#Wells Fargo Home Mortgage

Text

Latino Wells Fargo Employees Accuse Bank Of Anti-Latino Bias

Here We Go Again! Latino Wells Fargo Employees Accuse Bank Of Anti-Latino Bias In A Predatory Lending Scheme

A group of current and former Latino Wells Fargo employees has filed a federal lawsuit against Wells Fargo. The employees from the company’s bilingual mortgage sales team are alleging race-based discrimination.

The suit alleges:

“Wells Fargo forces its employees on the Bilingual team…

View On WordPress

#banking#banks#foreclosures#mortgages#Wells Fargo#Wells Fargo accounting errors#Wells Fargo ATM near me#Wells Fargo Bank#Wells Fargo bank fraud#Wells Fargo Bank NA#Wells Fargo Bank near me#Wells Fargo Foreclosure Defense#Wells Fargo Foreclosure Help#Wells Fargo Foreclosures#Wells Fargo fraud#Wells Fargo Home Mortgage#Wells Fargo mortgage fraud#Wells Fargo pulls out of mortgage lending#Wells Fargo RMBS lawsuit#Wells Fargo scandals#Wells Fargo Servicing

0 notes

Text

10 Best Mobile Home Loans For Bad Credit Guaranteed Approval

Are you looking to buy a mobile home but worried about financing due to bad credit? Don’t fret! While securing a mobile home loan with bad credit can be challenging, there are absolutely options available. This blog post will explore the best mobile home loans for bad credit in 2024 and equip you with tips to get home loans guaranteed approval for your dream manufactured home financing bad…

View On WordPress

#2. VA-Guaranteed Home Loan Program#20 000 mobile home loans for bad credit#3. FHA Title I Program#4. Rocket Mortgage#5. Fannie Mae MH Program#7. FHA Rate Guide#8. Wells Fargo Home Mortgage#apply for a mobile home loan online bad credit#bad credit loans for mobile home#bad credit loans for mobile home in enterprise#bad credit loans for mobile homes#bad credit mobile home loans#bad credit mobile home loans guaranteed approval for veterans#bad credit mortgage loans for mobile homes#best companies for mobile home loans bad credit#best mobile home loans for bad credit#credit human mobile home loans#getting a loan for a mobile home with bad credit#guaranteed mobile home loans for bad credit#home equity loans for bad credit on mobile homes#home equity loans for mobile homes with bad credit#home loans for mobile homes bad credit#loan for mobile home bad credit#loan for mobile home with bad credit#loans for a mobile home on bad credit#loans for bad credit for mobile homes#loans for mobile home bad credit#loans for mobile homes in parks bad credit#loans for mobile homes with bad credit#mobile home and land loans for bad credit

0 notes

Text

PORTLAND, Ore. (KOIN) — A former Portland lawyer was sentenced to more than eight years in federal prison Monday after defrauding over 100 clients out of millions of dollars in insurance proceeds, according to the U.S. District Attorney’s Office.

Lori E. Deveny, 57, was also ordered to pay over $4.5 million in restitution to her victims.

“It’s hard to overstate the extraordinary impact Ms. Deveny’s crimes had on the many innocent and vulnerable victims who trusted her. As a former attorney, she had a special responsibility to her clients and to the public, but she repeatedly abused this trust and prioritized her own needs. This is a just sentence for serious crimes,” said Ethan Knight, Chief of the Economic Crimes Unit for the U.S. Attorney’s Office.

“The cruelest thing of all is knowingly providing false hope. Having already suffered losses, Ms. Deveny’s clients deserved an attorney who represented their best interests. What they got instead was someone who inflicted more loss,” added Special Agent in Charge Bret Kressin, IRS Criminal Investigation (IRS-CI), Seattle Field Office. “Today, Ms. Deveny is receiving what she never provided her clients: a picture of reality that those who choose to defraud will face the consequences of their actions.”

Court documents say that between April 2011 and May 2019, Deveny defrauded at least 135 of her clients out of over $3.8 million in insurance proceeds by stealing clients’ identities, forging insurance checks, depositing client funds into her personal bank account and deceiving clients continually by telling them they would eventually receive compensation for their injuries. Many of her victims were particularly vulnerable due to their severe brain and bodily injuries, the U.S. Attorney’s Office said.

Deveny’s scheme also cost Oregon State Bar Client Security Fund, Wells Fargo and the IRS, according to investigators. Due to the state bar making partial restitution payments to some of Deveny’s clients, their security fund lost $1.2 million, one of the largest losses in the organization’s history. Wells Fargo reportedly lost $52,000 due to a forged check and the IRS lost over $621,000 when Deveny didn’t report the money she stole on her tax returns.

Deveny used the proceeds to pay more than $150,000 on foreign and domestic airline tickets, more than $173,000 on African safari and big game hunting trips, $35,000 on taxidermy expenses, $125,000 on home renovations, $195,000 in mortgage payments, more than $220,000 in cigars and related expenses, $58,000 on pet boarding and veterinary costs, $41,000 on recreational vehicle expenses, $50,000 for a Cadillac vehicle, and $60,000 on stays at a luxury nudist resort in Palm Springs, Calif.

“While serving as an attorney, Ms. Deveny brazenly stole money that should have gone to pay for health care for her clients for serious injuries and ailments. Instead, that money funded things like big game hunting trips to Africa and home remodeling. She took advantage of people who were physically and emotionally hurting by forging insurance checks, stealing the funds and lying to her clients about the payouts,” said Kieran L. Ramsey, Special Agent in Charge of the FBI Portland Field Office. “These actions not only got her disbarred but are now putting her behind bars. The FBI applauds our partners at IRS-CI and the U.S. Attorney’s Office, as we continue to bring to justice those who commit this kind of unconscionable financial fraud that harms the people in our shared community.”

A grand jury returned a 24-count indictment on Deveny on May 7, 2019, charging her with mail, bank, and wire fraud, as well as aggravated identity theft, money laundering and filing a false tax return. She pled guilty to one count each of mail, wire, and bank fraud, and also plead guilty to money laundering, filing a false tax return and two counts of aggravated identity theft on June 27, 2022.

28 notes

·

View notes

Text

CFPB Orders Wells Fargo to Pay $3.7 Billion for Widespread Mismanagement of Auto Loans, Mortgages, and Deposit Accounts

The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines. The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes.

Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank. Wells Fargo also charged consumers unlawful surprise overdraft fees and applied other incorrect charges to checking and savings accounts. Under the terms of the order, Wells Fargo will pay redress to the over 16 million affected consumer accounts, and pay a $1.7 billion fine, which will go to the CFPB's Civil Penalty Fund, where it will be used to provide relief to victims of consumer financial law violations.

Learn more about the enforcement action.

3 notes

·

View notes

Text

Las Cruces, Nm Actual Estate Homes For Sale In Las Cruces, Nm

March three, 2022 SANTA FE — Governor Michelle Lujan Grisham yesterday signed House Bill ninety five, which makes discovering and enrolling in high quality reasonably priced well being coverage easier for New Mexicans. The Easy Enrollment Act , sponsored by Representative Liz Thomson, Senator Liz... Changes increase take care of mothers from 60-days to a full year SANTA FE – The Lujan Grisham administration announced on Wednesday that it'll broaden Medicaid protection for postpartum care for brand new mothers by increasing protection from 60 days to a full 12 months. New Mexicans in need encouraged to apply SANTA FE – A new water benefit, the Low-Income Household Water Assistance Program , is on the market to help households with water and wastewater costs, introduced the New Mexico Human Services Department. State to deliver millions in rebates, economic aid this summer season SANTA FE - The New Mexico Taxation & Revenue Department and Human Services Department are partnering to ship revenue tax rebates and economic aid payments signed into law by Gov. Michelle Lujan...

HSD Representatives might be obtainable to assist with constituent companies Saturday Aug. 10, 10 a.m. – Gov. Michelle Lujan Grisham and the New Mexico Human Services Department strongly oppose the federal government’s proposed rule adjustments eliminating Broad-Based Categorical Eligibility from the Supplemental Nutrition Assistance Program .

Many folks start by figuring out what they can afford as a month-to-month payment. A widespread start line is to calculate 25% of your gross monthly earnings to assist decide a manageable monthly mortgage payment. "It was an exquisite seamless experience getting my mortgage from Wells Fargo. Everyone I worked with was skilled, clear, and made the process homes for sale in las cruces nm very clean. I am very grateful and would undoubtedly recommend Wells Fargo to others." Get knowledgeable concerning the mortgage an homebuying process, from beginning your own home search to planning your subsequent move. Knowing what to search for during your new home search might help you store confidently.

In discovering the average value, all costs of homes listed are added after which divided by the number of homes sold. Our top-rated real estate agents in High Range are local experts and are ready home builders in las cruces to answer your questions on properties, neighborhoods, schools, and the newest listings for sale in High Range. Redfin has a local workplace at 314 S Guadalupe St., Santa Fe, NM 87501.

Waste Connections is amongst the largest full-service provider of stable waste collection, offering non-hazardous strong waste collection, recycling and landfill disposal providers to industrial, industrial, municipal and residential customers. Waste Connections (TSX/NYSE) is the third largest solid waste management firm in North America with a network of operations in forty one states and 6 provinces. We are striving for a greener and cleaner tomorrow in all our areas unfold across North America. Contact us right now to be taught more about waste management and recycling services. Nathan Small, a state consultant from the Las Cruces area, has been amongst these making an attempt to smooth New Mexico’s transition to an economic system that’s viable.

We utilize distinctive assets to market to a large audience of potential Buyers to get more eyes on your property. Combine yr round consolation with the potential for a lifetime of savings with our Energy Smart Home Package. Help cut back vitality value the day you purchase your Clayton Built® home. Send Message Email me listings and house associated data. As of December 2022, the common house hire in Las Cruces, NM is $553 for a studio, $811 for one bed room, $1,292 for two bedrooms, and $1,311 for 3 bedrooms.

The lower their expenses, the better retirees will fare in a specific metropolis. If so many American staff are nervous about their monetary future, what different choices provide a pathway to a comfortable retirement? According to Gallup polling, workers homes for sale in las cruces new mexico in 2021 deliberate to retire at age sixty four on average, compared to age 60 in 1995. Relocate to an area where you'll be able to stretch your dollar with out sacrificing your way of life.

– Amid a housing market suffering from high mortgage charges, inflation woes and recession fears, housing costs in the us are anticipated to fall next 12 months, though the market isn’t prone to see a leap in consumers as a result. Monthly payment quantity does not embrace property taxes, owners insurance coverage or monthly mortgage insurance and due to this new homes las cruces fact might be higher. The principal and curiosity fee is predicated on an rate of interest of 6.5% and APR of three.94%, 30-YR Fixed FHA mortgage with three.5% down payment. Credit phrases are based on credit score and present market, charges might vary. Income and/or geographic restrictions could apply to completely different loan options together with $0 down financing.

2 notes

·

View notes

Link

#bestmortgagelenders#bestmortgagelendersusa#bestmortgagerates#comparingmortgagelenders#howtochooseamortgagelender#howtochoosemortgagelender#howtofindthebestmortgagelender#howtogetthebestmortgagerate#howtopickamortgagelender#mortgage#mortgagebroker#mortgageinterestrates#mortgagelender#mortgagelenders#mortgagerate#mortgagerates#Mortgages#questionstoaskamortgagelender

0 notes

Text

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates — things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates.

That could help unlock opportunities for you. When you’re ready, let’s connect with real estate agents from KM Realty Group LLC. That way you’ll be prepared to take action when the time is right for you.

0 notes

Text

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

#exprealty#losangeles#homeownership#realestateagent#federal reserve#mortgageapplication#realestatetips#keepingcurrentmatters

0 notes

Text

How the Federal Reserve’s Next Move Could Impact the Housing Market

How the Federal Reserve’s Next Move Could Impact the Housing Market

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The overwhelming expectation is that they’ll cut the Federal Funds Rate at their upcoming meeting, driven primarily by recent signs that inflation is cooling, and the job market is slowing down. Mark Zandi, Chief Economist at Moody’s Analytics, said:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is one of the key factors that influences mortgage rates – things like the economy, geopolitical uncertainty, and more also have an impact.

When the Fed cuts the Federal Funds Rate, it signals what’s happening in the broader economy, and mortgage rates tend to respond. While a single rate cut might not lead to a dramatic drop in mortgage rates, it could contribute to the gradual decline that’s already happening.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

And any upcoming Federal Funds Rate cut likely won’t be a one-time event. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

Here’s what experts in the industry project for mortgage rates through 2025. One contributing factor to this ongoing gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

So, with recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to lead to a moderate decline in mortgage rates (shown in the dotted lines). Here are two big reasons why that’s good news for both buyers and sellers:

1. It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates could help ease the lock-in effect. That’s where people feel stuck within their current home because today’s rates are higher than what they locked in when they bought their current house.

If the fear of losing your low-rate mortgage and facing higher costs has kept you out of the market, a slight reduction in rates could make selling a bit more attractive again. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. It Should Boost Buyer Activity

For potential homebuyers, any drop in mortgage rates will provide a more inviting housing market. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a move.

What Should You Do?

While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening.

And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. That could help unlock opportunities for you. When you’re ready, let’s connect. That way you’ll be prepared to take action when the time is right for you.

0 notes

Text

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best possible decision for your homeownership plans.

Here’s an early look at the most recent projections on mortgage rates, home sales, and prices for 2025.

Mortgage Rates Are Projected To Come Down Slightly

Mortgage rates play a significant role in the housing market. The forecasts for 2025 from Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo show an expected gradual decline in mortgage rates over the course of the next year (see chart below):

Mortgage rates are projected to come down because continued easing of inflation and a slight rise in unemployment rates are key signs of a strong but slowing economy. And many experts believe these signs will encourage the Federal Reserve to lower the Federal Funds Rate, which tends to lead to lower mortgage rates. As Morgan Stanley says:

“With the U.S. Federal Reserve widely expected to begin cutting its benchmark interest rate in 2024, mortgage rates could drop as well—at least slightly.”

Read more

0 notes

Text

CFPB Spanks Wells Fargo With Yet Another Fine

CFPB Spanks Wells Fargo With Yet Another Fine

The CFPB Spanks Wells Fargo With Yet Another Fine Yesterday For Ripping Off Consumers. This Time It’s For $3.75 Billion

The CFPB spanks Wells Fargo with another fine by the CFPB yesterday. The CFPB has ordered Wells Fargo Bank to pay $3.7 billion for violations across several of its largest product lines. This includes mortgage and auto loans that resulted in thousands of customers allegedly…

View On WordPress

#banking#banks#foreclosure#foreclosure defense#foreclosures#mortgage fraud#mortgages#real estate#Wells Fargo#Wells Fargo accounting errors#Wells Fargo Bank#Wells Fargo bank fraud#Wells Fargo Bank NA#Wells Fargo Bank near me#Wells Fargo Foreclosure Defense#Wells Fargo Foreclosure Help#Wells Fargo Foreclosures#Wells Fargo fraud#Wells Fargo Home Mortgage#Wells Fargo mortgage fraud#Wells Fargo RMBS lawsuit

0 notes

Text

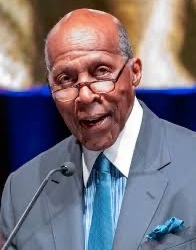

Attorney Vernon Eulion Jordan Jr. (August 15, 1935 – March 1, 2021) was a business executive and civil rights activist who worked for various civil rights movement organizations before becoming a close advisor to President Bill Clinton.

He has become known as an influential figure in American politics.

He was born in Atlanta to Mary Belle (Griggs) and Vernon E. Jordan Sr. He had a brother, Windsor. He was a cousin of James Shaw, a musician who is professionally billed as The Mighty Hannibal.

He grew up with his family in the segregated societal cosmos of Atlanta. He was an honors graduate of David T. Howard High School. Rejected for a summer internship with an insurance company after his sophomore year in college because of his race, he earned money for college for a few summers by working as a chauffeur to former city mayor Robert Maddox, then a banker. He graduated from DePauw University. He earned a JD at Howard University School of Law. He was a member of the Omega Psi Phi and Sigma Pi Phi Fraternities.

He returned to Atlanta to join the law office of Donald L. Hollowell, a civil rights activist. The firm, including Constance Motley, sued the University of Georgia for racial discrimination in its admission policies. The suit ended with a Federal Court order demanding the admission of two African Americans, Charlayne Hunter, and Hamilton E. Holmes.

He became directly involved in activism in the field, serving as the Georgia field director for the NAACP. From the NAACP, he moved to the Southern Regional Council and then to the Voter Education Project.

He became the executive director of the UNCF. He was president of the NUL.

He married Shirley (née Yarbrough), who died in 1985. They have a daughter, Vickee Jordan Adams, who works in media relations for Wells Fargo Home Mortgage. In 1986 he remarried, Ann Dibble Jordan. #africanhistory365 #africanexcellence #sigmapiphi #omegapsiphi

1 note

·

View note

Text

<img src="https://lh3.googleusercontent.com/drive-storage/AJQWtBNj0ugQqRMkfwiCYV6P8_xCK4lS9nrxE0h9_UYhchC7wF3Qwy3453LGuA516mIvYIBSPBYxd8lcEdYad0iPDpuKfqgzaXgYdJMFQC5l165qCw=s700"> Mastering NJ Mortgage Rates: 2024 Homebuyer's Essential Guide

The real estate market remains highly competitive as we approach 2024, with mortgage rates playing a crucial role in homebuyers' decisions. Staying informed about mortgage rate trends and understanding financing options is essential for New Jersey homebuyers. According to recent forecasts, the average 30-year fixed mortgage rate should hover around [XX.XX]% in 2024. Monitoring these changes helps buyers make educated decisions and secure the most advantageous deals available.

Comparing Mortgage Rates

Securing the most favorable mortgage rate requires careful research and strategic comparisons. Here’s a step-by-step guide to ease your efforts: Research Multiple Lenders: Expand your search to include both local and national lenders. Some of the top mortgage lenders in New Jersey include Wells Fargo, Quicken Loans, and loanDepot. Request Personalized Quotes: Contact your selected lenders for tailored mortgage rate quotes based on your specific financial situation, including credit score, down payment, and loan amount. Compare Rates and Fees: Evaluate each quote by comparing the interest rates, annual percentage rates (APRs), and closing costs. A lower interest rate might not be the best choice if the associated fees are exceptionally high. Negotiate Terms: Don’t shy away from negotiating your mortgage terms. With some negotiation, you may secure a better interest rate or reduced fees.

Understanding Financing Options

Choosing the appropriate financing option is vital for homebuyers. Here are some popular choices along with their unique features:

Fixed-rate Mortgages: Provide a fixed interest rate and consistent monthly payments throughout the loan term, offering predictability.

Adjustable-rate Mortgages (ARMs): Feature initially lower rates that can adjust over time based on market conditions, beneficial if you plan to sell or refinance before rates adjust.

FHA Loans: Insured by the Federal Housing Administration, these loans have lower down payment requirements and lenient credit standards, perfect for first-time buyers and those with lower credit scores.

VA Loans: Available to eligible veterans, military members, and surviving spouses. VA loans offer competitive rates, no down payment, and lower closing costs.

USDA Loans: Offered by the U.S. Department of Agriculture, these loans assist rural and suburban homebuyers with low to moderate incomes, providing zero down payment and competitive interest rates.

Here's a quick comparison table to help you understand the key differences:

Loan Type Interest Rate Down Payment Eligibility Fixed-rate Consistent 5-20% General ARMs Initially low, adjustable 5-20% General FHA Varies 3.5% First-time buyers, low credit scores VA Competitive None Veterans, military members USDA Competitive None Rural/suburban, low to moderate income

Gathering Necessary Documentation

Preparing for your mortgage application involves assembling essential documents to expedite the process. Ensure you have:

Photo ID

Social Security numbers

W-2 forms or tax returns from the past two years

Pay stubs from the past 30 days

Bank statements from the past two months

Proof of other income sources

Credit history reports

Purchase agreement

Home appraisal and inspection reports

Navigating Mortgage Rates and Financing Options

Successfully navigating mortgage rates and financing options in 2024 necessitates strategy and foresight:

Monitor Rate Trends: Regularly check mortgage rate trends to identify the optimal time for applying.

Compare Rates and Fees: Review multiple lenders to ensure you secure the most favorable rate and terms.

Explore Financing Options: Determine which type of financing best suits your financial situation.

Prepare Your Documents: Gather all necessary documentation in advance to streamline the application process.

Consider a Broker: Working with a mortgage broker can simplify the process and provide access to a broad range of lending options.

By remaining informed and prepared, New Jersey homebuyers can confidently navigate the mortgage landscape in 2024, securing the best possible financing for their dream homes. #MortgageRates #HomeBuying #NewJersey #HomeLoans #RealEstate2024 Don't wait on favorable rates! Explore your financing options at https://www.kvibe.com/blog-posts/navigating-new-jersey-mortgage-rates-2024

0 notes

Text

Mortgage Rates Hit Lowest Level Since April, Easing Housing Market Pressures

Source – MarketWatch

Declining Mortgage Rates

Mortgage rates in the United States have dropped to their lowest level since early April, providing a slight reprieve for the country’s increasingly unaffordable housing market. According to Freddie Mac, the average rate for a standard 30-year fixed-rate mortgage was 6.87% in the week ending June 20, down from 6.95% the previous week. This marks the third consecutive weekly decline and follows a peak of 7.22% earlier this year.

Freddie Mac’s chief economist, Sam Khater, attributed the decrease to signs of cooling inflation and market expectations of potential Federal Reserve rate cuts. He expressed optimism about the impact of lower mortgage rates combined with improving housing supply dynamics.

Federal Reserve Influence and Market Impact

Despite recent declines, current mortgage rates remain notably higher than pre-2022 levels when the Federal Reserve began raising interest rates to combat inflation. While borrowing costs are expected to ease somewhat this year, economists caution that significant drops below 6% are unlikely. The Federal Reserve’s decisions indirectly influence mortgage rates through movements in the benchmark 10-year US Treasury yield, which adjusts in anticipation of Fed policy changes.

Challenges in the Housing Market

Although recent rate reductions offer a glimmer of hope, the overall US housing market continues to face challenges exacerbated by elevated interest rates. Recent government data revealed disappointing figures for new home construction in May, with housing starts falling to the lowest level since 2020. Building permits, a forward indicator of future construction activity, also fell short of economists’ expectations.

The National Association of Home Builders/Wells Fargo Housing Market Index, which measures builder sentiment, reported a decline to its lowest level since December. NAHB Chairman Carl Harris highlighted that high mortgage rates are deterring potential buyers, while builders contend with increased costs for construction loans, labor shortages, and limited available land.

Persistent Affordability Issues

Rising home prices further compound the affordability crisis across America. The S&P CoreLogic Case-Shiller US National Home Price Index indicated a 6.5% year-over-year increase in March, reaching record highs in urban centers like San Diego, Los Angeles, and New York. This marks the sixth time the index has hit a new peak in the past year, underscoring strong demand despite economic pressures.

According to the annual Demographia International Housing Affordability report, California hosts some of the most expensive housing markets in the US, alongside Honolulu, Hawaii. Affording a median-priced home typically requires a substantial down payment, often exceeding $127,000 — approximately double the median annual salary of a US worker, as analyzed by Zillow.

Chief Economist Skylar Olsen of Zillow noted that achieving such savings can be challenging without external financial support, prompting some buyers to explore options like relocating, pooling resources with others, or renting out extra space to manage affordability constraints.

As the housing market navigates fluctuating mortgage rates and soaring prices, stakeholders anticipate continued adjustments in policy and market conditions to address ongoing affordability challenges nationwide.

Curious to learn more? Explore our articles on Enterprise Wired

0 notes

Text

Apply Professional Doctor Loan Online | Best Loan for Doctors

Medical professionals often face unique financial challenges that require specialized lending solutions. One such solution is the professional doctor loan, designed specifically to meet the needs of physicians, dentists, and other medical practitioners. These loans offer favorable terms, competitive interest rates, and flexible repayment options that cater to the high-income potential and financial stability of healthcare professionals. With the advent of digital banking, applying for these loans online has become more convenient and accessible than ever. This article explores the best professional loan for doctor available and the online application process, providing a comprehensive guide for medical professionals seeking financial assistance.

Understanding Professional Doctor Loans

Professional doctor loans are tailored to meet the distinct financial needs of medical practitioners. These loans can be used for various purposes, including purchasing a home, refinancing existing debt, starting or expanding a practice, or covering the costs of education and training. Key features of these loans include:

High Loan Amounts: Recognizing the high earning potential of medical professionals, lenders often offer larger loan amounts compared to traditional loans.

Competitive Interest Rates: Due to the low-risk profile of medical professionals, these loans typically come with lower interest rates.

Flexible Repayment Terms: Lenders provide flexible repayment options, including deferred payments during residency or fellowship periods.

No Private Mortgage Insurance (PMI): Many doctor loans do not require PMI, even with lower down payments.

Tailored Underwriting: The underwriting process for doctor loans takes into account future earning potential rather than current income, making it easier for new doctors with significant student debt to qualify.

Best Professional Doctor Loan Providers

Several financial institutions stand out for their professional doctor loan offerings. Here are some of the best providers:

1. SunTrust Bank (now Truist)

SunTrust’s doctor loan program is known for its competitive terms and customer-centric approach. Key features include:

No PMI: Available for loans up to $1.5 million.

Low Down Payment: As little as 0% down for loans up to $750,000.

Flexible Loan Options: Fixed and adjustable-rate mortgages (ARMs) available.

2. Bank of America

Bank of America offers a tailored program for medical professionals with attractive benefits:

High Loan Limits: Up to $1 million with no down payment.

No PMI: PMI is not required, which can save doctors a significant amount of money.

Deferred Payments: Payment deferment options during residency.

3. PNC Bank

PNC’s medical residency loan program provides favorable terms for new doctors and residents:

Low Down Payments: As little as 5% down for loan amounts up to $1 million.

No PMI: This reduces the overall cost of borrowing.

Flexible Underwriting: Considers future income potential.

4. Wells Fargo

Wells Fargo offers a comprehensive suite of products for medical professionals, including:

Home Mortgages: Specialized mortgage products for doctors.

Practice Loans: Financing for starting or expanding a medical practice.

Student Loan Refinancing: Competitive rates for refinancing existing student loans.

Applying for a Professional Doctor Loan Online

The process of applying for a doctor loan online is straightforward and efficient. Here’s a step-by-step guide:

Step 1: Research and Compare Lenders

Begin by researching various lenders that offer professional doctor loans. Compare their terms, interest rates, loan limits, and repayment options. Utilize online comparison tools and read reviews to gauge customer satisfaction and reliability.

Step 2: Gather Required Documents

Prepare the necessary documentation to streamline the application process. Commonly required documents include:

Proof of identity (e.g., driver’s license, passport)

Proof of income (e.g., employment contract, recent pay stubs)

Medical degree or certification

Proof of residency or fellowship (if applicable)

Credit report

Step 3: Pre-Qualification

Many lenders offer online pre-qualification, which provides an estimate of the loan amount you might qualify for based on a soft credit check. This step does not affect your credit score and gives you an idea of your borrowing power.

Step 4: Online Application

Once you’ve selected a lender, fill out their online application form. This will typically include personal information, employment details, and the loan amount you’re seeking. Most lenders have user-friendly platforms that guide you through each step.

Step 5: Submit Documentation

Upload the required documents through the lender’s secure online portal. Ensure that all documents are clear and complete to avoid delays in the approval process.

Step 6: Loan Approval and Offer

After reviewing your application and documentation, the lender will provide a loan offer. This offer will detail the loan amount, interest rate, repayment terms, and any other relevant conditions. Review the offer carefully and don’t hesitate to ask questions if anything is unclear.

Step 7: Acceptance and Disbursement

If you accept the loan offer, the lender will finalize the paperwork and disburse the funds. This can often be done electronically, ensuring a quick and convenient process.

Tips for a Smooth Application Process

Maintain a Good Credit Score: A higher credit score can secure better loan terms and lower interest rates.

Be Transparent: Provide accurate and honest information to avoid complications during the approval process.

Seek Professional Advice: Consider consulting with a financial advisor to understand the implications of different loan options.

Stay Organized: Keep all documents and communication organized to streamline the process.

Conclusion

Loan for doctor are an excellent financial tool for medical professionals, offering tailored solutions to meet their unique needs. By leveraging the convenience of online applications, doctors can easily access the funds they need for personal or professional growth. Whether purchasing a home, refinancing student loans, or expanding a practice, these loans provide the financial flexibility and support that medical professionals deserve. By carefully researching lenders, preparing necessary documentation, and understanding the application process, doctors can secure the best loan options available and achieve their financial goals with confidence.

0 notes

Text

Stocks erase earlier gains as bond yields climb

New Post has been published on https://petn.ws/iWfnX

Stocks erase earlier gains as bond yields climb

Homebuilder stocks fell on Monday after a closely watched housing sentiment index broke a four-month streak of gains amid high mortgage rates. The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) stayed at 51 in April, unchanged from March. To be sure, any number over 50 indicates that more builders view conditions […]

See full article at https://petn.ws/iWfnX

#OtherNews

0 notes