#angel investors south africa

Text

David Sacks Net Worth: How Did PayPal Co-Founder and ‘All-In’ Podcast Host Make His Fortune?

An accomplished entrepreneur and angel investor, David Sacks doesn’t disclose the exact figures of his wealth. Despite him being a member of the “PayPal Mafia” and one of the most affluent Silicon Valley tech moguls, Sacks’ net worth feels like it’s a closely guarded secret, as none of the known billionaire trackers seem to list his name. Various sources estimate his net worth in quite a broad range, suggesting that it could be anywhere from hundreds of millions to potentially a couple billion dollars.

That being said, the secrecy of Sacks’ wealth won't preclude us from scrutinizing closely his entrepreneurial journey, possible income streams, political affiliation, and controversies. So if you’re curious to learn more about the member of the “All-In” crew, one of the richest podcast groups out there, read on!

Early life and Education

David Oliver Sacks was born on May 25, 1972, in Cape Town, South Africa, to a Jewish family. He emigrated to Tennessee, United States, with his parents when he was five years old and attended an all-boy Memphis University School. After high school, he went to get his BA in Economics at Stanford University, graduating in 1994. Four years later, he scored another academic achievement, obtaining a Juris Doctorate degree from the University of Chicago Law School.

Sacks’ family has always been reasonably affluent thanks to his father’s career as an endocrinologist, but the future entrepreneur didn’t want to follow in his footsteps. Instead, David Sacks took inspiration from his grandfather’s entrepreneurial journey as a candy factory owner in the 1920s, envisioning a similar path for himself. The solid groundwork for such pursuits has already been laid by his prestigious degrees, opening to the young entrepreneur-hopeful the doors to the most lucrative networking opportunities and business deals.

Co-founding PayPal

Fresh out of law school, David Sacks took an offer as a management consultant from McKinsey & Company but quit after just one year to join a newly founded e-commerce startup Confinity as the product leader, working alongside Peter Thiel, Luke Nosek, and Max Levchin. The company was initially conceived as a security software provider for hand-held devices such as Palm Pilots, the predecessors of modern smartphones. However, this business model failed to take off, so Confinity instead went to create an email money framework, which later became known internationally as PayPal.

As a product leader, Sacks was the driving force behind the pivot, persuading reluctant Levchin to give “email money” a try. After being promoted to the role of COO, Sacks oversaw the company's product management and design, business development, sales and marketing, customer service, and human resources, as PayPal bulldozered its way through competition, positioning itself as a major player in the online payments industry. In 2002, after a successful merger with Elon Musk’s online payments company X.com, PayPal went public through an IPO under the ticker PYPL at $13 per share.

The group of PayPal’s founders and early employees has remained connected as a tight-knit social and business community, earning them the title of “PayPal Mafia.” The moniker gained traction as many members readily embraced it (David Sacks currently has “PayPal Mafia” listed as a job description on LinkedIn under his years at the company). The bonds fostered between young entrepreneurs during their formative years at PayPal later led to numerous business collaborations and joint ventures, setting for life virtually all members and probably their descendants for several generations ahead.

Other notable ventures

As mentioned, most PayPal alumni later went on to found other successful companies, and David Sacks is no exception from the rule. In 2008, Sacks launched enterprise collaboration startup Yammer together with Adam Pisoni, a fellow co-founder from another successful venture, a genealogy website Geni.com. Having started as an internal feature for Geni.com, Yammer soon became one of the fastest-growing SaaS startups in history, hitting 8 million users in the first four years and seeing its rapid success acknowledged with the grand prize at the TechCrunch50 conference. In 2012, the company was acquired by Microsoft for $1.2 billion, making it one of the fastest unicorn exits in SaaS.

In 2017, Sacks co-founded Craft Ventures, a VC firm that makes investments in early-stage SaaS and marketplace startups. The company raised $1.32 billion in fresh capital across its two funds, bringing its total assets under management to $3.3 billion. According to Sacks, the rise of generative AI opens new horizons for SaaS companies, which are actively using cutting-edge tech to build new products and enhance user experience.

Besides being a co-founder at the above companies, Sacks had a brief stint as an interim CEO of Zenefits, the human resources SaaS platform, where the tech mogul has previously served as a COO. Under his leadership, the startup has successfully handled the internal compliance crisis. In May 2024, Sacks officially launched his other venture, Glue, an AI-powered competitor to Slack.

Since David Sacks’ name almost exclusively pops up in the context of Silicon Valley’s bubbling world of tech and entrepreneurship, it may be quite a surprise to learn that the PayPal Mafia’s Don is also a moderately successful film producer. After Paypal’s acquisition by eBay in 2002, he financed and produced a satirical comedy Thank You for Smoking that got nominated for the two Golden Globes and was subsequently bought by Twentieth Century Fox. Sacks also produced a biopic Daliland about surrealist artist Salvador Dali, acquired by Magnolia Pictures in 2023.

Finally, David Sacks is also known as a prolific angel investor, having poured his funds into more than 20 tech unicorns, which include Affirm, AirBnB, ClickUp, Eventbrite, Facebook, Gusto, Houzz, Lyft, OpenDoor, Palantir, Postmates, ResearchGate, Reddit, Rumble, Slack, SpaceX, Twitter, Uber, and Wish.

All In Podcast

To the non-SV circles orbiters, David Sacks is primarily known as one of the four co-hosts, aka ‘Besties,’ of the tech and politics-focused podcast ‘All-In.’ Alongside fellow venture capitalists Jason Calacanis, Chamath Palihapitiya, and David Friedberg, Sacks shares his takes on pressing issues in tech and business with around 100,000 monthly listeners (as per Muck Rack data).

Since the launch episode that discussed the COVID-19 pandemic's impact on businesses in March 2020, the All-In podcast has built a dedicated fanbase among tech professionals and amateur investors. So far, the quartet of entrepreneurs has worked up over 175 episodes of the podcast, each lasting one to two hours.

Controversies and Political Affiliations

As a close associate of Peter Thiel, whose money gave rise to the new brand of radical techno libertarianism that postulates freedom's incompatibility with democracy, David Sacks appears to hold similar views, which started to gain him more critical mainstream coverage after he ramped up his backing of Donald Trump for president in 2024.

Sacks' crusade against the “woke” started as early as 1995, when he co-authored with Thiel the book titled The Diversity Myth: Multiculturalism and the Politics of Intolerance at Stanford, which argued that the “multiculturalist ideology” was destroying the Western heritage, pointing to Stanford’s efforts to add more works by women and minorities to the philosophy curriculum as evidence for a sinister plot against the West.

Another controversy Sacks found himself marred in was him seemingly losing the plot over the Russian invasion of Ukraine. Initially standing by the contrarian albeit still rational position that the US has no interests in Ukraine, over time Sacks evolved to express what seemed to many as an open support for Russia’s actions, going as far as to accuse Ukraine of perpetrating the ISIS-claimed terrorist attack in the Moscow shopping mall that took the lives of 145 civilians.

After the bank run that caused the collapse of Silicon Valley Bank, Sacks urged the Federal Deposit Insurance Corporation to step in and bail out SVB depositors, drawing criticism for the apparent mismatch between his calls for government intervention and his libertarian penchant for minimal regulation. A significant part of SVB customers were Bay Area startups that had put in more than the $250,000 covered by federal insurance.

Personal life

On July 7, 2007, David Sacks married Jacqueline Tortorice, with whom he fathered two daughters and one son. For the combined celebration of his 40th birthday and their fifth anniversary, Sacks threw a lavish 18th-century-themed party at the $125 million Fleur de Lys mansion in Los Angeles, with Snoop Dogg as entertainment. This extravaganza, which gathered the A-listers of the Silicon Valley tech scene, also marked the end of Yammer’s acquisition talks with Microsoft, boosting Sacks’ net worth to a new high at the time.

As a billionaire’s wife and Silicon Valley socialite, Jacqueline Tortorice is a largely unfamiliar name to the broader public. From her LinkedIn profile, however, it becomes evident that she played a big part in preserving and expanding her family’s wealth: for more than 10 years, she has been the CEO of Sacks Family Office, managing her family’s assets and philanthropic endeavors.

Besides her role at the family office, Jacqueline is also listed as a founder and CEO of San Francisco-based skin-safe homewear brand Saint Heaven and a host of the Blindspot podcast.

What is David Sacks’ net worth in 2024?

At the time of writing, David Sacks’ net worth is estimated to be somewhere between $250 million to $2 billion. Such a broad range can be attributed to Sacks keeping the exact figure of his wealth private, so any educated guess about the actual state of his finances can diverge pretty widely from reality depending on the timing of his equity exits.

Sacks’ wealth accumulation began with his early role at PayPal, so it’s almost certain he got a handsome equity deal as an insider. His next successful venture was Yammer, which sold to Microsoft for $1.2 billion, but how much Sacks got from it again remains unknown to the public. His other companies such as Craft Ventures and Glue most likely contributed a non-negligible amount to his net worth as well.

As an angel investor in many successful businesses, Sacks must have profited from the sale of his equity stake after the companies went public. His involvement in the cryptocurrency space can be thought of as another contributing factor to his wealth, as Sacks is known to have invested in digital asset manager BitGo and Bitcoin’s Lightning Labs. It’s unclear whether the venture capitalist holds crypto himself, but given his favorable outlook on it suggests that he may have some direct or indirect exposure.

Overall, David Sacks’ net worth seems to be an eclectic mix of cash, equity, digital assets, and other financial instruments, reflecting his versatility and business savvy in the tough world of venture capital.

This article was originally posted on Coinpaper.

0 notes

Text

Unleashing the Potential: Finext Conference 2024 - The Future of Fintech in Africa

Africa, a continent rich with diversity and untapped potential, is on the brink of a financial revolution. The Finext Conference 2024, set to take place in Johannesburg, South Africa, is poised to be a pivotal event in the fintech industry, driving forward innovation, collaboration, and sustainable growth. This event is not just another conference; it's a confluence of minds, technologies, and visions that will shape the future of financial services in Africa.

The Rising Fintech Landscape in Africa

The African fintech landscape has been experiencing unprecedented growth. In recent years, the continent has seen a surge in fintech startups, leveraging technology to provide financial services to the unbanked and underbanked populations. Mobile money platforms like M-Pesa in Kenya have revolutionized the way people transact, demonstrating the transformative power of fintech. The Finext Conference 2024 aims to build on these successes, bringing together industry leaders, entrepreneurs, investors, and policymakers to discuss and strategize the next steps in this exciting journey.

Key Themes and Highlights

1. Financial Inclusion and Empowerment

One of the core themes of the Finext Conference 2024 is financial inclusion. With over 60% of adults in sub-Saharan Africa lacking access to formal banking services, fintech offers a pathway to economic empowerment. The conference will feature sessions on innovative solutions to bridge the financial gap, including mobile banking, digital wallets, and blockchain technology. Attendees will have the opportunity to hear from pioneers who have successfully implemented these solutions and learn about the latest advancements in the field.

2. Regulatory Frameworks and Policies

For fintech to thrive, a supportive regulatory environment is crucial. The conference will host panels with key policymakers and regulators who will discuss the current regulatory landscape and future directions. Topics will include balancing innovation with security, fostering cross-border collaboration, and creating a conducive environment for fintech startups. This dialogue is essential for ensuring that regulatory frameworks evolve in tandem with technological advancements, providing a stable and secure foundation for growth.

3. Investment and Funding Opportunities

Investment is the lifeblood of innovation. The Finext Conference 2024 will provide a platform for startups to pitch their ideas to a global audience of investors. With venture capitalists, angel investors, and financial institutions in attendance, the event offers unparalleled opportunities for networking and funding. Workshops and sessions on securing investment, scaling operations, and managing financial health will equip entrepreneurs with the knowledge and tools they need to succeed.

4. Technological Innovations

From artificial intelligence to blockchain, technological innovations are at the heart of the fintech revolution. The conference will showcase cutting-edge technologies and their applications in the financial sector. Attendees can expect demonstrations of AI-powered financial advisory services, blockchain-based transaction systems, and the latest in cybersecurity measures. These technologies not only enhance efficiency but also open up new possibilities for financial services delivery.

Networking and Collaboration

One of the most valuable aspects of the Finext Conference 2024 is the opportunity for networking and collaboration. The event will bring together a diverse group of stakeholders, including fintech entrepreneurs, established financial institutions, technology providers, government representatives, and academia. Through interactive sessions, workshops, and social events, attendees will have the chance to forge meaningful connections, share insights, and collaborate on projects that drive the fintech ecosystem forward.

Conclusion

The Finext Conference 2024 is more than just an event; it's a catalyst for change in the African fintech landscape. By fostering dialogue, showcasing innovation, and providing a platform for collaboration, the conference aims to accelerate the growth and impact of fintech across the continent. As Africa continues to embrace digital transformation, the insights and connections gained at this conference will be instrumental in shaping a future where financial services are accessible, efficient, and inclusive for all.

Join us in Johannesburg for an inspiring journey into the future of fintech. Let’s unlock the potential of Africa together.

0 notes

Text

Navigating the Terrain: Starting a Business in South Africa

In the vibrant landscape of South Africa, entrepreneurial spirit thrives amidst a rich tapestry of cultures, landscapes, and opportunities. From the bustling urban hubs of Johannesburg and Cape Town to the serene winelands of Stellenbosch, South Africa offers a diverse and dynamic environment for budding entrepreneurs. However, like any venture, starting a business in South Africa requires careful planning, understanding of the market, and adherence to legal and regulatory frameworks. In this guide, we'll explore the essential steps and considerations for embarking on your entrepreneurial journey in the Rainbow Nation.

Market Research and Business Planning: Before diving into the business world, it's crucial to conduct comprehensive market research. Understand the demand for your product or service, identify your target audience, and analyze your competitors. This research will form the foundation of your business plan, outlining your goals, strategies, and financial projections. Additionally, consider cultural nuances and regional variations within South Africa's diverse population to tailor your offerings effectively.

Choosing the Right Business Structure: South Africa offers various business structures, including sole proprietorships, partnerships, private companies, and public companies. Each structure has its own legal and tax implications, so it's essential to choose the one that aligns with your business goals and future growth plans. Consult with legal and financial advisors to determine the most suitable structure for your venture.

Registering Your Business: Registering your business is a mandatory step in establishing your presence in South Africa. Depending on your chosen business structure, you'll need to register with the Companies and Intellectual Property Commission (CIPC), South Africa's regulatory body for business entities. Ensure compliance with all registration requirements and obtain the necessary permits and licenses specific to your industry.

Navigating Legal and Regulatory Requirements: South Africa has a complex legal and regulatory environment governing businesses. From labor laws to tax regulations, entrepreneurs must navigate various requirements to ensure legal compliance. It's advisable to seek professional assistance from lawyers and accountants specializing in South African business law to avoid any pitfalls and ensure adherence to all statutory obligations.

Accessing Funding and Financing: Securing adequate funding is often a significant challenge for startups. Fortunately, South Africa offers a range of financing options, including government grants, loans, venture capital, and angel investors. Research available funding opportunities and explore partnerships with financial institutions and venture capitalists to access the capital needed to fuel your business growth.

Building a Strong Network: Networking is invaluable for entrepreneurs seeking to establish their businesses in South Africa. Attend industry events, join entrepreneurial communities, and leverage social media platforms to connect with potential collaborators, mentors, and customers. Building a robust network not only provides valuable insights and support but also opens doors to new opportunities and partnerships.

Embracing Technology and Innovation: In today's digital age, leveraging technology and innovation is essential for business success. Embrace digital tools and platforms to streamline operations, reach a broader audience, and enhance customer engagement. Whether it's e-commerce solutions, digital marketing strategies, or data analytics, incorporating technology into your business model can give you a competitive edge in the South African market.

Prioritizing Diversity and Inclusion: South Africa is a melting pot of cultures, languages, and traditions, making diversity and inclusion integral to business success. Embrace diversity within your team, foster an inclusive work environment, and tailor your products and services to cater to the needs of South Africa's diverse population. By embracing diversity, you not only tap into new markets but also foster innovation and creativity within your organization.

Adapting to Economic and Political Dynamics: Like any country, South Africa is subject to economic fluctuations and political developments that can impact businesses. Stay informed about macroeconomic trends, regulatory changes, and geopolitical developments that may affect your industry. Maintain flexibility and adaptability in your business strategy to navigate challenges and seize opportunities as they arise.

Committing to Corporate Social Responsibility: As a business owner in South Africa, contributing to the social and environmental well-being of the community is essential. Embrace corporate social responsibility initiatives that address local challenges, support sustainable development, and foster positive social impact. By aligning your business values with societal needs, you not only build a stronger brand reputation but also make a meaningful difference in the lives of others.

In conclusion, starting a business in South Africa offers a myriad of opportunities for aspiring entrepreneurs. By conducting thorough research, navigating legal requirements, accessing funding, building networks, embracing innovation, prioritizing diversity, and committing to social responsibility, you can establish a successful venture in this dynamic and diverse market. With determination, resilience, and a clear vision, your entrepreneurial journey in South Africa can be both rewarding and transformative.

0 notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#project funding#equity investors#equity capital#capital raising#equity investor#rich cocovich top consultant in private funding#cocovich#(richard cocovich]#richard cocovich and global star capital#[rich cocovich]#rich cocovich review#rich cocovich and global star capital#global star capital customer reviews

0 notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#private equity#equity funding#equity financing#project funding professionals#equity#project funding#equity capital#cocovich#rich cocovich top consultant in private funding#capital raising#global star capital review#rich cocovich baseball#rich cocovich review

0 notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#private equity#equity funding#equity financing#project funding professionals#equity#project funding services#private funding project funding#rich cocovich top consultant in private funding#cocovich#global star capital review#rich cocovich review

0 notes

Text

Vineeta Singh’s Biography: The Story You Must Know

Vineeta Singh has achieved recognition as one of India’s Top 10 youngest entrepreneurs, as per the IDFC First Bank and Hurun Report. She has been featured on the cover pages of esteemed business magazines such as Forbes India, Business Today, and Businessworld. In 2007, Singh co-founded her first start-up, Quetzal, but it faced challenges. Undeterred, she proved her determination by launching her second startup, FAB BAG, in 2012. This subscription platform delivered beauty products monthly. Simultaneously, in 2015, she co-founded her third startup, Sugar Cosmetics, alongside her husband.

Sugar Cosmetics specializes in selling cosmetics and personal care products tailored for the Indian market. In an interview with Business Today, Singh disclosed that funding was conditional on her husband’s full-time involvement, a situation she considered discriminatory against women.

Regarding Vineeta Singh’s ownership in SUGAR Cosmetics, she possesses approximately 22.98% of shares. The company itself constitutes 57.02%, while ESOP accounts for 9.11%, Angel investors hold 4.44%, and other stakeholders have 0.03%.

Vineeta Singh Biography: Interesting Facts

Since her early years, Vineeta has consistently earned gold medals for academic achievements and showcased prowess as an exceptional athlete.

In 2007, while at IIM Ahmedabad, Vineeta was honored with the Dulari Mattu Award for being the best female all-around player.

Vineeta’s decision to turn down a ₹1 crore offer from a global investment bank garnered attention, earning her a spot on the cover of a weekly magazine.

Acknowledged by The Economic Times as a young business leader, Vineeta received the prestigious 2020 Business Leader Under Forty Award.

In 2021, Forbes India Magazine featured Vineeta on its list of the country’s most powerful women.

A seasoned runner, Vineeta has completed over 14 full and half marathons. Notably, she conquered the Comrades Ultra Marathon in South Africa—an 89-kilometer race to be completed within 12 hours. Her remarkable achievement earned her a bronze medal after successfully completing the race three times.

Recognized as one of the 100 most thoughtful women globally, Vineeta’s intellectual contributions have made a significant impact.

Adding to her diverse portfolio, Vineeta served as a judge on Shark Tank India Season 1 in 2021. This television program is groundbreaking in its dedication to supporting aspiring business owners and aiding in the growth of their ventures.

Vineeta Singh: Awards and recognition

Businessworld honored her with the BW Disrupt 40 Under 40 Award in 2021.

In 2021, Forbes included her in their prestigious 40 Under 40 list.

Recognizing her outstanding contributions, Vineeta received the Forbes India W-Power Award in 2021.

The 2019 Entrepreneur Awards in Delhi acknowledged her venture, presenting her with the coveted Start-up of the Year Award.

Demonstrating leadership on a global scale, she earned a spot on the Young Global Leadership list of the World Economic Forum in 2022.

Throughout the period of 2001 to 2005, spanning four Inter IIT Sports Meets, she showcased her athletic prowess by securing two gold and two silver medals for IIT Madras.

Vineeta Singh Biography: Key Takeaway

Vineeta Singh stands as an embodiment of success and serves as a role model for countless women in India and around the world. Being featured among India’s Top 10 Youngest Entrepreneurs underscores her exceptional capabilities and resilience as a successful business leader and entrepreneur. Her unwavering commitment and dedication to her work have garnered well-deserved recognition from industry leaders on a global scale.

0 notes

Text

The IPO pricing range for Megatherm Induction is Rs 100-108 per share.

Megatherm Induction's IPO Heats Up: Price Band Set at Rs 100-108 per Share

Megatherm Induction Limited, a manufacturer of induction heating and melting products, is gearing up for its initial public offering (IPO) and has announced a price band of Rs 100-108 per share. This news has sparked interest among investors in the niche steel equipment space.

What does the price band signify?

The price band provides a range within which investors can bid for Megatherm Induction shares during the IPO. This range is set by the company and its investment bankers, considering factors like the company's financials, future growth prospects, and market conditions.

What to expect next?

The IPO opens for subscription on January 25, 2024, and closes on January 30, 2024. During this period, investors can submit bids at any price within the specified range. Once the subscription period closes, the final issue price will be determined based on the demand received from investors.

Key facts about Megatherm Induction:

Established in 2010, the company primarily serves the steel, foundry, forging, and metalworking sectors.

Its core products include induction melting furnaces and heating equipment, along with plant and machinery related to steel melt shops.

Megatherm also manufactures electric arc furnaces for alloy and special steel industries.

The company boasts a strong order book of approximately Rs 29,000 lakh as of July 2023.

It has a global customer base, exporting to South America, Africa, the Gulf region, Europe, SAARC countries, and Southeast Asia.

Is Megatherm Induction a good investment?

Whether Megatherm Induction is a good investment depends on your individual risk appetite and investment goals. Here are some factors to consider:

Growth potential: The Indian steel industry is expected to grow steadily in the coming years, which could benefit Megatherm.

Niche market: The company operates in a niche market with limited competition, potentially offering higher profit margins.

Financials: While Megatherm is profitable, its revenues and net income are relatively small. This could indicate higher risk compared to larger established companies.

Valuation: The final issue price will determine the valuation of the company, which needs to be compared to its peers and future growth prospects before making an investment decision.

For more information visit us:

0 notes

Text

19

Bria was the biological half-sister of Paris, Nicholai, Baron II, and Conrad. She was a month and ten days older than Paris, making her the oldest of five children. Considering how they treated her while she was a child, she was not at all excited. Richard explained that Jean was her father through adoption. He adopted her after her mother was diagnosed with AIDS, so he could take care of her when she died. What about him and Kathy? They couldn’t take her because they had Paris.

That hurt but she kept it to herself. She told them she didn’t want anything from them. What about a relationship? Not until Paris sincerely apologized for what she said when they were fourteen. He would talk to her about that. What did she say exactly?

“She said she hoped I got AIDS like my mother and fucking died. Being fourteen doesn’t excuse what she said because she was old enough to know better.”

Brad silently agreed. He had driven her to one of the many Hilton Hotels in Los Angeles. The family-owned thousands of hotels around the world. They all went back to the first one founded in 1919 by Conrad Hilton. From what she told him about Paris, he was happy she didn’t turn out like her. It sounded like she was a spoiled brat. Bria was down-to-earth and humble.

What was she currently doing in terms of a job? She was an investor and stay-at-home cat mother to their two cats. Other than that, nothing. What about her boyfriend? He was a musician and songwriter with a bachelor’s degree in communication studies. After graduating, he was thinking about applying to law school but he chose to pursue music instead. He was the oldest of three boys and his family was middle class. His parents helped them out by taking Bria to her appointments.

His father and brother built a ramp for her wheelchair, so he could bring her up and down the stairs. Who owned the house they lived in? She did. It was bought with her ex-boyfriend, but her name was on the paperwork. Before, she was living in a home that was owned by her mother.

They remembered that house. What did she know about her mother? Not much. Her father didn’t like talking about her because it was too difficult for him. They learned her mother, Marie was from Windhoek, Namibia in South Africa. She had been born and raised there, though her parents were from Krakow in Poland. They came to South Africa because he was a locum tenens physician, who went to different countries.

They found that interesting. How did she meet her father, Jean? College. They took an accounting course together and she helped him with his English. Did she know how she was infected with AIDS? She was told it was a tainted blood transfusion during labor. That was correct.

Polish, Namibian, and French (by adoption). Richard was Norwegian and German. After the meeting ended, she and Brad decided to get something to eat at the hotel restaurant. She was overwhelmed with everything they learned, especially about her parents. It didn’t matter that Jean wasn’t her birth father because he was the only father she ever had.

Richard and Kathy would never take the place of her parents. Brad agreed. He was curious as to why they wanted a relationship with her after twenty years. Was it because Paris just happened to run into her and that made them suddenly remember her? He didn’t know but he was suspicious about it. Whatever she decided about having a relationship with them, he would support her. He just wanted her to be careful. She nodded and he kissed the side of her head.

“How did I deserve you?”

He laughed. “I was going to ask you that question.”

When they got home, he helped her upstairs to rest. He also gave her some ibuprofen because she mentioned she had a headache. Her oncologist recommended it, though they should keep track of her other symptoms. At the moment, she only had a headache and fatigue. He kissed her forehead again and said he would check on her in an hour. Okay.

Bria had symptoms of a cold. When she woke up the next day, Brad noted she had a sore throat, a cough, and a stuffy nose. He called her oncologist in case they needed to go to the hospital. The oncologist didn’t want her to go to the hospital because she would just pick up more infections. She should stay home, drink a lot of fluids, and rest as much as possible. He should not allow anyone over if they or anyone in their household was sick. That included children or babies.

After the call, he brought her downstairs with a blanket on her lap for breakfast. He made her a fruit smoothie with oats. It would fill her stomach. He didn’t want her to take a nap until her stomach settled. She nodded, as she slowly ate. The phone rang, so he got up to answer it. It was Brad wanting to know if he could see Bria.

He told him she had a cold, so he was limiting visitors. Did he have symptoms of a cold or flu? No, he didn’t. He asked her if he could come over. She nodded, so he put the phone back to his ear and gave him the okay to come over. Because of her condition, she may not be very talkative. That was okay with him. He mostly wanted to apologize to her. When he showed up, she had eaten as much of her smoothie as she could before she became full.

He brought her into the living room before answering the door. Brad and Brad officially introduced themselves. Was he also Bradley? No, his first name was Bradford, but he got asked that question a lot.

They went into the living room after he washed his hands. He finally saw why he needed to do so. Bria was sick. Very sick. If he didn’t know it was her, he wouldn’t have recognized her. Her beautiful hair was gone. They sat down on the couch with her sitting in her chair. Bradford excused himself to get a water bottle for her. Did he want anything? No, thank you. He didn’t know what to say to her. I’m sorry. That was how he started the conversation.

“I’m sorry for my behavior towards you and Tiny when I was drinking. There’s no excuse or justification. Thank you for standing by me and also for leaving me. I never should have put you into that situation but I did and I never want to be that person again.”

“Thank you. I forgave you already because I didn’t want to be angry with you forever.”

“How are you doing? Chester didn’t tell me anything.”

When Bradford came back, he handed her a water bottle. Thank you. She took a drink before answering his question. The reason why Chester didn’t say anything was probably because Mike told him not to. She was diagnosed with Acute Lymphoblastic Leukemia. What did that mean? It meant her good cells and bad cells were fighting each other.

Her bad cells were trying to go up to her brain through her spinal cord. They were doing everything they could to prevent that. If they reached her brain, she could have a seizure or a stroke. She was doing chemotherapy five days a week for two weeks. Then, she had a week off to recover before starting another round. She lost feeling in her legs from the chemotherapy. That was why she was in a wheelchair. To save her voice, Bradford went into more detail.

She was diagnosed while in the hospital with severe morning sickness. You were pregnant? Yes, he wasn’t the father. He nodded.

“We had to terminate the pregnancy, so she could start chemotherapy. It started with swollen lymph nodes. Initially, they thought she had HIV, mono, lupus, or rheumatoid arthritis. They did a blood test and it came back positive for cancer.”

“I’m sorry. I know why Chester didn’t tell me. It wouldn’t have been appropriate.”

They agreed. Bradford was getting calls from his parents and the band wondering how she was doing. He excused himself to call his mother back. As he was doing that, Garfield and Tiny came over to them. They saw a strange human sitting on their couch, so they went over to investigate him. Garfield jumped up to her lap. She said hello to him. Where was his sister? She was around somewhere.

Tiny climbed up on the couch and went over to the stranger. She sniffed him and she recognized his scent. Hi, human! She head-butted him, making him laugh. There’s my girl! He picked her up and held her on his lap. Meow! Now they both had a human! Brad asked about the new cat. She introduced Garfield. He was around the same age as Tiny, just a few months younger. She adopted him from a shelter. He could see why his name was Garfield.

Bradford gave his mother an update. She was going to stay home for a week to help her immune system. That was what her oncologist recommended. He was also screening people. They couldn’t have any symptoms of a cold or flu.

Neither could anyone they lived with. She was visiting with her ex-boyfriend at the moment in the living room. Joyce agreed screening visitors was a good idea. She would let his father know when he got home. He was out running errands at the moment. Brad appreciated that. After finishing the call, he hung up and went back out to the living room.

@zoeykaytesmom @feelingsofaithless @alina-dixon @fiickle-nia

1 note

·

View note

Text

Mark Albarian Goldline

Goldline's President, Mark Albarian, is a popular name in the precious metals trading industry. The company has made news for its global operations, which provide a platform for investors and collectors to trade in gold and silver coins, as well as other precious metals.

This article delves into Mark Albarian's early days, the rich history, and the strategic shifts that have shaped Goldline into the industry leader it is today.

For detailed information, check out: Goldline Reviews

Mark Albarian: Early Years

Attending UC Berkeley and UCLA (1978-1983), Mark Albarian dual-majored in Economics and Political Science. Between 1983 and 1984, he served as Assistant Vice President of West Coast Bank's Numismatic Department. Following that, he held the role of Vice President at Valley State Bank Collateral Loan Division from 1984 to 1986.

During 1986-1991, he co-founded a successful rare coin and precious metals company in Los Angeles. With ANA membership since 1980, he consulted for numismatic firms (1979-1983). Taking office as Goldline's President in January 1992, Mark Albarian assumed leadership.

About Goldline

Goldline traces its roots back to the formation of a Deak & Co. subsidiary in 1960. The company was founded by Nicholas Deak, a Hungarian immigrant who initially specialized in foreign exchange and gold coins and bullion. Over the decades, Goldline has been bought and sold multiple times, with each transition shaping its future direction.

The Deak & Co. Era

In the late 1970s, Deak & Co. emerged as the largest storefront gold retailer in the U.S. However, by the early 1980s, they experienced growing pains due to rapid expansion, particularly during the gold economic bubble which burst by 1982. It was during this time that the company decided to shift its focus to the wholesale market, providing services to companies rather than individuals.

Deak & Co. had a significant impact on the international gold market, particularly through the sale of South Africa's Krugerrand. However, they were forced to halt sales due to pressures related to South Africa's apartheid system in 1985.

The Transfer of Ownership

The transition phase saw Deak & Co. change hands multiple times. In 1985, a Singapore-based lawyer purchased the company for $52 million. The following year, Australia's Martin Properties Ltd. acquired the foreign exchange and gold business for $12 million. By 1990, the London-based Thomas Cook Group bought the company for $10-$12 million.

The company saw a significant rebranding in the 1990s. It changed its name to Goldline International, Inc., and Mark Albarian, a prominent figure in the industry, became its president. Under his leadership, Goldline acquired the assets of Gold & Silver Emporium and later, Dreyfus Precious Metals, Inc., enhancing its market position.

Why Are Investors Diversifying Their Portfolio?

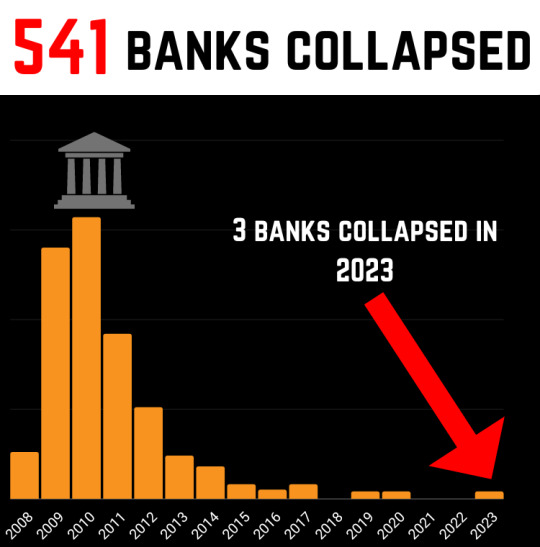

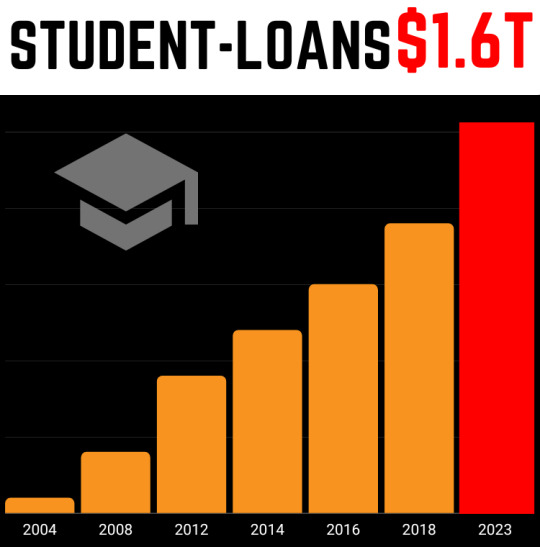

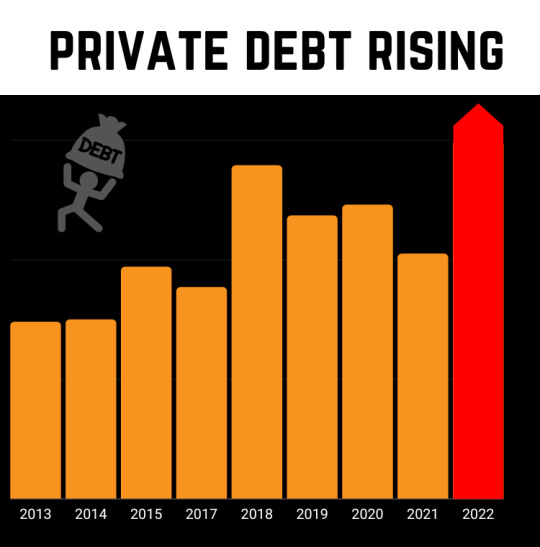

Experts agree that the financial market is now even more fragile than pre-2008. Will your retirement portfolio weather the imminent financial crisis? Threats are many. Pick your poison..

The financial system would be in great peril if one or more big banks fail.

"When we get to a downturn, banks won't have the cushion to absorb the losses. Without a cushion, we will have 2008 and 2009 again."

Student debt, which has been on a steep rise for years, could figure greatly in the next credit downturn.

"There are parallels to 2008: There are massive amounts of unaffordable loans being made to people who can't pay them"

The US national debt has spiked $1 trillion in less than 6 months!

"If we keep throwing gas on flames with deficit spending, I worry about how severe the next downturn is going to be--and whether we have enough bullets left ,"

Total household debt rose to an all-time high of $13.67 trillion at year-end 2019.

"Any type of secured lending backed by an asset that is overvalued should be a concern… that is what happened with housing."

Get in touch with an expert using the button down below:

The Expansion Phase

The new millennium brought further opportunities for growth. In 2005, Goldline was sold to three investor groups: Prudential Capital, Goldline management, and Goldline’s former chairman. In 2009, CIVC, a Chicago-based private equity company, acquired a controlling interest in Goldline, marking a transaction worth over $50 million.

Goldline has made a name for itself as a reliable retailer of various precious metals. The company deals in gold coins, silver coins, platinum, bullion bars and coins, and other precious metals. It has managed to build a strong customer base, with its growth reflected in its revenue figures. In 2009, Goldline reported sales revenue of $825 million, securing its position among the fastest-growing companies in Los Angeles County, California.

Marketing Efforts

Goldline has adopted a multi-channel marketing strategy, leveraging the power of the internet, radio, and television. They have also enlisted the support of prominent figures like Jay W. Johnson, the former Director of the United States Mint, and John Mercanti, the retired 12th Chief Engraver of the U.S. Mint, as spokespersons.

Goldline operates through various modes, including phone, internet, and in-person. The company ensures transparency in its operations, with all fees, commissions, and pricing details disclosed in writing to customers. However, it has faced criticism for its high markups, particularly on collectible coins.

The Legal Controversies

Over the years, Goldline has faced several legal challenges. In 2011, the Santa Monica City Attorney's Office charged Goldline with 19 counts of theft and fraud. However, in 2012, all criminal charges associated with the investigations were dropped as part of a settlement agreement.

Conclusion

The journey of Goldline is a testament to the company's resilience and adaptability. Despite facing numerous challenges, it has managed to steer its course and emerge as a leading player in the precious metals trading industry.

The company's commitment to transparency, customer service, and ethical business practices continues to guide its operations as it looks towards the future.

To find a detailed analysis of the company, I suggest checking out Goldline Reviews.

Check out our top gold IRA firms of the year if you're thinking about investing in a gold IRA.

Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly.

Also, the list will help you understand what the industry's best has to offer. Furthermore, it helps with what you might miss out on.

Find the best Gold IRA company in your state

Read the full article

0 notes

Text

Once abundant with crypto activity, the East Asia digital asset market is facing a cooldown. Chainalysis, a blockchain analytics company, notes in its report that the last few years remain notable in terms of declining affairs. The activity declined after the Chinese government played hardball with the market. Currently, East Asia accounts for nearly 9 percent of the global crypto market.

A Tailwind For East Asia Crypto Market

Crypto activity took a nosedive between Q1 and Q3 2020 in East Asia. By that time, the Middle East and North Africa (MENA) region saw rising crypto affairs. The report mentions that East Asia may experience a potential tailwind through Hong Kong (HK). Chainalysis cites HK’s improving relationship with China could possibly lead to this. Trading and mining activities in China primarily provided an uplift to crypto activities in East Asia.

Source: Chainalysis

Hong Kong’s crypto sector received $64 Billion in cryptocurrencies from July 2022 to June 2023. However, South Korea and Japan lead these metrics with over $1 Trillion worth of digital assets received. A better part of Hong Kong’s crypto sector is driven by its over-the-counter (OTC) market.

Moreover, the nation enjoys a major portion of institutional crypto transactions ($10 Million or more) in contrast to any other country the report mentions. South Korea falls short in the category but tops Professional investments (between $10K to $1 Million). Japan appears most in line with the global averages according to Chainalysis.

China is seeing 73.5 percent of crypto activity through centralized exchanges (CEXs) followed by South Korea. South Korea is witnessing only 26.1 percent of activity from decentralized exchanges (DEXs). The report mentions that TerraLuna’s collapse might be the reason for this. Meanwhile, Hong Kong’s activities are coming from DEXs only, same goes for Taiwan.

Chainalyis highlights China was home to the most active crypto markets until it cracked down in 2020. However, recent developments indicate that the Chinese crypto sector might be picking up pace again and Hong Kong may be a testing ground. A couple of OTC firm founders acknowledged “a diverse array of use cases power crypto adoption in China and Hong Kong,” the report reads.

Hong Kong On Its Way To Become a Crypto Hub

In July 2023, the Hong Kong government announced they would establish a Task Force to promote Web3 development in the country. Entrepreneur and angel investor Yat Siu is appointed as an official member of the team. He said, “It is a real honor to serve both Hong Kong and the Web3 community in a common cause to advance the development of our industry.”

The cryptocurrency market is down today with market capitalization losing over 2% in the past 24 hours. Bitcoin (BTC) was down by more than 2% while Ethereum (ETH) was down by nearly 4%.

0 notes

Text

Greetings Xi Jinping Cyril Ramaphosa CARICOM HSBC,

I would like to do Mandarin Bilingual Sensory Play through Haipai Cuisine in South Africa. By the time I am fluent with a group of Gastronomy Investors my Districts will be built. Xi this can be a form of Gastronomy Sales Pitch to Angel Investors for Offshore Aquaculture and Haipai Immigration Funding through China Agriculture Banking.

Regards,

Adrian Blake-Trotman

0 notes

Text

Smartphone re-commerce startup Badili raises $2.1M pre-seed funding

Smartphone re-commerce startup Badili raises $2.1M pre-seed funding

Badili, a Kenya-based smartphone re-commerce startup, has raised $2.1 million pre-seed funding to scale its operations within Africa; one of the fastest-growing mobile phone market in the world.

The Venture Catalysts, V&R Africa, Grenfell holdings, and SOSV, participated in the round, as did family offices and angel investors from Kenya, Nigeria, South Africa and India.

Buoyed by the new funding,…

View On WordPress

0 notes

Text

1 note

·

View note

Text

South African startup Talk360’s seed funding hits $7M after new backing

South African startup Talk360’s seed funding hits $7M after new backing

Months after the initial close of its seed round, Talk360, a South African Voice over Internet Protocol (VoIP) startup, has raised an additional $3 million, bringing the total investment raised in the round to $7 million.

Talk360’s latest investors include Allan Gray E2 Ventures (AGEV), Kalon Venture Partners, E4E Africa, Endeavor, existing lead investor HAVAÍC, and a number of angel investors…

View On WordPress

0 notes