#aeps registration online free

Text

Get Aeps registration online free with Voso portal

Get aeps registration online free and offer aadhar AePS services to your customers and earn the highest commissions in the industry using VOSO portal.

Voso empowers retailers so they can offer online services like Aeps, matm, pan card, and insurance to their customers. Upgrade your shop with voso.

AePS permits clients to carry on with work exchanges utilizing just their aadhar. This is so helpful for them as they needn't bother with some other reports other than their aadhar cards and the name of their bank. Therefore, more individuals are utilizing it. In this way, by offering AePS exchange administrations you can draw in additional clients to your business, and procure the most noteworthy commission on each finished exchange through VOSO.

0 notes

Text

How to Become an AeronPay Merchant

AeronPay provides you with a wide range of digital payment services including online recharge & bill payments, UPI services in India, and many more. AeronPay is a leading payment solutions provider to e-commerce merchants.

AeronPay Enables merchants for an entire suite of contactless payment options including UPI balance, credit and debit cards, AEPS, EMIs, and bank offers, and sends a digital bill to avoid contact.

Accepting Payment has never been so easy. AeronPay is a unified fintech platform that helps retailers provide customers with a truly Omni channel and delightful shopping experience.

AeronPay retail payment solutions enable retail institutions to accept payment methods like credit cards, debit cards, and wallets via mobile apps, web checkout, QR codes, NFC, kiosks, POS, etc. AeronPay also offers invoicing capabilities, chargeback, and refund mechanisms with inbuilt reconciliation and settlement modules to help retail institutions work smoothly.

Coupled with a loyalty management solution and payment insights, AeronPay also empowers the business to have the proper connection with the customer. It helps retail institutions launch campaigns, give rewards and incentives to loyal customers, and interact with them via mobile notifications to ensure repeat business.

Before becoming a merchant on AeronPay, a seller must complete the AeronPay Merchant registration process on AeronPay's website. Becoming an AeronPay Merchant is free and registration takes only a few minutes.

Step 1: Go to AeronPay's Website.

Step 2: Provide the details required for the account.

Step 3: Complete the email verification process.

Step 4: Complete the mobile number verification process.

Step 5: Update business information and address.

Step 6: Provide KYC Documents (More on this below)

Step 7: For verification, AeronPay will take maximum 3-5 working days.

Step 8: Once your all documents are approved your account will be activated within 1 working day

0 notes

Text

Rainet

Who is Rainet?

Rainet is a leading technology company that specializes in providing innovative web development services and software solutions to businesses across the globe. With a team of highly skilled professionals, Rainet has established itself as a trusted partner for companies looking to enhance their online presence and streamline their operations. From developing custom websites and mobile applications to providing cutting-edge APIs such as Bharat Bill Payment System API and PAN API, Rainet offers a wide range of services that cater to the diverse needs of its clients.

Web Development Service

At Rainet, we pride ourselves on providing comprehensive web development services to our clients. Our team of experts is skilled in building responsive websites and developing web applications that meet the unique needs of each client. We also offer app development services, having developed award-winning mobile apps for clients across various industries.

Our approach to web development involves working closely with our clients to understand their specific requirements and goals. From there, we develop a customized plan that ensures the final product meets all expectations. Additionally, we provide ongoing maintenance and support to ensure that our clients' websites and applications continue to function at optimal level.

Bharat Bill Payment System API

Rainet Technology Private Limited offers a Bharat Bill Payment System (BBPS) API integration service that allows consumers to pay their bills seamlessly and securely. The BBPS is an initiative of the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI), which enables customers to make bill payments through a single platform. Rainet's BBPS API is integrated with the NPCI platform, ensuring a secure payment process. Additionally, the API supports multiple payment options such as credit cards, debit cards, and net banking. With Rainet's BBPS API integration service, businesses can provide their customers with a convenient and hassle-free way to pay their bills.

Education Portal Development

Rainet Technology Pvt. Ltd. offers education portal development services that cater to all types of learners, from school children to working professionals. The platform provides a comprehensive solution that enables users to access a range of courses, programs, and degrees delivered entirely online. An education portal is an online platform that simplifies a school's logistics with advantages for everyone on board - students, teachers, parents, and administration [3]. With the rise in digital tools, the portal's role in schools has widened. Apart from applying to courses, tracking applications, and managing student data, portals are now being used for e-learning and distance learning programs.

Rainet Technology Pvt. Ltd.'s education portal development services provide customized solutions that cater to the specific needs of educational institutions. The company's team of experts works closely with clients to understand their requirements and develop portals that are user-friendly and easy to navigate. The education portal developed by Rainet Technology Pvt. Ltd. includes features such as course management systems, online registration systems, grade books, discussion forums, and multimedia content [4]. These features help students learn at their own pace while providing teachers with tools to monitor progress and provide feedback.

Overall, Rainet Technology Pvt. Ltd.'s education portal development services offer an excellent solution for educational institutions looking to enhance their online presence while providing students with flexible learning options.

B2B Software Reseller

As a B2B software reseller, Rainet Technology Private Limited offers innovative solutions for transactional services such as AEPS, DMT, and recharge. Their white label framework provides a comprehensive one-stop solution for businesses looking to expand their offerings and increase revenue streams. With a simple registration process, resellers can join the platform and gain access to a vast network of buyers and suppliers. Rainet's best B2B reseller software provides resellers with multiple commission structures from their merchants and retailers [5]. This allows businesses to earn more profits while providing valuable services to their customers. The company's expertise in software development ensures that the products offered are reliable and efficient, making them an ideal partner for any business looking to enter the B2B software reselling market.

Pan API

Rainet Technology Pvt. Ltd. offers a PAN Card Verification API service, which is designed to help businesses verify the authenticity of PAN cards quickly and easily. This API integration is an example of how Rainet Technology uses the latest technologies to meet the unique needs of its clients. The company's team of highly experienced professionals has expertise in developing innovative solutions tailored according to specific needs of their clients [6].

With this service, businesses can easily verify PAN card details such as name, date of birth, and PAN number. This can be especially useful for companies that need to verify customer identities for various purposes, such as opening bank accounts or providing financial services. By using Rainet Technology's PAN verification API integration, businesses can streamline their processes and improve their overall efficiency.

Overall, Rainet Technology Pvt. Ltd.'s PAN Card Verification API service is just one example of the company's commitment to delivering innovative solutions that help its clients achieve their goals [7].

Conclusion

In conclusion, Rainet has proven to be a reliable and innovative company in the field of web development and software solutions. Their expertise in developing education portals and providing B2B software reseller services has made them stand out among their competitors. Additionally, their integration of Bharat Bill Payment System API and PAN API has made online transactions more accessible and secure for their clients. Overall, Rainet's commitment to providing quality services and staying up-to-date with the latest technology trends is commendable. If you are looking for a trustworthy partner for your web development needs, Rainet is definitely worth considering.

Visit Website: https://rainet.co.in/

#best digital marketing agency#best digital marketing company in Noida#android app development company#mobile app development company#best IT company in Noida#iOS app development company#e-commerce website development company#B2B reseller software company#B2B white label software company#software development company in Noida#bike rental app development company#bike rental app#domestic money transfer software solution#Recharge API Software Development#PAN API Integration#bbps#bbps login#bbps website

0 notes

Text

IPPB revises service charges for these Aadhaar-enabled payment system transactions

IPPB (India Post Payments Bank) has revised the Aadhaar Enabled Payment System service charges, effective from December 1, 2022. According to the National Payments Corporation of India (NPCI), "Allows online interoperable financial inclusion transactions at PoS (MicroATMs), through a business correspondent of any bank using Aadhaar authentication.aepsThere are six different ways through which transactions can be completed.

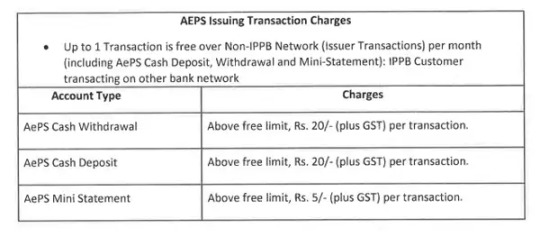

Service Charges on AEPS by IPPB

As per IPPB (India Post Payments Bank) notification, cash withdrawal, cash deposit and mini statement are free for non-IPPB customers only up to one transaction per month. On exceeding the free transaction limit,aepsIssuers will be charged Rs 20 plus GST on each cash withdrawal and cash deposit while each mini statement transaction will be charged Rs 5 plus GST.

Guide for AEPS Transactions

Under this scenario, the following are the required inputs to be followed by the customer:

Banks' name

Aadhaar number

Fingerprint captured during enrollment

Benefits of AEPS

The Aadhaar-enabled payment system allows users to make payments using their Aadhaar number and biometrics in a safe and secure manner.

By using biometric/iris information and demographic data from Aadhaar, the payment system eliminates the possibility of fraud and non-genuine activity.

The Aadhaar-enabled payment system will facilitate delivery of government entitlements such as NREGA, social security pension, disabled old age pension, etc. of any central or state government body using Aadhaar authentication.

Aadhaar-enabled payments facilitate interoperability between banks, in a safe and secure manner

With most BC beneficiaries being unbanked and underbanked, the model allows banks to offer financial services beyond their branch networks.

Services provided by AEPS

Cash deposit

cash withdrawal

balance inquiry

mini statement

Aadhaar to Aadhaar Fund Transfer

Authentication

BHIM AADHAAR

Become an authorized member

IGS Digital Center Limited is a service provider that enables you to offer 300+ services to your customers while maintaining the highest level of quality. Additionally, each service you provide will earn you a respectable commission. It is quite simple to get IGS Digital Center Limited Member ID and sign up to work as an AEPS Agent. To help you understand the whole process, we have included some steps in this post.

You must first apply for a member ID.

Any photo ID proof like Driving License, Passport, PAN Card, Voter ID or Aadhaar Card is required.

After that, you will go to the verification stage, when our team will check your information and supporting documents. At this point, your application may be accepted or rejected.

After approval of your application, we move on to the payment and settlement process. After paid registration, we present your Member ID and give you a contract, which you need to print on stamp paper and send back to us.

As a result, you are now a certified member of IGS Digital Center Limited.

After document verification, KYC staff will generate your member ID, activate your services, and train you before approving your documents.

1 note

·

View note

Text

Why is AEPS Considered a UPI for Rural India?

Aadhaar Enabled Payment System (AEPS) is a payment service that lets a bank customer use Aadhaar as his or her identity to access his or her Aadhaar enabled bank account. The goal of the AEPS system is to give people more power, especially in rural areas, by giving everyone access for financial and banking services through Aadhaar.

AEPS infrastructure is a great move toward solving the basic banking problems caused by the lack of Digitalization in rural India by allowing basic banking transactions, increasing the use of digital financial services in rural India, and filling them into the formal financial system. As India is now a developing Nation and so a rural area should be, making the rural areas more digitalized, more cashless, and more educated about digitalization, AEPS has been a key role for rural people and thus it has been a modern UPI for the rural people of India.

How to use AEPS as UPI?

It’s easy to use AEPS; all you have to do is give the correct Aadhaar number, and the payment will be sent to the right merchant.

• Download the app on the Android or iOS platform

• Register for the service by giving details about your bank account.

• Set up a VPA and get an MPIN

Benefits of AEPS Payments

As part of “Paperless, Cashless, and Faceless” services across the country, especially in rural and remote areas, different ways to make digital payments are being offered. These include Banking Cards, Mobile Wallets, Internet Banking, Mobile Banking, Bank Pre-paid Cards, Micro ATMs, and Aadhaar Enabled Payment System (AEPS) Also, with the move to digital, banking services will be available to customers on a 24/7 basis and on all days of the year, including bank holidays.

• Cost-effective and less transaction fee: There are a lot of payment apps and mobile wallets that don’t charge any kind of service fee or processing fee for the service they provide. The UPI interface is one example of a service that the customer can use for free. Costs are going down because of the many digital ways to pay.

• Discounts and cashback: Customers who use digital payment apps and mobile wallets can get a lot of rewards and discounts. Many digital payment banks offer cash-back deals that are pretty good. This is great for customers and makes them more likely to stop using cash.

• One-stop solution for paying bills: Many digital wallets and payment apps can be used to pay bills all in one place. This makes it easy to pay for things like utilities. All of these utility bills, like cell phone bills, internet bills, and electricity bills, can be paid through a single app without any hassle.

Which are the best AEPS services provider in Rajasthan?

Paydeer Company is one of the best AEPS service provider companies in Rajasthan. You can start your own AEPS banking service with us as an admin and can offer cashless banking and financial services to your members.

Many fintech companies also support financial inclusion by setting up their own banking correspondent agent networks that offer AEPS services to their communities. These networks can also help people who don’t have bank accounts but have an Aadhar card join the formal financial system without having to go to a bank branch.

Conclusion

Since the cashless economy, the Indian government has been working on a number of projects to meet the financial needs of the last mile consumer. In a country like India, where digital literacy is still low, one important part of promoting digital payments among rural populations is how easy it is for them to use these methods in their daily lives.

Tags: aeps pe rajasthan, rajasthan aeps portal services, aeps cash withdrawal rajasthan, rajasthan aeps department, rajasthan aeps transaction limit, rajasthan aeps machine, rajasthan aeps service provider, rajasthan aeps agent registration, rajasthan aeps near me, rajathan aeps registration online

Originally Published at :- https://paydeer.medium.com/why-is-aeps-considered-a-upi-for-rural-india-5617dcc2e4ba

0 notes

Text

CSP Bank Mitra: Documents Needed and Registration Procedure

Making financial products and services low-cost, accessible and affordable for low-income groups and businesses is known as financial inclusion. Banks use CSP banking points which, after getting CSP Registration, provides such services.

The majority of poor Indians live in the village area. These poor people are unable to connect to banking services. These poor people give up on these opportunities. This is where Bank CSP Provider can help them provide access to the banking system by providing associated services.

Services provided by Bank CSP Provider:-

• Send money to your bank account

• Inquiries regarding IMPS transactions/balances

• Fixed Deposit / E-KYC

• Pay cash

• Mini ATM

• Aadhaar Payment System (AEPS Facility)

• Withdrawal card / ID card

• Loan deposit / Fixed deposit

• Social Security System (PMJJY, PMSBY, APY)

• Insurance Service

• Online payment transfer

• Bank Loan

What kind of documents do you need for CSP registration?

• Police confirmation (within six months of age)

• Application form

• Two passport-sized personal photos

• PAN card (required)

• Identity card (voter ID / driver's license / passport, etc.)

• Proof of store address

• Address proof (electricity bill, power distribution card, etc.)

• NPD account

• Innovative digital banking service with e-MITRA

Who can start the kiosk banking system?

Store owners, retailers, small business owners, and even individuals can apply to set up a standing kiosk. The eligibility criteria for Bank CSP Provider are:

• Minimum age: 18 years old

• Qualifications: The person must have passed the secondary exam

• Minimum space required to install a kiosk: 100-200 square meters. leg

• Applicants need to make sure that their computers and internet are available.

Store owners or small business owners can incorporate to get CSP Registration that requires the small business to have an MSME registration. Banks must provide the equipment needed to set up a kiosk using this, such as kiosks, fingerprint scanners, and computer-compatible software.

Kiosk banking registration procedure:

• First, the customer needs to open an account without luxury.

• Next, they need to proceed to Know Your Customer Verification (KYC).

• The corresponding bank performs the KYC verification process and validates the submitted documents.

• Once the KYC process is complete, individuals are free to use their accounts to trade.

Article Source: https://applyforcspbank.finance.blog/2022/01/17/csp-bank-mitra-documents-needed-and-registration-procedure/

0 notes

Video

undefined

tumblr

Roundpay Merchant App is highly secure gives an ease of access to the merchants to work effectively & efficiently.

Roundpay App Features:

★ Easy Merchant Registration: Simple process to become Roundpay Money Merchant / Agent all you need is mobile number & basic KYC documents

★ Mobile and DTH Recharge: Recharge your Customer's prepaid mobile and DTH for all telecom operators like Jio, Airtel, Vodafone, Idea, Reliance,BSNL,Dish TV, Sun Direct,Videocon D2H & others.

★ Cash Withdrawal (Micro-ATM): Merchants can help customers to withdraw cash from ANY bank account (SBI, PNB, Allahabad Bank, Bank of Baroda, ICICI + 180 more banks) with Aadhaar number & fingerprint only

★ Easy movement of money to Bank : Roundpay Merchant can transfer earned money in bank account in few taps.

★ Money Transfer (DMT): Merchants/Agents can take cash from customers and transfer money to any bank accounts across India.

★ MPOS – Merchants can accept payments through credit cards/ debit cards with the help of their mobile phone and MPOS machine.

★ Bharat Bill Payment (BBPS): Merchant can fetch & pay utility bills of their customers which includes: Gas, Electricity, Water,Education Fees,Insurance Premium)

★ Railway Ticket:Become IRCTC authorized agent and use Roundpay wallet as payment method at booking check out

★ Travel: Roundpay Merchant can book Domestic and Internation Flights Ticket Air, Domestic and Internation Hotels Oyo Rooms for their customers.

★ Pancard Services: Merchant can create new PAN card for their customers online From UTI With Help of Our Expert.

★ Wallet Upload: On the go wallet upload feature using digital payments like UPI, NetBanking, Credit Card, Debit Card.

★ App Notifications: Stay updated with various attractive offers.

★ Transaction History: Roundpay provides you with a detailed Account Statement of your online shop. See all your transaction and how much have you earned on them. Control your online business with relevant reports at your disposal.

★ 24*7 Availability: Provide hassle free services to customer available 24*7

★ User Friendly Interface: Fast, simple & easy interface

★ Secure & Robust: Secure mobile app with multiple layers of authentication to ensure security and Most advanced Level (RD service) AEPS integration from four biometric companies - Morpho, Mantra

visit here for information: https://www.roundpay.in/

Source Link: https://youtu.be/YoQIorj6C-Q

#Mobile Recharge API Provider India#mini atm machine#aadhar micro atm#Aadhaar Enabled Payment System#Recharge API Provider In India

0 notes

Photo

How to Register for AEPS Service: 7 Easy Steps

Going cashless and making online payments has lots of advantages. It is a quicker and convenient way to deposit cash, transfer cash, or make any online purchase. With the advancement in technology, many new online methods are introduced and people are now using them for many reasons. But in many online payment methods, you have to share your confidential information and some people are reluctant to share their information. So, they prefer to use traditional ways of making transactions, which is very time-consuming. For this reason, the Government has launched a great way to make transactions only with your Aadhaar card. Through Aadhaar Enabled Payment System (AEPS), the Aadhaar cardholders can carry out monetary transactions and AEPS balance inquiry by way of Aadhaar based verification. This service is given by the National Payments Corporation of India to the financial institutions by using your Unique Identification Number printed on the Aadhaar card. You can do AEPS registration through an AEPS agent to avail of numerous benefits of this service.

Benefits of AEPS registration online:

Safe secure process

Easy and convenient

Time-saving and hassle-free

Less documentation

Easy access to your bank account just using Aadhaar Authentication

Only 2 things are required for a cash transaction that is Aadhaar card and biometric information.

Operates among several banks

Works as m-ATM

Benefits of AEPS service portals

Single tip withdrawal of money

Saves time and hassle

No need to visit banks

No need to visit ATM

Remembering your password or pin is not required

An easy and fast method of transaction

No need to carry an Aadhaar card with you

Services You Can Avail through AEPS online registration :

Cash Withdrawal

Cash transfer

Bank balance mini-statement

AEPS Online Registration Process:

You need to follow 7 simple steps for AEPS registration.

Step 1: Visit the nearest banking corresponded in your zone or visit the nearest iServeU outlet correspondent in your area.

Step2: Enter your 12-digit Aadhaar number of the unique identity number printed on your Aadhaar card in the POS-point of sale machine.

Step 3: Choose the type of transaction you want to make like cash withdrawal, intrabank or interbank fund transfer, obtain a mini statement, balance inquiry.

Step 4: Choose the name of the bank

Step 5: Fill in the amount of the transactions.

Step 6: Through your biometrics, authenticate the transaction.

Step 7: The transaction will be finished in no time.

At the end of the AEPS transaction, a money receipt will be generated along with a successful message. The message will inform you that your transaction is completed successfully. You will also receive a message from IPPB as well as your linked bank.

Advantages of AEPS portal registration for agents:

There are many advantages of AEPS portal registration for agents.

By AEPS registration, the agents can convert their shop to a mini ATM.

Agents can avail the highest commission

Smaller investment but big profit

Instant settlement of cash

Profitable business opportunity

How to become an AEPS agent?

Many fintech companies are training retailers to become AEPS agents. You can become an iServeU Aeps agent and can earn commission on every successful transaction. All you need to do is present your PAN Card and Aadhaar Card and fill the Aadhaar Enabled Payment System AEPS registration form.

Any business partner can do AEPS registration online </strong>with a simple documentation process.

Want to become an iServeU AEPS agent and earn a lucrative commission? Connect with us. iServeU is providing AEPS services with 2 banks and users can start AEPS services with self-authentication. iServeU is the best AEPS portal to do smooth cash withdrawal, transfer, and bank inquiry at any point in time. For more info, visit us at or feel free to call us on +918338088000.

0 notes

Link

Voso empowers retailers so they can offer online services like Aeps, matm, pan card, and insurance to their customers. Upgrade your shop with voso.

0 notes

Photo

Start Your Own Business in Few Steps by Providing Digital Services Like AEPS, Bill Payment & MiniATM

यदि आपके पास अपनी दूकान या ऑफिस हैं तो आज ही DOGMA SOFT LIMITED से जुड़े और अपना व्यापार बढ़ाये।

क्या आपको अलग अलग बैलेंस मेन्टेन करना पढता है?

क्या आप अलग.अलग Login ID से परेशान है?

क्या आप कंपनियों के Support से परेशान है?

आपकी इन सभी परेशानियों का समाधान Dogma के पास है.

1. Same Day ID activation

2. No monthly Charges

3. Earn Upto 1 Lac monthly. Distributor Invited

अब हमारे पास IT की 100+ Services Category जिसमे 500+ Products है जो एक ही Wallet से लिंक है व ज्यादा Margin, Best Support, Auto System से आपकी Monthly Income भी बढे|

We don’t Sell Products We Sell Solutions of The Problems और इसलिए आज हम 100+ IT Services उब्लब्ध करा रहे है :-

1. Pan Centre consultancy online and offline

2. Electricity bill payment with extra commission. No surcharge

3. Bus/ flight/Rail/IRCTC ticket booking id's at lowest rates

4. AEPS and miniATM

5. Money transfer in APP with lowest charge in market

6. GST Suvidha Kendra+complete taxation Suvidha Kendra with ITR & TDS return

7. Business loan

8. Registration services – FSSAI, MSME, TM, ISO etc

9. Digital merchant replacement of swipe machine and multiple QR code

10.Insurance - bike/car, health, life, term insurance and insurance premium deposit

11. Complete education management software for school college ITI computer coaching centre

12. Website design development, bulk SMS, toll free no, SEO, SMO etc.

ग्राहक नहीं दोस्त बनाते हैं हम।

#AEPS#miniATM#DomesticMoneyTransfer#MiniatmService#ItService#FintechServiceProvider#Franchisee#StartupBusiness#BusinessFranchisee#DigitalService#India#AEPSServiceProvider#MiniatmMachine#Recharge#Insurance#BBPS#Taxation#Rajasthan

0 notes

Photo

Enhance Your Income by Providing 100+it Services Under One Roof in Your Office/Ghop/Grocery Store and Serve Services Like AEPS, Money Transfer & Pan Card Center etc.

यदि आपके पास अपनी दूकान या ऑफिस हैं तो आज ही DOGMA SOFT LIMITED से जुड़े और अपना व्यापार बढ़ाये।

Get AEPS, Mini ATM, Pan Centre, GST Registration/Taxation Centre, Insurance, Money Transfer and 100+ IT Services on Single wallet and start earning with the Most Powerful Earning Platform of Dogma Soft.

क्या आपको अलग अलग बैलेंस मेन्टेन करना पढता है?

क्या आप अलग.अलग Login ID से परेशान है?

क्या आप कंपनियों के Support से परेशान है?

आपकी इन सभी परेशानियों का समाधान Dogma के पास है.

1. Same Day ID activation

2. No monthly Charges

3. Earn upto 1 Lac monthly. Distributor Invited

अब हमारे पास IT की 100+ Services Category जिसमे 500+ Products है जो एक ही Wallet से लिंक है

आप अपनी ADVISOR /DSO की Team बढ़ाए जिससे आपकी Income बढे व ज्यादा Margin ,Best Support ,Auto System से आपकी Team की Income भी बढे.

We don’t Sell Products We Sell Solutions of The Problems और इसलिए आज हम 100+ IT Services उब्लब्ध करा रहे है

1. Pan centre consultancy online and offline

2. Electricity bill payment with extra commission. No surcharge

3. Bus/ flight/Rail/ IRCTC ticket booking id's at lowest rates

4. AEPS and miniATM

5. Money transfer in APP with lowest charge in market

6. GST suvidha Kendra+complete taxation suvidha Kendra with ITR & TDSreturn

7. Business loan

8. Registration services – FSSAI, MSME, TM, ISO etc

9. Digital merchant replacement of swipe machine and multiple QR code

10.Insurance - bike/car, health, life, term insurance and insurance premium deposit

11. Complete education management software for school college ITI computer coaching centre

12. Website design development, bulk SMS, toll free no, SEO, SMO etc

#AEPS#MiniATM#mATM#AEPSServiceProvider#MiniATMmachine#DomesticMoneyTransfer#BBPS#ItServiceProvider#FintechService#NewBusinessStartup#COVID19#DigitalServices#Franchise#BusinessIdeas#Shop#India

0 notes

Photo

Business बढ़ाओ , पैसा कमाओ !!

यदि आपके पास अपनी दूकान या ऑफिस हैं तो आज ही DOGMA SOFT LIMITED से जुड़े और अपना व्यापार बढ़ाये।

Get AEPS, Mini ATM, Pan Centre, GST Registration/Taxation Centre, Insurance, Money Transfer and 100+ IT Services on Single wallet and start earning with the Most Powerful Earning Platform of Dogma Soft.

क्या आपको अलग अलग बैलेंस मेन्टेन करना पढता है?

क्या आप अलग.अलग Login ID से परेशान है?

क्या आप कंपनियों के Support से परेशान है?

आपकी इन सभी परेशानियों का समाधान Dogma के पास है.

1. Same Day ID activation

2. No monthly Charges

3. Earn upto 1 Lac monthly. Distributor Invited

अब हमारे पास IT की 100+ Services Category जिसमे 500+ Products है जो एक ही Wallet से लिंक है

आप अपनी ADVISOR /DSO की Team बढ़ाए जिससे आपकी Income बढे व ज्यादा Margin ,Best Support ,Auto System से आपकी Team की Income भी बढे.

We don’t Sell Products We Sell Solutions of The Problems और इसलिए आज हम 100+ IT Services उब्लब्ध करा रहे है

1. Pan centre consultancy online and offline

2. Electricity bill payment with extra commission. No surcharge

3. Bus/ flight/Rail/ IRCTC ticket booking id's at lowest rates

4. AEPS and mini ATM

5. Money transfer in APP with lowest charge in market

6. GST suvidha Kendra+complete taxation suvidha Kendra with ITR & TDS return

7. Business loan

8. Registration services – FSSAI, MSME, TM, ISO etc

9. Digital merchant replacement of swipe machine and multiple QR code

10.Insurance - bike/car, health, life, term insurance and insurance premium deposit

11. Complete education management software for school college ITI computer coaching centre

12. Website design development, bulk SMS, toll free no, SEO, SMO etc

#AEPS#MoneyTransfer#Insurance#FranchiseBusiness#NewBusiness#SetupBusiness#FranchiseeModal#BBPS#mATM#miniATMDevice#MiniATMService#aepsserviceprovider#PanCardCenter#DomesticMoneyTransfer#Recharge#DigitalServices#ItServices#GSTSuvidhaKendra

0 notes

Text

What is the basic meaning of AEPS ?

Aadhaar powered online payment system (AEPS) is a protected payment mechanism provided mostly by the National Payments Corporation of India (NPCI) that enables aadhaar connected personal bank account holders to make use of basic banking services such as the use of balance inquiry and cash withdrawal.

Customers simply just need to say BANKIT online retailer only their own 12-digit aadhaar number and also aadhaar bank name. The approval of fingerprints is made using a biometric system to allow use of the facility. Aeps Services is pretty much comman nowadays.

Aadhaar-based final payment scheme

Aadhar enabled payment system really is a banking led model that enables free online interoperable financial transactions at PoS (Point of Sale/Micro ATM) via the new business Correspondent (BC)/Bank Mitra of any other bank that uses aadhaar authentication. You can also become an Aeps Service Provider. You can take out the Aeps Service Provider Company List and then compare all the major services that it gives.

BANKIT itself is an AePS service provider organisation with a robust Aadhaar Payment System network. Contact us whether you need AEPS App or wish to become another Aeps White Label Partner, or you might be a reseller or a retailer. Become the Best Aeps Service Provider In India. We have got an end to the real solution for AEPS, UPI, payment gateway, and also a lot of times much more. BANKIt is free online AePS registration process is very fast and quick. It needs a lot of hardwork to be the Best Aeps Service Provider in the whole country.

Aadhaar fingerprint scanner and sometimes aadhar iris scanner are the most widely used aadhaar biometric devices that help determine the identity of the individual. You can do the Aeps Service Registration anytime.

Limit of move of AEPS

there is also a standard cap imposed by RBI for transactions made through the AEPS, although banks are free to specify a limit on any of these financial transactions. Aeps Money Transfer is an easy task nowadays. Few big banks really have actually set again the transaction limits to prevent abuse or misappropriation of this method. Many major banks have indeed set a daily cap of INR 50,000 on the overall transactions made by anybody, although they may differ from bank to bank as indicated.

Reason for AEPS

The Indian Government took the "Cashless India" new initiative and thereby agreed to get all unbanked parts of society together under the same banking umbrella. This is not achievable physically for people living in isolated and remote areas. And that is exactly why the current government has already come up with this kind of new facility to somehow provide them with the access to banking existing facilities, where many individuals really can effortlessly submit or receive funds and take advantage of both banking and otherwise non-banking facilities available with the help of micro-ATMs and perhaps banking officials. In addition, purchases made by means of fingerprint or even iris recognition make the procedure safe and secure.

The AEPS process has also already removed the difficulty of getting a real physical banking passbook and bank debit card, since these financial transactions can only be carried out with your Aadhaar number and otherwise your fingerprints.

0 notes

Video

youtube

How to open IPPB account in mobile - IPPB account kaise khole - zero balance account how to open ippb account in dop finacle how to open ippb account in post office online how to open ippb account online in telugu how to open ippb bank account how to open ippb current account how to open ippb merchant account how to open ippb regular account how to open ippb account without pan card how to open ippb account in post office how to open a ippb account how to open account in ippb app how to open a bank account in ippb how to open ippb bank account online how to open digital account in ippb how to open account in ippb how to open account in ippb online how to open ippb account online how to open new account in ippb unable to open ippb account online how to open rd account in ippb online how to open ppf account in ippb how to open rd account in ippb how to open sb account in ippb is it good to open ippb account who can open ippb account How to open IPPB account in Mobile IPPB account login IPPB Regular saving account IPPB basic saving account IPPB account opening Menu IPPB App How to convert IPPB digital account to regular account IPPB account opening process in Finacle Page Navigation More results ippb mobile ippb app ippb ifsc code ippb micro atm ippb account open ippb toll free number ippb merchant ippb mobile banking apk ippb bank ippb online ippb account ippb apk ippb atm card ippb aeps ippb agent login ippb account check ippb a/c opening ippb a/c ippb a/c details is ippb a nationalised bank is ippb a public sector bank is ippb a jan dhan account is ippb a central govt job what is a ippb machine ippb balance enquiry ippb branch ippb bank app ippb bank full form ippb bank near me ippb branch name ippb bank app download ippb b ippb customer care ippb card ippb customer id ippb csp ippb current account ippb charges ippb check balance ippb card image ippb download ippb debit card ippb digital account ippb digital account open ippb details ippb download apk ippb dbt ippb details in hindi dop ippb ippb email ippb email id ippb exam ippb e kyc ippb established ippb error ippb exam syllabus ippb e banking pnb e statement ippb full form ippb full form in hindi ippb full kyc ippb full name ippb fd interest rate ippb facilities ippb form ippb franchise apply online ippb fmenu ippb gmail ippb gds ippb gds commission ippb gl code ippb guidelines ippb gpay ippb gov.in ippb guide ippb helpline number ippb hd logo ippb hindi ippb hq ippb how to login pnb home loan ippb holiday list 2020 ippb how to register ippbase.h ippb ifsc ippb ifsc code motihari ippb ifsc code siwan ippb ifsc code darbhanga ippb interest rate ippb ifsc code siwan bihar ippb imps charges ippb jobs ippb joint account ippb job profile ippb jan dhan account ippb jankari ippb jan dhan account opening ippb jobs 2020 ippb job recruitment ippb ka ifsc code ippb kyc ippb kya hai ippb ka ippb ka full form ippb kyc form ippb ka matlab ippb khata ippb login ippb logo ippb loan ippb location ippb latest news ippb logo png ippb limit ippb login customer id ippb mobile app ippb mobile banking ippb mini statement ippb mobile banking app download ippb m atm ippb m ippb near me ippb net banking ippb new account ippb neft charges ippb news ippb number ippb new user activation ippb news in hindi ippb online account ippb online service ippb opening ippb open account ippb online form ippb otp ippb officer salary ippb passbook ippb passbook print ippb post bank ippb photos ippb patna ifsc code ippb passbook image ippb pdf password ippb passbook format ippb qr card ippb quora ippb qr card login ippb qr card charges ippb qualification ippb question paper 2018 ippb quizlet ippb qas ippb q r card ippb registration ippb recruitment ippb rd ippb rates and charges ippb rd interest rate 2020 ippb rd interest rates ippb rd rates ippb rrb merger ippb scan ippb salary ippb saving account ippb sitamarhi ifsc code ippb sms banking pnb saharsa ifsc code ippb status ippb siwan ippb transaction charges ippb transfer limit ippb training ippb twitter ippb to paytm ippb therapy ippb training app ippb upi ippb upi id ippb user id ippb url ippb upi link ippb upsc ippb uses ippb upi pin ippb vacancy ippb virtual debit card ippb vpa id ippb video ippb vacancy online form ippb vacancy 2020 ippb vs sbi ippb vs posb ippb wikipedia ippb website ippb withdrawal ippb webmail ippb withdrawal limit per day ippb whatsapp group ippb whatsapp number ippb welcome kit ippb youtube ippb your account is locked ippb yojana ippb.your ippb sukanya yojana ippb previous year question paper ippb know your customer id ippb sukanya samriddhi yojana ippb zero account ippb zero balance account ippb zero balance account opening online ippb zimbra ippb bank zero balance account ippb 0 balance account SONUS KNOWLEDGE #sonusknowledge #ippb #ippbmobile #ippbbank #ippbmobilebanking #ippbaccountkaisekhole #zerobalanceacount by Sonus Knowledge

0 notes

Video

youtube

ICICI BANK mpos machine price MINI ATM 100 - 5 RS commission

ICICI Mpos suman bar : Icic Bank Mini ATM Merchant par transaction commission R's 5 Contact 7047379419

ALL HELP THIS LINK bank mpos cost 2600+1500 (fast time 2600/) r+d

ICICI Mpos Taroke Shor: *ICICI MARCHENT SERVICE* *(Swipe machine)* *FREE PROMOTION GOING ON FOR LIMITED PERIOD* *GPRS Machine* 1 E3 No ICICI account mandatory. 2 E3 No Current Account required. 3 E3 365 days settlement service. 4 E3 Dual sim GPRS machine. 5 E3 UPI facilities in one touch.(Real Time credit facility) 6 E3 Also EMI facilities available.(T&C applied) 7 E3 Cash @ POS (Mini ATM) service is very easy with handsome incentives. 8 E3 Also have bank funding(Loan) facilities. (T&C applied) *NON GPRS MACHINE* 1 E3 No ICICI account mandatory. 2 E3 No Current Account required. 3 E3 365 days settlement service. 4 E3 Can access with your smart phone. 5 E3 Easy to carry in pocket. 6 E3 Magnatic & chip base both card can be accessible.

Ezeepay portal

Apes 900/ malti savise (account open) 3000/

offical sight commilist

payswiff merchant registration 4000/

ongo merchant registration 6700/

paynear merchant registration 6500/

aadher atm 600/ (retilar) 5600/ (distubter)

mpos or csp id call 7047379419

next mosambee mpos

mosambee all help video OFFICIAL SIGHT PIVOT to get 150 million PVT(Pivot Token) and 500,000 USD airdrops: PIVOT is a community for cryptocurrency investors. this link to join my WhatsApp group app joining What app Hot dence. SIGHT Video explains Benefits of Installing Paynear mPOS & Cashless Transactions. Contact For Details 13 7047379419

MPOS 6500/-

ALL HELP PART 1 2 *SUPER DISTRIBUTOR* :- SUMAN BAR Contract.- 7047379419 (Call and WhatsApp, calling time 11AM to 5PM Only)

*Paysuperfast icici bank* CALL 7047379419

*Cash Deposit*

*Cash Withdrawal*

*Balance Enquiry*

*Fund Transfer*

*Mini Statement*

*AEPS 13 Aadhaar Banking*

*MPOS Machine*

*Aadhar pay*

*Pan card Portal*

*Recharge Portal*

*Tickets Booking Portal*

*Railway tickets*

*Flight ticket booking*

*Bus booking* etc.... *

RETAILER - 999/- *DISTRIBUTOR - 6500/- (10 id)

(COMING SOON OPEN BANK ACCOUNT)

*Support*.:- *SUPER DISTRIBUTOR* :- SUMAN BAR Contract.- 7047379419 (Call and WhatsApp, calling time 11AM to 5PM Only)

CSP HELP BENGLI - ENGLISH - HINDI UPDATE HELP (BENGLI O OTHER) CALL FOR ALL INDIA

ALL BANK CSP ID CALL FOR - 7047379419 (SUMAN)

BANK HELP VIDEO ANY BANK A/C BALANE ENQUIRY

BANK HELP VIDEO ANY BANK CASH DEPOSIT 13 WITHDRAWL

BANK HELP VIDEO ANY BILL PAYMENTS( ELECTRICITY) MOBILE O DTH RECHARGE

BANK HELP VIDEO ANY BANK RAIL TICKET BOOKING

BANK HELP VIDEO ANY BANK PAN COPEN

MINI ATM ( PRIVET ) BANK HELP VIDEO ANY BANK

BANK DMT

BANK HELP VIDEO ANY BANK retailer certificates downloads

BANK HELP VIDEO ANY BANK COMMICON

Google Adwords - Digital Marketing BENGLI time earn money online ads 2018 label 10 pc (only)

How to Earn Money Online bengli 2018 allTime Jobs India

Maine mCent Browser ko default browser set kiya hai and mujhe har mahine recharge free milta hai, aapko bhi try karna chahiye. Time Jobs 5% label 10 easy ways surfe.be ads fase book or youtube

1 - To main page:

2 - To extension page: I am fanny video, Injoy sent you Rs.50 cash, why not take only 15 seconds to get it now? this link to join my WhatsApp group

blogspot -+ official sight -= 1

2 - Google adwords digital marketing WITH BENGALI ALL VIDEO

===> Click here today

0 notes

Link

BOB Kiosk Banking Software Free Download BOB CSP/ Business Correspondent Softwares,aadhaar enabled payment system aeps ,aadhaar seeding , aadhaar enabled payment system , sbi kiosk banking , kiosk banking , sbi kiosk , kiosk onlinesbi ,kiosk sbi ,kiosk banking sbi, sbi csp ,kiosk sbi online, online sbi kiosk,kiosk banking,kiosk onlinesbi,csc bank ,online kiosk banking,kiosk banking pnb,boi kiosk banking commission, boi kiosk banking software, bank of india kiosk registration, boi bc list, bank of india bc agent, bank of india kiosk indore madhya pradesh, boi passbook online, bank of india m passbook,BOI Kiosk Banking,Bank Of India Kiosk Banking ,kiosk bank,csp online,csp ragistrion,bank mitr ragistrion,grahk seva kendra,apna csc,banking,privet banking,jan seva kendra,mini bank,apnacsc bankmitr,what is kisok,sbi kisok,pnb kisok,kisok online

0 notes