#What is the future of Optimistic and Zero-Knowledge Rollups?

Explore tagged Tumblr posts

Text

Optimistic Rollups vs ZK-Rollups: A Quick Guide

As blockchain technology continues to revolutionize industries, the need for scalable solutions becomes increasingly urgent. Ethereum, one of the leading blockchain networks, faces significant challenges in handling high transaction volumes efficiently. Enter rollups, a game-changing layer 2 scaling solution designed to alleviate these issues.

Rollups are an innovative approach to improving blockchain scalability by processing transactions off the main chain (Layer 1) and then submitting them in batches, thus reducing congestion and costs. There are two main types of rollups: Optimistic Rollups and ZK-Rollups (Zero-Knowledge Rollups). Optimistic Rollups assume transactions are valid by default and only use fraud proofs to handle disputes, offering lower gas fees and increased throughput. However, this method introduces a slight delay in transaction finality due to the need for challenge periods.

On the other hand, ZK-Rollups leverage zero-knowledge proofs to validate transactions, providing immediate finality and enhanced security. While this approach requires significant computational resources, it ensures that transactions are inherently valid and almost impossible to tamper with. The blog delves into a detailed comparison between these two rollup types, highlighting their unique advantages, drawbacks, and ideal use cases.

Intelisync, a leader in blockchain development services, has successfully implemented rollup solutions to address scalability challenges for various clients. By leveraging these advanced technologies, Intelisync helps businesses enhance their blockchain platforms' performance and user experience. Ready to scale your blockchain application? Contact Intelisync today to explore how we can support your journey towards Learn more....

#Blockchain Development Services#Comparing The Differences Between Optimistic and ZK-rollups#Ethereum Scaling Explained#Fraud and Error Handling#How do I get started with optimistic and zero-knowledge rollups?#Optimistic Rollups vs ZK-Rollups#What are Optimistic Rollups?#What is better: optimistic or zero-knowledge rollups?#What is the future of Optimistic and Zero-Knowledge Rollups?

0 notes

Text

What Are the Latest Innovations in Cryptocurrency and Blockchain Development?

Cryptocurrency and blockchain technology have evolved significantly over the past decade. What began as a niche area with Bitcoin in 2009 has now exploded into a multi-billion-dollar industry with innovations in finance, supply chain, healthcare, and beyond. Blockchain's decentralized nature and cryptocurrencies' ability to offer decentralized financial services have led to a wave of technological advancements that continue to reshape industries.

As we move through 2025, the world of cryptocurrency and blockchain development continues to evolve. In this blog, we will explore some of the latest innovations that are driving the future of this technology and discuss how they are revolutionizing various industries.

1. Layer 2 Solutions for Scalability

One of the most persistent challenges facing blockchain and cryptocurrency development is scalability. As networks like Ethereum gain popularity, their capacity to handle a large number of transactions simultaneously has been pushed to its limits. Layer 2 solutions are emerging as a game-changing innovation that addresses these scalability issues without compromising decentralization or security.

Layer 2 solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups or zk-Rollups for Ethereum, are designed to take transactions off the main blockchain (Layer 1) and process them on secondary layers. These solutions enhance transaction throughput while keeping the cost of transactions low and ensuring faster confirmation times. With these solutions, the potential for blockchain technology to scale for enterprise-level applications is more feasible than ever.

By implementing these techniques, blockchain can handle millions of transactions per second, opening the door for mass adoption of decentralized applications (dApps) and services.

2. Zero-Knowledge Proofs (ZKPs)

Zero-Knowledge Proofs (ZKPs) are gaining prominence as a privacy-enhancing technology that allows one party to prove to another party that a statement is true without revealing any additional information about the statement itself. In the context of blockchain and cryptocurrency, ZKPs can significantly enhance privacy while maintaining transparency and security.

One of the most significant applications of ZKPs is in zk-Rollups, which we mentioned earlier in the context of scalability. ZKPs help to aggregate multiple transactions into a single proof that can be verified on the main chain, drastically reducing the amount of data that needs to be processed. In doing so, it not only boosts scalability but also preserves the privacy of users.

ZKPs are also being integrated into privacy coins like Zcash, which allow for completely private transactions by concealing transaction details like sender, receiver, and transaction amount. The introduction of zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) has helped push this innovation forward, providing the mathematical foundation for privacy and scalability improvements.

3. Decentralized Finance (DeFi) Innovations

Decentralized Finance (DeFi) has grown rapidly in the past few years, and it continues to be one of the most transformative innovations in cryptocurrency. DeFi platforms use smart contracts on blockchain networks to offer financial services such as lending, borrowing, trading, and staking without intermediaries like banks.

In 2025, DeFi is evolving with the advent of new financial products and features. New innovations include flash loans, yield farming, and automated market makers (AMMs), all of which aim to provide greater financial access, improve liquidity, and reduce barriers to entry. More DeFi protocols are incorporating non-fungible tokens (NFTs) and synthetic assets, which are expanding the range of available financial instruments.

Additionally, cross-chain interoperability is becoming a key focus in the DeFi space. Platforms like Polkadot and Cosmos are working toward facilitating communication between different blockchain networks, enabling seamless cross-chain transactions. This innovation will allow DeFi projects to interact with multiple blockchain ecosystems, creating more flexibility for users and developers.

4. NFTs and Tokenization

Non-Fungible Tokens (NFTs) have been one of the most talked-about innovations in blockchain technology. NFTs are unique digital assets representing ownership of a specific item or piece of content, whether it be art, music, virtual real estate, or collectibles. While NFTs initially gained attention in the art and entertainment industries, their utility has expanded to numerous other sectors, including gaming, real estate, and intellectual property rights.

One of the latest innovations in the NFT space is tokenizing physical assets. This is known as Real-World Asset (RWA) tokenization, where tangible assets like real estate, commodities, or even fine art are represented as NFTs. This process makes it easier to trade, transfer, and fractionalize ownership of high-value assets, democratizing access to traditionally illiquid markets.

Tokenization also plays a crucial role in the expansion of decentralized finance, where assets can be tokenized and used as collateral for loans, creating new financial opportunities for individuals and businesses alike.

5. Interoperability and Cross-Chain Development

The ability for different blockchain networks to communicate and work together has been a major hurdle for the industry. However, the development of interoperability solutions has been one of the most exciting innovations in recent years.

Platforms like Polkadot, Cosmos, and Chainlink are focused on bridging the gap between blockchain networks, allowing for smoother communication and transactions across different chains. The advent of cross-chain bridges allows tokens to be transferred across multiple blockchains without the need for centralized exchanges. This development is enabling greater liquidity and fostering the growth of a multi-chain ecosystem.

With interoperability, blockchain networks will be able to support a wider array of use cases, fostering innovation across different sectors, from DeFi to supply chain management.

6. Sustainability and Eco-Friendly Blockchains

As concerns over the environmental impact of cryptocurrencies, particularly Bitcoin's energy consumption, continue to rise, developers are working to create more eco-friendly blockchain solutions. The energy-intensive Proof-of-Work (PoW) consensus mechanism is being replaced by more energy-efficient consensus mechanisms like Proof-of-Stake (PoS) and its variants.

Ethereum, the second-largest cryptocurrency network, has transitioned to PoS with its Ethereum 2.0 upgrade, which reduces the network's energy consumption by up to 99%. Other projects like Cardano and Solana have adopted PoS and other energy-efficient protocols from the beginning.

Furthermore, the development of green mining technologies and carbon offset programs is helping to reduce the carbon footprint of cryptocurrency mining. These innovations align the industry with global efforts to combat climate change and promote sustainability.

7. Artificial Intelligence and Blockchain Integration

The integration of artificial intelligence (AI) with blockchain technology is one of the most promising areas of innovation. AI can be used to enhance blockchain applications in various ways, such as improving the security of smart contracts, automating processes, and optimizing supply chain management.

AI algorithms can help predict market trends and optimize decentralized financial platforms, while blockchain provides a secure, transparent, and immutable record of data. The combination of these two technologies can lead to more efficient systems and applications that are not only innovative but also scalable and secure.

Conclusion

The cryptocurrency and blockchain space is advancing rapidly, with new innovations and breakthroughs emerging every year. From scalability improvements like Layer 2 solutions to the privacy-enhancing Zero-Knowledge Proofs, the developments we see today are laying the foundation for the future of decentralized technologies.

As blockchain technology continues to mature, we can expect more industries to adopt decentralized systems, leading to more inclusive and transparent solutions across finance, healthcare, supply chains, and beyond. With innovations in DeFi, NFTs, cross-chain interoperability, and eco-friendly blockchain development, the next wave of blockchain technology will continue to disrupt traditional systems and create new opportunities for businesses and consumers alike.

The future is bright for cryptocurrency and blockchain development, and those who are ready to embrace these innovations will be at the forefront of the next technological revolution.

0 notes

Text

The Future of Ethereum: What’s Next After Ethereum 2.0?

Ethereum has long been one of the most influential and widely used blockchain platforms in the cryptocurrency world. After the highly anticipated Ethereum 2.0 upgrade (also known as Eth2), many in the blockchain community are now asking: What comes next for Ethereum? In this article, we will explore the key upgrades Ethereum 2.0 brought to the table and look ahead at the next steps for the platform’s evolution.

What Is Ethereum 2.0?

Before diving into the future, it’s important to understand what Ethereum 2.0 (Eth2) entails. Ethereum 2.0 is a series of upgrades aimed at improving the scalability, security, and sustainability of the Ethereum blockchain. The major change introduced with Ethereum 2.0 was the transition from the Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS). This move is designed to make Ethereum more energy-efficient, reduce transaction costs, and enhance the network’s ability to process more transactions per second (TPS).

The main phases of Ethereum 2.0 include:

The Beacon Chain (Phase 0): Launched in December 2020, this established the Proof of Stake mechanism and allowed validators to stake ETH on the new network.

The Merge (Phase 1.5): In September 2022, Ethereum merged its original PoW chain with the PoS Beacon Chain, officially ending mining and transitioning fully to PoS.

Shard Chains (Phase 2): This phase will introduce shard chains, splitting the Ethereum blockchain into smaller, more manageable pieces to dramatically increase the network’s scalability.

With Ethereum 2.0 now fully integrated, what lies ahead for the Ethereum ecosystem?

What’s Next After Ethereum 2.0?

While Ethereum 2.0 is a monumental shift, there are still many upgrades and improvements planned for the future. Here’s a look at what’s next in the Ethereum roadmap:

1. Sharding and Scalability

The biggest change coming to Ethereum after Ethereum 2.0 is sharding. Sharding is the process of dividing the Ethereum network into smaller pieces, or “shards,” each of which processes its own transactions and smart contracts. This will increase the scalability of Ethereum by allowing the network to process many more transactions in parallel.

Sharding is expected to address one of Ethereum's most significant challenges—scalability. As Ethereum’s usage grows, the blockchain can become congested, leading to slow transaction times and high fees. Sharding will help alleviate this by distributing the load across multiple shards, which will significantly improve throughput and lower gas fees for users. GCB Exchange is an ideal platform for users who want to trade Ethereum and other cryptocurrencies seamlessly, as it’s built to handle the increased scalability that sharding will bring.

2. Ethereum Improvement Proposals (EIPs)

While Ethereum 2.0 has made vast improvements, the network is continually evolving with Ethereum Improvement Proposals (EIPs). These are suggestions made by the Ethereum community to improve various aspects of the blockchain. Some of the most notable future EIPs include:

EIP-4844 (Proto-danksharding): This proposal aims to bring proto-danksharding to Ethereum, a short-term solution to enable cheaper rollups before full sharding implementation.

EIP-4488: Aiming to lower the cost of data availability for layer 2 solutions, this proposal would provide a temporary boost to Ethereum's scalability and improve Ethereum's throughput.

The continued development of these EIPs will help shape the future of the network, bringing about improvements in both performance and user experience, and platforms like GCB Exchange are well-positioned to take advantage of these future improvements.

3. Layer 2 Solutions: Optimism and ZK-Rollups

While sharding will provide a major scalability boost, Layer 2 solutions such as Optimistic Rollups and Zero-Knowledge (ZK) Rollups will play a crucial role in Ethereum’s future.

Optimistic Rollups and ZK-Rollups are technologies that process transactions off the Ethereum main chain, reducing congestion and lowering fees. Optimistic rollups assume transactions are valid by default and only verify them when challenged, while ZK-rollups use cryptographic proofs to validate transactions instantly.

These Layer 2 solutions are already in use on the Ethereum network and will continue to grow in importance as Ethereum expands. They are essential for improving Ethereum’s scalability, reducing gas fees, and increasing the speed at which transactions are processed. GCB Exchange supports many of these advanced Layer 2 solutions, allowing users to trade Ethereum with minimal fees and faster transaction times.

4. Ethereum as the Backbone for Web3 and Decentralized Finance (DeFi)

Ethereum’s transition to a fully decentralized and scalable network will further solidify its position as the backbone of Web3 and DeFi ecosystems. Web3 aims to create a decentralized internet where users have control over their data and assets. Ethereum, with its smart contract capabilities, is perfectly suited to support Web3 applications.

The growing popularity of DeFi (Decentralized Finance) applications, which allow users to access financial services without intermediaries, also depends heavily on Ethereum’s infrastructure. As Ethereum scales and becomes more efficient, DeFi platforms will be able to reach more users, offer faster transactions, and lower fees—unlocking greater potential in the decentralized finance space. GCB Exchange offers a variety of DeFi-related services, ensuring users can easily participate in the decentralized financial ecosystem while keeping their assets secure.

5. Ethereum and the Rise of NFTs

Another area where Ethereum’s future looks promising is in the field of NFTs (Non-Fungible Tokens). Ethereum remains the dominant blockchain for NFTs, with the majority of NFT projects being built on the network. As Ethereum 2.0 and beyond evolve, the NFT ecosystem will continue to thrive, offering new possibilities for artists, gamers, and creators across various industries.

NFTs could potentially expand beyond digital art and collectibles into other sectors such as gaming, virtual real estate, and identity verification. Ethereum’s continuous improvements will allow for more efficient and user-friendly NFT creation and trading, solidifying its role as the NFT platform of choice.

6. Sustainability and Energy Efficiency

Ethereum’s switch to Proof of Stake (PoS) through Ethereum 2.0 was a critical step towards reducing its energy consumption and environmental impact. While Bitcoin’s energy-intensive mining process remains a point of criticism, Ethereum’s PoS mechanism significantly reduces its carbon footprint.

Looking forward, Ethereum’s development team and broader ecosystem will likely continue to focus on sustainability, potentially incorporating additional green technologies into its operations. Ethereum’s commitment to environmental responsibility will likely influence the future of the blockchain space and attract more environmentally conscious investors and developers.

Conclusion: Ethereum’s Bright Future

Ethereum has already undergone one of the most transformative upgrades in blockchain history with Ethereum 2.0. As the network continues to evolve, Ethereum’s roadmap promises even greater scalability, efficiency, and decentralization. The introduction of sharding, improvements through EIPs, the rise of Layer 2 solutions, and Ethereum’s continued dominance in Web3, DeFi, and NFTs, ensure that Ethereum’s future remains as bright as ever.

Ethereum’s ongoing upgrades will solidify its position as the leading blockchain platform and a core component of the decentralized web. As Ethereum matures and adapts to the changing demands of the crypto ecosystem, the future looks promising for developers, investors, and users alike. Whether you’re trading Ethereum or exploring the new DeFi landscape, GCB Exchange offers a secure, scalable, and user-friendly platform to navigate the evolving crypto world.

1 note

·

View note

Text

Exploring Layer 2 Scaling Solutions for Blockchain Efficiency

As the adoption of blockchain technology continues to grow, the need for improved efficiency and scalability becomes increasingly important. Layer 2 scaling solutions have emerged as a pivotal advancement, addressing the limitations of primary blockchain networks, particularly those that rely on Layer 1 infrastructure like Ethereum. This article explores what Layer 2 solutions are, their benefits, challenges, and their future in the evolving landscape of blockchain technology.

Understanding Layer 2 Scaling Solutions

Layer 2 refers to protocols built on top of existing blockchain networks (Layer 1) that aim to enhance transaction throughput and reduce fees without compromising the security and decentralization of the underlying blockchain. These solutions enable faster and cheaper transactions by offloading some of the transaction processing from the main blockchain.

The need for Layer 2 scaling solutions arose from the limitations of Layer 1 networks, which often struggle with high transaction fees and slow confirmation times during periods of increased demand. By creating a secondary layer, developers can create a more efficient and user-friendly experience for blockchain users.

Key Types of Layer 2 Solutions

State Channels: This solution allows users to conduct transactions off-chain and only settle the final result on the main blockchain. State channels are particularly useful for applications that require numerous transactions between two parties, such as gaming or micropayments. By enabling off-chain interactions, state channels significantly reduce the load on the main blockchain.

Rollups: Rollups are a popular form of Layer 2 scaling that aggregates multiple transactions into a single batch before submitting them to the main chain. There are two main types: optimistic rollups, which assume transactions are valid and only verify them if challenged, and zk-rollups, which utilize zero-knowledge proofs to ensure transactions are valid without revealing sensitive information. Rollups effectively increase transaction throughput while minimizing costs.

Plasma: Plasma is a framework that allows developers to create child blockchains connected to the main Ethereum chain. These child chains can process transactions independently, and only the final results are sent back to the main chain. Plasma enhances scalability by allowing numerous child chains to operate concurrently.

Sidechains: Sidechains are independent blockchains that run parallel to the main chain and can interact with it. They enable specific features or functionalities, allowing developers to create tailored environments without burdening the main network. Sidechains facilitate interoperability and can improve overall network performance.

Benefits of Layer 2 Scaling Solutions

Increased Transaction Speed: One of the most significant advantages of Layer 2 scaling solutions is the potential for faster transaction processing. By reducing the number of transactions processed on the main chain, Layer 2 solutions can significantly speed up confirmations, leading to a more seamless user experience.

Lower Fees: Transaction fees can be a barrier to entry for many users, especially during peak usage periods. Layer 2 solutions often enable lower fees by offloading transactions, making blockchain technology more accessible to a wider audience.

Enhanced User Experience: With faster and cheaper transactions, users can interact with decentralized applications (dApps) more easily. This improvement in usability can drive higher adoption rates and encourage innovation within the blockchain ecosystem.

Scalability for dApps: Developers can build more complex and resource-intensive applications without worrying about the limitations of Layer 1 networks. Layer 2 solutions provide the scalability needed to support a growing number of users and transactions.

Challenges and Considerations

Despite their numerous advantages, Layer 2 scaling solutions also face challenges:

Security Risks: While Layer 2 solutions are designed to enhance scalability, they can introduce new security vulnerabilities. For instance, state channels may require users to trust their counterparts, and rollups rely on the security of the main chain for finality. Developers must carefully assess the trade-offs between scalability and security.

User Adoption: For Layer 2 solutions to succeed, users and developers need to adopt them. This requires education and awareness about the benefits and workings of these solutions. Without widespread acceptance, the potential of Layer 2 may remain untapped.

Interoperability: As various Layer 2 solutions emerge, ensuring compatibility and seamless communication between different solutions becomes crucial. Without effective interoperability, the ecosystem may become fragmented, hindering broader adoption.

The Future of Layer 2 Scaling Solutions

The future of Layer 2 scaling solutions looks promising as more projects are developed and integrated into existing blockchain networks. As Layer 1 platforms continue to evolve, the collaboration between Layer 1 and Layer 2 solutions will be vital in overcoming the challenges posed by scalability and transaction fees.

Furthermore, as the demand for decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications grows, Layer 2 solutions will play an essential role in meeting these needs. By facilitating faster and cheaper transactions, they will enable the development of more complex and engaging dApps, ultimately driving the mass adoption of blockchain technology.

Get in Touch:

🌐 Website: https://www.nollars.com/

🔗 https://nollars.blogspot.com/

🔗 https://sites.google.com/view/nollars/home

Conclusion

In conclusion, Layer 2 scaling solutions represent a significant step forward in the evolution of blockchain technology. By enhancing transaction speed, reducing fees, and improving the user experience, these solutions are well-positioned to address the limitations of existing Layer 1 networks. As the ecosystem continues to mature, the collaborative integration of Layer 1 and Layer 2 solutions will pave the way for a more scalable and accessible blockchain future. The journey is just beginning, and the potential for innovation is immense.

0 notes

Text

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

New Post has been published on https://thedigitalinsider.com/layer-2-solutions-and-how-they-will-affect-ethereum-technology-org/

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

If you’re active in the crypto domain, you’ve probably noticed a fall in the popularity and usage of Ethereum. This has mostly come from the high fees that come with making transactions on the platform, moving users from once-popular areas to more favorable ones, such as BSC and SOL.

In an attempt to bring back the old glory of ETH, a thing called Layer 2 was created, and today, LI.FI is bringing you on a journey of the solutions that Layer 2 brings with it, creating new possibilities for Ethereum.

Ethereum cruptocurrency – artistic impression. Image credit: WorldSpectrum via Pixabay, free licence

What is Layer 2?

First, let’s get to know our main actor – Layer 2. We can simply describe it as being an add-on to lower blockchains, called Layer 1, with its role being a tool for better connectivity and interoperability between blockchains. Just as DeFi Saver helps you with managing your assets, Layer 2 helps the transaction of them, making the whole process faster and smoother.

We can imagine the whole of Ethereum as one big river, and its water, representing transactions, growing more and more, causing it to overload and leak. Layer 2 solutions, in this case, would represent chutes separating from the river and taking part of the leverage of water with them, making it easier for the river to flow smoothly, just as they make transactions in the crypto world.

Now that we’ve defined Layer 2, let’s see exactly how it helps Ethereum.

Types of Layer 2 solutions and how they impact Ethereum

There are several solutions that have been and are developing to help Ethereum.

The first one is a sidechain. As described above, they serve as side blockchains running parallel to Ethereum. Two of them are connected by a bridge. Sidechains have worse security systems and serve only as a roundabout way of transactions.

The next one would be rollups. Rollups are a scaling technique that executes transactions outside the main Ethereum chain (off-chain) but stores transaction data on-chain. The core idea is to “roll up” or bundle many transactions into a single one, thereby reducing the overall load on the network. Rollups can be divided into optimistic and zero-knowledge. The main difference between them is the way they do or do not decide whether the transaction is valid.

The third solution would be state channels. State channels involve two or more participants locking a portion of the blockchain’s state (e.g., a set amount of cryptocurrency) in a multi-sig contract. Transactions between these participants then occur off-chain, and only the final state is recorded on the blockchain. Transactions within a state channel are nearly instant, as they don’t require blockchain confirmation each time. State channels offer more privacy since intermediate transactions aren’t publicly recorded on the blockchain.

One limitation of state channels is that they are best suited for scenarios where participants are known and willing to engage in multiple transactions over time.

Conclusion – Layer 2 solutions run so that Ethereum can walk!

These solutions, together with many others, have over time helped Ethereum to start getting back on track by taking the role of the accelerator of the transaction processes. By covering different holes in the Ethereum operating system, these solutions make sure the platform keeps performing better and better. Thanks to them, the future of Ethereum promises a more scalable and sustainable environment for crypto lovers to roam around!

#add-on#assets#Blockchain#bridge#bundle#channel#connectivity#crypto#cryptocurrency#data#Difference Between#Environment#Ethereum#Fintech news#Future#how#it#network#One#operating system#Other posts#privacy#process#Security#Special post#sustainable#technology#time#tool#transaction

0 notes

Text

Rollup Wars: Battle Rages For the Future Of Ethereum Scaling

Hello Defiers! Here’s what we are covering today! News Layer 2 Podcast Video Shorts News Layer 2 Rollup Wars: Battle Rages For the Future Of Ethereum Scaling Matter Labs Co-founder Takes Aim At Zero-Knowledge Technology By Samuel Haig On Jan. 29, Steven Goldfeder, the co-founder of Offchain Labs, the team behind leading optimistic rollup, Arbitrum, took aim at what he describes as a commonly…

View On WordPress

0 notes

Text

Josh Stark and Evan Van Ness are publishing year in Ethereum overview, if I’m right this is 3rd edition. Highlights:

Those cities are growing fast. Because Ethereum is open to everyone, many different users have found reasons to build on it:

Markets use it as financial infrastructure

Artists use it to give permanence to their work

Assets use it as a settlement layer

Communities use it to govern shared resources

Layer 2 arrives - after years of development, L2 protocols launch on mainnet and expand Ethereum’s capacity

Creator economy goes mainstream - NFTs are everywhere and artists use Ethereum to earn billions

Core protocol upgrades - the Ethereum R&D community ships multiple upgrades, preparing for the transition to Proof of Stake

DAOs pass the tipping point - DAOs become a viable tool for communities to self-govern, accumulating billions of assets and drawing in new users

L2s were popping

Arbitrum and Optimism are notable as the first generalized rollups to reach production. This means that each rollup operates like a natural extension of Ethereum - they are “EVM compatible”. Users can easily migrate Ethereum-based assets to them, and developers can deploy Solidity contracts and applications to the rollups themselves where users can interact with them.

Optimistic rollups and Zero-Knowledge rollups.

In a Zero-Knowledge rollup, cryptography is used to prove that the transaction was valid and store that proof on Ethereum. Most of the data can be thrown away (meaning you don’t need to store it on-chain), and only a tiny piece of data remains. But it is enough to mathematically prove that the transaction was valid.

ZK rollups work by converting code that runs on the rollup into a special mathematical equation. This equation is what gives us the concise proofs that are stored on mainnet.

It is a lot easier to define such an equation when the possible inputs are constrained. For instance, if we are only going to do simple token transfers. These application specific equations are easier to design.

The NFT ecosystem is in very early stages. Remember that a year ago, the market for NFTs barely existed. Today the vast majority of volume and users are concentrated on one platform (OpenSea). However, there are many projects working on launching competitors, including decentralized exchanges. As we learned from the history of decentralized exchanges (a “dex”) and Uniswap’s incredible growth, decentralized projects that give ownership to their users can meaningfully compete with centralized incumbents.

These creators are not just casual users, but core members of the Ethereum community who depend on it and have a meaningful stake in the ecosystem. This change has led to an influx of new people, ideas, communities, talent, viewpoints and concerns, changing Ethereum’s ecosystem and influencing its future.

This year, client teams and the larger R&D community shipped two substantive upgrades to Ethereum mainnet: “Berlin” in April, and “London” in August. These upgrades included multiple changes. Most notable was EIP-1559, which reformed the Ethereum fee market (discussed in depth below), but also included critical changes like EIP-2929 which improved Ethereum’s defense against DOS attacks.

EIP-1559 had multiple goals:

Make it less likely that a user would overpay for their transaction

Reduce the rate of stuck transactions

Enhance protocol security by making re-orgs less likely, and making DOS attacks more expensive

Burn a portion of fees, which can accrue value to ETH and raise Ethereum’s economic security

In April, the Rayonism project saw developers hack together testnets that simulated the merge, as well as some early sharding designs.

In October, client teams gathered in Greece for the Amphora retreat that produced a short-lived multi-client testnet.

In November, the Kintsugi testnet continued that work with a long-lived multi-client testnet based on the latest specification.

DAOs:

ENS, ConstitutionDAO, PleaserDAO, FWB, MakerDAO became DAO

Tools:

In 2021, the range of tools available to create and manage DAOs expanded:

Mirror launched a suite of tools that help people create “Media DAOs”: joint publishing and ownership of content created on Mirror.

Coordinape spun out of the Yearn community, and offers a framework for distributed teams to collaboratively decide on compensation for work done by DAO members.

Rabbithole launched tools to onboard new users to DAOs and build the skills and credentials to work for DAOs.

Forward-thinking governments have developed novel legal structures to streamline DAO formation and reporting, like in Wyoming.

Huge progress on:

Identity

Gaming

Public goods funding

0 notes

Photo

New Post has been published on https://coinprojects.net/want-to-improve-blockchain-infrastructure-work-under-layer-two-solutions/

Want to improve blockchain infrastructure? Work under layer-two solutions

There has been a lot of talk about how blockchain unlocks endless enterprise opportunities. And although all this buzz has not entirely translated to tangible results, the explosion of the decentralized finance and nonfungible token (NFT) markets has laid down markers on what is achievable and how blockchain can truly impact even the most conservative industries.

So unlike two to four years ago, developers, entrepreneurs and businesses are not just blindly joining the bandwagon. It is no longer about what blockchain can do. Now the questions being asked revolve more around how best to utilize the technology for the best results. Therefore, blockchain has slowly evolved from a buzzword to mainstream adoptable technology. If this does not indicate real growth and development, then what does?

Related: Blockchain technology can change the world, and not just via crypto

However, this doesn’t mean that it has been smooth sailing so far. Ever since we began to view blockchain as a viable technology to power mainstream applications, the throughput performances of blockchains, particularly those that have been widely adopted, have come under intense scrutiny. Understandably, scalability remains a yardstick to judge the readiness of blockchain networks to take up enterprise applications.

Using Ethereum as a case study, it is safe to say that many Ethereum users have dealt firsthand with the downsides of unscalable blockchain infrastructure. From my experience, high transaction fees resulting from network congestion are a potential deal-breaker for retail investors. For the average user, there is no way to justify paying as high as $70 as a fee for executing a single transaction that might not even be worth up to $100.

Notably, Ethereum’s inability to scale accordingly has, to an extent, stifled the establishment of the DeFi and NFT sectors, with retail investors and traders interested in executing low-value transactions often forced to watch from the sidelines. Even Vitalik Buterin recently acknowledged the severity of this situation, noting that the current scaling and fee system is unsustainable if the goal is for social network projects powered by NFTs to thrive on the Ethereum network.

And so, the question is: How have blockchain developers responded to this recurring issue?

Is layer one ever enough?

I believe that the ultimate aim is to solve the blockchain trilemma, which is finding a balance between decentralization, security and scalability. More often than not, blockchains have to sacrifice one of these three features. In most legacy blockchains, including Bitcoin and Ethereum, the infrastructural design adopted sacrifices scalability for security and decentralization.

It must be said that Bitcoin and Ethereum are the two most popular blockchains not just because they are the first of their kind but also because they have established themselves as arguably the most decentralized and secure blockchain networks out there. In essence, what they lack in scalability, they make up for in other core blockchain requirements. While this was enough in the early years of their operation, the influx of blockchain applications has certainly put immense pressure on Layer 1 chains to evolve and incorporate scalability-focused infrastructures.

Related: Where does the future of DeFi belong: Ethereum or Bitcoin? Experts answer

While it is much easier for the newer blockchains to adjust accordingly by implementing scalable infrastructure from scratch, it is a lot more difficult for those with existing infrastructure to do the same. As witnessed in the case of Ethereum, it may entail a complete overhaul of the existing infrastructure. Moving an existing blockchain economy worth billions of dollars to a new blockchain infrastructure comes with bags of risks. A lot could go wrong, especially since it has never been done before at such a scale.

So, ordinarily, the obvious choice is for DApp developers and users to opt for scalable focused Layer 1 chains. Expectedly, the list of Layer 1 chain solutions trying to take advantage of the explosion in demand for fast blockchain infrastructures has increased over the years — notable mentions are Binance Smart Chain, Tron and EOS. However, as we have discovered, decentralization is seemingly not the strongest suit of these options. Faced with the blockchain trilemma mentioned earlier, most of the alternatives to Ethereum and Bitcoin have settled for speed over decentralization. Therefore, it becomes a question of preference and what developers are willing to trade-off.

Perhaps a third and more favorable option is to go for layer-two solutions. With this, developers can at least ascertain that they can access all of the bits and pieces necessary for creating optimal blockchain applications.

Are layer-two solutions the immediate answers to blockchain’s trilemma?

The scalability flaws of the Ethereum blockchain have forced solutions to build networks on top of existing ones and take up some of the transaction and computing loads clogging the mainnet. A multi-layered approach ensures that developers continue to enjoy the high liquidity of the Ethereum blockchain and yet evade the bottlenecks associated with the ecosystem.

The idea is to carry out all of the computation and scalable payment off-chain and intermittently record the final state of such activities on the Layer 1 blockchain. Whether it is optimistic rollups, state channels, plasma or zero-knowledge rollups (zk-rollups), the goal remains the same: Sidestep the apparent limitations of decentralized blockchains.

Already, Polygon (previously called Matic) has achieved a lot of traction as a second layer solution ideal for Ethereum applications looking to enable a scalable platform free from the effect of network congestion. For instance, the Polygon version of SushiSwap, Sushi, recorded a 75% increase in the number of users in the first week of September, according to DappRadar. Barring a recent plunge in the activities on Polygon, which I believe is a momentary setback, users have awakened to the possibilities that layer-two solutions offer, especially when it comes to retail DeFi.

Interestingly, it is not only the DeFi sector that is undergoing this dynamic shift. The NFT market has also begun to migrate to layer two with a particular solution that reportedly saves over $400,000 in gas fees just 24 hours after launch. In July, OpenSea announced that it has integrated with Polygon to enable gas-free trades on its NFT marketplace. Note that Polygon is not the only layer-two solution making waves currently. Other layer-two infrastructures that have made a splash are Celer Network and Arbitrum.

The influx of layer-two adoption has led me to believe that developers have settled for multi-layered blockchain infrastructure as the ideal architecture for creating a top-notch blockchain experience. If this trend continues, which very much seems certain, at least until Ethereum 2.0 comes online, Layer 2 applications will become as valuable as their Layer 1 counterparts. Therefore, joining the Layer 2 party is a reasonable choice for developers looking to improve on existing blockchain infrastructures or build new decentralized apps.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Andrey Sergeenkov is an independent researcher, analyst and writer in the cryptocurrency space. As a firm supporter of blockchain technology and a decentralized world, he believes that the world craves such decentralization in government, society and business. He is the founder of BTC Peers, an independent media outlet.

Source link By Cointelegraph By Andrey Sergeenkov

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #TronNetwork #TRX

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#TronNetwork#TRX#Blockchain#CryptoPress

0 notes

Text

Annotated edition, Week in Ethereum News, Jan 19, 2020

This is the 6th of 6 annotated editions that I promised myself to do.

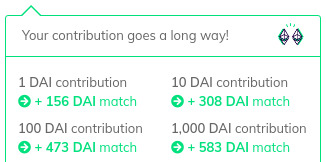

Like last week, it’s an opportunity to shill my Gitcoin grant page. Right now a 1 DAI (you can give ETH or any token) has an insane matching. Where else can you get a 150x return on a buck?

There’s about 24 hours left at the time this was published.

I shared on Twitter the graph of my subscriber count for the last 90 days:

The newsletter has gotten big enough to the point where the subscriber churn is enough to force negative days. It used to be that the day I sent the email, I’d get 90% of my new subs for the week from posting on Reddit. Now Reddit is saturated, and the number only goes up because of the long tail of word of mouth - which seems to be mostly seeded by the RTs of people who make the weekly most clicked as I post it to Twitter.

It’s clear that I’ve mostly bumped up against the ceiling of people who are willing to subscribe to a tech-heavy Eth newsletter. Perhaps there are other marketing channels, but seems unlikely to find people who want a newsletter, even if they are Eth devs.

This annotated version is an attempt to test whether writing for a larger audience would succeed. I think to some degree it has, but I also haven’t done a great job of contextualizing, nor adding narratives. Still working on it.

Eth1

Notes from the latest eth1 research call. How to get to binary tries.

Guillaume Ballet argues for WASM precompiles for better eth1 to prepare for eth2

StarkWare mainnet tests find that a much bigger block size does not affect uncle rate and argues that a further decrease in gas for transaction data would be warranted

Guide to running Geth/Parity node or eth2 Prysm/Lighthouse testnet on Raspberry Pi4

Nethermind v1.4.8

Eth1 is moving toward a stateless model like Eth2 will have. This will help make Eth1 easier to seamlessly port into eth2 when phase 1 is live.

In the meantime, people are figuring out what makes sense. Is it WASM precompiles? Will client devs agree to it?

StarkWare wants to reduce the gas cost again, which would make rollup even cheaper and provide more transaction scalability.

Eth2

The incentives for good behavior and whistleblowing in Eth2 staking

Danny Ryan’s quick Eth2 update – updated docs explaining the spec currently under audit

Options for eth1 to eth2 bridges and phase1 fee market

Simulation environment for eth2 economics

Ryuya Nakamura proposes the subjective finality gadget

Lighthouse client update – 40x speedup in fork choice, 4x database speedup, faster BLS

Prysmatic client update – testnet with mainnet config

A guide to staking on Prysmatic’s testnet

How to build the Nimbus client on Android

Evaluating Eth2 staking pool options

If you’re going to read one post this week in full, the “incentives for good behavior” is probably the one. This isn’t new info, but it’s nicely packaged up and with the spec under audit, this is very likely to be the final info. This answers many of the questions that people come to Reddit and ask.

Danny Ryan’s quick updates are also packed full of info.

the spec is out for audit. the documentation all got overhauled to explain the decisions -- ie, things needed for an audit -- with the expectation of a post-audit spec in early March. Obviously we hope for minimal changes and then set a plan for lunch.

There’s been lots of talk about how long we need to run testnets for, but i think it’s quite clear that anything more than a month or so of testnets is overkill. We’ve had various testnets for months, the testnets will get increasingly multi-client, including from genesis. Phase 0 is going to be in production but not doing anything in production - a bit like the original release of Frontier in July 2015.

We should push to launch soon. Problems can be hardforked away and the expectations should be very similar to the launch of Frontier.

Layer2

Plasma Group -> Optimism, raises round from Paradigm/ideo for optimistic rollups

Auctioning transaction ordering rights to re-align miner incentives

A writeup of Interstate Network’s optimistic rollup

Plasma Group changed their name to Optimism and raised a round. It’s hardly a secret that layer2 has been a frustration in Bitcoin/Ethereum for years, with no solution reaching critical mass, and sidechains simply trading off decentralization/trustlessness. Plasma Group decided to go for rollup instead of Plasma, due to the relative ease of doing fully EVM through optimistic rollup. Respect to Paradigm for having conviction and leading the round, as well as IDEO.

The auctioning of ordering rights is part of their solution.

Also cool is Interstate Network, who is building something similar. I’m unclear why they decided to launch with a writeup on Gitcoin grants, but it is worthy of supporting.

Stuff for developers

Truffle v5.1.9, now Istanbul compatible.

Truffle’s experimental console.log

New features in Embark v5

SolUI: generate IPFS UIs for your Solidity code. akin to oneclickdapp.com

BokkyPooBah’s Red-Black binary search tree library and DateTime library updated to Solidity v0.6

Overhauled OpenZeppelin docs

Exploring commit/reveal schemes

Using the MythX plugin with Remix

Training materials for Slither, Echidna, and Manticore from Trail of Bits

Soon you’ll need to pay for EthGasStation’s API

As of Feb 15, you’ll need a key for Etherscan’s API

Hard to miss the “time to get a key” for the API trend. But to be fair, it makes sense to require keys. It’s not surprising that providing it for free is not a business model.

Ecosystem

Gavin Andresen loves Tornado.Cash and published some thoughts on making a wallet on top of Tornado Cash

MarketingDAO is open for proposals

Almonit.eth.link launches, a search engine for ENS + IPFS dweb

Build token pop-up economies with the BurnerFactory

Tornado.cash is such a huge thing for our ecosystem that I feel no problem highlighting it forever. The complete lack of privacy isn’t 100% solved, but if you care about your privacy, Tornado Cash is super easy to use. I’ve said it before, but participating in Tornado is a public good -- you’re increasing the anonymity set.

The dweb using ENS and IPFS is interesting, worth watching to see how it evolves, though currently it only has 100 sites.

I hope to see more pop-up economies happen. It’s a great way to onboard people and give a better glimpse of the future than making people wait an hour for transactions to confirm.

Enterprise

EEA testnet launch running Whiteblock’s Genesis testing platform

Plugin APIs in Hyperledger Besu

Privacy and blockchains primer aimed at enterprise

A massive list of corporations building on Ethereum

Sacramento Kings using Treum supply chain tracking to authenticate player equipment

Neat to see the Kings experimenting with new tech, even if in small ways.

Meanwhile that list of building on Ethereum has 700+ RTs at the moment. Goes to the MarketingDAO above - there are many ETH holders who feel like Ethereum is undermarketed.

Governance and standards

EIP2464: eth/65 transaction annoucements and retrievals

ERC2462: interface standard for EVM networks

ERC2470: Singleton Factory

bZxDAO: proposed 3 branch structure to decentralize bZx

Application layer

Livepeer upgrades to Streamflow release – GPU miners can transcode video with negligible loss of hashpower so video transcoding gets cheaper

Molecule is live on mainnet with a bonding curve for a clinical trial for Psilocybin microdoses

Liquidators: the secret whales helping DeFi function. Good walkthrough of DeFi network keepers.

Curve: a uniswap-like exchange for stablecoins, currently USDC<>DAI

New Golem release has Concent on mainnet, new usage marketplace, and Task API on testnet

Gitcoin as social network

rTrees. Plant trees with your rDai

In typical Livepeer fashion, they didn’t hype up their release very much, but I think Streamflow could end up being very big. They think they can get the price point down for transcoders to being cheaper than centralized transcoders. How? Because GPU miners want to make more money and GPU miners can add a few transcoding streams with negligible loss of hashpower. This will become even more crucial when ETH moves to proof of stake, and miners will need to get more out of their hardware.

Lots of people loved rTrees. As a guy who has done all the CFA exams, I have had the time value of money drilled into me too much to ever think of anything as “no loss” but people love the concept.

Psychedelic microdosing and tech has become a thing. Tim Ferriss led fundraising a Johns Hopkins psychedelic research center, it will be interesting to see if Molecule becomes a hit in the tech community outside crypto.

Tokens/Business/Regulation

The case for a trillion dollar ETH market cap

Continuous Securities Offering handbook

The SEC does not like IEOs

Former CFTC Chair Giancarlo and Accenture to push for a blockchain USD

Tokenizing yourself (selling your time/service via token) was all the rage this week, kicked off by Peter Pan. Here’s a guide to tokenizing yourself

Avastars: generative digital art from NFTs

Speaking of the Eth community wanting more marketing, the trillion dollar market cap piece was the most clicked this week.

If you haven’t checked out Continuous Securities, it’s a neat idea.

The tokenizing yourself trend is easy to laugh at or dismiss, but they’re some small experiments that are worth watching.

General

Chris Dixon: Inside-out vs outside-in tech adoption

baby snark: Andrew Miller’s tutorial on implementation and soundness proof of a simple SNARK

Blake3 hash function

Justin Drake explains polynomial commitments

New bounty (3000 USD) for improving cryptanalysis on the Legendre PR

Mona El Isa’s a day in the life for asset management in 2030. We need more web3 science fiction

SciFi and zero knowledge (”moon math” as it occasionally gets called) section.

SciFi shows us the future, and zero knowledge solutions increasingly aren’t just the future, but also the present.

Full Week in Ethereum News post

0 notes