#What is a ETH coin worth?

Text

Crypto Jackpot: Small Investment, 1.6 ETH and Huge Profit of $1.77 Million!

Recently a big jackpot was seen in the cryptocurrency market. A cryptocurrency trader investing in cryptocurrency turned a small amount of cryptocurrency into huge profits. With only 1.6 ETH (worth approximately $3,694), he made 770 ETH, which is approximately $1.77 million, in just 12 minutes.

His incredible success and huge profits in a short period of time have astonished the crypto community…

View On WordPress

#best cryptocurrency news#crypto news#cryptocurreency news#cryptocurrency news#cryptocurrency news predictions#cryptocurrency news today#cryptocurrency news websites#Ethereum latest news#ethereum news#How much will 1 Ethereum be worth in 2030?#mike solana#real time cryptocurrency news#shiba inu cryptocurrency news#solana news#top cryptocurrency news sites#What is a ETH coin worth?

1 note

·

View note

Text

What is Neurix Profit?

Neurix Profit is a cutting-edge cryptocurrency trading platform designed to help users automate their trading experience. In recent years, trading bots like Neurix Profit have gained popularity due to their ability to perform trades automatically, without constant user supervision. By utilizing advanced algorithms, Neurix Profit monitors the crypto market 24/7, searching for the best buy and sell opportunities for major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). But how does it work, and is it worth considering for your trading strategy?

One of the standout features of Neurix Profit is its simplicity. The platform claims that even beginner traders can benefit from it. Once you set up your desired trading parameters, such as risk tolerance and preferred trading strategy, the bot takes over. Neurix Profit is designed to execute trades based on real-time market data, making decisions faster than any human trader could. This allows users to potentially capitalize on market fluctuations without being glued to their screens. For more information, you can visit the official site (https://neurix-profit.com/)/.

Another advantage of Neurix Profit is its range of supported cryptocurrencies. Investors can trade not only Bitcoin and Ethereum but also altcoins like Litecoin (LTC), Binance Coin (BNB), and others. This versatility enables traders to diversify their portfolios and take advantage of the unique opportunities that each cryptocurrency presents. The platform's claimed success rate is competitive, though it's important to remember that all trading, especially in the crypto world, carries risks.

Neurix Profit also offers an easy-to-use interface, making it suitable for both novice and experienced traders. While there is no mobile app available yet, the web platform is accessible and easy to navigate. One key feature is the demo account, which allows users to test the platform before risking real money. This is a valuable tool for those looking to familiarize themselves with the bot's functionality without committing funds upfront.

In conclusion, Neurix Profit provides an automated trading solution that claims to help investors maximize profits in the volatile crypto market. However, as with any trading platform, it's essential to approach with caution and start small to evaluate its performance. To learn more, check out https://neurix-profit.com/.

0 notes

Text

Cryptocurrency Exchanges: Picking the Best Platform for How You Trade

You can trade bitcoins more than ever in the last few years. Now, investors are looking for good plans and reliable coins signs to help them get through this market that is always changing. Since more people want to sell digital assets, there are more sites that want to get the attention of buyers. If you want to find the best crypto trading signs to help you decide, it can be hard to find the right market for the way you trade. You should think about the most important things when picking a bitcoin exchange. This full guide will go over them all. If you want to trade, this will help you find the best site for you.

Security: The Most Important Thing

Your first thought should be about protection when picking a cryptocurrency company. There have been hacks and security holes in the crypto world, and digital assets worth millions of dollars have been stolen. If you want to keep your money safe, look for exchanges that put protection steps like

Two-step verification (2FA)

Most of the money is kept in cold storage.

Regular checks for security

Insurance plans to pay for possible losses

Strong history of keeping things safe

Reliable platforms have put a lot of money into security infrastructure to keep their users' funds safe and make sure trades go through smoothly, even ones based on crypto signals.

Trading Pairs That Are Open

It's important that an exchange has a lot of different trading pairs, especially if you want to trade bitcoins. Most platforms have popular pairs like BTC/USD and ETH/USD, but the altcoin pairs they offer can be very different. Before picking an exchange, think about how you plan to trade and the cryptocurrencies you want to buy.

For instance, if you only want to deal with big cryptocurrencies, a site like Coinbase Pro might be enough. You might want an exchange with more options, though, if you want to trade a lot of different altcoins or follow a lot of different buying signs for cryptocurrencies.

Trade and Liquidity Amount

Liquidity is important for making trades fast and at fair prices, especially when acting on crypto trading tips that expire soon. Spreads and gaps are usually tighter on exchanges with a lot of activity. This can have a big effect on how profitable your trade is. If you want to trade pairs, look for platforms that see a lot of trades every day.

You can find information about trade amounts on different exchanges on websites like CoinMarketCap and CoinGecko. This will help you find the platforms with the best liquidity for your chosen assets.

Fees and How Costs Work

Trading fees can cut into your earnings, especially if you follow a lot of signs and trade a lot. When comparing platforms, pay close attention to how they set their fees, which should include:

Fees to make and take

Fees to deposit and receive money

Fees for changing money

Some platforms let users with a lot of dealing or holding their own native tokens pay less in fees. When comparing how much different sites cost, think about how often you trade.

Trading Tools and the User Interface

The experience of the person can be very different between trades. Some platforms have easy-to-use interfaces for new users, while others have more complicated tools for traders with more experience. Think about how much you know and what features you need:

For starters: Look for companies that have teaching materials and clean, easy-to-use interfaces.

Expert sellers should know: Look for exchanges that let you use complicated trade tactics by giving you access to advanced order types, charting tools, and APIs.

Following the rules and being limited by geography

There are different rules for how to handle cryptocurrency in each country, and some markets might not be open everywhere.

Also, think about how the exchange feels about money laundering and "Know Your Customer" rules. Some traders like platforms with few Know Your Customer (KYC) rules, but markets that are controlled and have strict compliance rules often offer better security and legal protection.

Option to Deposit and Withdraw

Having it simple to add and remove money from an exchange is important for dealing, especially when you need to act quickly on market chances. Look for sites that let you transfer and withdraw money in a number of different ways, such as:

Transfers between banks

Credit and debit cards

Transfers of cryptocurrency

Payment providers (like Skrill and PayPal)

Keep an eye on the withdrawal limits and times as well, as they may affect your ability to take advantage of buying chances.

Help for Customers

Customer service that responds quickly can be very helpful in the fast-paced world of bitcoin trade. Look for exchanges that offer a lot of ways to get help, like live chat, email, and the phone. You can get an idea of how good an exchange's customer service is by reading reviews and stories from other users.

Plus extra services and features

There are now a lot of swaps that offer extra features to get and keep people. Some of these are:

Opportunities for farming with stakes and return

Futures contracts and selling on margin

Large sales can be placed over-the-counter (OTC).

You can trade on the go with mobile apps

Adding support for hardware wallets

Think about which of these features fits best with your trade strategy and goals, as well as how they might work with cryptocurrency signs.

Community and the Environment

A strong ecosystem and group around an exchange can offer useful tools and chances. Search for sites that:

Send news and updates on a regular basis

Give out trade tips and educational information

Have a footprint on social media sites and online communities

Work together on crypto projects

Conclusion

If you want to be successful at trading, whether you use the best crypto trading signs or make up your own methods, you need to make sure you choose the right cryptocurrency platform. You can find a platform that is perfect for your trading style and goals if you give it some thought. Some of the things you should think about are security, trading pairs given, liquidity, fees, user experience, and legal compliance.

Which exchange is best for you will depend on your needs, how you trade, and how willing you are to take chances. Find out about different sites and compare them. You could also try out small deals first to see how things go before putting down a lot of money. When you trade cryptocurrencies, the world is exciting and always changing. Having the right exchange by your side will help you make the most of the trade opportunities that come your way.

0 notes

Text

What is Etherium (ETH) and how does it work?

Ethereum: From 2015 to Today

What is Ethereum (ETH)?

Known by its ticker ETH, Ethereum is a distributed, open-source blockchain network featuring smart contract functionality. It extends blockchain capabilities beyond basic value exchanges, allowing developers to create distributed applications (dApps). Essentially, Ethereum acts as a universal machine that executes code precisely as intended, reducing risks of outages, fraud, or external manipulation. This has transformed finance, gaming, and various other sectors.

Ethereum History

Here’s a quick rundown of Ethereum’s history:

V.Buterin Proposes Ethereum (Late 2013): In late 2013, Buterin introduced the idea of Ethereum. He aimed to expand blockchain’s capabilities beyond BTC by creating a decentralized platform for various applications.

Crowdsale Funds Ethereum Development (2014): In 2014, an online crowdsale effectively gathered over $18 million worth of Bitcoin to fund Ethereum’s development.

Ethereum Network Launches (July 30, 2015): On July 30, 2015, the Ethereum network was officially launched, starting with an initial supply of 72 million ETH coins.

Ethereum 2.0 Upgrade (Ongoing): Currently, Ethereum is undergoing a major update known as Ethereum 2.0. This involves transitioning from a proof-of-work (PoW) to proof-of-stake (PoS) validation system to enhance scalability, safety, and sustainability.

How Does Ethereum Work?

Ethereum is like a virtual ecosystem where various parts work together to create a secure and functional network. Here’s a look at the core elements that power Ethereum:

Distributed Ledger: Operates on a common ledger upheld by a network of computers (nodes). Each node retains a blockchain copy and adheres to protocols for transaction validation. Example: Think of nodes as librarians, each keeping a complete copy of a book that gets updated with every transaction.

Blockchain: Facilitates smart contracts, self-executing agreements with terms coded digitally. Example: It’s like a vending machine, where the contract executes automatically when conditions are met.

Smart Contracts: Operate within the Ethereum Virtual Machine (EVM). Example: Picture EVM as a worldwide computer processing these contracts without interruption.

Ethereum Virtual Machine (EVM): Ethereum’s virtual stage for running smart contracts. Example: Imagine it as a theater where every script (contract) gets performed exactly as written.

Consensus Mechanism: Transitioning from PoW to PoS. Example: Moving from a heavy lifting contest (PoW) to a collective stake game (PoS) for decision making.

Proof of Work (PoW): Miners tackle intricate puzzles to confirm transactions. Example: It’s like a race where miners solve complex riddles to earn rewards.

Proof of Stake (PoS): Validators protect the network by pledging ETH, reducing energy usage, and improving scalability. Example: Think of it as a game where players put up their tokens to secure the network and earn interest.

Dencun Upgrade: Combines Deneb and Cancun improvements to enhance network efficiency. Example: It’s like upgrading the engine and the tires of a car simultaneously to improve its performance.

What is Ethereum Used For?

Ethereum’s versatility allows it to support a myriad of applications, making it a foundation in the blockchain sector. Here are some of the most impactful uses of Ethereum:

Decentralized Autonomous Organizations (DAOs): Use smart contracts for enforcing rules and decision-making without centralized control. Gained traction in corporate governance and community initiatives. Example: Aragon has enabled multiple new DAOs for decentralized project funding. Imagine a club where decisions are made by coded rules instead of a president.

Non-Fungible Tokens (NFTs): Represent ownership of unique digital items such as art and music, guaranteeing authenticity and scarcity. The market spans virtual real estate and exclusive digital collectibles. Example: Decentraland’s virtual properties have increased in value, attracting major brands for digital storefronts. Think of it as owning a unique digital painting that can’t be copied.

Decentralized Finance (DeFi): Provides services such as lending, borrowing, and trading without intermediaries. Integrated with traditional finance, creating new hybrid financial products. Example: Aave has introduced a new protocol, integrating with major banks for seamless crypto and fiat lending. Imagine a bank where all transactions are governed by code, eliminating the need for human intermediaries.

What Will Happen to Ethereum in the Future?

Source: pixabay.com

The Future of Ethereum: Key Insights

Scalability and Security: Ethereum is constantly being updated to make it faster and safer.

Blockchain Analyst Alex Johnson: “Switching to proof of stake will make Ethereum way more scalable.”

Role in Web3: Ethereum will be very important for building a new, decentralized internet.

Tech Futurist Jamie Wu: “As we move towards Web3, Ethereum will be essential for creating a user-focused internet.”

Institutional Adoption: We might see more big companies start using Ethereum by the end of 2024.

Financial Expert Sarah Lee: “Ethereum is likely to be adopted by many institutions, especially for decentralized finance and digital assets.”

Decentralized Applications: The possibilities for new apps on Ethereum are endless, limited only by what developers can imagine.

Developer Advocate Priya Singh: “Ethereum’s flexible platform will inspire the creation of many innovative decentralized apps.”

Bitcoin vs. Ethereum: What to Choose?

Should I Invest in Mining ETH?

Mining ETH can be profitable, especially with Ethereum 2.0 promising increased efficiency and rewards for validators. The network’s growing adoption and upgrades suggest a bright future for ETH mining. However, potential investors should consider the technical requirements and energy consumption involved. User-friendly platforms like our app offer guidance and support for starting Ethereum and other cryptocurrency mining, maximizing returns.

1 note

·

View note

Text

Which Currency is Used for NFT?

NFTs are now a prominent feature of the digital world, especially in the new web3 era. It is worth emphasizing that such assets are purchased and traded for different cryptocurrencies; however, the most popular one on the decentralized platform is Ethereum (ETH). Nonetheless, the possibilities of currencies involved in NFTs are increasing while the market and its products evolve.

Ethereum: The Dominant Currency

The cryptocurrency used in transactions related to NFT is Ethereum. That is because the Ethereum platform was the first to incorporate high-class contracts for achieving the functions needed to develop and trade in NFTs. Another feature critical in NFT marketplaces is trust and reliability, which the Ethereum network offers through a decentralized platform that guarantees Data security and prevents tampering. Ethereum standard Erc-721 and Erc-1155 paved the way for most non-fungibles by allowing interaction and integration with most Blockchains.

Other Cryptocurrencies

Still, Ethereum remains the most prevalent cryptocurrency used for NFTs; other cryptocurrencies get accepted as the web3 era unfolds and more Blockchains enable NFT features. Some of the world’s popular cryptocurrencies, like Binance Coin (BNB), Flow (FLOW), and Tezos (XTZ), are famous for NFT trading. These considerations are usually cheaper in transactions and quicker in processing, suitable for creators/collectors within the NFT domain.

Binance Smart Chain

BSC has gained much adoption in the development of DeFi applications because of less charge compared to Ethereum’s. BNB is the official currency used on BSC for the trade of NFT. The decentralized platform of BSC allows the users to go through the platform and conduct their transactions efficiently and securely.

Did you know what flow blockchain is?

Did you Know Flow is a Blockchain that has been specifically designed for digital collectibles and games by a company called Dapper Labs? Built from the ground up for scalability and high-speed transactions, it uses FLOW as its native currency. The focus on user experience and developer-friendly tools makes Flow an ideal platform for NFT development.

Tezos

Tezos is one of the most efficient platforms for NFTs and uses XTZ as its base token. Tezos is a decentralization where the community decides on improvements and modifications.

The concept of decentralization lies mainly in trading operations that include NFT. Cryptocurrencies chosen for NFTs can cope with there being no control over the transactions. This decentralization increases the protection of data because it brings down the probability of having a centralized structure that may easily be hacked. All the transactions are validated by the multiple nodes on the Blockchain network, which makes them unique and guaranteed on the Blockchain. It also invigorates transparency and raises a certain level of people’s confidence in the concept of NFTs.

Data Security in NFT Transactions

Did you know Data security is a critical aspect of NFT transactions. Blockchain technology has inherently high levels of security because of decentralization with an unchangeable ledger. Every transfer of one NFT is documented in the disposer & the changes cannot be made. Hence making the records of the assets remain fixed. It is such security that is required to protect digital assets, especially as they become valuable and popular.

#socialfi#web3.0#decentralised finance#web3platform#floyxweb3#socialmedia#floyx#web3website#web3community#nftmarketplace

0 notes

Text

[ad_1]

Within the dynamic world of cryptocurrencies, token utility performs a vital position in figuring out the worth and viability of a mission. Understanding the utility of a token is important for traders in search of to make knowledgeable selections within the ever-evolving crypto market panorama. On this article, we'll delve deep into the idea of token utility, exploring its numerous kinds, real-world examples, challenges, future developments, and implications for traders and initiatives alike. The crypto market is large and staying educated is important for traders! Rapid Evex Professional may also help you in studying, offering you with a gateway to premium funding schooling corporations. What's Token Utility?Token utility refers back to the performance and function of a cryptocurrency token inside its respective ecosystem. In contrast to token worth, which is primarily decided by market demand and hypothesis, token utility derives from its capacity to serve a selected operate or present tangible advantages to its customers. It's important to tell apart token utility from tokenomics, which encompasses the financial mannequin and distribution mechanism of a token.Varieties of Token Utility

Transactional Utility: Transactional utility refers back to the capacity of a token to facilitate transactions inside a selected ecosystem. For instance, Ethereum's native token, Ether (ETH), serves as gas for executing sensible contracts and powering decentralized functions (dApps) on the Ethereum blockchain.

Governance Utility: Governance utility permits token holders to take part within the decision-making course of inside decentralized initiatives. Tokens with governance utility usually enable holders to vote on protocol upgrades, adjustments to community parameters, or the allocation of neighborhood funds. Examples embrace the governance tokens of decentralized autonomous organizations (DAOs) like MakerDAO and Compound.

Entry Utility: Entry utility grants token holders entry to particular options or companies inside a platform. This might embrace premium content material, unique occasions, or enhanced performance. For example, some decentralized finance (DeFi) protocols require customers to carry a certain quantity of tokens to entry superior options or take part in yield farming.

Staking and Rewards: Staking utility includes the power of token holders to stake their tokens as collateral to safe the community, validate transactions, and earn rewards in return. Staking is a basic mechanism in lots of proof-of-stake (PoS) and delegated proof-of-stake (DPoS) blockchain networks. Tokens with staking utility incentivize holders to actively take part in community upkeep and safety.

Actual-world ExamplesInspecting real-world examples can present beneficial insights into the varied functions of token utility and its influence on the crypto market.

Ethereum (ETH): Because the main sensible contract platform, Ethereum's native token, Ether (ETH), possesses multifaceted utility. Past its transactional utility for executing sensible contracts, Ether serves as a type of cost for transaction charges and fuel on the Ethereum community. Moreover, Ether holders have governance rights by way of Ethereum Enchancment Proposals (EIPs) and take part in protocol upgrades.

Binance Coin (BNB): Binance Coin (BNB) is the native token of the Binance alternate ecosystem, providing numerous utility options. BNB holders profit from discounted buying and selling charges, take part in token gross sales on the Binance Launchpad, and might use BNB for funds inside the Binance ecosystem. Moreover, BNB has transitioned to a local token on the Binance Sensible Chain, enhancing its utility for DeFi functions and cross-chain interoperability.

Challenges and DangersWhereas token utility presents quite a few alternatives, it additionally entails sure challenges and dangers that traders and initiatives should navigate.

Regulatory Challenges: The regulatory panorama surrounding

utility tokens continues to be evolving, with regulators scrutinizing initiatives for compliance with securities legal guidelines. Figuring out whether or not a token constitutes a safety or utility could be complicated and should influence its authorized standing and market accessibility.

Funding Dangers: Investing in tokens with restricted utility or speculative worth carries inherent dangers. Initiatives that fail to ship on their promised utility or face regulatory scrutiny might expertise value volatility and investor backlash.

Enhancing Utility: Initiatives should repeatedly innovate and improve the utility of their tokens to stay aggressive and sustainable in the long run. This may occasionally contain increasing use circumstances, bettering governance mechanisms, or fostering neighborhood engagement.

Future TendenciesThe way forward for token utility holds important promise, pushed by ongoing innovation and adoption throughout the crypto ecosystem.

Interoperability: As blockchain interoperability turns into more and more prevalent, tokens with cross-chain utility are poised to realize traction. Interoperable tokens can seamlessly transfer between totally different blockchain networks, unlocking new prospects for decentralized finance, gaming, and asset tokenization.

Token Requirements: The emergence of token requirements like ERC-20 and ERC-721 has standardized token performance and enabled the widespread adoption of utility tokens. Future developments in token requirements are prone to additional streamline token creation and interoperability throughout numerous blockchain ecosystems.

ConclusionToken utility is a basic idea that underpins the worth and performance of cryptocurrencies within the digital financial system. By understanding the assorted types of token utility, traders could make knowledgeable selections, whereas initiatives can design sustainable ecosystems that foster innovation and development. Because the crypto market continues to evolve, token utility will stay a key determinant of success and longevity in an more and more aggressive panorama.

[ad_2]

Supply hyperlink

0 notes

Text

A massive amount of Ethereum, valued at $12 million, was recently transferred by a single whale. This significant movement raises questions about the impact on ETH's price in the Market. Experts are closely watching to see how this transaction will affect the cryptocurrency's value. Stay tuned for updates on this developing story.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Ethereum's Netflow has shown a positive trend lately as ETH was on the verge of hitting the $3,000 mark. Recent reports reveal that a significant amount of Ethereum coins, worth millions of dollars, were transferred by one of the early ETH holders to a popular exchange, Coinbase. This move, despite being relatively small, has contributed to the recent surge in positive Netflow for ETH transactions.

The wallet belonging to the early Ethereum holder had deposited a substantial amount of ETH to exchanges since 2021, with the recent transfer leaving them with over $7 million worth of ETH. This transfer has played a role in the heightened positive Netflow observed in Ethereum transactions in recent days.

Analysis of Ethereum's Netflow chart indicates a noteworthy increase in positive flow, with the exchange inflow surging to over 18,000. This uptrend in inflow suggests increased activity on exchanges, with over 83,000 ETH entering exchanges at the time of writing.

Furthermore, the volume of Ethereum has seen an uptick, reaching around $10.1 billion, after a slight dip in the previous trading session. The price of ETH is also showing a positive trend, nearing the $3,000 price zone with a 1.7% surge in trading price to around $2,980.

In conclusion, Ethereum's recent movements suggest a bullish sentiment in the Market, with potential for further price appreciation. Keep an eye on ETH as it continues to show positive indicators amidst the crypto Market fluctuations.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is the significance of the $12 million whale transfer in Ethereum?

The $12 million whale transfer in Ethereum refers to a large amount of ETH being moved between wallets, potentially impacting the Market.

2. Will the whale transfer affect Ethereum's price?

Large transactions like the $12 million whale transfer can sometimes cause price fluctuations in Ethereum, depending on how the Market reacts to the movement of funds.

3. How can investors protect themselves from price fluctuations caused by whale transfers?

Investors can protect themselves from price fluctuations by diversifying their portfolios, setting stop-loss orders, and staying informed about Market trends.

4. Should investors be concerned about the whale transfer in Ethereum?

Investors should be aware of large transactions like the $12 million whale transfer, but it's important to remember that Market movements are normal and can occur for various reasons.

5. What should I do if I'm worried about the impact of the whale transfer on Ethereum's price?

If you're concerned about the impact of the whale transfer on Ethereum's price, consider

consulting with a financial advisor or doing further research to make informed investment decisions.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/what-is-altcoin-season-when-will-it-start-or-is-it-already-here/

What Is Altcoin Season? When Will It Start? Or Is It Already Here?

What Is Altcoin Season? When Will It Start? Or Is It Already Here?

Altcoin season, a term on the lips of many cryptocurrency enthusiasts since Bitcoin's recent surge to unprecedented heights, is a phenomenon many have eagerly anticipated. However, despite this anticipation, only a select few coins and tokens, along with many meme coins, have experienced substantial growth. This has led to speculation that altcoin season may never arrive, as funds flowing into spot Bitcoin ETFs may not be redirected towards the broader cryptocurrency market. But is this the full story?

With the invaluable insights of some highly credible crypto experts, this article takes a deep dive into the current state of the cryptocurrency market. It focuses on the 'altcoin season' concept and its potential impact on market trends. The article explores why altcoin season has yet to occur and predicts when it may begin. It also offers insights on how to recognize its onset. Additionally, the article highlights the types of alternative cryptocurrencies (altcoins) that may be worth watching during this period.

The Concept of Altcoin Season

Firstly, let's touch on the concept of altcoin season, a term that lacks a universally accepted definition. Some assume it refers to a period where numerous altcoins are experiencing a surge in value, with many believing that it's already underway. Given the recent performance of certain altcoins, one could argue that it's already here. However, this definition falls short of accurately capturing the concept, so here’s a more precise and nuanced explanation.

An altcoin season is an extended timeframe during which most alternative coins exhibit notable outperformance compared to Bitcoin. This can be gauged by analyzing the price of an altcoin with Bitcoin, for example, ETH/BTC. When assessing the BTC pair for various altcoins, it becomes evident that their performance has not been particularly strong. However, this does not imply that they have not experienced price increases in fiat currency; rather, it indicates that their gains have been comparatively lower when measured against Bitcoin.

The current situation with ETH and BTC is a significant development in the cryptocurrency market. ETH's value has decreased compared to BTC, which has raised concerns among traders and investors. Historically, increases in BTC's value have often been followed by a shift in investments towards alternative cryptocurrencies, leading to a period where most altcoins perform better than BTC.

Source: Coinmarketcap

In the past, the trend has been to invest in ETH and then move on to other major alternative cryptocurrencies, followed by mid-cap and small-cap altcoins. It is important to note that this progression is not always precise but generally aligns with the idea that investors gravitate towards more speculative crypto assets as market momentum continues. Interestingly, in the current scenario, there has been limited shifting of funds into ETH, as indicated by the underperformance of the ETH/BTC pair mentioned earlier.

Furthermore, it appears that the influx of capital did not favor midcaps and small-caps but instead directed attention towards micro-cap meme coins for speculative purposes. It is important to note that while certain altcoins like Solana's SOL have shown impressive performance compared to BTC, most altcoins, including ETH, have not surpassed BTC's growth. This suggests that the altcoin season may have yet to arrive fully.

As indicated earlier, cryptocurrencies with smaller market capitalizations tend to be riskier. This is because crypto with a smaller market cap has the potential to experience more significant and rapid price increases compared to those with larger market caps. However, on the flip side, small-cap cryptocurrencies are also prone to more substantial drops in value, highlighting the risk/reward ratio.

The notable 100x returns often associated with certain altcoins are typically achievable with those that have smaller market caps, explaining the hype around the altcoin season. Nevertheless, there are indications that the current cryptocurrency market cycle differs from previous ones, which could have significant implications for the returns on altcoins.

The Question on Everyone's Mind: When Will Altcoin Season Arrive?

Many wonder why the current market cycle hasn't followed the same pattern as previous ones, with altcoins yet to take center stage. To understand this, we must first acknowledge the unique factor setting this cycle apart: spot Bitcoin ETFs. As discussed earlier, some believe these ETFs are hindering the rotation into altcoins, as investors cannot easily switch from ETFs to altcoins, at least in theory. However, some investors may be cashing out their ETF gains and moving their funds to cryptocurrency exchanges like Coinbase, where they can invest in altcoins.

The catch is that most investors in spot Bitcoin ETFs are not your average retail investors but seasoned institutional investors. These institutional investors, also known as TradFi whales, have a significant influence on the market. As a result, their preferences for alternative cryptocurrencies may diverge from those of the typical crypto enthusiast. Notably, there has been substantial institutional interest in SOL, which could explain its outperformance compared to BTC.

However, the crypto market is not solely composed of institutional investors. There are two other types of crypto investors: crypto whales and retail investors. Crypto whales, which are large holders of cryptocurrencies, have been the primary influencers in the crypto market so far. Their shift from Bitcoin to alternative coins has led to past cycles in altcoins, while retail investors have pushed these coins to their peak values. Put simply, the crypto market has not lost anything. It has merely introduced a new main character, figuratively speaking.

The lack of an alt season is not caused by the introduction of ETFs but rather by the actions of crypto whales and retail investors. The analysts at Coinbureau suggest that these crypto whales are not shifting their investments or rotating into altcoins because there currently needs to be more retail investors interested in purchasing them.

Source: Crypto Max on X

Numerous indicators suggest that retail investors are gradually becoming more interested in cryptocurrency despite their limited participation in the current market upswing. This is evidenced by increased retail trading activity on cryptocurrency exchanges, the growing popularity of crypto exchange apps, rising search volumes for crypto-related terms, and heightened social media engagement with crypto content. However, these metrics have not reached the levels indicating a massive influx of new retail investors into the cryptocurrency market.

The crucial factor here is the influx of new retail investors. While millions of retail investors from previous cycles are still active or returning, we need to see more new entrants into the market. This is a significant concern, as altcoins rely heavily on new investors to drive their growth and create upward momentum. As a retail investor, you can influence the altcoin season. There need to be marginal buyers.

As Coinbureau states, “We need new people for our altcoin bags to pump, probably because most of us have already allocated as much as we can to our favorite coins and tokens. In the absence of these new people, there's not that much for us to do except speculate on memecoins, and it's quite possible that the memecoin pumps we've seen have been coordinated by the crypto whales. They probably know that the only retail investors around right now are experienced enough to use DEXs.”

The Onset of Altcoin Season

After analyzing the delay in the arrival of altcoin season, the next question is when we can expect it to begin. The straightforward answer is that it will start when a sufficient number of retail investors take notice. This will prompt crypto whales to shift their focus from Bitcoin to altcoins that retail investors will then eagerly buy into, leading to a chain reaction of FOMO (fear of missing out). However, a more in-depth analysis, which necessitates a look back at the previous cycle, reveals a more intricate scenario. Most of us envision the upcoming altcoin season as a repeat of the last cycle, but the reality may be more complex.

The issue lies in the significant differences observed in the previous cycle. Due to a worldwide pandemic, billions of individuals were confined to their homes while a few hundred million received a stimulus payment, providing them additional funds. These events led to widespread speculation in both stocks and cryptocurrencies. Today, the situation is starkly contrasted as interest rates across various nations are at their highest levels in years. Unofficial inflation rates are soaring in most countries, reaching double digits. Several countries are experiencing or nearing recession.

Above all, most individuals are reportedly accumulating unprecedented levels of debt to maintain their standard of living. This trend starkly contrasts with the circumstances observed during the previous alt season. A positive aspect is that the prolonged persistence of these conditions may prompt governments and central banks to provide comparable forms of economic support, never mind the possibility of an existential shock.

This means that there will likely come a time when economic conditions mirror those seen during the pandemic, with similar fiscal and monetary support levels. The exact timing is uncertain, but it may take a significant event to prompt such action. Identical to past patterns, this could cause a brief decline in cryptocurrency and other asset values, followed by a stabilization period and a sharp price increase as the stimulus takes effect.

If the current state of the market persists, altcoins may suffer under unfavorable circumstances. If trends continue, including high interest rates, rising inflation, recurring recessions, and mounting retail debt, the subsequent altcoin season may fall short of expectations. It's essential to recognize that the cryptocurrency market has undergone significant changes since the previous cycle, with factors beyond spot Bitcoin ETFs contributing to its evolution.

Regulations in the US, UK, and other countries have made it more difficult for retail investors to reach offshore trading platforms where highly speculative altcoins are traded. The upcoming EU stablecoins regulations are anticipated to impact the cryptocurrency market significantly. It has been announced that USD stablecoins will no longer be allowed in the EU by the end of the year, potentially reducing the options for retail investors to trade cryptocurrencies.

Identifying the Arrival of Altcoin Season

To determine the onset of the altcoin season, keep a close eye on several key indicators. These include retail trading volume, the popularity of crypto exchange apps, Google searches, and social media views related to cryptocurrency. When you observe a steady increase in these metrics, alt season is likely imminent. Interestingly, there are signs that this trend may already be underway. For instance, search queries related to buying cryptocurrency have started to rise after years of stagnation, although they still have a long way to go before reaching their previous peak.

Source: Google Trends

The current market dynamics are making it challenging to determine whether we are witnessing the inception of a new alt season or a fleeting speculative surge. A valuable approach to shed light on this puzzle is examining how cryptocurrency projects promote themselves, specifically during periods of heightened attention. A typical pattern among cryptocurrency projects is to unveil significant announcements when public interest is at its peak.

There have been instances where crypto projects have postponed significant updates and announcements due to a lack of interest from retail investors. Despite this, numerous crypto projects have been making notable announcements, which could suggest the beginning of a new altcoin season. However, these announcements have not resulted in significant speculative buying, indicating that retail investors remain scarce.

Source: CoinMarketCal

As the popularity of cryptocurrency projects grows, you may notice a surge in big announcements and subsequent price increases for their coins or tokens. This is often a sign that retail investors have entered the market. When these altcoin announcements start making headlines in mainstream news, it could indicate that the market is nearing its peak.

Some of you have probably encountered additional key indicators, like inquiries from friends and family regarding the crypto market or, worse, seeking advice on investing in meme coins. However, these signals may not hold much weight unless individuals actively invest. Suppose widespread media coverage of altcoins is not leading to a substantial market increase, and your acquaintances are not showing significant interest. In that case, it may not truly be an alt season.

A possible indicator of an impending alt season is to evaluate whether these signs are present when, based on historical patterns, an altcoin season would be expected to occur from a cycle perspective. However, this can be difficult to determine as the introduction of spot Bitcoin ETFs has disrupted the typical cycle. For reference, the current phase of the cycle should resemble the early 2020 period, characterized by gradually increasing prices followed by a sudden crash triggered by an unexpected event before ultimately continuing their upward trend.

It's worth considering that our timeline may be advancing at an accelerated pace. Specifically, we could be closer to the late 2020 stage of the crypto market cycle, irrespective of the introduction of Bitcoin ETFs. With two completed crypto cycles (2017 and 2021) under their belts, millions of individuals are now familiar with the narrative and its subsequent developments.

Source: Bitcoin News on X

The impact is that we won't have to wait 12 months for the altcoin season to begin like we did in 2020. Instead, it could start in just a few months. However, this is based on the assumption that we're on an accelerated timeline. It's possible that cryptocurrency is still following the same schedule, which means we might be ahead of schedule for alt season.

Which Altcoins Should Be Monitored

Which altcoins should you watch this season? I concur with Coinbureau that it might be ideal to start building up your portfolio if we are in the early stages of the altcoin season. However, it's essential to note that this is not financial advice, and it's equally possible it's not the best time to do so.

Coinbureau analysts suggest that the altcoins you must watch this season will be the most accessible to retail investors. As mentioned earlier, EU regulations and, consequently, the structure of the crypto market will ensure that most retail investing will take place on onshore exchanges like Coinbase. In light of this potential scenario, focusing on altcoins listed on Coinbase may be prudent.

This is connected to a previous point about market capitalization. The higher the market cap, the lower the risk and the potential reward. The smaller the market cap, the bigger the risk, but the bigger the reward. Selecting a cryptocurrency with a lower price tag may also be advantageous. Many individual investors assume that a lower price indicates the possibility of more significant price increases, but the market cap is the most important. Therefore, by choosing a low price and market cap cryptocurrency, you can establish some solid fundamentals, often referred to by some influencers as "pumpamentals."

While being listed on Coinbase and having a low price point and market capitalization can benefit an altcoin, more is needed to guarantee success. For an altcoin to truly thrive, it must fit into a broader, bullish narrative that resonates with the average retail investor. This article explores the dominant narratives likely to drive the next bull market.

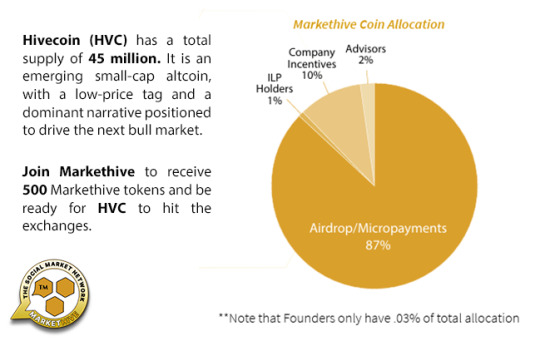

Image: Markethive.com

Researching the tokenomics of the crypto you want to invest in is vital to ensure it is genuine and has maximum potential. This involves examining the future circulation of coins or tokens, as you wouldn't want to invest in a promising altcoin only to face a sudden sell-off by the developers and their venture capital supporters. Also, you need to select a smart contract cryptocurrency on which the most promising tokens are trading.

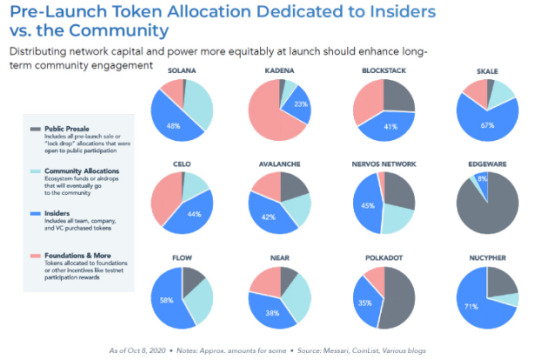

Image: Cointelegraph

It is essential to understand that holding onto a promising altcoin for a longer term could be beneficial if you enter the market at the right time. Numerous cryptocurrency enthusiasts can confirm that they would have been equally successful today if they had kept their altcoins during the market downturn. Cryptocurrency, at its core, is designed to revolutionize various systems, so it's important to have a long-term perspective on your investments.

Although many of these systems and their associated projects may fail, a few will endure. The ones that survive have the potential to become extremely valuable, possibly even worth trillions of dollars in the future, much like Bitcoin, which is currently valued at over $1 trillion. It is crucial to note that BTC boasts the lengthiest and most proven track record among all coins and tokens, rendering it the most secure cryptocurrency to retain in comparison.

Other cryptos will more than likely someday achieve the same safe haven status as BTC, so considering all the key indicators along with a crypto’s community, utility and purpose, ecosystem, and solutions it offers in the spectrum, it shouldn’t be too hard to work out which ones to watch out for. For that large-cap security, you might want to consider investing in the original cryptocurrency that has the potential to become the global reserve currency.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

What Is Baby doge?

Its main function as a meme coin is to raise awareness of animal welfare and pet adoption. With over 2.5 million followers across all of the social media outlets it looks like it is working.

Once the coin hit the main stream they built multiple apps and tools such as a swap and aggregator, chess game, NFT collections, partnered with payment and wallet apps, farming as a service, Baby Doge Card, exclusive merch discounts for holders, all while donating over $1 million to animal adoption. So the coin is proving its worth out there in the meme market.

There are a few places you can buy the coin but for me the best place for free baby doge is to go to this free baby doge faucet. They payout 1,250,000 Baby doge per claim and you can claim up to 20 times a day.

Baby doge started on the Binance Smart Chain (BSC) but has also moved over to the Ethereum (ETH) network. There has been a total supply of 420,000,000,000,000,000 coins minted and of those 50% of them have been burned.

Another really cool option Baby doge has is that it gives anyone that has baby doge in there wallet "it has to be on the BNB smart chain" free baby doge every day. So free Baby doge for doing nothing.

The community receives a 5% fee for every transaction. So every time someone uses baby doge you get a small percentage deposited into your wallet. It is actually a 10% fee for every transaction but the other 5% goes to powering the project and they burn a few.

Overall I really like the coin and hope it hits the roof this coming year like I think all coins will. 2024 is the season of crypto.

0 notes

Text

Best Crypto Leverage Trading Platform in 2023

In today’s date, using a trading platform that satisfies specific your needs is important when it comes to crypto leverage trading. The most necessary factors to consider are if the platform is reliable, how much leverage there is, the number of currencies, what features are offered, and security.

We have spent hours thoroughly examining dozens of leverage trading websites in order to compile this list of the top sites for 2023. But before proceeding further, it is important to know what Crypto leverage trading is, and how it works.

So, let’s get started! To know everything in depth.

What is Crypto Leverage Trading?

Leveraged trading in cryptocurrency involves borrowing money to gain access to extra cash in an effort to increase earnings from a profitable trade. You are increasing your profits by the amount of leverage you employ if the price goes in the right direction. For instance, if you employ 5x leverage, your profits will be 5x greater than they would be if you didn’t.

But there are risks associated with this. If the price changes in the opposite direction, your losses will also be significantly bigger and you risk losing all of your invested money very rapidly. Leverage trading is only something we advise experienced traders to undertake; if you have never traded before, avoid doing so.

How Does Crypto Leverage Trading Work?

Crypto leverage trading is a bit like borrowing money to make your potential profits much bigger. Instead of using only the money you have, you can use some extra borrowed money to control a much bigger investment. For example, if you use 10 times (10x) leverage, you can control crypto worth $10,000 with only $1,000 of your own.

But remember, while this can help you make more money, it can also make your losses much bigger if the trade doesn’t go well. If things don’t go as planned, you could lose more money than you put in. It’s important to be careful and manage the risks, especially because cryptocurrencies can be very unpredictable. To do this kind of trading, you need to really understand how the market is moving and use special trading platforms that offer this borrowing option.

Suggested read: Advantages and Disadvantages of Cryptocurrency

The Best Crypto Leverage Trading Platforms in 2023

Here, we are going to mention the best Crypto leverage trading platform. Let’s have a quick look:

CapitalXtend

CapitalXtend stands out as a well-loved crypto derivatives exchange, presenting an astonishing leverage of up to 1:5000 on Bitcoin contracts. What truly sets it apart are its impressive attributes: a sturdy trading platform, exceptional liquidity, and minimal delays.

Because privacy is one of the most important aspects of cryptocurrencies, CapitalXtend is a great option for leveraged traders. Your personal information is safe because it is simple for you to access our trading platform.

2. Margex

Margex provides low trading costs, timely price updates, and leverage of up to 100x. The trading commission is 0.019% for makers and 0.060% for takers. With bank-grade security and 100% of assets stored in offline cold storage, Margex is not only easy to use but also incredibly secure. Additionally, they created the ground-breaking MP Shield System, which shields users from any pricing manipulation.

Margex only handles 13 digital assets, which is a relatively restricted selection when compared to other crypto exchanges. This is a minor drawback. The majority of the widely used leverage traded coins, including BTC, ETH, XRP, LTC, ADA, and SOL, are included, which is wonderful news.

3. MEXC

MEXC is the best exchange for seasoned cryptocurrency traders because it supports more than 1,520+ cryptocurrencies, and over 2,110 trading pairs, and gives up to 125x leverage.

With zero fees for spot trading and 0.0/0.01% for futures trading, MEXC also offers the lowest trading fees. Additionally, the platform offers one of the top customer support departments.

MEXC also has a copy trading option, allowing you to imitate any of the platform’s most successful investors. This function is helpful for beginners to leverage trading because it eliminates the need for you to perform your own technical analysis or market analysis. Just rely on the expertise and experience of someone with a track record of success.

Take advantage of this exclusive welcome gift if you’re thinking about joining MEXC.

4. Inveslo

Inveslo is a more recent platform for Crypto leverage trading, it has quickly become the best because of a few key factors. This platform presents an astonishing leverage of up to 1:2000 on Bitcoin contracts. This provides additional flexibility and allows traders to increase their profits from successful trades.

Inveslo doesn’t limit your choices either; it supports a wide array of cryptocurrencies, empowering investors to diversify their portfolios and explore various avenues. Security is a top concern for Inveslo, underlining its commitment to safeguarding your investments.

5. Binance

Harnessing the power of its Binance Futures platform, a global cryptocurrency exchange that needs no introduction, Binance steps into the world of leveraged trading.

When it comes to Bitcoin futures, Binance shines bright, offering the highest leverage available in the market — an impressive 125x. Binance’s influence goes beyond leverage, as it opens up avenues for trading in fiat currencies and an array of trading pairs.

6. Kraken

The US-based leverage trading platform Kraken has long been regarded as one of the most reliable in the cryptocurrency industry. Numerous alternatives, including leverage trading, spot trading, and futures contracts, are available on the simple platform.

Market and limit orders are available for margin trading, which is quite practical. The costs are extremely minimal, starting at just 0.02% to open a position and rolling over at 0.02% every four hours to keep it open.

Final Thoughts

Within the realm of the cryptocurrency market, leverage trading stands as a powerful tool for amplifying earnings. However, it’s important to tread carefully due to the associated risks.

The crypto trading platforms mentioned in this article not only offer leverage trading options but also prioritize the safety of their users. As you make your decision, choose the best Crypto leverage trading platform that fits your requirements, and remember to engage in mindful trading practices.

Originally Published on WordPress

Source: https://capitalxtend992667378.wordpress.com/2023/08/28/best-crypto-leverage-trading-platform-2023/

0 notes

Text

Dogecoin, Ethereum, and Everlodge are amongst the extra fascinating altcoins to look at within the ongoing crypto rally.

Albeit completely different, all of those tasks try to place themselves the most effective they will for what appears to be a much-anticipated bull market.

Abstract:

Dogecoin’s worth pumps 5.2%.

Ali Martinez predicts Ethereum to succeed in $1,900.

Everlodge’s worth has elevated from $0.02 to $0.023.

Visit the Everlodge presale and win a luxury holiday to the Maldives

Dogecoin (DOGE) Aiming To Surpass the $0.07 Degree

Dogecoin, the unique meme coin has been widespread ever since its launch again in 2021. Dogecoin shortly climbed up the ranks after being promoted by high figures like Elon Musk. The meme coin hit an all-time excessive of $0.7376 in Could 2021 earlier than plummeting to the $0.06 degree in October 2023.

Regardless of this vital worth drop, Dogecoin nonetheless stays a high ten largest crypto ranked by market capitalization. As of the time of this writing, the value of Dogecoin not too long ago jumped by 7.7% to succeed in $0.069.

Additionally, there was a rise in DOGE’s buying and selling quantity, highlighting growing help for the meme coin. Because of this, some analysts have predicted that the Dogecoin worth may goal for the $0.07 mark and doubtlessly surpass it within the coming days.

Ethereum (ETH) To Attain $1,900

On October twentieth, crypto analyst, Ali Martinez, informed his Twitter followers that Ethereum is heading for the $1,900 degree. In keeping with the analysts, ETH has fashioned an ascending triangle sample, which is a bullish formation.

Ali stated Ethereum is “prepared” to bounce off the ascending triangle’s hypotenuse. Furthermore, the analyst emphasised that the Ethereum coin should shut above the 18-day SMA (round $1,745) to succeed in $1,900. As of October thirtieth, the value of Ethereum has elevated by 8.1% up to now week to hit $1,818.

Ethereum’s worth has proven nice restoration along with the remainder of the crypto market. In the meantime, the final time Ethereum reached $1,900 was in July 2023.

Everlodge (ELDG) Captures Whale Consideration With Distinctive Options

Similar to Dogecoin and Ethereum, traders within the Everlodge presale are sweeping tokens. Everlodge is engaged on a blockchain actual property market. It's going to enable extra individuals to spend money on trip houses, accommodations, and fancy villas.

What makes Everlodge distinctive over conventional platforms is its NFT fractionalization method to property co-ownership. It's the first challenge on this planet to mix fractional trip residence possession with timeshare and NFT know-how. In addition to, customers get further advantages on the platform.

As well as, traders can commerce their NFTs on Everlodge or different ERC-20 suitable marketplaces. They will additionally use their property-backed NFTs as collateral to acquire loans. Buyers who purchase the Everlodge token, ELDG, can stake them to earn passive earnings each month.

Buyers who maintain the ELDG token additionally get particular reductions once they purchase properties on the marketplace. The Everlodge challenge is presently in its sixth presale section, promoting its ELDG tokens for $0.023 every.

Discover out extra concerning the Everlodge (ELDG) Presale:

Web site: https://www.everlodge.io/

Telegram: https://t.me/everlodge

Disclaimer: The above article is sponsored content material; it’s written by a 3rd social gathering. CryptoPotato doesn’t endorse or assume duty for the content material, promoting, merchandise, high quality, accuracy, or different supplies on this web page. Nothing in it must be construed as monetary recommendation. Readers are strongly suggested to confirm the data independently and thoroughly earlier than participating with any firm or challenge talked about and do their very own analysis. Investing in cryptocurrencies carries a danger of capital loss, and readers are additionally suggested to

seek the advice of knowledgeable earlier than making any choices that will or is probably not based mostly on the above-sponsored content material.

Readers are additionally suggested to learn CryptoPotato’s full disclaimer.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Provide: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Text

What happened: On Wednesday a total of 1,695.49 Ether ETH/USD worth $2,589,907, based on the current value of Ethereum at time of publication ($1,527.53), was burned from Ethereum transactions. Burning is when a coin or token is sent to an unusable wallet to remove it from circulation.

Why it matters: On August 5th, 2021, the Ethereum blockchain implemented an important upgrade known as EIP-1159. This Ethereum improvement proposal changed the fee model drastically. Now each transaction includes a variable base fee that adjusts according to the current demand for block space. This base fee is burned, or permanently removed from circulation, lowering the supply of Ether forever.

See Also: How to Buy Ethereum & When Will Ethereum 2.0 Launch

Ethereum is currently issuing new Ether at a rate of 4% per year, although this is expected to decrease to around 0.5-1% as a part of the Ethereum 2.0 upgrade. Once this occurs, many speculate that the burn rate of Ether will be greater than the token's issuance, causing ETH to become a deflationary currency.

The net annualized issuance rate for Ether yesterday was 1.15%.

Data provided by Glassnode

0 notes

Text

Explain main standards for Ethereum ERC20 tokens?

Ethereum introduced the concept of decentralized applications and blockchain-based protocols.

Introduction

Although Ethereum has its own “coin” called ETH, which can be used in the same way as BTC, its main purpose is to serve as gas to power transactions and operations in applications and protocols built on top of the network. Developers of these applications can create in-app currencies or digital assets that are stored on the Ethereum blockchain. These are what we call tokens, and they must adhere to certain “rules” called ERC20 token development standards.

Explain main standards for Ethereum ERC20 tokens?

Token standards are a set of rules that allow the development of cryptocurrency tokens on various blockchain protocols. These standards provide guidelines for the creation, issuance and adoption of new tokens on the main blockchain. These norms are known as ERC (Ethereum Request for Comments) in the context of Ethereum, and they provide the guidelines for the tokens that can be generated on that platform.

Each ERC token is identified by a serial number, which corresponds to the number of the “request for comments” in which these standards were proposed. In addition to the three ERC standards that are most widely used in Ethereum, there is another new, very interesting standard:

1.ERC-20: First introduced in 2015, ERC-20 is a token standard that allows developers to create fungible tokens for their Ethereum-based applications or protocols. ‘Decomposable’ means divisible and non-unique. For example, fiat currencies such as the dollar are fungible, as is BTC (1 BTC is worth 1 BTC, no matter where it is issued).

ERC-20 tokens are most often developed by technology-focused organizations or companies. Tokens created using ERC-20 are compatible with each other and with compatible services throughout the Ethereum ecosystem. All of this makes it easier for community members and businesses to adopt and use them in a wide range of applications, as anyone can create their own token Any digital item without having to start from scratch with programming.

It is important to emphasize that while ERC-20 tokens can be easily transferred to many applications, they are not stored in accounts. Tokens only exist within a contract, which is like an autonomous database. Thus, users need a wallet running on the Ethereum blockchain to “see” their balance of ERC-20 tokens;

2.ERC-721: Unlike ERC-20s, ERC-721 is a token standard that allows developers to create non-functional tokens (NFTs) — “non-functional” means that each token has a unique value and acts as verifiable unique digital objects. which cannot be exchanged with each other like ERC20 tokens.

ERC-721 tokens are often used to represent ownership on the blockchain for many items, such as contracts for physical assets, digital collectibles, and digital art. In addition, they cannot be exchanged for others due to their unique characteristics. In a nutshell, the ERC-721 standard was created to address the need to provide uniqueness to the tokens of the Ethereum ecosystem.

3.ERC-1155: Combining the best aspects of the first two standards listed above, ERC-1155 is a token standard that allows developers to create both fungible and non-fungible tokens, and also introduces the innovation of the ability to create semi-fungible tokens.

ERC-1155 tokens are used primarily for NFT game development, as a single contract can be created to support multiple types of customizable tokens. This type of contract greatly reduces the complexity of the token creation process, since playing an NFT would require a large amount of assets circulating in the system (which could be objects collected by players).

4.ERC-4907: Defined as a standard for leased non-playable tokens, ERC-4907 takes NFT ownership to a more advanced level by being the first to automatically revoke usage rights upon expiration. Under ERC-4907, the lessee can perform certain operations on the leased asset, but cannot transfer the asset to a third party or assume full control. This is an important innovation because it can improve the experience for both the NFT owner and the lessee by giving the NFT itself more flexibility.

What is the process for creating ERC standards?

The Ethereum ecosystem is on the path to decentralization, but it still needs a core of developers who set the rules, call for updates, and set standards. However, before doing this, you must go through the Ethereum Improvement Proposal (EIP), which is a document that includes proposed features and processes for the Ethereum blockchain network. Once a proposal is submitted, it is discussed and put to a vote to either reject it or move forward with its implementation. Once this process is approved and completed, the original document becomes an ERC standard that other developers can use to create their own tokens.

For each type of ERC token, there are precise core features that must be implemented, which vary depending on the purpose for which they were created. Taking ERC20 token generator as an example, the functions would be as follows:

TotalSupply: provides information on the total supply of tokens;

BalanceOf: provides the owner’s account balance;

Transfer: sends the predetermined tokens to the predetermined address;

TransferFrom: transfers the specified number of tokens from the specified address;

Approve: Allows the spender to withdraw a set number of tokens from the specified account;

Resolution: Returns a set number of tokens from the spender to the owner.

The above features are required. In addition, there are other optional ones that are used to define the characteristics of the new token, such as giving it a human-readable name, setting a symbol, and indicating the divisibility of the token.

Use Cases & Real Applications

Since their initial introduction, ERC tokens have been used for a variety of purposes and have contributed to the growth of various use cases and applications. Below are some use cases by token type.

Stablecoins: These fiat-pegged tokens often use the ERC-20 token standard. Since this standard has become popular, it has generated significant network effects. Cryptocurrency users can rest assured that any stablecoin created using the ERC-20 standard will interoperate with hundreds of other ERC-20 tokens and those services that already accept ERC-20 tokens. Today, most Dapps (decentralized applications) accept ERC-20 stablecoins, as well as all centralized services such as crypto exchanges.

Utility Tokens: These tokens are the most common types of tokens in the cryptocurrency market. They are used to obtain a specific service and satisfy various usage conditions, such as being gas for various applications, giving voting rights to service users, or being used to pay fees in a DApp. Today, the majority of tokens in circulation are or were ERC-20 (there are cases where some tokens subsequently moved to another blockchain).

CryptoPunks: Crypto art collectibles presented as NFTs on the Ethereum blockchain. At the beginning of its release, CryptoPunks were tied to the ERC-20 standard, which was not suitable for making the token completely unique. For this reason, the team ended up modifying the ERC20 development code enough to release non-volatile items, which inspired the development of ERC-721 soon after. Therefore, it can be said that CryptoPunks technically predates the standard Ethereum ERC-721 NFT token.

NFTs online gaming: As the gaming industry evolves, ERC-1155 tokens are becoming a tool with enormous potential as they have demonstrated a higher degree of interoperability than their predecessors. A video game that contains a huge number of collectibles and tradable items on its platform cannot rely on anything other than the ERC-1155 standard to run smoothly. Since a single smart contract can store multiple items, both removable and non-replaceable, any number of items can be sent in a single transaction to one or more recipients. Therefore, in terms of scalability, ERC-1155 tokens represent a considerable advancement.

Conclusion

The entire Ethereum ecosystem has once again demonstrated that it is capable of developing ever more efficient solutions to create an entirely new user-driven economy on the Internet. Since the ERC standards were first introduced, we have seen developers and users come up with even more advanced and specific standards that are suitable for every branch of the crypto industry.

0 notes

Text

Arbitrage between exchanges. Real earnings and guide for beginners.

In this article I will tell you about cryptocurrency arbitrage between exchanges. What is it? How can you make money on it? Which exchanges can be used, and which ones are better to bypass? What service is popular among all arbitrageurs? The answer to all these questions you will find in this article.

The basic rule of arbitrage. Buy cheaper, sell more expensive. If you managed to buy cheaper on one exchange, transfer to another exchange and sell, congratulations you have realized inter-exchange arbitrage.

Since the cryptocurrency market is still forming between exchanges there are huge spreads (% difference) and anyone can make good money on it.

It sounds as simple as possible, but there are many pitfalls that I will tell you about.

Read in the article:

-Cryptocurrency arbitrage - what is it?

-How cryptocurrency arbitrage between exchanges works

-Scanner and screener for cryptocurrency arbitrage

-How you can make money from it

-What is important to remember

Cryptocurrency arbitrage - what is it?

I think most of you have heard the word "arbitrage", but not everyone realizes what it really is.

Cryptocurrency arbitrage is a way to make money on the price difference of a token. Here is a simple, but understandable example: 1 Bitcoin on the Binance exchange costs $20000, while on another exchange, let's say Gate, the price of 1 Bitcoin is $20300. You buy on the first exchange, transfer and sell on the second exchange earning 300 dollars. This is the easiest way to make money on arbitrage.

How cryptocurrency arbitrage between exchanges works

How does arbitration work and where does the difference come from? Arbitrage situations arise for many reasons. For example, on one exchange the volume of trades in coin A is 1 million dollars. On the second exchange for the same coin - 100 thousand dollars. If someone buys a token on a less liquid exchange, for example, even for 5000 dollars, the rate will skyrocket and a spread will occur.

Unfortunately, exchanges are not part of a coalition, do not use a common policy. Low volume on some cryptocurrency exchanges leads to the fact that the rate does not immediately adapt to the average price.

A recent example, the Bitcoin rate in Nigeria was worth $50,000 while worldwide the rate was $25,000.

There are several types of arbitrage:

-The simplest is arbitrage on price differences on individual exchanges. Bought on Binance sold on Gate. ( I gave an example with bitcoin above). But there are a lot of nuances that I will tell you about.

-Arbitrage within one exchange (it is often called triangle) - for example for 10000 USDT, buy BTC, then exchange BTC for ETH, and sell ETH for USDT and get your %. The most dead way now as all exchanges close these opportunities and earnings are minimal with this method.

-Classic arbitrage - two deposits on two different exchanges. For example, on the exchange Binance BTC costs 20000$ and on the exchange Gate price 20100$. You sell on Binance and immediately buy on Gate. That is, you do NOT transfer and do not waste time on it, do not confuse with the first method. You simultaneously sell on one exchange and buy on the second. Best way!

Scanner and screener for cryptocurrency arbitrage

There are so many options, but I settled on arbitragescanner. I looked at real reviews on the internet and saw a lot of positive ones. The scanner is on the 1st place in all ratings, including on crypto. ru and on other authoritative resources.

Subscription price:

-Test - 69$/month (5 coins at a time, 60+ CEX crypto exchanges, 40 CEX currency pairs, 2 TG channels Ability to change coins at any time, Access to Message Test, Convenient CMS (or admin panel), Personalized notifications, Arbitrage Academy (basics), Support 24/7

-Pro - 199$/month (Arbitrage Screener, 10 coins at a time, 60+ CEX crypto exchanges and 20+ DEX in 10 different blockchains, 5 TG channels, 100 CEX currency pairs and 10 DEX currency pairs, Arbitrage Academy (+30 cases), Support 24/7, Closed arbitrage chat).

***Recommend to all beginners to take this tariff and above, because from this tariff you will have access to the screener (shows arbitrage between exchanges)!

-Expert - $399/month ( Arbitrage screener, 30 coins at a time, 60+ CEX crypto exchanges and 20+ DEX in 10 different blockchains, 15 TG channels, 300 CEX currency pairs and 30 DEX currency pairs, Arbitrage Academy (+70 cases), Support 24/7, Closed arbitrage chat).

-Guru - 1199$/6months ( Arbitrage Screener, 30 coins at a time, 60+ CEX crypto exchanges and 20+ DEX in 10 different blockchains, 15 TG channels, 300 CEX currency pairs and 30 DEX currency pairs, Arbitrage Academy (+70 cases), 24/7 Support, Closed Arbitrage Chat + Free access to the private party on the yacht 165ft on October 26 in Dubai).

-VIP - 1999$/year ( ( Arbitrage Screener, 30 coins at a time, 60+ CEX crypto exchanges and 20+ DEX in 10 different blockchains, 15 TG channels, 300 CEX currency pairs and 30 DEX currency pairs, Arbitrage Academy (+70 cases), 24/7 Support, Closed Arbitrage Chat + Free access to the private party on the yacht 165ft on October 26 in Dubai).

How do you capitalize on that

You've been notified:

Screenshot taken from arbitragescanner bot

You've checked 1 exchange

Next, we checked 2 exchanges

Bought → transferred → sold.

What is important to remember

A high spread can be a consequence of:

-The exchange/input of this or that token;

-Token takes additional transfer fees (For example BABYDOGE takes 5% from each transfer);

-Little liquidity;

-Different cryptocurrencies with the same name are listed on exchanges;

Be careful and check the information several times before making any transactions!

Conclusion: