#aadhaar based payment system

Explore tagged Tumblr posts

Text

Aadhaar Enabled Payment System - Overview

Aadhaar enabled payment system is the new way of online banking transactions. It has changed landscape of financial transaction in India. Now people don't need to be visit to bank or ATM for banking transactions. By visiting nearby BC (business correspondent) a bank customer can perform all basic banking facilities by leveraging their Aadhaar card number and finger-print authentication.

To learn more about Aadhaar enabled payment system, its benefits, roles, features, future scope and business opportunities, visit this blog now or for business enquiries call at (+91)7230001612

#aadhaar enabled payment system#aeps aadhaar enabled payment system#aadhaar based payment system#aadhaar based payment#aeps payment#aadhar card based payment system#aeps software#aeps business#aeps services

0 notes

Text

Aadhaar Enabled Payment System (AEPS) Registration API: Simplifying Payments with JustForPay

In today's digital world, secure and seamless payment systems are crucial for businesses and consumers alike. The Aadhaar Enabled Payment System (AEPS) is a revolutionary solution that uses Aadhaar (the unique identification number in India) to enable secure transactions. With the Aadhaar Enabled Payment System (AEPS) Registration API offered by JustForPay, businesses and service providers can easily integrate AEPS payment services into their platforms.

This blog will delve into the benefits and features of the AEPS Registration API from JustForPay and how it simplifies payment processes for businesses, merchants, and customers.

What is AEPS (Aadhaar Enabled Payment System)?

AEPS is a payment system that allows financial transactions to be authenticated through an individual’s Aadhaar number. It empowers users to carry out banking transactions using their Aadhaar-linked bank accounts. Whether it’s cash deposits, withdrawals, balance inquiries, or fund transfers, AEPS provides a secure and convenient way for customers to access banking services directly from service points like retail stores, agents, and business establishments.

How Does AEPS Work?

AEPS operates on the Aadhaar number and the associated biometric data of the user. Transactions are carried out through the following simple steps:

Customer Initiates the Transaction: The user provides their Aadhaar number and authenticates the transaction through biometric verification (fingerprint or iris scan).

Bank Authentication: The bank verifies the biometric details with the Aadhaar database to authenticate the transaction.

Transaction Completion: Once authenticated, the transaction is processed, whether it's a withdrawal, deposit, or transfer.

Why AEPS is Important for Businesses?

AEPS has become a popular solution for businesses because it eliminates the need for physical cards and PINs, reducing the risks associated with traditional payment methods. With AEPS, transactions can be made easily and securely using Aadhaar-linked biometric data. The key advantages for businesses are:

Cost-Effective Transactions: AEPS offers lower transaction fees compared to traditional banking systems.

No Need for Physical Infrastructure: AEPS doesn’t require POS machines or card swipes, making it an affordable option for small businesses and service providers.

Secure Transactions: The use of biometric verification ensures secure and fraud-proof payments.

Financial Inclusion: AEPS enables access to banking services in remote areas where traditional banking infrastructure may not be present.

The JustForPay AEPS Registration API

JustForPay is a leading provider of digital payment solutions, and their AEPS Registration API is designed to simplify the AEPS integration process for businesses, financial institutions, and payment service providers. By integrating this API, businesses can offer AEPS services to their customers with minimal effort.

Key Features of the JustForPay AEPS Registration API:

Simple Integration: The API is easy to integrate into any website or application, whether you’re running a small business or a large-scale enterprise.

Secure Biometric Authentication: The API supports biometric authentication for users, ensuring that every transaction is verified securely.

Real-time Transactions: It allows businesses to perform real-time transactions for withdrawals, deposits, balance checks, and transfers.

Wide Bank Coverage: The API supports transactions with all major banks in India, providing broad accessibility for users.

Mobile & Web Compatibility: The API can be seamlessly integrated with both mobile applications and web-based platforms, offering flexibility to businesses.

Easy Registration Process: The AEPS Registration API from JustForPay makes it quick and straightforward for new users to get started with AEPS services.

Benefits of Using the AEPS Registration API from JustForPay

Ease of Access for Customers: Customers can easily perform financial transactions without needing a bank card, PIN, or credit/debit card details.

No Internet Dependency for Transactions: Transactions can be done offline in areas with limited internet connectivity, improving financial inclusion.

Increased Business Reach: By enabling AEPS services, your business can attract more customers from different socio-economic backgrounds, especially in rural or underserved areas.

Faster Transactions: AEPS transactions are quicker than traditional bank transactions, enhancing customer satisfaction and boosting business operations.

Compliance with Regulatory Standards: The JustForPay AEPS API adheres to all regulatory and security standards set by the Indian government, ensuring smooth and compliant transactions.

How to Get Started with AEPS Registration API?

Getting started with the AEPS Registration API from JustForPay is simple:

Sign Up: Visit the JustForPay website and register for an account to access their AEPS API services.

Integration: Once registered, you can access API documentation that guides you through the integration process, whether you are integrating it into a website, app, or POS system.

Complete Registration: Follow the process to complete the registration with the bank(s) supported by the AEPS API. Once completed, you will be ready to begin offering AEPS services to your customers.

Start Transacting: After successful integration and registration, you can start processing AEPS transactions on your platform.

Conclusion

The Aadhaar Enabled Payment System (AEPS) is a game-changer in the world of digital payments, offering a secure, cost-effective, and accessible payment solution for businesses and customers alike. With the AEPS Registration API from JustForPay, integrating AEPS into your business operations has never been easier. By using this API, businesses can offer fast and secure banking services to their customers, increase financial inclusion, and enhance customer satisfaction.

If you're looking to integrate AEPS services into your platform, JustForPay is the perfect partner to simplify the process and ensure a smooth, secure, and compliant payment experience.

#Aadhaar Based Cash Withdrawal A#Aadhaar Enabled Payment System Aeps Registration Api#Aadhaar Enabled Payment System Near Me Api#Aadhaar Enabled Payment System Services Api

0 notes

Text

Aadhaar Enabled Payment System (AEPS) Registration with JustForPay

In today’s fast-paced digital world, financial transactions are becoming increasingly automated and secure. One such innovative solution is the Aadhaar Enabled Payment System (AEPS), which has revolutionized how individuals access banking services. If you are looking to leverage AEPS for seamless and secure transactions, the JustForPay platform offers a hassle-free registration process to get started. In this blog, we will take you through the AEPS registration process with JustForPay and explain how it can benefit you.

What is AEPS?

AEPS is a unique payment system powered by the Government of India that allows individuals to perform basic banking transactions using their Aadhaar number. This service is available round-the-clock and is accessible via micro-ATMs, POS terminals, and smartphones with biometric authentication. AEPS enables users to withdraw or deposit money, check their bank balance, and transfer funds using just their Aadhaar number, eliminating the need for traditional bank account details.

Key Features of AEPS:

Aadhaar-based Authentication: Transactions are validated through biometric authentication (fingerprint/iris scan) linked to the user’s Aadhaar number.

Secure Transactions: AEPS ensures the highest level of security through Aadhaar-based authentication and end-to-end encryption.

Universal Access: AEPS can be used by anyone, including individuals in rural areas who might not have access to traditional banking facilities.

24/7 Availability: AEPS services are available 24/7, providing users with convenience and flexibility.

Benefits of AEPS:

Convenience: AEPS simplifies financial transactions as it does not require the user to carry a debit card or remember long account numbers.

Financial Inclusion: AEPS promotes financial inclusion by providing banking access to underserved communities.

Quick Transfers: You can send money instantly to any bank account using just the recipient’s Aadhaar number.

Low Cost: Since the transaction costs are low, AEPS offers an affordable alternative for individuals and businesses alike.

How to Register for AEPS with JustForPay

Registering for AEPS with JustForPay is simple and straightforward. Whether you are a business owner, agent, or individual, the process is designed to be user-friendly. Here’s a step-by-step guide to help you get started:

Step 1: Visit the JustForPay AEPS Registration Page

Go to the official JustForPay website and navigate to the Aadhaar Enabled Payment System Services. This is where you will begin your registration process.

Step 2: Fill in Your Details

You’ll be required to provide your basic information such as your name, contact details, and Aadhaar number. Make sure that all the details you provide are accurate to avoid any issues during the verification process.

Step 3: Verification of Aadhaar Details

Once you’ve submitted your details, JustForPay will verify the authenticity of your Aadhaar number against the database provided by the Unique Identification Authority of India (UIDAI). This is an important step to ensure that your Aadhaar details are correct and linked to your bank account.

Step 4: Set Up Your Security Information

For secure transactions, you will need to set up your personal security information, such as a PIN or password, and biometric data (fingerprint/iris scan). This ensures that only you can authorize transactions from your account.

Step 5: Receive Confirmation and Start Using AEPS

After successful registration and verification, you will receive a confirmation message from JustForPay. You can now begin using the AEPS services for various banking transactions like withdrawals, deposits, balance inquiries, and fund transfers.

Why Choose JustForPay for AEPS?

Reliable Platform: JustForPay offers a secure and trustworthy platform for conducting AEPS transactions, ensuring your money and data are safe.

Ease of Use: The registration process is simple, and the interface is designed to be user-friendly, making it easy for anyone to use.

24/7 Customer Support: If you face any issues or need assistance with your AEPS transactions, JustForPay offers round-the-clock customer support.

Multiple Transaction Options: With JustForPay, you can access a wide range of financial services, making it a one-stop solution for your banking needs.

Conclusion

AEPS is transforming the way we conduct financial transactions in India, and JustForPay is making it even easier to access this service. By registering for AEPS with JustForPay, you unlock a world of financial convenience, security, and inclusion. Whether you are an individual looking for easier access to banking services or a business aiming to offer AEPS to your customers, JustForPay has got you covered.

Get started with AEPS today and enjoy the convenience of biometric-based transactions that are fast, secure, and accessible at any time!

For more information or to begin your registration, visit JustForPay AEPS Registration now.

#Aeps Aadhaar Enabled Payment System#Aadhaar Enabled Payment System Services#Aadhaar Enabled Payment System Near Me#Aadhaar Enabled Payment System Aeps Registration#Aadhaar Based Cash Withdrawal

0 notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

2 notes

·

View notes

Text

As Per the New Rule, How to Link Aadhaar with the IRCTC Account to Book Tatkal Tickets?

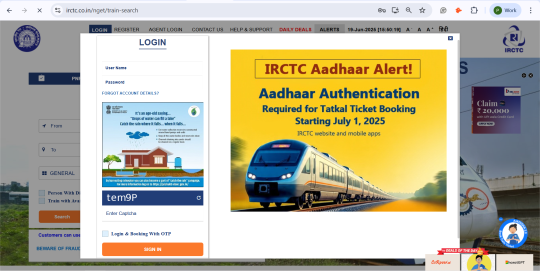

The Ministry of Railways has announced an important update for travellers. From 1st July 2025, Passengers who want to book their Tatkal tickets must have their Aadhaar verified on the official website of IRCTC.

This new rule of IRCTC ensures tight security and stops fraudulent bookings for a safe and secure journey for the genuine passengers.

While Tatkal train tickets are gone in just a few minutes, if you want your Tatkal booking faster, getting Aadhaar verified today is a smart move you can make. In this blog, you’ll be guided about:

New rule, and what do they mean?

How do you link your Aadhaar with your IRCTC profile?

Step-by-step to link Aadhaar Card

Answers to the most common questions about the latest update

Why did IRCTC make Aadhaar Linking Mandatory for Tatkal Ticket Booking System?

IRCTC has tightened Tatkal ticket booking rules to:

To reduce fake bookings & tout misuse

To speed up passenger verification

To allow passengers to pre-fill verified passenger details

Pre-Requisites

Before you proceed with linking your Aadhaar, you must have the following:

An active IRCTC account

Valid Aadhaar number

Mobile number linked to Aadhaar number

How to Link Aadhaar to IRCTC (Step-by-Step Guidance)

Step 1: Visit the Official Website of IRCTC www.irctc.co.in

Step 2: Go to the Menu on the top right corner.

Step 3: Click on “Log in”.

Step 4: Enter your username and login password. Enter the captcha shown below.

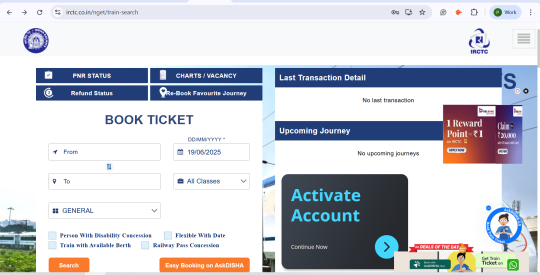

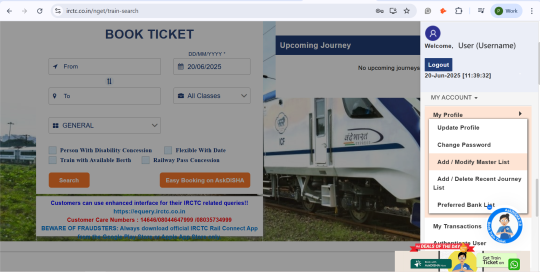

Step 5: Once you sign in, you will land on the home page. Now, click on the menu icon shown in the top right corner.

Step 6: Look for “Authenticate user” in “My Account” section.

Step 7: You will be redirected to the screen as shown below.

Step 8: Enter your 12-digit Aadhaar number. Here, your name must be written the same as on your Aadhaar Card.

Step 9: Click on “Verify Details and Receive OTP.” Note that you will only receive OTP when your name and your birthdate are matched using your aadhaar number.

Step 10: Enter the OTP received on your device and click the checkbox below to confirm the details you have entered.

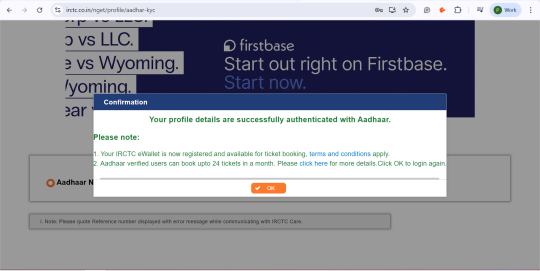

Step 11: Click on “Submit” and wait for confirmation.

How to Add Aadhaar-Verified Passengers to Your Account?

Step 1: Go to Menu > My Profile > Add/Delete Master List as shown below.

Step 2: You will be redirected to the screen shown below. Fill out the details and hit the “Submit” button.

Note: Having your master list ready in the IRCTC helps you get your tickets booked faster.

Top Tatkal Ticket Booking Tips for 2025

Log in 10–15 minutes early to avoid sudden logouts.

Use fast, stable internet while booking your tickets.

Make sure you are on mobile data for the added privacy of your data.

Pre-save payment methods and top up the IRCTC eWallet in advance.

Create and Aadhaar-verify your Master List for instant autofill.

Choose boarding or destination stations wisely for better seat availability.

Don’t waste time choosing berths. Select ‘Book’ if confirm berths are not available.

Prefer UPI or net banking over debit cards with slow OTP delivery.

Use the QuickBooks option if your Master List is set.

Stay calm, type accurately, and don’t refresh the payment page.

Frequently Asked Questions (FAQs): IRCTC Aadhaar Linking for Tatkal Booking System

Q. Is linking Aadhaar on IRCTC compulsory for Tatkal booking system in 2025?

A. It is not compulsory for all kinds of bookings. But, for Tatkal tickets, having Aadhaar-based verification is recommended for faster processing and to avoid last-minute errors.

Q. What if my Aadhaar is not linked to IRCTC?

A. You can still book tickets. Every time you wish to book tickets for you and your co-passengers, you will have to enter and verify manually each time, which can make the booking process longer.

Q. Can I book Tatkal tickets without linking Aadhaar?

A. Yes, it is possible.

Q. How many passengers can I add after linking Aadhaar?

A. A regular IRCTC account can add up to 6 passengers to the master list. If your account is Aadhaar verified, you can add up to 12 passengers.

Q. Will linking Aadhaar speed up Tatkal booking for sure?

A. Since passenger details are pre-verified. But practical speed still depends on your internet speed, payment method, and IRCTC server load. So stay prepared.

Final Thoughts

Being a citizen of India, Aadhaar-based verification is not optional, but a must-have if you wish to get your tickets booked hassle-free.This small step of Aadhaar verification is a step taken by IRCTC that enables genuine passengers to grab their Tatkal tickets without any unnecessary issues. So, don’t wait until the last minute! Link your Aadhaar today, understand the new booking flow, and travel stress-free tomorrow.

Source Link: IRCTC New Rules You Must Know Before Your Next Confirmed Train Ticket Booking

0 notes

Text

How Digital Public Infrastructure is Revolutionizing Financial Inclusion in India

India’s rapid digital transformation has caught the world’s attention—not just in terms of tech innovation, but in how it has reshaped financial access for millions. The backbone of this change is India’s Digital Public Infrastructure (DPI): a stack of interoperable systems like Aadhaar, UPI, DigiLocker, and the Account Aggregator framework. Together, they’ve created a financial ecosystem that is inclusive, scalable, and data-rich.

But to truly harness the power of DPI, professionals need strong analytical capabilities. That’s where Certification Courses for Financial Analytics in Thane come into play—offering individuals the skillset to decode vast financial datasets and contribute to India’s inclusive growth story.

What Is Digital Public Infrastructure (DPI)?

Digital Public Infrastructure refers to core systems that facilitate identity, payments, and data exchange in an open, scalable, and secure way. India’s DPI includes:

Aadhaar – Biometric-based unique digital ID for over 1.3 billion people.

UPI (Unified Payments Interface) – A real-time payment system processing over 13 billion transactions monthly (as of May 2025).

DigiLocker – A cloud-based platform for issuing and verifying documents.

Account Aggregator – A consent-based data-sharing framework enabling individuals to share financial data securely.

Together, these form the foundation for delivering banking, insurance, credit, and welfare services across the socio-economic spectrum.

The DPI Impact on Financial Inclusion

✅ Banking the Unbanked

Over 500 million people have been brought into the formal banking system via Jan Dhan accounts linked to Aadhaar and mobile numbers. DPI has eliminated barriers like physical documentation and geographical access.

✅ Seamless Credit Access

With the Account Aggregator (AA) framework, lenders can now access verified financial data (with consent) to underwrite loans faster. This is revolutionizing credit access for MSMEs, gig workers, and rural entrepreneurs.

✅ Cost Reduction & Efficiency

Traditional banking and KYC costs have significantly dropped thanks to eKYC and digital documentation via DigiLocker, making financial services more affordable.

✅ Direct Benefit Transfers (DBT)

Government subsidies and welfare payments are now seamlessly deposited into beneficiary accounts through Aadhaar-based DBT, cutting out middlemen and leakage.

Why Financial Analytics Matters in DPI-Driven Finance

India’s DPI generates massive amounts of transactional and behavioral data every second. Banks, fintechs, NBFCs, and policymakers rely on financial analysts to make sense of this data and design effective, inclusive solutions.

Here’s how Certification Courses for Financial Analytics in Thane help bridge the gap:

Learn to work with UPI and AA datasets

Use tools like Python, SQL, Power BI, and Excel for data modeling

Understand financial inclusion metrics and risk scoring models

Apply statistical techniques to assess DPI’s impact on credit access or savings behavior

Train with case studies based on Indian financial systems

Use Cases: Analytics in Action

📊 Predicting Creditworthiness in Rural Lending

By analyzing income patterns from bank statements (via Account Aggregator), analysts can develop credit scoring models tailored for non-salaried borrowers.

📊 Optimizing DBT Programs

Government agencies use analytics to track whether welfare funds are reaching the intended beneficiaries, ensuring more efficient use of taxpayer resources.

📊 Fraud Detection in UPI Payments

Machine learning models help detect anomalies in UPI transaction patterns, flagging potential fraud and increasing trust in the system.

📊 Product Design for Financial Inclusion

Fintechs use location, behavior, and transaction data to create products like sachet insurance or micro-loans, tailored to low-income users.

Why Choose Certification Courses for Financial Analytics in Thane?

Thane, located near Mumbai—the financial capital of India—offers proximity to top banks, fintech companies, and startups. Choosing a financial analytics course in Thane gives learners access to:

Industry-Experienced Faculty: Learn from experts with hands-on experience in digital finance.

Live Projects & Internships: Apply learning to real-time DPI-related financial datasets.

Job Placement Support: Career services geared toward roles in analytics, risk, and product strategy.

Peer Learning: Interact with professionals from finance, data science, and public policy sectors.

Career Paths in DPI-Powered Finance

Role

Key Skills

Where You Fit In

Financial Data Analyst

SQL, Tableau, Python

Analyze trends in UPI usage, DBT effectiveness

Credit Analyst (AA Model)

Risk scoring, ML models

Design credit solutions for underserved segments

Policy Analyst

Statistics, policy understanding

Evaluate impact of DPI on financial inclusion

Product Analyst – Fintech

UX + Data

Build better digital banking products for Bharat

Conclusion: Building India’s Financial Future

India’s DPI is one of the most ambitious digital inclusion projects globally—and it’s working. But its true power lies in how well we use the data it generates to build more equitable financial systems.

By enrolling in Certification Courses for Financial Analytics in Thane, you gain the ability to turn raw data into real-world financial impact—improving access, reducing risk, and helping millions achieve financial stability.

0 notes

Text

Low CIBIL Score? Here’s How You Can Still Get the Loan You Deserve

Let’s be real: banks don’t care about your emergencies when your CIBIL score is in the gutter. You’re judged by a number—and if that number is below 650, you’re instantly blacklisted. But here’s the good news: CIBIL defaulters loan options are real, and they’re growing fast in India’s evolving digital finance world.

If you’ve been rejected multiple times and are tired of hearing “NO,” this guide is for you. Let’s break down how to secure a loan for CIBIL defaulters, why FinCrif is a game-changer, and how to apply for loan with low CIBIL score without wasting time, dignity, or hope.

What Is a CIBIL Defaulter?

CIBIL (Credit Information Bureau of India Limited) tracks your financial behaviour, especially loan repayments. A score below 650 or consistent payment defaults puts you in the “defaulter” category.

But guess what? One bad financial phase shouldn’t define your future. That’s where CIBIL defaulters loan solutions come in—to give you a second chance.

Why Do Banks Refuse Loans for CIBIL Defaulters?

Traditional banks are extremely risk-averse. If your credit score is low, you’re labeled as “unreliable,” even if the default happened years ago or due to circumstances beyond your control (job loss, medical emergency, etc.).

Banks don’t look beyond the score. But FinCrif does.

With FinCrif, you can apply for loan with low CIBIL score by providing alternative verifications—like income stability, updated KYC, and current repayment capacity.

Can CIBIL Defaulters Really Get a Loan? Yes—Here’s How

Don’t fall for fake promises or illegal lending apps. Getting a loan for CIBIL defaulters is 100% possible through regulated NBFCs and digital lending platforms like FinCrif.

Here’s what you need:

Stable Monthly Income – Salaried or self-employed with income proof.

Updated Documents – PAN, Aadhaar, Bank Statement.

Honest Disclosure – Be upfront about your defaults.

Willingness to Pay Higher Interest – It’s the tradeoff for low score risk.

Once verified, your CIBIL defaulters loan gets approved based on today’s financial behaviour—not your past mistakes.

How to Apply for Loan with Low CIBIL Score: Step-by-Step

At FinCrif, the process is designed to be transparent, fast, and inclusive. Here’s how to apply:

Visit FinCrif’s Website Go to www.fincrif.com and select “Loan for CIBIL Defaulters.”

Enter Your Basic Details Name, mobile, income, and PAN/Aadhaar.

Upload Key Documents Bank statement, salary slips (or ITR), and ID proof.

Custom Credit Assessment FinCrif uses a dynamic risk profile—not just CIBIL. So you get a fair shot.

Loan Disbursal If approved, your CIBIL default loan is credited within hours.

Done. No humiliating interviews. No rejections based purely on a score.

Types of Loans for CIBIL Defaulters Available

FinCrif and similar platforms offer various CIBIL defaulters loan options:

Personal Loans – Up to ₹2 Lakhs for urgent needs.

Secured Loans – Backed by gold, FD, or insurance.

Business Loans – For self-employed individuals with consistent cash flow.

Payday Loans – Small-ticket, short-term loans to cover immediate gaps.

All these are designed to help you rebuild—not punish you.

Why FinCrif Is a Better Choice for CIBIL Default Loans

FinCrif isn’t just another digital loan app. It’s built to serve people who’ve been rejected by the system. Here's why it's the best platform for a loan for CIBIL defaulters:

✅ Credit Score Isn’t Everything – Other financial behaviors matter too.

✅ No Predatory Rates – Transparent and fair interest, even for high-risk borrowers.

✅ Fast Processing – Get approval and money in hours, not weeks.

✅ Easy Repayment Options – EMI plans that don’t choke your wallet.

FinCrif believes you are more than a credit score—and your future shouldn’t be judged by your past.

Real Talk: The Cost of a CIBIL Defaulters Loan

Let’s not sugarcoat it—CIBIL default loan options often come at a higher interest rate. Why? Because you’re a higher risk. But if you choose the right platform (like FinCrif), the terms are still manageable and fair.

Remember, the goal isn’t just to get a loan—it’s to rebuild your credit score. Timely repayments on these loans can help you climb back up.

How to Improve Loan Approval Chances

Want to increase your odds of getting approved for a loan for CIBIL defaulters? Follow these tips:

Clear Any Small Outstanding Dues Even settling small credit card bills can lift your score.

Apply for Lower Amounts First Start small. Prove your repayment capacity.

Avoid Multiple Applications Too many rejections can damage your score further.

Be Honest on Application Lenders hate hidden defaults. Honesty builds trust.

Submit Consistent Bank Statements Show stable income flow—even if you’re self-employed.

FAQs on CIBIL Defaulters Loan

Q. Can I get a loan if my CIBIL score is below 550? Yes, with FinCrif’s alternative credit profiling, approval is still possible.

Q. Do I need to submit collateral? No, unsecured loans are available. But secured options have better terms.

Q. Will this improve my CIBIL score? Absolutely—if you repay on time.

Q. Is FinCrif a bank? No, it’s a digital lending platform that works with RBI-registered NBFCs.

Final Words: It’s Time to Rewrite Your Financial Story

A bad credit score isn’t a life sentence. You deserve financial dignity, even if you've slipped up in the past. FinCrif makes it possible to apply for loan with low CIBIL score and move toward a stable, secure future.

Whether it’s an emergency, a dream, or just getting your financial confidence back—CIBIL defaulters loan options are your shot at redemption.

So stop waiting. Stop begging. Start taking control.

Visit www.fincrif.com and apply for your CIBIL default loan now.

0 notes

Text

✅ PAN-Aadhaar Verification API: Streamline Compliance & Prevent Fraud

In today's digital landscape, verifying user identity quickly and accurately is essential for businesses operating in financial services, fintech, lending, insurance, and beyond. One key regulatory requirement in India is the linkage and verification of PAN (Permanent Account Number) with Aadhaar. The PAN-Aadhaar Verification API helps businesses meet this requirement with ease, speed, and security.

🔍 What is PAN-Aadhaar Verification API?

The PAN-Aadhaar Verification API allows businesses to verify whether a user's PAN is linked with their Aadhaar in real-time. This verification is conducted using government-approved data sources and ensures compliance with the latest KYC (Know Your Customer) and AML (Anti-Money Laundering) norms.

🚀 Key Advantages

1. Real-Time Verification

No more delays in manual checks. Get instant confirmation of PAN-Aadhaar linkage status for seamless user onboarding and transaction processing.

2. Government-Compliant

The API is aligned with regulatory standards, ensuring your business stays compliant with the latest income tax and KYC rules.

3. Bulk Verification Support

Need to verify thousands of users? The API supports high-volume, batch verification to save time and operational effort.

4. Fraud Prevention

Prevent identity fraud by verifying the authenticity of PAN-Aadhaar linkage before processing loans, payouts, or registrations.

5. Easy API Integration

The API is designed for fast integration with your platform—whether it's a mobile app, web portal, or internal system.

6. Cost-Efficient & Scalable

Automating verification reduces operational costs and scales effortlessly with your growing customer base.

💼 Who Should Use It?

NBFCs & Banks: For customer onboarding & loan disbursals

Fintech Platforms: For KYC and fraud checks

Insurance Providers: For policy issuance & verification

Payment Gateways: For user validation before transactions

HR & Payroll Firms: For employee onboarding & compliance

🔐 Why It Matters

The Indian government has made PAN-Aadhaar linkage mandatory for most financial and legal processes. Businesses that fail to comply risk penalties and operational disruptions. Automating this verification using a reliable API not only saves time but ensures regulatory compliance and data accuracy.

🌐 Conclusion

The PAN-Aadhaar Verification API is an essential tool for any digital-first business looking to streamline verification, reduce fraud, and ensure compliance. Whether you handle thousands of users or just a few, this API can greatly enhance your onboarding and KYC workflows.

Power your compliance with NifiPayments – Simple, Secure, Scalable. #DigitalIndia #PANVerification #AadhaarVerification #FintechSolutions #RegulatoryCompliance #NifiPayments #KYCAPI #APISolutions

0 notes

Text

🌐 How UPB is Empowering Rural India through Digital Banking

🌐 How UPB is Empowering Rural India through Digital Banking

🔹 Introduction – Digital Desh Ki Nayi Pehchaan

India is growing rapidly in the digital space, but rural areas still lag behind when it comes to modern banking. Long distances, lack of documents, and limited awareness have kept banking out of reach for many.

This is where UPB—Universal Payment Bank—is playing a game-changing role. It’s not just making banking digital—it’s making it accessible, easy, and inclusive for people in villages and small towns.

🔹 The Rural Banking Problem

Many people in rural India face challenges like

🚶♂️ Banks are too far.

📄 No proper ID documents

🕒 Time wasted in long lines

📉 No idea about digital transactions

As a result, they depend on cash and informal systems, which are unsafe and slow.

🔹 UPB—A Ray of Hope in the Villages

UPB brings banking to people's fingertips, even if they live miles away from a bank branch.

✅ No paperwork

✅ No travel

✅ No waiting

All you need is a phone with internet and basic documents.

🔹 Key Benefits of UPB for Rural India

1. 📱 Easy Account Opening

Villagers can open a bank account with Aadhaar and PAN from home. No branch visit needed.

2. 🧾 Access to Subsidies and Govt. Schemes

Now people can receive government payments like pensions, DBT, or subsidies directly into their UPB account.

3. 💸 Direct Money Transfer

Migrants can send money home instantly using UPI or IMPS without visiting any bank.

4. 🧍 Self-Employment Opportunity

People in villages can become UPB agents and earn by offering services like recharge, bill payment, and money transfer.

🔹 Real-Life Example

🚜 Ram, a farmer from Bihar, never had a bank account due to travel and documentation issues. Through UPB, he opened an account in 10 minutes using his Aadhaar. Today, he receives his crop subsidies and electricity bill discounts directly into his account.

🔹 UPB Services Popular in Rural Areas

Service Impact in Villages Mobile Recharge No more traveling to town stores. Bill Payment Pay electricity bills from home. Micro ATM Service Withdraw money using Aadhaar QR Code Payments. Local shops now accept digital pay. Loan Applications Access to small credit digitally

🔹 Creating Rural Entrepreneurs

UPB is also creating self-reliant micro-entrepreneurs. How?

By giving villagers the power to open accounts for others

Earning commission on each service

Building trust in their area as local “banking partners”

This is a big step toward financial independence in rural Bharat.

🔹 Government and UPB Together

Many UPB platforms work with government programs like

Jan Dhan Yojana

Direct Benefit Transfer (DBT)

PM-Kisan and pension schemes

Aadhaar-enabled Payment System (AEPS)

Together, they ensure speed, safety, and transparency in money flow to rural people.

🔐 Is UPB Safe for Rural Users?

Yes, absolutely. UPB uses:

OTP-based login

Aadhaar + biometric verification

Safe UPI/IMPS/NEFT systems

RBI-compliant processes

So even first-time users can trust the platform.

🔚 Conclusion: UPB—A New Lifeline for Rural India

UPB is not just a bank; it’s a digital bridge connecting Bharat to India's mainstream economy. It gives

✅ Farmers a place to save and receive funds

✅ Women's control over money

✅ Shopkeepers a chance to go digital

✅ Youth a path to self-employment

In short, UPB is powering India’s villages with the strength of smartphones and the promise of equality.

🔖 Captions:

“Bank nahi, Bharat badal raha hai—UPB ke saath.”

“Gaon tak banking laaya UPB—Digital Bharat ki asli shuruaat.”

“Smartphone + UPB = Smart Gaon”

🏷️ Hashtags:

#UPB #RuralBanking #DigitalIndia #SmartVillage #FinancialInclusion #MobileBanking #UPBForVillages #TechInRural #UPBChangeMakers #BankingForBharat

Visit here :- https://www.tumblr.com/

0 notes

Text

How NBFCs Are Leveraging Technology for Financial Inclusion in India

India’s financial landscape is undergoing a major transformation, and Non-Banking Financial Companies (NBFCs) are at the forefront of this change. Traditionally serving segments that are underserved or excluded by banks, NBFCs have played a key role in bridging the financial inclusion gap. But what’s truly driving their scale and success today is technology.

In this article, we’ll explore how NBFCs are using technology to expand their reach, streamline operations, and empower India’s unbanked population.

What is Financial Inclusion?

Financial inclusion means ensuring that individuals and businesses have access to affordable and useful financial products — including credit, insurance, savings, and payments — delivered in a responsible and sustainable manner.

Millions in India, especially in rural and semi-urban areas, still lack access to formal banking services. This is where NBFCs step in with customized, tech-enabled financial solutions.

How NBFCs Are Leveraging Technology

1. Digital Onboarding and eKYC

NBFCs now offer paperless onboarding through Aadhaar-based eKYC, video KYC, and PAN verification. This simplifies the process of account opening and loan applications — especially in remote areas where physical document collection is difficult.

Real-time identity verification

Faster loan approvals

Reduced fraud and human error

2. AI & ML for Credit Scoring

Traditional banks often reject applicants due to a lack of formal credit history. NBFCs are changing this by using alternative data and AI-powered credit scoring models.

They analyze:

Mobile usage patterns

Utility bill payments

Social media activity

Transaction history (via UPI)

This helps assess the creditworthiness of first-time borrowers and gig workers who may not have a CIBIL score.

3. Cloud-Based Core Lending Platforms

Modern NBFCs use cloud-native core systems to manage:

Loan origination

Disbursement

Repayments

NPA tracking

These platforms reduce operational costs and allow easy scalability, even for small NBFCs operating in Tier 2 and Tier 3 cities.

4. Mobile Lending Apps

NBFCs have launched user-friendly mobile apps for loan applications, EMI payments, and customer service. These apps support regional languages and intuitive design — making them accessible to non-tech-savvy users.

Some NBFCs also use WhatsApp banking and IVR-based services for last-mile access.

5. Digital Payment Integration

NBFCs have integrated with UPI, Bharat BillPay, and AEPS (Aadhaar Enabled Payment System) to simplify collections and repayments. This improves cash flow management and makes borrowing more flexible.

Instant disbursement via UPI

EMI reminders and autopay options

Rural agents can accept payments through biometric devices

6. Field Force Digitization

NBFCs with physical agents now use mobile CRMs and geo-tagging tools to track field officers in real time. This increases accountability, improves loan recovery, and brings transparency to doorstep banking models.

Impact on Financial Inclusion

Thanks to tech adoption, NBFCs have been able to:

Reach millions of new-to-credit customers

Offer micro-loans and small-ticket finance with minimal paperwork

Empower women, farmers, and small businesses with digital tools

Create employment opportunities through agent-based models

Reduce dependency on informal credit sources (like moneylenders)

Real-World Examples

LendingKart: Uses data analytics to give small business loans with zero collateral

Aye Finance: Uses biometric KYC and psychometric tests for micro-entrepreneurs

KreditBee: Offers short-term digital loans to salaried and self-employed youth

Svatantra Microfin: Offers digital financial products to women in rural India

Compliance and Data Security

Technology also helps NBFCs stay compliant with RBI guidelines by:

Enabling secure data storage

Providing audit trails

Integrating with credit bureaus

Ensuring GDPR and IT Act compliance

As NBFCs grow digitally, cybersecurity and data protection are being treated as top priorities.

What’s Next for Tech-Driven NBFCs?

The future of NBFCs is digital-first. We can expect:

Blockchain-based loan contracts for transparency

Voice-enabled banking in regional languages

AI chatbots for 24/7 customer service

BNPL (Buy Now Pay Later) options integrated with UPI apps

Open banking APIs connecting NBFCs with fintechs and marketplaces

Conclusion

NBFCs are not just filling the gaps left by traditional banks — they’re leading innovation in financial services, especially for the underbanked. By embracing technology, NBFCs are accelerating India’s journey toward true financial inclusion, one digital step at a time.

For More Information Visit us: https://www.bharatinttech.com/

0 notes

Text

How Do Micro-Entrepreneurs Benefit from AEPS Services?

Micro-entrepreneurs play a vital role in India’s economy, especially in rural and semi-urban areas where large corporations and formal institutions have limited reach. These small-scale business owners often operate with minimal infrastructure and face significant challenges in accessing formal banking systems. The introduction of AEPS Services (Aadhaar Enabled Payment System) has transformed the financial landscape for micro-entrepreneurs by providing them with accessible, secure, and efficient banking capabilities. Through innovative platforms and APES software solutions, AEPS has unlocked new opportunities for these entrepreneurs to grow and thrive.

1. Access to Banking in Remote Areas

Many micro-entrepreneurs operate in locations where traditional banks and ATMs are either scarce or non-existent. AEPS Services allow them to perform essential banking transactions such as cash withdrawal, balance inquiries, and fund transfers using only their Aadhaar number and biometric authentication. This eliminates the need for travel to distant bank branches, saving both time and money. The accessibility of AEPS empowers micro-entrepreneurs to manage their finances more efficiently and focus more on their business operations.

2. Cost-Effective Financial Transactions

One of the biggest advantages of AEPS Services is that it allows users to conduct transactions without needing a debit card, credit card, or smartphone. Since many micro-entrepreneurs may not afford advanced devices or internet services, AEPS bridges the digital divide by enabling transactions through basic biometric verification. APES software used by agents simplifies the process further by offering low-cost transaction models. This makes banking not just more accessible, but also more affordable for micro-businesses.

3. Cash Management and Liquidity

Liquidity is essential for the smooth operation of any business. Micro-entrepreneurs often rely on daily cash flow to procure goods, pay suppliers, and handle emergencies. AEPS Services enable them to withdraw or deposit cash conveniently through local banking agents. This constant access to liquidity helps them maintain stock, meet sudden expenses, and ensure uninterrupted operations. With the availability of AEPS-enabled agents in their vicinity, they can manage cash flow on a real-time basis.

4. Revenue Diversification for Micro-Agents

Many micro-entrepreneurs, particularly in retail businesses such as grocery shops, mobile recharge centers, or local service providers, become AEPS agents themselves. By offering AEPS Services to their local community, they earn commissions on every transaction. This serves as an additional source of income and enhances their business model. The use of APES software by these micro-entrepreneurs allows them to handle transactions professionally and maintain detailed records for accountability and planning.

5. Faster and Secure Transactions

AEPS Services provide real-time transaction processing, which is crucial for micro-entrepreneurs who depend on immediate payments to continue operations. The Aadhaar-based biometric authentication used in APES software ensures high levels of security, significantly reducing the risk of fraud and identity theft. Unlike traditional banking where paperwork or delays can slow down processes, AEPS allows fast and verified access to funds.

6. Digital Financial Literacy and Inclusion

As micro-entrepreneurs interact more with AEPS Services and APES software, they gradually become more digitally literate. This exposure enhances their understanding of digital finance, which is a stepping stone to broader financial services such as loans, insurance, and savings instruments. AEPS acts as an entry point for these entrepreneurs into the formal financial ecosystem, promoting greater inclusion and economic stability.

7. Support for Government Schemes and Subsidies

AEPS Services are often used as a channel for the direct benefit transfer (DBT) of government subsidies, welfare payments, and financial support schemes. Micro-entrepreneurs receiving subsidies for agriculture, small business promotion, or social welfare can easily access their funds using AEPS. This direct, secure, and transparent method ensures that funds reach the rightful recipients promptly, strengthening their business capabilities without bureaucratic delays.

8. Enhanced Customer Engagement

For micro-entrepreneurs who offer AEPS Services, the footfall at their outlets increases. Customers visit for banking transactions and may end up purchasing goods or services. This dual-functionality increases sales and builds a loyal customer base. The reliability and convenience of AEPS foster trust in the entrepreneur, improving their reputation within the community.

Conclusion

AEPS Services, supported by robust APES software platforms, are revolutionizing the way micro-entrepreneurs operate in India. From basic cash access to acting as banking agents, these services open doors to financial empowerment and growth. By simplifying banking, reducing transaction costs, and promoting financial inclusion, AEPS enables small businesses to overcome traditional barriers and thrive in a digital economy.

Xettle Technologies is one such innovator dedicated to enhancing AEPS capabilities for micro-entrepreneurs. With user-friendly APES software and a commitment to digital inclusion, Xettle Technologies empowers local business owners to serve their communities better while growing their own ventures. As AEPS adoption continues to expand, the future looks promising for India’s micro-entrepreneurship ecosystem.

0 notes

Text

Digital Identity Solutions Market Poised for Growth Amid Rising Cybersecurity and Authentication Demands Worldwide

The Digital Identity Solutions Market is entering a phase of robust growth, driven by the twin forces of escalating cybersecurity threats and the surge in demand for strong authentication methods. As organizations across industries accelerate digital transformation, comprehensive and secure user verification systems have become indispensable. Below, we explore the dynamics shaping this landscape, the key technologies driving change, major industry trends, sector-specific adoption, regional variations, and future projections.

1. Market Context: Why Now?

a. Escalating Cyber Threats

In recent years, cyberattacks—ransomware, data breaches, phishing—have not only increased in frequency but also in sophistication. Large-scale breaches involving identity theft and credential compromise have underscored the urgent need for strong identity verification. Incidents such as the 2024 data breaches at major payment processors and healthcare carriers have illuminated just how vulnerable legacy authentication methods like passwords remain.

b. Remote Work and Digital Service Expansion

The shift to remote work models and virtual customer engagement has significantly broadened the digital “attack surface.” Employees logging in from home, often on personal devices, have forced enterprises to reevaluate authentication practices. Consumer-facing online transactions—banking, retail, healthcare—have similarly grown more complex, leading to a surge in demand for frictionless yet secure digital identity solutions.

c. Regulatory Pressure

Regulatory frameworks around the world—GDPR in Europe, CCPA in California, CDPA in Virginia, and PDPA in Singapore—continue to impose strict requirements on identity data security and privacy. Governments have also introduced identity mandates, such as eIDAS Verified Digital Credentials in the EU and India’s expanding Aadhaar-linked services, fostering trust and compliance needs in digital identity ecosystems.

2. Key Technologies Fueling Adoption

a. Biometric Authentication

Fingerprint, facial recognition, and voice biometrics are now mainstream. Mobile device manufacturers have built secure enclave hardware capable of storing biometric templates locally. Meanwhile, multi-factor authentication (MFA) often leverages biometrics as a convenient second factor. That said, biometric vulnerabilities and spoofing attempts remain ongoing challenges, requiring continuous innovation.

b. Artificial Intelligence and Machine Learning

AI/ML are playing dual roles—strengthening authentication and detecting fraud. Behavioral biometrics track patterns like typing dynamics or mouse movement to enable continuous verification. Predictive analytics model transaction patterns in real time, triggering additional checks for anomalous behavior. According to a 2024 market study, solutions with integrated AI modules deliver 30–40% higher fraud detection rates compared to static rule-based systems.

c. Blockchain and Decentralized Identifiers (DIDs)

Blockchain-based identity models enable users to own and manage credentials, sharing them only when needed. Decentralized Identifiers and verifiable credentials (as defined by the W3C) support portable and secure identity claims. Use cases like digital wallets for vaccines, academic credentials, or licenses are gaining traction in Europe, North America, and the Middle East.

3. Market Trends and Signals

Unified Identity Platforms: Organizations are consolidating legacy point solutions into unified identity platforms covering workforce, consumer, and partner identities under a single pane.

Zero Trust Security Adoption: The shift toward Zero Trust architectures—“never trust, always verify”—elevates the importance of forging dynamic identity solutions.

Passwordless Authentication: WebAuthn and FIDO2 protocols are being adopted rapidly by browsers, mobile, and enterprise apps. Microsoft and Google see millions of users shifting away from passwords each quarter.

Regulatory Certification: Identity providers are pursuing ISO 27001, SOC 2, and cybersecurity certifications to meet corporate compliance, prompting greater enterprise uptake.

4. Industry Verticals Leading Uptake

a. Banking and Financial Services

One of the earliest and most active adopters, this sector enforces KYC/KYB standards, risk profiling, and PSD2 compliance. Mobile apps now integrate face matches with liveness detection during onboarding; biometric logins are standard, and banking institutions invest heavily in identity fraud monitoring.

b. Healthcare

Telehealth platforms and digital patient portals demand secure patient identity proofing and privacy compliance.

c. Public Sector

National ID programs (such as India’s Aadhaar and Estonia’s e‑ID) have matured; a growing number of countries are exploring sovereign digital identity systems for passporting, voting, and public benefits.

d. E‑Commerce and Retail

To protect against account takeover (ATO) fraud, digital identity checks have expanded at login, transaction points, and delivery. Risk‑based scoring and biometric verification tools reduce false positives and cart abandonment.

5. Regional Dynamics

North America remains a dominant market, driven by nimble fintech adoption, regulatory scrutiny, and high perceived cybersecurity risk.

Europe, led by the EU’s eIDAS2 regulations, is a hub for cross‑border identity innovations—wallet pilots run in Spain, Germany, and Poland.

Asia‑Pacific sees rapid adoption: India’s digital ID ecosystem is scaling; Australia and Singapore are piloting digital wallet schemes; and China integrates mobile biometrics into daily life.

Middle East & Africa: UAE and Saudi Arabia are building smart city identity integrations; digital IDs are being used to connect education, healthcare, and traffic systems.

6. Competitive Landscape

Major players in the sector include Okta, Microsoft Azure AD, Ping Identity (now part of Thoma Bravo), SailPoint, ForgeRock, and CyberArk in workforce identity. Consumer and government identity are being contested among IDEMIA, Thales, OneSpan, and Innovatrics. Emerging disruptors focus on decentralized identity (e.g. uPort, Sovrin) and embedded authentication services (like Socure, Jumio, Onfido).

Key Competitive Differentiators:

Scalability & Reliability: Can the solution handle 10 million active users?

UX and Frictionless Flow: Does the system respect privacy, such as via selective disclosure?

Ecosystem Connectivity: How well does the provider integrate into existing IT and SaaS apps?

Compliance Coverage: Is it certified for GDPR, HIPAA, PCI‑DSS, etc.?

Adaptability: Can the system evolve to support decentralized models, 5G devices, and IoT?

7. Challenges and Restraints

Despite rapid growth, hurdles remain:

Data privacy concerns: Biometric and personal information must be guarded carefully.

Standards fragmentation: Not all countries and industries align on blockchain identity or biometric specs.

Cost and complexity: Smaller organizations can find it hard to build internal expertise.

Security trade-offs: Even biometrics can be spoofed—continuous research and red teaming exercises are essential.

8. Market Forecast

The global digital identity solutions market, valued near USD 33 billion in 2024, is projected to reach USD 85 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 15–17% during the 2025‑2030 period. Growth engines include:

Mass deployment of X.509 certificates in IoT and device-to-device authentication.

Enterprise shift toward passwordless identity.

Expansion of cross-border digital ID ecosystems.

Government e‑ID initiatives continuing in developing regions.

9. Strategic Recommendations

Enterprises should adopt a phased approach: start with workforce SSO/MFA, layer risk‑based behavioral analytics, then extend to B2C or partner identity.

Vendors must differentiate by building open, modular cloud platforms, obtaining compliance certifications, and fostering trust through transparency and audit practices.

Policy makers should collaborate across borders on global identity standards, while ensuring citizens’ privacy rights aren’t compromised.

10. Outlook: What Lies Ahead

Over the next decade, more digital identity will be user-centric, portable across platforms, and governed by privacy-respecting consent frameworks. Advances in privacy-enhancing technologies (PETs) like zero‑knowledge proofs and homomorphic encryption will bolster user control and interoperability. Meanwhile, quantum‑resistant cryptography and deep learning‑driven risk assessments promise a more secure digital future. In our hyper‑connected world, digital identity is foundational—a keystone for trust, openness, and resilience.

In Summary

The digital identity solutions market stands at a pivotal juncture. With cybersecurity risks escalating and digital services proliferating worldwide, robust identity authentication systems are no longer optional. Backed by biometrics, AI-driven analytics, blockchain portability, and cloud-enabled scalability, this market is set to grow strongly, while emphasizing user privacy and regulatory compliance. Organizations that invest wisely in modern digital identity tools will gain both security assurance and competitive differentiation in a more digital-first era.

0 notes

Text

Understanding the Aadhaar Enabled Payment System (AEPS) API: A Comprehensive Guide

Unlock the potential of digital payments with our comprehensive guide on the Aadhaar Enabled Payment System (AEPS) API. Explore its features, benefits, and implementation strategies to streamline financial transactions using Aadhaar authentication. Perfect for developers, businesses, and tech enthusiasts looking to enhance their payment solutions.

#Aadhaar Enabled Payment System Api#Aeps Cash Withdrawal Api#Aeps Balance Enquiry Api#Aadhaar Based Cash Withdrawal Api#Aadhaar Enabled Payment System Aeps Registration Api#Aadhaar Enabled Payment System Near Me Api#Aadhaar Enabled Payment System Services Api#Aeps Aadhaar Enabled Payment System Api

0 notes

Text

Documents Required For GST Registration

Introduction to GST Registration

Getting your business GST-registered is not just a legal formality—it’s your ticket to running a credible and compliant operation in India. But before you jump in, it’s important to understand the documents required for GST registration, because even a small mistake can lead to delays or rejection. GST (Goods and Services Tax) has streamlined the indirect tax system, making compliance easier for businesses of all sizes. Whether you're a freelancer, shop owner, or running a growing enterprise, having your paperwork in order is the first big step toward becoming a recognized player in the market.

Why GST Registration is Mandatory

So, why is it such a big deal? Because without GST registration:

You can't legally collect GST from customers.

You can’t claim input tax credits on purchases.

You're vulnerable to penalties under GST law.

Business expansion becomes harder due to compliance issues.

The government has made GST registration mandatory for businesses whose turnover exceeds ₹40 lakhs (₹20 lakhs for services), or ₹10 lakhs for northeastern and hill states. Also, any e-commerce seller or interstate supplier must register regardless of turnover.

Who Needs to Register for GST?

The following categories are required to obtain GST registration:

Businesses crossing the prescribed turnover limit

Casual taxable persons

Agents of suppliers

Input service distributors (ISD)

Non-resident taxable persons

E-commerce operators and aggregators

Anyone required to deduct tax at source (TDS)

Those supplying through e-commerce platforms

Even if you don’t fall into one of these, voluntary registration is possible and often beneficial, especially for input tax credit eligibility.

Categories of Taxpayers Under GST

GST doesn’t treat all taxpayers the same. Based on turnover, business structure, and operational nature, the system classifies registrants into specific categories, each with unique compliance and documentation requirements.

Regular Taxpayers

This is the most common category. Regular taxpayers need to file monthly returns and maintain detailed records. Their GST documentation includes:

PAN and Aadhaar

Proof of business registration

Principal place of business proof

Bank account proof

Photographs and authorization documents

Composition Scheme Holders

Smaller businesses (turnover up to ₹1.5 crore) can opt for the Composition Scheme to pay tax at a flat rate. Their documentation requirements are slightly simplified but still include:

PAN and Aadhaar

Business proof

Declaration of turnover

Bank details

This scheme restricts you from issuing taxable invoices and limits interstate transactions.

Casual Taxable Persons and Non-Resident Taxpayers

These individuals conduct business occasionally or without a fixed place in India. Their documents should include:

Passport and Visa (for foreigners)

Temporary business place proof

Bank authorization

Advance tax payment under GST

This category requires an advance deposit of the estimated tax liability.

Basic Documents Required for GST Registration

Let’s dig into the heart of the matter—the core documents you’ll need to get registered under GST. Without these, your application might get rejected or returned for rectification.

PAN Card of the Applicant

The PAN (Permanent Account Number) card is the foundation of GST registration. It's used to link your business to your tax profile. For businesses, the PAN must be in the name of the entity, not the proprietor. All legal entities, including companies, LLPs, and trusts, need a PAN for GST.

Key Points:

Must be a scanned copy (clear and colored)

Details must match business records

PAN is used to generate the GSTIN (Goods and Services Tax Identification Number)

Aadhaar Card of the Applicant

Aadhaar authentication has become a critical part of GST registration to avoid fake identities and shell companies. With Aadhaar-based authentication, you can even skip physical verification.

Why it matters:

Speeds up the GST approval process

Avoids additional document scrutiny

Helps in verifying identity during filing

Ensure the mobile number linked to Aadhaar is active for OTP verification.

Photograph of the Applicant

This might seem minor, but it’s a mandatory requirement:

Proprietor: One passport-size photo

Partners/Directors: Photos of all

Authorized Signatory: Photo of the person filing the application

The photo must be recent, high-quality, and preferably on a white background.

Business-Related Documents

In addition to personal documents, the government needs to verify your business’s legal status. This ensures you're a legitimate operation.

Proof of Business Registration/Incorporation Certificate

This document proves that your business is officially recognized. Depending on the business type:

Sole Proprietor: No separate certificate, PAN serves the purpose

Partnership: Partnership deed

Company: Certificate of Incorporation from MCA

LLP: LLP Agreement and incorporation certificate

Without these, the business isn’t considered valid in the eyes of GST.

Partnership Deed or MOA & AOA

These foundational documents define the internal structure and operation of your business.

The MOA (Memorandum of Association) outlines business objectives.

AOA (Articles of Association) defines rules and responsibilities.

The partnership deed declares the terms between partners.

These are vital for businesses that have multiple stakeholders.

Authorization Form for Authorized Signatory

If someone else is filing the GST application on your behalf, you'll need to authorize them legally. This applies especially to companies, LLPs, and partnerships.

This form must:

Be signed by a competent authority

Include PAN and Aadhaar of the authorized person

Be uploaded along with other documents

Address Proof of the Business Place

The government wants to know where your business operates. The type of address proof depends on whether the premises are owned, rented, or shared.

Own Premises: Electricity Bill or Property Tax Receipt

For owned property, any government-issued document showing ownership and address will work. This includes:

Latest electricity bill

Property tax receipt

Municipal khata certificate

These documents should be:

Not older than 2 months

Clear and legible

Matching with the application address

Rented/Leased Premises: Rent Agreement and NOC

Renting your business place? Then you must provide:

A registered rent agreement

NOC (No Objection Certificate) from the owner

This assures the tax authorities that you have legal occupancy of the place.

Shared Property: Consent Letter and Utility Bill

If you're operating from a co-working space or shared address:

A consent letter from the original owner is mandatory

Attach a utility bill as address proof

Mention the co-working space agreement, if applicable

Without this, your GST registration can face scrutiny or rejection.

Bank Account Proof

Every GST registrant must furnish valid bank account details to receive tax refunds and ensure compliance with return filings. Here’s what you’ll need:

Cancelled Cheque

A cancelled cheque is often the simplest way to prove your bank account’s existence. It should include:

Account holder’s name

Account number

IFSC and MICR code

Bank name and branch

Ensure the cheque is from a current or savings account under the business name (for companies or partnerships). If your business is new and you haven’t received cheque books yet, don’t worry—there are alternatives.

Bank Statement

A recent bank statement (not older than 2 months) serves as solid proof of account ownership. Make sure:

The document is in PDF or scanned format

It includes your business name and address

There are visible transactions (for authenticity)

This is particularly helpful for startups that haven’t ordered cheque books yet.

Passbook’s First Page

Another acceptable option is the front page of your bank passbook, which displays:

Account number

Account holder’s name

Bank IFSC and branch

Make sure the scan is high-quality and legible. This is a go-to option when both cheques and bank statements are unavailable.

Additional Documents for Specific Business Types

While the core set of documents remains similar, some businesses require additional paperwork based on their structure.

LLP Documents

Limited Liability Partnerships (LLPs) must submit:

LLP Incorporation Certificate

LLP Agreement

PAN of LLP

Address proof

Authorization form (if the signatory is not a partner)

These documents should reflect the LLP���s legal identity and operational structure. Even if you’re a small LLP, all formalities apply the same.

HUF Documents

HUFs (Hindu Undivided Families) have unique identity requirements:

PAN of HUF

Aadhaar of Karta (head of the HUF)

Declaration by Karta

Bank details in the HUF name

In these cases, the Karta is treated as the authorized person, and all compliance rests on them.

Foreign Companies and Branches

Foreign businesses operating in India must provide:

Passport of the authorized signatory

Indian business address proof

Bank account details in India

Certificate of incorporation from the home country (translated if not in English)

Additionally, notarization or an apostille may be required depending on the origin country's laws.

GST Registration Documents for Different Entities

Documentation needs vary depending on your business type. Here’s a detailed breakdown:

Sole Proprietorship

For sole proprietors, GST registration is straightforward:

PAN and Aadhaar of the proprietor

Photo of pthe roprietor

Address proof of the business place

Bank account proof (in the proprietor’s name)

Since there’s no legal separation between the business and the owner, all documents are in the individual’s name.

Partnership Firm

A partnership firm needs a few more things:

PAN of a partnership firm

Partnership deed

Aadhaar and PAN of all partners

Photograph of all partners

Address proof

Authorization form for the signatory

Be cautious to ensure that the deed is signed and stamped correctly; this is often where mistakes happen.

Private Limited Company

For Pvt Ltd companies, documentation is a bit more comprehensive:

PAN of the company

Certificate of incorporation (from MCA)

MOA and AOA

PAN and Aadhaar of directors

Board resolution authorizing the signatory

Bank details and address proof

Ensure the directors' details on the MCA match those submitted under GST.

Trusts and Societies

Trusts and societies often overlook GST, but if they engage in commercial activity, it’s mandatory. Required documents include:

PAN of the trust/society

Trust deed or registration certificate

PAN and Aadhaar of trustees

Authorization letter

Address proof

Even NGOs involved in trade must comply.

Common Mistakes to Avoid During Document Submission

Your GST application can get rejected or delayed due to simple document-related errors. Let’s tackle the most common ones:

Mismatched Details

One of the top reasons for rejection is a mismatch of information between PAN, Aadhaar, bank details, and the GST application. To avoid this:

Double-check spelling of names

Ensure address formats are consistent

Use updated Aadhaar and PAN info

Don’t assume small inconsistencies won’t matter—they do.

Outdated Utility Bills

Only the latest utility bills are accepted as address proof. Make sure:

The bill is not older than 60 days

It matches the business address

The file is in a readable format (PDF or JPG)

Expired documents often result in system rejection, especially for rented premises.

Unclear Scanned Documents

Blurry or poorly scanned documents are a big no-no. Common issues include:

Cropped images cutting off key details

Photos with glare or reflections

Handwritten or smudged pages

Always scan in colour, ensure clarity, and preview before uploading. A rejected application adds unnecessary delays to your business plans.

Digital Signature Certificate (DSC) Requirements