosing to move forward with the foreclosure. It’s like the modification agreement never existed (except that the bank received more mortgage payments during those months of the trial period) or the banks just didn’t want to grant a modification. This behavior by the banks and loan services is troubling because it violates their own loan servicing guidelines set forth under the government’s Making Home Affordable program.

In these situations, the borrower home owner may have a lawsuit for breach of contract, misrepresentation, or maybe a lawsuit based on intentional conduct (tort) against that bank. If you find yourself in such a situation, we urge you to reach out to us. We can help you fight foreclosure and secure a better outcome for you and your family.😊🥰

0 notes

Text

Just like our Oregon Criminal Officials such Gov. Brown, Rep. Nathanson, Sen. Floyd Prozanski etc.. with the help of Wells Fargo. who are covering up for the most criminal Official: Late Frohnmayer, late Rep. Bob Ackerman who stole my Fully paid Condo!

My social Security # is BLOCKED at the Employment office, for more than Three years NOW. I can't sign in to look for a job! This had happened after my name was cleared from the fabricated criminal record that was done by the criminal late Dave Frohnmayer!

Gov.Kate Brown Appointed 100 Judges.She made sure before she leaves, she appointed TWO more Judges to cover her back!

Arrest Gov. Brown, Rep. Nathanson & the Rest of Oregon Criminal Officials who are complicit with the Most Criminal Officials late Frohnmayer, late Rep. Ackerman!

OR. late A.G. Frohnmayer had deleted all records in L.C. It shows I'd changed my name to Nadia Sindi.Left old name Faika Sindi.Changed letters to Saika Findi! Frohnmayer has trapped me in a criminal record since 1987!

0 notes

Text

Top Mortgage Lenders: An Overview of Their Services

Choosing the right mortgage lender can be a daunting task. In this article, we will discuss some of the best nearest mortgage lenders, before you look for “top mortgage lenders near me”.

Quicken Loans

Quicken Loans is one of the leading online mortgage lenders in the United States. It offers a variety of mortgage products, including home purchase loans, refinance loans, home equity loans, and more. With an easy-to-navigate website and a commitment to customer service, Quicken Loans makes it easy to choose the right loan option for your needs. The company provides competitive rates and a streamlined application process, making the entire process of getting a loan simple and efficient. Quicken Loans also offers a wide range of tools and resources to help individuals make informed decisions about their finances. With helpful calculators, expert advice, and financial guidance, Quicken Loans makes it easier to assess your options and make the best decision for your situation. Whether you are looking for a new home loan or need to refinance an existing loan, Quicken Loans is here to help you every step of the way.

Lender Processing Services

Lender Processing Services (LPS) is a leading provider of mortgage and real estate services. They offer a comprehensive suite of services and solutions designed to improve efficiency, reduce costs, and streamline the mortgage process. LPS provides loan origination and servicing solutions to lenders, servicers, investors, government entities, and other mortgage industry participants. Their services include loan origination software, loan servicing software, loan sale and transfer services, foreclosure and REO services, valuation services, title services, tax processing services, and more. LPS also provides enterprise data management solutions that help lenders to quickly and accurately access customer data across multiple channels. With their innovative solutions, lenders can reduce operational costs while improving customer service levels. In short, LPS is a trusted partner for financial institutions looking to maximize efficiency and profitability in the mortgage market.

Wells Fargo Home Mortgage

Wells Fargo Home Mortgage is an excellent choice for those looking to purchase a home or refinance their existing mortgage. The company offers a variety of loan products that are designed to meet a wide range of financial needs. From low down payment loans, through jumbo mortgages, Wells Fargo Home Mortgage has the right loan for you. Wells Fargo also provides a vast array of customer service options, from personalized in-person service to 24/7 online access. Their knowledgeable staff is there to help you through the entire process, from application to closing. Not only does Wells Fargo offer competitive rates and terms, but they also have a variety of mortgage features available to meet your needs. Whether you're looking for a fixed-rate loan, adjustable rate loan, or something in between, Wells Fargo Home Mortgage has you covered. They also provide flexible repayment terms and options, making it easier to get the right loan for you. With over 150 years of experience in the mortgage industry, Wells Fargo Home Mortgage is one of the most trusted mortgage lenders in NYC for your business. With their commitment to service, competitive rates and products, and knowledgeable staff, they are sure to be the right choice for your home mortgage needs.

Reaching a conclusion is not always an easy task. It requires careful consideration of all the facts and evidence at hand. After considering all the facts and evidence, it is important to be able to draw out the key points, identify any implications and make your final decision. It is important to remember that a conclusion isn't just a statement or opinion; it must be based on facts and evidence. There should also be a thoughtful consideration of the options available, the implications of each option and an assessment of the risks and benefits associated with each one. Ultimately, it's up to you to make a decision that you are confident in and that you feel will be beneficial in the long run. Taking the time to properly reach a conclusion can help ensure that you have made an informed decision and can help avoid any potential negative consequences.

0 notes

Text

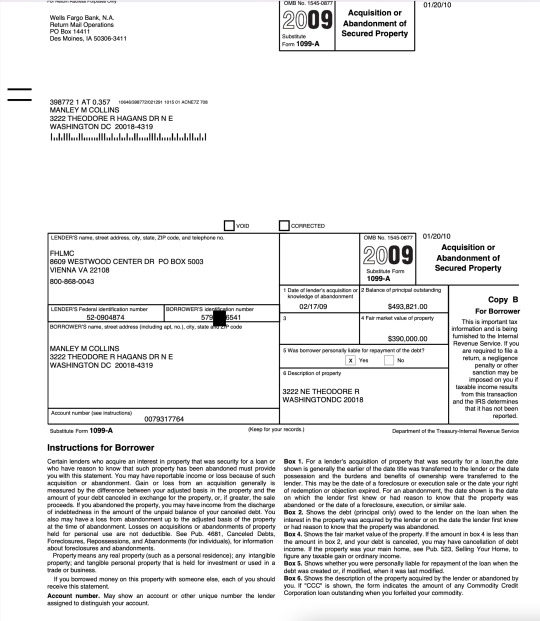

Yes, I talked about home ownership under my journal entry HUD – Journal Entry #6. People thought I was crazy because the proof of the Washington, DC home at 3222 Theodore R Hagans Dr NE – all the pictures from start to finish went with my storage drives.

Yes, I did finance and signed a contract on the Washington, DC home. United States Congress and each State I resided Congress are wondering why they are getting letters associated with the 2007 physical assault at the United States Department of Defense intelligence community setting, which all the major materialistic losses started.

Now, I am at the end of the scientific bell curve; in which, I am back at the point of making the same amount of money I did as a Freshman at South Carolina State University with work study and tuition refund for overpayment.

The government now steps in and decides to say they are going to give me funding to help me. America capitalism can smell the money and I see the greed. Now, the government gave this same funding to my biological mother, made her isolate herself and crazy until finally she died and never saw social security retirement. The government takes biological father at his 63rd/64th birthday before he could claim social security retirement. Of course, I do not know all my biological father’s business. Thus, leaves me at my current age and I already told the government I am going to continue to do whatever the f*** I want, where I want, and how I want. I am salvaging the remaining of my life after what the church did, government did, family did, friends did, strangers did, school did, legal/law did, organizations did, employers did, and life says it is my fault. My vitals are at 100% close to perfect and now coming out of the mental health illnesses, the government and people think while I am fully conscious to make a decision on how I want death to end my life. After March 26, 2016 to April 3, 2016 week, a very dark, psychotic, phoenix personality arose out of the Gemini horoscopic sign.

I read all the rules about the government funding. I said enough loss and stop taking because I already do not give a d***. This is a current event and will be reentered in a journal entry.

After I loss the Atlanta home at Wynsley Way with all the upgrades and pre-qualified and qualified by Bank of America due to independent inspector findings, I bought the Washington, DC home at $535,000 with all upgrades at full retail price. I loss the home to foreclosure and my $40,000 downpayment with it. Bank of America pre-qualified me for the loan, but could not go forward because the house needed a jumbo loan that they could not provide. Here is the proof of paperwork by Wells Fargo, who financed the jumbo loan to finance the home. Witnesses that saw the home – neighbors, auntie and cousin from the Mack family, local DC friends, college students when I tried to do Craigslist rentals like AirBnb, etc.

Yes, America I will keep reminding you of the physical and real loss and hurt behind a struggling African-American male achieving the old school American dream. So let me see America or the Globe do the past.

#house#3222 theodore r hagans dr ne#washington#dc#social security administration#social security insurance#ssa#ssi#disability#wells fargo#jumbo loan#manley marvell collins

3 notes

·

View notes

Text

youtube

This is me and they added a "voice hinder" to purify the sound and we used teeth and nose pieces so I looked like her.

In Promise of a New Day you'll see i kept my hair down and you don't get a clean shot of Mark's face.

Because we stole children from kidnappers and replaced them with their parents, we tried to remain unknown. Just a person in the background.

So most videos i am in, yoh can't quite recognize me as we did a temporary change so i could just go plain and untouched up in real life I wouldn't need camouflage. It was easier that way.

It did kind of make me sad i would always be unknown and someone else would take credit for my work. Because of evil people in the world. It seems they always got their way, but not me.

At any rate, my voice was heard and people did oay to hear it, which would make you think would make me feel good. But it didn't. I just gave the money away (although Michael Jackson did invest it for me -- i still didn't have it) so it impacted my feelings that i was worthless and no one cared what I had to say. Or that i was a liar, allowing others to say what i felt, knowing they didn't and could never clearly quite understand me. The true me. And i wished people could feel my sadness just for me. To know how i felt worthless, i couldn't even have a family. Not a mom nor dad nor pa. No one. Just me. I really truly had no one. Just myself. When i thought of it that way. I felt power. I felt I could do things. Not relying on anyone was ajd is true power. No one could tell me otherwise. I decided. So i was Number One. One wasnt the loneliest number. I and only I could be Number One. And i would get to work! And save other people's children.

But how? I was ruthless. I couldn't be a beggar. I couldn't ask how I was doing. I had to KNOW. I had to KNOW myself. I had to KNOW ME. I had to have that power to thrust myself into the world and take it over.

But how? What did i need most? People at home with their families. People next to me on the couch to keep my spirits up.

NO!!! I HAD NO ONE. JUST ME. NO ONE ELSE. ONLY ME FOR NOW. Until the Conclusion. Just me.

Only me forever now. No one else.

Privacy and dominance. But how? I can take over the world. I Cleopatra. Must! Or it would not be saved.

I can't save anything, not my husband or my kid..

NO. I'm not saving anything! I'm taking over! Move! Get out the way! Now it's my land! Indians! (Native Americans) Sit! You stay! You live there? Don't move! Okay you can move but you don't leave. Wait. Do you want to live someplace else? I can help. But not today

Power and dominance. I have the power, that is I. I a the power of the world.

Move! Don't move! Who cares? Home! Now where is home. Home is what is needed. Home is where the heart is. Home is love. Hearts are love. That's all,we need then.

Step One: give all Humans a home of their own.

Step Two: take over the world

No, wait. That is a pre-requisite.

World Dominance. No. I'm being dominated.

Be until-dominated

Huh.

That shouldn't be step one? What the fuck here...

I should have all this done before people get their houses.

Oh well. This is the aftermath.

Steps 2 through 1 million: HELL for myself.

H E double hockey sticks

May be at one point I'll get Mark back. And the son!

The sun! Hmmm i wonder what i could do with that... Could it explode? Check on that. That could be bad.

Man I got to make this list right. New paper...

Okay self goal...

Oh right. First i need Privacy. Then I'll need Dominance. Is dominance power? I'll have to ask my dad uncle. But I don't think so. I think you can have power and leave people the Hell alone. I'll include both just in case I'm right.

Lets see here.

People in Homes then they will Learn Love.

There that's done. My life's goalzzzzz.

Then i can rest and May be enjoy something of my future. I'm only 12! No 13. So I'm let's see... What am I? 7 less. 6.

World Dominance at 6 years of age. This is nutty.

Cleopatra I guess it is then

Lets watch MTV, see if I am on.

....

In the year 2020 i own 76% of the Earths land and 94% of the Earths Oceans, Lakes, Seas and Rivers.

I'm 35. My friends and family own the rest.

I own 72 mortgage companies. I can take your house and your land at any time. I own Selene Finance one of the world's biggest that buys foreclosure mortgages.

All the mortgage companies that i own will start charging 0% interest rates on all home loans. We will not advertise, your payment will remain the same in the paper bills but online it will decrease by the interest change. Then in 4 months we will no longer mail paper bills. Or make phone calls if you're late. This will counter balance the decrease in money. As we put our employees in a different position doing something more lucrative at a promoted rate of pay.

Do please continue to pay your mortgages and look online to see the amounts you owe. It will also save you a stamp or cost you the price of and envelope if you insist to mail a check.

Insurance rates for homes and autos that i own will decrease by 72%

The General. Allstate. Liberty Mutual. American Modern.

Be one of our customers within the next 6 months and you'll enjoy these savings for life as They go by your social security number.

Otherwise the decrease from the original pricing will be 36% for 6 months then 20% thereafter.

No more than a 2% increase on your rates if you are ib an auto accident, guaranteed. 2.2% if you have full coverage which i recommend as the prices are very similar within 10% per month capped at $10 difference. And we will pay for your car AND theirs if you totally trash it. Otherwise liability only pays for theirs and it's a waste of money for you. And within 2 months of today, 2.16.2020 we will discontinue carrying liability for our auto insurance.

But you can price check at other companies such as Progressive which I traded Jesse James for American Home for. Which then rebranded to American Family then American Modern. American Modern Family if you kept up. ;) They also offer car and motorcycle and include flood insurance so you don't need to purchase an additional policy. Mortgage such as Wells Fargo don't notice that every year So call us or your insurance broker and we/they will rip them a new ass hole to stick their head in that notifies them there's flood insurance IN the policy so you don't have to pay more.

I wanted American Home because that's what I had and i got it because of the flood insurance and obviously Wells Fargo wouldn't read that inclusion. And i really liked it. So we cover motorcycles too now

In case y'all West Coast Chopper lovers want a discounted rate and just one policy for your home and auto. --it is seperated because mortgage usually pays insurance but one website shows you all. So it's easier to remember what you've done in life.

Gerber, Globe, United Mutual and Town Home life insurances are all discounted at 60% for life.

Business owners with my insurances with no claims in the last 6 years (2014) will see surprise discounts in the future.

World Dominance. See you There. I will make it. That. I know i will. Hopefully Mark will make it to his skin... Till then... I know he's thinking of y'all.

I wrote and sang this song to him.

And yes when i was 19 i shaved my head. This was a bald cap and wig. He was dead 9 months. So this song is my baby. And watching it on MTV produced my goals and depression. And my need to crawl out of the shame the evil side of the world had put me in.

I never felt shame again. I knew the real Sinead O'Conner wouldn't let me. So I didn't either.

Sinead. Here's to you. The real me and how you made me feel and see myself.

Every one thank Her for my Goal of World Dominance.

To the real woman who played my spirit, Tasha. Thank you for allowing yourself to be my voice to be heard around the world. Nothing compares to that. Thank all of you woman whom did, have and will.

youtube

2 notes

·

View notes

Link

Michaela Christian lost a long battle with Wells Fargo in 2013 to save her Las Vegas home, a defeat she says changed the course of her life. When the bank refused to modify her mortgage, Christian moved in with a friend and scrambled to rebuild her life.

Five years later, Wells Fargo admits it made a mistake. Christian, 46, qualified for the kind of mortgage help that may have saved her home after all.

It is a mistake the giant bank admits it made nearly 900 times over several years, pushing hundreds of distressed homeowners into foreclosure.

Christian said that when she learned of Wells Fargo's error, "I was sick to my stomach."

"They destroyed me and destroyed my everything."

Wells Fargo's admission is part of a cascade of lapses that increased scrutiny of the San Francisco bank with some Democrats in Congress calling for the ouster of its chief executive, Tim Sloan. Over the last two years, the bank paid more than $1 billion in fines after admitting it opened millions of bogus accounts customers didn't want and then found itself in more trouble after improperly repossessing thousands of cars.

The bank has repeatedly apologized for its missteps but is struggling to repair its image. Customers who lost their homes are being offered compensation or can enter mediation, company officials say.

Wells Fargo says an internal review found the bank denied help to hundreds of homeowners after fees charged by foreclosure attorneys were improperly used when the bank determined whom to offer mortgage help. The computer error began in 2010 and was not corrected until last April, the bank said.

Overall, 870 homeowners were denied help for which they qualified, including 545 who lost their homes to foreclosure. Wells Fargo says it has reached most of the customers affected and set aside $8 million to compensate them, though industry analysts say that number is likely to increase.

The revelation echoes the complaints of thousands of borrowers in the years after the financial crisis that banks were stingy about offering help with borrowers' exploding loans.

"Wells Fargo failed to maintain its systems, failed to find problems when they occurred and then masked the problem for years," said Alys Cohen, staff attorney for the National Consumer Law Center.

Christian bought her home in 1998, when she was just 24. At the time, the three-bedroom home was on the outskirts of a growing Las Vegas. There weren't a lot of stores nearby, but Christian said she loved the neighborhood. "In the 15 years we were there, everything was perfect," she said.

But in 2011, Christian lost her job as a bartender as the economy continued to sputter after the global financial crisis. Then she was in a car accident that left her with a fractured pelvis and crushed tibia. "I wasn't even able to walk for seven months. I couldn't work."

One of her first calls for help, she said, was to Wells Fargo. Christian asked the bank to defer her more than $1,000 monthly mortgage payment or lower the 7% mortgage interest rate to the prevailing rate at the time, about 4%. That would have lowered her payments to about $500 a month, Christian said.

"They said, 'Have a nice day' and denied it," she said.

A few months later, Christian said, Wells Fargo began foreclosure proceedings against her. With the help of her father, she found a job that allowed her to maneuver with a cane, and spent months searching for help, she said. Christian said she even offered Wells Fargo an additional $4,000 to make up for some of her missed payments.

Ultimately, Christian said, she faced what she considered an unfathomable choice: sell her home or lose it in foreclosure.

"It was the last thing I wanted," she said. "I didn't want to uproot my son. He had grown up there."

After a quick sale of the home, Christian temporarily moved in with a friend and then into an apartment.

"I was in a daze," Christian said through tears. "I thought, 100%, I was going to be able to save my home. I had my finances in order. I could not for the life of me figure out why they wouldn't refinance."

The answer came in September when Christian received a letter and a $15,000 check from Wells Fargo, admitting its mistake.

"We want to make things right," the letter states. "We realize that our decision impacted you at a time you were facing a hardship."

Wells Fargo's letter didn't explain how it determined Christian was due only $15,000. She sold the home for $135,000 in 2013; Redfin now estimates it is worth about $250,000. And Christian estimates she had already accumulated about $30,000 in equity after making mortgage payments for more than a decade. And that, she said, doesn't include the $20,000 pool she had installed.

(Conitnue Reading)

162 notes

·

View notes

Photo

Flags, Foreclosure & Courts

The "return of Britain to Britain" via BREXIT was fabulously celebrated yesterday with a great deal of flag waving, and the British People rallied in the streets and dockyards, in the pubs and alleys, waving and cheering the Union Jack.

This effusive nationwide flag-waving and the ceremonies marking the end of Britain's involvement in the European Union also brought the gold-fringed flag into the Public Eye, with many Commentators thinking it was an Admiralty Flag. Not so.

As a result of many years of research by USNA Aboriginals into exactly this hard-to-track-down question, we can definitively tell the world that flags with gold fringe added to their edges are called the "National Colors" --- and are "Ceremonial Flags" used by the Executive Branch of the Government --- having no other standing or meaning as flags.

That is, they are the equivalent of decorative elements, trotted out --- in this case --- by the Prime Minister's Office, presenting the "National Colors" but not truly representing Great Britain.

This should raise some eyebrows. Why use a "Ceremonial Flag" and not the actual flag, if Britain is truly free and independent of the EU? Was this a mistake? A cry for help? What does the absence of the actual Union Jack on such an occasion mean?

Time will tell what --if anything-- the use of the "Ceremonial Flag" means. But our friends throughout Britain and in the Commonwealth should be well-informed by our experience with the use of this same "fake flag" in foreign colonial corporate American Courts.

Anyone can display a Ceremonial Flag for any reason. It's like bunting. It isn't really a flag.

In the corporate tribunals used to fleece Americans over the past two centuries, these "flags" were used to lend the appearance of authority and to encourage people to assume an association of these courts with USNA lawful government --- when in fact no such association exists.

Regardless of what the use of gold-fringed flags may portend, it is apparent that rank and file Brits have felt as constrained and as abused by the EU as others around the world, and are fortunate enough to escape relatively intact.

The words "relatively intact" are used because Britain has indeed suffered for a long time as a result of its inclusion in the EU, and trillions of dollars have been drained out of its economy, and its basic industries have been reduced to mere shadows of their former glory.

This has served to leave Britain among the Walking Wounded, but now walking at any rate. Its British Pound Sterling is still viable. It's land ownership and lawful banking movement is burgeoning. People are waking up across the Pond, and throughout the Commonwealth, just as we are.

Some of our most avid researchers and effective advocates are British and Australian. Having caught on to the ways and means of The Great Fraud, they have sunk their teeth in it with gusto.

As a result, we now have proof of a world-spanning conspiracy implemented by banks and members of the Bar Association employed in high-ranking governmental capacities in both Britain and North America. The object? To bail-out and reward the banks and other crooks, on the backs of British and USNA "taxpayers".

Simultaneously, in both Britain and North America, in September of 2007, the same exact bank and securities fraud was carried out. It involved misrepresenting securities corporations as banks using trademark names -- "Bank of Scotland" and "Wells Fargo Bank, N.A." ---- the creation of fake ACCOUNTS in offshore locations -- the Isle of Jersey and Puerto Rico, respectively, the establishment of fake lines of credit based on British and America land assets, and the sale of these bogus asset interests to unwary investors worldwide.

These criminals defrauded the SEC and the Stock Exchanges and the IRS out of billions, and the British and American TAXPAYERS out of trillions, plus, placed all our assets at risk ---- all based on the creation of fake offshore bank ACCOUNTS in our names and other "legal" chicanery.

This was the preparation for the bank bailout months before the situation erupted in 2008. The immortal picture of Hank Paulson wandering down the street in a March gale, taken by surprise by the collapse of Lehman Brothers, is complete, absolute, total bunk. A very nice landing for all concerned -- including Paulson -- had been set up months in advance, with British and American TAXPAYERS on the hook for it.

And now, the details of this cozy deal are known and have been extracted from the Public Records in both Britain and North America, all of it occurring in September 2007, which definitely suggests a concerted and conspiratorial plan to defraud the landowners and taxpayers in both countries.

Both schemes involved high ranking members of the Bar operating in government offices.

In America, no less than The Office of the United States Attorney General, orchestrated this fraud. Let's explain a bit about what these Bastards have done.

They begin with public land records, which, being public, are available to anyone. These consist of survey and "plat" maps and similar records that identify unique physical parcels of land and soil belonging to people and businesses of all kinds.

Then, they send out people with clipboards, pretending to be agents of the lawful government, and these unwitting individuals are given the task of assigning descriptions to USNA land and soil assets. This may be as simple as assigning a Parcel Number, or a Street Name and Number, or it may be a "Municipal" Lot and Block designation, and so on.

They use this description to establish false claims on your property.

Imagine that you have a pedigreed horse named "Seattle Slew" and a Third Party that you don't know and who doesn't know you, wanders down the road, sees your horse, and decides to call your horse "Seattle Thunder", then goes home and records an ownership interest in "Seattle Thunder" --- at your address, of course.

It's very much the same situation that has been orchestrated to steal your land and soil and to assert false claims in commerce against you and your property assets. They rename it by issuing a new "property description", register an ownership interest in your renamed property that doesn't actually exist, and then copyright this description in the name of their corporation.

So, when they "foreclose" they aren't actually foreclosing on you and they aren't even foreclosing on your property. They are foreclosing on their description of your property.

And we may all judge how much THAT is worth in the actual world of facts. For the cost of employing someone to assign names to property that doesn't belong to them, they pretend to own your land by owning a description of it.

And, by the way, they do the same exact thing with you and your name, only they are a little more subtle about it. They take your Given Name, donated to you by your parents, and by various means of unconscionable contract and subtle variation of your Given Name, contrive to own "you", too.

It's the same basic fraud involving identity theft, identity substitution, and false claims.

This is how they have contrived to "unlawfully convert" patented Freeholds --- private property --- into "public trust" property, and to convert you, a lawful landlord, into a mere tenant.

In the 2007 Song and Dance here in America, they renamed all our Counties using a subtly different style of naming them, pretended that --- "Prest-O! Change-O!" -- these were all new "counties" --- of some kind, and based on this "new" asset base, gave themselves new "Master Form Deeds of Trust" and also, brand new Credit Lines all based on, purportedly, our land and soil.

This is, of course, just more re-labeling of "Seattle Slew" as "Seattle Thunder", it's all taking place without your knowledge or consent, it's all as phony as a three-dollar bill, and it needs to be stopped. It's a gross crime and betrayal of the actual Public Trust.

This is what they call "hypothecation" --- a process by which these fraud artists "hypothecate" a debt -- as in, "hypothetical debt" -- against your Good Name and your property, without your knowledge or consent, and then, having committed this crime, hold you and your assets responsible for whatever debts they run up.

Using this identity theft mechanism, they steal the value of your Good Name and your actual property assets by using both as collateral backing their debts. It's as if you co-signed a loan for them, and you were conveniently never consulted about any of this.

Here in North America, the involvement of the United States Attorney General's Office in this grotesque scam and the misuse of the Wells Fargo Bank brand name to create the individual ACCOUNTS and the "renaming" of the USNA Counties, suggests that both the DOJ and The Office of the United States Attorney General need to be liquidated for High Crimes.

It also suggests that the Municipal and Territorial "State of State" organizations that accepted and recorded and helped to expedite these False Claims and the Courts and Court Officers who enforced these False Claims are all engaged in similar High Crimes against the Public Interest and against private property interests, too ---- and also need to be liquidated, with all assets (including but not limited to the Hot Air) returned to the actual owners of record.

After all, no matter what you call him, there is still only one horse, and that horse rightfully belongs to the man who bought him in Good Faith, who feeds him, and waters him, and provides him with pasture, and trains him, and puts a barn over his head.

The horse does not belong to some sorry-assed conniving bureaucrat spinning lies and making up new names and hiding behind a desk in Washington, DC.

Anyone having any trouble understanding these basic facts needs to get in contact with the actual government of this country: The United States of North America, Unincorporated.

The United States of North America - The Republic of North America

1 note

·

View note

Text

Ways in Which Credit Repair Companies in Fort Worth TX Can Help You Restore Credit

Repairing poor credit is not an easy task. It requires patience, due diligence, and professionalism. Every individual has the right to repair their credit. But without knowledge on how to do this, it may become a challenge. Working with credit repair companies Fort Worth TX to restore poor credit is more beneficial than doing it yourself. Not only will they help to improve your credit rating, but they can also impart confidence and knowledge you need to make better financial decisions in the long run.

Professional credit repair companies have the knowledge and skills to handle the credit restoration process well. With consumer credit knowledge and protection laws at their disposal, they can handle all the creditors and substantiate what they report to the credit bureaus about you. They’ll also help you to monitor your credit score, work with you to ensure you settle your debts and offer education on credit management. It’s, therefore, necessary to have a qualified advocate to take care of restoring your credit.

Here are ways credit repair firms can help restore your credit:

Researching the laws and best practices

Credit repair companies Fort Worth TX spend time training for professional development in their areas of expertise. Laws keep changing as new case laws are created. Creditor behaviors change too, meaning that new processes must be implemented. Therefore, credit repair firms constantly learn and evolve their programs and best practices to ensure better outcomes for you.

Mortgage correction

There are many cases of foreclosures, loan mods and short sales that are incorrectly reported to credit bureaus. Most errors of short sales reporting as foreclosures or charge-offs, or foreclosures with no deficiency balance are often handled by credit restoration companies. These erroneous cases are usually reported by uncooperative banks, and they need credit repair companies Fort Worth TX to successfully fix every field to report correctly. They can also work with attorneys in cases of litigation on your behalf.

Collections

Individuals with debt and credit issues fall victims to debt collection and harassment from collection firms. They get intimidating and aggressive calls from collectors for the old accounts they haven’t settled. Credit repair Fort Worth Texas firms will advise you on how to deal with debt collection harassment and identify strategies for managing the collections on your credit report.

Late Payments

Late payments that are already reported to the credit bureau are not easy to correct. But if successfully removed, late payments can help to improve your credit rating. Credit repair companies Fort Worth TX have effective approaches that will help to remove late payments from your report. You are at more advantage if your payment history has been positive for a long time. The credit repair firms know how to package this information properly to achieve positive outcomes.

Mortgage Derogatories

The economy can fluctuate and force you to foreclose on your home during hard times. This will severely damage your credit and prevent you from getting financial assistance from the lending institutions. With credit repair Fort Worth Texas at your service, your mortgage derogatories will be handled professionally. These firms have significant expertise and solid track records in dealing with such mortgage derogatories including short sales or foreclosures as well as bad credit home loans.

Charge-offs

If your credit report has a charge off, you need help from professional credit repair companies Fort Worth TX. They will consider your time-frame for resolving the matter and other factors like the age of the debt and your financial state at the time of default. They will aggressively dispute the charge-off using the appropriate laws and ensure effective results.

Judgments

In most cases, judgments show on your credit report because of the third parties hired by the credit bureaus. They are hired to scrub the public records at the courts and append them to your report. The process can present a lot of errors that only credit repair Fort Worth Texas firms can address. They have the tools that can effectively remove judgments from your credit report.

Bankruptcy

Rebuilding credit after chapter 7 bankruptcy is not easy. You need a professional to help with your bankruptcy account that was erroneously reported. Credit repair Fort Worth Texas firms have excellent programs that will correct erroneous reporting that is damaging your credit rating and causing other issues.

Tax Liens

Your tax liens require special attention since they can stay on your credit report for a very long time. Only professional credit repair companies Fort Worth Texas can get your paid tax federal tax liens and other tax liens. They have the right processes to get rid of all tax liens from your report and restore your credit.

Identity theft

Identity theft is a crime, and the process of recovering your identity and restoring your good credit can be daunting. It involves taking particular steps before you embark on the disputing process. Credit repair specialists will empower you with knowledge about the consumer laws that govern identity theft. They’ll also help you with all the procedures necessary to regain your identity as well as your credit score.

Student Loans

Most of the student loans default for reasons such as lack of disposable incomes, loss of job, and high penalties and fees on the loans. This may impact negatively on your credit score. When you engage the services of professional credit repair firms, they will help in removing the student loan default from your report. They’ll also make sure that you get proper information and advice regarding your student loan debt repayment options.

Whether you have legitimate or unverified errors on your credit report, getting professional credit repair is important. Reputable credit repair companies have credit repair programs to help you regain your financial standing. They can tailor your credit repair needs to the appropriate program that will restore your credit health. You also need to understand that there is no quick fix to credit repair. It is a process that requires time and patience to achieve the desired result.

Contact -

Address - Wells Fargo Tower 201 Main Street Suite 600, Fort Worth, Texas 76102, USA

Email - [email protected]

Phone - +1(214)-919-8773

Website - D818 Consulting

Blog - How to Get Bad Credit Loans in Fort Worth TX

1 note

·

View note

Text

CFPB Spanks Wells Fargo With Yet Another Fine

CFPB Spanks Wells Fargo With Yet Another Fine

The CFPB Spanks Wells Fargo With Yet Another Fine Yesterday For Ripping Off Consumers. This Time It’s For $3.75 Billion

The CFPB spanks Wells Fargo with another fine by the CFPB yesterday. The CFPB has ordered Wells Fargo Bank to pay $3.7 billion for violations across several of its largest product lines. This includes mortgage and auto loans that resulted in thousands of customers allegedly…

View On WordPress

#banking#banks#foreclosure#foreclosure defense#foreclosures#mortgage fraud#mortgages#real estate#Wells Fargo#Wells Fargo accounting errors#Wells Fargo Bank#Wells Fargo bank fraud#Wells Fargo Bank NA#Wells Fargo Bank near me#Wells Fargo Foreclosure Defense#Wells Fargo Foreclosure Help#Wells Fargo Foreclosures#Wells Fargo fraud#Wells Fargo Home Mortgage#Wells Fargo mortgage fraud#Wells Fargo RMBS lawsuit

0 notes

Text

How Do I Find Short Sales in Charlotte, NC? Tips for Locating Short Sales and Short Sale Agents

This article will help you find short sales and short sale agents in Charlotte, North Carolina! If you’re searching for either, you’re in the right place. I’m here to walk you through the short sale process.

To begin, though, I’ll define what a short sale is and why it’s an excellent opportunity for buyers like you.

Then we’ll take a look at Charlotte, North Carolina, the 17th largest city in the United States. Charlotte is growing at more than three times the national average. In fact, millennials are flocking there, making it the number one city where they’re relocating.

Finally, I’ll guide you to finding short sales in Charlotte. And as an experienced short sale real estate agent, I’ll provide my contact information.

What is a Short Sale?

A short sale refers to a home sold for less than what’s owed on the mortgage (Chen, 2021). As an example, meet Justin and Maria, a newly-married couple with twins on the way. They owe $285,000 on their home, but a devastating work accident almost took Justin’s life last year.

The couple has fallen behind on their mortgage payments due to medical expenses. Despite their best efforts, they haven’t been able to catch up. There’s some good news, though. With prior approval from their lender, Justin and Maria can sell their home at a lower cost in a short sale.

You might hear a short sale called a pre-foreclosure sale. It’s a lengthy process with a lot of paperwork, but it isn’t as damaging to Justin and Maria’s credit as a foreclosure. And if the house sells, Maria’s parents have an empty rental where the expanding family can live.

There are some steps the couple will need to follow. First, the lender wants a letter explaining why Justin and Maria can’t pay their mortgage. Next, the couple will also have to provide tax returns and bank statements for the last couple of years. Finally, Justin and Maria need to list their assets and any other debts owed.

Soon, Justin and Maria’s lender approves their home for a short sale. This relieves their financial burden and stress in a big way. Their house soon sells for $240,000, and that money goes back to the lender. The bank decides to forgive the outstanding balance (the remaining $45,000). Sometimes, though, a lender will attempt to recover the difference.

While a short sale isn’t ideal for a homeowner, it’s a chance for buyers like you to get an exceptional deal on a home. Before we talk more about that, let’s learn about Charlotte and what makes it an incredible city to call home.

Charlotte, NC: Let’s Go!

Why Charlotte, NC? I’ll tell you! Charlotte has 885,000 people and is rapidly expanding. The weather includes 218 days of sunshine a year and an average temperature of 71 degrees (Charlotte, 2021).

Charlotte is also known for banking with Bank of America and Wells Fargo headquartered there.

Every city’s got ‘em, but Charlotte’s fun facts are particularly fascinating:

· Charlotte kicked off the Carolina Gold Rush in 1799 after a young boy found a real gold nugget.

· Many movies filmed in Charlotte, including The Hunger Games, Talladega Nights, and Days of Thunder.

· Charlotte holds the title of Pimento Cheese Capital of the world. 45,000 pounds are churned out every week!

· Charlotte is the birthplace of President James Polk.

· The city’s name came from the Queen of Great Britain, Charlotte of Mecklenburg-Strelitz. Charlotte is often nicknamed the Queen City, or QC (Mulvihill, 2017).

If you’re looking for entertainment, Charlotte’s got that covered for all ages. Consider the following popular attractions:

· Bechtler Museum of Modern Art, displaying mid-20th century modern art

· Harvey B. Gantt Center, celebrating African-American artists, creators, and musicians

· The Billy Graham Library, journeying through the life of evangelist Billy Graham

· Reed Gold Mine, sharing artifacts dedicated to gold mining and its history

· Carowinds Amusement Park, offering world-class rides and entertainment all year

· ImaginOn, providing a world-class library for kids (named one of the best in the nation!) that’s separated by age and has two theaters on site

· Discovery Place, catering an interactive science museum to children and families

Don’t forget the endless choices for:

· Shopping

· Incredible food (you must try the BBQ!)

· Nightlife

· Live music

· Hiking trails

· Luxurious spas

And when it comes to sports, Charlotte boasts the following:

· NBA’s Charlotte Hornets

· NFL’s Charlotte Panthers

· Minor league baseball team Charlotte Knights

· NASCAR’s Charlotte Motor Speedway and Hall of Fame

Also, see the U.S. National Whitewater Center, which offers over 30 outdoor activities. You might spot some Olympic athletes training there.

Now let’s turn our attention to finding short sales.

Finding Short Sales

To score a short sale, you must find the short sale. Don’t worry--I have several tricks to share. Then, I’ll point you to a competent real estate agent in Charlotte.

1. The Multiple Listing Service, or MLS, is a great source for finding homes eligible for a short sale. You can use this database to find discounted properties. Be aware that the language might not include the words “short sale.” With this in mind, keep an eye out for other indicators in home listings:

Subject to Bank Approval

Headed to Auction

Preapproved by a Bank

Notice of Default

Third-party Review Required

Also, some systems allow you to search by short sales, so check out the filters.

2. The local courthouse stores records of pre-foreclosures. A lender must file a form for a foreclosure complaint, and you can access these public records as a third party.

3. Check out those classified ads. They sometimes list short sales and can be a valuable resource.

4. Finally, I recommend doing an internet search for short sales. As you know, you can find anything on the internet, and short sales are no exception. Pay attention to the filters to narrow down your search to find what you’re looking for.

Short Sale Agent in Charlotte

Real estate agents have resources, experience, and insight in short sales. A skilled real estate agent can help save you time (and money) and guide you through the process. Additionally, agents often know about short sales before they’re announced.

To find your short sale agent for Charlotte, contact me, Nancy Braun, with Showcase Realty. Lean on my experience to guide you through the searching process. You can contact me at 704-997-3794 or through my website, shortsaleadvisors.us.

While I’ve given you some tips to research on your own, I encourage you to let me put my expertise to work for you! Hope to talk to you soon!

References

Charlotte, North Carolina (2021). Charlotte Gateway District. Retrieved on June 29, 2021. About Charlotte, North Carolina | Gateway District Development | Uptown Charlotte (charlottegatewaydistrict.com)

Chen, J. (2021, May 21). Short sale (real estate). Investopedia. Retrieved on June 29, 2021. Short Sale (Real Estate) Definition (investopedia.com)

Mulvihill, C. (2017, November 1). 10 facts about Charlotte you never knew were true. Only in Your State. Retrieved on June 29, 2021. 10 Fun Facts About Charlotte (onlyinyourstate.com)

Sources of Information

Baker, H. (2019, August 25). How to find short sales: 4 best ways. Mashvisor. Retrieved on June 29, 2021. How to Find Short Sales: 4 Best Ways | Mashvisor

Mulvihill, C. (2017, September 6). Here are 5 museums in Charlotte that you absolutely must visit. Only in Your State. Retrieved on June 29, 2021. 5 Must Visit Museums In Charlotte (onlyinyourstate.com)

Weintraub, E. (2020, March 14). Finding short sale listings in MLS. The Balance. Retrieved on June 29, 2021. How to Find Short Sale Listings in MLS (thebalance.com)

youtube

In case you cannot view this video here, please click the link below to view How Do I Find Short Sales in Charlotte, NC? on my YouTube channel: https://www.youtube.com/watch?v=trdTdlfSvXg

0 notes

Text

http://www.salem-news.com/articles/january112014/corruption-petition-ns.php?fbclid=IwAR0n668Efngx8J3l95dUI5tufiMmD73OQWgy2oCp2eovOjeokwQRFW2AbWA

https://jameszogby.com/washingtonwatch2021s/anti-semitism-amp-anti-arab-bigotry-part-i?emci=4f103383-1fee-eb11-a7ad-501ac57b8fa7&emdi=4b99fac9-f5ee-eb11-a7ad-501ac57b8fa7&ceid=376192

https://youtu.be/_-0J49_9lwc

https://www.wweek.com/portland/article-21195-reputation-for-rent.html

https://www.wweek.com/portland/blog-30283-u-of-o-prof-files-bar-complaint-in-long-v-kroger-case.html

http://www.salem-news.com/articles/january112014/corruption-petition-ns.php?fbclid=IwAR0n668Efngx8J3l95dUI5tufiMmD73OQWgy2oCp2eovOjeokwQRFW2AbWA

https://www.dailyemerald.com/archives/uo-president-faces-ethics-complaints/article_de9248c1-bf32-53ea-9a2b-8b67c4c08ad1.html

https://www.thefreelibrary.com/University+president+faces+ethics+complaint.-a0153374882?fbclid=IwAR1lSXHpNvxvFW0TxkLDBhjELusnbonQkvyk8I3L7Ovt2UnNodwONa0nD2o

Late Oregon A.G. Dave Frohnmayer and Both D.A. Doug Harcleroad, Alex Gardner with the Lane County Sheriff, trapped me in a criminal record since 1987. They have changed first letter in my first name to "S" So I couldn't expunged it!!

http://petitions.moveon.org/sign/justice-for-nadia-sindi… My life with Liberal Klans in Oregon!! Arab/Muslim Americans are treated less than animals! We are called Sand N… We are being prosecuted in a daily basis! High tech lynching, institutionally racism! Especially for Arab women!! Oregon late A.G. Dave Frohnmayer had my SS# blocked & prevented me from getting employed, made me homeless and jobless! Dave Frohnmayer was the one who started & initiated the fraud of Foreclosed-houses & taking over our homes! His bank robber Rep.Bob Ackerman, Doug McCool, UO Prof. Margaret Hallock. Hired Scarlet Lee/Barnhart Associates. Forged my family’s signature. Gave our fully paid Condo to the thief Broker Bob Ogle, his mom Karen Ogle was working in the USA Consulate in Jeddah, Saudi Arabia. She administered the power of attorney to have my sister signature, added her son to the deed. Sold without my signature! Bob Ackerman had never responded to the Summon from the Court, and the sheriff never served me or arrested him either!! ThIs is what kind of criminal government we have in Oregon!! Arrest Rep. Bob Ackerman, Doug Mccool, Broker Bob Ogle, his mom Karen Ogle, Scarlet Lee/Barnhart Associates, UO Prof. Margaret Hallock, Wells Fargo Both D.A. Doug Harcleroad, Alex Gardner told me they have NO JURISDICTION on Frohnmayer! Oregon criminal Officials are complicit with these crimes against me! Both EPD, Lane County Sheriff Dept. and the FBI had been told to step down from investigating the bank robber Rep. Bob Ackerman & the rest of Lane County Criminal Officials are complicit with him!! I ran five times for public offices! Voter Fraud & Sedition by Lane County government to protect & cover up for the two criminals Frohnmayer & Ackerman!! Oregon government is complicit with their crimes!! https://facebook.com/groups/justice4nadiasindi… http://davefrohnmayer.com Please sign petition. https://change.org/petitions/a-g-eric-holder-sent-jeff-merkley-gov-john-kitzhaber-investigate-abuse-of-power-and-criminal-forgery-by-former-oregon-a-g-david-frohnmayer-and-lane-county-government#share…. Dave Frohnmayer was going to kill

me by sending some fabricated story after he called the manager where I used to live to tell her he was waiting for him to pick him up from the Airport! Then Frohnmayer sent me a team of Doctors for Mental health to Evaluate me

0 notes

Link

Decline 45th High School Reunion

I cannot attend the reunion for reasons cited below but rest assured that my spirit will be there.

I remember attending 9th grade home room in the fall of 1969 as a skinny 14 year old not knowing what my future will be at East Paterson High School. Well I am 63 years old and the results are nearly in.

I had just finished 8 years at St. Anne's Parochial School. I had a good friend named George Wolfe who had dated Rhonda Frattolillo. He attended Fair Lawn High School so I felt lost in the new environment.

Growing up on 18th Avenue I had also known Tommy Moriarty. I spoke to a childhood friend the other day. She told me about the passing of Tommy who died at the age of 62. Tommy had down syndrome. He lived with his rather large family on 16th Avenue. My memory is hazy but some of the details of my childhood have stayed with me. We grew up together for the period of roughly 1965-1968. Many hours were spent sleigh riding on the small hill located near Tommy's house on 16th Avenue. One day my family's dog ran out the door and it seemed like at least 20 children including Tommy tried to catch him. Pepper ran into the woods near the Garfield Water Works. Eventually despite the snow and other dangers Pepper was returned. I asked my Mom about Tommy being different and at the time the term retarded was used. My Mom who was generally soft spoken told me that God made all children in his likeness. Soon after this I was standing on top of 16th Avenue hill waiting to sleigh down it. Tommy was there and asked me if I was his friend. We rode down the hill on the sleigh together. Rest in peace Tommy.

At East Paterson High School I remember being called to Dr Varese the Principal's office in 1972. I was nervous but he congratulated me on receiving a New Jersey State Scholarship. I believe my father who was a Veteran of World War II at Pearl Harbor had something to do with it. I did not serve in the military the draft had ended when I became eligible. Besides I had seen enough fighting outside the third wing of the high school to realize that it was just plain stupid.

I was interested in sports especially baseball throughout my high school years. I am enclosing a picture of my high school jacket. I was too nervous to ask any girls to the proms but if I had the nerve I would have asked Roberta Fisher. Please hug her for me at the reunion. She is a good friend and a wonderful lady. I remember wrestling with you and realizing that you were a skilled wrestler. I remember playing one on one Basketball with Tony Zappala and losing but I was not intimidated by his New Jersey All State superior skills. I remember pitching my first inning in Varsity baseball and realizing that my 80 MPH fastball was not enough to win a ticket to the Major Leagues. But I loved the competition and had some meager success to build on.

After high school I attended College and continued to play baseball. In 1974 I pitched a three hitter against the 11th ranked community college in the nation putting our team in first place. I remember Dennis Walling hitting a double off me in the first inning. When I walked back to the bench my coach told me he was a really good hitter and somehow I got him out the next three times I faced him. Walling went on to have a Hall of fame career in the major leagues. But my ego grew really large that day. I wanted to pitch the 2nd game of the doubleheader but the coach thought otherwise.

In 1974 I heard Paul McCartney’s Band on the Run and my life was changed. If you are ever in a bad mood play this song and you will know what I mean.

In 1976 I dated the first love of my life named Linda Lane. Her father was a wealthy businessman from Paterson New Jersey. Linda attended College in Pennsylvania. I remember driving down to see her and wondering what the future holds for me. In 1977 I proposed to Linda at Valley Forge State Park. She said yes if we could resolve our religious differences. This was true love only encumbered by my Roman Catholic faith vs. her born again Christian beliefs despite the fact that her father was Jewish and her mother was Roman Catholic.

I broke up with Linda and decided to take my 1968 Chevy Nova (I had rebuilt the engine in the snow of the 1977 winter) and move to California. I lost the opportunity for inherited wealth for the California dream by humming the Beach boys songs of the 60's as my friend Lamont and I drove to Long Beach California. I also had an Accounting degree from William Paterson College and $5,000.00. I planned to retire by age 40 with $100,000.00. I remember saying that I had no intention of reading another book until I have some fun. While we looked for apartments I found one but when Lamont turned up to sign the papers it was rented. I found another and made sure Lamont was not there to sign papers. There are bigots apparently all of the country. I really hate bigots.

In late 1978 I met a California girl with a golden smile named Laura Lambert that has graced my life for 40 years. That year I also met Ron Beaman from Nebraska. We have been friends all these years which I consider myself lucky. The next 8 years were spent living in a two bedroom apartment one block from the beach playing basketball with about 40 friends every weekend. I owned a small accounting business.

In 1980 I cried when John Lennon died.

In 1986, Laura and I bought our first piece of Real Estate, a one bedroom condo. It was a bit intimidating. By 2008 we bought/sold over 100 properties, so much for being nervous.

In the late 80’s I met the first of two attorneys that I am also friends with. Gene Goldman is a good attorney whose only deficiency is being weak in billable hours. I believe his calming disposition helped me in dealing with homeowners associations.

By 1994 Laura and I had accumulated 10 pieces of real estate and I had obtained real estate Brokers licenses in California and Nevada. My first real estate sale was to a single mom. She cried when I gave her the keys and I did too when I received a check for $2,200.00 for about 4 hours of work. It seemed so easy. At the loan signing her parents apologized for her being gay. I did not know what to say to the assholes. I wanted the deal to go through so I kept my mouth shut. In 1996 my daughter Rhiannon was born (named after the Fleetwood Mac song of 1977).

In 2002 I attended two concerts, Paul McCartney and Bruce Springsteen in Las Vegas. This makes up for not seeing Bruce Springsteen at Mr. D’s on the corner of Market Street and Midland Avenue. I realized that Paul McCartney and the Beatles were God’s gift to mankind. How lucky were we to experience this?

By 2004 I had a million dollars in the bank and 8 properties. I would go down to the Las Vegas courthouse to buy foreclosures. One property I did not have any information on started bidding at $30,000. I knew the people bidding were attorneys who regularly bought so when the bidding reached $400,000 I started chirping in. I bought it sight unseen for $425,000.00. As I paid the lady one of the attorneys said he was upset and wanted it. I drove my Lexus quickly to the property which was in a gated community. It was a fixer upper that I hoped to sell $575,000.00 and make $30,000.00 on. Well in 4 months after remodeling the price had soared to $675,000.00. I had made $100,000.00 on a house bought sight unseen. My ego grew again.

In 2005 at Christmas time I walked into Wells Fargo Bank in Henderson Nevada with my daughter Rhiannon and asked the teller how much the Wells Fargo Stuffed Stagecoach was. She responded by giving it to my daughter telling her that I was their biggest customer. My ego expanded again.

In 2006 Laura and I met Lon and Mary Searle and their fine family. They are mormons that have great values. Of course we do not agree on Joseph Smith.

By 2008 my material wealth had diminished considerably but luck would have it I found out that my ancestors arrived at Jamestown Virginia in 1629 and I was the 12th generation. I decided to take Laura and Rhiannon and move to Williamsburg Virginia. There was no stopping my love for United States History which began reading about Ethan Allen and the Green mountain Boys at St. Anne's in 2nd grade. Sure Kennedy was shot that same year but if the truth be known it wasn't Oswald who did it. There was a severe recession on except I did not notice it because of my families history unfolded before my eyes. I found the original family cemetery and plantation and a historical figure named Dred Scott who did not have his birthplace recognized. I fixed that in a couple of years by connecting two documents 40 years and 700 miles apart. Isn’t history grand?

In 2009 I met Richard Lincoln Francis, clerk of the Southampton County Court in Virginia. He is descended from Abraham Lincoln and I consider him a good friend who is qualified to be President of the United States. He is my East coast attorney, we have had more fun than should be allowed. To give you an example we had a trial over a Hines lucky rock that rivals the OJ Simpson trial of the century. I have taught Rick the 8 things to drive a golf ball successfully. He is a terrible student who has a tendency to make phone calls while teeing off. I believe this violates some rules.

Since moving to Williamsburg Virginia I have written five books. My disdain for reading that occurred after college was over. The second book involving the research to discover Dred Scott's birthplace is being converted into a movie. It is entitled Walk With You, the story of Dred Scott and the Blow Family of Virginia. It is about 8 children 6 white and 2 black that grew up and bonded together to take on the President and Chief Justice of the United States. I have met Hollywood stars including Ed Asner. My time is currently possessed in seeing this venture is completed to fruition.

My life has been blessed by God and living in the greatest country in the world. I have lived the American dream which consists of association with all ethnic groups. My first twenty two years living in New Jersey were great. My next twenty three years in California were better. My next 8 years in Henderson Nevada were living the dream. The next 5 years in Williamsburg were amazing. And the last few years touring the United States with Laura are the best ever. Opportunities if you use education to advance yourself. If these members of our class are among the living: Robert Motta, Robert Hurley, and Joseph Lasica, please give them my best.

Our democracy is currently under attack by a greedy lying moron who has no business occupying the world's beacon of freedom head office. This will change soon. If any of the morons who voted for this clown have issue I will be happy to meet them outside the 3rd wing at EPHS and give them a taste of true Democracy from someone who has lived it. I have had only two fights in my life. I am undefeated and plan to stay that way.

Warmest Regards,

Jeffrey Allen Hines

Class of 1973

#walkwithyou

#neveragain

#bluewave2018

8 notes

·

View notes

Text

Historic Home Heroes

Old homes have a special place in our hearts. Preserving them is essential for saving limited resources, reducing costs, and cementing the important stories of our past. Lately, the public has caught on to the valuable experience had by owning an old home, and historic house heroes can be found saving endangered structures across the country. Continue reading below to discover two such couples that have been integral in preserving the stories of two fascinating houses.

Danascara Place

In 2018, Jessica Rhodes rescued a historic New York home, known as Danascara Place from foreclosure and has spent the last couple of years restoring it to its former glory. Through the rehab process, Jessica also got to work learning the home’s complete history, and its past is nothing but astonishing.

Frederick Harman Visscher, who was born to Dutch immigrants, purchased 1,000 acres of land, which include the property of Danascara Place, in Albany, New York in 1750. Frederick’s son, the younger Frederick, commanded the Third Regiment of the Tryon County Militia during the Revolutionary War.

The Visschers became well-known for their support of the war, which caused tension between them and the other families in town. One of their neighbors, Sir John Johnson, led the Mohawk Valley raids of 1780 and attacked the Visscher family. American Indians left the younger Frederick Visscher for dead and burned down the original house on the property. However, Frederic survived rescued his brother and was treated to dinner by George Washington because of his heroism.

Around 1795, Frederick constructed the original section of Danascara Place, a 1 ½ story Federal home. After he died in 1809, Frederick’s son, Frederick Herman Visscher, inherited the property. Frederick Herman Visscher’s daughter, Gazena Catherine, married Judge Jesse D. DeGraff and had a son, Alfred DeGraff. Alfred enlarged the home, turning it into a 2 ½ story Italianate mansion.

The DeGraff family remained in possession of the home until 1951. During the last 70 years, it changed hands many times. For a short while, previous owners transformed the mansion into small apartments. It has survived two foreclosures and a fire that destroyed part of an addition. We are thrilled that Danascara Place has finally landed in the hands of an owner that understands the importance of its past.

Duncan Manor

Cheap Old Houses is a blog, Instagram sensation, and now HGTV show that stars Ethan and Elizabeth Finkelstein. Elizabeth is an experienced historic preservationist and Ethan is a digital marketer. As lovers of old homes, they became frustrated with how difficult it is for shoppers to find old homes for sale online. To help save historic, abandoned homes in America, they started the websites CIRCA and Cheap Old Houses.

In 2014, Dave and Randi Howell were perusing the Cheap Old Houses website when they spotted and instantly fell in love with the nineteenth-century Italianate mansion, listed in Towanda, Illinois. After purchasing it, they established a nonprofit to help fund the needed restorations.

The home’s architecture is show-stopping and even caught the attention of FX producers, who used it as a filming location for the show Fargo, but beyond its gorgeous brick façade, the house also contains an intriguing past.

William R. Duncan, a pioneer farmer, built Duncan Manor circa 1870. Duncan was originally from Kentucky, but he was drawn to Central Illinois's fertile farmland. Supposedly, he built the remarkable home as a showplace that would be noticed by train travelers on their way to Chicago.

Unfortunately, Duncan never was able to fully enjoy the fruits of his labor. The home ended up costing more than he bargained, greatly depleting his income. Soon after the house was completed, his wife died of illness. A few years later, his teenage son drowned in a swamp near the home. In 1876, Duncan became suddenly ill while attending a nearby fair and died on his way back to the mansion.

Although unproven, some suspect that Duncan may have kept Black American servants in the lower level. The basement appears to be divided into living quarters, and the basement windows have iron bars. A trap door on the second floor that leads to a room in the basement has been noted by experts as an odd feature.

After the Duncans, various tenants rented the home. The Sullivan family purchased the house in 2008, planning to restore it to its original glory, but the vision has never come close to completion until now.

Are you ready to rescue an old home?

Whether you are a realtor, owner, or potential buyer, our firm offers services to assist your journey. We research the histories of homes and discover the stories behind previous owners, original land ownership, architectural significance, and more! Visit our website to learn more.

0 notes

Link

Quisling Senate Democrats are collaborating with congressional Republicans and President Trump to roll back the Dodd-Frank financial reform bill. So far they have broken a filibuster, and the bill looks set for passage. It's an immensely horrible idea that significantly raises the risk of a future financial crisis.

However, it should also be emphasized that this deregulation package is racist both in specifics and in general effect. It's a perfect demonstration of how centrist Democrats sell out their most loyal voting bloc to predatory Wall Street banks.

So what is in the bill? As David Dayen explains in great detail (along with Elizabeth Warren), it's a core of maybe somewhat-justifiable reforms for smaller banks that has been larded up with a slew of handouts and deregulations for quite large banks — not the very biggest, but ones of the size that helped touch off the 2008 crisis, like Countrywide Financial. "Congress is unlikely to pass much significant legislation in 2018, so lobbyists have rushed to stuff the trunk of the vehicle full," Dayen writes. However, perhaps most egregious in regulatory terms, there are also a set of regulatory rollbacks that Citigroup lobbyists got added to the bill which would benefit the very largest banks.

What's more, proposed fixes for some of this stuff are all scams, as Dayen patiently explains in another post.

Now, Sen. Bob Corker (R-Tenn.) has introduced an amendment which would undo most of these latter Citi-written provisions. The fact that a Tennessee Republican is balking at this banker handout tells you how bad this is. And the fact that centrist Democrats are being squirmingly dishonest about the contents of the bill tells you they know exactly what moral wrong they are committing. (And it's anybody's guess whether Corker's amendment will get a vote.)

Financial deregulation in general is racist for two main reasons.

The first is relatively passive: Deregulation raises the risk of a general economic crash, which harms African-Americans disproportionately due to their being clustered on the bottom of the income ladder. Since blacks tend be poorer than whites and are often the last hired and first fired, they get the worst of it when a recession hits.

But the second reason is actively racist: Banks have long tended to directly prey on black people, whether it was abusive contract selling decades agoor shoving middle-class black families who qualified for normal home mortgages into subprime loans during the housing bubble. (Or as Wells Fargo employees called it, tricking "mud people" into "ghetto loans.")

The ensuing foreclosure crisis — carried out by banks and mortgage servicers, and powerfully enabled by centrist liberal and then-Treasury Secretary Tim Geithner — was one of the great epochs of black wealth destruction in U.S. history. From 2007-2016, average black home wealth declined by 28 percent, while the average home wealth of whites fell by only 16 percent. (Over that same period, the mostly-white top 1 percent, whose wealth is mostly in stocks, increased its wealth by $4.9 million on average.) To this day, blacks and Latinos have far greater trouble getting home loans than whites.

This shouldn't be too surprising. In general, it's easier to squeeze profit out of a defenseless population through deception and force than it is to conduct rigorous underwriting and analysis.

That brings me to the most morally odious part of this bill: its rollback of data-gathering requirements intended to prevent lending discrimination. As Zach Carter explains:

The Senate could vote as early as Thursday on a [Sen. Tim] Kaine-sponsored bill that deliberately undermines the government's ability to enforce laws against racial discrimination in the housing market. The legislation would block the Consumer Financial Protection Bureau from collecting key data showing when and where families of color are being overcharged for home loans or steered into predatory products. [HuffPost]

(Continue Reading)

#politics#the left#the week#centrists#neoliberals#neoliberal capitalism#structural inequality#financial industry#wall street#curruption#institutional racism

80 notes

·

View notes