#apple stock

Text

Quick midnight theory about welcome home. Everyone is trying to figure out whose the villain and whose the victims. But what if home and wallet aren't the only possible villains of the show. What if there were two Wally's that were in the show. That or Wally has a split personality disorder that causes him to switch. But my theory came when I saw " as above so below". What if there's two of wally like one that was in the original show and another that came or was developed for wally to cope with the reality he isn't real. I'm just saying what if wally is the villain and the victim.

#welcome home#welcome home arg#wally darling#wally x barnaby#apple stock#clown oc#welcome home theory#fnaf oc#fnaf 2

55 notes

·

View notes

Text

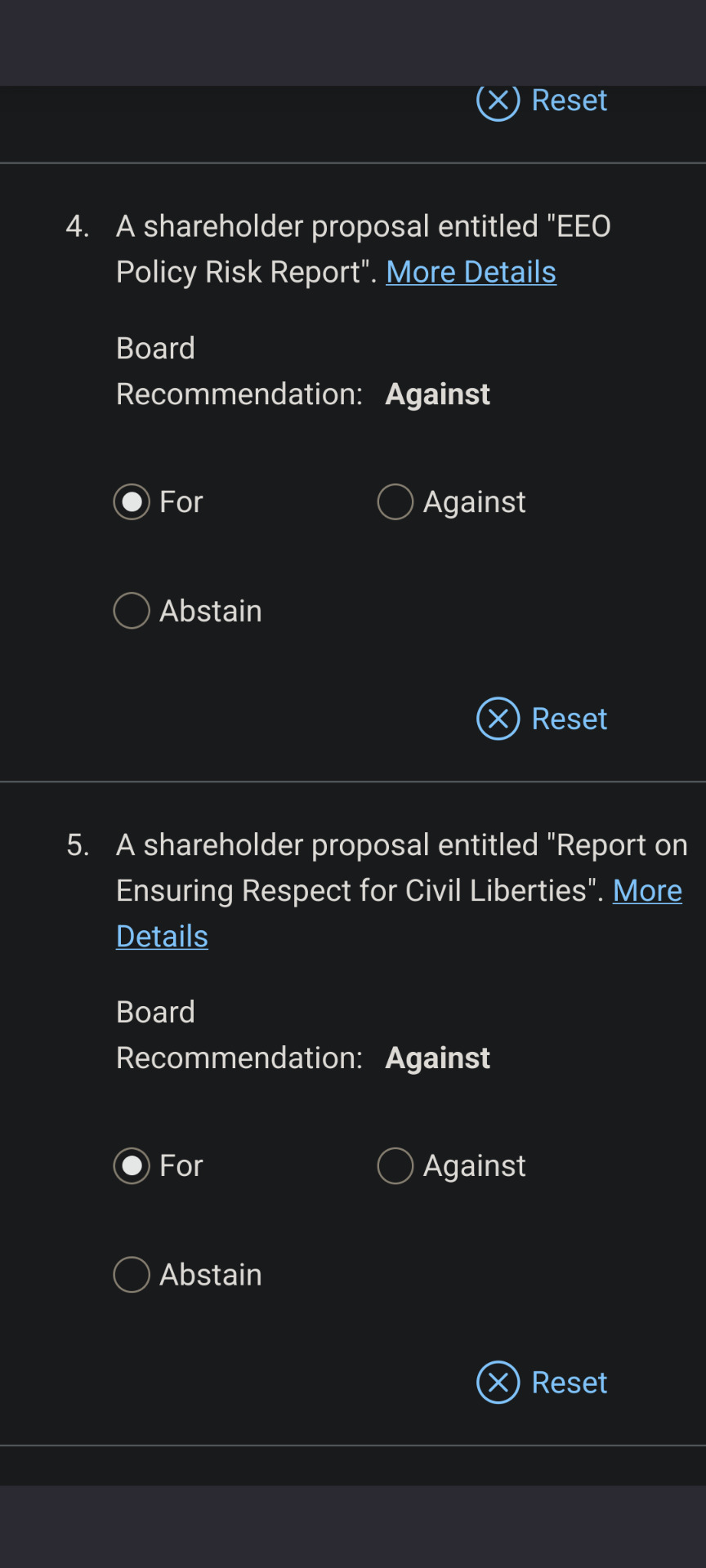

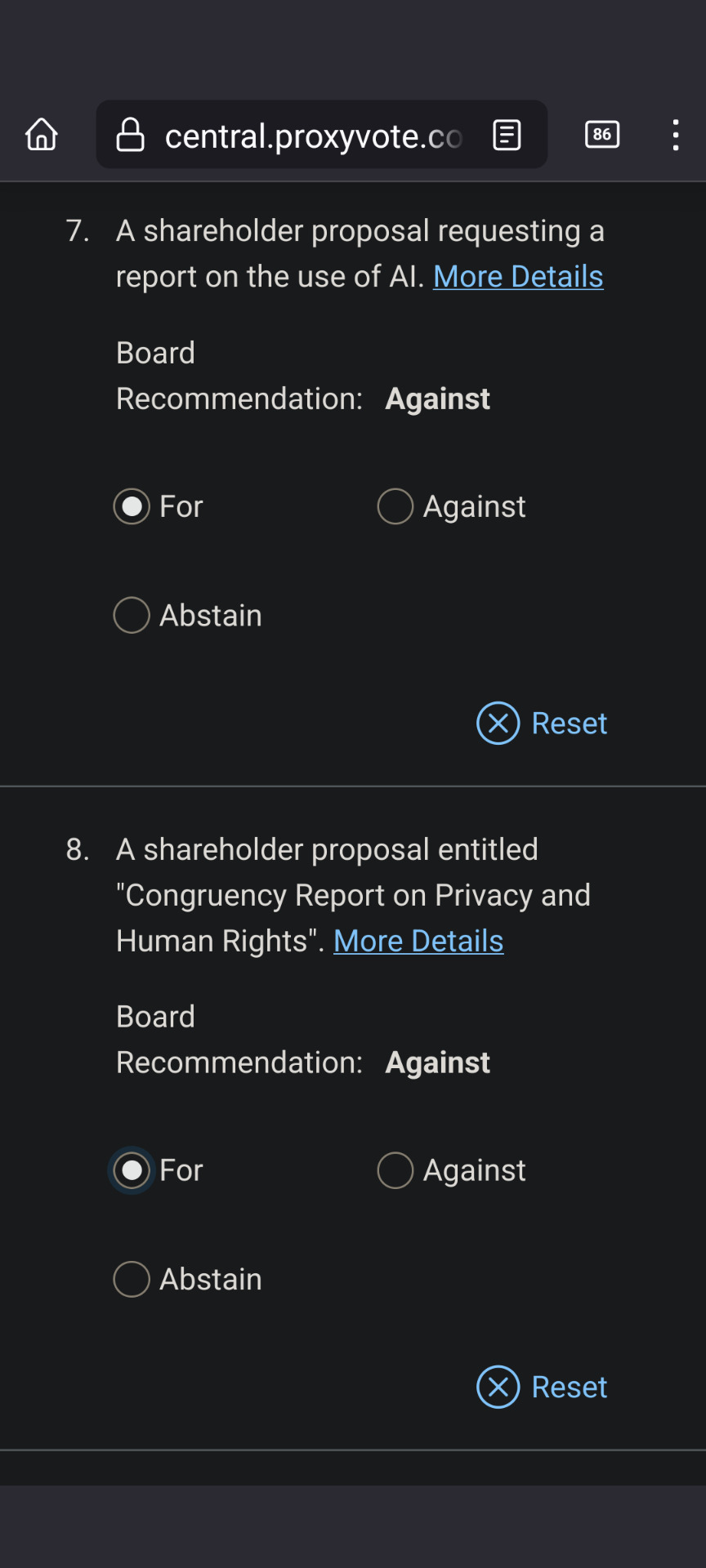

so I bought apple stocks on Cash app because idk profit? but I got to vote on their yearly bullshit and you would be absolutely *shocked* to see what the board voted against:

4 notes

·

View notes

Photo

(via GIPHY)

#giphy#art#illustration#apple#tumblr#artists on tumblr#graphic design#digital art#pop art#illuminati#modern art#steve jobs#consume#they live#apple store#graphic art#apple stock#political art#apple logo#hal hefner#eye of horus#new iphone#political meme#modern society#eye of apple#apple announcement#new ipads#they live and we sleep#apple news conference#cult of apple

2 notes

·

View notes

Text

Top 5 US Stocks to buy for Long Term | 2023

Hey Everyone . So , Today In this Article We Are Going To Talk About the Top 5 US Stocks For Long Term . The Shares Which I will Tell You Today Are the Best Us Stocks That Will Definitely Gives You Profit . So , Don't Just Invest By Reading My Article , You Can Invest But Try To Gain Some Knowledge about The Company . So Let's Begin The Topic :

TOP 5 US STOCKS TO BUY FOR LONG TERM :

NO 1 . APPLE

NO 2 . AMAZON.COM

NO 3 . TESLA

NO 4 . MICROSOFT CORPORATION

NO 5 . VISA

WHY I PICKED THESE 5 STOCKS ?

APPLE :

The Apple Stock Price Is Continuously Rising . If You will Checks the Last 6 Month Result You Will See That It Has Rise from $159 To $174 Approx $16 Rise In Just Last 6 Month And That's a Good Thing . Apple Stock Price Rises Every Year Because Of Company Value As It Bring Amazing Phone With Amazing Features .

If You See 1 Year Back The Price Of Apple Stock Was $125 And Now Currently It's $174 and Soon It Will Reach $200 . I Recommend you To Invest In This Stock Because it Will Give You a Huge Profit In Future ...

AMAZON.COM :

Everybody Knows Amazon Right ? . So , Currently The Price Of Amazon Is Falling And It's a Great Opportunity To Buy The Stock In Low Price . What You Think Amazon Price will Not Rise ? . As We The Technology Is Rapidly Growing and Everyone Is Busy In Their Life . So , In Future You Will See a Huge Rise in Amazon Stock Because Of The Rise In Population And Everybody Wants The Thing Just by Sitting Instead Of Going Out And Purchasing It ...

So , Currently The Price of Amazon Stock is $129 . If You will See It's Chart To Google You will Find That It's Price is Falling From Last 1 Month . So , I 100% Recommend You To Buy This Stock And In Last 1 Year it Has Rise From $114 to $129 . I know It's Not a Huge Rise in Price But In Future It Will Be On the Top .

TESLA :

Who Don't Know Elon Musk . The Richest Person in the World And the Owner Of Spacex And Tesla . Tesla Stock Price is Falling From Last 20-25 Days . On 18 September 2023 The Stock Price Was $271 And Now It's $241 . What a Huge Fall in Tesla Stock Price . Many People Will Sell It Because the Price Is Falling But The Intelligent Investor's Will Buy It Right Now Because the Price has Fallen .

The Last Year Company Was in Loss And The Share Price Went Down Approx $50 in a Year . See , As You Know The Petrol Cars will Be Getting Banned In Future Because Of So Much Pollution and ELECTRIC CAR OF ELECTRIC VEHICLE Are Launched . So , it's 99% Confirmed that The Price Of Tesla Will Increase In Future .

MICROSOFT CORPORATION :

Microsoft Corporation Is a Huge and Oldest Company And Currently It's Price Is Also Falling From Last 1 Month It Has Fall About $10 in The Last 1 Month . The Current Stock Price is $317 .

But In The Last 6 Months It Has Rise About $40 and It's a Good Rise in Price And In Last 1 Year It Has Rise About $80 . That's a Huge Rise in Price . Imagine This Is The Price Of One Stock And If You Have Hundreds or Thousands of Stocks It Will Make You Rich In Future .

VISA :

The Stock Price Of Visa Is Also Falling From Last 1 Month . It has Fallen About $7 Last Month . The Current Stock Price is $235 And May Be It Will Rise In Future . I am Saying This Because Of It's Company Performance In Last Year . But I Recommend You To Buy It For Atleast 4 - 5 Years . Hold Your Stock For 4 - 5 Year's And Then It Will Give You a Good Profit .

So , These are the Top 5 US Stocks For Long Term . Please Remember We Don't Have Any Exact Information That It Will 100% Rise . We Say This By Analysing The Market And The Performance Of The Company In Last Few Years . So , Invest At Your Risk .

But Yes , According To Our Research We are Sure That in 4 - 5 Year's The Price of These Stocks Will Go Very High .

Thanks For Reading ...

Earn Money With Shaan

3 notes

·

View notes

Text

A Fruitful Investment: Analyzing Apple's Stock Price

When it comes to investing in the stock market, few companies have captured the attention of both seasoned investors and newcomers quite like Apple Inc. (NASDAQ: AAPL).

The tech giant, known for its iconic products like the iPhone, iPad, and Mac, has not only revolutionized the way we live but also how we invest.

Let's take a closer look at Apple's stock price and what makes it such an appealing investment option.

Steady Growth: Apple's stock price has demonstrated impressive resilience and growth over the years. Since its IPO in 1980, the company has weathered economic storms and market fluctuations to become one of the most valuable publicly traded companies globally.

This track record of steady growth has made Apple a favorite among long-term investors.

2. Product Innovation: One of the key factors behind Apple's stock price success is its commitment to innovation. The company's ability to consistently release groundbreaking products keeps consumers coming back for more.

Whether it's the latest iPhone model or a revolutionary new service like Apple Music or the Apple Watch, innovation drives consumer demand, which in turn positively impacts stock performance.

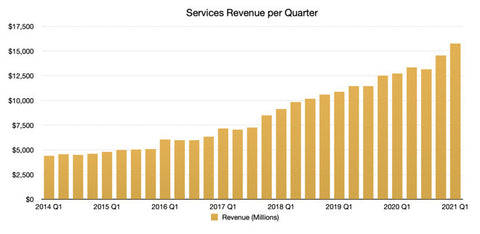

3. Services Revenue: Apple's shift towards a services-based business model has also contributed significantly to its stock price. The App Store, Apple Music, iCloud, and other services generate a steady stream of high-margin revenue.

This diversified income stream is seen as a stabilizing force in the stock's performance.

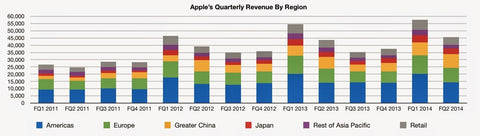

4. Global Presence: Apple's global reach extends far beyond its Cupertino headquarters. The company's products and services are available in nearly every corner of the world.

This global presence not only ensures a wide customer base but also helps mitigate risks associated with regional economic downturns.

5. Shareholder Returns: Apple has a long history of returning value to its shareholders through dividends and stock buybacks.

These actions not only reward long-term investors but also create demand for the stock, which can drive its price higher.

Conclusion:

While past performance is not indicative of future results, Apple's stock price history paints a picture of a company that has consistently delivered value to its shareholders.

Its combination of product innovation, service revenue, global presence, and commitment to shareholders makes it a compelling choice for investors seeking long-term growth and stability.

However, as with any investment, it's essential to conduct thorough research, consider your financial goals, and consult with a financial advisor before making any investment decisions.

Apple's stock may be sweet, but it's essential to ensure it aligns with your overall investment strategy and risk tolerance.

Hope you enjoyed this small piece of information.

3 notes

·

View notes

Text

He’s the apple of my eye 👁️ 🍎

6 notes

·

View notes

Text

Apple displays 🍎

Image y/n giving wally these as a gift

Wally don't eat those

5 notes

·

View notes

Text

Apple Stock Is a Top Pick, and Sales Will Beat Estimates, Says Morgan Stanley

8 notes

·

View notes

Text

#investing#stock market#finance#business#personal finance#stocks#stock market today#tesla stock#apple stock#nvidia stock#rivian stock#google stock#tsla stock#meta stock#aapl stock#nio stock#business loans best#business bank account for startups#online business checking account no credit check#online business account no credit check#mortgage refinance quote#best refinance rates 15 year fixed#business accounts for startups#online business bank account no credit check#business loan comparison

1 note

·

View note

Text

Fight the Fed - A Raw 2024 Investment Reality Check

Myth of the Elite 7 – Mega cap stocks were not the only path to success

Challenging the Status Quo – Over-reliance on traditional investment mantras, in particular conventional wisdom surrounding the Federal Reserve has been an investment loser

Reality Check – Lightning rarely strikes in the same place twice. Look outside the popular favorites for new themes as we head into 2024

The Price Tag…

View On WordPress

#Apple Stock#David Nelson CFA#Don&039;t fight the fed#Economy#Federal Reserve#Investing 2024#Jay Powell#Magnificent 7 Stocks#NVidia

0 notes

Text

Apple: A Trillion-Dollar Journey in Innovation and Investment

Written by Delvin

In the realm of technology and innovation, few companies have captured the world’s imagination quite like Apple Inc. Renowned for its sleek designs, cutting-edge products, and a commitment to pushing the boundaries of what’s possible, Apple has become a global household name. Beyond its remarkable products, Apple has also made waves in the financial world, earning itself the…

View On WordPress

#Apple Stock#assets vs liabilities#dailyprompt#Financial#Financial Freedom#Financial Independence Retire Early#Financial Literacy#First Trillion Dollar Company#Generational Wealth#knowledge#money#Passive Income#Personal Finance#Wealth

1 note

·

View note

Text

youtube

DO THIS NOW | FROM INCARCERATED TO INCORPORATED

This video provides an overview of the current stock market and the best strategies to navigate it during this bear market. It explores the importance of diversifying your investments, understanding the risks and rewards associated with investing, and the benefits of long-term investing. Additionally, the video provides tips and advice on how to make the most of the current market conditions.

#tesla stock#apple stock#stock market#google stock#microsoft stock#microsoft share price#purchasing more shares#profit from investing#best profitable shares to buy today#low investment high profit shares#trusted profit investment company#most profitable investments#profitable shares to buy today#bear market#Youtube

0 notes

Text

Turning Customers into Brand Advocates

Not all brands have been able to do it. Apple, Tesla, Canon and few others could be the best possible examples. This is not a rocket science that is difficult to understand or implement. It starts with a right set of attitudes. Attitude to excel in design that exceeds customers’ expectations, resulting in delight from awesome Moment of Truth (MOT), that is what counts toward success. Add to…

View On WordPress

#Apple brand communication#apple stock#apple watch series#Canon blogs#canon positioning#Tesla brand communication#tesla news#Tesla sports car#tesla stock

0 notes

Text

https://sixkart.com/apple-visionpro-worlds-first-spatial-computer/

0 notes

Text

Apple Expected To Report First Quarterly Revenue Decline In Four Years

Tech behemoth Apple could report its first decline in quarterly revenue in nearly four years, reports claim.

A weak economy has prompted many tech companies to lay off employees in large numbers recently but Apple has managed to stand its ground in the face of challenges by not hiring too many people.

But now it appears that some decline in revenue is inevitable, especially after disruption to the production cycle caused by the Covid-19 pandemic and the strict lockdown in China that only recently ended. Apple has been looking to diversify its manufacturing portfolio for quite some time now - with more interest in India and Vietnam.

Apple's woes continue

Apple has suffered when protests related to China's strict Covid-19 curbs brought production to a halt at a Foxconn plant, Apple's biggest hardware supplier.

The iPhone maker, which is scheduled to report its December quarter after markets close on Thursday, is expected to announce its first revenue decline in nearly four years as manufacturing disruptions in China curbed its ability to deliver premium iPhones.

Reuters reported that iPhone sales fell by about 5% in the holiday quarter of 2022, considered the peak season for gadget sales - and the company is expected to acknowledge the same in the coming days.UBS analysts expect iPhone sales to have held up better in the United States than China and Europe, as the economies reeled from the impact of COVID-19 and the Russia-Ukraine war. The last time iPhone sales fell was during the peak of Covid-19 pandemic in August-October 2020. For the important holiday quarter, the company struggled to keep up with demand for its latest premium iPhone 14 Pro models as China’s zero-Covid policies caused upheaval at a smartphone factory in Zhengzhou. In November, Apple issued a rare warning about disruptions to output of the iPhone 14 Pro. Even then, iPhone sales are expected to hold steady in the United States compared to China and Europe that have been affected by the Covid-19 pandemic and Russia's invasion of Ukraine.

Apple services like Apple Music and Apple TV+ are also expected to report their lowest revenue growth for the last quarter of 2022, adding to the company's woes.Even after disruptions at Chinese plants and the negative impact of Covid-19 pandemic, Apple is expected to pick up the pace this year as production resumes in China and diversification begins with focus on India.Analysts, however, expect a much-faster recovery this time as factories have restarted in China and Apple diversifies its production footprint with plants in India.

wristwatchstraps.co

0 notes